Shows

Wealth Independence Podcastv2.5 - The “Old Playbook” for Real Estate Is DeadThe Wall Street Journal recently declared commercial real estate “too cheap to ignore.” Dustin and Adam break down the article’s claims, challenge some cherry-picked data, and explain what institutional investors returning as net buyers for the first time since 2022 actually signals.Commercial real estate values are down from 2022 peaks on average…but how much of that decline reflects a real structural problem versus a correction from a bubble fueled by cheap debt? The discussion also digs into why comparing real estate returns to Nvidia’s 70% gains misses the point entirely, and why REITs are a poor proxy for...

2026-02-0622 min

Wealth Independence Podcastv2.4 - Development Risk, Timing, and Deal-Breakers (ft. Eugene Gershman)How do real estate development deals actually work for passive investors? And what makes them riskier than buying existing properties?Dustin and Adam sit down with Eugene Gershman, a second-generation developer with 20+ years of experience who now partners with landowners across the country to bring projects from raw land to stabilized assets. Eugene explains the two-tier capital structure many developers use: early-stage “GP funds” (comparable to startup seed capital) where investors take more risk but participate in the sponsor’s profit sharing, followed by traditional LP investments once permits are secured and construction is priced.He als...

2026-01-3039 min

Wealth Independence Podcastv2.3 - No Investor Left Behind: Real Estate Depreciation & Bonus DepreciationDepreciation is one of real estate’s most powerful tax advantages – and maybe its most misunderstood. Dustin and Adam break down what passive investors actually need to know about real estate depreciation, including bonus depreciation, cost segregation studies, and the tax benefits that flow through to syndication investors.Bonus depreciation is back at 100%, and despite how aggressive it sounds, it’s actually the proper accounting method. But depreciation losses come with limitations that catch many high-earning W-2 investors off guard – particularly around how passive losses can and can't be used. The discussion also covers depreciation recapture, a sale exp...

2026-01-2324 min

Wealth Independence Podcastv2.2 - From Dry Cleaning to Real Estate Freedom (ft. Ian Noble)What happens after you sell a 14-store business with 90 employees? Ian Noble joins Adam and Dustin to share his journey from dry cleaning entrepreneur to passive real estate investor, revealing the emotional identity shift after exiting a business, and explaining how his business background shaped his approach to evaluating passive investment opportunities.Dustin and Adam explore Ian's dual investment strategy: combining steady cash flow from private lending with equity upside through mobile home parks. Ian explains why interest rate concerns shouldn’t keep investors waiting, how passive investing delivered tax benefits after his exit, and the questions ev...

2026-01-1637 min

Wealth Independence Podcastv2.1 - The Active to Passive Income FrameworkDustin and Adam tackle a fundamental question for business owners and high-earning professionals: when does it make sense to convert active income into passive investments rather than reinvesting in your business or career?They explore why syndications often provide better risk-adjusted returns than building your own real estate portfolio, particularly for investors who lack the time or desire to manage properties directly.The discussion covers the four ways real estate generates returns (appreciation, principal paydown, tax benefits, and cash flow) and why passive investments become increasingly tax-efficient as your portfolio grows. They examine the opportunity...

2026-01-0922 min

Wealth Independence Podcastv2.0 - Welcome to Wealth Independence Version 2Dustin and Adam reflect on completing their first full year of the Wealth Independence Podcast (version 1) and share what’s ahead for version 2.The conversation covers which content resonated most with listeners, including strong feedback on the “No Investor Left Behind” series, particularly the cap rates episode. They discuss plans to expand educational content with topics like waterfall structures, bring on more established names from their network, and feature interviews with actual passive investors who've built substantial portfolios.Episode Release Notes & Resources:Goal setting episode: https://www.wealthindependencepod.com/2432117/episodes/16376511-v1-0-goal...

2026-01-0210 min

DropZone Radio with GootZDropZone 2025 YEAR MIXDROPZONE 2025 Year Mix with GootZ

Intro

Asat & Mrak – Nobody

Sonny Fodera – Tell me

Benny Benassi & ARTBAT – Love is Gonna Save Us

Armin van Buuren & Omnia – Love

Bowers & Bidwell – Wide Open

Tritonal – Watch Us Glow

Above & Beyond – Quicksand

ALAT – Run

Taygeto – Breathe (All My Love)

Rodrigo Deem – A New World

Oliver Smith feat Amy j Pryce – Open Up (Hausman Remix)

HNTR – Shook Ones Pt. III

Layton Giordani & Linney feat Sarah de Warren – Act Of God

Sean Ashton – Where Have You Gone

Hosanna & Westend – Drum Death

CamelPhat & Elderbrook – Cola (ARTBAT Remix)

CID feat Taylr Renee – Fancy $hit

Chris Lorenzo – Appetite

Roddy Lima – Night Time

Orjan Nilsen...

2026-01-021h 55

Wealth Independence Podcastv1.51 - “Alternative” Investments & the Knowledge Gap ProblemDustin and Adam break down a recent Wall Street Journal article examining the push to bring private assets into 401(k) plans, and why this approach misses the point for passive investors seeking true alternatives. The discussion reveals a troubling reality: nearly 40% of Americans have never heard of private credit funds, and mainstream financial education continues to overlook the alternative investment space entirely.The episode explores the fundamental difference between real private investments and the repackaged “alternatives” being positioned for 401(k) inclusion. While Apollo and BlackRock angle to capture a portion of the $13 trillion 401(k) market, Dustin and Adam...

2025-12-2627 min

Wealth Independence Podcastv1.50 - Asset Protection: Trusts, LLCs, and Privacy StrategiesDustin and Adam explore the often-overlooked world of asset protection for real estate investors and high-income professionals. They break down the key difference between control and ownership, explaining how properly structured trusts and LLCs can create legal barriers that protect your assets without sacrificing your ability to manage them day-to-day.The conversation covers why living in America (where anyone can sue anyone for anything) makes asset protection especially relevant, addressing scenarios from slip-and-fall accidents at rental properties to car accidents and disgruntled business partners. They explain equity stripping, how asset searches work, and why making yourself look “br...

2025-12-1931 min

Wealth Independence Podcastv1.49 - No Investor Left Behind: Ratio Utility Billing System (RUBS)In this “No Investor Left Behind” episode, Dustin and Adam demystify RUBS (Ratio Utility Billing System) and explain how this common multifamily value-add strategy can significantly increase a property's net operating income and valuation.Using a practical example, they demonstrate how implementing a $40 per unit monthly utility billback across 20 units can add approximately $160,000 in property value when calculated at a 6% cap rate.The discussion covers different RUBS approaches, from occupancy-based formulas to flat-fee structures. Dustin and Adam emphasize the critical importance of market analysis before implementing RUBS, explaining that success depends heavily on whether utility bill...

2025-12-1217 min

Wealth Independence Podcastv1.48 - Don’t Fall for the Doom and GloomDustin and Adam tackle a question many passive investors face right now: is the market too high to invest? With concerns about AI investment bubbles, potential recessions, and stock market volatility dominating headlines, it’s easy to fall into analysis paralysis. In this episode, they make the case for why focusing on cash-flowing real estate investments provides a fundamentally different risk profile than timing the equity markets.The conversation explores why some wealthy investors continue rebalancing toward stocks despite valuations, and contrasts this with the benefits of income-generating assets that provide cash flow, tax advantages, and debt pa...

2025-12-0526 min

Wealth Independence Podcastv1.47 - Gratitude, Freedom, and Hard-Won LessonsIn this Thanksgiving special, Dustin and Adam step back from deal analysis to reflect on gratitude, freedom, and the mistakes that shaped their investing journey. They discuss critical lessons learned the hard way, including the challenges of investing out of state too early and why property size can matter more than cap rates when factoring in real costs like travel and management.Adam shares insights from investing in smaller out-of-state properties versus larger multifamily assets, explaining how economies of scale affect everything from travel expenses to operational efficiency. The discussion explores what freedom and independence really mean...

