Shows

Lantzkampen”Tjing pax”Kodjo Akolor och Ahmed Berhan möter Carl-Johan Ulvenäs och Vendela Lundberg i Lantzkampen Lyssna på alla avsnitt i Sveriges Radios app. I lag Kodjo och Ahmed har vi stjärnkomikerna Kodjo Akolor och Ahmed Berhan och i lag Carl-Johan och Vendela har vi P3ID-stjärnorna Carl-Johan Ulvenäs och Vendela Lundberg!Firades på fettisdagen en mumifierad semla som stått i ett glasskåp på Sveriges Radio i 20 år? Är 70% av invånarna i Arvidsjaur överviktiga? Säger Barack Obama att han bara skämtade när han i en podd sa att det f...

2026-02-2049 min

Radiofynd”Hjälpsamma herrn” bjöd på akustisk slapstickCarl-Gustaf Lindstedt fick sitt genombrott i radiofarsen Hjälpsamma herrn. Men, hur hjälpsam var han egentligen som husfader? Lyssna på alla avsnitt i Sveriges Radios app. 1951 bjöd Radiotjänst på akustisk slapstick med stjärnskottet Carl-Gustaf Lindstedt. ”Hjälpsamma herrn” var radiofarsen som kom att bli Lindstedts stora genombrott, där han tog till vara på ljudmediets möjligheter att förstärka oljud för bästa komiska effekt.Carl-Gustaf Lindstedt axlar alltså rollen som ”husfadern”, en karl som gärna beskriver sig som huslig, men det han tar sig för mynnar så got...

2026-01-1604 min

P1 Kultur ReportageUnika växtbilder i fotoboken ”Linnés herbarium”Fotografen och konstnären Lena Granefelt har med hjälp av en ny fotografisk metod gett nytt liv åt Carl von Linnés växtsamlingar. Lyssna på alla avsnitt i Sveriges Radios app. ”Linnés herbarium. Växtarkens dolda historia” heter en ny fotobok av Lena Granefelt med texter av Sverker Sörlin och formgiven av Nina Ulmaja. Boken berättar historien om världens kanske mest kända växtsamlare: Carl von Linné, född 1707 i Småland och död 1778 i Uppsala. Läkare och botaniker och besatt av att ordna och sortera all världens växter oc...

2025-11-2614 min

Lantzkampen”Ciggen och hennes make”Fritte Fritzson och Anders Sparring möter Carl-Johan Ulvenäs och Vendela Lundberg Lyssna på alla avsnitt i Sveriges Radios app. Komikerstjärnorna Fritte Fritzson och Anders Sparring möter P3 ID-stjärnorna Carl-Johan Ulvenäs och Vendela Lundberg!Laddade Simona Mohamsson upp inför SVT:s partiledardebatt genom att kolla på nya säsongen av ”Gift vid första ögonkastet”? Stämmer det att svenska män aldrig har kommunicerat med varandra via gruppchattar så mycket som efter Sveriges förlust mot Kosovo i måndags? Förbjuds byggarbetarna som byter tak på Hörby kommunhus att...

2025-10-1749 min

The Found & Funded PodcastEpisode 6 'Self-funded, self-doubt and self-belief: Darnell Irozuru's acquisition story'Send us a textFrom finance to founder; trading career certainty for autonomy and long-term impact.In our season finale, Carl Lundberg is joined by Darnell Irozuru, CEO of Birch Faraday Capital and 2024 ETA Award winner, to unpack his ETA journey.Darnell’s instinct for entrepreneurship has been central to this story, starting with his own tutoring business straight out of university. Initially chasing FIRE (Financial Independence Retire Early), he’s now focused on building a long-term hold-co and growing his care business sustainably.Listen along to find out how he tack...

2025-07-2547 min

The Found & Funded PodcastTrailer: Episode 6 'Self-funded, self-doubt and self-belief: Darnell Irozuru's acquisition story’Send us a text"I would not want to put my worst enemy through what I went through in that year, in terms of the highs and lows of getting that deal over the line."Faced with setbacks and challenges, Darnell Irozuru's first acquisition was anything but smooth. As someone who likes to hit the ground running, Darnell found himself doubting his decision to trade a sturdy 9-5 for entrepreneurship. Find out what drove Darnell to leave a stable finance career in pursuit of ownership and impact, how he fought through self-doubt to c...

2025-07-2301 min

The Found & Funded PodcastEpisode 5: Why I bought a white-collar business: Toby Henry's leap into ETASend us a textIn our penultimate episode of the season, Carl Lundberg is joined by Toby Henry, CEO of Accelerator Solutions, to unpack the personal and professional driving force behind his ETA journey.After starting out in financial services and spending seven years in management consulting, Toby realised he wanted more from his career.Inspired by his entrepreneur parents, Toby shares what drew him to the search fund model, how he's balancing legacy and leadership, and why flexibility, autonomy, and purpose continue to shape every decision he makes.LinkedIn...

2025-07-0445 min

The Found & Funded PodcastTrailer: Episode 5 'Why I bought a white-collar business: Toby Henry's leap into ETA'Send us a textA sneak preview of what's to come in this week's episode. After starting out in financial services and spending seven years in management consulting, Toby realised he wanted more from his career.Inspired by his entrepreneur parents, Toby shares what drew him to the search fund model, how he's balancing legacy and leadership, and why flexibility, autonomy, and purpose continue to shape every decision he makes.LinkedInInstagramWebsite

2025-07-0301 min

The Found & Funded PodcastEpisode 4: Building a Holdco - The Value Creation PlaybookSend us a textSergey Sushentsev, Co-Founder of Astra Holdings, shares how a failed succession plan sparked his journey into ETA. He unpacks his deal sourcing tactics, Astra’s 3-step value creation playbook - professionalise, incentivise, digitise - and why the HoldCo model is a game-changer for long-term growth.LinkedInInstagramWebsite

2025-06-1352 min

The Found & Funded PodcastTrailer: Episode 4 'Building a Holdco: The value creation playbook'Send us a textNew episode coming soon! Hear from Sergey Sushentsev, Co-Founder of Astra Holdings, as he shares the personal story behind his passion for succession planning, his approach to sourcing deals, and how Astra creates value through its three-part playbook: professionalise, incentivise, and digitise.Make sure you're subscribed for when episode four drops on 13 June.LinkedInInstagramWebsite

2025-06-1101 min

The Found & Funded PodcastEpisode 3: Switching sides: Investor to search fund operatorSend us a textEpisode three has landed. Traditional searcher, Allison Stuckless, sits down with Carl Lundberg to share her journey from investment banker at JP Morgan, to stand-up comedian in the UK and then into the world of search. Plus Allison puts Carl in the hot-seat with some of her questions on the economic trajectory of the UK, managing seller expectations as a searcher, and what it takes to get a deal over the line. LinkedInInstagramWebsite

2025-05-3041 min

The Found & Funded PodcastTrailer: Episode 3 'Switching sides - Investor to search fund operator’Send us a textOur next guest to join Carl in the hot seat is traditional searcher, Allison Stuckless, Founder and Managing Partner of Vericor Capital. Allison shares her journey from investment banker at JP Morgan, to stand-up comedian in the UK and then into the world of search. Stay tuned for the full episode, coming on 30 May. LinkedInInstagramWebsite

2025-05-2800 min

Buy and BuildThe CEO Roundtable with Will Hunnam (Forza Doors) and Carl Lundberg (Gerald Edelman)What does it take to step into the CEO seat—whether by acquisition or promotion? In this special episode, Will Hunnam (Forza Doors) and Carl Lundberg (Gerald Edelman) return to share their personal leadership journeys, challenges of managing legacy teams, and how implementing the Entrepreneurial Operating System (EOS) transformed their approach to strategy and culture. We explore: The reality of becoming a first-time CEO Lessons from inheriting vs. building company culture How EOS creates clarity and drives accountability The hard conversations leaders must face Whether you're scaling an...

