Shows

Issues of InterestFinTech in the banking industryIn this episode of "Issues of Interest," host Pat Morin sits down with Bryan Mulcahey, managing partner at FS Vector, to delve into the evolving landscape of FinTech and its impact on the banking industry. They explore how bank techs and embedded banking FinTechs are transforming financial services. Bryan shares insights on the advantages and opportunities FinTechs offer banks, such as improved customer experiences and expanded services. The conversation also touches on the role of AI, highlighting its potential to enhance efficiency and combat fraud. Tune in to discover how banks can leverage FinTech partnerships to stay competitive and...2025-02-2517 min

Issues of InterestFinTech in the banking industryIn this episode of "Issues of Interest," host Pat Morin sits down with Bryan Mulcahey, managing partner at FS Vector, to delve into the evolving landscape of FinTech and its impact on the banking industry. They explore how bank techs and embedded banking FinTechs are transforming financial services. Bryan shares insights on the advantages and opportunities FinTechs offer banks, such as improved customer experiences and expanded services. The conversation also touches on the role of AI, highlighting its potential to enhance efficiency and combat fraud. Tune in to discover how banks can leverage FinTech partnerships to stay competitive and...2025-02-2517 min Issues of InterestState and Local Tax Considerations for the Banking IndustryOn this episode of "Issues of Interest," Nick Smetana, tax manager, joins Leanne Scott, state and local tax principal, to discuss sales and use tax matters for banks and financial institutions. Discover why these often overlooked tax types are crucial, the importance of self-assessing use tax, and the impact of recent legislative changes in states like Vermont and Maine. Tune in for insights and practical advice to navigate the ever-evolving tax landscape.2025-01-2927 min

Issues of InterestState and Local Tax Considerations for the Banking IndustryOn this episode of "Issues of Interest," Nick Smetana, tax manager, joins Leanne Scott, state and local tax principal, to discuss sales and use tax matters for banks and financial institutions. Discover why these often overlooked tax types are crucial, the importance of self-assessing use tax, and the impact of recent legislative changes in states like Vermont and Maine. Tune in for insights and practical advice to navigate the ever-evolving tax landscape.2025-01-2927 min Issues of InterestExploring meals and entertainment tax deductionsIn this episode of "Issues of Interest", host Adam Aucoin speaks with Connor Smart about the complexities of tax deductions for meals and entertainment, just in time for the holiday season. They explore the impact of the Tax Cuts and Jobs Act on these expenses, the upcoming changes in 2025, and the importance of meticulous record-keeping. Whether you're navigating business lunches or holiday parties, this episode offers valuable insights to help you stay compliant and make the most of your deduction.Find Connor's article which delves further in this topic here. 2024-12-1814 min

Issues of InterestExploring meals and entertainment tax deductionsIn this episode of "Issues of Interest", host Adam Aucoin speaks with Connor Smart about the complexities of tax deductions for meals and entertainment, just in time for the holiday season. They explore the impact of the Tax Cuts and Jobs Act on these expenses, the upcoming changes in 2025, and the importance of meticulous record-keeping. Whether you're navigating business lunches or holiday parties, this episode offers valuable insights to help you stay compliant and make the most of your deduction.Find Connor's article which delves further in this topic here. 2024-12-1814 min Issues of InterestTax Impact of a Trump Presidency on Community BanksIn this episode of Issues of Interest, Joe Jalbert, banking practice lead, and Adam Aucoin, tax principal, discuss what they are hearing about potential tax changes in Trump’s second presidency. Adam talks about the tax changes during President Trump’s first term before outlining what came up on the campaign trail including possible adjustments to the tax rate, extensions for the Tax Cuts and Jobs Act, as well as shifts in how tipped income and Social Security benefits are taxed. Adam and Joe also discuss when these reforms could occur and steps community banks can take to b...2024-11-2119 min

Issues of InterestTax Impact of a Trump Presidency on Community BanksIn this episode of Issues of Interest, Joe Jalbert, banking practice lead, and Adam Aucoin, tax principal, discuss what they are hearing about potential tax changes in Trump’s second presidency. Adam talks about the tax changes during President Trump’s first term before outlining what came up on the campaign trail including possible adjustments to the tax rate, extensions for the Tax Cuts and Jobs Act, as well as shifts in how tipped income and Social Security benefits are taxed. Adam and Joe also discuss when these reforms could occur and steps community banks can take to b...2024-11-2119 min Issues of InterestRevealing the Truth Behind Common Cybersecurity Myths and Related Best PracticesIn this episode of "Issues of Interest," Information Systems and Risk Assurance principal Pat Morin joins cybersecurity manager Pawel Wilczynski to discuss the importance of cybersecurity for banks and financial institutions of all sizes. They address common misconceptions, such as the belief that small businesses are not targets for cybercriminals and that cybersecurity is solely an IT issue. The episode highlights steps organizations can take to boost security including employee training, strong passwords, and multifactor authentication. The cybersecurity e-book mentioned in the episode can be found on our website. 2024-10-3019 min

