Shows

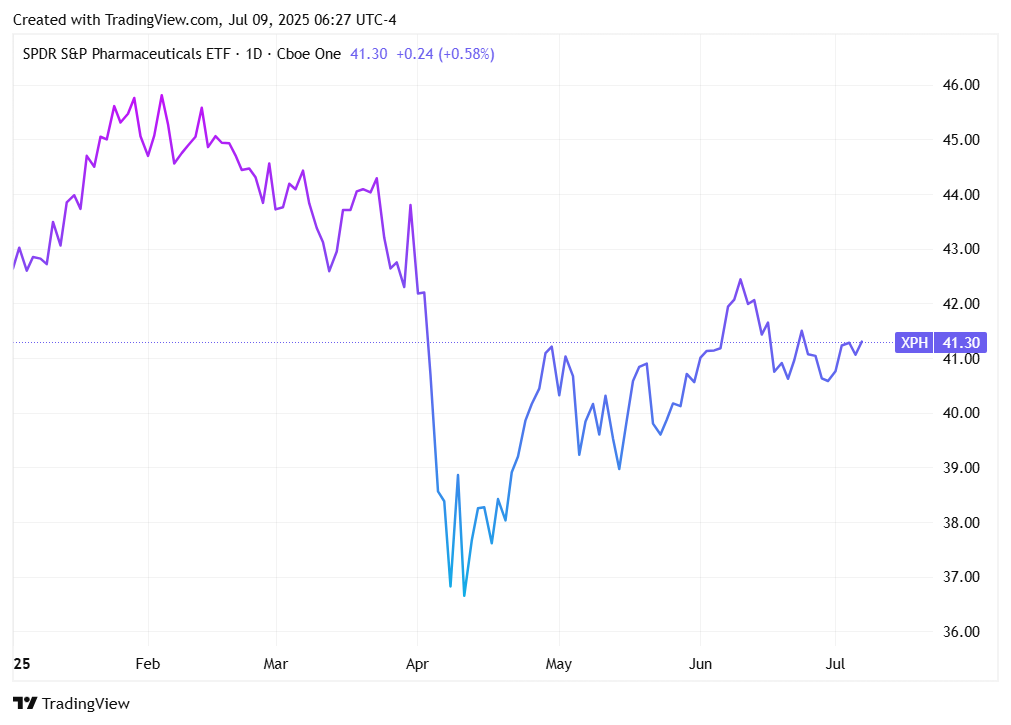

Contrarian Investor PremiumFed Meeting Minutes, New Tariff ThreatsGood morning contrarians! Welcome to the Daily Contrarian, our morning look at events likely to move markets. It is Wednesday, July 9, 2025. Today’s Stocks On The Contrarian Radar©️ segment features pharmaceuticals, specifically MRK , and can be read at the bottom of this page.State of PlayStocks have meandered this week due to lack of catalysts, just as was anticipated. As we eye or board of indicators for signs of direction at 0715 ET things are pretty quiet:* Stock index futures are unchanged with no major US index moving more than 0.2% from the break-even point...2025-07-0916 min

Contrarian Investor PremiumFed Meeting Minutes, New Tariff ThreatsGood morning contrarians! Welcome to the Daily Contrarian, our morning look at events likely to move markets. It is Wednesday, July 9, 2025. Today’s Stocks On The Contrarian Radar©️ segment features pharmaceuticals, specifically MRK , and can be read at the bottom of this page.State of PlayStocks have meandered this week due to lack of catalysts, just as was anticipated. As we eye or board of indicators for signs of direction at 0715 ET things are pretty quiet:* Stock index futures are unchanged with no major US index moving more than 0.2% from the break-even point...2025-07-0916 min Capital Call: with The Millegan BrothersCan David Deming Fix Interest Rates and Self-Driving Cars in One Episode?David Deming, Pegasus Equestrian Director, joins the Millegan Brothers to discuss why the market’s at all-time highs despite war drums in Iran, sticky tariffs, and the Fed doing literally nothing. We unpack why interest rates aren’t going down anytime soon, how Turkey accidentally became a macroeconomics horror story, and whether oil at $130 is still just a vibe check away.Also on deck: Google might be the cheapest trillion-dollar company in the Mag7, Waymo is quietly eating Tesla’s RoboTaxi lunch, and Quinn dismantles the Rothschild-Waterloo myth like it’s a bad Reddit conspira...2025-06-2355 min

Capital Call: with The Millegan BrothersCan David Deming Fix Interest Rates and Self-Driving Cars in One Episode?David Deming, Pegasus Equestrian Director, joins the Millegan Brothers to discuss why the market’s at all-time highs despite war drums in Iran, sticky tariffs, and the Fed doing literally nothing. We unpack why interest rates aren’t going down anytime soon, how Turkey accidentally became a macroeconomics horror story, and whether oil at $130 is still just a vibe check away.Also on deck: Google might be the cheapest trillion-dollar company in the Mag7, Waymo is quietly eating Tesla’s RoboTaxi lunch, and Quinn dismantles the Rothschild-Waterloo myth like it’s a bad Reddit conspira...2025-06-2355 min The Contrarian Capitalist PodcastChris Stadele - Cobalt, Commodities, Corn and moreToday’s podcast features Chris Stadele of the popular LiveSquawk Commodity Corner newsletter.In this thoroughly informative podcast, Chris and I discuss:* Tariffs/recent exemptions and non-exemptions on commodities* The 1 element that Chris is quasi-bullish on - and why* A recent company CC invested in and why (not a financial recommendation)* A plethora of elements including gold, silver, platinum, palladium, rhodium and the potential outlooks and plays that are available* The importance of having physical metals as part of your portfolio* And much more...2025-04-1737 min

The Contrarian Capitalist PodcastChris Stadele - Cobalt, Commodities, Corn and moreToday’s podcast features Chris Stadele of the popular LiveSquawk Commodity Corner newsletter.In this thoroughly informative podcast, Chris and I discuss:* Tariffs/recent exemptions and non-exemptions on commodities* The 1 element that Chris is quasi-bullish on - and why* A recent company CC invested in and why (not a financial recommendation)* A plethora of elements including gold, silver, platinum, palladium, rhodium and the potential outlooks and plays that are available* The importance of having physical metals as part of your portfolio* And much more...2025-04-1737 min The Contrarian Capitalist PodcastAndreas Jones - The 1st steps towards financial + lifestyle masteryToday’s podcast features Andreas Jones, Father, Husband, and Army Combat Veteran. Andreas Jones is the Founder and Editor of KindaFrugal.com, the Well & Wealthy Newsletter and also the Author of Financial Dignity.YOU CAN WATCH THE VIDEO HEREIn this thoroughly informative podcast, we discuss:* The importance of outlining your finances and where you stand at the moment* Why visions and values are imperative for financial and lifestyle success* Plan B both geopolitically and financially* The 1 big barrier in the way that could be stopping YOU ri...2025-04-1538 min

The Contrarian Capitalist PodcastAndreas Jones - The 1st steps towards financial + lifestyle masteryToday’s podcast features Andreas Jones, Father, Husband, and Army Combat Veteran. Andreas Jones is the Founder and Editor of KindaFrugal.com, the Well & Wealthy Newsletter and also the Author of Financial Dignity.YOU CAN WATCH THE VIDEO HEREIn this thoroughly informative podcast, we discuss:* The importance of outlining your finances and where you stand at the moment* Why visions and values are imperative for financial and lifestyle success* Plan B both geopolitically and financially* The 1 big barrier in the way that could be stopping YOU ri...2025-04-1538 min Capital Call: with The Millegan BrothersCapital Call #1 - Trump Tarrifs: Liberation (from Profits) Day - Musings from the Woodworth Contrarian Fund Managers / Millegan BrothersTariffs, tantrums, and $6 trillion in vanishing value—what better time for the first-ever Capital Call? On this so-called “Liberation Day,” investors were liberated mostly from their gains. Quinn and Drew, managers of the Woodworth Contrarian Fund, unpack policy chaos, circuit breakers, and why Kohl’s might just be the thrift store Picasso—buried under junk, but worth a second look.www.Woodworth.FundCapital Call #1 with Quinn Millegan & Drew Millegan , managers of the Woodworth Contrarian Fund.April 4th 2025 Post-market-close2025-04-0759 min

Capital Call: with The Millegan BrothersCapital Call #1 - Trump Tarrifs: Liberation (from Profits) Day - Musings from the Woodworth Contrarian Fund Managers / Millegan BrothersTariffs, tantrums, and $6 trillion in vanishing value—what better time for the first-ever Capital Call? On this so-called “Liberation Day,” investors were liberated mostly from their gains. Quinn and Drew, managers of the Woodworth Contrarian Fund, unpack policy chaos, circuit breakers, and why Kohl’s might just be the thrift store Picasso—buried under junk, but worth a second look.www.Woodworth.FundCapital Call #1 with Quinn Millegan & Drew Millegan , managers of the Woodworth Contrarian Fund.April 4th 2025 Post-market-close2025-04-0759 min The Contrarian Capitalist PodcastNicole Vilaca - Latin America is the current Plan B hotspot! (Plus 2 Plan B myths busted!)Today’s podcast guest is Nicole Vilaca of Work, Wealth and Travel & Worldwise Capital. Nicole is an avid traveller, a true internationalist and has spent time living and travelling in a number of countries on a number of continents.YOU CAN WATCH THE VIDEO HEREIt was an absolute pleasure to be able to chat with Nicole. We spoke about a wide variety of subjects and countries, including:* The importance of travelling* Why Latin America is currently the Plan B hotspot* Tax efficiency, lifestyle + why a Plan B is no...2025-04-0432 min

