Shows

The Power Of Zero ShowThe Roth Conversion Myth Most Financial Advisors Get WrongDavid McKnight addresses a myth floating around the financial world: "For a Roth conversion to make sense, you need many years for the Roth to grow so you can recoup the taxes you paid to the conversion." David stresses why this way of thinking is fundamentally wrong – it's built on the wrong assumption that all the money in your IRA belongs to you… when it actually doesn't. Remember: your IRA isn't one pile of money but two piles sitting in the same account. One pile belongs to you, while the other to the IRS. Wh...

2026-01-1407 min

The Johnny Beane PodcastExclusively Van Halen: David Lee Roth Announces 30-Date 2026 North American Tour! 1/5/26David Lee Roth Announces 30-Date 2026 North American Tour

David Lee Roth is officially back on the road.

The former Van Halen frontman has announced a 30-date tour across the U.S. and Canada, kicking off April 16 in Airway Heights, Washington, and wrapping up August 7 in Sturgis, South Dakota.

The announcement follows Roth’s return to the stage in May 2025, ending a five-year hiatus. That comeback debuted at the M3 Festival, where Roth introduced a new eight-piece backing band that included four dedicated backing vocalists.

“We’ve reached the end of my first retirement,” Roth joked during the performance. “How many retirement...

2026-01-0539 min

The Power Of Zero ShowCongress Just Proposed a Major Change to Roth IRA's—Here's What It Means for YouDavid McKnight addresses a brand new proposal that could transform the way Americans use Roth IRAs and Roth 401(k) – and that could have serious implications for your retirement flexibility, liquidity, and long-term tax strategy. With the current status quo, if a person has money in a 401(k) or even a Roth 401(k), they can usually roll it out into an IRA when they retire or leave their job. However, money can't roll the other direction: you can't take a Roth IRA and move it into a Roth 401(k)... A new bipartisan bill introduced by...

2025-12-3108 min

The Power Of Zero ShowWhat Are the Creditor Protection Rules for Roth IRAs and Roth 401(k)s?In today's episode, David McKnight breaks down the creditor protection rules for Roth IRAs and Roth 401(k)s, as well as why more and more Americans are turning to tax-free accounts to insulate themselves from creditors… and the Government itself. In theory, under Federal Law, all IRAs traditional or Roths receive a certain level of bankruptcy protection under the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005. However, that protection is specifically tied to bankruptcy proceedings. If you're sued in civil court, the Federal bankruptcy statute doesn't automatically apply, state law takes over… By p...

2025-12-2408 min

The Power Of Zero ShowTop Five Reasons to Pick a Roth 401(k) Over a Traditional 401(k)This episode features David McKnight sharing the top five reasons why a Roth 401(k) is far superior to a traditional 401(k). Something important to keep in mind: the decision you make today will determine how much of your retirement money your future self actually gets to keep. David touches upon the fact that choosing the wrong 401(k) could cost you hundreds of thousands of dollars in unnecessary taxes in retirement. Tax rate risk is the first big reason why you should consider investing in a Roth 401(k) over a traditional 401(k). ...

2025-12-1708 min

The Power Of Zero ShowSuze Orman Says Roth IRAs Are Great — But Here's What She's MissingThis episode sees David McKnight look at Suze Orman, who, despite being one of the most widely recognized financial voices in America, shares what appears to be incomplete advice. David believes that Orman has done a lot of good for a lot of people thanks to her financial discipline-centered approach (in addition to being a big proponent of Roth IRAs). He agrees with Orman: "Roth IRAs are powerful, no doubt about it. You contribute after tax dollars, your money grows tax-free, and, provided you meet the requirements, you can withdraw those funds in retirement 100% tax-free".

2025-12-1010 min

Just Keep TalkingBrother Love Chats with Drummer Francis Valentino of David Lee RothBrother Love Chats with Drummer Francis Valentino on Just Keep Talking PodcastPlease Support This Show Here!https://linktr.ee/brotherloverocksIn this episode of the Just Keep Talking podcast, Brother Love welcomes drummer Francis Valentino to his home for an in-depth conversation. They explore themes of creativity, mental health, and the authentic experiences of artists. Francis shares insights into his drumming career, including his current role with David Lee Roth, and reflects on his roots in New Jersey's music scene. The discussion is peppered with funny anecdotes, thoughts on musical influences, and...

2025-12-0953 min

The Power Of Zero ShowThe 3 Questions You MUST Answer BEFORE Doing a Roth ConversionDavid McKnight addresses three key questions you must be able to answer before executing a single Roth conversion. Too many people go for Roth conversions without a game plan – this is something that can lead to overpaying taxes and running out of money sooner than anticipated. David points out that if you can't answer the three key questions, you should stop and reevaluate because guessing here can cost you big. "What's the total amount I should convert from my IRA or 401(k) to tax-free?" is the first and most critical of the three qu...

2025-12-0306 min

The Power Of Zero ShowFive Roth Conversion Myths Busted: What Most Americans Get WrongDavid McKnight busts some of the most common Roth conversion myths that are costing retirees hundreds of thousands – if not millions – of dollars over the course of retirement. The "Don't worry about Roth conversion, you'll be in a lower tax bracket when you retire" myth is based on two flawed assumptions. The first one is that your lifestyle will drop significantly in retirement, while the second is the one related to future tax rates being the same or lower than they are today. David points out that, in retirement, people want to maintain their...

2025-11-2607 min

MMA Financial TalkLife Insurance? Roth IRA? What You Need to Know!On today’s show, we’re going to consider the pros and cons of life insurance and Roth IRAs for retirement income as well as saving in a 401(k) and an IRA in the same year.

2025-11-0100 min

Biblioteca Del Metal - (Recopilation)David Lee Roth And Van Halen Band - (Salto Por Locura De Calor)Quieres Crear Tu Propio Podcats Con Ivoox y Monetizarlos, Facil Y Con Ventajas Exclusivas, Decidete A Provar Y Ser Un Creador De Contenido:

Premium anual:

https://www.ivoox.vip/premium?affiliate-code=5cc75a5f002b45173af9c387ed4fcde2

Premium Mensual:

https://www.ivoox.vip/premium?affiliate-code=5d30f7f823522c126f14774e9901e1d8

David Lee Roth (Bloomington, Indiana, 10 de octubre de 1954)[1] es un cantante estadounidense de hard rock. Es conocido por haber sido el vocalista original de la banda de rock estadounidense Van Halen, primero de 1974 a 1985 y, décadas después, desde 2007 hasta la disolución del grupo...

2025-10-3153 min

The Power Of Zero ShowWhy Dave Ramsey's Roth Conversion Advice Could Cost You a FortuneDavid McKnight discusses one of the most destructive pieces of retirement advice he has ever heard: that you should never do a Roth conversion in retirement or within five years of retiring. Dave Ramsey believes you should forego doing a Roth conversion if you're within five years of retirement or are already retired – because of the so-called Five-Year Rule. The problem with this approach, according to David, is that Ramsey is misinterpreting what that rule actually means, in addition to confusing multiple rules and applying them to the wrong people. Ramsey's advice, continues Da...