Issues of InterestRevealing the Truth Behind Common Cybersecurity Myths and Related Best PracticesIn this episode of "Issues of Interest," Information Systems and Risk Assurance principal Pat Morin joins cybersecurity manager Pawel Wilczynski to discuss the importance of cybersecurity for banks and financial institutions of all sizes. They address common misconceptions, such as the belief that small businesses are not targets for cybercriminals and that cybersecurity is solely an IT issue. The episode highlights steps organizations can take to boost security including employee training, strong passwords, and multifactor authentication. The cybersecurity e-book mentioned in the episode can be found on our website. 2024-10-3019 min Issues of InterestLessons learned from the adoption of CECLTune in to the latest podcast episode of Issues of Interest from Baker Newman Noyes, where host Jordin Milano discusses the implementation and lessons learned from Current Expected Credit Loss (CECL) adoption in the banking and financial services industry. Joined by guests Mark Haberland and Chase Ogden from Darling Consulting Group, this episode delves into the importance of ongoing monitoring, the CECL control environment, and effective governance. Discover how institutions can take ownership of their models, perform sensitivity testing, and monitor model assumptions. A note from Darling Consulting Group: Thank you for listening to t...2024-09-2630 min

Issues of InterestLessons learned from the adoption of CECLTune in to the latest podcast episode of Issues of Interest from Baker Newman Noyes, where host Jordin Milano discusses the implementation and lessons learned from Current Expected Credit Loss (CECL) adoption in the banking and financial services industry. Joined by guests Mark Haberland and Chase Ogden from Darling Consulting Group, this episode delves into the importance of ongoing monitoring, the CECL control environment, and effective governance. Discover how institutions can take ownership of their models, perform sensitivity testing, and monitor model assumptions. A note from Darling Consulting Group: Thank you for listening to t...2024-09-2630 min Issues of InterestPrivate Foundations in the Banking IndustryMany banks consider setting up private foundations because of the advantages they can provide. Private foundations can provide key PR benefits, help improve a bank’s standing in the community, provide an opportunity for members of the community to serve in a board role, and can control timing of charitable contributions.In this episode of Issues of Interest, BNN tax principals Adam Aucoin and Nick Porto discuss the intricacies of setting up and managing private foundations for banks. They talk through potential benefits, highlight potential pitfalls, and provide practical advice for avoiding common mistakes.Here at...2024-08-2723 min

Issues of InterestPrivate Foundations in the Banking IndustryMany banks consider setting up private foundations because of the advantages they can provide. Private foundations can provide key PR benefits, help improve a bank’s standing in the community, provide an opportunity for members of the community to serve in a board role, and can control timing of charitable contributions.In this episode of Issues of Interest, BNN tax principals Adam Aucoin and Nick Porto discuss the intricacies of setting up and managing private foundations for banks. They talk through potential benefits, highlight potential pitfalls, and provide practical advice for avoiding common mistakes.Here at...2024-08-2723 min Issues of InterestHow can banks use R&D credits to their advantage?In this episode of Issues of Interest, BNN tax principal Adam Aucoin speaks with Dave Fleischer, principal at Business Resource Services, about R&D credits, what banks need to consider, and how they can plan ahead and use credits to their advantage. Banks and financial institutions are constantly navigating volatility and change. Here at Issues of Interest we help you stay current on what’s happening in the industry so you can achieve success for your institution. We cover assurance, tax, business advisory, and technology topics and trends affecting the industry. Subscribe today to receive news and...2024-06-2618 min

Issues of InterestHow can banks use R&D credits to their advantage?In this episode of Issues of Interest, BNN tax principal Adam Aucoin speaks with Dave Fleischer, principal at Business Resource Services, about R&D credits, what banks need to consider, and how they can plan ahead and use credits to their advantage. Banks and financial institutions are constantly navigating volatility and change. Here at Issues of Interest we help you stay current on what’s happening in the industry so you can achieve success for your institution. We cover assurance, tax, business advisory, and technology topics and trends affecting the industry. Subscribe today to receive news and...2024-06-2618 min Issues of InterestAndroscoggin Bank’s Corporate Impact Program: Promoting sustainable lending and investment in MaineIn this special guest episode of Issues of Interest, Pat Morin and Kirsten Dionne speak with Androscoggin Bank CEO, Neil Kiely, about a recent sustainability loan project the bank worked on with our ESG practice. Pat, Kirsten, and Neil discuss how the project came about, how they approached it in service of Androscoggin's overall ESG goals, and how this effort is reflective of the broader ESG space in Maine, New England, and beyond.2024-06-0327 min

