Shows

Everyday Wellness: Midlife Hormones, Menopause, and Science for Women 35+Ep. 532 Medicine Has Lost Its Way – The Most Honest Take on What’s Broken | Menopause with Drs. Lazris & RothToday, I am honored to connect with doctors Andy Lazris and Alan Roth, the authors of A Return to Healing. Dr. Lazris, a physician practicing geriatric primary care medicine in Maryland, is a Certified Medical Director who orchestrates medical care and provides education for several long-term care facilities. Dr Roth is a physician, practicing family medicine and palliative care in New York. He is the Chairman of the Department of Family Medicine and Ambulatory Care at MediSys Health Network. In our discussion, we explore the impact of the Flexner Report, including how it has reshaped our medical system and clinical g...

2025-12-241h 01

Everyday Wellness: Midlife Hormones, Menopause, and Science for Women 35+Ep. 532 Medicine Has Lost Its Way – The Most Honest Take on What’s Broken | Menopause with Drs. Lazris & RothToday, I am honored to connect with doctors Andy Lazris and Alan Roth, the authors of A Return to Healing. Dr. Lazris, a physician practicing geriatric primary care medicine in Maryland, is a Certified Medical Director who orchestrates medical care and provides education for several long-term care facilities. Dr Roth is a physician, practicing family medicine and palliative care in New York. He is the Chairman of the Department of Family Medicine and Ambulatory Care at MediSys Health Network.

In our discussion, we explore the impact of the Flexner Report, including how it has reshaped our medical s...

2025-12-2458 min

pharmaphorum PodcastOn AI and computational support of biochemistry, with Alan RothAI’s growing influence in pharma is transforming traditional drug discovery timelines.

In a new pharmaphorum podcast, web editor Nicole Raleigh speaks with Dr Alan Roth, CEO of Oxford Drug Design, about the use of AI to accelerate discovery of new treatments for cancer, infectious diseases, and cystic fibrosis.

Roth discusses combining deep enzyme biology expertise with GenAI and targeting leucyl-tRNA synthetase.

You can listen to episode 231 of the pharmaphorum podcast in the player below, download the episode to your computer, or find it - and subscribe to the rest of the series – on Appl...

2025-12-1621 min

The Retirement SpectrumTaxes on Sale? Why You Need to Look at Your Roth 401k Right NowYou’ve been great at saving, but how do you make that money last for 30 years? Alan Cohen breaks down the week's financial news, focusing on the essential steps for retirement success. Learn about key topics like protecting your nest egg against market downturns, securing guaranteed lifetime income, and the crucial differences between Traditional vs. Roth 401k plans. Get expert insight on de-risking your portfolio, dealing with taxes in retirement, and the importance of having a robust income strategy. To learn more about Alan and the team at Spectrum Wealth Partners, go to www.spectrumwp.com....

2025-12-0928 min

Your Money, Your WealthRoth IRA vs. Traditional IRA: Which is Better for Retirement Savings?McDreamy Dempsey wants to know if converting to Roth in the 37% tax bracket ever makes sense, and Gary in La Crosse warns Joe Anderson, CFP® and Big Al Clopine, CPA about Roth conversion "lag" and when it DOESN'T make sense to convert, today on Your Money, Your Wealth® podcast 558. Plus, Wine Guy and Gal in Northern California want a spitball on whether they should protect their ACA subsidies or keep converting to Roth before Medicare kicks in. Then it's the classic question for Robert in Napa, Luke and Lorelai in Indiana, and Phil and Claire in California: should they sa...

2025-12-0251 min

Conversations with Calvin; WE the SpeciesALAN ROTH; Screenwriter, Nicholl Fellowship Award, Producer, Adjunct Prof Screenwriting-Fairleigh Dickinson University; LIVE from New York#realconversations #screenwriter #professor #Hollywood#Casablanca #producer #author #NichollFellowshipCONVERSATIONS WITH CALVIN WE THE SPECIES hosted by CalvinSchwartzMeet ALAN ROTH, Screenwriter. “Speaking of movies, I’m ahopeless romantic, as many know. My first novel, Vichy Water, arrived from deepspace after my 44th viewing of ‘Casablanca.’ Alan and I talk about Bogart andthe Epstein brothers, screenwriters of that movie. Alan arrived in my field ofvision from deep networking space and illuminated me with his journey intoscreenwriting and his vast command and knowledge of Hollywood and the art ofscreenwriting. What lit his fire was winning the coveted Nicholl...

2025-11-251h 07

Your Money, Your WealthRoth Conversions vs. 0% Capital Gains Rate: a Retirement Tax Trap?Joe Anderson, CFP® and Big Al Clopine, CPA spitball Roth conversions, capital gains, and retirement readiness from every angle, today on Your Money, Your Wealth® podcast number 556. Joe Momma from Virginia wants to know if his zero percent capital-gains strategy is too good to be true, if he can trust his advisor, and if it's finally time to start converting to Roth. David in Poway is already converting his IRA to Roth, but should they convert his wife Shannon's too? Thomas wonders when in retirement to finally start using the Roth money he's saved, instead of just admiring it. An...

2025-11-1831 min

Sofia UnfilteredWhy Modern Medicine Feels So Cold (and What to Do About It) with Dr. Alan Roth & Dr. Andy Lazris EP 75Have you ever left a doctor’s office feeling rushed, dismissed, or more like a “chart” than a person? You’re not imagining it.In this episode of Sofia Unfiltered, host Riley Rees sits down with two nationally recognized physicians—Dr. Alan Roth and Dr. Andy Lazris, co‑authors of A Return to Healing—to unpack how a century of policy decisions, corporate interests, and profit‑driven care reshaped medicine into something unrecognizable.From the 1911 Flexner Report and the elimination of diverse medical schools, to today’s overtesting, overprescribing, and 8‑minute appointments, Drs. Roth and Lazris reveal why ev...

2025-11-0447 min

Your Money, Your WealthShould You Convert to Roth Before or After You Retire?Joe Anderson, CFP® and Big Al Clopine, CPA tackle one of the trickiest timing questions in retirement planning, today on Your Money, Your Wealth podcast number 553: when should you convert to Roth, while you're still earning, or after retirement? First, James from Texas wonders if it's worth maxing out his high-fee 457 plan, or if he's better off investing in a low-cost brokerage account. Full-time travelers "Lois and Clark" want to know how much they should keep converting to Roth now that they're on Medicare. Ray Charles in Chicago is burned out on corporate life and plans to quit at 55. I...

2025-10-2840 min

Retirement 360Roth Conversions and Medicare Open Enrollment - October 12, 2025Alan and Troy take a look at Roth conversions, when they can make sense and how to do them to get the best tax benefits from them. Then Alan is joined by Elizabeth Gillette to talk about Medicare Open Enrollment, which begins this Wednesday.Retirement 360 is a Sunday morning radio tradition in the Louisville, Kentucky area, running for well over a decade. Alan Mercuio and Troy Bolton of Mercurio Wealth Advisors take a look at economic issues and topics related to retirement planning, as well as educating listeners to help prepare them for their post-working years, whatever they...

2025-10-1251 min

Retire Right with Alan BeckerInterest Rate Shake-Up: Retiree Moves That MatterWhat do falling interest rates, Roth conversions, and soup season have in common? On this episode, Alan Becker and Nikki Vivas mix timely financial headlines with practical retirement wisdom—plus a dash of personality you won’t want to miss. Whether you love a good chunky Campbell's soup reference or you’re worried about what the Fed’s recent moves mean for your retirement income, you’ll find something to chew on.Thinking about protecting your retirement from market volatility or wondering if now’s the moment to go Roth? Alan breaks down the essentials without getting lost in financial...

2025-10-1157 min

Your Money, Your WealthIs Your Roth Conversion Timing All Wrong? (Financial Blunders)Joe and Big Al spitball on how to avoid screwing up the timing of your Roth conversions, today on Your Money, Your Wealth® podcast number 550. Barrie from New York is 62 and single, and she's been diligently converting pre-tax money each year for lifetime tax-free Roth growth. Should she continue after she retires next year? "Jerry and Elaine" want to retire in the next six years and still leave the kids an inheritance. When should they start Roth conversions? Alex in Pennsylvania is a 31-year-old software engineer. Should he convert his IRA to Roth all at once? Plus, how can h...

