Shows

Fiscal FoxholeShould you stay past 20? w/ guest Brandon LovingierShould You Stay Past 20? Military Retirement, Career Choices & Market Lessons with guest Brandon Lovingier🎙️ HostsRob MooreOmen QuelvogEpisode SummaryIn this episode, Rob and Omen kick off the new year with reflections on career decisions, market lessons from 2025, and a deep dive into military retirement choices. They welcome back their first-ever guest, Brandon Lovingier, for a candid conversation about the decision to stay in the military past 20 years—and what really matters when making big life changes.Featured GuestBrandon Lovingier (EnlistedMoney.com)Army Veteran/financi...

2026-01-141h 14

Fiscal FoxholeMotrin, Missed Sleep, and Million Dollar Pension w/ guest Brandon LovingierIn this episode, Omen and Rob welcome their first guest to the foxhole: Brandon Lovingier, Army veteran and creator of “The Enlisted Money Guy.” Together, they tackle the big question: “Is 20 years in the military really worth it?” Brandon shares his personal journey, the financial and emotional ups and downs of military life, and how service members can make empowered career decisions. The conversation blends practical advice, honest reflections, and a few laughs about foxhole etiquette.📰 This Week’s HeadlineFAFSA Opens Early: Omen and Rob discuss the Department of Education’s early release of the FAFSA (Free...

2025-10-221h 03

The Next Tour podcastEpisode 14 - Transition and Financial ReadinessIn this episode of The Next Tour, Ian and Andia talk with Brandon Lovingier about financial readiness, financial health, and tips to become financially independent. As the host of his own website and video series, Enlisted Money, Brandon brings a fresh perspective to all servicemembers, veterans, and family members who are looking to do better with their own finances. He also holds designations as a Chartered Financial Consultant (ChFC®) and a Military Qualified Financial Planner (MQFP®), underscoring his capabilities and credibility. His best piece of advice: just get started. Check out his webpage to access resources that will help yo...

2025-06-0129 min

The Military Money Manual PodcastIs Military Retirement Worth It? | Valuing Military Retirement w/ The Enlisted Money Guy, Brandon Lovingier #174The military retirement is one of the best benefits in the world... but is it worth the cost in years of your life? Summary: How is military retirement pay calculated Military retirement can be worth at least $1,500,000! Benefits for military retirees Intangible benefits of military service What veterans miss about the military after retirement Links: Enlisted Money @enlistedmoneyguy on Instagram Brandon's blog post- Is Doing 20 Years in the Military Worth it? past episodes w/ Brandon include: ep 96- Enlisted Money Basics ep 128- Continuation Pay ep 143- DCFSA Brandon Lovingier, ChFC®, MQFP®, joined th...

2025-05-1234 min

The Military Money Manual PodcastBlended Retirement System | BRS Pension, Matching Contributions, Continuation Pay #149Do you still get a pension under the BRS? YES! We can't believe this myth and misinformation is still spreading around the military. Spencer and Jamie break down the three components of the military's Blended Retirement System (BRS) and address common misconceptions. They explain how the pension calculation works, discuss TSP matching benefits, and detail continuation pay options across different services. The hosts emphasize that servicemembers still receive a pension under BRS and highlight both the advantages and potential pitfalls of the system. Questions discussed: How is the pension calculated under BRS? What are...

2024-11-1123 min

The Out and About PodcastNavigating Finances and Planning Resources for Service Members with Brandon LovingierBrandon Lovingier, ChFC®, MQFP® aka The Enlisted Money Guy™, served over 18 years in the Army — including deployments to Iraq and Afghanistan. After navigating his own financial challenges, he became committed to helping other service members avoid similar mistakes he made and achieve financial freedom. Through his Enlisted Money website, blog, and educational videos, Brandon shares practical resources and strategies to empower the military community to make smart financial decisions.Featured Resources Enlisted Money Enlisted Money Confessions Enlisted Money Success Stories MilMoneyCon ChooseFI Military Facebook Group

2024-11-0617 min

ABOUT THAT WALLET272: [Brandon Lovingier] Money, Military and MarriageHost Anthony Weaver welcomes Brandon Lovingier @enlistedmoney, a military veteran and financial consultant, to discuss the importance of building strong financial habits and the challenges that come with managing money. Brandon shares his personal journey from financial struggles to becoming a financial planner, emphasizing the importance of budgeting, automation, and the emotional aspects of spending.Join us as we discuss:The emotional and financial challenges that Brandon faced and how he overcame them.The significance of budgeting and creating a system that works for you.The impact of military service on financial planning and the unique...