Issues of InterestAndroscoggin Bank’s Corporate Impact Program: Promoting sustainable lending and investment in MaineIn this special guest episode of Issues of Interest, Pat Morin and Kirsten Dionne speak with Androscoggin Bank CEO, Neil Kiely, about a recent sustainability loan project the bank worked on with our ESG practice. Pat, Kirsten, and Neil discuss how the project came about, how they approached it in service of Androscoggin's overall ESG goals, and how this effort is reflective of the broader ESG space in Maine, New England, and beyond.2024-06-0327 min Issues of InterestIs your institution ready for Business Intelligence?In this episode, Travis Hersom and Darren Fishell discuss how institutions and businesses can use business intelligence to their advantage and what they should consider including data pipelines, data quality, visualization, and security. 2024-04-2422 min

Issues of InterestIs your institution ready for Business Intelligence?In this episode, Travis Hersom and Darren Fishell discuss how institutions and businesses can use business intelligence to their advantage and what they should consider including data pipelines, data quality, visualization, and security. 2024-04-2422 min Issues of InterestHow the Tax Relief for American Families and Workers Act of 2024 could impact banks and financial institutionsIn this episode of Issues of Interest, Nick Amann speaks with Adam Aucoin about the Tax Relief for American Families and Workers Act of 2024 (H.R. 7024) bill that is currently in the Senate. Adam discusses what the current bill includes and the potential impacts for banks and financial institutions if it passes. More information on the how the bill could impact individuals can be found here. 2024-02-2818 min

Issues of InterestHow the Tax Relief for American Families and Workers Act of 2024 could impact banks and financial institutionsIn this episode of Issues of Interest, Nick Amann speaks with Adam Aucoin about the Tax Relief for American Families and Workers Act of 2024 (H.R. 7024) bill that is currently in the Senate. Adam discusses what the current bill includes and the potential impacts for banks and financial institutions if it passes. More information on the how the bill could impact individuals can be found here. 2024-02-2818 min Issues of InterestThird-Party Vendor ManagementIn this episode of Issues of Interest, Zach Porter speaks with Pat Morin about third-party vendor management for banks and financial institutions. Pat outlines common reasons banks and financial institutions use third-parties and how to monitor those third parties and the related risks. He also discusses how to ensure third-parties provide the information needed for evaluation, and what your options are if you have concerns over the level of service or information provided by third-parties. More information on the FDIC's recent guidance on evaluating third-parties can be found on our website. 2024-01-2920 min

Issues of InterestThird-Party Vendor ManagementIn this episode of Issues of Interest, Zach Porter speaks with Pat Morin about third-party vendor management for banks and financial institutions. Pat outlines common reasons banks and financial institutions use third-parties and how to monitor those third parties and the related risks. He also discusses how to ensure third-parties provide the information needed for evaluation, and what your options are if you have concerns over the level of service or information provided by third-parties. More information on the FDIC's recent guidance on evaluating third-parties can be found on our website. 2024-01-2920 min CSA Security UpdateWhy CPA Firms Excel in Cybersecurity AttestationsIn the latest CSA Security Update Podcast episode, we delve into the fascinating world of cybersecurity attestations and explore why CPA firms are increasingly leading the charge in this domain. Host John DiMaria is joined by Pawel Wilczynski, Cybersecurity Manager at Baker Newman Noyes (BNN), a top-ranked tax, assurance, and advisory firm and an accredited CSA STAR Assessment Firm.The episode delves into why CPA firms, traditionally known for financial audits, are exceptionally well-suited for cybersecurity attestations and how they apply their expertise in ensuring rigorous processes and adherence to standards like CSA STAR when performing cybersecurity...2024-01-1728 min

CSA Security UpdateWhy CPA Firms Excel in Cybersecurity AttestationsIn the latest CSA Security Update Podcast episode, we delve into the fascinating world of cybersecurity attestations and explore why CPA firms are increasingly leading the charge in this domain. Host John DiMaria is joined by Pawel Wilczynski, Cybersecurity Manager at Baker Newman Noyes (BNN), a top-ranked tax, assurance, and advisory firm and an accredited CSA STAR Assessment Firm.The episode delves into why CPA firms, traditionally known for financial audits, are exceptionally well-suited for cybersecurity attestations and how they apply their expertise in ensuring rigorous processes and adherence to standards like CSA STAR when performing cybersecurity...2024-01-1728 min Issues of Interest409A Nonqualified Deferred Compensation PlansIn this episode of Issues of Interest, Adam Aucoin speaks with Connor Smart about deferred compensation and 409A. Connor explains what 409A is, why it is important, and what the consequences and penalties are for noncompliance. With the severe consequences of 409A plan failure in mind, Adam and Connor discuss some of the key points to keep a plan compliant under 409A, where plan failures most often occur, and some of the tax planning nuances and complexities surrounding nonqualified deferred compensation plans.2023-12-1924 min