2025-10-0749 min

The Retirement SpectrumRoth Conversions, Headlocks, and How to Outsmart Uncle SamAre you ready to discover the secrets to smarter retirement planning and avoid costly mistakes? Join Alan Cohen and the Spectrum Wealth Partners team as they break down the essentials of portfolio x-rays, Roth conversions, and defensive investing. Learn how to protect your assets, minimize taxes, and navigate today’s financial uncertainties—all with a dash of humor and real-life stories. Whether you’re retired or just starting to plan, this episode delivers practical insights for every stage of your financial journey. To learn more about Alan and the team at Spectrum Wealth Partners, go to www.spectru...

2025-10-0725 min

Your Money, Your WealthRoth Conversions: When to Make 'Em, When to Take 'Em A YMYW listener from Missouri and his wife are retired at 69 and 67, with less than $2 million dollars. Should they continue converting retirement savings to Roth for the tax-free growth? What should they do about long term care insurance? More importantly, is our listener's name (Cousy) pronounced "Cuzzy" or "Koozy"? Speaking of Roth conversions, must "Peggy Hill" wait five years to withdraw her conversion money, or only its earnings? That's today on Your Money, Your Wealth® podcast number 547 with Joe Anderson, CFP® and Big Al Clopine, CPA. Plus, is Skipper's retirement payout plan the killer deal he thinks it is? Ho...

2025-09-1643 min

Just the Tip Podcast by F+B MiamiMiami Nightlife Uncovered: Alan Roth on Building Rosa Sky & GiselleAlan Roth is a driving force in Miami nightlife. From starting as a cashier at News Café, to helping open the Delano’s iconic Blue Door restaurant, to now creating some of the city’s most talked-about spots—Rosa Sky rooftop, Giselle Miami, and the Jagger Suite—Alan has built experiences that define how Miami goes out.In this Just a Tip podcast episode, we cover:How Alan Roth went from the ground floor to owning Miami nightlife hotspotsThe story behind Rosa Sky and Giselle, two of Miami’s best rooftop bars and re...

2025-09-101h 37

Your Money, Your WealthWhat The New Law Means For Your Roth IRA!One Big Beautiful Bill is now law. How does it impact your Roth conversion strategies and other financial decisions? Plus, you may have seen or heard other advisors talking about their strategies for getting your retirement savings into tax-free Roth accounts. How are these different from a good ol' Roth conversion, and what do Joe and Big Al think of them? Find out today on Your Money, Your Wealth® podcast number 545 with Joe Anderson, CFP® and Big Al Clopine, CPA. Also, why is Ed Slott, CPA, the man known to many as "the IRA guru," such a fan of pe...

2025-09-0238 min

Humans & AIDr. Alan Roth — AI in Drug Discovery, AI Innovation and Limitations, Human OversightDr. Alan Roth, CEO of Oxford Drug Design, has a diverse background in life sciences spanning research, capital markets, consultancy, and company leadership. He began as a chemist at Merck in New Lead Discovery, later serving as a consultant at McKinsey and Director at Commerzbank Asset Management overseeing bio-investments. He co-founded and led Chiral Quest, Inc., and was a Royal Society Entrepreneur in Residence at Oxford, where he is also a Visiting Lecturer. He holds degrees from Cornell, Columbia, and Oxford.

Dr. Alan Roth

LinkedIn: https://www.linkedin.com/in/alandroth/?originalSubdomain=ukWebsite: http...

2025-08-1933 min

The Key IngredientGiselle to Rosa Sky: Alan Roth's Vision for Miami Nightlife

Stefan Contorno

Sun, Jul 13, 1:45 PM

to me

Welcome to The Key Ingredient Podcast!

Hey everyone, and welcome back to The Key Ingredient Podcast, the show that brings you the secret sauce behind incredible success stories. Today, we're taking you on a journey to the vibrant heart of Miami's hospitality scene.

I'm thrilled to have with me a true visionary in the restaurant and nightlife world: Alan Roth, one of the brilliant minds behind two of Miami's hottest spots, Giselle and Rosa Sky Rooftop.

In this episode, Alan opens up about his remarkable entrepreneurial journey. We'll...

2025-07-301h 09

Shrink Me? I am just waking upCut the Cord: What Alan Eustace’s 135,000-Foot Jump Reveals About Betrayal and Autonomy135,000 feet above Earth, Alan Eustace let go. No rocket. No capsule. Just a suit and a cord. He cut it. And fell. Four and a half minutes. Faster than sound. Alone. Until he landed. Changed.This episode is about that kind of fall. Not into Earth, but into you. Into truth, ... and into autonomy.I'm Dr. Lia Roth, psychoanalyst and author of Get In or Get Out But Don’t Stay in the Freakn’ Middle. And in this episode, I want to talk to all of us who are in freefall. After betrayal. After burnout. After pl...

2025-07-2017 min

The Retirement SpectrumRoth Conversions, Risk & Retirement: What You Need to Know NowIs your retirement plan built to last 30 years—or even 40? In this episode of The Retirement Spectrum, Alan Cohen breaks down the real risks retirees face, from rising taxes to outliving their savings. He explains how Roth conversions, protective growth investments, and income planning can help you build a more resilient retirement strategy. Whether you’ve saved $500K or $5 million, Alan shares how to structure your portfolio for confidence, flexibility, and long-term success. To learn more about Alan and the team at Spectrum Wealth Partners, go to www.spectrumwp.com. See omnystu...

2025-07-0845 min

Industry Talks Hospitality PodcastUntold Story of Rosa Sky Miami | Alan Roth & Tim Petrillo | Industry Talks Hospitality Podcast

They lost $150,000 in 3 days. Faced real estate disasters. Built iconic brands like Rosa Sky. And still believe hospitality is worth the chaos. Alan Roth and Tim Petrillo are titans in hospitality. From unexpected partnerships to rooftop miracles, this is the raw, untold story of nightlife, loss, reinvention — and what’s coming next for restaurants.

They reveal:

● Why one of their businesses collapsed in just 72 hours

● What it takes to make a hospitality partnership work

● How Rosa Sky was born out of a sunset (and a little weed)

2025-06-301h 07

Your Money, Your WealthWhen Do Roth Conversions STOP Making Sense?Ryan in Texas is in the 32% tax bracket. Where should he save for retirement so he'll be in a lower bracket? Should Weronika in Texas pay the taxes now to convert to Roth for lifetime tax-free growth in the future, even though she's in the 37% tax bracket? And Jerry in Phoenix wonders if there is a point where Joe would come to the conclusion that Roth conversions no longer make sense? Stay tuned for the 7 reasons to consider NOT converting to Roth, today on Your Money, Your Wealth podcast number 535 with Joe Anderson, CFP® and Big Al Clopine, CPA. F...

2025-06-2426 min

The Practice of the Practice Podcast | Where Modern Psychology Meets the Business of TherapyTIME Magazine Named Dr. Alan Roth a Guardian of Healthcare | POP 1208How can we fix America’s healthcare system to focus on true healing? Why must medicine shift from numbers to relationships, and how can we redefine wellness and success in care?

Joe Sanok talks with Dr. Alan Roth—TIME-featured physician and healthcare reform advocate—on transforming medicine into patient-centered, preventive care.

The post TIME Magazine Named Dr. Alan Roth a Guardian of Healthcare | POP 1208 appeared first on How to Start, Grow, and Scale a Private Practice | Practice of the Practice.

2025-05-2132 min

Your Money, Your WealthWhen to HOLD OFF on Doing Roth ConversionsJohn in Boston is in the 32% tax bracket. Should he do Roth conversions? Flight Deck Dad and Irish Girl in Pensacola have a lot of tax-free pension income. Should they do Roth conversions? Bert and Ernie in New Jersey wonder if they should convert to Roth or take advantage of zero percent capital gains tax rates. Joe Anderson, CFP® and Big Al Clopine, CPA spitball for all of them today on Your Money, Your Wealth® podcast number 529. Plus, Michael and his wife in Bellevue are 34, in the 24% tax bracket and wonder if they should contribute to tax-free or tax-deferred ac...

2025-05-1337 min

Your Money, Your WealthRoth IRA is "The Greatest Account Ever" Per Ed Slott. But Why?Just about every week here on YMYW, Joe and Big Al talk about converting your retirement savings to Roth accounts. But why? What's the big deal? Today the "IRA guru" Ed Slott, CPA returns to Your Money, Your Wealth® in podcast number 526 with Joe Anderson, CFP® and Big Al Clopine, CPA to tell us why he calls the Roth IRA "the greatest account ever created." (Here's a hint: it's all about having tax-free income in retirement - and beyond.) Plus, where to prioritize saving for retirement? Jerry Tom in St. Louis wants to know. Are Christian and Tiffany in Mo...

