Shows

Strong Songs"Black Hole Sun" by SoundgardenTurns out some songs stand on their own, however memorable-slash-horrifying their music video might have been.Written by: Chris CornellProduced by: Michael BeinhornAlbum: Superunknown (1994)Listen/Buy via SongwhipALSO DISCUSSED:"Spoonman" and "The Day I Tried to Live" by Chris Cornell and Soundgarden from Superunknown, 1994Kim Thayil interview at SongfactsNorah Jones' cover of "Black Hole Sun," Live in 2021"In My Life" by Lennon/McCartney from Rubber Soul, 1965The 2021 Strong Songs interview with session guitarist Andrew Synowiec"Tom Sawyer" by Rush from Moving Pictures, 1981--------------------

2024-03-0856 min

Strong Songs"In Your Eyes" by Peter GabrielStrong Songs Season Six kicks off with a widely requested classic: Peter Gabriel's 1986 yearner "In Your Eyes." Because why hire one rhythm section when you can hire two for twice the price?Written by: Peter GabrielProduced by: Daniel LanoisAlbum: So (1986)Listen/Buy via SongwhipALSO DISCUSSED:Rick Beato's Interview with So producer Daniel Lanois"DIY" by Peter Gabriel from Peter Gabriel 2: Scratch, 1978"Sledgehammer," "Don't Give Up," and "Big Time" by Gabriel from So, 1986Kwame Ansah-Brew demonstrates the Talking Drum--------------------FEBRUARY 2024 WHOLE-NOTE PATRONS

2024-02-2353 min

Strong SongsStrong Solos, Vol. 2: Electric Guitar-alooThe electric guitar is a beautiful, maddening instrument, and man does it sound good in the right hands. On this episode, Kirk takes a deep dive into solos by guitar legends Charlie Christian, Wes Montgomery, Jimi Hendrix, and Larry Carlton.FEATURED/DISCUSSED:"Seven Come Eleven" by Charlie Christian and Benny Goodman, recorded by the Benny Goodman Sextet in 1939"Fried Pies" by Wes Montgomery from Boss Guitar, 1963"Hey Joe" by Billy Roberts recorded by the Jimi Hendrix Experience on Are You Experienced?, 1967Larry Carlton's solo on "Kid Charlemagne" by Donald Fagen and Walter Becker (AKA Steely Dan...

2023-11-171h 04

Strong SongsA Little Extra ZeldaOn this bonus episode, originally recorded as a Patreon bonus in 2022, Kirk goes through a few great Legend of Zelda pieces that he didn't manage to get into on last year's Zelda-focused Strong Songs episode. If you want to hear next week's new episode on Tears of the Kingdom early, go become a patron now!FEATURED:"Tears of the Kingdom Theme" from The Legend of Zelda: Tears of the Kingdom, comp. Manaka Kataoka, Maasa Miyoshi, Masato Ohashi, Tsukasa Usui"Song of Storms," "Dark World/Lorule Theme," "Gerudo Valley," and "The Great Fairy's Fountain" by K...

2023-10-2724 min

Strong SongsBelle & Sebastian's Very Good Chord ProgressionKirk takes a tour through the cycling, modulating chord sequence in Belle & Sebastian's buoyant 2017 song "The Girl Doesn't Get It."Variation 1: | C | Dm7 | Bb | Gm FVariation 2: | C | D | Bm | Esus EVariation 3: | A | Bm | A/C# | Esus EFEATURED/DISCUSSED:"The Girl Doesn't Get It" by Belle & Sebastian from How To Solve Our Human Problems, Vol. 1, 2017"I Will Always Love You" by Dolly Parton performed by Whitney Houston on The Bodyguard soundtrack, 1992--------------------OCTOBER 2023 WHOLE-NOTE PATRONSCorpus Frisky – Ben Barron – Catherine Warner – Damon White...

2023-10-2021 min

Strong SongsCounterpoint, Chaka Kahn, & Peter GabrielKirk answers your questions on 60s pop counterpoint, Chaka Kahn syncopation, Taylor Swift's re-recording project, good practice habits, Peter Gabriel's "Sledgehammer," and more.FEATURED/DISCUSSED:"You've Got Your Troubles" by Roger Greenaway and Roger Cool, recorded by The FortunesContrapunctus 1 by J.S. Bach recorded by the Emerson String Quartet on Bach: The Art of Fugue, 2003T.I.B.W.F. by The Budos Band, from The Budos Band, 2005"Dying to Get To Europe" by Ketil Bjornstad from Seafarer's Song, 2004"The Place Where He Inserted the Blade" by Black Country, New Road from Ants From Up There, 2022"...

