Shows

Money Life with Chuck JaffeJillian Johnsrud: 'Why retire once when you can retire often?' Jillian Johnsrud, the podcaster behind "Retire Often," and the author of a new book out this week that goes by the same title, says that a lot of people mess up their retirement lifestyle by not preparing for it with smaller retirements — lasting a month or more — during their prime working years. Not only do these smaller times allow people to recharge and rejuvenate, they become dry runs for the real thing, allowing pre-retirees to sample ideas and then plan how to execute the best concepts. Johnsrud — who says she has retired at least a dozen times despite only being i...

2025-09-101h 03

The Military Money Manual PodcastDual Military Millionaires: Financial Independence in 4 Years, Navy Lifestyle Tips, and Maintaining Connection as a Couple #184 Carol and Ken didn't just imagine a life beyond the military- they designed one. In just four years, they transformed from brand-new ensigns with zero TSP contributions into self-made millionaires. In this episode, we'll unpack the financial strategy, discipline, and teamwork that helped them achieve Lean FIRE (financial independence, retire early) before 30—all while navigating dual military careers and deployments. They get real about: Starting from scratch: Misconceptions about TSP, military pay issues, and their humble financial beginnings Mindset over mechanics: Why a simple strategy, applied consistently, beats fancy budgeting tools Sacrifice and simplicity: Li...

2025-07-141h 02

The Military Money Manual PodcastWhy File for VA Disability | "I'm Good" and Other Lies Veterans Tell Themselves with Doug Nordman #180 Did you know even a 0% rating can unlock important benefits for you and your family? Why do so many veterans delay or avoid filing for VA disability compensation? It's not about the money—it's often about identity, pride, and a labyrinth of red tape. Doug Nordman joins Spencer to break the silence and stigma surrounding VA disability claims, while sharing personal stories, tough truths, and practical advice every veteran—and their family—needs to hear. 🎯 Episode Highlights 1. The Hidden Costs of "I'm Good" How military culture conditions veterans to downplay symptoms The long-term...

2025-06-2348 min

The Military Money Manual PodcastRaising Money Smart Kids in Military Families with Daniel Kopp #164How to teach your military kids about healthy and positive money habits, set expectations for college, use the GI Bill, and leverage 529s and other investment accounts for your military family. With today's guest, Daniel Kopp, we discussed: Teaching kids spending, saving, and giving buckets Teach, demo, supervise with your kids Give them chances to fail Wants vs. needs & delayed gratification Don't make money a big secret- talk about it Evolving the lessons you teach your kids as they age 529s, UTMAs, taxable brokerage accounts, and life insurance Tax efficient gifting strategies FAFSA for military families...

2025-03-0356 min

Inspired MoneyRetirement Travel Adventures: Exploring New Horizons in Luxury Why This Episode Is a Must-Listen Are you ready to redefine retirement travel? Whether you dream of luxury cruises, guided tours, or experiencing life as a full-time traveler, this episode of Inspired Money opens up endless possibilities. Discover how retirees are embracing adventurous travel while sticking to budget-friendly strategies. Our panel delves into the mental, social, and personal benefits of travel, offering insights that make luxurious experiences attainable without straining your finances. Meet the Expert Panelists Tim Leffel: An award-winning travel writer and author, Tim specializes in budget-conscious travel and expat living. His...

2025-02-201h 14

Catching Up to FITaking it to the Streets: Best Pro Tips for Late Starters - Episode 118In this episode, we're taking it to the streets of Atlanta, GA where the 2024 FinCon took place. FinCon is the largest (and funnest) conference for independent content creators in the personal finance space. We wish you could have been there but since we couldn't bring our audience to FinCon, we're bringing a little FinCon to you. We chatted with some of them and asked the big question: "What is your best tip for late starters?" 🔗Connect with us Buy CUtFI a coffee Record a message for CUtFI Huge thanks to...

2025-01-2212 min

EverydayFI35. Doug N. - Part 2: "Money nerds unite!"Subscribe on Apple, YouTube, and Spotify. Welcome to EverydayFI, the podcast that explores the lives and stories of everyday people in the financial independence community. Today on the show I'm chatting with Doug — again! This is part two of our conversation and we get into the meat of things. Episode Links: Episode page The Millionaire Next Door Bill Bengen, Safe Withdrawal Rate The Trinity Study Early-retirement.org Work Less, Live More, Bob Clyatt Military Guide to Financial Independence, Doug Nordman How to Raise a Financial Savvy Family, Doug Nordman CampFI FinCon We're Talking Millions, Pa...

2024-12-3049 min

Finding Financial Freedom with The Frugal Physician - Finance, Wellness, Budget, Student Loans, Wealth, Doctor, Fitness, MoneyEp83: Military Money Hacks: Doug Nordman on Early Retirement & Smart SavingsIn this episode of the Financial Freedom Podcast, we welcome Doug Nordman, a retired U.S. Navy submariner, author, and financial independence advocate. Doug shares his inspiring journey to early retirement, practical tips for frugal living, and strategies for raising financially literate kids to prepare them for a life of financial stability. This episode is perfect for anyone looking to achieve financial independence, learn how to live a debt-free lifestyle, break free from overconsumption, and build generational wealth while adopting habits for long-term financial success. If you're starting your journey toward retirement planning this episode is a...

2024-12-2749 min

The Note Closers Show PodcastMilitary FIRE (Financial Independence, Retire Early) with Doug NordmanReady to Dive into Financial Independence? A Hang 10 with Doug Nordman!This episode of The NoteClosure Show is totally rad, dudes and dudettes! We're hanging ten with Doug Nordman, a retired Navy submariner who's not only achieved financial independence but also manages to squeeze in daily surf sessions. Seriously, this guy's life is the ultimate blend of discipline, smart investing, and catching some serious waves. Forget the boring old retirement – Doug's showing us how to live the dream!This isn't your grandpappy's finance podcast. We're deep-diving into practical strategies, sharing actionable tips, and even dropping some military slang (because, wh...

2024-11-1348 min

The Note Closers Show PodcastMilitary FIRE (Financial Independence, Retire Early) with Doug NordmanReady to Dive into Financial Independence? A Hang 10 with Doug Nordman!This episode of The NoteClosure Show is totally rad, dudes and dudettes! We're hanging ten with Doug Nordman, a retired Navy submariner who's not only achieved financial independence but also manages to squeeze in daily surf sessions. Seriously, this guy's life is the ultimate blend of discipline, smart investing, and catching some serious waves. Forget the boring old retirement – Doug's showing us how to live the dream!This isn't your grandpappy's finance podcast. We're deep-diving into practical strategies, sharing actionable tips, an...

2024-11-1348 min

Mark's Money MindEducating the Next Generation to Achieve Financial Freedom | Episode 031In this episode Mark responds to a listener's email about how to teach financial literacy to high school students and children. Mark emphasizes the importance of simplifying finance concepts, highlighting his motto: 'Make Some, Save and Invest, Live on the Rest.'

He recounts personal stories to illustrate industriousness, saving, investing, and conscious spending as vital components of financial freedom. He also encourages involving children in financial conversations and shares recommended reading for financial literacy.