2025-04-2251 min

Getting to Third Space with Lamar and TomS2E8 - Truth, Truthiness, and Not So Truthy ConversationsCivil conversations and dialogue are made more difficult when participants are not speaking honestly, are simply parroting the ideas of others, or are unwilling to consider being changed through dialogue. In this episode, Lamar and Tom talk about conversations in which truth is illusive, and truthiness is not valued.Learn more: The work of Alan Yarborough and his organization, Habits of Discourse, was part of the inspiration of this episode:https://www.habitsofdiscourse.com/How We Check OurselvesFact Checking: Because there are a lot of things happening…some tru...

2025-04-1446 min

Your Money, Your WealthShould You Switch Retirement Contributions to Roth?Is it better to save for retirement in traditional 401(k)s and IRAs, or in Roth accounts? That's today on Your Money, Your Wealth® podcast 518 with Joe Anderson, CFP® and Big Al Clopine, CPA. Plus, what are the rules around contributing to two different types of Roth accounts? If required minimum distributions will be staggered because of a couple's age difference, should they convert their retirement savings to Roth, or leave it alone? But first, Joe and Big Al have a backdoor Roth conversion withdrawal debate to settle. Access free financial resources and the episode transcript: https://bi...

2025-02-2540 min

Your Money, Your WealthDeferred Comp, Roth Strategies, Asset Protection (and Gold)Mike and his wife in Tampa are 39 and 36, they've got nearly a million bucks saved. Are they on track for retirement? Kate in California is 55 and hopes to retire in the next couple of years. How should she manage deferred compensation and retirement withdrawals? That's today on Your Money, Your Wealth® podcast number 514 with Joe Anderson, CFP®, and Big Al Clopine, CPA. Plus, Joe and Big Al answer questions from our YouTube viewers on considering IRMAA when making Roth conversions, paying Roth conversion taxes quarterly or in December or in January, protecting a gifted house from a child's ex, an...

2025-01-2831 min

The Gracious TwoThe Gracious Two - LIVE Show 061 - Alan RothCensorship, Gaslighting and Digital Transparency:The Gracious Two, John Rotolo and Chad Gracey discussed the censorship of the Trump-Rogan interview by Google, with Chad expressing his belief that this was an act of election interference. They also discussed Kamala Harris's reluctance to appear on Rogan's show, with Chad suggesting that she is a gaslighter and narcissist who doesn't want her true loyalties to be revealed. They also touched on the controversy surrounding Kamala's claim of working at McDonald's, with Chad stating that the picture of her in a McDonald's uniform was fake.

2025-01-201h 01

Your Money, Your WealthDefusing a Future Tax Bomb With Roth ConversionsDoes it make sense for Alex and his wife in Massachusetts to do Roth conversions now to the top of their eventual tax bracket? Steve in San Diego got serious about saving for retirement after Joe and Big Al gave him some tough love 5 years ago. Is he good to retire now, and should he convert to Roth? That's today on Your Money, Your Wealth® podcast number 510 with Joe Anderson, CFP® and Big Al Clopine, CPA. Plus, can Barbara in New Jersey's grandson move excess 529 funds to a Roth and withdraw the money after 5 years? PWare has a cunning pl...

2024-12-3133 min

Your Money, Your Wealth9 Answers to Boost Tax-Free Roth Retirement IncomeJoe Anderson, CFP® and Big Al Clopine, CPA spitball on paying the tax on your Roth conversions on Your Money, Your Wealth® podcast number 507. If you take the money out of your retirement account, what does Joe mean that you'll be "paying the tax to pay the tax to pay the tax"? Can you pay it from the Roth account itself, or from your monthly pension tax withholding? Are the fellas wrong on this whole topic altogether? They also spitball on withdrawing Roth 401(k) contributions that were rolled to an IRA, those infamous 5-year rules for withdrawals from Roth ac...

2024-12-1034 min

Your Money, Your WealthRules for Inheritances and Making Roth Contributions for OthersCan Ted and Georgette convert $1.6M in an inherited trust to Roth without distributing it? Should the trust own their home so they can use the home equity? Melissa was added as joint owner on her parents' bank accounts after a medical event, but what have they done? Should Ralph and Alice use the required minimum distribution from their inherited IRA to pay Roth conversion taxes? That's today on Your Money, Your Wealth® podcast 504 with Joe Anderson, CFP® and Big Al Clopine, CPA. Plus, can Theodore contribute to a his wife Louise's Roth IRA? Can Marc make Roth contributions fo...

2024-11-1939 min

Your Money, Your WealthWhen to Pay Off Your Home, Retire, and Do Roth ConversionsWhen should Jack and Swan in Florida pay off their home, retire, and convert their savings to Roth for lifetime tax-free investment growth? Jennifer in Colorado wonders whether she should take taxes into account when calculating her expenses, and whether she should pay off her home to be debt-free in retirement? That's today on Your Money, Your Wealth® podcast 503 with Joe Anderson, CFP® and Big Al Clopine, CPA. Plus, should Kevin in Scottsdale collect Social Security in 2025, or postpone and do Roth conversions over the next two years? Should Skipper in Texas do Roth conversions to the top of th...

2024-11-1252 min

Your Money, Your WealthSpend RMDs, or Reduce Distributions and Taxes With Roth Conversions?Hawkeye and Elle are age 61 and in the 32% tax bracket. How should they get money into their Roth accounts for tax-free retirement income? Clark and Ellen are 69 and 68, expenses will pretty much be covered by their fixed income, but they'd like to leave Roth money to their kids. Should they keep converting to Roth, or use required minimum distributions for their living expenses? Tom and his wife are 73, and fixed income will cover their retirement spending too. Is it advantageous to them to make three huge Roth conversions beyond their marginal tax bracket to reduce future RMDs? Should they...

2024-10-0839 min

Your Money, Your WealthTax-Savvy In-Plan Roth Conversions and Inherited IRA WithdrawalsShould David in Ohio use 457 funds to do an in-plan Roth conversion in his 403(b) plan, and should he hire a financial advisor? Chris in DC needs a retirement and Roth conversion spitball analysis, and he needs help getting out of a variable annuity. Kim is anxious that she made a mess of her finances and she wonders how much she should convert to Roth, today on Your Money, Your Wealth® podcast number 497 with Joe Anderson, CFP® and Big Al Clopine, CPA. Plus, what's the best way for Alissa in Cedar Rapids, Iowa to make tax-efficient withdrawals from an in...

2024-10-0143 min

Your Money, Your Wealth3 Strategies to Pay Roth Conversion TaxesToday on Your Money, Your Wealth® podcast 495, Joe Anderson, CFP® and Big Al Clopine CPA spitball on three different listeners' strategies for paying the tax on a Roth conversion now, to have lifetime tax-free growth on that money in the future. Should Neo in San Clemente, California convert to Roth at the beginning or end of the year in his plan to make quarterly estimated tax payments on his conversion? Is it a good strategy for Tim in Minnesota to use reimbursements from his health savings account to pay Roth conversion taxes? And what do Joe and Big Al th...

2024-09-1733 min

Your Money, Your WealthExchange Funds Explained, Roth Conversion TimingWhat is an exchange fund and is it a good thing if you have a lot of capital gains like Bryan in New York? That's today on Your Money, Your Wealth® podcast 492 with Joe Anderson, CFP® and Big Al Clopine, CPA. Plus, what should be the timing and ordering of Billy Joe and Bobby Sue's Roth conversion strategy to help them achieve 33 years of retirement income? Is Boston overspending or underspending in retirement? Should Andy keep life insurance policies for her kids with ADHD? How does the 5-year rule for Roth withdrawals apply to inherited Roth IRAs for Karen? Vi...

2024-08-2747 min

Your Money, Your WealthMarket Timing Retirement Withdrawals and Roth ConversionsIs timing the market when you withdraw money from your retirement accounts or do Roth conversions an effective strategy to minimize tax and maximize returns for YMYW listener Robert? That's today on Your Money, Your Wealth® podcast 488 with Joe Anderson, CFP® and Big Al Clopine, CPA. Plus, should Doug change his 60/40 asset allocation, and should he start a solo 401(k)? Jefe plans to withdraw from his retirement accounts beyond the top of the 24% tax bracket for the first few years of retirement. Is there any reason to put it in a brokerage account rather than converting it to Roth? Th...