2025-10-2207 min

The Power Of Zero ShowFour Ways to Pay Tax on Your Roth ConversionDavid McKnight addresses something that can make or break your Roth conversion strategy: how you actually pay the tax. David kicks things off by sharing that Federal and state estimated tax payments are usually made in four equal installments: April 15th, June 15th, September 15th, and January 15th of the following year. Did you know that doing a Roth conversion in December, like many people do, will lead to the IRS pretending that income was earned evenly throughout the year? If you don't account for that, you could get hit with an underpayment p...

2025-10-1507 min

The Retirement Roadmap Show with David NagyRoth Conversions - Don't Leave Tax Brackets on the TableThis episode dissects the powerful financial strategy of Roth conversions, a tool that can help you pay taxes on your retirement savings at today's rates instead of tomorrow's. We'll explore how strategically converting funds can prevent your income from being pushed into a higher tax bracket in retirement. Tune in to learn how to seize this opportunity and avoid leaving valuable tax savings on the table.

2025-09-2700 min

The Power Of Zero ShowWill Safe Harbor Rules Protect You If You Do a 4th Quarter Roth Conversion?David McKnight looks at why many people wait until the fourth quarter to do a Roth conversion, the potential penalties, and what can be done to avoid having to pay underpayment penalties to the IRS. David begins the episode by highlighting the fact that a lot of investors wait until Q4 before they do a Roth conversion – and they prefer to pay taxes on it in cash instead of simply having the taxes withheld by the IRS. From a mathematical standpoint, it's the correct thing to do because it allows you to get 100% of the co...

2025-06-1806 min

The Power Of Zero ShowHow to Avoid the Roth Over-Conversion TrapIn today's episode, David McKnight focuses on whether you should do a Roth conversion, how much you should convert per year, and whether it's possible to over-convert to Roth. David explains that an effective tax rate is the actual percentage of your income that you pay in taxes after accounting for deductions, exemptions, and credits. For David, the only reason you should do a Roth conversion is if you believe that your effective tax rate in retirement will be higher than your marginal tax rate today. David touches upon a couple of reasons...

2025-06-1107 min

The Power Of Zero ShowThe 8 Taxes You Could Pay When Doing a Roth Conversion (Is it worth it?)In this episode of the Power of Zero Show, host David McKnight looks at every possible tax or cost that may result from a Roth conversion. The first tax you'll have to pay when executing a Roth conversion is federal income tax. Whatever portion of your IRA you convert to Roth is realized as ordinary income and piled right on top of all your other income. David is an advocate for not converting to Roth unless you think your federal tax rate in retirement is likely to be higher than it is today.

2025-05-1410 min

The Power Of Zero ShowShould You Take More Risk in Your Roth Accounts Than Your Other Investments?This episode of the Power of Zero show explores whether you should be taking more risks in your Roth accounts than in your other investments. Host David McKnight kicks things off by stating that if you have Roth IRAs or Roth 401(k)s in your portfolio, you should be allocating 100% of these dollars to a stock allocation. That's because these are your most tax-efficient investments and they'll remain tax-free right up until your death – and even 10 years beyond. Remember: you want the biggest returns in your portfolio to take place in a tax-free en...

2025-05-0707 min

The Power Of Zero ShowDebunking Doug Andrew's Roth IRA Hit Job VideoIn this episode of The Power of Zero Show, host David McKnight looks at Doug Andrew's recent video in which he implored his audience to never use a Roth IRA or a Roth 401(k) again. Andrew sees Indexed Universal Life insurance (IUL) as far superior and believes it should be the source of the vast majority of your distributions in retirement. While David likes IUL in certain circumstances, he isn't a fan of sales strategies that debase every other viable tax-free alternative in an effort to exalt IULs. For David, the video is...

2025-04-3012 min

The Power Of Zero ShowWhat Percentage of Your Retirement Savings Should You Have in Traditional IRA vs. Roth?What percentage of your retirement savings should you allocate toward traditional IRAs and 401(k)s vs. Roth IRAs and Roth 401(k)s? That's what this episode explores. Traditional financial guru advice says that it's impossible to predict where tax rates are going down the road. Therefore, you may hear that your best bet is to simply have 50% of your money in tax-deferred and 50% of your money tax-free. David is somehow perplexed by the guru's point of view about the future of tax rates being an unknown. However, signs that things won't...

2025-04-2306 min

The Power Of Zero ShowThe Five Cardinal Rules of Roth ConversionsDavid McKnight goes through his five cardinal rules for doing a Roth conversion. The first principle is simple: don't do a Roth conversion that bumps you into a tax bracket that gives you heartburn. Not sure about what a heartburn-inducing tax bracket looks like? David shares a simple "rule of thumb" you can follow. In your zeal to get your Roth conversion done before tax rates go up for good, don't bump into the 32% tax bracket along the way. The second cardinal rule ties into the almost certainty that Congress will...

2025-04-1608 min

The Power Of Zero ShowHow to Take Advantage of the Retirement Income Valley for Roth ConversionsWondering when you should start thinking about a Roth conversion? That's exactly what David McKnight dives into in this episode of The Power of Zero Show. The retirement valley is that dip in taxable income that happens after you retire but before RMDs kick in – at age 73 or 75, depending on your birth year. David walks through an example: you've got $2 million in your IRA and want to convert all of it to Roth. If you take action during that valley, you can convert more while staying in the 24% tax bracket the whole time....

2025-04-0906 min

The Power Of Zero Show5 Huge Benefits of the Roth IRA!Today's episode addresses five reasons why a Roth IRA is one of David KcKnight's favorite tax-free investments. Unlike other retirement accounts, Roth IRAs give you 100% liquidity on all contributions. While David isn't necessarily suggesting that you use your Roth IRA as an emergency fund, it's nice to know that you won't have to wait until age 59 ½ to be able to access those funds. If you happen to take out your Roth IRA contributions, you can put that money back within 60 days as long as your Roth IRA was not involved in a rollover du...

2025-03-1907 min

Open Forum in The Villages, FloridaThe Magical World of David HimelrickSend us a textExploring The Villages: Magic, Mental-ism , and Classic Cars with David HimelrickIn this episode of 'Open Forum in The Villages, Florida,' host Mike Roth interviews David Himelrick, a resident of The Villages and former college professor with an intriguing background in horticulture, magic, mental-ism, and psychic entertainment. David shares his journey from academia to performing magic, his interest in the supernatural, and his philosophy on magic as a form of entertainment. They discuss his seven-volume book series 'Hooks, Lines, and Thinkers,' filled with h...

2025-01-1727 min

The Power Of Zero ShowAt What Tax Bracket Should I STOP Contributing to Roth: Responding to The Money Guy ShowIn this episode, host David McKnight tackles a question about the tax bracket at which you should stop contributing to the Roth IRA and start contributing to the traditional IRA. The inspiration for this episode was a recent episode of The Money Guy Show. David believes that advice such as that shared on The Money Guy Show doesn't consider most of the people asking questions like the one addressed in the episode. Those are people whose combined marginal tax rates fall between 25% and 30%. Generally, David likes the idea of having a...