2025-05-2159 min

The Found & Funded PodcastEpisode 2: Rethinking deal origination - Insights from BizCrunch’s CEOSend us a text'Leave your job, become a self-funded searcher and start building relationships’ - Gareth Hawkins. In our brand new episode featuring Gareth Hawkins, CEO of BizCrunch, Carl and Gareth explore how data, technology, and a relationship-first approach are reshaping how searchers find and close deals. Whether you're an aspiring searcher, investor, or operator, this episode challenges you to think differently about how deals get done.Listen now on Apple, Spotify or watch along on YouTube. LinkedInInstagramWebsite

2025-05-1650 min

The Found & Funded PodcastTrailer: Episode 2 'Rethinking deal origination - Insights from BizCrunch’s CEO’Send us a textEpisode two coming soon...In this brand new episode, Carl sits down with Gareth Hawkins, to dive into how deal sourcing is evolving and why traditional methods may get left behind. From data-driven strategies to the future of search, this is a must-listen for anyone in the world of acquisitions, private equity, or search funds. Be sure to tune in on Friday 16 May.LinkedInInstagramWebsite

2025-05-1401 min

The Found & Funded PodcastSeason 2 episode 1: 'A self-funded acquisition with no external equity'Send us a textEpisode one of this brand new season kicks off with Olivier Stapylton-Smith, Director of Serv-Ice Refrigeration. Listen along as Carl and Olivier deep dive into self-funded search, initial deal pipeline, the importance of having a good support system, and balancing being an entrepreneur with having a family. LinkedInInstagramWebsite

2025-05-0245 min

The Found & Funded PodcastTrailer: Season 2 Episode 1 'A self-funded acquisition with no external equity'Send us a textAn official first look at what's to come in episode one of season two... 👀'A self-funded acquisition with no external equity' with Olivier Stapylton-Smith, Director of Serv-Ice Refrigeration, will be dropping on 2 May 2025.In the season two premiere, we learn more about Olivier’s self-funded search journey and explore why he chose the acquisition path after launching his own company. Make sure you are subscribed so you don’t miss an episode.LinkedInInstagramWebsite

2025-04-3001 min

Det' grinerenPåskeI denne episode skal Leonora, Carl og Anders lave en vittighed, der får dig til at sige ha-ha hare! For det er påske, og hvad er egentlig mere gakket end gækkebreve, chokoladeæg og Jesus' korsfæstelse? Og så får de hjælp af komiker Pelle Lundberg, der egentlig ikke synes, påsken giver nogen mening. Hør hvorfor i dagens episode af Det Grineren! Husk at du kan sende en joke ind til: grineren@dererhuligennem.dk. Optag en joke med en mobiltelefon, og send den ind til os. Husk at spørge din...

2025-04-1220 min

The Found & Funded PodcastBonus clip: Episode 5 'The self-funded path to success - Harvard Business School to CEO'Send us a text"Ask for money, get advice. Ask for advice, get money." - Alex Glasner on seeking investment. Bringing you a never seen before bonus clip from episode five 'The self-funded path to success - Harvard Business School to CEO'. In this extended cut, Alex shares how he found himself with an over subscribed cap table and his best advice for those who are looking to be a more confident negotiator.LinkedInInstagramWebsite

2025-04-0106 min

NASCAR Weekly PodcastClashing Finishes, Option Tires, Auto Club Updates, Carl Edwards Return, and MORE!!!Phoenix was actually a really fun weekend, and we look atall of it! Also Carl Edwards is back... with Prime!Visit the Daily Downforce at dailydownforce.com Learn more about your ad choices. Visit megaphone.fm/adchoices

2025-03-132h 34

NWPClashing Finishes, Option Tires, Auto Club Updates, Carl Edwards Return, and MORE!!!Phoenix was actually a really fun weekend, and we look at all of it! Also Carl Edwards is back... with Prime!Visit the Daily Downforce at dailydownforce.com

2025-03-132h 31

The Found & Funded PodcastEpisode 6: 'How ETA is attracting venture capital and private equity investors'Send us a textThe final episode of the season is here! Deal making, industry expertise and sourcing the right company - these are all skills this week's guest looks for as an investor in the ETA space. Joyce Mackenzie Liu, CFO and CEO of Pegafund, joins Carl behind the mic for episode six to explore how venture capital and private equity intersects with the world of entrepreneurship through acquisition, as well as how to leverage cashflow to accelerate growth.LinkedInInstagramWebsite

2025-01-2446 min

The Found & Funded PodcastTrailer: Episode 6 'How ETA is attracting venture capital and private equity investors'Send us a textJoyce Mackenzie Liu is in the hot seat this week, as she and Carl explore how venture capital and private equity intersects with the world of entrepreneurship through acquisition. Comparing the differences and similarities to the search fund model, what Joyce looks for as an investor when considering backing an entrepreneur, and leveraging cashflow to accelerate growth - this is a discussion you won't want to miss!Episode six, 'How ETA is attracting venture capital and private equity investors', will be available to stream tomorrow at 4pm on Spotify, A...

2025-01-2301 min

Fotbollsmorgon666. The number of the beastProgramledare: Dawid FjällPanel: Elsa Alm & Robin BerglundGäster på länk: Viktor LundbergGäster i Studion: Myggan, Alex Letic och Pelle Nilsson & Carlos Esterling00:00 Programstart16:48 Senaste nytt om Premier League29:06 Viktor Lundberg om att lägga skorna på hyllan och framtiden i ÖIS49:35 Myggans onsdagsjanne tillsammans med Svenska spel58:25 Vi gästas av SVTs stjärnduo Alex Letic & Pelle Nilsson01:32:32 Carlos Esterling från EY reder ut hur svensk fotboll mår ekonomisktRedaktione...

2025-01-152h 16

Fotbollsmorgon666. The number of the beastProgramledare: Dawid FjällPanel: Elsa Alm & Robin BerglundGäster på länk: Viktor LundbergGäster i Studion: Myggan, Alex Letic och Pelle Nilsson & Carlos Esterling00:00 Programstart16:48 Senaste nytt om Premier League29:06 Viktor Lundberg om att lägga skorna på hyllan och framtiden i ÖIS49:35 Myggans onsdagsjanne tillsammans med Svenska spel58:25 Vi gästas av SVTs stjärnduo Alex Letic & Pelle Nilsson01:32:32 Carlos Esterling från EY reder ut hur svensk fotboll mår ekonomisktRedaktione...

2025-01-152h 16

The Found & Funded PodcastEpisode 5 'The Self-Funded Path to Success: Harvard Business School to CEO'Send us a textAlex Glasner acquired Workpays with an over subscribed cap table and a solid infrastructure in place. From Harvard Business School to CEO; Carl sits down with the self-funded searcher, to reveal why he undertook a search, how he approached investors and picked his cap table, what he was looking for in a business and the most valuable advice he has received along the way. Find out his secrets to success in episode five!LinkedInInstagramWebsite

2025-01-1049 min

The Found & Funded PodcastTrailer: Episode 5 'The Self-Funded Path to Success: Harvard Business School to CEO’Send us a textHere's a preview of what's to come. Featuring self-funded searcher, Alex Glasner, episode five explores Alex's passion for entrepreneurialism and his path to success. From working for Parliament, to becoming Managing Director of his first search acquisition, Workpays, and his strategic approach to the self-funded search process - you won't want to miss this one. Coming on 10 January... Subscribe to our YouTube to be notifiedLinkedInInstagramWebsite

2025-01-0801 min

The Found & Funded PodcastEpisode 4: 'Secrets for raising your search fund: What investors look for'Send us a textIn this episode, featuring alongside Carl, is renowned search fund mogul, Bramley Johnson. This episode is part two of our mini series on fundraising and investment and Carl asks the questions we've all been curious about; What are your best tips for getting a deal closed? Can you share any advice for aspiring searchers? What are the key considerations for searchers looking for investment?Watch or stream episode four 'Secrets for raising your search fund: What investors look for' now.LinkedInInstagramWebsite

2024-12-2048 min

The Found & Funded PodcastTrailer: Episode 4 'Secrets for raising your search fund: What investors look for'Send us a textGet ready for episode four... 🍿Featuring search funds legend, Bramley Johnson, this episode is all about #investment and #fundraising. Carl asks the questions we've all been curious about; What are your best tips for getting a deal closed? Can you share any advice for aspiring searchers? What are the key considerations for searchers looking for investment?Be sure to tune in on #Apple, #Spotify or #YouTube on 20 December to hear about Bramley's journey. 🔔 P.S Have you subscribed to our YouTube channel? Head to the link in...

