Shows

Infographic Instant with Bryane MichaelPng inflationExplains inflation in png2024-07-1204 min

Infographic Instant with Bryane MichaelPng inflationExplains inflation in png2024-07-1204 min Infographic Instant with Bryane MichaelGeneration Z has little say in the financial infrastructure that will govern future generationsWe are building the new internet on the bones of the old. Like the early attempts to build airplanes using flappable wings. We take our grandfathers' understanding of law and economics - and try to apply it to Web3.

In this podcast, I describe how a new set of laws and conventions could help us break out of the 'lock in' which keeps us using New Tech (blockchains, lithium-ion, artificial intelligence, tokens) like the wood and paper of old tech.

I give examples of how FinTech could change the way we live. And how 70-80 year old men simple add-on...2023-12-291h 15

Infographic Instant with Bryane MichaelGeneration Z has little say in the financial infrastructure that will govern future generationsWe are building the new internet on the bones of the old. Like the early attempts to build airplanes using flappable wings. We take our grandfathers' understanding of law and economics - and try to apply it to Web3.

In this podcast, I describe how a new set of laws and conventions could help us break out of the 'lock in' which keeps us using New Tech (blockchains, lithium-ion, artificial intelligence, tokens) like the wood and paper of old tech.

I give examples of how FinTech could change the way we live. And how 70-80 year old men simple add-on...2023-12-291h 15 Regulatory RamblingsGeneration Z has little say in the financial infrastructure that will govern future generationsAt the heart of Dr. Bryane Michael’s conversation with Regulatory Ramblings host Ajay Shamdasani is whether FinTech can help solve the social, financial, and economic problems previous generations like the Baby Boomers contributed to. They discuss whether Gen-Z's potentially decentralized world of finance will look radically different from ours. Gen-Zers and now Gen Alpha will grow up in a world designed and run almost exclusively by baby boomers. The DBS power outage was supposedly partly caused by a 'missing generation' unable to take charge during the crisis. Why have huge, octogenarian, organizational men-created lumbering bureaucracies that Fin...2023-12-201h 15

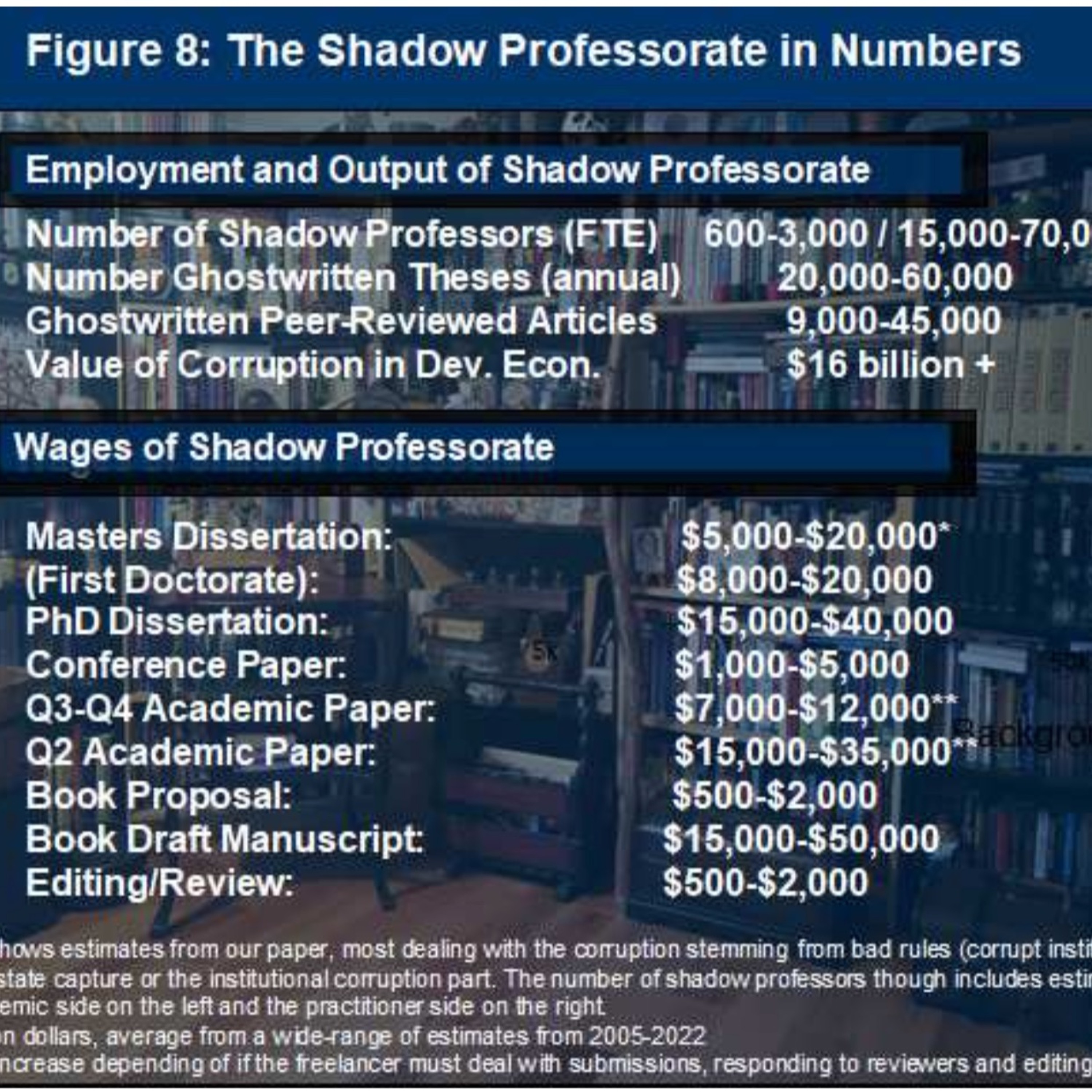

Regulatory RamblingsGeneration Z has little say in the financial infrastructure that will govern future generationsAt the heart of Dr. Bryane Michael’s conversation with Regulatory Ramblings host Ajay Shamdasani is whether FinTech can help solve the social, financial, and economic problems previous generations like the Baby Boomers contributed to. They discuss whether Gen-Z's potentially decentralized world of finance will look radically different from ours. Gen-Zers and now Gen Alpha will grow up in a world designed and run almost exclusively by baby boomers. The DBS power outage was supposedly partly caused by a 'missing generation' unable to take charge during the crisis. Why have huge, octogenarian, organizational men-created lumbering bureaucracies that Fin...2023-12-201h 15 Infographic Instant with Bryane MichaelThe Corrupt Institutions of Development Economics and Its Shadow ProfessoriateMost of us use theories and empirical results from development economics all day long at the office. What if much of it led to under-development because of a shadowy group of advocates (or those who profess) benefit from bad theory and practice? I describe this Shadow Professoriate, the rules that keep it going strong, and their wages. I provide ball-park estimates of the harm they cause and how they cause this harm. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=41880182022-08-1726 min

Infographic Instant with Bryane MichaelThe Corrupt Institutions of Development Economics and Its Shadow ProfessoriateMost of us use theories and empirical results from development economics all day long at the office. What if much of it led to under-development because of a shadowy group of advocates (or those who profess) benefit from bad theory and practice? I describe this Shadow Professoriate, the rules that keep it going strong, and their wages. I provide ball-park estimates of the harm they cause and how they cause this harm. https://papers.ssrn.com/sol3/papers.cfm?abstract_id=41880182022-08-1726 min Infographic Instant with Bryane MichaelHow To Find An Arbitrator For Your Cross-Border DisputeAfraid to arbitrate a dispute because you don't want to spend thousands of dollars on lawyers? You don't need to. In this clip, I tell you everything you need to know about finding and hiring an arbitrator like me, the arbitration process and what you can expect to get out of it.2022-04-2011 min

Infographic Instant with Bryane MichaelHow To Find An Arbitrator For Your Cross-Border DisputeAfraid to arbitrate a dispute because you don't want to spend thousands of dollars on lawyers? You don't need to. In this clip, I tell you everything you need to know about finding and hiring an arbitrator like me, the arbitration process and what you can expect to get out of it.2022-04-2011 min Infographic Instant with Bryane MichaelWhy Do Economists Use Models?Why Do Economists Use Models? by Bryane Michael2022-04-1519 min

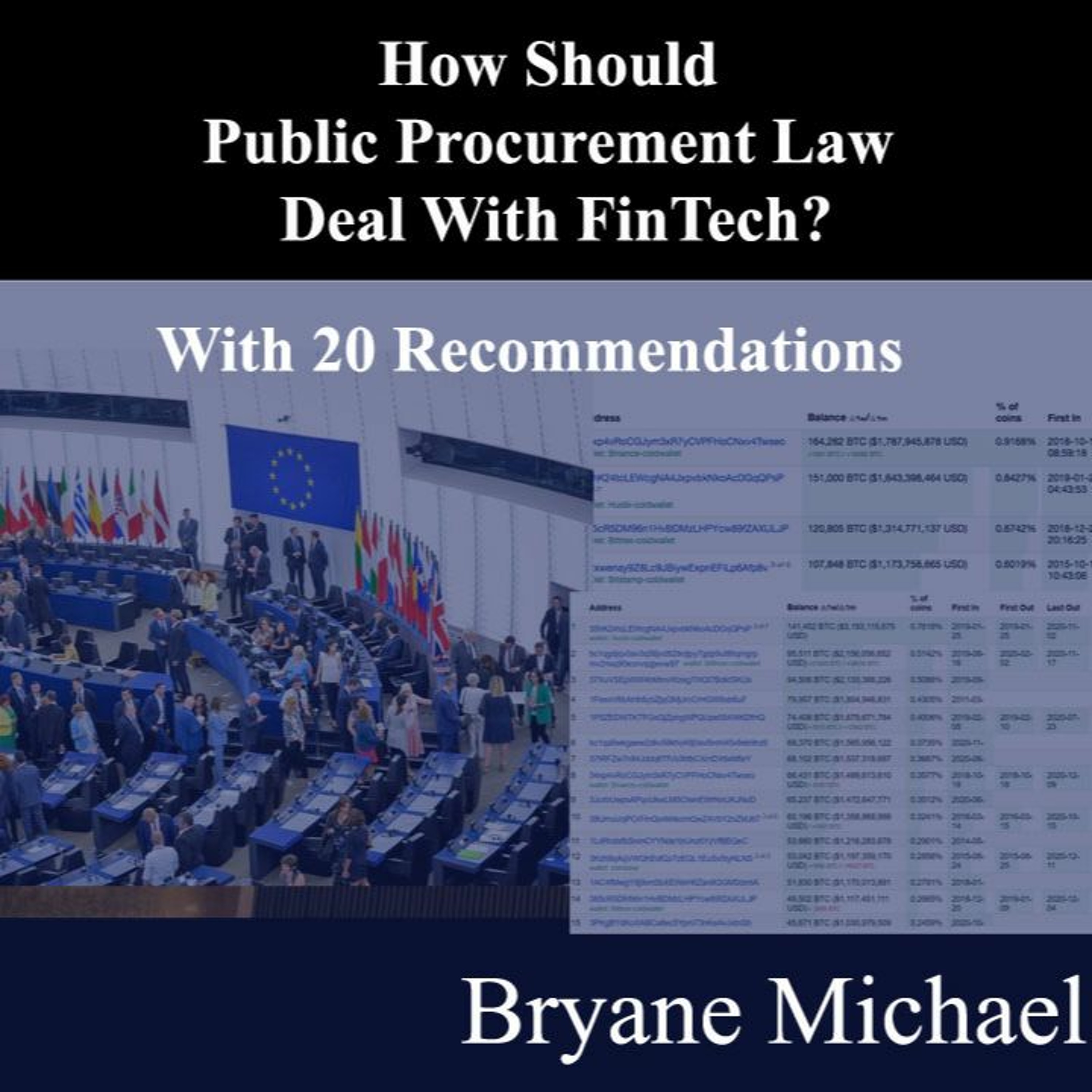

Infographic Instant with Bryane MichaelWhy Do Economists Use Models?Why Do Economists Use Models? by Bryane Michael2022-04-1519 min Infographic Instant with Bryane MichaelHow Can Public Procurement Law Affect FinTech?Governments are trying to procure innovative FinTech sectors. Yet, no one yet knows what such FinTech should look like. In our paper, we look at how to amend existing procurement law domestically and internationally. For the paper: http://ssrn.com/abstract=3976018.2021-12-0225 min

Infographic Instant with Bryane MichaelHow Can Public Procurement Law Affect FinTech?Governments are trying to procure innovative FinTech sectors. Yet, no one yet knows what such FinTech should look like. In our paper, we look at how to amend existing procurement law domestically and internationally. For the paper: http://ssrn.com/abstract=3976018.2021-12-0225 min Legacy BattleBryane Heaberlin U.S. Soccer Star joins Legacy Battle episode #17: Greatest Male and Female Soccer PlayerBryane Heaberlin Goal Keeper for Eintracht Frankfurt, and U.S. World Cup Winner joins the Legacy Battle debate of the Greatest Male and Female Soccer Player. We do not own the rights to the music and video clips used in this podcast. “Copyright Disclaimer, Under Section 107 of the Copyright Act 1976, allowance made for ‘fair use’ for purposes such as criticism, comment, news reporting, teaching, scholarship, and research. Fair use is a use permitted by copyright statue that might otherwise be infringing. Non-profit, educational, or personal use tips the balance in favor of fair use."2021-03-231h 18

Legacy BattleBryane Heaberlin U.S. Soccer Star joins Legacy Battle episode #17: Greatest Male and Female Soccer PlayerBryane Heaberlin Goal Keeper for Eintracht Frankfurt, and U.S. World Cup Winner joins the Legacy Battle debate of the Greatest Male and Female Soccer Player. We do not own the rights to the music and video clips used in this podcast. “Copyright Disclaimer, Under Section 107 of the Copyright Act 1976, allowance made for ‘fair use’ for purposes such as criticism, comment, news reporting, teaching, scholarship, and research. Fair use is a use permitted by copyright statue that might otherwise be infringing. Non-profit, educational, or personal use tips the balance in favor of fair use."2021-03-231h 18 Infographic Instant with Bryane MichaelWanda Case Study: What Should Chairman Wang Do?Wanda Dalian Chairman Jian-Lin WANG had a decision to make. Should he, and Wanda by implication, compete with Disney aggressively, or do something else? What should the company's grand strategy be? And what is the role of the People's Republic's government in all this?

This teaching video should help you with the issues behind the case study. Listen to the case study here -- and read it on the link below. Look at the YouTube video for pointers from the Teaching Note. And prepare to think about the major issues involved in the case. For advanced MBA and management students...2019-03-0132 min

Infographic Instant with Bryane MichaelWanda Case Study: What Should Chairman Wang Do?Wanda Dalian Chairman Jian-Lin WANG had a decision to make. Should he, and Wanda by implication, compete with Disney aggressively, or do something else? What should the company's grand strategy be? And what is the role of the People's Republic's government in all this?

This teaching video should help you with the issues behind the case study. Listen to the case study here -- and read it on the link below. Look at the YouTube video for pointers from the Teaching Note. And prepare to think about the major issues involved in the case. For advanced MBA and management students...2019-03-0132 min Infographic Instant with Bryane MichaelWriting Anti-Corruption Regulations When Laws Don't WorkAnti-corruption laws are generally failing all over the world. Can regulation -- rather than legislation - hold the answer to more effectively fighting corruption? In this 'how to' episode, we describe 10 years of research on writing these rules. We argue that these rules teach us about the way administrative law is evolving - and how anti-corruption law forms its own area worthy of study.

For the papers we referenced, see:

1. Drafting International Regulations: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=995978

2. Designing a Preventive AC Agency: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1468957

3. Lessons from the OECD...2018-03-2909 min

Infographic Instant with Bryane MichaelWriting Anti-Corruption Regulations When Laws Don't WorkAnti-corruption laws are generally failing all over the world. Can regulation -- rather than legislation - hold the answer to more effectively fighting corruption? In this 'how to' episode, we describe 10 years of research on writing these rules. We argue that these rules teach us about the way administrative law is evolving - and how anti-corruption law forms its own area worthy of study.

For the papers we referenced, see:

1. Drafting International Regulations: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=995978

2. Designing a Preventive AC Agency: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=1468957

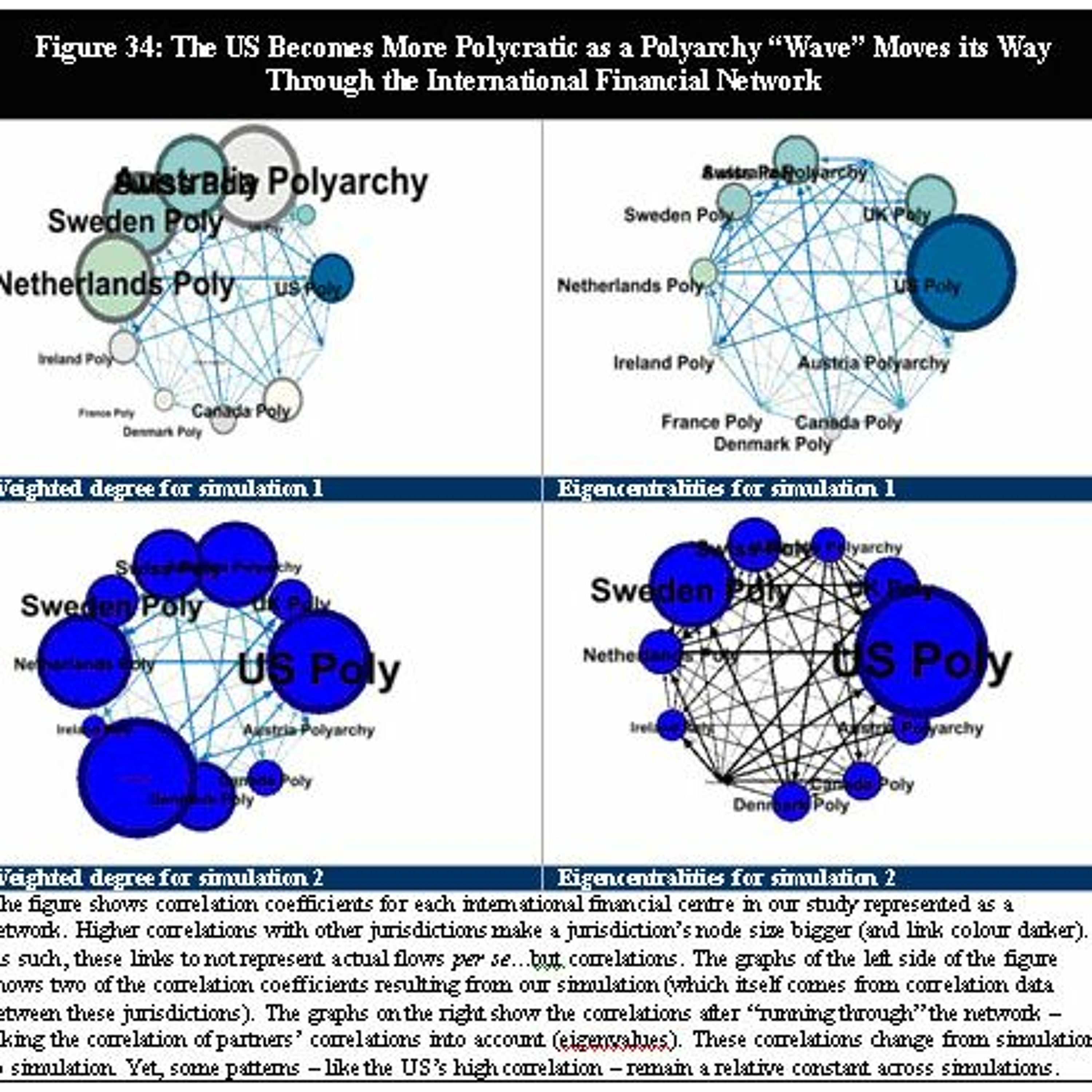

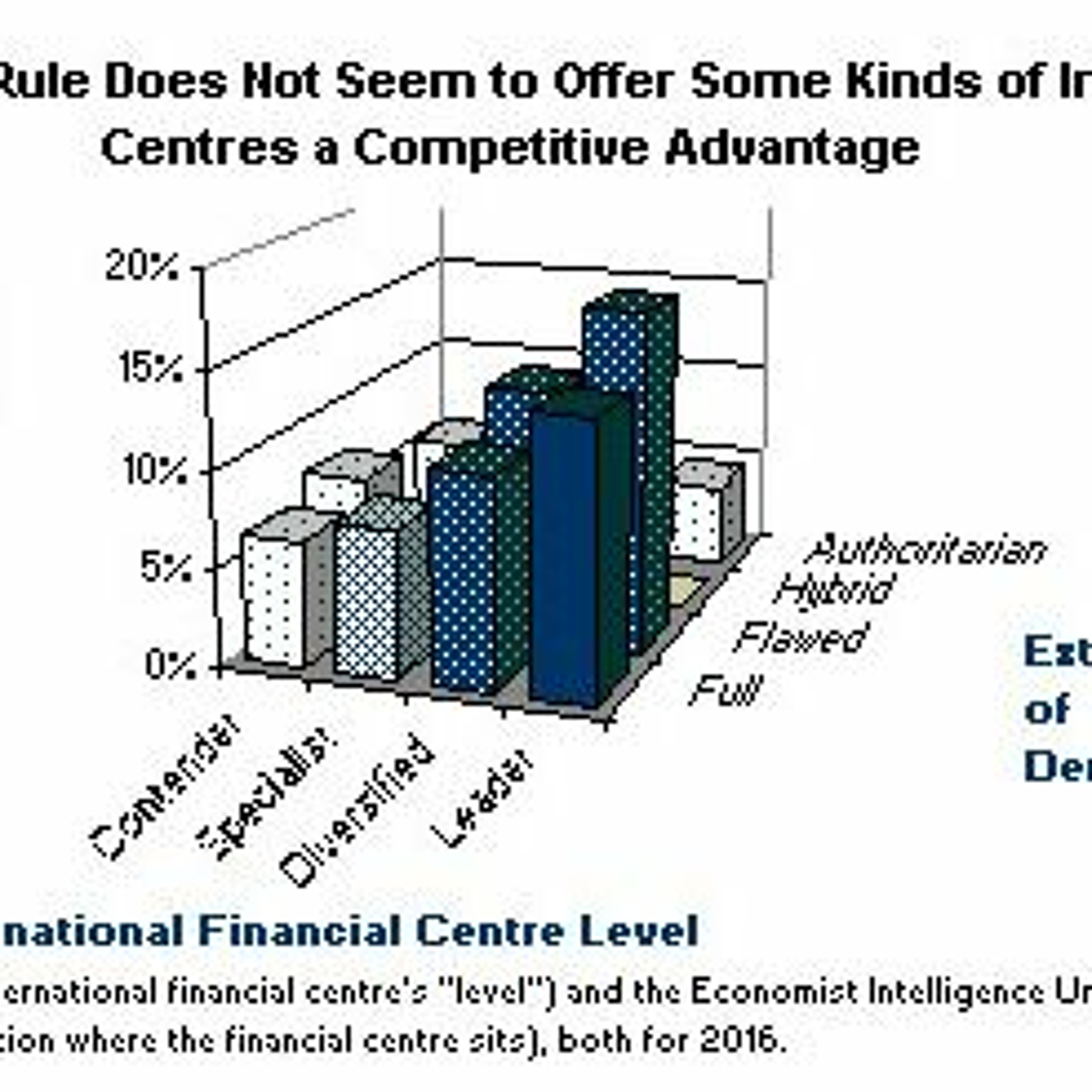

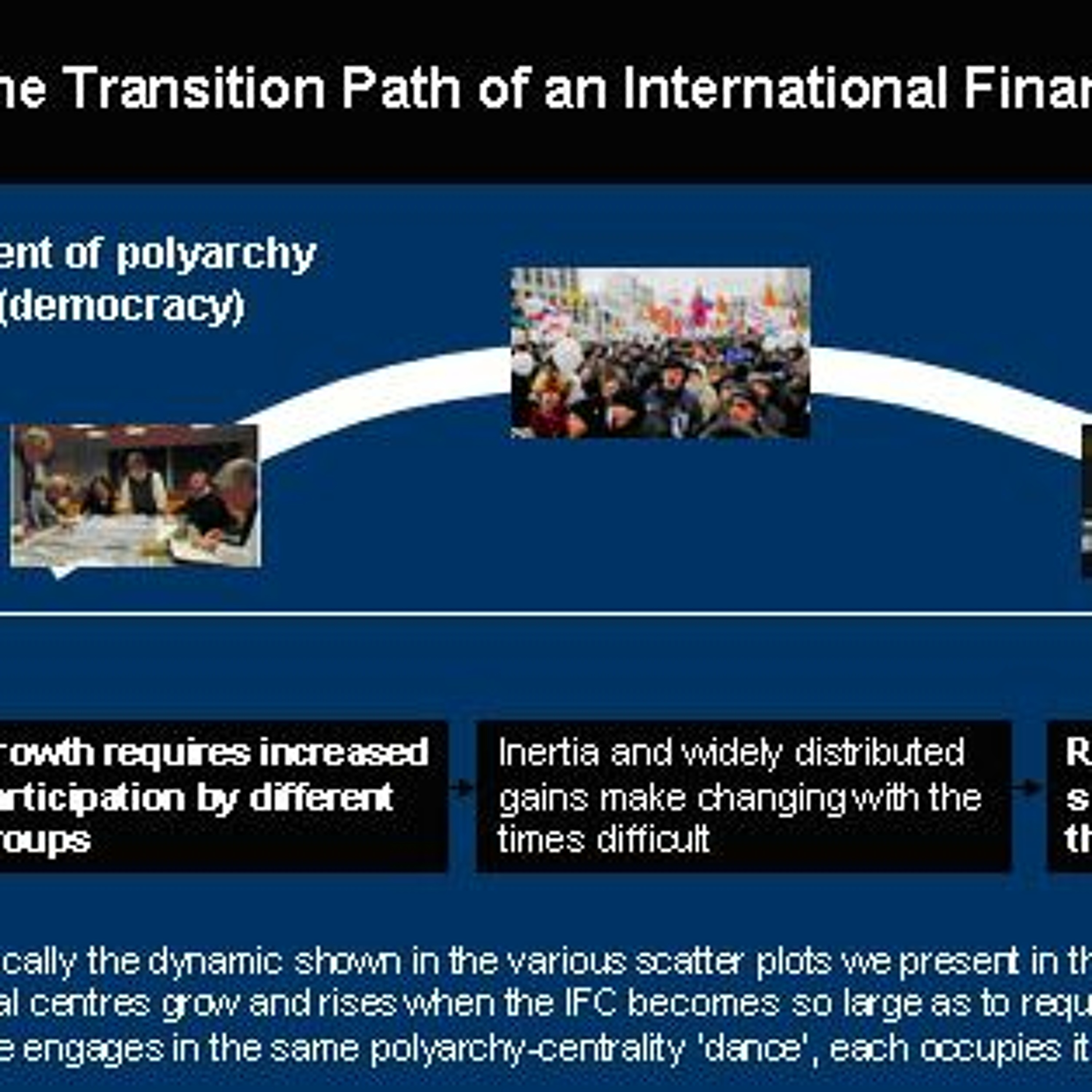

3. Lessons from the OECD...2018-03-2909 min Infographic Instant with Bryane MichaelThe Results about Polyarchy and Financial Centre SuccessWe find that financial centres balance democracy and autocracy, depending on trends in other international financial centres. Democracy can encourage financial innovation. Yet, autocracy can encourage 'focus' and cost-saving measures. The question is not whether an international financial centre benefits from becoming more democratic -- but whether it benefits by becoming more democratic RIGHT NOW.2018-03-2608 min

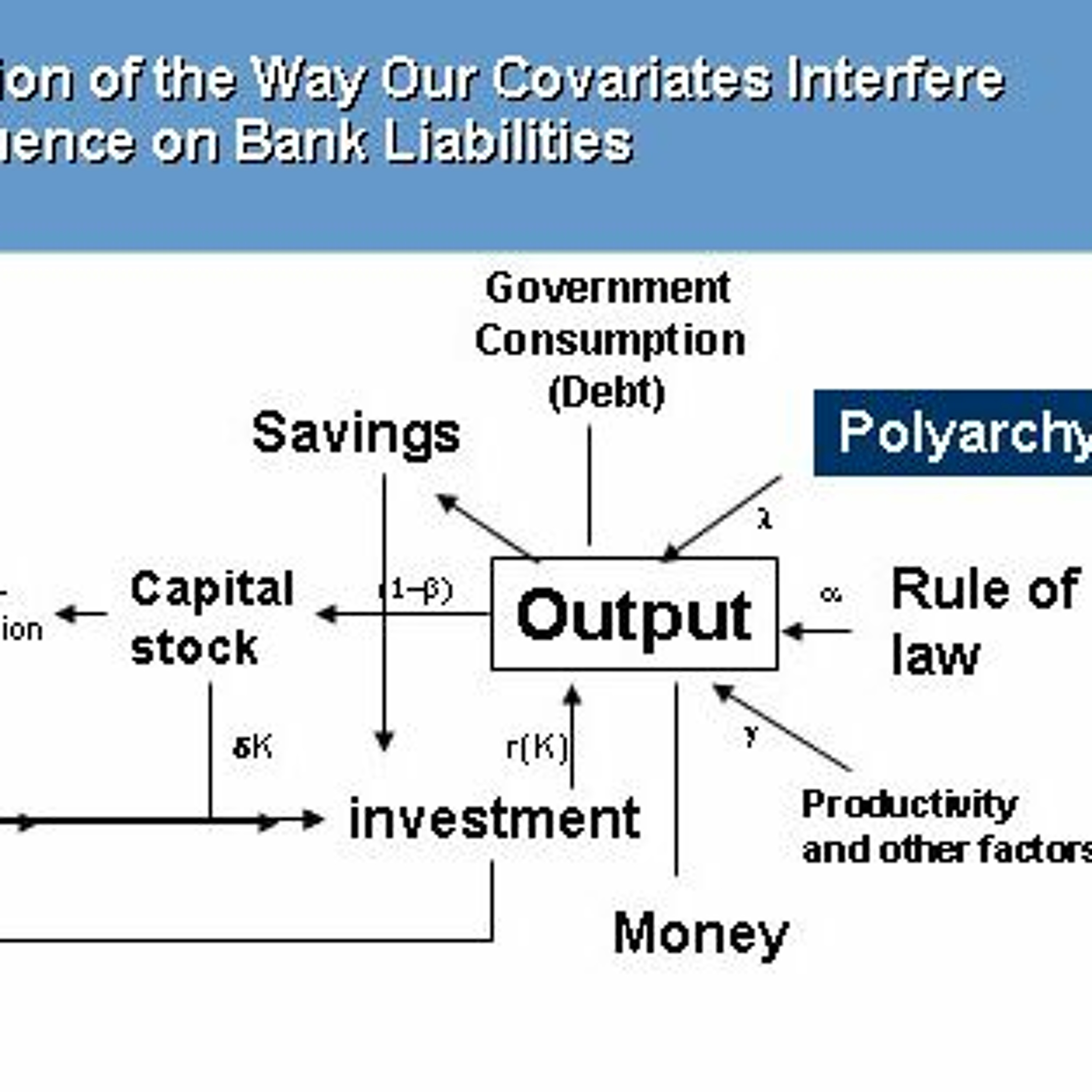

Infographic Instant with Bryane MichaelThe Results about Polyarchy and Financial Centre SuccessWe find that financial centres balance democracy and autocracy, depending on trends in other international financial centres. Democracy can encourage financial innovation. Yet, autocracy can encourage 'focus' and cost-saving measures. The question is not whether an international financial centre benefits from becoming more democratic -- but whether it benefits by becoming more democratic RIGHT NOW.2018-03-2608 min Infographic Instant with Bryane MichaelThe Model and Econometrics of Polyarchy and Financial CentresData do not speak for themselves. Only a model can help us make sense of the flood of data we see. Only econometric analysis helps us separate the signal from the noise. We review our model and the way we adjust global financial networks for distorting variables like the way economies shift over time.2018-03-2611 min