2025-01-0806 min

Meilensteine - Alben, die Geschichte machtenXMAS-Special 2024 – Mit den Foo Fighters, David Lee Roth und Camouflage

In diesem Jahr wird es im Meilensteine XMAS-Special definitiv rockig und schrill und als Garnierung gibt es noch eine dicke Portion Synthies oben drauf. Den Start in dieses Special macht Musikredakteur Stephan Fahrig mit dem Soloalbum des Van-Halen-Sängers David Lee Roth.

Die volle, bunte Packung 80er-Rock: David Lee Roth und "Eat 'Em And Smile"

Für David Lee Roth ist "Eat 'Em And Smile" 1986 sein erstes Soloalbum nach der Trennung von der Band Van Halen. Und für Musikredakteur Stephan Fahrig stimmt auf diesem Album ganz viel. David Lee Roth ist hier stimmlich in seiner Bestform, erklärt S...

2024-12-2356 min

The Power Of Zero ShowThe Top 6 Reasons to Do a Roth ConversionToday's episode looks at the top 6 reasons why doing a Roth conversion may be the right move for you. The disastrous fiscal condition of the U.S. is the first reason why you should consider doing a Roth conversion. David explains why debt in and of itself isn't the issue – and what the real problem with it is. Doing a Roth conversion with today's low tax rates can be a way for you to shield your retirement savings from the impact of higher taxes down the road. Not sure what tax rat...

2024-11-0606 min

The Power Of Zero ShowUnderstanding the Tricky Roth 401(k) Distribution RulesDavid McKnight explains how a lack of knowledge about Roth 401(k) distribution rules can lead to unexpected taxes and penalties. This episode dives into practical insights to help you steer clear of unwelcome surprises from the IRS. David illustrates what happens if you withdraw from your Roth 401(k) before age 59½, and how these rules differ from those of a traditional Roth IRA. He subsequently tackles the question of when post-59½ withdrawals of Roth 401(k) growth can be completely tax-free. Roth 401(k) distributions can be confusing – especially if you're planning to take funds...

2024-10-3004 min

The Power Of Zero ShowIs Dave Ramsey STILL Wrong on Roth Conversions?In the past, David McKnight has been critical of gurus like Dave Ramsey. However, this episode looks at a video in which Ramsey seems to have slightly changed his views. Ramsey emphasizes that one key benefit of a Roth IRA is the potential to drastically reduce or even eliminate Required Minimum Distributions (RMDs). David explains that the decision to pursue a Roth conversion typically depends on whether you expect your future tax rate to be higher than it is today. David discusses a missed opportunity in Ramsey's advice to a caller, highlighting a...

2024-10-2310 min

The Retirement Roadmap Show with David NagyTaxes on Sale and Roth ConversionsIn this episode, we dive deep into the tax implications of selling investments and Roth conversions. Learn how to minimize your tax burden while maximizing your retirement savings. We'll discuss strategies for timing your sales, understanding tax brackets, and making informed decisions about Roth conversions.

2024-09-0700 min

The Power Of Zero ShowCan I Avoid IRMAA When Doing a Roth Conversion?David starts the conversation by explaining what IRMAA is, if you should be worried about it when doing a Roth conversion, and whether there are ways around it. David defines the acronym IRMAA, Income-Related Monthly Adjusted Amount. This is an additional charge you could be required to pay on your Medicare Part B premiums. As your income goes up in retirement, your Medicare Part B premium increases with it. David explains why standard deductions do not apply when calculating IRMAA. What is the link between IRMAA and doing Roth conversions? Roth...

2024-08-2806 min

The Power Of Zero ShowWhy You Must Do a Roth Conversion Before Your Spouse Dies (Bonus: Your Kids Will Love You)Today's episode is part of David's interview with Mark Byelich. David and Mark address Mark's concept of "suddenly single". David once met an Uber driver who had saved $1.5M. All financial advisors gave him the same advice "don't change anything" but David had something different to share. A Roth conversion is something married couples should consider to avoid being automatically catapulted into the 22% or 24% tax bracket if one spouse dies. David breaks down the thought process behind considering a Roth conversion even if you feel like you've done everything right.

2024-08-0713 min

The Power Of Zero ShowBeware of This Tax Bracket When Doing a Roth ConversionToday's video is part two of David's interview with Larry DeLegge, the co-founder of Power of Zero. They discuss the tax bracket you should avoid when doing a Roth conversion. They start the conversation by describing why it's a no-brainer to pay your taxes today at 22 or 24% marginal rates. Instead of rushing to complete Roth conversions by 2026 and potentially bumping into higher tax brackets, David suggests stretching the conversions over several years. After 2026, the tax brackets are expected to increase, with the 22% bracket becoming 25% and the 24% bracket becoming 28%. However, these brackets...

2024-06-1908 min

Center Stage: An Abandoned Albums PodcastEpisode 707 - Darren Paltrowitz's prose captures the essence of David Lee Roth's personality and contributions to the music industry, making "DLR" a must-read.Is it time to re-evaluate David Lee Roth?

Darren Paltrowitz is a talented writer renowned for his insightful work. His new book, "DLR: How David Lee Roth Changed The World," is out now and a must-read for any Van Halen or DLR fan.

In this engaging biography, Paltrowitz delves into the life and career of the iconic rock musician and former frontman of Van Halen. With meticulous research and a keen storytelling ability, he offers readers an intimate glimpse into David Lee Roth's journey and his enduring impact on the rock world.

Paltrowitz's prose captures t...

2024-03-241h 08

The Power Of Zero ShowThe Two 5-Year Roth Rules ExplainedThis episode explores the two different five-year rules for Roth IRAs instituted by the IRS to prevent people from abusing them. The first five-year rule applies to earnings on Roth contributions and determines whether those distributions can be taken tax-free. The second rule concerns Roth conversions and lets you know whether conversion principles can be accessed penalty-free. David explains that, for the purposes of the five-year rule, the clock starts the first time any money is contributed to a Roth IRA by either contribution or conversion. Once the five-year rule has...

2024-03-1307 min

Center Stage: An Abandoned Albums PodcastIs it time to re-evaluate David Lee Roth?Is it time to re-evaluate David Lee Roth?Darren Paltrowitz is a talented writer renowned for his insightful work. His new book, "DLR: How David Lee Roth Changed The World," is out now and a must-read for any Van Halen or DLR fan.In this engaging biography, Paltrowitz delves into the life and career of the iconic rock musician and former frontman of Van Halen. With meticulous research and a keen storytelling ability, he offers readers an intimate glimpse into David Lee Roth's journey and his enduring impact on the rock world. Paltrowitz's p...