2023-09-0854 min

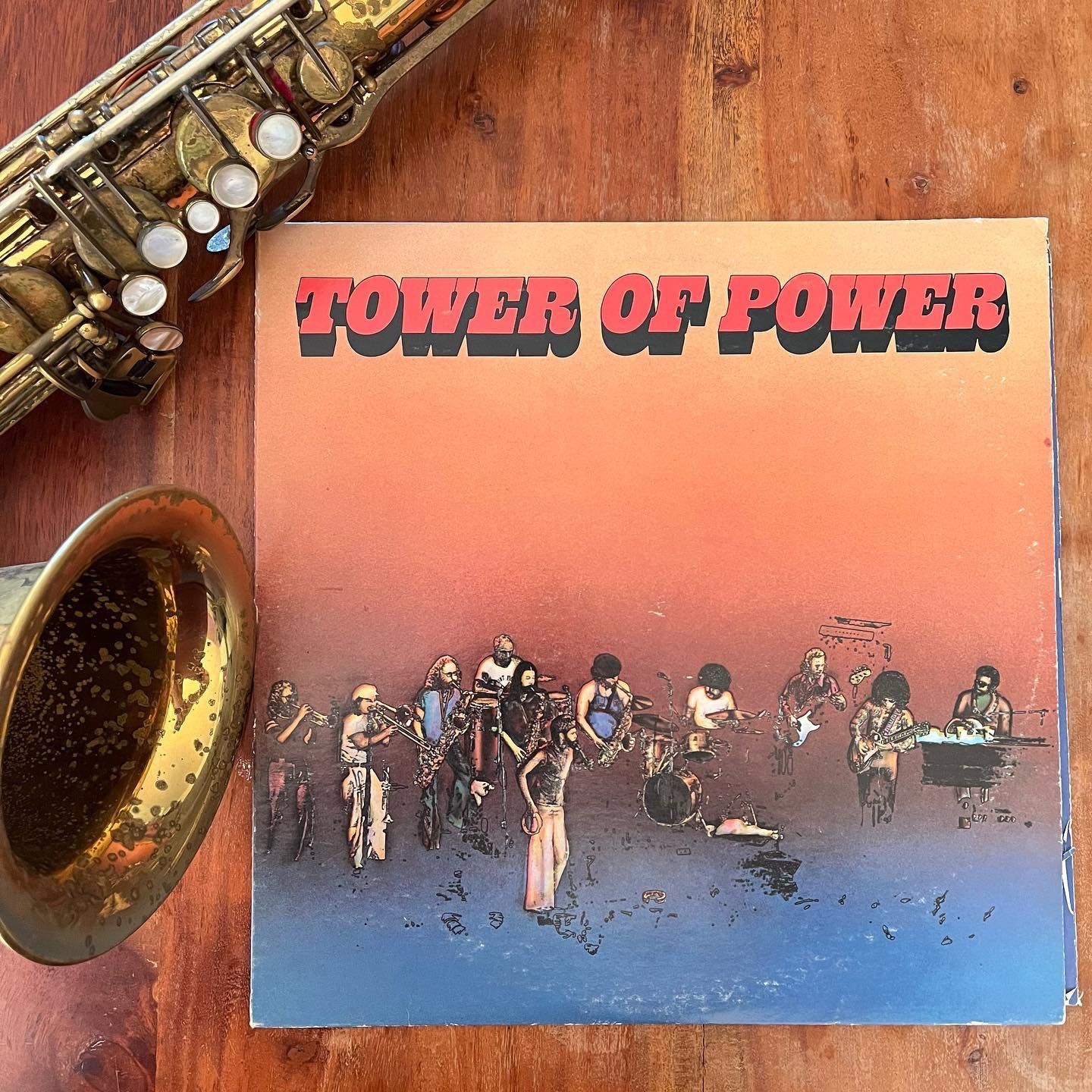

Strong Songs"Soul Vaccination" by Tower of PowerKirk climbs inside the machine-gun rhythms and unstoppable grooves of the legendary Oakland funk outfit Tower of Power.Written by: Doc Kupka and Emilio CastilloAlbum: Tower of Power (1973)Listen/Buy via SongwhipALSO DISCUSSED:"What is Hip?" "Squib Cakes" "Only So Much Oil in the Ground" "Don't Change Horses (In the Middle of a Stream)," "So Very Hard to Go," "Credit," all by Tower of Power"Saturday Night Live" theme by Howard Shore, feat. Lenny Pickett"Cold Sweat," "I Got the Feelin'," "Mother Popcorn," "Funky Drummer" by James Brown, 1967...

2023-08-2549 min

Strong SongsAn Operatic Odyssey, with Luigi BocciaSpecial guest Luigi Boccia takes Kirk on a magical journey through the world of the opera tenor, from Caruso and Lauri Volpi to Di Stefano and Pavarotti.Featuring performances by Luciano Pavarotti, Giuseppe Di Stefano, Enrico Caruso, Franco Corelli, Giacomo Lauri Volpi, Jussi Björling, Sergei Lemeshev, and Jon Vickers.Find a Spotify playlist of Luigi's many Tenor examples here.--------------------JULY 2023 WHOLE-NOTE PATRONSCatherine Warner – Damon White – Kaya Woodall – Dan Austin – Jay Swartz – Miriam Joy – Sean D. Winnie – Rush – Daniel Hannon-Barry – Ashley Hoag – Christopher Miller – Jamie White – Christopher McConnell – David Mascett...

2023-07-143h 38

Strong Songs"No One Knows" by Queens of the Stone AgeIt's time for a journey of the mind, as Kirk picks apart one of the best hard rock tunes of the early 2000s.Queens of the Stone Age's "Songs for the Deaf" includes enough bangers that it was tough to pick a single song to focus on, but in the end, "No One Knows" won the day with its combination of grit, groove, and focus. On this episode, Kirk dives deep into the tune's tightly wound, surprisingly swinging arrangement, with special focus on Dave Grohl's meticulous drumming.Artist: Queens of the Stone Age...