Issues of Interest409A Nonqualified Deferred Compensation PlansIn this episode of Issues of Interest, Adam Aucoin speaks with Connor Smart about deferred compensation and 409A. Connor explains what 409A is, why it is important, and what the consequences and penalties are for noncompliance. With the severe consequences of 409A plan failure in mind, Adam and Connor discuss some of the key points to keep a plan compliant under 409A, where plan failures most often occur, and some of the tax planning nuances and complexities surrounding nonqualified deferred compensation plans.2023-12-1924 min Issues of InterestKey takeaways from the Bank Tax InstituteIn this episode of Issues of Interest, Adam Aucoin speaks with Tabitha Lamontagne about what they heard earlier this month at the Bank Tax Institute. Their discussion includes insights on the Employee Retention Credit, tax planning in a rising interest rate environment, deductions and timing issues, and what they are watching in the economic outlook. 2023-11-3016 min

Issues of InterestKey takeaways from the Bank Tax InstituteIn this episode of Issues of Interest, Adam Aucoin speaks with Tabitha Lamontagne about what they heard earlier this month at the Bank Tax Institute. Their discussion includes insights on the Employee Retention Credit, tax planning in a rising interest rate environment, deductions and timing issues, and what they are watching in the economic outlook. 2023-11-3016 min Issues of InterestCybersecurity for the banking industryIn this episode, Pat Morin speaks with Pawel Wilczynski about the current cybersecurity landscape, covering issues impacting the banking industry such as ransomware and third-party risk, as well as strategies organizations and bank leaders can use to minimize cyber risk. For additional resources check out: https://www.bnncpa.com/resources/cybersecurity-risks-in-the-banking-industry/2023-10-3126 min

Issues of InterestCybersecurity for the banking industryIn this episode, Pat Morin speaks with Pawel Wilczynski about the current cybersecurity landscape, covering issues impacting the banking industry such as ransomware and third-party risk, as well as strategies organizations and bank leaders can use to minimize cyber risk. For additional resources check out: https://www.bnncpa.com/resources/cybersecurity-risks-in-the-banking-industry/2023-10-3126 min Issues of InterestCECL Updates and Best PracticesIn this episode of Issues of Interest from Baker Newman Noyes, Mark Haberland, of Darling Consulting Group, joins Jordin Milano, assurance senior manager at Baker Newman Noyes, to discuss the current state of CECL model validations and some things to consider as institutions adopt and implement their models. You can see additional corresponding materials here:CECL is coming - Is your institution ready? by Joseph Jalbert: https://www.bnncpa.com/resources/cecl-is-coming-is-your-institution-ready/CECl Toolkit from Baker Newman Noyes: https://www.bnncpa.com/resources/current-expected-credit-loss-standard-toolkit/2023-09-2820 min

Issues of InterestCECL Updates and Best PracticesIn this episode of Issues of Interest from Baker Newman Noyes, Mark Haberland, of Darling Consulting Group, joins Jordin Milano, assurance senior manager at Baker Newman Noyes, to discuss the current state of CECL model validations and some things to consider as institutions adopt and implement their models. You can see additional corresponding materials here:CECL is coming - Is your institution ready? by Joseph Jalbert: https://www.bnncpa.com/resources/cecl-is-coming-is-your-institution-ready/CECl Toolkit from Baker Newman Noyes: https://www.bnncpa.com/resources/current-expected-credit-loss-standard-toolkit/2023-09-2820 min Issues of InterestTax planning for your institution: credits, deductions, and multistate considerationsIn this episode of Issues of Interest from Baker Newman Noyes, Adam Aucoin and Leanne Scott from BNN's financial institutions industry practice discuss current trends in tax planning for banks and financial institutions. Adam also covers several credits impacting the tax landscape and Leanne summarizes a few multi-state considerations for banks operating across state lines. You can see additional corresponding materials here:Tax Planning for your Financial Institution by Adam Aucoin: https://www.bnncpa.com/resources/tax-planning-for-your-financial-institution-in-the-current-environment/Remote Workers & Multi-State Tax: 9 Key Considerations by Leanne Scott: https://www.bnncpa.com/resources/remote-workers-multi-state-tax-9-key-considerations/2023-08-2921 min

Issues of InterestTax planning for your institution: credits, deductions, and multistate considerationsIn this episode of Issues of Interest from Baker Newman Noyes, Adam Aucoin and Leanne Scott from BNN's financial institutions industry practice discuss current trends in tax planning for banks and financial institutions. Adam also covers several credits impacting the tax landscape and Leanne summarizes a few multi-state considerations for banks operating across state lines. You can see additional corresponding materials here:Tax Planning for your Financial Institution by Adam Aucoin: https://www.bnncpa.com/resources/tax-planning-for-your-financial-institution-in-the-current-environment/Remote Workers & Multi-State Tax: 9 Key Considerations by Leanne Scott: https://www.bnncpa.com/resources/remote-workers-multi-state-tax-9-key-considerations/2023-08-2921 min The Growth Advisor PodcastEpisode 14: Discussing Cybersecurity with PawelToday we are talking with Pawel Wilczynski, who is a cybersecurity manager at Baker Newman Noyes.