The Contrarian Capitalist PodcastNicole Vilaca - Latin America is the current Plan B hotspot! (Plus 2 Plan B myths busted!)Today’s podcast guest is Nicole Vilaca of Work, Wealth and Travel & Worldwise Capital. Nicole is an avid traveller, a true internationalist and has spent time living and travelling in a number of countries on a number of continents.YOU CAN WATCH THE VIDEO HEREIt was an absolute pleasure to be able to chat with Nicole. We spoke about a wide variety of subjects and countries, including:* The importance of travelling* Why Latin America is currently the Plan B hotspot* Tax efficiency, lifestyle + why a Plan B is no...2025-04-0432 min The Contrarian Capitalist PodcastCraig Hemke - Comex, Open Interest mischief & precious metalsToday’s podcast guest is Craig Hemke of the TF Metals Report. Craig began his career in financial services in 1990 but retired in 2008 to focus on family and entrepreneurial opportunities.Since 2010, Craig has been the editor and publisher of the TF Metals Report, found at TFMetalsReport.com, an online community for precious metal investors.Craig also writes for Sprott Money Ltd and is the host of the Ask The Expert podcast for Sprott Money Ltd.YOU CAN WATCH THE VIDEO HEREIt was an absolute pleasure to be able to chat wi...2025-04-0324 min

The Contrarian Capitalist PodcastCraig Hemke - Comex, Open Interest mischief & precious metalsToday’s podcast guest is Craig Hemke of the TF Metals Report. Craig began his career in financial services in 1990 but retired in 2008 to focus on family and entrepreneurial opportunities.Since 2010, Craig has been the editor and publisher of the TF Metals Report, found at TFMetalsReport.com, an online community for precious metal investors.Craig also writes for Sprott Money Ltd and is the host of the Ask The Expert podcast for Sprott Money Ltd.YOU CAN WATCH THE VIDEO HEREIt was an absolute pleasure to be able to chat wi...2025-04-0324 min The Contrarian Capitalist PodcastA repeat of the 1848 revolutions? Politics gone mad in Europe + Gold, Silver & other worldwide updatesToday’s podcast looks at:* Politics gone mad in Germany + France* How Europe could witness something similar to the 1848 Revolutions* Gold hitting new ATH’s* Mr Slammy keeps Silver in check on Silver Squeeze Day* General podcast + content updates for The Contrarian Capitalist* And moreThe Contrarian Capitalist aims to help you become wealthier & a better investor through educational writings, market analysis, expert podcasts & prudent Plan B information. Subscribe today + join the growing community!Contrarian Capitalist FREE subscribers get:* Free access to p...2025-04-0119 min

The Contrarian Capitalist PodcastA repeat of the 1848 revolutions? Politics gone mad in Europe + Gold, Silver & other worldwide updatesToday’s podcast looks at:* Politics gone mad in Germany + France* How Europe could witness something similar to the 1848 Revolutions* Gold hitting new ATH’s* Mr Slammy keeps Silver in check on Silver Squeeze Day* General podcast + content updates for The Contrarian Capitalist* And moreThe Contrarian Capitalist aims to help you become wealthier & a better investor through educational writings, market analysis, expert podcasts & prudent Plan B information. Subscribe today + join the growing community!Contrarian Capitalist FREE subscribers get:* Free access to p...2025-04-0119 min The Contrarian Capitalist PodcastAlasdair Macleod - Gold is money and everything else is creditToday’s podcast features Alasdair Macleod the very popular MacleodFinance Substack YOU CAN WATCH THE VIDEO HEREIn this thoroughly informative podcast, we discuss:* The Silver Squeeze motion and why it is happening* LBMA & COMEX * Why Gold is potentially becoming a Giffin Good* Diocletian’s famous Edict of Maximum Prices + why Gold holds its true worth over time* The fact that Gold is money and everything else is credit* Credit + Debt bubbles* How to protect yourself moving forwards* And more...2025-03-2744 min

The Contrarian Capitalist PodcastAlasdair Macleod - Gold is money and everything else is creditToday’s podcast features Alasdair Macleod the very popular MacleodFinance Substack YOU CAN WATCH THE VIDEO HEREIn this thoroughly informative podcast, we discuss:* The Silver Squeeze motion and why it is happening* LBMA & COMEX * Why Gold is potentially becoming a Giffin Good* Diocletian’s famous Edict of Maximum Prices + why Gold holds its true worth over time* The fact that Gold is money and everything else is credit* Credit + Debt bubbles* How to protect yourself moving forwards* And more...2025-03-2744 min Contrarian Investor PremiumThursday TariffsGood morning contrarians! Welcome to the Daily Contrarian, our morning look at events likely to move markets. It is Thursday, March 27. Today’s Stocks On The Contrarian Radar©️ segment features automakers, especially $STLA , and starts at the bottom of this page.State of PlayStocks sold off again yesterday, reversing most of the week’s gains especially in tech land. It was not all bad however as consumer staples stocks gained ground. As we eye our board of indicators for signs of direction at 0710, things appear mixed:* Stock index futures are flat, with no majo...2025-03-2708 min

Contrarian Investor PremiumThursday TariffsGood morning contrarians! Welcome to the Daily Contrarian, our morning look at events likely to move markets. It is Thursday, March 27. Today’s Stocks On The Contrarian Radar©️ segment features automakers, especially $STLA , and starts at the bottom of this page.State of PlayStocks sold off again yesterday, reversing most of the week’s gains especially in tech land. It was not all bad however as consumer staples stocks gained ground. As we eye our board of indicators for signs of direction at 0710, things appear mixed:* Stock index futures are flat, with no majo...2025-03-2708 min The Contrarian Capitalist PodcastPlan B Paraguay - Why Paraguay is an underrated country with plenty to offerPlan B is incredibly important. There is a lot of turmoil going on across the world and it is unfortunately likely to get worse before it gets better. All hope is not lost and there are plenty of superb Plan B options out there for you.Today’s podcast guest is Paul Kitson from Plan B ParaguayIt was an absolute pleasure to be able to chat with Paul. The conversation bought back many happy memories from my travels in Paraguay back in 2014 and also bought to light a lot of great things that Paraguay ha...2025-03-2535 min

The Contrarian Capitalist PodcastPlan B Paraguay - Why Paraguay is an underrated country with plenty to offerPlan B is incredibly important. There is a lot of turmoil going on across the world and it is unfortunately likely to get worse before it gets better. All hope is not lost and there are plenty of superb Plan B options out there for you.Today’s podcast guest is Paul Kitson from Plan B ParaguayIt was an absolute pleasure to be able to chat with Paul. The conversation bought back many happy memories from my travels in Paraguay back in 2014 and also bought to light a lot of great things that Paraguay ha...2025-03-2535 min The Contrarian Capitalist PodcastEgon von Greyerz - It's going to be an exciting time if you are on the right side of the market!Today’s podcast features Egon von Greyerz, Founder of VON GREYERZ and a writer on gold, silver, and wealth preservation.YOU CAN WATCH THE VIDEO HEREIn this thoroughly informative podcast, Egon von Greyerz discusses:* The best way to protect yourself in these times of turmoil and uncertainty* Chaos And The Triumph Of Survival* Current Financial unrest* Current Social unrest* The Credit/Derivatives Markets* A key difference between Gold and Silver* Why history gives us an indication of what lies ahead...2025-03-2042 min

The Contrarian Capitalist PodcastEgon von Greyerz - It's going to be an exciting time if you are on the right side of the market!Today’s podcast features Egon von Greyerz, Founder of VON GREYERZ and a writer on gold, silver, and wealth preservation.YOU CAN WATCH THE VIDEO HEREIn this thoroughly informative podcast, Egon von Greyerz discusses:* The best way to protect yourself in these times of turmoil and uncertainty* Chaos And The Triumph Of Survival* Current Financial unrest* Current Social unrest* The Credit/Derivatives Markets* A key difference between Gold and Silver* Why history gives us an indication of what lies ahead...2025-03-2042 min The Contrarian Capitalist PodcastFrank Wright - The evil empire is dissolving and we are living in the endgame of the old orderToday’s podcast and video (podcast above and video below) features the return of the superb Frank Wright. A lot of topics are discussed, including:* What is currently happening in the UK+ EU and why* The death knell for liberalism* The smoke and mirrors of what people say and what they do* US/Russia relations and the importance of nationalism* Who are the real extremists?* And moreI would highly recommend that people follow/subscribe to Frank Wright as well as reading his recent articles, in...2025-03-191h 06

The Contrarian Capitalist PodcastFrank Wright - The evil empire is dissolving and we are living in the endgame of the old orderToday’s podcast and video (podcast above and video below) features the return of the superb Frank Wright. A lot of topics are discussed, including:* What is currently happening in the UK+ EU and why* The death knell for liberalism* The smoke and mirrors of what people say and what they do* US/Russia relations and the importance of nationalism* Who are the real extremists?* And moreI would highly recommend that people follow/subscribe to Frank Wright as well as reading his recent articles, in...2025-03-191h 06 The Contrarian Capitalist PodcastThe Macro Butler - Stagflation, Gold, Silver, Platinum, Plan B, War & moreToday’s podcast guest is Laurent Lequeu aka The Macro ButlerYOU CAN WATCH THE VIDEO HEREThis wide-ranging conversation explored the current challenges (and potential outlook) for the S&P 500/USA economy as well as:* Gold* Silver* Mining Companies and why they are undervalued* Platinum* Uranium* Plan B and why it is imperative that you have one* Overall geopolitical challenges and why the EU is hell bent on having a warContact InformationYou can connect to...2025-03-1850 min