2024-07-3048 min

Retirement Coach's CornerAdding Social Security to Your Retirement Income PlanIn retirement, your income source is different than it was during your working years. With inflation and market fluctuations to consider, how can you build an income plan that is strong and stable? Alan and Troy share what a comprehensive retirement income plan looks like and what kind of accounts you want to draw from first. Then, they talk through strategies around Roth conversions. Is it right for you? While there are limits to how much you can contribute to a Roth IRA each year, does that rule apply for Roth conversions? What kind of impact could...

2024-07-0212 min

Your Money, Your WealthRoth Conversions vs. Required Minimum DistributionsShould Mike in Virginia keep using his IRA money to pay the tax on his Roth conversions? How do you do a Roth conversion when you don't have the money to pay the tax? That's PeterLemonJello's question, but is it the question he should be asking? Spitballing Roth IRA conversion strategies to reduce your taxable required minimum distributions (RMD) in retirement - that's today on Your Money, Your Wealth® podcast 484 with Joe Anderson, CFP® and Big Al Clopine, CPA. Plus, Susan and Mike in Ohio are retired, in the 24% tax bracket, and considering converting $50k or $75k to Roth...

2024-06-0438 min

Your Money, Your Wealth401(k) vs. Roth: Where to Save for RetirementKyle and his fiancée are in their 30s, have done a great job saving, and are in a high tax bracket. Would it make more sense for them to contribute to their 401(k)s or Roth 401(k)s for retirement? Mick's wife Pam has both W-2 and sole proprietor income - where should she save for retirement? That's today on Your Money, Your Wealth® podcast 480 with Joe Anderson, CFP® and Big Al Clopine, CPA. Plus, the fellas spitball for Janet on where junk bonds belong in a portfolio, they untangle the pro-rata and aggregation rules concerning 401(k) to Rot...

2024-05-0741 min

Your Money, Your WealthWhat's the Break-Even Point on Roth Conversions?Are there ever times when going all Roth isn't the best strategy? How do you determine the break-even point on doing Roth conversions? That's today on Your Money, Your Wealth® podcast number 477, as Joe Anderson, CFP® and Big Al Clopine, CPA spitball on marginal vs. effective tax rates for Joseph Allen, saving to after-tax brokerage or pre-tax 403(b) for Gigi in Illinois, the arithmetic of Roth conversions for Carl Spackler in Florida, and the mega backdoor Roth for Jefe in Texas. For something completely different, we'll wrap it up with a discussion of tax forms that need to be fi...

2024-04-1646 min

A Day in Miami ShowSmoking with Wilt Chamberlain | Alan RothWe had a pleasure to sit down and talk with Miami's nightlife and hospitality royalty and legend - Alan Roth.

Alan is a true veteran when it comes to Miami's hospitality. He went from working at an iconic Delano Hotel to opening the popular Rosa Sky Rooftop, along with Giselle on top of the famous club E11EVEN.

Check out this podcast where Alan talks about how Miami's nightlife has changed over the decades, his new projects, and his craziest stories from working in hospitality for over 30 years, including smoking with the legendary Wilt Chamberlain.

Enjoy!

Alan Roth:

Instagram...

2024-04-0938 min

Your Money, Your WealthWill Roth Conversions Put You On Track to Retire Early?Rob and his wife in North Carolina are 51 and 44 and would like to retire in the next 3-5 years. Are they on track, and what should they consider as far as Roth conversions are concerned once the tax brackets go back up, which they're slated to do when that provision in the Tax Cuts and Jobs Act sunsets at the end of 2025? Is Mark in West Virginia on track to retire at 59 and a half, and do Joe and Big Al have any pointers on how he can find the love of his life? Mike and Gina in Rhode...

2024-03-1250 min

Your Money, Your WealthHow Much Should You Convert to Roth IRA?Big Tex, Paul in Maryland, and Nick in Alabama all need to know how much money they should convert to Roth to pay as little tax as possible, today on Your Money, Your Wealth® podcast 471 with Joe Anderson, CFP® and Big Al Clopine, CPA. Johnny and June forgot to convert their backdoor Roth money - are they in trouble? Darren in Nevada has no plans at all to do Roth conversions, but surprisingly still listens to YMYW, and still wants a spitball on his retirement and real estate investment strategies. Plus, can Lolly Pop in New Jersey be less mi...

2024-03-0553 min

Your Money, Your Wealth401(k) Ins & Outs, Roth Conversion Benefits, and Divorce FinancesErik in MN is divorced, and the OC Birdman of South OC is getting divorced. Should Erik contribute to pre-tax retirement accounts or Roth? How should the Birdman and his soon-be-ex time the sale of their house and the filing of their taxes? That's today on Your Money, Your Wealth® podcast 469 with Joe Anderson, CFP® and Big Al Clopine, CPA. Plus, Don has questions about the 401(k) rule of 55 and excess 529 plan college savings. Valerie in Portland wants to know what to do with her old 401(k), and how to invest her new retirement accounts. An advisor tells K-Dog in...

2024-02-2050 min

Your Money, Your WealthRoth Conversions to Pay Less Tax on Retirement WithdrawalsShould Peter LemonJello, who has high income, and his wife, who is retired with zero income, file their taxes as married filing separately so they can start Roth conversions? What are the tax implications of Roth conversions for Randy in Chi-town, an early retiree in the 32% tax bracket? Caity with a C in SLC is self-employed and over the income max to contribute to a Roth, so now what? And Ben in Oceanside, CA wants to know what impact Roth conversions will have on required minimum distributions after age 73? Joe Anderson, CFP® and Big Al Clopine, CPA spitball on a...

2024-01-3047 min

Sound Up! with Mark Goodman and Alan LightMusic news on Madonna, David Lee Roth, Justin Timberlake and the audience sounds off on music festivals.Music news on Madonna, David Lee Roth, Justin Timberlake and the audience sounds off on music festivals.TRT 41:11Break at 19:48Use generic promo Description On this episode of Sound Up! with Mark Goodman and Alan Light, we cover the latest music new including Madonna’s response to the recent lawsuit brought on by 2 fans for her late concert start time, Corey Taylor cancels tour, Justin Timberlake’s return with a new single and video, David Lee Roth starts feud with Wolfgang Van Halen and more - Plus you the sound up audien...

2024-01-2642 min

Your Money, Your WealthTax Strategies, Backdoor Roth, Buy vs. RentIt's a voice message extravaganza as Joe and Big Al talk about tax gain harvesting on Dante in New York's daughter's custodial account, and the tax impacts of Leon in Chicago investing in his brokerage account. The fellas also spitball on whether Michelle in San Diego, en route to San Francisco, should buy or rent in her 60's, the mega backdoor Roth and the pro rata rule for Sean and his cichlids in Winter Springs, Florida, and whether Jason in NOLA can do the backdoor after recharacterizing his contribution. Plus, should Kevin in Ohio make like the Steve Miller...

2024-01-1655 min

Your Money, Your WealthRetirement Investing, Roth Conversion Pros & Cons: YMYW Best of 2023We're revisiting your favorite Your Money, Your Wealth topics and Derails of 2023 in this Roth and retirement investing mega-episode. Safe investing when you're risk averse, mutual funds vs. ETFs, stable value funds, and estimating retirement income needs when you're a young saver with a pension made the YMYW best of 2023 on the investing side. On the Roth side, what to do when there's too much money in your traditional IRA, whether Roth conversions are really as good as they sound, and who's right about the Roth conversion strategy, our listener or his advisor? Timestamps: 01:05 - How...

2024-01-091h 11

Your Money, Your WealthRoth & Retirement Spitball, Insurance, and the Origins of YMYWSpitballing on early retirement and Roth conversions to finish 2023. How can Jack and Diane (no, the other, other Jack and Diane, these are the ones in Rochester, MN) bridge the gap to retirement at age 61? Can Michael in San Diego do a Roth conversion without it impacting his taxes? Plus, what should "the Flintstones" do with their whole life insurance policies? What spitballs of wisdom do the fellas have for Michael, who is "benefit-less" in Kansas City, MO? Then, we wrap up the final episode of the year with the YMYW origin story. Timestamps: 00:48 - How t...