2024-12-1801 min

The Found & Funded PodcastEpisode 3: Securing investment: Maximising Search Fund Investment SuccessSend us a textIf you're a searcher at the investment stage of your journey, or an aspiring searcher curious about investment methods, this episode is for you.You'll learn about about a range of investment avenues, first hand, from a seasoned search fund adviser, such as:Debt fundingAsset backed lendingInvoice financingVendor financingEquity fundingAnd more!Thank you to Nick Wallis for joining us on this episode and sharing your expertise. LinkedInInstagramWebsite

2024-12-0645 min

The Found & Funded PodcastTrailer: Episode 3 'Securing Investment: Maximising Search Fund Investment Success'Send us a textWe have hit the halfway point of the series! In episode three, Carl is joined by Nick Wallis, Head of Deal Advisory at Gerald Edelman.Nick discusses his experience in the search fund space, exploring key topics including debt funds, searcher credibility, Asset Based Lending (ABL) and the vital role of a debt adviser. They also explore options like invoice financing, vendor financing and equity funding. You don't want to miss this episode! LinkedInInstagramWebsite

2024-12-0401 min

The Found & Funded PodcastEpisode 2: Building Your Search Fund: From Aspiration to Reality, with guest Adam JohnsonSend us a textTune in and get excited! In episode two Carl is joined by Adam Johnson, CEO of Water Direct and winner at The ETA Awards 2023, Deal of The Year (Traditional). Adam shares his journey as a successful acquisition entrepreneur, from how he got started as a traditional searcher, uncovering the trials and tribulations of the search fund process, to who he las learnt the most from in the industry. LinkedInInstagramWebsite

2024-11-2244 min

The Found & Funded PodcastTrailer: Episode 2 'Building Your Search Fund: From Aspiration to Reality'Send us a textHere's a preview of what's to come in our second episode of The Found & Funded Podcast! 🗣️🎙️Joined by Adam Johnson, CEO of Water Direct, Carl digs deep and asks the questions we've all been wanting answers to...Who made up your cap table? If you could go back, is there anything you would have changed? Was it always smooth sailing for you? Adam tells all, from how his deal died (more than once), to the one piece of advice for entrepreneurs that has stuck with hi...

2024-11-2001 min

The Found & Funded PodcastEpisode 1: Demystifying Search Funds, with guest William AbellSend us a textIn the first episode to kick off the season, Carl alongside guest William Abell, explores the search fund model. From configuring your cap table, common pitfalls with deal mechanics, to seeking out the target. Carl and Will also discuss how you can sustain your search, the difference between self-funded and traditional search and who's the right fit for the search fund model. We hope you enjoy the first episode, let us know what you think over on our social media!Want to watch this episode? Subscribe to...

2024-11-0837 min

The Found & Funded PodcastTrailer: Episode 1 'Demystifying Search Funds'Send us a textHere's a preview of what's to come in our first episode of The Found & Funded Podcast! 🗣️🎙️Joined by Partner at Gerald Edelman, William Abell, Carl Lundberg kicks off this first episode with a deep dive into the search fund model, 'Demystifying Search Funds'.Where did it come from? How does it work? What kinds of search are there?The pair also share some hard truths about the industry and the kinds of people who undertake a search.You don't want to miss the premiere of season one...

2024-11-0701 min

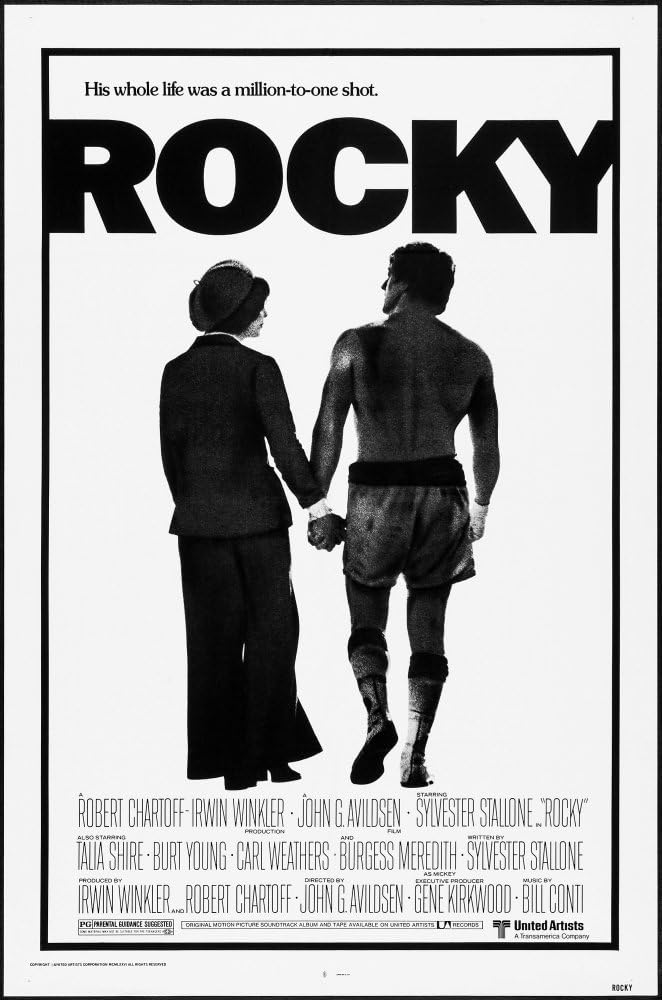

NostalgiaCastEpisode 110: ROCKY (1976)Yo, Adrian, we did it! NostalgiaCast closes out its '70s season by stepping into the ring with ROCKY, directed by John G. Avildsen and starring Sylvester Stallone, Talia Shire, Carl Weathers, Burgess Meredith, and Burt Young. The gloves are off as Jonny and Darin spar over the movie's aspirational qualities, its acting and filmmaking choices, and how it became the heavyweight champion of underdog sports dramas by encompassing both Stallone's rise to the top and the indomitable human spirit.

2024-10-031h 05

Vetenskapsradion HälsaIntensiv träning för äldre gav bättre korttidsminne (R)Intensiv träning på en minut gav bättre arbetsminne för personer över 65 år. 72-åriga Gerd Andersson i Umeå tyckte det var kul att få testa en för henne helt ny träningsform. Lyssna på alla avsnitt i Sveriges Radios app. Det handlar om att cykla intensivt i intervaller. Just de väldigt intensiva perioderna är sex sekunder långa. De ska upprepas 10 gånger med vila emellan. Sex sekunder på tio gånger blir 60 sekunder, alltså en minut. Men med uppvärmning och den intensiva träningen, samt vila så blir det allt som allt ett...

2024-09-1919 min

P3 IDJan Emanuel – miljonerna, medierna och maktenHan är dokusåpakändisen som blev riksdagspolitiker, välfärdsentreprenör och influencer. Under våren 2024 har P3 ID följt Jan Emanuels kandidatur till Europaparlamentet. Lyssna på alla avsnitt i Sveriges Radios app. P3 ID Jan Emanuel: Miljonerna, medierna och makten är en berättelse som tar oss med till hans stökiga uppväxt i Uppsalaförorten Gottsunda, in i kriminaliteten och droger.– Väldigt många av mina år har varit ganska röriga kan man väl säga. Inte bara lycka, säger Jan Emanuel till P3 ID. I avsnittet...