2025-11-2822 min

Wealth Independence Podcastv1.46 - Why Smart Investors Never Go It AloneDustin and Adam explore one of the most underappreciated aspects of building wealth: the power of investing alongside others and being part of a mastermind community.They share real examples from their experience in groups like Robert Helms and Russell Gray’s syndication mastermind and Ken McElroy’s Collective, showing how exposure to different perspectives transformed their underwriting approach and deal selection.The discussion turns to how passive investing itself serves as an educational vehicle by opening doors to new markets, asset classes, and relationships you wouldn’t otherwise access. They explain how a single invest...

2025-11-2122 min

Wealth Independence Podcastv1.45 - The Complexity Trap in Real Estate SyndicationsDustin and Adam tackle a common misconception in real estate syndication investing: that complicated deal structures signal sponsor sophistication.They break down why simpler structures, like straight 80/20 splits, often serve passive investors better than multi-tiered waterfalls and accruing preferred returns. They walk through real-world examples of overly complex deal structures, including waterfalls with multiple performance tiers and preferred returns with catch-up provisions. They also explain how these structures can actually create misalignment between sponsors and investors, add administrative complexity, and in some cases, disincentivize sponsors who fall behind on accrued preferences.Drawing from their experience...

2025-11-1424 min

Accredited Investor EdgeTwo Ways High Earners Can Legally Reduce Taxes (with Adam Penn, Bidwell Capital)Can you really reduce your taxes without owning a business?Adam Penn, founder of Bidwell Capital, explains how high-income earners can legally and effectively cut their tax bills using real estate and oil & gas investments.We talk about the short-term rental tax rules, oil and gas deductions, and red flags to avoid in private placement deals.Adam also shares his path from software engineer to fund manager, and how everyday investors can follow the same playbook.Guest: Adam Penn, Founder of Bidwell CapitalGuest Contact: linkedin.com/in/adamjpenn | adam@bidwellcapitalfund.com...

2025-11-131h 07

Wealth Independence Podcastv1.44 - No Investor Left Behind: Understanding Cap RatesIn this first episode of a new “No Investor Left Behind” series, Dustin and Adam break down one of commercial real estate’s most critical concepts: capitalization rates (cap rates).The conversation covers how cap rates function as the primary valuation multiplier in commercial real estate, the relationship between Net Operating Income (NOI), cap rates, and property value, and why understanding this metric is crucial for evaluating any commercial real estate investment opportunity.Adam and Dustin walk through real-world examples showing how small changes in NOI can create significant value appreciation, and more importantly, how sponso...

2025-11-0726 min

Wealth Independence Podcastv1.43 - Don’t Let Bad Deals Kill Your Investment StrategyDustin and Adam tackle a critical topic many passive investors face: recovering from investment losses and knowing when to get back in the market.After reaching out to investors about a new investment opportunity, Adam noticed a pattern: roughly 10% responded that they’d lost money in multiple deals and were writing off entire investment categories as a result.The discussion covers why this reaction, while understandable, often prevents investors from capitalizing on current opportunities, and explores the importance of learning from losses rather than letting them sideline you completely, particularly as market cycles shift....

2025-10-3125 min

Wealth Independence Podcastv1.42 - When “Passive” Real Estate Isn't Actually PassiveDustin and Adam dive into the harsh reality of “passive” real estate investing, exposing why the common advice to “just hire a property manager” for single-family rentals often creates more problems than it solves.The discussion covers why good property managers are expensive and hard to find, especially for smaller properties, and how the best property management companies don’t even manage properties for other investors. They explore how syndications and private placements offer truly passive investment opportunities by putting experienced general partners between you and operational headaches.Additional topics include why asset management is more compl...

2025-10-2416 min

Wealth Independence Podcastv1.41 - Tax Planning for Passive InvestorsDustin and Adam dive deep into proactive tax planning strategies specifically designed for passive investors. They explain why waiting until March to think about the previous year’s taxes is too late and share their systematic approach to tax optimization throughout the year.The discussion includes the short-term rental “loophole” strategy for W-2 earners, qualifying for real estate professional status, and the critical importance of working with qualified tax professionals who understand alternative investments. Key topics include the tax benefits of oil and gas investments, cost segregation studies, and bonus depreciation opportunities.They also address a comm...

2025-10-1724 min

Wealth Independence Podcastv1.40 - The Liquidity MisconceptionDustin and Adam challenge the common assumption that stock market liquidity provides a meaningful advantage over real estate investments. They explore why many investors view the illiquidity of real estate as a downside and argue that this perspective may actually hinder long-term wealth building.They examine the trade-offs between liquidity and volatility, explaining how frequent price fluctuations can damage compounding returns over time. They share practical insights on why cash-flowing assets often provide better “liquidity” through monthly income than traditional liquid investments, and discuss how this applies particularly to retirement accounts and long-term investment strategies.The...

2025-10-1018 min

Wealth Independence Podcastv1.39 - Behind the Scenes of a 20-Unit AcquisitionDustin and Adam go behind the scenes of a recent 20-unit multifamily acquisition, pulling back the curtain on what passive investors typically don’t see: the last-minute surprises, changing terms, capital raising challenges, and sponsor decision-making that happens right up until closing day.The discussion covers the realities of working with local banks versus larger lenders, how unexpected insurance requirements can materially impact deal returns, and the importance of conservative expense estimates in underwriting. Adam shares how a $4,900 flood insurance surprise affected year-one cash flows and his approach to protecting investor returns through fee adjustments.Fo...

2025-10-0324 min

Wealth Independence Podcastv1.38 - Out-of-State Real Estate Reality CheckThinking about buying rental properties out of state? Dustin and Adam share hard-earned lessons from managing 25+ units in Memphis while living hundreds of miles away. This episode reveals why out-of-state real estate investing is rarely as passive as it seems, covering the real challenges of building reliable contractor teams in different markets, dealing with quality control from a distance, and the hidden costs that can wipe out years of cash flow.The discussion includes practical realities like finding trustworthy contractors, managing emergency repairs remotely, and why some markets make team-building significantly harder than others. Adam and Dustin...

2025-09-2616 min

Wealth Independence Podcastv1.37 - When Deals Don’t PerformAdam and Dustin tackle a topic most investors prefer to avoid: what happens when your real estate investments underperform or lose money entirely.The conversation includes candid insights about different levels of deal performance, from cash flow shortfalls to complete capital losses, along with why position sizing is the most critical risk management tool for passive investors. The discussion also explores the safety nets that can protect your investments during challenging times, including debt structure considerations and cash flow versus appreciation plays.Drawing from real-world examples, including their own Memphis four-plex deal and a recent...

2025-09-1920 min

Wealth Independence Podcastv1.36 - Finding Deals When Others RetreatFresh from the Limitless Financial Freedom Expo, Dustin and Adam deliver boots-on-the-ground insights from networking with dozens of active and passive investors. Rather than sitting in sessions, they spent their time in conversations with deal makers, capital raisers, and fellow investors to get a real pulse on today’s market conditions.Their key takeaway? While conference attendance was down 25% and fewer vendors were present, serious money is still moving and some of the best investment opportunities in years are available right now – but finding those opportunities often requires pivoting away from crowded asset classes toward overlooked opportunities.

