Shows

craft & crash outswhat if we're not good enough? our first crash out of the yearcraft & crashouts is a writing podcast where ari kuplu and mikayla cerar talk about their own personal writing journeys as they seek to become traditionally published.books we are reading:Eileen by Ottessa Moshfegh: https://www.goodreads.com/book/show/23453099-eileenAssassin’s Apprentice by Robin Hobb: https://www.goodreads.com/book/show/21956219-assassin-s-apprenticebooks / resources / authors mentioned:Fantasy Then and Now: Panel with George RR Martin , Robin Hobb, Rebecca Roanhorse, and Ryan Cahill: https://www.youtube.com/watch?v=rl1sS8MXjFICharacters an...

2026-01-1955 min

Early Retirement - Financial Freedom (Investing, Tax Planning, Retirement Strategy, Personal Finance)This Is When I Recommend You STOP Saving For RetirementMost people think the safest path to retirement is to keep saving more, no matter how close they are to the finish line. But what if there comes a point where saving actually matters less, and investing well, living well, and spending with intention matter more?In this end-of-year episode, Ari shares why many near-retirees may need to rethink their instinct to “just keep saving.” He breaks down the surprising point where portfolio growth outweighs new contributions, why being “qualified-rich and cash-poor” can limit your freedom, and how over-saving can quietly eat into the healthiest, most meaningful years of...

2025-12-2913 min

Virtual Memories ShowEpisode 668 – The Guest List 2025Virtual Memories Show:

The Guest List 2025

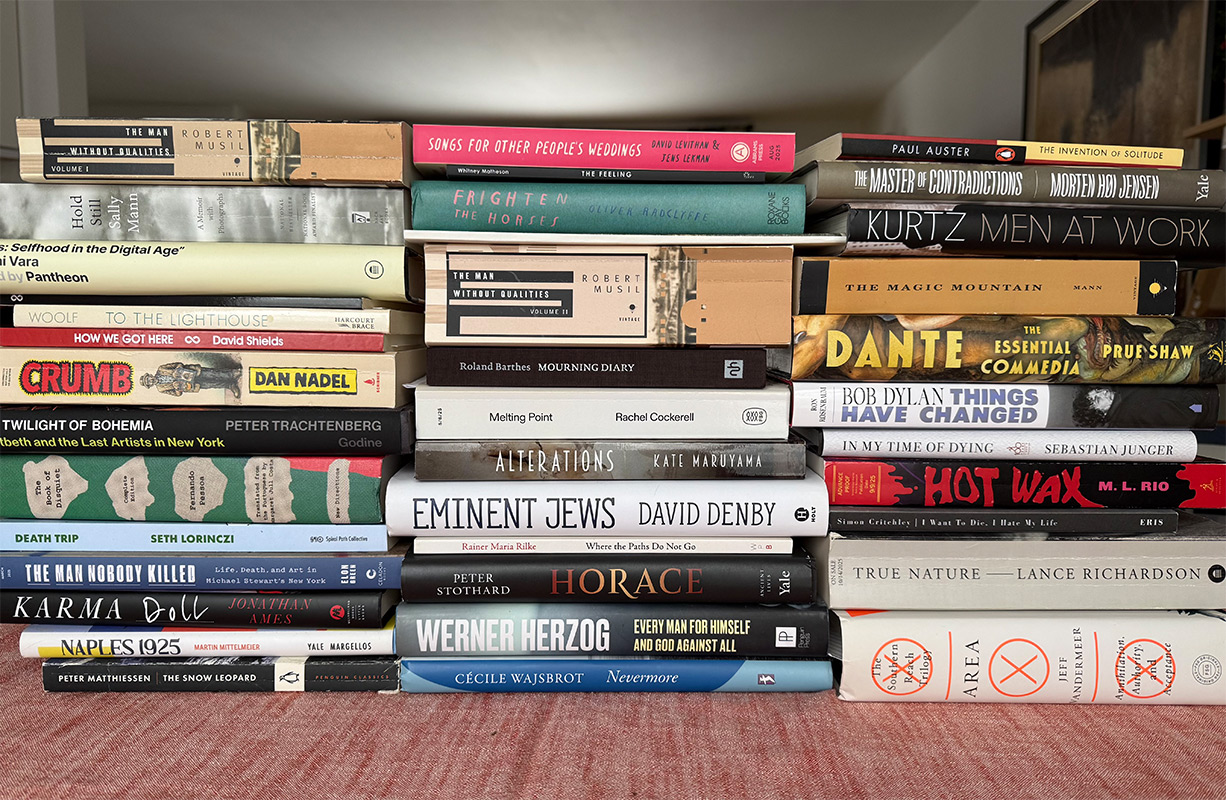

It’s time for our year-end Virtual Memories Show tradition, now celebrating its thirteenth anniversary: The Guest List! I reached out to 2025’s pod-guests and asked them about the favorite book(s) they read in the past year, as well as the books or authors they’re hoping to read in 2026! Twenty-six guests responded with wonderful, idiosyncratic, and illuminating book recommendations: Jonathan Ames, Kayla E., Dan Goldman, Dean Haspiel, Jennifer Hayden, Rian Hughes, Paul Karasik, Glenn Kurtz, David Leopold, Seth Lorinczi, Sacha Mardou, Kate Maruyama, Whitney Matheson, Josh Neufeld, Lance Richar...

2025-12-231h 21

The Virtual Memories ShowEpisode 668 - The Guest List 2025It's time for our year-end Virtual Memories Show tradition, now celebrating its thirteenth anniversary: The Guest List! I reached out to 2025's pod-guests and asked them about the favorite book(s) they read in the past year, as well as the books or authors they're hoping to read in 2026! Twenty-six guests responded with wonderful, idiosyncratic, and illuminating book recommendations: Jonathan Ames, Kayla E., Dan Goldman, Dean Haspiel, Jennifer Hayden, Rian Hughes, Paul Karasik, Glenn Kurtz, David Leopold, Seth Lorinczi, Sacha Mardou, Kate Maruyama, Whitney Matheson, Josh Neufeld, Lance Richardson, Ari Richter, ML Rio, Dmitry Samarov, Jonathan Sandler, Damion Searls...

2025-12-231h 21

Early Retirement - Financial Freedom (Investing, Tax Planning, Retirement Strategy, Personal Finance)How To Decide When To Turn On Social SecurityDeciding when to claim Social Security is one of the most important retirement choices you’ll make, but most people approach it the wrong way. They pick an age early, cling to it for years, and assume the “best” decision never changes. In reality, the right claiming strategy shifts as your life shifts: your spouse’s benefit, your health, your spending, your tax plan, and even how much joy you’re getting out of retirement all matter far more than a hard rule.In this episode, Ari explains why Social Security should never be treated as a one-time...

2025-12-0811 min

Early Retirement - Financial Freedom (Investing, Tax Planning, Retirement Strategy, Personal Finance)How Much Fixed Income Do You Really Need in Retirement?Stop letting your birthday decide your bond mix.That “age in bonds” rule feels safe, but it can quietly rob you of growth, freedom, and spending power.In this episode, Ari challenges the traditional 60/40 rule and shows how to build a smarter allocation based on your actual life, not your birth year. Using a real client story—a couple with $2 million in a 401(k), $85K in rental income, and $50K in part-time work—we explore how to balance risk, income, and long-term security without falling into the target-date trap.You’ll hear:

2025-12-0116 min

Early Retirement - Financial Freedom (Investing, Tax Planning, Retirement Strategy, Personal Finance)Why Asset LOCATION (NOT "Allocation") Overlooked In Retirement PlanningEveryone wants better returns. Almost no one talks about where those returns should live.You can own all the right investments and still lose thousands a year if they sit in the wrong place.Asset location is one of those quiet advantages that doesn’t make headlines but changes everything behind the scenes. It’s how you line up your accounts so they work together instead of against each other. The difference isn’t theoretical. It’s real tax savings, smoother withdrawals, and more flexibility when life doesn’t go according to plan.Ari Taublieb...

