Shows

The Macro Trading FloorRecession Risks & ReflexivityAlf and Brent discuss the reflexivity bias: now that the S&P500 is rallying again, investors are keen to talk about AI Capex driving indexes higher - where were they when we hit 4,800? Always be aware of your negative and positive biases. The duo also discusses recession odds and a gameplan to approach rates, FX and equity markets.

To contact Alf: ping Alfonso Peccatiello on Bloomberg

To contact Brent: ping Brent Donnelly on Bloomberg

Podcast transcript: https://www.spectramarkets.com/tmtf-transcript-01may25/2025-05-0236 min

The Macro Trading FloorRecession Risks & ReflexivityAlf and Brent discuss the reflexivity bias: now that the S&P500 is rallying again, investors are keen to talk about AI Capex driving indexes higher - where were they when we hit 4,800? Always be aware of your negative and positive biases. The duo also discusses recession odds and a gameplan to approach rates, FX and equity markets.

To contact Alf: ping Alfonso Peccatiello on Bloomberg

To contact Brent: ping Brent Donnelly on Bloomberg

Podcast transcript: https://www.spectramarkets.com/tmtf-transcript-01may25/2025-05-0236 min The Macro Trading FloorTrillions of US Dollars To Sell?!This week, Alf and Brent focus on an obscure yet crucial component of FX flows: the hedging needs from large institutional investors. These whales own $33+ trillion of USD-denominated assets, and over the last 15 years they have systematically under-hedged their USD exposure - were they to change their mind forecasting a weaker USD, there could be trillions of US Dollars to sell.Want to chat with Alf? Ping him (Alfonso Peccatiello) on BloombergWant to chat with Brent? Ping him (Brent Donnelly) on Bloomberg2025-04-2532 min

The Macro Trading FloorTrillions of US Dollars To Sell?!This week, Alf and Brent focus on an obscure yet crucial component of FX flows: the hedging needs from large institutional investors. These whales own $33+ trillion of USD-denominated assets, and over the last 15 years they have systematically under-hedged their USD exposure - were they to change their mind forecasting a weaker USD, there could be trillions of US Dollars to sell.Want to chat with Alf? Ping him (Alfonso Peccatiello) on BloombergWant to chat with Brent? Ping him (Brent Donnelly) on Bloomberg2025-04-2532 min The Macro Trading FloorThe Bond Vigilantes Are HereAlf and Brent discuss the incredible price action we are witnessing: USD down, equities down, and now bond yields up too. This is what Bond Vigilantes price action looks like, and while it's typical in emerging markets it's almost unprecedented in the US. Want to reach out to Alf? Ping him on BBG: Alfonso PeccatielloWant to reach out to Brent? Ping him on BBG: Brent DonnellyTranscript: https://www.spectramarkets.com/tmtf-transcript-10apr25/2025-04-1136 min

The Macro Trading FloorThe Bond Vigilantes Are HereAlf and Brent discuss the incredible price action we are witnessing: USD down, equities down, and now bond yields up too. This is what Bond Vigilantes price action looks like, and while it's typical in emerging markets it's almost unprecedented in the US. Want to reach out to Alf? Ping him on BBG: Alfonso PeccatielloWant to reach out to Brent? Ping him on BBG: Brent DonnellyTranscript: https://www.spectramarkets.com/tmtf-transcript-10apr25/2025-04-1136 min The Macro Trading FloorWake Up: The German Fiscal Stimulus Is HugeAlf and Brent discuss the German fiscal stimulus announcement: with its gigantic magnitude and fast-track process, this marks a historical turnaround for Germany and Europe. The implications for markets are big in stocks, bonds, and FX.If you want to chat with Alf, ping him (Alfonso Peccatiello) on Bloomberg or send an email to alf@palinurocapital.comIf you want to chat with Brent, ping him (Brent Donnelly) on Bloomberg.2025-03-0736 min

The Macro Trading FloorWake Up: The German Fiscal Stimulus Is HugeAlf and Brent discuss the German fiscal stimulus announcement: with its gigantic magnitude and fast-track process, this marks a historical turnaround for Germany and Europe. The implications for markets are big in stocks, bonds, and FX.If you want to chat with Alf, ping him (Alfonso Peccatiello) on Bloomberg or send an email to alf@palinurocapital.comIf you want to chat with Brent, ping him (Brent Donnelly) on Bloomberg.2025-03-0736 min The Macro Trading FloorGrowth Scare: Yes or No?Alf and Brent unpack the last big market moves which investors are broadly interpreting as a growth scare. Is that the correct interpretation? And in general: are we going to have a US growth scare or not?Interested in Alf's institutional macro research?Contact him (Alfonso Peccatiello) on Bloomberg or via alf@themacrocompass.comInterested in Brent's daily FX research reports?Contact him (Brent Donnelly) on Bloomberg or check out Spectra AM/FX2025-02-2837 min

The Macro Trading FloorGrowth Scare: Yes or No?Alf and Brent unpack the last big market moves which investors are broadly interpreting as a growth scare. Is that the correct interpretation? And in general: are we going to have a US growth scare or not?Interested in Alf's institutional macro research?Contact him (Alfonso Peccatiello) on Bloomberg or via alf@themacrocompass.comInterested in Brent's daily FX research reports?Contact him (Brent Donnelly) on Bloomberg or check out Spectra AM/FX2025-02-2837 min The Macro Trading FloorThe Next Big Macro TradeMarkets are caught between cross currents, and the thesis for a stronger USD / sticky inflation seems as valid as the thesis for gentle disinflation / slower growth. Brent and Alf discuss what the next big macro trade could be.Want access to Alf's institutional macro research? Ping him (Alfonso Peccatiello) on Bloomberg or send an email at alf@themacrocompass.comWant access to Brent's research notes? Ping him (Brent Donnelly) on Bloomberg or visit https://www.spectramarkets.com/am-fx/Transcript: https://www.spectramarkets.com/tmtf-transcript-20fe...2025-02-2135 min

The Macro Trading FloorThe Next Big Macro TradeMarkets are caught between cross currents, and the thesis for a stronger USD / sticky inflation seems as valid as the thesis for gentle disinflation / slower growth. Brent and Alf discuss what the next big macro trade could be.Want access to Alf's institutional macro research? Ping him (Alfonso Peccatiello) on Bloomberg or send an email at alf@themacrocompass.comWant access to Brent's research notes? Ping him (Brent Donnelly) on Bloomberg or visit https://www.spectramarkets.com/am-fx/Transcript: https://www.spectramarkets.com/tmtf-transcript-20fe...2025-02-2135 min The Macro Trading FloorHow To Trade Tariff DayIn this episode, Alf and Brent reflect on the upcoming ''Tariff Day'' and how to trade it. The duo shares their scenario-based approach covering multiple asset classes including bonds, FX and equities.Alf can be reached via X (@MacroAlf) and on Bloomberg (Alfonso Peccatiello)Brent can be reached via X (@@donnelly_brent) and on Bloomberg (Brent Donnelly)Show notes: https://50in50.substack.com/p/trade-6-options-or-cashTranscript: https://www.spectramarkets.com/tmtf-transcript-17jan25/2025-01-1733 min

The Macro Trading FloorHow To Trade Tariff DayIn this episode, Alf and Brent reflect on the upcoming ''Tariff Day'' and how to trade it. The duo shares their scenario-based approach covering multiple asset classes including bonds, FX and equities.Alf can be reached via X (@MacroAlf) and on Bloomberg (Alfonso Peccatiello)Brent can be reached via X (@@donnelly_brent) and on Bloomberg (Brent Donnelly)Show notes: https://50in50.substack.com/p/trade-6-options-or-cashTranscript: https://www.spectramarkets.com/tmtf-transcript-17jan25/2025-01-1733 min The Macro Trading FloorThe US Dilemma in 2025Alf and Brent discuss the US dilemma in 2025: should Trump be aggressive out of the gate with tariffs sacrificing growth for foreign policy victories, or should he focus on other priorities allowing Powell to cut rates and facilitate the refinancing of $7 trillion of maturing Treasuries? The duo also discussed the perils and benefits of leverage in trading and investing.Do you want to ask questions to Brent and Alf?Reach out to Alfonso Peccatiello and Brent Donnelly on Bloomberg.Transcript: https://www.spectramarkets.com...2024-12-1336 min

The Macro Trading FloorThe US Dilemma in 2025Alf and Brent discuss the US dilemma in 2025: should Trump be aggressive out of the gate with tariffs sacrificing growth for foreign policy victories, or should he focus on other priorities allowing Powell to cut rates and facilitate the refinancing of $7 trillion of maturing Treasuries? The duo also discussed the perils and benefits of leverage in trading and investing.Do you want to ask questions to Brent and Alf?Reach out to Alfonso Peccatiello and Brent Donnelly on Bloomberg.Transcript: https://www.spectramarkets.com...2024-12-1336 min Billion Dollar Backstory 202474: Ex-ING $20B Bond Mgr to 500k Macro Research Followers to New Macro HedgeFund, Meet Palinuro Capital Founder / CIO Alfonso PeccatielloAlfonso Peccatiello built a following of 500,000 on social media by doing something radical – by being a real, authentic human in the fund world. And that authentic social presence helped him close investment deals for his new hedge fund, Palinuro Capital. Alfonso’s story is proof that it pays to challenge the status quo and to put people (and connections) first – even in a numbers-obsessed industry. Want the full story? Join Alfonso and Stacy as they discuss:Alfonso’s backstory: How a car accident sparked his...2024-12-0952 min

