Shows

The Mysteries of Latin America With Andrew ColónShe Had To Dress As A Man To Join Pancho Villa’s Army—And Was Rewarded With...They followed her into battle. They never knew she was a woman. And when the truth came out, the system erased her.

To fight inside Pancho Villa’s army, Petra Herrera cut her hair, wore men’s clothes, and became Pedro Herrera. As Pedro, she led sabotage missions, destroyed bridges, cut power to entire cities, and helped take Torreón — one of the most strategic railway hubs in northern Mexico.

When her secret came out, her soldiers stayed loyal. The system didn’t.

She was denied rank, denied recognition, and forced to build her own a...

2026-01-0613 min

Tax Notes TalkLess Is Moore: The Supreme Court's Ruling in Moore v. United StatesTax Notes managing legal reporter Andrew Velarde breaks down the Supreme Court's decision in Moore v. United States and its implications for the future of tax.To hear from the Moores' lawyers, watch the upcoming Taxing Issues webinar here.Listen to our previous Moore episodes:A Recap of SCOTUS Oral Arguments in Moore v. United StatesMoore Money, More Tax Problems? Analyzing Moore v. United StatesFor additional coverage, read these articles in Tax Notes:Moores' Counsel Says Case Signals Court Is Not Open to Novel TaxesSupreme Court Says Transition Tax Is Con...

2024-06-2813 min

Tax Notes TalkLiberty Global and the Economic Substance DoctrineTax Notes managing legal reporter Andrew Velarde discusses the economic substance doctrine dispute in Liberty Global Inc. v. United States and its potential implications. For previous Moore episodes, listen to the following:A Recap of SCOTUS Oral Arguments in Moore v. United StatesMoore Money, More Tax Problems? Analyzing Moore v. United StatesFor additional coverage, read these articles in Tax Notes:ABA Section of Taxation Meeting: Liberty Global Is a Warning Against High-Level Business PurposeLiberty Global Appeals Economic Substance Loss to Tenth CircuitLiberty Global Promises Economic Substance Doctrine AppealEconomic Substance Doctrine Constrains Liberty Globa...

2024-02-0215 min

Tax Notes TalkA Recap of SCOTUS Oral Arguments in Moore v. United StatesTax Notes managing legal reporter Andrew Velarde breaks down the Supreme Court's oral arguments in Moore and predicts what's next for the case.For additional coverage, read these articles in Tax Notes:Government May Have Upper Hand in Moore, but Court May Go NarrowMoore Sold Shares in Transition Tax Company for Big GainMoores Fire Back That Macomber Is Controlling, Not Mere DictumTransition Tax Drafter: Quit It With ‘Mandatory Repatriation Tax’Small Business Groups Enter the Moore Fray in Defense of the TaxMoore Amicus Offers Supreme Court Off-Ramp From Realization QueryMacomber Dictum Not Controlling in Moore, Government Says...

2023-12-1530 min

South Phoenix Oral History Project3.9 "Reading Places of Their Own"Welcome back to the "South Phoenix Oral History Project" after a rejuvenating summer break! In Episode 9, your hosts Summer and Ele kickstart the season with an enlightening discussion about Andrew Wiese's groundbreaking work, "Places of Their Own: African American Suburbanization in the Twentieth Century."The cozy image of suburbia often doesn't conjure associations with African-American communities. However, Wiese's pioneering research challenges this notion, revealing a century-long history of black residents in the suburbs, a population that has nearly doubled to nearly twelve million in recent decades. "Places of Their Own" takes us...

2023-11-0724 min

Tax Notes TalkAn Update on the Foreign Tax Credit Rules and IRS ReliefTax Notes reporter Andrew Velarde discusses the latest developments on the final regulations for claiming foreign tax credits, including the IRS’s decision to delay implementation and the tax community’s response. For more on the foreign tax credits, listen to "The Final Foreign Tax Credit Rules: Complaints and Confusion."For additional coverage, read these articles in Tax Notes:IRS Says It Anticipates Extending FTC Relief Notice Another YearTreasury to Publish FTC Guidance on Pillar 2 Taxes by Year-EndGOP Taxwriters to Air Grievances to OECD Leaders in EuropeSilicon Valley Asks IRS to Extend Foreign Tax Cred...

2023-09-1517 min

Tax Notes TalkMoore Money, More Tax Problems? Analyzing Moore v. United StatesProfessor Hank Adler of Chapman University discusses the income realization requirement dispute in the transition tax case Moore v. United States before the Supreme Court, and its implications on the U.S. tax system. For additional coverage, read these articles in Tax Notes:News Analysis: Limiting the Fallout From MooreSupreme Court to Hear Transition Tax Case With Vast ImplicationsFollow us on Twitter:David Stewart: @TaxStewTax Notes: @TaxNotes***CreditsHost: David D. StewartExecutive Producers: Jasper B. Smith, Paige JonesShowrunner: Jordan ParrishAudio E...