Infographic Instant with Bryane MichaelThe Model and Econometrics of Polyarchy and Financial CentresData do not speak for themselves. Only a model can help us make sense of the flood of data we see. Only econometric analysis helps us separate the signal from the noise. We review our model and the way we adjust global financial networks for distorting variables like the way economies shift over time.2018-03-2611 min Infographic Instant with Bryane MichaelWhat Data Say About Democracy and Financial SuccessGlancing at the data may show that democracy serves as the best incubator for financial centre success. We show the data - before applying the usual adjustments and controls which rigorous scientists would apply to make the data more reliable. We show how autocracy plays a greater role than one might think.2018-03-2608 min

Infographic Instant with Bryane MichaelWhat Data Say About Democracy and Financial SuccessGlancing at the data may show that democracy serves as the best incubator for financial centre success. We show the data - before applying the usual adjustments and controls which rigorous scientists would apply to make the data more reliable. We show how autocracy plays a greater role than one might think.2018-03-2608 min Infographic Instant with Bryane MichaelWhy Care about Democracy's Effect on International Financial Centres?Many people see democracy as bad for developing an international financial centre. Qatar. UAE. Moscow. Istanbul. Jersey. Malta. Shanghai... the list goes on. We describe why the question holds extra relevance now in the Brexit and Hong Kong full reversion to Mainland authority - and review our findings.2018-03-2603 min

Infographic Instant with Bryane MichaelWhy Care about Democracy's Effect on International Financial Centres?Many people see democracy as bad for developing an international financial centre. Qatar. UAE. Moscow. Istanbul. Jersey. Malta. Shanghai... the list goes on. We describe why the question holds extra relevance now in the Brexit and Hong Kong full reversion to Mainland authority - and review our findings.2018-03-2603 min Infographic Instant with Bryane MichaelDoes Democracy Help Grow an International Financial Centre?Does democracy or autocracy political institutions best allow policymakers to grow their international financial centres? In this presentation, we show how these centres must respond to each other. Democratic inclusion in one place depends on another place. So does its centrality in the global financial system. We describe the importance of this question, tell what the data say, describe our view of the world and the way we must fix our data and finally present our results. Our research has implications from Brexit to Hong Kong post-2047... and everything in-between.2018-03-1932 min

Infographic Instant with Bryane MichaelDoes Democracy Help Grow an International Financial Centre?Does democracy or autocracy political institutions best allow policymakers to grow their international financial centres? In this presentation, we show how these centres must respond to each other. Democratic inclusion in one place depends on another place. So does its centrality in the global financial system. We describe the importance of this question, tell what the data say, describe our view of the world and the way we must fix our data and finally present our results. Our research has implications from Brexit to Hong Kong post-2047... and everything in-between.2018-03-1932 min Infographic Instant with Bryane MichaelWhy Should Central Banks Buy Private Securities as Part of Monetary Policy?Central banks conduct monetary policy mostly through government securities markets (ie they buy and sell government bills, bonds, etc.) -- when not directly tampering with interest rates. Why should governments buy companies' securities directly - rather than support banks to do this? For more, see: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=30237952017-08-2205 min

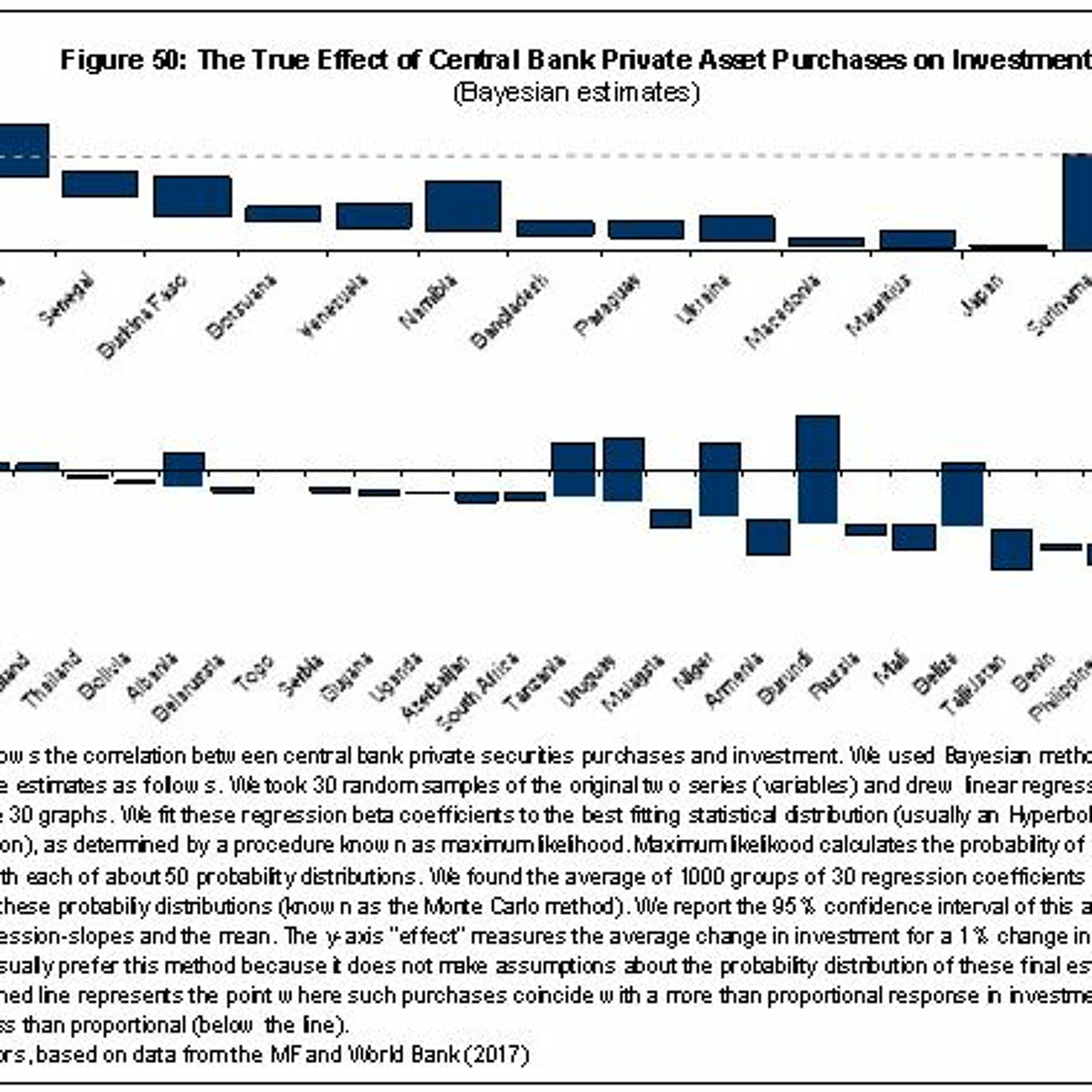

Infographic Instant with Bryane MichaelWhy Should Central Banks Buy Private Securities as Part of Monetary Policy?Central banks conduct monetary policy mostly through government securities markets (ie they buy and sell government bills, bonds, etc.) -- when not directly tampering with interest rates. Why should governments buy companies' securities directly - rather than support banks to do this? For more, see: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=30237952017-08-2205 min Infographic Instant with Bryane MichaelWhich Central Banks' Private Securities Purchases Would Most Goose Investment?Which central banks' private securities purchases would contribute the most toward real investment in their jurisdiction(s)? Such monetary policy helps most when conventional monetary policy has failed (or will likely fail because of liquidity traps) and the executive part of government sags in corruption and incompetence. For more, see: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=30237952017-08-2210 min

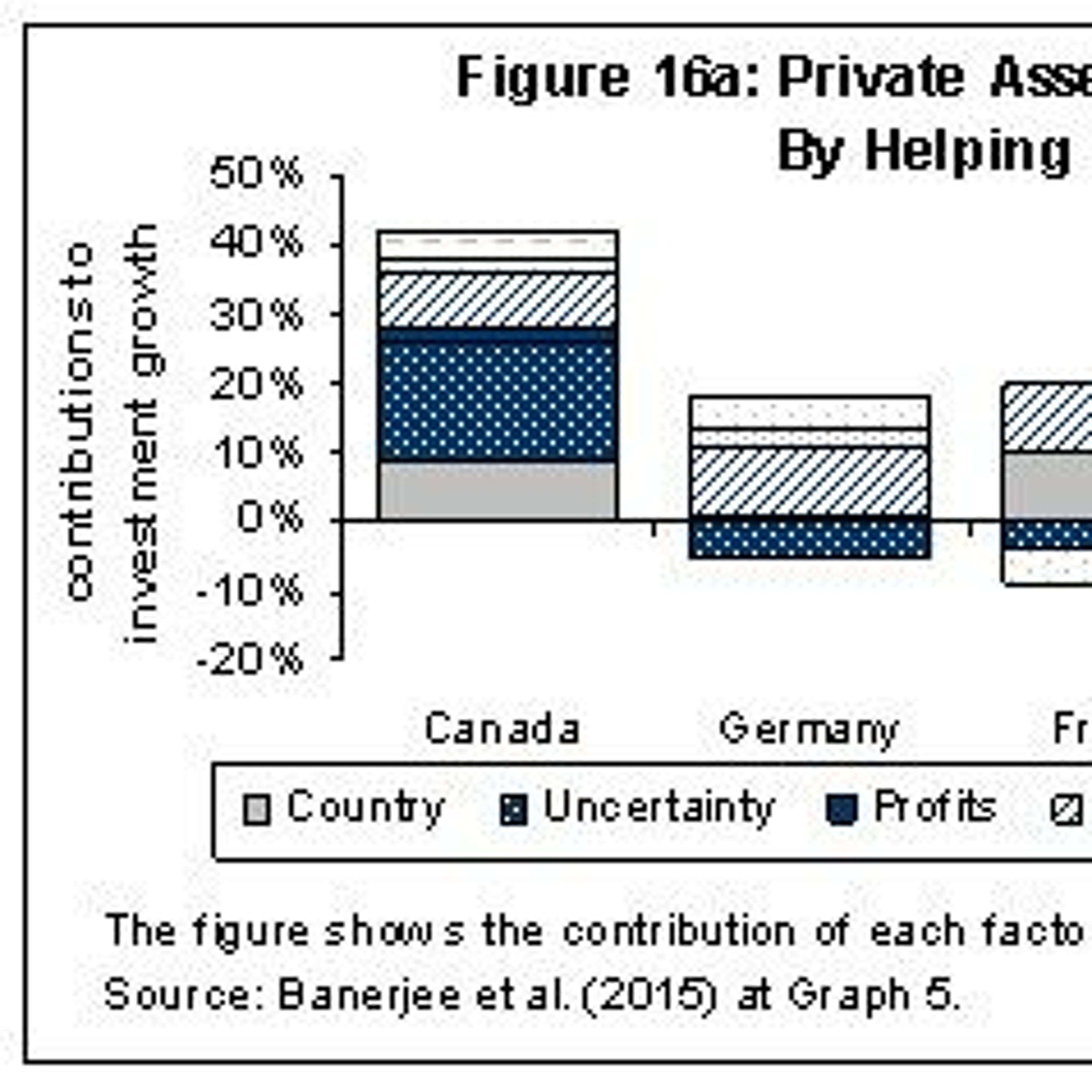

Infographic Instant with Bryane MichaelWhich Central Banks' Private Securities Purchases Would Most Goose Investment?Which central banks' private securities purchases would contribute the most toward real investment in their jurisdiction(s)? Such monetary policy helps most when conventional monetary policy has failed (or will likely fail because of liquidity traps) and the executive part of government sags in corruption and incompetence. For more, see: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=30237952017-08-2210 min Infographic Instant with Bryane MichaelDo Central Bank Private Asset Purchases Actually Encourage Real Investment?Econometric evidence shows a pretty clear line between central bank unconventional monetary policy (outright purchases) and output - usually because of its effects via money policy mechanisms. What about its effects on real investment (like in DNA sequencers, 3D printers, IP patents and "real" investment)? For more, see: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=30237952017-08-2206 min

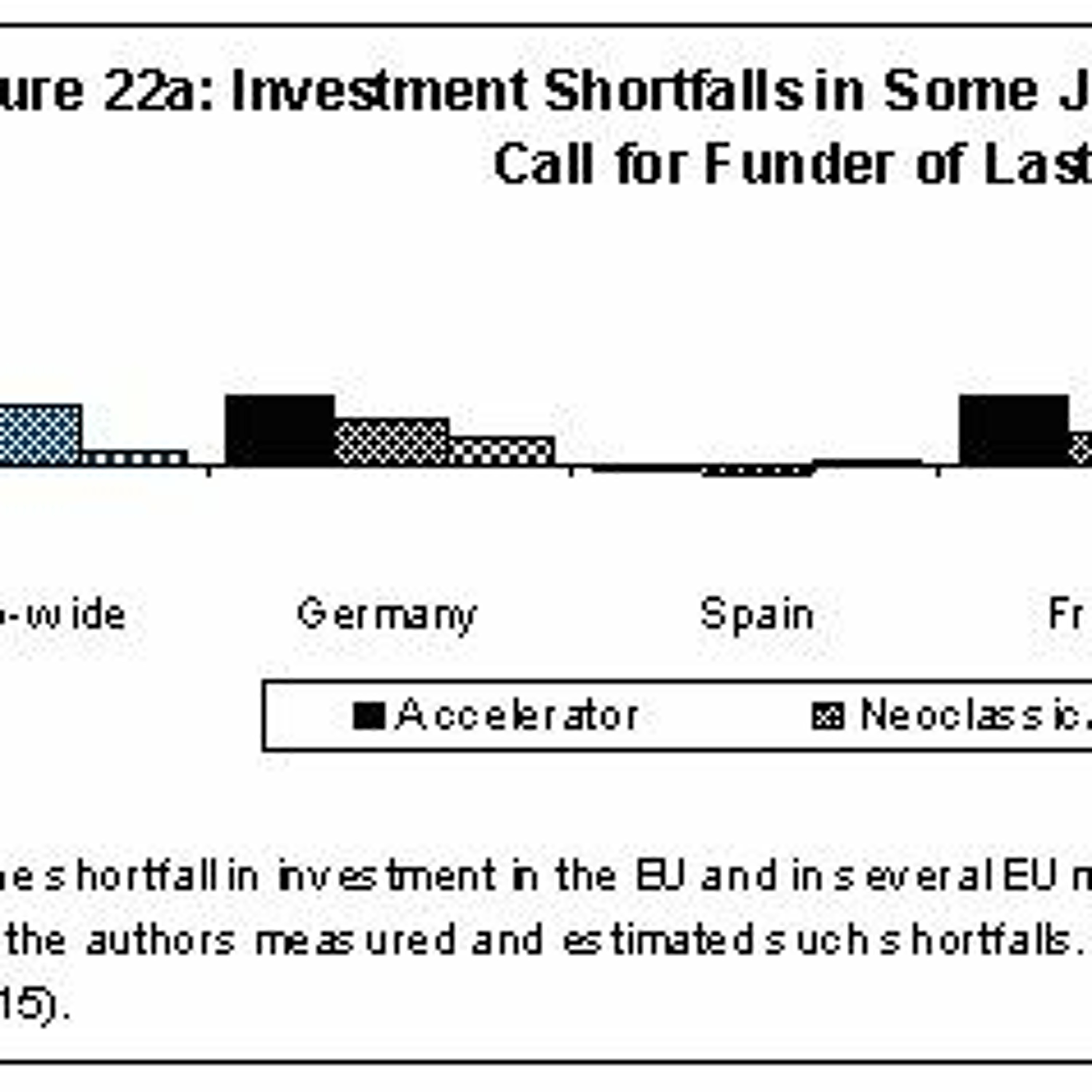

Infographic Instant with Bryane MichaelDo Central Bank Private Asset Purchases Actually Encourage Real Investment?Econometric evidence shows a pretty clear line between central bank unconventional monetary policy (outright purchases) and output - usually because of its effects via money policy mechanisms. What about its effects on real investment (like in DNA sequencers, 3D printers, IP patents and "real" investment)? For more, see: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=30237952017-08-2206 min Infographic Instant with Bryane MichaelShould Central Banks Be Funders of Last Resort?Would unconventional monetary policy aimed at buying private sector securities (stocks and bonds) helped boost lackluster investment? Particularly in developing and emerging markets? We look at the role that central banks - as funders of last resort - might have played in promoting investment. For more, see: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=30237952017-08-2204 min

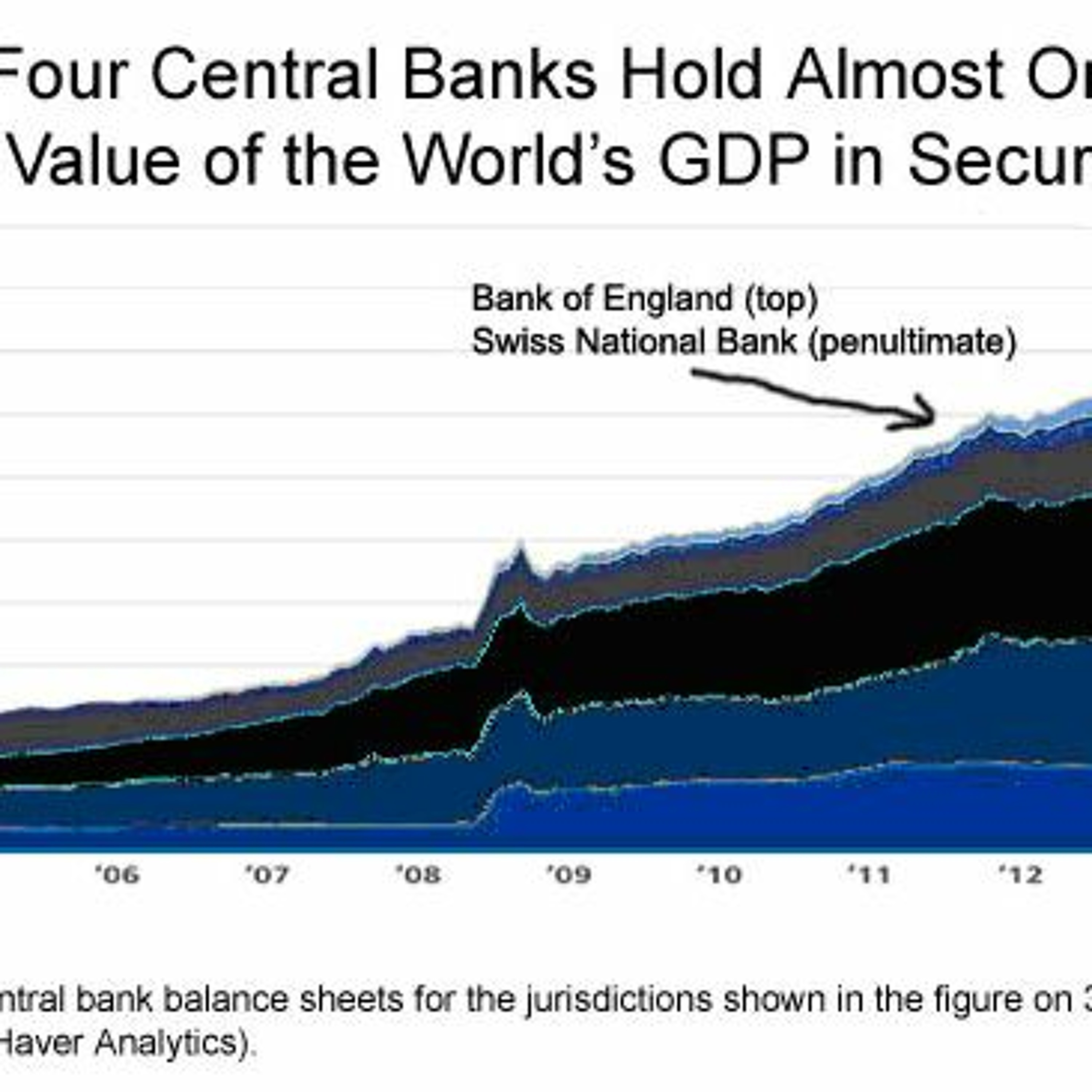

Infographic Instant with Bryane MichaelShould Central Banks Be Funders of Last Resort?Would unconventional monetary policy aimed at buying private sector securities (stocks and bonds) helped boost lackluster investment? Particularly in developing and emerging markets? We look at the role that central banks - as funders of last resort - might have played in promoting investment. For more, see: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=30237952017-08-2204 min Infographic Instant with Bryane MichaelBallooning Central Bank Balance Sheets as Opportunity for Companies?Central banks around the world bought up alot of securities. To what extent have central banks turned to buying private sector securities in a macroeconomic environment characterised by zero percent interest rates, low growth, investment, and ballooning debts? For more, see: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=30237952017-08-2202 min

Infographic Instant with Bryane MichaelBallooning Central Bank Balance Sheets as Opportunity for Companies?Central banks around the world bought up alot of securities. To what extent have central banks turned to buying private sector securities in a macroeconomic environment characterised by zero percent interest rates, low growth, investment, and ballooning debts? For more, see: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=30237952017-08-2202 min Infographic Instant with Bryane MichaelCentral Banks as Funders of Last Resort: Intro and FindingsWhy can't central banks normally buy stocks and bonds from the private sector? What happens if/when they do? We introduce our subject, and quickly present our findings (that central bank purchases can promote investment under certain circumstances).

For more, see: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=30237952017-08-2204 min

Infographic Instant with Bryane MichaelCentral Banks as Funders of Last Resort: Intro and FindingsWhy can't central banks normally buy stocks and bonds from the private sector? What happens if/when they do? We introduce our subject, and quickly present our findings (that central bank purchases can promote investment under certain circumstances).

For more, see: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=30237952017-08-2204 min Infographic Instant with Bryane MichaelFull Presentation: Central Banks' Securities Purchases' Effect on InvestmentWhy don't central banks buy our companies' stocks and bonds? Should they fund mostly governments? And expand credit through banks? We look at central banks' role as a "funder of last resort." We find that investment increases when central banks buy private sector assets - except under a certain "sloth effect." We describe how law fails to give central banks the authority they need - and show how drafting a nominal GDP target objective directly into the central bank law helps promote investment and growth. For more: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=30237952017-08-2246 min

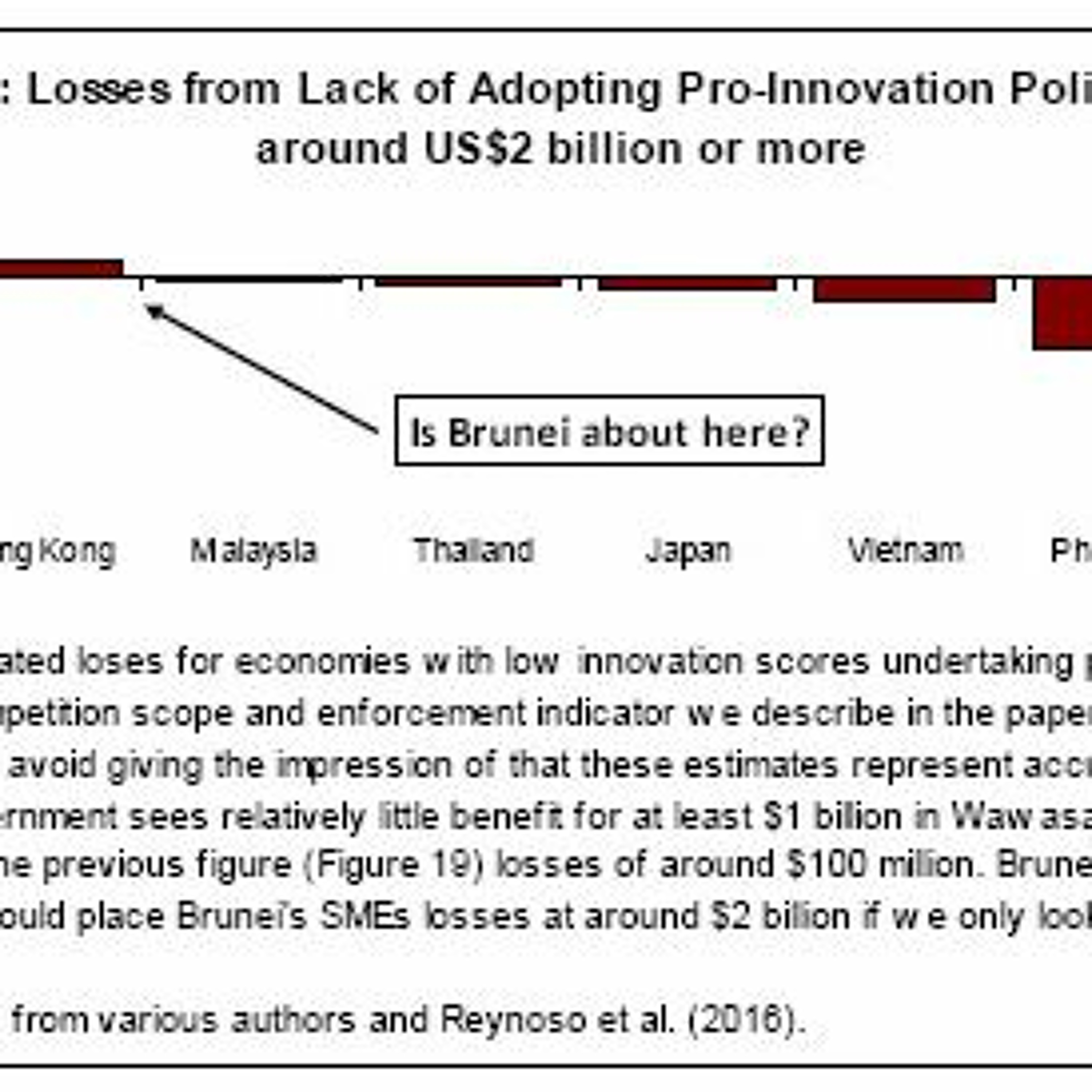

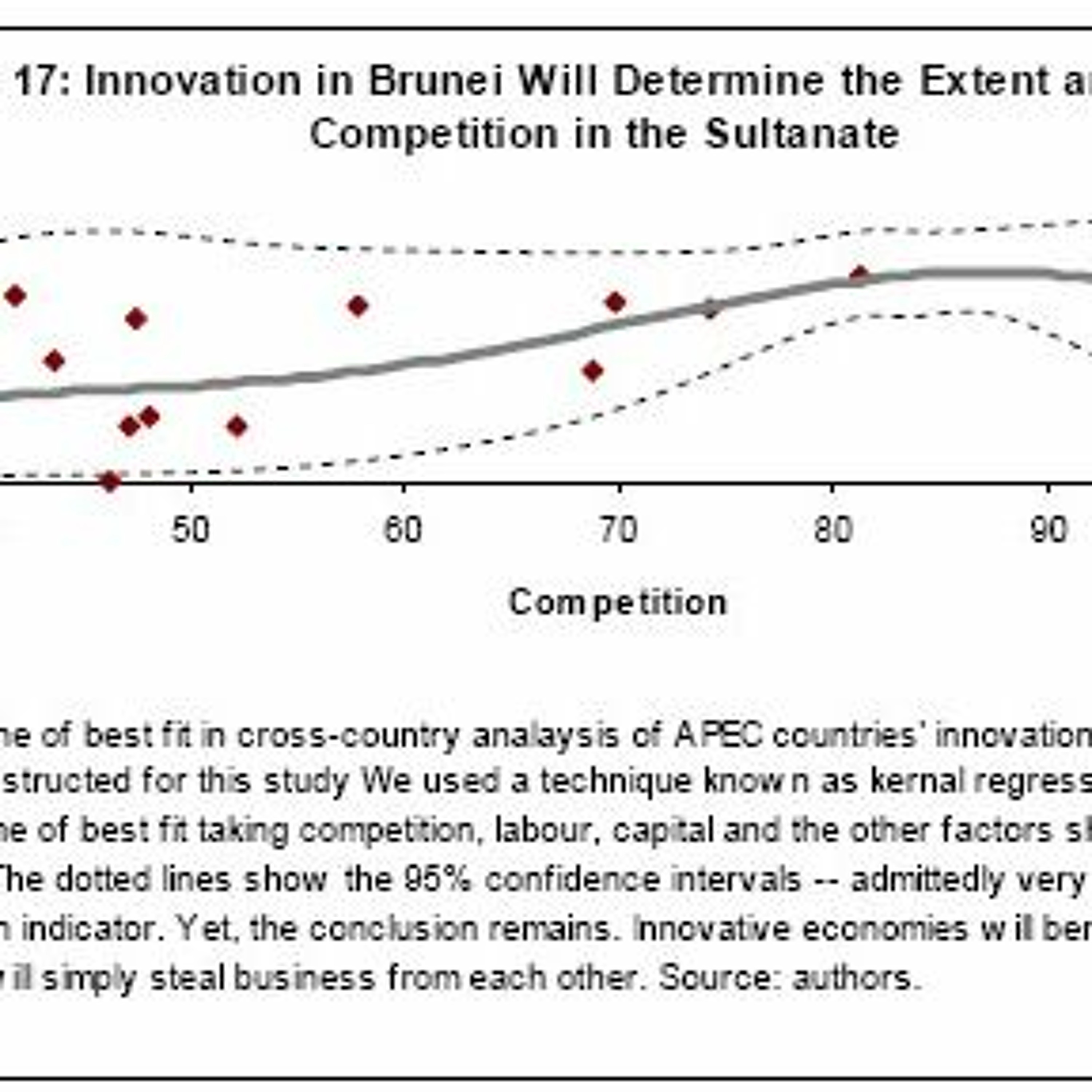

Infographic Instant with Bryane MichaelFull Presentation: Central Banks' Securities Purchases' Effect on InvestmentWhy don't central banks buy our companies' stocks and bonds? Should they fund mostly governments? And expand credit through banks? We look at central banks' role as a "funder of last resort." We find that investment increases when central banks buy private sector assets - except under a certain "sloth effect." We describe how law fails to give central banks the authority they need - and show how drafting a nominal GDP target objective directly into the central bank law helps promote investment and growth. For more: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=30237952017-08-2246 min Infographic Instant with Bryane MichaelWho Wins from the World-Wide Competition Law Copy-a-thon?Most governments copied competition law "best practice" - without accompanying templates on improving innovation/productivity. Competition acts are easy to copy. New ideas are not. Some countries like Singapore and Hong Kong will win out from more competition. Vietnam and even Japan won't -- unless law incentivises creativity.

To see how much money your country will win/lose, see: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=30002402017-08-0104 min

Infographic Instant with Bryane MichaelWho Wins from the World-Wide Competition Law Copy-a-thon?Most governments copied competition law "best practice" - without accompanying templates on improving innovation/productivity. Competition acts are easy to copy. New ideas are not. Some countries like Singapore and Hong Kong will win out from more competition. Vietnam and even Japan won't -- unless law incentivises creativity.

