Shows

The NDA PodcastPartners In DesignTo partner or not to partner?83% of our listeners say they want a business partner. But the reality? It’s complicated. You spend more time with your co-founder than you do your family. How do you choose the right person to go into business with? Handle conflict when creativity clashes with cash? And what is it like for the teams caught in the middle of founder tension?In this episode, we unpack the partnership recipe: why most billion-dollar startups are built by teams, why solo founders are more likely to sur...

2026-01-1451 min

Invisible InkEp 82 - Valuation is a (Financial) Story, Here’s How to Get it Right, With Dan GrayDan Gray, Head of Insights of Equidam, joins Shubha Chakravarthy to demystify one of the most misunderstood topics in early-stage fundraising—startup valuation. With over two decades in early-stage ventures, Dan reframes valuation not as a number but as a story that links a founder’s vision, strategy, and financial logic.Check out Dan's practical guidance for deep tech and non-consensus founders, and the systemic issues in venture capital that create hurdles for deep tech founders, and a smarter, story-driven approach to raising capital. Highlights include:Why founders must treat valuation as a story, not a num...

2025-11-021h 10

The Peel with Turner NovakUntold Startup Lessons from Dozens of Academic Research Papers with Dan Gray at EquidamDan Gray is the Head of Insights at Equidam.If you’re a tech and investing nerd like us, you’ll love this conversation. We cover everything Dan’s learned reading dozens of academic research papers on startups and venture capital, debunking many popular narratives of the industry.We talk about the dangers of pre-mature startup scaling, the importance of origination stage investing, the concept of startup catering and why so many startups look the same, and the role of mega funds play in the ecosystem.W...

2025-09-252h 06

Motion BlurDan Gray – What's Wrong with Venture?A deeper discussion on the shortcomings (and benefits) of ventureToday we’re interviewing Dan Gray, head of insights at Equidam. We’ve been following Dan’s work throughout the past year and decided to have him on as we begin talking to more LPs about their allocation strategies and perspectives.Dan’s twitter account is a great follow — he frequently shares lots of data-driven insights and rebukes for a lot of the “tried and true” aphorisms. This episode is filled with hot takes, enjoy!🔗 Dan’s BioDan is the Head of Insights at...

2025-09-191h 20

The Equidam PodcastPitch Preparation with Jorian HooverSummaryIn this episode, Jorian Hoover, a fundraising consultant, shares insights on the fundraising process for startups. He emphasizes the importance of founders taking charge of their fundraising efforts, preparing thoroughly, and understanding their readiness to raise capital. The conversation covers common mistakes, building a strong investor list, crafting an effective pitch deck, and navigating the fundraising timeline. Jorian also discusses valuation strategies and shares a success story from a client who effectively raised capital.

2025-09-121h 13

This is 令和スタートアップVC は「騎手」と「馬」どちらに投資すべきか?マルクス・アウレーリウス「自省録」/鳥トマト「東京最低最悪最高!」/瀬戸口みづき「ローカル女子の遠吠え」/出内テツオ「ふつうの軽音部」/押見修造「瞬きの音」/宮下英樹「大乱 関ヶ原」/VC は「騎手」に投資すべきか、「馬」に投資すべきか?/人(創業者)vs事業(ビジネス)/今日は「人優先」/チームを最も重要な考慮事項と評価/スタートアップを創業からIPOまで追跡したある調査では、事業の質が創業チームの特性よりも成功を予測する上でより有効/VCは創業者の属性に過度に注目すると悪影響/多くのVCが「人優先」を表面的な属性と捉える/アイデアやビジネス戦略、テクノロジーは人と切り離せない/人中心主義は間違っているわけではない/最も成功しているVCはジョッキーや馬を探しているのではなく、ケンタウロスを見つける/■参照先:スピーダ スタートアップ情報リサーチhttps://initial.inc/enterpriseShould VCs Invest In ‘Jockeys’ Or ‘Horses’?https://news.crunchbase.com/venture/startup-funding-people-business-considerations-gray-equidam/令スタでは取り上げて欲しいテーマやご質問を募集しています。↓のフォームから是非ご記入ください(匿名です)https://forms.gle/mkoihcHgTJUu4UVp8