2024-06-241h 16

The Deep Wealth Podcast - Unlock Your Deep Wealth In Business and LifeLead M&A Deal Advisor Nick Wallis Reveals Little-Known And Proven Strategies To Capture The Best Deal On Your Exit (#337)Send a text“Believe in yourself and don’t put off for tomorrow what you can do today.” -Nick WallisOn this episode of the Deep Wealth Podcast, host and nine-figure post-exit entrepreneur Jeffrey Feldberg discusses liquidity events and M&A transactions with Nick Wallis, a partner at Gerald Edelman. Nick shares his insights from over 15 years in finance, focusing on selling private businesses valued between 5 to 100 million.00:00 Meet Nick Wallis: A Finance Expert with a Story to Tell00:24 Deep Wealth Mastery: Transforming Business Owners' Lives05:10 The Importance of Speed...

2024-05-2753 min

The Deep Wealth Podcast - Unlock Your Deep Wealth In Business and LifeMaverick Accountant Carl Lundberg Reveals How To Increase Enterprise Value For Your Liquidity Event (#316)Send a text“Enjoy the journey as you’re exactly where you need to be.” - Carl LundbergUnderstanding the Art and Science of a Successful Liquidity Event: A Conversation with Carl LundbergIn this episode, Jeffrey Feldberg hosts Carl Lundberg, a partner at Gerald Edelman LLP, to discuss the importance of planning for a liquidity event. Carl highlights the common mistakes business owners make such as not preparing adequately or leaving too much value on the table. They further emphasize on the role of advisors in the M&A process, the im...

2024-03-1339 min

Making Billions: The Private Equity Podcast for Fund Managers, Alternative Asset Managers, and Venture Capital InvestorsSearch Funds: How Smart Founders Secretly Launch CompaniesSend a text"RAISE CAPITAL LIKE A LEGEND: https://offer.fundraisecapital.co/free-ebook/"Hey, welcome to another episode of Making Billions. I'm your host, Ryan Miller and today I have my dear friend Carl Lundberg. Carl is the CEO at Gerald Edelman LLP. With his expertise in acquisitions in search funds, due diligence, debt funding for UK acquisitions and management buy ins. So what this means is that Carl understands how to buy companies for entrepreneurs, is about to teach you how to do the same.Subscribe on Y...

2024-02-2627 min

Inside MusiCastJonathan LundbergOn this episode of Inside MusiCast we’re taking you to Stockholm, Sweden for a chat with drummer Jonathan Lundberg. We met Jonathan in 2020 at the Pages tribute concert at the Stockholm club Fasching, and while we already knew about his incredible talent, seeing him perform live was an eye (and ear) opening experience. His new album "Fragments" was released a few months ago and it enlists some of the best musicians in Scandinavia, including Erik Linder, Henrik Linder, Kristian Kraftling, Carl Mörner Ringström, Oskar Nilsson, Sara Nordenberg and many others. He also reaches out to his friend...

2024-02-0550 min

We Live to BuildBusiness Deadlines Are Mostly Nonsense (And No One Gets Hurt)Are business deadlines really a matter of life and death? According to Carl Lundberg, CEO at M&A firm Gerald Edelman, they're mostly nonsense. In this insightful interview, Carl argues that we're not working in an emergency room, and we must accept that sometimes things don't get done on time because something more important comes up. He also provides a masterclass on how to value a business, explaining the difference between enterprise value and equity value, and the secret to finding great off-market deals through proprietary outreach. Check out the company: https://www.geraldedelman.comBook...

2024-01-1639 min

Multiply Your Success with Dr. Tom DuFore188. Entrepreneurship Through Acquisition—Carl Lundberg, Partner, Gerald EdelmanIf you’re listening in to our podcast, chances are that you are the founder of your business. But, there is a whole opportunity for folks who might be interested in entrepreneurship through acquisition. Our guest today is Carl Lundberg, who is an expert at supporting people to become entrepreneurs through acquisition. TODAY'S WIN-WIN: Delegate to create trust with your team and operational leverage.LINKS FROM THE EPISODE:You can visit our guest's website at: https://www.geraldedelman.com/Link discussed: www.searchfunder.comAttend our...

2024-01-1526 min

M&A Talk: #1 Podcast on Selling a BusinessFor New Sellers: What Sellers Should Know About Selling Their Business to a Search FundThis international edition of M&A Talk focuses on search funds and highlights multiple ways to fund an acquisition. Carl Lundberg offers an in-depth discussion of search funds, how money is raised for entrepreneurs, and differences in the M&A world between the UK and the US. He discusses investment funding in the UK, what buyers typically look for in a company, differences between a search fund, PE firm, angel investors, and other financial buyers, and the dynamics involved when working with a search fund. View the complete show notes for this episode. Learn More:

2023-10-191h 06

Vetenskapsradion HälsaIntensiv träning för äldre gav bättre korttidsminne (r)Intensiv träning på en minut gav bättre arbetsminne för personer över 65år. 71-åriga Gerd Andersson i Umeå tyckte det var kul att få testa en för henne helt ny träningsform. Lyssna på alla avsnitt i Sveriges Radios app. Det handlar om att cykla intensivt i intervaller. Just de väldigt intensiva perioderna är sex sekunder långa. De ska upprepas 10 gånger med vila emellan. Sex sekunder på tio gånger blir 60 sekunder, alltså en minut. Men med uppvärmning och den intensiva träningen, samt vila så blir det allt som allt ett...

2023-07-1319 min

Hör du som har öronFödandets mystikI dagens avsnitt söker vi oss vidare in mot de erfarenhetsvärldar där kroppen och mystiken möts och ställer oss frågan vilka lärdomar vi kan dra av födandets principer. Vår gäst är Nina Berglund, Högsbohöjds alldeles egna barnmorska. Ytterligare en inspirationskälla i dett avsnitt är Jonna Bornemars bok Jag är himmel och hav. Musik: Jonathan Johansson Klippning: Johan Lundberg

2023-06-0851 min

Hör du som har öronOm världen som Guds kroppI detta avsnitt undersöker vi sambanden mellan gudsbild och levt liv. Finns det gudsbilder som kan omforma den värld vi lever i? Vi ger oss ut i parken utanför kyrkan och lyssnar in bina, hönsen och lammet. Musik: Jonathan Johansson Klippning: Johan Lundberg

2023-06-0855 min

Sänt i P1Så låter Sverige - en Nationaldagsmorgon från GöteborgPå nationaldagsmorgon öppnar vi öronen för hur Sverige låter. Programledare Britta Svanholm Maniette lotsar från musiken på Gustav Vasas tid till utrotningshotade ljud. Lyssna på alla avsnitt i Sveriges Radios app. Norge har Edvard Grieg, Finland har Jean Sibelius och Danmark har Carl Nielsen – men varför har inte Sverige en nationaltonsättare? Vår ciceron, musikprofessor Mattias Lundberg, berättar om hur musiken har låtit i Sverige under 500 år och vi får ett smakprov från musiken på Gustav Vasas tid med Romeo & Juliakören på Gripsholms slott, en av Vasaborgarna.

2023-06-061h 17

Hör du som har öronKroppen som varat i världenI detta avsnitt välkomnar vi vår första gäst Anja Bergh. Med henne samtalar vi om hur vi kan förbli vid liv i en värld av hot. Finns det vägar ut ur det dominanta och tudelade förhållningssätt som genomströmmar västerländsk kultur, teologi och kroppsuppfattning? Kanske finns svaret i bilden av ett glas Gin & Tonic? Episode artwork: Broderi av Emelie Ribeiro Musik: Jonathan Johansson Klippning: Johan Lundberg

2023-04-271h 17

P3 IDEvin Ahmad – Shakespeare, Snabba Cash och den inre kärringenHon är författaren och skådespelaren som porträtterat allt från Hamlet till techentrepenören Leya och samtidigt känt sig märkt av etiketter. En berättelse om frihet, evig identitetskris och att axla en huvudroll. Lyssna på alla avsnitt i Sveriges Radios app. Evin Ahmad (f. 1990) har synts på filmduken och teaterscenen i halva sitt liv. Efter scenskolan släpper hon sin debutroman, medverkar i uppmärksammade tv-serier och vinner pris för sina skådespelarinsatser.Men skuldkänslorna är samtidigt stora – för att vara den som fick chansen.P3 ID...

