Shows

Excess ReturnsYou Can't Eat Risk-Adjusted Returns | AQR's Pete Hecht on Portable Alpha's Capital Efficient EdgeIn this episode of Excess Returns, we sit down with Pete Hecht of AQR to break down portable alpha, capital efficient portfolio construction, and how investors can combine equity beta with truly diversifying sources of alpha. We cover how portable alpha works in practice, how it solves the funding problem for alternative strategies, and why implementation details like leverage, liquidity, and financing costs matter more than most investors realize. If you’re interested in diversification, long short investing, managed futures, equity market neutral strategies, or improving total returns without giving up equity exposure, this discussion provides a practical and de...

2026-02-1259 min

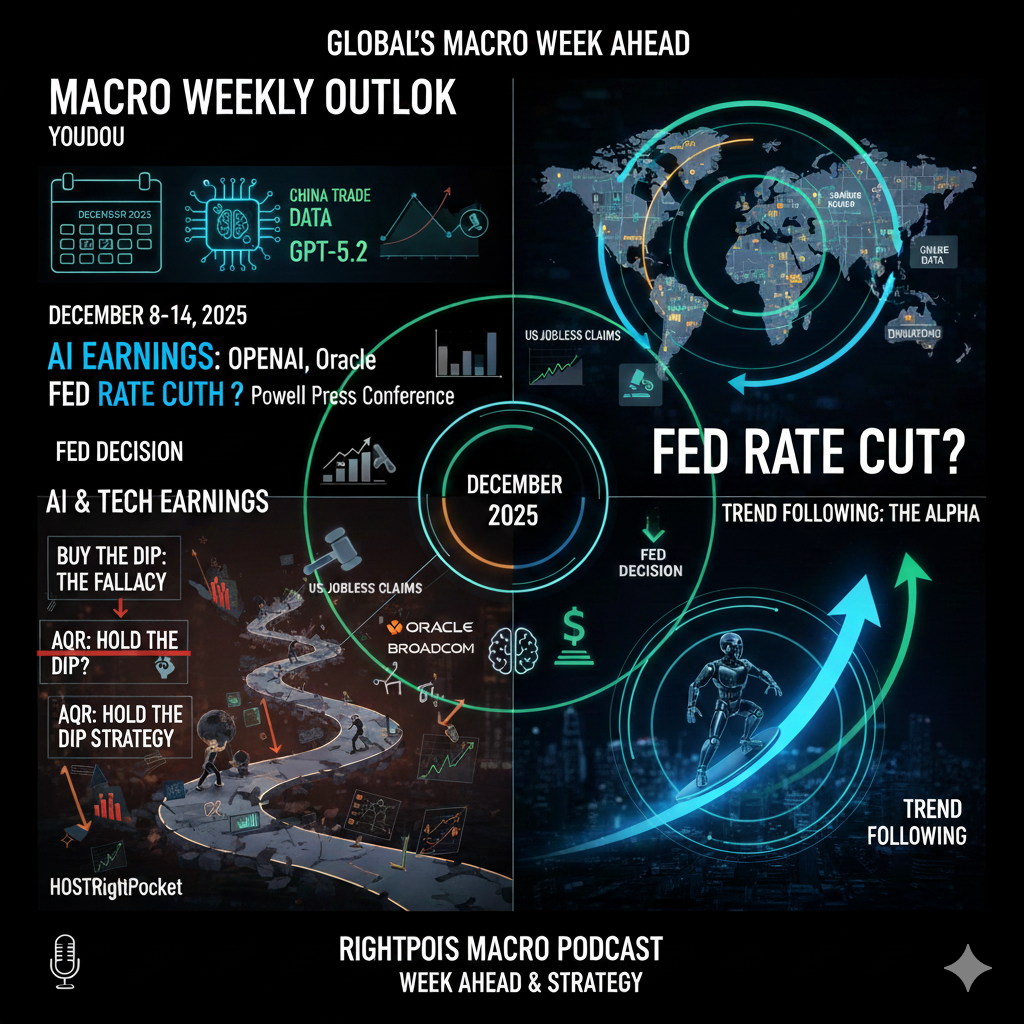

左兜进右兜AQR 策略:美股宏观周复盘20251207本周宏观复盘主要内容: 美股市场回顾 美国宏观数据及重点事件 AQR 《hold the dip》策略部分【市场回顾】近5交易日,纳斯达克指数涨幅0.91%,标普500涨幅0.31%,道琼斯指数涨幅0.50%,罗素2000指数涨幅0.84%,费城半导体指数涨幅3.84%。如果您有港美股 开户需求或想换券商,请微信私信我。券商专业人员会协助你完成整个流程。允许我赚个广告费的话,就用这个开户链接,写我的邀请码:ZQBCEK开户港美股请点击我!我们每期节目的英文原文件,都会在知识星球《左兜进右兜 / 美股研报》中分享。感兴趣的朋友,欢迎加入查阅英文原文。本期内容:主播左兜儿幕后制作右兜如需获得更多及时研报、英文原文,欢迎加入我们的付费知识星球《左兜进右兜/美股研报》量化模型交易信号,模型交易实时日志,欢迎加入我们的付费Discord社区,微信咨询:Right_pocket090

2025-12-0807 min

The Meb Faber Show - Better InvestingAQR’s Antti Ilmanen – US Exceptionalism: Growth Story or Valuation Trap? | #607Today’s guest is Antti Ilmanen, Global Co-head of the Portfolio Solutions Group at AQR Capital Management.

In today’s episode, Antti discusses the complexities of investment returns, the importance of understanding both objective and subjective expectations, and the dangers of relying on past performance as a guide for future investments. We explore the current state of the US market, the role of diversifiers in portfolios, and the behavioral biases that affect investor decisions. Antti also contrasts the behaviors of bond investors, which tend to be more contrarian, and equity investors, which tend to extrapolate.

(0:00) Star...

2025-11-211h 03

UBS On-Air: Market MovesHow should I be positioned? with Cliff Asness (AQR) and Jason Draho (UBS CIO)Cliff joins Jason at the 1285 podcast studio in New York to cover a wide-range of topics, including the growing impacts of electronic trading to financial markets, along with how machine learning and artificial intelligence are influencing approaches to investing. Plus, thoughts on the state of more traditional portfolio strategies, and the current macroeconomic environment. Featured are Jason Draho, Head of Asset Allocation Americas, UBS Chief Investment Office, and Cliff Asness, Founder, Managing Principal and Chief Investment Officer at AQR Capital Management. Host: Daniel Cassidy

2025-09-2639 min

Facts vs Feelings with Ryan Detrick & Sonu VargheseCliff Asness Returns (Ep. 150)In the latest episode of Facts vs Feelings, Ryan Detrick, Chief Market Strategist, and Sonu Varghese, VP, Global Macro Strategist, welcome back legendary investor Cliff Asness, Co-Founding Partner, Managing Principal, and Chief Investment Officer of AQR Capital Management. From market bubbles and speculative manias to AI-driven strategies and even Superman movies, this milestone 150th episode blends sharp market insight with candid (and fun) conversation.Key Takeaways:Bubble Talk: Cliff explains why today’s markets are expensive but stop short of a true “bubble.”Black Swan Events: Why extreme market shocks happen...

