Shows

Instant PaymentsBONUS Ep 08: Breaking Down the CFPB's New Advisory Opinion on Earned Wage AccessIn this bonus episode of the Instant Payments Podcast, host Tal Clark, CEO of Instant Financial, and Heather Heebner, head of compliance at Instant Financial, discuss the CFPB advisory opinion released December 23, 2025. The conversation delves into the current regulatory environment of earned wage access (EWA) at both the federal and state levels, the history of advisory opinions from the CFPB, and the implications for employers and EWA providers. They also explore how this new ruling affects compliance, the differences between previous advisory opinions and the current one, and what it means for the overall industry. The episode provides valuable...

2026-01-2017 min

Minimum CompetenceLegal News for Tues 12/23 - CFPB Funding Fights, Trump DEI Crackdown Hits Limits, Mercedes $120m Settlement and IRS VDP ReformThis Day in Legal History: Federal Reserve ActOn December 23, 1913, President Woodrow Wilson signed the Federal Reserve Act into law, creating the Federal Reserve System, the central banking system of the United States. The law was the culmination of decades of debate over banking reform, intensified by the financial panic of 1907. The Act aimed to provide the country with a safer, more flexible, and more stable monetary and financial system. It established twelve regional Federal Reserve Banks overseen by a central Board in Washington, D.C., striking a balance between public oversight and private banking interests.

2025-12-2307 min

Consumer Finance MonitorThe CFPB's Most Ambitious Regulatory Agenda Ever – Part 2Today's episode features Part 2 of our November 4 webinar, "The CFPB's Most Ambitious Regulatory Agenda Ever." (Part 1 of this series was released on December 18. We encourage you to listen to that episode as well). In Part 2, we continue to unpack the far-reaching implications of the Consumer Financial Protection Bureau's (CFPB) regulatory ambitions. The CFPB has published a sweeping agenda that promises to reshape the landscape for consumer financial services, and our panel of seasoned attorneys offers vital context and actionable insights for industry professionals, regulators, and informed consumers alike. Key Topics Discussed: · CFPB's Pre-Rule and Long-Term A...

2025-12-2346 min

Minimum CompetenceLegal News for Thurs 12/18 - Courts Block Trump CFPB Firings, Doctors Sue RFK Jr. HHS Over Vaccines, DC Guard Deployment Remains and Trump Ballroom Moves ForwardThis Day in Legal History: Trump ImpeachedOn December 18, 2019, the U.S. House of Representatives voted to impeach President Donald J. Trump, marking the third presidential impeachment in American history. The impeachment followed a months-long investigation centered on Trump’s dealings with Ukraine. House Democrats alleged that the president abused the powers of his office by pressuring a foreign government to investigate a political rival. A second article charged Trump with obstruction of Congress for directing executive branch officials not to comply with House subpoenas. The votes largely split along party lines, reflecting deep political polarization....

2025-12-1806 min

Financial Forward: The Future of Consumer Finance & BankingCFPB State Regulator Portal: Turning Complaints Into Real Supervisory YieldSend us a textEpisode DescriptionIn this episode of Financial Forward, host Jim McCarthy sits down with John McNamara, former Principal Assistant Director for Markets at the Consumer Financial Protection Bureau (CFPB). Together, they pull back the curtain on how complaint data actually powered markets, supervision, and enforcement inside the Bureau—and what that means for state regulators today.Jim and John walk through the evolution of the CFPB complaint system, the value of normalized and validated data, and how the CF...

2025-12-151h 04

The College Investor Audio ShowTrump Administration Could Defund CFPB By 2026The Trump administration has escalated its campaign to defund the Consumer Financial Protection Bureau - setting in motion what could be its effective closure within a year.In a court filing (PDF File) this week, the administration said the CFPB cannot seek additional money from the Federal Reserve - its usual source of operating funds. The bureau said it has enough reserves to continue through December but “anticipates exhausting its currently available funds in early 2026.” Without congressional action, that timeline would mark the end of the CFPB’s ability to function.The Justice Department’s Office of...

2025-11-2307 min

Director of the Office of Management and Budget - 101"Vought's Bid to Reshape CFPB Faces Mounting Legal Challenges"Russell Vought, director of the Office of Management and Budget, has been at the center of significant developments in recent days regarding his leadership of the Consumer Financial Protection Bureau.Vought has been serving as acting director of the CFPB since February of this year. The Trump administration has now nominated Stuart Levenbach, a close aide to Vought at the OMB, to serve as the permanent director of the agency. According to multiple sources, this nomination is a technical maneuver designed to extend Vought's time as acting director under the Federal Vacancies Reform Act. Typically, someone can serve...

2025-11-2002 min

Director of the Office of Management and Budget - 101Vought's Contentious CFPB Reshaping: A Tactical Maneuver or Substantive Change?Russ Vought, the Director of the Office of Management and Budget, continues to make headlines this week as the Trump administration pursues an aggressive agenda to reshape federal agencies. Most recently, the White House nominated Stuart Levenbach, an energy official who serves as associate director of natural resources, energy, science and water at the Office of Management and Budget and a close aide to Vought, to become the permanent director of the Consumer Financial Protection Bureau. This nomination was announced on Tuesday and represents what insiders describe as a technical maneuver rather than a substantive leadership change.The...

2025-11-2002 min

Minimum CompetenceLegal News for Thurs 9/25 - Apple and US Bank Out from under CFPB, DOJ Probe into Letitia James, Boston Wrongful Arrest Settlement and AZ Criminal Law Licensing Plan Shot DownThis Day in Legal History: Sandra Day O’Connor Sworn in to SCOTUSOn September 25, 1981, Sandra Day O’Connor was sworn in as the first woman to serve on the United States Supreme Court, breaking a 191-year gender barrier in the nation’s highest judicial body. Nominated by President Ronald Reagan, O’Connor’s appointment fulfilled a campaign promise to appoint a woman to the Court and was confirmed by the Senate in a unanimous 99-0 vote. A former Arizona state senator and judge on the Arizona Court of Appeals, O’Connor brought to the bench a pragmatic ap...

2025-09-2506 min

Consumer Finance MonitorA Deep Dive into the Fight for the CFPB's SurvivalWe recently wrote about the August 15th D.C. Circuit Court of Appeals decision in the lawsuit brought by the labor unions representing CFPB employees against Acting Director Russell Vought. The unions sought injunctive relief in response to what they described as an attempted "shutdown" of the Bureau. In a 2–1 ruling, the Court of Appeals vacated a preliminary injunction issued by the District Court. That injunction had temporarily blocked the CFPB from carrying out a reduction-in-force ("RIF") that would have left the Bureau with only about 200 employees to carry out its statutory responsibilities. Today, our Co...

2025-08-2852 min

Fintech TakesFintech Takes x FairPlay Presents Model Citizens: Into the CFPB Void: Regulatory Free-for-All in Financial ServicesWelcome to Model Citizens: AI Compliance for Banks and Fintech Lenders, a six-part miniseries from the Fintech Takes podcast in partnership with FairPlay.

In this series, I’m joined by FairPlay’s Kareem Saleh (Founder & CEO) to explore how banks and fintechs can build fair, compliant lending systems in an era of regulatory uncertainty.

Episode 1 tackles one of the biggest questions in financial services today: what happens when the top federal watchdog (that was/is the CFPB) loses its bite?

Joined by David Silberman (former CFPB Assoc...

2025-07-2848 min

Financial Forward: The Future of Consumer Finance & BankingCFPB vs. FirstCash – Military Lending Enforcement & What Comes NextSend us a text“FirstCash, the CFPB, and Military Lending Protections: A Follow-Up to Our Service Member Panel”Release Date: July 2025🔍 Episode OverviewIn this special follow-up episode of Financial Forward, host Jim McCarthy revisits the critical topic of military financial protections in the wake of a major enforcement action by the Consumer Financial Protection Bureau (CFPB).Since the airing of our original Service Member Panel, the CFPB reached a $9 million settlement with FirstCash, Inc. and...

2025-07-2041 min

Financial Forward: The Future of Consumer Finance & BankingSCRA – Beyond the Uniform: Understanding the CFPB’s Growing Focus on Servicemember Financial ProtectionsSend us a textRecorded: Tuesday, July 1 | 1:00 PM CT Presented by: McCarthy Hatch🎯 Episode Overview:As the Consumer Financial Protection Bureau (CFPB) sharpens its lens on how financial institutions serve military members and their families, this live panel explores the evolving regulatory landscape and the moral imperative to do better.We go beyond compliance checklists to examine complaint data, identify institutional risks, and spotlight opportunities to lead with integrity.👥 Featured Panelists:Jim McCarthy Chairman, McCarthy Hatch Founding member of the CF...