2024-10-1539 min

Financial Advisors Want To Know PodcastEp 19: The Benefits of ParaplanningFinancial Advisors Want to Know: The Benefits of Paraplanning - Ep 19: Brandon LovingierWelcome to the Financial Advisors Want to Know podcast. This is Catherine Tindall. I'm a CPA over at Dominion Enterprise Services. We're a specialty tax and accounting firm that works for financial advisors. And on today's episode, I have Brandon Lovingier. He's the AKA the enlisted money guy. He's an army veteran with over 18 years of service, including deployments to Iraq and Afghanistan. And after a period of financial missteps, he and his wife became debt-free and started building wealth. He launched h...

2024-10-1117 min

The Military Money Manual PodcastDCFSA | Dependent Care Flexible Spending Account FSA for Military | With Brandon Lovingier, the Enlisted Money Guy #143Dependent care flexible spending account- is it even worth your time? (note: this is different than the HEALTHCARE FSA which was announced in Sept 2024- we have an episode coming out on that in a few weeks) Open season is coming up in mid-November to mid-December! For a limited time, Spencer is offering one-on-one Military Money Coaching sessions! Get your personal military money and investing questions answered in a confidential coaching call. We are publishing this episode now so you can think about it and prepare for open enrollment season coming up in...

2024-09-3017 min

The Military Money Manual PodcastContinuation Pay Calculation & Timing With BRS & TSP With Brandon Lovingier, the Enlisted Money Guy #128For a limited time, Spencer is offering one-on-one Military Money Coaching sessions! Get your personal military money and investing questions answered in a confidential coaching call. Confused about continuation pay? Join the club. Unfortunately, too many servicemembers and their leaders are confused about the continuation pay benefit in the BRS. In today's episode with Brandon Lovingier, ChFC®, MQFP® aka The Enlisted Money Guy™, we share all you need to know to understand the benefit. For active duty, it's currently: 2.5 times your monthly base pay in either a lump sum or up to 4 equal, annual paym...

2024-06-1027 min

Start100K36 - Crosspost from the Financial Feels PodcastThis was an episode I recorded on the Financial Feels podcast. I had a great conversation with Melissa Mazard! We talked about my childhood, joining the military, my relationship with money and my wife, and many other deep and interesting topics around money. I hope you like it!

2024-05-1522 min

Memories of Money PodcastMilitary and Money with Brandon Lovingier - UneditedThere are many misconceptions about the military financial experience. While the military offers many benefits to its members, an individual's behavior with money will determine their financial stability and success, both during and after service. This episode's guest shares his journey through navigating negative spending habits and enlisting in the army. Story Highlights: - Military and money - Accumulating debt - Relationships and money Episode Guest: Brandon Lovingier @enlistedmoneyguy; https://enlistedmoney.com/ Host: Melissa Mazard @prosperwithmel Unedited episodes include the full, behin...

2024-05-1242 min

Memories of Money PodcastMilitary and Money with Brandon Lovingier - EditedThere are many misconceptions about the military financial experience. While the military offers many benefits to its members, an individual's behavior with money will determine their financial stability and success, both during and after service. This episode's guest shares his journey through navigating negative spending habits and enlisting in the army. Story Highlights: - Military and money - Accumulating debt - Relationships and money Episode Guest: Brandon Lovingier @enlistedmoneyguy; https://enlistedmoney.com/ Host: Melissa Mazard @prosperwithmel Edited episodes are streamlined for a unique lis...

2024-05-1221 min

Vertical Momentum Resiliency Podcast V2From Keeping Others Free To Financial Freedom With Brandon LovingierDo You Have ANY Of Your Money

2024-05-091h 10

Vertical Momentum Resiliency Podcast 2.0The Enlisted Money Guy: Brandon Lovingier On Building Wealth From The Ground Up.Do You Have ANY Of Your Money 💰 From Your Military Service Left?