2025-08-2758 min

Odds on OpenFormer AQR and Two Sigma VP: How Quant Funds Will Use GenAI to Find EdgeWhat’s it really like working as a quant in fundamental research at Two Sigma—and how will AI, LLMs, and agentic workflows change quantitative trading strategies? Bill Mann, former Two Sigma fundamental researcher and founder of Harmonic Insights, joins Ethan Kho to break down how hedge funds build edge from widely available data and why “hacker” creativity still matters in systematic investing.Bill shares insights from AQR and Two Sigma, including how proprietary data pipelines become alpha generation engines, how to avoid crowding in popular factors, and what makes a great hedge fund strategy and the best work environm...

2025-08-1939 min

The Retirement and IRA ShowBuffered ETFs vs Stocks and Cash: EDU #2531Chris’s SummaryJim and I are joined by Matt Kaufman, Senior Vice President and Head of ETFs at Calamos Investments, to discuss buffered ETFs vs stocks and cash, focusing on AQR’s recent critiques. We examine the flaws in AQR’s methodology, the broader history of buffered products, and why these tools can offer certainty in retirement planning. Matt explains how buffered ETFs differ from accumulation strategies and why they may suit specific roles in a distribution-focused portfolio. We also touch on annuity comparisons and institutional adoption by endowments.

Jim’s “Pithy” SummaryChris and I welcom...

2025-07-3051 min

The Long ViewCliff Asness: ‘The Problem Was Never Beta. The Problem Was Paying Alpha Fees for Beta’Today on the podcast we welcome back Cliff Asness. Cliff is the founder, managing principal, and chief investment officer at AQR Capital Management. Cliff writes often about investing and financial matters on AQR’s website and has been a prolific researcher throughout his career, with his contributions appearing in many of the leading scholarly journals, including the Journal of Portfolio Management, Financial Analyst’s Journal, the Journal of Finance, and the Journal of Financial Economics. Before co-founding AQR, Cliff was a managing director and director of quantitative research for the asset management division of Goldman Sachs. Cliff Asness, welcome back...

2025-07-3054 min

UBS On-Air: Market MovesNavigating macroeconomic & geopolitical risks with Jordan Brooks, AQR Capital ManagementJordan Brooks serves as Principal and Co-Head of the Macro Strategies Group at AQR Capital Management. With no shortage of macroeconomic and geopolitical risks out there for investors to consider, Jordan explains what is top of mind for his team at AQR, and shares guidance when it comes to navigating these types of risks accordingly (including the role alternative investments can play in a portfolio). Host: Daniel Cassidy

2025-07-0915 min

The Bull of Wall Street#30 - Cliff Asness, Managing and Founding Principal, AQR Capital Management (recorded 06/23/25Jim, Talley and Paisley have an insightful conversation with one of the investment and hedge fund industries legends. Cliff shares his journey as the managing founder of AQR and the evolution of quantitative analysis. As AQR’s investment strategies have taken off targeting high net worth investors Cliff talks about the innovation that has helped their company take the lead in working with investment advisors. He also discusses his views around the economy and markets. Don’t miss this episode with one of the best in the business.

2025-06-231h 09

Alpha ExchangeDan Villalon, Global Co-Head of Portfolio Solutions, AQR Capital ManagementToday’s world of ETFs and mutual funds increasingly features new flavors, a popular one of which is derived from embedding optionality. There are plenty of ways in which one might contemplate risk managing and shaping the distribution of equity returns using options. Common strategies like overwriting create income, but limit upside. Others like the zero cost collars create both upside and downside guardrails on returns. These strategies can be back-tested. Because they also exist in the market, with more than $200bln in AuM, the performance of the funds can be evaluated as well. With this in mind, it wa...

2025-06-131h 05

Bloomberg TalksAQR Founder & CIO Cliff Asness Talks Buying OpportunitiesCliff Asness, AQR Capital Management founder, talks about the current state of markets, his investing philosophy, where he sees buying opportunities and how President Donald Trump's policies could impact investors. He is joined by Bloomberg's Matt Miller, Katie Greifeld, and Sonali Basak.See omnystudio.com/listener for privacy information.

2025-06-0317 min

How I Invest with David WeisburdE162: Why Most Investors Quit Before Winning w/Cliff AsnessCliff Asness is one of the most influential minds in quantitative investing and the Founder, Managing Principal and Chief Investment Officer at AQR Capital Management, which oversees over $100 billion in assets. In this wide-ranging conversation, we go deep into what makes a successful long-term strategy, how Cliff thinks about building portfolios, and why most investors misjudge both volatility and leverage.

He also shares what it was like launching AQR after his early work on momentum strategies at Goldman Sachs, and what he’s learned about investor behavior across cycles.

This is one of the most insightful and entertaining conversations we’ve h...

2025-05-091h 30

The New Barbarians PodcastAQR DNA in a Digital World: Systematic Edge with Connor Farley - The New Barbarians Episode #019📄 Episode Description:In this special live edition of The New Barbarians Podcast, we welcome back Connor Farley, CEO of Truvius and former AQR researcher, for a deep dive into systematic crypto investing, tax alpha, and navigating today's macro whipsaws. Bill, Mark, and Connor unpack:- The evolution of factor investing from TradFi to DeFi- Why Bitcoin may be emerging as a "soft haven" in volatile markets- How Truvius is automating tax-loss harvesting to enhance after-tax returns- Connor’s firsthand take on data quality, blockchain sectors, and portfolio construction- What AQR taught him—and how he's adapting it for crypto in 2025...

2025-05-081h 01

Masters in BusinessFrom AQR Quant to Founder & CIO with Brian HurstBarry speaks with Brian Hurst, Founder and Chief Investment Officer of ClearAlpha. Prior to founding ClearAlpha, Brian spent 21 years at AQR Capital Management as a portfolio manager, researcher, head of trading and the first non-Founding Partner at the firm. Brian also led numerous operating and investment committees including AQR's Strategic Planning Committee and the Risk Committee. He was instrumental in the design and implementation of AQR's trading platform and his time as senior portfolio manager placed him in charge of over $15 billion in hedge fund assets. Brian also Serves as a Member of the Yale New Haven Children's Hospital...

2025-01-1055 min

Risk Parity RadioEpisode 389: A Mini-Case Study About Entering Retirement, QSPNX, The Foibles Of Market Timing Bonds And Portfolio Reviews As Of December 20, 2024In this episode we answer emails from John, Jane and Christoph. We discuss financial and non-financial considerations when transitioning to retirement, the alternative investment strategy fund QSPNX, and revisit why you should not try to time bond investments anymore than you should try to time the stock market. And THEN we our go through our weekly portfolio reviews of the eight sample portfolios you can find at Portfolios | Risk Parity Radio.Additional Links: Choose FI Episode 508 With Yours Truly: 508 | 5% SWR, Revealed Preferences, and the 3 Stories | Frank Vasquez QSPNX Fund Summary: AQRFunds - AQ...