2025-07-081h 01

mffm - エムエフエフエム#94 ChimeとCircleが市場を席巻, CFPBはオープンバンキング規則を実質的に取り下げる形に - WorldFintechNews2025年6月# タイムスタンプ(0:00) Intro(9:07) ChimeとCircleが市場を席巻(25:21) CFPBはオープンバンキング規則を実質的に取り下げる形に# トピックスChimeとCircleが市場を席巻エピソード#90と#92で取り上げたCircleとChimeが上場し、それぞれ当初目標を大きく上回る初値をつけました。Circleは当初72億ドルの評価額を目指していましたが、米国でのステーブルコイン活用に関する報道やGENIUS法への期待を背景に、一時360億ドルまで上昇。これはPERで155倍という驚異的な評価となりました。Chimeも上場初日に37%高を記録し、時価総額は135億ドルとなりました。このIPOで8億6400万ドルを調達し、今年の米国では6番目の規模となりました。eToroやWeBullに続き、Fintech銘柄への熱狂が続いており、今後もさらなるFintech企業のIPOが期待できそうです。Chimeに関する田中さんのnote: https://note.com/ttanaka0731/n/n993c03ab864fhttps://fintechbusinessweekly.substack.com/p/circle-and-chime-post-ipo-pops-suggestCFPBはオープンバンキング規則を実質的に取り下げる形に2025年5月末、米国消費者金融保護局(CFPB)は、昨年秋に最終決定されたオープンバンキング規則(ドッド・フランク法第1033条)に対し、撤回を求める略式判決の申立てを行うという方針転換を見せました。この動きは、トランプ政権がCFPBに批判的な姿勢を強めている中、民主党政権下で定められたこの規則に対してもその姿勢が反映されたものと言えます。トランプ政権下のCFPBは、同規則は消費者が自身の情報にアクセスする権利を保障するものであり、第三者へのデータ提供を義務付ける権限は局にはない、さらに手数料徴収の禁止も議会の意図と乖離していると主張しています。仮にCFPBのこの主張が認められ、同規則が撤回された場合でも、これまで行われてきたオープンバンキング関連の企業活動は継続すると見られます。しかし、規制面での足踏みが生じることで、オープンバンキング関連の動きが加速する未来は不透明になりそうです。https://www.mofo.com/resources/insights/250613-a-hard-reset-on-1033-a-look-at-what-s-next-for-open-banking# 話し手瀧 俊雄執行役員 グループCoPA(Chief of Public Affairs) 兼 Fintech研究所長https://twitter.com/sutebuu廣瀨 明倫Public Affairs室 Fintech研究所リサーチヘッドhttps://note.com/akimichi_hirose/小林 豪https://twitter.com/GOU_0013

2025-06-2346 min

Crypto Radar Daily”Trump’s Crypto Regs Leave Users Vulnerable: CFPB Dismantled”In recent years, the world of cryptocurrency has seen a surge in popularity, with more individuals turning to digital currencies for their transactions. However, this growing trend has attracted the attention of regulators, leading to potential risks for crypto users.

One of the key entities responsible for protecting consumers in the financial sector is the Consumer Financial Protection Bureau (CFPB). Established after the 2008 financial crisis, the CFPB has played a crucial role in safeguarding individuals against unfair and deceptive practices by financial institutions.

The Trump administration has taken steps to weaken the CFPB, putting crypto...

2025-06-1903 min

Consumer Finance MonitorThe Impact of the Newly Established Priorities and Massive Proposed Reduction in Force (RIF) on CFPB Enforcement (Part 2)Our podcast show being released today is Part 2 of our two-part series featuring two former CFPB senior officers who were key employees in the Enforcement Division under prior directors: Eric Halperin and Craig Cowie. Eric Halperin served as the Enforcement Director at the CFPB from 2010 until former Director, Rohit Chopra, was terminated by President Trump. Craig Cowie was an enforcement attorney at the CFPB from July 2012 until April 2015 and then Assistant Litigation Deputy at the CFPB until June 2018. Part 1 of our two-part series was released last Thursday, June 12. The purpose of these podcast shows were...

2025-06-181h 00

Consumer Finance MonitorThe Impact of the Newly Established Priorities and Massive Proposed Reduction in Force (RIF) on CFPB Enforcement (Part 1)Our podcast shows being released today and next Wednesday, June 18 feature two former CFPB senior officers who were key employees in the Enforcement Division under prior directors: Eric Halperin and Craig Cowie. Eric Halperin served as the Enforcement Director at the CFPB from 2010 until former Director, Rohit Chopra, was terminated by President Trump. Craig Cowie was an enforcement attorney at the CFPB from July 2012 until April 2015 and then Assistant Litigation Deputy at the CFPB until June 2018. The purpose of these podcast shows were primarily to obtain the opinions of Eric and Craig (two of the country's most...

2025-06-1246 min

Consumer Finance MonitorThe Impact of the Newly Established Priorities and Massive Proposed Reduction in Force (RIF) on CFPB SupervisionOur podcast show being released today features two former CFPB senior officers who were key employees in the Supervision Division under prior directors: Peggy Twohig and Paul Sanford. Peggywas a founding executive of the CFPB when the agency was created in 2010 and led the development of the first federal supervision program over nonbank consumer financial companies. Beginning in 2012, as head of CFPB's Office of Supervision Policy, Peggy led the office responsible for developing supervision strategy for bank and nonbank markets and ensuring that federal consumer financial laws were applied consistently in supervisory matters across markets and regions. ...

2025-06-051h 11

Simply FinanceRegulatory Shifts: CFPB’s New Focus, FTC’s Fee Transparency, and FINRA’s Forward InitiativeIn today's episode, we explore the Consumer Financial Protection Bureau's strategic pivot away from Buy Now, Pay Later enforcement, the Federal Trade Commission's new rule mandating fee transparency, and FINRA's 'FINRA Forward' initiative aimed at modernizing financial regulations. Join us as we delve into the implications of these regulatory changes for consumers and the financial industry.

Sources:

https://bankingjournal.aba.com/2025/05/cfpb-to-deprioritize-enforcement-of-buy-now-pay-later-rule/

https://www.paymentsdive.com/news/cfpb-buy-now-pay-later-rule-payments/747387/

https://www.hklaw.com/en/news/intheheadlines/2025/05/cfpb-backs-off-buy-now-pay-later-oversight-signals-repeal-of-rule

https://www.hklaw.com/en/insights/publications/2025/05/cfpb-provides-status-update-regarding-buy-now-pay-later

https://www.consumerfinancialserviceslawmonitor.com/2025/05/cfpb-shifts-focus-away-from-buy-now-pay-later-loans/

https://www.livenowfox...

2025-05-1312 min

Minimum CompetenceLegal News for Thurs 4/24 - CFPB Retreats from PayPal Battle, Trump Sues Perkins Coie, Big Law Firms Fight Executive Orders and CA Bar Exam FalloutThis Day in Legal History: Easter RisingOn April 24, 1916, the Easter Rising erupted in Dublin as Irish republicans launched a bold and ultimately tragic insurrection against British rule. The event, intended to establish an independent Irish Republic, had enormous legal and constitutional consequences that would ripple through British and Irish law for years. Roughly 1,200 rebels seized key buildings across Dublin, proclaiming the establishment of the Irish Republic from the steps of the General Post Office.In response, the British government declared martial law and deployed thousands of troops to suppress the rebellion. Courts-martial were swiftly...

2025-04-2407 min

Consumer Finance MonitorEverything You Want to Know About the CFPB as Things Stand Today, and Lots More - Part 2Our podcast show being released today is part 2 of a repurposed interactive webinar that we presented on March 24 featuring two of the leading journalists who cover the CFPB - Jon Hill from Law360 and Evan Weinberger from Bloomberg. Our show begins with Tom Burke, a Ballard Spahr consumer financial services litigator, describing in general terms the status of the 38 CFPB enforcement lawsuits that were pending when Rohit Chopra was terminated. The cases fall into four categories: (a) those which have already been voluntarily dismissed with prejudice by the CFPB; (b) those which the CFPB has notified the...

2025-04-1752 min

Keys to Real EstateTownstone, the CFPB and a Stunning Reversal - Rich Horn | S2E4No one saw that coming! That was industry’s response when the Consumer Financial Protection Bureau (CFPB) reversed its stance on a discrimination case it had already settled. The change of heart was directly connected to the change in leadership at the bureau under the Trump administration. Garris Horn LLP Co-Managing Partner Rich Horn was one of the lead defense attorneys in the years-long case against Townstone Financial. Listen as Horn dives into the legal depths of one of the bureau’s most high-profile cases that drew no shortage of headlines. Horn’s insider knowledge of the facts and legal...