2025-07-1023 min

TBPNTesla Robotaxis, Saudi Arabia, AI in Big Tech, Art Market Update + GuestsTBPN.com is made possible by:Ramp - https://ramp.comFigma - https://figma.comVanta - https://vanta.comLinear - https://linear.appFigma - https://www.figma.comEight Sleep - https://eightsleep.com/tbpnWander - https://wander.com/tbpnPublic - https://public.comAdQuick - https://adquick.comBezel - https://getbezel.com Numeral - https://www.numeralhq.comPolymarket - https://polymarket.com

2025-05-133h 04

The Equidam PodcastEmbracing Uncertainty in a Post-SaaS WorldIn this episode of the Equidom Podcast, Dan Gray and Daniel Faloppa discuss the evolving landscape of startups, particularly focusing on the impact of AI, changes in venture capital, and the bifurcation of opportunities in the software sector. They explore how the economics of SaaS have shifted, the challenges new companies face in a saturated market, and the need for investors to adapt to a new reality where traditional metrics may no longer apply. The conversation highlights the importance of understanding risk and the changing dynamics of funding in the startup ecosystem.

2025-05-1235 min

The Equidam PodcastStartup Valuation Trends: AI and Mega-FundsIn this conversation, Daniel Faloppa and Dan Gray explore the current state of the fundraising environment for startups in 2025, discussing trends, challenges, and strategies for founders. They analyze the impact of global economic factors on valuations, the importance of cash flow, and the evolving dynamics between venture capital and private equity. The discussion also delves into the implications of AI on startup valuations and the necessity for founders to align with investors who share a long-term vision.

2025-04-081h 02

The Equidam PodcastThe State of VC in Q1 2025In this conversation, Daniel Faloppa and Dan Gray discuss the current state of the startup fundraising market, focusing on early-stage funding trends, the impact of AI on startups, and the disconnect between valuation and price. They analyze the challenges faced by European startups and explore future strategies for growth in a changing economic landscape. This conversation delves into the evolving landscape of deep tech investment, the impact of macroeconomic shifts on innovation, and the current state of AI funding in venture capital. The discussion highlights the challenges and opportunities presented by the changing dynamics of IPOs and secondary markets...

2025-03-051h 19

TheOnePointDecoding Startup ValuationsValuations topic is confusing and sometimes outright stressful for founders.

That’s why I invited Dan Gray, Head of insights of the Equidam platform for this episode of TheOnePoint.

And not just for founders. Many investors also don’t have the perfect grip on the topic. Due to their fund strategy setup, many investors might be valuation takers and not valuation setters.

And honestly, the whole practical aspect of the valuations is influenced by many factors, including supply-demand of capital from investors who may or may not be too focused on this KPI alone to do deals.

So, in a nu...

2025-01-1759 min

The Equidam PodcastThe State of European Tech, with Robin WautersIn this conversation, Daniel Faloppa (Equidam Founder & CEO) and Robin Wauters (Founder & Former CEO of Tech.EU) discuss the evolution of the European tech ecosystem, focusing on Wauters' journey with Tech.EU and the broader state of European tech.

They look at investment trends, productivity issues, and the importance of innovation. Wauters emphasizes the need for a shift in mindset among European founders and the necessity of creating scale-ups to drive growth and competitiveness in the global market.

They also cover the challenges and opportunities facing European startups in terms of talent retention, government support...