2023-07-2126 min

Tax Notes TalkTaxpayer Scores: Farhy Blocks International Reporting PenaltiesTax Notes reporter Andrew Velarde discusses the penalty dispute in Farhy v. Commissioner and the case’s implications for other penalties and future refund decisions. For additional coverage, read these articles in Tax Notes:In Farhy’s Wake, Taxpayer Advocate Renews Call for Penalty ChangeFallout From Farhy on Assessable Penalties Could Be ExtensiveIRS Lacks Assessment Authority for Information Return PenaltiesInformation Return Penalty Assessment Controversy Still SwirlsInformation Return Penalty Assessment Fight Coming to a HeadFollow us on Twitter:David Stewart: @TaxStewTax Notes: @TaxNotes***CreditsHost: David D. Stewart...

2023-05-0513 min

Tax Notes TalkWhirlpool Sends the Tax World SpinningTax Notes reporter Andrew Velarde discusses the tax structure dispute in Whirlpool v. Commissioner and the case’s future implications for multinational companies. For additional coverage, read these articles in Tax Notes: No Full Court Rehearing for Whirlpool, Sixth Circuit SaysWhirlpool Agitated Over Attempt to Brand It a Tax CheatParts Manufacturer Sees Daylight Between Itself and WhirlpoolDOJ Urges Circuit to Reject Whirlpool’s Call for RehearingGroups Line Up to Warn Circuit About Whirlpool FalloutWhirlpool Wants Circuit to Give Branch Income Case Another SpinWhirlpool’s Circuit Court Loss Could Cost It $95 MillionIn our “In the Pages” s...

2022-03-1822 min

Sounding BoardThe What’s Worse Game: Dad EditionAfter listening to the first What’s Worse Game, our Dad couldn’t resist getting in on the action, and so came up with a new list of competing horrors for Nic to challenge Andrew with.

The aim of the game is to pick the worst of the two options – not the least worst – and then explain why.

There are some absolute corkers in this week’s version of the Worst Game, and we cover such lovely topics as slavery, the BBC and Sadiq Khan.

Photo by Guillermo Velarde on Unsplash

Please visi...

2021-07-2933 min

Rumbo a tu VidaEp. 24: El papel de la religión en la sociedad hoy en día.En el episodio de hoy abordamos cuál es el papel que tiene la religión hoy en día, en una sociedad con muchísima tecnología y con personas que, cada vez más , se hacen preguntas sobre su origen,rumbo, metas, etc.

Manolo Velarde, biólogo y cristiano, quien completó el Trienio Básico de Teología en el Instituto San Pío X viene a nuestro podcast a charlar sobre el papel de la religión en la sociedad hoy en día y a contestar a preguntas que todos nos hemos hecho en algún momento.

Nuestr...

2021-01-1529 min

RUMBO A TU VIDAEp. 24: El papel de la religión en la sociedad hoy en día.En el episodio de hoy abordamos cuál es el papel que tiene la religión hoy en día, en una sociedad con muchísima tecnología y con personas que, cada vez más , se hacen preguntas sobre su origen,rumbo, metas, etc.Manolo Velarde, biólogo y cristiano, quien completó el Trienio Básico de Teología en el Instituto San Pío X viene a nuestro podcast a charlar sobre el papel de la religión en la sociedad hoy en día y a contestar a preguntas que todos nos hemos hecho en algún momento.Nuestra...

2021-01-1529 min

Tax Notes TalkThe Impact of the 2020 U.S. Elections on International TaxTax Notes senior legal reporter Andrew Velarde and contributing editor Robert Goulder discuss the influence of the 2020 U.S. elections on the international tax world. For additional coverage, read these articles in Tax Notes:Biden’s International Tax Proposals Missing Many PiecesEU Hopes to Repair Bilateral Relationship With U.S.Biden Win Brings Hope for Progress in Global Tax TalksTaxOps SALT expert Tram Le talks about her recently published piece, “Simplification Initiatives to Reduce Burdens for Remote Sellers.”**This episode is sponsored by Avalara. For more information, visit avalara.com/taxnotes.