2025-09-1218 min

Wealth Independence Podcastv1.35 - Amazon-Proof Real Estate Investing (ft. Steve Salvigsen)Dustin and Adam interview Steve Salvigsen of Sage Square Capital, a seasoned commercial real estate investor who specializes in strip mall and medical/retail properties.Steve shares his transition from residential development to building a successful portfolio of cash-flowing commercial assets, and dives deep into his unique investment thesis targeting secondary port cities like Savannah, Mobile, and Charleston, where major infrastructure investments are driving population and business growth.Steve discusses why he focuses on “medtail” properties…strategic combinations of medical and retail tenants that create stable, long-term income streams, and explains why neighborhood retail like pizza...

2025-09-0539 min

Wealth Independence Podcastv1.34 - Building Your Retirement Cash Flow PortfolioAdam and Dustin challenge the conventional retirement wisdom of shifting from stocks to bonds just when you need income most. Adam shares his personal journey from W-2 employee to building a cash-flowing real estate portfolio that generates consistent monthly income, explaining how he constructed a diversified investment strategy using rental properties, oil and gas investments, and strategic tax planning.The discussion includes why successful investors stay actively involved in their wealth management decisions rather than delegating everything to financial advisors, and explores practical portfolio construction techniques, including how to layer different investment types for both cash flow...

2025-08-2918 min

Wealth Independence Podcastv1.33 - Building Passive Income Through Private Credit (ft. Jared Benson)Dustin and Adam interview Jared Benson of Clotine Capital, a successful real estate broker who partnered to launch a debt fund while maintaining his real estate practice. Jared shares his journey from struggling with house flipping side projects to discovering the power of passive investing and eventually partnering with experienced operators to create an income-focused debt fund.Key topics include the critical differences between debt funds in today’s market, red flags to watch for in preferred equity deals, and why many “debt funds” are simply rescue capital for failed projects. The discussion also covers essential due dilige...

2025-08-2235 min

Wealth Independence Podcastv1.32 - Decoding GP Fees in Real Estate SyndicationsAdam and Dustin tackle one of the most misunderstood aspects of private real estate investing: general partner (GP) compensation. If you’ve ever wondered why deal sponsors take 20% of profits or bristled at acquisition fees, this episode dives deep into the economics behind GP fee structures and why they’re actually designed to benefit passive investors (if done correctly).The conversation ranges from real-world examples of fee arrangements, complex waterfall structures that incentivize outperformance, and why transparency in fee disclosure sets private deals apart from traditional Wall Street investments.Key topics include the difference between upfr...

2025-08-1520 min

Wealth Independence Podcastv1.31 - Should You Do All the Work Yourself?When you first discover passive real estate investing, a natural question emerges: “Why not just do all the work myself and make more money?” Dustin and Adam tackle this common dilemma facing passive investors.Drawing from Adam’s hands-on experience managing Airbnb properties – including 2AM guest calls and emergency repairs – they explore the true costs of active investing beyond just the financial returns. Discussion includes the critical trade-offs between higher cash returns and time freedom, using real examples from current flip projects and rental properties.They also introduce CPA Tom Wheelwright’s three-tier investment framework: retail (stoc...

2025-08-0817 min

Wealth Independence Podcastv1.30 - The Case Against Starting Small in Real EstateDustin and Adam challenge the conventional wisdom that real estate investors should “start small.” Drawing from their recent experience with a large Las Vegas deal, they explain why larger real estate investments often provide better execution, stronger teams, and more motivated service providers.They explore how bigger deals attract more qualified professionals (from lenders and insurance brokers to property managers) who are willing to dedicate more time and resources when the potential returns justify their involvement. This creates a stronger “team” around a bigger deal, often increasing the deal’s chances of success.Key topics include th...

2025-08-0120 min

Get TrancedDennis Besnij Pres. Deep In My Mind 106 (Deep & Progressive Pick)Atrym - Stay Here (Extended Mix) [Hathor].

DJ Lackmus - Blizzard (Extended Mix) [Interplay Flow]

Midnight Evolution - Silence (Extended Mix) [Elliptical Sun Recordings]

Hel_slowed & Lovlee - Left Of Us (Extended Mix) [Armind (Armada)].

AVIRA & ENNEA feat. Kayrae – Darkest Before Dawn (Extended Mix)[Armada Music]

MaMan - A Tiny Home in the Universe (Extended Mix) [Enormous Tunes]

Miratrix - Vetra (Extended Mix) [Pure Progressive]

Henri (BR) - Alive (Extended Mix)[Enormous Vision]

Sam Rose, Thysma - Stranger (Extended Mix) [Armada Electronic Elements]

Krismi - Drift Around Me (Extended Mix) [Magik Muzik]

Stone Van Brooken - INSOMNIA (Extended) [ERRORR]

nümin...

2025-07-291h 58

Wealth Independence Podcastv1.29 - You Make Your Money When You BuyDustin and Adam dive into one of the most fundamental principles of successful investing: “you make your money when you buy.” Using real examples from recent apartment building acquisitions and fix-and-flip projects, they discuss why the purchase price is often the biggest lever in determining investment success.They break down how overpaying upfront makes it nearly impossible to “earn your way out” of a deal (even with significant value-add improvements), and share insights on evaluating acquisition prices in today’s market, including why sponsors claiming a “20% discount to 2022 prices” might not actually be getting a good deal.For passi...

2025-07-2516 min

Enhanced SessionsEnhanced Sessions 808 with Darren Tate - Hosted by FariusThis week Farius is back live from the Enhanced Studios in London, as we welcome Darren Tate to Enhanced Sessions to celebrate his new EP 'Chrysalis' out next Friday on Enhanced Progressive! We also have the latest releases from EMBRZ, Chris Lake, Kasablanca & Innellea, Sentinel & Alesso, Adam Beyer, Orjan Nilsen, Hessian & LAR, Mauro Picotto, and more.

Send in your shoutouts to Farius: ▶ https://enhanced.ffm.to/whatsapp

Listen to our latest releases on your favourite streaming platform: ▶ https://ffm.to/latestreleases

Sign up to our newsletter to stay up to date: ▶ ffm.bi...

2025-07-181h 59

Wealth Independence Podcastv1.28 - From Behind the Iron Curtain to Real Estate Freedom (ft. Vessi Kapoulian)Dustin and Adam chat with Vessi Kapoulian, an experienced real estate investor with a unique background in commercial lending. Vessi shares her journey from growing up behind the Iron Curtain in Bulgaria to corporate America, where witnessing multiple restructures and income limitations sparked her transition to real estate investing.Drawing on her CRE lending experience reviewing hundreds of deals and investor financial statements, Vessi reveals what successful real estate investors do differently. She shares her critical due diligence framework for evaluating multifamily deals, including her 100-point checklist for vetting sponsors and properties.Vessi shares why...

2025-07-1838 min

Wealth Independence Podcastv1.27 - Beyond Cash Flow: Determining Return on EquityDustin and Adam explore a critical concept that many real estate investors overlook: analyzing an asset’s return on equity. While most investors focus solely on monthly cash flow, evaluating whether your equity is working as hard as it should be is an important part of portfolio management. Using practical examples, Adam and Dustin break down the difference between cash-on-cash returns and return on equity, showing how appreciation creates opportunities for strategic portfolio rebalancing.The conversation covers when it makes sense to be an opportunistic seller, even with cash-flowing properties, and how to identify when you...

2025-07-1118 min

Wealth Independence Podcastv1.26 - Red, White, and Cash FlowIn this Independence Day special episode, Dustin and Adam break down a three-step framework for making your own personal declaration of financial independence. They explore how to break free from single income sources and stock market-only portfolios by building multiple cash-flowing income streams through real estate syndications and private placements.Discussion includes the power of fractional ownership (via syndications) versus buying individual properties, emphasizing how passive investors can achieve diversification without the management burden, and covers practical deployment strategies for large capital amounts, including why rushing to deploy all your money at once can be a costly...