2024-01-311h 11

Shout It Out LoudcastDorm Damage "Author Darren Paltrowitz - DLR Book: How David Lee Roth Changed The World"On the 48th Episode of Dorm Damage With Tom & Zeus, the guys welcome author Darren Paltrowitz to discuss his exciting new book, "DLR Book: How David Lee Roth Changed The World"Author Darren Paltrowitz joins the guys for a fun discussion on Diamond David Lee Roth the quintessential frontman of the late 1970's and 1980's. The boys discuss his Van Halen days, post Van Halen days and more. Darren shares some exciting stories from his book and the guys even get in some KISS conversation.Don't miss this interview and get your copy of "DLR...

2024-01-171h 00

The Power Of Zero ShowWhat your Financial Advisor Is NOT Telling You About Roth ConversionsToday's episode is part two of David's interview with Power of Zero Advisor Terry DuPont. David talks about the approach many major money management institutions follow, and how it differs from how David and Terry do things. There are situations where large money management institutions forbid their advisors from ever bringing up, for example, Roth conversions. David invites listeners to browse the web trying to find a Ken Fisher article discussing the benefits of a Roth conversion. David discusses what makes the Power of Zero approach stand out in the financial p...

2023-10-2510 min

The Tapes ArchiveDavid Lee Roth 2019 InterviewLast week, we released an interview with David Lee Roth from 1984. This week, we are releasing another Roth interview, but 35 years later. We go from the height of Roth’s Van Halen career to his twilight years. I believe this interview is one of the most honest and humble interviews he’s ever given; he speaks very candidly on many topics. At the time of this interview in 2019, Roth was 65 years old and promoting his line of tattoo skin care products called Ink the Orginal. In the interview, Roth talks at great lengths about his parents and growi...

2023-10-041h 21

The Tapes ArchiveDavid Lee Roth 1984 InterviewA never-published interview with Van Halen's Diamond David Lee Roth. At the time of this interview in December 1984, Roth was 31 years old, and only months away from no longer being in Van Halen. In the interview, Roth talks about the future of Van Halen, his need for attention, whether he’s a bad role model, and what he wants on his tombstone. And in a Tapes Archive exclusive, Mr. Roth busts into an impromptu freestyle rap. The interview is conducted by a new Tapes Archive contributor, award-winning legendary entertainment journalist, screenwriter, producer, and author, Ethlie Ann Vare. For...

2023-09-2724 min

The Power Of Zero ShowFinancial Guru Loses $400k to Ill-Advised Roth Conversion (Is Your Money Safe?)David starts the conversation by describing how a financial guru, Derek Sall, allegedly lost $400k in an ill-advised Roth conversation. According to Sall, you're way more likely to have a lower income in retirement than you have today, so you'll likely be in a lower tax bracket in the future. But as we all know, tax rates must go up as early as 2026 to pay for unfunded government obligations. David made 3 observations to counter Derek's claims: Your income in retirement is not likely to be way lower than it is today. T...

2023-08-1606 min

Cover Your Assets KC PodcastToo Young For A Roth IRA?Is there such thing as contributing to a Roth IRA too soon? After a number of clients have asked how to fund a Roth IRA for a grandchild or college-aged child, David wanted to share all about this option and gift toward the future.

Here’s what you’ll learn on today’s show:

Is it possible to be too young to start a Roth IRA? (2:12)

What qualifications do you need to open a Roth IRA? (4:30)

Why should we pay attention to Roth IRAs? (6:16)

Can they withdraw early from the account? (8:03)

Any Roth opportunities to gift...

2023-07-2723 min

The Power Of Zero ShowWhy the Roth IRA Is NOT Enough (Graham Stephan Is Wrong!)There are a number of popular finance YouTube personalities like Graham Stephan talking about how you can be a millionaire by simply contributing $18 a day into a Roth IRA, but that doesn't tell the whole story. Not only is that advice too simple, it doesn't take into account the value of a million dollars thirty years in the future. Inflation will approximately reduce the spending power of that million into $250,000. The 4% Rule says that if you constrain yourself to only taking 4% of your day one retirement balance, adjusted for inflation as income, you...

2023-07-1909 min

The Power Of Zero ShowDave Ramsey Is Disastrously Wrong on Roth ConversionsThe biggest issue with Dave Ramsey's view on Roth Conversions, and most of his advice in general, is his one-size-fits-all approach which costs his listeners hundreds of thousands of dollars. Dave starts off on the right foot by recommending people pay the taxes up front for a Roth Conversion but then veers off the track pretty quick. Dave breaks down a hypothetical married couple filing in 2020 doing a Roth Conversion, but makes the mistake of conflating the 24% tax bracket as a trap of the Roth Conversion strategy. If you have more than a...

2023-06-2811 min 2023-06-0922 min

2023-06-0922 min

The Power Of Zero ShowShould you do a Roth 401(k) or a Traditional 401(k)? (The Answer May Surprise You!)The decision of whether to contribute to a Roth 401(k) or a Traditional 401(k) all comes down to whether you are likely to be in a higher tax bracket than you are now when you retire. The only determining factor in whether you should contribute to a Roth 401(k) is what you think your tax rate will be when you retire. David takes an example of two twin brothers and compares the difference between a Traditional 401(k) and a Roth 401(k) over the course of 30 years. The takeaway is that if tax rates remain the...

2023-05-3107 min 2023-05-2225 min

2023-05-2225 min 2023-05-0840 min

2023-05-0840 min 2023-04-1743 min

2023-04-1743 min

The Power Of Zero ShowHow to Avoid Over-Converting Your Roth IRADavid sits down with certified financial planner Mark Byelich to discuss how to avoid over-converting your Roth IRA. They start the conversation by describing how over-converting your Roth IRA could sink your retirement plan. According to David, you should execute a Roth conversion if your tax bracket is going to be higher during retirement than it is right now. For stress-free retirement, David believes retirees should constantly think about future tax rates and ways to get to the zero percent tax bracket. David and Mark predict that the Trump tax cuts wi...

2023-03-2218 min 2023-03-1343 min

2023-03-1343 min 2023-03-0237 min

2023-03-0237 min

Cover Your Assets KC PodcastEpisode 209: It’s Not Too Late For Your 2022 Roth Contributions... 5 Things You Should KnowWere you thinking about contributing to a Roth IRA last year but never get around to it? Good news! It’s not too late to make your Roth IRA contributions for 2022. In fact, David encourages most people to make, and even max out, this contribution. So, if you haven’t made your 2022 Roth contributions, now’s your chance.

If you’re looking for ways to invest, this is often a good place to allow your investments to grow tax-free. David explains the ins and outs of contributing to a Roth IRA, who can benefit from it, and why it’s...