Billion Dollar Backstory 202474: Ex-ING $20B Bond Mgr to 500k Macro Research Followers to New Macro HedgeFund, Meet Palinuro Capital Founder / CIO Alfonso PeccatielloAlfonso Peccatiello built a following of 500,000 on social media by doing something radical – by being a real, authentic human in the fund world. And that authentic social presence helped him close investment deals for his new hedge fund, Palinuro Capital. Alfonso’s story is proof that it pays to challenge the status quo and to put people (and connections) first – even in a numbers-obsessed industry. Want the full story? Join Alfonso and Stacy as they discuss:Alfonso’s backstory: How a car accident sparked his...2024-12-0952 min Billion Dollar Backstory74: Ex-ING $20B Bond Mgr to 500k Macro Research Followers to New Macro HedgeFund, Meet Palinuro Capital Founder / CIO Alfonso PeccatielloAlfonso Peccatiello built a following of 500,000 on social media by doing something radical – by being a real, authentic human in the fund world. And that authentic social presence helped him close investment deals for his new hedge fund, Palinuro Capital. Alfonso’s story is proof that it pays to challenge the status quo and to put people (and connections) first – even in a numbers-obsessed industry. Want the full story? Join Alfonso and Stacy as they discuss:Alfonso’s backstory: How a car accident sparked his...2024-10-2352 min

Billion Dollar Backstory74: Ex-ING $20B Bond Mgr to 500k Macro Research Followers to New Macro HedgeFund, Meet Palinuro Capital Founder / CIO Alfonso PeccatielloAlfonso Peccatiello built a following of 500,000 on social media by doing something radical – by being a real, authentic human in the fund world. And that authentic social presence helped him close investment deals for his new hedge fund, Palinuro Capital. Alfonso’s story is proof that it pays to challenge the status quo and to put people (and connections) first – even in a numbers-obsessed industry. Want the full story? Join Alfonso and Stacy as they discuss:Alfonso’s backstory: How a car accident sparked his...2024-10-2352 min The Macro Trading FloorFinancial Repression Is Here To StayAlf and Brent discuss the recent sharp moves in US election polls and betting markets: Trump's odds are moving up, and so are the odds of a Red Sweep. Is the market fully incorporating these odds? Also, the duo discusses the possibility of persistent financial repression regardless of who prevails in US elections. Finally, they engage in a discussion about the importance of correlations for macro portfolios.Want to be in touch with Alf? Ping Alfonso Peccatiello on Bloomberg or enroll in the two-weeks free trial of his institutional research: https://forms.gle/5GfSwfzovsFpCA5q...2024-10-1838 min

The Macro Trading FloorFinancial Repression Is Here To StayAlf and Brent discuss the recent sharp moves in US election polls and betting markets: Trump's odds are moving up, and so are the odds of a Red Sweep. Is the market fully incorporating these odds? Also, the duo discusses the possibility of persistent financial repression regardless of who prevails in US elections. Finally, they engage in a discussion about the importance of correlations for macro portfolios.Want to be in touch with Alf? Ping Alfonso Peccatiello on Bloomberg or enroll in the two-weeks free trial of his institutional research: https://forms.gle/5GfSwfzovsFpCA5q...2024-10-1838 min The David Lin Report50 Bps Cut Next Week? Fed Could Shock Markets; China Is 'Imploding' | Alfonso PeccatielloAlfonso Peccatiello, Founder of the Macro Compass, discusses the economy in China, outlook for U.S. growth and inflation, monetary policy, and the investment implications of today's macroeconomic environment.

Watch Alfonso's last interview with me: https://youtu.be/pHThK8AQbxA?si=o5fds3u81jaxYwAj

This video is distributed on behalf of Kootenay Silver (TSX.V:KTN | OTC: KOOYF). Learn more about Kootenay Silver here: https://kootenaysilver.com/

*This video was recorded on September 10, 2024

Subscribe to my free newsletter: https://davidlinreport.substack.com/

Listen on Spotify: https://open.spotify.com/show/510WZMFaqeh90Xk4jcE34s

Listen on Apple Podcasts...2024-09-1134 min

The David Lin Report50 Bps Cut Next Week? Fed Could Shock Markets; China Is 'Imploding' | Alfonso PeccatielloAlfonso Peccatiello, Founder of the Macro Compass, discusses the economy in China, outlook for U.S. growth and inflation, monetary policy, and the investment implications of today's macroeconomic environment.

Watch Alfonso's last interview with me: https://youtu.be/pHThK8AQbxA?si=o5fds3u81jaxYwAj

This video is distributed on behalf of Kootenay Silver (TSX.V:KTN | OTC: KOOYF). Learn more about Kootenay Silver here: https://kootenaysilver.com/

*This video was recorded on September 10, 2024

Subscribe to my free newsletter: https://davidlinreport.substack.com/

Listen on Spotify: https://open.spotify.com/show/510WZMFaqeh90Xk4jcE34s

Listen on Apple Podcasts...2024-09-1134 min The Macro Trading FloorA Tale of Crowded Macro TradesAlf and Brent reflect on the immense volatility hitting markets recently, and specifically on the unwind of carry trades: are we done here or is there more to come? Most importantly, they describe how to design and apply a risk management and position sizing framework so that when everybody panics you don't need to.Want to reach out to Alf? Ping Alfonso Peccatiello on BloombergBrent Donnelly can also be reached on Bloomberg, or via spectramarkets.comTranscript link here: https://www.spectramarkets.com/the-macro-trading-floor-transcript-12-august-2024/2024-08-1036 min

The Macro Trading FloorA Tale of Crowded Macro TradesAlf and Brent reflect on the immense volatility hitting markets recently, and specifically on the unwind of carry trades: are we done here or is there more to come? Most importantly, they describe how to design and apply a risk management and position sizing framework so that when everybody panics you don't need to.Want to reach out to Alf? Ping Alfonso Peccatiello on BloombergBrent Donnelly can also be reached on Bloomberg, or via spectramarkets.comTranscript link here: https://www.spectramarkets.com/the-macro-trading-floor-transcript-12-august-2024/2024-08-1036 min The Macro Trading FloorMacro Mayhem!Alf and Brent reflect on the massive bond market rally and the explosive move in the Japanese Yen - what’s next for macro?To contact Alf: send him an email at info@palinurocapital.com or contact him on Bloomberg (Alfonso Peccatiello)To contact Brent: ping him on Bloomberg (Brent Donnelly) or go on http://www.spectramarkets.com/Brent’s piece on positioning: https://50in50.substack.com/p/trade-11-sentiment-and-positioningTranscript: https://www.spectramarkets.com/the-macro-trading-floor-transcript-02-august-2024/2024-08-0239 min

The Macro Trading FloorMacro Mayhem!Alf and Brent reflect on the massive bond market rally and the explosive move in the Japanese Yen - what’s next for macro?To contact Alf: send him an email at info@palinurocapital.com or contact him on Bloomberg (Alfonso Peccatiello)To contact Brent: ping him on Bloomberg (Brent Donnelly) or go on http://www.spectramarkets.com/Brent’s piece on positioning: https://50in50.substack.com/p/trade-11-sentiment-and-positioningTranscript: https://www.spectramarkets.com/the-macro-trading-floor-transcript-02-august-2024/2024-08-0239 min The Macro Trading FloorWhere To Find Cheap Macro OptionalityAlf and Brent look into various ''Trump trades'' now that the odds of a Trump election and Republican sweep have increased: is there still juice left? And where? Specifically, they also reflect on the use of options as macro traders.Want to see Alf's Cheap Optionality Monitor?Ping him (Alfonso Peccatiello) on BloombergAnd take advantage of Brent's course offer!Think Like a Market Professional:www.spectramarkets.com/school - use code JULY24 for $500 offSt...2024-07-1939 min

The Macro Trading FloorWhere To Find Cheap Macro OptionalityAlf and Brent look into various ''Trump trades'' now that the odds of a Trump election and Republican sweep have increased: is there still juice left? And where? Specifically, they also reflect on the use of options as macro traders.Want to see Alf's Cheap Optionality Monitor?Ping him (Alfonso Peccatiello) on BloombergAnd take advantage of Brent's course offer!Think Like a Market Professional:www.spectramarkets.com/school - use code JULY24 for $500 offSt...2024-07-1939 min The Macro Trading FloorIt's Macro ShowTime!Alf and Brent discuss the interesting market reaction to the weak US CPI report, and they dig deep into the '''Trump trade'': how would you trade a Trump victory and why? They also talk about the US Dollar and bond markets.Want to chat with Alf on Bloomberg? Ping him (Alfonso Peccatiello)You can find Brent's work on Spectra Markets or ping him on BBG (Brent Donnelly)Transcript of the episode: https://www.spectramarkets.com/the-macro-trading-floor-transcript-12-july-2024/Elm Toin Coss experiment: https://el...2024-07-1239 min

The Macro Trading FloorIt's Macro ShowTime!Alf and Brent discuss the interesting market reaction to the weak US CPI report, and they dig deep into the '''Trump trade'': how would you trade a Trump victory and why? They also talk about the US Dollar and bond markets.Want to chat with Alf on Bloomberg? Ping him (Alfonso Peccatiello)You can find Brent's work on Spectra Markets or ping him on BBG (Brent Donnelly)Transcript of the episode: https://www.spectramarkets.com/the-macro-trading-floor-transcript-12-july-2024/Elm Toin Coss experiment: https://el...2024-07-1239 min The Macro Trading FloorWhat Powell Really MeantA big macro week is behind us: the combination of CPI and PPI releases provide us with solid information on where the disinflation trend stands. Alf and Brent also discuss Powell’s press conference + change in dots and the European political risks.Want to get in touch with Alf or Brent?Ping Alfonso Peccatiello on BloombergPing Brent Donnelly on Bloomberg2024-06-1439 min

The Macro Trading FloorWhat Powell Really MeantA big macro week is behind us: the combination of CPI and PPI releases provide us with solid information on where the disinflation trend stands. Alf and Brent also discuss Powell’s press conference + change in dots and the European political risks.Want to get in touch with Alf or Brent?Ping Alfonso Peccatiello on BloombergPing Brent Donnelly on Bloomberg2024-06-1439 min The Macro Trading FloorRisk Management PrinciplesAlf and Brent discuss the ECB and Bank of Canada cuts, and reflect on the big bond market moves seen recently coupled with carry trade implosions. The discussion focuses around risk management principles to prevent bad left tail outcomes when running carry trades, and how to identify positive expected value trades in macro.Alf is offering a 2-weeks free trial to his institutional research: ping Alfonso Peccatiello on Bloomberg to get in.Brent just launched Spectra School: www.spectramarkets.com/schoolTranscript of this ep...2024-06-0738 min