The Contrarian Capitalist PodcastThe Macro Butler - Stagflation, Gold, Silver, Platinum, Plan B, War & moreToday’s podcast guest is Laurent Lequeu aka The Macro ButlerYOU CAN WATCH THE VIDEO HEREThis wide-ranging conversation explored the current challenges (and potential outlook) for the S&P 500/USA economy as well as:* Gold* Silver* Mining Companies and why they are undervalued* Platinum* Uranium* Plan B and why it is imperative that you have one* Overall geopolitical challenges and why the EU is hell bent on having a warContact InformationYou can connect to...2025-03-1850 min Contrarian Investor PremiumHousing StartsGood morning contrarians! Welcome to the Daily Contrarian, our morning look at events likely to move markets. It is Tuesday, March 18. Today’s Stocks On The Contrarian Radar©️ segment features homebuilder stocks, especially $LEN , and starts at the bottom of this page.State of PlayStocks advanced yesterday — the second day in a row — but finished off the highs. As we eye our board of indicators for signs of direction at 0700, things are quiet:* Stock index futures are down a tiny bit. The Nasdaq is pointing to a drop of 0.3% at the open with the...2025-03-1808 min

Contrarian Investor PremiumHousing StartsGood morning contrarians! Welcome to the Daily Contrarian, our morning look at events likely to move markets. It is Tuesday, March 18. Today’s Stocks On The Contrarian Radar©️ segment features homebuilder stocks, especially $LEN , and starts at the bottom of this page.State of PlayStocks advanced yesterday — the second day in a row — but finished off the highs. As we eye our board of indicators for signs of direction at 0700, things are quiet:* Stock index futures are down a tiny bit. The Nasdaq is pointing to a drop of 0.3% at the open with the...2025-03-1808 min The Contrarian Capitalist PodcastDigital EU in Oct 25? The UK + EU are leading the war charge (but are focusing on the wrong people)Today’s podcast looks at:* Digital Euro (CBDC) likely coming in 2025* The typical globalist playbook of going to war and then coming up with the solution to save the masses (i.e. digital currency)* The fact that all roads lead to London* The UK is preparing for more discontent this summer* Internal discontent both within the UK + EU* The greatest threat to the UK + EU is NOT Russia but is instead themselves i.e. Sweden* Seizing of Russian FX Reserves will just add fuel to th...2025-03-1320 min

The Contrarian Capitalist PodcastDigital EU in Oct 25? The UK + EU are leading the war charge (but are focusing on the wrong people)Today’s podcast looks at:* Digital Euro (CBDC) likely coming in 2025* The typical globalist playbook of going to war and then coming up with the solution to save the masses (i.e. digital currency)* The fact that all roads lead to London* The UK is preparing for more discontent this summer* Internal discontent both within the UK + EU* The greatest threat to the UK + EU is NOT Russia but is instead themselves i.e. Sweden* Seizing of Russian FX Reserves will just add fuel to th...2025-03-1320 min Contrarian Investor PremiumProducer Prices, Jobless ClaimsGood morning contrarians! Welcome to the Daily Contrarian, our morning look at events likely to move markets. It is Thursday, March 13. Today’s Stocks On The Contrarian Radar©️ segment features $KMPR and starts at the bottom of this page. State of PlayYesterday saw a rally in tech stocks as the rest of the market was left behind. Staples actually dropped with bond prices. As we eye our board of indicators for signs of direction at 0705, all is quiet:* Stock index futures are flat as a board, with no major US index moving at al...2025-03-1309 min

Contrarian Investor PremiumProducer Prices, Jobless ClaimsGood morning contrarians! Welcome to the Daily Contrarian, our morning look at events likely to move markets. It is Thursday, March 13. Today’s Stocks On The Contrarian Radar©️ segment features $KMPR and starts at the bottom of this page. State of PlayYesterday saw a rally in tech stocks as the rest of the market was left behind. Staples actually dropped with bond prices. As we eye our board of indicators for signs of direction at 0705, all is quiet:* Stock index futures are flat as a board, with no major US index moving at al...2025-03-1309 min The Contrarian Capitalist PodcastBe aware of a rip your face off rally to the upside + the Art of the DealThere is a LOT of doom and gloom out there at the moment. Too much for my liking.Yes the major indices are down and yes they could go slightly lower as well. That being said, I firmly believe that the PPT (Plunge Protection Team) and the Fed will step in and sort it out. This will provide us with a rip your face off rally. New ATH’s across the major indices.This will catch a lot of people off guard.Once the tops have come in then it will well and tr...2025-03-1121 min

The Contrarian Capitalist PodcastBe aware of a rip your face off rally to the upside + the Art of the DealThere is a LOT of doom and gloom out there at the moment. Too much for my liking.Yes the major indices are down and yes they could go slightly lower as well. That being said, I firmly believe that the PPT (Plunge Protection Team) and the Fed will step in and sort it out. This will provide us with a rip your face off rally. New ATH’s across the major indices.This will catch a lot of people off guard.Once the tops have come in then it will well and tr...2025-03-1121 min The Contrarian Capitalist PodcastKris Rymer - $NOA + Identifying compelling market opportunitiesToday’s podcast guest is Kristopher Rymer of Safe Harbor Stocks (audio above).YOU CAN WATCH THE VIDEO HEREIt was an absolute pleasure to be able to chat with Kristopher Rymer about a plethora of topics including:* North American Construction Group Ltd (NYSE: NOA)* A recent successful investment/trade of Atmus Filtration Technologies ($ATMU)* Kris’s investment strategies i.e. what he looks for in companies and industries* FOMO and emotional control* PE IPO’s and other markets* Marex Group plc (MRX)...2025-03-0459 min

The Contrarian Capitalist PodcastKris Rymer - $NOA + Identifying compelling market opportunitiesToday’s podcast guest is Kristopher Rymer of Safe Harbor Stocks (audio above).YOU CAN WATCH THE VIDEO HEREIt was an absolute pleasure to be able to chat with Kristopher Rymer about a plethora of topics including:* North American Construction Group Ltd (NYSE: NOA)* A recent successful investment/trade of Atmus Filtration Technologies ($ATMU)* Kris’s investment strategies i.e. what he looks for in companies and industries* FOMO and emotional control* PE IPO’s and other markets* Marex Group plc (MRX)...2025-03-0459 min Contrarian Investor PremiumManufacturing PMIs, Construction SpendingGood morning contrarians! Welcome to the Daily Contrarian, our morning look at events likely to move markets. It is Monday, March 3. Today’s Stock On The Contrarian Radar©️ is $CACI at the bottom of this page. Be sure to read this month’s Contrarian Portfolio update letter!State of PlayStocks advanced on Friday, all thanks to a late-day rally that came out of nowhere. As we eye our board of indicators for signs of direction at 0640, it looks like risk-on is set to continue, thanks in no small part to the crypto market...2025-03-0309 min

Contrarian Investor PremiumManufacturing PMIs, Construction SpendingGood morning contrarians! Welcome to the Daily Contrarian, our morning look at events likely to move markets. It is Monday, March 3. Today’s Stock On The Contrarian Radar©️ is $CACI at the bottom of this page. Be sure to read this month’s Contrarian Portfolio update letter!State of PlayStocks advanced on Friday, all thanks to a late-day rally that came out of nowhere. As we eye our board of indicators for signs of direction at 0640, it looks like risk-on is set to continue, thanks in no small part to the crypto market...2025-03-0309 min The Contrarian Capitalist PodcastTrader Ferg - Platinum Group Metals (PGM's) + Oil and Natural GasToday’s podcast guest is Trader Ferg, a true Contrarian who has been a ‘‘Full-time trader for 8 years’’ and who has a ‘‘habit of hanging out in hated corners of the market that are uninvestable". (Audio above).YOU CAN WATCH THE VIDEO HEREIt was an absolute pleasure to be able to chat with Trader Ferg. We covered a variety of markets and commodities, including:* Platinum* Palladium* Rhodium* EV’s* Oil* Natural GasContact InformationYou can find Trader Ferg on Substack...2025-02-2755 min

The Contrarian Capitalist PodcastTrader Ferg - Platinum Group Metals (PGM's) + Oil and Natural GasToday’s podcast guest is Trader Ferg, a true Contrarian who has been a ‘‘Full-time trader for 8 years’’ and who has a ‘‘habit of hanging out in hated corners of the market that are uninvestable". (Audio above).YOU CAN WATCH THE VIDEO HEREIt was an absolute pleasure to be able to chat with Trader Ferg. We covered a variety of markets and commodities, including:* Platinum* Palladium* Rhodium* EV’s* Oil* Natural GasContact InformationYou can find Trader Ferg on Substack...2025-02-2755 min The Contrarian Capitalist PodcastDave Collum - No Holds BarredToday’s podcast guest is the fantastic Dave Collum (podcast above and video below)It was an absolute pleasure to be able to chat with Dave Collum and a big thank you to Dave for taking time out of his day to have an incredibly wind ranging chat. I even got put on the spot and have some homework to do as a result!Topics covered include:* Kash Patel’s appointment and what this could lead to with regards to documents being released* Covid + the fallout from it/repercussions* NATO...2025-02-261h 57

The Contrarian Capitalist PodcastDave Collum - No Holds BarredToday’s podcast guest is the fantastic Dave Collum (podcast above and video below)It was an absolute pleasure to be able to chat with Dave Collum and a big thank you to Dave for taking time out of his day to have an incredibly wind ranging chat. I even got put on the spot and have some homework to do as a result!Topics covered include:* Kash Patel’s appointment and what this could lead to with regards to documents being released* Covid + the fallout from it/repercussions* NATO...2025-02-261h 57 The Contrarian Capitalist PodcastQTR's Fringe Finance - Mental Health, DOGE, Gold + SilverToday’s podcast guest is Chris Irons of QTR’s Fringe Finance.YOU CAN WATCH THE VIDEO HEREI’m a keen admirer of the work done at QTR’s Fringe Finance and therefore it was an honour to be able to sit down and have a very open and candid conversation. Many topics were discussed, including:* Mental Health* Philadelphia Eagles/The Superbowl* DOGE and why it is a necessity* Gold* Silver* Monetary PolicyContact InformationYou can connect on Subst...2025-02-2559 min

