Shows

Buck$ Outside The Box PodcastStill buying into these outdated retirement rules?Join the Co-Investing Club and start building passive income through real estate: https://sparkrental.com/co-investing-club

Stop thinking about retirement, start thinking about financial independence. In this episode, Brian and Deni tear apart outdated retirement advice that financial planners have been repeating for decades.

We debunk:

→ The 60/40 portfolio allocation (and why bonds don't work like they used to)

→ The dangerous "Rule of 100" for asset allocation

→ The 4% safe withdrawal rule, even its creator says it's outdated

→ The 80% spending rule that assumes you'll spend less in retirement

→ Why Social Security won't cover 40% of your expenses anymore

→ The myth that you should sell all your rea...

2026-02-0316 min

Smart Money ConversationsEpisode 21 – Season One Finale: Bill Bengen on A Richer Retirement and the Future of Safe Withdrawal RatesTo close out Season One of SMC, Brett and Chris sit down with a true legend in retirement planning — Bill Bengen, the creator of the original 4% rule and author of the new book A Richer Retirement. Bill’s research reshaped how advisors and retirees think about generating income from portfolios. But retirement planning has evolved, and so has his thinking. In this conversation, Brett and Bill go beyond the headline rule of thumb and explore what actually creates a secure, flexible, and meaningful retirement today. They discuss: How Bill’s latest research updates t...

2026-01-261h 14

Two Quants and a Financial PlannerThe Retirement Rule No One Gets Right | Practical Lessons from Bill BengenIn this episode, we discuss our biggest lessons from our interview with Bill Bengen, the creator of the 4 percent rule, and are joined by special guest Ben Tuscai.We explore how one of the most widely cited ideas in retirement planning was developed, how it is often misunderstood, and how it should actually be used in real-world financial planning. The conversation bridges academic research and practical application, digging into safe withdrawal rates, sequence of returns risk, inflation, portfolio construction, and what retirement planning really looks like across decades of uncertainty.• How and why Bill Bengen or...

2026-01-041h 02

Retire With Style[Best of 2025 Repost] Episode 195: The 4% Rule and Beyond: Retirement Strategies with Bill BengenAs the year comes to a close, we’re taking a moment to revisit a few of our favorite Retire With Style episodes from 2025. This week, we’re replaying one episode that stood out in particular as Wade’s favorite conversation of the year, based on both the discussion and the questions it sparked from listeners.

We’ll be back with brand new episodes after the holiday break. Thanks for listening this year, and we look forward to continuing the conversation in 2026.

Repost from Episode 195

In this episode of Retire with Style, Wade Pfau and...

2025-12-2339 min

ETFatlas: Mastering the Craft of InvestingIs the 4% Rule Dead? Bill Bengen Updates His Legendary StrategyIn this episode, we sit down with William Bengen, the legendary creator of the “4% Rule” that revolutionized retirement planning worldwide. Bill shares his unique journey from an MIT aerospace engineer to a financial planner, explaining how he used historical data to solve the “how much can I spend” dilemma. He dives deep into the critical concepts of “Sequence of Returns Risk” and explains why inflation is actually a more dangerous enemy to retirees than stock market crashes.The conversation explores his latest research, which updates the safe withdrawal rate to 4.7% (or higher) by utilizing what he calls the “Four Free Lunc...

2025-12-1240 min

Talking Real Money - Investing TalkAlways Question SeasonThis Friday Q&A episode tackles a wide range of listener questions: whether someone with full pension income still needs bonds, how to fix a cluttered 403(b) invested through Corebridge, what to make of Bill Bengen’s new comments about higher withdrawal rates, how inherited IRAs are taxed over the 10-year rule, and a quick explanation of the difference between “securities” and “equities.” Along the way, Don delivers a vintage KOA radio tag, explains why simplicity beats complexity in retirement plans, and walks through why 8% withdrawal fantasies collapse under real-world math.

0:04 Friday Q&A intro and listener call-ins

2025-12-0524 min

Excess ReturnsHe Invented the 4% Rule | Bill Bengen on Why He Now Thinks 5% WorksFollow us on Substackhttps://excessreturnspod.substack.comBill Bengen, the creator of the 4% rule, joins us to revisit one of the most important ideas in financial planning and retirement research. In this conversation, he explains the origins of the 4% rule, how his thinking has evolved over 30 years, and why he now believes retirees can safely withdraw closer to 4.7% — or even more — under certain conditions. We explore the data behind his findings, how to think about inflation, valuations, longevity, and sequence of returns risk, and the philosophy of living well in retirement.

2025-11-1241 min

The Power Of Zero ShowSuze Orman Says 3%, Bill Bengen Says 4.7%--Who's Right on Sustainable Withdrawal Rates?David McKnight compares the approach of some of the biggest names in personal finance: Suze Orman, and William "Bill" Bengen (the man who invented the 4% Rule). In a recent interview covered by MSN, Suze Orman declared flat out that the 4% Rule is dead since markets are volatile, interest rates fluctuate, and people are living longer. David shares the "origin story" of how the 4% Rule came to be – and its creator Bill Bengen. Interviewed by MSN, Bengen updated his research and concluded that, based on current data, a 4.7% withdrawal rate is now sustainable. ...

2025-10-2909 min

The Financial Samurai PodcastPermission To Live It Up In Retirement With Bill Bengen, Father Of The 4% Rule Going To 5%Bill Bengen, the father of the 4% Rule, is back with a new book titled A Richer Retirement. In it, he raises his SAFEMAX—or safe withdrawal rate—from 4% to 5%. This change has major implications: retirees can confidently spend more and enjoy life to the fullest, while those pursuing FIRE or traditional retirement may not need to save as aggressively or work as long to achieve financial freedom. See related Financial Samurai post: Persmission To Live It Up In Retirement Free Financial Analysis Offer From Empower If you have over $100,000 in investable assets—whether in sav...

2025-10-2224 min

The Financial Samurai PodcastPermission To Live It Up In Retirement With Bill Bengen, Father Of The 4% Rule Going To 5%Bill Bengen, the father of the 4% Rule, is back with a new book titled A Richer Retirement. In it, he raises his SAFEMAX—or safe withdrawal rate—from 4% to 5%. This change has major implications: retirees can confidently spend more and enjoy life to the fullest, while those pursuing FIRE or traditional retirement may not need to save as aggressively or work as long to achieve financial freedom. See related Financial Samurai post: Persmission To Live It Up In Retirement Free Financial Analysis Offer From Empower If you have over $100,000 in investable assets—whether in sav...