If you would like your question answered on the show, please send an email to Mark@MarksMoneyMind.com and put “pod...

2024-10-1133 min

Mile High FI PodcastMilitary Path to Financial Freedom - B.J. | MHFI 217Doug and Carl chat with Air Force veteran & physician B.J., who shares his journey toward Financial Independence and life beyond material success. B.J. discusses how military benefits like pensions & healthcare can pave the way to financial success, the personal growth he experienced after achieving FI, and the pursuit of deeper happiness beyond owning dream items such as a Lamborghini. Post-military retirement, B.J. emphasizes the importance of giving back to the community and explores his decision to continue working, motivated by a desire to serve others.

Save 50% site-wide on your new mattress, pillow, and bedding ov...

2024-05-281h 33

Inspired Budget#153: Raising Money Smart Teens with Rob PhelanRob Phelan, a high school financial educator, is on a mission to change how kids, specifically teenagers, learn about money. In this episode you’ll learn:How to have conversations about money with teenagersHow to create opportunities for teens to practice managing moneyFinancial challenges faced by young adults - and how to prepare teens to face these challengesPractical strategies you can do at home to teach your kids/teens about moneyCheck out Doug Nordman and Carol Pittner's Book Raising Your Money Savvy FamilyCheck out Dan Sheek's Book First to a MillionChe...

2024-04-1836 min

Catching Up to FICatching the Wave to FI | Doug Nordman & Carol Pittner | 067Doug Nordman and Carol Pittner are a financially-savvy father-daughter duo who take us on their money journey as a family. From learning about money management through unique family practices like the "Bank of Carol," to achieving financial independence, Doug and Carol share the milestones, strategies, and setbacks of their financial journeys. They discuss the importance of saving, investing, and making prudent life choices, all set against the backdrop of their unique military lifestyle. Moreover, they discuss the profound impact of teaching financial literacy from a young age. Whether you're a late starter to financial independence or seeking to pave...

2024-03-241h 31

Mark's Money MindA Simple Mantra: Make Some, Save & Invest, Live on the Rest | Episode 002

In this episode of Mark’s Money Mind, host Mark Trautman, CFP® explains his financial freedom cornerstone mantra: Make Some, Save & Invest, Live on the Rest.

Discussing his personal stories, insights from various books, and advice rooted in practical experience, Mark emphasizes the importance of living within one’s means, the benefits of saving and investing early, and the significance of making informed educational and career choices.

He shares his personal journey, discusses various pathways to earning income, the importance of college cost consideration, and touches upon how to prioritize savings and investments. Additionally, Mark delves...

2024-03-0548 min

Well Kept Wallet Podcast - Personal Finance Show that Helps You Achieve Your Financial Goals126: How to Create Financial Independence that Lasts w/ Doug NordmanDoug Nordman shares how he personally reached financial independence in 1999. He and his wife have been living off of the safe withdrawal rate of 4% since that time. He is the author of The Military Guide to Financial Independence and Retirement and Raising Your Money-Savvy Family for Next Generation Financial Independence, which he co-wrote with his daughter.

2024-02-0646 min

MILMO Show{Encore} The Steps to Financial Independence Retire Early (FIRE)The state of the economy has everyone feeling the squeeze. It's not a great feeling and may have you thinking of ways to work your finances. One of those ways could be becoming part of the FIRE movement or Financial Independence Retire Early. Or just part of the Financial Independence movement. I thought now might be a good time to bring back a special episode I did with Doug "Nords" Nordman on F.I.R.E to get you inspired. In this episode, we cover: History and evolution of the F.I.R.E. mo...

2023-09-0447 min

The Military Money Manual Podcast#31 Doug Nordman: How to Live on the 4% Rule, Recover from Investing Mistakes, and Start a Kid's 401k

2023-03-211h 02

MoneyDad PodcastRaising your Money Savvy Family for Next Generation FI with Doug Nordman and Carol PittnerSend us a text#041. Today’s guests are Doug Nordman and Carol Pittner, a father/daughter duo who provide interesting and contrasting perspectives on raising money savvy families. Doug and his daughter Carol talk the importance of teaching delayed gratification skills to kids. They discuss the concepts and ideas around ’20 minutes per day’ ‘The one special thing’, the ‘Bank of Carol Certificate Deposit System’, and the Kid 401(k), all ideas used while Carol was growing up. Doug and Carol talk about how kids best learn about spending decisions through making bad choices and allowing kids...

2023-02-2858 min

How To Teach Your Kids About Money#7: How A Children's Personal Finance Teacher Raises His Own Money Savvy Son, with guest Rob PhelanRob Phelan is a high school math and personal finance teacher in Maryland. He also is the co-author of a financial education curriculum, as well as the founder of The Simple Startup, which is a program for 10 to 18-year-olds to start their own businesses based on the premise that entrepreneurship is a future-proof life skill. He started on this path about five years ago when his son was born.

Here are some of the key takeaways and opportunities discussed:

👉 Some states require a half-year or full year of financial literacy education in high schoo...

