Shows

The 95 Podcast: Conversations for Small-Church PastorsBurn The Boxes: Becoming Who God Made You To Be As A Pastor's Wife (w/ Whitney Shafer) - Episode 310Whitney Shafer is a pastor’s wife, a certified mental health coach, and the founder of Vibrant, a space created just for women in ministry who feel stretched thin and overlooked.After more than 25 years in church life, she has seen how easily pastors’ wives lose themselves in expectations they were never meant to carry. That’s why she wrote Burn the Boxes! Whitney wants to help you rediscover who you are in Christ and start walking in freedom again.Today's podcast conversation is peels back the curtain to the secret struggles that many wives of pastor...

2025-11-0454 min

The 95 Podcast: Conversations for Small-Church PastorsFinding Support Through G6 Allies (w/ Michael Shafer) - Episode 303Dr. Michael Shafer is a seasoned pastor and the Executive Director of G6 Allies, a ministry dedicated to equipping pastors and their families with the tools they need to be resilient leaders who build healthy churches.He’s also the creator of Stocks for Pastors, a financial education platform that helps ministry leaders invest wisely and build long-term financial confidence. Dr. Shafer teaches the same biblically grounded investing strategies he has used personally for more than 15 years to supplement his ministry income. His passion is to help pastors defeat the financial challenges that often come with ministry so the...

2025-09-1653 min

It's Murder, Y'allEp 35 - The Gatlinburg Hotel MurdersGatlinburg, Tennessee, is a mountain resort town known for the beauty of the surrounding Great Smoky Mountains. In the 1980s, however, brutal murders at two local hotels--The Rocky Top Village Inn and the Holiday Inn--would change the area forever and introduce some infamous Gatlinburg ghost stories.

Come follow us on Instagram: @itsmurderyall

Our website is finally up and running (woot woot!): itsmurderyall.com

Sources

State of Tennessee v. Joseph Charles DeModica (1990)

State of Tennessee v. Edward Leroy Haris (1992)

Waxman, L. (1988, August 30). Slaying suspect ‘ready, willing’ to participate, prosecutor says. The...

2024-07-061h 01

The Other 22 HoursAna Egge on co-writing with your dreams, meditation practice, and skateboarding.Ana Egge - who Lucinda Williams calls 'the folk music Nina Simone' - has released 13+ records, starting with her first in 1994, and including some produced by Steve Earle, is a luthier, and has toured with John Prine, Shawn Colvin, Jimmie Dale Gilmore, Ron Sexmith, Lucinda, and Iris Dement amongst others. In one of our more intriguingly esoteric conversations, we talk a lot about meditation practice and how that influences your creativity and approach to your career as a whole, as well as how Ana stumbled across her incredible practice of co-writing with her own dreams!Get more...

2024-04-2441 min

The Financial Purpose PodcastEp 39: Election Economics & The Battleground of NarrativesClients always want to know what I think politically and where I stand. In this episode, I share some data on the economy and even my opinion of the two presidential candidates and how their campaigns will likely spin narratives around economic data to their favor. As observers and participants in this democratic process, it’s essential to navigate these narratives wisely, armed with a comprehensive understanding of objective economic truths and their broader implications.Reference sources:GDP data: https://www.bea.gov/news/2024/gross-domestic-product-fourth-quarter-and-year-2023-third-estimate-gdp-industry-andTrade defcit data: ht...

2024-04-1649 min

The Financial Purpose PodcastEp 38: The Final ChecklistThis topic has been heavy on my heart for a few weeks. March was an interesting month for our family, a mix of deep loss and also life stage celebration. In reflection, it’s been a stark reminder of my need - and your need - to place a better and more meaningful focus on a subject none of us like to think about but absolutely need to prepare for: the end of life. Listen to this episode as I bust 8 common estate planning myths and share 5 things you can do NOW to protect your loved ones wh...

2024-04-0939 min

The Financial Purpose PodcastEp 37: How to use EBITDA to drive your businessIf you’re running a business, you’ve probably come across the term EBITDA. Understanding this metric can be incredibly useful, providing insights into your company’s operating performance and helping to shape your strategic decisions.EBITDA is an acronym that stands for Earnings Before Interest, Taxes, Depreciation, and Amortization. It zeros in on the earnings from your business's core operations by leaving out expenses that can vary widely between different companies, such as tax rates and interest expenses. This gives you a cleaner measure of your company’s profitability from its day-to-day activities.Listen to this...

2024-03-2633 min

Preacher Feature- 1450Is America Too Far Gone?- Featuring Dale PollardIt is a wonderful blessing to get to live in America, but our country is in a dire situation. What do we need to do to get back on track?

2024-03-0932 min

The Financial Purpose PodcastEp 36: To Bitcoin, or Not To Bitcoin?Bitcoin ETFs are officially available on US listed exchanges. This is a significant development in crypto trading. These ETFs providing greater access to the volatile yet potentially rewarding world of cryptocurrencies, particularly Bitcoin.As with any investment, careful consideration is crucial. Cryptocurrency is still is a tricky asset class for many investors when it comes to deciding if, when, and how much to invest.In this episode, I’ll break down some key factors to keep in mind when deciding how much crypto exposure may be right for your investment portfolio.Thanks fo...

2024-02-0637 min

The Financial Purpose PodcastEp 35: Corporate Transparency ActOriginally passed in 2021, the Corporate Transparency Act is now in effect. If you own a corporation or LLC created in the U.S. and registered with your respective state, there’s a good chance you will need to take action to comply with the law. This episode features special guest Wendy Anderson, Esq., Business Attorney. Wendy has been following this law since enacted, and she joins us on the Financial Purpose Podcast to help us get prepared to meet the requirements. Listen to learn more about the Corporate Transparency Act, how it applies to you, an...

2024-01-0952 min

The Financial Purpose PodcastEp 34: The Year No One Called [Correctly]2023 might be one of the most unexpected years of all time, certainly as the markets and economy are concerned. It seemed like everyone was calling for a recession. It never came. Most unexpected might be the magnitude of the stock market rally, which looks to be ending the year with a punctuation mark!As we head into 2024, the major themes I’m watching include:* Potential for Fed rate cuts* Is the economy truly slowing based on persistently high borrowing costs and increasing household debt levels?* Stock market may see high single-digit ga...