On This Episode Of The Vertical Momentum Resiliency Podcast With Host Richard Kaufman Veteran-Keynote speaker-Comeback Coach We Sit Down With Brandon Lovingier.

To Listen/Watch Click Here-https://linktr.ee/VerticalMomentum?utm_source=linktree_admin_share

My Hot 🥵 Take…

🎙️ Dive into the world of financial wisdom with Brandon Lovingier, aka The Enlisted Money Guy! In our latest podcast episode, "Maximizing Military Pay: Financial Freedom Tips," Brandon shares invaluable insights on managing money smartly in the military. 🚀💵

🔗 From battling debt to building wealth, he unpacks strategies that turned his financial life around and can do...

2024-05-091h 10

Advised | with Rick LuchiniTaking Control Of Your Financial Journey | with Brandon LovingierToday is an important discussion around mindset for any stage of your financial journey. Listen as we discuss finding balance between saving and living, and defining success on your own terms. Enjoy!

My guest, Brandon Lovingier, ChFC®, MQFP® aka The Enlisted Money Guy™, has served over 18 years in the Army – including deployments to Iraq and Afghanistan. He established Enlisted Money to help enlisted service members avoid the same mistakes he made and achieve financial freedom. He’s spoken at MilMoneyCon and loves mentoring other service members.

www.enlistedmoney.com

2024-03-2636 min

Advised | with Rick LuchiniTaking Control Of Your Financial Journey | with Brandon LovingierToday is an important discussion around mindset for any stage of your financial journey. Listen as we discuss finding balance between saving and living, and defining success on your own terms. Enjoy!

My guest, Brandon Lovingier, ChFC®, MQFP® aka The Enlisted Money Guy™, has served over 18 years in the Army – including deployments to Iraq and Afghanistan. He established Enlisted Money to help enlisted service members avoid the same mistakes he made and achieve financial freedom. He’s spoken at MilMoneyCon and loves mentoring other service members.

www.enlistedmoney.com

2024-03-2636 min

Start100K35 - What is Enough?How do you define enough I know for me this is kind of a difficult question and it's something that I wanna get into a little bit deeper this month with some of my other writing and I just think about this in terms of so many things um you know I mean is this money is it time is it lifestyle is it freedom and you know for me I think there's a little components of all of that I think that whenever it comes down to you know enough or we'll call it enoughness then you know...

2024-02-0108 min

Start100K34 - Money Day 2024 Was a Success!Read my article on Enlisted Money If you’re a money nerd like me, you’ll love creating your own little “holiday” for it – Money Day! I originally got this concept from J.D. Roth’s blog, Get Rich Slowly. Our annual Money Day has evolved over the years, but it’s a great forcing function to keep us on track financially. This also serves as an excuse for me to nerd out and annoy my lovely wife with money talk for a day. To be clear, she plays a huge role in Money Day and our financ...

2024-01-1305 min

Start100K33 - Hunting for a New High-Yield Savings Account HYSAIt has been years, actually, over a decade since we changed banks for our high-yield savings account (HYSA). But this is the year, I had a bad experience. I’m actually kind of embarrassed about it, but more on that later. Long story short, we were not being valued as loyal customers and I refuse to stay with a bank that treats me unfairly. Housekeeping note: I have no affiliate or partnership relationships with any of the banks mentioned. This is just my own experience and opinion. There are no referral or affiliate links in th...

2024-01-1207 min 2024-01-0703 min

2024-01-0703 min

MILMO ShowDeciding to Use the DCFSA, Dependent Care Credit, and Divorced ParentsEnrollment for the new Dependent Care Flex Spending Account is now open until December 11th, 2023. According to the Office of Financial Readiness, the DCFSA is a pre-tax account used to pay for eligible dependent care services such as child or adult day care. If you have kids, you know childcare costs can break a family's budget and determine a military spouse's ability to work or go to school. Using the DCFSA to save for your childcare expenses can help, but how do you know it's right for you and how much money to save? In this episode, B...

2023-11-2740 min

The Veteran Finance PodcastTSP and Aligning Your Money with Your Values with Brandon Lovingier the Enlisted Money Guy l E19In this episode, I talk with Brandon Lovingier, the Enlisted Money Guy about investing in the TSP, military retirement, and aligning your money with your values.