Clients turn to Pawel for help conducting cyber assessments, readiness assessments for major frameworks and things cyber.

He works with a variety of clients – both public and private – with a particular focus on financial and insurance institutions and the technology industry. His clients include financial institution services bureaus, regional banks, and software-as-a-service providers.

According to the Verizon data breach investigations report, 82% of all cyberattacks have a human element, and so we talk about the best practices in cybersecurity hygiene-the foundational concepts which will help keep...2023-07-1258 min

The Growth Advisor PodcastEpisode 14: Discussing Cybersecurity with PawelToday we are talking with Pawel Wilczynski, who is a cybersecurity manager at Baker Newman Noyes.

Clients turn to Pawel for help conducting cyber assessments, readiness assessments for major frameworks and things cyber.

He works with a variety of clients – both public and private – with a particular focus on financial and insurance institutions and the technology industry. His clients include financial institution services bureaus, regional banks, and software-as-a-service providers.

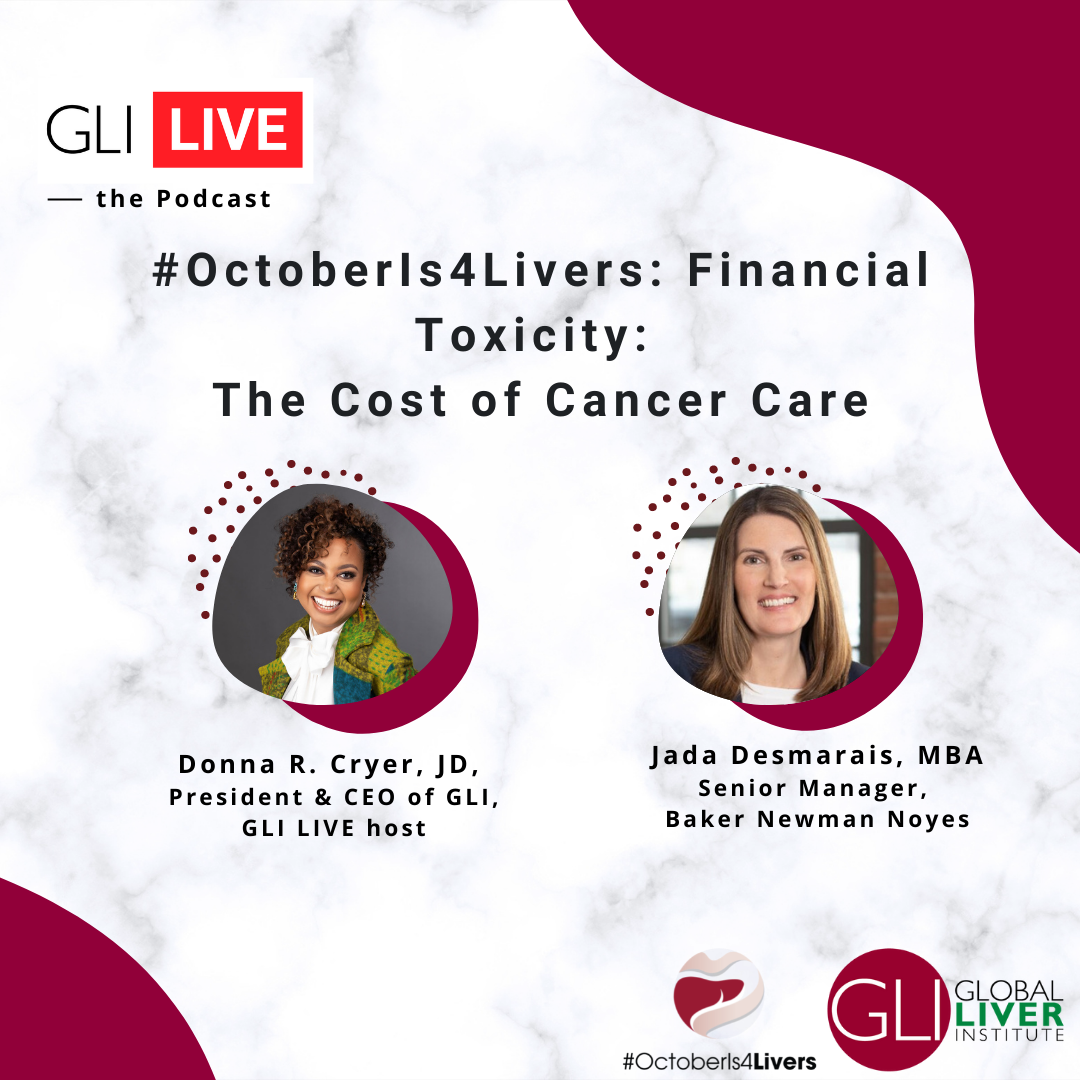

According to the Verizon data breach investigations report, 82% of all cyberattacks have a human element, and so we talk about the best practices in cybersecurity hygiene-the foundational concepts which will help keep...2023-07-1258 min GLI LIVE#OctoberIs4Livers - Financial Toxicity: The Cost of Cancer CareOur host, Donna Cryer, is joined by guest Jada Desmarais, MBA, Senior Manager, Baker Newman Noyes to discuss #cancer related financial toxicity and the true cost of cancer care.2022-10-2628 min

GLI LIVE#OctoberIs4Livers - Financial Toxicity: The Cost of Cancer CareOur host, Donna Cryer, is joined by guest Jada Desmarais, MBA, Senior Manager, Baker Newman Noyes to discuss #cancer related financial toxicity and the true cost of cancer care.2022-10-2628 min HFMA’s Voices in Healthcare FinanceThe five essential people on every patient’s cancer care team (and why a financial advocate should be one of them)Jada Desmarais of Baker Newman Noyes discusses the importance of a cohesive care team for patients with cancer.

2022-08-1517 min

HFMA’s Voices in Healthcare FinanceThe five essential people on every patient’s cancer care team (and why a financial advocate should be one of them)Jada Desmarais of Baker Newman Noyes discusses the importance of a cohesive care team for patients with cancer.

2022-08-1517 min Down To BusinessEpisode 75: Unpacking the complexities of NH's interstate tax battlesThis week NH Business Review Editor Jeff Feingold, newly back at the mic after vacation, talks with Leanne Scott, JD, LL.M., a senior manager in Baker Newman Noyes' tax practice. They discuss the Supreme Court's recent decision not to hear the case on whether NH residents working from home for Massachusetts companies should have to pay MA income tax. They dig into the implications, and other thorny issues created by having such different state tax structures in two adjoining states. This week's episode is brought to you by McLane Middleton, providing trusted legal services to businesses throughout the...2021-08-1124 min