2025-07-0417 min

Wealth Independence Podcastv1.25 - The Billionaire Investment Playbook (ft. Bob Fraser)Dustin and Adam sit down with Bob Fraser, co-founder and CFO of Aspen Funds. Bob, a Berkeley computer science graduate and former programmer turned successful entrepreneur, shares his journey from losing everything in the dot-com crash to building a private equity firm focused on macro-driven investing strategies.The wide-ranging discussion includes the power of uncorrelated assets like real estate, oil and gas, and private credit in building truly diversified portfolios. Bob emphasizes the importance of manager selection in private markets and why passive investors should become the “CEO of their money” rather than outsourcing investment decisions. The conv...

2025-06-2738 min

Wealth Independence Podcastv1.24 - Unregistered Securities and Other Investor MythsDustin and Adam tackle the common concerns and misconceptions that often keep high-income professionals from exploring private real estate investments.If you've ever wondered why your financial advisor steers you away from private placements or why these “unregistered securities” sound so risky, this episode breaks down the reality behind the (mostly unfounded) fears.The hosts explain why most CFPs aren't trained in alternative investments, explore the structural reasons behind advisor hesitancy, and demystify LLC structures used in real estate syndications. They also address the “unregistered security” concern head-on, explaining how SEC regulations actually work and why thes...

2025-06-2024 min

Wealth Independence Podcastv1.23 - Trust & Long-Term Thinking In Real Estate Private Equity (ft. Ellis Hammond)Dustin and Adam are joined by Ellis Hammond, Vice President of Capital at Aspen Funds, who shares his unique journey from college ministry to managing capital for 850+ accredited investors. Ellis reveals critical insights that most passive investors overlook when evaluating sponsors and deals, including why asking about debt structure is more important than track record alone, plus the key questions that separate trustworthy long-term sponsors from those likely to struggle in market cycles.The conversation covers essential due diligence factors including co-investment requirements, legacy planning, sponsor liquidity, and why thinking generationally rather than transactionally leads t...

2025-06-1339 min

Wealth Independence Podcastv1.22 - The “Infinite Return” Strategy ExplainedDustin and Adam break down the concept of “infinite returns” – a powerful real estate investment strategy that allows you to recover 100% of your initial investment while maintaining full ownership of the asset.They explain how the favorable debt available in real estate enables strategic refinancing and can help you pull out your original capital to deploy into additional properties – creating a snowball effect that accelerates portfolio growth.The discussion includes real-world examples, including a case study of an investor who turned a $4 million down payment into $14 million in cash-out proceeds while actually reducing their monthly debt ser...

2025-06-0618 min

Wealth Independence Podcastv1.21 - New Passive Investment: Oil and Gas with Downside ProtectionDustin and Adam dive into a unique oil and gas investment opportunity that differs significantly from traditional drilling plays. Instead of focusing solely on tax benefits through new drilling, this deal centers on acquiring existing producing wells and strategically reinvesting cash flows from those wells to drill new wells, expanding the overall portfolio.They begin by reinforcing their fundamental investment thesis for oil and gas, highlighting the strong correlation (R=0.993) between GDP growth and oil consumption in developed nations, along with a supply-demand imbalance that drives their confidence in energy investments despite shifting political narratives around green...

2025-05-3027 min

Wealth Independence Podcastv1.20 - Real Deal Deep Dive: 20-Unit PropertyJoin Dustin and Adam for a detailed walkthrough of a potential 20-unit studio apartment acquisition in Northern California.The analysis covers an all-studio property located nine blocks from a major university in Chico, California. Adam and Dustin examine the property's financials, renovation potential, and strategies for increasing income through unit improvements and rent optimization.Key discussion points include flood zone considerations, California rent control implications, the economics of self-management versus third-party management, and creative income strategies like furnished month-to-month rentals. Multiple financing scenarios, including initial purchase terms and future refinancing strategies, provide listeners with a...

2025-05-2333 min

Wealth Independence Podcastv1.19 - When Your Portfolio Becomes Your PaycheckDustin and Adam explore the psychological shift and risk tolerance adjustments required when transitioning from investing with outside income (such as from a job or business) to living solely off investment returns.They contrast the security of adding to investment principal from W-2 or other active income against relying entirely on investment returns, and share insights on why real estate provides stability during stock market volatility through consistent rents and lower liquidity, using the April 2025 stock market drop as a timely example..This episode includes practical approaches to portfolio construction, position sizing, and deployment strategies...

2025-05-1628 min

Wealth Independence Podcastv1.18 - The Quiet Power of Consistent ReturnsThis week, Adam and Dustin explore the transformative power of compounding in investment strategies.Drawing insights from Morgan Housel's 2023 book “Same as Ever,” they discuss why investors achieving consistent, moderate returns typically outperform those chasing spectacular gains over the long term.The conversation provides practical wisdom on how breaking compounding through capital loss can devastate your wealth-building timeline (requiring substantially more time and higher returns just to recover), putting Warren Buffett's famous rule “Don't lose money” into real-world context for passive investors.The episode examines why a disciplined approach focused on consistent cash flow cre...

2025-05-0915 min

Wealth Independence Podcastv1.17 - The Knowledge-Action Balance in Smart InvestingAre you hesitant to venture beyond familiar investments? In this insightful episode, Dustin and Adam explore the critical balance between understanding investments and expanding your portfolio.They challenge the common advice of “don't invest in what you don't understand” by emphasizing that investors should view knowledge gaps as opportunities for growth rather than permanent barriers. Through compelling examples – from their mentor's strategic entry into billboard investing to Adam's step-by-step approach to house flipping – they demonstrate how starting small, leveraging existing expertise, and learning through calculated action creates powerful investment opportunities.Whether you're a seasoned real estate i...

2025-05-0223 min

Wealth Independence Podcastv1.16 - From Tech to Alternative Investments (ft. Daniel Holmlund)This week, we welcome former software engineer Daniel Holmlund, who shares hard-won insights on building a diversified passive income portfolio in today's challenging economic environment.Daniel, a former Intel engineer turned full-time investor, explores practical strategies for balancing liquidity needs with higher-return investments. Our discussion covers unique investment opportunities beyond traditional real estate, from aircraft engine syndications to deals with special advantages (like his Houston property with a 99-year tax exemption).Learn why Daniel avoids generic “value-add” real estate deals in the current market, how to identify red flags when evaluating potential investments, and why cash...

2025-04-2542 min

Wealth Independence Podcastv1.15 - Drilling Into Oil & Gas Investment OpportunitiesDustin and Adam explore oil and gas investments as a strategic alternative to traditional real estate for passive investors.They break down how these investments offer significant tax advantages – including possible 80%+ first-year deductions against active (W-2) income – while generating meaningful cash flow with targeted capital returns within 24-36 months.The conversation covers critical due diligence factors when evaluating operators, why “proven undeveloped” wells offer better risk-adjusted returns than speculative wildcatting, and practical strategies to mitigate investment risks. Adam shares his five years of experience in the space, including lessons learned from both successful and unsuccessful investme...

2025-04-1834 min

Wealth Independence Podcastv1.14 - Is IRR IRRelevant?Dustin and Adam tackle the misuse of the Internal Rate of Return (IRR) in investment decision-making, explaining why relying solely on IRR can lead passive investors astray, especially when comparing different types of real estate investments.The discussion breaks down how IRR calculations can be easily manipulated through uncontrollable assumptions, why timing of cash flows dramatically impacts this metric, and when IRR might actually work against long-term hold strategies.Whether you're evaluating your next passive investment opportunity or refining your due diligence process, this episode provides crucial insights into looking beyond flashy return projections to...