2023-12-2640 min

Your Money, Your WealthHow to Invest: Bonds, CDs, and Roth ConversionsJoe and Big Al spitball on investing in index funds, bonds, CDs, treasuries, annuities, net unrealized appreciation on company stock, and where to park cash right now. Plus, how do taxes, Roth conversions or the Mega Backdoor Roth, and donor advised funds factor into those investing strategies? Will and Debbie in Gettysburg are investing an inheritance, LJ in Philly and Jane want the fellas' take on the pros and cons of various safe investments, Roger and Jessica in Cowtown Ft. Worth need four different financial spitballs, and should M.E. in Atlanta do a Roth conversion and put money...

2023-12-1947 min

Your Money, Your WealthCan High Earners Fund a Roth IRA Without Paying More Tax?Steve & Sharon in Minnesota are high earners - can they get more money into their Roth IRA without paying more tax? Should Fred in western New York do Roth conversions before required minimum distributions kick in? If Mike in Utah saves on healthcare premiums now, will that mean large RMDs and tax bills for him later? Should Mark in Maryland do a backdoor Roth after maxing out his 401(k)? And should Joseph in Kansas contribute to his new employer's traditional or Roth 401(k)? Timestamps: 00:49 - Should We Do Roth Conversions Before RMDs Kick In? (Fred, western NY...

2023-11-1453 min

The Alan Sanders ShowConversation with Carol Roth, author of "You Will Own Nothing"Today’s bonus episode is my sit-down conversation with Carol Roth. Carol describes herself as a “recovering” investment banker. She is the author of, “The War on Small Business,” is the New York Times bestselling author of, “The Entrepreneur Equation," and her latest book is called, “You Will Own Nothing.” She has worked in a variety of capacities across industries, including currently as an outsourced CCO, as a director on public and private company boards and as a strategic advisor. She advocates for small business, small government and big hair. Having heard Carol on my buddy Dennis Kneale’s show, “...

2023-10-2844 min

Your Money, Your WealthMega Backdoor Roth Conversion 5-Year Rule and Bond InvestingShould Jim in New Jersey do the YMYW-infamous Megatron (the Mega Backdoor Roth IRA) or use his Roth 401(k) - and how can he keep bonds out of his Roth accounts? Joe and Big Al discuss the January first start date when it comes to the 5-year rule on Roth conversions for Nancy in Wisconsin, and they spitball on those Roth clocks for withdrawals and tax-efficient investments for Johnny Mercer in Savannah, GA, who also wants to know the pros and cons of bonds vs. bond funds vs. CDs. Plus, should Brad in St. Louis incorporate bonds into his...

2023-10-1742 min

Your Money, Your WealthMarket Timing, Pension, & Roth Conversion Retirement SpitballHow will a diet COLA on a pension affect retirement plans for Joe and Barb in Tulsa? Percy in South Carolina has a pension too. He's timing the market, but should he change his investing strategy as he approaches retirement? Plus, Michael in Virginia needs ideas to fund a custodial Roth IRA for his 3-year-old and 2-month-old kids, and Rocco in NYC catches Big Al on capital gains exclusions. But first, will scary future events mean Michelle in San Diego will have to pay more tax and the highest possible Medicare premiums? Timestamps: 00:44 - Will Scary F...

2023-09-0540 min

Your Money, Your WealthWhat Are the Rules for Taking Money From a Roth IRA?Charles has had it with Joe and Big Al stumbling through the Roth 5-year rules, so he explains to Joe and Big Al, once and for all, the rules for withdrawing money from a Roth IRA. Plus, is Shane missing any retirement risks before he retires early at age 55? Nick wants to know if employers are required to adopt all of the provisions in the SECURE Act 2.0, or if they can pick and choose which to implement, like they can with the rule of 55? Plus, how can Stew offset huge capital gains on the sale of an inherited house...

2023-08-2936 min

The Locher RoomEmmy Award-Winning Filmmaker, Lead Pac-12 analyst and New York Times Best-Selling Author - Yogi Roth 11-2-2022Please join Yogi Roth, the Emmy award-winning Pac-12 football analyst, filmmaker, New YorkTimes best-selling author and former USC Football assistant coach, in The Locher Room.Yogi is the co-author of a new self-help/advice book for 5-Star athletes and their parents titled 5-STAR QB. The book is a compilation of candid, as told to interviews with more than 50 quarterbacks of their respective high school & college experiences on the field, and features letters of advice and encouragement from a slew of current and former college and NFL players, coaches, and analysts.Yogi will be here...

2023-08-111h 10

Your Money, Your WealthAre Roth Conversions Really As Good as They Sound?Christine isn't sure that Roth conversions are all they're cracked up to be. Erick needs a retirement spitball analysis for his Roth conversions, annuities, and the real estate in his self-directed IRA, Billy the disgruntled attorney wants to know if he can retire now, and Zach wonders just how bad is it to rely on the lottery for retirement? But first, Joe and Big Al spitball military retirement strategies. Timestamps: 01:16 - I'm 22, Military. Should I Be Spending More Instead of Saving So Much? (Cole - voice) 06:19 - I'm 27. How Should I Max Out Military and Second J...

2023-08-0148 min

Your Money, Your Wealth$7M Tax-Free or $10M Retirement? Backdoor Roth or Lower Fees?Should Carl Spackler stick with his backdoor Roth strategy, or go for lower fees? Should Kevin go all Roth, or stick with his current three tax-diversified buckets strategy? (That depends - would he rather have $7 million tax-free, or $10 million in tax-deferred retirement accounts?) Can Lily claim all the extra allowances she can, to jam as much money as possible into her Roth? Can Dave retire now and ride his motorcycle into the Bavarian Alpine sunset, and does Peggy Lee need to be feverish about the tax underpayment penalty with her Roth strategy? Timestamps: 00:53 - Do I...

2023-07-2542 min

Your Money, Your WealthHSA to Roth, RMD Investing, and Social Security StrategiesCan you convert your health savings account (HSA) to Roth, and do the five-year Roth withdrawal clocks apply? What should you do with money you'd been putting to your student loan debt if you're part of the student loan forgiveness program? What's the best way to invest your RMDs, or required minimum distributions? How does IRMAA, the income-related monthly adjustment amount for Medicare, apply to zero-coupon municipal bonds? And finally, strategies for collecting survivor Social Security benefits. Timestamps: 00:49 - Can I Convert a Health Savings Account HSA to Roth IRA and Do the 5-Year Rules Apply? (P...

2023-05-1633 min

Your Money, Your WealthRoth Conversions & Retirement Spitball AnalysisShould Edith and Archie live off their non-qualified accounts and pay Roth conversion taxes from their 401(k)? How can Johnny from Knoxville do Roth Conversions and stay in a low tax bracket Plus, at age 31, are Shad and his wife saving enough for retirement? What should Tech Chick do with her severance package after being laid off from her tech industry job? Finally, listener comments on retirement plan education, Roth conversions, and the 5-year Roth clocks. Timestamps: 00:39 - Live Off Non-Qualified Accounts, Pay Roth Conversion Tax From 401(k)? (Edith & Archie, TX) 11:35 - How to Do Roth C...

2023-03-2150 min

Retirement Coach's CornerEp 41: Mailbag – Roth Conversions, Inherited IRAs, Rental Properties & More It’s time to open up the mailbag and find out what’s on your mind when it comes to financial planning. In this episode, we’ll cover five different topics that impact both pre-retirees and retirees and we’ll coach you through each of these planning items today. Alan and Troy will discuss Roth conversions, why inherited IRA withdrawals have different rules, how to find a trustworthy advisor, rental properties, and tax planning. There’s a wide range of topics so we hope this episode touches on something you’ve been curious about. If you have anything you’...

2023-03-0216 min

Your Money, Your WealthSECURE 2.0, FIRE, Tax Arbitrage & Roth Retirement SpitballWith the new SECURE Act 2.0 rules regarding retirement savings contributions, should your company match go into the traditional or Roth 401(k)? Joe and Big Al also discuss whether you can or should do Roth conversions when your company fails non-discrimination testing for highly compensated employees (HCEs), the mega backdoor Roth vs. the employee stock purchase plan, and they spitball a tax arbitrage strategy. Plus, a retirement spitball for a 37-year-old couple wanting to retire in their 60s, and another couple wanting to FIRE (financial independence/ retire early) - but are they screwing up and creating a huge future tax...