To see how much money your country will win/lose, see: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=30002402017-08-0104 min Infographic Instant with Bryane MichaelCompetition Law Only Helps SMEs with Accompanying Innovation LegislationThe international organisations have pressured most countries into adopting competition laws. Many governments rightfully ignore them - because they harm domestic business (and particularly SMEs). If lawmakers adopt an innovation act at the same time as an antitrust act though, competition law can do more good than harm. For more, see: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=30002402017-08-0104 min

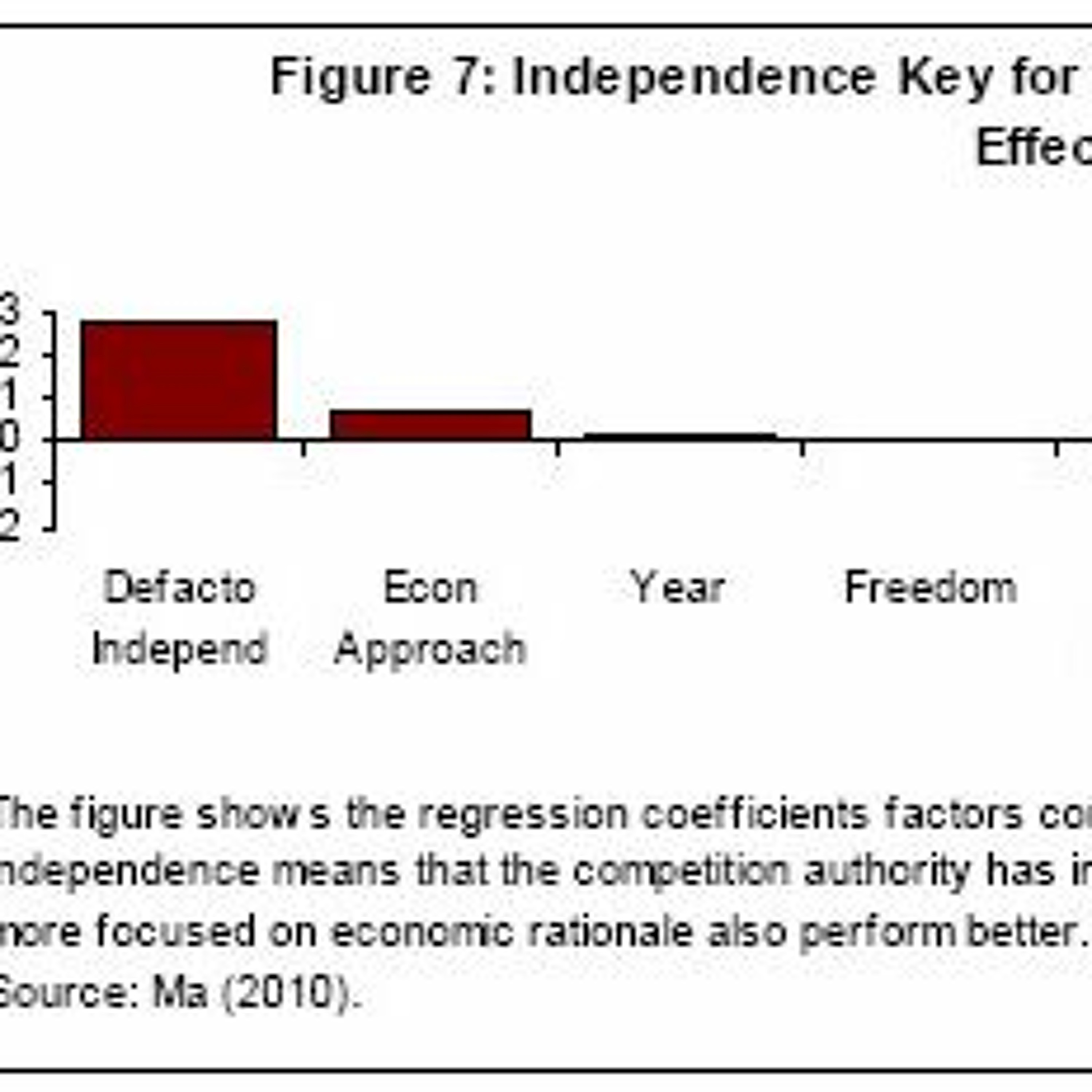

Infographic Instant with Bryane MichaelCompetition Law Only Helps SMEs with Accompanying Innovation LegislationThe international organisations have pressured most countries into adopting competition laws. Many governments rightfully ignore them - because they harm domestic business (and particularly SMEs). If lawmakers adopt an innovation act at the same time as an antitrust act though, competition law can do more good than harm. For more, see: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=30002402017-08-0104 min Infographic Instant with Bryane MichaelDoes Legal Independence for Competition Authorities Actually Matter?Like with central banks, conventional wisdom has increasingly made competition authorities (commissions) independent. How does such independence look like in black letter law? Does the econometric evidence suggest that independence makes competition "better"? For more, see: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=30002402017-08-0104 min

Infographic Instant with Bryane MichaelDoes Legal Independence for Competition Authorities Actually Matter?Like with central banks, conventional wisdom has increasingly made competition authorities (commissions) independent. How does such independence look like in black letter law? Does the econometric evidence suggest that independence makes competition "better"? For more, see: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=30002402017-08-0104 min Infographic Instant with Bryane MichaelWho Has the Best Competition Law for SMEs?Competition law helps shape competition in a jurisdiction. "Better" laws help protect vulnerable businesses like small and medium enterprises (SMEs) - without hurting consumers. How do we measure the quality of such competition law? Who is ahead... and behind? For more, see: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=30002402017-08-0103 min

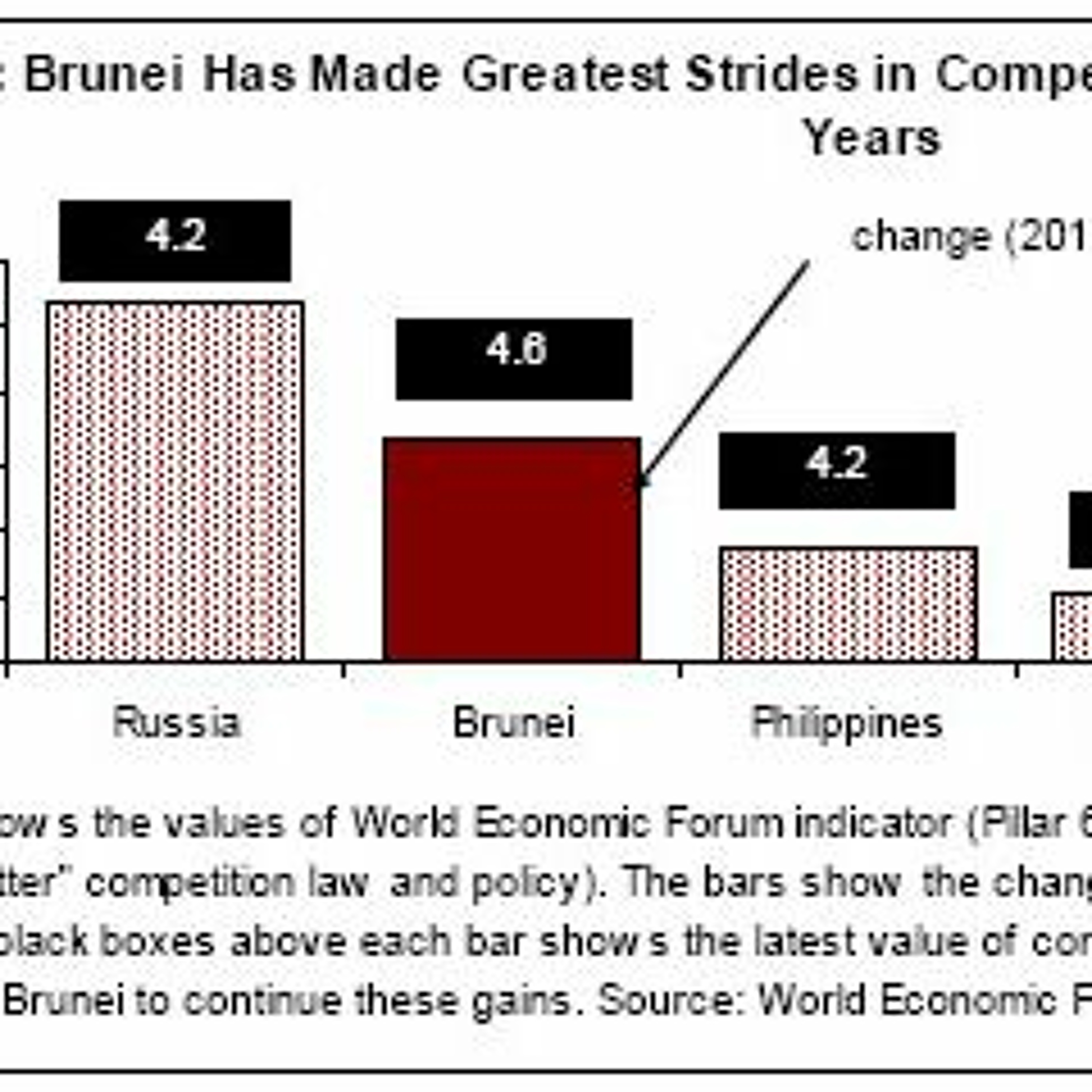

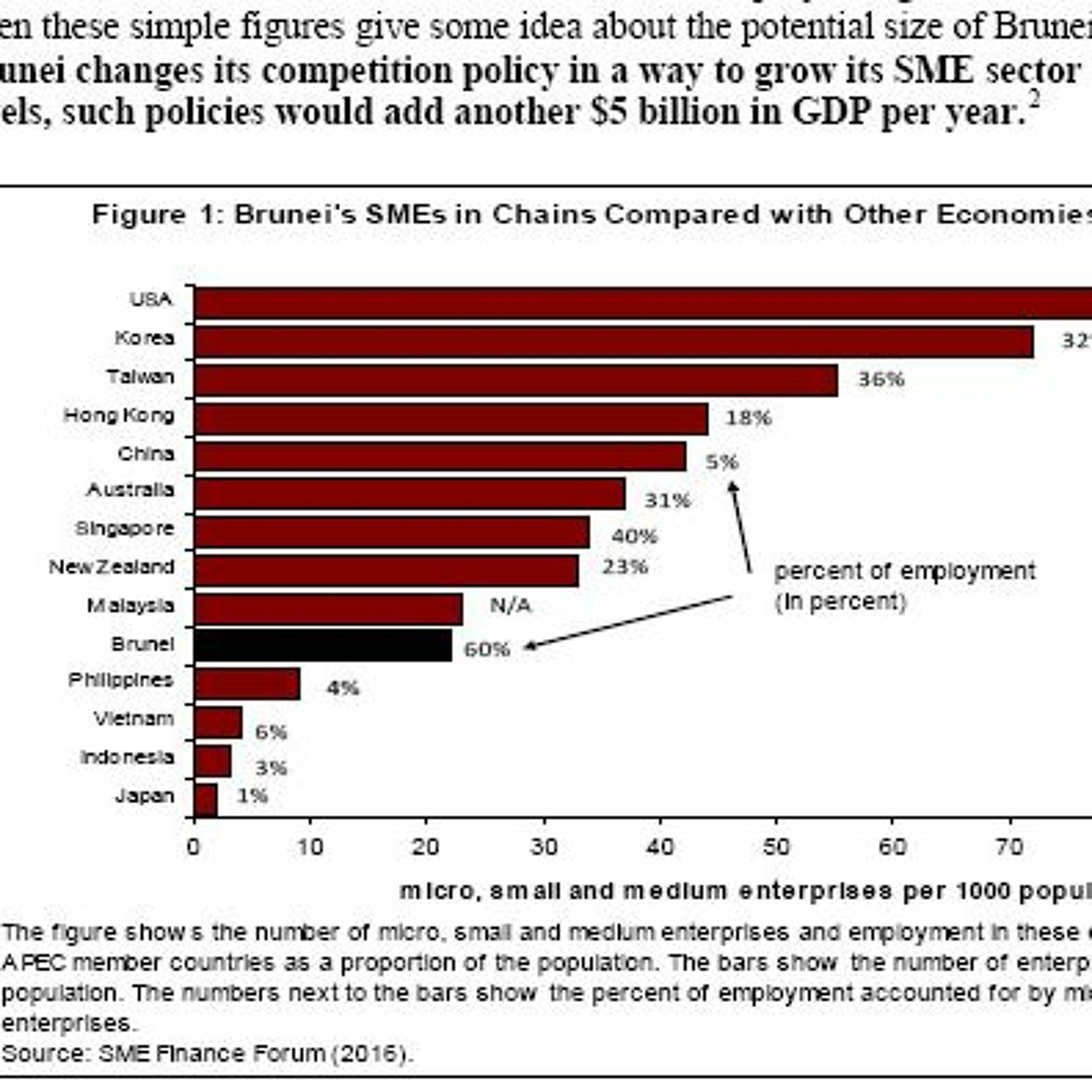

Infographic Instant with Bryane MichaelWho Has the Best Competition Law for SMEs?Competition law helps shape competition in a jurisdiction. "Better" laws help protect vulnerable businesses like small and medium enterprises (SMEs) - without hurting consumers. How do we measure the quality of such competition law? Who is ahead... and behind? For more, see: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=30002402017-08-0103 min Infographic Instant with Bryane MichaelWho Has the Most and Best SMEs?SMEs provide much employment and longer-term economic growth. They also often provide the next, new idea which leads to entire industries. Which countries encourage these SMEs? How competitive are they? For more, see: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=30002402017-08-0102 min

Infographic Instant with Bryane MichaelWho Has the Most and Best SMEs?SMEs provide much employment and longer-term economic growth. They also often provide the next, new idea which leads to entire industries. Which countries encourage these SMEs? How competitive are they? For more, see: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=30002402017-08-0102 min Infographic Instant with Bryane MichaelHow to Draft Competition Laws to Help SME Development?Competition often hurts SMEs more than helps them. In this presentation, we review competition laws in various countries (mostly Asia and Brunei as a concrete example). Without passing innovation legislation at the same time, competition law could well do more harm than good. For more, see: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=30002402017-08-0121 min

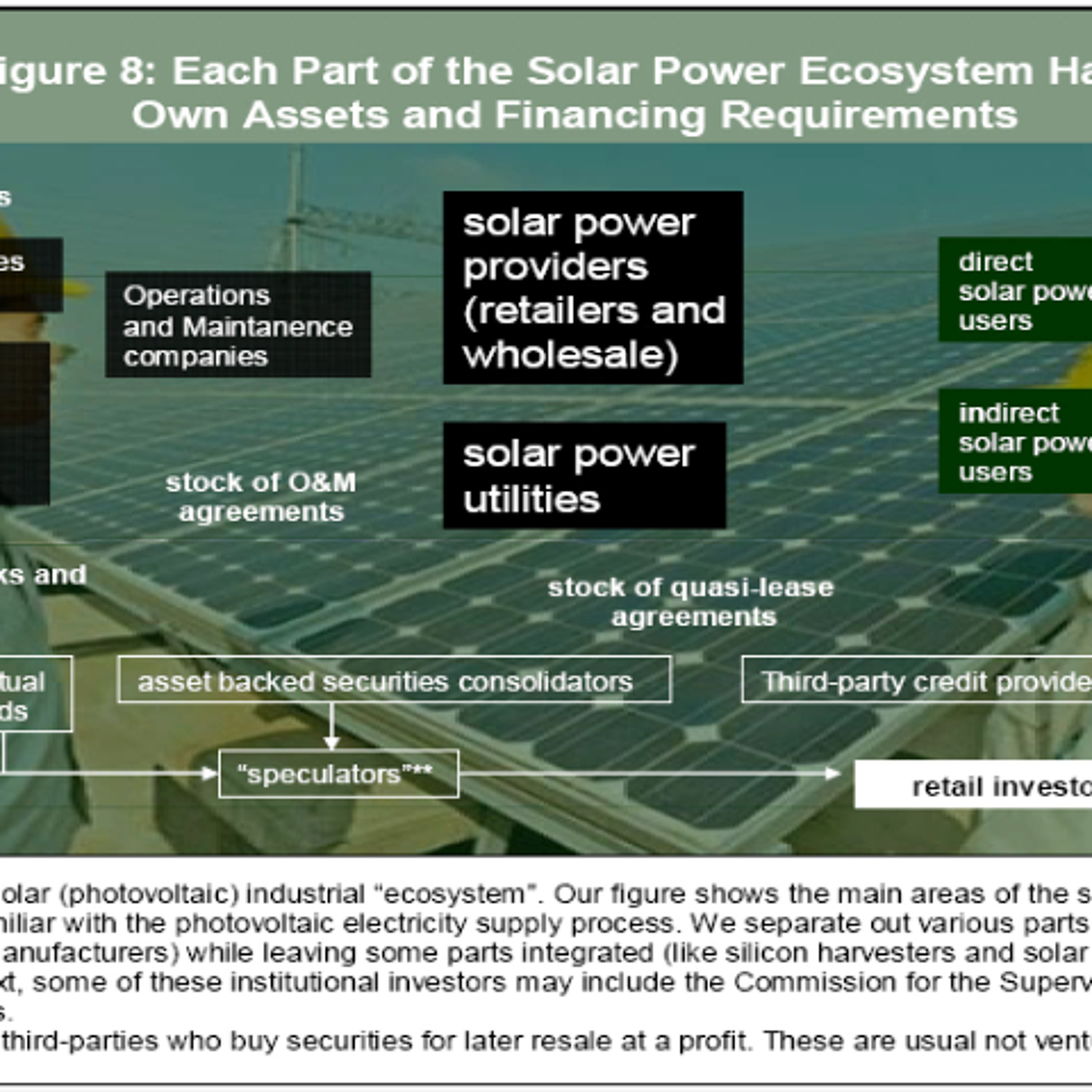

Infographic Instant with Bryane MichaelHow to Draft Competition Laws to Help SME Development?Competition often hurts SMEs more than helps them. In this presentation, we review competition laws in various countries (mostly Asia and Brunei as a concrete example). Without passing innovation legislation at the same time, competition law could well do more harm than good. For more, see: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=30002402017-08-0121 min Infographic Instant with Bryane MichaelRegulating a Better International Financial CentreWhat concrete laws can a jurisdiction pass to make its financial institutions more attractive for sunrise industries looking for money? We illustrate how new laws in Hong Kong can make its financial institutions ready to fund the complex and capital-intensive industries like the solar/photovoltaic sector. For more, see: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=24952592017-03-0604 min

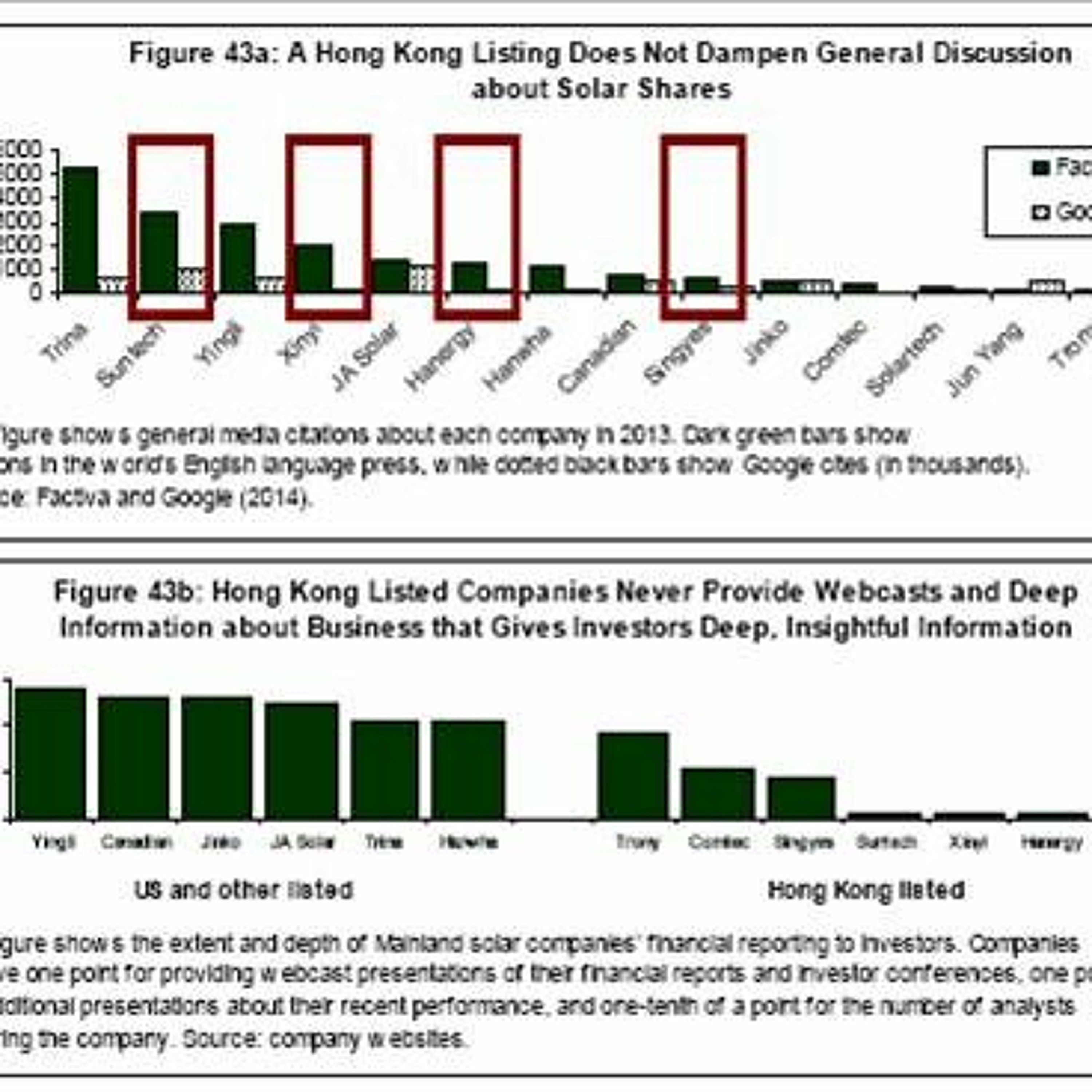

Infographic Instant with Bryane MichaelRegulating a Better International Financial CentreWhat concrete laws can a jurisdiction pass to make its financial institutions more attractive for sunrise industries looking for money? We illustrate how new laws in Hong Kong can make its financial institutions ready to fund the complex and capital-intensive industries like the solar/photovoltaic sector. For more, see: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=24952592017-03-0604 min Infographic Instant with Bryane MichaelMaking Markets for Information with an International Financial CentreAn international financial centre represents a technology, a method of generating information about new opportunities and risks. We describe the value of information in an international financial centre using China's solar industry and Hong Kong's financing of that industry as an example. For more, see: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=24952592017-03-0606 min

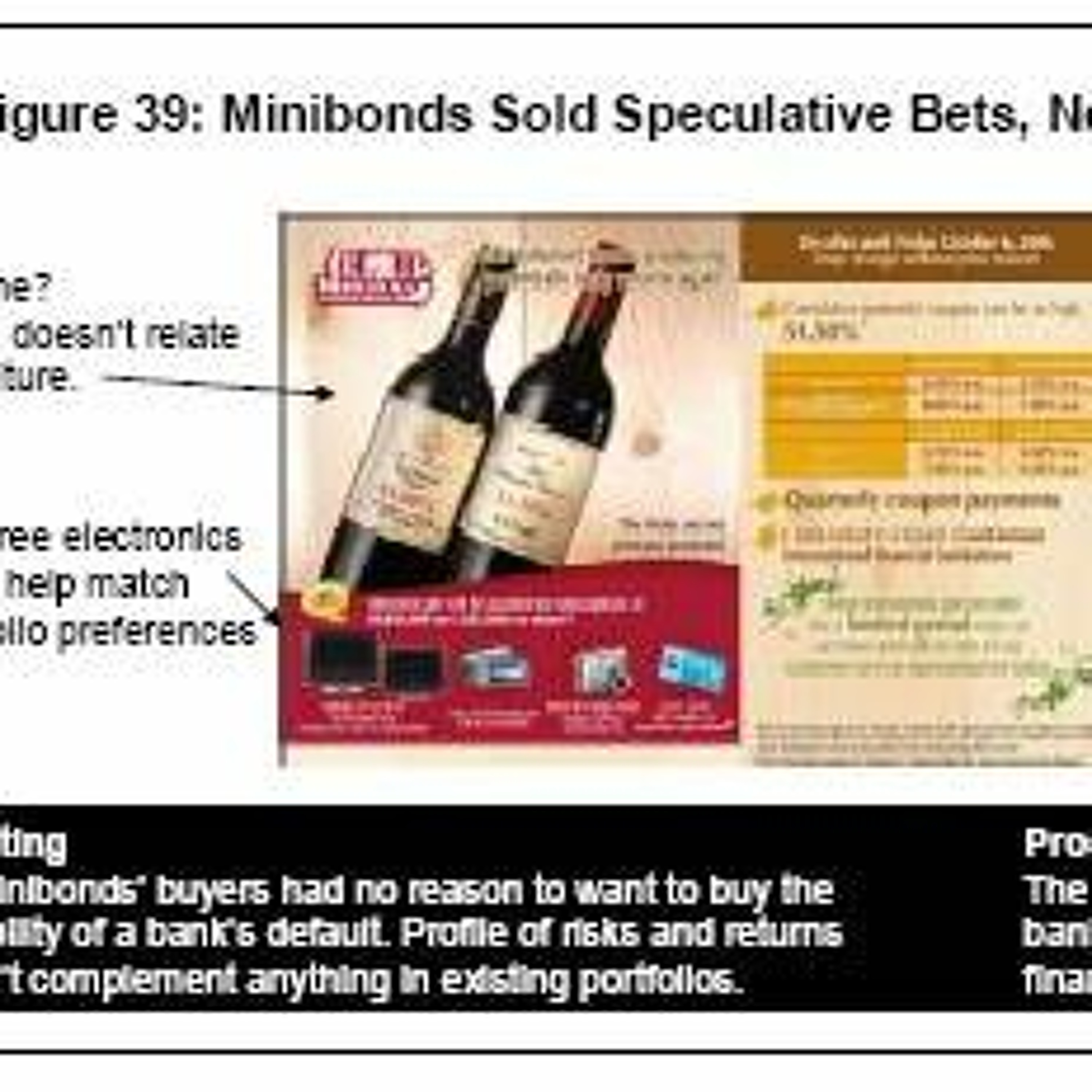

Infographic Instant with Bryane MichaelMaking Markets for Information with an International Financial CentreAn international financial centre represents a technology, a method of generating information about new opportunities and risks. We describe the value of information in an international financial centre using China's solar industry and Hong Kong's financing of that industry as an example. For more, see: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=24952592017-03-0606 min Infographic Instant with Bryane MichaelWhy Securitisation Represents the Next Wave of International Financial Centre FinanceBenefits from securitisation well exceed the current offering of securitised debt and assets. An international financial centre ready to securitise a sunrise industry can fill a large void -- and earn large profits. Hong Kong's own experience has been to make casino bet instruments, rather than productive assets. Yet, it does not have to be that way. For more, see: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=24952592017-03-0610 min

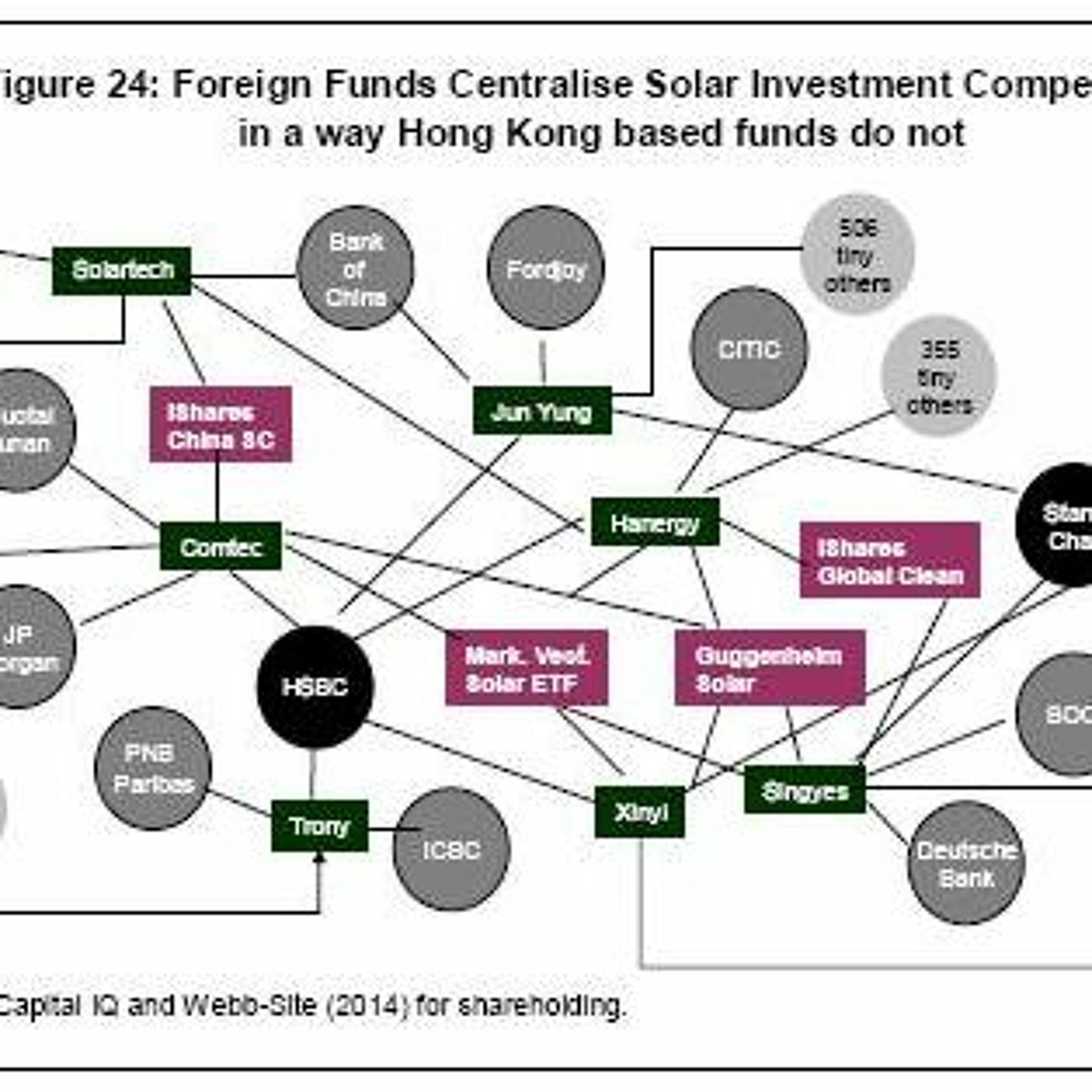

Infographic Instant with Bryane MichaelWhy Securitisation Represents the Next Wave of International Financial Centre FinanceBenefits from securitisation well exceed the current offering of securitised debt and assets. An international financial centre ready to securitise a sunrise industry can fill a large void -- and earn large profits. Hong Kong's own experience has been to make casino bet instruments, rather than productive assets. Yet, it does not have to be that way. For more, see: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=24952592017-03-0610 min Infographic Instant with Bryane MichaelChicago Disintermediated China's Solar Industry Value ChainsHow can an international financial centre dominate a sunrise industry's value chains? In this presentation, we show how US financial institutions disintermediated China's solar energy financing value chains -- locking out rivals in Hong Kong. For more, see: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=24952592017-03-0607 min