2025-11-2417 min

Early Retirement - Financial Freedom (Investing, Tax Planning, Retirement Strategy, Personal Finance)Why Only 3% of US Retirees Have Over $1MMost headlines shout that you need millions to retire comfortably. The truth? It depends on you. Ari breaks down what “enough” really means, and how to design a plan that fits your lifestyle, health, and peace of mind, not someone else’s spreadsheet.In this episode, you’ll hear real-life stories that prove one size doesn’t fit all. A saver with $3 million who can’t enjoy travel because of sciatica. A Chevron retiree with $487K, a paid-off home, and a $2,800 monthly budget living his version of freedom. Same markets, totally different outcomes—and both work....

2025-11-0310 min

Early Retirement - Financial Freedom (Investing, Tax Planning, Retirement Strategy, Personal Finance)Will Low Returns Ruin Your Retirement? (How to Interpret Goldman Sachs 3% Forecast) | Root TalksWhat if the next 10 years bring just 3% returns from the S&P 500?In this episode, we turn that forecast into a real-world retirement plan—not panic. You’ll learn how to stress test your portfolio, build flexibility into your spending, and design a withdrawal strategy that can survive tough markets.Listen as Ari and James break down:Sequence-of-returns risk — why bad early years hurt more than bad averages.The modern 4% rule — how to use it as a guardrail, not a guarantee.Diversification that actually works — adding small caps, valu...

2025-10-2316 min

Early Retirement - Financial Freedom (Investing, Tax Planning, Retirement Strategy, Personal Finance)How To Save On Healthcare In 2026 (If Retired)Feeling like healthcare makes early retirement impossible? It’s a common belief, but often fixable with thoughtful income planning. Premium tax credits under the ACA aren’t vanishing; the enhanced credits are scheduled to sunset after 2025, and the pre-2021 rules (including the ~400% FPL income cap) are slated to return in 2026 unless Congress acts. The takeaway: managing MAGI matters.In this episode, Ari Taublieb, CFP®, walks through a practical, illustrative case: a 60-year-old couple with ~$1.55M spread across taxable, pre-tax, and Roth accounts. You’ll see how the source of withdrawals (e.g., har...

2025-10-2011 min

Early Retirement - Financial Freedom (Investing, Tax Planning, Retirement Strategy, Personal Finance)A Beginner's Guide To Roth ConversionsAre you overthinking your Roth conversion strategy? While Roth conversions can be powerful, not every retiree needs them. In this video, you’ll learn when a Roth conversion truly makes sense—and when it may just add unnecessary complexity.Using the “cauliflower analogy,” we break down how Required Minimum Distributions (RMDs) can push retirees into higher tax brackets, and why paying taxes now can sometimes help avoid bigger bills later. But there’s an even more important question: could you be better off retiring earlier or spending more instead of over-optimizing your tax plan?We’ll also high...

2025-10-0610 min

Early Retirement - Financial Freedom (Investing, Tax Planning, Retirement Strategy, Personal Finance)What's The Average 401(k) Balance At My Age? Am I On Track?Think you know how much people save for retirement?The median American over 65 has just $100,000 saved, yet the average household spends $57,000 a year in retirement, with $20,000 going to housing alone. The math doesn’t work.At Root Financial, most clients retire with $2–3M and plan to spend $100K–$200K annually. That’s not about bragging. It’s a reminder that if you’re here, you’re likely already thinking beyond the basics.Rules like “save 10%” or “withdraw 3%” don’t fit everyone. The difference between struggling and thriving often comes down to advanced planning—...