2025-10-2224 min

Retire With StyleEpisode 200 CelebrationWelcome to a milestone episode of Retire With Style! In this celebratory 200th installment, Wade and Alex take a break from the usual deep dives into retirement planning to reflect on their journey so far, from a hesitant start to a full-blown podcast and lifestyle brand. They revisit some of the most popular episodes, listener feedback (the good, the bad, and the hilarious), and the evolving purpose behind the podcast. They also share future plans, new content arcs, and maybe even a little pickleball-inspired merch talk. Whether you’re a longtime listener or brand new to the show, this ep...

2025-10-141h 02

Talking WealthThe One Thing Everyone Gets Wrong About the 4% Rule | Ben with Benefits - Bill BengenOn this episode of Ben with Benefits, Ben Carlson speaks with Bill Bengen, creator of the famed “4% rule,” to revisit the groundbreaking research he published over 30 years ago and answer the question on every retired client’s mind: Does the 4% rule still hold up today? They share insights about misconceptions about the 4% rule, what a “safe” withdrawal rate actually means, why so many retirees struggle to shift from saving to enjoying their wealth, and what advisors can do to guide clients through this process with confidence.

This episode is sponsored by Betterment Advisor Solutions. Grow your RIA, your way by visiting...

2025-10-0324 min

Boomer Banter, Real Talk about Aging WellSustainable Withdrawal Strategies to Make Your Money Last in RetirementAre you worried about whether your retirement money will last? You’re not alone! In today’s episode, we’re diving into the nitty-gritty of calculating a withdrawal rate from your retirement account. We’ll unpack the famous 4% rule and see if it’s still the best way to plan for our golden years, or if we need to rethink our strategies. Joining us is the insightful Bill Bengen, who’s got some fresh ideas on how to stretch that nest egg while keeping your peace of mind intact. This conversation is all about empowerment. Bill explain...

2025-09-3029 min

Retire With StyleEpisode 197: RWS Live! With Bill Bengen: Part 2In this conversation, Wade Pfau, Alex Murguia and Bill Bengen discuss various aspects of retirement planning, focusing on risk management, asset allocation, and the implications of market conditions on withdrawal rates. Bengen shares insights on adjusting the traditional 4% rule based on current market valuations and inflation, emphasizing the importance of a diversified portfolio and the role of annuities. The discussion also covers the significance of sequence of returns risk and the potential benefits of rising equity glide paths in retirement strategies.

Takeaways

A 65% stock allocation is recommended for retirees.

Risk management involves adjusting asset a...

2025-09-2331 min

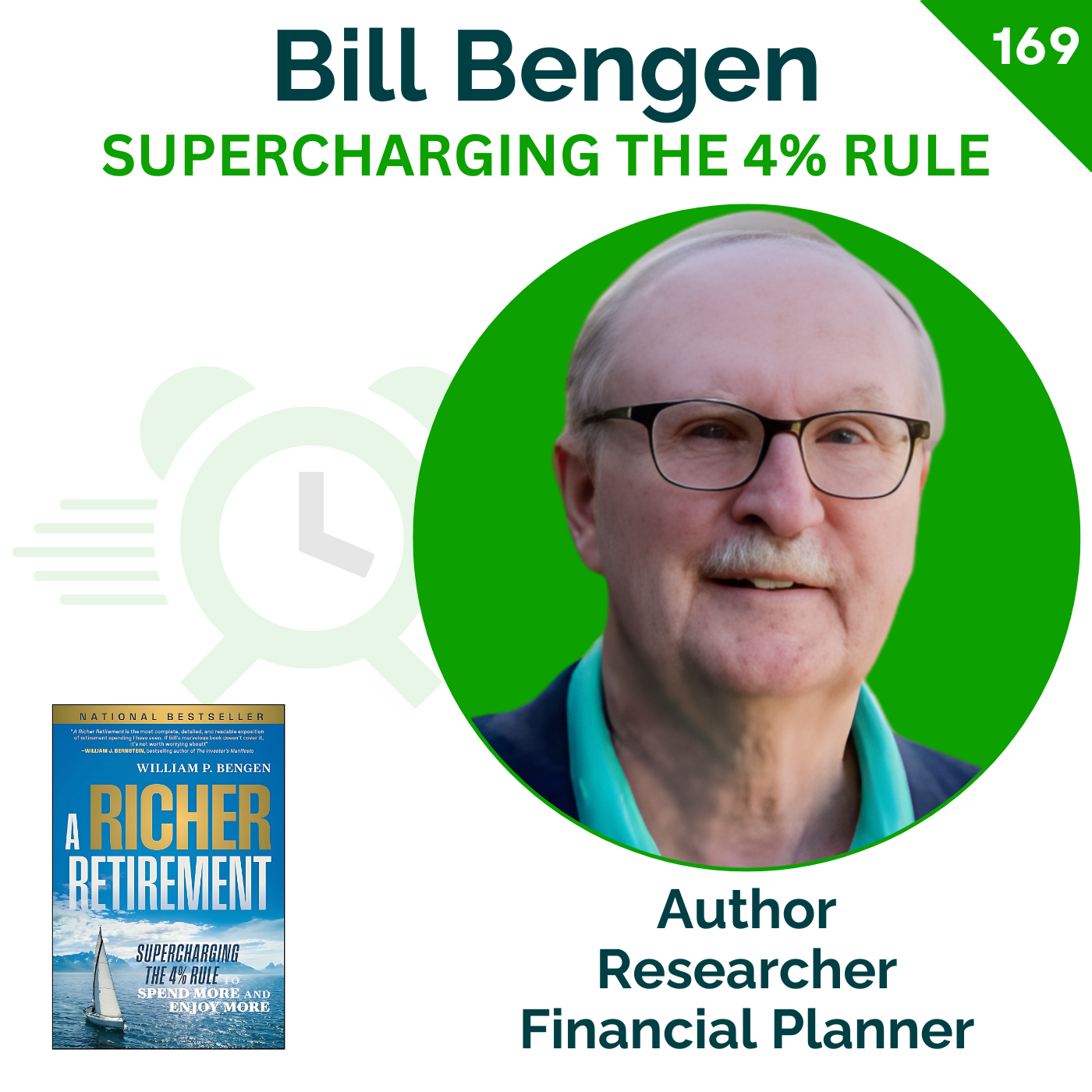

Catching Up to FIA Richer Retirement: The 4.7% Rule | Bill Bengen | 169We are welcoming back the man behind the most debated number in retirement, Bill Bengen- this time with a special appearance from his lovely wife, Barbara. We take a brief detour to hear their love story and how they met, before getting into his new book, 'A Richer Retirement: Supercharging the 4% Rule to Spend More and Enjoy More'. He joins us in this episode to: Break down the primary goals of the book Help you understand what's required to create and manage a successful personal retirement withdrawal plan Step us through all the tools required to make your m...