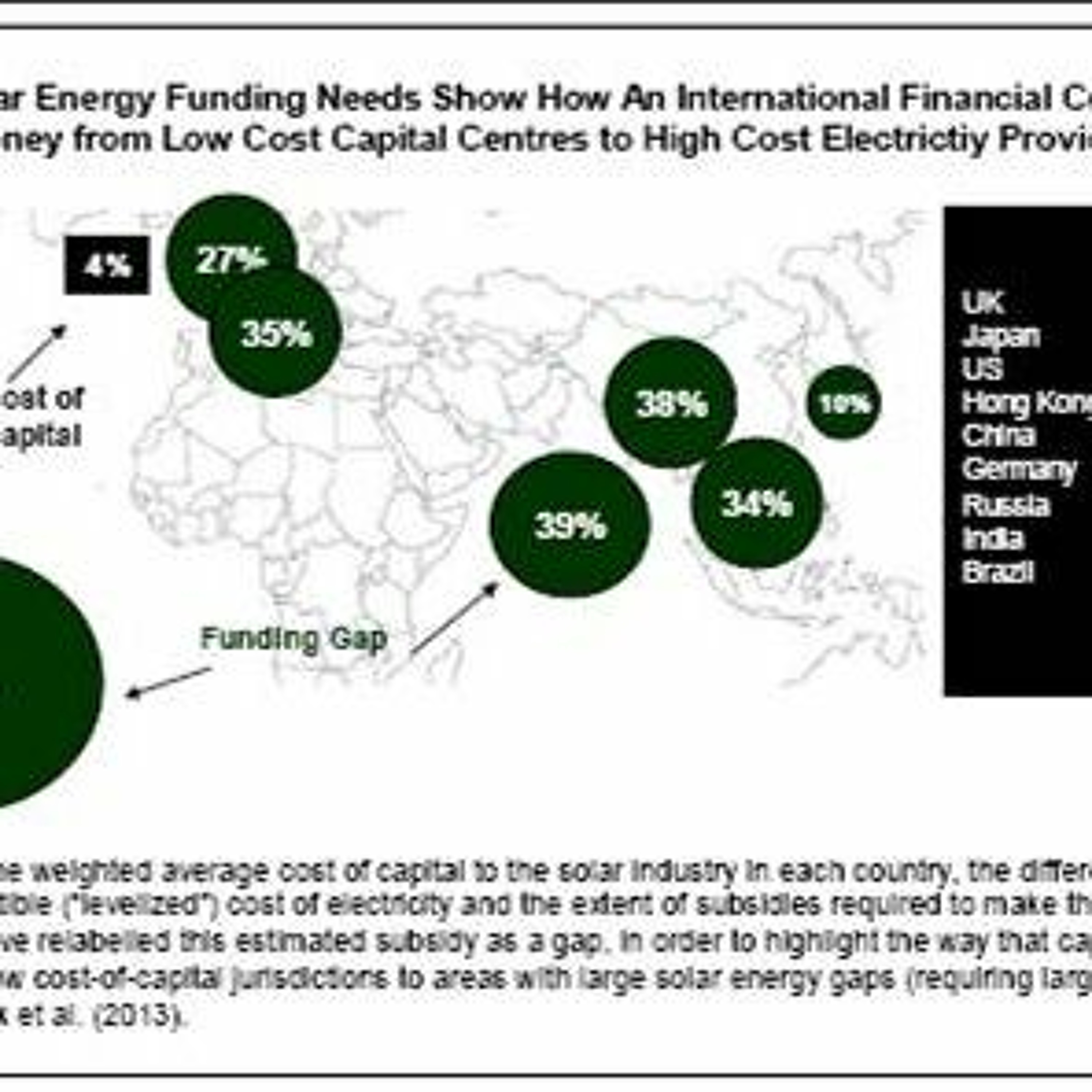

Infographic Instant with Bryane MichaelChicago Disintermediated China's Solar Industry Value ChainsHow can an international financial centre dominate a sunrise industry's value chains? In this presentation, we show how US financial institutions disintermediated China's solar energy financing value chains -- locking out rivals in Hong Kong. For more, see: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=24952592017-03-0607 min Infographic Instant with Bryane MichaelThe Economics and Finance of an International Financial CentreWhat drives the development of an international financial centre? We show how to estimate the economic impacts of a sunrise industry on a financial centre like Hong Kong. We also estimate the supply/demand for various types of securities used to fund the solar industry. For more, see: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=24952592017-03-0608 min

Infographic Instant with Bryane MichaelThe Economics and Finance of an International Financial CentreWhat drives the development of an international financial centre? We show how to estimate the economic impacts of a sunrise industry on a financial centre like Hong Kong. We also estimate the supply/demand for various types of securities used to fund the solar industry. For more, see: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=24952592017-03-0608 min Infographic Instant with Bryane MichaelEstimating the Assets a Sunrise Industry Will Generate for BanksHow much money will a financial centre's financial institutions book from a sunrise industry. We illustrate the market sizing exercise -- showing how to estimate demand for various types of securities from a new sector. For more, see: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=24952592017-03-0611 min

Infographic Instant with Bryane MichaelEstimating the Assets a Sunrise Industry Will Generate for BanksHow much money will a financial centre's financial institutions book from a sunrise industry. We illustrate the market sizing exercise -- showing how to estimate demand for various types of securities from a new sector. For more, see: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=24952592017-03-0611 min Infographic Instant with Bryane MichaelStandard Advice on Financial Centres is WrongWant to build a world-class financial centre? Dont focus on banks. Focus on the sunrise industry that banks will lend to (finance). We review the standard approach to international financial centre development -- showing why its wrong. For more, see: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=24952592017-03-0603 min

Infographic Instant with Bryane MichaelStandard Advice on Financial Centres is WrongWant to build a world-class financial centre? Dont focus on banks. Focus on the sunrise industry that banks will lend to (finance). We review the standard approach to international financial centre development -- showing why its wrong. For more, see: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=24952592017-03-0603 min Infographic Instant with Bryane MichaelBuilding Better Financial Centres: Hong Kong and the Solar IndustryWant to make a world-class financial centre? Dont focus on banks. Focus instead on creating the new industries whose money your banks will handle. This presentation reviews the way that financial centres grow -- and talks presents the law which can help foment such a financial centre. For more, see https://papers.ssrn.com/sol3/papers.cfm?abstract_id=24952592017-03-0651 min

Infographic Instant with Bryane MichaelBuilding Better Financial Centres: Hong Kong and the Solar IndustryWant to make a world-class financial centre? Dont focus on banks. Focus instead on creating the new industries whose money your banks will handle. This presentation reviews the way that financial centres grow -- and talks presents the law which can help foment such a financial centre. For more, see https://papers.ssrn.com/sol3/papers.cfm?abstract_id=24952592017-03-0651 min Infographic Instant with Bryane MichaelIntroduction to Comparative Public Sector Budgeting and Financial ManagementThe first in a series of informal videos I made for my class at Columbia U in Comparative Budgeting and Public Financial Management. Focuses on the course's skills and cases. The quality isn't great -- but why not to share with those interested?2017-01-142h 08

Infographic Instant with Bryane MichaelIntroduction to Comparative Public Sector Budgeting and Financial ManagementThe first in a series of informal videos I made for my class at Columbia U in Comparative Budgeting and Public Financial Management. Focuses on the course's skills and cases. The quality isn't great -- but why not to share with those interested?2017-01-142h 08 Infographic Instant with Bryane MichaelTackling Case Studies in Comparative Financial ManagementThe second in a series of informal videos I made for my class at Columbia U in Comparative Budgeting and Public Financial Management. Focuses on using class skills to succeed in mid-terms and finals (ie analysing real-world, practical cases). The audio quality isn't great -- but why not to share with those interested?2017-01-142h 32

Infographic Instant with Bryane MichaelTackling Case Studies in Comparative Financial ManagementThe second in a series of informal videos I made for my class at Columbia U in Comparative Budgeting and Public Financial Management. Focuses on using class skills to succeed in mid-terms and finals (ie analysing real-world, practical cases). The audio quality isn't great -- but why not to share with those interested?2017-01-142h 32 Infographic Instant with Bryane MichaelEmpirical Methods in Comparative Public Financial ManagementThe fourth in a series of informal videos I made for my class at Columbia U in Comparative Budgeting and Public Financial Management. Focuses on using data to take decisions about government budgets and financial statements. The quality isn't great -- but why not to share with those interested?2017-01-144h 02

Infographic Instant with Bryane MichaelEmpirical Methods in Comparative Public Financial ManagementThe fourth in a series of informal videos I made for my class at Columbia U in Comparative Budgeting and Public Financial Management. Focuses on using data to take decisions about government budgets and financial statements. The quality isn't great -- but why not to share with those interested?2017-01-144h 02 Infographic Instant with Bryane MichaelComparative Public Financial Management: Using What You KnowThe third in a series of informal videos I made for my class at Columbia U in Comparative Budgeting and Public Financial Management. Focuses on using class skills in practical case study applications. The quality isn't great -- but why not to share with those interested?2017-01-141h 57

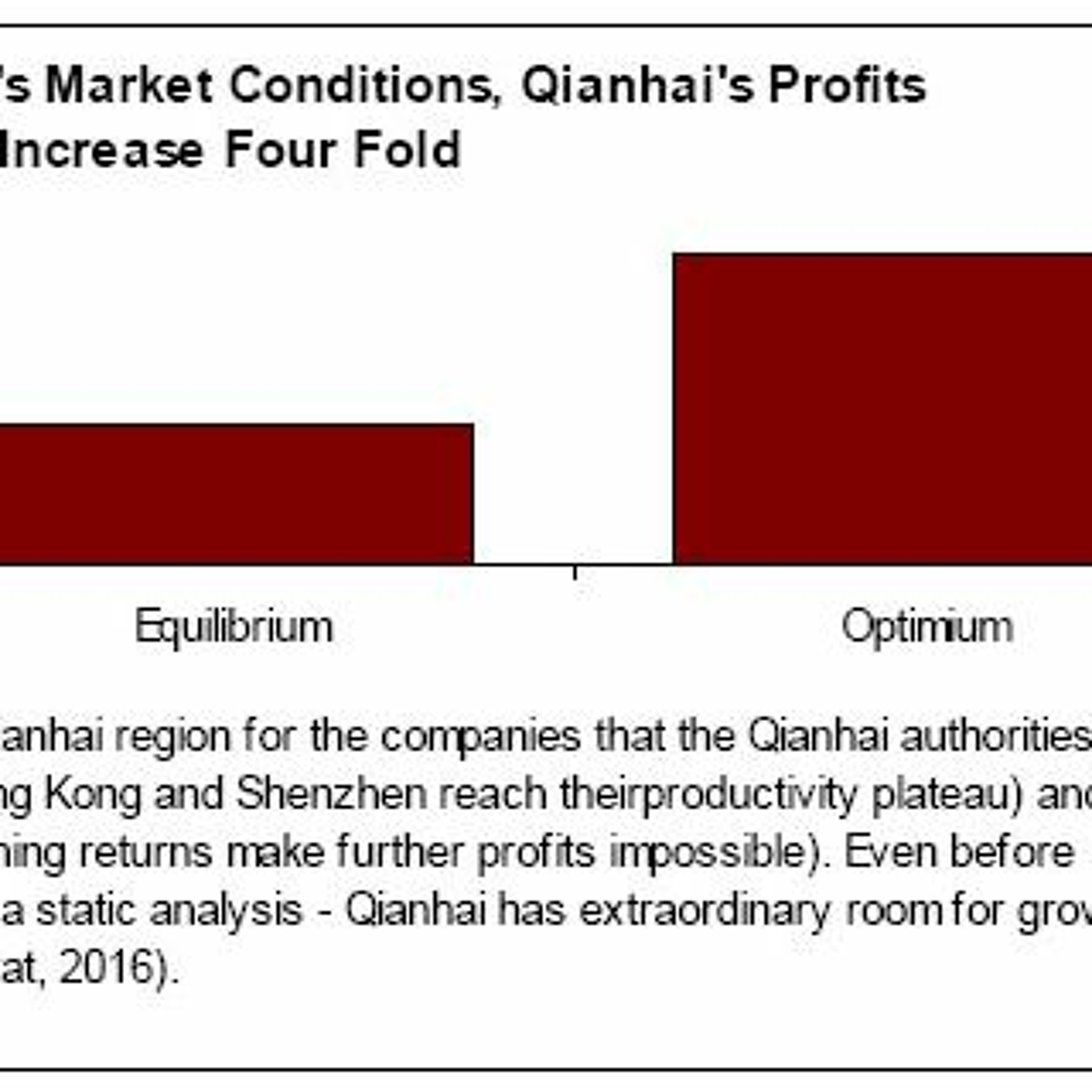

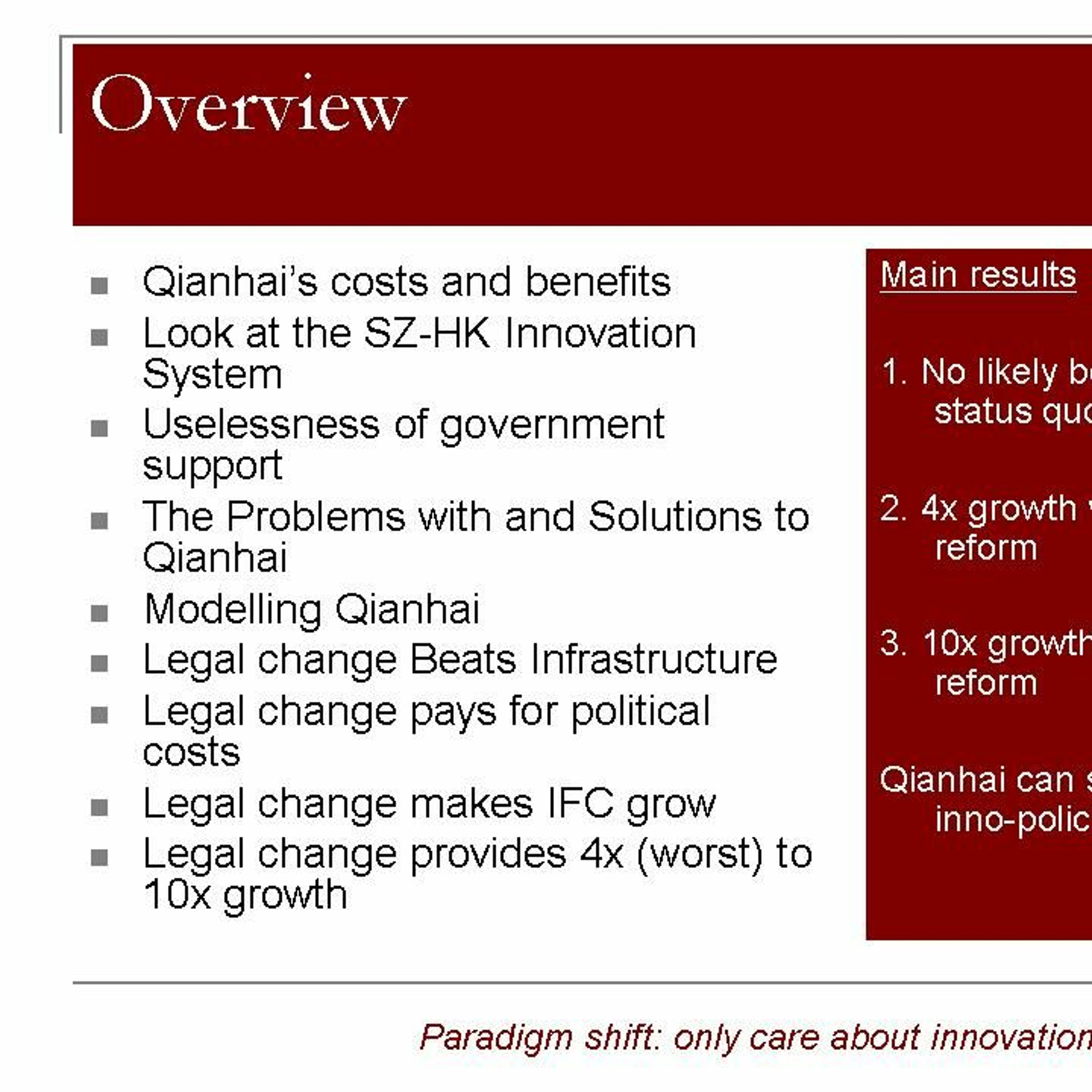

Infographic Instant with Bryane MichaelComparative Public Financial Management: Using What You KnowThe third in a series of informal videos I made for my class at Columbia U in Comparative Budgeting and Public Financial Management. Focuses on using class skills in practical case study applications. The quality isn't great -- but why not to share with those interested?2017-01-141h 57 Infographic Instant with Bryane MichaelLegal Reform's Profits in/for QianhaiHow much extra money can Qianhai companies make -- in a world where local governments adopt the best policies possible? About 10 times more than they would otherwise.2017-01-1014 min

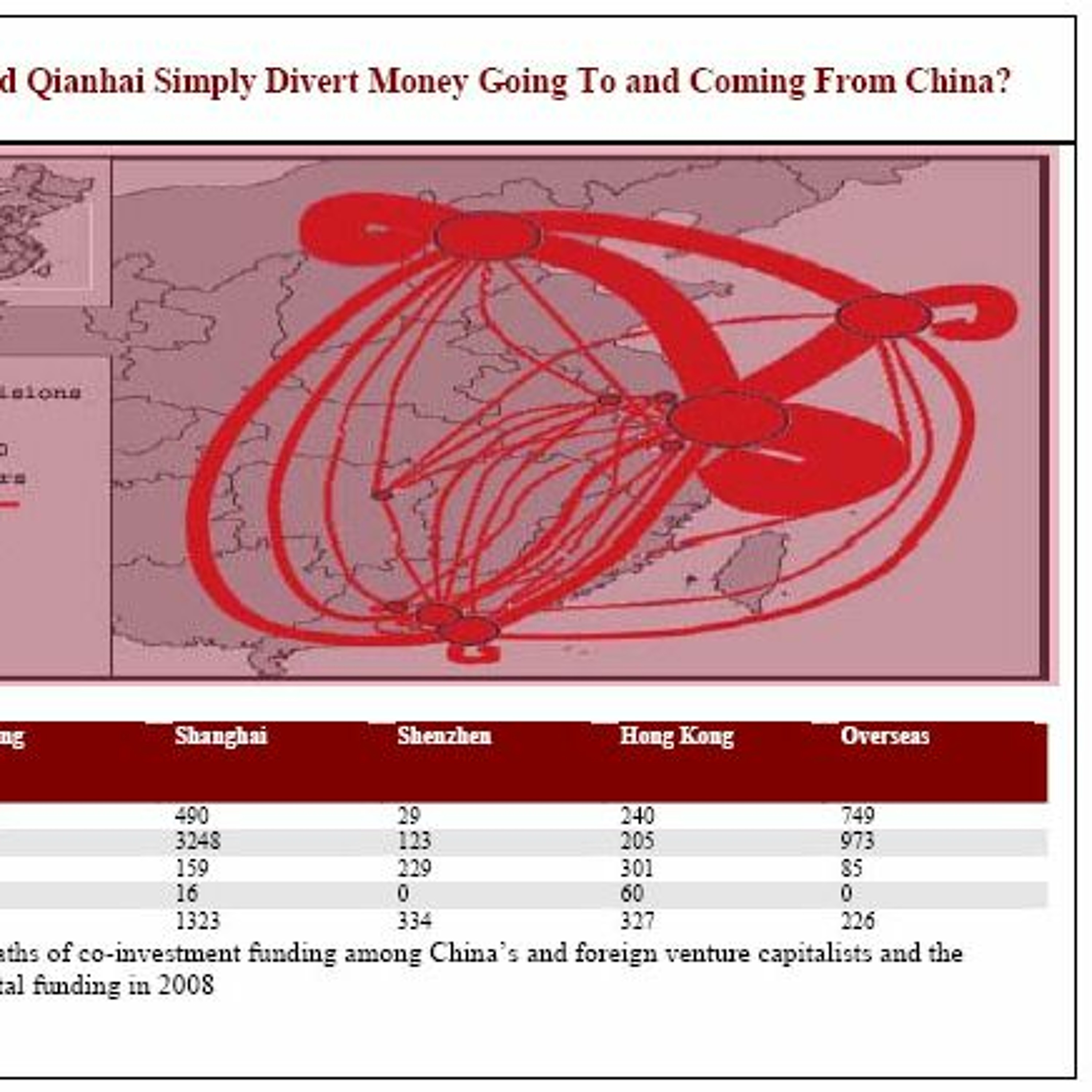

Infographic Instant with Bryane MichaelLegal Reform's Profits in/for QianhaiHow much extra money can Qianhai companies make -- in a world where local governments adopt the best policies possible? About 10 times more than they would otherwise.2017-01-1014 min Infographic Instant with Bryane MichaelWhat Exactly Are Qianhai's Problems?Qianhai can become so much more than just another urban development. We show the data about designing better urban innovation incubators. And review Hong Kong's failed innovation policy. For more, see: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=29076082017-01-1006 min

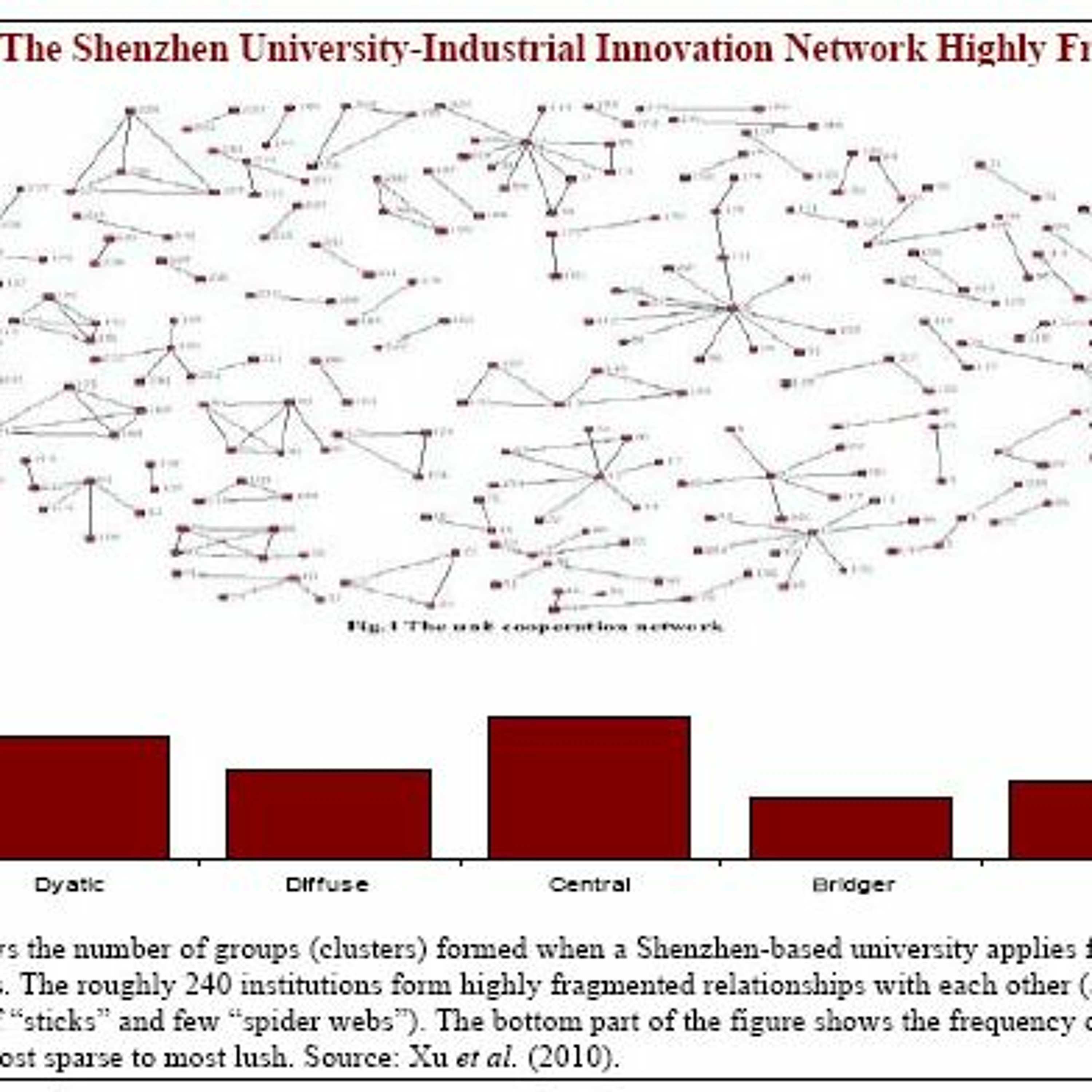

Infographic Instant with Bryane MichaelWhat Exactly Are Qianhai's Problems?Qianhai can become so much more than just another urban development. We show the data about designing better urban innovation incubators. And review Hong Kong's failed innovation policy. For more, see: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=29076082017-01-1006 min Infographic Instant with Bryane MichaelUnderstanding the Hong Kong-Shenzhen Innnovation SystemShenzhen does not grow the garden variety type of garage-style tech companies. How do companies, universities and government bodies come together to make start-ups? What does this suggest about Qianhai's future performance? For more, see: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=29076082017-01-1005 min

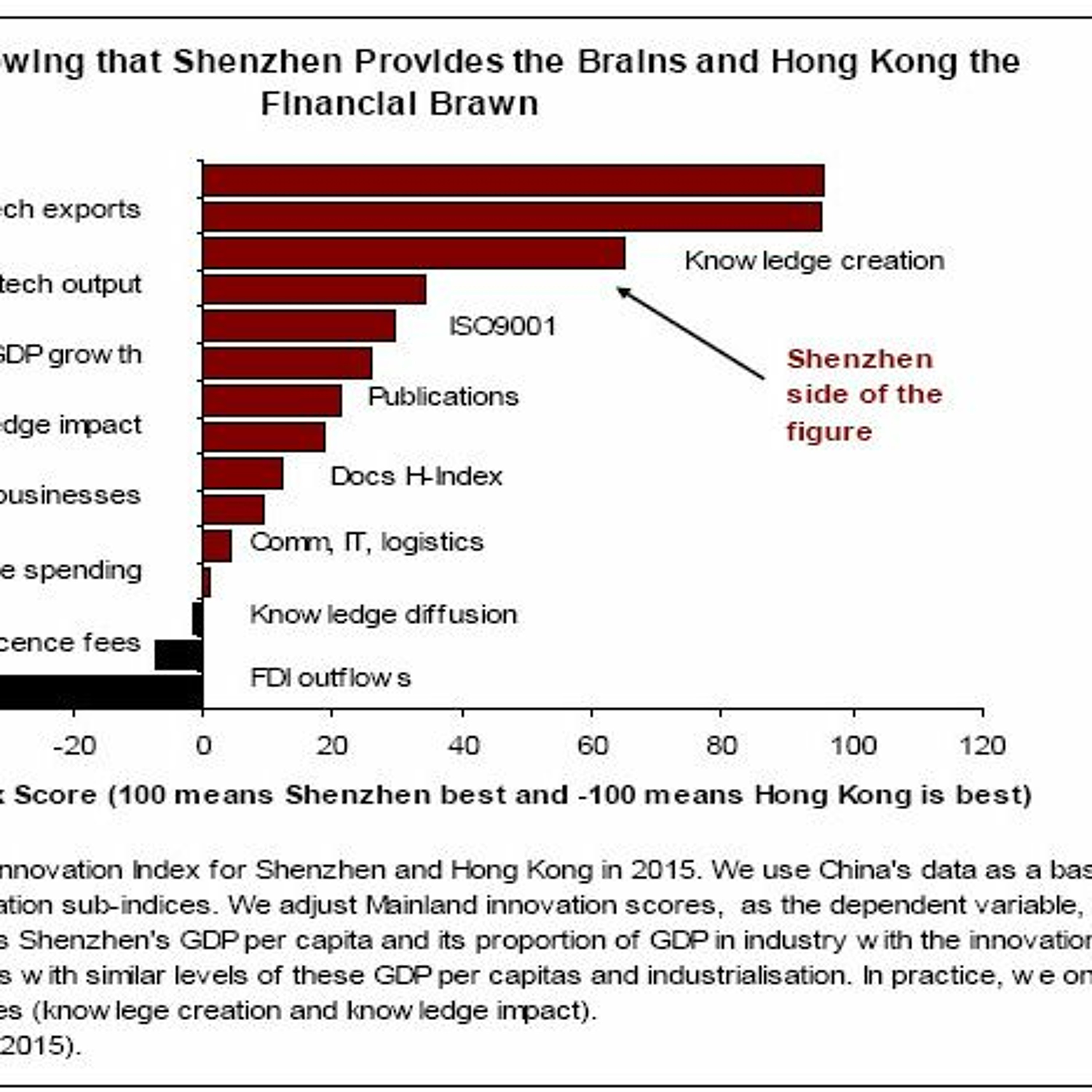

Infographic Instant with Bryane MichaelUnderstanding the Hong Kong-Shenzhen Innnovation SystemShenzhen does not grow the garden variety type of garage-style tech companies. How do companies, universities and government bodies come together to make start-ups? What does this suggest about Qianhai's future performance? For more, see: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=29076082017-01-1005 min Infographic Instant with Bryane MichaelSynergy Between Shenzhen's Brains and HK's Financial BrawnShenzhen and Hong Kong bring something different - and complementary -- to the Qianhai innovation park (urban development). We review the data - and show how Qianhai can become so much more than just a fancy place to live and work. For more, see: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=29076082017-01-1004 min

Infographic Instant with Bryane MichaelSynergy Between Shenzhen's Brains and HK's Financial BrawnShenzhen and Hong Kong bring something different - and complementary -- to the Qianhai innovation park (urban development). We review the data - and show how Qianhai can become so much more than just a fancy place to live and work. For more, see: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=29076082017-01-1004 min Infographic Instant with Bryane MichaelQianhai: How Not to Design an Innovation HubThe data suggest that a bespoke innovation park serving Hong Kong and Shenzhen won't have much impact on company profits. Or innovation. We review the econometric studies - and Qianhai's costs. For more, see: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=29076082017-01-1007 min

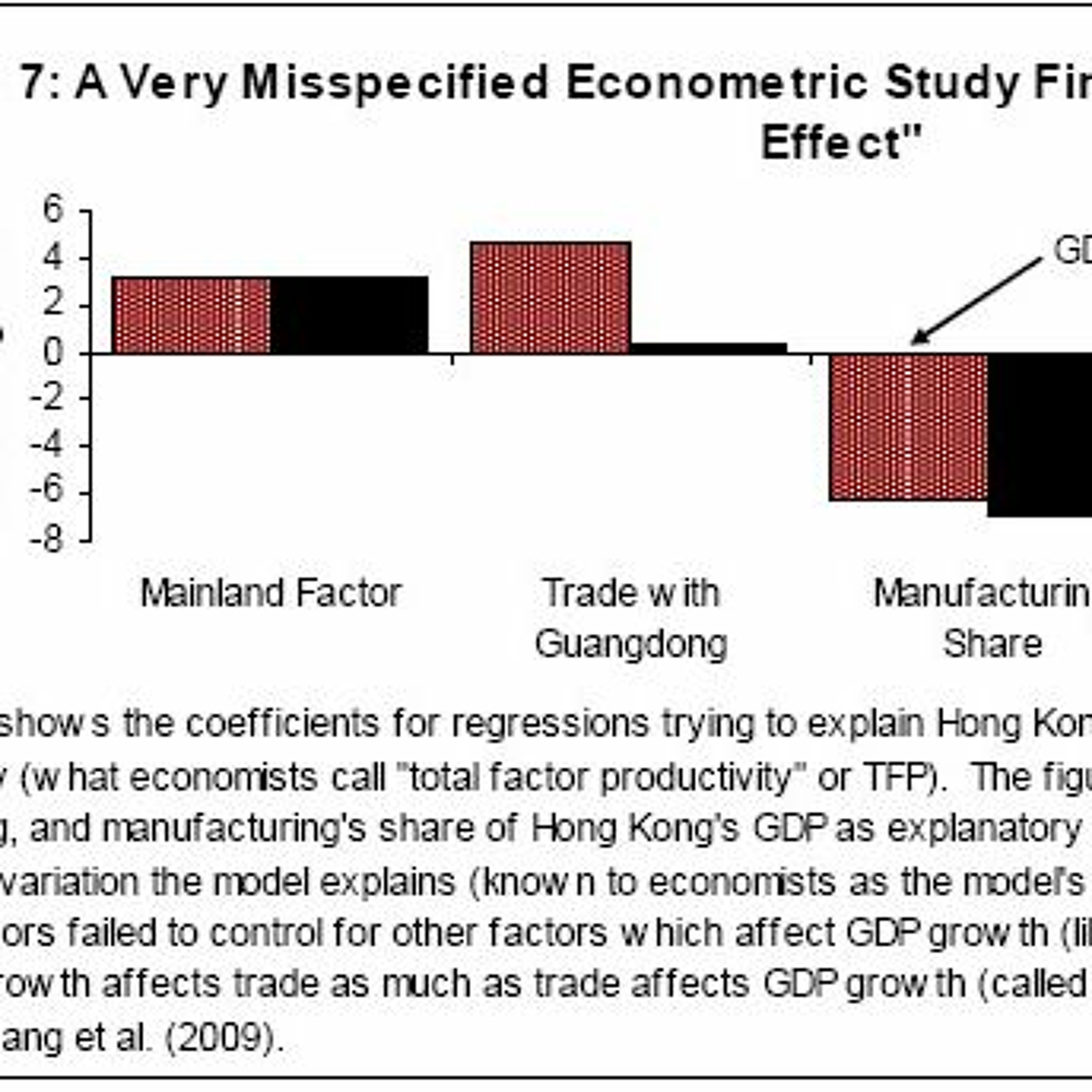

Infographic Instant with Bryane MichaelQianhai: How Not to Design an Innovation HubThe data suggest that a bespoke innovation park serving Hong Kong and Shenzhen won't have much impact on company profits. Or innovation. We review the econometric studies - and Qianhai's costs. For more, see: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=29076082017-01-1007 min Infographic Instant with Bryane MichaelBrief Overview of Qianhai Innovation StudyThe video presents the major sections of our larger study - and presents the main results. Qianhai -- a property development in Shenzhen -- can revolutionize innovation for Hong Kong and Guangdong, if local policymakers let it. For more, see: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=29076082017-01-1005 min