2025-09-0112 min

Early Retirement - Financial Freedom (Investing, Tax Planning, Retirement Strategy, Personal Finance)Here's How To Plan For Social Security If You Retire EarlyToo many people delay retirement just to boost their Social Security benefits, often at the cost of time, energy, and joy. But at Root, we believe retirement planning should be about more than just maximizing one metric. It should be about maximizing your life.If you're working extra years simply to avoid gaps in your earnings history or to earn a slightly higher monthly benefit, it's worth rethinking the bigger picture. In many cases, the trade-off isn't worth the lost years of freedom and vitality.A more holistic strategy might involve intentionally drawing from your...

2025-07-1419 min

Early Retirement - Financial Freedom (Investing, Tax Planning, Retirement Strategy, Personal Finance)Why Brokerage Accounts Might Be the Most Underrated Tool in Your Financial PlanYou’ve probably heard that maxing out your 401(k) and IRA is the smartest move you can make. But for many investors, that strategy alone may lead to a surprising challenge: becoming "qualified rich, cash poor." In other words, having plenty saved, but locked away in accounts you can’t easily access without tax consequences or penalties.That’s where the often-overlooked brokerage account comes in.Also called a taxable, individual, or joint account, the brokerage account offers unmatched flexibility. No age restrictions. No early withdrawal penalties. And potential long-term capital gains tax treatment instead of hig...

2025-06-2618 min

Early Retirement - Financial Freedom (Investing, Tax Planning, Retirement Strategy, Personal Finance)Avoid These 6 Common Mistakes When Retiring EarlyIn this episode, Ari explores six common oversights in early retirement planning that can create unnecessary stress and limit flexibility in the long run.• Not establishing a taxable brokerage account to access funds before traditional retirement age• Overlooking healthcare planning, including available subsidies, which may impact retirement timing• Missing opportunities for tax efficiency through strategies like Roth conversions or coordinated withdrawals• Underestimating the importance of physical health when planning for an active retirement lifestyle• Limiting retirement vision to essential expenses, rather than factoring in meaningful goals and experiences• Focusing only on finances without cons...

2025-05-0517 min

The Virtual Memories ShowEpisode 635 - Ari RichterArtist, professor and now like-it-or-not cartoonist Ari Richter joins the show to talk about his fantastic book, Never Again Will I Visit Auschwitz: A Graphic Family Memoir of Trauma & Inheritance (Fantagraphics). We talk about how he he began this project in the wake of the Tree of Life massacre in 2018, how it helped him exorcise the demons of his imagination after a lifetime of hearing his family's stories about the Holocaust, and how the book centered around intergenerational trauma and collaboration. We get into how he incorporated his grandfathers' holocaust memoirs into the book, why he found different styles...

2025-04-221h 31

Early Retirement - Financial Freedom (Investing, Tax Planning, Retirement Strategy, Personal Finance)4 Tax Strategies To Consider This YearTax strategy is the most overlooked aspect of financial planning, yet it could save you thousands over your lifetime by minimizing your total tax burden rather than just focusing on this year's bill.• Roth conversions let you pay taxes at potentially lower rates now to avoid higher taxes later in life• Asset location matters – keep growth investments in Roth accounts and more conservative assets in brokerage accounts• Health insurance premium planning can drastically reduce your healthcare costs through ACA subsidies• Capital gains harvesting allows married couples to realize up to $96,700 in gains tax-free each year•...

2025-04-2116 min

Early Retirement - Financial Freedom (Investing, Tax Planning, Retirement Strategy, Personal Finance)Healthcare Analysis: How We Save Our Clients Thousands Before Medicare BeginsHealthcare costs shouldn't stop you from retiring early, especially when strategic planning can reduce those expenses from $1,000+ to as little as $50 per month. We explore how proper account structure and withdrawal strategies can save you tens of thousands in healthcare premiums during the critical pre-Medicare years.• "Superhero accounts" (brokerage/taxable accounts) offer tremendous flexibility for controlling taxable income• Capital gains from brokerage accounts are taxed more favorably than IRA withdrawals • Strategic income planning can qualify you for ACA subsidies, potentially saving $70,000+ over five years• Tax gain harvesting at 0% capital gains rate provides additional opportunities• Bal...