Down To BusinessEpisode 75: Unpacking the complexities of NH's interstate tax battlesThis week NH Business Review Editor Jeff Feingold, newly back at the mic after vacation, talks with Leanne Scott, JD, LL.M., a senior manager in Baker Newman Noyes' tax practice. They discuss the Supreme Court's recent decision not to hear the case on whether NH residents working from home for Massachusetts companies should have to pay MA income tax. They dig into the implications, and other thorny issues created by having such different state tax structures in two adjoining states. This week's episode is brought to you by McLane Middleton, providing trusted legal services to businesses throughout the...2021-08-1124 min Down To BusinessEpisode 70: Exploring Strategies For The New Hybrid WorkplaceIlona Davis, Business & Technology Advisory Principal at Baker Newman Noyes, joins NH Business Review editor Jeff Feingold to discuss strategy and optimization for the new, post-pandemic hybrid workplace. They dig into why it's important for each business to identify its goals and strategies before crafting a policy that will support those, rather than taking a one-size-fits-all approach. They also discuss the pros and cons of remote working, and the downside of interacting solely through technology. This week's episode is brought to you by McLane Middleton, providing trusted legal services to businesses throughout the region for over 100 years. For a co...2021-07-0826 min

Down To BusinessEpisode 70: Exploring Strategies For The New Hybrid WorkplaceIlona Davis, Business & Technology Advisory Principal at Baker Newman Noyes, joins NH Business Review editor Jeff Feingold to discuss strategy and optimization for the new, post-pandemic hybrid workplace. They dig into why it's important for each business to identify its goals and strategies before crafting a policy that will support those, rather than taking a one-size-fits-all approach. They also discuss the pros and cons of remote working, and the downside of interacting solely through technology. This week's episode is brought to you by McLane Middleton, providing trusted legal services to businesses throughout the region for over 100 years. For a co...2021-07-0826 min BNN Tax SnacksBNN Tax Snacks: Net Operating Losses for the 2020 TaxpayerIn this episode, Josh and John discuss planning opportunities for businesses and individuals that may have a net operating loss (NOL). They'll cover general rules for NOLs in 2020 and items to consider when planning for 2020 and beyond. BNN Tax Snacks is a podcast from Baker Newman Noyes covering timely and impactful federal and state tax developments affecting our clients, friends, and other listeners. In the tax world, the impact of 2020 will be felt for quite some time. In the next several episodes of BNN Tax Snacks, you'll hear from a few of our tax specialists about...2021-02-0222 min