2025-04-1117 min

Wealth Independence Podcastv1.13 - Vision-Aligned Investing (ft. Robby Butler)Join Adam and Dustin in an insightful conversation with Robby Butler, Managing Director of Y Street Capital, where they explore Robby’s transition from philanthropic fundraising to real estate development and syndication.Robby shares valuable wisdom about investor alignment, long-term vision setting, and what sophisticated family offices look for when vetting syndicators. He offers practical insights on evaluating sponsor teams, understanding the importance of business stability behind syndications, and aligning investment timeframes with personal goals. His unique perspective on freedom as “reaching full potential” rather than simply escaping work provides a thought-provoking framework for wealth-building.Whethe...

2025-04-0434 min

Wealth Independence Podcastv1.12 - Legally Paying No Taxes By Following the Government’s PlaybookDustin and Adam challenge the widely accepted notion that “making more money means paying more taxes,” revealing how successful investors strategically follow the tax code as a playbook rather than viewing it as an unavoidable burden.The hosts share practical strategies such as real estate professional status, oil and gas investments, and equipment depreciation, and how a combination of these approaches has allowed Adam to legally pay zero federal income tax for the last five years.They emphasize the importance of partnering with a forward-thinking CPA focused on tax strategy rather than just compliance, why chan...

2025-03-2827 min

Wealth Independence Podcastv1.11 - Weathering Stock Market Storms With Real EstateDustin and Adam tackle recent stock market volatility and why real estate provides superior shelter during financial storms.Government spending cuts may create short-term market turbulence, but rental income historically remains stable through economic uncertainty. And while stock portfolios can lose significant value overnight, income-producing properties continue generating predictable cash flow – historical data shows tenant payment streams persist through market corrections, with rent rarely decreasing even during recessions.In this episode, passive investors concerned about market instability will find practical strategies for wealth preservation and consistent returns through strategic real estate investments that stand firm wh...

2025-03-2126 min

Wealth Independence Podcastv1.10 - The Retirement Crisis: Cash Flow vs. Equity DrawdownIn this eye-opening episode, Dustin and Adam tackle the fundamental flaws in traditional retirement planning that leave even wealthy retirees fearing they'll outlive their savings.They analyze recent research showing that half of retirees worry about outliving their nest eggs, and explain why the conventional "save-and-drawdown" model creates psychological stress regardless of portfolio size. They explain why the better approach is to accumulate cash-flowing assets that provide perpetual income without depleting principal.Whether you're just starting your investment journey or approaching retirement, this episode offers an alternative framework for financial independence that focuses on sustainable...

2025-03-1421 min

Wealth Independence Podcastv1.9 - No More Income Tax?This week, Dustin and Adam explore the potential implications of President Trump's proposal to eliminate the federal income tax in favor of tariffs.Beyond the political conversation, the discussion includes how such a fundamental tax code change might impact real estate investors and passive income strategies. Would the elimination of income tax diminish real estate's tax advantages or create new opportunities?Whether this proposal materializes or not, this episode offers valuable insights into the interconnected nature of tax policy and investment strategy, helping you understand the true foundations of wealth creation beyond tax considerations.

2025-03-0720 min

Wealth Independence Podcastv1.8 - Strategic Education & Networking for Accelerated Wealth BuildingIn this value-packed episode, Dustin and Adam dive into a topic crucial for passive real estate investors: strategic education and building the right network.They explore the balance between continuous learning and taking action, sharing personal insights on avoiding "analysis paralysis" through education. They also discuss how joining investment groups and masterminds has transformed their real estate businesses, providing access to high-level connections and problem-solving resources.Whether you're just starting your investment journey or looking to scale your portfolio, this episode offers practical guidance on investing in yourself, getting into the right rooms, and leveraging...

2025-02-2824 min

Wealth Independence Podcastv1.7 - Pivot or Stay the Course? Protecting Capital in Changing MarketsIn this practical episode, Dustin and Adam explore the dichotomy of knowing when to pivot or stay the course with your investments, along with the critical importance of having multiple exit strategies in any investment – and when staying the course might be the better option.Through personal experiences in both tech stocks and real estate, they demonstrate how proper exit planning can protect capital even when market conditions change dramatically. Whether you're investing in real estate or stocks, learn why entering any investment without an exit strategy can leave you vulnerable to market shifts.Get ac...

2025-02-2124 min

Wealth Independence Podcastv1.6 - From Engineer to Real Estate Developer: A Freedom Journey (ft. Aram Sarkissian)Join Dustin and Adam as they sit down with Aram Sarkissian, a former electrical engineer turned real estate developer, who shares invaluable insights on navigating the alternative investment environment.Aram reveals how his engineering background and business acumen helped him identify and capitalize on real estate opportunities, from Louisiana townhomes to modular construction in Austin, TX.He discusses why every pro forma is inherently imperfect and why macro trends matter more than complex spreadsheets, and shares practical strategies for evaluating investment opportunities, the importance of strategic pivoting in changing markets, and why true freedom in...

2025-02-1442 min

Wealth Independence Podcastv1.5 - Inside the Analysis of a $20,000,000 Apartment DealIn this practical walkthrough, Dustin and Adam pull back the curtain on their recent analysis and offer on a $20 million apartment deal in Las Vegas.Passive investors will learn how experienced operators evaluate multifamily opportunities, from initial spreadsheet analysis to final offer strategy. Dustin and Adam dive deep into their actual underwriting process, sharing insights on how they assess value-add potential, calculate returns, and make strategic decisions about purchase price.Whether you're evaluating sponsors (and their processes) or looking to understand what drives real estate investment returns, this episode provides passive investors with valuable insights...

2025-02-0729 min

Wealth Independence Podcastv1.4 - What is Freedom?In this thought-provoking episode, Dustin and Adam explore the fundamental relationship between freedom and wealth building.They discuss how regulatory constraints can limit investment opportunities and wealth creation, using real-world examples from the cannabis and crypto industries. They also share insights on how wealth can be used to create optionality in all aspects of life, including healthcare, geographic mobility, and asset protection.Learn why having multiple options - from second passports to alternative investment structures - isn't just about protecting wealth, but about creating the freedom to maximize opportunities.This episode offers a...

2025-01-3124 min

Wealth Independence Podcastv1.3 - 2025 Multifamily Forecast: Rates, Rents, and ReturnsDustin and Adam analyze a comprehensive market forecast from a $3 billion multifamily investment group, breaking down ten key predictions for 2025 and sharing their own takes along the way.The predictions cover crucial trends affecting passive real estate investors, including a return to positive rent growth in many markets, the evolving landscape of real estate financing, and the impact of construction costs and insurance premiums on investment returns.The discussion also includes insights on market-specific opportunities, debt fund strategies, and the growing affordability gap that continues to drive rental demand.Whether you're currently invested...

2025-01-2425 min

Wealth Independence Podcastv1.2 - Finding Overlooked Real Estate MarketsIn this tactical episode, Dustin and Adam dive deep into multifamily market selection strategies that all passive investors should know.Drawing from their experience investing across multiple states, they analyze why certain markets present better opportunities for yield and steady returns. The discussion includes the unique advantages of Las Vegas's limited new construction pipeline, Reno's continued jobs growth, and the sustained population growth in select Southeast markets.Learn the practical criteria Dustin and Adam use for evaluating markets, understanding the impact of institutional capital on deals and investor returns, and identifying opportunities in secondary markets...

2025-01-1721 min

Wealth Independence Podcastv1.1 - A Journey To True Freedom ft. Saket JainJoin us for a profound conversation with former Airbnb executive Saket Jain as he shares his journey from the constraints of corporate life to discovering true freedom through alternative investments.Saket shares how a 2017 layoff served as a wake-up call that transformed his definition of security and independence, leading him to methodically build personal freedom through investing in various asset classes, including real estate and venture capital.Discover how he balances analytical thinking with practical execution, how he avoids common investment pitfalls, and his approach to build lasting wealth while prioritizing personal freedom. Saket offers...