2025-04-1746 min

Disrupt Your Money: Liberation through Financial Education for Marginalized Business OwnersDefunding Consumer Protection: How Weakening the CFPB Puts Marginalized Entrepreneurs at Greater RiskIn this episode of Disrupt Your Money, we rip the “boring policy” label off the Consumer Financial Protection Bureau (CFPB) and show you exactly how defunding it becomes open season on marginalized small business owners. This isn’t abstract politics—it’s about whether there’s anyone standing between you and predatory lenders, junk fees, or shady fine print when you’re just trying to run your business and pay your people.You’ll walk away with a crash course in policy-as-self-defense and a concrete action plan—from calling your reps with scripts in hand to supporting pro-consumer candi...

2025-04-1519 min

Consumer Finance MonitorEverything You Want to Know About the CFPB as Things Stand Today and Lots More - Part 1Our podcast show being released today is Part 1 of a repurposed interactive webinar that we presented on March 24, featuring two of the leading journalists who cover the CFPB - Jon Hill from Law360 and Evan Weinberger from Bloomberg. Our show began with Jon and Evan chronicling the initiatives beginning on February 3 by CFPB Acting Directors Scott Bessent, Russell Vought and DOGE to shut down or at least minimize the CFPB. These initiatives were met with two federal district court lawsuits (one in DC brought by the labor unions who represents CFPB employees who were terminated and the...

2025-04-1051 min

Consumer Finance MonitorA Deep Dive Into Judge Jackson's Preliminary Injunction Order Against CFPB Acting Director VoughtOur special podcast show today deals primarily with a 112-page opinion and 3-page order issued on March 28 by Judge Amy Berman Jackson of the U.S. District Court for the District of Columbia in a lawsuit brought, among others, by two labor unions representing CFPB employees against Acting Director Russell Vought. The complaint alleged that Acting Director Vought and others were in the process of dismantling the CFPB through various actions taken since Rohit Chopra was fired and replaced by Acting Director Scott Bessent and then Acting Director Russell Vought. This process included, among other things, the termination of...

2025-04-0455 min

Consumer Finance MonitorProminent Journalist, David Dayen, Describes his Reporting on the Efforts of Trump 2.0 to Curb CFPBToday's podcast show features a discussion with David Dayen, executive editor of the American Prospect, which is an online magazine about ideas, politics, and power. He's the author of "Chain of Title: How Three Ordinary Americans Uncovered Wall Street's Great Foreclosure Fraud," which was published in 2016. David has written and published about 10 or so articles in which he chronicles in great detail the apparent effort by the Trump Administration, acting through Scott Bessent and Russell Vought, to dismantle the CFPB by abruptly ordering a cessation of all activities and layoffs of probationary and term employees and a plan to...

2025-04-031h 00

Minimum CompetenceLegal News for Mon 3/17 - CFPB Reinstates, Trump Targets More Law Firms and Defies Court Orders, WH's Role in TikTok Sale and Trump Admin Plan to Starve Social Security and MedicareThis Day in Legal History: National Referendum on ApartheidOn March 17, 1992, South Africa took a decisive step toward dismantling apartheid through a historic national referendum. White South African voters were asked whether they supported the government’s efforts to end apartheid and negotiate a new, democratic constitution. An overwhelming 68.7% voted in favor, signaling broad support for ending over four decades of racial segregation. This referendum provided then-President F.W. de Klerk with the political mandate to continue negotiations with the African National Congress (ANC) and other groups. The result was a major victory for the anti-apartheid movement, wh...

2025-03-1708 min

Consumer Finance MonitorProf. Hal Scott Doubles Down on His Argument That CFPB is Unlawfully Funded Because of Combined Losses at Federal Reserve BanksOn June 6 of last year, Prof. Hal Scott of Harvard Law School was our podcast guest. On that occasion he delved into the thought-provoking question of whether the Supreme Court's decision on May 16 in the landmark case of CFSA v. CFPB really hands the CFPB a winning outcome, or does the Court's validation of the agency's statutory funding structure simply open up another question - namely, whether the CFPB is legally permitted under Dodd-Frank to receive funds from the Federal Reserve even though the Federal Reserve Banks have lost money on a combined basis since September 2022. Dodd-Frank provides that...

2025-03-1356 min

On The MarketIs the Mortgage Industry Safe with CFPB Under Fire?Is the mortgage industry still safe? The Consumer Financial Protection Bureau (CFPB) has been ordered to halt all work while awaiting a new Trump-appointed director. While you may not often hear about this government agency, the CFPB plays a huge role in the mortgage industry and is the reason 2008-style lending practices have not been brought back to the market.With uncertainty surrounding the CFPB—will it be downsized, shut down, or remain unchanged?—many in the mortgage and real estate industries are concerned about what’s next. Chris Willis, host of The Consumer Finance Podcast, joins the sh...

2025-03-1328 min

Payments Pros – The Payments Law PodcastCFPB's Inquiry Into Payments PrivacyIn the latest episode of Payments Pros, host Carlin McCrory welcomes Kim Phan to discuss the Consumer Financial Protection Bureau's (CFPB) recent inquiries into enhancing privacy protections.On January 10, the CFPB sought public input on improving privacy safeguards and curbing harmful surveillance and digital payments, particularly those offered by large technology platforms. The CFPB is particularly interested in comments on existing financial privacy laws and issues related to intrusive data collection and personalized pricing.Carlin and Kim highlight the CFPB's ongoing efforts to regulate big tech firms, which they view as operating outside traditional banking...

2025-03-0520 min

Kelley Drye Ad Law Access PodcastMultistate Coalition Files Amicus Brief Warning Against Efforts to Dismantle the CFPBPaul L. Singer, Abigail Stempson, Beth Bolen Chun, and Andrea deLorimier

A coalition of all 23 democratic attorneys general filed an amicus brief in the U.S. District Court for the District of Maryland warning against efforts by the Trump Administration to defund and disband the Consumer Financial Protection Bureau (CFPB). The brief comes in the wake of the outgoing CFPB’s call for state action, in a foreshadowing of events to come.

In their brief, the coalition, co-led by New Jersey Attorney General Matthew J. Platkin and New York Attorney General Letitia James, argues that the administration’s efforts to elim...

2025-03-0504 min

The Texas Real Estate & Finance Podcast with Mike MillsThe CFPB Under Trump & HUD Layoffs – The Future of Real EstateThe real estate and mortgage industries are facing major disruptions—are you ready? With the CFPB under Trump rolling back regulations and HUD layoffs threatening FHA loan processing, these changes could significantly impact Realtors, lenders, and homebuyers. In this episode, we break down how these shifts could reshape the housing market and what real estate professionals must do now to stay ahead.📢 Episode OverviewThe CFPB under Trump is undergoing major restructuring, and HUD layoffs could slow down FHA and USDA loan approvals—but what does this mean for Realtors, lenders, and homebuyers? In this episode...

2025-03-0452 min

The Banker Next DoorEpisode 332: Does the CFPB have a future?This episode examines a recent article from Bank Director titled “Chaos consumes CFPB, causing uncertainty” and recent reporting from CNBC. The CFPB was effectively shut down a few weeks ago when acting director Russell Vought took over. All legal cases and regulatory rules were halted upon further review. The CFPB has 1,700 employees but is only required to have a few hundred by law. Will the CFPB be shut down completely, reduced to a very small regulator, or just get streamlined to be more efficient? Links to the Bank Director article and CNBC reporting are included below.

Link: Chaos...

2025-03-0315 min

Minimum CompetenceLegal News for Fri 2/28 - KPMG Law Firm, CFPB Drops Cases Against Financial Firms, Judge Orders DGE Testimony and Ruling Blocks Federal Job CutsThis Day in Legal History: Reichstag Fire DecreeOn February 28, 1933, German President Paul von Hindenburg issued the Reichstag Fire Decree, formally known as the Presidential Decree for the Protection of People and State. The decree was a direct response to the Reichstag fire the night before, which the Nazi Party blamed on Communists. It suspended key civil liberties, including freedom of speech, press, assembly, and protection from unlawful detention. The decree also allowed warrantless arrests and indefinite imprisonment of political opponents. Using this power, the Nazis swiftly arrested thousands of Communists, Socialists, and other adversaries. T...