2024-12-1859 min

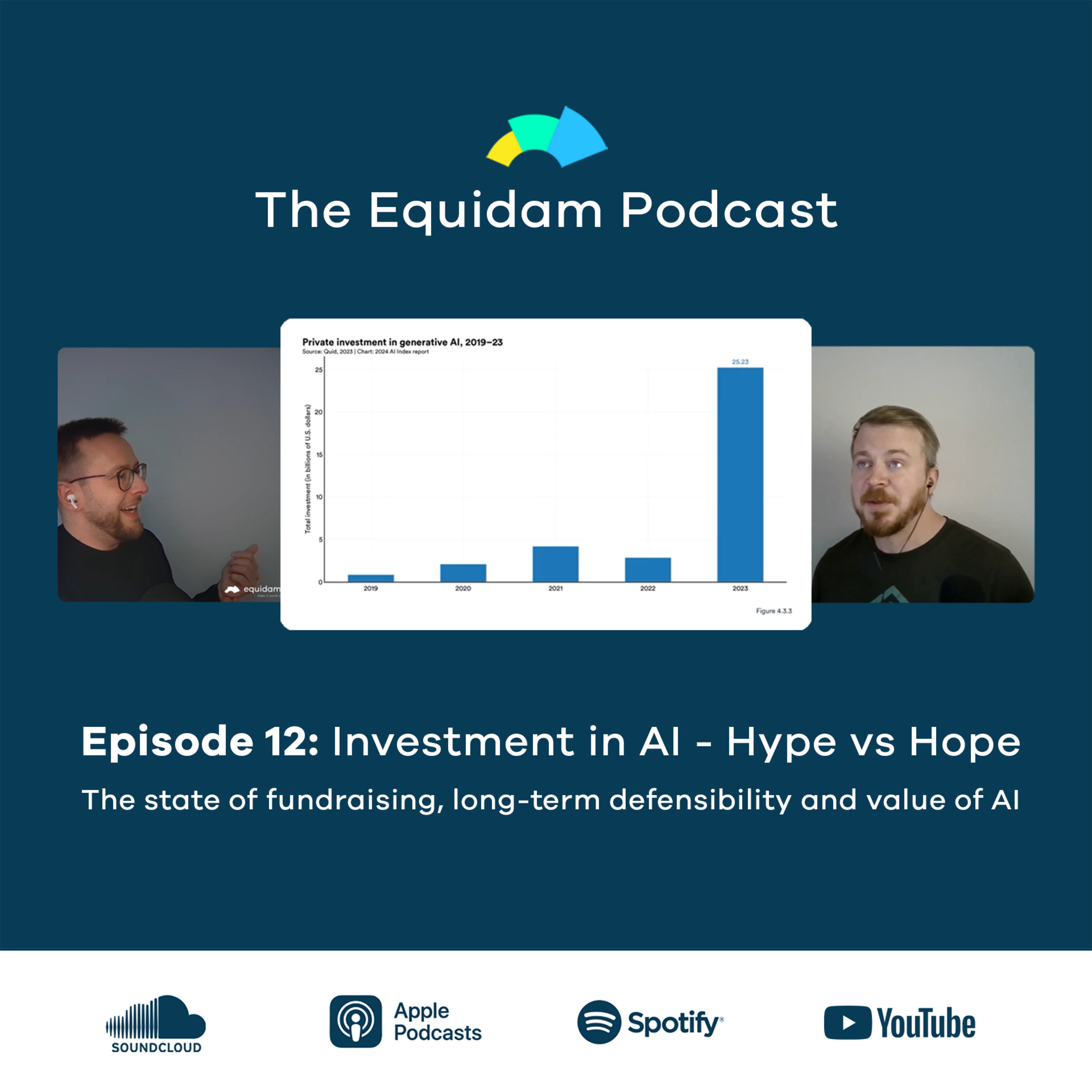

The Equidam PodcastInvestment in AI: Long-term defensibility and value creationThis episode explores the rapid rise of AI investment, the differences between AI infrastructure and startups, the implications of general intelligence on business models, the impact of AI on work and creativity, and the competitive landscape between incumbents and startups in the AI space.

In this conversation, Daniel Faloppa and Dan Gray look at the evolving landscape of technology investments, particularly the tension between hardware and software, the implications of AI on capital and innovation, and the future of productivity and work.

They also consider the risks of overinvestment in AI, the importance of understanding...

2024-12-121h 03

The Equidam PodcastEmployee Stock Options 101: ESOP and Cap Table Wisdom from the Founders of EquityPeopleIn this episode, we dive into the complexities of equity stock compensation for startup employees, with Špela Prijon and Tamas Varkonyi — the Co-Founders of EquityPeople.

We run through a range of topics related to ESOPs and cap table management, including the importance of aligning equity incentives with company goals, the challenges of determining fair equity distribution, and the common pitfalls that founders encounter.

We also cover some current trends in equity compensation across different regions, underscoring the necessity for founders to be informed and proactive in their approach to equity management.

00:55 The Evolution of Equity Compensation

02:33 The Role of Equ...