2023-01-1449 min

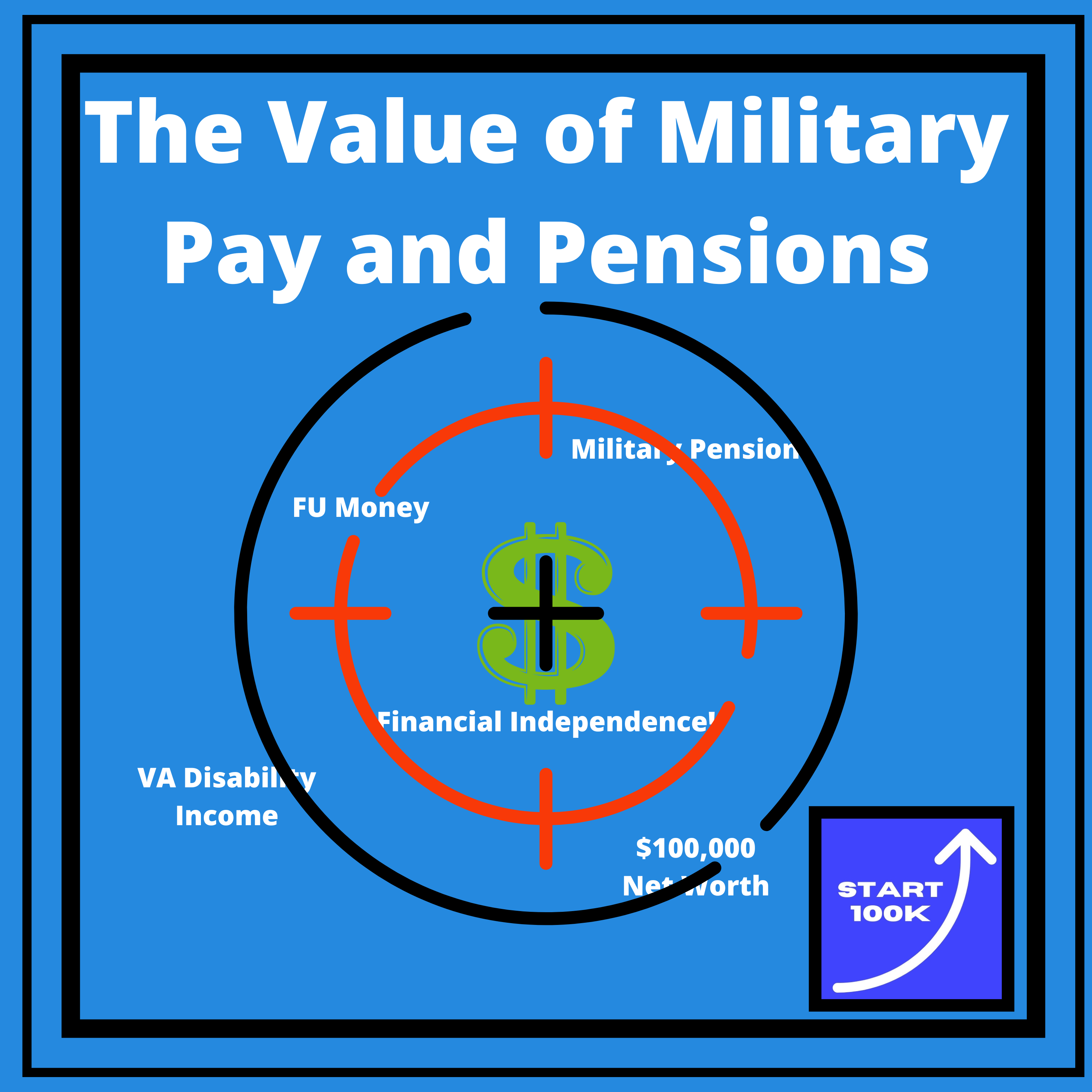

Start100KEpisode 31 - The Value of Military Pay and PensionsEpisode 31 - The Value of Military Pay and Pensions As a service member getting closer and closer to retirement myself, I like to look at and think about how to value my military pension. I recently received my last promotion I plan to get before I retire, so I’m getting a lot more serious about how this fits into our overall plan for financial security and independence. Erik has posted a few different articles that I thought were interesting and he’s also created some nifty spreadsheets (who doesn’t love a good spreadsheet?) that I...

2023-01-1438 min

The Stacking Benjamins ShowBuilding a Financially Independent FamilyDoug Nordman isn't your typical dad. While other fathers were out working, Doug was busy surfing, because he'd focused on financial independence from an early age. Today, he and his adult daughter Carol Pittner join us to discuss how Doug and his wife created a financial modeling system for their daughter and how that daughter (Carol) is now creating her own system at home. We talk about the value of making mistakes, the similarities between good parenting and poker, strategies for creating teachable moments, and more.In our headline segment, social security is in the news. The...

2022-10-241h 20

ChooseFI398 | Troy & Lindsay | Households of FI UpdateIn this episode: career changes, up-skilling, re-prioritizing, accruing debt for value, childcare, and emergency funds. The journey to FI is never linear. Sometimes we can find ourselves thinking the only way to meet our goals is to follow a strict plan, which can make adjusting said plan feel like a daunting set back. Well, our returning Households of FI guests Troy and Lindsay believe that flexibility during ones journey to FI can provide you with tremendous value! Making changes in your life, whether it's accruing temporary debt or changing careers, can actually lead to big time payoffs...

2022-10-0759 min

Start100KEpisode 28 - Be a FI Leader - Interview with Doug Nordman - MilMoneyCon 2022Doug Nordman has been a really positive influence and great mentor for me. He was gracious enough to share some of his thoughts about how junior leaders in the military can take care of those they lead financially. For more from Doug, please visit his website, find him on Facebook, or send him an email at nordsnords@gmail.com. https://militaryfinancialindependence.com/ Be sure to pick up a copy of his books too! https://militaryfinancialindependence.com/about/books/ https://militaryfinancialindependence.com/about/book-money-savvy-family/ Please share this show with...

2022-10-0418 min

Spare Change PodcastEpisode 17: Finding Financial Independence with Doug NordmanRecorded August 6th, 2022.

Doug Nordman and I discuss retirement planning and building financial confidence within a family.

Social Media:

https://linktr.ee/Spare_Change_Podcast

https://www.instagram.com/themilitaryguid/

https://twitter.com/TheMilitaryGuid

Links:

https://militaryfinancialindependence.com/

https://finconexpo.com/

#financialindependence #estateplanning #hawaiilife #behavioraleconomics #militarytransition

---

Support this podcast: https://podcasters.spotify.com/pod/show/spare-change-podcast/support

2022-08-081h 00

Mom Autism MoneyThe Finances of Raising an Autistic Child in the MilitaryToday we talk military life, finances and Autism with Rich Davis. Rich retired after a 28-year career in the US Navy as a helicopter pilot. He and his family reside in Roanoke, Virginia where he volunteers with his church, as the education coordinator for a local museum, and where he is involved with the local art scene as a photographer. He has an adult son with autism who lives with he and his wife and works in the community. We'll discuss a whole range of topics, including: The Exceptional Family Member Program (EFMP). Tricare access at all stages o...

2022-06-0747 min

Earn & InvestCan You Teach Financial Wellness w/ JL Collins, Jessica Collins, Doug Nordman, and Carol PittnerCan you truly teach financial wellness? Even if someone is not ready to hear? We discuss with father and daughter duos JL and Jessica Collins, and Doug Nordman and Carol Pittner. Hear the trials and tribulations of well intentioned dads and their much smarter daughters. Learn more about your ad choices. Visit megaphone.fm/adchoices

2022-04-1855 min

The Military Money Manual Podcast#31 Doug Nordman: How to Live on the 4% Rule, Recover from Investing Mistakes, and Start a Kid's 401kDoug Nordman from The Military Guide joins us today on the Military Money Manual Podcast. While he would never say it, Doug is a bit of a legend in the personal finance, FIRE, and military finance community. He retired 20 years ago in 2002 after a 20 year career in the Navy. I stoppd by Doug's house in Hawaii to have a conversation with him about all kinds of great military FI topics. Doug was an early beta-reader of The Military Money Manual: A Practical Guide to Financial Freedom available at shop.militarymoneymanual.com. This is the perfect book to...

2022-03-141h 02

Start100KEpisode 11 – FU Money for Military Don't Stay Only for the MoneyI’m Chatting with my good friend David about the importance of building up FU money quickly and how this can help members of the military make the best decision for them based on just on money, but what will make them happy. I step-sold myself into staying longer and longer in the military and if I had the finances built up in my first enlistments, I might have taken a different path. Take it from me, if you’re not enjoying it, it’s time to look for an exit. I hope this discussion will be helpful t...

2022-01-1021 min

BiggerPockets Real Estate PodcastHow to Get Your First, Second, or Next Rental Property

If you’re looking to buy your first (or next) rental, you’ve come to the right place! BiggerPockets was founded to help real estate investors network, build their skills, and grow their portfolios. In today’s episode, master of multifamily and all things rental-property related, Brandon Turner, shares how you can build momentum and get your next deal under contract.By overcoming the three roadblocks of real estate investing, you’ll be able to scale your portfolio to heights you’ve never imagined. Achieve financial freedom or surpass it entirely with intelligent, consistent investing so you (and your f...