Time Stamps:

00:00-01:35 Intro to Brandon

01:35-10:58 Investing in the TSP with and Without a Pension

10:58-12:32 Calculating Your “FI” Number

12:32-20:16 Protecting Loss of Life or Income with Insurance

20:16-28:38 How to think about the right amount of Risk for YOU

28:38-38:32 Matching your Money to What You Actually Want in Life

38:32-41:51 Conclusion

Resources:

Blog Post on Military Retirement

Start 100K

Your Virtual Paraplan...

2023-10-3141 min

Spare Change PodcastEpisode 50: Enlisted Money Guy with Brandon LovingierRecorded October 1st, 2023.

I discuss with Brandon Lovingier ( ) his journey in the military and personal finance communities, resources he’s developed, and the importance of financial literacy.

Social Media:

https://instagram.com/Spare_Change_Po...

https://www.facebook.com/profile.php?...

http://www.tiktok.com/@spare_change_p...

https://instagram.com/enlistedmoneyguy?igshid=MzRlODBiNWFlZA==

Links:

https://www.sparechangepodcast.org

https://linktr.ee/Spare_Change_Podcast

https://enlistedmoney.com/

https://enlistedmoney.com/emergency-fund/

Email:

dawson@sparechangepodcast.org

hello@enlistedmoney.com

#enlistedmoney #milmoneycon #militarypay #sparechangepodcast #personalfinance

---

Support this podcast: https://podcasters.spotify.com/pod/show/spare-change-podcast/support

2023-10-0324 min

The Military Money Manual PodcastThe Enlisted Money Guy, Brandon Lovingier - Money Mistakes, Combatting Overspending, What Officers Should Know About Enlisted Money #96In this episode, Jamie is joined by The Enlisted Money Guy, Brandon Lovingier from EnlistedMoney.com to discuss the financial differences between enlisted service members and officers, combatting the desire to spend, and what resources are available to enlisted servicemembers. The Enlisted Money Guy on instagram: @enlistedmoneyguy Shownotes can be found at militarymoneymanual.com/ep96 If you have a question you would like us to answer on the podcast, please reach out on instagram.com/militarymoneymanual or email podcast@militarymoneymanual.com. If you want to maximize your military paycheck, check out S...

2023-10-0233 min

The Veteran Finance PodcastBuilding Enlisted Money with Brandon Lovingier l E7In this episode, I discuss with Brandon how he got started in the military finance space with Start 100K, Your Virtual Paraplanner, and Enlisted Money and what he is working on to deliver financial planning to enlisted military members.

Time Stamps:

00:00-2:18 Intro to Brandon

2:18-6:15 How Brandon Got Started into the military finance space

6:15-17:00 Enlisted Money and the future of military financial advice

17:00-21:01 How the enlisted mindset is different from officers

21:01-24:23 Aligning your Money with your Values

24:23-30:59 Closing and Action Items

Resources Mentioned:

Start 100K

Your Virtual Para...

2023-07-1930 min

Start100KEpisode 31 - The Value of Military Pay and PensionsEpisode 31 - The Value of Military Pay and Pensions As a service member getting closer and closer to retirement myself, I like to look at and think about how to value my military pension. I recently received my last promotion I plan to get before I retire, so I’m getting a lot more serious about how this fits into our overall plan for financial security and independence. Erik has posted a few different articles that I thought were interesting and he’s also created some nifty spreadsheets (who doesn’t love a good spreadsheet?) that I...

2023-01-1438 min

Start100KEpisode 30 - Let’s Talk Crack Money with Zac SpainhourCrack money??? Listen in as Zac Spainhour and Brandon talk about what “crack money” is and what to do about it. Hear about ideas to keep your crack money in check while still living life. Simplicity and ease of use are definitely keys to keeping your finances on track and under control. To learn more about Zac Spainhour, please follow him on LinkedIn and check out his YouTube channel! https://www.linkedin.com/in/zspainhour/ https://www.youtube.com/channel/UCuKkqIDPeq1asGzFvZq5iiA Links refenced: https://www.cnbc.com/2019/10/01/thos...