2025-09-211h 02

Ready For RetirementYou Could Spend WAY More Than the 4% Rule Suggests (Says the Man Who Created It)Financial planning’s most famous guideline just got an upgrade. In this exclusive interview, James speaks with Bill Bengen—the MIT-trained engineer turned financial advisor who created the 4% rule—about his updated research and what it means for retirees today.Bengen reveals that diversification alone can raise the safe withdrawal rate to 4.7%, and under certain market conditions, retirees may be able to withdraw 6%, 7%, or even 8% annually. The original 4% rule was never meant to reflect average scenarios. It was built from the worst-case retirement timing in modern history. Even then, a 4% withdrawal strategy lasted 30 years. Bengen’s findings show tha...

2025-09-2021 min

Retire With StyleEpisode 196: RWS Live! With Bill Bengen: Part 1In this live Q&A session, Wade Pfau, Alex Murguia, and Bill Bengen discuss the intricacies of safe withdrawal rates in retirement, focusing on the relevance of the 4% rule, the impact of inflation, and the importance of investment strategies. They explore various topics including the significance of account types, the risks associated with stock picking, and the necessity of adjusting withdrawal rates based on market conditions and personal circumstances. The conversation emphasizes the need for a tailored approach to retirement planning, considering factors like tax efficiency and rebalancing strategies.

Takeaways

Inflation is a significant r...

2025-09-1629 min

Risk Parity RadioEpisode 454: A Master Plan For Mr. Bill And Portfolio Reviews As Of September 12, 2025In this episode we answer one big long email from Mr. Bill (actually Dr. Bill). We discuss a planning process grounded in good data science, forecasting techniques and decision theory, and how we incorporate the concepts described in Bill Bengen's new book, using Dr. Bill as our guinea pig.And THEN we our go through our weekly portfolio reviews of the eight sample portfolios you can find at Portfolios | Risk Parity Radio.Additional Links:Father McKenna Center Donation Page: Donate - Father McKenna CenterRisk Savvy Lecture: Risk Savvy: How to Mak...

2025-09-141h 07

Risk Parity RadioEpisode 453: Managed Futures, Bengen's New Book, And Vanguard Personal Advisor FolliesIn this episode we answer emails from Adam, Private Cowboy, and Jose. We discuss managed futures (again with references!), Bill Bengen's latest book and how it integrates into our approach, and the pros and cons of a Vanguard Personal Advisor-created portfolio and the hypocritical quandaries it creates with the gods of Simplicity.Links:Demystifying Managed Futures: Demystifying Managed FuturesBloomberg Presentation On Investments In Inflationary Environments: MH201-SteveHou-Bloomberg.pdfDunn Capital Analysis: High-Vol-Trend-Following-Trend-Index-Edition-0825-DIGITAL.pdfKardinal Financial Video: What is Alternative Investing?Interview of Bill Bengen: Episode 195: The 4...

2025-09-1155 min

Retire With StyleEpisode 195: The 4% Rule and Beyond: Retirement Strategies with Bill BengenIn this episode of Retire with Style, Wade Pfau and Alex Murguia talk with William Bengen, pioneer of the 4% rule in retirement planning. They explore the rule’s evolution, how inflation and market valuations shape sustainable withdrawals, and Bengen’s current recommendations. The discussion highlights the role of asset allocation, the importance of withdrawal strategies, and why ongoing monitoring is essential for a secure retirement.

Takeaways

William Bengen modernized retirement income planning with the 4% rule.

Inflation is a critical factor in determining sustainable withdrawal rates.

Market volatility can significantly impact retirement portfolios.

A comprehensive withdrawal plan shou...

2025-09-0939 min

MONEY MATTERS with Christopher HensleyMoney Matters 334- The Man Behind the 4% Rule W/ Bill Bengen🎙️ Episode #334 – The Man Behind the 4% Rule: Bill Bengen on Inflation, Flexibility, and a Richer Retirement What if the greatest risk to your retirement portfolio isn't a market crash—but inflation? In this episode of Money Matters, Christopher Hensley, RICP®, sits down with Bill Bengen, the creator of the legendary 4% Rule for safe withdrawal rates. Now, 30 years later, Bengen reflects on what still holds up, what's changed, and how retirees and advisors can adapt withdrawal strategies in a world of sticky inflation, volatile markets, and longer life expectancies. Whether you're planning your own retirement or advisin...

2025-09-0520 min

Risk Parity RadioEpisode 447: The OG Cowbell, Some Dueling Blog Posts, Spending And Enjoying More With Bill Bengen, And Musings About Gold 'N BitcoinIn this episode we answer emails from Evan, James and Brandy. We discuss the joys of more cowbell from first principles and its origin story, a recent back-and-forth between Karsten and Tyler, the inherent problems with trying to massage data with crystal balls and what it's really revealing about the shortcomings of a basic 75/25 portfolio, some nuggets from Bill Bengen's new book, and some musings about bitcoin and gold.Links:Early Retirement Now Article: Can we increase the Safe Withdrawal Rate with Small-Cap Value Stocks? – SWR Series Part 62 - Early Retirement NowPortfolio Char...

2025-08-2029 min

Informed Decisions Independent Financial Planning & Money PodcastTake 5%, not 4% from my ARF - with Bill Bengen (creator of the 4% rule!)Welcome to Informed Decisions Podcast, where we bring you expert insights for Irish investors and retirees. Today, we have a rip-roaring guest joining us - Bill Bengen, the financial planner who literally wrote the book on retirement withdrawals. Back in 1994, Bill's groundbreaking research established what became known worldwide as the "4% rule". This was the cornerstone of retirement planning, that suggests you can safely withdraw 4% of your portfolio annually without running out of money. But here's where it gets interesting for our Irish listeners: Bill has been revisiting his own work, and his latest...

2025-08-1138 min

Afford AnythingJL Collins Part 2: What Happens When You Don't Need to Work Anymore?#625: What do you do when you've reached financial independence? JL Collins says it depends entirely on your spending rate, not just your net worth.

Collins joins us for part two of our conversation about what happens after you reach financial independence. He tackles the question of whether you should invest differently once you've "won the game."

Someone with $5 million spending $100,000 per year sits in a completely different position than someone with the same amount spending $200,000 per year. The first person can afford to stay aggressive with stocks. The second person needs bonds to smooth the...