2021-12-021h 47

MILMO ShowThe Steps to Financial Independence Retire Early (FIRE)Taking small steps to financial independence can have a big impact on your retirement. Many people talk about F.I.R.E or financial independence, retire early. But what are the steps you should take to get there? And does F.I.R.E look the same for everyone? In this episode, my guest, Doug Nordman shares the steps you can take to F.I.R.E., how to handle debt in the process, and how to leverage your military benefits to achieve financial independence faster. Doug served for 20 years of active duty in the...

2021-11-0847 min

ChooseFI349 | Paper Returns Vs. Real Returnsthis week's episode, Brad and Jonathan discuss the importance of knowing the difference between paper returns and real returns. If an asset has a certain value in the market, it does not mean that said value will exist once an attempt to liquidate the asset is made! Later in the episode, they dip into the mailbag and answer listener questions about episode 332 and tax planning! Resources Mentioned In Today's Conversation Follow Brad on Twitter! Millenial Revolution Raising Your Money-Savvy Family For Next Generation Financial Independence by Carol Pittner and Doug Nordman Second...

2021-11-0147 min

Hack Your WealthTeaching your kids about money and financial independence#80: Teaching kids about money isn’t easy, but it’s crucial if you want to boot them off your payroll after they graduate from school.But while financial literacy is good, helping your kids build the mindset and momentum to achieve financial independence is even better.It requires that they internalize (and value) aggressive saving, investing, and compounding…not just living within their means.That’s why I was so excited to chat this week with Doug Nordman and Carol Pittner, father and daughter co-authors of a new book on how to t...

2021-09-211h 24

Money Pilot Financial Advisor PodcastEpisode 60 Reserve RetirementToday were celebrating episode 60 by talking about Guard and Reserve retirement. If you find trying to figure out what your retirement pay will be and how to qualify, you are not alone. Here's a link to the online DoD retirement calculator https://militarypay.defense.gov/Calculators.aspx and Doug Nordman’s blog post in The Military Guide at https://the-military-guide.com/reserve-retirement-calculator/ Doug gives you the numbers and formulas written out more background. First, to determine if you will be eligible for retirement you need to look at the number of points you build up and the num...

2021-08-2511 min

The Lessons in Real Estate ShowEpisode 63: Become Financially Free and Independent with Doug NordmanIn this week's episode, we are joined by the author and founder of The Military Guide, Doug Nordman. Doug served 20 years in the U.S. Navy and retired at age 41. In 1999, he and his spouse Carol reached financial independence and has bought and sold homes over the last 37 years. They have also published several books providing a roadmap for service members, veterans, and their families on how they can become financially independent.

Tune in and don't miss this episode with Doug as he shares with us how you can reap financial rewards and how to avoid the...

2021-03-2551 min

Everyday Bucket List: Travel Ideas, Local Adventures & Money Hacks#16: Is a Slow Travel Experience on Your Bucket List? Live Like a Local While Away w/ Doug Nordman#16 In this session of the Everyday Bucket List Podcast, I chat with Doug Nordman again of TheMilitaryGuide.com. We have a conversation that covers what slow travel is, what are good slow travel destinations and how to choose where to go. Whether you're hoping to spend two weeks, a month or live abroad for awhile like Stanley Tucci from Searching for Italy, get ideas for what this entails and if it's something you can pull off soon, while on your journey to financial independence, etc.

2021-03-2436 min

The Military Millionaire PodcastHow To Achieve Financial Freedom in The Military with Rich Carey and Doug Nordman!Episode: 131

Rich Carey and Doug Nordman

Join your hosts, David Pere and Alex Felice, with guests Doug Nordman and Rich Cary as they talk about investing and asset allocations during the pandemic. While in the military, Rich paid off $230k for a mortgage. Now, he's acquired a fourplex and six-plex during the pandemic as an addition to his properties.

Later, Doug shares a story on getting a 529 account for a granddaughter and explains what it teaches about picking an asset allocation that one can live with personally. For Doug, everything flows, first and...

2021-02-2645 min

The Kinetic Man: Christ-Centered | Veteran-Focused | Investor-Minded53. A Money-Savvy Family with Doug Nordman and Carol Pittner"Train up a child in the way he should go; even when he is old he will not depart from it." - Proverbs 22:6 "How will your kids reach financial independence?" Doug Nordman and Carol Pittner answer this burning question in their new book, Raising Your Money-Savvy Family for Next Generation Financial Independence and we are blessed to have them both on our show to give a little background behind the book and some fun stories and teachings to go alongside. If you have children, this is a must read! Raising Your Money-Savvy Family for Next Generation Financial Independence

O...

2021-02-1553 min

ChooseFI296 | Transition Planning from a Military Career on the Path to FI |Doug Nordman We are circling back to check in with our Households of FI families. First up are Matt and Megan, our international, dual military couple. Having a military pension is like having multiple lottery tickets. You have both healthcare and an inflation-fighting pension, but how many of these lottery tickets do you need to really crush this game? Naval service is Doug Nordman's family business. In addition to his own 20 years of service in the Navy, his wife almost had 20 years of active duty service in the Navy before finishing her career in the Reserves. And then their daughter joined the...

2021-02-151h 41

Everyday Bucket List: Travel Ideas, Local Adventures & Money Hacks#10: Is a Vacation to Hawaii on Your Bucket List? Find Fun Things to Do in Oahu w/ Doug Nordman of The Military Guide #10 Hoping for a Hawaiian vacation? I chat with local Doug Nordman of The Military Guide. In this episode of The Everyday Bucket List podcast, we'll discuss where to go in Hawaii! We cover: Unique travel experiences Everyday life in Hawaii Embracing slow travel In this Everyday Bucket List episode with Doug Nordman, a retired submariner, provided valuable information about living in Hawaii and traveling. It was interesting to hear about the unique experiences and adventures, such as the backpacking trip in Haleakala Crater on Maui, which is a bucket list item...

2021-01-2737 min

The MapleMoney ShowGrowing Up Financially Independent, with Doug Nordman and Carol PittnerEvery parent wants the best for their children, which is why we teach them how to manage money properly. And while we sometimes get mixed results, the truth is that it’s a lot cheaper to make mistakes with money when you’re 12-years old. My guest this week had an excellent example to follow as she was growing up. That’s because Carol Pittner’s parents became financially independent before she turned 10. And when her dad retired early at age 41, Carol witnessed firsthand the benefits of saving money early and often, and she’s followed in his footst...

2021-01-1342 min

BiggerPockets Money PodcastRetired at 35: How Robert from Stop Ironing Shirts Achieved FI Even During The Great Recession

Robert from Stop Ironing Shirts has had quite a lucrative career path. Starting out as a bank teller in college, he learnt that he really enjoyed math that had dollar signs attached to the numbers. From there, he launched his career forward, first as a commercial banker, and later becoming a well-paid top executive.While he had a great job and a partner who was also bringing in a solid paycheck every month, he slowly started to get tired of the corporate bureaucracy, politics, location dependency, and long hours.Robert has made some mistakes on...