2023-04-101h 06

Vetenskapsradion HälsaIntensiv träning för äldre gav bättre korttidsminneIntensiv träning på en minut gav bättre arbetsminne för personer över 65år. 71-åriga Gerd Andersson i Umeå tyckte det var kul att få testa en för henne helt ny träningsform. Lyssna på alla avsnitt i Sveriges Radios app. Det handlar om att cykla intensivt i intervaller. Just de väldigt intensiva perioderna är sex sekunder långa. De ska upprepas 10 gånger med vila emellan. Sex sekunder på tio gånger blir 60 sekunder, alltså en minut. Men med uppvärmning och den intensiva träningen, samt vila så blir det allt som allt ett...

2023-03-3019 min

Cyril & Stig - I otakt med samtidenDen svenska konstscenen & Carl Michael LundbergCyril och Stig talar samtida konst efter att ha sett målaren Carl Michael Lundbergs utställning på Konstakademin. Båda två, särskilt Stig är skeptiska till det mesta som görs i dagens svenska konstvärld. De ringer även upp CM Lundberg hemma i SandvikenLyssna, dela och stötta oss gärna. Hosted on Acast. See acast.com/privacy for more information.

2023-03-0749 min

P3 IDSilvio Berlusconi – Italiens eviga comeback kidHan har varit Italiens rikaste och mäktigaste man med stort inflytande över såväl politiken och medierna, som fotbollsvärlden. En historia om en underhållare och entreprenör som aldrig är uträknad. Lyssna på alla avsnitt i Sveriges Radios app. När högernationalistiska Giorgia Meloni blir Italiens premiärminister 2022, är Silvio Berlusconi nästan 90 år gammal. Men han är fortfarande ledare för sitt egenstartade, liberalkonservativa parti Forza Italia – som ingår i regeringskoalitionen.Under sina dryga 60 år som yrkesverksam i ett Italien där politiken många gånger präglas av kaos...

2022-12-1953 min

P3 IDCarolina Gynning – går genom eldHon är konstnärssjälen som vunnit Big Brother, kallats skandaldrottning och blivit folkkär. En berättelse om glamour, ensamhet och självporträtt. Lyssna på alla avsnitt i Sveriges Radios app. Carolina Gynning (f. 1978) blir tidigt modellscoutad och bestämmer sig för att lämna Skåne, och ge sig ut i världen. När hon går in i Big Brother-huset i början av 2000-talet har hon gjort nedslag i bland annat Milano, Paris och Playboy mansion i Los Angeles. Sedan dess har hon blivit programledare, framgångsrik konstnär o...

2022-12-051h 06

Grunden Media Podcast#201 – Ebbot LundbergI avsnitt #201 fann vi skydd mot höststormarna på trevliga kungstensbaserade kafferosteriet Gringo! Bland de nymalda kaffeångorna hittade vi också den lika värmande Ebbot Lundberg, artist, låtskrivare, göteborgsk rockikon – och inom en kommande framtid aktuell med albumet Beyond the Kybalion! Förutom årets spretande musikprojekt pratar vi också bl.a. om den göteborgska musikidentiteten, vi minns Tommy Blom, Freddie Wadling, Bruce Emms – och vi peppar också inför Soundtrack Of Our Lives kommande återförening! Dessutom – historien om Sure Tråkings Trio, en bisarr Frank Drebinkänsla vid ett Göteborgsderby – och kaftanen som inte bara ble...

2022-11-221h 04

P3 IDDavid Beckham – fotbollshunk, stilikon och Qatar-ambassadörHan är den fotbollstokige Londongrabben vars drömmar gick i uppfyllelse, superstjärnan som banade väg för en ny sorts sportprofil, och blev den hårt kritiserade ambassadören för Gulfstaten Qatar. Lyssna på alla avsnitt i Sveriges Radios app. I oktober 2021 presenteras fotbollsikonen David Beckham som det nya ansiktet utåt för Qatar, och fotbolls-VM som arrangeras i landet 2022.Beckham blir snart hårt kritiserad av människorättsorganisationer som Amnesty och Human Rights Watch, som hävdar att han bidrar till att skönmåla ett land där migrantarbeta...

2022-11-071h 14

P3 IDMarine Le Pen – högernationalismens grande dameBerättelsen om makthavaren som växer upp i den franska extremhögerns huvudnäste, vars politiska karriär för alltid kommer att förknippas med hennes kontroversielle far vare sig hon vill eller inte. Lyssna på alla avsnitt i Sveriges Radios app. Marine Le Pen är 8 år gammal när hon vaknar mitt i natten av att någon har försökt spränga hennes familjehem i bitar med en stor laddning dynamit. Attentatet är riktat mot hennes pappa, Jean-Marie Le Pen. Han är grundare av det högernationalistiska partiet Nationella Fronten och är känd för si...

2022-10-101h 07

P3 IDCharles III – kung till sistHistorien om monarken som fått stryk av skolkamrater, manglats av tabloidpressen, sökt andlig tröst hos gurus och stått i centrum för en enormt uppmärksammad otrohetsskandal. Lyssna på alla avsnitt i Sveriges Radios app. När Storbritanniens drottning Elizabeth II dör i början av september 2022, är hennes äldsta son Charles 74 år gammal. Prinsen av Wales ska bli kung.Han är en man som fått vänta i decennier på sitt livs kärlek. Han har kallats för både blyg och känslig, för en action man och en...

2022-09-261h 22

P3 IDCarrie Fisher – rebellen, demonerna och Star WarsBerättelsen om en skådespelerska, författare och komiker som i hela sitt vuxna liv var prinsessan Leia med en hel värld samtidigt som hon brottades med psykisk ohälsa och missbruksproblem. Lyssna på alla avsnitt i Sveriges Radios app. När den första Star Wars-filmen går upp på biograferna 1977 kan ingen ana vilken betydelse den kommer få. Den omedelbara ikonen, prinsessan Leia, spelas av Carrie Fisher (1956-2016). Hon är dotter till Hollywoodstjärnorna Debbie Reynolds och Eddie Fisher, ett par som senare figurerar i en av 50-talets största kändisskandaler.

2022-09-121h 09

Kultur GävleborgSandra Englunds konstnärliga utforskande av sin dolda resande identitetRegion Gävleborg utlyste under våren 2021 särskilda uppdrag kopplade till Sveriges nationella minoriteters kultur och nationella minoritetsspråk.

Sandra Englund var en av kulturskaparna som fick ett uppdrag (www.regiongavleborg.se/minoritet/sarskildauppdrag).

Sandra Englund upptäckte för några år sedan att hon tillhör resandefolket. Hon har konstnärligt utforskat identitetsskapande processer relaterat till sin egen släkt och dess fotografiska material. Hon har gestaltat en resandehistoria i berättelsen om en nyfunnen familjebakgrund.

Sandra Englunds konstnärliga uppdrag 2021: www.regiongavleborg.se/kultur/tvarperspektiv/nationella-minoriteter-och-minoritetssprak/romer---romani-chib/sandra-englunds-konstnarliga-uppdrag-2021

Sandra Englunds konto på Instagram: detdoldarvet (detdoldaarvet@gmail.com)

Reportage...

2022-06-3025 min

Människor och troPsalm 201 – hur man blir älskad av alla (repris)Lagom till midsommar viger vi ett helt avsnitt åt Waldemar Åhléns och Carl David af Wirséns Sommarpsalm En vänlig grönskas rika dräkt. Programmet sändes första gången i juni 2021. Lyssna på alla avsnitt i Sveriges Radio Play. Älskad av såväl ateister som djupt troende och omåttligt populär vid både bröllop, begravning och sommarfest. Hör den sjungas, tolkas och analyseras under midsommarstöket, medan vi guidar dig genom historien om denna svenska psalms tillkomst.

Hör kören sjunga 38 minuter och 48 sekunder in i a...