2023-02-0745 min

Your Money, Your WealthBear Market Survival & the 5W1H of Roth Conversions: YMYW Best of 2022IRA withdrawal strategies when you retire in a down market, Roth contributions vs. Roth conversions, converting now or waiting to convert to Roth in retirement, and why you'd want to lose today's tax savings and contribute to Roth in the first place, today on the best of the YMYW podcast 2022. Plus, how to know if your financial plan is on track and the funniest Derails of the year. Visit the podcast show notes for more financial resources - including the free guide to the SECURE Act 2.0 - episode transcript, and Ask Joe & Big Al On Air for a retirement...

2023-01-1045 min

The Alan Sanders ShowThe Twitter Files part 3 - Election interference through January 6-8Today we spend the entire episode breaking down The Twitter Files part 3, dealing with the shadow banning of President Donald J. Trump from early 2020 through his eventual expulsion after January 6, 2021. Matt Taibbi reveals Twitter was already affecting the election by turning on their “visibility filtering” on the President of the United States of America. With all of the other murderous, tin-horn, two-bit dictators around the world with their Twitter account intact, it was the leader of the free world who would find himself banned from being able to freely communicate with Americans. Twitter folks inside knew they were...

2022-12-1237 min

Your Money, Your WealthRoth IRA 5-Year Rules: How to Withdraw Money With No Taxes or PenaltiesJoe and Big Al clarify once and for all those 5-year clocks for withdrawing money from your Roth accounts. How do the 5-year Roth IRA rules impact the taxation of dividend income? Do the 5-year rules for Roth withdrawals impact thrift savings plan (TSP) to Roth conversions as well? Plus, why contribute to a Roth in the first place and lose today's tax savings? Joe and Big Al rise to that challenge and they discuss Roth conversions and required minimum distributions from an inherited IRA. Show notes, free financial resources, transcript, Ask Joe & Big Al On Air: https://bit...

2022-11-1547 min

Voices of True CrimeMitchel P. Roth - Fire in the Big HouseOn April 21, 1930—Easter Monday—some rags caught fire under the Ohio Penitentiary’s dry and aging wooden roof, shortly after inmates had returned to their locked cells after supper. In less than an hour, 320 men who came from all corners of Prohibition-era America and from as far away as Russia had succumbed to fire and smoke in what remains the deadliest prison disaster in United States history.Within 24 hours, moviegoers were watching Pathé’s newsreel of the fire, and in less than a week, the first iteration of the weepy ballad “Ohio Prison Fire” was released. The deaths br...

2022-11-1341 min

Voices of True CrimeMitchel P. Roth - Man with a Killer Smile: The Life and Crimes of a Serial Mass MurdereOn a cold, windy December night in 1926, hell was unleashed on a tenant farm near Farwell, the last Texas town before the New Mexico border. Prone to the bottle and fits of rage, the burly man with the smiling blue eyes was in no mood to quarrel with his third wife over his bootleg whisky and sexual abuse of his stepdaughter. He went from room to room in the house, killing his wife and each child with primitive cutting tools and his bare hands. By the time he concluded his bloody work, he had taken the lives of nine...

2022-11-1145 min

Retirement Coach's CornerEp 34: Mailbag: Can I Retire Now?Wondering what to do about the market right now? Troy and Alan coach three different people through their investment decisions. From when to become more conservative in your investments to using a Roth 401(k) option to retiring early, you’ll want to hear what they have to say on today’s show. How would Troy and Alan build a plan around these people and their unique situations? Here are the questions we answer from the mailbag: At what age do I need to become a conservative investor? (1:13) Should I use the Roth 401(k) option at work? (5:40) Can I...

2022-10-2017 min

Your Money, Your WealthIs Now the Time for a Roth Conversion, or Wait Until Retirement?Should you convert money from your pre-tax retirement accounts to Roth now, or wait until retirement, or until required minimum distributions kick in? Should a mid-30s couple do Roth Conversions or Backdoor Roth? Should a 93-year-old open his first ever Roth and start converting? What's a good retirement savings mix between pre-tax and post-tax? And the fellas do a worst-case scenario retirement spitball analysis. Show notes, free financial resources, Ask Joe & Big Al On Air: https://bit.ly/ymyw-393

2022-08-3044 min

Your Money, Your WealthRoth IRA, 457, TSP, and Retire Early SpitballJoe & Big Al talk strategy for converting to Roth and paying tax from the IRA when you have limited funds, eliminating required minimum distributions (RMD) on a Roth 457 and avoiding the 5-year Roth clock, and Roth 457, Roth IRA, and Roth TSP. Plus, the fellas spitball pension options, retiring early, and an intricate and potentially risky deferred compensation strategy. Show notes, free financial resources, Ask Joe & Al On Air: https://bit.ly/ymyw-377

2022-05-1045 min

Your Money, Your WealthRoth Conversion Retirement Spitball AnalysisDoes it make sense to do larger "Calvin Johnson" (megatron, aka mega backdoor) Roth conversions when the financial markets are way down? Should you convert to Roth now, or in retirement? How do you spitball the right amount to have in 529 plans for education savings? And are the rules for doing a backdoor Roth the same if you're married filing separately? Show notes, free financial resources, Ask Joe & Al On Air: https://bit.ly/ymyw-375

2022-04-2643 min

Your Money, Your WealthWhen Must You Pay Roth Conversion Taxes?When do you have pay the taxes on a Roth IRA conversion to avoid any IRS penalties? Was it a mistake to convert to Roth IRA? What percentage of your assets should be in tax-free, tax-deferred, and taxable accounts to give maximum flexibility in retirement? And finally, do Roth conversions count as income toward your eligibility to contribute to a Roth, and how will a pension be taxed? Podcast show notes, episode transcript, free financial resources, Ask Joe & Al On Air: https://bit.ly/ymyw-371

2022-03-2934 min

Your Money, Your WealthRoth Conversions vs. Roth ContributionsShould you use Roth contribution money to pay Roth conversion tax instead? Does the IRS really penalize ineligible Roth contributions? How will a mega backdoor Roth be taxed, and will the step transaction doctrine apply? Are family Social Security benefits affected if the spouse works? Plus, spitballing retirement pension options, and your comments. Show notes, free resources, Ask Joe & Al On Air: https://bit.ly/ymyw-366

2022-02-2250 min

The Locher RoomGaycation Travel Show with Ravi Roth 6-11-2021GAYCATION MAGAZINE has launched a brand-new digital travel show, GAYCATION TRAVEL SHOW, hosted by LGBT+ travel expert & YouTube content creator, Ravi Roth. Ravi will join me in The Locher Room to help celebrate Pride month and discuss his incredibly popular blog and his new travel show. Ravi was named as Gaycities "Best Insta Traveler of 2019" and Metrosource's "People We Love in 2020," Roth has trekked the globe, exploring Queer culture in over 32 countries, documenting his travels through his own RAVI ROUND THE WORLD brand. Every Friday, GAYCATION TRAVEL SHOW will air new episodes exclusively through Gaycation Magazine's official YouTube...

2022-02-1155 min

Your Money, Your WealthIt Could Be Over for the Mega Backdoor Roth IRAJoe & Big Al outline the House Ways and Means Committee's sweeping tax proposal that would impact Roth contributions, Roth conversions, RMDs, the backdoor Roth IRA and mega backdoor Roth (Megatron), marginal and capital gains tax rates, wash sale rules, and more. Plus, safe retirement income and withdrawal strategies, when NOT to do a Roth IRA conversion, and solo 401(k) retirement savings for self-employed small business owners. Show notes, free resources, Ask Joe & Al On Air: https://bit.ly/ymyw-344

2021-09-2147 min

Retirement Coach's CornerEp 11: Traditional IRA or Roth IRA?What should you know about a traditional IRA vs. a Roth IRA? Today we will talk about the differences in these accounts and why they matter for your financial plan. Read more and get additional financial information: https://mercurioadvisors.com/podcast/ep-11-traditional-ira-or-roth-ira/ What we discuss: 1:06 - What’s the difference between a traditional vs. Roth IRA? 3:45 - You may have the option of a Roth 401(k) at work. 6:35 - Why don’t many people have much money in a Roth? 10:19 - Who should...