The Contrarian Capitalist PodcastQTR's Fringe Finance - Mental Health, DOGE, Gold + SilverToday’s podcast guest is Chris Irons of QTR’s Fringe Finance.YOU CAN WATCH THE VIDEO HEREI’m a keen admirer of the work done at QTR’s Fringe Finance and therefore it was an honour to be able to sit down and have a very open and candid conversation. Many topics were discussed, including:* Mental Health* Philadelphia Eagles/The Superbowl* DOGE and why it is a necessity* Gold* Silver* Monetary PolicyContact InformationYou can connect on Subst...2025-02-2559 min The Contrarian Capitalist PodcastDon Durrett - The 1 main belief you need for investing/speculating in mining stocksToday’s podcast guest is Don Durrett of goldstockdata.com (podcast above).YOU CAN WATCH THE VIDEO HEREIt was an absolute pleasure to be able to chat with Don Durrett. We covered a lot of subjects, including:* The 1 main belief needed if you want to invest/speculate in mining stocks* The importance of Gold being a tier 1 asset under Basel III regulations* What sort of market correction could happen in March/April 2025* A 30,000ft overview of the current state of the S & P 500* A 30,000ft...2025-02-2153 min

The Contrarian Capitalist PodcastDon Durrett - The 1 main belief you need for investing/speculating in mining stocksToday’s podcast guest is Don Durrett of goldstockdata.com (podcast above).YOU CAN WATCH THE VIDEO HEREIt was an absolute pleasure to be able to chat with Don Durrett. We covered a lot of subjects, including:* The 1 main belief needed if you want to invest/speculate in mining stocks* The importance of Gold being a tier 1 asset under Basel III regulations* What sort of market correction could happen in March/April 2025* A 30,000ft overview of the current state of the S & P 500* A 30,000ft...2025-02-2153 min The Contrarian Capitalist PodcastJoel Bowman - Javier Milei, $LIBRA 'coins', Argentina, DOGE + A Deep StateToday’s podcast guest is Joel Bowman of the very popular newsletter Notes from the End of the World (podcast above).YOU CAN WATCH THE VIDEO HEREIt was an absolute pleasure to be able to chat with Joel Bowman and I’d like to say a massive thank you to Joel for taking the time out of his day to talk about a wide variety of subjects, including:* Javier Milei + $LIBRA meme coin issues* Boots on the ground of what has been happening in Argentina since Javier Milei took office2025-02-2038 min

The Contrarian Capitalist PodcastJoel Bowman - Javier Milei, $LIBRA 'coins', Argentina, DOGE + A Deep StateToday’s podcast guest is Joel Bowman of the very popular newsletter Notes from the End of the World (podcast above).YOU CAN WATCH THE VIDEO HEREIt was an absolute pleasure to be able to chat with Joel Bowman and I’d like to say a massive thank you to Joel for taking the time out of his day to talk about a wide variety of subjects, including:* Javier Milei + $LIBRA meme coin issues* Boots on the ground of what has been happening in Argentina since Javier Milei took office2025-02-2038 min The Contrarian Capitalist PodcastTrump, DOGE, The Dollar & GoldToday’s podcast explores the following topics:* Central banks buying Gold and a run on the physical bullion market(s)* Trump + Putin Chat but don’t expect peace instantaneously* DOGE & Unemployment numbers moving forwards (THE UK NEEDS ONE TOO)* Why Gold going up is actually the US Dollar going down* How and why the USA is gearing up for a possible Gold backed monetary resetSpecial OfferI recently made a mistake in the back office of Contrarian Capitalist with regards to some welcome e-mails. As a...2025-02-1316 min

The Contrarian Capitalist PodcastTrump, DOGE, The Dollar & GoldToday’s podcast explores the following topics:* Central banks buying Gold and a run on the physical bullion market(s)* Trump + Putin Chat but don’t expect peace instantaneously* DOGE & Unemployment numbers moving forwards (THE UK NEEDS ONE TOO)* Why Gold going up is actually the US Dollar going down* How and why the USA is gearing up for a possible Gold backed monetary resetSpecial OfferI recently made a mistake in the back office of Contrarian Capitalist with regards to some welcome e-mails. As a...2025-02-1316 min Contrarian Investor PremiumInflation Watch WeekGood morning contrarians! Welcome to the Daily Contrarian, our morning look at events likely to move markets. It is Monday, Feb. 10. Today’s Stocks On The Contrarian Radar©️ section featuring $NWL starts at the bottom of this page.State of PlayFresh news from tariff land, with President Trump saying he will impose 25% charges on steel and aluminum tariffs. As we eye our board of indicators for signs of direction at 0700 that has impacted commodity markets:* Commodities are gaining ground. Not just steel and aluminum, but gold and silver, which are up over 1%. WTI c...2025-02-1008 min

Contrarian Investor PremiumInflation Watch WeekGood morning contrarians! Welcome to the Daily Contrarian, our morning look at events likely to move markets. It is Monday, Feb. 10. Today’s Stocks On The Contrarian Radar©️ section featuring $NWL starts at the bottom of this page.State of PlayFresh news from tariff land, with President Trump saying he will impose 25% charges on steel and aluminum tariffs. As we eye our board of indicators for signs of direction at 0700 that has impacted commodity markets:* Commodities are gaining ground. Not just steel and aluminum, but gold and silver, which are up over 1%. WTI c...2025-02-1008 min Contrarian Investor PremiumMore Earnings, Sino-US Trade WarGood morning contrarians! Welcome to the Daily Contrarian, our morning look at events likely to move markets. It is Wednesday, Feb. 5. Happy Hump Day! Today’s Stocks On The Contrarian Radar©️ segment features $GOOG / $GOOGL and can be read at the bottom of this page. Be sure to read the monthly portfolio update!State of PlayStocks rallied yesterday, led by tech. There was unfortunately some bad news after the close from tech land as Google/Alphabet earnings disappointed investors. As we eye our board of indicators for signs of direction at 0640, that is we...2025-02-0508 min

Contrarian Investor PremiumMore Earnings, Sino-US Trade WarGood morning contrarians! Welcome to the Daily Contrarian, our morning look at events likely to move markets. It is Wednesday, Feb. 5. Happy Hump Day! Today’s Stocks On The Contrarian Radar©️ segment features $GOOG / $GOOGL and can be read at the bottom of this page. Be sure to read the monthly portfolio update!State of PlayStocks rallied yesterday, led by tech. There was unfortunately some bad news after the close from tech land as Google/Alphabet earnings disappointed investors. As we eye our board of indicators for signs of direction at 0640, that is we...2025-02-0508 min Contrarian Investor PremiumFed Back in Focus: Meeting Minutes, Waller SpeechGood morning contrarians! Welcome to the Daily Contrarian, our morning look at events likely to move markets. It is Wednesday, Jan. 8. Today’s Stock on the Contrarian Radar©️is $HSIC (see the bottom of the page). State of PlayStocks dropped yesterday after hotter-than-anticipated economic data brought fears of higher-for-longer interest rates. As we eye our board of indicators for signs of direction at 0645, things are pretty quiet:* Stock index futures are pointing to a slight uptick at the open. The Nasdaq and S&P 500 are up 0.3%;* Cryptos are continuing to drop...2025-01-0810 min

Contrarian Investor PremiumFed Back in Focus: Meeting Minutes, Waller SpeechGood morning contrarians! Welcome to the Daily Contrarian, our morning look at events likely to move markets. It is Wednesday, Jan. 8. Today’s Stock on the Contrarian Radar©️is $HSIC (see the bottom of the page). State of PlayStocks dropped yesterday after hotter-than-anticipated economic data brought fears of higher-for-longer interest rates. As we eye our board of indicators for signs of direction at 0645, things are pretty quiet:* Stock index futures are pointing to a slight uptick at the open. The Nasdaq and S&P 500 are up 0.3%;* Cryptos are continuing to drop...2025-01-0810 min Contrarian Investor PremiumMore EarningsGood morning contrarians! Welcome to the Daily Contrarian, our morning look at events likely to move markets. It is Tuesday, Dec. 10. The Bottom Line segment of today’s podcast starts at (3:52), followed by Stocks on the Contrarian Radar©️ featuring Google ($GOOG / $GOOGL ) at (5:50) for listeners who want to skip ahead.State of PlayStocks dropped a bit yesterday on news of an antitrust probe by Chinese regulators into Nvidia (NVDA ) that sounds in no way to be politically motivated. As we eye our board of indicators for signs of direction at 0645, there isn’t an awful l...2024-12-1011 min

Contrarian Investor PremiumMore EarningsGood morning contrarians! Welcome to the Daily Contrarian, our morning look at events likely to move markets. It is Tuesday, Dec. 10. The Bottom Line segment of today’s podcast starts at (3:52), followed by Stocks on the Contrarian Radar©️ featuring Google ($GOOG / $GOOGL ) at (5:50) for listeners who want to skip ahead.State of PlayStocks dropped a bit yesterday on news of an antitrust probe by Chinese regulators into Nvidia (NVDA ) that sounds in no way to be politically motivated. As we eye our board of indicators for signs of direction at 0645, there isn’t an awful l...2024-12-1011 min Contrarian Investor PremiumNvidia Earnings, Target’s Big MissGood morning contrarians! Welcome to the Daily Contrarian, our morning look at events likely to move markets. It is Wednesday, Nov. 20. The Bottom Line segment of today’s podcast starts at (4:38), followed by Stocks on the Contrarian Radar©️ featuring $TGT and $BORR at (6:22) for listeners who want to skip ahead.State of PlayStocks advanced yesterday with tech the leader. As we eye our board of indicators for signs of direction at 0700, things are pretty quiet:* Stock index futures are flat with no major US index moving more than 0.2% from the break-even point;...2024-11-2011 min