2022-06-2344 min

Lundajournalen – Radio AFLundajournalen - S.2 - Avsnitt 17Stor sportspecial i dagens Lundajournalen. Det blir allt från ishockey och golf till hoppa hage. Vi tar även pulsen på Lunds utbytesstundenter. Allt det senaste du inte behövde höra finns bara i Lundajournalen. I programmet kan det förekomma produktplaceringerar. Vi tar inte ansvar för eventuella biverkningar eller annan orsakad skada.Inslagsproducenter: Amanda Liljeqvist Pelle Schumacher Måns Fischerström Aron Schuurman Daniel SolvoldI rollerna: Amanda Liljeqvist som Franske studenten Valerie, vice radioshopskonsult och Marry Fotström Pelle Schumacher som Curling- och ishockeyreporter Beata Tornesel som Cali from the Vali Leo Nordlund som Herman Hagman Daniel Solvold so...

2022-04-1143 min

Gött Tjöt om Aktier75. Effekten av Rysslands invasion av UkrainaKrig har olyckligtvis nog brutit ut i Europa och konsekvenserna kan komma att bli avsevärda. Markus och Tim försöker blicka bortom fronten och analysera de kort- och långsiktiga effekterna av Rysslands invasion av Ukraina. För er som gillar krigshistoria berättar vi även hur du kan investera i anrika Bofors. Bolag, främst svenska, med stor exponering mot området som nämns i podden är: BAE Systems PLC $BAES, Ferronordic $FNM, Carlsberg $CARL B, Amido $AMIDO, G5 $G5EN och Medicover $MCOV B. I Veckans Volley studsar vi fram att även onoterade bol...

2022-02-2847 min

Ålandspodden#16 Hanna Lundström & Peter MattssonDagens gäster är Hanna Lundström och Peter Mattsson. Hanna berättar om sin resa med gymmet Vibe som nu kommer att bli Ålands första OCR-gym. Peter Mattsson (IFK Mariehamn) talar i sin tur om den senaste tidens kavalkad i nyförvärv, bland annat Robin Sid, och i slutet av intervjun meddelar han planerna man har för Arvid Lundberg. Carl & Daniel talar om lönerna i Mariehamns stad, Meat Loaf, Lego samt Erik Enge och årets Guldbagge-gala. Carl lyckas också övertyga Daniel om att förstora upp Ålandspoddens annons i tidningen. Programledare: Carl Lönndahl & Daniel Dahlén. Fo...

2022-01-2700 min

Buy and BuildCarl Lundberg - Financial Due Diligence Best PracticesThis week we speak with Carl Lundberg, partner at Gerald Edelman, a top 50 accounting firm with an affinity for assisting entrepreneurial SMEs. Carl's specialism is corporate finance, in particular transaction services including financial due diligence (FDD) and valuations. In this episode we cover the various levels of FDD from light-touch to full blown quality of earnings, valuation, and transaction advisory services. Enjoy!

2022-01-1738 min

Spring med Petra & CO#245: Kristoffer Triumf, snygga löpsteget och 16 Weeks of HellKristoffer Triumf är programledare för en av de första och största poddarna i Sverige: Värvet. Det var han som inspirerade mig att starta Maratonpodden och idag har Kristoffer hunnit intervjua de allra flesta – inklusive självaste kung Carl Gustaf. Genom åren har jag noterat att Kristoffer då och då har hintat om att där finns ett intresse för träning. I avsnittet med Antikrundanprogramledaren Anne Lundberg avslöjar han till och med att springa maraton står på hans bucketlist. Och när vi DM:ade inför den här intervjun kryper det också fram att ha...

2021-12-241h 08

Gött Tjöt om Aktier60. Vassaste optionen i derivatvärlden med Carl BjörkegrenHur tjänar man pengar när börsen går ner? Carl Björkegren hjälper oss genom derivatens djungel. Köpa köpoptioner och sälja säljoptioner är några av de saker som täcks i veckans avsnitt. Få tillgång till hela investeringsverktygslådan med derivat. I Veckans volley delar Carl med sig av några tips på hur man kan göra det enklare för sig att lyckas på börsen.Vi välkomnar alla former av inspel till: nantingomaktier@gmail.com Instagram: www.instagram.com/nantingomaktier/Support this show h...

2021-11-0156 min

Gött Tjöt om Aktier49. Alternativa investeringar del 2: FastighetsfokusNågonsin funderat på att investera i andra tillgångar utanför börsen för att diversifiera portföljen? Det har vi, varpå vi bjudit in affärsutvecklaren Love Josefsson från SBP Nordic för snack om investeringar i fastighetsobligationer. Love, en gammal UA:are berättar även om investeringsprincipen om bolag med “tyska” företagskulturer och hur det kan gå till för att bli styrelseproffs. Aktier som nämns är bland annat danska Carlsberg $CARL-B,Brdr Hartmann $HART, Troax $Troax med flera. Vi välkomnar alla former av inspel till nantingomaktier@gmail.comInstagram: @nanting...

2021-08-1650 min

Gött Tjöt om AktierAvsnitt 49 - Alternativa investeringar del 2: FastighetsfokusNågonsin funderat på att investera i andra tillgångar utanför börsen för att diversifiera portföljen? Det har vi, varpå vi bjudit in affärsutvecklaren Love Josefsson från SBP Nordic för snack om investeringar i fastighetsobligationer. Love, en gammal UA:are berättar även om investeringsprincipen om bolag med “tyska” företagskulturer och hur det kan gå till för att bli styrelseproffs. Aktier som nämns är bland annat danska Carlsberg $CARL-B,Brdr Hartmann $HART, Troax $Troax med flera. Vi välkomnar alla former av inspel till nantingomaktier@gmail.com Instagram: www.ins...

2021-08-1650 min

The Opinionated Brothas PodcastBack After a Two-Month Layoff!Travis and DJ return after a two month layoff, and man do they have a lot to talk about. Critical Race Theory and Juneteenth leadoff. Future and Nick Canon's mission to be fruitful and multiply is discussed, and Travis stans over a Lil Nas X track! Just half of what's in store! Stay tuned!https://youtu.be/xqapblkrfTE - Dr. Carl Mack on Roland Martin Unfilteredhttps://youtu.be/akc4rux9Ijs - Dr. Carl Mack on The Benjamin Dixon ShowMusic CreditsSun Goes DownLil Nas X

2021-07-041h 15

Människor och troPsalm 201 – hur man blir älskad av allaLagom till midsommar viger vi ett helt avsnitt åt Waldemar Åhléns och Carl David af Wirséns Sommarpsalm En vänlig grönskas rika dräkt. Lyssna på alla avsnitt i Sveriges Radio Play. Älskad av såväl ateister som djupt troende och omåttligt populär vid både bröllop, begravning och sommarfest. Hör den sjungas, tolkas och analyseras under midsommarstöket, medan vi guidar dig genom historien om denna svenska psalms tillkomst.

Hör kören sjunga 38 minuter och 48 sekunder in i avsnittet.

Medverkande:

Johan Pejler, Rad...

2021-06-2344 min

Flora and Friends - Your botanical cup of teaThe mystery of the flickering nasturtiumNasturtium Episode 1

Find out more about your Flora&Friends hostess Judith via the Flora-L website.

The original publication by Elisabeth Christina Linné in the Transactions of the Royal Swedish Academy of Sciences

Annika Windahl Ponténs PhD thesis about the Identity and materiality in the household of Linné

Other resources about the Linné family:

Biography: Gunnar Brobergs "Mannen som ordnade naturen. En biografi över Carl von Linné", Natur&Kultur, 2019.

Fiction: Christina Wahldéns "Den som jag trodde skulle göra mig lycklig"

And for visiting Linné Hammarby and the Linnean g...

2021-02-2424 min

P3 MusikdokumentärDua Lipa - Självständig till varje prisHon flyttar som 15-åring ensam från Kosovo för att slå igenom som popstjärna och blir den första albanska grammyvinnaren någonsin. Lyssna på alla avsnitt i Sveriges Radios app. I en airbnb-lägenhet i London sitter Dua Lipa i en vit silkesskjorta och sänder live på instagram. Hon ska berätta om lanseringen av sitt nya album.