2020-07-2255 min

Strong Songs"Last Goodbye" by Jeff BuckleyThe bells in the church tower chime, so it's time to grab our Telecasters and talk about Jeff Buckley.Specifically, it's time for a deep dive into Buckley's "Last Goodbye," one of the centerpiece songs on his sole studio album, Grace. There'll be spacious drums, grand basslines, spiraling string parts, alternative guitar tunings, and of course, loads of beautiful singing.Artist: Jeff BuckleyAlbum: Grace (1994)Written by: Jeff BuckleyListen/Buy via Album.LinkALSO REFERENCED/DISCUSSED:“Mojo Pin,” "Grace," "Hallelujah" and "Corpus Christi Carol" all from...

2020-04-2959 min

Plan With DanHow Does Flying Relate to Retirement Planning?You don’t need to be understand the basics behind flying but you’ll need some guidance from a professional to grasp the finer points and nuances to the actual process. Believe it or not, there are a number of parallels between flying and retirement planning and that’s what we plan to tackle on this episode.

Today's rundown:

0:29 – What’s on today’s show.

1:01 – Dan has some news to share about the podcast.

2:02 – In the News: Trend in the wedding industry where couples are taking out loans for their ceremony.

3:00 – There...

2019-09-1928 min

Plan With DanChallenges That Millennials Face in Financial PlanningIt’s easy to take shots at millennials and joke about many of the stereotypes that follow them around, but that’s not always fair. That younger generation faces many new challenges that weren’t around 15-20 years ago, and it makes it difficult to start saving and planning for retirement. We’ll address those issues in this episode.

Check out the show notes for this episode by clicking here.----more----

Today's rundown:

0:37 – Dan is preparing for his annual trip to Israel.

3:10 – Financial issues that might impact millennials.

4:15 – Education has changed so...

2019-09-0520 min

Plan With DanPotential Financial Pitfalls for Someone Entering a Nursing HomeWhen facing the decision to put a loved one into a nursing home, the last thing you want to be concerned about is their safety and security. That’s true of financial and physical health. There are some financial pitfalls that you need to know about so you can protect your family.

Check out the full show notes by clicking here.

Today's rundown:

0:28 – Dan is celebrating a milestone.

2:36 – Introducing today’s topic of elder abuse.

3:42 – The first thing you need to do with your parents or children if you’re getting ol...

2019-08-1516 min

Plan With DanThings You Should Consider When Inheriting a HomeInheriting a home can be major life change and it bring with it a number of decisions that need to be made. Depending on who else was included in the inheritance, you’ll have to figure out what you want to do with it. Every decision brings a different set of pros and cons so understanding those will help you determine what option is best.

To see the show notes, click here. ----more----

Check out today's rundown below:

2:55 – The situation that surrounds inheriting a home.

3:45 – When you inherit a home, you essentia...

2019-08-0117 min

Plan With DanWeaknesses in 401k Retirement PlansOne of the most popular retirement plans that people utilize is the 401(k). It’s often the easiest place to start when you begin saving for your future and a many times a employer will offer the option as part of a compensation package. The 401(k) definitely serves its purpose but there are some weaknesses that might make you look to other investment opportunities.

See the show notes by clicking here. ----more----

Take a look at the full rundown of the show below and click the timestamp to skip to a specific portion of the epi...

2019-07-1821 min

Plan With DanFinding Financial Security“Financial security” might mean different things to different people, but for nearly everyone, finding financial security is the most important part of their retirement plan. So, how do you define financial security?

Full show notes: http://betzelwealthadvisors.com/2019/07/finding-financial-security/

----more----

Tactical Points:

In The News

1:15 RMD age change

Congress is working on a bill that would raise the RMD (required minimum distributions) age from 70.5 to 72. Would this be a good thing?

Dan was really excited when he first heard about this change and he is all for it.

There’s increase...

2019-07-0421 min

Plan With DanThe Real Definition Of “Safe Money”

Today's Objective...

It seems that people have different definitions of “safe money” as it relates to their savings. Let’s discuss some of those varying explanations of the term and why it’s an important conversation for any retiree or pre-retiree to have.

Check out the full show notes for this episode: http://betzelwealthadvisors.com/2019/06/the-real-definition-of-safe-money/

Tactical Points:

2:09 How do people define safe money?

This term makes Dan think about insurers trying to sell annuities or those “education” steak dinners that you might have eve...

2019-06-2015 min

Plan With DanFamous Last Words (You Don’t Want to Say!) In Retirement

Hopefully your famous last words in life won’t be “Hey y’all, watch this!” And in the financial world, there’s quite a few phrases that you don’t want to be your famous last words either… Dan talks through some common financial phrases that certainly aren’t words to live by.

Check out the full show notes: http://betzelwealthadvisors.com/2019/06/famous-last-words-you-dont-want-to-say-in-retirement

----more----

Tactical Points:

2:58 “I want to get out of the market and stay out (after 2008)”

Dan says this is not the kind of person who would be h...

2019-06-0621 min

Plan With Dan5 Simple Retirement Questions (That Are Hard to Answer)These five questions are quite common. They're deceptively simple, and depending on your situation, they can be quite complex to answer. Beyond a simple “yes” or “no” answer, let’s hear what Dan has to say about these important retirement questions.

Click the link to receive your FREE Retirement Rescue Toolkit: https://bv341.infusionsoft.com/app/page/taxfree-kit

Click the link to read more from Dan's Blog: http://betzelwealthadvisors.com/2019/05/5-simple-retirement-questions-that-are-hard-to-answer/

2019-05-1621 min

Plan With DanTo Fish Or Cut Bait?Decision-making can be tough, and it's often tempting not to make any decision at all. As you research a decision, you're often hit with a barrage of information, and if you're not careful, you can find yourself stuck. However, there comes a time when we all need to fish or cut bait as the saying goes. Discover the importance of decisiveness and the dangers of analysis paralysis.