Infographic Instant with Bryane MichaelBrief Overview of Qianhai Innovation StudyThe video presents the major sections of our larger study - and presents the main results. Qianhai -- a property development in Shenzhen -- can revolutionize innovation for Hong Kong and Guangdong, if local policymakers let it. For more, see: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=29076082017-01-1005 min Infographic Instant with Bryane MichaelFixing Qianhai as an Innovation CentreQianhai is a new innovation centre -- meant to combine the powers of Hong Kong and Shenzhen. Yet, right now, its just another real estate project. How can we change local laws to make Qianhai a profit centre? How can Qianhai fix Hong Kong's currently failing innovation policies? For more, see: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=29076082017-01-1052 min

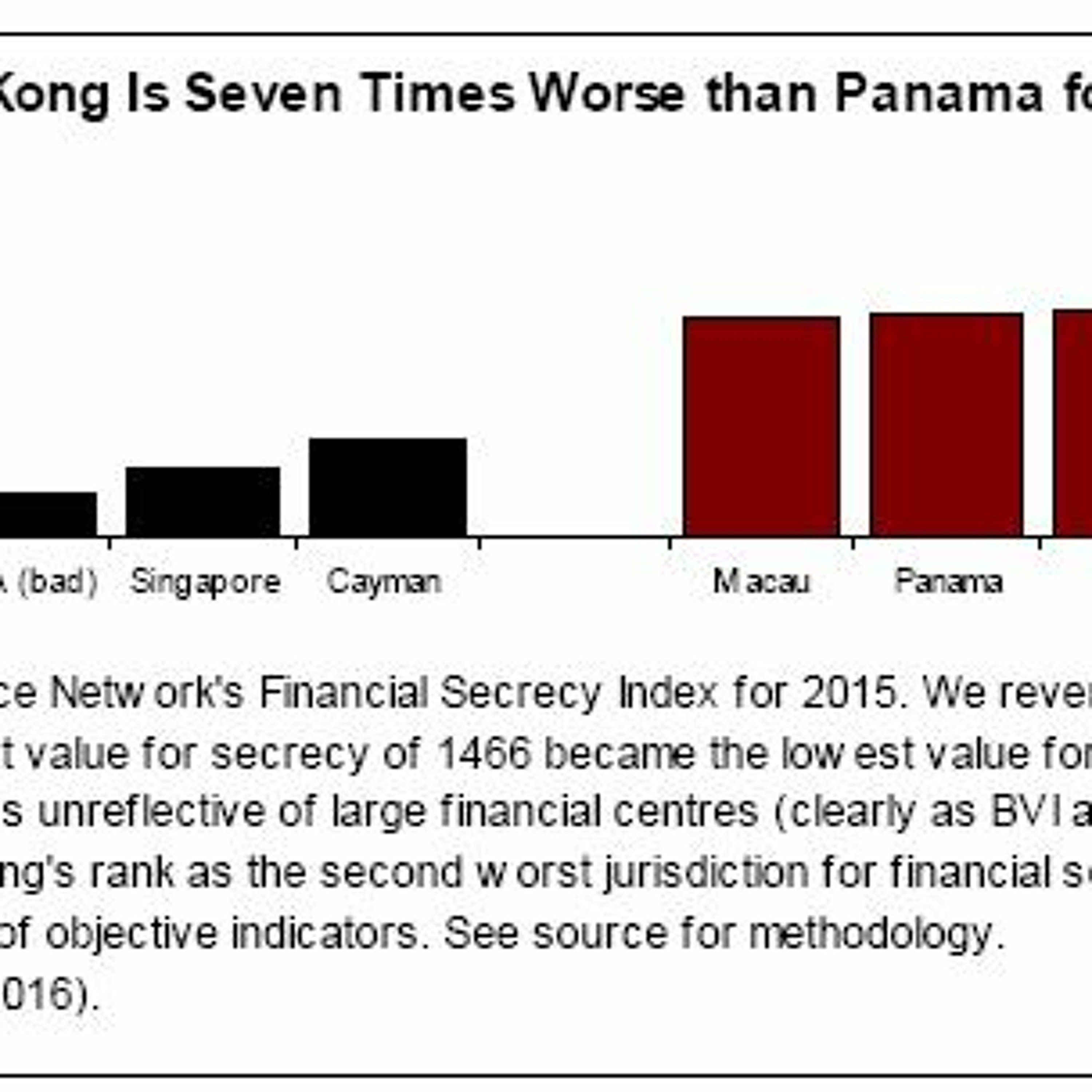

Infographic Instant with Bryane MichaelFixing Qianhai as an Innovation CentreQianhai is a new innovation centre -- meant to combine the powers of Hong Kong and Shenzhen. Yet, right now, its just another real estate project. How can we change local laws to make Qianhai a profit centre? How can Qianhai fix Hong Kong's currently failing innovation policies? For more, see: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=29076082017-01-1052 min Infographic Instant with Bryane MichaelCan Hong Kong Clean Up its Own Corporate Governance?Hong Kong has come a lot way in terms of strengthening its corporate governance. Yet, Mainland markets need it to do more. We show Hong Kong's corporate governance weaknesses -- and show that reform won't cost Hong Kong's offshore incorporation and company secretarial firms very much. For more, see: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=29148652016-12-1004 min

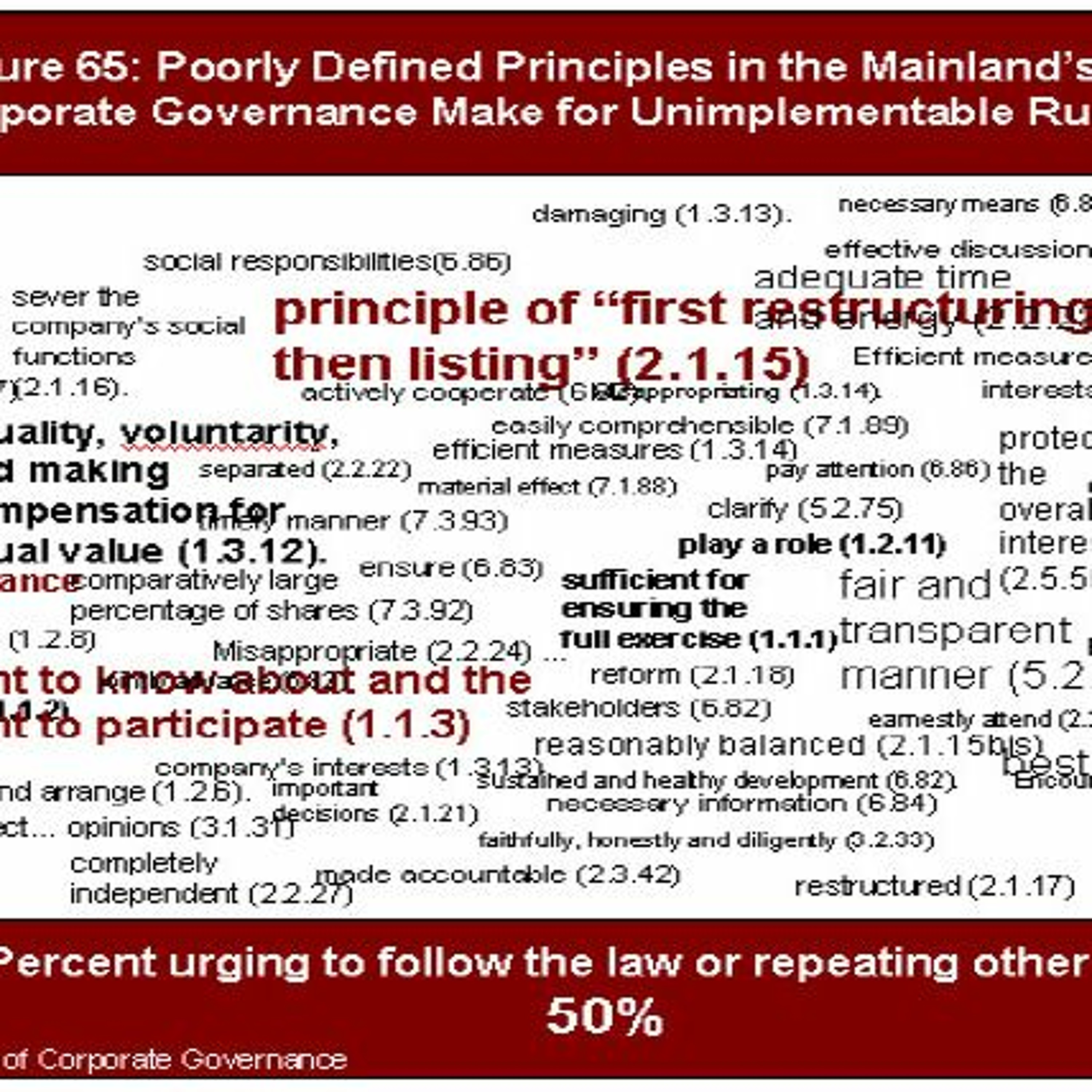

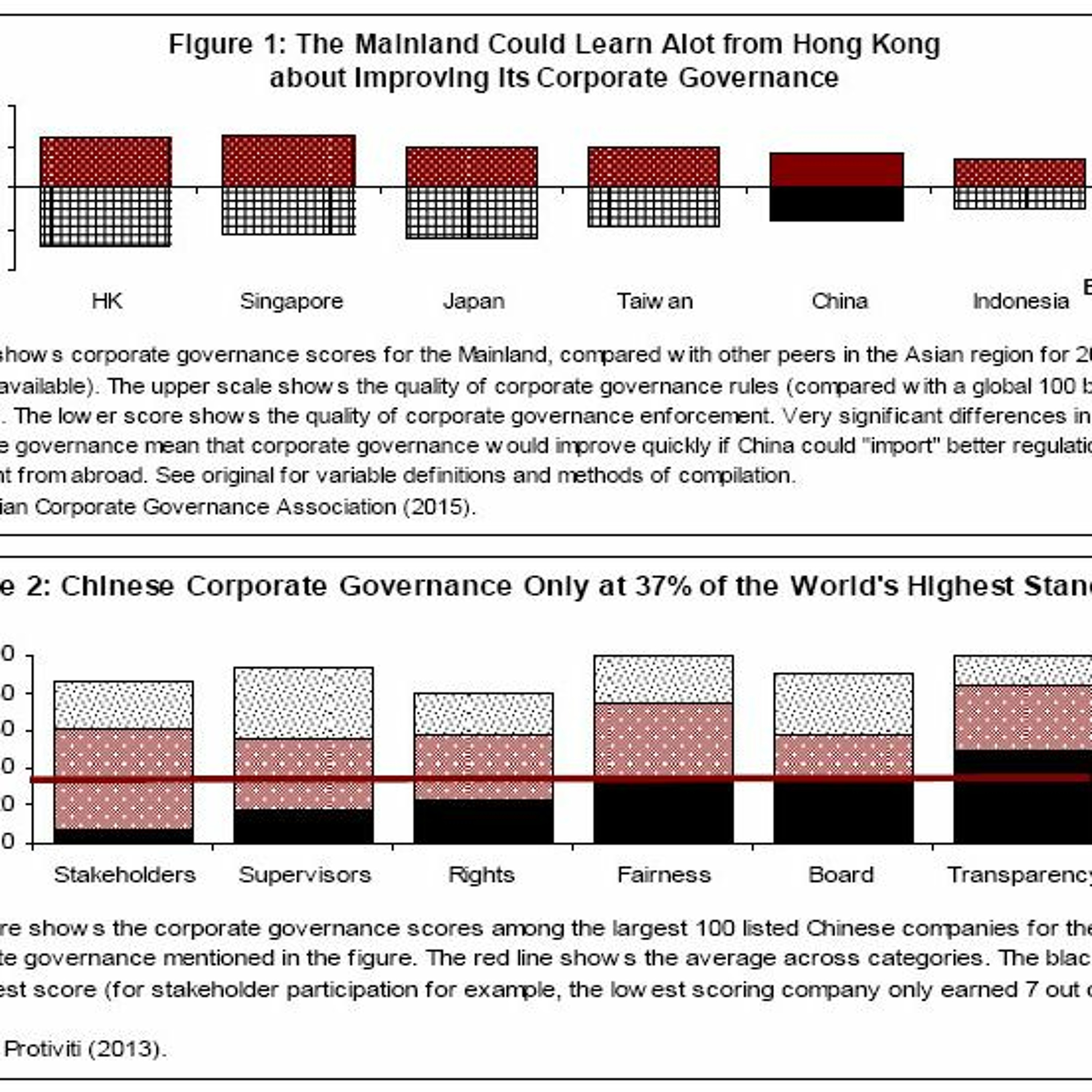

Infographic Instant with Bryane MichaelCan Hong Kong Clean Up its Own Corporate Governance?Hong Kong has come a lot way in terms of strengthening its corporate governance. Yet, Mainland markets need it to do more. We show Hong Kong's corporate governance weaknesses -- and show that reform won't cost Hong Kong's offshore incorporation and company secretarial firms very much. For more, see: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=29148652016-12-1004 min Infographic Instant with Bryane MichaelWhy China Can't Reform its Own Corporate GovernanceChina's economic fundamentals indicate that now is the perfect time to reform its corporate governance. Yet, China's institutions have "locked-in" existing poor corporate governance. Only outside influence from places like the US (or Hong Kong?) can help. For more, see: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=29148652016-12-1006 min

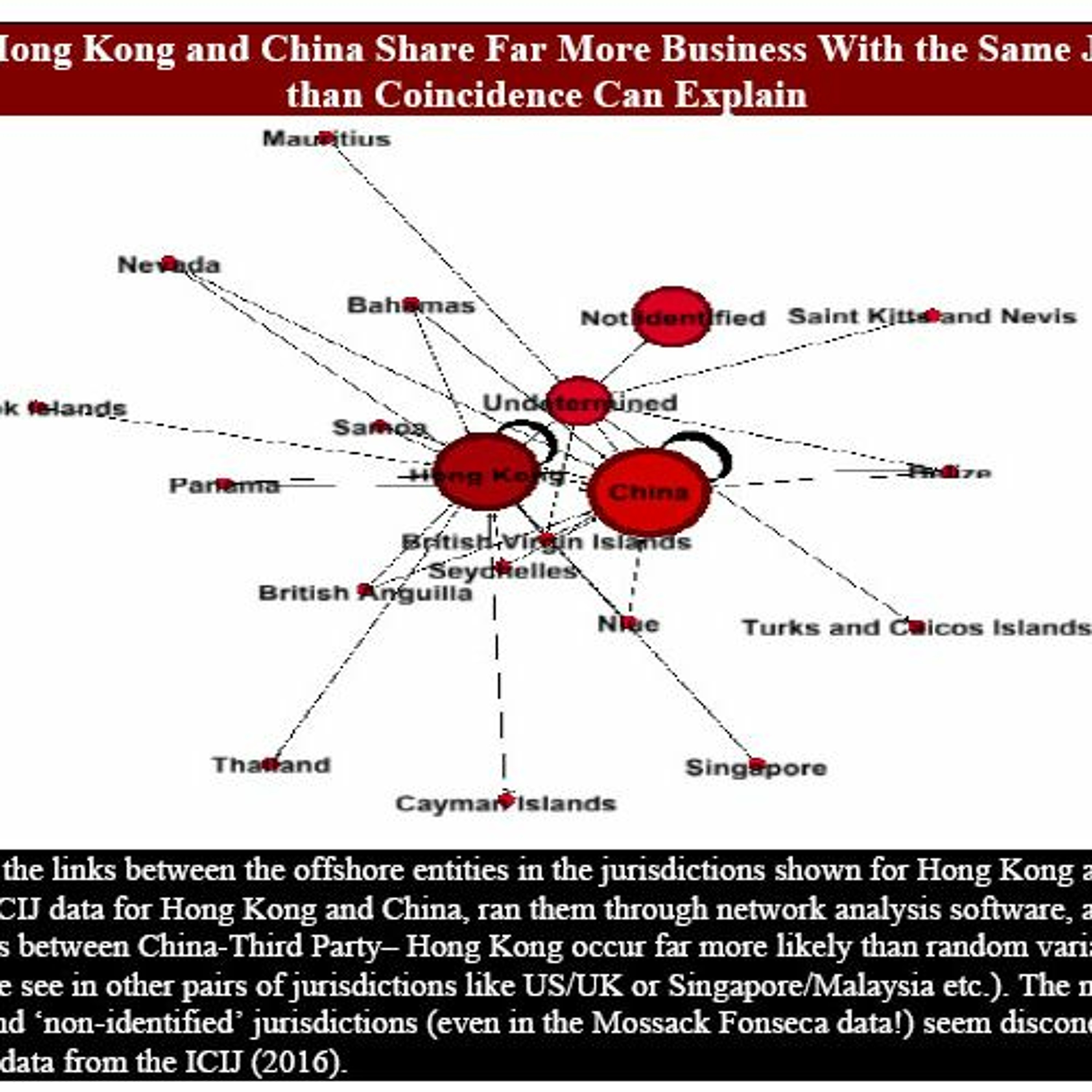

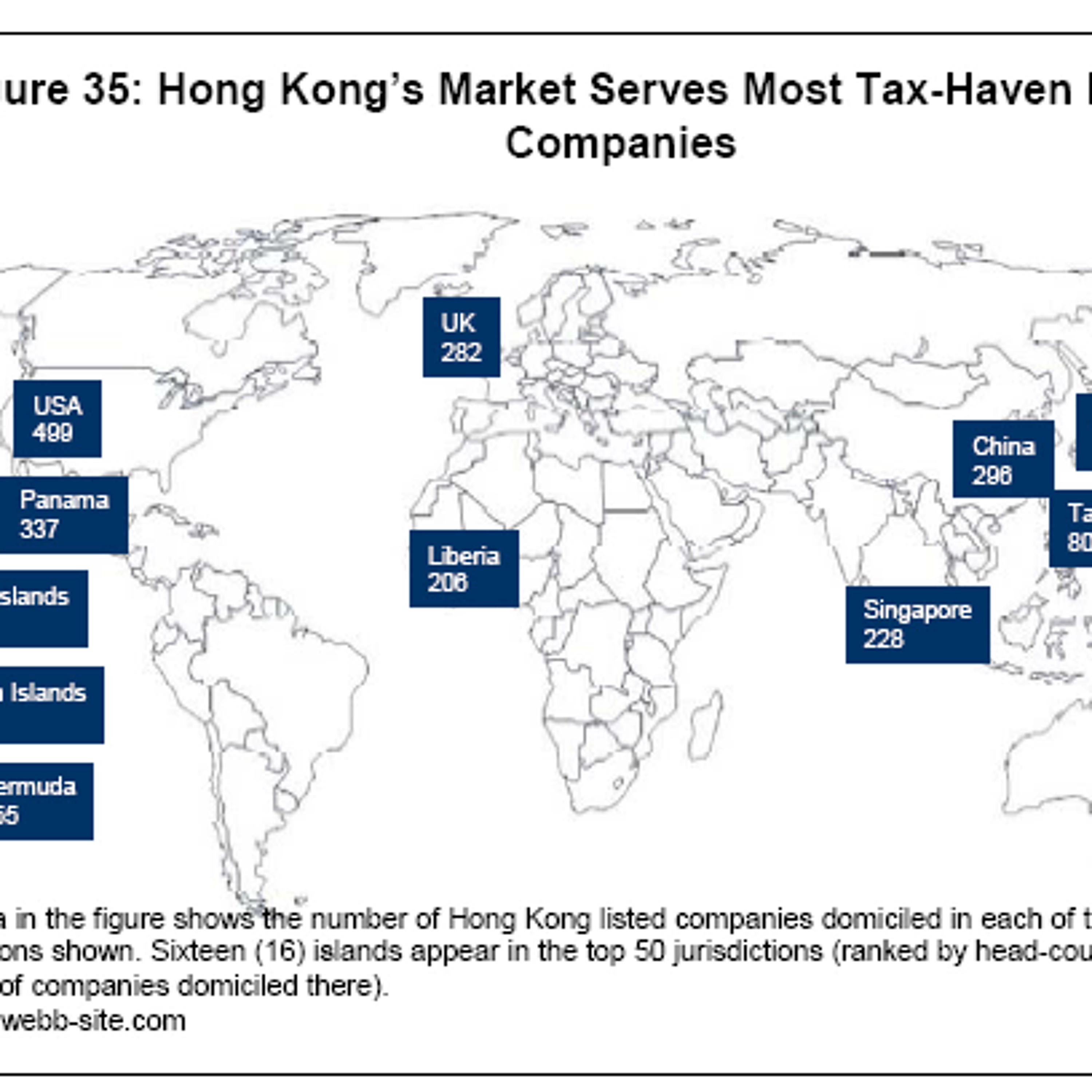

Infographic Instant with Bryane MichaelWhy China Can't Reform its Own Corporate GovernanceChina's economic fundamentals indicate that now is the perfect time to reform its corporate governance. Yet, China's institutions have "locked-in" existing poor corporate governance. Only outside influence from places like the US (or Hong Kong?) can help. For more, see: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=29148652016-12-1006 min Infographic Instant with Bryane MichaelHow Does Hong Kong's Corporate Governance Reverberate in China?Hong Kong's and the Mainland's offshore relations and corporate governance are interlinked. We describe the waves of offshore incorporations in the region. We also provide evidence suggesting that China's poor corporate governance practices allowed companies to skirt Hong Kong's stricter governance standards. For more, see: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=29148652016-12-0910 min

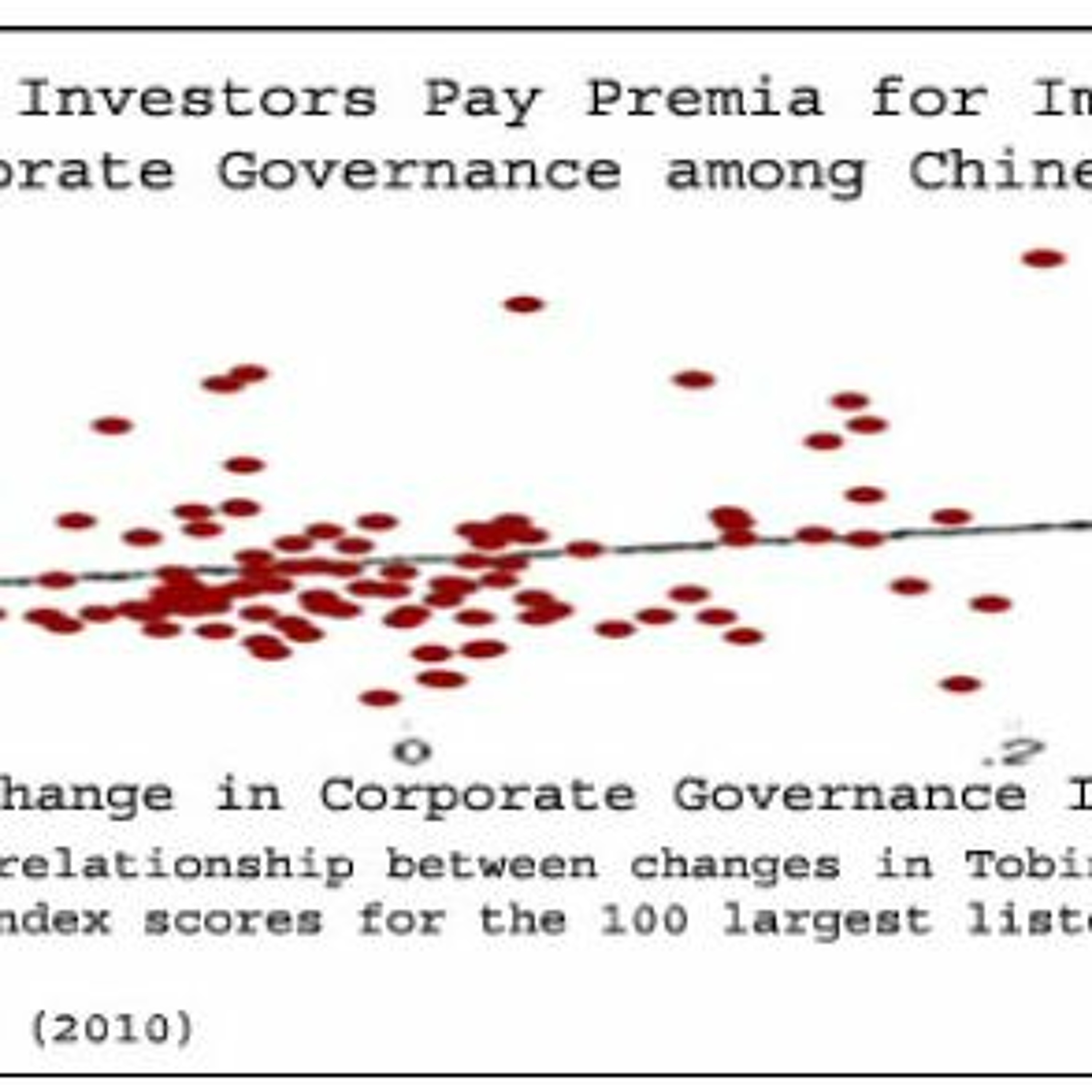

Infographic Instant with Bryane MichaelHow Does Hong Kong's Corporate Governance Reverberate in China?Hong Kong's and the Mainland's offshore relations and corporate governance are interlinked. We describe the waves of offshore incorporations in the region. We also provide evidence suggesting that China's poor corporate governance practices allowed companies to skirt Hong Kong's stricter governance standards. For more, see: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=29148652016-12-0910 min Infographic Instant with Bryane MichaelThe Economic Consequences of China's Corporate GovernanceHow much does China's poor corporate governance cost companies? How much would they benefit from reform? For more, see: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=29148652016-12-0908 min

Infographic Instant with Bryane MichaelThe Economic Consequences of China's Corporate GovernanceHow much does China's poor corporate governance cost companies? How much would they benefit from reform? For more, see: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=29148652016-12-0908 min Infographic Instant with Bryane MichaelThe Quantitative Level and Variability of China's Corporate GovernanceHow does Chinese corporate governance rank relative to other jurisdictions? How many of its companies excel and/or falter in making profits from better corporate governance. For more, see: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=29148652016-12-0904 min

Infographic Instant with Bryane MichaelThe Quantitative Level and Variability of China's Corporate GovernanceHow does Chinese corporate governance rank relative to other jurisdictions? How many of its companies excel and/or falter in making profits from better corporate governance. For more, see: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=29148652016-12-0904 min Infographic Instant with Bryane MichaelHong Kong's Role in Improving Corporate Governance in China: Lessons from the Panama PapersHow can Hong Kong learn the lessons (and obtain the benefits) from the US's extra-territorial corporate governance laws. We describe data measuring the quality of China's corporate governance. We describe how Hong Kong's corporate governance regulations impact on Chinese governance. And describe how we arrived at benefits of $333 billion in extra market value from adopting better corporate governance at home and abroad. For more, see: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=29148652016-12-0939 min

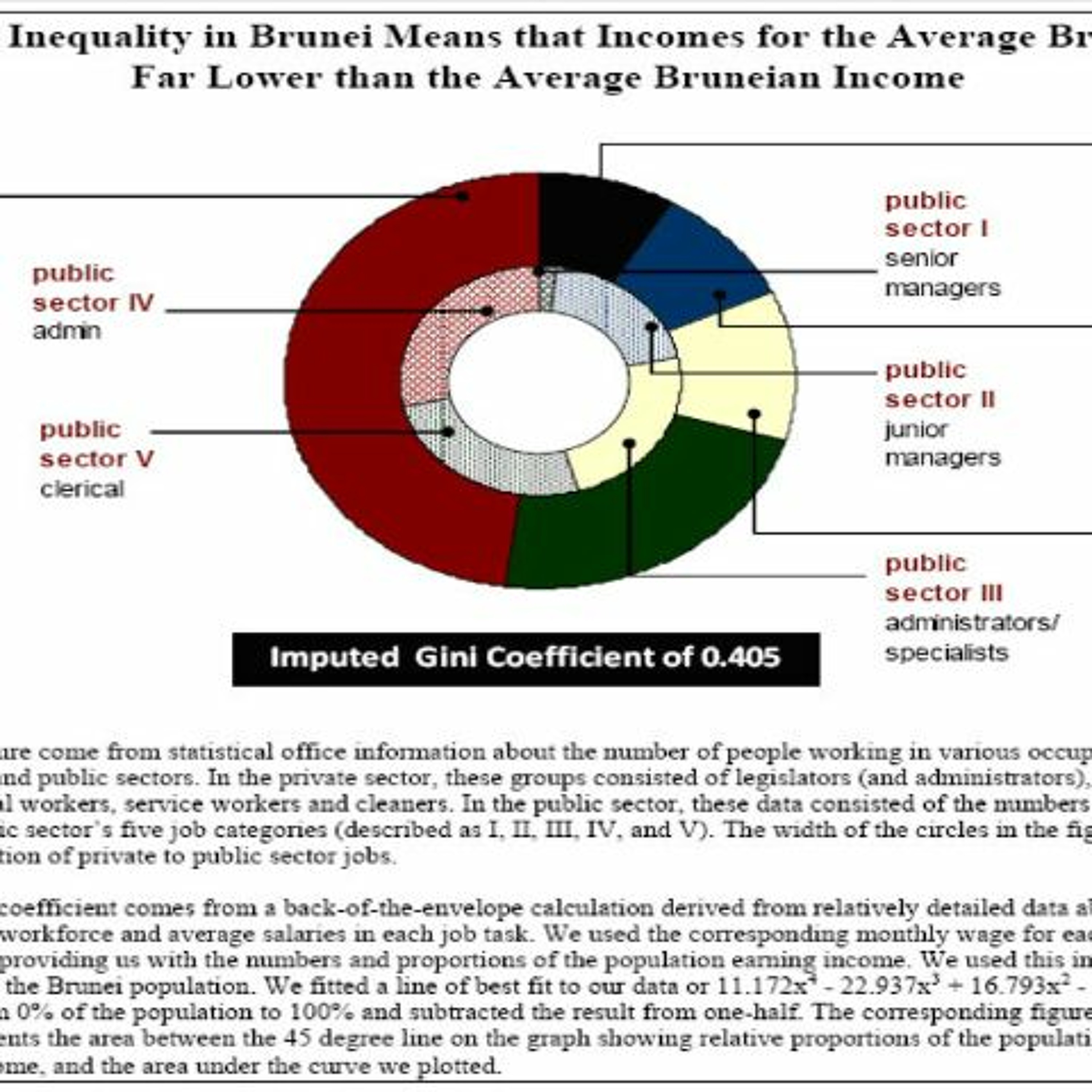

Infographic Instant with Bryane MichaelHong Kong's Role in Improving Corporate Governance in China: Lessons from the Panama PapersHow can Hong Kong learn the lessons (and obtain the benefits) from the US's extra-territorial corporate governance laws. We describe data measuring the quality of China's corporate governance. We describe how Hong Kong's corporate governance regulations impact on Chinese governance. And describe how we arrived at benefits of $333 billion in extra market value from adopting better corporate governance at home and abroad. For more, see: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=29148652016-12-0939 min Infographic Instant with Bryane MichaelHow Bad is Inequality in Brunei (a look at its Gini Coefficient)Good luck trying to find an estimate for inequality in Brunei. Until now. Using publicly avaiable information, we show Brunei's 0.4 Gini coefficient rates favorably with other countries like even Malaysia.