Det är mars 2020, håret är nyblonderat och luggen hålls bak av två hårspännen. Den nya looken är timad till hennes kommande världsturné.

I två år har Dua Lipa för...

2020-12-1556 min

P3 MusikdokumentärDaft Punk - Maskinen bakom maskernaBerättelsen om två barndomskompisar som från ett pojkrum i Montmartre skapade musik som revolutionerade en hel genre. Lyssna på alla avsnitt i Sveriges Radios app. I danstältet på Coachellafestivalen trängs publiken i ett vibrerande beckmörker. Det är april 2006 och elektroduon Daft Punk befinner sig på på botten av sin karriär.

Fans och kritiker har avfärdat deras senaste album som rutinmässig och oinspirerad. Robotarna som en gång revolutionerade den elektroniska musiken har börjat avfärdas som föredettingar.

Det ingen vet är att duon i hemlighet...

2020-11-1755 min

Grunden Media Podcast# 148 – Agneta Sjödin

Agneta Sjödin är en av våra mest välkända och omtyckta TV-profiler. I avsnitt #148 blir det en rad minnen från tre decennier i branschen, bl.a. om hur hon halkade in på programledarbanan, anekdoter från inspelningarna på Fort Boyard, vänskapen med Gunde Svan och saknaden efter kollegan Adam Alsing. Carl-Magnus Eriksson och Jakob Olsson intervjuar, några inflik från beatlesnördige handledar-Erik dyker också upp – Agneta har ju träffat självaste George Harrison!!

Foto: Andreas Lundberg

2020-11-0630 min

Grunden Media Podcast# 148 – Agneta Sjödin

Agneta Sjödin är en av våra mest välkända och omtyckta TV-profiler. I avsnitt #148 blir det en rad minnen från tre decennier i branschen, bl.a. om hur hon halkade in på programledarbanan, anekdoter från inspelningarna på Fort Boyard, vänskapen med Gunde Svan och saknaden efter kollegan Adam Alsing. Carl-Magnus Eriksson och Jakob Olsson intervjuar, några inflik från beatlesnördige handledar-Erik dyker också upp – Agneta har ju träffat självaste George Harrison!!

Foto: Andreas Lundberg

2020-11-0600 min

P3 MusikdokumentärStormzy – den ofrivillige aktivistenFrån drogförsäljning och knivslagsmål i södra London till Time Magazines omslag. Stormzy har på kort tid blivit rösten för unga svarta i Storbritannien. Lyssna på alla avsnitt i Sveriges Radios app. Alla hjärtans dag 2017. Den brittiske rapparen Stormzy har på kort tid blivit en av Storbritanniens snabbast växande artister.

Han somnar tillsammans med sin flickvän i sin nya bostad i Chelsea i västra London, efter ett kändismingel på Elle-galan.

Området har tidigare varit hemstad för både kungligheter och tidi...

2020-10-0658 min

Zombified: Your Source for Fresh BrainsApocalyptish Times: Season 3 live premierJoin Zombified hosts Athena & Dave for an apocalyptish afternoon as we launch Season 3 of the Zombified podcast. We talk with immunologist Jessica Brinkworth and zombie apocalypse survival expert Cam Carlson about our current apocalyptish times. We also chat with Channel Zed director Ilana Rein, collaborating producer Erica O'Neil and host of the Dr. Zed Show, Joe Alcock. Don't miss the special appearance from Carl Flink and Black Label Movement. They join us in hazmat suits and describe their plans to dance their way from Minnesota to Arizona in an RV as part of Channel Zed's new reality show, Unreal...

2020-10-031h 17

Litteraturväven - podden om gestalter ur litteraturhistorien#14 Gunnar Ekelöf: jag har drömt mig ett livHan var outsidern som tog den europeiska modernismen till Sverige, samtidigt om han plågades av svek och själslig förtvivlan. Han var drömmaren vars lyrik kom att förändra den svenska diktarkonsten. Litteraturväven berättar historien om Gunnar Ekelöf: Jag Har Drömt Mig Ett Liv. Följ oss gärna på instagram för att se vad som är på gång.

Litteraturväven är ett program av och med Jonas Stål, med inläsningar av Beatrice Berg, Hanna Wintzell och Dick Lundberg. Gunnar Ekelöfs porträtt är tecknat av Irem Babovic.

KÄLLOR:

[Litter...

2020-09-1346 min

Husky InternationalClimate Neutral mountain guide Carl Lundberg live interview at Spotifys New Years party, #32I must admit that I was very surprised when I received an e-mail from Spotify where I was asked to record a live podcast when they arranged their ”End of the Year Party” for their employees in Sweden.I’m not a big player - but Spotify sure is.All their staff got to choose between different interests to match them to different dinner venues - and the ones that showed an extra interest in winter, skiing and mountains ended up at a after ski themed dinner party where I did a short live p...

2020-01-1627 min

HuskyClimate Neutral mountain guide Carl Lundberg live interview at Spotifys New Years party, #32I must admit that I was very surprised when I received an e-mail from Spotify where I was asked to record a live podcast when they arranged their ”End of the Year Party” for their employees in Sweden.I’m not a big player - but Spotify sure is.All their staff got to choose between different interests to match them to different dinner venues - and the ones that showed an extra interest in winter, skiing and mountains ended up at a after ski themed dinner party where I did a short live p...

2020-01-1627 min

Tidens Rum PodcastTiden är en dröm. Ett Hörspel av Sten BjörnulfsonTIDEN ÄR EN DRÖM är ett hörspel för radio av Sten Björnulfson.

I föreställningen finns bostadsrättsföreningens ständigt observante ordförande. Där är Ludmila som varje natt drömmer om kriget. Där är den unga tjejen, kvinnan med mobilen och flera andra. Och drömmen som vandrar fritt in och ut i deras sovrum och besöker deras drömmar och verkligheter.

TIDEN ÄR EN DRÖM är ett hörspel om människor som famlar efter tiden, jagas av den, försöker fånga den, ställer sitt sista...

2019-03-2657 min

Bildningspodden#81 Richard WagnerHur ska vi förhålla oss till RICHARD WAGNER (1813-1883)? Han är kompositören och dramatikern som revolutionerade operakonsten med sina kolossala allkonstverk och banade väg för den moderna musiken. Många har liknat hans musikdramatik vid en drog, fullkomligt omöjlig att värja sig ifrån. Men Wagner är också förknippad med unkna ideologier. Hans antisemitism är omvittnad och efter hans död dyrkades hans germanska operadramer av nazisterna.

Vem var egentligen Richard Wagner? Går det att lyssna på hans musik utan att ta ställning till hans åsikter? Är det en myt att att hans extremt...

2018-09-121h 11

Scandinavian MAN Radio Hour01:18 Jan Carl Adelswärd ”The creatives are extremely important for the company, but nothing works unless you have the ability to actually make money”. Jan Carl Adelswärd is a well-known investor in the Swedish fashion industry and has previously worked with brands like Filippa K and Wesc. Today he is involved in companies like Sneakersnstuff, Stutterheim, and his own brand Baron Bags. Scandinavian MAN met Jan Carl for a conversation about the fine art of balancing between the creative and the commercial, and how e-commerce is quickly transforming the industry. Enjoy! Thanks to Helio coworking spaces for hosting us in their pod studio.

The music...

2018-03-2840 min

???????????Episode #11 Jon Walter LundbergThis episode of the Yugen Podcast is coming at you strait from the assembly line. In the episode we talk to Jon Walter Lundberg, who has been a regular floater at the float center.

Jon is the perfect example of the type of person one comes across when one runs a float center. Both Carl and Fredrik enjoyed amazing post-float conversations with Jon on several different occasions leading up to this episode. So Carl made the call to bring Jon in and sit him down in front of the mic so we could share some of his genius with the...