2022-12-1428 min

Start100KEpisode 29 - Financial Wisdom of a Six-Year-OldMy son, Owen asked to record a podcast episode with me, so here you go. Enjoy!

2022-11-1805 min

Start100KEpisode 28 - Be a FI Leader - Interview with Doug Nordman - MilMoneyCon 2022Doug Nordman has been a really positive influence and great mentor for me. He was gracious enough to share some of his thoughts about how junior leaders in the military can take care of those they lead financially. For more from Doug, please visit his website, find him on Facebook, or send him an email at nordsnords@gmail.com. https://militaryfinancialindependence.com/ Be sure to pick up a copy of his books too! https://militaryfinancialindependence.com/about/books/ https://militaryfinancialindependence.com/about/book-money-savvy-family/ Please share this show with...

2022-10-0418 min

Start100KEpisode 27 - Grab Your Slice of Financial Independence with Monica Scudieri - MilMoneyCon InterviewCheck out the interview with Monica Scudieri! We discuss her new book: Grab Your Slice of Financial Independence. Monica’s story is really inspiring to really anyone, but especially if you’re working through struggles on your journey to become financially secure and independent. Check out her website and where you can pick up a copy at : https://www.grabyourslice.com/ Please share this show with someone you know. You can also pick your favorite episode and share it on social media. I’d love to hear from you, shoot me a note at...

2022-09-0821 min

Start100KEpisode 26 - Google Forms Budgeting ExperimentBudgeting isn’t particularly fun. We’ve recently started using a simple, homemade Google form to augment our envelopes and automation that we normally use. So far, we’ve had great success with it! Full article: https://start100k.com/google-forms-budgeting/ Even if you try and change the name to spending plan or whatever, its still a budget. It’s not fun. So I attempted to make it as simple as possible to track spending as we go. Please share this show with someone you know. You can also pick your favorite episode and share...

2022-08-1809 min

Start100KEpisode 25 - Flying Too Close to the SunWhen you have a lot of goals in life, but only so much time and resources, you can suffer from burnout. I have a continual battle with this in my life. I'm working on it. I hope this is helpful. Regardless, please share your thoughts and feedback with me. Shoot me a note at podcast@start100k.com

2022-06-0910 min

Start100KEpisode 24 - Removing Labels To Evaluate OpportunitiesIt gets really hard to evaluate things objectively sometimes. This is true for investments, large purchases, and even career opportunities. I want to talk a little today about how I like to think about things in a way that lets me separate my emotions temporarily in order to evaluate things more objectively. Here’s the “trick” if you want to call it that. Remove the names and labels of whatever you’re talking about. For example, if we were going to talk about investing in real estate, stocks, or treasury bonds, we could simply call...

2022-04-1806 min

Start100KEpisode 23 - Stop Comparing Yourself to OthersI believe that it is impossible to feel better about yourself by comparing yourself to other people. What does feel good? Comparing yourself to who you used to be. I talk about my personal mission statement of perpetual improvement in Episode 10. I work hard to improve every person, project, or organization I’m involved with. This includes myself. If I look back in time, I should be able to see that I’ve improved immensely over time. When I look back 5 or 10 years, I hardly recognize the person I was then. My per...

2022-04-0412 min

Start100KEpisode 22 - Extended Vehicle Warranty TipHave you ever purchased an extended vehicle warranty? Have you later decided you didn't want that warranty anymore? If so, take a listen to this short tip on how you might be able to get some of your money back!

2022-03-2804 min

Start100KEpisode 21 - Monetary Benefits of Military ServiceHear about monetary benefits of military service including how to get paid to go to college and evaluating what kind of a pay cut you might get when exiting military service. To ask a question, email podcast@start100k.com and I’ll be happy to address your questions in a future episode. To contact David, please email: david@ dreamfinancialcoaching.com/ Now go get started! Links: https://mycaa.militaryonesource.mil/mycaa/get-started https://skillbridge.osd.mil/ https...

2022-03-2125 min

Start100KEpisode 20 – Is Getting a Tax Refund a Good Thing?Is getting a tax refund a good thing? I used to think so, but now I feel a little bit differently. Here’s how I try to imagine the process of how we pay taxes in the US. Basically, we have what I like to think of as an imaginary cookie jar that you are filling up as the year goes on. You know that you have to give Uncle Sam a few of the cookies you made over the course of the year, but you’re not exactly sure how many he needs...