For more, see https://papers.ssrn.com/sol3/papers.cfm?abstract_id=23956612016-11-2602 min

Infographic Instant with Bryane MichaelHow Bad is Inequality in Brunei (a look at its Gini Coefficient)Good luck trying to find an estimate for inequality in Brunei. Until now. Using publicly avaiable information, we show Brunei's 0.4 Gini coefficient rates favorably with other countries like even Malaysia.

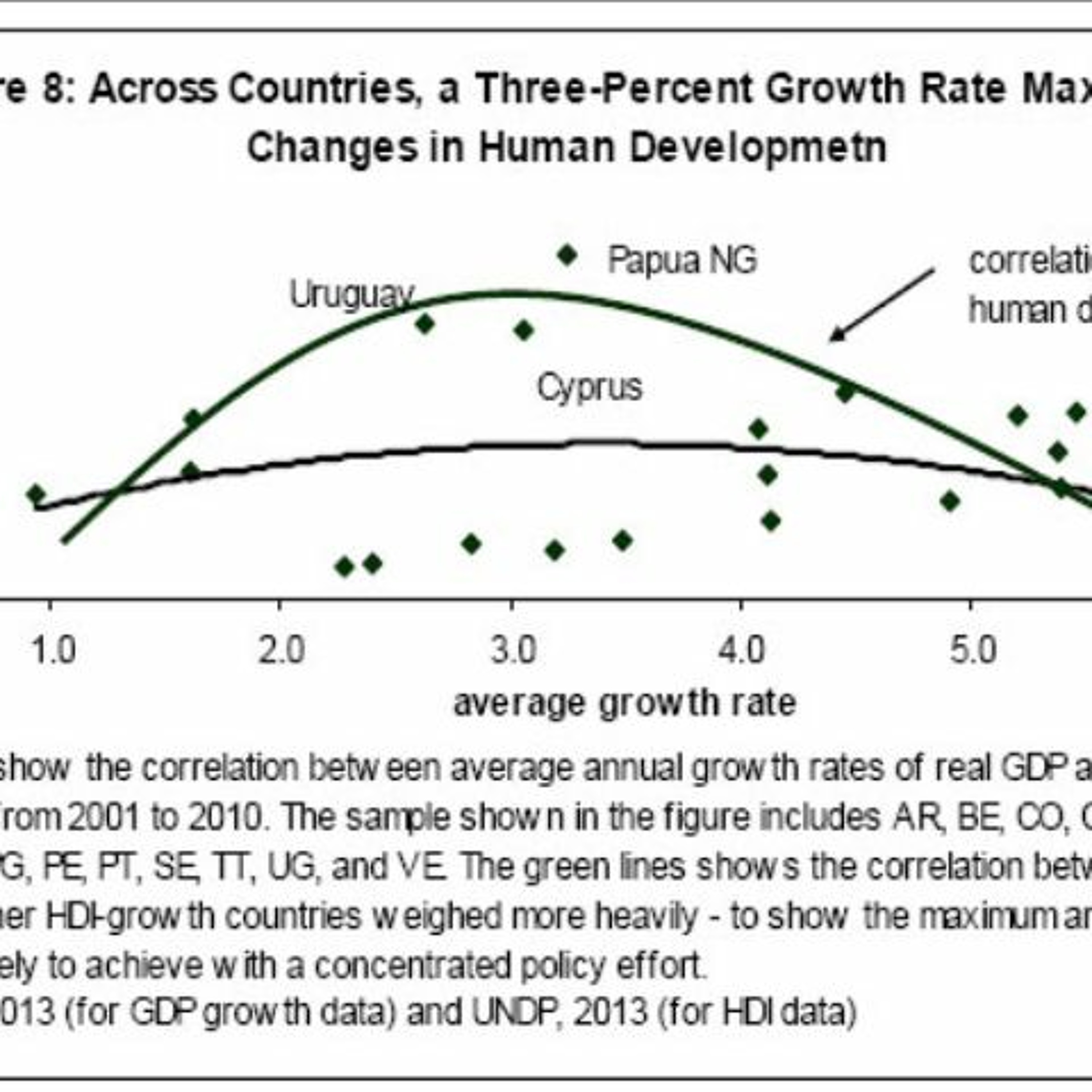

For more, see https://papers.ssrn.com/sol3/papers.cfm?abstract_id=23956612016-11-2602 min Infographic Instant with Bryane MichaelHow Fast Should we Grow GDP to Max Out our Human Development Scores?GDP growth needs to follow a "health route." Too fast or too slow, and growth hurts broader social development. In this session, we describe the 3% growth target which seems to maximize the social development of countries like Brunei. For more, see https://papers.ssrn.com/sol3/papers.cfm?abstract_id=23956612016-11-2603 min

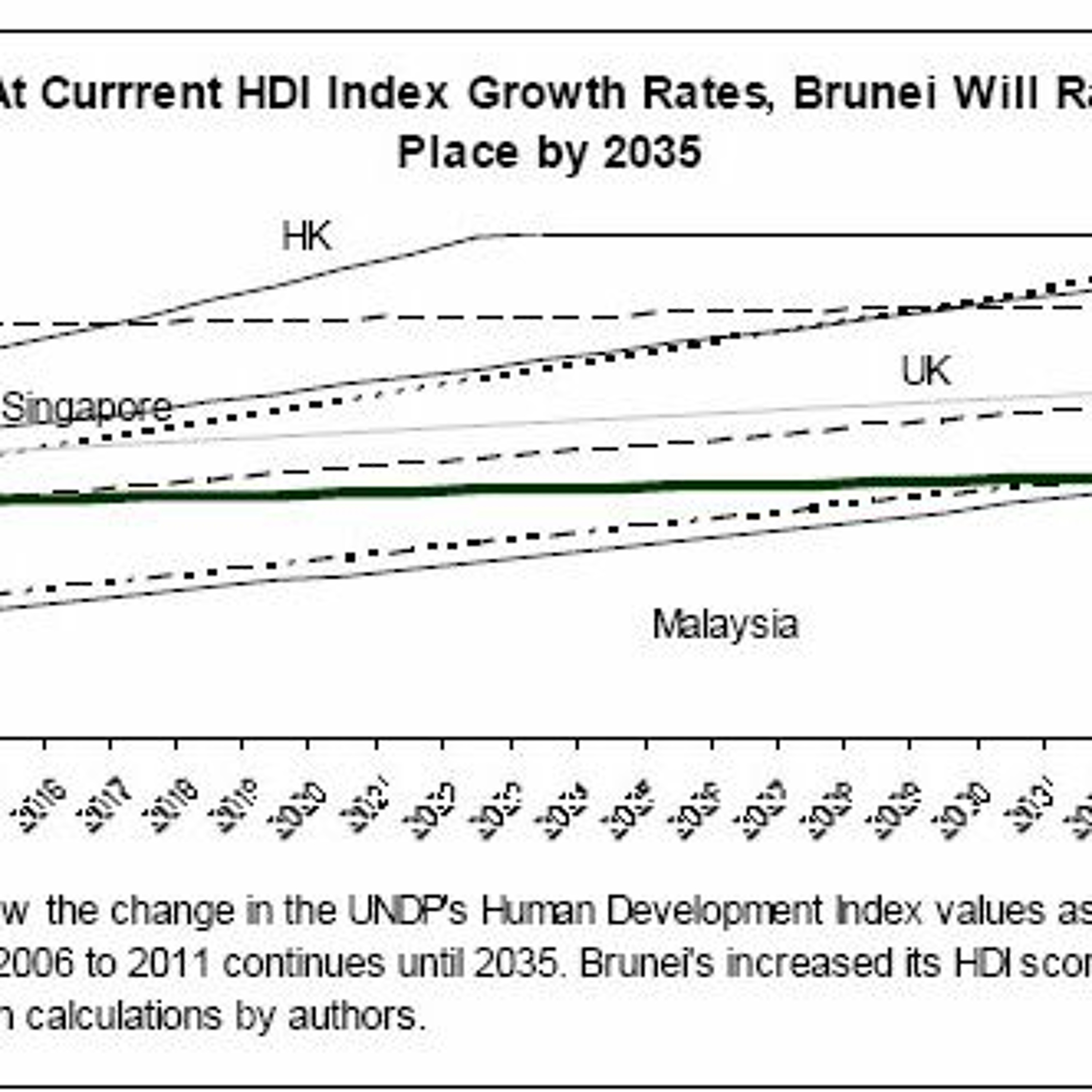

Infographic Instant with Bryane MichaelHow Fast Should we Grow GDP to Max Out our Human Development Scores?GDP growth needs to follow a "health route." Too fast or too slow, and growth hurts broader social development. In this session, we describe the 3% growth target which seems to maximize the social development of countries like Brunei. For more, see https://papers.ssrn.com/sol3/papers.cfm?abstract_id=23956612016-11-2603 min Infographic Instant with Bryane MichaelCan we use Human Development Indices as a Headline Indicator of Government’s Success?Using human development indicator scores seems like a great way to measure government's performance. One simple number tells how good a government chases our hopes and dreams for us. Yet, as more countries use HDI targets, would we see an HDI "arms race"?

For more, see https://papers.ssrn.com/sol3/papers.cfm?abstract_id=23956612016-11-2604 min

Infographic Instant with Bryane MichaelCan we use Human Development Indices as a Headline Indicator of Government’s Success?Using human development indicator scores seems like a great way to measure government's performance. One simple number tells how good a government chases our hopes and dreams for us. Yet, as more countries use HDI targets, would we see an HDI "arms race"?

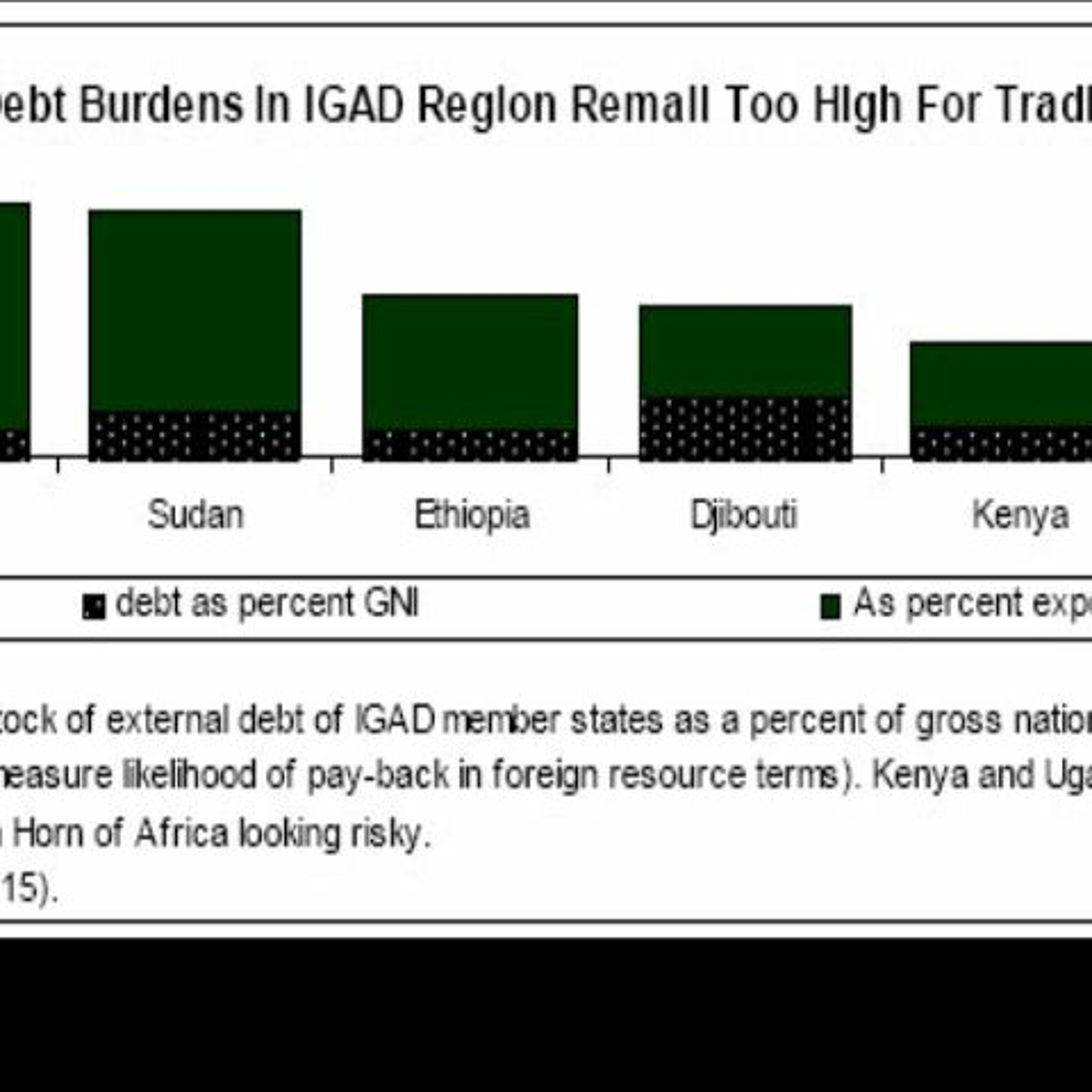

For more, see https://papers.ssrn.com/sol3/papers.cfm?abstract_id=23956612016-11-2604 min Infographic Instant with Bryane MichaelNext Generation Development Banks as More Blackstone than World BankLoans will never be repaid in the IGAD region. In this episode, we describe how securitisation - and selling shares of hard assets (or debts) - can bring the $40 billion needed by countries like Djibouti, Eritrea, Ethiopia, Sudan, Somalia, Kenya and Uganda. For more, seehttps://papers.ssrn.com/sol3/papers.cfm?abstract_id=27906612016-11-2312 min

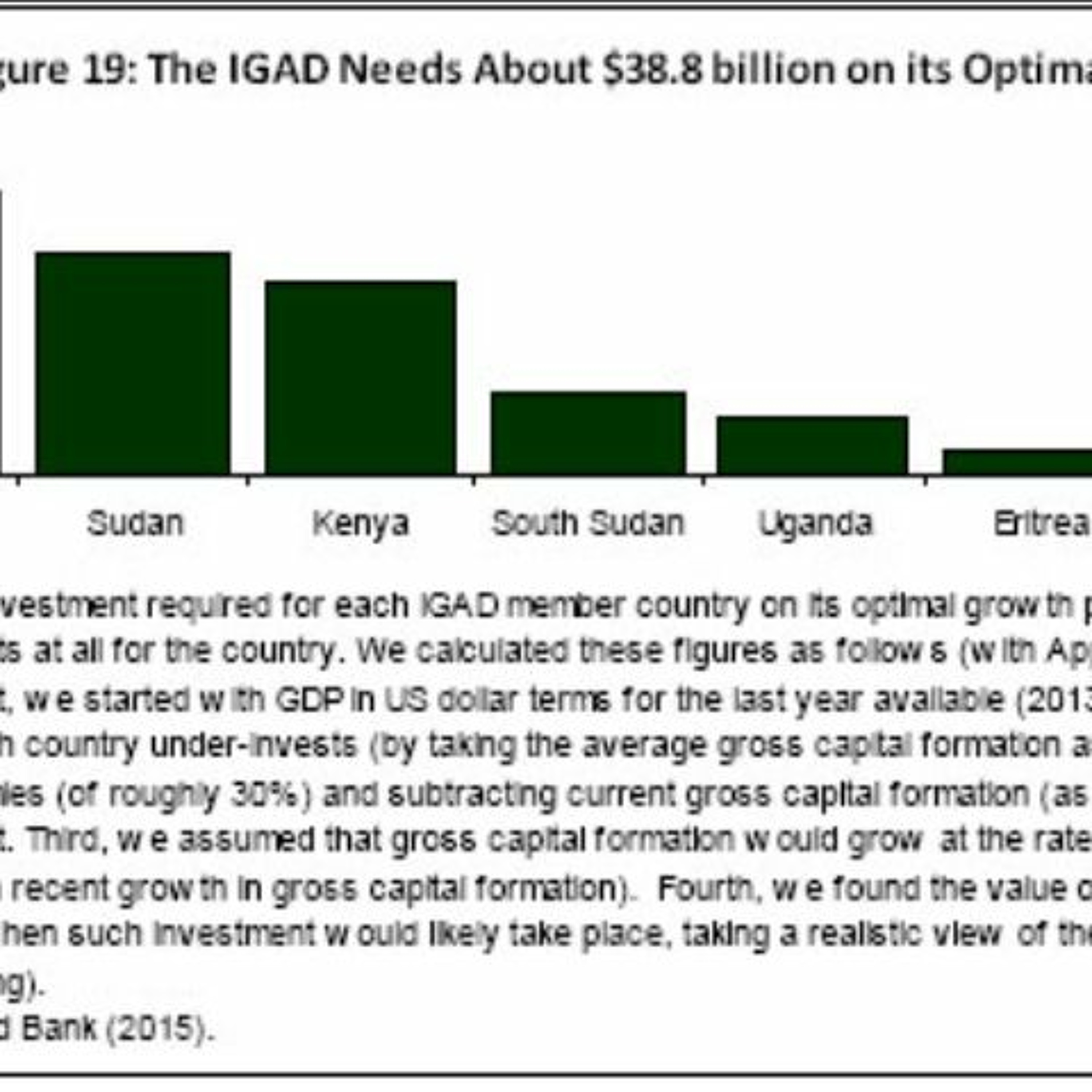

Infographic Instant with Bryane MichaelNext Generation Development Banks as More Blackstone than World BankLoans will never be repaid in the IGAD region. In this episode, we describe how securitisation - and selling shares of hard assets (or debts) - can bring the $40 billion needed by countries like Djibouti, Eritrea, Ethiopia, Sudan, Somalia, Kenya and Uganda. For more, seehttps://papers.ssrn.com/sol3/papers.cfm?abstract_id=27906612016-11-2312 min Infographic Instant with Bryane MichaelHow Much Development Finance Does the IGAD Region Need?The IGAD region contains the poorest countries in the world. Perfect candidates for development bank lending/finance. How much money should these financial institutions give? About $40 billion. For more, see https://papers.ssrn.com/sol3/papers.cfm?abstract_id=27906612016-11-2306 min

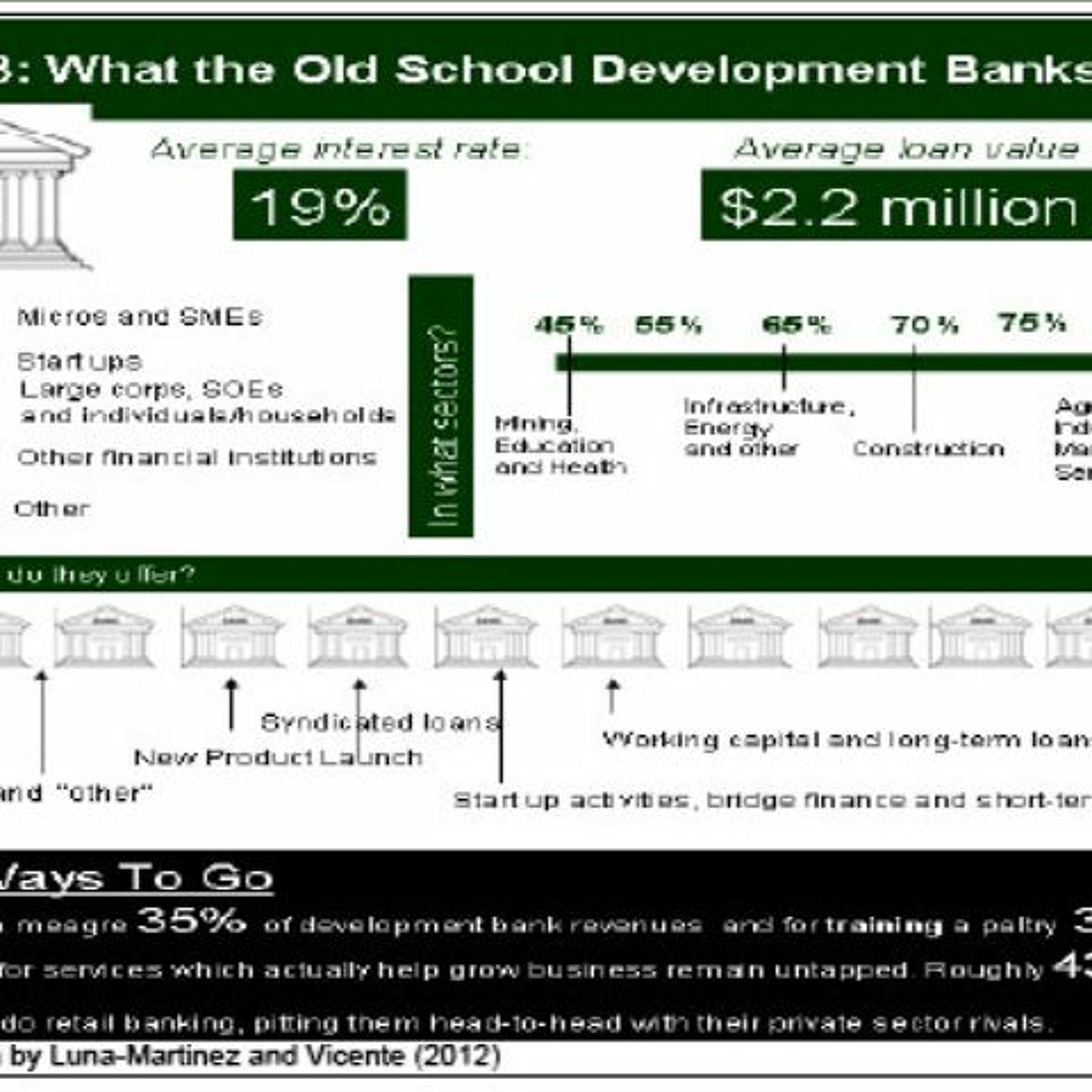

Infographic Instant with Bryane MichaelHow Much Development Finance Does the IGAD Region Need?The IGAD region contains the poorest countries in the world. Perfect candidates for development bank lending/finance. How much money should these financial institutions give? About $40 billion. For more, see https://papers.ssrn.com/sol3/papers.cfm?abstract_id=27906612016-11-2306 min Infographic Instant with Bryane MichaelAssessing "Old School" Development BankingWhat do we know about the successes and failure of development banks so far? We describe the data -- showing how development banks have had high lending costs, low loan amounts, and socially inefficient project choices. For more, see https://papers.ssrn.com/sol3/papers.cfm?abstract_id=27906612016-11-2306 min

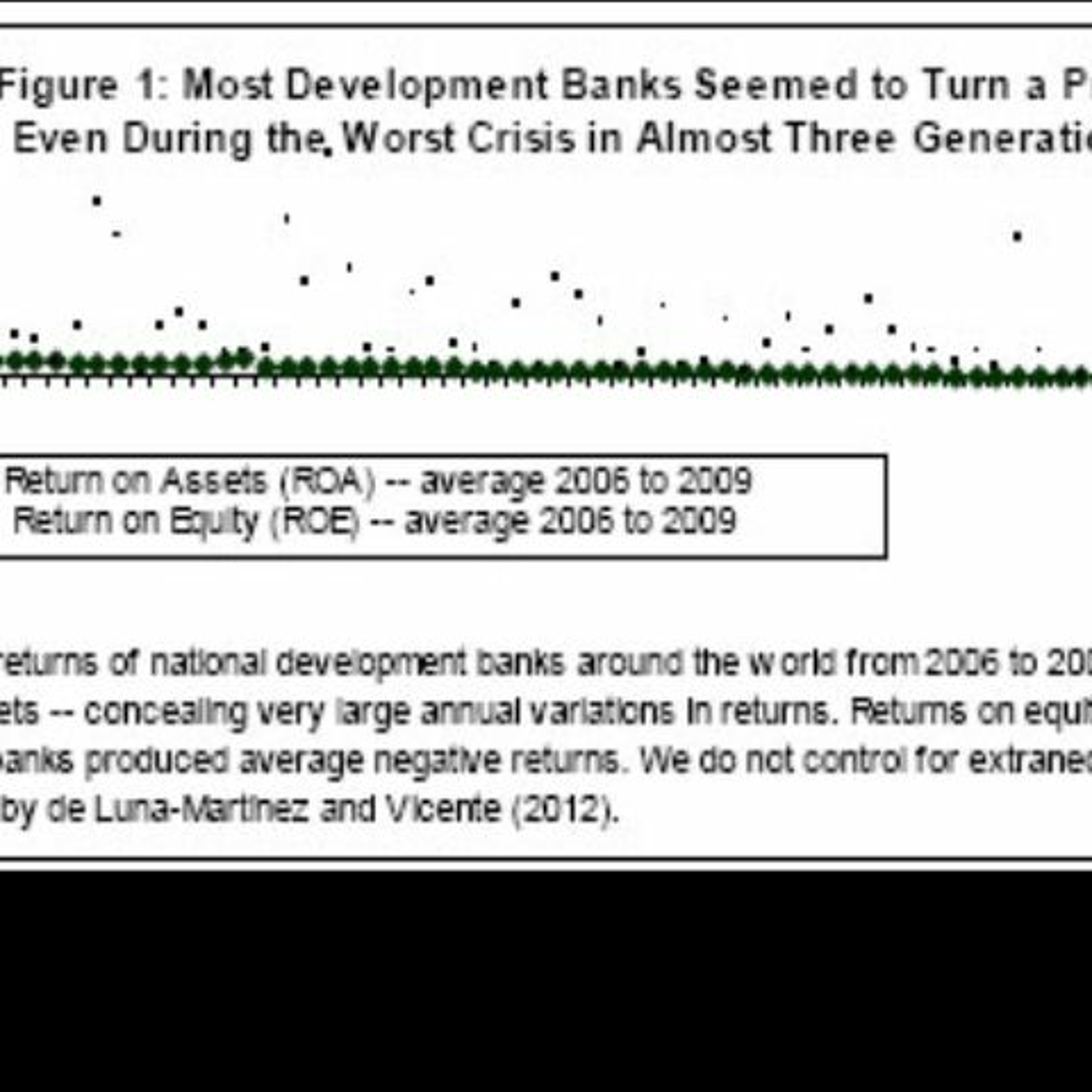

Infographic Instant with Bryane MichaelAssessing "Old School" Development BankingWhat do we know about the successes and failure of development banks so far? We describe the data -- showing how development banks have had high lending costs, low loan amounts, and socially inefficient project choices. For more, see https://papers.ssrn.com/sol3/papers.cfm?abstract_id=27906612016-11-2306 min Infographic Instant with Bryane MichaelHow Successful Have Development Banks Been?Many countries continue to set up development banks. Should they? We show data about effectiveness of development banks. They have a good record of turning a profit. But a poor record of promoting development. For more, see https://papers.ssrn.com/sol3/papers.cfm?abstract_id=27906612016-11-2306 min

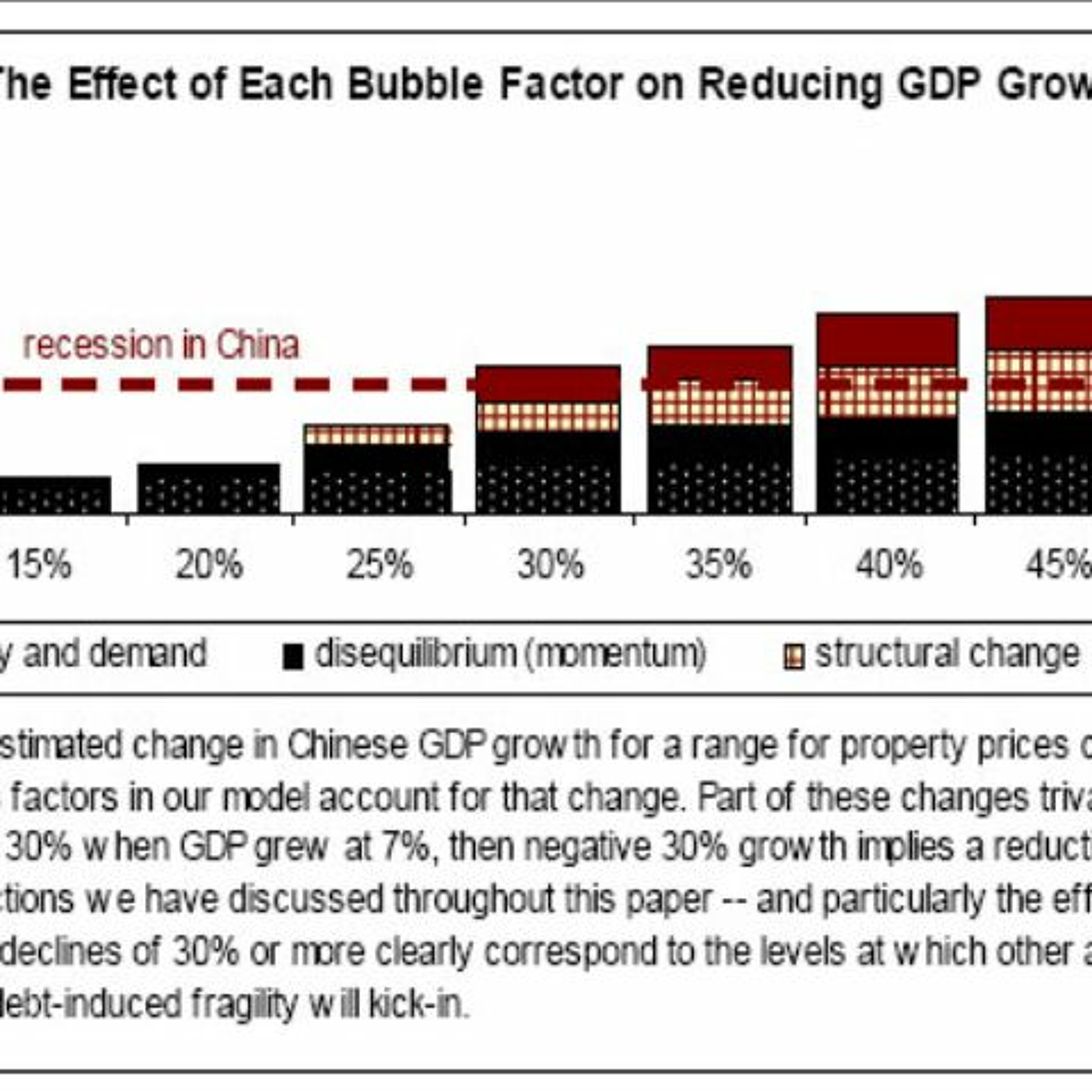

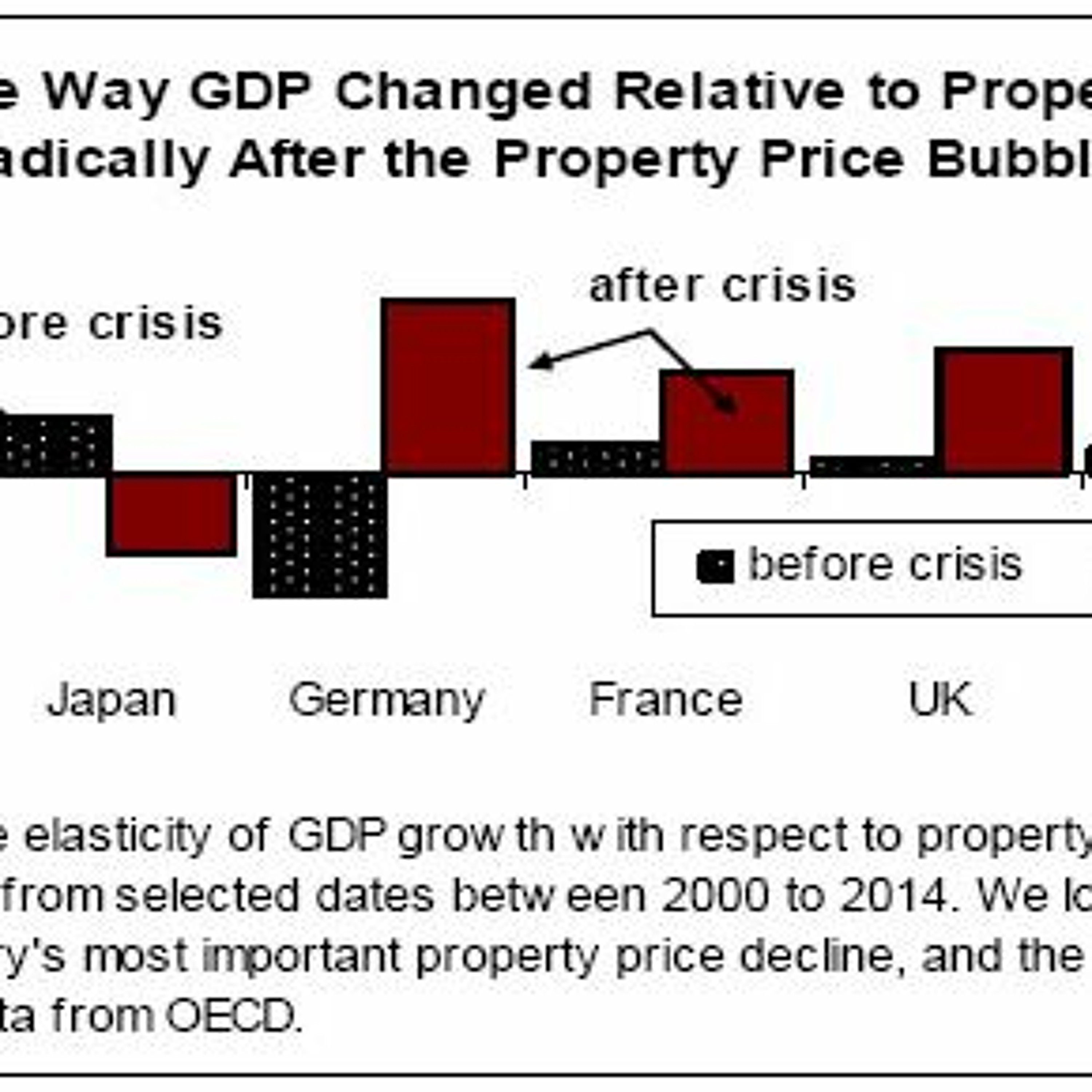

Infographic Instant with Bryane MichaelHow Successful Have Development Banks Been?Many countries continue to set up development banks. Should they? We show data about effectiveness of development banks. They have a good record of turning a profit. But a poor record of promoting development. For more, see https://papers.ssrn.com/sol3/papers.cfm?abstract_id=27906612016-11-2306 min Infographic Instant with Bryane MichaelHow Far Should Chinese Real Estate Prices Fall to Cause a Recession?We present the data showing how far China's real estate prices need to drop in order to wipe out China's current GDP growth. We talk about the 4 sources of economic shocks -- and weigh their relative effects. For more, see https://papers.ssrn.com/sol3/papers.cfm?abstract_id=27855032016-11-2305 min