Click the link to receive your FREE Retirement Rescue Toolkit: https://bv341.infusionsoft.com/app/page/taxfree-kit

Click the link to read more from Dan's Blog: http://betzelwealthadvisors.com...

2019-05-0222 min

Plan With DanConventional Wisdom Isn’t Always So WiseWouldn’t it be great if retirement came with a simple manual we could all follow step-by-step? It would sure make things easier. Unfortunately, there’s no such universal manual and to make matters worse, most of the conventional wisdom about the financial world also tends to lead people astray when they follow the advice blindly.

Check out http://betzelwealthadvisors.com/2019/04/conventional-wisdom-isn’t-always-so-wise for the full blog post, show notes, and related links to this episode.

2019-04-1821 min

Plan With DanWhen Is It "Safe" For You To Retire?Do you have enough money to retire? At what age or dollar amount will you get there? How can you be sure? These are all questions we’ll talk about in today’s podcast.

Visit http://betzelwealthadvisors.com/2019/04/when-is-it-"safe"-for-you-to-retire? to view the full show notes of today's episode and related resources and links.

2019-04-0421 min

Plan With DanThe 5 Most Common Pain Points In Your Financial LifeWhen it comes to financial planning, everyone has some kind of pain point. They're different for each client, but everyone has something that bothers them. Dan explains how he helps his clients to alleviate their "pain points."

Click the link to receive your FREE Retirement Rescue Toolkit: https://bv341.infusionsoft.com/app/page/taxfree-kit

Click the link to read more from Dan's Blog: http://betzelwealthadvisors.com/2019/03/the-5-most-common-pain-points-in-your-financial-life/

2019-03-2117 min

Plan With DanThe 6 Things Wasting Away In Your Financial Junk DrawerYou probably have a junk drawer at home. It's filled with knick knacks like rubber bands, clothespins, and ink pens, and highlighters. While you might not realize it, you probably have a financial junk drawer as well. Discover six things you could be giving a better purpose.

Click the link to receive your FREE Retirement Rescue Toolkit: https://bv341.infusionsoft.com/app/page/taxfree-kit

Click the link to read more from Dan's Blog: http://betzelwealthadvisors.com/2019/03/the-6-things-wasting-away-in-your-financial-junk-drawer/

2019-03-0718 min

Plan With DanEpisode #76: Watch Out For These Financial MistakesJoin us as we outline some of the crucial financial mistakes we see our clients making. Don't worry, we'll outline how to avoid them as well.

Click the link to receive your FREE Retirement Rescue Toolkit: https://bv341.infusionsoft.com/app/page/taxfree-kit

Click the link to read more from Dan's Blog: http://betzelwealthadvisors.com/2019/02/episode-76-financial-mistakes/

2019-02-2120 min

Plan With DanEpisode #75: Little Missed DetailsThe little missed details in your financial plan could be costing you. Pay attention to the fine print, and cover the little things in your retirement plan.

Click the link to receive your FREE Retirement Rescue Toolkit: https://bv341.infusionsoft.com/app/page/taxfree-kit

Click the link to read more from Dan's Blog: http://betzelwealthadvisors.com/2019/02/episode-75-little-missed-details/

2019-02-0719 min

Plan With DanEpisode #74: Mark Twain's Financial Wisdom Part 02There's a lot to be learned from the wit and wisdom of Mark Twain. Join us as we dive into part two of our series on his famous sayings.

Click the link to receive your FREE Retirement Rescue Toolkit: https://bv341.infusionsoft.com/app/page/taxfree-kit

Click the link to read more from Dan's Blog: http://betzelwealthadvisors.com/2019/01/episode-74-mark-twains-financial-wisdom/

2019-01-1719 min

Plan With DanEpisode #73: Mark Twain's Financial Wisdom Part 01There's a lot to be learned from the wit and wisdom of Mark Twain. Join us as we discover what he might have to say about our finances.

Click the link to receive your FREE Retirement Rescue Toolkit: https://bv341.infusionsoft.com/app/page/taxfree-kit

Click the link to read more from Dan's Blog: http://betzelwealthadvisors.com/2019/01/episode-73-mark-twains-financial-wisdom/

2019-01-0315 min

Plan With DanEpisode #72: You've Lost That Financial FeelingFinancial planning is more than math and logic. There are times when it's important to consider your emotions. Dan helps us tap into that financial feeling.

Click the link to receive your FREE Retirement Rescue Toolkit: https://bv341.infusionsoft.com/app/page/taxfree-kit

Click the link to read more from Dan's Blog: http://betzelwealthadvisors.com/2018/12/episode-72-financial-feeling/

2018-12-2019 min

Plan With DanEpisode #71: Defining Risk ToleranceRisk tolerance is a buzzword that gets used in many financial conversations, but what is it, and how does it affect your retirement plan? Dan explains.

Click the link to receive your FREE Retirement Rescue Toolkit: https://bv341.infusionsoft.com/app/page/taxfree-kit

Click the link to read more from Dan's Blog: http://betzelwealthadvisors.com/2018/12/episode-71-defining-risk-tolerance/

2018-12-0618 min

Plan With DanEpisode #70: Settling Financial DebatesDepending on who you ask, you'll get varying answers to some of retirement's most pressing questions. Dan will help us settle these financial debates.