2020-12-141h 04

The MapleMoney ShowUnpacking a Lifetime of Financial Independence, with Doug NordmanHave you ever wondered how some people can walk away from their careers years, even decades, before the traditional retirement age? My guest this week did just that, almost twenty years ago. Today, he and his wife remain financially independent, having survived three separate recessions. Doug Nordman is the author of the book, “The Military Guide to Financial Independence and Retirement” and founder of TheMilitaryGuide.com. He joins me on the show to share his financial independence story You can find the show notes for this episode at https://maplemoney.com/125 Do you pref...

2020-11-1838 min

So Money with Farnoosh Torabi1108: How to Talk to Your Kids About Money with Authors Doug Nordman and Carol PittnerWhether you’re struggling for the words (and patience) to discuss topics like allowances and college costs with your teenager or want to encourage your 4th grader to save at a young age, my guests have advice on how to teach financial principles to your kids throughout the years. Doug Nordman and Carol Pittner are the father-daughter authors of the book Raising Your Money-Savvy Family for Next Generation Financial Independence. The book is part personal stories, part practical advice, guiding readers on how to instill financial values in their kids starting as early as Kindergarten, or as the authors say, “afte...

2020-10-1400 min

Find Your FreedomFamily FIRE: How To Teach Your Kids About Money with Carol Pittner#38: How do you raise kids to be good with money? Teaching kids about money at a young age is so important. Carol Pittner co-authored the new book “Raising Your Money-Savvy Family For Next Generation Financial Independence” with her father Doug Nordman. In the book, they share how to educate your child about money from both the parent and the child’s perspective. In this interview, Carol shares what her early-retiree parents taught her to put her on the path to reaching LeanFIRE at the age of 27. We discuss how old she was when her parents taught different financial concepts, the mo...

2020-10-091h 08

Expert(ish) PodcastEp15 - Building an Exit Strategy with Doug NordmanIt's difficult while you're on active duty and you're busy with family. It's tremendously hard to take a step back and think about what your next five years are going to be like. Especially if you're coming up on that transition point, pulling your head out of the fog of work and being able to make a plan is more difficult. Today’s guest of the Expert(ish) Podcast, Doug Nordman, will share his expertise in achieving financial independence. He will also talk about the evolution of authoring financial books for the military, his motivations in writing, an...

2020-09-1444 min

Marriage Kids and Money: Personal Finance for FamiliesMoney Smart Kids: Raising Children to Understand Financial Independence - with Doug Nordman and Carol PittnerRaising money-smart kids gives them a better shot at financial independence. Co-Authors of the new book, "Raising Your Money-Savvy Family for Next Generation Financial Independence", Doug Nordman and Carol Pittner explain how this type of planning helped their family achieve financial independence.Also, BusyKid's Gregg Mursett shares how their chore and reward app helps the financial literacy process and gets your kids working and earning fast. RESOURCES**Sponsor + Partners + Deals: https://www.marriagekidsandmoney.com/sponsors Learn more about your ad choices. Visit megaphone.fm/adchoices

2020-09-0751 min

ChooseFI246 | Overcoming and Battling Financial Abuse | Rachael Partleton What happens when someone is using your finances to prevent you from making decisions that are in your own best interest? What does financial abuse look like and can you reclaim your financial life? Rachael shares her story and how she's become passionate about economic empowerment. Although she had a successful career and what appeared to be a healthy relationship from the outside, Rachael found herself in a relationship with someone who walked all over her. Slowly over time, Rachael's boyfriend began chipping away at her confidence and inserting himself into her finances, putting his name on all o...

2020-08-2450 min

BiggerPockets Money PodcastSecrets of a Money Savvy Family with Doug Nordman and Carol Pittner

Doug Nordman wanted to teach his daughter about money. But he knew that to get it right, he’d have to start when she was very very small. So he did. First, he taught her how to count, then he taught her how to add, then he showed her what she could do with money by using cash in transactions.As Carol got older, she was able to handle the cash herself, learning how to make change, count change, etc. Carol started “earning” her own money, through allowance and jobs - which could only be done after her (n...

2020-08-031h 24

MILMO ShowHow to Raise Your Family Money Savvy (with Carol and Doug)We teach our children their ABCs, arithmetic, and basics of life as they grow to become members of our society but who's teaching them to be money-savvy? Doug and Carol are joining me to discuss how parents can set their children up for financial success and independence. As Father and Daughter, they bring a unique perspective, providing an inside look on both sides of Carol's financial education. The show notes can be found here: https://laceylangford.com/podcast/how-to-raise-your-family-money-savvy/ Doug Nordman served for 20 years on active duty in the U.S. Na...

2020-08-031h 02

Wildly Wealthy LifeHaving The Ability To Make Choices With Doug Nordman and Carol PittnerSome people say more money gives you more problems. But more than that, wealth gives you the simple ability to make choices. These decisions can help you get to where you want to be in life and do what you love. Doug Nordman, the author of the book The Military Guide to Financial Independence and Retirement and the Founder of The Military Guide, and his daughter, Carol Pittner, a retired Navy Reservist, join Lee Hughes and Kat Hughes to talk about financial independence, high savings rates, and more in today’s episode. Don’t miss this episode to discover how...

2020-07-291h 15

Wildly Wealthy LifeHaving The Ability To Make Choices With Doug Nordman and Carol PittnerSome people say more money gives you more problems. But more than that, wealth gives you the simple ability to make choices. These decisions can help you get to where you want to be in life and do what you love. Doug Nordman, the author of the book The Military Guide to Financial Independence and Retirement and the Founder of The Military Guide, and his daughter, Carol Pittner, a retired Navy Reservist, join Lee Hughes and Kat Hughes to talk about financial independence, high savings rates, and more in today’s episode. Don’t miss this episode...

2020-07-291h 15

Wildly Wealthy LifeHaving The Ability To Make Choices With Doug Nordman and Carol PittnerSome people say more money gives you more problems. But more than that, wealth gives you the simple ability to make choices. These decisions can help you get to where you want to be in life and do what you love. Doug Nordman, the author of the book The Military Guide to Financial Independence and […]

2020-07-2900 min

The Military Millionaire PodcastDavid Pere and Alexander Felice reflect on their journey so far (roughly translated to: Dave and Alex talk shit)Episode: 100

David Pere and Alexander Felice

Join David Pere and Alexander Felice for Military Millionaire’s 100th episode! We get into the stories of how the amazing duo ended up where they are now. They also share real estate stories and give a peek on their other projects. Also, Alex plugs his entire existence. Stay tuned, and enjoy the podcast!

In this episode, expect to hear:

When Alex realized that real estate was it!

Alex throws a strong curveball.

How Dave got into podcasting.

Alex starting on YouTube and blogging.

Being a litt...