2024-12-2352 min

Orion's The Weighing MachineCliff Asness of AQR - Balancing Risks and Rewards for a Quantitative ApproachToday, Rusty and Robyn are joined by Cliff Asness, Founder, Managing Principal and Chief Investment Officer at AQR Capital Management. He is an active researcher and has authored articles on a variety of financial topics for many publications, including The Journal of Portfolio Management, Financial Analysts Journal, The Journal of Finance and The Journal of Financial Economics. He has received five Bernstein Fabozzi/Jacobs Levy Awards from The Journal of Portfolio Management, in 2002, 2004, 2005, 2014 and 2015. Financial Analysts Journal has twice awarded him the Graham and Dodd Award for the year’s best paper, as well as a Graham and Dodd Exc...

2024-11-191h 46

AQR QualversationsQualversations with guest Seema HopeIn the 9th and final episode of this mini-series, AQR member Emma Kirk sits down with Seema Hope, the Global Head of Consumer Research at The Economist. With over 20 years of experience in publishing, Seema offers an insider’s perspective on the industry, proudly embracing her role as well-rounded generalist. Seema shares invaluable life lessons drawn from her extensive career. This episode provides an authentic glimpse into the realities of working in publishing, balancing a career with raising two daughters, and confronting personal vulnerabilities. This candid conversation with someone who has a wealth of experience is truly unmissable.

2024-11-1851 min

AQR QualversationsQualversations with Guest Alex HodgsonIn the 8th episode of the AQR podcast "Qualversations," AQR member Emma Kirk chats with Alex Hodgson about her fascinating journey from advertising and media to international research. Alex, an open-minded and dynamic guest, has embraced every opportunity that came her way, living in Spain, London, the Midlands, and spending the last 20 years in Australia. Tune in as they cover a wide range of topics, from travel and motherhood to invaluable career advice. This episode is packed with wisdom and inspiration, and we hope you find it as enriching as we did.

2024-10-1437 min

AQR QualversationsQualversations with guest Rhea FoxIn the 7th episode of the AQR podcast "Qualversations”, AQR member Emma Kirk sits down with Rhea Fox to discuss her dynamic and successful career in insight and beyond. Join them as they delve into the key differences between agency and client-side roles, the art of establishing an insight-driven culture, and the value of sometimes taking a step back to move forward. Rhea also shares her insights on the importance of resilience in the face of redundancy and the benefits of broadening your professional scope. Whether you're passionate about insights or marketing more broadly, this episode is a must-listen.

2024-09-1640 min

Greenbook Podcast124 — Building Global Standards in Qualitative Research: Martha Llobet on AQR’s VisionIn this episode of the GreenBook Podcast, host Karen Lynch sits down with Martha Llobet, CEO of Q2Q Global and board member of the Association for Qualitative Research (AQR). Martha shares her journey from quantitative to qualitative research, highlighting the deeper insights qualitative offers and the importance of cultural interpretation in global markets. They discuss the role of AQR in promoting high standards, supporting younger researchers, and embracing AI while maintaining the essential human touch in research. Martha also shares her experiences in expanding her business and offers advice to aspiring female founders. Tune in for a thoughtful...

2024-09-0937 min

InsightsPapo com Gestor #231 - Desvendando investimentos quantitativos com a AQRComo utilizar modelos quantitativos para construir investimentos descorrelacionados com o cenário? Com mais de US$ 100 bilhões de dólares sob gestão e 25 anos de história, a gestora americana AQR tem feito a diferença na indústria de fundos. Por isso, a nossa conversa é com Gregor Andrade, head global de desenvolvimento de negócios institucionais da empresa. O gestor global de fundo de fundos da Bradesco Asset, Marcus Sena, também participa. A apresentação é da gestora de Soluções de Investimento da Bradesco Asset, Juliana Maeda. Acompanhe! O conteúdo a seguir exposto...

2024-08-1635 min

Facts vs Feelings with Ryan Detrick & Sonu VargheseInvesting Insights with Cliff Asness (Ep. 95)How do you balance rigorous research with open-mindedness in investing? How do you communicate effectively with clients during volatile times?This week, Ryan Detrick, Chief Market Strategist at Carson Group & Sonu Varghese, VP, Global Macro Strategist at Carson Group, chat with Cliff Asness, Managing and Founding Principal at AQR Capital Management, for an insightful discussion on market strategies and the nuances of value investing. Cliff shares his thoughts on the current state of value investing, explores the concept of 'value spread,' and even dips into some fun side topics.They discuss: Th...

2024-07-3155 min

What's the Alternative? Meet the ManagerWhat's the Alternative? | Episode 14 | The Smoothing Effect featuring Cliff AsnessWelcome to Banrion Capital Management’s What’s the Alternative Podcast! Join host Shana Orczyk Sissel, the “Queen of Alternatives” Founder & CEO of Banrion Capital Management, as she interviews leaders in the alternative investment space. Learn more about their firms, their passions and about the many different ways investors can use alternative investments to add value in their investment portfolios. In this episode Shana sits down with legendary hedge fund manager, Cliff Asness, to discuss how advisors can best evaluate alternative investment strategies whether public or private. Cliff is a Founder, Managing Principal and Chief Investme...

2024-07-1650 min

AQR QualversationsQualversations with guest Anna CliffeIn our 6th episode of the AQR podcast Qualversations AQR Board member DebbieNewbould chats with Anna Cliffe founder and joint chief exec of research agency TrinityMcQueen. Debbie and Anna cover everything from what it takes to be an entrepreneur, management buy outs and being a female business owner. Oh, and there’s a sprinkling ofDolly Parton in there too.Qualversations : designed to expand perspectives and deliver thought provoking opinionpieces

2024-07-0930 min

AQR QualversationsQualversations with guest Julie FullerIn our 5 th episode of the AQR podcast Qualversations, AQR Board member Judy Taylor chatsto Julie Fuller, who went from nurse, to health visitor, to mum-at-home recruiter, tofounder and co-owner of The Fuller Research Group. They talk Julie’s role in changing ourindustry, building businesses and being an employer of almost 100 people. Julie talks aboutwhy being a carer personality has held her in good stead all her life and why chaos suits her.Qualversations : designed to expand perspectives and deliver thought provoking opinionpieces

2024-06-1833 min

AQR QualversationsQualversations with guest Vicki CookeIn our 4 th episode of the AQR podcast Qualversations, AQR Board member Judy Taylor talksto Vicki Cooke, co-founder and Chair of Thinks Insight about her prolific research career.Together they talk values, being disenchanted at school and how inspirational it has been towork with real leaders, like the (then) Prince of Wales and Tony Blair.Qualversations : designed to expand perspectives and deliver thought provoking opinionpieces

2024-05-1434 min

Capital Allocators – Inside the Institutional Investment IndustryCliff Asness - Simple Investing is HardCliff Asness is the Founder and CIO at AQR, an investment management firm at the intersection of financial theory and practice that oversees $100 billion in assets. He is famously intelligent, comical, and irreverent, all wrapped into one. Our conversation covers Cliff's journey from studying market efficiency under Eugene Fama to capitalizing on market inefficiencies at AQR. We discuss regime changes in factors, difficult periods for performance and AQR's business, research innovation, machine learning, index funds, pod shops, areas of cognitive dissonance, private equity, and serving on investment committees. Learn More Follow Ted on Twitter...