Click the link to receive your FREE Retirement Rescue Toolkit: https://bv341.infusionsoft.com/app/page/taxfree-kit

Click the link to read more from Dan's Blog: http://betzelwealthadvisors.com/2018/11/episode-70-settling-financial-debates/

2018-11-1515 min

Plan With DanEpisode #69: Hidden ExpensesJust because you can't plainly see all the hidden expenses in your portfolio doesn't mean they aren't there. Uncover areas to watch for hidden costs.

Click the link to receive your FREE Retirement Rescue Toolkit: https://bv341.infusionsoft.com/app/page/taxfree-kit

Click the link to read more from Dan's Blog: http://betzelwealthadvisors.com/2018/11/episode-69-hidden-expenses/

2018-11-0117 min

Plan With DanEpisode #68: Important Financial Terms You Should KnowFinancial terms can quickly get confusing. Dan helps us to better understand the tricky jargon we might have heard before.

Click the link to receive your FREE Retirement Rescue Toolkit: https://bv341.infusionsoft.com/app/page/taxfree-kit

Click the link to read more from Dan's Blog: http://betzelwealthadvisors.com/2018/10/episode-68-important-financial-terms/

2018-10-1819 min

Plan With DanEpisode #67: Tax Planning And RetirementTax planning is one of the key elements of a sound retirement plan. Discover how to steward your wealth and save in taxes in retirement.

Click the link to receive your FREE Retirement Rescue Toolkit: https://bv341.infusionsoft.com/app/page/taxfree-kit

Click the link to read more from Dan's Blog:http://betzelwealthadvisors.com/2018/10/episode-67-tax-planning-retirement/

2018-10-0418 min

Plan With DanEpisode #66: Ask Yourself Five Retirement QuestionsPlanning for retirement is daunting. It’s difficult to know where to begin. Ask yourself these five questions to start the conversation.

Click the link to receive your FREE Retirement Rescue Toolkit: https://bv341.infusionsoft.com/app/page/taxfree-kit

Click the link to read more from Dan's Blog:http://betzelwealthadvisors.com/2018/09/episode-66-ask-yourself-five-retirement-questions/

2018-09-2016 min

Plan With DanEpisode #65: Elements Of A Successful RetirementA successful retirement addresses your emotional, financial, social, and spiritual needs. Do you have what it takes? Learn what generates success.

Click the link to receive your FREE Retirement Rescue Toolkit: https://bv341.infusionsoft.com/app/page/taxfree-kit

Click the link to read more from Dan's Blog: http://betzelwealthadvisors.com/2018/09/episode-65-successful-retirement/

2018-09-0620 min

Plan With DanEpisode #64: Giving Money Mission StatementsMission statements give our dollars a purpose. They help us to develop a sound strategy in our portfolio. Let’s find out whether you’re effectively putting your money to work for you.

Click the link to receive your FREE Retirement Rescue Toolkit: https://bv341.infusionsoft.com/app/page/taxfree-kit

Click the link to read more from Dan's Blog: http://betzelwealthadvisors.com/2018/08/episode-64-mission-statements/

2018-08-1617 min

Plan With DanEpisode #63: What Demographics Can Tell UsStatistics can give us helpful insight into how you’re approaching your finances. Explore financial demographics, and see what they say about retirement.

Click the link to receive your FREE Retirement Rescue Toolkit: https://bv341.infusionsoft.com/app/page/taxfree-kit

Click the link to read more from Dan's Blog: http://betzelwealthadvisors.com/2018/08/episode-63-what-financial-demographics-can-tell-us/

2018-08-0220 min

Plan With DanEpisode #62: Debunking Financial MythsThere’s an almost endless list of retirement planning myths that need to be debunked. We’ll debunk some of

these misleading statements that often lead people astray. Put on your “mythbuster” hat and let’s go.

Click the link to receive your FREE Retirement Rescue Toolkit: https://bv341.infusionsoft.com/app/page/taxfree-kit

Click the link to read more from Dan's Blog: http://betzelwealthadvisors.com/2018/07/episode-62-debunking-financial-myths/

2018-07-1926 min

Plan With DanEpisode #61: Things You Can't ControlIn retirement planning, there are many things that are completely out of your control. Fortunately, the things

that you can control allow you to deal with those things you can’t.

Click the link to receive your FREE Retirement Rescue Toolkit: https://bv341.infusionsoft.com/app/page/taxfree-kit

Click the link to read more from Dan's Blog: http://betzelwealthadvisors.com/2018/07/episode-61-things-you-cant-control/

2018-07-0523 min

Plan With DanEpisode #60: (I Can't Get No) Retirement SatisfactionIt seems like a basic goal: We all want to achieve some measure of satisfaction in retirement. But how do we get there? What are some of the smaller goals we can set along the way? Dan will show us how he helps people achieve things like confidence, security, independence and peace of mind on the way to ultimately reaching retirement satisfaction.

Click the link to receive your FREE Retirement Rescue Toolkit: https://bv341.infusionsoft.com/app/page/taxfree-kit

Click the link to read more from Dan's Blog: http://betzelwealthadvisors.com/2018/06/episode-60-retirement-satisfaction/

2018-06-2115 min

Plan With DanSeven Estate Planning Mistakes You Need To AvoidUnfortunately, it's easy to make mistakes when it comes to estate planning. Dan will outline seven of the most common estate planning mistakes he sees people make and gives us suggestions on how to avoid these.