2025-04-0719 min

Early Retirement - Financial Freedom (Investing, Tax Planning, Retirement Strategy, Personal Finance)How To Plan For Big One-Time Expenses Before You RetireThis episode focuses on effectively managing significant one-off financial expenses in retirement and the best strategies for portfolio withdrawals. We explore different sources of withdrawals, tax considerations, and how to balance immediate needs with long-term financial security.• The impact of one-time expenses on portfolio sustainability • Analyzing options: taxable accounts, tax-deferred accounts, and Roth IRAs • The importance of understanding tax implications in retirement planning Join our community at the Root Collective! It’s free and filled with resources to help you navigate your financial journey.Create Your Custom Early Retir...

2025-03-0618 min

Early Retirement - Financial Freedom (Investing, Tax Planning, Retirement Strategy, Personal Finance)Retirement Planning With Guaranteed Income (Pension, Social Security, Rental Income, etc.)The episode sheds light on the importance of personalized retirement planning, especially for those with guaranteed income sources like pensions. Listeners learn how risk tolerance, investment allocations, and tax strategies should align with their unique financial situations for optimal retirement success.• Emphasizing the role of guaranteed income sources in investment strategies • The importance of personalized financial planning over cookie-cutter strategies • Understanding how risk tolerance changes during retirement • Demonstrating asset allocation strategies based on income needs • The value of proactive tax planning and Roth conversions • Addressing the need for cohesive financial guidance among different advisor...

2025-02-1717 min

Ready For RetirementRoot Talks: How Should I Split Retirement Withdrawals Between Pretax and Roth Accounts?In this episode, we're talking about the importance of a strategic withdrawal plan in retirement to keep taxes in check and set you up for long-term financial stability. Ari and I break down why a simple 50/50 split between traditional and Roth accounts isn't enough—you need to plan based on your tax situation and future needs. Using a listener's example, we walk you through how to think about tax brackets, required minimum distributions (RMDs), and when it might make sense to convert funds to a Roth IRA.We also discuss the role of asset location—putting riskier inve...

2025-02-1324 min

Early Retirement - Financial Freedom (Investing, Tax Planning, Retirement Strategy, Personal Finance)You Don't Need A Tax Preparer. You Need A Tax Planner.This episode emphasizes the critical difference between tax planning and tax preparation, illustrating how strategic planning can lead to significant tax savings over a lifetime. Throughout the conversation, we explore essential insights on why relying solely on CPAs may not be enough, the importance of proactive financial coordination, and when to utilize tax strategies for optimal retirement planning.• Defining tax planning versus tax preparation • Real-life story illustrating CPA limitations • Importance of holistic financial planning • The cauliflower analogy for tax strategy • Benefits of Roth conversions and tax gain harvesting • Encouraging early retirement for tax flexibility

2025-01-1315 min

Early Retirement - Financial Freedom (Investing, Tax Planning, Retirement Strategy, Personal Finance)STOP! Consider THIS Before Doing a Roth ConversionToo many people think a Roth conversion will fix all of their problems. Surgery can be great, but not always necessary. Our conversation takes a deep dive into the heart of retirement planning, focusing on the flexibility between spending habits and Roth conversions. Imagine a couple with varying monthly spending plans, trying to figure out how they can adapt to avoid unnecessary financial maneuvers. We stress the significance of aligning your financial decisions with your personal goals, ensuring that you're not sacrificing your quality of life for mere tax savings. Life goals should alw...

2024-11-2832 min

Y-Option: College Football with Yogi RothAndy Staples - Coast to Coast4 teams remain unbeaten and none reside in the south. So this week, Y-Option went down south to talk to an expert in all things college football, Andy Staples. Andy is the host of Andy & Ari On3, a daily college football podcast covering every major story. He joined us to dive into the CFP, how many teams should make the expanded playoff from the SEC and B1G, as well as his thoughts on the Heisman.He gives his take on the Washington State Cougars, both USC and UCLA and of course what last weekend was l...