2024-05-131h 08

The Meb Faber Show - Better InvestingCliff Asness: Timely & Timeless Investment Wisdom | #528Today’s guest is Cliff Asness, co-founder, managing principal and Chief Investment Officer at AQR Capital Management. In today’s episode, Cliff & I start by talking about some quotes he may or may not have said in the past. Then we kick around a bunch of topics. We talk about diversifying by both asset class and geography, the challenge of managing short-term expectations while keeping a long-term perspective, and how AQR is implementing AI and machine learning in their investment process. (1:20) - Welcome to our guest, Cliff Asness(1:45) - Cliff’s article in the Fina...

2024-04-051h 06

AQR QualversationsQualversations with Ellie ConstaIn the third and final podcast in our Mini Series Debbie Newbould interviews Ellie Consta. Ellie set up the all female strings quartet Her Ensemble. In covid Ellie had an epiphany moment asking the question: why aren’t we showcasing more female composers in classical music? Why aren’t we challenging classical music norms? Debbie chats to her about being a young female leader in the classical music scene and what it takes to step up and take action.

2024-03-2634 min

Risk Parity RadioEpisode 327: Quick-Time Harch, AQR Funds, Bond Ladders, Global Population And Portfolio Reviews As Of March 22, 2024In this episode we answer emails from Andrew, Sean, and MyContactInfo. We discuss QDSIX and other AQR funds and their approaches, good and bad uses of bond ladders, and macro-issues pertaining to projected global population declines in the future.And THEN we our go through our weekly portfolio reviews of the seven sample portfolios you can find at Portfolios | Risk Parity Radio.Additional links:QDSIX fact page: AQR Diversifying Strategies Fund - QDSIXBen Carlson Article on Bond Funds vs. Bond Ladders: Owning Individual Bonds vs. Owning a Bond Fund - A W...

2024-03-2444 min

Why Invest?Private vs Public Assets: Part One with Antti Ilmanen, AQR Capital ManagementIn this two-part mini-series, we are joined by two giants of the investment world to argue the merits of opportunities across public listed equity markets and the growing universe of unquoted private assets.This episode Antti Ilmanen, author and Global Co-Head of the Portfolio Solutions Group at AQR Capital Management, joins us to contend why the outlook for public listed equities is favourable over private assets.Antti critically assesses the concept of illiquidity premium, noting the risks and rewards associated with private equity, including the impact of leverage and market volatility and touches...

2024-01-3135 min

AQR QualversationsQualversations with guest Polly McMasterIn the second episode of the AQR podcast Qualversations AQR Board member Debbie Newbould interviews Polly McMaster, Founder and CEO of the clothing brand The Fold. Polly’s ambition is to empower women through helping them achieve their ambitions. Debbie chats to her as she tracks her journey from researching mouse herpes (yes, you read that right) to dressing royalty. Qualversations : designed to expand perspectives and deliver thought provoking opinion pieces

2024-01-1632 min

AQR QualversationsQualversations with guest Jill PayOur first podcast for AQR members features Jill Pay, the first female Sergeant at Arms of the Houses of Parliament. A glass ceiling that took almost 700 years to break through! Debbie chats to her about being at the heart of British pageantry, meeting the Queen and Barack Obama and her current role with the Gender Pay Index.This episode of Qualversations is presented by Debbie Newbould.For more information from AQR please visit https://www.aqr.org.uk or search #theaqr

2023-12-0135 min

Masters in BusinessCliff Asness on Celebrating 25 Years With AQRBloomberg Radio host Barry Ritholtz speaks to Cliff Asness, co-founder, managing principal and chief investment officer at AQR Capital Management LLC, which holds more than $100 billion in assets under management. Prior to co-founding AQR, he was a managing director and director of quantitative research for the asset management division of Goldman Sachs Group Inc. See omnystudio.com/listener for privacy information.

2023-11-2737 min

Facts vs Feelings with Ryan Detrick & Sonu VargheseTalking Investing Lessons with Cliff Asness (Ep. 55)Investing is a complex and uncertain activity that requires careful analysis, discipline, and patience. There are many factors that can influence the performance of different investment strategies, such as market conditions and investor preferences.Today, we speak with a leading figure in the field.In this special edition of the Facts Vs. Feelings podcast, recorded live at the Excell conference in Nashville, Ryan Detrick & Sonu Varghese speak with Cliff Asness, Managing and Founding Principal at AQR Capital Management.Together, they chat about investment management, the importance of understanding uncertainty in the m...

2023-10-1138 min

Orion's The Weighing MachineDaniel Villalon of AQR - Replay: Investing in the Face of Market RisksDue to the many risks facing today's market, many investors wonder whether now is the time to invest or just sit on the sidelines. While diversification can minimize exposure to any single economic, political, or market event, it's important to know the market's top risks to enable investors to manage expectations and protect their portfolios. But what are today's top market risks, and how can investors move forward?In this episode, Rusty and Robyn talk with Daniel Villalon, Principal and Global Co-Head of the Portfolio Solutions Group at AQR Capital Management. In his role, Daniel oversees the...

2023-08-2959 min

Excess ReturnsThe Opportunity in Emerging Markets with AQR's Dan Villalon

International stocks, and particularly emerging market stocks, have struggled relative to US stocks for a long time. That has led some to suggest that international diversification no longer makes sense for investors. But valuations in the space and lessons from history would suggest otherwise.

In this episode we discuss the issue with AQR's Dan Villalon, who has authored two research papers that use a data driven approach to look at it. We discuss the current valuations in both international and emerging market stocks and the opportunity they may present for long-term investors. We also discuss the foundational arguments for...

2023-08-2457 min

Lightup Financial【Lightup Weekly Seminar】讲座实录-AQR税务优化对冲基金介绍观看视频请点击更多讲座信息请点击您对AQR税务优化对冲基金有了解吗?您对税务优化策略和手段感到困惑吗?您知道税务优化如何影响投资组合的收益吗?如果您想了解:如何根据多种定量策略进行税赋优化如何将投资组合调配到最优的税务状态如果您不想因为缺乏税务知识而多缴税款如果您不想因为不理解税法规而面临处罚如果您不想因为税收问题而影响投资收益最大化欢迎来参加我们的AQR税务优化分享会,资深税务与投资专家将为您提供专业解析和实操方案,让您更好地理解AQR税务优化对冲基金,掌握税务优化策略与手段,构建税效最大化的投资组合。

2023-07-281h 12

Alpha ExchangeDaniel Villalon, Global Co-Head of Portfolio Solutions, AQR Capital ManagementAs Global Co-head of Portfolio Solutions at AQR Capital Management, Dan Villalon is primarily engaged in helping the firm’s clients address constantly evolving challenges around risk management. Central to these, of course, is the search for efficient sources of diversification. In this context, our discussion explores research his team has done in two primary areas.First, we talk about defending against drawdowns that are both fast and slow and back-tests that compare options-based hedging with strategies like trend following that do not require explicit premium payments. For rapid market sell-offs, like those that occurred during the GF...