2022-03-1406 min

Start100KEpisode 19 – Is It Always Best to Do It Yourself?Doing it yourself, or DIY, is a common way for people to save money, but is it always the best choice? Let's talk about some wins and fails when it comes to DIY and some rules around how to decide when you should and should not do it yourself. To contact me, please email podcast@start100k.com. Now go get started!

2022-03-0717 min

Start100KEpisode 18 - How To Save Money On Groceries Food is one place we actually spend more on, but we are still pretty frugal. Here’s what I mean. We prioritize health and performance. We buy high quality meats and vegetables. We also use a lot of spices, so that adds a bit to the budget as well. To take advantage of all these tips, you might need to work on your cooking skills a bit. However, that's a very worthwhile goal! Here’s how we save on groceries: Keep an Eye Out For Free Food...

2022-02-2811 min

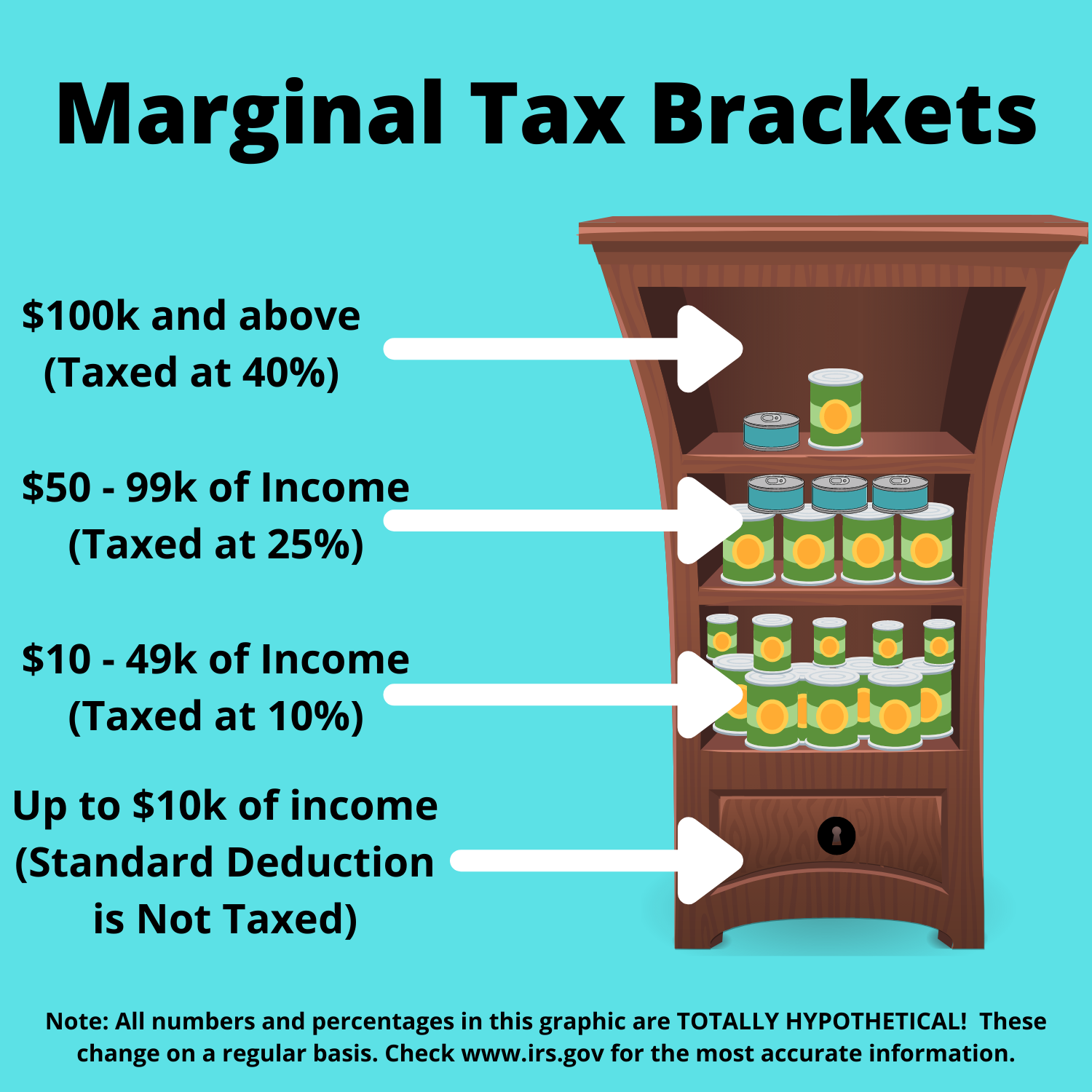

Start100KEpisode 17 – How Income Tax Brackets WorkEpisode 17 – How Income Tax Brackets Work Have you ever wondered how the U.S. federal income tax brackets work? You might be surprised at what you didn’t know. Today, I’ll explain how income tax brackets work and why that’s important to understand as you unlock your earning potential. Action Items: Take a look at the IRS website and check out the current income tax brackets. Accept that income taxes are part of life and don’t let the idea of paying more in taxes keep you from making more money. Share and subscrib...

2022-02-2110 min

Start100KEpisode 16 - Budget Is Not A Bad WordCreating a budget for the first time can be so intimidating, but it doesn’t have to be! Whether you know a little or a lot about personal finances, having a budget is vital. No matter what, you need to make a plan that works for you and others that you share a budget with. If you don’t have anything else to start with, you can use a simple budget template in Excel or Google Sheets and get started. We’ve got budget templates that you can download for free here. We won’t ask for your ema...

2022-02-1413 min 2022-02-0713 min

2022-02-0713 min

Start100KEpisode 14 – The Cost of Earning More versus SavingWhich is more important? Earning or saving more money? I’ll talk about the facts around both and how to strike a balance between the two schools of thought. Spoiler alert! They’re both important! Full article: https://start100k.com/the-cost-of-earning-more-versus-saving/ Action Items: Check to see what your top marginal tax bracket is for your federal and state income. If you don’t understand how the marginal tax brackets work, don’t worry, I didn’t either. I’ll cover this in another episode. Take the Klontz Money Script Inventory to fin...