2025-02-2812 min

Fintech TakesBank Nerd Corner: CFPB, De Novos, and The Crypto-BaaS ReckoningWelcome back to Bank Nerd Corner, featuring yours truly and #1 among all bank nerds, Kiah Haslett, Banking and Fintech Editor at Bank Director.By the time you’re reading this, we’ve had ~3 weeks of “fun” updates from the CFPB, and we have a lot to unpack!First up, who actually wants the CFPB gone? Gutting the CFPB won’t end consumer protection; it just shifts the burden. Funny how the loudest CFPB critics are the ones who profit most from consumer confusion. Even some bank execs admit the CFPB keeps markets fair. Referees are annoying...

2025-02-191h 22

mffm - エムエフエフエム#86 米メガバンクの決算まとめ, 誰も銀行をディスラプトできていない?, CFPBが全ての業務をストップ - WorldFintechNews2025年2月# タイムスタンプ(1:22) 米メガバンクの決算まとめ(29:00) 誰も銀行をディスラプトできていない?(41:21) CFPBが全ての業務をストップ# トピックス米メガバンクの決算まとめ米国の主要メガバンク6社(JPモルガン・チェース、バンク・オブ・アメリカ、シティグループ、ウェルズ・ファーゴ、ゴールドマン・サックス、モルガン・スタンレー)の2024年通年決算が出揃いました。2024年、米国の銀行株は好調に推移。銀行株の代表的な指標であるKBW銀行指数(BKX)は、年間で33%上昇し、S&P500を9.4ポイント上回るパフォーマンスを記録し、2016年以来最大のアウトパフォームとなりました。各行に共通する傾向として、特に投資銀行部門が成長を遂げました。利下げや株価の上昇が追い風となり、M&AやIPOなどのディールフローが活発化したことが大きな要因とされています。一方で、リテール部門も予想を上回る業績を記録する銀行が多く、各社のCEOも好調な決算に対して前向きなコメントを発表しました。今回は、各銀行の主要な数値とトピックについて詳しく見ています。誰も銀行をディスラプトできていない?2020年以降、スタートアップ投資は急増し、コロナ禍の財政出動による消費の拡大、クレジットカードの貸付残高の増加、さらに利上げによる高利回り口座の普及など、Fintech業界にとっては追い風の状況が続いていました。しかし、2025年現在、預金やクレジットカード市場で既存メガバンクは堅調に成長を見せています。メガバンクも近年、デジタルサービスの強化を進めており、Fintech企業が強みとしていたUI/UX面での優位性が縮小しています。この結果、Fintechが銀行をディスラプトすることは想定よりも難しい状況となりつつあり、Fintechが銀行業界をディスラプトすることの難しさが強調される結果となりました。https://www.popularfintech.com/p/no-one-is-disrupting-banksCFPBが全ての業務をストップ2025年1月、新たに発足したトランプ政権は、大統領就任翌日に消費者金融保護局(CFPB)のロヒト・チョプラ局長を解任し、行政管理予算局長官のラッセル・ボート氏を局長代理に任命しました。2月9日、ボート局長代理はCFPBの全職員に対し、すべての業務の中断と出社禁止を命令。さらに、イーロン・マスク氏が率いる「政府効率化省(Department of Government Efficiency, DOGE)」がCFPBの運営を掌握し、同局は一時的に閉鎖されました。CFPBは2011年、エリザベス・ウォーレン氏を中心に民主党政権下で創設され、金融規制の強化や消費者保護を目的としていました。しかし、トランプ政権は金融規制緩和を推進し、CFPBの独立性を疑問視する姿勢をとっており、トランプ大統領の公約にもCFPBの閉鎖が掲げられていました。2011年以降、長年政争の対象となっていたCFPBが今後どうなるのか。大手Fintech企業の規制や、オープンバンキング規則へも大きく影響する可能性が高いトピックだけに、大きな注目が集まります。https://www.pymnts.com/news/regulation/2025/with-cfpb-closed-open-banking-awaits-next-steps/https://openbanker.beehiiv.com/p/deletethecfpb# 話し手瀧 俊雄執行役員 グループCoPA(Chief of Public Affairs) 兼 Fintech研究所長https://twitter.com/sutebuu廣瀬 明倫パブリック・アフェアーズ室 / Fintech研究所リサーチヘッド小林 豪https://twitter.com/GOU_0013

2025-02-1756 min

Financial Forward: The Future of Consumer Finance & BankingThe Future of the CFPB: A Surprising Conversation with Banking Expert Ron ShevlinSend us a textEpisode Summary:The Trump Administration wants to shut down the Consumer Financial Protection Bureau (CFPB)—a move that has divided the financial industry. Is it a necessary rollback of overreach or a dangerous erosion of consumer protections? To unpack this, Jim McCarthy sits down with Ron Shevlin, a nationally recognized expert on banking and credit unions, and Chief Research Officer at Cornerstone Advisors. Ron has spent years analyzing financial services trends, regulatory impacts, and the evolution of consumer finance. While he supports ef...

2025-02-141h 00

Consumer Finance MonitorWill the State Attorneys General and Other State Agencies Fill the Void Left by the CFPB?Today's podcast show is a repurposing of the second half of a webinar we produced on January 17, 2025. That webinar was Part 3 of our webinar series entitled "The Impact of the Election on the CFPB and Others." In Part 3, we focus on the role of state attorneys general in a rapidly shifting CFPB environment. Our previous podcast show, released on Tuesday February 11th, was a repurposing of the first half of our January 17th webinar in which Alan Kaplinsky had a "fireside chat" with Matthew J. Platkin, the New Jersey Attorney General. See here. The importance of Part 3...

2025-02-121h 05

Ahead of the Curve: A Banker's PodcastUpdates on CFPB 1071 and 1033 for community financial institutionsThe CFPB 1071 regulation has sparked plenty of debate and concern among financial institutions. Since our last 107 1 episode in March, there have been some key developments, including the Supreme Court's decision to uphold the CFPB’s funding structure and the new administration's 60-day pause on the rule. We’ll discuss how community financial institutions are responding—whether with resignation, adaptation, or continued hesitancy—and the practical steps they’re taking to comply.Up next is an overview of CFPB 1033, the open banking rule, and what it means for community banks as they face new requirements for consumer data access and...

2025-02-0322 min

Consumer Finance MonitorAlan Kaplinsky's "Fireside Chat" with Kathy Kraninger, Former Director of the CFPB During Trump 1.0Today's podcast episode is a repurposing of Alan Kaplinsky's "fireside chat" with Kathy Kraninger, the Director of the CFPB during the second half of President Trump's presidency from December 2018 until January 2021. (This was originally the first half of a webinar we did on January 6, 2025 which was entitled "The Impact of the Election on the CFPB - Supervision and Enforcement." The January 6 webinar is Part 2 of a 3-part series. Next Thursday, we will release the second half of that webinar which will feature Ballard Spahr partners, John Culhane and Mike Kilgariff, who will take a deep dive into the expected...

2025-01-231h 00

Consumer Finance MonitorThe Impact of the Election on the CFPB: What to Expect on Key Regulatory Issues During Trump 2.0Today's podcast episode is part two of our December 16th webinar, where we discussed the impact of the election on CFPB rulemaking. Part one consisted of a "fireside chat" with David Silberman, who held several senior-level positions at the CFPB for almost ten years under both Democratic and Republican administrations. In part two, Ballard Spahr partners John Culhane and Joseph Schuster address the following questions: 1. What will happen to CFPB regulations issued before January 20, such as the CFPB's credit card late fee rule, which is currently being challenged in a Texas federal court? 2. What will...