2023-12-1931 min

The Financial Purpose PodcastEp 33: What you need to know before year endAre you financially ready for year end? In this episode I share a few factors to consider between now and December 31st, including retirement planning, tax planning, 529 planning, and estate planning. Buckle up and take notes! This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit thefinancialpurpose.substack.com

2023-11-3039 min

The Financial Purpose PodcastEp 32: $33 Trillion and uncertaintySigns of economic uncertainty are showing up in more places throughout the BIG economy, which impacts the LOCAL economy that you and I intersect every day. From home prices to mortgage rates, car prices to auto loan rates, inflation to wages, there’s evidence the economy is slowing down a little… or, at least taking a breather. As the federal government continues deficit spending without much caution for later consequence, inflation continues to be a primary factor in consumer costs and driver of fed monetary policy. What do you need to be doing as things beco...

2023-10-2645 min

The Financial Purpose PodcastEp 31: Working ON vs IN your businessMany business owners start their businesses because they see a need they can solve, they’re tired of being paid less than their true value, and they want to work for themselves rather than someone else. One day you wake up and your business is running. Revenue is coming in, costs are going out, and you’re busier than ever. Ask yourself: is your operations engine running as efficiently as it could? Are you willing to shed the number of hats you’re wearing in order for the business to reach the next level? Is your P...

2023-10-1054 min

Elementality for Financial Advisors | Elements Financial Vitals System™Simplify Financial Planning With Elements with Dale ShaferHow am I doing? Getting that question answered is often on the mind of people who seek out a financial advisor. Helping them articulate and define their financial purpose so you can provide the best answer is your challenge. On this Elementality, Abby welcomes Dale Shafer, of Life Moves Wealth Management, who explains how Elements gives clients financial clarity.

2023-10-0332 min

The Financial Purpose PodcastEp 30: Get your business house in order!In this episode of The Financial Purpose Podcast, I talk with Paloma Goggins, Corporate and M&A Attorney and founder of Nocturnal Legal. Listen for our discussion what business owners need to know about forming business entities, creating and maintaining good operating agreements, and most importantly - how to prepare for an eventual smooth exit by beginning with the end in mind. Visit https://nocturnallegal.com/ to learn more about Paloma and Nocturnal Legal.Learn more about Dale L Shafer II, CFP® and Life Moves Wealth here.

2023-10-0356 min

The Financial Purpose PodcastEp 29: How to choose the right financial advisorHave you ever wondered how to choose the right financial advisor?Whether you’re looking to work with a financial advisor for the first time, or you are looking to change advisors, the looming question in your mind might be:HOW DO I CHOOSE THE RIGHT FINANCIAL ADVISOR… FOR ME?One thing I will admit is there’s no shortage of financial advisors in the world –In fact, when it was suggested to me by a friend of mine that I should consider being a financial advisor, my response was “hey...

2023-09-0840 min

The Financial Purpose PodcastEp 28: Becoming a 1%-erToday I want to talk about becoming a 1%er.I’m not talking about those that fall in the higher earning bracket…. Although that may be a goal for some…And, I’m not talking about that particular motorcycle club either….But what I am talking about is Kaizen.Kaizen, in practice, usually delivers small improvements that yields big results over time. It starts by simply improving by 1% at a time. I have found this to be an effective way to get to where you want to be...

2023-08-1525 min

The Financial Purpose PodcastEp 27: Personal Finance is Personal!“This isn’t going to be my story anymore…”In this episode of the Financial Purpose Podcast, I'm joined by special guest Sarah VanHoose for a conversation around how to change your money story. Listen to hear how she and her husband got serious about their money values, paying off more than $500,000 of debt in three years!And, hear how she decided to leave her corporate health care career to fully launch her financial and corporate coaching business, Journey to Influence. Money shame exists all across the wealth spectrum and Sarah is on a...

2023-07-1845 min 2023-07-141h 00

2023-07-141h 00

The Financial Purpose PodcastEp 26: Unlocking Retirement Financial FreedomHeard all the bad stories about reverse mortgages? Have you heard about the many ways a reverse mortgage can actually unlock financial freedom in retirement? In this episode of the Financial Purpose Podcast I'm joined by Reverse Mortgage Specialist Andrew Kish for a conversation on the power of reverse mortgages. Learn more about Andrew here. Learn more about sound financial planning and defining your financial purpose at lifemoveswealth.com Andrew Kish NMLS #2115541 Luminate Home Loans NMLS #150953 This is a public episode. If you would...

2023-07-0654 min

The Financial Purpose PodcastEp 25: How to Stay BrokeThe term “how to stay broke” returns more than 694 MILLION Google search results! Apparently a lot of people are talking about and are concerned about this topic. A recent CNBC financial literacy survey found that 56% of respondents cited living paycheck-to-paycheck; also, 57% of people earning +$100,000 per year are concerned about the health of their personal finances. In this episode of the Financial Purpose Podcast, I identify six specific actions - or inactions - you can take to stay broke. I also offer tips along the way for breaking out of these bad financial habits.How...

2023-06-2735 min

The Virtual Ingenuity Business PodcastHow to Make Financial Decisions that Are in Alignment with Your Financial Purpose, Season 3, Episode 4Show Notes

In this episode of The Virtual Ingenuity Business Podcast, Claudine Land, Business Strategist of Virtual Ingenuity, LLC, and Dale L. Shafer II, Founder, and Financial Advisor of Life Moves Wealth Management discuss strategies to align your finances for making informed financial decisions.

Dale L Shafer II, is a CERTIFIED FINANCIAL PLANNERTM (CFP®), Accredited Portfolio Management AdvisorTM (APMA®), and Certified Divorce Financial Analyst (CDFA®). Out of the office, he is most likely found exploring outdoors and hiking with his wife or on his bike. He also rocks out behind a drum kit or a guitar and enjoys...