2024-11-221h 05

After The PitchATP 73: Business Valuation 101On today's episode of After The Pitch, we’re going to dig into a topic that’s often misunderstood in the world of business acquisitions: how to evaluate the cost of a business. If you’re new to buying businesses or just want to sharpen your skills, understanding business valuations is a must. Don’t fall for common myths—educate yourself or partner with professionals to make sure you’re not overpaying or missing out on valuable opportunities. We’ll talk about some myths surrounding valuations, key factors to consider, and even share tools and resources that can help you w...

2024-11-0908 min

The Equidam PodcastSAFE Caps & Discounts: Creating simpler and more transparent instruments

In this conversation, Daniel and Dan discuss the current state of the early-stage financing ecosystem, focusing on SAFEs (Simple Agreements for Future Equity) and convertible notes. They explore the evolution of SAFEs and how they have become the dominant form of early-stage fundraising. They also discuss the differences between SAFEs and convertible notes, the challenges of setting caps and discounts, and the potential problems with stacking multiple SAFEs. The conversation highlights the need for standardization and consensus in the industry. In this conversation, Daniel and Dan discuss the biases and complexities surrounding convertible notes and the need for a...

2024-08-091h 12

The Equidam PodcastBuilding venture success across Europe with Peach Zwyssig of AxelraIn Episode 9 of the Equidam podcast, Daniel is joined by Peach Zwyssig, CEO and Co-Founder of Axelra, a venture builder based in Switzerland.

They talk about how a venture builder can help founders overcome some of the hurdles in setting up a new startup, fundraising challenges and business growth.

The Equidam podcast is hosted by Daniel Faloppa (Equidam's CEO) , and focuses on startup fundraising trends around the world, with a particular focus on valuation for early stage companies.

Find out more: www.equidam.com

2024-06-121h 11

The Equidam PodcastStartup Valuation Methodology & ExternalitiesIn this episode we talk about valuation methodology, accounting for different aspects of risk and reward, as well as the mostly unaccommodated factor of externalities.

Thank you for joining us!

The Equidam podcast is co-hosted by Daniel Faloppa (Equidam's CEO) and Dan Gray (Equidam's Head of Marketing), and focuses on startup fundraising trends around the world, with a particular focus on valuation for early stage companies.

Find out more on equidam.com.

2023-11-2839 min

The Equidam PodcastArtificial Intelligence and the Y Combinator premiumIn this episode we cover a number of topics, including -

Changes in average and top quartile valuations, globally

Numbers available here: https://www.equidam.com/parameters-update-p5-7-average-and-maximum-valuations/

The unique considerations of valuation for the purpose of pricing employee stock options

Why Y Combinator graduates can justify seeking above market rates

And whether AI has any application to the valuation conundrum

As always, thank you for joining us!

The Equidam podcast is co-hosted by Daniel Faloppa (Equidam's CEO) and Dan Gray (Equidam's Head of Marketing), and...

2023-09-1146 min

The Equidam PodcastThe ROI of Venture Dollars, with Will Bricker of Hustle FundWelcome back to the Equidam podcast!

Today we speak to Will Bricker, data nerd and venture capitalist based out of New York working for Hustle Fund, a pre-seed venture firm. We discussed Hustle Fund's philosophy and Will's role there, as well as valuation at the earliest stages and in the frothiest markets, the startup revenue premium, the ROI of venture dollars, and much more.

Thanks for joining us.

The Equidam podcast is co-hosted by Daniel Faloppa (Equidam's CEO) and Dan Gray (Equidam's Head of...

2023-06-1244 min

Be An AngelE5- Mistake #4 Not Structuring The Right Price And TermsListen to this episode of “Be An Angel Podcast” where we discuss the effects of not structuring the right price and terms. Different terminologies will be introduced and explained first, such as the PTP Method, and the B&A Method. We will get to know the reason why is it important to know what the business is worth and why is benchmark research beneficial. Why is it important to take the best bits from ventures? In this episode, we will get to know a deeper understanding of why it is important to know that not everybody has good intentions for...