2025-01-0956 min

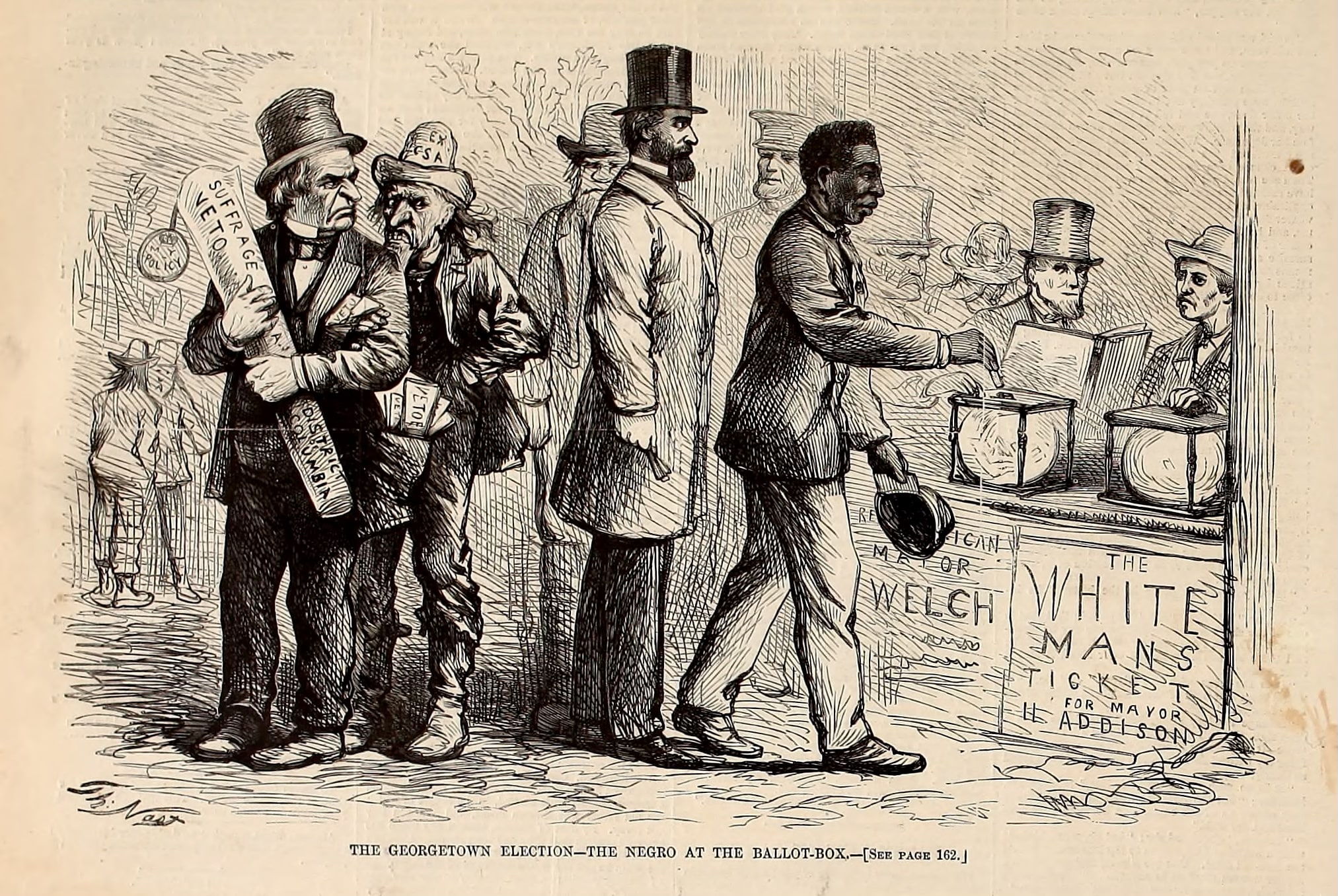

Minimum CompetenceLegal News for Weds 1/8 - CFPB vs. Experian, TikTok at SCOTUS, Alaska Lawsuit on Arctic Drilling and Column Tuesday on Pittsburg 'Jock Tax'This Day in Legal History: District of Columbia Suffrage ActOn this day in legal history, January 8, 1867, the U.S. Congress overrode President Andrew Johnson's veto to enact the District of Columbia Suffrage Act. This landmark legislation granted African American men the right to vote in the nation's capital, making it the first federal law to extend voting rights to Black men. This milestone occurred three years before the ratification of the 15th Amendment, which would prohibit racial discrimination in voting nationwide. The Act was a significant step during the Reconstruction era, as the United St...

2025-01-0807 min

Payments Pros – The Payments Law PodcastNavigating Consumer Protection: The CFPB's Expanding ReachIn the latest episode of Payments Pros, host Carlin McCrory welcomes Jesse Silverman to discuss the Consumer Financial Protection Bureau's (CFPB) recent order asserting supervisory authority over Google Payment Corp.The CFPB's claim is based on Dodd-Frank Section 1024, which includes a category for entities posing a risk to consumers. The CFPB cited 267 consumer complaints about Google Pay products as the basis for its action. Jesse highlights the ambiguity in terms like "risk" and "reasonable cause" within the Dodd-Frank Act and questions the material impact of CFPB supervision. Google Payment Corp. has sued the CFPB, arguing that the...

2025-01-0823 min

Consumer Finance MonitorAlan Kaplinsky's "Fireside Chat" with Former CFPB Leader David Silberman: His Experience During the Prior Transition from the Obama Administration to Trump 1.0Today's podcast episode is a repurposing of part one of our December 16 highly-attended and praised webinar consisting of Alan Kaplinsky's exclusive interview of David Silberman, who held several senior positions at the CFPB for almost 10 years under both Democratic and Republican administrations. Part two of our December 16 webinar, featuring Ballard Spahr partners John Culhane and Joseph Schuster, is to be released on January 9. They focus their attention on the impact of the election on the CFPB's regulations (final and proposed). Our December 16 webinar is the first part of our three-part intensive look at this transitional period for the CFPB...

2025-01-0238 min

Holland & Knight Legal PodcastThe CFPB Takes Action Against VyStar Credit UnionIn this episode of his "Clearly Conspicuous" podcast series, "The CFPB Takes Action Against VyStar Credit Union," consumer protection attorney Anthony DiResta examines the Consumer Financial Protection Bureau's (CFPB) action against VyStar Credit Union ordering the company to pay $1.5 million for a failed online banking system rollout that left consumers unable to access their accounts. The CFPB found that VyStar violated the Consumer Financial Protection Act by ignoring red flags and rushing an untested platform, resulting in significant harm to its members. In this episode, Mr. DiResta highlights the CFPB's authority to take action against large credit unions and the...

2024-12-1805 min

Consumer Finance MonitorConsumer Federation of America ("CFA") Speaks Out About CFPB's and FTC's Direction During the Trump AdministrationIf you work for a bank or other consumer financial services provider, you will want to listen closely to how consumer advocates are reacting to Trump's election insofar as the CFPB and FTC are concerned. In today's podcast episode, we're joined by Erin Witte and Adam Rust (the "CFA Reps") from CFA. We focus first on CFPB and FTC regulations that might be finalized during the lame duck session of Congress. The CFA Reps express hope that the FTC would finalize its so-called "junk fee reg" which, as proposed, called for "all-in" pricing (I.e., disclosure of...

2024-12-121h 04

Holland & Knight Legal PodcastThe CFPB and NCUA Take Action Against VyStar Credit UnionIn this episode of his "Clearly Conspicuous" podcast series, "The CFPB and NCUA Take Action Against VyStar Credit Union," consumer protection attorney Anthony DiResta examines the Consumer Financial Protection Bureau's (CFPB) action against VyStar Credit Union ordering the company to pay $1.5 million for a failed online banking system rollout that left consumers unable to access their accounts. The CFPB, in partnership with the National Credit Union Administration (NCUA), found that VyStar violated the Consumer Financial Protection Act by ignoring red flags and rushing an untested platform, resulting in significant harm to its members. In this episode, Mr. DiResta highlights the...

2024-12-1105 min

Data-Driven Finance: The Financial Intelligence PodcastKat Cloud of Yodlee on CFPB 1033 Rule ComplianceOur guest on this episode of Data Driven Finance is Kat Cloud, Principal Director of Open Banking Compliance at Yodlee. Kat is also a Board member at the Financial Data Exchange, and prior to her time at Yodlee was head of UK Public Policy for Plaid. We discuss open banking compliance, specifically touching on the new CFPB 1033 rule, which is important for all financial institutions to be aware of. Topics covered include:

What is open banking? How does it differ from how financial institutions operate today?

What has to happen for open banking to reach its full promise?

...

2024-12-0624 min

Holland & Knight Legal PodcastThe CFPB Highlights Alleged Deceptive Debt Collection PracticesIn this episode of his "Clearly Conspicuous" podcast series, "The CFPB Highlights Alleged Deceptive Debt Collection Practices," consumer protection attorney Anthony DiResta examines the Consumer Financial Protection Bureau's (CFPB) Summer 2024 Supervisory Highlights. The publication focuses on several areas of concern in consumer financial services, including auto and student loan servicing, debt collection practices, medical payment products and account freezes. In auto loan servicing, the CFPB identifies issues with inadequate notifications for final manual payments in auto-pay systems, while student loan servicers were found to have excessive barriers to assistance and inaccurate information about forbearance programs. Debt collectors were cited for...