2020-11-2040 min

Tax Notes Talk2020 Foresight: Tax Legislation and RegulationsTax Notes's Jeremy Scott, Stephanie Cumings, and Andrew Velarde review what happened with tax legislation and guidance in 2019 and what lies ahead in 2020.For additional coverage, read these articles in Tax Notes:Conservatives Worry TCJA Could Be Death Blow to Future Tax CutsSenate Sends $426B in Tax Cuts to Trump's DeskA Look Ahead: Democrats to Stand Behind Wealth Taxes in 2020A Look Ahead: Eyes Still on TCJA International GuidanceA Look Ahead: Parking Regs Should Address Fair Market ValueA Look Ahead: Carried Interest and Form Changes Will Be Focus for Partnerships

2020-01-0324 min

Tax Notes TalkBehind the Scenes of OIRA and Draft TCJA RegsJonathan Curry and Andrew Velarde discuss the draft regulations Tax Notes obtained from the Office of Information and Regulatory Affairs.For additional coverage, read these articles in Tax Notes:New OIRA Drafts Reveal Tweaks to TCJA GuidanceOIRA Leadership Shuffle Opens Door to Tax Reg Review Shake-UpOIRA’s Tax Reg Reviews Remain a ‘Black Box’ Despite Draft RegsSpotlight on OIRA’s Review Process Eases Politicization ConcernsOIRA’s Imprint on Tax Regs Revealed in New Cache of Documents***This episode is sponsored by University of California, Irvine Law School’s Graduate Tax Program. For more informa...

2019-07-1920 min

Tax Notes TalkABA Meeting: Key Insights Into TCJA GuidanceEric Yauch and Andrew Velarde highlight the major themes that came up at the American Bar Association Section of Taxation meeting in Washington, including interesting insights into recent and coming regulations. For more coverage of the ABA meeting, read these articles in Tax Notes:IRS Considering More Safe Harbors in O-Zone RulesPartnerships Can Defer Section 1231 Gain Under O-Zone RulesTreasury Carefully Considering Interest Definition in Final RulesTriple Net Lease Changes Likely in Final 199A Safe HarborIRS Won’t Be as Forgiving of TCJA Comment DeadlinesWilkins Predicts Temporary Regs Will Disappear From RulemakingTreasury, IRS Open to Suggestions on PT...

2019-05-2812 min

Tax Notes TalkGILTI and the State ResponsesAndrew Velarde talks to Joe Calianno of BDO about the pending final guidance on the global intangible low-taxed income provision enacted as part of the Tax Cuts and Jobs Act, and Paige Jones talks to Scott Smith of BDO about the state responses to GILTI.

2019-05-2327 min

Tax Notes TalkThe Year Ahead: Tax Legislation and RegulationsJeremy Scott, Stephanie Cumings, and Andrew Velarde provide a review of what happened with tax legislation and guidance in 2018 and what's ahead in 2019.For additional coverage, read these articles in Tax Notes:Neal Planning for TCJA Hearing by January’s EndA Look Ahead: Legislators Queuing Up Multiple Retirement BillsA Look Ahead: Healthcare Tax Policy Could Stem From Divided CongressHouse Passes GOP Tax Bill With No Hope for EnactmentA Look Ahead: Awaiting Clarification of 199A and Audit Regime RulesA Look Ahead: Questions Abound on Exec Comp Grandfathering RuleA Look Ahead: 2019 Should See Final Bonus and Tax Accounting Re...

2019-01-0422 min

Tax Notes TalkABA Meeting: Key TakeawaysAndrew Velarde highlights the significant insights from the recent American Bar Association Section of Taxation meeting in Atlanta, where the Tax Cuts and Jobs Act was once again the main topic of discussion.For additional coverage of the ABA meeting, read these articles from Tax Notes:TCJA Shaping Global Discussion as Several Regs Near CompletionU.S. Antiabuse Rules, Imperfect International Tax Regs ComingTransition Tax Guidance Will Extend Transfer Agreement Due Date'Guideposts’ Revealed for R&D-intensive Business SpinoffsTreasury Clarifies 199A De Minimis Rules Have Cliff Rental Property Ownership Could Decide 199A EffectsTreasury: Qualified Improvement Property Needs Technical Cor...

2018-10-1210 min

Tax Notes TalkProposed GILTI Regs: The DetailsAndrew Velarde and Alexander Lewis provide an in-depth look into the proposed regs on global intangible low-taxed income.

Read Tax Notes’ latest coverage of the proposed GILTI regs:

Treasury Assuages Some Concern Over GILTI Antiabuse Rule Breadth

GILTI Regs Signal Business Interest Limits Might Apply

Proposed GILTI Regs Could Result in Taxable Phantom Income

Practitioners Bristle at GILTI Antiabuse Provision

Practitioners Throw More Shade at GILTI Antiabuse Rules

GILTI Regs Focus on Computations, Punt on FTC Issues

2018-09-2716 min

Tax Notes TalkInsights Into TCJA GuidanceAndrew Velarde and David Stewart take a look back at the American Bar Association Section of Taxation May meeting and highlight the important guidance and developments that were discussed.