2023-05-121h 15

Adventure Capital by WefunderValuation Evaluation, with Daniel FaloppaIn this interview, we chat with Daniel Faloppa, founder & CEO of Equidam, a platform which produces data driven valuations for startups to understand how much their companies are worth. https://www.equidam.com/Hosted by Jonny PriceProduced by Amalia Stern "Wefunder does not endorse, recommend, or advise investing in any company”

2023-04-1437 min

Adventure Capital by WefunderValuation Evaluation with Daniel FaloppaValuation Evaluation with David Faloppa In this interview, we chat with David Faloppa, founder & CEO of Equidam, a platform which produces data-driven valuations for startups to understand how much their companies are worth. Hosted by Jonny PriceProduced by Amalia Stern "Wefunder does not endorse, recommend, or advise investing in any company”

2023-04-1109 min

The Equidam PodcastThe Founders' Financial Crisis: Silicon Valley BankIn this episode of the Equidam podcast we talk about the collapse of silicon valley bank, the reponse from the startup world, and the resolution on Monday morning.

What other options were available to startups?

Given what we knew about Silicon Valley Bank, why was this such a surprise?

How much did caps-lock bashing VCs help?

Thanks for joining us.

The Equidam podcast is co-hosted by Daniel Faloppa (Equidam's CEO) and Dan Gray (Equidam's Head of Marketing), and focuses on startup fundraising trends around the world, with a particular focus on valuation for early stage c...

2023-03-1726 min

The Equidam PodcastThe State of Startup Valuation - February 2023In this special episode we discuss the 5.6 Parameters Update for the Equidam platform, looking at a range of market data impacting startup valuations, including industry multiples, average and maximum valuations around the world, and some of the drivers of discount rates used in our methodologies.

Thanks for joining us. The Equidam podcast is co-hosted by Daniel Faloppa (Equidam's CEO) and Dan Gray (Equidam's Head of Marketing), and focuses on startup fundraising trends around the world, with a particular focus on valuation for early stage companies. If you're a founder or an investor in that bracket, these conversations s...

2023-02-2230 min

The Equidam PodcastThe Drivers of Valuation in Venture CapitalIn this episode we talk about the principles of valuation for venture capital. What are the fundamental drivers of 'value' in a startup opportunity, how are they measured, and what are the consequences of that approach? Specifically, what role do multiples and 'comparables' play in valuation, and why?

How much of a startup's valuation is driven by the business, and how much is driven by the market?

Whether you're an investor or a founder, we hope this conversation poses some interesting questions about methodology and motivation.

Thanks for joining us. The Equidam po...

2023-02-0854 min

The Equidam PodcastChallenges for Venture CapitalIn this episode we talk about some of the challenges facing venture capital as an asset class, how it has changed over the years, and the role it plays in broader investment strategies.

Is venture capital still backing 'aventurers', or is it just picking winners?

Is there an overlooked opportunity in 'middle risk' companies?

The Equidam podcast is co-hosted by Daniel Faloppa (Equidam's CEO) and Dan Gray (Equidam's Head of Marketing), and focuses on startup fundraising trends around the world, with a particular focus on valuation for early stage companies.

Find out mo...

2022-11-0441 min

The Equidam PodcastWelcome to the Equidam podcast!We start this episode by explaining why we've decided to launch a podcast. (It's not because the world needed another entrepreneurship podcast.)

To begin this series, we start by sharing some perspective about exactly what startup valuation is, in terms of process and outcome. We compare that to more traditional company valuation, and why the two differ.

We also look more broadly at the current fundraising environment, recent trends (falling valuations, slower rounds) and some of the reasons why.

The Equidam podcast is co-hosted by Daniel Faloppa (Equidam's CEO) and Dan Gray (Equidam's Head o...

2022-09-2240 min

Startuprad.io - The Authority on German StartupsExclusive Data on Startup Funding in Germany, Austria and Switzerland with EquidamThis time we do not interview an entrepreneur or investor from GSA, but we speak to Daniel. His startup equidam helps to value startups. He shares exclusive data with us on the GSA startups."We helped to value more than 130.000 startups."Daniel Faloppa, Founder and CEO equidamSubscribe HereFind all options to subscribe to our newsletter, podcast, YouTube channel, or listen to our internet radio station here:https://linktr.ee/startupradio "A lot of news around is just about the best startups. This g...