2023-06-2126 min

The Financial Purpose PodcastEp 24: Cracking the Marketing CodeLearn more about Claudine here: * Website: https://virtualingenuityllc.com/ * Facebook: https://www.facebook.com/Virtuallyexe* Instagram: https://www.instagram.com/virtualingenuityllc/* LinkedIn: https://www.linkedin.com/in/claudineland/* The Virtual Ingenuity Business Podcast on Apple Podcast: * The Virtual Ingenuity Business Podcast on Spotify: This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit thefinancialpurpose.substack.com

2023-06-1343 min

The Financial Purpose PodcastEp 23: Stock PickingHonest investors can attest that stock picking is hard. A strong conviction pick can lead to out-performance one year and under-performance the next. Or, vice-versa.I recently saw a discussion on Twitter among financial professionals based on the following question:Without Googling the answer, what is the best performing US stock over the last 20 years?Some of the responses included companies like:* Microsoft (MSFT)* UnitedHealth Group (UNH)* Apple (AAPL)* Amazon (AMZN)* Nvidia (NVDA)* Berkshire Hathaway (BRK'A / BRK'B)* Walmart (WMT)

2023-05-2648 min

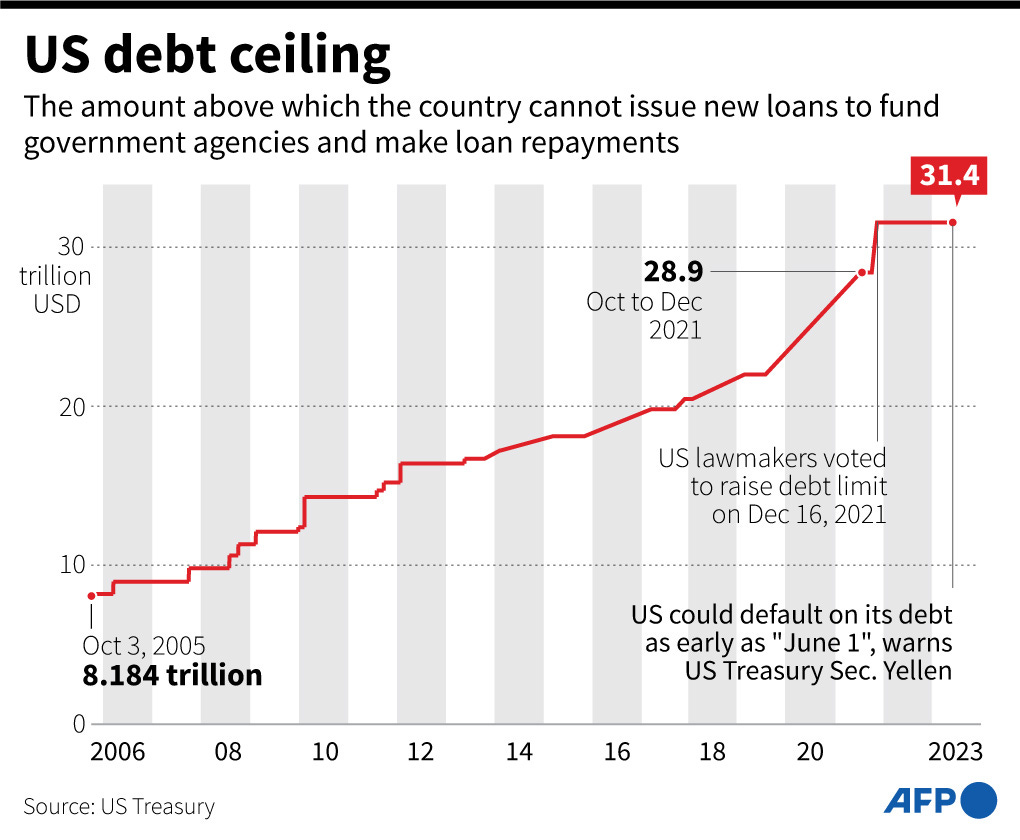

The Financial Purpose PodcastEp 22: Debt CeilingThe U.S. debt ceiling is all over the news today, so let’s talk about it.Before 1917, Congress had the ability to use the Power of the Purse at their own discretion. In effort to make the federal government fiscally responsible, the debt ceiling was created.The debt ceiling cap currently stands at roughly $31.4tn. That limit was breached back in January.Is a U.S. default likely?Since 1960, Congress has acted 78 separate times to permanently raise, temporarily extend, or revise the definition of the debt limit – 49 times under Republican presi...

2023-05-0921 min

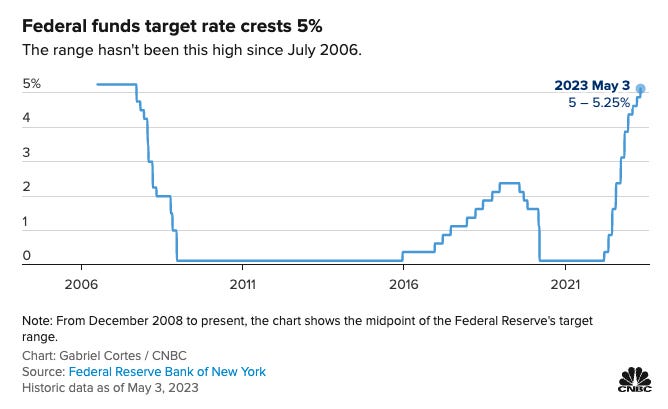

The Financial Purpose PodcastEp 21: Give me 10!The Fed raised rates again today - the 10th hike in this current cycle. Just 13 months ago the Fed funds range was 0.00%-0.25%; with today’s hike, it is now 5.00%-5.25%.The Fed funds rate is one of the primary monetary policy tools. By raising this rate, the Fed is slowing a heated economy by indirectly influencing consumer and business borrowing rates. In this episode of the Financial Purpose Podcast, I’ll explain at a high level what the Fed funds rate is, how it works, and what it could mean for the econ...