2025-01-1036 min

New Culture ForumSam Bidwell: How Elon Musk Sent The Grooming Gangs Scandal Global"Is Britain's Anti-White State Illegitimate?"

How Elon Musk sent the grooming gangs scandal global.

On today's #NCFDeprogrammed, hosts Harrison Pitt & Connor Tomlinson discuss the grooming gang scandal with journalist Sam Bidwell of the Adam Smith Institute.

2025-01-0951 min

Wealth Independence Podcastv1.0 - Goal Setting for Freedom-First InvestorsIn release v1.0, Dustin and Adam break down their market outlook for 2025 and share proven goal-setting frameworks that passive real estate investors can implement immediately.Learn why stability in lending markets may create more attractive buying opportunities this year, especially in multifamily properties. The hosts discuss why 2025-2026 could present a prime window for acquisitions before the projected housing supply crunch hits.Beyond market insights, discover practical goal-setting systems, frameworks, and techniques that successful investors use.Whether you're building a real estate portfolio or diversifying into passive investments, this episode provides actionable strategies...

2025-01-0327 min

Thinking Class#059 - Sam Bidwell - How Britain's Politicians Broke The Social ContractSam Bidwell is the Director of the Next Generation Centre at the Adam Smith Institute and has worked as a Parliamentary Researcher, and as a Press and Research Consultant for the Commonwealth Enterprise and Investment Council. His writing on foreign affairs has been published internationally, including in Australia, Pakistan, and Bangladesh, and he was a contributor to the 2023 Commonwealth Security Review. Sam is a graduate of the University of Cambridge where he studied Law at Sidney Sussex College, specialising in public law, jurisprudence, and legal history.In this episode, Sam and I think out loud about whether...

2025-01-031h 04

Kapture CastUniteAfterlife_Winter_Set3TrackList:

1 Anyma,Massano,Nathan Nicholson Angel in the Dark 4A 128,00 03:19 2024-12-29

2 070 Shake Black Dress (Anyma Remix) 6A 127,00 04:37 2023-10-29

3 Boris Brejcha Space X - Edit 6A 125,00 03:37 2024-12-27

4 Laura van Dam,P.O.U,Jamie Lee Harrison Rule the World 10A 124,00 03:29 2024-12-29

5 Laura van Dam Insomnia 10A 128,00 03:17 2024-12-29

6 Joris Voorn,Jan Blomqvist Flora 11A 124,00 03:22 2024-12-27

7 Henri Bergmann,Wennink Here's The Fear 11A 123,00 06:12 2024-12-27

8 ARTY,Stadiumx,Jason Walker,Scorz Thousand Lives - Scorz Remix 8A 125,00 03:08 2024-12-29

9 Empire Of The Sun,Adam Sellouk We Are The People - Adam Sellouk Remix 9A 123,00 04:17 2024-12-29

10 Blue Boy...

2024-12-301h 38

Wealth Independence Podcastv0.3 - Cash Flow vs EquityIn release v0.3, Dustin and Adam dive deep into a fundamental choice facing real estate investors: prioritizing cash flow or equity appreciation.Through real-world examples, including Adam's experience maintaining financial stability after losing his tech job, they explore why successful investors prioritize cash flow while still capturing appreciation. Learn how different investment strategies - from private debt funds to development projects - balance these two elements, and why many seasoned investors focus first on sustainable cash flow.Adam and Dustin break down practical strategies for achieving "infinite returns" through real estate, demonstrating how passive investors...

2024-12-2735 min

Wealth Independence Podcastv0.2 - Clues in the News: Geopolitics, Tariffs, and Real Estate ImpactIn this "Clues in the News" episode, Dustin and Adam break down how global events and policy changes affect real estate investors' bottom line. From analyzing the real impact of proposed tariffs on construction costs to examining how demographic trends outweigh short-term market fears, they look to cut through the noise to focus on what actually moves the needle for passive real estate investors. They explore why supply-demand fundamentals matter more than international headlines, discuss the potential housing supply crunch expected in 2026-2028, and examine how policy shifts could affect rent growth and labor costs.

2024-12-2028 min

Friday VibesFriday Vibes (Dec 13th 2024)Set recorded from Friday Vibes Liveset (December 13th, 2024)

Featuring new tunes in Trance, Progressive, Melodic Techno and More

Tracklist

• Michael Anthony - On The Run [Consequence Of Society Recordings]

• Tencode - Heal Me (Extended Mix) []

• David Granha - Childhood []

• Panama, Cristoph, Tigerblind - Control (Extended Mix) []

• David Granha - Childhood []

• AN3M - Burned [Legs Akimbo Records]

• Vintage Culture, Izzy Bizu, Arodes - If I Live Forever (Arodes Remix) []

• Hausman - Scared of You (Extended Mix) []

• San Mateo Drive - You (Extended Mix) [As You Are]

• Tim Walche - I'll Be Your Light (Extended Mix) [This Never Happened]

• DIM3NSION Ft. Sinead McCarthy...

2024-12-143h 30

Vicious SessionsFriday Vibes (Dec 13th 2024)Set recorded from Friday Vibes Liveset (December 13th, 2024)

Featuring new tunes in Trance, Progressive, Melodic Techno and More

**Tracklist**

• Michael Anthony - On The Run [Consequence Of Society Recordings]

• Tencode - Heal Me (Extended Mix) []

• David Granha - Childhood []

• Panama, Cristoph, Tigerblind - Control (Extended Mix) []

• David Granha - Childhood []

• AN3M - Burned [Legs Akimbo Records]

• Vintage Culture, Izzy Bizu, Arodes - If I Live Forever (Arodes Remix) []

• Hausman - Scared of You (Extended Mix) []

• San Mateo Drive - You (Extended Mix) [As You Are]

• Tim Walche...

2024-12-143h 30

Wealth Independence Podcastv0.1 - Welcome to Wealth IndependenceIn this inaugural episode, hosts Dustin Bailey and Adam Penn introduce the Wealth Independence podcast and share their backgrounds transitioning from tech careers to alternative investments.They discuss how their experiences in software engineering and the corporate world led them to pursue passive income through real estate and private markets.They explain their "freedom first" investment philosophy and why they believe traditional financial advice often misses important opportunities in alternative investments.They also outline their vision for future episodes, including guest interviews, deal reviews, and market analysis.Watch...

2024-12-1337 min

The ScepticSam Bidwell: The Tories’ Immigration DisasterWelcome to episode 22 of the Sceptic! On the show this week, host Laurie Wastell speaks to the following guests:

Sam Bidwell, writer and commentator and the Director of the Next Generation Centre at the Adam Smith Institute, on the social and economic disaster of the latest immigration numbers – and how best to reverse it.

Fleur Meston, co-host of the Bombshells podcast and campaigner against assisted suicide, on the passage of the Terminally Ill Adults (End of Life) Bill at its second reading.

And for our premium subscribers, Laurie speaks to Madeline Grant, parliamentary sk...

2024-12-061h 04

British Thought LeadersYoung People Are United on Core Issues and Will Take Britain Forward: Sam BidwellNTD’s Lee Hall sits down with Sam Bidwell, director of the Next Generation Centre at the Adam Smith Institute think tank. Bidwell says the idea that Britain’s youth are all woke and Left-leaning is a myth, that the broken social contract is a radicalizing force, and that young people of different political beliefs are united on many key policy issues.