2023-07-251h 01

The DerivativeAlt (Digital) Trend Following with Sarah Schroeder of Coinbase Asset Mgmt.How do you get a job at a top quant shop? With a little love from grandma?! How do you navigate a systematic strategy in the fast-moving world of digital assets? On this episode of The Derivative, Sarah Schroeder of Coinbase Asset Management (formerly One River Digital) covers a range of topics related

to crypt/digital assets, including the formation and vision of One River Digital, its purchase by Coinbase, the importance of counterparty risk management,

trend-following and directional strategies, allocation to digital assets, central bank digital currencies, and the role of women in the hedge fund space.

...

2023-04-271h 44

TopTradersUnplugged.comTTU135: Moving Beyond Pure Price Trends ft. Yao Hua Ooi, Principal at AQR Capital ManagementToday, we are joined by Yao Hua Ooi, Principal at AQR Capital Management, for a conversation on how they use systematic tools like trend following, to take advantage of inefficiencies in markets. We discuss the pros and cons of risk premia strategies and how they manage to improve the Sharpe ratio while making sure the "dual" mandate is fulfilled, how they have moved beyond pure price trends as part of the evolution of their trend programs. We also discuss the process of building a trend following strategy and why they prefer to build models rather than mimic a strategy through...

2023-02-271h 21

Top Traders UnpluggedTTU135: Moving Beyond Pure Price Trends ft. Yao Hua Ooi, Principal at AQR Capital ManagementToday, we are joined by Yao Hua Ooi, Principal at AQR Capital Management, for a conversation on how they use systematic tools like trend following, to take advantage of inefficiencies in markets. We discuss the pros and cons of risk premia strategies and how they manage to improve the Sharpe ratio while making sure the "dual" mandate is fulfilled, how they have moved beyond pure price trends as part of the evolution of their trend programs. We also discuss the process of building a trend following strategy and why they prefer to build models rather than mimic a strategy...

2023-02-271h 21

Infinite LoopsCliff Asness — FTX, Hedge Funds and the Value SpreadCliff Asness is the Founder, Managing Principal and Chief Investment Officer at AQR Capital Management. Prior to co-founding AQR Capital Management, he was a Managing Director and Director of Quantitative Research for the Asset Management Division of Goldman, Sachs & Co. Cliff joins the show to discuss FTX, AMC , why hedge funds aren't hedging, the role of index funds and a whole lot more. Important Links: Cliff's Twitter Cliff's Blog AQR Capital Management Do Hedge Funds Hedge? Show Notes: Cliff's take on FTX and crypto The...

2023-01-121h 03

Orion's The Weighing MachineDaniel Villalon of AQR Capital Management - Investing in the Face of Market RisksDue to the many risks facing today's market, many investors wonder whether now is the time to invest or just sit on the sidelines. While diversification can minimize exposure to any single economic, political, or market event, it's important to know the market's top risks to enable investors to manage expectations and protect their portfolios. But what are today's top market risks, and how can investors move forward?In this episode, Rusty and Robyn talk with Daniel Villalon, Principal and Global Co-Head of the Portfolio Solutions Group at AQR Capital Management. In his role, Daniel oversees the...

2022-08-0259 min

Success That LastsAfter Tax Investment Returns with Nathan SosnerNathan Sosner is a national thought leader and Principal at AQR Capital Management, where he specializes in sophisticated investment programs for high-net-worth clients. His research on tax-aware investing has been published in the Journal of Wealth Management and the Financial Analyst Journal, who awarded him the Graham and Dodd Award for the best paper of the year in 2020. Nathan joins Jared Siegel to discuss the importance of tax efficiency.Here are a few highlights from their conversation:

The main difference between tax-agnostic and tax-aware strategies at AQR, Nathan shares, is that tax-aware funds t...

2022-07-2136 min

Excess ReturnsInvesting in a World of Low Expected Returns with AQR's Antti IlmanenInvestors have enjoyed above average returns for decades now. But long-term evidence suggests that those lofty returns won't last forever. In this episode we take a deep dive into the topic of expected returns with AQR's Antti Ilmanen. Antti is the author of Expected Returns: An Investor's Guide to Harvesting Market Rewards, which many consider to be the seminal work on the topic and has recently released a new book Investing Amid Low Expected Returns: Making the Most When Markets Offer the Least.

We discuss the concept of expected returns and dig into the details of how...

2022-07-1258 min

Risk Parity RadioEpisode 178: AQR Articles, Wild West Gambling Problems, Japan And Portfolio Reviews As Of June 3, 2022In this episode we answer emails from George, Grant, Visitor #4090, Justin and Lili. We discuss the long-time usage and popularity of risk parity concepts by professional investors, a levered Golden Butterfly portfolio, the website chat function, Japan, crypto (a little) and consulting services. And my general laziness.And THEN we our go through our weekly portfolio reviews of the seven sample portfolios you can find at Portfolios | Risk Parity Radio.Additional Links:AQR Paper "Understanding Risk Parity": Understanding Risk Parity (aqr.com)Recent Cliff Asness Interview: Cliff Asness: Value Stocks Still Look...

2022-06-0535 min

The Long ViewCliff Asness: Value Stocks Still Look Like a BargainOur guest this week is Cliff Asness. Cliff is a founder, managing principal, and chief investment officer at AQR Capital Management. Cliff writes often about investing and financial matters on AQR’s website and has been a prolific researcher throughout his career, with his contributions appearing in many of the leading scholarly journals, including the Journal of Portfolio Management, Financial Analyst Journal, the Journal of Finance, and the Journal of Financial Economics. This work has earned him accolades, including the James R. Vertin Award, which the CFA Institute bestows on those who produced a body of research notable for it...

2022-05-3156 min

The Meb Faber Show - Better InvestingAntti Ilmanen, AQR – Investing Amid Low Expected Returns: Making the Most When Markets Offer the Least | #413Today’s guest is Antti Ilmanen, Principal and Global Co-head of the Portfolio Solutions Group at AQR Capital Management and author of Investing Amid Low Expected Returns: Making the Most When Markets Offer the Least.In today’s episode, Antti provides a blueprint for investors as decades of tailwinds are turning into headwinds. He highlights timeless investment practices and what the empirical evidence says about things major asset class premia, illiquidity premia and style premia. He shares his thoughts on home country bias, the value / growth spread today, and what he thinks about diversifiers like trend following.

2022-05-091h 23

The Investors First PodcastCliff Asness, AQR: Fama, Quant & Captain AmericaOur guest today is Cliff Asness, Founder, Managing Principal and Chief Investment Officer at AQR Capital Management. He has authored articles on financial topics in almost every major financial publication and his awards are too many to list. He received his Ph.D. from University of Chicago while learning under Nobel Laureate Gene Fama. Notably, his bio states that "he still feels guilty trying to beat the market" after all these years because of his work with Gene. In today's episode, we start with Cliff's education background and how his father's aim for diversification in education paid o...

2021-09-091h 16

Forging Mettle Podcast033 | Doug Strycharczyk | What is mental toughness?Find out why we all need mental toughness in our lives, how we can develop it and what exactly it is. With it we have more success, more fulfillment in life, less stress, anxiety and fear. Can we assess how mentally tough we are - we can. Do women or men score higher on these assessments - one of the genders does. Listen to find out and learn more as we dig in on the topic with expert Doug Strycharczyk.