2025-07-1559 min

Retirement Starts TodayThe Father of the 4% Rule - an Interview with Bill BengenIf you've been anywhere close to a retirement podcast over the last 10-20 years, you've heard of the 4% rule. And like many people, you might have questions about it. We're going to hear about it directly from the horse's mouth as we talk to Bill Bengen, who first articulated the 4% withdrawal rate as a rule of thumb for withdrawal rates from retirement accounts. The 4% rule is not a rigid rule but a guideline. Its application requires careful consideration of individual factors, including health, life expectancy, and specific financial circumstances. Bengen encourages retirees to tailor their...

2025-06-1621 min

BiggerPockets Money Podcast4% Rule Creator Bill Bengen Reveals His NEW 5% Retirement StrategyThe 4% rule just got a major update! Bill Bengen, the creator of the famous 4% withdrawal rule, returns to share his latest research that’s changing retirement planning forever. Welcome back to the BiggerPockets Money podcast! Discover why he’s now recommending a 4.7% withdrawal rate and what this means for YOUR retirement strategy. In this […]

2025-06-0600 min

BiggerPockets Money Podcast4% Rule Creator Bill Bengen Reveals His NEW 5% Retirement StrategyThe 4% rule just got a major update! Bill Bengen, the creator of the famous 4% withdrawal rule, returns to share his latest research that’s changing retirement planning forever. Welcome back to the BiggerPockets Money podcast! Discover why he’s now recommending a 4.7% withdrawal rate and what this means for YOUR retirement strategy. In this […]

2025-06-0600 min

BiggerPockets Money Podcast4% Rule Creator Bill Bengen Reveals His NEW 5% Retirement StrategyThe 4% rule just got a major update! Bill Bengen, the creator of the famous 4% withdrawal rule, returns to share his latest research that's changing retirement planning forever. Welcome back to the BiggerPockets Money podcast! Discover why he's now recommending a 4.7% withdrawal rate and what this means for YOUR retirement strategy.

In this episode, you'll learn:

Why Bill Bengen updated his iconic 4% rule after decades of research

The psychology behind why retirees struggle to actually spend their money

How market conditions should influence your withdrawal strategy

The role real estate...

2025-06-0649 min

Life, Money, and Living WellRetirement on 4% and More : Bill BengenRetirement is coming. Your plan, and your preparation, can be the difference between twilight years that are a pleasure… and those that are a pain. Consider this: the last 30 years has seen the first generation retiring primarily without a pension. As life expectancy increases, the need for retirement funds, and to use them wisely, has never been more important. To put it bluntly, retirement is a balancing act trying to avoid having more years of life than funds in the bank. That's where financial adviser Bill Bengen comes in. Bill first articulated the 4% pe...

2025-05-0656 min

聽進理投EP120 提領率4%夠嗎?掌握8個退休金提領重點讓你不再擔心錢!本集聽進理投(EP120)聊聊發表「4%提領率」的 Bill Bengen 將出版新書《A Richer Retirement: Supercharging the 4% Rule to Spend More and Enjoy More》,本集就來聊聊 Bill Bengen 對於退休金提領的 8 個重點,歡迎點擊收聽! 00:28 4% 提領率是什麼? 05:35 發表「4%提領率」的Bill Bengen 要出新書了 07:27 重點 1:如何知道自己的提領率? 10:59 重點 2:避免活太久卻沒錢用的困境 12:54 重點 3:考慮稅務成本,不要掉進高股息的陷阱 16:24 重點 4:你想留下多少錢? 17:21 重點 5:別忘了資產配置 21:07 重點 6:即使退休了依然要再平衡 22:28 重點 7:你是不是巴菲特? 25:13 重點 8:一年領一次或每月領一次差別在哪裡? 本集節目也有 YouTube 影片版喔! See omnystudio.com/listener for privacy information.

2025-04-1028 min

Marriage Kids and Money: Personal Finance for FamiliesRetirement Is Now Easier - Bye 4% Rule, Hello 5% Rule | Bill BengenCan you really retire comfortably with a 5% withdrawal rate? Financial researcher and author Bill Bengen—the creator of the legendary 4% rule—joins us to share why his latest research shows that 5% is the new 4%. In this interview, Bill explains how his thinking has evolved, what today’s retirees should know, and how you can plan smarter for a fulfilling, financially free retirement.RESOURCES:

Sponsors + Partners + Deals

A Richer Retirement (book): https://amzn.to/4iWzaVJ (affiliate)

CHAPTERS00:00 – Intro – Bill Bengen01:53 – What is the 4% rule?...

2025-04-0829 min

Inspired MoneyRetirement Income Strategies: Maximizing Returns for Financial FreedomWhy This Episode Is a Must-Listen Planning for retirement can feel overwhelming with its complexities and uncertainties. This episode of "Inspired Money" tackles the essential question: How do you turn your savings into reliable income that will last throughout retirement? We bring together a panel of four esteemed experts to share proven strategies, actionable insights, and industry wisdom to help you craft a solid retirement income plan. Whether you are just beginning to think about retirement or looking to refine your strategy, this episode offers valuable advice on diversifying your income, managing taxes, and inflation-proofing your financial future....

2025-03-271h 05

Decoding RetirementRetirees Rejoice: Bengen's Safe Withdrawal Rate Jumps to 4.7%In this episode of Decoding Retirement, America’s definitive voice on retirement, Robert 'Bob' Powell speaks with Bill Bengen, "4% rule" Researcher/Author of "A Richer Retirement", about how to create retirement income plans.Find out everything you need to know about the new and improved "4.7% rule".Retirement planning doesn’t mean locking up your money for a rainy day and forgetting about it. Planning your future means reacting to events today. Decoding Retirement gives you the tools to navigate the years ahead, and take action now! Each week, Robert 'Bob' Powell will dissect the big headline...

2025-03-0424 min

Advised | with Rick LuchiniCreator of 4% Rule Reveals His New Retirement Strategy | with Bill BengenIn this episode, we welcome legendary retirement researcher Bill Bengen, the creator of the original 4% rule, to discuss his latest findings and how retirement withdrawal strategies have evolved. If you’re planning for financial independence, early retirement, or traditional retirement, this episode is essential!

🔹 What is the new 4% rule, and how has it changed?

🔹 How to determine a safe withdrawal rate in today’s market

🔹 The impact of inflation on retirement portfolios

🔹 Stock market valuation and its role in retirement planning

🔹 How to avoid running out of money in retirement

🔹 Investment strategies to maximize long-term...