2023-02-2315 min 2023-02-1621 min

2023-02-1621 min 2023-02-0115 min

2023-02-0115 min 2023-01-2139 min

2023-01-2139 min 2023-01-1326 min

2023-01-1326 min 2023-01-0527 min

2023-01-0527 min 2022-12-2920 min

2022-12-2920 min 2022-12-2625 min

2022-12-2625 min

The Power Of Zero ShowThe Roth Conversion Mistake That Could Sink Your RetirementDavid kicks off the conversation by revealing that tax rates will revert to where they were in 2017 - you have only four years to take advantage of the historically low tax rates and do a Roth conversion. David explains that most people will try to accelerate their Roth conversion efforts before the 2026 deadline. The problem with this is that trying to accelerate your conversions could bump you into the dreaded 32% tax bracket. You don't have to be a mathematician to realize that the 32% tax bracket is a 33% increase over the 24% - and an unnecessary expense to...

2022-12-1409 min

David HairabedianTheology, Kneeology or Meeology, Dr. David C. HairabedianTheology, Kneeology or Meeology, Dr. David C. Hairabedian

Ministry Time at the Phoenix Prayer Pavilion, David & Joanna Hairabedian The Importance of Hearing God's Voice, David Hairabedian

David & Joanna recently produced a 6 CD Series entitled Freedom in the Glory at Sid Roth Studios. purchase here: https://tinyurl.com/SidRothCDSeries

Watch also "How to Freeze Time: with David on Sid Roth

https://www.youtube.com/watch?v=c44rFdAZGAU

David's Podcasts: http://davidspodcasts.com/

David's TikToks: http://davidstiktok.com/

David's Youtube: http://davidsyoutube.com/

David's Vimeo: http://davidsvimeo.com/

David's Sid Roth Radio interview https://sidroth.org/radio/radio-archives/david-hairabedian/

Our recent...

2022-11-101h 11

The Power Of Zero ShowShould the Federal Government Get Rid of the Roth IRA?Today's episode of The Power of Zero Show addresses the question 'Should the Federal Government get rid of the Roth IRA?' In a recent MarketWatch article, Alicia Munnell, founder of Boston College's Center for Retirement Research, opined that it's time to start thinking about getting rid of the Roth 401(k) and the Roth IRA – and gave three reasons why. Firstly, Munnell believes that Roth IRAs can be hijacked by Congress to pay for expensive partisan legislation. Secondly, she thinks that Roth IRAs should be eliminated because they can turn into tax dodges fo...

2022-10-1907 min

David HairabedianThe Mystery of Yom Kippur - David & Joanna HairabedianThe Mystery of Yom Kippur - David & Joanna Hairabedian

The Importance of Hearing God's Voice, David Hairabedian

David & Joanna recently produced a 6 CD Series entitled Freedom in the Glory at Sid Roth Studios. purchase here: https://tinyurl.com/SidRothCDSeries

Watch also "How to Freeze Time: with David on Sid Roth

https://www.youtube.com/watch?v=c44rFdAZGAU

David's Podcasts: http://davidspodcasts.com/

David's TikToks: http://davidstiktok.com/

David's Youtube: http://davidsyoutube.com/

David's Vimeo: http://davidsvimeo.com/

David's Sid Roth Radio interview https://sidroth.org/radio/radio-archives/david-hairabedian/

Our recent VCM newsletter and Free eBook on healing: https://conta...

2022-10-1047 min

David HairabedianSpiritual Hindrances to Prayer - Pt 1 - David & Joanna Hairabedian, VirtualChurchMedia.comSpiritual Hindrances to Prayer - David & Joanna Hairabedian, VirtualChurchMedia.com

The Importance of Hearing God's Voice, David Hairabedian

David & Joanna recently produced a 6 CD Series entitled Freedom in the Glory at Sid Roth Studios. purchase here: https://tinyurl.com/SidRothCDSeries

Watch also "How to Freeze Time: with David on Sid Roth

https://www.youtube.com/watch?v=c44rFdAZGAU

David's Podcasts: http://davidspodcasts.com/

David's TikToks: http://davidstiktok.com/

David's Youtube: http://davidsyoutube.com/

David's Vimeo: http://davidsvimeo.com/

David's Sid Roth Radio interview https://sidroth.org/radio/radio-archives/david-hairabedian/

Our recent VCM newsletter and Free eBook on healing: https...

2022-09-0856 min

David HairabedianDavid Hairabedian Interview, Sid Roth, Its SupernaturalDavid Hairabedian Interview, Sid Roth, Its Supernatural

David & Joanna recently produced a 6 CD Series entitled, Freedom in the Glory at Sid Roth Studios. purchase here: https://sidroth.org/store/products/freedom-in-the-glory-6-cd-audio-series-by-david-code-9804/

Watch also "How to Freeze Time: with David on Sid Roth

https://www.youtube.com/watch?v=c44rFdAZGAU

Listen to Podcast/Radio interview https://sidroth.org/radio/radio-archives/david-hairabedian/

Our recent VCM newsletter and Free eBook on healing: https://conta.cc/3FdOF8i

Visit the site: https://virtualchurchmedia.com/

How can I give my tithes and offerings, support, or partner with David and Joanna?

Online: VirtualChurchMedia.com...

2022-06-271h 15

The Power Of Zero ShowShould High Income Earners Do Roth Conversions?This episode focuses on a question David recently got from a couple – they made $650,000 per year and wanted to know whether they should consider doing a Roth conversion. Some details about the California-based couple who asked David their question: they're both age 50, with $1.5M in their old IRAs and 401k. They had a lifestyle need of approximately $100,000 after tax, and had about $1M in liquid savings in their taxable bucket. And, lastly, they were contributing $100,000 per year to that bucket and were growing it in plain taxable mutual funds. The couple, which represents the case-study fo...

2022-04-2013 min

Cover Your Assets KC PodcastEpisode 152: 7 Roth Conversion MisconceptionsHow much do you really know about Roth conversions? David walks us through common misconceptions and shares why Roth conversions may be worth considering before the end of the year.

Read more and get additional financial resources here: https://www.coveryourassetskc.com/episode-152-7-roth-conversion-misconceptions

What we discuss on this episode:

0:33 - Christmas is coming!

2:11 - How soon do you need to do a Roth conversion?

3:54 - Who can do a Roth conversion?

4:54 - What are the conversion limits?

6:00 - Can yo...

2021-12-0919 min

Invest SmarterWhy and How to Start a Roth IRA for your Child | Should You Wait for a Dip to Buy Stocks?Today we talk about Roth IRAs for your kids and why you shouldn't wait for a dip to invest. Outline of the ShowRoth IRA for you kids [4:06]Don't wait for the dip [14:00]On today's show, we talk about why and how to open a Roth IRA for your child. Roth IRAs are super powerful. You put after-tax dollars into it, and you take the money out tax-free in retirement when you are over age 59 ½. Now if you have kids, I want you to consider opening a Roth IRA for them. A...