2021-09-1619 min

Your Money, Your WealthRoth 401(k), Conversions, RMDs, and Cap GainsHow to calculate Roth conversions to reduce taxes at required minimum distribution age? What are the rules for RMDs from Roth 401(k)? How does the 5 year Roth clock factor into a decision to leave money in an old Roth 401(k) or roll it to a new Roth IRA? Do reinvested dividends count as Roth contributions? Do capital gains count towards the capital gains income bracket? IRA contributions for minors and the unemployed, and how would you spend lottery winnings? Podcast show notes: https://bit.ly/ymyw-342

2021-09-0745 min

Your Money, Your WealthRoth Conversions, Medicare, and Required Minimum DistributionsDo Roth IRA conversions increase Medicare premiums? How can you convert to Roth and stay below the IRMAA threshold (that is, Medicare's Income-Related Monthly Adjustment Amount)? Also, a Roth conversion strategy to account for RMDs, those 5-year rules for withdrawing from your Roth depending on whether you're over or under age 59 and a half, and "how much should I have in a Roth to be in a low tax bracket in retirement?" Financial resources, transcript, Ask Joe & Big Al On Air: https://bit.ly/YMYW-332

2021-06-2937 min

Your Money, Your WealthIs the Backdoor Roth IRA a Good Strategy For You?Are you eligible for a backdoor Roth IRA conversion? Is it taxed? How does a Roth 401k differ from a Roth IRA? Can you buy Mom's condo for below market value & rent it back to her? Can you max out Dad's Roth? Can you file 2020 taxes before receiving IRS form 1098? How should you diversify your portfolio into international investments? Plus, capital gains and ordinary income, and a correction on deemed Social Security. Access the transcript & financial resources, ask money questions: https://bit.ly/YMYW-314

2021-02-2343 min

Your Money, Your WealthHow to Do the Mega Backdoor Roth IRABackdoor Roth IRA withdrawal rules and the mechanics of the mega backdoor (dump truck!) Roth. Can you still contribute to a Roth after a rollover? How do you calculate Roth conversion taxes due to the pro-rata rule? Also, calculating a long retirement number or by age, a radical portfolio rebalance, why basis, gains, and losses are tracked, and donating stock upon death. Plus, does your financial advisor's location matter? Transcript, financial resources, ask your money questions: https://bit.ly/YMYW-308

2021-01-1244 min

Your Money, Your WealthBorrow Money to Pay Tax on a Roth IRA Conversion?Should you borrow money to pay the tax on a Roth IRA conversion? Should you do a Roth conversion or capture non-qualified long term capital gains? How will Social Security benefits affect taxes after a backdoor Roth IRA conversion? Should a highly compensated employee use the mega backdoor Roth strategy? Are the tax savings on a conversion worth it? Plus the fellas explain the pro-rata rule - again. Access the episode transcript and financial resources, and send in your money questions: https://bit.ly/YMYW-301

2020-11-2447 min

Your Money, Your WealthBackdoor Roth Conversions and Investing for KidsAre you screwing up your Backdoor Roth IRA conversion? Find out. Plus, tax on mega-Backdoor Roth conversions, Medicaid spend-down rules and your Roth IRA, and Joe and Big Al take a burning confession about Roth conversions and IRS form 8606. Also, more on Vanguard's VTSAX and dividend yield, and various options for investing for minor kids including Paul Merriman's suggestions, UTMA, and brokerage accounts. Access transcript and financial resources, and send in money questions: https://bit.ly/YMYW-293

2020-09-2945 min

Your Money, Your WealthReal Estate, Roth Conversions, and Social SecurityReducing real estate taxes, leveraging new rental income properties, coordinating Social Security benefits with Roth conversions, and bragging about your 401(k) balance. Also, 5-year Roth clocks, converting from your TSP, Roth conversion vs. Backdoor Roth conversion, and paying taxes on conversions. Plus, a chat about Social Security survivor benefits - and freezers. Send in money questions and access the episode transcript and free financial resources in the podcast show notes: https://bit.ly/YMYW-279

2020-06-2342 min

Your Money, Your WealthBear Market Investing Strategies and Revisiting the 5-Year Roth IRA Withdrawal RulesTax loss harvesting, Roth conversions and more: Joe and Big Al explain how bear markets like the one we're in now are the time to utilize these investing strategies in your retirement portfolio. And the fellas go over those Roth IRA 5-year withdrawal rules again. They'll cover some Roth withdrawal mistakes and Roth rollover consequences, and they have a mea culpa for one of their peers. Send in money questions, read the transcript & access free financial resources: http://bit.ly/YMYW-265

2020-03-1750 min

Retirement 360Coronavirus And The MarketsThe DOW slid almost 13% in one week due to the news of the Coronavirus. When will it stop? Will it continue to slide? Alan and Randy talk about how this recent scare has affected the market and what they expect it to do when comparing it to previous outbreaks. In contrast to the Coronavirus talk, Randy and Alan also talk about a "backdoor Roth IRA" and go through the pros and cons of going into retirement with a Roth IRA. While there are contribution and income limits, there is a strategy called the "Backdoor Roth" you should hear about!

2020-03-0252 min

Your Money, Your WealthRoth Conversions from a Thrift Savings Plan TSP?The thrift savings plan (TSP) explained, and the rules around Roth conversions from TSPs. Plus, Joe and Big Al answer your questions about, what else, Roth conversions and contributions: age limits on making conversions, backdoor Roth conversions, Roth contribution phase-outs and recharacterizations, and the pro-rata rules. Plus, Joe explains, again, his distaste for fixed index annuities, and we find out why Big Al is called "Big". Ask money questions, read the transcript & access free financial resources: http://bit.ly/YMYW-254

2019-12-3149 min

Your Money, Your WealthShould You Convert to Roth IRA All at Once or Over Time?How much of a Roth conversion should you do and when? Does it make sense to convert to a Roth IRA all in one year, or to do it over time, based on your age? Joe and Big Al explain the reasoning behind their answer to this common retirement investing question. Plus, they answer your questions about converting from a thrift savings plan (TSP) to a Roth, limits when contributing to retirement accounts and a traditional IRA, and doing the tax math to decide if a Roth conversion is right for you. Ask money questions, read the transcript & access...

2019-12-1037 min

Your Money, Your WealthAnswers to Your Top Roth Conversion QuestionsYour Roth IRA questions answered: when should you do a Roth conversion? Should you wait until you're in retirement to convert? What kind of income is it? How do you convert slowly so the tax bite doesn't hurt so much? How long do you have to work before you can contribute to a Roth IRA? Does the 5-year rule apply for Roth withdrawals after age 59 1/2? Plus, answers to non-Roth money questions about estate planning, reverse mortgages, transferring from a variable annuity to a traditional IRA, and using HSA funds to pay Medicare premiums. Transcript, free resources, and show notes...

2019-10-0146 min

Retirement 360Uncle Sam And His Retirement PlanHave you heard about Uncle Sam and his retirement plan? Here's a hint - he doesn't retire when you do. Your taxes are essentially Uncle Sam's "retirement plan" and when you retire, you only keep on paying them. Alan talks a bit about paying taxes in retirement and how to factor them in to your anticipated retirement income. Does it make sense to convert your Traditional IRA to a Roth IRA? What are the pros and cons of doing so? Tons of "baby boomers" are at a stage in their financial life where they're considering this but might not be...

2019-09-1652 min

Ain't Talkin' 'Bout Van HalenEpisode 25 - What's David Lee Roth been up to? (Fixed Audio!)Goodness us, Dear Listener! What can we say but bestow our humblest apologies... it's been an age – an ice (cream man) age! SooOoo long in fact, that actual new VH-based news has surfaced of late and is occurring “riiiiiiiiiiiiiiight NOW.” So we’ve veered off the usual album-review highway and stopped off at the nearest cheap motel to devote an entire episode to ‘New VH/Roth/Hagar News’ – complete with impromptu jingles! Well, it had to be done... for one thing, David Lee Roth decided to make a tattoo cream (obvs) and then promote it on multiple different outlets being David Lee Roth in...

