Shows

Stock Market Options Trading172: The 0DTE Trend Spread Engine: Building in PublicIn this episode, Eric breaks down the core ideas behind the 0DTE Trend Spread Engine (TSE) and how it fits into the broader Alpha Crunching philosophy of trading probabilities, not predictions.The TSE is built to systematically identify high-probability SPX credit spread ideas by combining intraday trend, time-based structure, and defined risk. Rather than reacting to every move, the focus is on stacking small statistical edges and letting data—not emotions—drive decisions.This episode also explains why strike selection and credits can vary, why these are trade ideas (not alerts), and how Alpha Crunching appr...

2025-12-1917 min

Stock Market Options Trading168: SPX Levels, Weekly Trade Setups & a Profitable LEAP StrategyIn this episode, Eric and Brian kick off the week with a look at the SPX options market, recent price action, and key gamma levels heading into FOMC week. Eric recaps his recent put credit spread trades from Alpha Crunching, discusses how he’s managing new positions into record highs, and explains how he’s balancing bullish exposure with call credit spreads and discretionary hedges. The conversation also covers upcoming events—including major tech earnings from Apple, Microsoft, and Google—and how they might influence market sentiment.Brian shares a practical example of a LEAPS diagonal trade on AVGO...

2025-10-2727 min

Stock Market Options Trading166: 📈SPX Rebounds Hard — What Last Week’s Selloff Really Taught Us👉 Join us live every Monday at StockMarketOptionsTrading.net to be part of the next Zoom call and get your questions answered in real time.📈 Market Recap & Trading Lessons:🚀 Big rebound after last week’s 200-point SPX drop — market shakes off China tariff and shutdown worries🍏 Apple headlines and possible government deal spark optimism📊 Moving averages still recovering — 5-day hasn’t crossed back above 10-day yet🧠 Eric explains how one huge candle can distort technical indicators short-term💰 Shows an Iron Condor entered during the volatility spike — wide wings, 25% profit target⚡ Volatilit...

2025-10-2115 min

Stock Market Options Trading165: When Uptrends Break🎯 Get 50% off AlphaCrunching.com with code SPX50 — your edge for data-driven SPX option strategies.In this episode, Eric O’Rourke breaks down what happens when an uptrend breaks — and how traders can stay grounded when volatility spikes. He covers the recent tariff shock, key SPX levels to watch (6650–6800), and why the market’s recovery above the volume trigger could signal renewed bullish momentum.Eric also discusses risk management in trend-following strategies, explains how short-term setbacks fit within high-win-rate systems, and shares insights from the latest Alpha Crunching forecast showing a cautious but stabilizing market outlook.Want to...

2025-10-1519 min

Stock Market Options Trading164: Expectancy vs. Win Rate: What Really MattersIn this episode of the Stock Market Options Trading Podcast, Eric dives into the concept of expectancy—a key metric that blends win rate, average win size, and average loss size into one number that helps traders understand whether a strategy has a real edge over the long run.We break down why a high win rate alone doesn’t guarantee profits (think 98% win rate ads…), and how expectancy provides better context by showing how much you can expect to make or lose per trade on average. Eric also shares updates inside Alpha Crunching: the Trade Ideas tab no...

2025-09-2919 min

Stock Market Options Trading162: SPY Options Trading DiscussionJoin us for another live session of the Stock Market Options Trading Podcast with Eric and co-host Brian as we dive into trading SPY options. We start by comparing SPY vs SPX — looking at the key differences in contract size, settlement style, tax treatment, and liquidity.Brian also shares details on his Delta Neutral “double diagonal” strategy with SPY, walking through trade setups, adjustments, and lessons learned from managing the position. We cover how rolling strikes works, how IV impacts results, and why this approach may fit best in lower-volatility environments.Eric wraps up by discus...