2021-10-1820 min

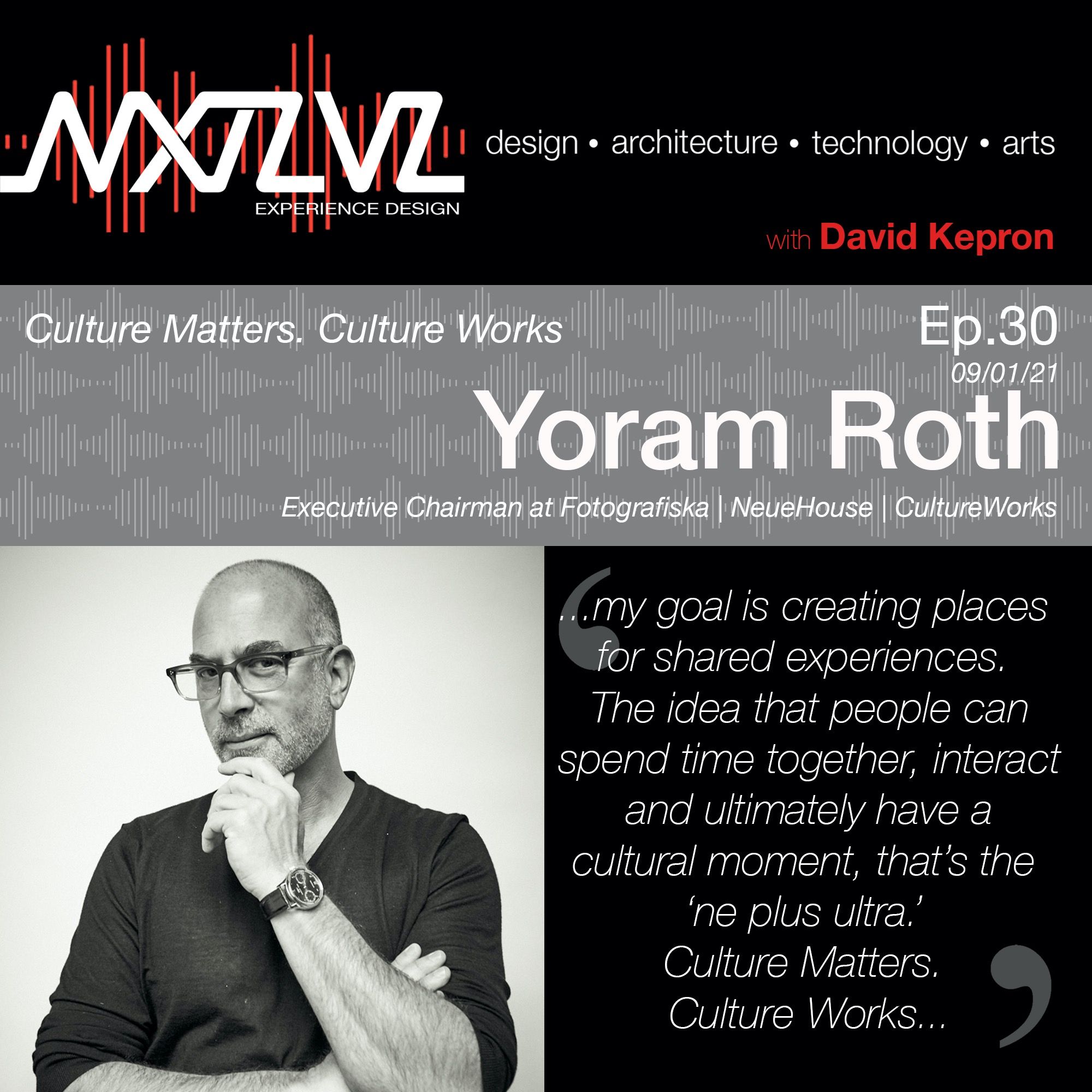

NXTLVL Experience DesignCulture Matters. Culture Works. with Yoram Roth Executive Chairman at Fotografiska | NeueHouse | CultureWorksABOUT YORAM ROTH:Yoram’s Profile: linkedin.com/in/yoramrothwebsites:yoramroth.com (Personal Website)cultureworks.com (Company Website)fotografiska.com (Company Website)Social Media:Twitter: https://twitter.com/yoramroth Instagram: yoram_rothLinkedIn Article: https://www.linkedin.com/pulse/looming-arms-race-cultural-experience-economy-yoram-roth/?trackingId=awEYFGPlTHShS8wDRg1OqQ%3D%3D Email: yoram.roth@cultureworks.comBIO:Executive Chairman: CultureWorks is the holding company, management and development platform for culture, experience and hospitality brands. Fotografiska is redefining the modern museum...

2021-09-011h 07

Notes From An ArtistA Conversation With John Regan (Frehley's Comet, Peter Frampton, David Bowie, Rolling Stones)Send us a textSideman, bandmember, producer, composer, arranger, vocalist, recording artist, and bassist, among other titles, if we were to list John Regan’s entire curricula vitae we may break the internet. A master pocket and melodic player, among John’s credits include his extensive tenure with Peter Frampton, along with his work on stage and/or in the studio with Ace Frehley’s Comet, Dave Edmunds, Stephen Stills, John Waite, Patty Smythe’s Scandal, Rolling Stones, David Bowie, Robin Trower, Billy Idol, Mick Jagger, David Lee Roth, Michael Monroe, and John Phillips, to cite a select f...

2021-06-0856 min

Excel in RetirementElection 2020 Analysis - Should you Convert to a Roth IRA - What EVERY Retirement Plan Needs - Show 22In this show David Treece, a financial adviser, shares with you his election analysis and explains how COVID-19 has impacted this election. He explains how this election may affect you and your retirement. David also shares how we build all weather financial plans at Clients Excel that are built to withstand market volatility. Also, he shares with listeners reasons why you may want to consider a Roth IRA conversion and why some people probably don't need to consider a Roth conversion. David ends the show by discussing what everyone's financial plan must have. He covers...

2020-10-2137 min

The Power Of Zero ShowShould I Do a Roth 401k?Should you be contributing to your Roth 401(k)? The short answer is yes because anything with the word Roth in front of it is truly tax-free. What does it mean to be truly tax-free? Roth 401(k)'s pass both litmus tests for what makes something tax-free. If you're younger than 50, you can put in $19,500 each year, and if you're over the age of 50, you can catch up a bit with an additional $6,500. You can also still get the match when contributing to your Roth 401(k). Your company will put those dollars into your tax-deferred bucket.

2020-04-2915 min

The Power Of Zero ShowWhy Now Is the Perfect Time to Do a Roth Conversion with David McKnightThe coronavirus downturn in the market is actually the perfect time to do a Roth Conversion because of the double sale that's going on. The first sale involves the next six years where we get to enjoy the lowest tax rates we are likely to see in our lifetimes. The second sale is due to the 35% drop in the stock market, your assets are now at much lower values and that means the tax on a potential Roth Conversion is also 35% lower. If you were to hypothetically convert a $1 million IRA this year your tax...

2020-04-0115 min

Cover Your Assets KC PodcastEpisode 66: Everything You Need To Know About Roth ConversionsHave you heard about Roth conversions? Wonder if it’s the right thing for you? David talks through different scenarios related to Roth conversions to see if it’s something that could benefit you.

Read more and get additional resources here: https://coveryourassetskc.com/episode-66-everything-you-need-to-know-about-roth-conversions/

Today's rundown:

1:38 - What is a Roth conversion?