2020-07-241h 19

Don't Retire...Graduate!Military Money: How Military Families Can Become Financially Savvy

Eric is joined by retired Navy veteran Doug Nordman to discuss how military families can take advantage of the financial resources provided for them and how you can raise a money-savvy family. Show notes & more: https://brotmanmedia.com/season-2-episode-14-military-money-how-military-families-can-become-financially-savvy Learn more about your ad choices. Visit megaphone.fm/adchoices

2020-07-2331 min

ChooseFI232| Raising a Money-Savvy Family for Next-Generation Financial Independence | Doug Nordman and Carol PittnerDoug Nordman and Carol Pittner Join the show to talk about how to raise your children to think about the potential of money in a positive way For more information on the show and for shownotes visit https://www.choosefi.com/232

2020-07-131h 06

Earn & InvestHow Not To Screw Up Your Kids w/ Doug Nordman and Carol PittnerIn this episode we have Doug Nordman and Carol Pittner on to discuss their upcoming book Raising Your Money-Savvy Kids For Next generation Financial Independence. Also, a short segment with listener Patrick about finding meaning and purpose once finances are settled. Learn more about your ad choices. Visit megaphone.fm/adchoices

2020-06-151h 37

The Real Estate JAMEpisode 13: Financial freedom & family with guest Doug NordmanJoin JD, Annabel, and Melissa (The Real Estate Jam) with Doug Nordman as he talks about his experience with military families and financial independence. He details his story about how he got into financial independence through buying houses in Hawaii during the real estate recession in 2000. Doug shares how he has been helping military families understand financial freedom and how he has been able to instill the same mindset into this own family. By the end of this episode, you will learn to track your spending, figure out where you waste money, and make a p...

2020-05-0433 min

FamVestor PodcastRaising Your Money-Savvy FamilyDoug Nordman retired at age 41 after maintaining a high savings rate despite not being high earning. He has been retired for the past 20 years and has remained financially independent through three recessions. This allowed him to provide his daughter with a valuable financial education. Carol Pittner, having learned these valuable lessons in her youth, is now rapidly approaching financial independence herself. Together, this father-daughter duo have amassed wealth and knowledge to be passed down to future generations. Carol and Doug are the authors of “Raising Your Money-Savvy Family For Next Generation Financial Independence”, which comes out la...

2020-04-301h 05

Vroom Vroom Veer with Jeff SmithCarol Pittner and Doug Nordman – Raising Financially Savvy ChildrenDoug Nordman served for 20 years of active duty in the U.S. Navy’s submarine force and retired in 2002 at the age of 41. He and his spouse, a retired Navy Reservist, reached financial independence in 1999 on a high savings rate.

Carol Pittner was born & raised in Hawaii, and joined the Navy on a ROTC scholarship. She’s been stationed around the world on a destroyer and an aircraft carrier before moving to the Reserves. She and her active-duty spouse are rapidly approaching financial independence on a high savings rate.

Carol and Doug's Vroom Veer Stories

Doug was born in Pittsburgh, got to...

2020-04-0649 min

BiggerPockets Money PodcastCoronavirus: Is it Time To Give Up On Financial Independence?

In this week’s episode, Scott & Mindy bring back four previous guests (and introduce a brand new–and future–guest) to talk about retirement, the stock market, and how this current environment is affecting their spending, saving and investing.Andy Hill last joined us for Episode 34 - and boy has his life changed! He left formal employment in January (and shares some surprising info about his income & investing prospects.Amy & Tim discuss their House Sitting & Travel Hacking plans, and how they are on hold during this unprecedented travel lockdown.Kristy & Bryce share how their...

2020-04-061h 46

How to MoneyAchieving Financial Independence in the Military with Doug Nordman #166Our guest today, Doug Nordman starts every morning by checking the surf forecast to see how he’s going to spend the day. He and his wife are financially independent and live on the island of Oahu, which is a surfer’s paradise! Doug was able to achieve this amazing life by taking advantage of the financial benefits offered to him by the military, as well as through standard practices like budgeting and investing extra money towards retirement. He was enlisted in the Navy where he had a career as a submariner, and now he writes about money over at T...

2020-02-1754 min

Earn & InvestThe Problem With Lookin Out For Mom and Dad w/ Cameron Huddleston, Jen Smith, Stephen Chen, and Doug NordmanWhat happens when your financial future is put in jeopardy by your parents? We discuss how to talk to parents about financial issues in the midst of aging, health care crises, and sometimes poor decision making. Featuring Cameron Huddleston, Jen Smith, Stephen Chen, and Doug Nordman. Learn more about your ad choices. Visit megaphone.fm/adchoices

2020-02-171h 04

The MapleMoney ShowWhat Does FIRE Mean to You? Live at FinConWhat do the terms financial Independence and early retirement mean to you? Did you know that the concept has an acronym, and itís fueling a movement thatís growing in popularity across North America? FIRE, or Financial Independence, Retire Early, promotes the idea of making compromises today, to gain financial freedom in the future. My distinguished guests were none other than Doug Nordman, of the Military Guide, Mark Seed, from My Own Advisor, and J.D. Roth, from Get Rich Slowly. In this episode we chat about the whole idea of financial independence, and retiring early....

2019-09-2528 min

The Money ExchangePractical tips for financial independence - Eps - 30Learn some great savings tips from Doug Nordman. Doug served for 20 years of active duty in the U.S. Navy's submarine force and retired in 2002 at the age of 41. He and his spouse, a retired Navy Reservist, reached financial independence in the late 1990s on a high savings rate. They've lived in Hawaii for over 30 years, and their daughter was born & raised on Oahu. These days Doug enjoys surfing, slow travel, writing, reading, home improvement, and more surfing. Doug is the author of "The Military Guide To Financial Independence And Retirement" and founder of The-Military-Guide.com. (He donates all of his w...

2019-09-1616 min

The Boldin Your Money PodcastDoug Nordman: Military Retirement BenefitsThe thirtieth NewRetirement podcast. This time, Steve Chen is joined by guest Doug Nordman — author and founder of The Military Guide — and discusses what life is like being financially independent and how Doug got there by being smart on military retirement benefits.

Recording, editing done by Davorin Robison.

© 2019 NewRetirement Inc.

2019-08-241h 05

The Podcast4PatriotsP4P-003: Doug NordmanWant to be financially independent by age 41? How about on a military income? If you think that sounds impossible, listen to this interview with Doug Nordman from Oahu, Hawaii! Doug and his wife have been financially independent (and retired "early") since before "FIRE" was a cool movement! Yes, he's a real estate investor, but that's not his source of retirement income. More importantly, he is a sound financial guy with real expertise in how military members might plan ahead to REALLY retire when they leave the military after 20 years. Other military veterans would do well to listen to a f...

2019-03-0143 min

Earn & Invest5. How to Raise Financially Responsible Children w/ JL Collins, Jane Collins, and Doug Nordman Three guests share their experience raising financially responsible children. Our panelists are Doug Nordman of The Military Guide, JL Collins of jlcollinsnh and The Simple Path to Wealth, and a special treat Jane Collins is joining us for her very first podcast appearance.We discuss parenting styles, nature vs. nurture, allowances, and a host of great stories about raising kids. Resources:https://the-military-guide.com/The Military Guide to Financial Independence and Retirementhttps://jlcollinsnh.com/The Simple Path to Wealth*Disclosure: Some o...