Click here for Dan's Retirement Rescue Toolkit.

2018-06-1417 min

Plan With DanSpousal Conflicts: Savers vs. SpendersA lot of couples will often have one spouse who is the saver of the pair and the other is the spender. How can you effectively prepare for your financial future with such differing personalities? Dan will take us through the action steps he takes when working with couples through issues like this.

Click here for Dan's Retirement Rescue Toolkit.

2018-06-0718 min

Plan With DanPlaying Retirement Catch-upIf you're a little behind in preparing for retirement, don't be afraid. A lot of people are in the same boat. There's good news, however. With some discipline and some good saving and planning strategies, it's possible to make up a lot of ground in a relatively short period of time without taking undue risk. Dan will take us through a scenario of a 50 year old person who needs to start playing retirement catchup. You'll be amazed by how quickly things can turn around.

Click here for Dan's Retirement Rescue Toolkit.

2018-05-3114 min

Plan With DanHow Do You React To Market CorrectionsAnytime the market is moving in a downward direction, or even just wavering, we see people react in various ways. Take a listen to see if you identify with one of these common reactions to market corrections. Do you over-trade as a response? Do you stick your head in the sand or run around like a chicken with your head cut off? Dan will give you ways you can avoid becoming your worst enemy and show you how to keep particular emotions and reactions in check during times of market turmoil.

Click here for Dan's R...

2018-05-2412 min

Plan With DanStory TimeWe’ve probably all had one of those moments where we didn’t listen to the advice someone was trying to give us. Let’s hear about a time it happened in the financial world when someone didn’t listen to the advice of their financial advisor and later wished that they had.

Click here for Dan's Retirement Rescue Toolkit.

2018-05-1709 min

Plan With DanLessons I Have Learned From My Clients Who Have RetiredJust as clients can learn a lot from Dan, Dan can learn some lessons from his clients. Hear about Dan's experiences with retired clients and how they have shaped his financial perspective and strategies.

Click here for Dan's Retirement Rescue Toolkit.

2018-05-1013 min

Plan With DanThe Five Things I Wish Every Investor Knew About Market VolatilityThere are some misunderstandings out there about market volatility, especially with the recent instability in the stock market. Let's explore some of the important lessons every investor should know about the nature of volatility.

2018-05-0312 min

Plan With DanThe Most Overlooked And Forgotten Element of Retirement PlanningA few weeks back, we talked about what a holistic plan really looks like. One of the five core elements also happens to be one of the most overlooked and forgottten pieces of a retirement plan. For a myriad of reasons, individuals and even financial advisors often skip over the family legacy or estate planning portion of a plan. Failing to plan for that element can lead to a lot of confusion and frustration within families. Dan will share with us some of the heartbreaking stories he's witnessed, but we'll also share some of the success stories that have...

2018-04-2615 min

Plan With DanThe Guy Who Freaked Out On The Plane: What He Can Teach Us About Market CrashesDan was on an international flight recently (flew on the Dreamliner, in fact), and sat next to a passenger who was suffering from Aerophobia, the fear of flying. The fear and nervousness was so paralyzing it caused quite the disruption on the 14-hour journey. It got Dan thinking about how we react to stressful situations in the financial world. Do you feel a sense of panic when the market takes a tumble? Do you spend a lot of time worrying about what you can't control? If so, this is the podcast for you. We'll discuss some ways you can...

2018-04-1917 min

Plan With DanThe Reasons Why Everyone, Regardless of Age or Income Level, Needs A Roth IRANo matter where you fall on the age or income spectrum, it's probably a good idea for you to at least consider a Roth IRA. In almost every case, you'll reap some great rewards by utilizng that retirement savings vehicle. Dan will walk us through why it's typically a good idea to have a Roth IRA in your arsenal and lay out some of the top benefits you'll encounter.

Click here for Dan's Retirement Rescue Toolkit

2018-04-1211 min

Plan With DanWhat Does Holistic Or Comprehensive Financial Planning Really Look Like?Some people think they have a comprehensive financial plan, but in reality their plan often lacks critical components. Some people will figure out the right way to structure an income plan, but they'll overlook the role of taxes or healthcare. Sometime the investment plan is solid, but there's no plan of action for how to distribute those funds as income in retirement. Dan will walk us through the five key areas you need to address to truly have a "holistic" or comprehensive financial plan.

Click here for Dan's Retirement Rescue Toolkit

2018-04-0515 min

Plan With DanThe Five Things We Wish Everyone KnewAs financial professionals, there are things that we wish everyone knew and understood. On this podcast, we’ll explore how a financial advisor’s job would be different, and easier, if everybody understood at least five things.

Click here for Dan's Retirement Rescue Toolkit.

2018-03-2914 min

Plan With DanMaking Your Own Financial LuckThere’s a lot of talk in March about leprechauns, four leaf clovers and pots of gold at the ends of a rainbow. The bad news, however, is that none of those things will help you get wealthy or retire successfully. Well, okay, if you find a pot of gold you’ll be in pretty good shape. But those odds are slim at best. So, instead of waiting for luck to find us, how about we make our own financial luck? Here are some easy tips to follow to make it happen.

Click here for Dan's...

2018-03-2216 min

Plan With DanFinancial Power Of AttorneyWe discuss Dan's blog about an article he wrote on guidlines with powers of attorney.

2018-03-1512 min

Plan With DanMailbag: The 4% Rule, Inheritance, And Spousal DisagreementsWe answer questions from listeners like you regarding the 4% rule, what to do when inheriting stocks, and how to get on the same page with a spouse.