Doug is the CEO of AQR and for AQR International – Founded in 1989, AQR is no...

2021-05-1948 min

Finance Simplified®EP 20 — Simplifying Quantitative Finance Part 2 with Aaron Brown, formerly of AQR Capital ManagementIn this episode, my co-host Alex Patel and I continue our conversation with Aaron Brown, the former Chief Risk Manager at AQR Capital Management, about quantitative finance. We delve into topics like important quantitative finance concepts, careers in quantitative finance, Aaron’s own career and thoughts on the future of quantitative finance, and much more!

Check out the episode to learn about quantitative finance in a simplified way!

Aaron Brown is the former Chief Risk Manager at AQR Capital Management, one of the largest and most renowned hedge funds in the world as well as a...

2021-04-1533 min

A Better HR BusinessEpisode 97 - Doug Strycharczyk of AQR InternationalMy guest today is Doug Strycharczyk, CEO of AQR International.

AQR International provides clients of all types with a complete solution around the assessment and development of important themes such as mindset, resilience, leadership, team working and personal effectiveness.

To see the list of topics as well as all the details of my other guests, check out the show notes here:

www.GetMoreHRClients.com/Podcast

WANT MORE CLIENTS?

Want more clients and/or want to position your agency or consultancy as a thought leader in the Human Resources industry...

2021-04-0642 min

Finance Simplified®EP 19 — Simplifying Quantitative Finance Part 1 with Aaron Brown, formerly of AQR Capital ManagementIn this episode, my co-host Alex Patel and I talk to Aaron Brown, the former Chief Risk Manager at AQR Capital Management, about quantitative finance. We delve into topics like the basics of quantitative finance, the history of quantitative finance, common misconceptions, how quantitative finance approaches risk management, and much more!

Check out the episode to learn about quantitative finance in a simplified way!

Aaron Brown is the former Chief Risk Manager at AQR Capital Management, one of the largest and most renowned hedge funds in the world as well as a professor and author...

2021-04-0129 min

The Sales Maul PodcastEpisode 36 - Mental Toughness Maul with Doug Strycharczyk Part 3Our Sales Ruggers are back with Part 3 on Mental Toughness with Doug Strycharczyk, CEO at AQR back! Listen to Gerry, Ryan and Doug do what they do best ---> Sales Maul! Doug continues to share his vast knowledge with us on this value packed episode!

Connect with Doug on LinkedIn here - https://www.linkedin.com/in/dougstrycharczyk/

Visit AQR's website: https://aqrinternational.co.uk/

2021-03-2044 min

The Sales Maul PodcastEpisode 33 - Mental Toughness Maul with Doug Strycharczyk Part 1The first episode was so good that our sales ruggers had to bring Doug Strycharczyk, CEO at AQR back! Listen to Gerry, Ryan and Doug do what they do best ---> Sales Maul! Doug continues to share his vast knowledge with us on this value packed episode!

Connect with Doug on LinkedIn here - https://www.linkedin.com/in/dougstrycharczyk/

Visit AQR's website: https://aqrinternational.co.uk/

2021-02-2734 min

The Sales Maul PodcastEpisode 30 - Mental Toughness Maul with Doug Strycharczyk Part 1This episode is so good that our sales ruggers are already planning a part 2 to this conversation. Listen to Gerry, Ryan and Doug Strycharczyk do what they do best ---> Sales Maul! Doug is CEO at AQR and shares his vast knowledge with us on this value packed episode!

Connect with Doug on LinkedIn here - https://www.linkedin.com/in/dougstrycharczyk/

Visit AQR's website: https://aqrinternational.co.uk/

2021-01-2840 min

Empathy Always Wins with Ally Salama#39. Developing Mental Toughness Through The Power of Self Awareness with Amrika Bhogaita and Doug StrycharczykSupport the show by dropping us a rating and review on Apple Podcast! Music: “Daydream” by Ash. Available on Spotify, Apple Music & Anghami.Doug is the CEO of AQR International – Founded in 1989, AQR is now recognised as one of the most innovative test publishers in the world working in more than 80 countries. AQR has established its reputation as a thought leader in mental toughness. Doug has worked with Professor Peter Clough and Dr John Perry for 25+ years to define Mental Toughness and to create the world’s leading measure of Mental Toughness, the MTQ.He is co-author...

2021-01-051h 05

Hola, Mundo16x2 - ArgentinaLlega otro capítulo del podcast Hola Mundo. En esta ocasión, hablaremos de Argentina y contaremos con la “segunda opinión” de LosMundo.

Esto es lo que vas a encontrar en este programa…

- Por qué queríamos ir a Argentina

- Cómo imaginábamos que iba a ser nuestra Argentina

- Cuándo, cómo y qué ruta hicimos.

- Palabras by Chapka: “puteadas”

- Qué nos encontramos en Argentina

- Anécdotas

- Viajando con los sentidos: mapa sonoro, cromoviajismo, a qué sabe y huele Argentina.

- Qué recuerdo y sensación tenemos, ¿volveríamos?

- La segunda opinión: LosMund...

2020-12-2047 min

Hola, Mundo16x2 - ArgentinaLlega otro capítulo del podcast Hola Mundo. En esta ocasión, hablaremos de Argentina y contaremos con la “segunda opinión” de LosMundo.Esto es lo que vas a encontrar en este programa…- Por qué queríamos ir a Argentina- Cómo imaginábamos que iba a ser nuestra Argentina- Cuándo, cómo y qué ruta hicimos.- Palabras by Chapka: “puteadas”- Qué nos encontramos en Argentina- Anécdotas- Viajando con los sentidos: mapa sonoro, cromoviajismo, a qué sabe y huele Argentina.- Qué recuerdo y s...

2020-12-2047 min

Demystifying Mental ToughnessWhy is Mental Toughness Important?Professor Peter Clough needs little introduction. Whilst at the University of Hull, Peter initiated a programme of work which led to the development of the 4Cs concept for Mental Toughness – published in 2002 and is now comfortably the most widely adopted description of Mental Toughness globally. Since that time, he has collaborated with researchers all over the world to examine the concept further and to identify links to important aspects of work and life – his name appears on around 50 peer-reviewed papers. By inclination an applied psychologist, his work has always focused on real-world issues. In recent times...

2020-11-2740 min

Bogleheads On Investing PodcastEpisode 027: Cliff Asness, host Rick FerriDr. Cliff Asness is a Founder, Managing Principal, and Chief Investment Officer at AQR Capital Management, a quantitative money manager overseeing $186 billion in assets as of December 2019. Prior to co-founding AQR Capital Management, he was a Managing Director and Director of Quantitative Research for the Asset Management Division of Goldman, Sachs & Co. He is an award-winning researcher on quantitative investment strategies and has authored articles for many publications, including The Journal of Portfolio Management, Financial Analysts Journal, The Journal of Finance, and The Journal of Financial Economics.

Cliff received a B.S. in economics from the...