Contrarian Investor PremiumNvidia Earnings, Target’s Big MissGood morning contrarians! Welcome to the Daily Contrarian, our morning look at events likely to move markets. It is Wednesday, Nov. 20. The Bottom Line segment of today’s podcast starts at (4:38), followed by Stocks on the Contrarian Radar©️ featuring $TGT and $BORR at (6:22) for listeners who want to skip ahead.State of PlayStocks advanced yesterday with tech the leader. As we eye our board of indicators for signs of direction at 0700, things are pretty quiet:* Stock index futures are flat with no major US index moving more than 0.2% from the break-even point;...2024-11-2011 min Contrarian Investor PremiumInflation Back on the MenuGood morning contrarians! Welcome to the Daily Contrarian, our morning look at events likely to move markets. It is Wednesday, Nov. 13. The Bottom Line segment of today’s podcast starts at (4:15) followed by Stocks On The Contrarian Radar©️ at (6:39) feat $HOG for listeners who want to skip ahead.State of PlayStocks dropped yesterday for the first time since the election. As we eye our board of indicators for signs of direction at 0630, things appear quiet:* Cryptos appear to be stabilizing after dropping overnight. Or at least Bitcoin is, up 2024-11-1311 min

Contrarian Investor PremiumInflation Back on the MenuGood morning contrarians! Welcome to the Daily Contrarian, our morning look at events likely to move markets. It is Wednesday, Nov. 13. The Bottom Line segment of today’s podcast starts at (4:15) followed by Stocks On The Contrarian Radar©️ at (6:39) feat $HOG for listeners who want to skip ahead.State of PlayStocks dropped yesterday for the first time since the election. As we eye our board of indicators for signs of direction at 0630, things appear quiet:* Cryptos appear to be stabilizing after dropping overnight. Or at least Bitcoin is, up 2024-11-1311 min Contrarian Investor PremiumLeading Indicators, a Big Week for EarningsGood morning contrarians! Welcome to the Daily Contrarian, our morning look at events likely to move markets. It is Monday, Oct. 21. The Bottom Line segment of today’s podcast starts at (2:30) followed by Stocks on the Contrarian Radar©️ feat agricultural producers $BG and $ADM for listeners who want to skip ahead.State of PlayStocks closed at fresh record highs again on Friday. As we eye our board of indicators for signs of direction at 0650, things are a bit all over the place:* Stock index futures are down a bit, led by tech. The N...2024-10-2109 min

Contrarian Investor PremiumLeading Indicators, a Big Week for EarningsGood morning contrarians! Welcome to the Daily Contrarian, our morning look at events likely to move markets. It is Monday, Oct. 21. The Bottom Line segment of today’s podcast starts at (2:30) followed by Stocks on the Contrarian Radar©️ feat agricultural producers $BG and $ADM for listeners who want to skip ahead.State of PlayStocks closed at fresh record highs again on Friday. As we eye our board of indicators for signs of direction at 0650, things are a bit all over the place:* Stock index futures are down a bit, led by tech. The N...2024-10-2109 min Contrarian Investor PremiumChina Trade Balance Weighs on Commodities, Fed SpeakersGood morning contrarians! Welcome to the Daily Contrarian, our morning look at events likely to move markets. It is Monday, Oct. 14. The Bottom Line segment of today’s podcast starts at (2:13), followed by Stocks on the Contrarian Radar©️ feat $CAT for listeners who want to skip ahead.State of PlayChina overnight reported trade balance statistics that fell short of estimates. That is weighing on commodities markets, as we eye our board of indicators for signs of direction at 0705:* WTI crude oil is down 2.5% to trade below $74/barrel. Copper is down 1.5%;* Stock...2024-10-1405 min

Contrarian Investor PremiumChina Trade Balance Weighs on Commodities, Fed SpeakersGood morning contrarians! Welcome to the Daily Contrarian, our morning look at events likely to move markets. It is Monday, Oct. 14. The Bottom Line segment of today’s podcast starts at (2:13), followed by Stocks on the Contrarian Radar©️ feat $CAT for listeners who want to skip ahead.State of PlayChina overnight reported trade balance statistics that fell short of estimates. That is weighing on commodities markets, as we eye our board of indicators for signs of direction at 0705:* WTI crude oil is down 2.5% to trade below $74/barrel. Copper is down 1.5%;* Stock...2024-10-1405 min Contrarian Investor PremiumMicron Earnings, New Home SalesGood morning contrarians! Welcome to the Daily Contrarian, our morning look at events likely to move markets. It is Wednesday, Sept. 25. The Bottom Line segment of today’s podcast starts at (1:18) and Stocks on the Contrarian Radar©️ at (2:25) for listeners who want to skip ahead.State of PlayAs we eye our board of indicators for signs of direction at 0650, things are very quiet:* Stock index futures are flat with no major US index moving more than 0.2% from the break-even point;* Commodities aren’t doing anything either. WTI crude oil is down 0...2024-09-2506 min

Contrarian Investor PremiumMicron Earnings, New Home SalesGood morning contrarians! Welcome to the Daily Contrarian, our morning look at events likely to move markets. It is Wednesday, Sept. 25. The Bottom Line segment of today’s podcast starts at (1:18) and Stocks on the Contrarian Radar©️ at (2:25) for listeners who want to skip ahead.State of PlayAs we eye our board of indicators for signs of direction at 0650, things are very quiet:* Stock index futures are flat with no major US index moving more than 0.2% from the break-even point;* Commodities aren’t doing anything either. WTI crude oil is down 0...2024-09-2506 min Contrarian Investor PremiumHome Prices, Consumer Confidence, Some EarningsGood morning contrarians! Welcome to the Daily Contrarian, our morning look at events likely to move markets. It is Tuesday, Sept. 24. The Bottom Line segment of today’s podcast starts at (3:32) and Stocks on the Contrarian Radar©️ at (5:06) for listeners who want to skip ahead.State of PlayAs we eye our board of indicators for signs of direction at 0655 things are pretty quiet with the exception of commodities:* Stock index futures are barely moving from the break-even point. The Nasdaq is up 0.3%;* Commodities are showing some signs of life however, with...2024-09-2408 min

Contrarian Investor PremiumHome Prices, Consumer Confidence, Some EarningsGood morning contrarians! Welcome to the Daily Contrarian, our morning look at events likely to move markets. It is Tuesday, Sept. 24. The Bottom Line segment of today’s podcast starts at (3:32) and Stocks on the Contrarian Radar©️ at (5:06) for listeners who want to skip ahead.State of PlayAs we eye our board of indicators for signs of direction at 0655 things are pretty quiet with the exception of commodities:* Stock index futures are barely moving from the break-even point. The Nasdaq is up 0.3%;* Commodities are showing some signs of life however, with...2024-09-2408 min Contrarian Investor PremiumFed WeekGood morning contrarians! Welcome to the Daily Contrarian, our morning look at events likely to move markets. It is Monday, Sept. 16. The Bottom Line segment of today’s podcast starts at (1:52) and Stocks on the Contrarian Radar©️ at (3:29) for listeners who want to skip ahead.State of PlayAs we eye our board of indicators for signs of direction at 0650 there is not an awful lot to go on:* Stock index futures are quiet with the exception of small caps, which are moving higher. The Russell 2000 is up 0.6%;* Commodities aren’t doing m...2024-09-1607 min

Contrarian Investor PremiumFed WeekGood morning contrarians! Welcome to the Daily Contrarian, our morning look at events likely to move markets. It is Monday, Sept. 16. The Bottom Line segment of today’s podcast starts at (1:52) and Stocks on the Contrarian Radar©️ at (3:29) for listeners who want to skip ahead.State of PlayAs we eye our board of indicators for signs of direction at 0650 there is not an awful lot to go on:* Stock index futures are quiet with the exception of small caps, which are moving higher. The Russell 2000 is up 0.6%;* Commodities aren’t doing m...2024-09-1607 min Contrarian Investor PremiumConsumer Price Index, Election ResetGood morning contrarians! Welcome to the Daily Contrarian, our morning look at events likely to move markets. It is Wednesday, Sept. 11. The Bottom Line segment of today’s podcast starts at (3:25) and Stocks on the Contrarian Radar©️ at (5:36) for listeners who want to skip ahead.State of PlayAs we eye our board of indicators for signs of direction at 0655, the outlook would appear to be mixed:* Stock index futures are pointing to a lower open, led by small caps. The Russell 2000 is down 0.4% with S&P 500 and Nasdaq futures down 0.2% each;* C...2024-09-1108 min

Contrarian Investor PremiumConsumer Price Index, Election ResetGood morning contrarians! Welcome to the Daily Contrarian, our morning look at events likely to move markets. It is Wednesday, Sept. 11. The Bottom Line segment of today’s podcast starts at (3:25) and Stocks on the Contrarian Radar©️ at (5:36) for listeners who want to skip ahead.State of PlayAs we eye our board of indicators for signs of direction at 0655, the outlook would appear to be mixed:* Stock index futures are pointing to a lower open, led by small caps. The Russell 2000 is down 0.4% with S&P 500 and Nasdaq futures down 0.2% each;* C...2024-09-1108 min Contrarian Investor PremiumChina Trade, Oracle Earnings to Keep Relief Rally GoingGood morning contrarians! Welcome to the Daily Contrarian, our morning look at events likely to move markets. It is Tuesday, Sept. 10. The Bottom Line segment of today’s podcast starts at (2:41) and Stocks on the Contrarian Radar©️ at (4:41) for listeners who want to skip ahead.State of PlayStocks advanced yesterday on no news with S&P 500 and Nasdaq advancing more than 1% each. Good news from Oracle ($ORCL ) earnings after the close has that stock up 9% overnight. As we eye our board of indicators for signs of direction at 0655 there isn’t much to go by quit...2024-09-1008 min