The Macro Trading FloorRisk Management PrinciplesAlf and Brent discuss the ECB and Bank of Canada cuts, and reflect on the big bond market moves seen recently coupled with carry trade implosions. The discussion focuses around risk management principles to prevent bad left tail outcomes when running carry trades, and how to identify positive expected value trades in macro.Alf is offering a 2-weeks free trial to his institutional research: ping Alfonso Peccatiello on Bloomberg to get in.Brent just launched Spectra School: www.spectramarkets.com/schoolTranscript of this ep...2024-06-0738 min The Macro Trading FloorDon't Make This MistakeFree Trial to Alf's Institutional Research?Ping Alfonso Peccatiello on Bloomberg for more info!In this podcast, Alf invites Peter Farac (aka @countdraghula on Twitter) to the show.Peter brings a wealth of experience running money and has specific skills in rates and vol markets.Alf and Peter discuss where the US business cycle actually is, how markets are positioned, and talk shop: how do we actually trade these markets?Follow Peter @countdraghula on X, Free Newsletter: www.macroisdead.com2024-05-3128 min

The Macro Trading FloorDon't Make This MistakeFree Trial to Alf's Institutional Research?Ping Alfonso Peccatiello on Bloomberg for more info!In this podcast, Alf invites Peter Farac (aka @countdraghula on Twitter) to the show.Peter brings a wealth of experience running money and has specific skills in rates and vol markets.Alf and Peter discuss where the US business cycle actually is, how markets are positioned, and talk shop: how do we actually trade these markets?Follow Peter @countdraghula on X, Free Newsletter: www.macroisdead.com2024-05-3128 min The Macro Trading FloorHow To Trade Macro Now?(Links mentioned in the podcast are in the show notes below: check them out!)Alf and Brent discuss the soft patch the US seems to be going through and the CPI number released this week. If markets are going to continue with this low-vol grind higher, how do you trade macro now? Also, China seems to be cooking something big this time.- Contact me (Alfonso Peccatiello) on Bloomberg to check out the Crowded Trades Indicator- Link to Bill Bishop piece on China: 2024-05-1735 min

The Macro Trading FloorHow To Trade Macro Now?(Links mentioned in the podcast are in the show notes below: check them out!)Alf and Brent discuss the soft patch the US seems to be going through and the CPI number released this week. If markets are going to continue with this low-vol grind higher, how do you trade macro now? Also, China seems to be cooking something big this time.- Contact me (Alfonso Peccatiello) on Bloomberg to check out the Crowded Trades Indicator- Link to Bill Bishop piece on China: 2024-05-1735 min The David Lin Report'Fragilities' In Economy Exposed; 'Breakage' Is Next | Alfonso PeccatielloAlfonso Peccatiello, Founder of The Macro Compass, discusses the fragilities in the economy that will eventually lead to "breakage".

You’re being watched RIGHT NOW and the only way to stop it is by using a VPN. Avoid hacks and protect your privacy before it’s too late! NordVPN offers 65% Off on a 2-year plan +4 extra months! Try it for 30 days or GET YOUR CASH BACK!

https://nordvpn.com/davidlin

*This video was recorded on May 8, 2024

Listen on Spotify: https://open.spotify.com/show/510WZMF...

Listen on Apple Podcasts: https://podcasters.spotify.com/pod/sh...

FOLLOW ALFONSO PECCATIELLO:

Join thou...2024-05-1120 min

The David Lin Report'Fragilities' In Economy Exposed; 'Breakage' Is Next | Alfonso PeccatielloAlfonso Peccatiello, Founder of The Macro Compass, discusses the fragilities in the economy that will eventually lead to "breakage".

You’re being watched RIGHT NOW and the only way to stop it is by using a VPN. Avoid hacks and protect your privacy before it’s too late! NordVPN offers 65% Off on a 2-year plan +4 extra months! Try it for 30 days or GET YOUR CASH BACK!

https://nordvpn.com/davidlin

*This video was recorded on May 8, 2024

Listen on Spotify: https://open.spotify.com/show/510WZMF...

Listen on Apple Podcasts: https://podcasters.spotify.com/pod/sh...

FOLLOW ALFONSO PECCATIELLO:

Join thou...2024-05-1120 min The Julia La Roche Show#150 Alfonso Peccatiello On The Risk of a Global Recession Triggered by China's Deleveraging And The Spillover Effects Not Many Are Paying Attention ToAlfonso Peccatiello, founder of the Macro Compass, discusses the macro view of the current market and investor expectations.

He challenges the narrative of a structurally stronger US economy and presents a contrarian perspective. Peccatiello highlights the ambiguous data and warning signs in the economy, particularly in relation to China's deleveraging process and the spillover ripple effects on other economies.

Peccatiello emphasizes the importance of portfolio construction and diversification to protect purchasing power. He concludes by sharing his background and the launch of a macro fund.

Takeaways

Investors are adjusting th...2024-03-0730 min

The Julia La Roche Show#150 Alfonso Peccatiello On The Risk of a Global Recession Triggered by China's Deleveraging And The Spillover Effects Not Many Are Paying Attention ToAlfonso Peccatiello, founder of the Macro Compass, discusses the macro view of the current market and investor expectations.

He challenges the narrative of a structurally stronger US economy and presents a contrarian perspective. Peccatiello highlights the ambiguous data and warning signs in the economy, particularly in relation to China's deleveraging process and the spillover ripple effects on other economies.

Peccatiello emphasizes the importance of portfolio construction and diversification to protect purchasing power. He concludes by sharing his background and the launch of a macro fund.

Takeaways

Investors are adjusting th...2024-03-0730 min Resolve Riffs Investment PodcastAlfonso Peccatiello - Economic Uncertainty Ahead: Fix Your 60/40 Strategy NOWIn this discussion, the ReSolve team is joined by Alfonso Peccatiello, financial analyst, to discuss the current state of the economy, the impact of Biden's stimulus, and the intricacies of investing in the current financial landscape. They delve into a wide range of topics, providing valuable insights for anyone interested in understanding the complexities of the financial markets.Topics Discussed• The impact of Biden's stimulus on the economy and how it has helped the economic indicators pick up again• The current state of growth, inflation, and the cent...2023-11-301h 38

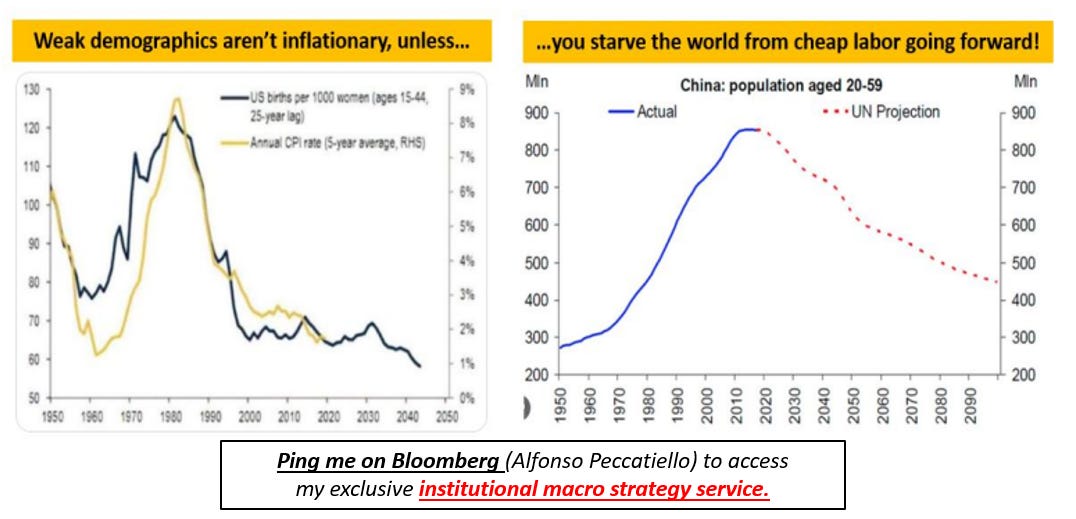

Resolve Riffs Investment PodcastAlfonso Peccatiello - Economic Uncertainty Ahead: Fix Your 60/40 Strategy NOWIn this discussion, the ReSolve team is joined by Alfonso Peccatiello, financial analyst, to discuss the current state of the economy, the impact of Biden's stimulus, and the intricacies of investing in the current financial landscape. They delve into a wide range of topics, providing valuable insights for anyone interested in understanding the complexities of the financial markets.Topics Discussed• The impact of Biden's stimulus on the economy and how it has helped the economic indicators pick up again• The current state of growth, inflation, and the cent...2023-11-301h 38 The Macro CompassInflation: What Next?Before we start, a short announcement:* If you are an institutional investor and you want to try my dedicated macro research, ping me on Bloomberg (Alfonso Peccatiello) for a 2-weeks free trial.I will also be in London on Dec 6: if you want to meet for business send over an email at pro@themacrocompass.com.Now, back to the piece!Forget inflation predictably floating around 1.5% as in the last decade.Does this mean this paradigm shift will see inflation consistently print at 4% going forward? Not necessarily. But...2023-11-2009 min