Infographic Instant with Bryane MichaelHow Far Should Chinese Real Estate Prices Fall to Cause a Recession?We present the data showing how far China's real estate prices need to drop in order to wipe out China's current GDP growth. We talk about the 4 sources of economic shocks -- and weigh their relative effects. For more, see https://papers.ssrn.com/sol3/papers.cfm?abstract_id=27855032016-11-2305 min Infographic Instant with Bryane MichaelHow Will China's "Bubble Economics" Play Out?How will changes in real estate prices likely affect China's growth? In this episode, we describe the data which might help us predict (if not at least understand) banking, real estate and even sovereign crises. For more, see https://papers.ssrn.com/sol3/papers.cfm?abstract_id=27855032016-11-2304 min

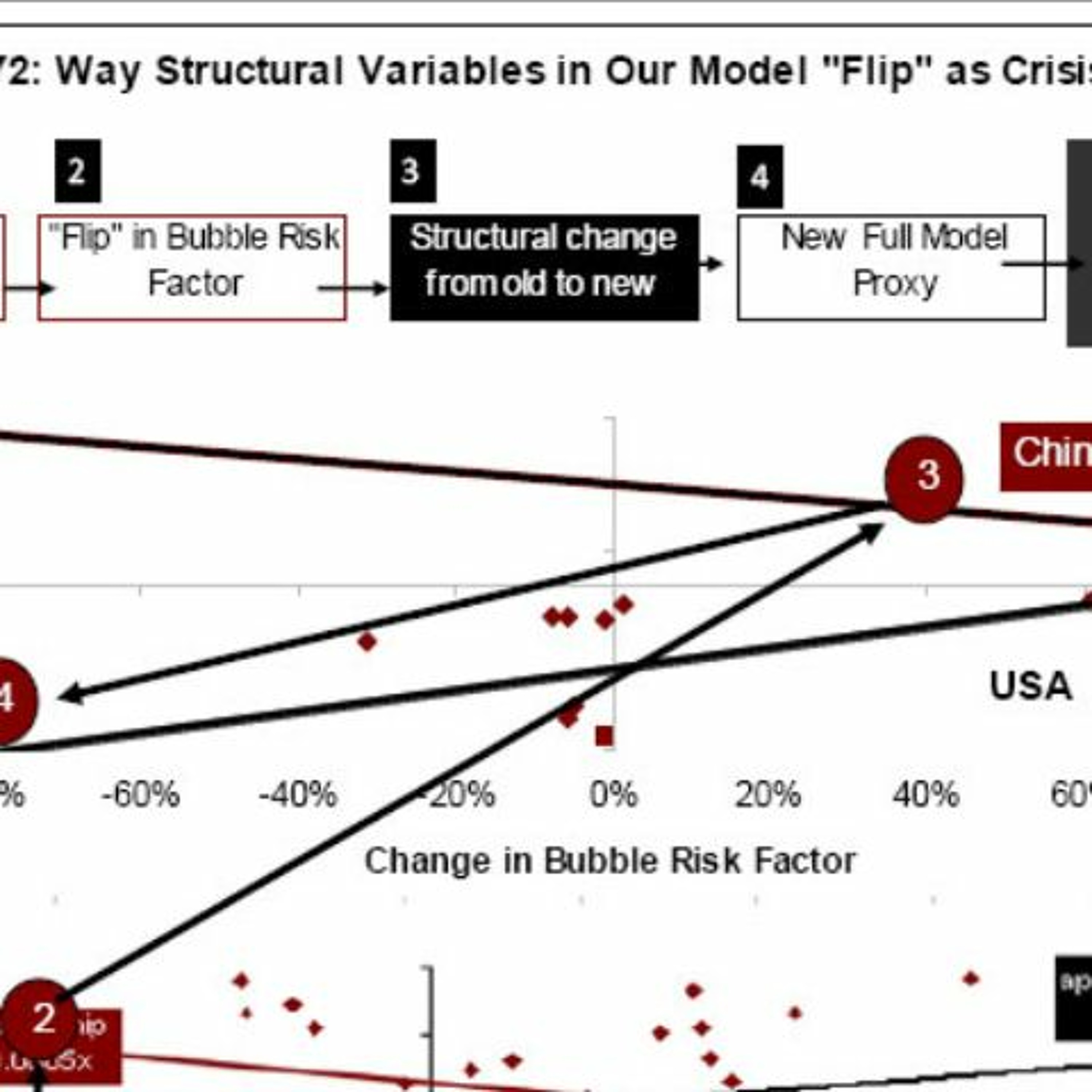

Infographic Instant with Bryane MichaelHow Will China's "Bubble Economics" Play Out?How will changes in real estate prices likely affect China's growth? In this episode, we describe the data which might help us predict (if not at least understand) banking, real estate and even sovereign crises. For more, see https://papers.ssrn.com/sol3/papers.cfm?abstract_id=27855032016-11-2304 min Infographic Instant with Bryane MichaelWhat is Bubble Economics?We describe how economies -- and especially China's economy -- respond to different economic rules before versus after a crisis. We present data from major OECD economies' real estate and banking sectors before and after crisis -- and the model which allows us to understand China's growth better. For more, see https://papers.ssrn.com/sol3/papers.cfm?abstract_id=27855032016-11-2304 min

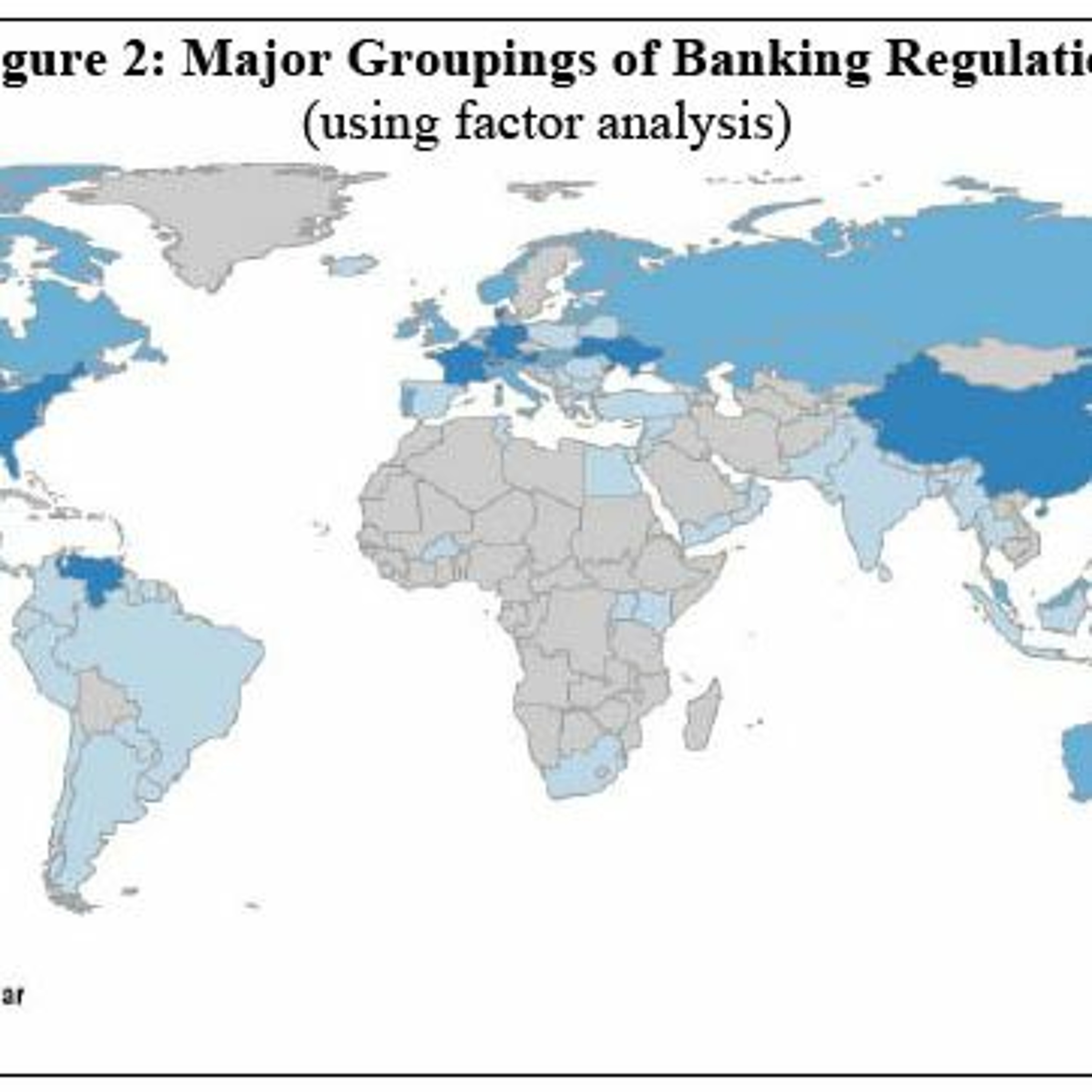

Infographic Instant with Bryane MichaelWhat is Bubble Economics?We describe how economies -- and especially China's economy -- respond to different economic rules before versus after a crisis. We present data from major OECD economies' real estate and banking sectors before and after crisis -- and the model which allows us to understand China's growth better. For more, see https://papers.ssrn.com/sol3/papers.cfm?abstract_id=27855032016-11-2304 min Infographic Instant with Bryane MichaelWhat is the Financial Complexity Index?Infographic instant episode describing new data showing banking restrictiveness by country. We introduce our index of the similarity of banking and financial regulations around the world. Listen if you want to know the best/worst countries to invest/bank. For the paper, see https://papers.ssrn.com/sol3/papers.cfm?abstract_id=25639812016-11-2310 min

Infographic Instant with Bryane MichaelWhat is the Financial Complexity Index?Infographic instant episode describing new data showing banking restrictiveness by country. We introduce our index of the similarity of banking and financial regulations around the world. Listen if you want to know the best/worst countries to invest/bank. For the paper, see https://papers.ssrn.com/sol3/papers.cfm?abstract_id=25639812016-11-2310 min Infographic Instant with Bryane MichaelThe Law and Economics of Corporate Governance Reform in Hong KongWhat does legal theory and economics teach us about the way corporate governance needs to change in Hong Kong? In this presentation, we review the problems with Hong Kong's corporations. We show how some simple changes can help bring much more money to this international financial centre.2015-06-0349 min

Infographic Instant with Bryane MichaelThe Law and Economics of Corporate Governance Reform in Hong KongWhat does legal theory and economics teach us about the way corporate governance needs to change in Hong Kong? In this presentation, we review the problems with Hong Kong's corporations. We show how some simple changes can help bring much more money to this international financial centre.2015-06-0349 min Infographic Instant with Bryane MichaelWhat Can Other Financial Centres Learn from Hong Kong's Proposed Financial Law ReformHong Kong sits perilously close to China -- geographically and economically. If and when crisis hits the Mainland, Hong Kong's financial centre will probably suffer. What can lawmakers do to protect an international financial centre highly dependent on a fragile larger hitherland? In this presentation, we review the amendments we propose to Hong Kong's own financial law. We talk about the tools and mind-set regulators need to get their jurisdictions ready for the crisis.2015-06-0238 min

Infographic Instant with Bryane MichaelWhat Can Other Financial Centres Learn from Hong Kong's Proposed Financial Law ReformHong Kong sits perilously close to China -- geographically and economically. If and when crisis hits the Mainland, Hong Kong's financial centre will probably suffer. What can lawmakers do to protect an international financial centre highly dependent on a fragile larger hitherland? In this presentation, we review the amendments we propose to Hong Kong's own financial law. We talk about the tools and mind-set regulators need to get their jurisdictions ready for the crisis.2015-06-0238 min Infographic Instant with Bryane MichaelCan the Hong Kong ICAC Help Fight Corruption on the Mainland?What can Hong Kong learn from the EU's experience in tackling corruption across borders? In this presentation, I talk about the ways that Hong Kong can import successful legal provisions from other jurisdictions (particularly the US and EU).2015-06-0138 min

Infographic Instant with Bryane MichaelCan the Hong Kong ICAC Help Fight Corruption on the Mainland?What can Hong Kong learn from the EU's experience in tackling corruption across borders? In this presentation, I talk about the ways that Hong Kong can import successful legal provisions from other jurisdictions (particularly the US and EU).2015-06-0138 min Infographic Instant with Bryane MichaelHow to Draft an International Financial Centre's Financial LawHow can regulators draft more competitive financial law? For the jurisdictions lower down on the Y/Zen rankings, what can they do to raise they rankings -- and grab more money sloshing around global financial markets?2015-05-1547 min

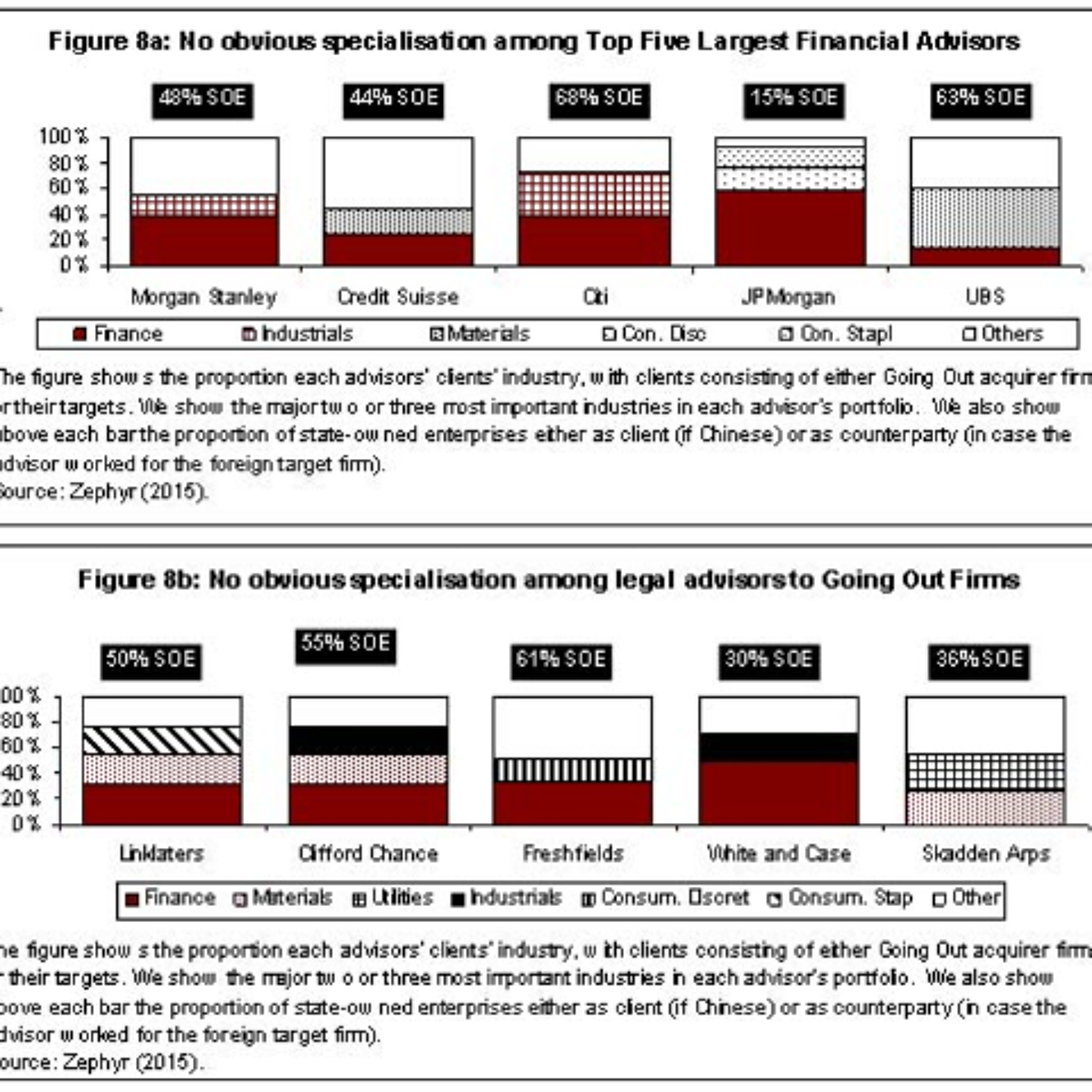

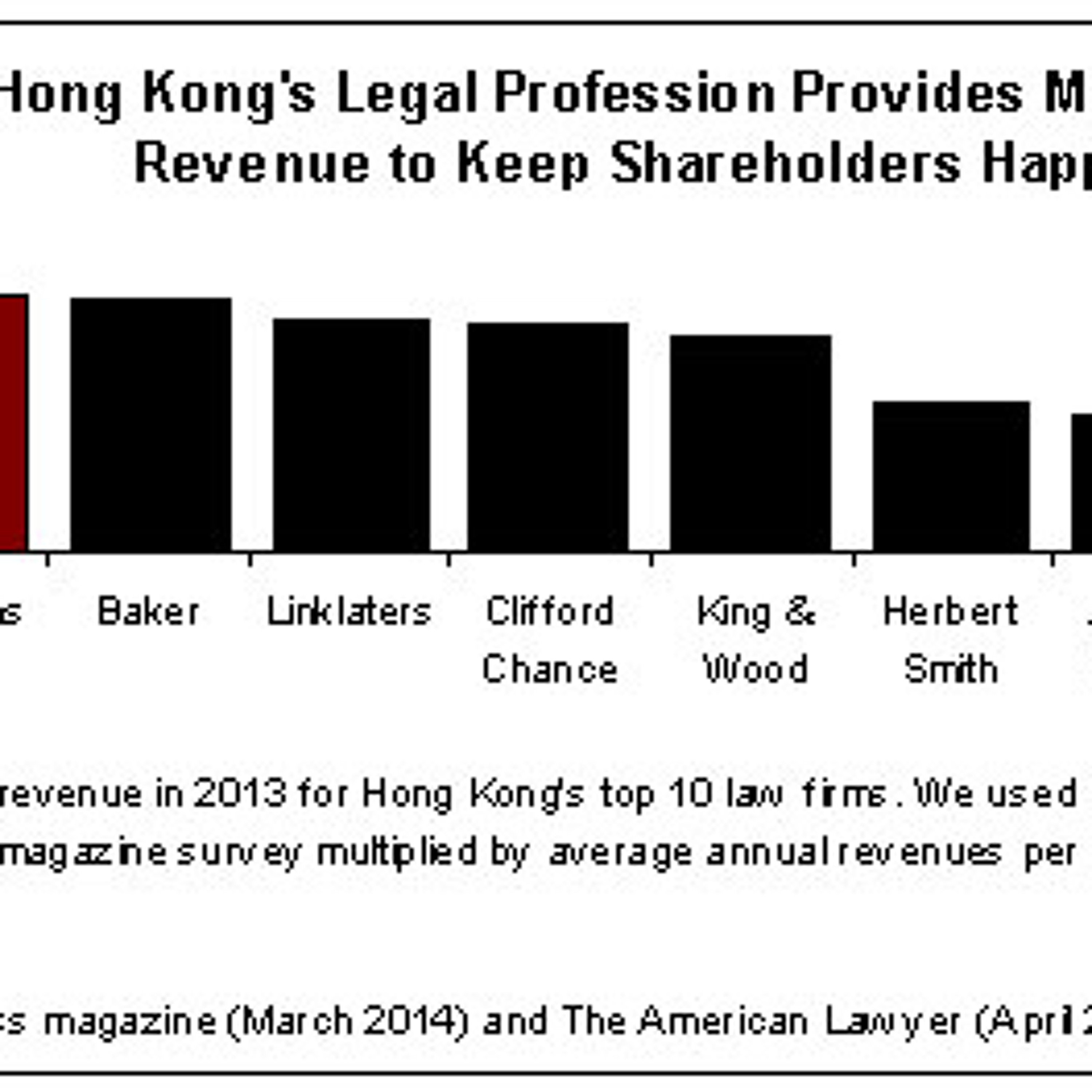

Infographic Instant with Bryane MichaelHow to Draft an International Financial Centre's Financial LawHow can regulators draft more competitive financial law? For the jurisdictions lower down on the Y/Zen rankings, what can they do to raise they rankings -- and grab more money sloshing around global financial markets?2015-05-1547 min Infographic Instant with Bryane MichaelLaw Firms and I-Banks Don't Specialise by Industries to CompeteLaw firms and global investment banks compete vigorously for clients from emerging markets. In this segment, we discuss the Chinese industries these clients come from. We show that elite advisers do not specialise in order to attract mandates.2015-04-0406 min

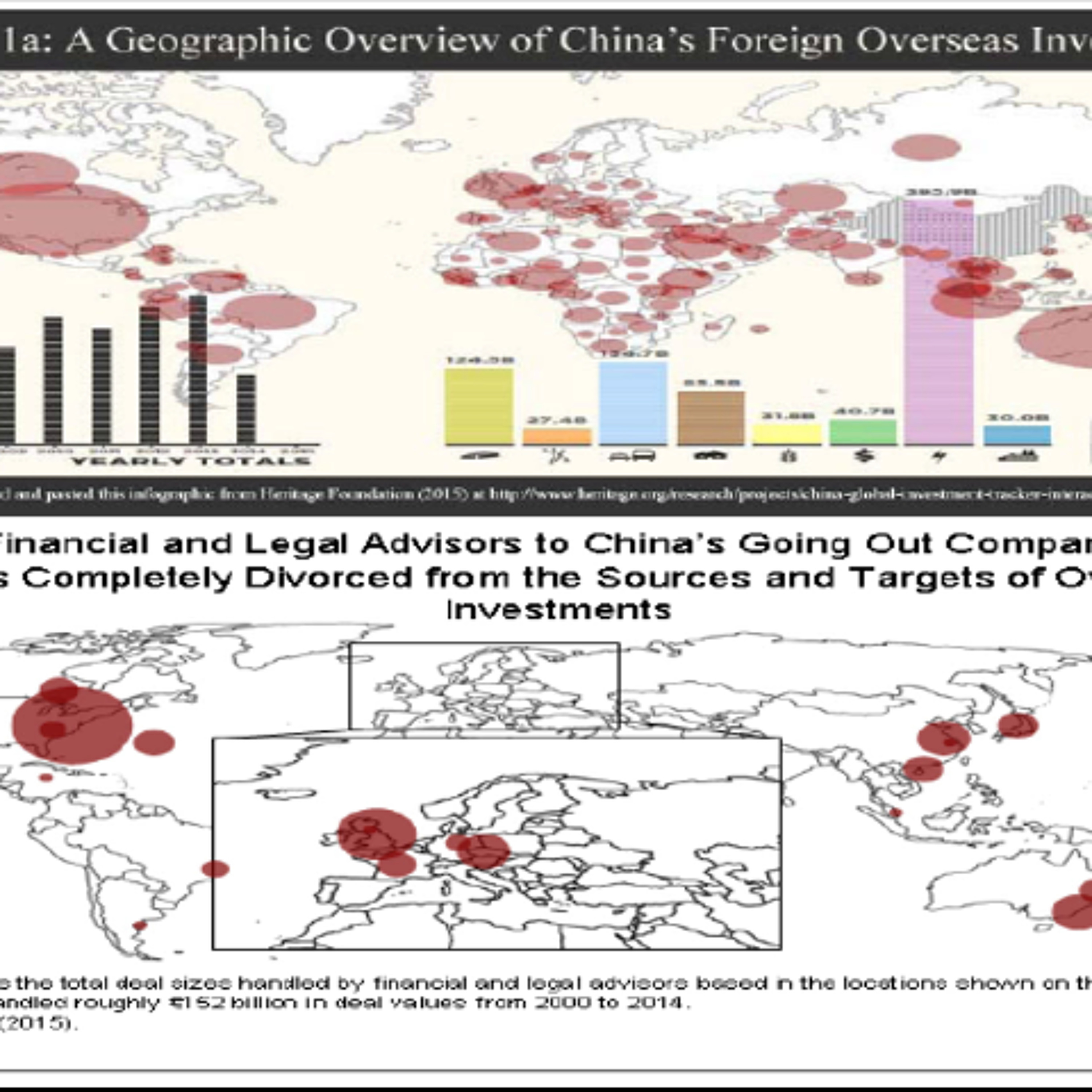

Infographic Instant with Bryane MichaelLaw Firms and I-Banks Don't Specialise by Industries to CompeteLaw firms and global investment banks compete vigorously for clients from emerging markets. In this segment, we discuss the Chinese industries these clients come from. We show that elite advisers do not specialise in order to attract mandates.2015-04-0406 min Infographic Instant with Bryane MichaelWhich Global Law Firms and I-Banks Advise Chinese Companies?This presentation provides the overview of the "mystery of China's divorced advisors." Chinese companies choose law firms and I-banks outside of China and their target companies' countries. Why? We motivate our discussion of the reasons in future infographics...2015-04-0304 min

Infographic Instant with Bryane MichaelWhich Global Law Firms and I-Banks Advise Chinese Companies?This presentation provides the overview of the "mystery of China's divorced advisors." Chinese companies choose law firms and I-banks outside of China and their target companies' countries. Why? We motivate our discussion of the reasons in future infographics...2015-04-0304 min Infographic Instant with Bryane MichaelSecuritising Hong Kong's Law FirmsHong Kong's law firms should be allowed to trade on the stock exchange. Historical inequalities have possibly deprived them of the same levels of capital as their foreign rivals/colleagues.2014-11-1804 min

Infographic Instant with Bryane MichaelSecuritising Hong Kong's Law FirmsHong Kong's law firms should be allowed to trade on the stock exchange. Historical inequalities have possibly deprived them of the same levels of capital as their foreign rivals/colleagues.2014-11-1804 min Infographic Instant with Bryane MichaelChina's Solar Finance Can Grow - with the Right FinancingThis is the audio version of the China Economic Review article on funding solar energy in China.

For more, see: http://www.chinaeconomicreview.com/solar-securitization2014-11-0409 min

Infographic Instant with Bryane MichaelChina's Solar Finance Can Grow - with the Right FinancingThis is the audio version of the China Economic Review article on funding solar energy in China.