2023-05-0322 min

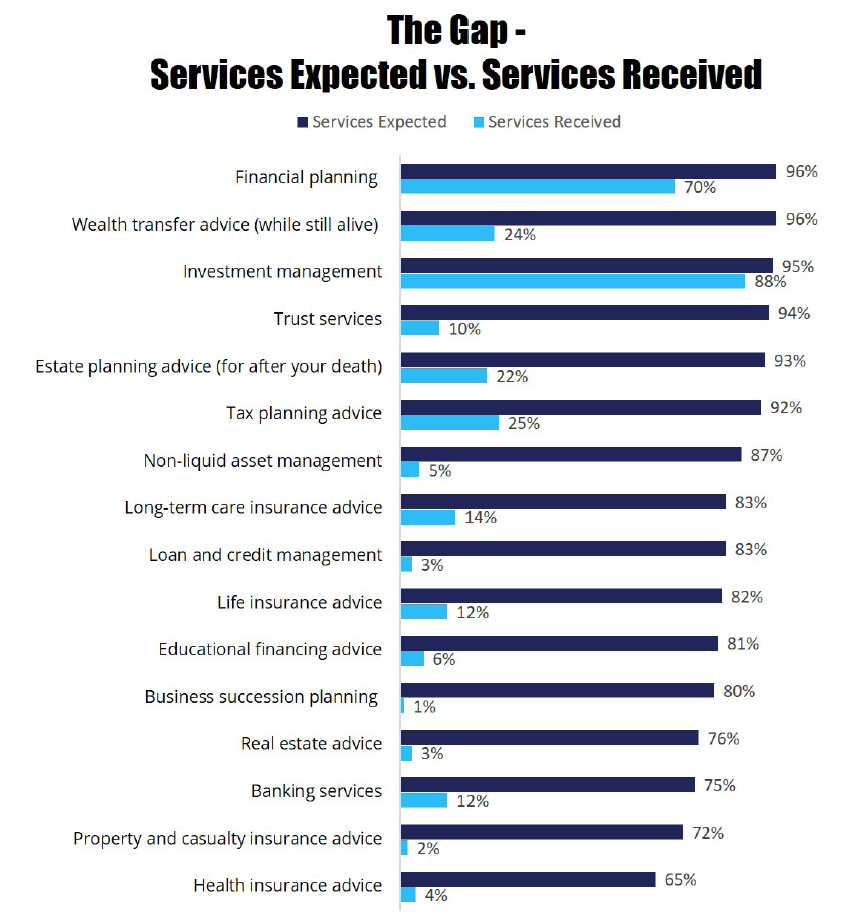

The Financial Purpose PodcastEp 20: What do you want from me?What services do you expect from your financial advisor? What are you actually getting?Think about it. Is there a gap between your advisory expectations and the reality?Research from SpectremGroup among wealthy investors shows there’s a massive gap in many crucial wealth management services.There are many reasons why such gaps may exist, including: * Speciality held by the advisor* Expectations of communication and services provided not clearly established* Client may view “comprehensive” planning as an add-on or “upsell” service, not fully understanding the link between planning f...

2023-04-2541 min

The Financial Purpose PodcastEp 19: Retirement LeakageYou have four options available for your 401(k) plan when changing jobs... yet almost half of job changers cash out. A Harvard Business Review study found that approx. 41% of employees took a cash distribution when changing jobs... and 85% of those people cashed out the entire balance! This is called retirement leakage, and cashing out can be detrimental to your long-term financial and retirement health. In this episode I discuss the four options available, why people cash out their 401(k)s when changing jobs, and what employers and financial advisors can do...