Contrarian Investor PremiumChina Trade, Oracle Earnings to Keep Relief Rally GoingGood morning contrarians! Welcome to the Daily Contrarian, our morning look at events likely to move markets. It is Tuesday, Sept. 10. The Bottom Line segment of today’s podcast starts at (2:41) and Stocks on the Contrarian Radar©️ at (4:41) for listeners who want to skip ahead.State of PlayStocks advanced yesterday on no news with S&P 500 and Nasdaq advancing more than 1% each. Good news from Oracle ($ORCL ) earnings after the close has that stock up 9% overnight. As we eye our board of indicators for signs of direction at 0655 there isn’t much to go by quit...2024-09-1008 min American NuthouseThe Reason(s) for The Dyspeptic ContrarianWith nothing much going on in the presidential campaign this week, except for more dyed in the wool Republicans coming out for Kamala Harris, I decided to regale you with the origin story of the Dyspeptic Contrarian.You've heard me rant about a lot of this before, so please forgive me. I just figured that these things were important enough to bare repeating.There are lots of headlines as well, so please sit back and enjoy and be grateful that for all its faults we still inhabit the greatest country on Earth. 2024-09-0845 min

American NuthouseThe Reason(s) for The Dyspeptic ContrarianWith nothing much going on in the presidential campaign this week, except for more dyed in the wool Republicans coming out for Kamala Harris, I decided to regale you with the origin story of the Dyspeptic Contrarian.You've heard me rant about a lot of this before, so please forgive me. I just figured that these things were important enough to bare repeating.There are lots of headlines as well, so please sit back and enjoy and be grateful that for all its faults we still inhabit the greatest country on Earth. 2024-09-0845 min Contrarian Investor PremiumManufacturing PMIs, Construction SpendingGood morning contrarians! Welcome to the Daily Contrarian, our morning look at events likely to move markets. It is Tuesday, Sept. 3. The Bottom Line segment of today’s podcast starts at (4:19) for listeners who want to skip ahead.State of PlayIt was a quiet, long holiday weekend in the US. Now September trading is about to get underway and with it the last month of the third quarter. As we eye our board of indicators for signs of direction at 0645, some risk-off is clearly developing in all but one area on our board:...2024-09-0307 min

Contrarian Investor PremiumManufacturing PMIs, Construction SpendingGood morning contrarians! Welcome to the Daily Contrarian, our morning look at events likely to move markets. It is Tuesday, Sept. 3. The Bottom Line segment of today’s podcast starts at (4:19) for listeners who want to skip ahead.State of PlayIt was a quiet, long holiday weekend in the US. Now September trading is about to get underway and with it the last month of the third quarter. As we eye our board of indicators for signs of direction at 0645, some risk-off is clearly developing in all but one area on our board:...2024-09-0307 min Contrarian Investor PremiumJobless Claims, PMIs, Jackson Hole Kick-OffGood morning contrarians! Welcome to the Daily Contrarian, our morning look at events likely to move markets. It is Thursday, Aug. 22. The Bottom Line segment of today’s podcast starts at (5:56) and Stocks on the Contrarian Radar at (7:25) for listeners who want to skip ahead.State of PlayThe big news yesterday came from the Bureau of Labor Statistics revising its annual jobs growth downward by some 800,000 jobs, or almost 30%. The market didn’t seem too bothered by this and closed higher anyway. As we look at our board of indicators for signs of direction at 0...2024-08-2211 min

Contrarian Investor PremiumJobless Claims, PMIs, Jackson Hole Kick-OffGood morning contrarians! Welcome to the Daily Contrarian, our morning look at events likely to move markets. It is Thursday, Aug. 22. The Bottom Line segment of today’s podcast starts at (5:56) and Stocks on the Contrarian Radar at (7:25) for listeners who want to skip ahead.State of PlayThe big news yesterday came from the Bureau of Labor Statistics revising its annual jobs growth downward by some 800,000 jobs, or almost 30%. The market didn’t seem too bothered by this and closed higher anyway. As we look at our board of indicators for signs of direction at 0...2024-08-2211 min Contrarian Investor PremiumRetailer Earnings, FOMC Meeting MinutesGood morning contrarians! Welcome to the Daily Contrarian, our morning look at events likely to move markets. It is Wednesday, Aug. 21. The Bottom Line segment of today’s podcast starts at (3:27) and Stocks on the Contrarian Radar at (5:02) for listeners who want to skip ahead.State of PlayYesterday was a quiet session as anticipated but the S&P 500 and Nasdaq did drop for the first time in nine trading days. As we look at our board of indicators at 0645, things are pretty quiet:* Stock index futures are flat with the exception of sm...2024-08-2110 min

Contrarian Investor PremiumRetailer Earnings, FOMC Meeting MinutesGood morning contrarians! Welcome to the Daily Contrarian, our morning look at events likely to move markets. It is Wednesday, Aug. 21. The Bottom Line segment of today’s podcast starts at (3:27) and Stocks on the Contrarian Radar at (5:02) for listeners who want to skip ahead.State of PlayYesterday was a quiet session as anticipated but the S&P 500 and Nasdaq did drop for the first time in nine trading days. As we look at our board of indicators at 0645, things are pretty quiet:* Stock index futures are flat with the exception of sm...2024-08-2110 min Contrarian Investor PremiumA Few Earnings to Start a Slow Week…Good morning contrarians! Welcome to the Daily Contrarian, our morning look at events likely to move markets. It is Monday, Aug. 19. The Bottom Line segment of today’s podcast starts at (3:27) and Stocks on the Contrarian Radar at (6:18) for listeners who want to skip ahead.State of PlayAs we look at our board of indicators for signs of direction at 0700, all is pretty quiet:* Stock index futures are mostly unchanged. Only the Russell 2000 which tracks small caps is moving at all from the break-even point, up 0.2%;* Cryptos are dr...2024-08-1910 min

Contrarian Investor PremiumA Few Earnings to Start a Slow Week…Good morning contrarians! Welcome to the Daily Contrarian, our morning look at events likely to move markets. It is Monday, Aug. 19. The Bottom Line segment of today’s podcast starts at (3:27) and Stocks on the Contrarian Radar at (6:18) for listeners who want to skip ahead.State of PlayAs we look at our board of indicators for signs of direction at 0700, all is pretty quiet:* Stock index futures are mostly unchanged. Only the Russell 2000 which tracks small caps is moving at all from the break-even point, up 0.2%;* Cryptos are dr...2024-08-1910 min Contrarian Investor PremiumConsumer PricesGood morning contrarians! Welcome to the Daily Contrarian, our morning look at events likely to move markets. It is Wednesday, Aug. 14. The Bottom Line segment of today’s podcast starts at (2:35) and Stocks on the Contrarian Radar at (4:47) for listeners who want to skip ahead.State of PlayStocks rallied yesterday after producer prices showed more signs of dropping inflation. As we look at our board of indicators for signs of direction at 0640, some risk-on appears to be developing ahead of the CPI at 0830:* Stock index futures are flat with the exception of sm...2024-08-1410 min

Contrarian Investor PremiumConsumer PricesGood morning contrarians! Welcome to the Daily Contrarian, our morning look at events likely to move markets. It is Wednesday, Aug. 14. The Bottom Line segment of today’s podcast starts at (2:35) and Stocks on the Contrarian Radar at (4:47) for listeners who want to skip ahead.State of PlayStocks rallied yesterday after producer prices showed more signs of dropping inflation. As we look at our board of indicators for signs of direction at 0640, some risk-on appears to be developing ahead of the CPI at 0830:* Stock index futures are flat with the exception of sm...2024-08-1410 min Contrarian Investor PremiumAll Eyes on Jobless ClaimsGood morning contrarians! Welcome to the Daily Contrarian, our morning look at events likely to move markets. It is Thursday, Aug. 8. The Bottom Line segment of today’s podcast starts at (4:36), with ‘Stocks on the Contrarian Radar’ commencing at (7:47) for listeners who want to skip ahead.State of PlayStocks bounced around yesterday, rallying big at the open then dropping into the close. As we look at our board of indicators for signs of direction at 0630, the mood seems to be one of caution:* Stock index futures are pointing to a lower open, but th...2024-08-0810 min

Contrarian Investor PremiumAll Eyes on Jobless ClaimsGood morning contrarians! Welcome to the Daily Contrarian, our morning look at events likely to move markets. It is Thursday, Aug. 8. The Bottom Line segment of today’s podcast starts at (4:36), with ‘Stocks on the Contrarian Radar’ commencing at (7:47) for listeners who want to skip ahead.State of PlayStocks bounced around yesterday, rallying big at the open then dropping into the close. As we look at our board of indicators for signs of direction at 0630, the mood seems to be one of caution:* Stock index futures are pointing to a lower open, but th...2024-08-0810 min Contrarian Investor PremiumEarnings + Fed + Payrolls = Another Big WeekGood morning contrarians! Welcome to the Daily Contrarian, our morning look at events likely to move markets. It is Monday, July 29. The Bottom Line segment of today’s podcast starts at (3:29) for listeners who want to skip ahead. Be sure to check out the new ‘Stocks on the Contrarian Radar’ segment at the bottom of this page and (4:39) on the podcast.State of PlayStocks rallied on Friday, recovering some ground from the previous trading days. As we look at our board of indicators for signs of direction at 0645, risk on seems to be the story...2024-07-2908 min