3:37 - What benefit does a Roth conversion provide?

8:33 - What are common mistakes when it comes to Roth conversions?

11:11 - What’s the right way to do a Roth conversion?

2020-03-0520 min

The Power Of Zero ShowThe Difference Between Tax-Deferred and Tax-Free with David McKnightDavid gets the same question nearly every single week. Someone invariably asks about how if they do a Roth conversion, won't they have less money working for them in the tax-free bucket and need more time to catch up compared to had they just left the money in the tax-deferred bucket? If the government came up to you and offered to loan you some money and wouldn't tell you what the interest rate will be, would you cash the check? Putting money into your 401(k) is very similar, by doing so you are letting the government tell...

2020-02-0515 min

The Power Of Zero ShowLast Call For Roth Conversions! with David McKnightThe last weeks of December are critical in terms of taking advantage of your last opportunities to do Roth conversions for the 2019 tax year. Many people think you can go all the way until December 31 but that's not always going to be the case. Some companies require you to submit a Roth conversion much earlier because they can take some time to process. Missing the Roth conversion deadline can have major tax implications. With a traditional IRA you can fund it up until April 15 of the following year, but that's not the case with Roth...

2019-12-1817 min

The Power Of Zero ShowWhat is an L.I.R.P. Conversion? with David McKnightDavid becomes very uneasy when advisors recommend that their clients take the money in their IRA and convert all of it into an LIRP. The LIRP has a lot of benefits, but it really should be used in conjunction with other streams of tax-free income. The LIRP is powerful only to the extent that it's used in collaboration with, in most cases, four to six other streams of tax-free income. That's when it really shines. An LIRP conversion is something that you would use with a client when there are no other opportunities for Roth...

2019-10-3016 min

TheRothShow#27: The street of dreams,The street of dreams,Every bet a sure thing,Savage Streets,Gang Girls and dream peddlers,Orgy Town,2 hot for hell,Fraternity of Shame,V is for Vegas,Sweet as sin and twice as dangerous,..Vegas was just the sales girl, her product was depravity,The musky fragrance of sativa clung to her lips,In that strange, savage world of night, Roth was the undisputed king.

2019-10-0133 min 2019-09-0909 min

2019-09-0909 min

The Power Of Zero ShowThe Great Roth Conversion Myth with David McKnightYou will find articles on the internet that claim that if you are going to do a Roth Conversion you have to do it a number of years before retirement, because you must have the ability to recuperate the dollars you've paid towards tax, but that doesn't stand up to the math. David goes over the example of two brothers, each taking a different approach to investing $100. One goes for the tax deduction on the front-end approach, and one for the tax-free approach. The moral of the story is that most people believe that if...

2019-08-2813 min

The Power Of Zero Show15 Things You Should Know about the Roth IRA--Part 2 with David McKnightToday, we continue last week's discussion of 15 Things You Should Know about the Roth IRA, with Part 2. You can not take a required minimum distribution from an IRA and turn it into a conversion, you have to deposit it somewhere else. The ideal scenario is to preemptively convert all your IRA's to Roth IRA's before you would want to. Roth conversions have to be done before December 31 but that makes it a real challenge to know what your modified adjusted gross income will be for the year by that time of the year. ...

2019-07-3115 min

TheRothShow#16 Green Hornets..TITLE: Green Hornets..Freeze; Where’s Roth?Looking for a needle in a..The perfect HotdogMy my, things are particularly clean today.TITLE: About an hour and a half above the Kentucky border..The scenic Route (Off-road comfort on a dog-nose seat) In case you need the phone, just knock..New York City, New Years Eve; 2 days later.Cross-Training (Gymnastics for the brain).T...

2019-07-3059 min

The Power Of Zero Show15 Things You Should Know about the Roth IRA--Part 1 with David McKnightA true tax-free investment will meet two basic tests. They will first be free from every type of tax which means free from federal tax, state tax, and capital gains tax. The second thing is that the investment can't count as provisional income. Roth IRA's meet all those criteria as long as you are at least 59 and a half. Anything with the word Roth in front of it should be embraced as a truly tax-free investment, including Roth IRA's, Roth Conversions, and Roth 401(k)'s. You can't make a significant amount of money and invest...

2019-07-2414 min

TheRothShow#16: David Lee Roth’s 4th of July Christmas Special..Untouched by Human handsIon Bru for a ten spot..Pot LuckIf you had to live in a beer ad, which one would you choose..?The Patron Saint of Midnight..How I became a relationship god (part 12)A PHD in THCNot popular like beer, more like French Fries..Cultivate your buzzShould I make another sex tape?Breakfast of Champions..Timing is everything, (What time do...

2019-07-0940 min

Cover Your Assets KC PodcastEpisode #33: Should You Contribute To A Roth or Traditional IRA?Are you trying to decide where you should contribute money toward retirement? Whether you are 20 or 60, David will talk through some of the things to consider before you decide between a Roth IRA or traditional IRA. The difference down the line is worth taking time to thoroughly consider now.

Full show notes: https://coveryourassetskc.com/episode-33-should-you-contribute-to-a-roth-or-traditional-ira/

----more----

Equipping Points:

1:25 Where do I contribute: Roth IRA or traditional IRA?

The main difference is taxes, which can be a massive difference. With a traditional IRA you get a tax deduction the year of the deposit, b...

2019-07-0314 min

TheRothShow#14 David Lee Roth tries Scotland’s IRN BRU, for the first time..Powered by IRN BRU..A Fist to face confrontation..The trouble with Bru is a week later I’m drowsy again..When I’m a hamburger..No animals were harmed in the testing of this product..In fact nothing natural has been anywhere near this product.Songs for my dogYour hairy little face..No-one plays ball like you..Let’s just sit here forever..Let’s just sit here forever some more..The mysterious noise.Am I s...

2019-06-2648 min

TheRothShow#10 - EDC: High Point of the Evening...High Point of the EveningThe same Haircut as youVegas ConfidentialIs that the mouse or the marshmellow?Reefer Magic / Please recycleHot Slots on PotRoth Rocks Holland pops

2019-05-2857 min

TheRothShow#04 - The Roth Report: Pot Shop Donut Stop…VidaliaRoscoe Blvd Tattoos Cannabis updateWhite Trash Sandwich reviewSpam TacosGirl Scout cookiesGateway drug to good musicCraft DonutsGreen Earth Collective

2019-04-1652 min

TheRothShow#03 - Dave goes to Vegas...Dave goes to VegasThe planPerfect combinationthe roth report(Food news and cannibis reviews)

2019-04-1647 min

The Power Of Zero ShowWhat's Better - the Roth IRA or the LIRP? with David McKnightEvery once in a while an advisor will attempt to elevate the LIRP by diminshing the Roth IRA. They may, for example, say that the Roth IRA has some inherent limitations, including income limitations--if you make too much money or too little money--lack of plan completion insurance, and the inability to access the money until you're 59.5 years old. You're also susceptible to declines in the stock market. The Life Insurance Retirement Plan, on the other hand, has no contribution limits and no income limitations. It's often referred to as the rich man's Roth because it has many...