2024-11-1207 min

Minimum CompetenceLegal News for Thurs 11/7 - Trump Admin Will Scale Back CFPB and EPA Rules, Giuliani Faces Court over Defying Orders, R&D Expensing is BrokenThis Day in Legal History: FDR Wins Fourth TermOn November 7, 1944, Franklin D. Roosevelt won an unprecedented fourth term as President of the United States, solidifying his role as a defining leader during one of the nation's most challenging periods. First elected in 1932, Roosevelt took office at the height of the Great Depression and implemented the New Deal to revive the struggling economy. By the time of his fourth election, the U.S. was fully engaged in World War II, and Roosevelt's leadership was seen as essential to the Allied victory effort.Roosevelt's extended presidency...

2024-11-0707 min

Consumer Finance MonitorHow the CFPB Is Using Interpretive Rules to Expand Regulatory Requirements for Innovative Consumer Financial Products; Part Two—Earned Wage AccessToday's podcast, which repurposes a recent webinar, is the conclusion of a two-part examination of the CFPB's use of a proposed interpretive rule, rather than a legislative rule, to expand regulatory requirements for earned wage access (EWA) products. Part One, which was released last week, focused on the CFPB's use of an interpretive rule to expand regulatory requirements for buy-now, pay-later (BNPL) products. We open with a discussion of EWA products, briefly describing and distinguishing direct-to-consumer EWAs and employer-based EWAS. We review some of the consumer-friendly features that are common to EWAs, including that there is no...

2024-10-2442 min

The Real Estate REplayConsumer Battles: How CFPB Funding and Political Shifts Impact Your FinancesPrepare to uncover the truth about your financial protection and what the future holds for the Consumer Financial Protection Bureau (CFPB) as we edge closer to the 2024 election. Why does it matter who funds the CFPB, and how could these political decisions impact your wallet? Join Wendy Gilch, in this special episode of the Real Estate Replay, where we promise you'll gain insights into the tug-of-war between oversight and independence affecting one of the most influential consumer watchdogs in the financial realm. We also discuss a few people that are currently up for re-election, how financial institutions c...

2024-10-1810 min

Consumer Finance MonitorHow the CFPB Is Using Interpretive Rules to Expand Regulatory Requirements for Innovative Consumer Financial Products; Part One - Buy-Now, Pay-LaterToday's podcast, which repurposes a recent webinar, is the first in a two-part examination of the CFPB's use of an interpretive rule, rather than a legislative rule, to expand regulatory requirements for buy-now, pay-later (BNPL) products. Part Two, which will be available next week, will focus on the CFPB's use of a proposed interpretive rule to expand regulatory requirements for earned wage access (EWA) products. We open with an overview of what interpretive rules are and how they differ procedurally and substantively from legislative rules. The intended use of interpretive rules is to explain the meaning of...

2024-10-1742 min

Financial Forward: The Future of Consumer Finance & BankingFinancial Watchdog: A Dive into CFPB’s Complaint Mechanism [LinkedIn Live: Part 1]Send us a textIn this comprehensive episode of Financial Forward, host Jim is joined by Camie Keilen, a senior executive with extensive compliance risk management experience, to explore the Consumer Financial Protection Bureau's (CFPB) Complaints Enterprise. The discussion traces the program's origins following the 2008 mortgage crisis, addresses the evolution of consumer complaint handling, and examines the practical challenges faced by financial institutions in meeting strict CFPB regulations. Key topics include the introduction of a public complaints portal, response and tracking expectations, and policy changes that foster better consumer complaint management. The episode p...

2024-10-1725 min

Financial Forward: The Future of Consumer Finance & BankingFrom Complaints to Compliance: How Data Shapes Financial Institutions & CFPB Power [LinkedIn Live Part 2]Send us a textIn this episode of Financial Forward, hosts Camie Keilen and Jim delve into the evolution and impact of the Consumer Financial Protection Bureau's (CFPB) data-driven complaints enterprise. They discuss the transformation of regulatory practices through complaint data, the role of evolving taxonomies, and the proactive use of data to tackle regulatory challenges. The episode also covers the differences in enforcement approaches, highlighting how AI and technologies aid in real-time complaint analysis, and the importance of timely, independent data analysis for banks. Reflecting on the early days of the CFPB, th...

2024-10-1735 min

Credit Union Regulatory Guidance Including: NCUA, CFPB, FDIC, OCC, FFIECCFPB Rohit Chopra's Remarks at the National Housing Conferencewww.marktreichel.comhttps://www.linkedin.com/in/mark-treichel/# Show Notes: CFPB on Housing - Prepared Remarks of CFPB Director Rohit Chopra## Episode OverviewThis episode covers the prepared remarks of CFPB Director Rohit Chopra at the National Housing Conference on September 9, 2024. The remarks focus on mortgage refinancing and its potential impact on homeowners and the economy.## Key Points1. Interest rates and their impact on mortgage decisions2. Current state of the mortgage refinancing market3. Expectations for lower interest rates in the future4. Potential benefits...

2024-09-1013 min

Holland & Knight Legal PodcastCFPB Warns of Manipulation in Digital Comparison Shopping ToolsIn this episode of his "Clearly Conspicuous" podcast series, "CFPB Warns of Manipulation in Digital Comparison Shopping Tools," consumer protection attorney Anthony DiResta discusses the Consumer Financial Protection Bureau's (CFPB) circular warning about comparison shopping operators potentially violating federal law. The CFPB's guidance explains how certain practices can deceive consumers who rely on these tools for unbiased information about financial products, particularly in the credit card and mortgage markets. He also notes that the CFPB's circular is part of broader efforts to level the playing field for consumers across various financial product and service industries.

For more, visit: https://www...

2024-09-0406 min

Consumer Finance MonitorThe CFPB's Registry of Nonbanks and Circular that Certain Contract Terms Violate LawThe CFPB recently issued yet another final rule the agency says will help deter violations of consumer protection laws. This rule requires certain nonbank entities to register with the CFPB upon becoming subject to any order from local, state, or federal agencies or courts involving consumer protection law violations. The registry rule applies to any supervised or non-supervised nonbank that engages in offering or providing a consumer financial product or service and any of its service provider affiliates unless excluded. The CFPB will require the nonbank entities that are subject to the rule to register the specific terms and...

2024-08-2958 min

Payments Pros – The Payments Law PodcastEarned Wage Access: Exploring the CFPB's Proposed Interpretive RuleIn this special crossover episode of Payments Pros and The Consumer Finance Podcast, Carlin McCrory, Keith Barnett, and Chris Willis are joined by Jason Cover and Mark Furletti to discuss the Consumer Financial Protection Bureau's (CFPB) proposed interpretive rule on earned wage access (EWA) products. EWA allows employees to access wages they have earned before payday, with two main models: employer-integrated and direct-to-consumer. The conversation explores the differences between EWA and payday lending, emphasizing that EWA typically does not involve finance charges or obligations to repay.The podcast explains the CFPB's proposed interpretive rule, which replaces the 2020...

2024-08-2220 min

The Consumer Finance PodcastEarned Wage Access: Exploring the CFPB's Proposed Interpretive RuleIn this special crossover episode of Payments Pros and The Consumer Finance Podcast, Carlin McCrory, Keith Barnett, and Chris Willis are joined by Jason Cover and Mark Furletti to discuss the Consumer Financial Protection Bureau's (CFPB) proposed interpretive rule on earned wage access (EWA) products. EWA allows employees to access wages they have earned before payday, with two main models: employer-integrated and direct-to-consumer. The conversation explores the differences between EWA and payday lending, emphasizing that EWA typically does not involve finance charges or obligations to repay.The podcast explains the CFPB's proposed interpretive rule, which replaces the 2020...

2024-08-2220 min

Consumer Finance MonitorBuy Now, Pay Later – Evolution, Regulation, and What You Need to Know about the CFPB Interpretive Rule Effective July 30"Buy Now, Pay Later" (BNPL) products emerged relatively recently as a new approach enabling consumers to enjoy the ability to make a purchase and then pay for it over time. Today's episode, during which we explore the evolution of BNPL products and important recent developments in BNPL regulation, is hosted by Alan Kaplinsky, former practice leader and current Senior Counsel in Ballard Spahr's Consumer Financial Services Group, and features Ballard Spahr Partners Michael Guerrero and Joseph Schuster. We first discuss the structure and mechanics of BNPL products, and the benefits they afford to consumers, merchants, and creditors...