2025-03-0441 min

Catching Up to FIMr 4% is now Mr 5% | Bill Bengen | 111In this episode we welcome the legendary Bill Bengen! He is the creator of the infamous 4% rule that is referenced in any quality conversation about retirement and withdrawal rates. There's been spirited debates and lengthy discussions about Bengen's research but there is no one better than the man himself to weigh in on what he thinks about it 30 years later. We talk about the evolution of Bengen's research, his thoughts on market timing vs. managing risk, and he gives us a preview of his upcoming book geared toward consumers. 🔗Connect with us Buy CUtFI...

2024-12-1558 min

Financial ConditioningMastering the Mega Backdoor Roth IRA and Innovative Retirement StrategiesIn episode 49 of Financial Conditioning, Simon Karmarkar explores the mega backdoor Roth IRA, beginning with an overview of the Roth IRA and its benefits. He delves into the specifics of the mega backdoor Roth IRA strategy, explaining how to contribute and the tax implications and withdrawal rules associated with it. Simon emphasizes the critical role of employer involvement in this strategy. The episode also covers retirement withdrawal strategies, including an explanation of the 4 percent rule, with insights from Bill Bengen. Simon concludes by examining innovative financial planning techniques and offering final thoughts on personalized strategies for financial success.

(0:00) Welcome and...

2024-11-2513 min

Risk Parity RadioEpisode 381: Retirement Account Basics, Some Cool New Podcasts, And Portfolio Reviews As Of November 22, 2024In this episode we answer an email from Tom, Tom the Podcaster's Son (a/k/a "Patrick Star"). We discuss the basics of retirement accounts in honor of the annual benefits enrollment period and some rules of thumb for contributing to them, with a little commentary on HSAs. We also discuss interesting recent podcasts featuring Bill Bengen, Corey Hoffstein and Cliff Asness. And our friend Jackie Cummings Koski.And THEN we our go through our weekly portfolio reviews of the eight sample portfolios you can find at Portfolios | Risk Parity Radio.Additional links:Bil...

2024-11-2457 min

Afford AnythingThe Father of the 4% Rule Finally Sets the Record Straight#560: Bill Bengen, the former rocket scientist who discovered the "4 percent rule" of retirement planning, joins us at the Bogleheads conference in Minnesota. Bengen clarifies that calling it a "rule" is misleading since it doesn't fit everyone's situation. The 4 percent figure came from studying the worst-case scenario since 1926, when someone who retired in 1968 could only safely withdraw 4.2 percent annually. Out of 400+ retirees in his database, that was the only one who had such a low safe withdrawal rate — most could take out much more.Recent research has pushed the "safe" wi...

2024-11-2255 min

The Financial Samurai PodcastThe 4% Rule: Clearing Up Misconceptions With Its Creator Bill Bengen I had the pleasure of speaking with Bill Bengen, creator of the "4% Rule" for retirement planning. Bill has been a reader of Financial Samurai for many years and has always been courteous in the comments section when I write about safe withdrawal rates. So, I figured it was time we had a chat to clear up some misconceptions. For those unfamiliar, the 4% Rule, developed by Bill in the 1990s, suggests that traditional retirees (around age 65) can safely withdraw 4% of their retirement portfolio in the first year—adjusted for inflation in subsequent years—without runn...

2024-11-1546 min

The Financial Samurai PodcastThe 4% Rule: Clearing Up Misconceptions With Its Creator Bill Bengen I had the pleasure of speaking with Bill Bengen, creator of the "4% Rule" for retirement planning. Bill has been a reader of Financial Samurai for many years and has always been courteous in the comments section when I write about safe withdrawal rates. So, I figured it was time we had a chat to clear up some misconceptions. For those unfamiliar, the 4% Rule, developed by Bill in the 1990s, suggests that traditional retirees (around age 65) can safely withdraw 4% of their retirement portfolio in the first year—adjusted for inflation in subsequent years—without runn...

2024-11-1546 min

The Financial Harmony™ Podcast4% Rule Guru Bill Bengen Reveals How to Maximize Your Retirement Income!In this episode, Dr. Preston Cherry talks about retirement income, breaking down the famous 4% rule with its creator, Bill Bengen, renowned for his groundbreaking work in retirement planning.Key Points:1. The 4% rule should be seen as a flexible guideline rather than a strict rule, adaptable to individual retirement timelines and economic conditions.2. Creating a diversified investment portfolio is crucial for managing risks and optimizing returns.3. Continual assessment and adjustment of the retirement plan are essential.4. Implementing strategies like guardrails allows retirees to adjust their withdrawal rates in response to market and inflation...

2024-11-0724 min

The Humans vs Retirement Podcast4% and Beyond! The Evolution of Safe Withdrawal Strategies with Bill BengenSummary In this episode of the Humans vs Retirement podcast, I interview Bill Bengen, the pioneer of the 4% safe withdrawal strategy, who shares insights from his extensive research on retirement income strategies. Bill discusses the evolution of the 4% safe withdrawal rate, revealing that the worst-case scenario may now be closer to 5%. He emphasises the importance of diversification, glider path investing, and rebalancing in enhancing withdrawal rates. The conversation also delves into the risks of inflation and the significance of understanding personal inflation rates in retirement planning. Bill concludes with thoughts on...

2024-09-2743 min

Your Retirement Planning SimplifiedEp #99: The 4% Rule Revisited: How to Craft a Safe Retirement Withdrawal Rate Have you heard these retirement myths? The 4% rule is the only safe withdrawal rate, asset allocation doesn't matter in retirement, and setting a fixed withdrawal rate is the best strategy. But is it true? In this episode, Joe speaks with Bill Bengen, a seasoned financial advisor who is widely recognized for his pivotal role in introducing the 4% rule for retirement planning. With a rich background spanning over three decades, Bengen's profound research has significantly influenced the approach to safe withdrawal rates and asset allocation strategies in retirement planning. His expertise extends beyond conventional wisdom, delving into the in...

2024-07-2531 min

Catching Up to FIThe Life and Death of The 4% Rule | Christine Benz | 077Christine Benz is the Director of Personal Finance and Retirement Planning at Morningstar. Christine shares her extensive insights into retirement planning, emphasizing the flexibility and adaptability of the 4 percent guideline over the rigid 4 percent rule. She discusses the value of variable withdrawal strategies, the importance of personalizing one's retirement plan, and tackles the nuances of various saving vehicles like HSAs. Bill, Jackie, and Christine also chat about the sequence of returns risk and offer practical advice on asset allocation and preparing for healthcare costs in retirement. Additionally, she highlights the significance of community and working in retirement for financial...