2019-04-0317 min

The Power Of Zero ShowThe Back Door Roth and Roth Recharacterizations with David McKnightWith a Roth IRA you have income limitations. At a certain amount of income, the amount you can put into a Roth IRA begins to reduce and at $203,000 in yearly income you can no longer do a Roth IRA. This is problematic for people that have a lot of taxable income in a given year. There are ways around the limitation but it comes with strings attached. If you make more than $203,000 in gross income as a married couple, you can take advantage of a Traditional IRA. The tradeoff here is you get a tax deduction now...

2019-03-2714 min

The Power Of Zero ShowShould I Do A Roth Conversion? with David McKnightAnyone can do a Roth conversion. You need to have money in an IRA. There are no income limitations. The question comes down to how much tax you want to pay. Do you feel like your tax bill will be lower or higher if you were to postpone the payment of that tax? Some opponents of Roth conversions will say that you won't get the full amount of money in your IRA working for you. However, you have to remember that the IRS partners with you in that account and their portion of that money...

2019-02-2724 min

The Power Of Zero ShowDavid McKnight's Interview with the Nation's #1 Financial Podcast, Stacking BenjaminsThe story David tells at the beginning of the book is a tale about David Walker, the former Comptroller General for the federal government. Back in 2008 he appeared on a radio show and told them that tax rates have to double. The math says that the country is going to go bankrupt unless tax rates go up dramatically in the next ten years. Most of us are putting money into tax-deferred plans hoping that taxes will be lower in the future than they are now. Back in the 70's and 80's the tax-deferred strategy actually...

2019-01-2317 min

Metal MomentBonus – Learning Japanese in the Style of David Lee Roth Today I talk about how podcasting sells music. The resurgence of Vinyl. Learning about my home country Japan, through David Lee Roth. Learning Japanese with Host Hinohara Chiaki. Learning English with Host Chiaki Hinohara. 一緒に英語をデーヴィットを通おして学びましょう。ドランカー度 4 .2

Beer Of The Moment:

Hitachinon Nest Nipponia Pilsner Beer

Featured Tracks:

David Lee Roth: A Little Ain’t Enough (A little Ain’t Enough – 1991)

Cinderella: Nobody’s Fool (Night Songs – 1986)

Learning Japanese with Host Chiaki in the style of David Lee Roth:

Five Star: 五つ星

Don’t make a fool of me : こきにするな

Patron:Hiroshi Tanida ($5)

Support the show by becoming a member of the Metal Moment Podcast...

2016-07-1100 min

Japanese Metal Head Show - Jpn & Eng Bilingual Show / Beer / Music / Guitar Talk / ビール / メタル / 英会話Bonus – Learning Japanese in the Style of David Lee Roth Today I talk about how podcasting sells music. The resurgence of Vinyl. Learning about my home country Japan, through David Lee Roth. Learning Japanese with Host Hinohara Chiaki. Learning English with Host Chiaki Hinohara. 一緒に英語をデーヴィットを通おして学びましょう。ドランカー度 4 .2

Beer Of The Moment:

Hitachinon Nest Nipponia Pilsner Beer

Featured Tracks:

David Lee Roth: A Little Ain’t Enough (A little Ain’t Enough – 1991)

Cinderella: Nobody’s Fool (Night Songs – 1986)

Learning Japanese with Host Chiaki in the style of David Lee Roth:

Five Star: 五つ星

Don’t make a fool of me : こきにするな

Patron:Hiroshi Tanida ($5)

Support the show by becoming a member of the Metal Moment Podcast...

2016-07-1100 min

Metal Moment Podcast - English & Japanese Bilingual Show / Interviews / Guitar Talk / Beer / メタル / ビールBonus – Learning Japanese in the Style of David Lee Roth Today I talk about how podcasting sells music. The resurgence of Vinyl. Learning about my home country Japan, through David Lee Roth. Learning Japanese with Host Hinohara Chiaki. Learning English with Host Chiaki Hinohara. 一緒に英語をデーヴィットを通おして学びましょう。ドランカー度 4 .2

Beer Of The Moment:

Hitachinon Nest Nipponia Pilsner Beer

Featured Tracks:

David Lee Roth: A Little Ain’t Enough (A little Ain’t Enough – 1991)

Cinderella: Nobody’s Fool (Night Songs – 1986)

Learning Japanese with Host Chiaki in the style of David Lee Roth:

Five Star: 五つ星

Don’t make a fool of me : こきにするな

Patron:Hiroshi Tanida ($5)

Support the show by becoming a member of the Metal Moment Podcast...

2016-07-1100 min

Japanese Metal Head Show - Jpn & Eng Bilingual Show / Beer / Music / Guitar Talk / ビール / メタル / 英会話Bonus – Where is David Lee Roth, on the Dog Days Of Podcasting Day 17 Just came back from an unexpected visit from the Dentist. Half of my face and tongue is numb. I replay the shortest show that I have ever produced. David Lee Roth Style. His “The Roth Show” podcast was fantastic.

Featured Track:

Van Halen: Jump (1984 – Warner Bros 1984)

Topics Include:

– The Roth Show

– David Lee Roth’s Tokyo Hi-Power Style Radio Show

– Female Translator Etsuko

Dog Days of Podcasting is a 31 day podcasting challenge created by Kreg Steppe in 2012. I’m going to hit record for the next 31 days. No edits, just l...

2015-08-2108 min

Metal MomentBonus – Where is David Lee Roth, on the Dog Days Of Podcasting Day 17 Just came back from an unexpected visit from the Dentist. Half of my face and tongue is numb. I replay the shortest show that I have ever produced. David Lee Roth Style. His “The Roth Show” podcast was fantastic.

Featured Track:

Van Halen: Jump (1984 – Warner Bros 1984)

Topics Include:

– The Roth Show

– David Lee Roth’s Tokyo Hi-Power Style Radio Show

– Female Translator Etsuko

Dog Days of Podcasting is a 31 day podcasting challenge created by Kreg Steppe in 2012. I’m going to hit record for the next 31 days. No edits, just l...

2015-08-2108 min

Metal Moment Podcast - English & Japanese Bilingual Show / Interviews / Guitar Talk / Beer / メタル / ビールBonus – Where is David Lee Roth, on the Dog Days Of Podcasting Day 17 Just came back from an unexpected visit from the Dentist. Half of my face and tongue is numb. I replay the shortest show that I have ever produced. David Lee Roth Style. His “The Roth Show” podcast was fantastic.

Featured Track:

Van Halen: Jump (1984 – Warner Bros 1984)

Topics Include:

– The Roth Show

– David Lee Roth’s Tokyo Hi-Power Style Radio Show

– Female Translator Etsuko

Dog Days of Podcasting is a 31 day podcasting challenge created by Kreg Steppe in 2012. I’m going to hit record for the next 31 days. No edits, just l...

2015-08-2108 min