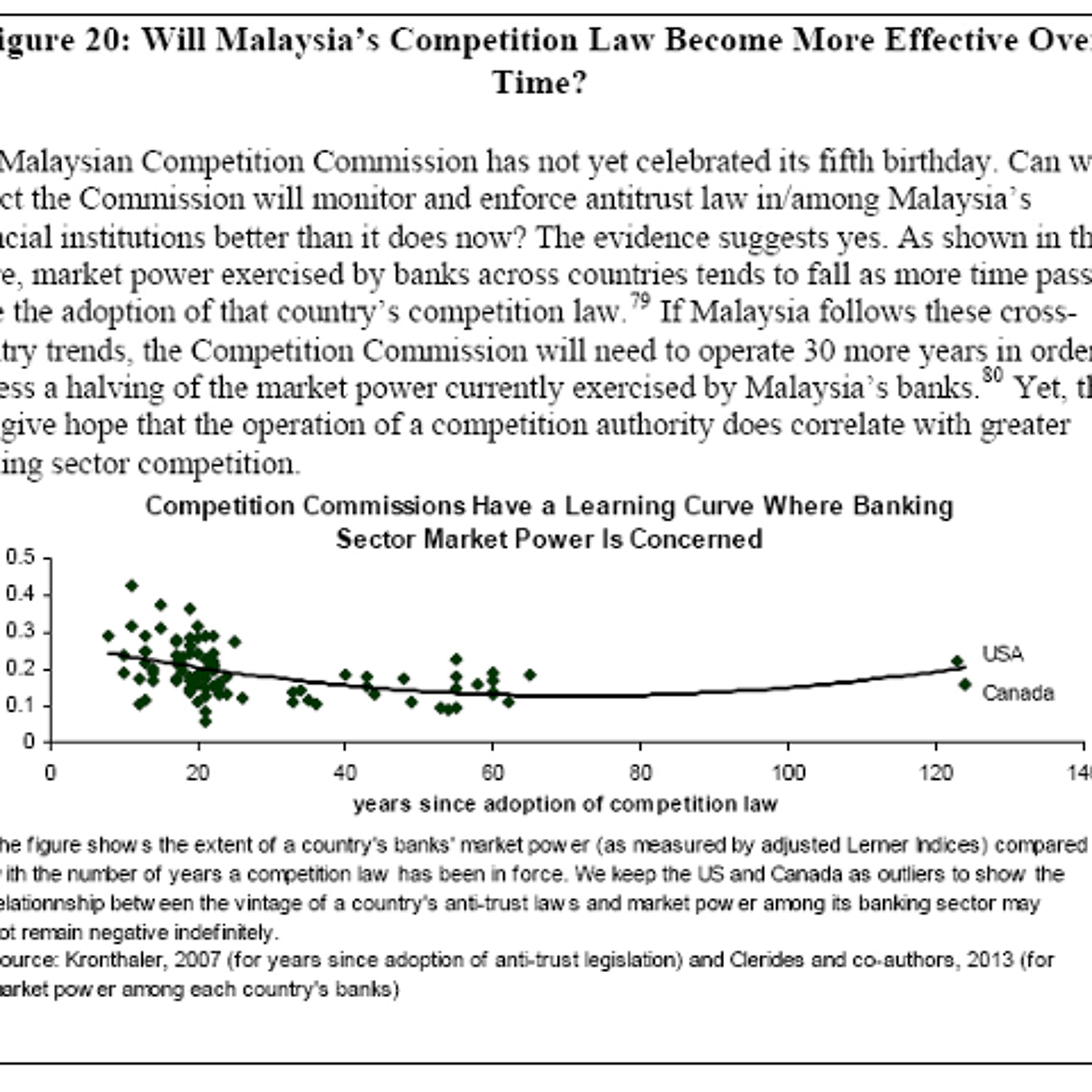

For more, see: http://www.chinaeconomicreview.com/solar-securitization2014-11-0409 min Infographic Instant with Bryane MichaelHow Long Does a Competition Commission Need to Reach Full Effectiveness?Cross-country data suggest that a new competition commission may need to wait 60 years to achieve full effectiveness.2014-10-3004 min

Infographic Instant with Bryane MichaelHow Long Does a Competition Commission Need to Reach Full Effectiveness?Cross-country data suggest that a new competition commission may need to wait 60 years to achieve full effectiveness.2014-10-3004 min Infographic Instant with Bryane MichaelWhich Malaysian Sectors Likely Suffer from Anti-Competitive Behaviour?In this Infographic Instant, we look at related party transactions across Malaysia's economic sectors. How prevalent are related party transactions? What does it mean for the Competition Act?2014-10-2904 min

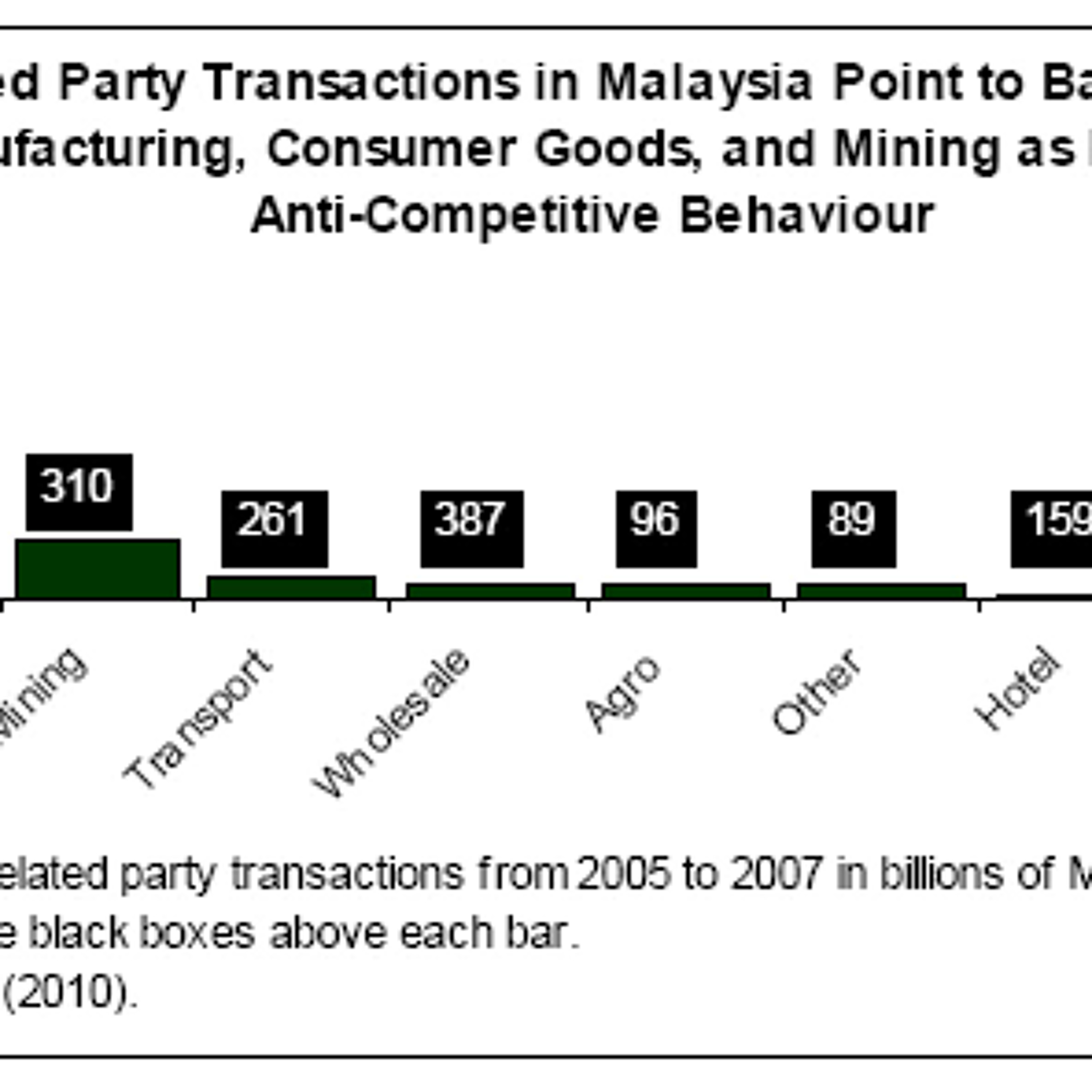

Infographic Instant with Bryane MichaelWhich Malaysian Sectors Likely Suffer from Anti-Competitive Behaviour?In this Infographic Instant, we look at related party transactions across Malaysia's economic sectors. How prevalent are related party transactions? What does it mean for the Competition Act?2014-10-2904 min Infographic Instant with Bryane MichaelWhich Countries Have the Most Anti-Competitive Banking Sectors?Which countries' banks have the highest mark-ups? In this Infographic Instant, we look at the likely distortions to banking sector competition -- as a prelude to thinking about the effectiveness of competition laws in Malaysia2014-10-2903 min

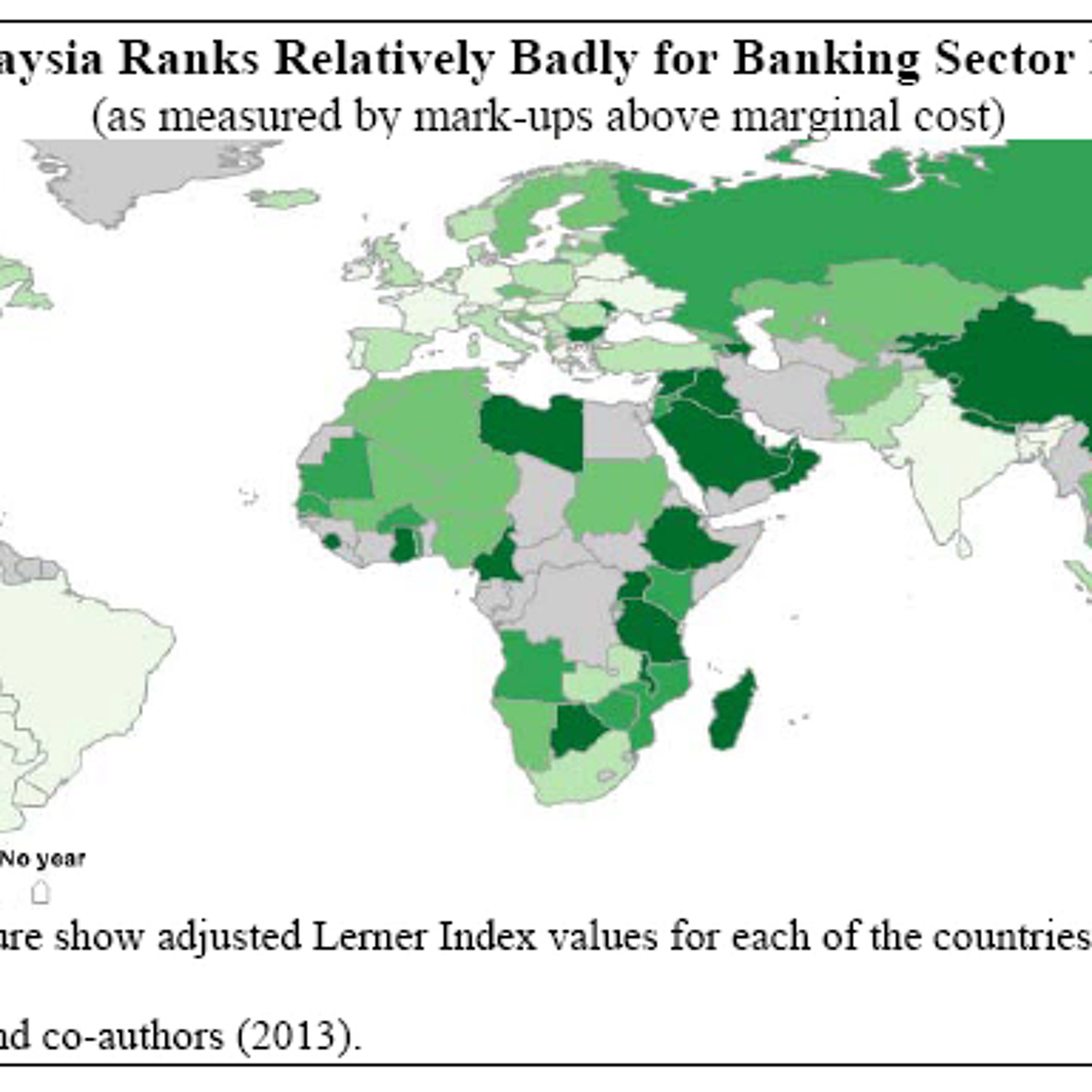

Infographic Instant with Bryane MichaelWhich Countries Have the Most Anti-Competitive Banking Sectors?Which countries' banks have the highest mark-ups? In this Infographic Instant, we look at the likely distortions to banking sector competition -- as a prelude to thinking about the effectiveness of competition laws in Malaysia2014-10-2903 min Infographic Instant with Bryane MichaelMaking Hong Kong's a Better Tax HavenCan Hong Kong maintain its status as an international financial centre once it stops relying on secrecy? In this audio brief, we describe how Hong Kong can maintain its "dual-track" financial sector -- with one part a modern, open and transparent centre and another with a closed and secret area of activity.2014-10-0905 min

Infographic Instant with Bryane MichaelMaking Hong Kong's a Better Tax HavenCan Hong Kong maintain its status as an international financial centre once it stops relying on secrecy? In this audio brief, we describe how Hong Kong can maintain its "dual-track" financial sector -- with one part a modern, open and transparent centre and another with a closed and secret area of activity.2014-10-0905 min Infographic Instant with Bryane MichaelAudio Brief: The Four Trillion Emerging Market Infrastructure GoldrushIn this Infographic Instant Audio Brief, we look at the major opportunities for investors and design firms in emerging markets' infrastructure boom. We look at how investors, professional services providers and (of course) design/consulting firms, can get their piece of the $4 trillion bonanza.2014-10-0646 min

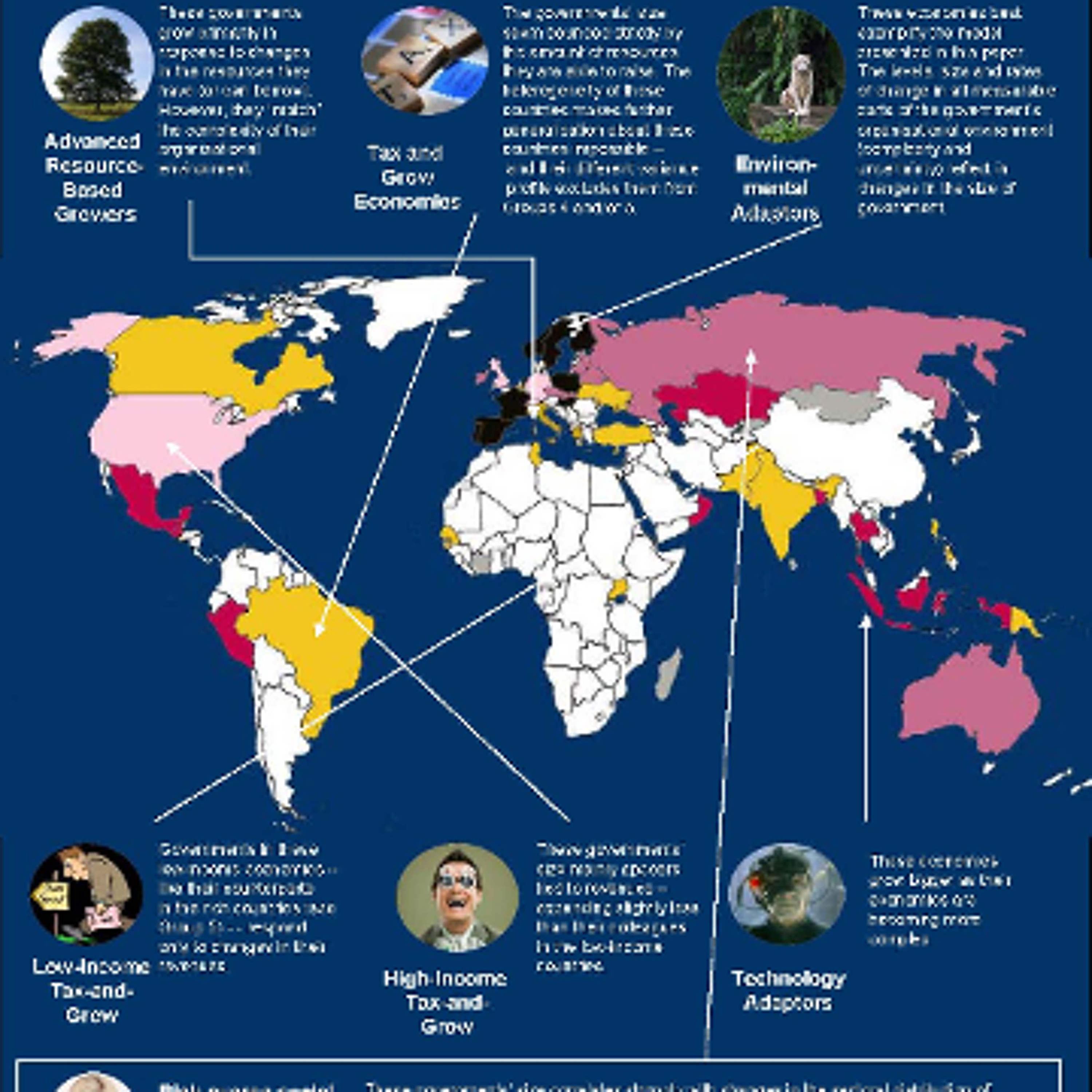

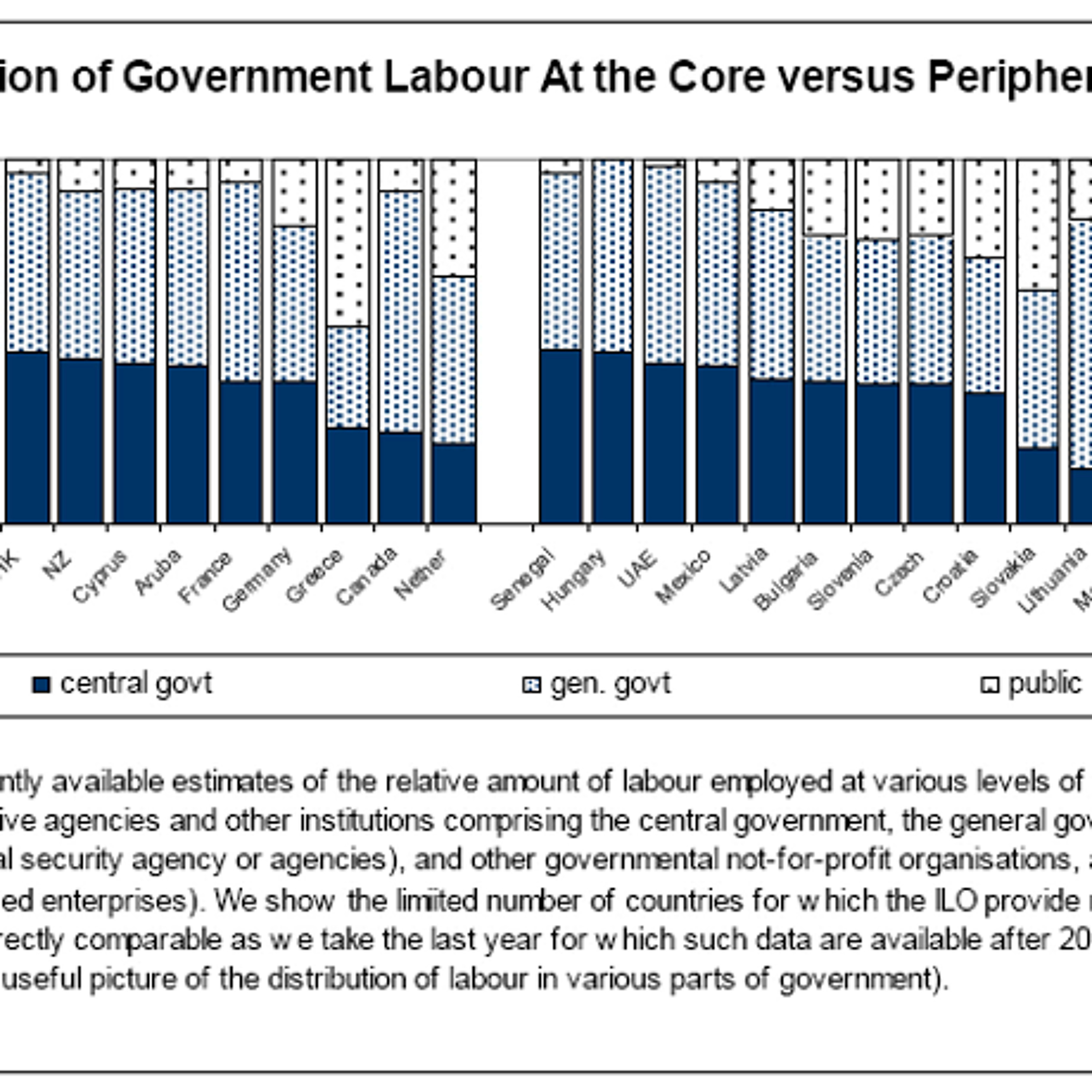

Infographic Instant with Bryane MichaelAudio Brief: The Four Trillion Emerging Market Infrastructure GoldrushIn this Infographic Instant Audio Brief, we look at the major opportunities for investors and design firms in emerging markets' infrastructure boom. We look at how investors, professional services providers and (of course) design/consulting firms, can get their piece of the $4 trillion bonanza.2014-10-0646 min Infographic Instant with Bryane MichaelGovernment Structure and Convergence ClubsDifferent groups of governments change their organisational structures in different ways. Find out which governments roll with the changing economic punches -- and which do not.2014-10-0607 min

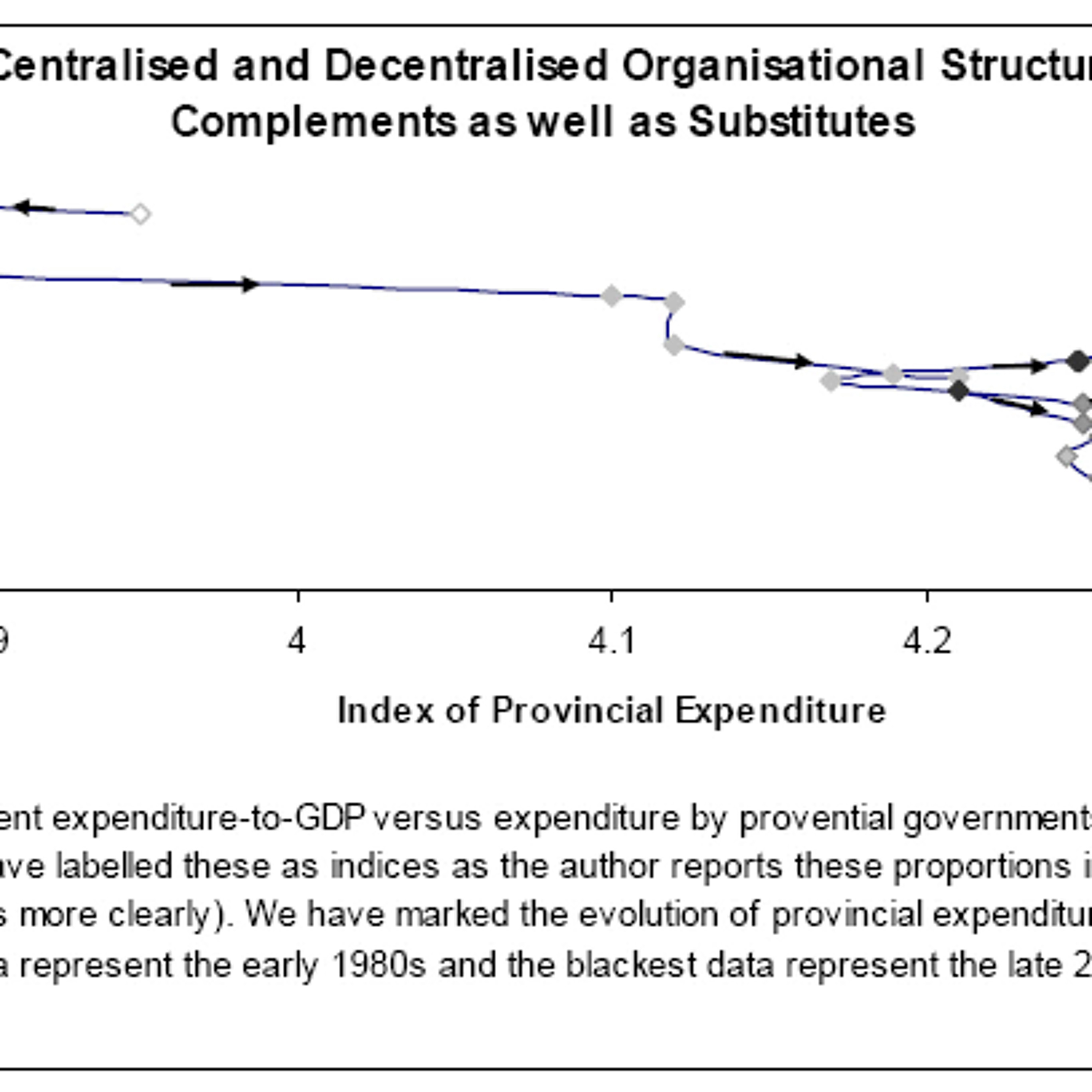

Infographic Instant with Bryane MichaelGovernment Structure and Convergence ClubsDifferent groups of governments change their organisational structures in different ways. Find out which governments roll with the changing economic punches -- and which do not.2014-10-0607 min Infographic Instant with Bryane MichaelHow Do Governments Decentralise? The China CaseGovernments don't simply choose the best level of decentralisation and stop there. They constantly adjust their margins of centralisation to fit with changing social and economic circumstances.2014-10-0604 min

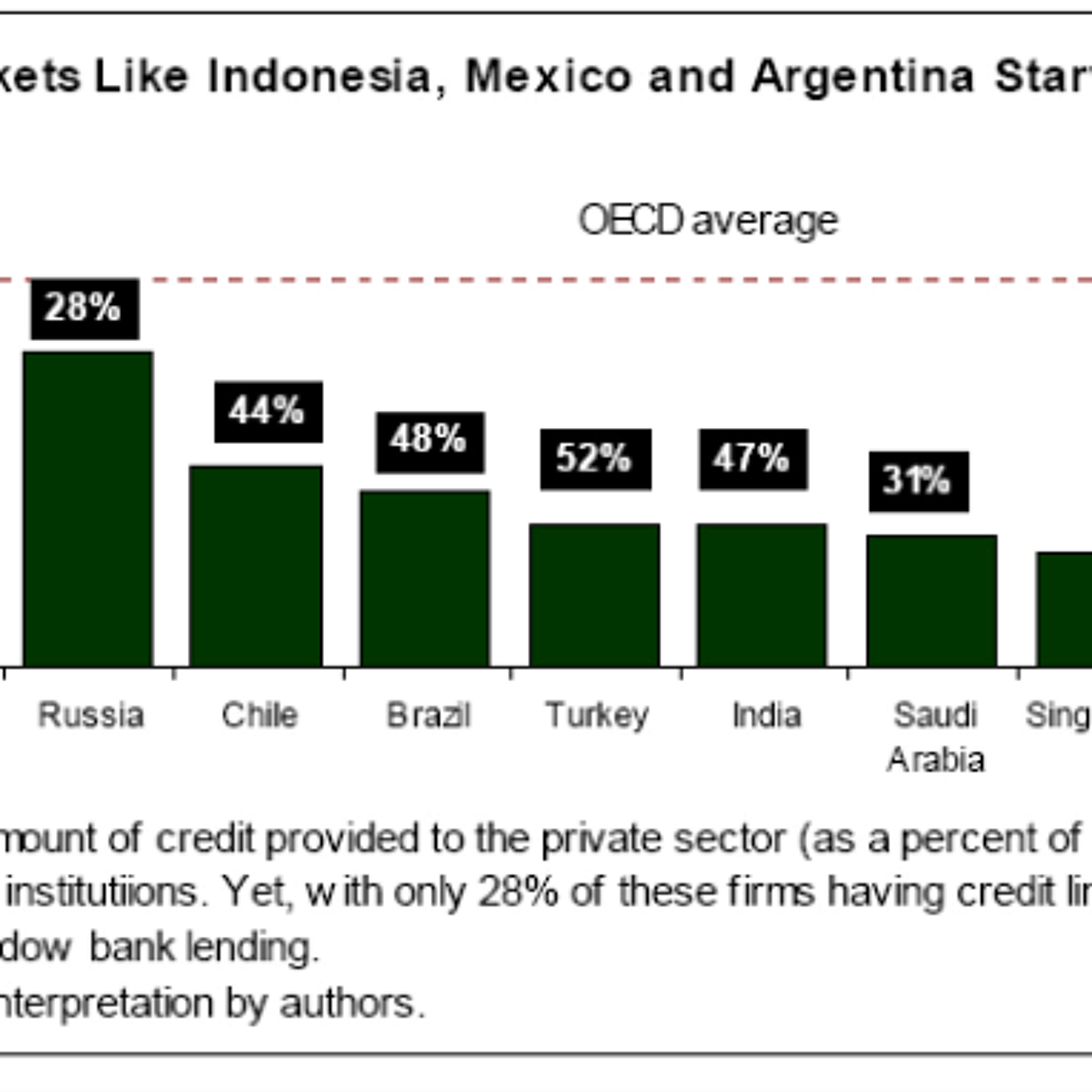

Infographic Instant with Bryane MichaelHow Do Governments Decentralise? The China CaseGovernments don't simply choose the best level of decentralisation and stop there. They constantly adjust their margins of centralisation to fit with changing social and economic circumstances.2014-10-0604 min Infographic Instant with Bryane MichaelWhich Countries Need Shadow Banking the Most?Which countries are starved for credit? In this infographic instant, we look at relative credit expansion in various emerging markets. We identify which emerging markets represent shadow banking opportunities for aspiring domestic and foreign shadow bankers.2014-10-0505 min

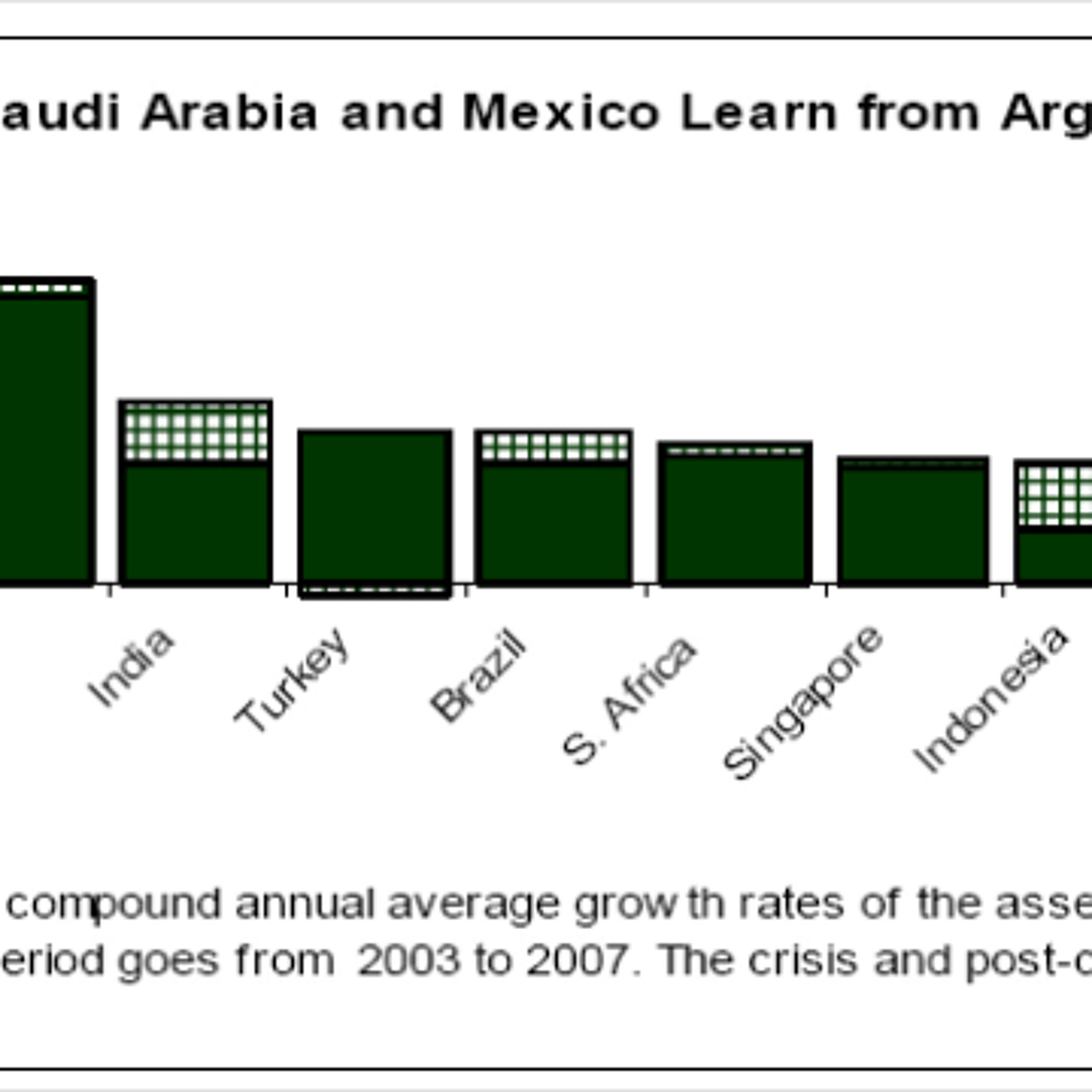

Infographic Instant with Bryane MichaelWhich Countries Need Shadow Banking the Most?Which countries are starved for credit? In this infographic instant, we look at relative credit expansion in various emerging markets. We identify which emerging markets represent shadow banking opportunities for aspiring domestic and foreign shadow bankers.2014-10-0505 min Infographic Instant with Bryane MichaelWhere is Shadow Banking Growth the Highest?In this infographic instant, we look at where shadow banking is growing the fastest. These emerging markets hold great promise for shadow bankers looking to make inroads into these markets2014-10-0504 min

Infographic Instant with Bryane MichaelWhere is Shadow Banking Growth the Highest?In this infographic instant, we look at where shadow banking is growing the fastest. These emerging markets hold great promise for shadow bankers looking to make inroads into these markets2014-10-0504 min Infographic Instant with Bryane MichaelWhen is central government stronger than local government?This infographic instant describes which countries have larger central governments, and which ones have larger local governments. We show the data, and talk about why some local governments are larger than others.2014-10-0506 min

Infographic Instant with Bryane MichaelWhen is central government stronger than local government?This infographic instant describes which countries have larger central governments, and which ones have larger local governments. We show the data, and talk about why some local governments are larger than others.2014-10-0506 min Infographic Instant with Bryane MichaelHow Much Money Can Bankers Earn From China's Solar Industry?In this infographic, we look at the value chains driving Chinese solar companies' revenue growth. We look at each of the securities which would likely earn Hong Kong's financial institutions money.2014-10-0413 min

Infographic Instant with Bryane MichaelHow Much Money Can Bankers Earn From China's Solar Industry?In this infographic, we look at the value chains driving Chinese solar companies' revenue growth. We look at each of the securities which would likely earn Hong Kong's financial institutions money.2014-10-0413 min