2022-01-3111 min

Start100KEpisode 13 – The Importance of Having an Emergency FundFull Article: https://start100k.com/?p=93 Imagine this, you’re working to get your finances on track, paying down debt, and your car breaks down or you have an emergency room visit and have to pay a deductible. If you have an emergency fund, you pay for it with your cash and then build it back up and move on. If you didn’t have the emergency fund, you would now likely have to borrow that money which would further compound your problems. I know for us, having the cash on hand for these things...

2022-01-2407 min

Start100KEpisode 12 – Book Review for The Total Money Makeover by Dave RamseyI’m reviewing The Total Money Makeover by Dave Ramsey. This book was introduced to me by JD Roth’s blog Get Rich Slowly. This is the book that started our journey to becoming debt free and put us on the path to financial independence. My wife and I read The Total Money Makeover chapter by chapter and discussed everything as we went along. I enjoyed reading it together and then talking about what things we would and would not do. Our journey to becoming debt free was a great accomplishment and really brought us closer to...

2022-01-1711 min

Start100KEpisode 11 – FU Money for Military Don't Stay Only for the MoneyI’m Chatting with my good friend David about the importance of building up FU money quickly and how this can help members of the military make the best decision for them based on just on money, but what will make them happy. I step-sold myself into staying longer and longer in the military and if I had the finances built up in my first enlistments, I might have taken a different path. Take it from me, if you’re not enjoying it, it’s time to look for an exit. I hope this discussion will be helpful t...

2022-01-1021 min

Start100KEpisode 10 - Perpetual Improvement for the New Year and New IntroCan you save an extra dollar a day? We’re now in the time of year where New Year’s resolutions are made. Big lofty goals are hanging in the air, but most will not stick. It’s not because the goals are wrong or too big. It’s because we forget about the power of the process. If you want to lose weight, start with 5 minutes a day of working out and never skip. Make a new rule that you won’t park at the front of the parking lot. Take the stairs exclusively. If you want to save more money, f...