2025-09-0936 min

Stock Market Options Trading160: This Week in Options Trading: INTC, Broken Wing Butterfly, SPX 0DTEThis Week in Options Trading with Eric & Brian 🎙️📈In this episode, Eric and Brian recap a volatile week in the markets, share updates on recent SPX trades, and walk through trade setups they’re watching. Topics include:Last week’s market moves, Powell’s comments, and how they affected options positionsAn Intel trade idea: building a position with stock, covered calls, and long-term outlookA deep dive into a broken wing butterfly setup on Carvana and why it flips the risk/reward compared to standard spreadsKey economic events on this week’s calendar (GDP, core PCE, jobs data) and how th...

2025-08-2547 min

The Circle: The Queer Men's Embodiment PodcastIntimacy Without Sex: A Queer Conversation on Asexuality With Hannah O'RourkeIn this episode of The Circle, we explore asexuality and the many ways intimacy can thrive outside of sexual expression. Eric and Tim are joined by Hannah O’Rourke—a yoga teacher and early childhood educator—who shares her experience identifying as asexual and how it reshaped her understanding of romance, validation, and connection. Together, they unpack the difference between romantic and sexual orientation, what it means to be demisexual, and how embodiment practices can help people attune to their true desires. This conversation challenges cultural assumptions about sex and identity, and offers a liberating lens for queer folks naviga...

2025-08-2156 min

Stock Market Options Trading159: This Week in Options Trading: SPX Credit Spreads, ANET Diagonal SpreadWelcome to the first segment on the show of This Week in Options Trading with Eric O’Rourke and Brian Terry! We’ll be going live every Monday at 12pm ET to share option strategies, market setups, and answer community questions in real time.👉 To RSVP for future live sessions: https://stockmarketoptionstrading.net/eventsIn this kickoff episode, Eric walks through the Monday 7DTE Put Credit Spread strategy powered by Alpha Crunching’s Weekly Triumph Rate (WTR). He compares backtest results of holding to expiration versus taking early profits and shows why risk/reward balance is key fo...

2025-08-1847 min

Stock Market Options Trading158: This Week In The S&P500: Two Primary Drivers of the Stock Market Right Now.In this week's episode, we cover the major economic reports and catalysts driving the markets and what caused the current break in the uptrend.🎥 Mentioned in this episode:Check out the latest YouTube video where Eric explains how the ASD indicator from Alpha Crunching helps spot slowing momentum and potential SPX trend reversals — before they happen.📺 Watch here: https://youtu.be/H48aAu4WxBA💡 Get 50% off your first year at AlphaCrunching.com

2025-08-0409 min

Stock Market Options Trading157: SPX 0DTE Risk Free Profit Forest Walkthrough🎧 Episode Description – SPX 0DTE Risk-Free Profit ForestIn this episode, Eric breaks down a risk-free SPX trade using the “Profit Forest” approach—where the focus is on locking in gains and building multiple profit zones on the risk graph, rather than chasing max reward with max risk.📺 Watch the full video version of this trade on YouTube here: https://youtu.be/ONQCRfjrMZ0📹 Also check out these related videos on risk-free 0DTE setups:🌲SPX 0DTE Iron Butterfly Risk Free Walkthroughhttps://youtu.be/AUpTVV-a4sQ🌲SPX 0DTE Options Strategy: Risk Free Trade Walkthroughhttps://youtu.be/nSLOBTKgvmw

2025-06-2410 min

Stock Market Options Trading156: This Week In The S&P500: SPX Forecast, Levels, FOMCSPX Market Outlook, FOMC Setup & This Week’s Trade Ideas"In this episode of the Stock Market Options Trading Podcast, Eric breaks down the current SPX market setup heading into a big week of economic events, including Wednesday’s FOMC meeting. After last Friday’s selloff, the market rallied hard on Monday—highlighting the continued volatility.Eric recaps last week’s inflation data (CPI, PPI), stronger-than-expected consumer sentiment, and why these may give the Fed room to ease up. He also walks through this week’s AlphaCrunching forecast, revealing a potential shift toward late-week weakness and how that...