2018-05-2510 min

Tax Notes TalkA Look Ahead at the ABA Section of Taxation MeetingAndrew Velarde provides a preview of the upcoming American Bar Association Section of Taxation May meeting and the important guidance and developments that may be discussed.

2018-05-0911 min

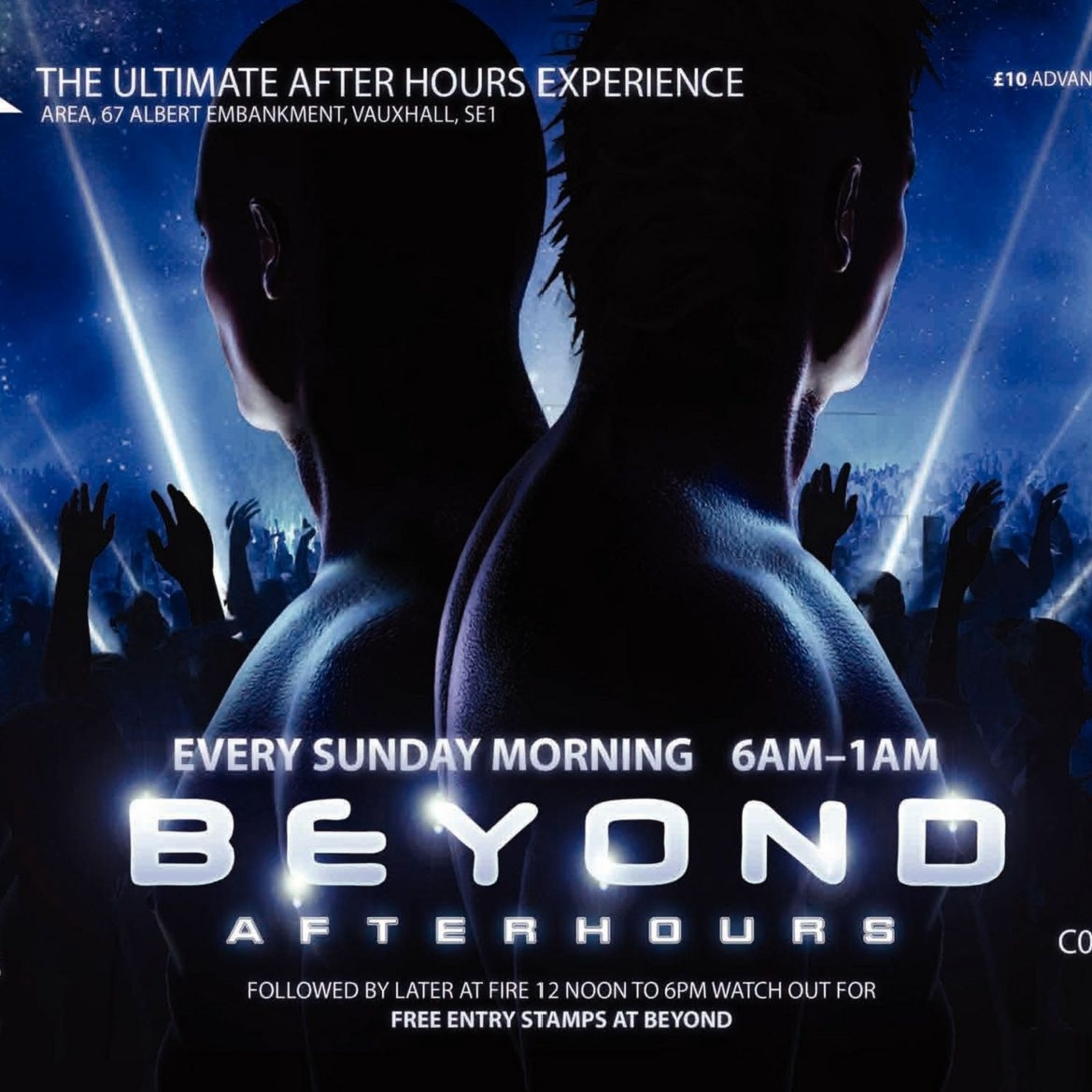

STEVE PITRON HOUSE SESSIONSBEYOND Jan 2009: PART 1Jan 2009 PODCAST: BEYOND

My first Podcasts for 2009: two episodes dedicated to the biggest and best London after-hours club: BEYOND.

This reflects the music I play there: Big, Bold Bouncy Upfront House – true to always being ‘uplifting’ and having a ‘funkier’ edge – even if the beats are tough…

BEYOND has remained my favourite clubbing experience over the years – I’ve had some of my best clubbing moments at the Coloseium (its first home) and at AREA (its new home) - which opens as BEYOND every Sunday between 06.00 and 13.00.

It is also my favourite place and time to play.

You can’t beat After-hours…...

2009-01-071h 03