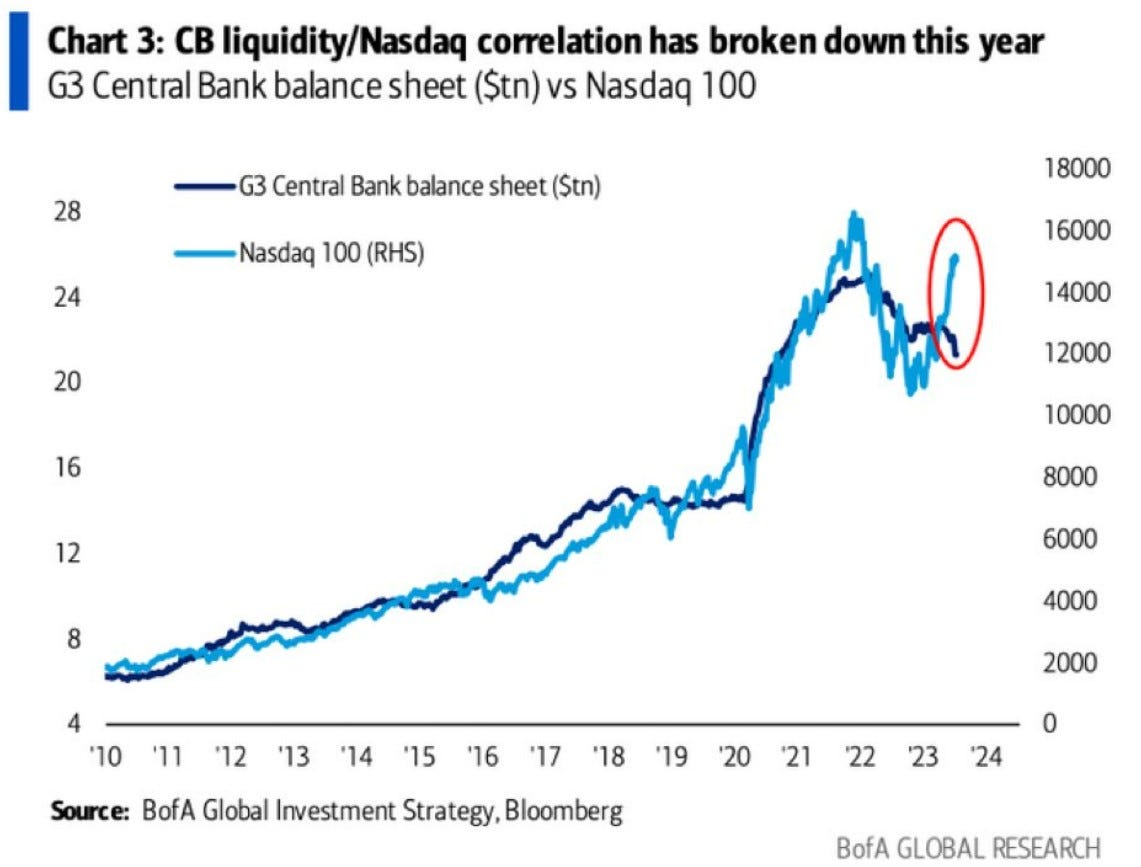

The Macro CompassInflation: What Next?Before we start, a short announcement:* If you are an institutional investor and you want to try my dedicated macro research, ping me on Bloomberg (Alfonso Peccatiello) for a 2-weeks free trial.I will also be in London on Dec 6: if you want to meet for business send over an email at pro@themacrocompass.com.Now, back to the piece!Forget inflation predictably floating around 1.5% as in the last decade.Does this mean this paradigm shift will see inflation consistently print at 4% going forward? Not necessarily. But...2023-11-2009 min The Macro CompassThe Liquidity IllusionThe big Central Bank week is here: ECB, BoJ, Fed…wow!Well…if you are an institutional investor who enjoys my macro analysis, I have great news for you!I just launched a live Bloomberg chat service and institutional research service dedicated to you!I'll cover macro, Central Bank and market events daily through an interactive BBG chat and deliver institutional-focused macro research pieces - ping me on Bloomberg (Alfonso Peccatiello) or email at pro@themacrocompass.com for a 2-weeks FREE trial!Yes: it costs you nothing to try!This is one...2023-07-2408 min

The Macro CompassThe Liquidity IllusionThe big Central Bank week is here: ECB, BoJ, Fed…wow!Well…if you are an institutional investor who enjoys my macro analysis, I have great news for you!I just launched a live Bloomberg chat service and institutional research service dedicated to you!I'll cover macro, Central Bank and market events daily through an interactive BBG chat and deliver institutional-focused macro research pieces - ping me on Bloomberg (Alfonso Peccatiello) or email at pro@themacrocompass.com for a 2-weeks FREE trial!Yes: it costs you nothing to try!This is one...2023-07-2408 min Supply ShockThe Recession Paradox | Alfonso PeccatielloFollow Forward Guidance On Spotify: https://spoti.fi/3Y0oueYFollow Forward Guidance On Apple Podcasts: https://apple.co/3hXQu2FFollow Blockworks Macro On YouTube: https://bit.ly/3NKpujX--Alfonso Peccatiello, founder of The Macro Compass, returns to Forward Guidance to discuss why there's no U.S. recession as of yet, how long is the lag of rate hikes' effect on the economy, and why bonds haven't performed well despite a rapid fall in inflation. Jack and Alfonso debate whether central banks print money, and Alfonso poses a spirited...2023-07-191h 12

Supply ShockThe Recession Paradox | Alfonso PeccatielloFollow Forward Guidance On Spotify: https://spoti.fi/3Y0oueYFollow Forward Guidance On Apple Podcasts: https://apple.co/3hXQu2FFollow Blockworks Macro On YouTube: https://bit.ly/3NKpujX--Alfonso Peccatiello, founder of The Macro Compass, returns to Forward Guidance to discuss why there's no U.S. recession as of yet, how long is the lag of rate hikes' effect on the economy, and why bonds haven't performed well despite a rapid fall in inflation. Jack and Alfonso debate whether central banks print money, and Alfonso poses a spirited...2023-07-191h 12 Forward GuidanceThe Recession Paradox | Alfonso PeccatielloAlfonso Peccatiello, founder of The Macro Compass, returns to Forward Guidance to discuss why there's no U.S. recession as of yet, how long is the lag of rate hikes' effect on the economy, and why bonds haven't performed well despite a rapid fall in inflation. Jack and Alfonso debate whether central banks print money, and Alfonso poses a spirited challenge to the predictive power of liquidity (bank reserves) on risk assets. Filmed on July 12, 2023.Follow Alfonso: https://twitter.com/MacroAlfFollow Jack Farley on Twitter https://twitter.com/JackFarley96...2023-07-161h 11

Forward GuidanceThe Recession Paradox | Alfonso PeccatielloAlfonso Peccatiello, founder of The Macro Compass, returns to Forward Guidance to discuss why there's no U.S. recession as of yet, how long is the lag of rate hikes' effect on the economy, and why bonds haven't performed well despite a rapid fall in inflation. Jack and Alfonso debate whether central banks print money, and Alfonso poses a spirited challenge to the predictive power of liquidity (bank reserves) on risk assets. Filmed on July 12, 2023.Follow Alfonso: https://twitter.com/MacroAlfFollow Jack Farley on Twitter https://twitter.com/JackFarley96...2023-07-161h 11 The Intrinsic Value Podcast - The Investor’s Podcast NetworkMI271: The Long Term Debt Cycle & De-Dollarization “Fairytale” Explained w/ Alfonso PeccatielloRebecca Hotsko and Alfonso Peccatiello discuss the current market outlook, including the driving force behind the market rally, its sustainability, Alfonso’s prediction of a 0% rate cut by the Fed in 2024, and a whole lot more!Alfonso Peccatiello is former Head of a $20 billion Investment Portfolio and now is the Founder and author of The Macro Compass, which is an investment strategy firm that provides financial education, macro insights and investment ideas.IN THIS EPISODE, YOU’LL LEARN:00:00 - Intro.02:05 - His current market outlook, whether this recent mark...2023-05-0954 min

The Intrinsic Value Podcast - The Investor’s Podcast NetworkMI271: The Long Term Debt Cycle & De-Dollarization “Fairytale” Explained w/ Alfonso PeccatielloRebecca Hotsko and Alfonso Peccatiello discuss the current market outlook, including the driving force behind the market rally, its sustainability, Alfonso’s prediction of a 0% rate cut by the Fed in 2024, and a whole lot more!Alfonso Peccatiello is former Head of a $20 billion Investment Portfolio and now is the Founder and author of The Macro Compass, which is an investment strategy firm that provides financial education, macro insights and investment ideas.IN THIS EPISODE, YOU’LL LEARN:00:00 - Intro.02:05 - His current market outlook, whether this recent mark...2023-05-0954 min The Macro Trading FloorFirst Republic Under Stress, Now What?Subscribe To The Macro Trading Floor: https://www.youtube.com/channel/UCFk1qCySNf2FIzIidVVW81A -- On today's episode of The Macro Trading Floor, Alfonso & Andreas discuss the continued banking turmoil as First Republic Bank lost around $100 Billion in deposits & saw its stock plunge over 95%. How will this impact loan growth & credit creation in the economy, and how will that in turn impact markets? To hear all this & more, you'll have to tune in! -- Follow Andreas: https://twitter.com/AndreasSteno Follow Alf: https://twitter.com/MacroAlf Follow Blockworks: https://twitter.com/Blockworks_ Subscribe To The Macro Compass: https://www...2023-04-3043 min

The Macro Trading FloorFirst Republic Under Stress, Now What?Subscribe To The Macro Trading Floor: https://www.youtube.com/channel/UCFk1qCySNf2FIzIidVVW81A -- On today's episode of The Macro Trading Floor, Alfonso & Andreas discuss the continued banking turmoil as First Republic Bank lost around $100 Billion in deposits & saw its stock plunge over 95%. How will this impact loan growth & credit creation in the economy, and how will that in turn impact markets? To hear all this & more, you'll have to tune in! -- Follow Andreas: https://twitter.com/AndreasSteno Follow Alf: https://twitter.com/MacroAlf Follow Blockworks: https://twitter.com/Blockworks_ Subscribe To The Macro Compass: https://www...2023-04-3043 min The Macro Trading FloorWhat's Happening In Global Macro?Subscribe to The Macro Trading Floor YouTube channel: https://www.youtube.com/channel/UCFk1qCySNf2FIzIidVVW81A -- On today's episode of The Macro Trading Floor, Alfonso & Andreas take a tour of the global macro landscape by looking at the key themes to watch around the globe. We discuss the signals emerging out of Asia and how this will spillover into European & U.S markets. To hear all this and more, you'll have to tune in! -- Follow Andreas: https://twitter.com/AndreasSteno Follow Alf: https://twitter.com/MacroAlf Follow Blockworks: https://twitter.com/Blockworks_ Subscribe To The Macro Compass...2023-04-2338 min