2018-11-261h 12

The FI Show009 | Camp FI South Takeaways & Community FeedbackThe first portion of this podcast is feedback from last week's episode: The Low-Hanging Fruits of FI.

Anonymous talks about Project FI and tells us about calling to get cell phone data reports.

Cody's mom asks us to clarify how WiFi works.

Luke from Forming the Life talks about the power of automation.

Jeremy corrects Cody about AskTrim and mentions Truebill.

Mike weighs in about Sling TV for watching football.

Emily tells us about saving money on groceries with Checkout 51.

Camp FI South

The second portion of this episode was recorded LIVE from Camp FI South! Whitney Hansen of Money...

2018-10-1318 min

The Financial Independence Show009 | Camp FI South Takeaways & Community FeedbackThe first portion of this podcast is feedback from last week’s episode: The Low-Hanging Fruits of FI.

Anonymous talks about Project FI and tells us about calling to get cell phone data reports.

Cody’s mom asks us to clarify how WiFi works.

Luke from Forming the Life talks about the power of automation.

Jeremy corrects Cody about AskTrim and mentions Truebill.

Mike weighs in about Sling TV for watching football.

Emily tells us about saving money on groceries with Checkout 51.

Camp FI South

The second portion of this episode was recorded LIVE from Camp...

2018-10-1318 min

We Travel There with Lee HuffmanOahu, HI | Doug Nordman shares his favorite surfing spotsLet's catch some waves in Oahu, Hawaii. Today’s guest is Doug Nordman, a retired Navy submariner who now writes for The Military Guide. I have great respect for this retired submariner. Doug shares his favorite surf spots and explains where you can swim with sea turtles. Today’s show notes will be available at WeTravelThere.com/oahu Don’t wait in airport security lines. We have a special limited time offer for listeners. Try CLEAR free for 2 months, when you go to wetravelthere.com/clear and sign up today.

2018-09-2424 min

From the Battlefield to the BoardroomEpisode 43 - The Military Guide: Financial Independence, Part 2If achieving financial freedom is a dream of yours, make sure you listen to the conclusion of our conversation with Doug Nordman, author of The Military Guide to Financial Independence and Retirement / founder of The Military Guide website. Doug and Brian Henry (Orion’s Senior Vice President of Recruiting) join the show to discuss:

• Financially preparing to leave the military

• Additional resources for financial education

2018-06-1526 min

From the Battlefield to the BoardroomEpisode 42 - The Military Guide: Financial Independence, Part 1Orion’s goal is to provide resources to not only help you in your job search, but throughout your entire military to civilian transition. In this episode I’m joined by Doug Nordman, author of The Military Guide to Financial Independence and Retirement / founder of The Military Guide website, and Brian Henry, Senior Vice President of Recruiting at Orion.

During Part 1 of our conversation with Doug, we’ll discuss:

• Retirement options

• The decision to leave active duty

• Recent changes in the military pension system

• Financial myths of retirement

2018-06-1132 min

Her Dinero MattersFinancial Independence and How To Reach It With Doug Nordman | HMM 143Financial independence, what does it really mean and what does it take to achieve it? Doug Norman joins us on the podcast to share what it means to him, his story on how he reached financial independence and so much more! What you'll learn about in today's episode:

The definition of financial independence and some misconceptions behind it

How he reached financial independence in less than 20 years

His recommendations to achieve financial independence

Why it is important to know the difference between frugality and deprivation

A behind the scenes look at what his typical day looks like being fin...

2018-05-2432 min

Crushing DebtThe Military GuideIn this week's episode, we interview Doug Nordman ("Nords") about his book The Military Guide, which you can find on his website, the-military-guide.com. Nords joined the Submarine Force (Navy) right out of college and, upon retirement, found that there was a lack of information to show military members how to retire without having to go back to work. The Military Guide provides service-members, veterans and their families with a road map for becoming financially independent. For more information, visit his website, or contact me at Shawn@YesnerLaw.com or www.YesnerLaw.com.

2018-05-1719 min

Retro VGM Revival HourSTAGE 54: Pinball GamesIn the days before video games, various local arcades were packed wall-to-wall with pinball machines.

Playing a pinball game is total feast for the senses. there are so many different ways to appreciate it, each experience is filled with great history, are technically innovative, display beautiful artwork, and have amazing sound. Playing a pinball machine is an immersive, interactive experience!

so for todays STAGE of the retro VGM Revival hour we are going to play some selected tracks from various pinball games to begin your journey to pinball wizard status.

===========Game – Composer – Title – Year – Company========

1.) Vegas – Unknown – “Main Play”- July 1st, 1990 –...

2018-02-281h 27

ChooseFI057R | CampFi Roundtable 2017057R | A roundtable discussion at CampFI including talks on the military, the flexibility of the FI plan and reaching FI before your partner. On today's episode we cover: Everyone's at a different FI stage in the community Doug Nordman talks about the military and FI How Doug manages his time Natalie talks about the importance of keeping the FI plan flexible JD Roth's 2018 challenge and his view on the FI community The huge wealth of knowledge and feeling of being in a tribe at Camp FI The factor of a successful individual: resilience Cody e...

2018-01-1248 min

The Investor ShowVETERANS EDITION: “How i retired from the military a millionaire w/ Doug NordmanVETERANS APPERCIATTION: How I retired from the military a millionaire W/ Author and Founder of The Military Guide Doug Nordman Check out his book(all proceeds go to veterans): http://amzn.to/2iG8z2lFacebook: https://www.facebook.com/theinvestors...Instagram: https://www.instagram.com/theinvestor...Podcast: https://soundcloud.com/prince-dykesTwitter: https://twitter.com/royalfinancialsWebsite: www.royalfinancals.com Books: www.wesleylearnstoinvest.com

2017-11-1234 min

Adulting.tv Podcast[B039] Lifestyles of the Financially Independent ft. Doug NordmanDoug "Nords" Nordman shares his definition of financial independence and how you can achieve it. For more information, visit http://adulting.tv/ep/b039-lifestyles-financially-independent

2017-10-0841 min

Adulting with Harlan L. Landes and Miranda Marquit[Adulting B039] Lifestyles of the Financially Independent ft. Doug Nordman, The Military GuideWhat is it like to be financially independent? Doug Nordman from The Military Guide shares his story. More info.

The post [Adulting B039] Lifestyles of the Financially Independent ft. Doug Nordman, The Military Guide appeared first on Adulting.

2017-10-0700 min

Optimal Finance Daily - ARCHIVE 2 - Episodes 301-600 ONLYI Achieved Financial Independence in the U.S. Navy by Doug Nordman with Money BossGuest author Doug Nordman with Money Boss shares how he was able to achieve financial independence in the U.S. Navy. Episode 367: I Achieved Financial Independence in the U.S. Navy by Doug Nordman with Money Boss (Personal Finance Habits). J.D. Roth has been reading and writing about personal finance for a decade. Today he’s financially independent, but ten years ago, his money life was a disaster, with over $35,000 in consumer debt. He started turning everything around in 2004. By being the boss of your own life, you, too, can be the master of your own financial fate. The or...