2023-04-1031 min

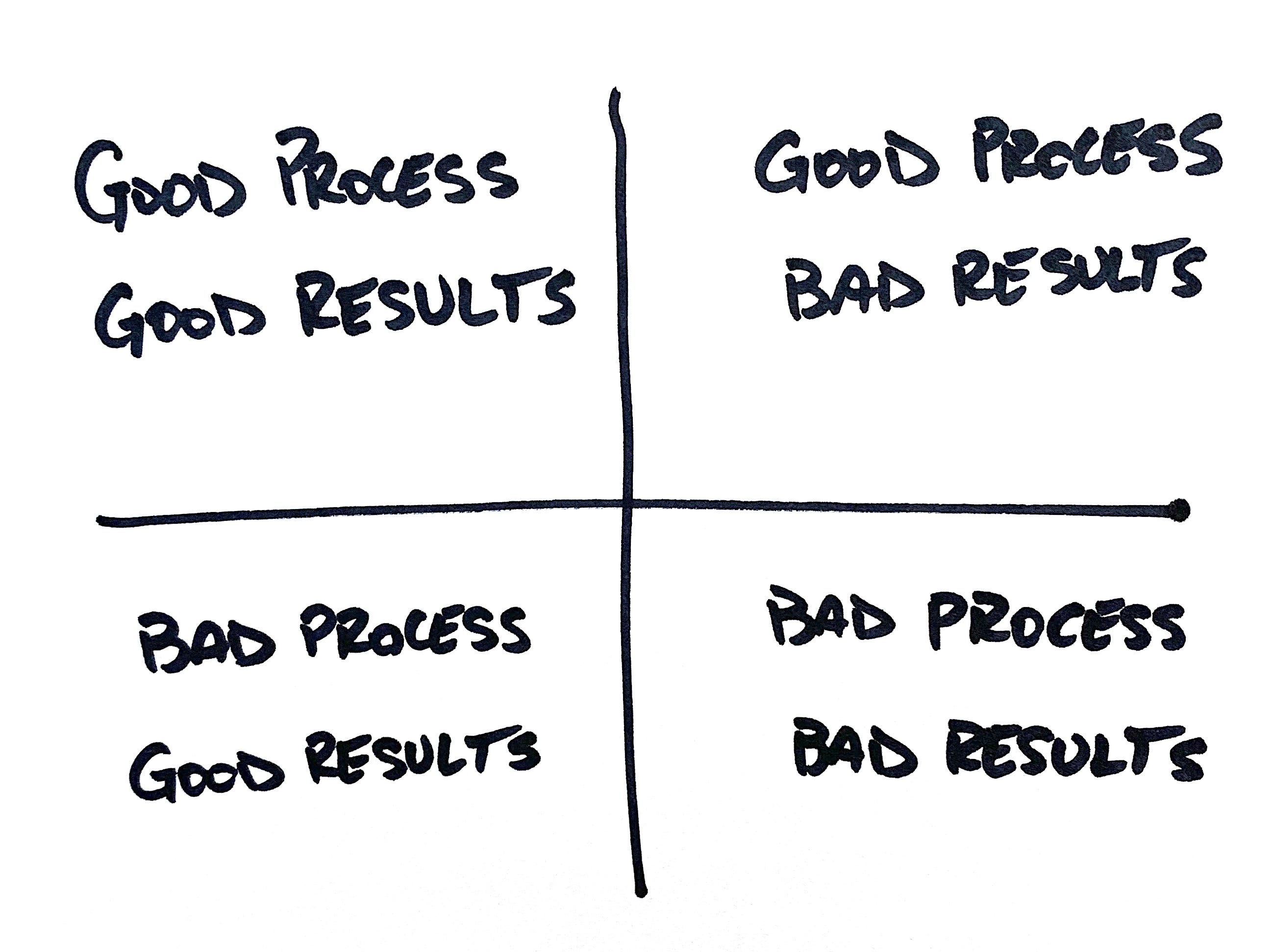

The Financial Purpose PodcastEp 18: Making better decisions!Making better decisions requires an effective and structured process.Consistently following such a process can be challenging, especially when emotions come into play. Emotions can cloud our judgment and steer us away from the logical path. This generally leads to suboptimal outcomes.The natural goal is to consistently achieve good results by following a reliable decision-making process. However, in high-pressure situations, our emotions can derail our efforts to do so. This episode of the Financial Purpose podcast offers an insightful visual aid to demonstrate how the quality of our decision-making process impacts our...

2023-04-0322 min

The Financial Purpose PodcastEp 17: Drift - The Continuum of Mental Health and MoneySince the pandemic, I have observed a drift in how people approach financial matters. People are slow to make important financial decisions, but faster to seek safety in times of volatility. In this episode of the Financial Purpose Podcast, I’m joined by Jamie L. Born, LCSW, CCTP to discuss how the continuum of mental health plays a role in money decisions. We discuss "Big T" and "little t" trauma, when you might be reacting from heart vs business (emotion vs logic), and when to seek help from a counselor. This is a...

2023-03-2348 min

The Financial Purpose PodcastEp 16: Banks and playing chicken with the Fed This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit thefinancialpurpose.substack.com

2023-03-1347 min

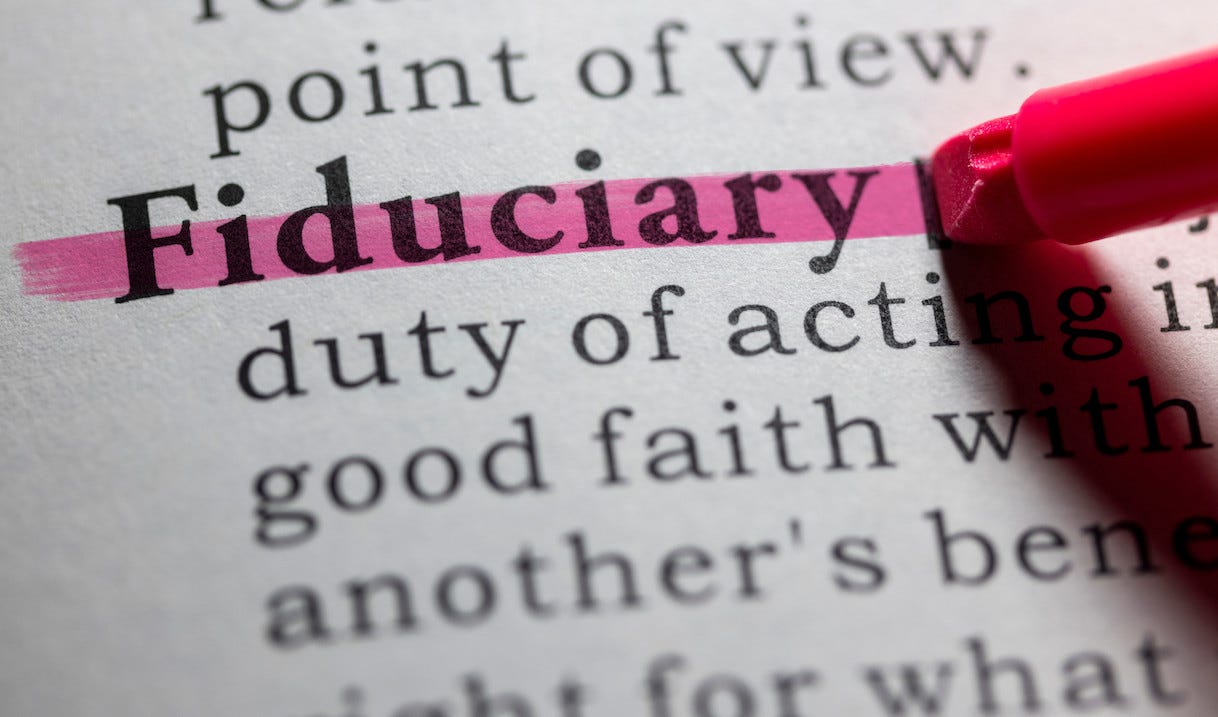

The Financial Purpose PodcastEp 15: Is your financial advisor a fiduciary?Watch this episode here: https://youtu.be/HynJE7IH_l8 This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit thefinancialpurpose.substack.com

2023-03-1051 min

The Financial Purpose PodcastEp 14: 5 tips for financial motion sicknessHave you ever been on a boat in rough waters? Or on a super fast-spinning ride? How about the back seat of a car on a mountain road. These are some of the times when you might feel motion sickness.The same is true when going through a major change in your life or when processing grief. These times can cause financial motion sickness.In this episode of the Financial Purpose Podcast, I discuss 5 tips for avoiding financial motion sickness, including:1) Avoid feeling rushed into decisions2) Revisit your financial purpose

2023-02-2812 min

The Financial Purpose PodcastEp 13: WordsIt's not just what we say or how we say it... it's also the words we use when doing the saying.In this episode I discuss the importance of having the same understanding of the words we use, specifically around money and in the advisory relationship. I also ask the listener the same question I ask in my first meeting a prospective client: if you could describe how you feel about money - today - using only one word, what's the first word that comes to mind?"Share you word in the comments!

2023-02-2021 min

The Financial Purpose PodcastEp 12: Burn the boatsStarting and running a business can be scary. Many fail. To increase your chances of success, you might have to burn the boats.In 1519, Hernán Cortés led a large expedition consisting of 600 Spaniards, 16 or so horses, and 11 boats to Mexico on a do-or-die treasure hunt. Upon arrival, Cortés made history by destroying his ships, leaving his crew no other alternative but success in their mission.Listen to Episode 12 Burn the Boats - The Financial Purpose PodcastThis episode features Jake Brown and Jake Morrow, owners of Freedom Brands.