BNN Tax SnacksBNN Tax Snacks: Net Operating Losses for the 2020 TaxpayerIn this episode, Josh and John discuss planning opportunities for businesses and individuals that may have a net operating loss (NOL). They'll cover general rules for NOLs in 2020 and items to consider when planning for 2020 and beyond. BNN Tax Snacks is a podcast from Baker Newman Noyes covering timely and impactful federal and state tax developments affecting our clients, friends, and other listeners. In the tax world, the impact of 2020 will be felt for quite some time. In the next several episodes of BNN Tax Snacks, you'll hear from a few of our tax specialists about...2021-02-0222 min BNN Tax SnacksBNN Tax Snacks: Strategic Tax Planning for Pass-Through EntitiesJosh and John are talking about tax planning and considerations for pass-through businesses, as well as potential impacts of the Biden proposal on these types of entities going into 2021. BNN Tax Snacks is a podcast from Baker Newman Noyes covering timely and impactful federal and state tax developments affecting our clients, friends, and other listeners. In the tax world, the impact of 2020 will be felt for quite some time. In the next several episodes of BNN Tax Snacks, you'll hear from a few of our tax specialists about business and tax topics directly related to t...2021-02-0228 min

BNN Tax SnacksBNN Tax Snacks: Strategic Tax Planning for Pass-Through EntitiesJosh and John are talking about tax planning and considerations for pass-through businesses, as well as potential impacts of the Biden proposal on these types of entities going into 2021. BNN Tax Snacks is a podcast from Baker Newman Noyes covering timely and impactful federal and state tax developments affecting our clients, friends, and other listeners. In the tax world, the impact of 2020 will be felt for quite some time. In the next several episodes of BNN Tax Snacks, you'll hear from a few of our tax specialists about business and tax topics directly related to t...2021-02-0228 min BNN Tax SnacksBNN Tax Snacks: Are there benefits to extending?Spring tax deadlines are coming up fast, and many businesses and individuals are once again dealing with a complex tax situation. You may be wondering: Is there any way I can lighten the load? Today, John and Josh are discussing what it means to extend your tax return filing deadline. Listen in to learn how you or your business may benefit from filing for a tax extension. BNN Tax Snacks is a podcast from Baker Newman Noyes covering timely and impactful federal and state tax developments affecting our clients, friends, and other listeners. In the tax world, t...2021-02-0221 min

BNN Tax SnacksBNN Tax Snacks: Are there benefits to extending?Spring tax deadlines are coming up fast, and many businesses and individuals are once again dealing with a complex tax situation. You may be wondering: Is there any way I can lighten the load? Today, John and Josh are discussing what it means to extend your tax return filing deadline. Listen in to learn how you or your business may benefit from filing for a tax extension. BNN Tax Snacks is a podcast from Baker Newman Noyes covering timely and impactful federal and state tax developments affecting our clients, friends, and other listeners. In the tax world, t...2021-02-0221 min BNN Tax SnacksYour changing working environment and 2020 taxes: What you need to knowDue to the state shutdowns caused by the pandemic, many individuals have transitioned to working remotely, often from states other than where their employer is based. Some individuals are choosing to relocate, temporarily or permanently, to states that they may feel are safer. What does this mean for the individual from a state tax perspective? In this episode, Merrill and Leanne discuss what individuals can do to ensure they are meeting their multi-state tax reporting obligations. BNN Tax Snacks is a podcast from Baker Newman Noyes covering timely and impactful federal and state tax developments affecting...2021-01-1819 min

BNN Tax SnacksYour changing working environment and 2020 taxes: What you need to knowDue to the state shutdowns caused by the pandemic, many individuals have transitioned to working remotely, often from states other than where their employer is based. Some individuals are choosing to relocate, temporarily or permanently, to states that they may feel are safer. What does this mean for the individual from a state tax perspective? In this episode, Merrill and Leanne discuss what individuals can do to ensure they are meeting their multi-state tax reporting obligations. BNN Tax Snacks is a podcast from Baker Newman Noyes covering timely and impactful federal and state tax developments affecting...2021-01-1819 min BNN Tax SnacksNexus and Remote Employees in 2020: State & Local Tax During COVID-192020 has brought the "work from home" environment to the forefront of our business and tax discussions. State shutdowns caused by the COVID-19 pandemic have forced many employers to close their business locations, with employees often working from states different than where their office is located. Leanne and Merrill are discussing this "new norm" and the potential state tax implications for businesses with employees now working remotely.BNN Tax Snacks is a podcast from Baker Newman Noyes covering timely and impactful federal and state tax developments affecting our clients, friends, and other listeners. As this most unusual year...2021-01-1818 min