2017-07-2509 min

Richer SoulEp 0018 Richer Soul - Raising Money Savvy Kids with Doug Nordman Today we are going to talk to Doug Nordman who retired at 41 and lives in paradise spending his days wondering about the surf report while he raised a financially savvy kid. There are some amazing incites that Doug shares and you will leave having a strong plan to raise your own money savvy kids. Remember you have to start when they are young! Doug is wonderful giving man and if you meet him I am sure he will invite you out surf with him in Hawaii. Don't forget to say thank you for his service t...

2017-05-021h 09

Rock Your Retirement ShowMilitary Transitions with Doug Nordman: Episode 59Doug Nordman is the author of ‘The Military Guide To Financial Independence And Retirement'.

Doug's writing has to do with Military Transitions.

If you think he's doing it for the money, you're wrong. All of his writing revenue is donated to military charities. He's a retired submariner who's been living in Hawaii for over fourteen years. So if you hear the birds in the background, it’s because he is in a tropical area! He and his wife, (who is a retired Navy Reservist), raised their daughter in the islands. They enjoy slow travel all over the world (some of it on mil...

2017-01-3042 min

Spouse Spouts-Episode 25: Let's Talk Money!Money, money, money. Finances, and more money. It seems so complicated, but is it?

When Susan was in college, she got into serious credit card debt. Susan also learned some tough lessons. But there's more that Susan wished she would have known when she was younger.

With this being a new year, Susan and Dave thought it would be helpful to bring Doug Nordman on Spouse Spouts to talk about finances and the military. There's a lot going on with upcoming tax season, and changes to retirement.

You can read about Doug here: http://the-military-guide.com/about/about-doug-nordman/

2017-01-1100 min

Financial Independence PodcastThe Military Guide – Angel Investing, Market Crashes, & 14 Years of Early RetirementToday on the Financial Independence Podcast, Doug Nordman (a.k.a. Nords) from The Military Guide joins me to talk about how he achieved financial independence at the age of 41 by serving in the military! Doug retired way back in 2002 so we dive into how he dealt with the market crashes that occurred at various stages on his path to financial independence, what 14 years of retirement has been like, and how he's found meaning outside of work. I know many of you enjoyed Doug's wisdom and insights on the previous episode so check out today's episod...

2016-09-3058 min

Financial Independence PodcastCamp Mustache – Q&A with Mr. Money Mustache, Afford Anything, & The Military GuideToday on the Financial Independence Podcast, I'm excited to share a live Q&A session with Mr. Money Mustache, Paula Pant from Afford Anything, and Doug Nordman from The Military Guide! This panel discussion took place back in May at Camp Mustache — an annual retreat in the Pacific Northwest organized by Mr. Money Mustache readers. In this episode, you'll not only hear about… Mr. Money Mustache's biggest splurges The investing mistakes I still can't seem to avoid Paula's favorite thing about financial independence Doug's suggestion for discovering the meaning of life …, but you'll also get vari...

2016-09-121h 06

Afford AnythingHow I Became a Millionaire on a Military Salary - with Doug Nordman#33: After serving in the Navy for 20 years, Doug Nordman, then-age 41, retired from his military career. Most of his peers started second careers in the civilian world. But Doug didn't. He had an ace up his sleeve: he had spent his military career saving 40 percent of his income. By the time he turned 41, he held an investment portfolio worth $1 million. Those investments, coupled with a Naval pension for $30,000 per year, propelled him into financial independence. He's remained retired since leaving the Navy. He's now 55. He surfs three times a week. He travels to Europe on a whim. His retirement portfolio survived two...

2016-07-1137 min

The Steve Pomeranz ShowFrom Average Joe To Millionaire: Retire Comfortably With MillionsHow To Retire Comfortably With MillionsA friend of mine recently sent me a video clip from Yahoo! It was a pretty simple clip and yet very powerful, so I thought I’d share it with you. The video featured two down-to-earth regular guys who spoke in simple terms about how much they earned and what they did to retire comfortably with millions in their bank accounts.DougThe first to speak – Doug Nordman, age 53. Doug and his wife spent 20 years in the U.S. Navy. Doug’s salary peaked at about $88,000 per year before he ret...

2015-12-0206 min

Radical Personal Finance209-The Insider Secrets of Angel Investing! (Or What Angel Investing is Really Like): Interview with Doug Nordman (And, Should I Rent or Buy?)Today, I welcome Doug Nordman back to the show! Doug is an early retiree (he retired at 41) and his hobby is helping other military personnel improve their financial lives.

One of the more interesting aspects of Doug's financial life is his involvement in private business as an angel investor. He's not only involved with the community of investors near him in Hawaii, he's also committed a substantial amount of his savings toward his investments.

In this interview you'll learn:

Why Doug invests his money in private companies even though the majority of his investments a...

2015-06-231h 23

The Military Wallet Podcast with Ryan GuinaTMW 002: Financial Independence & Early Retirement on a Military SalaryIs early retirement your goal? This podcast shows how military members can become financially independent and retire early on a military salary. Join us as we interview Doug Nordman, author of The Military Guide to Financial Independence & Retirement, as we discuss how you can retire for good, whether or not you stay on active duty for 20 years and to earn a military pension.

2014-10-0156 min

Money Mastermind ShowHow Networking Can Help Your CareerComing to you live from FinCon, our panel is joined by an all-star cast to cut through all the buzzword-heavy noise that surrounds the mention of “networking” – and give you the straight goods on what really works. https://moneymastermindshow.com/episode17-how-networking-can-help-your-career/ Some important questions discussed in this episode: What’s the difference between authentic networking and robotic business card exchanging? How do I network if I’m an introvert that is terrified of big groups? Where should I be looking for networking opportunities? Is it all about looking for people that I can ask for fa...

2014-09-1928 min

The Financial Mentor PodcastEarly Financial Independence With Luke Landes

Click here to download the transcript of Luke's best early financial independence tips!

Free Instant Access

Sure, you want early financial independence.

But how do you achieve it?

What are the necessary action steps to reach the goal, and how can you expect your life to change afterward? Surprisingly, it doesn't work like most people think.

In this latest addition to our podcast series featuring early financial independence success stories (see previous episodes with Darrow Kirkpatrick and/or Doug Nordman), Luke Landes shares how he achieved freedom from...

2014-02-031h 07

The Financial Mentor PodcastEarly Retirement Success Story with Doug Nordman

Click here to download the transcript of Doug's early retirement tips!

Free Instant Access

Early retirement is surprisingly simple.

In this fourth session of the Financial Mentor podcast, Doug Nordman reveals in plain language how he did it – so you can too.

What is particularly important to note about Doug's ideas is how consistent they are with the other “early retirement success stories” in this podcast despite his unusual path to early retirement.

In other words, while most financial success stories are about entrepreneurs and business owners who strike...

2013-10-0158 min

The Financial Mentor PodcastEarly Retirement Success Story with Doug NordmanEarly retirement is simple. Discover how to do it with confidence and security in this interview with Doug Nordman illustrating the essential principles nearly everyone must follow. Doug's story is a great example because his path was unusual, but the principles he followed are not. They are timeless and essential to achieving the goal. Discover how...

2013-10-0100 min