2022-04-2131 min.jpg)

Startup & Tech News from Germany, Austria, and Switzerland by Startuprad.io™Exclusive Data on Startup Funding in Germany, Austria and Switzerland with EquidamThis time we do not interview an entrepreneur or investor from GSA, but we speak to Daniel. His startup equidam helps to value startups. He shares exclusive data with us on the GSA startups.

"We helped to value more than 130.000 startups."Daniel Faloppa, Founder and CEO equidam

Subscribe Here

Find all options to subscribe to our newsletter, podcast, YouTube channel, or listen to our internet radio station here:

https://linktr.ee/startupradio

"A lot of news around is just about the best startups. This gives entrepreneurs the wrong impression...

2022-04-2131 min

Startuprad.io™ – Europe’s Voice on Startups, VC, Innovation & GrowthExclusive Data on Startup Funding in Germany, Austria and Switzerland with EquidamThis time we do not interview an entrepreneur or investor from GSA, but we speak to Daniel. His startup equidam helps to value startups. He shares exclusive data with us on the GSA startups.

"We helped to value more than 130.000 startups."Daniel Faloppa, Founder and CEO equidam

Subscribe Here

Find all options to subscribe to our newsletter, podcast, YouTube channel, or listen to our internet radio station here:

https://linktr.ee/startupradio

"A lot of news around is just about the best startups. This gives entrepreneurs the wrong impression o...

2022-04-2131 min

Equidam - Startup Valuation & Fundraising KnowledgeScaling Up Your Startup | Interview with Kees de JongIn this interview serial entrepreneur turned investor Kees de Jong talks about successfully scaling two companies and managing a third one away from bankruptcy. Check out our article here: https://www.equidam.com/scaling-up-your-startup/

Discover your company value in minutes and for free on: https://www.equidam.com/

2017-05-1626 min

EquidamScaling Up Your Startup | Interview with angel investor Kees de JongIn this interview serial entrepreneur turned investor Kees de Jong talks about successfully scaling two companies and leading third one away from bankruptcy. For more details, take a look at our article: https://www.equidam.com/scaling-up-your-startup/

Compute your company value for free and in minutes on: https://www.equidam.com/s

2017-05-1626 min

Equidam - Startup Valuation & Fundraising KnowledgeMilestones To Raise Series A In 2017Here's some information on what changed in the VC market after 2015 and how that affects entrepreneurs.

Read more in our article on Milestones to raise Series A in 2017: https://www.equidam.com/milestones-to-raise-series-A-in-2017

If you like this podcast subscribe to our channel for more educational videos of our startup resources.

Check how much your company is worth here: https://secure.equidam.com/signup.php

2016-11-0815 min

Equidam - Startup Valuation & Fundraising KnowledgeWhat To Offer To InvestorsHow to convince investors? What should I offer them? Stay tuned to hear our take on it. For more insights check our article here: https://www.equidam.com/what-to-offer-to-investors/

Compute your company valuation for FREE and in minutes on: https://www.equidam.com/

2016-10-2803 min

Equidam - Startup Valuation & Fundraising KnowledgeConvertible Debt: Risks And Terms To Be Aware OfGianluca Valentini, co-founder of Equidam, explains why convertible debt is a complicated security that can have drastic implications at the moment of conversion.

For more follow the link: https://www.equidam.com/convertible-debt-risks-and-terms/

Find out how much your company is worth on: https://www.equidam.com/

2016-10-2804 min

Equidam - Startup Valuation & Fundraising KnowledgeHow To Reach Out To InvestorsHow to choose between business angels and VCs? How to approach the two types of investors? This podcast answers those two questions.

For more insights check out out article: https://www.equidam.com/how-to-reach-out-to-investors-video/

Compute your company valuation for free and in minutes on: https://www.equidam.com/

2016-10-2833 min

Equidam - Startup Valuation & Fundraising KnowledgeHow To Create A Startup Pitch DeckIn this podcast we outline the most important parts of a pitch deck.

To download our free template click here: https://www.equidam.com/how-to-create-

a-startup-pitch-deck-template-included/

Find out how much your company is worth on: https://www.equidam.com/

2016-10-2826 min

Equidam - Startup Valuation & Fundraising KnowledgeFinancial Projections: Top Down ApproachThis podcast talks about the second approach to financial forecasting - top-down approach, and we also work out an example.