Click here for Dan's Retirement Rescue Toolkit.

2018-03-0813 min

Plan With DanThe Financial Lies We Tell OurselvesYou know it’s not a good thing to lie to yourself in any aspect of life. So, let’s “keep it real” and go over some of the common financial lies we tell ourselves and explore why it’s dangerous to approach retirement planning with these mindsets.

Click here for Dan's Retirement Rescue Toolkit.

2018-03-0112 min

Plan With DanShopping At The Retirement Grocery StoreYou probably have a specific routine for how you like to go grocery shopping. Some of us are list-makers, others kind of wing it. Some put everything neatly in the cart while you might be one of those folks who just tosses it all into a big pile. Let’s discuss how retirement is a lot like shopping for groceries. Try not to get too hungry while we do this...

Click here for Dan's "Retirement Rescue Toolkit".

2018-02-2211 min

Plan With DanThe Winter Financial OlympicsIn the spirit of the Winter Olympics, learn how financial planning could be similar to your favorite event, such as cross-country skiing, bobsledding, and more.

Click here for the "Retirement Rescue Toolkit"

2018-02-1514 min

Plan With DanMailbagWe get a lot of listener questions here on the Plan With Dan podcast. So much so that we like to answer a few of them every once in a while. In this mailbag edition of the podcast, Dan answers questions about longevity planning, lump sum planning, and more.

Click here for the "Retirement Rescue Toolkit".

2018-02-0815 min

Plan With DanStress And RetirementPsychologists have determined that retirement is the 10th most stressful event that you can experience in life. The events on the list that are considered more stressful include things like the death of a spouse, divorce, and going to jail. Let’s look at the ways to proactively deal with stress in retirement.

Click here for the "Retirement Rescue Toolkit".

2018-02-0111 min

Plan With DanTax Code Changes (With Special Guest): Part 2We'd like to welcome back special guest Deb Oskin. Deb is an Enrolled Agent and ordained minister. We'll discuss her role in helping members of the clergy with tax preparation.

Click here for the "Retirement Rescue Toolkit".

For more information on Deb Oskin's tax services, visit http://www.oskintax.com/

2018-01-2521 min

Plan With DanTax Code Changes (With Special Guest): Part 1We are joined by special guest Deb Oskin, an enrolled tax agent and an ordained minister, to unpack the recent changes to the United States' tax code.

For the "Retirement Rescue Toolkit", visit https://bv341.infusionsoft.com/app/page/taxfree-kit

For more information on Deb Oskin's tax services, visit http://www.oskintax.com/

2018-01-1823 min

Plan With DanFinancial ResolutionsYou’ve probably made some resolutions for 2018. You’ve probably already failed at some of those resolutions. So, maybe take a stab at starting some very attainable financial resolutions.

For the "Retirement Rescue Toolkit", visit https://bv341.infusionsoft.com/app/page/taxfree-kit

2018-01-1119 min

Plan With DanCollision Of Fear And GreedThe fear we all felt in 2008 is in the rearview mirror. Now the natural response is to be greedy with the recent stock market success we've experienced. How can we reconcile and deal with these different emotions as we try to successfully navigate through the current economic landscape? Dan takes a peek at the collision that takes place betwen our emotions and our financial goals.

For the "Retirement Rescue Toolkit", visit https://bv341.infusionsoft.com/app/page/taxfree-kit

2018-01-0419 min

Plan With DanCommon 401k QuestionsA lot of Americans have 401k accounts. Let’s cover some of the common questions we get from 401k owners. You probably have some of these questions on your mind anyway. Oh, and this advice generally applies if you have a 403b or similar type of account, too.

For the "Retirement Rescue Toolkit", visit https://bv341.infusionsoft.com/app/page/taxfree-kit

2017-12-2813 min

Plan With DanFinancial Santa ClausIn the spirit of the holiday season, let’s pretend that Dan is Santa Claus, and he's filling up the stockings of retirees and pre-retirees with useful financial resources. But you can only fit 6 items into the stocking. Which 6 would you choose?

For the "Retirement Rescue Toolkit", visit https://bv341.infusionsoft.com/app/page/taxfree-kit

2017-12-2118 min

Plan With DanStory Time: Fee ShockLet’s hear about a time when somebody was completely shocked to find out what exactly they were paying in fees inside their portfolio.

For the "Retirement Rescue Toolkit", visit https://bv341.infusionsoft.com/app/page/taxfree-kit

2017-12-1413 min

Plan With DanFinancially Savvy Grandparenting: Part 2Part 2 of our discussion of the 7 tips for grandparents to consider as they help their grandchildren grow into financially savvy adults.

For the "Retirement Rescue Toolkit", visit https://bv341.infusionsoft.com/app/page/taxfree-kit

Financially Savvy Grandparenting

A common question we often get, that’s not even really related to investing, is from retirees wanting to know how they can help pass their financial wisdom on to the next generation. So, let’s touch on six tips for grandparents to consider as they help their grandch...

2017-12-0716 min

Plan With DanFinancially Savvy Grandparenting: Part 1A common question we often get, that’s not even really related to investing, is from retirees wanting to know how they can help pass their financial wisdom on to the next generation. So, let’s touch on seven tips for grandparents to consider as they help their grandchildren grow into financially savvy adults.