2019-04-191h 26

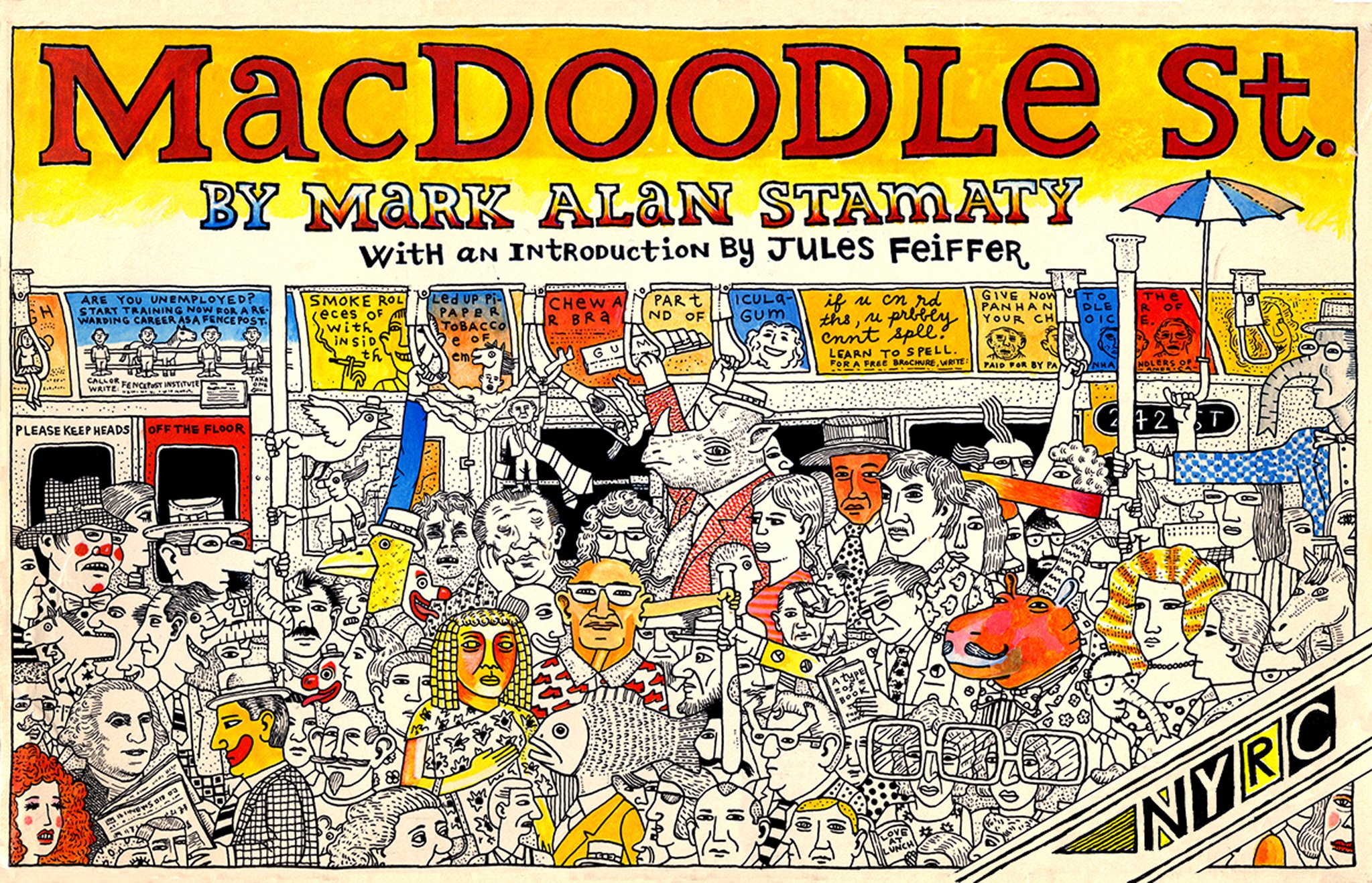

The Virtual Memories ShowMark Alan Stamaty To celebrate the new 40th anniversary edition of MacDoodle St. (New York Review Comics), Mark Alan Stamaty joins the show for a conversation about that comic strip/graphic novel and what it meant for him and his career. We get into how it felt to draw a coda for this collection and how looking back at this work affects the two graphic novels he's working on. We also talk about the joy of drifting, what it means to be a New York flaneur after 50+ years in the big city, his lifelong lament over the Dodgers leaving Brooklyn, t...

2019-04-011h 24

Your Money, Your WealthProblems With the Arguments Against Roth IRAsRic Edelman has some strong arguments against the Roth IRA. Joe & Big Al, aka "The Roth Brothers," offer their thoughts. Plus, understanding basis when it comes to Roth conversions. And what happens if you've already contributed, but by the end of the year you've exceeded the income limitation for Roth contributions? Can you open a Roth for your 12-year-old whose raking in babysitting bucks? What happens to your Roth when you die? It's an all Roth IRA episode! Transcript & show notes: http://bit.ly/YMYW-212

2019-03-1237 min

Retirement 360Corrections, Taxes and Planning for the FutureThe word "Correction' is circling the news, so what are you doing in case there is a pullback in the market? But other than worrying, learn what actions MWA Advisor Alan recommends in case there is the 10% drop. If you do not secure your accounts in the event of a correction, you will also want to consider preventing these mistakes at the 2018 tax season approaches. Alan and host, Randy Cook discuss the “6 Whopping Tax Mistakes that can Ruin your Retirement”: Retirement Tax Mistake #1: Assuming you will pay less taxes in retirement Retirement Tax Mistake #2: Not Planning for Social Security Taxation Reti...

2018-11-0549 min

Your Money, Your Wealth7 Reasons to Say Yes to a Roth IRAHow do you get motivated to save for retirement? Joe Anderson, CFP® and Alan Clopine, CPA share smart saving tips for retirement then shed light on why you shouldn't depend solely on your pension for future income. They close the hour with seven reasons why you should say yes to a Roth IRA. Original publish date January 28, 2017 (hour 1). Note that content may be outdated as rules and regulations have changed. 02:06 "I want to go over in this segment a few ways to motivate yourself to save more for retirement, and I think this is something that's true f...

2017-01-2834 min

Your Money, Your WealthWhat's the Difference Between a TSP and a Roth IRA?Will a financial advisor give you an unbiased opinion? What's the difference between a TSP and a Roth IRA? Joe Anderson, CFP® and Alan Clopine, CPA answer these questions and more in YMYW podcast episode 91. Original publish date December 17, 2016 (hour 2). Note that content may be outdated as rules and regulations have changed. 00:54 "A stretch IRA is a way for your children, when they inherit your IRA, to stretch it over their lifetime…this may go away…if it goes away, we will go back to old rules which means all money in the IRAs needs to be withd...

2016-12-1736 min

Your Money, Your WealthCracking Down on the 'Mega-Roth'Oregon's State Senator Ron Wyden is proposing a limit on Roth IRA accounts so high-income households would face restrictions on this tax-advantaged retirement account. Would this solve anything? Joe Anderson, CFP® and Big Al Clopine, CPA discuss in episode 63 of the YMYW podcast. Later, 6 reasons to convert to a Roth IRA in your 50s and 60s. Original publish date September 10, 2016 (hour 1). Note that content may be outdated as rules and regulations have changed. 00:00 - Intro 02:50 - "People who have a retirement plan through their employer tend to have more money in retirement." 05:17 - "Th...

2016-09-1037 min

HooniverseWe Wuv Wheels! w/ Alan Peltier from HRE WheelsWheels make the world go round... or something like that. It makes sense then that we're excited to have Alan Peltier on the podcast. He's the president of HRE Wheels, which produce what many consider to best the best rollers on the planet. Those people who consider that are correct, by the way.Other topics include the Infiniti G37 sedan versus Q50 sales issue, why buying a new Ferrari doesn't mean you get a chance to buy the halo Ferrari, and a few other bits of new car news. From there we turn to Jeffs' seething jealous...

2013-08-071h 09

Cincinnati Business TalkCincinnati Business Talk #104 Alan Bernstein, BB RiverboatsCincinnati Business Talk highlights the positive side of Cincinnati area businesses. We will be talking to CEOs who have won awards and had great success. Today's guest is Alan Bernstein the President of BB Riverboats. He has been in the resturant and tourist boating business since 1979.. He will share information about how he has made his btusinesses succeed. The show aired at 4 PM on Thursday April 4th. Listen to this link: http://tobtr.com/s/4612847 You can listen to the show on Apple iTunes as a Podcast. You can add the podcast at: http://www.blogtalkradio.com/Cincy-Business-talk.rss You can add...

2013-04-041h 05