2024-11-0735 min

Croydon Constitutionalists PodcastEpisode 94 - Sam Bidwell: Selling Economic LibertyWe are joined by Sam Bidwell, the Director of the Next Generation Centre at the Adam Smith Institute as we discuss the challenges of selling economic liberty and free markets to younger people.Get in touch:Twitter: @CroydonConst Email: contact@croydonconstitutionalists.ukFacebook: facebook/CroydonConstitutionalistshttp://croydonconstitutionalists.uk/

2024-09-0136 min

Friday VibesFriday Vibes (June 14th 2024)Set recorded from Friday Vibes Liveset (June 14th 2024)

Featuring new tunes in Trance, Progressive, Melodic Techno and More

Tracklist

• Leville, Etonika - Come with Me (Original Mix) [Axiom Music]

• Zack Martino & Higher Lane - Pieces (Extended Mix) [Enhanced]

• Woo York & Mark Tarmonea - Feeling [Watergate Records]

• Yero & Christian Burns - Wonderful Life (Kryder's Extended Guilty Pleasure Mix) [Krysteria Records]

• Cat Dealers & HRRTZ - Be Alright (Extended Mix) [Armada]

• Rafael Osmo - Comfort (Extended) [Vandit Alternative]

• Cary Crank & Mary Lean - Fight My Fears (Whoriskey Remix) [Sunexplosion]

• Paul Thomnas - Summersault (Extended Mix) [UV]

• Bluefield - Circle of Protection (Extended Mix) [Addictive Sounds]

...

2024-06-143h 29

Vicious SessionsFriday Vibes (June 14th 2024)Set recorded from Friday Vibes Liveset (**June 14th 2024**)

Featuring new tunes in Trance, Progressive, Melodic Techno and More

**Tracklist**

• Leville, Etonika - Come with Me (Original Mix) [Axiom Music]

• Zack Martino & Higher Lane - Pieces (Extended Mix) [Enhanced]

• Woo York & Mark Tarmonea - Feeling [Watergate Records]

• Yero & Christian Burns - Wonderful Life (Kryder's Extended Guilty Pleasure Mix) [Krysteria Records]

• Cat Dealers & HRRTZ - Be Alright (Extended Mix) [Armada]

• Rafael Osmo - Comfort (Extended) [Vandit Alternative]

• Cary Crank & Mary Lean - Fight My Fears (Whoriskey Remix) [Sunexplosion]

• Paul Thomnas - Summer...

2024-06-143h 29

Honestly Unbalanced#103 Ben Bidwell - Prioritising emotional intimacy in relationships,Ben Bidwell is a Human Potential Coach and Breathwork Practitioner, who helps people create better relationships and live a more fulfilling and purposeful existence.He has trained and qualified across multiple disciplines including NLP, Logotherapthy, Life Coaching, Meditation, Breathwork and Human Potential.(@benbidwell_) You'll learn about ... Societal expectations of of masculinity, tools that men can use to reconnect with their true selves, finding the gap between who we are and who we want to be, prioritising emotional intimacy in relationships, how to live a multifaceted life and moving away from using nudity as a hook...

2024-03-0352 min

Passive Real Estate Investing with MavericksOil, Gas & Short-Term Rentals with Adam PennTo access a FREE collection of resources, go to www.TheMaverickVault.com Join us for an insightful episode featuring Adam Penn, where we explore the dynamic intersection between the oil and gas industry and the world of short-term rentals. His expertise uncovers eye-opening insights you shouldn’t miss. So, tune in and be prepared to see these industries in a new light. Key Takeaways From This Episode The intricacies of the oil and gas industry Risks and rewards dynamics of oil investments Opportunities and challenges within the short-term rental m...

2023-12-1123 min

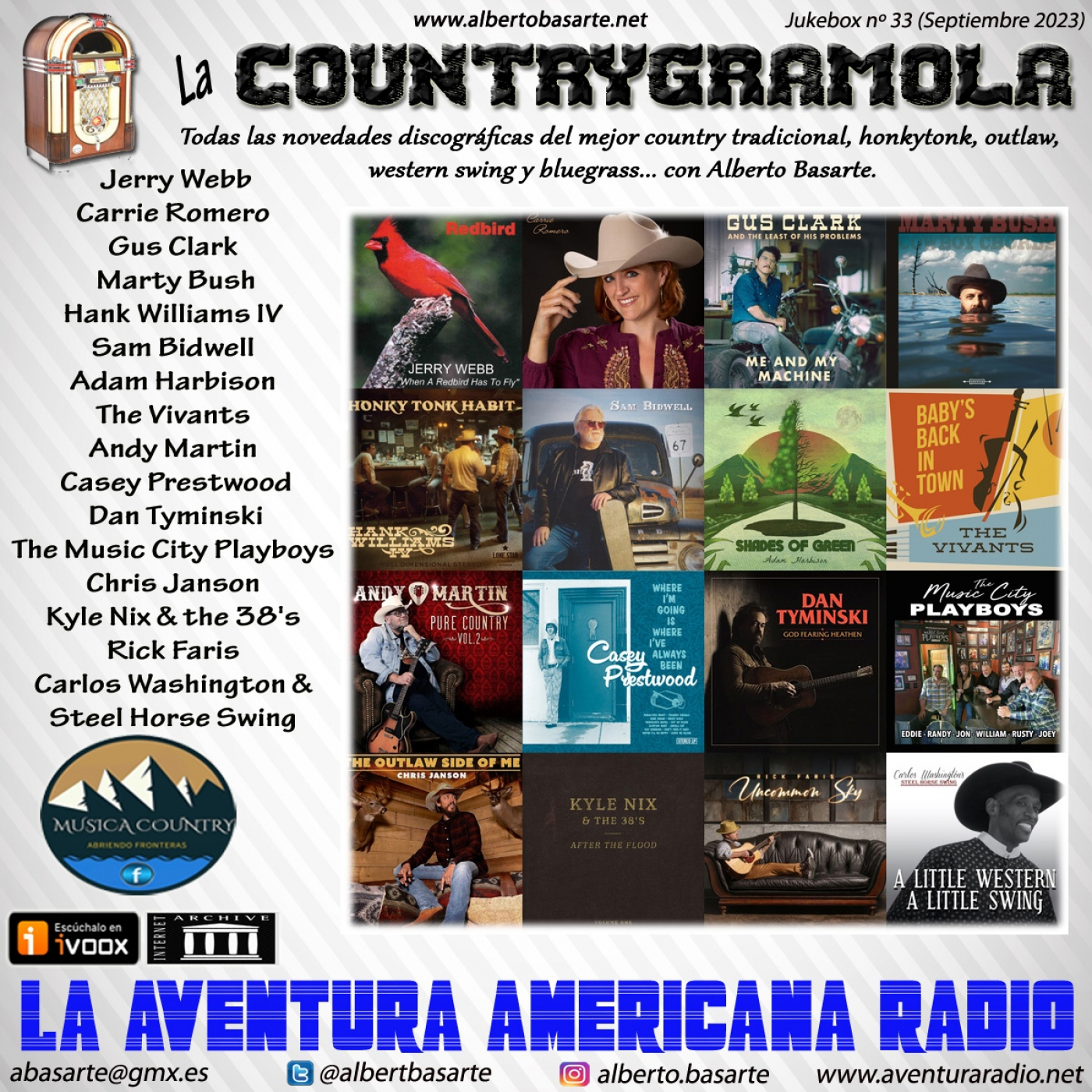

Podcast de Blue Moon Kentucky33- La Countrygramola (Septiembre 2023)Muy buenas amigos, damos ya la bienvenida al mes de septiembre con otra entrega de la Countrygramola, siempre con las novedades que giran en torno al country tradicional.

Esperando que disfrutéis con esta selección musical, os dejo los enlaces al podcast y poder escucharlo cuando mejor os venga.

Muchas gracias a todos...