2025-06-1608 min

Stock Market Options Trading155: This Week In The S&P500: Slowing Momentum Nearing All Time HighsThe S&P 500 is closing in on all-time highs, but is momentum starting to fade? In this episode, Eric O’Rourke breaks down the key SPX levels to watch, including major option walls, falling volatility, and upcoming economic events like CPI and PPI that could shake things up.You'll also get a look at this week’s Alpha Crunching trade ideas and market forecast, plus how Eric is managing a mix of put and call credit spreads to stay balanced as the uptrend continues.🔹 Get 50% off Alpha Crunching tools with code SPX50 at AlphaCrunching.com🔹...

2025-06-0909 min

Stock Market Options Trading153: SPX Options Setup After Surprise EU Tariff NewsIn this week’s episode of the Stock Market Options Trading Podcast, Eric recaps last week’s pullback in SPX, driven by fresh EU tariff headlines, and how the forecast data from Alpha Crunching has responded. He highlights the shift in market tone based on the Average Strength Deviation (ASD) metric, which has now gone negative — a potential warning sign for deeper weakness ahead.👉 You can access the Average Strength Deviation (ASD) indicator and all Alpha Crunching forecast tools at https://AlphaCrunching.com — use code SPX50 for 50% off your first plan.Eric also walks through a potential...

2025-05-2708 min

Stock Market Options Trading151: This Week In The S&P500: Your Charts Might Be Lying...📈 Volatility, Indicators, and the SPX Weekly Forecast | Episode 151In this episode of the Stock Market Options Trading Podcast, I cover how volatile price action can distort technical indicators—and what that means for traders. Using Alpha Crunching’s SPX Weekly Forecast as an example, we look at how past outlier moves (like the recent tariff news spike) are dropping out of the data and shifting indicator readings.I also walk through:Why this week’s forecast still looks bullish despite a lower net gainThe impact of recent news and options positioning on key SPX levelsPot...

2025-05-1213 min

Stock Market Options Trading150: SPX Forecast After 9-Day Rally | Iron Condor Strategy Adjustments📈 First Video Podcast, SPX Forecast After 9-Day Rally, Iron Condor Adjustments & Market ForecastsWatch the video here: https://youtu.be/Pk22BcCBfn0Welcome to episode 150 of the Stock Market Options Trading Podcast! 🎉This week’s special episode marks our very first video podcast — now available on YouTube and your favorite audio platforms like Apple and Spotify. If you're watching on YouTube, don’t forget there are 149 audio-only episodes full of SPX options strategies, technical analysis, and educational content.In this episode, Eric breaks down:🔴 Why he’s wearing a red shirt (hint...

2025-05-0515 min

Stock Market Options Trading149: This Week In The S&P500: Trading Iron Condors and TruflationWelcome back to the Stock Market Options Trading Podcast! I'm your host, Eric O'Rourke, and in this episode I break down the latest market action, key technical levels, and how I’m trading SPX options during this volatile stretch.📉 This week, the S&P500 dropped over 2% to start the week as uncertainty around tariffs continues to dominate headlines. I talk through how I’m navigating the range-bound market with iron condors and why I'm keeping trades short and wide.📊 I also share insights from Alpha Crunching’s Weekly Triumph Rate (WTR), which remains below 50% across the board —...

2025-04-2114 min

Stock Market Options Trading148: This Week In The S&P500: Tariff Turmoil, Fed Caution, and a Choppy BounceIn this episode, Eric recaps last week's wild ride in the S&P 500, driven by tariff headlines, a surprise 90-day pause, and a sharp oversold rally. He covers key economic data—including CPI, PPI, and sentiment numbers—and why they paint a mixed inflation picture. Eric also shares the latest SPX levels he's watching, how he's positioning with an iron condor, and what Alpha Crunching's updated weekly forecast reveals about the current choppy trend. This is still a headline-driven market, and patience remains key.Want to connect? Find me on X:Eric O'Rourke: http...

2025-04-1414 min

Stock Market Options Trading147: This Week in the S&P500: Market Volatility, Tariffs, and Fed SpeculationIn this episode, Eric discusses the sharp market selloff following the surprise "Liberation Day" announcement, ongoing tariff drama, and how global markets are reacting. He breaks down key SPX levels to watch (4900, 5000, 5100), headline-driven price action, and what the Fed’s emergency closed-door meeting might mean for traders. Eric also revisits a simple bear market hedge from a previous episode, explains why he's currently sitting in cash, and shares what he's watching for potential long-term buys. It’s a fast-moving week—stay nimble and patient.Want to connect? Find me on X:Eric O'Rourke: https://twitter.com/Op...