For more insights: https://www.equidam.com/financial-projections-top-down-approach/

Compute your company valuation for free and in minutes on: https://www.equidam.com/

2016-10-2811 min

Equidam - Startup Valuation & Fundraising KnowledgeFinancial Projections: The Bottom-Up ApproachIn this podcast we talk about what financial projections are and how to use the bottom-up approach to make projections.

For more insights check our resources: https://www.equidam.com/financial-projections-bottom-up-approach/

Find out how much your company is worth for free and in minutes on: https://www.equidam.com/

2016-10-2808 min

Equidam - Startup Valuation & Fundraising KnowledgePlanning And Timing FundraisingIn this podcast we talk about the right time to do fundraising and how to prepare for it.

For more insights check: https://www.equidam.com/planning-and-timing-fundraising/

Discover your company value! Find out how much your company is worth for free and in minutes on: https://www.equidam.com/

2016-10-2618 min

Equidam - Startup Valuation & Fundraising KnowledgeEquity Percentages To Offer Investors At Different RoundsThis video contains explanation of how much equity to offer to investors at different stages of development.

To get more insights take a look at our article: https://www.equidam.com/ranges-of-negotiation-at-different-stages-of-a-startup/

Discover your company value for free and in minutes on: https://www.equidam.com/

2016-10-2614 min

Equidam - Startup Valuation & Fundraising KnowledgeRaising Seed CapitalIn this podcast we discuss a few helpful tips for when you are raising seed capital. For more insights check out this article: https://www.equidam.com/raising-seed-capital-advice/

Find out how much your company is worth on: https://www.equidam.com/

2016-10-2605 min

Equidam - Startup Valuation & Fundraising KnowledgeEmployee Stock Options: Common Practices & ExamplesThere is no one-size-fits-all solution when it comes to assigning employee stock options but there are some similarities and terms we will talk about in the podcast.

To read more take a look at our article: https://www.equidam.com/employee-stock-options/

Compute your company value for free and in minutes on: https://www.equidam.com/

2016-10-2624 min

Equidam - Startup Valuation & Fundraising KnowledgeConvertible Debt vs Equity FinancingQuite frequently convertible debt is considered the better or even easier financing option compared to raising an equity round.

To find out more: https://www.equidam.com/convertible-debt-vs-equity-financing/

Discover your company value for free and in minutes on https://www.equidam.com/

2016-10-2615 min

Equidam - Startup Valuation & Fundraising KnowledgeComparables: How To Use Them To Defend Your ValuationIn valuation theory, comparables are referred to as those companies or deals that are similar in size, type of company and industry.

To learn more check out our article: https://www.equidam.com/comparables-defend-valuation/

Do you know your valuation? Find out how much your business is worth on: www.equidam.com

2016-10-2619 min

Equidam - Startup Valuation & Fundraising KnowledgeWhat Investors Look For In EntrepreneursIf you are a famous founder – you can raise capital even with a back-on-the-envelope business plan, because you have a high credibility in the market. If not there are certain characteristics VCs would like to see in founders. Take a look at our article and share your thoughts: https://www.equidam.com/what-investors-look-for-in-an-entrepreneur/

2016-10-2615 min

Equidam - Startup Valuation & Fundraising KnowledgeIncubator vs AcceleratorDo you know what the difference is between incubator and accelerator? How can you tell which one is better for your startup? Stay tuned!

Read more in our article: https://www.equidam.com/incubator-or-accelerator/

Compute your company value for free and in minutes on https://www.equidam.com/

2016-10-2112 min

Equidam - Startup Valuation & Fundraising KnowledgeDilution 101: Calculation & ExamplesDilution is the reduction in the ownership percentage in a certain company as an effect of the issuance of shares. Stay tuned to learn how to calculate it and work through a few examples.

For more details take a look at our article here: https://www.equidam.com/dilution-101-calculation-and-examples/

Find out how much your company is worth on: https://www.equidam.com/

2016-10-2111 min

Equidam - Startup Valuation & Fundraising KnowledgeUnit Economics For StartupsThis podcasts explains the concept of unit economics and works several real examples on how to calculate CLV, CAC, Churn rate, etc.