2023-02-0756 min

The Financial Purpose PodcastEp 11: Recession and other scary wordsWhen you hear the word RECESSION, what goes through your mind? How does it make you feel? Is it a scary word? Or, is it an opportunity word?With words like RECESSION, we have three factors to consider:1) The things we can control (government, the Fed, the market, etc.), which influences...2) Changes in your financial results (the numbers), which influences...3) Your emotions around the first two factorsIn this episode, we'll cover all three factors and give a couple tips on how to approach times like these. ...

2023-01-3139 min

The Financial Purpose PodcastEp 10: Spaghetti and financial planning This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit thefinancialpurpose.substack.com

2023-01-1706 min

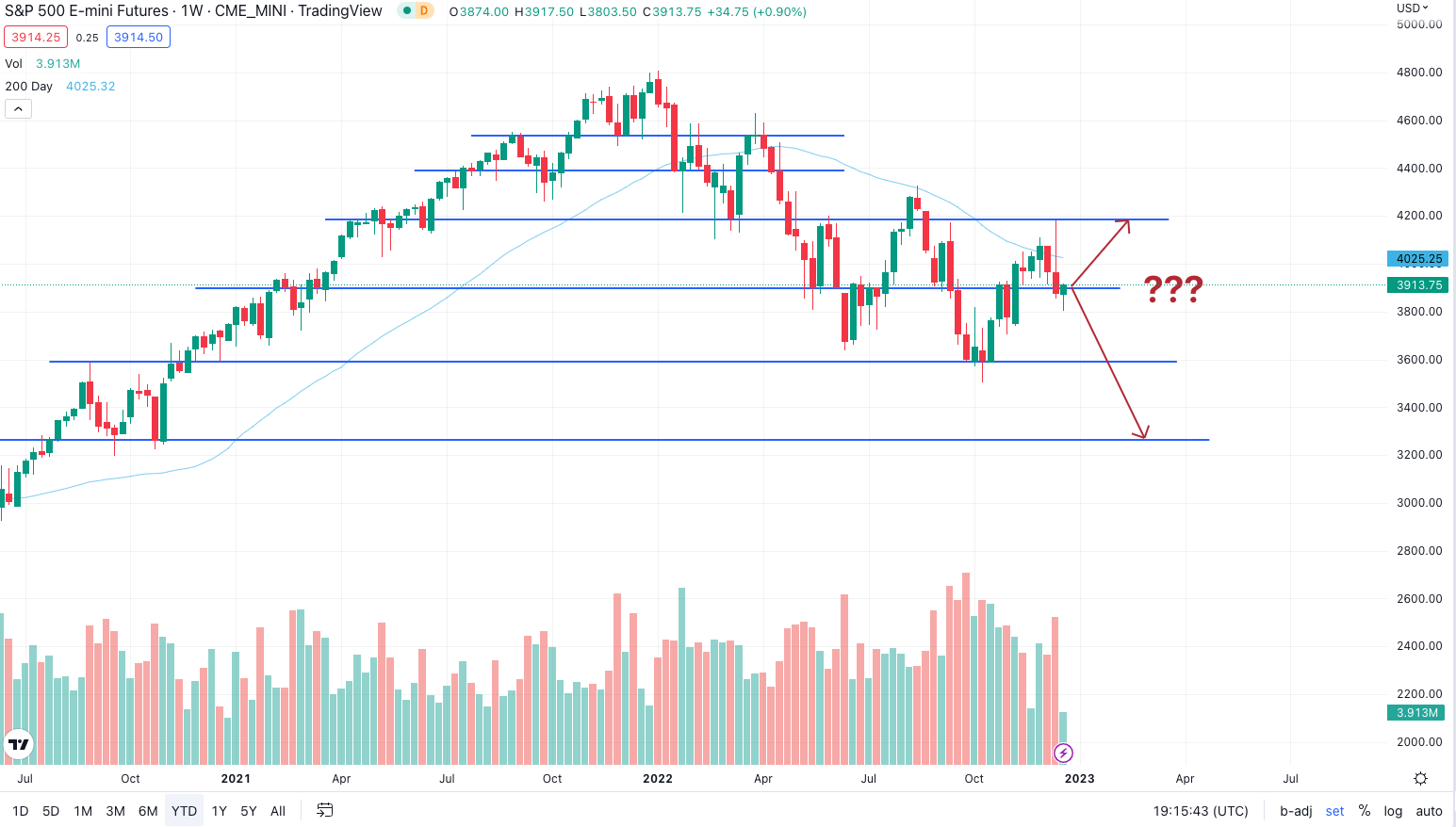

The Financial Purpose PodcastEp 9: Where is the market headed in 2023?Where is the market headed in 2023?The real question is where is the Fed going in 2023?One year ago, the Fed was suggesting that the inflation we were seeing was transitory. I was suggesting my clients that possibly it was not, and as it turns out inflation stayed around for all of 2022 and persists.This time last year, the federal funds rate was essentially 0.08%; it’s now sitting at about 3.78%. The last time we saw fed funds rate that high was all the way back in October 2005.US inflation bottomed at ri...

2022-12-2246 min

The Financial Purpose PodcastEp 8: The "If you give a mouse a cookie" effect This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit thefinancialpurpose.substack.com

2022-12-1735 min

The Yuckie Podcast#10 The Yuckie Podcast -Dale Shafer Financial AdvisorJake Squared sit down with Dale Shafer, our close friend, mentor, and financial advisor. Check Dale out at lifemoveswealth.com as well as his podcast "The Financial Purpose".

2022-12-121h 13

The Financial Purpose PodcastEp 7: Holidays and financial insecurityThe holiday season can be a time of joy and making new memories, or it can be a time of expectations that create stress and pressure around giving. This time of year can distort the heart vs wallet dynamic, which can lead to financial securities being expressed in a lot of different ways. In this episode we reflect on how the holidays have a unique way of exposing financial insecurities all over the wealth spectrum. Listen as I share my own financial insecurities tied to what I remember about Christmas as a kid and thoughts...