En esta trigésima tercera countrygramola, podremos disfrutar con los siguientes invitados:

1- Jerry Webb - Redbird (2023)

Don't Wanna Be Sorry / Make a Memory

2- Carrie Romero - I Walk On Faith (2023)

I Walk On Faith

3- Gus Clark - Me & My Machine (2023)

Me & My Machine

4- M...

2023-09-041h 11

Record Scratch with KaraProcessing Grief with Barri Leiner GrantChief Grief Officer ™ of The Memory Circle, Barri Leiner Grant shares with Kara her journey of living with the loss of her mother, Ellen. Barri left her career as a publicity and editorial stylist to help people cope with grief full-time. Grant has studied with the leading names in grief certification and education trainings with Claire Bidwell Smith, David Kessler, and Dora Carpenter. She combines her writing background and yoga/meditation training to craft a one-of-its-kind way forward in learning to live with loss and love your life. Open your heart and notebook — and sharpen your...

2023-06-1534 min

Record Scratch with KaraProcessing Grief with Barri Leiner GrantChief Grief Officer ™ of The Memory Circle, Barri Leiner Grant shares with Kara her journey of living with the loss of her mother, Ellen. Barri left her career as a publicity and editorial stylist to help people cope with grief full-time. Grant has studied with the leading names in grief certification and education trainings with Claire Bidwell Smith, David Kessler, and Dora Carpenter. She combines her writing background and yoga/meditation training to craft a one-of-its-kind way forward in learning to live with loss and love your life. Open your heart and notebook — and sharpen your...

2023-06-1534 min

Mindset Into TransformationEP 13 - Building Network Of Investors From Ground Up // Adam PennAdam Penn, who studied software engineering work in this field for 5 years before transitioning into real estate. He is now a managing partner of Bidwell Capital. He is both a real estate syndicator and investor. In this episode we talk about Adam’s first syndications, his mindset shift, how to ensure a deal is profitable and the do’s and don’t he has learnt in this journey. Reach out to Adam Penn: Website: https://adampenn.com/LinkedIn: https://www.linkedin.com/in/adamjpennBooks recommended: Never split the difference - Chris Voss

2022-11-2530 min

Another Woodshop PodcastEpisode 91: Knuckle Talk with Morgan Hop!Dan is working on more bowties! And a lot of them! He’s starting to work on the white oak door, as well as the door jam, and working on a bunch of cutting boards.Pete had a crazy week on Etsy and had to get a lot of orders out. Which is making him think about scaling his business to be able to increase the number of options.Morgan is building a workbench for his infinity CNC, he wants to run his new Onefinity sideways and upside down if...

2021-12-051h 59

Good Seats Still AvailableThe National Girls Baseball League - With Adam Chu Most baseball fans are familiar with the World War II-era All-American Girls Professional Baseball League from the hit 1992 movie "A League of Their Own" - but most do not know that there was another pro women's circuit that played only in the greater Chicago area at around the same time. Documentary filmmaker Adam Chu ("Their Turn At Bat") joins the pod to discuss the fascinating story of the National Girls Baseball League (1944-54) - formed out of the city's amateur softball talent-loaded Metropolitan League in 1944 - from which the AAGPBL had recruited many of its initial players a year earlier. Co...

2021-06-211h 36

Good Seats Still AvailableThe National Girls Baseball League - With Adam Chu Most baseball fans are familiar with the World War II-era All-American Girls Professional Baseball League from the hit 1992 movie "A League of Their Own" - but most do not know that there was another pro women's circuit that played only in the greater Chicago area at around the same time. Documentary filmmaker Adam Chu ("Their Turn At Bat") joins the pod to discuss the fascinating story of the National Girls Baseball League (1944-54) - formed out of the city's amateur softball talent-loaded Metropolitan League in 1944 - from which the AAGPBL had recruited many of its initial players a year earlier. Co...

2021-06-211h 36

Another Woodshop PodcastEpisode 46: Printed Mahogany Gooch WoodEpisode 46 - Dan is working on the teak floor, and he is working on a coffee bar as well as the giant ridiculous bookcase. Pete had a rough week. Worked in NYC a few days so it threw off his flow, he finally got his new bandsaw and 3D printers, and upgraded a few other small tools around the shop. He also got a storage unit to clean up the shop of some things that are not being used in this shop. Mike’s had a rough week too. He’s been working on some CNC boxes, quoting a bunc...

2021-01-251h 30

Cosmic Gate: WYM RadioCosmic Gate - WYM Radio 330Follow us here:

Spotify: https://spoti.fi/2cAY638

homepage: http://www.cosmic-gate.de

Facebook: https://www.facebook.com/cosmicgate/

Instagram: https://www.instagram.com/realcosmicgate/

===============================

Episode 326:

01. BT & Matt Fax - 1AM In Paris (Original Mix) [Black Hole Recordings]

02. The Madison - Come Back (Extended Mix) [AVA Recordings]

03. Cosmic Gate - Flatline (Kyau & Albert Radio Edit) [Wake Your Mind]

04. Orjan Nilsen - Instinct (Extended Mix) [Armind]

05. Capa & Nathan Ball - Necessary Evil (Extended Mix) [ZeroThree Recordings]

06. Vasily Goodkov...

2020-08-0300 min

Cosmic Gate: WYM RadioCosmic Gate - WYM Radio 330Follow us here:

Spotify: https://spoti.fi/2cAY638

homepage: http://www.cosmic-gate.de

Facebook: https://www.facebook.com/cosmicgate/

Instagram: https://www.instagram.com/realcosmicgate/

===============================

Episode 326:

01. BT & Matt Fax - 1AM In Paris (Original Mix) [Black Hole Recordings]

02. The Madison - Come Back (Extended Mix) [AVA Recordings]

03. Cosmic Gate - Flatline (Kyau & Albert Radio Edit) [Wake Your Mind]

04. Orjan Nilsen - Instinct (Extended Mix) [Armind]

05. Capa & Nathan Ball - Necessary Evil (Extended Mix) [ZeroThree Recordings]

06. Vasily Goodkov...

2020-08-0300 min

Cosmic Gate: WYM RadioCosmic Gate - WYM Radio 329Follow us here:

Spotify: https://spoti.fi/2cAY638

homepage: http://www.cosmic-gate.de

Facebook: https://www.facebook.com/cosmicgate/

Instagram: https://www.instagram.com/realcosmicgate/

===============================

Episode 326:

01. BT & Matt Fax - 1AM In Paris (Original Mix) [Black Hole Recordings]

02. The Madison - Come Back (Extended Mix) [AVA Recordings]

03. Cosmic Gate - Flatline (Kyau & Albert Radio Edit) [Wake Your Mind]

04. Orjan Nilsen - Instinct (Extended Mix) [Armind]

05. Capa & Nathan Ball - Necessary Evil (Extended Mix) [ZeroThree Recordings]

06. Vasily Goodkov...

2020-08-0359 min

Cosmic Gate: WYM RadioCosmic Gate - WYM Radio 329Follow us here:

Spotify: https://spoti.fi/2cAY638

homepage: http://www.cosmic-gate.de

Facebook: https://www.facebook.com/cosmicgate/

Instagram: https://www.instagram.com/realcosmicgate/

===============================

Episode 326:

01. BT & Matt Fax - 1AM In Paris (Original Mix) [Black Hole Recordings]

02. The Madison - Come Back (Extended Mix) [AVA Recordings]

03. Cosmic Gate - Flatline (Kyau & Albert Radio Edit) [Wake Your Mind]

04. Orjan Nilsen - Instinct (Extended Mix) [Armind]

05. Capa & Nathan Ball - Necessary Evil (Extended Mix) [ZeroThree Recordings]

06. Vasily Goodkov...

2020-08-0359 min