For more details take a look at our article: https://www.equidam.com/unit-economics-for-startups/

Compute your company value for free and in minutes on https://www.equidam.com/

2016-10-1412 min

EquidamConvertible Debt Vs Equity FinancingLet's break down the myths surrounding the concept of convertible debt.

For an elaborate calculation of a convertible note cap and discount check out this convertible note calculator: https://equidam.com/convertible-note-calculator/

Compute your business valuation on https://www.equidam.com/

2016-08-2315 min

EquidamComparables: How To Use Them To Defend Your ValuationComparables are useful when setting milestones for your company and you can use them to defend your financial projections and valuation to investors.

Read more at https://www.equidam.com/comparables-defend-valuation/

Compute your company value on https://www.equidam.com/

2016-08-1619 min

EquidamEmployee Stock Options: Common Practices And ExamplesCommon practices and examples regarding drawing up employee stock options agreements.

Read more on https://www.equidam.com/employee-stock-options/

Compute your company value at https://www.equidam.com/

2016-08-0924 min

EquidamPlanning And Timing FundraisingWhen to raise capital and when not to? Here are the steps to follow in these two phases of your startups to be able to close successful funding rounds.

To find out more, check out our article here: https://www.equidam.com/planning-and-timing-fundraising/

Find out how much your company is worth on https://www.equidam.com/

2016-07-2618 min

EquidamHow To Create Your Startup Pitch Deck - [template Included]You can download a free pitch deck template here: https://www.equidam.com/how-to-create-a-startup-pitch-deck-template-included/

The final goal of pitch decks is to mitigate risk perception and convince investors to support your startup. In this video, we explain how to do that for each of the 12 slides your pitch deck should include in order to lead to successful results.

2016-07-1926 min

EquidamFinancial Projections: Two Methods [Part 2] The Top-Down ApproachGuidelines on methods for computing financial projections and useful tools and tips. Free Financial Projections Template: https://www.equidam.com/financial-projections-template/

It is an already made Excel spreadsheet with clear and simple guidelines to follow in estimating your future numbers.

Read more about the bottom-up approach here: https://www.equidam.com/financial-projections-top-down-approach

2016-07-1111 min

EquidamFinancial Projections: Two Methods [Part 1] The Bottom - Up ApproachGuidelines on methods for computing financial projections and useful tools and tips. Free Financial Projections Template: https://www.equidam.com/financial-projections-template/

It is an already made Excel spreadsheet with clear and simple guidelines to follow in estimating your future numbers.

Read more about the bottom-up approach here: https://www.equidam.com/financial-projections-bottom-up-approach/

2016-07-0508 min

EquidamEquity Percentages to Offer Investors at Different RoundsEven if investors don't address is directly, valuation is always the starting point of negotiations. Gianluca Valentini, co-founder of www.equidam.com, explains what is its relation with equity stake and amount invested, and what are acceptable ranges of equity stake at the different stages.

To see our infographic follow the link: https://www.equidam.com/ranges-of-negotiation-at-different-stages-of-a-startup/

2016-06-2814 min

EquidamNegotiating with investors: 3 elements that make your story compellingCompany valuation is not only about financials: Gianluca Valentini, co-founder of www.equidam.com, explains the importance of your story when negotiating with investors and how to make it compelling.

Learn more at: https://www.equidam.com/negotiating-with-investors-three-elements-that-make-your-story-compelling/

Compute your company value on www.equidam.com

2016-06-2106 min

EquidamConvertible DebtGianluca Valentini, co-founder of www.equidam.com, explains why convertible debt is a complicated security that can have drastic implications at the moment of conversion and highlights some terms founders should be aware of.

Free convertible notes calculator: https://equidam.com/convertible-note-calculator.

2016-06-1404 min

EquidamRaising Seed CapitalGianluca Valentini, co-founder of www.equidam.com, gives his advice on how to successfully raise seed capital. He highlights what investors are looking for and two major deal-breakers.

Find out more on seed fundraising onhttps://www.equidam.com/raising-seed-capital-advice/

Compute your company valuation on https://www.equidam.com/

2016-06-1305 min