Contrarian Investor PremiumEarnings + Fed + Payrolls = Another Big WeekGood morning contrarians! Welcome to the Daily Contrarian, our morning look at events likely to move markets. It is Monday, July 29. The Bottom Line segment of today’s podcast starts at (3:29) for listeners who want to skip ahead. Be sure to check out the new ‘Stocks on the Contrarian Radar’ segment at the bottom of this page and (4:39) on the podcast.State of PlayStocks rallied on Friday, recovering some ground from the previous trading days. As we look at our board of indicators for signs of direction at 0645, risk on seems to be the story...2024-07-2908 min Contrarian Investor PremiumPCE Deflator, More Volatility for StocksGood morning contrarians! Welcome to the Daily Contrarian, our morning look at events likely to move markets. It is Friday, July 26. The Bottom Line segment of today’s podcast starts at (3:55) for listeners who want to skip ahead. Be sure to check out the new ‘Stocks on the Contrarian Radar’ segment at the bottom of this page and (6:17) on the podcast.State of PlayStocks got bounced around yesterday, with tech selling off anew. Small caps rallied however. All of this on no apparent news, though second-quarter GDP did exceed estimates, which briefly helped sentiment yester...2024-07-2609 min

Contrarian Investor PremiumPCE Deflator, More Volatility for StocksGood morning contrarians! Welcome to the Daily Contrarian, our morning look at events likely to move markets. It is Friday, July 26. The Bottom Line segment of today’s podcast starts at (3:55) for listeners who want to skip ahead. Be sure to check out the new ‘Stocks on the Contrarian Radar’ segment at the bottom of this page and (6:17) on the podcast.State of PlayStocks got bounced around yesterday, with tech selling off anew. Small caps rallied however. All of this on no apparent news, though second-quarter GDP did exceed estimates, which briefly helped sentiment yester...2024-07-2609 min Contrarian Investor PremiumPMIs, More EarningsGood morning contrarians! Welcome to the Daily Contrarian, our morning look at events likely to move markets. It is Wednesday, July 24. The Bottom Line segment of today’s podcast starts at (3:27) for listeners who want to skip ahead. Be sure to check out the new ‘Stocks on the Contrarian Radar’ segment at the bottom of this page and (5:24) on the podcast.State of PlayYesterday was pretty uneventful, though the Russell 2000 which tracks small caps did manage to rally by 1%, recapturing levels from last week. After the close Tesla ($TSLA ) earnings fell short of estimates, causin...2024-07-2409 min

Contrarian Investor PremiumPMIs, More EarningsGood morning contrarians! Welcome to the Daily Contrarian, our morning look at events likely to move markets. It is Wednesday, July 24. The Bottom Line segment of today’s podcast starts at (3:27) for listeners who want to skip ahead. Be sure to check out the new ‘Stocks on the Contrarian Radar’ segment at the bottom of this page and (5:24) on the podcast.State of PlayYesterday was pretty uneventful, though the Russell 2000 which tracks small caps did manage to rally by 1%, recapturing levels from last week. After the close Tesla ($TSLA ) earnings fell short of estimates, causin...2024-07-2409 min Contrarian Investor PremiumBiden Quits Race, A Big Week for EarningsGood morning contrarians! Welcome to the Daily Contrarian, our morning look at events likely to move markets. It is Monday, July 22. The Bottom Line segment of today’s podcast starts at (4:03) for listeners who want to skip ahead. Be sure to check out the brand new ‘Stocks on the Contrarian Radar’ segment at the bottom of this page and (5:25) on the podcast.State of PlayPresident Biden finally quit the presidential race yesterday, endorsing Vice President Harris. This does not appear to have affected betting markets any. For our purposes it doesn’t have much of an ec...2024-07-2209 min

Contrarian Investor PremiumBiden Quits Race, A Big Week for EarningsGood morning contrarians! Welcome to the Daily Contrarian, our morning look at events likely to move markets. It is Monday, July 22. The Bottom Line segment of today’s podcast starts at (4:03) for listeners who want to skip ahead. Be sure to check out the brand new ‘Stocks on the Contrarian Radar’ segment at the bottom of this page and (5:25) on the podcast.State of PlayPresident Biden finally quit the presidential race yesterday, endorsing Vice President Harris. This does not appear to have affected betting markets any. For our purposes it doesn’t have much of an ec...2024-07-2209 min Contrarian Investor PremiumTSM Earnings BeatGood morning contrarians! Welcome to the Daily Contrarian, our morning look at events likely to move markets. It is Thursday, July 18. The Bottom Line segment of today’s podcast starts at (3:04) for listeners who want to skip ahead. Be sure to check out the brand new ‘Stocks on the Contrarian Radar’ segment at the bottom of this page and (4:24) on the podcast.State of PlayStocks dropped yesterday as tech got beaten up. The Nasdaq fell by almost 3% for its worst day since late 2022. The selling was not broad-based however as Dow Industrials closed at fresh...2024-07-1808 min

Contrarian Investor PremiumTSM Earnings BeatGood morning contrarians! Welcome to the Daily Contrarian, our morning look at events likely to move markets. It is Thursday, July 18. The Bottom Line segment of today’s podcast starts at (3:04) for listeners who want to skip ahead. Be sure to check out the brand new ‘Stocks on the Contrarian Radar’ segment at the bottom of this page and (4:24) on the podcast.State of PlayStocks dropped yesterday as tech got beaten up. The Nasdaq fell by almost 3% for its worst day since late 2022. The selling was not broad-based however as Dow Industrials closed at fresh...2024-07-1808 min Contrarian Investor PremiumConsumer Prices, Earnings SeasonGood morning contrarians! Welcome to the Daily Contrarian, our morning look at events likely to move markets. It is Thursday, July 11. The Bottom Line segment of today’s podcast starts at (2:33) for listeners who want to skip ahead. Be sure to check out the new ‘Stocks on the Contrarian Radar’ section at the bottom of this page and (4:30) on the podcast.State of PlayStocks put in a broad-based rally yesterday, with major indexes surging into the close to gain north of 1% on the day. The S&P 500 and Nasdaq closed at fresh record highs yet ag...2024-07-1109 min

Contrarian Investor PremiumConsumer Prices, Earnings SeasonGood morning contrarians! Welcome to the Daily Contrarian, our morning look at events likely to move markets. It is Thursday, July 11. The Bottom Line segment of today’s podcast starts at (2:33) for listeners who want to skip ahead. Be sure to check out the new ‘Stocks on the Contrarian Radar’ section at the bottom of this page and (4:30) on the podcast.State of PlayStocks put in a broad-based rally yesterday, with major indexes surging into the close to gain north of 1% on the day. The S&P 500 and Nasdaq closed at fresh record highs yet ag...2024-07-1109 min Contrarian Investor PremiumNon-Farm Payrolls, Bitcoin Bear MarketGood morning contrarians! Welcome to the Daily Contrarian, our morning look at events likely to move markets. It is Friday, July 5. The Bottom Line segment of today’s podcast starts at (2:54) for listeners who want to skip ahead. Be sure to check out the new ‘One Year Ago Today’ section at the bottom of this page.State of PlayWelcome back from the July 4 holiday. We had elections in the UK and Bitcoin enter a bear market after this latest turn for the worse. As we eye our board of indicators for signs of direction at 055...2024-07-0509 min

Contrarian Investor PremiumNon-Farm Payrolls, Bitcoin Bear MarketGood morning contrarians! Welcome to the Daily Contrarian, our morning look at events likely to move markets. It is Friday, July 5. The Bottom Line segment of today’s podcast starts at (2:54) for listeners who want to skip ahead. Be sure to check out the new ‘One Year Ago Today’ section at the bottom of this page.State of PlayWelcome back from the July 4 holiday. We had elections in the UK and Bitcoin enter a bear market after this latest turn for the worse. As we eye our board of indicators for signs of direction at 055...2024-07-0509 min Contrarian Investor PremiumQuiet Summer Friday or Fear of ‘Higher for Longer’ Fed?Good morning contrarians! Welcome to the Daily Contrarian, our morning look at events likely to move markets. It is Friday, May 27. The Bottom Line segment of today’s podcast starts at (2:57) for listeners who want to skip ahead. Be sure to check out the new ‘One Year Ago Today’ segment at the bottom of this page.State of PlayStocks sold off yesterday as Nvidia ($NVDA ) earnings failed to carry the rest of the market. Reasons for the sell-off were not immediately obvious. Purchasing Manager Indexes came in well ahead of forecasts, which may have create...2024-05-2406 min

Contrarian Investor PremiumQuiet Summer Friday or Fear of ‘Higher for Longer’ Fed?Good morning contrarians! Welcome to the Daily Contrarian, our morning look at events likely to move markets. It is Friday, May 27. The Bottom Line segment of today’s podcast starts at (2:57) for listeners who want to skip ahead. Be sure to check out the new ‘One Year Ago Today’ segment at the bottom of this page.State of PlayStocks sold off yesterday as Nvidia ($NVDA ) earnings failed to carry the rest of the market. Reasons for the sell-off were not immediately obvious. Purchasing Manager Indexes came in well ahead of forecasts, which may have create...2024-05-2406 min Contrarian Investor PremiumMore EarningsGood morning contrarians! Welcome to the Daily Contrarian, our morning look at events likely to move markets. It is Thursday, May 9. The Bottom Line segment of today’s podcast starts at (2:15) for listeners who want to skip ahead. Be sure to check out the brand new ‘One Year Ago Today’ segment at the bottom of this page.State of PlayStocks were roughly unchanged yesterday in another quiet session. After the close Airbnb ($ABNB ) earnings disappointed investors and the stock dropped overnight. As we look at our board of indicators at 0630, risk appetite seems to be aba...2024-05-0903 min