2022-12-0518 min

The Financial Purpose PodcastEp 6: Credit cards? Yes, no, maybe, depends...Articles cited: https://www.cnbc.com/2022/11/15/household-debt-soars-at-fastest-pace-in-15-years-as-credit-card-use-surges-fed-report-says.htmlhttps://libertystreeteconomics.newyorkfed.org/2022/11/balances-are-on-the-rise-so-who-is-taking-on-more-credit-card-debt/https://fred.stlouisfed.org/series/PSAVERT This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit thefinancialpurpose.substack.com

2022-11-2922 min

The Financial Purpose PodcastEp 5: Crypto (won't say I told you so, but...)In this episode I discuss the promises made and broken by crypto, as exemplified by the recent blow up of SBF and FTX. Also, how decentralization in crypto is a pipe dream thanks to the efforts of the NY Fed and large banks in creating a digital dollar pilot. Crypto is not living up to billing - and I won't say I told you, but it's pretty darn close. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit thefinancialpurpose.substack.com

2022-11-1824 min 2022-11-171h 13

2022-11-171h 13

The Financial Purpose PodcastEp 3: Better to have financial goals or financial direction?One of the most common questions advisors ask prospective clients is: “what are your financial goals?” I happen to think it's a bad question.Financial services firms market a goal-centric approach to the general public. With this question, advisors are communicating that you need to have specific and well-defined financial goals in order to get somewhere.Let’s explore this concept and decide if it’s better to have a financial goal or a financial direction. This is a public episode. If you would like to discuss this with other subscribers or get acce...

2022-11-0913 min

The Financial Purpose PodcastEp 4: What is your financial purpose?What exactly is financial purpose?It’s the underlying reason behind your financial decisions, rooted in your values and priorities. This goes beyond just dollars and cents, helping you make decisions that align with what matters most to you.By focusing on your financial purpose, we shift the conversation from affordability to achieving what’s truly important.Listen to discover how the core element of our approach to financial advice centers around your financial purpose. This is a public episode. If you would like to discuss this with other subscribers or g...

2022-11-0926 min

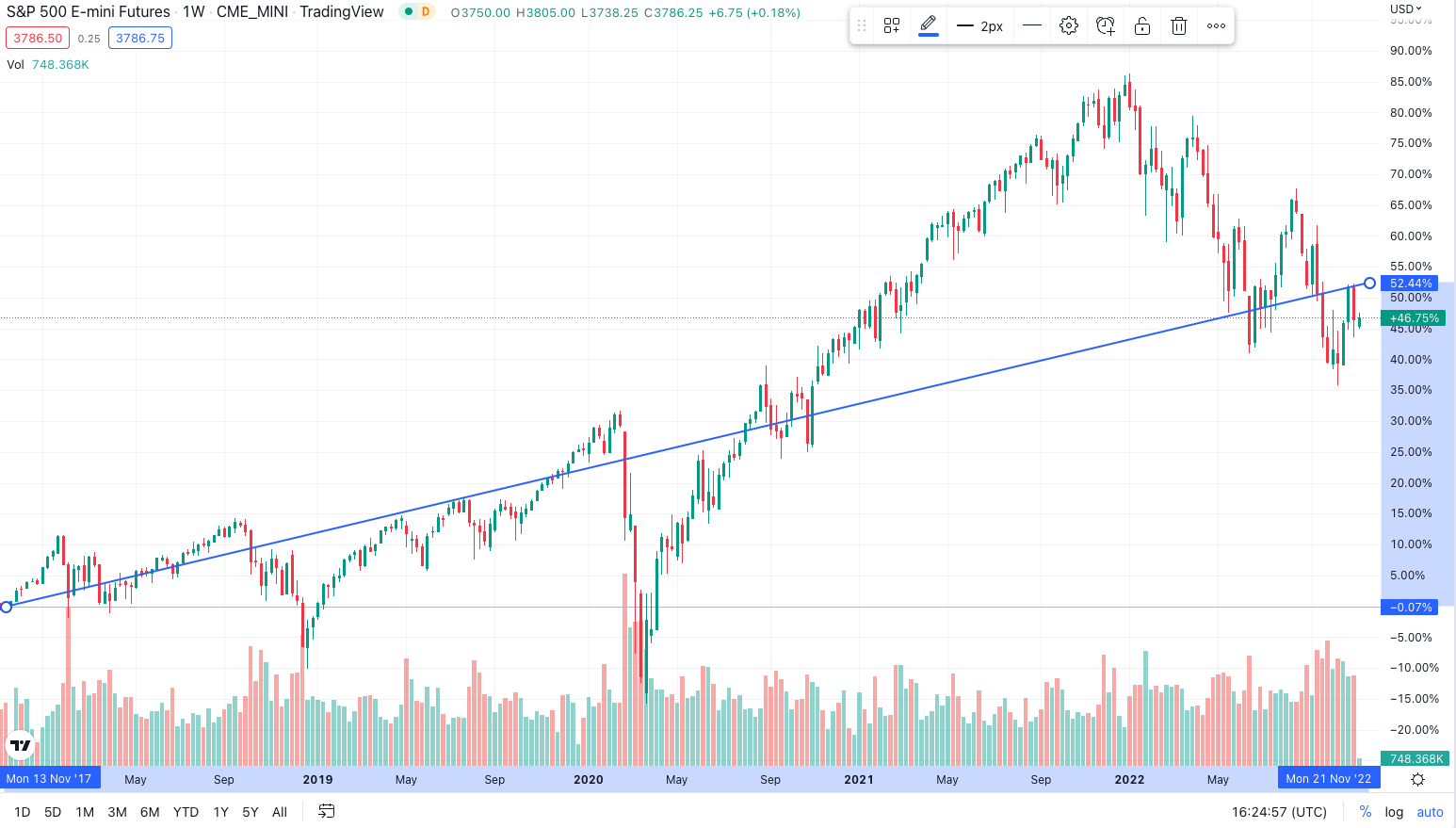

The Financial Purpose PodcastEp 2: Right on Track?In this episode I go back to November 2017 to establish a trend line from that time to November 2022. Given all the volatility since then, is the market actually right on track?One important note about trend lines: depending on where you draw them, you can communicate a variety of messages.This post gathers inspiration from this tweet: https://twitter.com/SouthernAdvicer/status/1587514476391469057Be sure to check out the blog post for this podcast to see the charts and figures referenced: https://thefinancialpurpose.substack.com/p/right-on-track This is...