2024-11-1248 min

Early Retirement - Financial Freedom (Investing, Tax Planning, Retirement Strategy, Personal Finance)3 Common Mistakes People Forget When Retiring EarlyHow can you ensure a secure and organized retirement plan without falling into common financial traps? In this episode, we promise to equip you with essential strategies that will help you avoid costly mistakes and make the most of your retirement savings. We'll discuss the importance of personalized financial planning and share the risks of mindlessly following others' investment moves, even if you're simply relying on your 401k. Listener Steve McCord offers a heartwarming reminder of the value in scrutinizing your financial plans, regardless of your net worth. We'll tackle the intricacies of Roth conversions and the p...

2024-10-2116 min

Early Retirement - Financial Freedom (Investing, Tax Planning, Retirement Strategy, Personal Finance)Here's How To Pay 0% In Taxes (ZERO Capital Gains)Can you save thousands on your lifetime tax bill with a simple strategy? Discover how tax gain harvesting can sometimes outperform Roth conversions when it comes to minimizing taxes on your investments. In this episode of the Early Retirement Podcast, I'll break down the nuances between capital gains taxes and ordinary income taxes and provide a practical example involving appreciated stock. Learn how you might pay 0% in capital gains taxes by strategically selling assets, using the capital gains tax brackets and standard deduction to your advantage. We’ll also address a real-life question about capital gains on a house sa...

2024-10-0712 min

Creative RiskThe Uncancellable Artist: Ari RothIn this episode, we sit down with Ari Roth—producer, playwright, dramaturg, educator, and former Artistic Director of Theater J, as well as the founder of Mosaic Theater Company of DC. A Chicago native and child of Holocaust refugees, Roth’s career has been anything but smooth. He has consistently sought out the gray areas in a theater landscape that’s become rigidly binary and moralistic.Now, as the founding artistic producing partner of Voices Festival Productions, Roth continues to challenge the status quo through bold, intercultural storytelling. Voices Festival Productions brings to life shows that explore the co...

2024-10-041h 40

Early Retirement - Financial Freedom (Investing, Tax Planning, Retirement Strategy, Personal Finance)Pension Decision - Lump Sum or Annuity?Choosing between a lump sum distribution and an annuity for your pension can be one of the most pivotal financial decisions you'll ever make. What could potentially put more money in your pocket—a flexible lump sum with inheritance potential or the security of guaranteed lifetime income with an annuity? Join us as we unpack this complex choice, exploring the benefits of each option through detailed analyses and real-world examples. Learn vital insights, such as tax implications and the optimal way to transfer a lump sum to an IRA, with guidance from our most recent client case study.

2024-09-2316 min

Early Retirement - Financial Freedom (Investing, Tax Planning, Retirement Strategy, Personal Finance)Don't Do Any Roth Conversions Before You Ask Yourself THISI often hear someone say "How much and when should I convert my assets to Roth?" when in reality the question should be "How can I live my ideal retirement and minimize taxes along the way?"Two very different questions.Create Your Custom Early Retirement Strategy HereGet access to the same software I use for my clients and join the Early Retirement Academy hereAri Taublieb, CFP ®, MBA is the Chief Growth Officer of Root Financial Partners and a Fiduciary Financial Planner specializing in helping clients r...

2024-09-1613 min

Early Retirement - Financial Freedom (Investing, Tax Planning, Retirement Strategy, Personal Finance)The Complete Guide To Optimizing Healthcare Costs Before 65Far too many people don't retire early because of healthcare costs. It can be significant at $2k/month...and it can be minimal at $50/month if you plan well. It's another cost to plan for and if you do it well, it can be the difference of hundreds of thousands of dollars over your retirement.In this episode, you'll learn how to determine your own healthcare cost (pre-65), how to qualify for federal subsidy, how to determine if you should do Roth Conversions instead, and pro tips from our clients who retired early and kept healthcare cost...

2024-09-0225 min