Contrarian Investor PremiumMore EarningsGood morning contrarians! Welcome to the Daily Contrarian, our morning look at events likely to move markets. It is Thursday, May 9. The Bottom Line segment of today’s podcast starts at (2:15) for listeners who want to skip ahead. Be sure to check out the brand new ‘One Year Ago Today’ segment at the bottom of this page.State of PlayStocks were roughly unchanged yesterday in another quiet session. After the close Airbnb ($ABNB ) earnings disappointed investors and the stock dropped overnight. As we look at our board of indicators at 0630, risk appetite seems to be aba...2024-05-0903 min Contrarian Investor PremiumNon-Farm PayrollsGood morning contrarians! Welcome to the Daily Contrarian, our morning look at events likely to move markets. It is Friday, May 3. The Bottom Line segment of today’s podcast starts at (2:00) for listeners who want to skip ahead. Be sure to check out the brand new ‘One Year Ago Today’ segment at the bottom of this page.State of PlayStocks advanced yesterday and got more good news after the close with Apple ($AAPL ) earnings. As we look at our board of indicators at 0630, it looks like risk-on is emerging ahead of non-farm payrolls at 0830:...2024-05-0304 min

Contrarian Investor PremiumNon-Farm PayrollsGood morning contrarians! Welcome to the Daily Contrarian, our morning look at events likely to move markets. It is Friday, May 3. The Bottom Line segment of today’s podcast starts at (2:00) for listeners who want to skip ahead. Be sure to check out the brand new ‘One Year Ago Today’ segment at the bottom of this page.State of PlayStocks advanced yesterday and got more good news after the close with Apple ($AAPL ) earnings. As we look at our board of indicators at 0630, it looks like risk-on is emerging ahead of non-farm payrolls at 0830:...2024-05-0304 min Contrarian Investor PremiumProspects of a 'Higher for Longer' Fed…Good morning contrarians! Welcome to the Daily Contrarian, our morning look at events likely to move markets. It is Wednesday, May 1. Happy May Day. Happy Fed Day. The Bottom Line segment of today’s podcast starts at (4:11) for listeners who want to skip ahead. Be sure to check out the brand new ‘One Year Ago Today’ segment at the bottom of this page.State of PlayStocks and bonds sold off yesterday for no reason that was immediately apparent. Then there were some bad earnings after the close with AMD ($AMD ), SuperMicro ($SMCI ), and Starbucks ($SBUX...2024-05-0107 min

Contrarian Investor PremiumProspects of a 'Higher for Longer' Fed…Good morning contrarians! Welcome to the Daily Contrarian, our morning look at events likely to move markets. It is Wednesday, May 1. Happy May Day. Happy Fed Day. The Bottom Line segment of today’s podcast starts at (4:11) for listeners who want to skip ahead. Be sure to check out the brand new ‘One Year Ago Today’ segment at the bottom of this page.State of PlayStocks and bonds sold off yesterday for no reason that was immediately apparent. Then there were some bad earnings after the close with AMD ($AMD ), SuperMicro ($SMCI ), and Starbucks ($SBUX...2024-05-0107 min Contrarian Investor PremiumAnother Massive Week for Earnings. Plus Fed, NFPs…Good morning contrarians! Welcome to the Daily Contrarian, our morning look at events likely to move markets. It is Monday, April 29. The Bottom Line segment of today’s podcast starts at (2:43) for listeners who want to skip ahead. Be sure to check out the brand new ‘One Year Ago Today’ segment at the bottom of this page.State of PlayStocks rallied on Friday after the PCE Deflator came in as forecast. As we look at our board of indicators at 0635, there are no clear signs of direction just yet ahead of a big week of ear...2024-04-2903 min

Contrarian Investor PremiumAnother Massive Week for Earnings. Plus Fed, NFPs…Good morning contrarians! Welcome to the Daily Contrarian, our morning look at events likely to move markets. It is Monday, April 29. The Bottom Line segment of today’s podcast starts at (2:43) for listeners who want to skip ahead. Be sure to check out the brand new ‘One Year Ago Today’ segment at the bottom of this page.State of PlayStocks rallied on Friday after the PCE Deflator came in as forecast. As we look at our board of indicators at 0635, there are no clear signs of direction just yet ahead of a big week of ear...2024-04-2903 min Contrarian Investor PremiumPCE Deflator to Crash Tech Party?Good morning contrarians! Welcome to the Daily Contrarian, our morning look at events likely to move markets. It is Friday, April 26. The Bottom Line segment of today’s podcast starts at (4:02) for listeners who want to skip ahead. Be sure to check out the brand new ‘One Year Ago Today’ segment at the bottom of this page. State of PlayStocks dropped yesterday after first-quarter GDP came in below forecasts while inflation data ran a bit hot. After the close Google ($GOOG ) and Microsoft ($MSFT ) reported stellar earnings and those stocks rallied overnight as a result...2024-04-2607 min

Contrarian Investor PremiumPCE Deflator to Crash Tech Party?Good morning contrarians! Welcome to the Daily Contrarian, our morning look at events likely to move markets. It is Friday, April 26. The Bottom Line segment of today’s podcast starts at (4:02) for listeners who want to skip ahead. Be sure to check out the brand new ‘One Year Ago Today’ segment at the bottom of this page. State of PlayStocks dropped yesterday after first-quarter GDP came in below forecasts while inflation data ran a bit hot. After the close Google ($GOOG ) and Microsoft ($MSFT ) reported stellar earnings and those stocks rallied overnight as a result...2024-04-2607 min Contrarian Investor PremiumA Few Earnings, Fed Beige BookGood morning contrarians! Welcome to the Daily Contrarian, our morning look at events likely to to move markets. It is Wednesday, April 17. The Bottom Line segment of today’s podcast starts at (2:50) for listeners who want to skip ahead.State of PlayStocks finished roughly flat yesterday after selling off early in the session. Fed Chair Jerome Powell said what should have been obvious, which is that the Fed needs to see more progress on inflation before they can cut interest rates. Perhaps because it was obvious, markets didn’t react as much as they migh...2024-04-1706 min

Contrarian Investor PremiumA Few Earnings, Fed Beige BookGood morning contrarians! Welcome to the Daily Contrarian, our morning look at events likely to to move markets. It is Wednesday, April 17. The Bottom Line segment of today’s podcast starts at (2:50) for listeners who want to skip ahead.State of PlayStocks finished roughly flat yesterday after selling off early in the session. Fed Chair Jerome Powell said what should have been obvious, which is that the Fed needs to see more progress on inflation before they can cut interest rates. Perhaps because it was obvious, markets didn’t react as much as they migh...2024-04-1706 min Contrarian Investor PremiumGeopolitical Risk Returns, or NotGood morning contrarians! Welcome to the Daily Contrarian, our morning look at events likely to move markets. It is Monday, April 15. Tax Day. The Bottom Line segment of today’s podcast starts at (6:20) for listeners who want to skip ahead.State of PlayIt was not what one would call a quiet weekend as news of Iran attacking Israel broke on Saturday afternoon. Cryptos initially sold off in a major way before rebounding as the attacks did little damage and a response from Israel has yet to materialize. As we look at our board of in...2024-04-1508 min

Contrarian Investor PremiumGeopolitical Risk Returns, or NotGood morning contrarians! Welcome to the Daily Contrarian, our morning look at events likely to move markets. It is Monday, April 15. Tax Day. The Bottom Line segment of today’s podcast starts at (6:20) for listeners who want to skip ahead.State of PlayIt was not what one would call a quiet weekend as news of Iran attacking Israel broke on Saturday afternoon. Cryptos initially sold off in a major way before rebounding as the attacks did little damage and a response from Israel has yet to materialize. As we look at our board of in...2024-04-1508 min Contrarian Investor PremiumProducer PricesGood morning contrarians! Welcome to the Daily Contrarian, our morning look at events likely to move markets. It is Thursday, April 11. The Bottom Line segment of today’s podcast starts at (3:53) for listeners who want to skip ahead.State of PlayStocks dropped yesterday after a hotter-than-anticipated CPI, but finished off the lows. Small caps saw the worst of it with the Russell 2000 giving up 2.8%. Bonds got beat up, especially at the short end of the curve, which makes sense given what the CPI says about Fed policy. As we look at our board of in...2024-04-1105 min

Contrarian Investor PremiumProducer PricesGood morning contrarians! Welcome to the Daily Contrarian, our morning look at events likely to move markets. It is Thursday, April 11. The Bottom Line segment of today’s podcast starts at (3:53) for listeners who want to skip ahead.State of PlayStocks dropped yesterday after a hotter-than-anticipated CPI, but finished off the lows. Small caps saw the worst of it with the Russell 2000 giving up 2.8%. Bonds got beat up, especially at the short end of the curve, which makes sense given what the CPI says about Fed policy. As we look at our board of in...2024-04-1105 min Contrarian Investor PremiumInflation EveGood morning contrarians! Welcome to the Daily Contrarian, our morning look at events likely to move markets. It is Tuesday, April 9. The Bottom Line segment of today’s podcast starts at (3:30) for listeners who want to skip ahead.State of PlayStocks did absolutely nothing yesterday. It was a quiet trading day as anticipated in light of the dearth of known events. As we look at our board of indicators at 0630, all is quiet once again on the eve of the CPI:* Stock index futures are basically flat again. No major index is mo...2024-04-0905 min