BNN Tax SnacksNexus and Remote Employees in 2020: State & Local Tax During COVID-192020 has brought the "work from home" environment to the forefront of our business and tax discussions. State shutdowns caused by the COVID-19 pandemic have forced many employers to close their business locations, with employees often working from states different than where their office is located. Leanne and Merrill are discussing this "new norm" and the potential state tax implications for businesses with employees now working remotely.BNN Tax Snacks is a podcast from Baker Newman Noyes covering timely and impactful federal and state tax developments affecting our clients, friends, and other listeners. As this most unusual year...2021-01-1818 min BNN Tax SnacksPPP loan forgiveness updateToday, we’re discussing a topic that’s been on business owners’ minds all year: the Paycheck Protection Program. As we’re approaching the end of 2020, Joe and Matt are talking about some things that borrowers in the Paycheck Protection Program (or PPP as it’s known) should be thinking about from both a tax planning perspective and from an accounting perspective.BNN Tax Snacks is a podcast from Baker Newman Noyes covering timely and impactful federal and state tax developments affecting our clients, friends, and other listeners. As this most unusual year draws to a close, BNN Tax Sn...2020-12-1517 min

BNN Tax SnacksPPP loan forgiveness updateToday, we’re discussing a topic that’s been on business owners’ minds all year: the Paycheck Protection Program. As we’re approaching the end of 2020, Joe and Matt are talking about some things that borrowers in the Paycheck Protection Program (or PPP as it’s known) should be thinking about from both a tax planning perspective and from an accounting perspective.BNN Tax Snacks is a podcast from Baker Newman Noyes covering timely and impactful federal and state tax developments affecting our clients, friends, and other listeners. As this most unusual year draws to a close, BNN Tax Sn...2020-12-1517 min BNN Tax SnacksEstate planning after the 2020 electionIn this episode of BNN Tax Snacks, Jean McDevitt Bullens and Jim Guarino revisit their Tax Planning Pointers mini-series to recap recent potential changes to estate and gifting strategies as a result of the changing political landscape.BNN Tax Snacks is a podcast from Baker Newman Noyes covering timely and impactful federal and state tax developments affecting our clients, friends, and other listeners. As this most unusual year draws to a close, BNN Tax Snacks covers a number of topics directly related to the pandemic and the resulting tax law changes it set in motion.2020-12-1532 min

BNN Tax SnacksEstate planning after the 2020 electionIn this episode of BNN Tax Snacks, Jean McDevitt Bullens and Jim Guarino revisit their Tax Planning Pointers mini-series to recap recent potential changes to estate and gifting strategies as a result of the changing political landscape.BNN Tax Snacks is a podcast from Baker Newman Noyes covering timely and impactful federal and state tax developments affecting our clients, friends, and other listeners. As this most unusual year draws to a close, BNN Tax Snacks covers a number of topics directly related to the pandemic and the resulting tax law changes it set in motion.2020-12-1532 min BNN Tax SnacksIndividual tax planning for 2020 year-end2020 has certainly been a strange year! In this episode of Tax Snacks, Kim and Jim are here to chat about year-end planning for individuals, the effects of the pandemic and presidential election results on tax planning, and what's on the horizon.BNN Tax Snacks is a podcast from Baker Newman Noyes covering timely and impactful federal and state tax developments affecting our clients, friends, and other listeners. As this most unusual year draws to a close, BNN Tax Snacks covers a number of topics directly related to the pandemic and the resulting tax law changes it set...2020-12-1531 min

BNN Tax SnacksIndividual tax planning for 2020 year-end2020 has certainly been a strange year! In this episode of Tax Snacks, Kim and Jim are here to chat about year-end planning for individuals, the effects of the pandemic and presidential election results on tax planning, and what's on the horizon.BNN Tax Snacks is a podcast from Baker Newman Noyes covering timely and impactful federal and state tax developments affecting our clients, friends, and other listeners. As this most unusual year draws to a close, BNN Tax Snacks covers a number of topics directly related to the pandemic and the resulting tax law changes it set...2020-12-1531 min Portland Press Herald AudioMaking It Work: How Small Businesses Can Close the Books on 2020 Congrats to small businesses on making it this far. Now join us on Oct. 21 to learn what tax, accounting and operational issues you should consider before year’s end. How about a primer on the more than a dozen grants and programs that could help your business now? Or a checklist to assess your financial health, especially if you’re considering big moves like deciding whether to close temporarily? On the panel: Dan Gayer, Baker Newman Noyes Steve Veazey, SCORE Mark Delisle, Maine Small Business Development Centers Sarah...2020-10-2359 min

Portland Press Herald AudioMaking It Work: How Small Businesses Can Close the Books on 2020 Congrats to small businesses on making it this far. Now join us on Oct. 21 to learn what tax, accounting and operational issues you should consider before year’s end. How about a primer on the more than a dozen grants and programs that could help your business now? Or a checklist to assess your financial health, especially if you’re considering big moves like deciding whether to close temporarily? On the panel: Dan Gayer, Baker Newman Noyes Steve Veazey, SCORE Mark Delisle, Maine Small Business Development Centers Sarah...2020-10-2359 min