2022-01-0306 min

Start100KEpisode 9 - Money Day Annual ReviewThis week, I’m going to talk about how to start planning out our annual review which I call Money Day. I got this concept from the Get Rich Slowly Blog. In short, it’s a day to set aside and take care of financial stuff. Ours has evolved over the years, but we’ve been doing this for the past 10 years. I’ll link to the article in the show notes. I highly recommend checking it out because it does contain some great ideas which I won’t be covering here. Aside from Christmas and Halloween, Money Day is my...

2021-12-2707 min

Start100KEpisode 8 - Setting Financial Goals and CheckpointsLinks: Investment Calculator: https://www.calculator.net/investment-calculator.html 4% Rule Resources: https://www.kitces.com/blog/bill-bengen-4-percent-rule-safe-withdrawal-rates-historical-returns-research-book/ https://www.kitces.com/blog/shiller-cape-market-valuation-terrible-for-market-timing-but-valuable-for-long-term-retirement-planning/ This week, I’m going to talk about how to start planning out your financial future and start making some goals toward your first $100K as well as checkpoints well beyond that. First though, I need to announce the winners from last week’s contest. Congratulations to Drew in Missouri and Dom in California! I’ll be getting their books sen...

2021-12-2114 min

Start100KEpisode 7 - Holiday Giveaway 2021Holiday Giveaway 2021! Email me with a money question to enter to win a copy of I Will Teach You To Be Rich by Ramit Sethi or The Total Money Makeover by Dave Ramsey. If you already have those, you can tell me who you would like me to gift it to and I’ll send it their way instead! Check out our Facebook group for a template net worth tracker and more. To contact me, please email podcast@start100k.com. Now go get started!

2021-12-1302 min

Start100KEpisode 6 - Why Start With $100,000? Plus How and What to TrackWhat’s so special about the first $100,000? How do I calculate my net worth? What do I include in my net worth? I’ll discuss these questions and present and example to show how powerful getting started really is. I’ll discuss the pinnacle point and what’s so cool about compounding growth. Check out our Facebook group for a template net worth tracker and more. To contact me, please email podcast@start100k.com. Now go get started!

2021-12-0610 min

Start100KEpisode 5 - Pros and Cons of Financial Security and IndependenceIn this episode I’ll discuss the pros and cons of pursuing financial security and independence. I created 4 categories to help me organize my thoughts on this: Positive Tangible Benefits, Negative Tangible Effects, Negative Non-Tangible Effects, and Positive Non-Tangible Benefits I’ll also discuss part of why I’m pursuing financial security and independence. Be sure to subscribe and join our Facebook group as well! References High income improves evaluation of life but not emotional well-being - Daniel Kahneman and Angus Deaton https://www.pnas.org/content/107/38/16489

2021-11-3010 min

Start100KEpisode 4 - Vehicle Fund ExplanationBuying and selling cars can be a real hassle, create stress, and be relatively unpredictable. In this episode I'll talk about how I take unpredictable vehicle expenses and turn them into a predictable monthly payment (to yourself!) that I call my vehicle fund. This takes what you would have been making in car payments and turns it into a savings account you can turn to when you need to pay for unexpected repairs or when you need to replace a vehicle. We've been using this method for a little over 7 years and have bought 5 vehicles r...

2021-11-2205 min

Start100KEpisode 3 - Forgive Your Money MistakesIn this episode I talk about the importance of letting go of money mistakes. There can be a lot of guilt and shame around past mistakes, but that only serves to keep us trapped somewhere we don't want to be. In order to move forward, we have to cut free from the things that are holding us back.

2021-11-1505 min

Start100KEpisode 2 - Car Buying and Selling - My Rules to Live ByVehicle purchase decisions are often the largest financial decision that many people make. As your net worth grows, these have a smaller impact on your financial well-being. However, they can have a crippling effect on your ability to grow wealth if you aren’t careful. For example, if my net worth is $100k and my car is worth $20k, that can drag my net worth down considerably if it depreciates by 20%. That would have a 4% reduction in my total net worth. If my net worth was $500k, that effect is minimized to 0.8% reduction in net worth. To keep myself on track...

2021-11-1211 min 2021-06-2039 min

2021-06-2039 min