2024-07-251h 00

Consumer Finance MonitorConsumer Financial Protection Bureau Wins in Supreme Court But Can the Fed Continue to Fund the CFPB Without Earnings?Special guest Alex J. Pollock, Senior Fellow with the Mises Institute and former Principal Deputy Director of the Office of Financial Research in the U.S. Treasury Department, joins us to discuss his recent blog post published on The Federalist Society website in which he urges Congress to look into the question of whether the Federal Reserve can lawfully continue to fund the CFPB if (as now) the Fed has no earnings. We begin with a review of the Supreme Court's recent decision in CFSA v. CFPB which held that the CFPB's funding mechanism does not violate the Appropriations...

2024-06-2756 min

Consumer Finance MonitorWhat Banking Leaders Need to Know About the U.S. Supreme Court Ruling That the CFPB's Funding Mechanism is Constitutional Part IIOn May 16, 2024, the U.S. Supreme Court ruled that the CFPB's funding mechanism does not violate the Appropriations Clause of the U.S. Constitution. This two-part episode repurposes a recent webinar. In Part II, we first discuss the CFPB's launch of Fair Credit Reporting Act rulemaking, proposed rule to supervise larger payment providers, proposed rule on personal financial data rights, and interpretive rule on buy-now-pay-later. We next discuss the operation of the Congressional Review Act and its potential impact on final CFPB rules if the November 2024 election results in a change in Administrations. We then discuss the impact of t...

2024-06-2033 min

Consumer Finance MonitorWhat Banking Leaders Need to Know About the U.S. Supreme Court Ruling That the CFPB's Funding Mechanism is Constitutional Part IOn May 16, 2024, the U.S. Supreme Court ruled that the CFPB's funding mechanism does not violate the Appropriations Clause of the U.S. Constitution. This two-part episode repurposes a recent webinar. In Part I, we first discuss the SCOTUS decision, the status of the CFPB's payday lending rule that was at issue in the underlying case, and a potential new challenge to the CFPB's funding that has been the focus of recent attention. We then discuss four cases still pending before SCOTUS in which the decisions could impact the CFPB. Next, we discuss the pending lawsuits challenging the CFPB's...

2024-06-1352 min

Consumer Finance MonitorDid the Supreme Court Hand the CFPB a Pyrrhic Victory?Special guest Professor Hal Scott of Harvard Law School joins us today as we delve into the thought-provoking question of whether the Supreme Court's recent decision in the landmark case of CFSA v. CFPB really hands the CFPB a winning outcome, or does the Court's validation of the agency's statutory funding structure simply open up another question: whether the CFPB is legally permitted to receive funds from the Federal Reserve if (as now) the Fed has no earnings. In other words, was the outcome in CFSA v. CFPB an illusory Pyrrhic victory for the CFPB? And, what happens next?

2024-06-0643 min

Consumer Finance MonitorAn Insider's View of the CFPBOur special guest this week is John Tonetti. After decades as an industry risk executive, Mr. Tonetti joined the Consumer Financial Protection Bureau (CFPB), where he worked for many years in roles including Debt Collection Program Manager, senior policy analyst, and internal consultant on numerous issues including debt collection and risk management policies and examinations. In this episode, Mr. Tonetti shares his perspectives from the point of view of an agency insider who served under every CFPB director and acting director in office to date. We first discuss the pitfalls of the CFPB's leadership structure, which gives...

2024-05-3059 min

NerdWallet's Smart Money PodcastHow the CFPB's Supreme Court Win Helps ConsumersLearn how the recent Supreme Court ruling on the Consumer Financial Protection Bureau (CFPB) affects your finances.How does the CFPB protect consumers? Why does the recent CFPB court decision matter? Hosts Sean Pyles and Anna Helhoski discuss the recent Supreme Court decision that upheld the CFPB’s funding structure, explaining its significance and what it means for consumer protections. They also explain the history and function of the CFPB, including its role in consumer finances, and provide actionable insights on how you can leverage its resources to resolve financial issues, including how to fi...

2024-05-2212 min

The Consumer Finance PodcastUnderstanding the CFPB's Rules for Risk-Based Nonbank SupervisionIn this episode of The Consumer Finance Podcast, Chris Willis discusses the recent changes the Consumer Financial Protection Bureau (CFPB) made to its rules for designating nonbanks subject to supervision due to potential risks to consumers. Willis provides a background on this authority granted to the CFPB by the Dodd-Frank Act and discusses the CFPB's increased use of this authority in recent years. He also delves into the implications of the CFPB's updated rules, emphasizing the need for nonbanks to prepare for potential supervision and to build robust compliance management systems. The episode provides valuable insights for nonbanks navigating...

2024-05-1610 min

The Consumer Finance PodcastAnalyzing the CFPB's Stance on Comparison Shopping and Lead Generation WebsitesIn this episode of The Consumer Finance Podcast, Chris Willis discusses the Consumer Financial Protection Bureau's (CFPB) recent circular on comparison shopping and lead generation websites. The CFPB asserts that certain practices related to these websites are abusive under the Dodd Frank Unfair, Deceptive, or Abusive Acts or Practices (UDAAP) regulation. The CFPB argues that it is abusive for website operators to influence their display or ranking of consumer financial products and services based on compensation they receive from product providers. Willis critiques the CFPB's stance, arguing that the Bureau is attempting to rewrite commerce rules by labeling practices...

2024-03-2812 min

RegFi PodcastWhat will Supervisory Exams Look Like for Tech Companies under CFPB's Proposed "Larger Participant" Rule?The CFPB's Proposed Larger Participant Rule for Payments Providers, if adopted, will subject large tech companies providing payments services and mobile wallets to bank-like supervisory examinations of their payments activities. Tech companies offering consumer finance services are already subject to CFPB enforcement, but the proposed rule would result in ongoing regulatory supervision by the Bureau. RegFi co-hosts Jerry Buckley, Sasha Leonhardt, Sherry Safchuk and Caroline Stapleton expand on their coverage from earlier this year, delving deeper into what newly covered institutions might expect from the examination process. The conversation includes an outline of the typical examination lifecycle, a discussion...

2024-03-2029 min

The Consumer Finance PodcastUnderstanding the CFPB's Proposed Digital Payments Larger Participants Rule and Its Implications for Digital AssetsIn this special crossover episode with Payments Pros and The Crypto Exchange, Ethan Ostroff, James Kim, and Carlin McCrory discuss the Consumer Financial Protection Bureau's (CFPB) proposed rule to supervise large tech companies and other providers of digital wallets and payment apps. The proposed rule asserts that digital assets are "funds" subject to the Dodd-Frank Act and other federal consumer financial laws and regulations, which would expand the CFPB's supervisory powers to examine companies facilitating crypto and other digital asset transactions.Our group discusses the legal basis for the CFPB's assertion of jurisdiction over digital assets, and...

2024-03-1425 min

Ahead of the Curve: A Banker's PodcastCFPB 1071 and the future of small business lending: What, when, and where to startSection 1071 of the Dodd-Frank Wall Street Reform and Consumer Protection Act requires financial institutions to collect and report data on small business lending to the Consumer Financial Protection Bureau (CFPB). The details of the CFPB 1071 rule are laid out in an extensive 888-page document, so it's no surprise that many financial institutions aren’t sure where to start when it comes to preparing for compliance.In this episode, Abrigo Senior Consultant Paula King offers a comprehensive exploration of the rule’s main elements, some first steps for compliance, and a brief overview of how it has been rece...

2024-03-1222 min

Payments Pros – The Payments Law PodcastUnderstanding the CFPB's Proposed Digital Payments Larger Participants Rule and Its Implications for Digital AssetsIn this special joint episode of Payments Pros and The Crypto Exchange, Ethan Ostroff, James Kim, and Carlin McCrory discuss the Consumer Financial Protection Bureau's (CFPB) proposed rule to supervise large tech companies and other providers of digital wallets and payment apps. The proposed rule asserts that digital assets are "funds" subject to the Dodd-Frank Act and other federal consumer financial laws and regulations, which would expand the CFPB's supervisory powers to examine companies facilitating crypto and other digital asset transactions.Our group discusses the legal basis for the CFPB's assertion of jurisdiction over digital assets, and...

2024-02-2724 min

The Crypto ExchangeUnderstanding the CFPB's Proposed Digital Payments Larger Participants Rule and Its Implications for Digital AssetsIn this special joint episode of Payments Pros and The Crypto Exchange, Ethan Ostroff, James Kim, and Carlin McCrory discuss the Consumer Financial Protection Bureau's (CFPB) proposed rule to supervise large tech companies and other providers of digital wallets and payment apps. The proposed rule asserts that digital assets are "funds" subject to the Dodd-Frank Act and other federal consumer financial laws and regulations, which would expand the CFPB's supervisory powers to examine companies facilitating crypto and other digital asset transactions.Our group discusses the legal basis for the CFPB's assertion of jurisdiction over digital assets, and...