The Macro Trading FloorWhat's Happening In Global Macro?Subscribe to The Macro Trading Floor YouTube channel: https://www.youtube.com/channel/UCFk1qCySNf2FIzIidVVW81A -- On today's episode of The Macro Trading Floor, Alfonso & Andreas take a tour of the global macro landscape by looking at the key themes to watch around the globe. We discuss the signals emerging out of Asia and how this will spillover into European & U.S markets. To hear all this and more, you'll have to tune in! -- Follow Andreas: https://twitter.com/AndreasSteno Follow Alf: https://twitter.com/MacroAlf Follow Blockworks: https://twitter.com/Blockworks_ Subscribe To The Macro Compass...2023-04-2338 min The Macro Trading FloorHere Is Why Markets Are RallyingOn today's episode of The Macro Trading Floor, Alfonso & Andreas begin by breaking down the bank earnings on the back of the recent banking turmoil across markets. We then discuss why markets are rallying as everything from the S&P, Banks & Bitcoin begin to retrace prior losses. With the U.S Dollar also erasing its gains against other major currencies, is this the perfect environment for a continued rally, or not? Finally, Alf & Andreas share their actionable trade ideas, but to hear that, you'll have to tune in! -- Today's show is sponsored by Public.com: Get a 4.9% yield when...2023-04-1638 min

The Macro Trading FloorHere Is Why Markets Are RallyingOn today's episode of The Macro Trading Floor, Alfonso & Andreas begin by breaking down the bank earnings on the back of the recent banking turmoil across markets. We then discuss why markets are rallying as everything from the S&P, Banks & Bitcoin begin to retrace prior losses. With the U.S Dollar also erasing its gains against other major currencies, is this the perfect environment for a continued rally, or not? Finally, Alf & Andreas share their actionable trade ideas, but to hear that, you'll have to tune in! -- Today's show is sponsored by Public.com: Get a 4.9% yield when...2023-04-1638 min The Macro Trading FloorThe Hiking Cycle Is OverOn today's episode of The Macro Trading Floor, Alfonso & Andreas discuss the recent economic data releases and the growth slowdown they are signalling. We then explore the chances of a Fed pause/pivot. Have the probabilities increased since the recent turmoil in the banking system has given the Fed more cover to reign in their hawkish stance? Finally, Alfonso & Andreas share their actionable trade ideas, but to hear that, you'll have to tune in! -- Follow Andreas: https://twitter.com/AndreasSteno Follow Alf: https://twitter.com/MacroAlf Follow Blockworks: https://twitter.com/Blockworks_ Subscribe To The Macro Compass: https://www...2023-04-0934 min

The Macro Trading FloorThe Hiking Cycle Is OverOn today's episode of The Macro Trading Floor, Alfonso & Andreas discuss the recent economic data releases and the growth slowdown they are signalling. We then explore the chances of a Fed pause/pivot. Have the probabilities increased since the recent turmoil in the banking system has given the Fed more cover to reign in their hawkish stance? Finally, Alfonso & Andreas share their actionable trade ideas, but to hear that, you'll have to tune in! -- Follow Andreas: https://twitter.com/AndreasSteno Follow Alf: https://twitter.com/MacroAlf Follow Blockworks: https://twitter.com/Blockworks_ Subscribe To The Macro Compass: https://www...2023-04-0934 min The Macro Trading FloorThe End of The US Dollar?On today's episode of The Macro Trading Floor, Alfonso & Andreas begin by discussing the banking turmoil of recent weeks and how commercial real estate could impact loan books in both the U.S and Europe. Alfonso & Andreas then move on to discuss the hot topic of the week, the U.S Dollar. With headlines hitting the wire mentioning energy transactions being conducted in Yuan and further relations between the BRICS nations, some investors believe this is a pivotal moment in the end of the U.S Dollar as world reserve currency. Alfonso & Andreas walk through what characteristics make a world...2023-04-0233 min

The Macro Trading FloorThe End of The US Dollar?On today's episode of The Macro Trading Floor, Alfonso & Andreas begin by discussing the banking turmoil of recent weeks and how commercial real estate could impact loan books in both the U.S and Europe. Alfonso & Andreas then move on to discuss the hot topic of the week, the U.S Dollar. With headlines hitting the wire mentioning energy transactions being conducted in Yuan and further relations between the BRICS nations, some investors believe this is a pivotal moment in the end of the U.S Dollar as world reserve currency. Alfonso & Andreas walk through what characteristics make a world...2023-04-0233 min The DerivativeSearching for Volatile Macro Environments with Alfonso Peccatiello, The Macro CompassWhat was the short-lived SVB baking crisis all about? Has it forced the Fed’s hand? Are we done tightening? Lots of Macro questions so who better to dig into it with than the appropriately nicknamed Macro Alf. In this episode of The Derivative, we sit down with Alfonso Peccatiello, founder of The Macro Compass and owner of the wonderful Twitter handle @MacroAlf to discuss the challenges of generating alpha in a low-volatility environment.

Peccatiello shares his experience of working for ING Bank and managing the Treasury Department's investment portfolio, how regulatory forces have pushed the large player...2023-03-301h 02

The DerivativeSearching for Volatile Macro Environments with Alfonso Peccatiello, The Macro CompassWhat was the short-lived SVB baking crisis all about? Has it forced the Fed’s hand? Are we done tightening? Lots of Macro questions so who better to dig into it with than the appropriately nicknamed Macro Alf. In this episode of The Derivative, we sit down with Alfonso Peccatiello, founder of The Macro Compass and owner of the wonderful Twitter handle @MacroAlf to discuss the challenges of generating alpha in a low-volatility environment.

Peccatiello shares his experience of working for ING Bank and managing the Treasury Department's investment portfolio, how regulatory forces have pushed the large player...2023-03-301h 02 The Macro Trading FloorBanks: The Big PictureOn today's episode of The Macro Trading Floor, Alfonso & Andreas discuss the continued turmoil across the banking sector. Alfonso & Andreas break down the liquidity measures set in place for the current period of banking turmoil which include the Fed's discount window, Bank Term Funding Program and the record $60 billion usage in the FIMA repo facility. To hear all this and more, you'll have to tune in! -- Follow Andreas: https://twitter.com/AndreasSteno Follow Alf: https://twitter.com/MacroAlf Follow Blockworks: https://twitter.com/Blockworks_ Subscribe To The Macro Compass: https://www.themacrocompass.com/ Subscribe To Steno Research: https://stenoresearch...2023-03-2648 min

The Macro Trading FloorBanks: The Big PictureOn today's episode of The Macro Trading Floor, Alfonso & Andreas discuss the continued turmoil across the banking sector. Alfonso & Andreas break down the liquidity measures set in place for the current period of banking turmoil which include the Fed's discount window, Bank Term Funding Program and the record $60 billion usage in the FIMA repo facility. To hear all this and more, you'll have to tune in! -- Follow Andreas: https://twitter.com/AndreasSteno Follow Alf: https://twitter.com/MacroAlf Follow Blockworks: https://twitter.com/Blockworks_ Subscribe To The Macro Compass: https://www.themacrocompass.com/ Subscribe To Steno Research: https://stenoresearch...2023-03-2648 min The Macro Trading FloorFrom Liquidity To A Credit CrisisOn today's episode of The Macro Trading Floor, Alfonso & Andreas discuss the continued fallout from the collapse of Silicon Valley Bank, and what it means for markets. The Fed's H.4.1 report was released this past week, which saw the balance sheet increasing by roughly $300 Billion. The balance sheet increase consisted of a record $152.9 billion usage in the Fed's discount window, $11.9 billion in the Fed's new BTFP facility & a final $142.8bn to guarantee all deposits at SVB and Signature Bank. With a rally in risk asset's, many viewed this as the return of QE, similar to the 2019 repo crisis. In this...2023-03-1944 min

The Macro Trading FloorFrom Liquidity To A Credit CrisisOn today's episode of The Macro Trading Floor, Alfonso & Andreas discuss the continued fallout from the collapse of Silicon Valley Bank, and what it means for markets. The Fed's H.4.1 report was released this past week, which saw the balance sheet increasing by roughly $300 Billion. The balance sheet increase consisted of a record $152.9 billion usage in the Fed's discount window, $11.9 billion in the Fed's new BTFP facility & a final $142.8bn to guarantee all deposits at SVB and Signature Bank. With a rally in risk asset's, many viewed this as the return of QE, similar to the 2019 repo crisis. In this...2023-03-1944 min The Macro Trading FloorPanic In The Banking SystemOn today's episode of The Macro Trading Floor, Alfonso & Andreas walk through the collapse of Silicon Valley Bank. On a historic week where we saw the collapse of the largest bank since 2008, we walk through the dynamics throughout 2020 - 2023 that caused SVB to fail, what risks lie ahead and if we should expect spillovers into the broader banking system. To hear all this and more, you'll have to tune in! -- Follow Andreas: https://twitter.com/AndreasSteno Follow Alf: https://twitter.com/MacroAlf Follow Blockworks: https://twitter.com/Blockworks_ Subscribe To The Macro Compass: https://www.themacrocompass.com/ Subscribe To...2023-03-1243 min