2024-05-261h 10

The Planning For Retirement PodcastEp. 37 - 3 flexible retirement withdrawal strategies to maximize spending during your lifetimeHave you heard of the 4% rule?! It's the most recognized benchmark for safe withdrawal rates in retirement. However, it lacks flexibility and often leaves retirees "under-spending," particularly in their prime retirement years.

Think Advisor put out this article (link below) that touched on three alternatives to the 4% rule and how they can potentially increase your spending capacity over time, while also protecting downside risk (outliving your assets).

I hope you enjoy this episode!

If you are interested in learning what it would be like to work with me, fill out my complimentary "Retirement...

2024-02-2229 min

The Planning For Retirement PodcastEp. 32 - Tactical ways to reduce your anxiety transitioning from saving to spending in retirementI decided to record this episode as a follow-up to Ep. 30 given how many questions and discussions I've heard from listeners. If you have not listened to Ep. 30 (link here), you should go back and listen as Cody Garrett joined me to talk about the challenge of psychologically going from "Saver to Spender" in retirement.

However, many of the follow-up questions were about what tactical action items you could take to get comfortable with "spending" down your retirement nest egg.

There are 7 potential tactics and philosophies you could adopt...

2023-12-1436 min

The Long ViewJohn Rekenthaler and Amy Arnott: What’s a Safe Retirement Spending Rate Today?Hi, and welcome to The Long View. I’m Christine Benz, director of personal finance and retirement planning for Morningstar. Our guests on the podcast today are Amy Arnott and John Rekenthaler. Amy and John are two of the co-authors, along with me, of some recently released Morningstar research on retirement spending rates. The paper is called The State of Retirement Income, and it’s an update on some research that we published in 2021 and 2022. Amy and John are both long-tenured Morningstar researchers and part of Morningstar Research Services LLC, which is a wholly owned subsidiary of Morningstar. Amy is a...

2023-11-1457 min

Mile High FI PodcastFinCon Recap and Mailbag – Random Episode | MHFI 189Grab your headphones for an eclectic episode of Mile High FI with hosts Carl Jensen and Doug Cunnington where they chat with special guest Mindy Jensen. They dive into life with a Tesla, the unforeseen hazards of owning one, and smart college fund investments for children. They also share their personal experiences from the recent FinCon conference and future financial independence retreats. In the soundcheck they embark on an entertaining journey reminiscing about a recent Guns N’ Roses concert, their insightful views on the band’s performance, and the unique aging crowd demographic. Poised amid finance and rock, their hearty b...

2023-11-141h 16

Catching Up to FISpongeBob and Drawdown Strategies | Frank Vasquez | 044Frank Vasquez is a mostly retired lawyer with over 30 years' experience in investing for his own accounts. He holds degrees in Economics and Engineering from the California Institute of Technology and a law degree from Georgetown University. He is extremely active in the Financial Independence community, answering questions of all types in forums and Facebook groups. He has appeared as a guest on the Choose FI, What's Up Next and Security Analysis podcasts, and run workshops at the EconoMe Conference. His involvement in FI topics and issues predates the FI Community as it is known today. He is the...

2023-10-291h 50

Risk Parity RadioEpisode 294: An Exquisite Dissection Of The "Four Percent Rule" And Portfolio Reviews As Of September 29, 2023In this episode we answer an email from Jeffrey about the "4% Rule". We discuss its origins, its three parameters (portfolio construction, time frame, and withdrawal mechanism), how it works, what it means and doesn't mean, its uses and misuses and how to make adjustments to improve your own outcomes.And THEN we our go through our weekly portfolio reviews of the seven sample portfolios you can find at Portfolios | Risk Parity Radio. We have a rebalancing of the Levered Golden Ratio portfolio.Additional links:Bill Bengen's Original 1994 Safe Withdrawal Rate Paper: FPA Journal - T...

2023-10-0146 min

Bogleheads On Investing PodcastEpisode 61: Cody Garrett on Early Retirement, host Jon LuskinCody Garrett is an advice-only financial planner passionate about helping families refine their path to financial independence (FI) as DIY investors. Cody specializes in comprehensive financial plan development, topic research, and personalized financial education.

This episode of the podcast is hosted by Jon Luskin, CFP®, a long-time Boglehead and financial planner. The Bogleheads are a group of like-minded individual investors who follow the general investment and business beliefs of John C. Bogle, founder and former CEO of the Vanguard Group. It is a conflict-free community where individual investors reach out and provide education, assistance, and relevant information to...

2023-08-281h 02

Conservatory ChatRetirement Rules of ThumbYou may have heard of the 4% rule in retirement. Basically, it means that you should be able to safely take out and spend 4% of your retirement portfolio in the first year of retirement, then increase that dollar amount by the inflation rate for the next 30 years, and you should be able to count on that income no matter what the markets do.Notice all the “shoulds” here. This “rule” was formulated by a financial planner named Bill Bengen back in the mid-1990s when he became curious about Money Magazine’s advice that retirees could take 10% out of their p...

2023-08-1504 min

Bogleheads On Investing PodcastEpisode 60: Jonathan Clements on ”My Money Journey,” host Jon LuskinJonathan Clements is the founder and editor of HumbleDollar. He’s also the author of a fistful of personal finance books, including My Money Journey and How to Think About Money, and he sits on the advisory board of Creative Planning, one of the country’s largest independent financial advisors.

Jonathan spent almost 20 years at The Wall Street Journal, where he was the newspaper’s personal finance columnist. Between October 1994 and April 2008, he wrote 1,009 columns for the Journal and for The Wall Street Journal Sunday. He then worked for six years at Citigroup, where he was Director of Fin...

2023-07-2450 min

Bogleheads On Investing PodcastEpisode 058: Mike Piper on ”More than Enough,” host Jon LuskinMike is the author of the popular blog “Oblivious Investor” at ObliviousInvestor.com and the creator of the free Open Social Security calculator at OpenSocialSecurity.com. He is also the author of several books on taxes, investing, and Social Security, and now a new book, More than Enough: A Brief Guide to the Questions That Arise After Realizing You Have More Than You Need.

This episode of the podcast is hosted by Jon Luskin, CFP®, a long-time Boglehead and financial planner. The Bogleheads are a group of like-minded individual investors who follow the general investment and bu...