For the "Retirement Rescue Toolkit", visit https://bv341.infusionsoft.com/app/page/taxfree-kit

2017-11-3016 min

Plan With DanStory Time: In The Nick Of TimeOccasionally, someone meets with an advisor just in the nick of time. Let’s hear about a time a client was about to make a bad financial mistake, but it was averted because of meeting with Dan Betzel.

For the "Retirement Rescue Toolkit", visit https://bv341.infusionsoft.com/app/page/taxfree-kit

2017-11-2114 min

Plan With DanMailbag: End Of Year Planning, Nursing Homes, Hating AdvisorsLet's answer your questions about end-of-year tax planning, how to handle assets before entrance into an nursing home and what to do if you hate all the financial advisors you've ever met.

For the "Retirement Rescue Toolkit", visit https://bv341.infusionsoft.com/app/page/taxfree-kit

2017-11-1617 min

Plan With DanCouch Potato DollarsYou haven’t gotten where you are in life by being lazy. If you have had children, you probably frequently told them not be a lazybones (or worse). You should do the same thing to your money. Get it off the couch. Lazy money or “couch potato dollars” can endanger your portfolio. Let’s talk about why that is.

For the "Retirement Rescue Toolkit", visit https://bv341.infusionsoft.com/app/page/taxfree-kit

2017-11-0914 min

Plan With DanElephants In The RoomWhen it comes to retirement planning, there can be several elephants in the room. Let’s discuss how a great retirement plan makes sure to address each of these elephants. And don’t let them catch you not paying attention. You know an elephant never forgets.

For the "Retirement Rescue Toolkit", visit https://bv341.infusionsoft.com/app/page/taxfree-kit

2017-11-0215 min

Plan With DanGlory DaysIt can be fun to reflect on the glory days of your life and the way things used to be. And it’s no different in the financial world; retirement planning used to be a lot easier than it is now. Let’s discuss a few issues that make retirement planning harder in today’s world.

For the "Retirement Rescue Toolkit", visit https://bv341.infusionsoft.com/app/page/taxfree-kit

2017-10-2615 min

Plan With DanOpportunities For ImprovementSometimes people just need a complete overhaul of their financial plan. Other times it’s just a matter of a few tweaks that make all the difference. Let’s look at some of the easy opportunities for improvement we commonly see in the investing world.

For the "Retirement Rescue Toolkit", visit https://bv341.infusionsoft.com/app/page/taxfree-kit

2017-10-1912 min

Plan With DanMailbagWe answer listener questions about long-term care, pensions, and advisor selection.

2017-10-1210 min

Plan With DanUnasked QuestionsLots of people have questions about their retirement, but most people should be asking other questions that they don’t even know to ask. Let’s break down the “un-asked questions” of the financial world.

2017-10-0509 min

Plan With DanRetirement RegretsThe old saying goes, “Smart people learn from their own mistakes. Geniuses learn from the mistakes of others.” Let’s look at some of the regrets we hear from people who wish they’d made different financial decisions, so you can learn from those missteps.

2017-09-2808 min

Plan With DanRequired Minimum DistributionsFind out what required minimum distributions are and learn how you can factor them into your retirement planning.

2017-09-2107 min 2017-09-1407 min

2017-09-1407 min 2017-09-0708 min

2017-09-0708 min

Plan With DanUniversal Retirement TruthsLearn the universal retirement truths you can apply to your planning strategy.

2017-08-3112 min

Plan With DanAre 401(k) Plans Right For You?A 401(k) is a great investing tool, but that doesn't mean it's universally the best for everyone. Learn whether a 401(k) is the right fit for you.

2017-08-2412 min

Plan With DanMailbagWe've heard your listener questions on gold and market timing. Find out how these investing strategies affect your portfolio.

2017-08-1709 min 2017-08-1012 min

2017-08-1012 min 2017-08-0309 min

2017-08-0309 min

Plan With DanAre You Playing A Financial Game Show?We'll discuss how your financial world may be closer to a game show than true planning.

2017-07-2712 min

Plan With DanMailbag: IRA, 401Ks, and BondsWe'll devote this whole show to listener questions. From IRAs to bonds, we do our best to resolve your retirement planning confusion.

2017-07-2008 min

Plan With DanFinancial "Blind Spots" You Should Look Out ForWe'll discuss some of the things you might not be thinking about when it comes to retirement.

2017-07-1311 min

Plan With DanFinancial IndependenceWe'll discuss the goals of financial independence, and how those goals can change from person to person.

2017-07-0610 min

Plan With DanCommon Money MistakesWe'll walk through some of the simple mistakes that can have a big impact.

2017-06-2921 min 2017-06-2211 min

2017-06-2211 min 2017-06-1515 min

2017-06-1515 min

Plan With DanWhere Do You StandWe'll discuss the different stages of retirement planning and how you think about them.

2017-06-0811 min

Plan With DanPre-Flight ChecklistWe'll make sure you have everything you need to take off into retirement.

2017-06-0115 min

Plan With DanBreaking Down Your Financial StatementsWe'll help you to better understand your complex financial statements.

2017-05-2511 min

Plan With DanMajor Life EventsWe'll discuss the impact major life events could have on your retirement. Don't worry; we'll make sure you're prepared.

2017-05-1816 min

Plan With DanRookie MistakesWe'll help you avoid the rookie mistakes even the most seasoned investors can make.

2017-05-1116 min

Plan With DanBeneficiary MistakesWe'll share with you five important mistakes people make when naming beneficiaries.

2017-04-2814 min