The Macro Trading FloorPanic In The Banking SystemOn today's episode of The Macro Trading Floor, Alfonso & Andreas walk through the collapse of Silicon Valley Bank. On a historic week where we saw the collapse of the largest bank since 2008, we walk through the dynamics throughout 2020 - 2023 that caused SVB to fail, what risks lie ahead and if we should expect spillovers into the broader banking system. To hear all this and more, you'll have to tune in! -- Follow Andreas: https://twitter.com/AndreasSteno Follow Alf: https://twitter.com/MacroAlf Follow Blockworks: https://twitter.com/Blockworks_ Subscribe To The Macro Compass: https://www.themacrocompass.com/ Subscribe To...2023-03-1243 min The Macro Trading FloorIt's Lonely On Disinflation IslandOn today's episode of The Macro Trading Floor, Alfonso & Andreas discuss the data points suggesting a possible resurgence of inflation in both the U.S and Europe. As the yield curve continues to reprice higher, how does this impact the higher for longer thesis in rates? Alf and Andreas then share their actionable trade ideas, but to hear that, you'll have to tune in! -- Today's show is sponsored by Public.com: Get a 5.1% yield when you open a government-backed Treasury Account.* That's a higher yield than a high-yield savings account.** Go to https://public.com/macrotradingfloor *26-week T-bill rate...2023-03-0534 min

The Macro Trading FloorIt's Lonely On Disinflation IslandOn today's episode of The Macro Trading Floor, Alfonso & Andreas discuss the data points suggesting a possible resurgence of inflation in both the U.S and Europe. As the yield curve continues to reprice higher, how does this impact the higher for longer thesis in rates? Alf and Andreas then share their actionable trade ideas, but to hear that, you'll have to tune in! -- Today's show is sponsored by Public.com: Get a 5.1% yield when you open a government-backed Treasury Account.* That's a higher yield than a high-yield savings account.** Go to https://public.com/macrotradingfloor *26-week T-bill rate...2023-03-0534 min The Macro Trading FloorThere's No Bull Case For Risk AssetsOn today's episode of The Macro Trading Floor, Alfonso & Andreas walk through the biggest stories of the week and discuss everyone's most asked question right now, hard landing, soft landing or no landing? As the U.S housing market drops the most since 2008, will the economy be able to handle higher rates for a sustained period of time? Alfonso & Andreas then walk through the best risk and reward trades in markets right now. To hear all this and more, you'll have to tune in! -- Follow Andreas: https://twitter.com/AndreasSteno Follow Alf: https://twitter.com/MacroAlf Follow Blockworks: https...2023-02-2637 min

The Macro Trading FloorThere's No Bull Case For Risk AssetsOn today's episode of The Macro Trading Floor, Alfonso & Andreas walk through the biggest stories of the week and discuss everyone's most asked question right now, hard landing, soft landing or no landing? As the U.S housing market drops the most since 2008, will the economy be able to handle higher rates for a sustained period of time? Alfonso & Andreas then walk through the best risk and reward trades in markets right now. To hear all this and more, you'll have to tune in! -- Follow Andreas: https://twitter.com/AndreasSteno Follow Alf: https://twitter.com/MacroAlf Follow Blockworks: https...2023-02-2637 min The Macro Trading FloorWhy Is Powell Ignoring "Animal Spirits"On today's episode of The Macro Trading Floor, Alfonso & Andreas reflect on the first six weeks of 2023. As most investors anticipated recessionary pressures in H1, and for markets to head lower, so far "animal spirits" persist, economic data remains strong and markets refuse to budge. Finally, Alf & Andreas share their actionable trade ideas, but to hear that, you'll have to tune in! -- Follow Andreas: https://twitter.com/AndreasSteno Follow Alf: https://twitter.com/MacroAlf Follow Blockworks: https://twitter.com/Blockworks_ Subscribe To The Macro Compass: https://www.themacrocompass.com/ Subscribe To Steno Research: https://stenoresearch.com/ Get top market...2023-02-1939 min

The Macro Trading FloorWhy Is Powell Ignoring "Animal Spirits"On today's episode of The Macro Trading Floor, Alfonso & Andreas reflect on the first six weeks of 2023. As most investors anticipated recessionary pressures in H1, and for markets to head lower, so far "animal spirits" persist, economic data remains strong and markets refuse to budge. Finally, Alf & Andreas share their actionable trade ideas, but to hear that, you'll have to tune in! -- Follow Andreas: https://twitter.com/AndreasSteno Follow Alf: https://twitter.com/MacroAlf Follow Blockworks: https://twitter.com/Blockworks_ Subscribe To The Macro Compass: https://www.themacrocompass.com/ Subscribe To Steno Research: https://stenoresearch.com/ Get top market...2023-02-1939 min The Macro Trading FloorRecession, Soft Landing or Higher For Longer? | Kevin FlanaganOn today's episode of The Macro Trading Floor, Andreas and Alfonso welcome Kevin Flanagan Head of Fixed Income Strategy at WisdomTree for a discussion on everything happening in global bond markets. Since 2022, the consensus has flip flopped from recession, to soft landing as markets have rallied, the labor market has remained strong, credit has been fairly contained and signs of financial stress dwindle. Kevin, Alfonso and Andreas walk through the scenarios in 2023 of recession, soft landing or higher for longer? Finally, Kevin shares his actionable trade idea, but to hear that, you'll have to tune in! -- Follow Kevin: https...2023-02-1257 min

The Macro Trading FloorRecession, Soft Landing or Higher For Longer? | Kevin FlanaganOn today's episode of The Macro Trading Floor, Andreas and Alfonso welcome Kevin Flanagan Head of Fixed Income Strategy at WisdomTree for a discussion on everything happening in global bond markets. Since 2022, the consensus has flip flopped from recession, to soft landing as markets have rallied, the labor market has remained strong, credit has been fairly contained and signs of financial stress dwindle. Kevin, Alfonso and Andreas walk through the scenarios in 2023 of recession, soft landing or higher for longer? Finally, Kevin shares his actionable trade idea, but to hear that, you'll have to tune in! -- Follow Kevin: https...2023-02-1257 min The Macro Trading FloorAnimal Spirits Are Back For MarketsOn today's episode of The Macro Trading Floor, Alfonso & Andreas take a look into another busy week in central banking with the Fed, ECB & BoE all announcing further rate hikes on their tightening cycles. Markets have rallied through January with the S&P 500 returning roughly 8% so far in 2023. With the most speculative risk asset's rallying the most, it seems that "animal spirits" are back for investors. Alfonso & Andreas walk through the liquidity backdrop before sharing their actionable trade ideas, but to hear that, you'll have to tune in! -- Follow Andreas: https://twitter.com/AndreasSteno Follow Alf: https://twitter.com...2023-02-0532 min

The Macro Trading FloorAnimal Spirits Are Back For MarketsOn today's episode of The Macro Trading Floor, Alfonso & Andreas take a look into another busy week in central banking with the Fed, ECB & BoE all announcing further rate hikes on their tightening cycles. Markets have rallied through January with the S&P 500 returning roughly 8% so far in 2023. With the most speculative risk asset's rallying the most, it seems that "animal spirits" are back for investors. Alfonso & Andreas walk through the liquidity backdrop before sharing their actionable trade ideas, but to hear that, you'll have to tune in! -- Follow Andreas: https://twitter.com/AndreasSteno Follow Alf: https://twitter.com...2023-02-0532 min Venture Europe: Entrepreneurship | Technology | Venture Capital | Eu/AccAlfonso Peccatiello - The effect of high interest rates on the economy, The probability of a recession, Europe position in the changing world order, Strategies to protect capitalIn the last 6 months I was trying to wrap my little head around the macro environment and the effects on the economy and to be honest on my pocket. I just didn't know how inflation, interest rate hikes, and debt cycles fit together to be able to create an investment thesis or at least protect my capital.

Our guest today will try to answer some of these questions so please welcome Alfonso Peccatiello Founder & CEO of The Macro Compass.

The Macro Compass is an investment strategy firm whose mission is to democratize professional macro analysis, b...2023-01-3137 min

Venture Europe: Entrepreneurship | Technology | Venture Capital | Eu/AccAlfonso Peccatiello - The effect of high interest rates on the economy, The probability of a recession, Europe position in the changing world order, Strategies to protect capitalIn the last 6 months I was trying to wrap my little head around the macro environment and the effects on the economy and to be honest on my pocket. I just didn't know how inflation, interest rate hikes, and debt cycles fit together to be able to create an investment thesis or at least protect my capital.

Our guest today will try to answer some of these questions so please welcome Alfonso Peccatiello Founder & CEO of The Macro Compass.

The Macro Compass is an investment strategy firm whose mission is to democratize professional macro analysis, b...2023-01-3137 min The Macro Trading FloorIs The Recession Already Over?On today's episode of "The Macro Trading Floor," Andreas and Alfonso interpret the latest macroeconomic data and prepare for a week of important central bank meetings. They wonder whether the recent bullish movements in nearly every risk asset is a sign that quantitative easing (QE) is back on a global scale (the answer is a firm “no”). After discussing commodity prices, Andreas and Alfonso explore whether a very unusual kind of recession occurred in 2022 that is already over. Lastly, they share their actionable trade ideas. Filmed on January 26th, 2023. -- Follow Andreas: https://twitter.com/AndreasSteno Follow Alf: https://twitter.com...2023-01-2932 min

The Macro Trading FloorIs The Recession Already Over?On today's episode of "The Macro Trading Floor," Andreas and Alfonso interpret the latest macroeconomic data and prepare for a week of important central bank meetings. They wonder whether the recent bullish movements in nearly every risk asset is a sign that quantitative easing (QE) is back on a global scale (the answer is a firm “no”). After discussing commodity prices, Andreas and Alfonso explore whether a very unusual kind of recession occurred in 2022 that is already over. Lastly, they share their actionable trade ideas. Filmed on January 26th, 2023. -- Follow Andreas: https://twitter.com/AndreasSteno Follow Alf: https://twitter.com...2023-01-2932 min Holland GoldAlfonso Peccatiello on the end of cheap energy, labor and money - Holland Gold, Monetary Horizons XL 2023 #4Alfonso Peccatiello, Founder and CEO of 'The Macro Compass', presents his views on macro-economics at the Holland Gold Monetary Horizons XL Event. Alfonso worked for many years as Head of Investments at ING Germany. Nowadays, he provides his subscribers via ' The Macro Compass' with extensive analyses on macro-economics and links this to concrete advice. Alfonso expects challenging times for the European economy.