2023-05-2936 min

Bogleheads® LiveMr. Money Mustache on Early Retirement (FIRE)Mr. Money Mustache answers questions about early retirement, investing, and more.The online blogging pseudonym of Peter Adeney, Adeney is an early icon in the early retirement community, championing frugality and a do-it-yourself approach to much of life – not just investing.Show NotesBogleheads® Live with Derek Tharp: Episode 41Bogleheads® Live with Christine Benz: Episode 37Bogleheads® Live with Bill Bengen: Episode 35Frugal Man Buys $52,000 Car – Why??The Betterment Experiment[EXPLICIT CONTENT] Health Care Sharing Ministries: Last Week Tonight with John Oliver (HBO)Bogleheads® Chapter Series – Health care planning for retirement2023 Conference - The John C...

2023-05-1546 min

Risk Parity RadioEpisode 253: A Taxonomy of Withdrawal Strategies And Analyses Of Their ComponentsIn this episode we answer emails from MyContactInfo and Chris. We follow up on Episode 251 with a taxonomy of five withdrawal strategies described in an article from the CFA institute and discuss a "not really a withdrawal strategy" that is classified as a form of mental accounting and does not impact safe withdrawal rates (at least not in a positive manner). We talk about how to classify annuities, bond ladders and portfolio-based withdrawal strategies. And we thank Chris and our other charitable donors for their support.Links:CFA Institute Article: Retirement Income: Six Strategies | CFA Inst...

2023-04-1340 min

The Money with Katie ShowDoes Early Retirement Still Work With 2023 Inflation? Featuring Bill BengenBill Bengen, who established the 4% safe maximum withdrawal rate (the rule on which most of financial planning relies), is a straight shooter, and his perspective on whether or not we’re currently in uncharted waters surprised me.But fear not—there’s a little-discussed element of planning for early (as well as regular!) retirement that might be our saving grace. We’ll unpack that, too.Learn more about our sponsor, Vin Social: https://www.vinsocial.vipLearn more about our sponsor, TaxAct: https://www.taxact.com/moneywithkatieLearn more about our sponsor...

2023-04-1232 min

Bogleheads® LiveDerek Tharp on Retirement Planning - 4% Rule vs. Monte CarloDerek Tharp answers questions about doing retirement planning, and whether Monte Carlo simulations or using a safe withdrawal rate (SWR) is the better approach.Show NotesBogleheads® Live with Derek Tharp: Episode 24Bogleheads® Live with Bill Bengen: Episode 35Bogleheads® Live with Christine Benz: Episode 37Evaluating Retirement Spending Risk: Monte Carlo Vs Historical SimulationsThe Retirement Distribution “Hatchet”: Using Risk-Based Guardrails To Project Sustainable Cash FlowsRetiree Portfolio ModelRob Berger: 5 Best Retirement Planners and AppsVariable percentage withdrawalJohn C. Bogle Center for Financial LiteracyBogleheads® ForumBogleheads® WikiBogleheads® RedditBogleheads® FacebookBogleheads® LinkedInBogleheads® TwitterBogleheads® on Investing podcastBogleheads® YouTube Bogleheads® Local ChaptersBogleheads® Virtual Online ChaptersBog...

2023-03-2737 min

The Optometry Money PodcastWhat is the 4% Safe Withdrawal Rule?Questions? Thoughts? Send a Text to The Optometry Money Podcast! We'll answer your question on the show.What is the 4% safe withdrawal rule? It's often talked about and cited in social media posts, blogs, and books. But where does it come from? What do you do with it? When is it useful and when is it not useful? Evon talks about the research behind the 4% sustainable withdrawal amount, its limitations, what it's useful for, and other helpful takeaways from the research. Have questions on anything discussed or want to have topics or questions...

2023-02-1535 min

Bogleheads® LiveChristine Benz: How much can I spend in retirement?Christine Benz answers the question, "how much can I spend in retirement?" Show NotesBogleheads® Live with Christine Benz: Episode 52022 Retirement Withdrawal Strategies ReportBogleheads® Live with Bill Bengen: Episode 35Is The United States A Lucky Survivor: A Hierarchical Bayesian ApproachThe 2.7% Rule for Retirement SpendingLong TIPS Are WackyJohn C. Bogle Center for Financial LiteracyBogleheads® ForumBogleheads® WikiBogleheads® RedditBogleheads® FacebookBogleheads® TwitterBogleheads® on Investing podcastBogleheads® YouTube Bogleheads® Local ChaptersBogleheads® Virtual Online ChaptersBogleheads® on Investing PodcastBogleheads® ConferencesBogleheads® BooksThe John C. Bogle Center for Financial Literacy is a 501(c)3 nonprofit organization. At Boglecenter.net, your tax-deductible donations are greatly apprecia

2023-01-2334 min

Afford AnythingWhat We Learned in 2022#420: Harvard professor Arthur Brooks described two types of intelligence – and explained, in scientific terms, the wisdom that comes with age.Dr. Ellen Vora, M.D., shared insight into the roots of procrastination, offering evidence-based tips for how to overcome our own inner demons of anxiety, fear and laziness.Psychology professor Bill von Hippel described why too much happiness is just as detrimental to our long-term health and wellbeing as too little happiness.Wall St. Journal columnist Spencer Jakab observed the perfect storm of conditions that gave rise to meme stonks and other oddities of...

2022-12-291h 29

Bogleheads® LiveBill Bengen: 4% Rule of ThumbBill Bengen - creator of the 4% rule of thumb - answers audience questions. Show NotesBogleheads® Live with Colleen Jaconetti: Episode 26Exploring the Retirement Consumption PuzzleJohn C. Bogle Center for Financial LiteracyBogleheads® ForumBogleheads® WikiBogleheads® RedditBogleheads® FacebookBogleheads® TwitterBogleheads® on Investing podcastBogleheads® YouTube Bogleheads® Local ChaptersBogleheads® Virtual Online ChaptersBogleheads® on Investing PodcastBogleheads® ConferencesBogleheads® BooksThe John C. Bogle Center for Financial Literacy is a 501(c)3 nonprofit organization. At Boglecenter.net, your tax-deductible donations are greatly appreciated.

2022-12-2631 min

The Long ViewChristine Benz and John Rekenthaler: Revisiting What Is a Safe Retirement Spending Rate After a Tough YearOn this week’s episode, we’ll be chatting about “The State of Retirement Income” study that Christine and I recently co-authored with our colleague John Rekenthaler, who joins us for this conversation. This is the second year we’ve conducted this study, which examines how much retirees can safely withdraw in retirement. Much has changed since last year as the stock and bond markets have sold off and inflation has risen sharply. This can create uncertainty about whether retirement assets will sustain spending over a multidecade horizon, an issue we explore in this study. In this episode, I’ll be asking...