2018-03-041h 26

Scandinavian MAN Radio Hour01:14 Carl Rivera”Our vision for Tictail is to build a category-defining business, one of the top five e-commerce businesses in the world”. Carl Rivera (formerly Waldecranz), CEO and co-founder of Tictail, talks about where his company is heading. Carl lives in New York, but Scandinavian MAN met Carl in his native Stockholm for a conversation about the highs and the lows of Tictail, the differences between running a company in Sweden and the US, and his views on the future of retail. Enjoy! Thanks to Helio coworking spaces for hosting us in their pod studio.

The music in the shows i...

2018-02-2030 min

Svenska Breakare PodcastIntervju: Carl "Calle" LundbergI dagens avsnitt får vi träffa Calle som är uppvuxen utanför Nyköping. Calle är för tillfället en av Sveriges bästa breakare. Det är ett intressant samtal då vi oftast invervjuar personer som redan varit på sin topp. Idag gästas vi av en person som är fortfarande påväg dit. Calle har redan åstadkommit mer en många breakare någonsin kommer göra. Men vår magkänsla är att mycket fortfarande finns kvar att hämta för denna unika dansare som för tillfället bor i Schweiz.

2017-08-201h 35

Svenska IshockeyförbundetHockeyPodden #27 Uffe möter Rasmus Asplund, Jacob Larsson, Gabriel Carlsson och Carl GrundströmUffe Lundberg tar ett snack om back och forwardsspel med JVM spelarna Rasmus Asplund, Jacob Larsson, Gabriel Carlsson och Carl Grundström, dagen före semifinalen mot Kanada. Du kommer att få höra tankar om deras spel och tips från spelarna om vad de tycker är viktigt att träna på som yngre spelare! Linus Berg står för tekniken bakom podcasten, direkt från Montreal! God lyssning!

2017-01-0415 min

Huskyavsnitt 109 - Protect Our Winters Sweden och Skitouring ScandinaviaProtect Our Winters, eller POW, dök först upp på min radar för mer än fem år sedan i samband med att snowboardlegenden och drömgästen för Husky, Jeremy Jones, startade POW för att samla profiler och varumärken inom vintersport för att tillsammans verka mot klimatförändringar som hotar vårt sätt att leva.För en tid sedan dök ett svenskt initiativ upp under namnet Save Our Snow. De hade tidigt kontakt med POW och i år gick de ut som officiell partner och fortsätter sitt engagemang med än starkare röst under...

2016-07-101h 11

Den svenska musikhistorien44. Almqvist och Geijer - finfina grejerTillsammans med vår gäst Lennart Hedwall tar vi tempen på 1800-talets svenska singer-songwriters. Bl.a. Carl Jonas Love Almqvist och Erik Gustaf Geijer. Med Mattias Lundberg och Esmeralda Moberg. Lyssna på alla avsnitt i Sveriges Radio Play. AVSNITTETS LÅTLISTA: https://open.spotify.com/user/1126630471/playlist/7MQBXo2rP8bmmIGx8yxxkVDen svenska musikhistorien produceras av produktionsbolaget Munck. Kontakta oss på dsm@sverigesradio.se Producent: David RuneSändningsdatum i FM P2: 2016-07-27

2016-05-0426 min

Den svenska musikhistorien42. Svensk folkmusik - ursprunget till Allt. I Södlings värld.Avsnitt 42. Carl Erik Södling tillhör de mer egensinniga gestalterna inom svenskt musikliv under 1800-talet. Musikforskare Mathias Boström hjälper oss att teckna porträttet av en fascinerande särling. Lyssna på alla avsnitt i Sveriges Radio Play. Med Mattias Lundberg och Esmeralda Moberg. DETTA AVSNITT SAKNAR LÅTLISTA PGA BRISTANDE UTBUD PÅ SPOTIFY.Den svenska musikhistorien produceras av produktionsbolaget Munck. Kontakta oss på dsm@sverigesradio.se Producent: David RuneSändningsdatum i FM P2: 2016-07-13

2016-04-1325 min

Musikrevyn i P2CD-revyn 6 mars 2016I programmet diskuterar panelen bl.a. Ysayes soloviolinsonater med Alina Ibragimova och den nykomponerade operan Anna Liisa av Veli-Matti Puumala. Dessutom väljer Johan ur ny Nielsen-symfoni-box. I panelen Camilla Lundberg, Evabritt Selén och Magnus Lindman som tillsammans med programledaren Johan Korssell betygsätter följande skivor: EUGÈNE YSAYE Sex soloviolinsonater op 27 Alina Ibragimova, violin Hyperion CDA 67993ANTONIO VIVALDI Teatro Alla Moda, Violinkonserter Amandine Beyer, violin, Gli Incogniti Harmonia Mundi HMC 902221VELI-MATTI PUUMALA Anna Liisa, opera i 3 akter Helena Juntunen, Jorma Hynninen, m.fl Helsingfors kammarkör, Tapiola Sinfonietta Jan Söderblom, dirigent ANTONÍN DVORÁK Symfoni...

2016-03-0600 min

Den svenska musikhistorien30. Solprästinnor och sängkammareko: 1700-talets operascenerNär den Kungliga teatern, d.v.s. operan, invigdes 1773 var det på sätt och vis en korsbefruktning av exklusiv hovkultur och folkparkernas sångspel. Med Mattias Lundberg och Esmeralda Moberg. Lyssna på alla avsnitt i Sveriges Radio Play. När den Kungliga teatern, d.v.s. operan, invigdes 1773 var det på sätt och vis en korsbefruktning av exklusiv hovkultur och folkparkernas sångspel. Den svenska musikhistorien vänder blickar och öron mot två stjärnor på dåtidens gryende operahimmel, Elisabeth Olin och Carl Stenborg, och berättar historien om hur musikdramatiken öppnades för offen...

2015-08-2623 minAllt vi säger är sant27. AvslutVi har kommit till slutet på en era, och det här är det allra sista avsnittet av "Allt vi säger är sant". Det handlar om avslut. Har vi några favoritslut på böcker? Varför är vi så spoilerkänsliga nu för tiden? Hur tänker vi själva när vi skriver slut? Och varför i hela friden tänker vi lägga ner podden?Lyssna direkt här, genom att trycka play: Eller ladda ner mp3-filen här. Vi finns också på iTunes!I avsnittet nämns följan...

2015-06-1500 minRadio Houdi#51 – Radio Houdi går på djupet

Det är tisdag och det är dags för NYTT avsnitt av Radio Houdi med John Houdi och Anders Hesselbom!

John erkänner sin narcissistiska ådra när han berättar om ett hemma-hos-reportage Expressen gör med honom. Anders avslöjar sig som kompositör av Commodore64-musik.

Men denna gången går John och Anders på djupet när det gäller Mästarnas Mästare som hör “spöken”, popsångare som tror på astrologi och är tveksam till Darwin, den kosmiska kalendern och mycket, mycket mer.

Glöm inte länkarna under k...

2013-09-1000 min

Lundströms BokradioInuti Sofi Oksanens dockskåpSofi Oksanen är i stan - aktuell med romanen När duvorna försvann (övers: Janina Orlov). Marie Lundström fick även träffa den lilla dockan som ser ut som Oksanen själv - och pratade om motstånd och anpasslighet. Kristian Lundberg återvänder till sina rötter med boken En hemstad berättelsen om att färdas genom klassmörkret. Reporter Jon Jordås träffar honom i Malmö. Lyssna på alla avsnitt i Sveriges Radios app. Dessutom tar vi upp fenomenet boksamlande. Finansmannen Sven Hagströmer berättar om sin flera tusen böcker stora sa...

2013-04-1343 min

MusikmagasinetTofft och Lundberg om sjuka toner 2011-02-28 kl. 12.00Hur låter ett radioprogram skapat för sjukskrivna och blir musiken intressantare om kompositören lider av psykisk ohälsa? Carl Tofft och Camilla Lundberg följer tanketråden sjuka toner och vi lyssnar till musik som ska gestalta sjukdom men också toner som kommit till på grund av ohälsa. Gäster i studion är kompositören Matti Bye och medieforskaren Johan Fornäs.

2011-02-2847 min