He explains why the European economy has been able to prosper in recent decades and why this is likely to be different in the coming years. Due to the war between Russia and Ukraine...2023-01-2443 min

Holland GoldAlfonso Peccatiello on the end of cheap energy, labor and money - Holland Gold, Monetary Horizons XL 2023 #4Alfonso Peccatiello, Founder and CEO of 'The Macro Compass', presents his views on macro-economics at the Holland Gold Monetary Horizons XL Event. Alfonso worked for many years as Head of Investments at ING Germany. Nowadays, he provides his subscribers via ' The Macro Compass' with extensive analyses on macro-economics and links this to concrete advice. Alfonso expects challenging times for the European economy.

He explains why the European economy has been able to prosper in recent decades and why this is likely to be different in the coming years. Due to the war between Russia and Ukraine...2023-01-2443 min The Macro Trading FloorAre Markets Really Priced For A Recession? | John NormandOn today's episode of The Macro Trading Floor, Andreas and Alfonso welcome John Normand Cross-Asset Strategist, JPM alum for a global macro tour of the world. John walks through the most anticipated recession in history by looking at the current market pricing in FX, rates and credit. Has the forecasted slowdown in 2023 really started to rear its head under the headlines in financial media? John then goes on to discuss the Chinese reopening and what implications the second largest economy coming back online will have for the rest of the global economy as inflation continues on it's current downtrend. Finally...2023-01-2255 min

The Macro Trading FloorAre Markets Really Priced For A Recession? | John NormandOn today's episode of The Macro Trading Floor, Andreas and Alfonso welcome John Normand Cross-Asset Strategist, JPM alum for a global macro tour of the world. John walks through the most anticipated recession in history by looking at the current market pricing in FX, rates and credit. Has the forecasted slowdown in 2023 really started to rear its head under the headlines in financial media? John then goes on to discuss the Chinese reopening and what implications the second largest economy coming back online will have for the rest of the global economy as inflation continues on it's current downtrend. Finally...2023-01-2255 min The Macro Trading FloorMacro Is Back With A Vengeance | Steve DrobnyOn today's episode of "The Macro Trading Floor," Andreas and Alfonso welcome Steve Drobny Founder and CEO at Clocktower Group for an inside look into the hedge fund industry. With the past two years spurring the return of macro volatility, many macro hedge funds have arisen, posting high returns in the timeframe. Steve, with his extensive connections in the hedge fund industry, walks through the past two years of higher inflation and how this changed the investing landscape compared to the 12 years prior. He then goes on to discuss what the coming decade could look like. Have we entered a...2023-01-1548 min

The Macro Trading FloorMacro Is Back With A Vengeance | Steve DrobnyOn today's episode of "The Macro Trading Floor," Andreas and Alfonso welcome Steve Drobny Founder and CEO at Clocktower Group for an inside look into the hedge fund industry. With the past two years spurring the return of macro volatility, many macro hedge funds have arisen, posting high returns in the timeframe. Steve, with his extensive connections in the hedge fund industry, walks through the past two years of higher inflation and how this changed the investing landscape compared to the 12 years prior. He then goes on to discuss what the coming decade could look like. Have we entered a...2023-01-1548 min The Macro Trading FloorThe Chinese Reopening: Bullish Or Bearish Oil? | Nitesh ShahOn today's episode of "The Macro Trading Floor," Andreas and Alfonso welcome Nitesh Shah Head of Commodity and Macroeconomic Research at WisdomTree for a discussion on the China reopening, how it will effect commodity markets and it's impact on broader markets. Energy was the strongest performing sector in 2022, but should we expect the same in 2023? Nitesh walks through the commodity supercycle thesis, as it conflicts with a business cycle downturn in 2023 and what this could mean for commodities, specifically oil, heading into 2023 and beyond. Finally, Nitesh shares his actionable trade idea, but to hear that, you'll have to tune in...2023-01-0856 min

The Macro Trading FloorThe Chinese Reopening: Bullish Or Bearish Oil? | Nitesh ShahOn today's episode of "The Macro Trading Floor," Andreas and Alfonso welcome Nitesh Shah Head of Commodity and Macroeconomic Research at WisdomTree for a discussion on the China reopening, how it will effect commodity markets and it's impact on broader markets. Energy was the strongest performing sector in 2022, but should we expect the same in 2023? Nitesh walks through the commodity supercycle thesis, as it conflicts with a business cycle downturn in 2023 and what this could mean for commodities, specifically oil, heading into 2023 and beyond. Finally, Nitesh shares his actionable trade idea, but to hear that, you'll have to tune in...2023-01-0856 min The Macro Trading FloorA 2023 Global Macro Outlook | Alfonso Peccatiello & Andreas Steno LarsenOn today's episode of "The Macro Trading Floor," Andreas and Alfonso look back at 2022, before sharing their global macro outlook for 2023. Reflecting on the best trades of the year, Andreas and Alfonso remember the greatest trades put forward by our guests in 2022. Turning to 2023, just how will the events of 2022 shape the global macro picture? We dive into the equity market outlook, what the liquidity cycle is telling us and finally, Andreas and Alfonso share their actionable trade ideas. To hear all this and more, you'll have to tune in! -- Follow Andreas: https://twitter.com/AndreasSteno Follow Alf: https...2023-01-0147 min

The Macro Trading FloorA 2023 Global Macro Outlook | Alfonso Peccatiello & Andreas Steno LarsenOn today's episode of "The Macro Trading Floor," Andreas and Alfonso look back at 2022, before sharing their global macro outlook for 2023. Reflecting on the best trades of the year, Andreas and Alfonso remember the greatest trades put forward by our guests in 2022. Turning to 2023, just how will the events of 2022 shape the global macro picture? We dive into the equity market outlook, what the liquidity cycle is telling us and finally, Andreas and Alfonso share their actionable trade ideas. To hear all this and more, you'll have to tune in! -- Follow Andreas: https://twitter.com/AndreasSteno Follow Alf: https...2023-01-0147 min The Macro Trading FloorInflation Will Fall off A Cliff In 2023 | Warren PiesOn today's episode of "The Macro Trading Floor," Andreas and Alfonso welcome Warren Pies Founder of 3Fourteen Research for a discussion on what to expect as we head into 2023. Warren begins by walking through the current macro cycle he sees us in as we wrap up 2022 and head into 2023. As the yield curve displays some very important signals, Warren draws historical comparisons over the past 40+ years that help investors understand when the Fed might be forced to pause on their current tightening cycle. Expecting inflation to significantly reduce next year, Warren identifies a good risk reward scenario in the bond...2022-12-2557 min

The Macro Trading FloorInflation Will Fall off A Cliff In 2023 | Warren PiesOn today's episode of "The Macro Trading Floor," Andreas and Alfonso welcome Warren Pies Founder of 3Fourteen Research for a discussion on what to expect as we head into 2023. Warren begins by walking through the current macro cycle he sees us in as we wrap up 2022 and head into 2023. As the yield curve displays some very important signals, Warren draws historical comparisons over the past 40+ years that help investors understand when the Fed might be forced to pause on their current tightening cycle. Expecting inflation to significantly reduce next year, Warren identifies a good risk reward scenario in the bond...2022-12-2557 min Insight is Capital™ PodcastAlfonso Peccatiello: Macro 301 – Behind today's most crucial macroeconomic, market concernsAlfonso Peccatiello, Founder, CEO, & Macro Strategist at The Macro Compass (https://themacrocompass.com) joins us for an amazing deep dive into what is behind all of today's macro-economic and macro-market considerations and discussions. If you're interested in getting at what is at the heart of today's volatile inflation, interest rate, bond yield, and monetary policy considerations across all regions including Europe and the US, don't miss this conversation.Alfonso Peccatiello's explanation of what is driving all macro considerations in the sobering monetary policy environment we find ourselves in today, is eye-opening. Macro Alf, (@macroalf on Twitter) as...2022-12-191h 08

Insight is Capital™ PodcastAlfonso Peccatiello: Macro 301 – Behind today's most crucial macroeconomic, market concernsAlfonso Peccatiello, Founder, CEO, & Macro Strategist at The Macro Compass (https://themacrocompass.com) joins us for an amazing deep dive into what is behind all of today's macro-economic and macro-market considerations and discussions. If you're interested in getting at what is at the heart of today's volatile inflation, interest rate, bond yield, and monetary policy considerations across all regions including Europe and the US, don't miss this conversation.Alfonso Peccatiello's explanation of what is driving all macro considerations in the sobering monetary policy environment we find ourselves in today, is eye-opening. Macro Alf, (@macroalf on Twitter) as...2022-12-191h 08 The Macro Trading FloorFelix Zulauf: The Fed Is Making A Policy ErrorOn today's episode of "The Macro Trading Floor," Andreas and Alfonso welcome Felix Zulauf of Zulauf Consulting for a discussion on the changing macro landscape and the policy error the Fed is making. Taking us on a global macro tour of the world, Felix argues that the past few decades of globalization could now be in reverse, and most investors are not well positioned for that transition. We then go on to discuss the trends in inflation, wether we will enter a recession in 2023 and finally Felix's actionable trade idea. To hear all this and more, you'll have to tune...2022-12-191h 04