2022-12-2048 min

One For The MoneyWill I Be Able to Retire?The question I’m most often asked is, “Will I be able to retire?” In this episode of the One for the Money podcast, I answer that question and share ways to know you’re on the right track. In the tips, tricks, and strategies portion, I explain how a simple rule can help you track your progress towards retirement. Listen to learn more!In this episode...Well, it depends… [01:06]Determining yearly expenses [03:37]Income sources [04:56]The 4% rule [05:44]How much will you need to save? [07:28]High impact factors [09:19]The rule of 72 [11:50]Where to startAs a Cer...

2022-10-0115 min

Afford AnythingAsk Paula: How Much Should I Invest vs. Keep in Cash?#394: Bill listened to our episode with Bill Bengen, father of the 4% rule, and he wants to know if there was a way for him to figure out how much money he should be keeping in cash.Sheryl gets stock from her company, and she would usually sell it…but the stock value has decreased. And now, she isn’t sure what she should do.Heather inherited an IRA but MUST empty it within ten years - but she doesn’t need it right now. What should she do??Julie and her husband have access...

2022-08-031h 04

The Long ViewWade Pfau: The Risks of Retirement TodayOur guest on the podcast today is Wade Pfau. He is professor of retirement income in the Ph.D. in financial and retirement planning program at the American College of Financial Services. He is also co-director of the American College Center for Retirement Income and RICP program director at the American College. Pfau has written several books, including his most recent, Retirement Planning Guidebook. He is a co-editor of the Journal of Personal Finance, and he publishes frequently in a wide variety of academic and practitioner research journals. He hosts the Retirement Researcher blog and is a regular contributor...

2022-08-0257 min

Afford AnythingAsk Paula: Help! My Bills Are Too High#390: We start this episode with two anonymous callers who have opposite problems: one says her bills are too high, while the other is worried that she’s saving too much.Anonymous (“Izzy”) saves A LOT. She wants to relax about her spending more, and start including more joy into her life. How should she approach the next 10 or 20 years, so that she can enjoy her financial security?A different anonymous caller (“Starlight”) has the opposite problem: her expenses are mounting. Her bills make her uncomfortable. She wants to shake up her investments so that she can tap he...

2022-07-061h 24

Retirement Starts TodayFather of 4% Rule Urges CautionWe've all heard of the 4% rule, but did you know that the creator's recommendation for it has changed over the years? I recently discovered an article from ThinkAdvisor.com that included an interview with the father of the 4% rule, Bill Bengen. In the retirement headlines segment, we'll take a close look at the article and learn directly from Mr. Bengen's perspective and then I'll offer my own. Don't miss out on this glimpse into the mind of the creator of the 4% rule. Outline of This Episode [2:12] Manage the risk portion of your retirement nest egg...

2022-05-3023 min

Risk Parity RadioEpisode 173: REITs, Struggling Bond Funds, More Cowbell And Portfolio Reviews As Of May 6, 2022In this episode we answer emails from Jamie, Jean-Luc and Geordi. We discuss a paper about REITs as a separate asset class, what to do about struggling bond funds, the value of small-cap value and choosing a retirement portfolio in line with Bill Bengen's recommendations.And THEN we our go through our weekly portfolio reviews of the seven sample portfolios you can find at Portfolios | Risk Parity Radio. Additional Links:Jamie's Article -- Are REITs A Distinct Asset Class?: delivery.php (ssrn.com)Correlation Matrix for Small Caps: Asset Correlations (portfoliovisualizer.com...

2022-05-0734 min

BiggerPockets Money PodcastThe April Stock Market Slump | Mindy & Carl’s Budget Review

Stock market crashes aren’t common, but when they happen, they often catch you by surprise. Thankfully, we’re not in the middle of a stock market crash, but this current correction or “dip” we’re riding has got some early retirement and FIRE chasers feeling a little anxious. Carl and Mindy Jensen, real estate and index fund investors, have seen a twenty-five percent drop in their portfolio just over the past six months alone. What effect does that have on their future financial plans?Welcome back to this month’s episode of Carl and Mindy’s...

2022-05-0626 min

The Money with Katie ShowThe Most Dangerous Misconceptions about the 4% Safe Withdrawal RateSo much of personal finance and early retirement #literature is predicated on the 4% safe withdrawal rate that it’s easy to forget that the “rule” was discovered in the 1990s by the original Freak in the Spreadsheets, Bill Bengen.And man, the financial media loves to splash sensational headlines about the 4% rule all over the place (“The founder of the 4% rule just changed it!”). You know the kind.But there are a lot of misconceptions about the 4% rule, including the recent criticisms that it’s no longer valid. If you ever want to retire, this episode is a...

2022-05-0444 min

Afford AnythingHow I Discovered The 4 Percent Retirement Rule, with Bill Bengen#377: Today’s episode is sheer retirement nerd bliss.We talk to the creator of the 4 percent retirement safe withdrawal rule, Bill Bengen.If you’re new to retirement planning, you might not yet grasp the gravity of this. Let’s cut to the chase: the 4 percent rule is one of the most revolutionary, groundbreaking insights in the field of retirement research in the past 30 years.To understand why, let’s climb in our time machines and return to 1994.Back then, many financial advisors were telling their clients that they could safely withdraw...

2022-04-271h 02

Ambitious Money Podcast93. How to NEVER run out of Money until you DIE! Yes you heard me, there is a way to never run out of money until you die and then what is left gets willed to your children. It’s called the 4% rule by Bill Bengen a retired financial adviser who first articulated the 4% withdrawal rate ("Four percent rule") as a rule of thumb for withdrawal rates from retirement and investment accounts. In this episode I break down how to get as much money invested as possible so you can allow time for compounding to do its thing and push you into millionaire status. Then you can withdraw 4% of your money every...

2022-04-0530 min

Risk Parity RadioEpisode 160: Blowing Up The Deathstar (Again!) And Our Weekly Portfolio Reviews As Of March 18, 2022In this episode we address emails from Thomas, Karen and Jeffrey. We discuss high-performing two-fund portfolios, Bill Bengen and Michael Kitces missiles into the Deathstar's crystal balls and exhaust ports, Karen's portfolio management, an updated and improved shortcut tool for analyses at Portfolio Visualizer and Portfolio Charts, and a query about investing in energy sector stocks.And THEN we scare you with our weekly portfolio reviews of the seven sample portfolios you can find at Portfolios | Risk Parity Radio.Additional links:NTSX/GLD portfolio and comparison analysis: Backtest Portfolio Asset Allocation (portfoliovisualizer.com)

2022-03-2042 min