2020-10-3058 min

It's Raining BotsAQR: contenuti di valore con il valore della trasparenza -(p.3)Con i suoi dieci anni di esperienza nell’offerta integrata di servizi dedicati alla Customer Interaction, e con una forte propensione alla vendita, AQR Group è un gruppo di proprietà 100% Italiana. Il nostro Paolo Emilio Colombo, su #ItsRainingBots, ha intervistato il CEO e fondatore Francesco Saverio Esposito per parlare di innovazione, cross canalità e iniziative di welfare nel settore BPO (Business Process Outsourcing).

2020-09-1618 min

It's Raining BotsAQR: contenuti di valore con il valore della trasparenza -(p.2)Con i suoi dieci anni di esperienza nell’offerta integrata di servizi dedicati alla Customer Interaction, e con una forte propensione alla vendita, AQR Group è un gruppo di proprietà 100% Italiana. Il nostro Paolo Emilio Colombo, su #ItsRainingBots, ha intervistato il CEO e fondatore Francesco Saverio Esposito per parlare di innovazione, cross canalità e iniziative di welfare nel settore BPO (Business Process Outsourcing).

2020-09-1610 min

It's Raining BotsAQR: contenuti di valore con il valore della trasparenza -(p.1)Con i suoi dieci anni di esperienza nell’offerta integrata di servizi dedicati alla Customer Interaction, e con una forte propensione alla vendita, AQR Group è un gruppo di proprietà 100% Italiana. Il nostro Paolo Emilio Colombo, su #ItsRainingBots, ha intervistato il CEO e fondatore Francesco Saverio Esposito per parlare di innovazione, cross canalità e iniziative di welfare nel settore BPO (Business Process Outsourcing).

2020-09-1618 min

Rebellion Research Educational SeriesAQR, Two Sigma & Interactive Brokers' Data Chief Talks BigData!AQR, Two Sigma & Interactive Brokers' Data Chief Talks BigData with RebellionResearch.com CEO Alexander Fleiss

2020-07-2309 min

The Acquirers PodcastCliff's Perspective: AQR's Clifford Asness on fundamental analysis and systematic value with Tobias Carlisle on The Acquirers PodcastCliff Asness is the co-founder of AQR Capital Management, a quantitative hedge fund firm. Cliff completed his PhD in finance at the University of Chicago in 1994. Asness was the Teaching Assistant for his dissertation adviser, Nobel laureate Eugene Fama and the economist, Kenneth French. Asness' doctoral dissertation was on "the performance of momentum trading, buying stocks with rising prices". Wikipedia credits Cliff with being the first to compile enough empirical evidence across a wide variety of markets to bring the ideas into the academic financial mainstream.

Cliff's firm: https://www.aqr.com/

Cliff's blog: https://ww...

2020-07-061h 09

The Rational Reminder PodcastDimensional's ETFs, Private Equity, and Prescribed Rate LoansWith private equity investments increasing in popularity, you may feel the pressure to expand your portfolio. Today's episode, we look at the data behind private equity returns to see if these investments add something to your portfolio that you couldn't get elsewhere. But first, we discuss some big news — that slow-moving Dimensional Fund Advisors are entering the ETF marketplace. After looking at the implications of this move, we use a Harvard paper as our springboard into the topic of private equity. By exploring the shift in demand for private equity, the paper establishes the context for why investors, especially in...

2020-07-021h 09

The Acquirers PodcastValue: After Hours LIVE S02E20: AQR's Is Value Dead, Baumol's Cost Disease, Weird TimesValue: After Hours is a podcast about value investing, Fintwit, and all things finance and investment by investors Tobias Carlisle, Bill Brewster and Jake Taylor. See our latest episodes at https://acquirersmultiple.com/

https://www.aqr.com/Insights/Perspectives/Is-Systematic-Value-Investing-Dead

About Bill: Bill runs Sullimar Capital Group, a family investment firm.

Bill's website: https://sullimarcapital.group/

Bill's Twitter: @BillBrewsterSCG

Value: After Hours is a podcast about value investing, Fintwit, and all things finance and investment.

About Jake: Jake is a partner at Farnam Street.

Jake's w...

2020-05-211h 07

The Rational Reminder PodcastRapid Fire Listener Questions, Wealthsimple's Victory Lap, and the Historic State of Value InvestingWe spend the bulk of today's episode considering whether Wealthsimple's use of long bonds and low volatility stocks is really protecting their clients' downside, and summing up recent arguments by Cliff Asness and AQR leveled against critiques on value investing. Before that, we kick things off with thoughts on why Elon Musk aims to have no possessions, before looking at the links between empathy and the theory of relativity as well as some productivity secrets in recent books by Charles Duhigg and Shane Parrish. Next up, we briefly address a bunch of listener questions on factor tilting, and ETFs...

2020-05-141h 12

The Rational Reminder PodcastCliff Asness from AQR: The Impact of Stories, Behaviour and RiskNo one credible ever said that investing was a simple endeavour. It might have some simple guidelines, that if followed are more likely to yield positive results, but the ins and outs of the markets, decisions and their impacts, movements and crashes are never straightforward one-dimensional cases. Our guest today, Cliff Asness, really brings this point to bear, showing the nuance and multiplicity of all the topics we discuss. As the experienced owner of AQR and a wealth of knowledge and insight, Cliff shares a host of ideas and thoughts on as many topics as we have time for...

2020-04-0952 min

ФинГрам6. Стоит ли доверять банкам - обсуждаем результаты AQR с Ерланом, Санжаром и МадинойНасколько надежно хранить деньги в наших банках и можно ли доверять финансовой системе?

Ответить на эти вопросы и повысить доверие населения попытался регулятор – Национальный банк Республики Казахстан, запустив в 2019 году обширную и беспрецедентную на пространстве СНГ проверку банков второго уровня. Оценка качества активов (asset quality review, AQR) покрыла 14 крупнейших банков РК, которые представляют 87% активов всего банковского сектора и 90% от общего ссудного портфеля.

В этом эпизоде я веду дискуссию с моими коллегами-финансистами: Ерланом, Санжаром и Мадиной. Мы все когда-то работали в финансовом секторе аудита, а сейчас Ерлан занимается консалтингом, Санжар - корпоративными финансами, и Мадина является старшим менеджером в компании Биг4, непосредственно была вовлечена в AQR. После прослушанной панельной дискуссии по AQR мы решили провести свою и начать обсуждение состояния банковской системы с Вами.

Мы обсудили:

что такое AQR

зачем и как он проводился

какие результаты он показал, и

какие последствия и изменения стоит ожидать.

Ссылка по эпизоду: Отчет по результатам AQR от 28 февраля 2020 г.

2020-03-0520 min

The Curious InvestorWho Is On the Other Side?How do we learn from situations where there are other forces at play? Former professional poker player and author Annie Duke looks at decisions when the outcomes are beyond our control, and AQR’s Toby Moskowitz delves into who is on the other side in factor investing.This podcast was recorded on October 2, 2019.The views expressed in this recording are the personal views of the participants as of the date indicated and do not necessarily reflect the views of AQR itself. AQR and its affiliates may have positions (long or short) or engage in...