The Macro Trading FloorFelix Zulauf: The Fed Is Making A Policy ErrorOn today's episode of "The Macro Trading Floor," Andreas and Alfonso welcome Felix Zulauf of Zulauf Consulting for a discussion on the changing macro landscape and the policy error the Fed is making. Taking us on a global macro tour of the world, Felix argues that the past few decades of globalization could now be in reverse, and most investors are not well positioned for that transition. We then go on to discuss the trends in inflation, wether we will enter a recession in 2023 and finally Felix's actionable trade idea. To hear all this and more, you'll have to tune...2022-12-191h 04 The Macro Trading FloorJurrien Timmer: The Trade For A 2023 RecessionOn today's episode of "The Macro Trading Floor," Andreas and Alfonso welcome Jurrien Timmer Director of Global Macro at Fidelity for a discussion about the recession many analysts see ahead in 2023. How could a recession in 2023 effect corporate earnings and markets more broadly? As liquidity ha already declined throughout 2022, could a recession be the catalyst to bring markets lower? Jurrien walks through all these dynamics and how the tightening of financial conditions has impacted Jurrien's favoured discount cash flow model. Finally, Jurrien shares his actionable trade idea, but to hear that, you'll have to tune in! -- Follow Jurrien: https...2022-12-1155 min

The Macro Trading FloorJurrien Timmer: The Trade For A 2023 RecessionOn today's episode of "The Macro Trading Floor," Andreas and Alfonso welcome Jurrien Timmer Director of Global Macro at Fidelity for a discussion about the recession many analysts see ahead in 2023. How could a recession in 2023 effect corporate earnings and markets more broadly? As liquidity ha already declined throughout 2022, could a recession be the catalyst to bring markets lower? Jurrien walks through all these dynamics and how the tightening of financial conditions has impacted Jurrien's favoured discount cash flow model. Finally, Jurrien shares his actionable trade idea, but to hear that, you'll have to tune in! -- Follow Jurrien: https...2022-12-1155 min The Macro Trading FloorHow To Trade The Chinese Turbulence | Alex CampbellWe apologise for any minor audio issues you may experience on today's episode. -- On today's episode of "The Macro Trading Floor," Andreas and Alfonso welcome Alex Campbell, the Founder of Rose AI, to the show for a discussion on the current situation in China. As inflation, de-globalization, and tight commodity markets continue to impact markets, Alex provides insights on the best ways to protect yourself in today's environment. Drawing on his extensive experience as the Head of Commodities at Bridgewater Associates, Alex delves into the structural underinvestment in the sector, how geopolitics have shaped the markets in 2022, and the...2022-12-0457 min

The Macro Trading FloorHow To Trade The Chinese Turbulence | Alex CampbellWe apologise for any minor audio issues you may experience on today's episode. -- On today's episode of "The Macro Trading Floor," Andreas and Alfonso welcome Alex Campbell, the Founder of Rose AI, to the show for a discussion on the current situation in China. As inflation, de-globalization, and tight commodity markets continue to impact markets, Alex provides insights on the best ways to protect yourself in today's environment. Drawing on his extensive experience as the Head of Commodities at Bridgewater Associates, Alex delves into the structural underinvestment in the sector, how geopolitics have shaped the markets in 2022, and the...2022-12-0457 min The Macro Trading FloorThomas Thornton: This Bear Market Isn't Over YetOn today’s episode of “The Macro Trading Floor,” Andreas and Alfonso welcome Thomas Thornton of Hedge Fund Telemetry joins the show to discuss the equity bear market in 2022. Tommy walks through what has happened in 2022, and what to expect in 2023 as investors face uncertainty if the recent rally is a bear market rally, or a bottom. Tommy goes on to discuss the energy trade and where the best risk/reward is in markets right now. Finally, Tommy shares his actionable trade idea, but to hear that, you'll have to tune in! -- Follow Tommy: https://twitter.com/TommyThornton Follow Andrea...2022-11-2753 min

The Macro Trading FloorThomas Thornton: This Bear Market Isn't Over YetOn today’s episode of “The Macro Trading Floor,” Andreas and Alfonso welcome Thomas Thornton of Hedge Fund Telemetry joins the show to discuss the equity bear market in 2022. Tommy walks through what has happened in 2022, and what to expect in 2023 as investors face uncertainty if the recent rally is a bear market rally, or a bottom. Tommy goes on to discuss the energy trade and where the best risk/reward is in markets right now. Finally, Tommy shares his actionable trade idea, but to hear that, you'll have to tune in! -- Follow Tommy: https://twitter.com/TommyThornton Follow Andrea...2022-11-2753 min The Macro Trading FloorJacob Shapiro: From Globalization To A Multipolar WorldOn today’s episode of “The Macro Trading Floor,” Andreas and Alfonso welcome Jacob Shapiro, Director of Geopolitics at Cognitive Investments for a discussion on the global trend to a multipolar world. In 2022, geopolitics has been one of the leading factors in markets, so we invited an expert in geopolitics to help us navigate this environment. Expecting a shift away from globalization and a more multipolar world over the next decade, this trend has many implications for economies around the world. Jacob walks through the U.S/China relations, Europe's energy crisis and discusses which countries are best positioned in this e...2022-11-2059 min

The Macro Trading FloorJacob Shapiro: From Globalization To A Multipolar WorldOn today’s episode of “The Macro Trading Floor,” Andreas and Alfonso welcome Jacob Shapiro, Director of Geopolitics at Cognitive Investments for a discussion on the global trend to a multipolar world. In 2022, geopolitics has been one of the leading factors in markets, so we invited an expert in geopolitics to help us navigate this environment. Expecting a shift away from globalization and a more multipolar world over the next decade, this trend has many implications for economies around the world. Jacob walks through the U.S/China relations, Europe's energy crisis and discusses which countries are best positioned in this e...2022-11-2059 min The Macro Trading FloorThe Real Stress Is Not In The US, But Elsewhere | Brent DonnellyOn today’s episode of “The Macro Trading Floor,” Andreas and Alfonso welcome Brent Donnelly President of Spectra Markets for a discussion on the economic weakness around the world. With market participants focusing on the U.S as Powell continues to fight inflation, Brent reminds us that the real stress is not in the U.S, but elsewhere. Looking to Canada, Brent walks through the fragility he sees in the Canadian economy, and discusses vulnerability in the housing market as mortgages reprice with higher interest rates. Finally, Brent shares his actionable trade idea, but to hear that, you'll have to tune i...2022-11-1355 min

The Macro Trading FloorThe Real Stress Is Not In The US, But Elsewhere | Brent DonnellyOn today’s episode of “The Macro Trading Floor,” Andreas and Alfonso welcome Brent Donnelly President of Spectra Markets for a discussion on the economic weakness around the world. With market participants focusing on the U.S as Powell continues to fight inflation, Brent reminds us that the real stress is not in the U.S, but elsewhere. Looking to Canada, Brent walks through the fragility he sees in the Canadian economy, and discusses vulnerability in the housing market as mortgages reprice with higher interest rates. Finally, Brent shares his actionable trade idea, but to hear that, you'll have to tune i...2022-11-1355 min The Macro Trading FloorDebt, Demographics & Deflation Ahead | Raoul PalOn today’s episode of “The Macro Trading Floor,” Andreas and Alfonso welcome Raoul Pal CEO & Co-Founder, Real Vision & Global Macro Investor to the show for a discussion on debt, demographics and deflationary pressures. Raoul discusses some of the structural deflationary forces that lie ahead for markets. How will these forces effect markets as the Fed, and central banks globally, progress through their fastest tightening cycle in recent history. How are rising rates & high inflation changing asset allocation in this period? Finally, Raoul shares his actionable trade idea, but to hear that, you'll have to tune in! -- This episode is spo...2022-11-0659 min

The Macro Trading FloorDebt, Demographics & Deflation Ahead | Raoul PalOn today’s episode of “The Macro Trading Floor,” Andreas and Alfonso welcome Raoul Pal CEO & Co-Founder, Real Vision & Global Macro Investor to the show for a discussion on debt, demographics and deflationary pressures. Raoul discusses some of the structural deflationary forces that lie ahead for markets. How will these forces effect markets as the Fed, and central banks globally, progress through their fastest tightening cycle in recent history. How are rising rates & high inflation changing asset allocation in this period? Finally, Raoul shares his actionable trade idea, but to hear that, you'll have to tune in! -- This episode is spo...2022-11-0659 min The Macro Trading FloorIs There A Bull Case For Markets? | Michael GayedOn today’s episode of “The Macro Trading Floor,” Andreas and Alfonso welcome Michael Gayed of Toroso Investments and publisher of The Lead-Lag Report to the show for a discussion on if their is a bull case for markets. Michael discusses the poor performance of bonds throughout the year as they failed to hedge equity drawdowns. What does this mean for the traditional 60/40? And how does the YTD performance compare with periods throughout history? Finally, Michael shares his actionable trade idea, but to hear that, you'll have to tune in! -- This episode is sponsored by Saxo Bank. Saxo Bank offers...2022-10-2355 min

The Macro Trading FloorIs There A Bull Case For Markets? | Michael GayedOn today’s episode of “The Macro Trading Floor,” Andreas and Alfonso welcome Michael Gayed of Toroso Investments and publisher of The Lead-Lag Report to the show for a discussion on if their is a bull case for markets. Michael discusses the poor performance of bonds throughout the year as they failed to hedge equity drawdowns. What does this mean for the traditional 60/40? And how does the YTD performance compare with periods throughout history? Finally, Michael shares his actionable trade idea, but to hear that, you'll have to tune in! -- This episode is sponsored by Saxo Bank. Saxo Bank offers...2022-10-2355 min Market DepthHow Macro Hedge Funds Are Viewing The World | Alfonso PeccatielloOn today's edition of Boiler Room, Alfonso Peccatiello walks through his most recent article on The Macro Compass titled "A Chat With The Top Macro Hedge Funds".After being in London for Blockworks' DAS Summit, Alfonso had the chance to speak with some some macro hedge funds. Alfonso reflects on their contrarian views from the conversations he had with those funds, to share how macro hedge funds are viewing the world in this market condition. To hear that, you'll have to tune in!--Follow Alfonso: https://twitter.com/MacroAlf 2022-10-2115 min