2024-02-2724 min

Holland & Knight Legal PodcastThe CFPB Targets Data Brokers with Latest Proposed RuleIn this episode of his "Clearly Conspicuous" podcast series, "The CFPB Targets Data Brokers with Latest Proposed Rule," consumer protection attorney Anthony DiResta shares his insight on the Consumer Financial Protection Bureau's (CFPB) proposed rules governing the practices of data brokers under the Fair Credit Reporting Act (FCRA). He outlines the comprehensive rules established by the FCRA that regulate consumer reporting agencies as well as the CFPB's previous studies regarding data brokers. Mr. DiResta explains that the key to staying on top of the current laws that deal with technological developments is to pay attention to the CFPB's initiatives that...

2024-02-0706 min

COMPLY: The Marketing Compliance PodcastRecent CFPB Rulemaking Activity & Looking Ahead for 20242024 is already shaping up to be an unprecedented year that will continue to be filled with regulatory and compliance pressures including increased rulemaking, examinations and enforcement. As we enter what is sure to be yet another busy year in the regulatory space, regulators are gearing up to ensure that consumer protection continues to be the focus of their ever-growing agenda.Today's episode is part 2 of a discussion featuring CFPB alumni Gary Stein and Melissa Baal Guidorizzi, where they discuss:Recent CFPB Rulemaking ActivitySteps you can take now to get ahead of regulatory scrutinyLooking ahead at rulemaking...

2024-01-1926 min

Payments Pros – The Payments Law PodcastDecoding the CFPB's Recent Report: An Examination of "Junk Fees" and Their Impact on ConsumersIn this episode of Payments Pros, Keith Barnett and Carlin McCrory discuss the Consumer Financial Protection Bureau's (CFPB) fall supervisory highlights, focusing on "junk fees." The report covers examinations in areas of deposits, auto servicing, and remittances completed between February and August 2023. The recent report reveals that their efforts have resulted in institutions refunding more than $140 million to consumers. The report primarily focuses on deposits as an area of supervisory observations.Keith and Carlin also note that the report discusses CFPB identifying unfair practices by financial institutions, which have been charging consumers representment nonsufficient funds (NSF) fees...

2024-01-1027 minNew York City Bar Association PodcastWhat's in Your Wallet: the CFPB Goes after Digital Wallets and Payment AppsThe City Bar Task Force on Digital Technologies explores the implications of the Consumer Financial Protection Bureau (CFPB)'s proposed rule on digital wallets and payment apps. After a review of the CFPB's authoritative reach, its enforcement authority, and its coordination with other regulatory agencies, we dig into the proposed rule – what its key provisions are, how its comment period was decided upon, and how it determines which entities will be affected. The group, which includes former senior CFPB officials, also discuss how attorneys could advise their clients about the CFPB entry into this space.

Tune in to hear more ab...

2023-12-2159 min

mffm - エムエフエフエム#57 マネーフォワード設立のきっかけにもなった家計簿アプリMintが事業クローズ, 大手決済アプリにCFPBが規制を提案へ, Plaidが信用情報機関になりレンディング領域へ進出 - WorldFintechNews 11月タイムスタンプ

(0:00) Fintech第一世代の家計簿アプリMintが事業クローズ

(28:33) 大手決済アプリにCFPBが規制

(35:15) Plaidが信用情報機関になりレンディング領域へ進出

# 今回取り上げたトピックと参考資料

・Fintech第一世代の家計簿アプリMintが事業クローズ

2006年創業、家計簿アプリのパイオニアであり、著名なFintech第一世代の企業であるMint。

マネーフォワードの設立にも大きく影響を与えた同社ですが、2009年にIntuitが$170Mで買収して以降、大きなニュースはなく、ついに事業閉鎖となりました。

Mintを利用している300万以上のユーザーは、Intuitが2020年に買収したCredit Karmaへの移行を促されるようです。

瀧さんに、Mintとの出会いから、マネーフォワードMEの誕生まで、当時のことを話していただきました。

アメリカの偉大なPFM:Mint.com – Finance Startups

Intuit Is Closing Personal-Finance App Mint, Shifts Users to Credit Karma

・大手決済アプリにCFPBが規制を提案へ

CFPBが、Apple PayやGoogle Pay, Cash Appなど大手決済アプリに、"銀行並み"の監査を"連邦レベル”で行うと発表しました。

バイデン政権のもとで活躍するCFPB長官ロヒト・チョプラ氏の元、Fintech業界におけるCFPBの存在感が増しています。

CFPB Proposes New Federal Oversight of Big Tech Companies and Other Providers of Digital Wallets and Payment Apps | Consumer Financial Protection Bureau

・Plaidが信用情報機関になりレンディング領域本格進出

Plaidが、信用情報機関として新たな組織を立ち上げることを発表しました。これまではあくまでデータを仲介していたPlaidですが、実際にデータを加工し、スコアリングし、レンディング領域へ大きく乗り出すようです。

金利が上昇している中、領域全体がにわかに盛り上がり始めています。

Lending smarter with cash flow data: Plaid’s path ahead in Credit

Plaid Officially Jumps Into Lending -

# 話し手

瀧 俊雄

執行役員 CoPA(Chief of Public Affairs) 兼 Fintech研究所長

https://twitter.com/sutebuu

小林 豪

Public Affairs室

https://twitter.com/GOU_0013

2023-11-1145 min

Real Money, Real ExpertsFacets of Consumer Protection with John McNamara, CFPBToday’s guest is John McNamara, Principal Assistant Director of Consumer Credit, Payments, and Deposits Markets at the CFPB. In this episode, John shares his professional journey from debt collection to his current role at the CFPB. He talks to us about the latest research from the Bureau, and gives us some of his favorite CFPB resources - designed to support you and your clients. We’re excited to have John join us on the main stage later this year. To hear more, we hope you’ll join us in NOLA or virtually: https://www.afcpe.or...

2023-10-2421 min

RegFi PodcastSpecial Episode: The CFPB's 1033 Rule in a NutshellJoin us for this bonus episode where the RegFi hosts share their initial reactions to the CFPB's proposed rule on Personal Financial Data Rights. The proposed rule, which implements Section 1033 of the Dodd-Frank Act, promises to have wide-ranging effects on banks, credit unions, credit card issuers, fintechs offering open banking services and consumers. Our team discusses the history behind the rule, its key provisions and how the rule will affect the industry, and expectations for the coming year as the CFPB seeks to bring this rule into effect. Links: Open Banking: What Financial Institutions Should Know...

2023-10-2322 min

RealEstateAF PodcastCFPB Fines Freedom Mortgage for Kickbacks - RESPA VIOLATIONSend us a textIn this episode of the Key Factors podcast, we discuss the recent CFPB fine against Freedom Mortgage for violating RESPA with kickbacks and pay for referrals.The CFPB found that Freedom Mortgage provided things of value, including subscription services, events, and monthly marketing service agreement payments, to real estate agents and brokers in exchange for referrals of mortgage loans.This is a serious violation of RESPA, which prohibits kickbacks and other forms of compensation in connection with mortgage lending.The CFPB fined Freedom Mortgage $1.75 million and ordered...

2023-08-231h 15

Payments Pros – The Payments Law PodcastCFPB's Larger Participant Rule for Consumer PaymentsIn this episode of Payments Pros, our hosts Keith Barnett, Carlin McCrory, and Josh McBeain join their colleague Chris Willis to discuss the Consumer Financial Protection Bureau's (CFPB) larger participant rule for consumer payments mentioned in its 2023 semiannual rulemaking agenda. During this podcast, they examine a myriad of topics concerning this rule, including the following:The current trend of CFPB supervision and why the CFPB is proposing this larger participant rule;The influence on the substantive law governing some aspects of payments;The implication of CFPB examinations of payments companies for the development of the law or regulatory...

2023-07-1121 min

The Consumer Finance PodcastCFPB's Larger Participant Rule for Consumer PaymentsPlease join Troutman Pepper Partner Chris Willis and colleagues Keith Barnett, Carlin McCrory, and Josh McBeain as they discuss the Consumer Financial Protection Bureau's (CFPB) larger participant rule for consumer payments mentioned in its 2023 semi-annual rulemaking agenda. During this podcast, they examine a myriad of topics concerning this rule, including the following:The current trend of CFPB supervision and why the CFPB is proposing this larger participant rule;The influence on the substantive law governing some aspects of payments;The implication of CFPB examinations of payments companies for the development of the law or regulatory expectations related to...

2023-07-0620 min