2019-10-0222 min

The Curious InvestorImplementation: Food for ThoughtCraftsmanship can be just as challenging for investors as it is for restaurateurs—to be successful, it involves finding the right balance of ingredients and creating a sustainable process. Tom Colicchio, Chef and Owner of Crafted Hospitality, and Adrienne Ross talk about how to build a system that works.This podcast was recorded on June 3, 2019.The views expressed in this recording are the personal views of the participants as of the date indicated and do not necessarily reflect the views of AQR itself. AQR and its affiliates may have positions (long or short) or engage in...

2019-09-1818 min

Take the Long ViewDavid Kabiller: From “Goldman Slacks” to AQR - “To Know Me is to Love Me”David Kabiller is hugely successful and doesn’t need to do podcast interviews, in fact, he rarely grants requests. Enjoy this special episode with the influential leader who assembled one of the most important quantitative money management firms (AQR) in the world. Key Topics: Introducing David Kabiller [00:46] Tennis talk and how the sport impacted David’s career [01:56] The early days and how David got interested in the investment world [6:35] David’s decision to work for Goldman Sachs [9:39] Meeting Cliff Asness, John Liew and Robert Krail and his ability to judge people [12:47] His path to leaving Goldman and star...

2019-09-0546 min

The Curious InvestorCan Machines Invest?Machine learning is thriving thanks to high-powered computing and a flood of data. But when it comes to investing, more data doesn’t necessarily mean better predictions. Horst Simon, Chief Research Officer of the Lawrence Berkeley National Laboratory, and Bryan Kelly, Head of Machine Learning at AQR, discuss the promise and potential perils of these computing advancements. This podcast was recorded on May 17, 2019.The views expressed in this recording are the personal views of the participants as of the date indicated and do not necessarily reflect the views of AQR itself. AQR and its...

2019-09-0420 min

The Curious InvestorCalculated RisksRisk is part of any endeavor, whether you’re managing money or multi-million-dollar robots on Mars. Steve Squyres, the Scientific Principal Investigator of the Mars Exploration Rover Project, and AQR’s Lars Nielsen offer two unique perspectives on managing risk.This podcast was recorded on April 15, 2019.The views expressed in this recording are the personal views of the participants as of the date indicated and do not necessarily reflect the views of AQR itself. AQR and its affiliates may have positions (long or short) or engage in securities transactions that are not consistent with...

2019-08-2129 min

The Curious InvestorExtra Credit in Active Fixed IncomeActive fixed income managers have tended to beat their benchmarks, but AQR’s Tony Gould and Scott Richardson peek under the hood of that outperformance to reveal that it’s highly correlated with equities.

This podcast was recorded on March 8, 2019.

The views expressed in this recording are the personal views of the participants as of the date indicated and do not necessarily reflect the views of AQR itself. AQR and its affiliates may have positions (long or short) or engage in securities transactions that are not consistent with the information and views expressed in this presentation. This recording has been prep...

2019-08-0719 min

The Curious InvestorWhy Merger Arb WorksMark Mitchell of AQR affiliate CNH Partners explains how, why, and when merger arbitrage works – and why knowing this still doesn’t make it easy.This podcast was recorded on May 3, 2019. Effective January 1, 2021 CNH Partners, LLC was renamed to AQR Arbitrage, LLC.The views expressed in this recording are the personal views of the participants as of the date indicated and do not necessarily reflect the views of AQR itself. AQR and its affiliates may have positions (long or short) or engage in securities transactions that are not consistent with the information and views expressed in t...

2019-07-2420 min

The Curious InvestorDiversify or Hedge?Diversification can help returns over the long-term but hedging offer advantages in the short term. Ronen Israel and Roni Israelov share their insights about each.This podcast was recorded on March 22, 2019. The views expressed in this recording are the personal views of the participants as of the date indicated and do not necessarily reflect the views of AQR itself. AQR and its affiliates may have positions (long or short) or engage in securities transactions that are not consistent with the information and views expressed in this presentation. This recording has been prepared solely for informational...

2019-07-1025 min

The Curious InvestorInverted Yield CurvesConventional wisdom says that when the yield curve inverts, the economy slows down. AQR Principal Jordan Brooks and David Kupersmith review the evidence, and discuss what it means for an investor’s bond portfolio.This podcast was recorded on May 21, 2019. The views expressed in this recording are the personal views of the participants as of the date indicated and do not necessarily reflect the views of AQR itself. AQR and its affiliates may have positions (long or short) or engage in securities transactions that are not consistent with the information and views expressed in this pr...

2019-06-2622 min

The Curious InvestorCommodities: Past, Present and FuturesCaroline Sasseville walks us through commodities—what they are, how their returns behave, and what investors should consider before investing. Bill Eckhardt of Eckhardt Trading Company tells us about trend following and his legendary commodities experiment with the “turtle traders.”This podcast was recorded on April 8, 2019. The views expressed in this recording are the personal views of the participants as of the date indicated and do not necessarily reflect the views of AQR itself. AQR and its affiliates may have positions (long or short) or engage in securities transactions that are not consistent with the inform...

2019-06-1228 min

The Curious InvestorMomentumAQR co-founder and Managing Principal Cliff Asness and Alpha Architect CEO Wes Gray discuss momentum – what it is and why it works.This podcast was recorded on April 1, 2019. The views expressed in this recording are the personal views of the participants as of the date indicated and do not necessarily reflect the views of AQR itself. AQR and its affiliates may have positions (long or short) or engage in securities transactions that are not consistent with the information and views expressed in this presentation. This recording has been prepared solely for informational purposes. Nothing contained in...

2019-05-2924 min

The Curious InvestorSeason 2Welcome to the second season of The Curious Investor, a podcast that tackles complex financial topics and explains how investing should be grounded in a healthy dose of skepticism and economic intuition.This podcast was recorded on April 15, 2019. The views expressed in this recording are the personal views of the participants as of the date indicated and do not necessarily reflect the views of AQR Capital Management, LLC (“AQR”) itself. AQR and its affiliates may have positions (long or short) or engage in securities transactions that are not consistent with the information and views...

2019-05-2201 min

Invest Like the Best with Patrick O'ShaughnessyCliff Asness – The Past, The Present & Future of QuantMy guest this week is Cliff Asness, the managing and founding principal at AQR Capital Management. 20 years after its founding in 1998, AQR manages $226 Billion dollars across a number of quantitatively based investing strategies. Cliff was an original quant researcher and he has long been one of the financial writers and thinkers that I look to for education and for inspiration. I distinctly remember reading one paper in particular—value and momentum everywhere—somewhat early in my career and thinking: this is the kind of research I want to do forever. You can always tell when talking to Cliff or hear...

2018-11-131h 26

The Curious InvestorFundamental… or Quant?Our guests debunk some common misconceptions about two approaches to investing: quantitative and fundamental. And they explain how their differences might actually make them complimentary. Disclaimer: This podcast was recorded on August 1, 2018. The views expressed in this recording are the personal views of the participants as of the date indicated and do not necessarily reflect the views of AQR itself. AQR and its affiliates may have positions (long or short) or engage in securities transactions that are not consistent with the information and views expressed in this presentation. This recording has been prepared solely for informational purposes...

2018-10-0319 min