2022-11-0817 min

The Financial Purpose PodcastEp 1: Set point theoryHave you ever heard of set point theory? At it relates to health, set point theory essentially states that your body has a normal set range for weight. Ever go on a cycle of diet and exercise, lose weight, only to see it return?Financial considerations are like bodies - everyone is different, and what works for some may not work the same for others. This is part of the work of financial planning - understanding how changes in your financial habits impact your financial health, and how you mentally and emotionally adjust to those changes.

2022-11-0517 min

Middle Class Film ClassGab & Chatter: Hellraiser / Deadstream / Derry Girls / The Grimcutty / As Above So Below / The Devil Below / AnnihilationOn this episode: Aronofsky defends Fraser, The Mummy 4 with a familiar face, and Netflix’s new business model. PLUS Liam Neeson sounds like Leslie Neilson, right?!? And John Carpenter calling his shot in the video game movie game...In news: Rachel Weisz, Jet Li, Predator, Super Mario Bros, Mario Mario, Luigi Mario, John Leguizamo, Bob Hoskins, Dennis Hopper, Mario Lemieux, Darren Aronofsky, Brendan Fraser, The Whale, Mean Girls, Daniel Franzese, TLC, Gabourey Sidibe, Ryan Reynolds, Martin Luther King, Chris Pratt, Michelle Yeoh, aria Bello, Dodgeball: An Underdog story, Justin Long, Indiana Jones, Nathan Drake, Binge Lord Dan, Ai...

2022-10-171h 11

The Pit Wall PodcastThe Pit Wall Podcast goes to North Wilkesboro! - Boo Boo Dalton, Jonathan Shafer, Chad McCumbee, Dale Tyre, Freddy Kraft, Landon Huffman, Lee PulliamSend us a textWe take the show on the road! We talk to Chad McCumbee, Boo Boo Dalton, Jonathan Shafer, Dale Tyre, Landon Huffman, Freddie Kraft, and Lee Pulliam!

2022-09-071h 57

Uncensored Real Estate PodcastHow Inflation is Impacting Real Estate & Our Daily LivesHave you recently visited a grocery store or gas station and noticed a significant increase in prices? If so, you may be wondering what's causing inflation and where the market is headed. In this episode, we sit down with Financial Advisor, Dale Shafer, to discuss the root causes of inflation and its potential impact on the market. From rising supply chain costs to changes in consumer behavior, there are numerous factors contributing to the current economic landscape. Tune in to gain valuable insights on inflation and how to navigate its effects on your personal finances.What you...

2022-07-0858 min

The Sound TestLIVE - 02/10/20 [Weekly VGM Radio & Podcast]As VGM lovers, we all come across tunes and soundtracks from games we've never played. In this episode, I explore my personal Top 5 games that, despite never playing, have excellent music. My regular listeners get in on the theme too, and plenty of recommendations are thrown around.

Otherwise, Quickfire News continues on strong with three new segments, while bookending rounds of the SFX Showdown should keep you on your feet. I also need the help of a new TTS guardian angel to pronounce one particular legend's name right.

In the VGM SongFight, Mario agrees that Rosalina's...

2020-10-042h 03

SoundON021 - March 20 through March 26 Music NewsJohn Bunzli’s new album, IV, is out everywhere you listen to music now! We’re pulling from our archives for next week’s show and featuring the interview we did with John back in November! Music Calendar Today, Wednesday March 20 300 Suns Brewing Drop In Acoustic Jam at 6PM Thursday March 21 Laughing Goat Tim Ostdiek, Bob Barrick, Molly Kollier at 8PM Illegal Pete’s Boulder Overt Defiance at 9PM License # 1 George Nelson Band at 9PM...

2019-03-2100 minthe1st10minutes018 - Sunless Sea, Pillars Of Eternity, Broken Age("Micromanagement Is The Secret") This week we take a break from our usual random game selection for a curated Kickstarter Special. Aaron is powerless before a game that asks him to collect stories. Tony creates a character and faces the conundrum of whether to skip audio dialogue. Steve points-and-clicks just in the nick of time. And, of course, we all discuss funding models, stretch goals, and tiered rewards. 0:02:25 - Sunless Sea 1:20:06 - Pillars Of Eternity 2:35:25 - Broken Age 3:21:56 - The Plugz Other mentions include: Kickstarter, Fallen London, Steam Greenlight, Steam Early Access, Joseph Conrad, Paradox Development Studio, Zafehouse: Diaries, War...

2015-08-2400 minthe1st10minutes012 - Metal Slug 3, Slender: The Arrival, Sid Meier's Civilization IV: Beyond The Sword("Edward Norton Is Still His Hulk") Steve (now officially designated 'The Shmups Guy') gets chased down a pier by a robot crab thing. Aaron (with a name we cannot possibly remember) gets to wander alone in the woods. Tony (still unable to shrug off the 'UI and Tooltips' nickname) temporarily becomes an immortal God-King doing battle with other such entities to take over an entire planet. And, of course, Civilization III was designed by Jeff Briggs and Soren Johnson, and Civilization: Beyond Earth was designed by Will Miller and David McDonough. 0:02:23 - Metal Slug 3 0:36:08 - Slender: The Arrival 1:35:48 - PT...

2015-08-2400 min

Time 4 HempDrug Truth Network - 06/11/15First broadcast on iHeartRadio and Time4Hemp.com 06/11/15Host Doug McVay talks with Dr. Denis Petro about medical cannabis, and with Professor Alfred McCoy about the CIA's history of involvement in drug trafficking.ANDHost Dean Becker talks withBill Levin, pastor of First Church of Cannabis, and Dale Shafer about his bust for cannabis.Please share this with your friends

2015-06-1159 min

Power-Up With: This Vivid Full Audiobook For Story Seekers.Whiskey Tango Foxtrot by David ShaferPlease visithttps://thebookvoice.com/podcasts/2/audible/144581to listen full audiobooks.

Title: Whiskey Tango Foxtrot

Author: David Shafer

Narrator: Bernard Setaro Clark

Format: mp3

Length: 15 hrs and 11 mins

Release date: 08-05-14

Ratings: 4 out of 5 stars, 484 ratings

Genres: Mash-Ups

Publisher's Summary:

2014-08-053h 11