2025-04-0709 min

Stock Market Options Trading146: This Week in the S&P500: How to Stay Defensive Without Going ShortIn this episode of the Stock Market Options Trading podcast, Eric welcomes back guest Brian Terry to discuss navigating the current choppy and volatile market. They cover the recent 10% correction in the S&P 500, key economic events for the week (including reciprocal tariffs and Powell’s upcoming comments), and how market levels like the 200-day moving average are influencing trading sentiment.Brian shares how he's using in-the-money covered calls to generate income with downside protection, even during pullbacks. They dive into sector rotation—highlighting strong performers like gold (GLD), utilities, and dividend stocks—and explain the mechanics behind...

2025-03-3121 min

Stock Market Options Trading145: This Week in the S&P500: Market Rally, Key Levels & SPX Trade SetupsIn this episode, Eric recaps the latest market action as the S&P 500 breaks back above the 200-day moving average following a strong Monday rally. He covers key levels from SpotGamma.com, including updated put and call walls, and discusses this week’s major economic events like GDP, Core PCE, and Consumer Sentiment. Eric also shares a few SPX trade setups from Alpha Crunching, including a bullish 7-day put credit spread using the Weekly Triumph Rate, and explains how he's navigating recent market volatility by staying mechanical.Use code SPX50 for 50% off your first month at...

2025-03-2511 min

Stock Market Options Trading144: A Simple Bear Market Hedging Strategy📢 Read the full blog post with charts and performance data: https://www.alphacrunching.com/blog/bear-market-hedging-strategySummary:In this episode of the Stock Market Options Trading Podcast, we break down a bear market hedging strategy that just triggered given the current market conditions.Right now, SPX is down about 10%—a textbook correction—but it’s also trading below the 200-day moving average, which we’re using as a key reference point for this strategy. While some traders debate whether this qualifies as a bear market, the real focus is on objective, rule-based...

2025-03-1417 min

Future of FitnessBryan O'Rourke - The Intersection of Fitness, Technology, and Global TrendsIn this engaging conversation, Eric Malzone and Bryan O'Rourke explore the evolving landscape of the fitness industry, touching on personal experiences, the necessity of content creation, reflections on 2024's growth, and the maturation of the market. They delve into the importance of authentic experiences in fitness and the challenges of human capital in the industry, highlighting the shift in career dynamics and the impact of technology on fitness delivery. In this conversation, Bryan O'Rourke and Eric Malzone explore the evolving landscape of consumer behavior, technology, and the fitness industry. They discuss the impatience economy, the backlash against poorly designed...

2025-03-1148 min

Stock Market Options Trading143: This Week In The S&P500: Volatile Trading RangeIn this episode of Stock Market Options Trading, host Eric O'Rourke recaps a wild week for the S&P 500, including a sharp sell-off, extreme volatility, and a bounce off key support near SPX 5800. 📉📈🔎 Key Topics Covered:✅ SPX range update: 5800-6200 🎯✅ Bullish trades not triggering and why patience pays✅ How Eric used iron condors to trade the chop ⚙️✅ Why the Fed’s rate cut timeline is shifting 📅✅ Key events this week: PMI, jobless claims, NFP, and Powell speaking 💼💬💡 Pro Tip: When markets get wild, risk/reward matters more than ever—and Eric explains...

2025-03-0307 min

Stock Market Options Trading142: This Week in the S&P500: False BreakoutIn this episode of Stock Market Option Trading, host Eric O'Rourke breaks down last week's failed SPX breakout and the sharp sell-off on Friday 📉. He recaps key economic events, including FOMC minutes 🏦, jobless claims 📊, and PMI data 📉, and discusses what to watch for this week, such as GDP 📈, jobless claims 💼, and core PCE 💵.🔥 Options Flow Insights: Eric dives into recent bearish options activity, key market levels, and how Alpha Crunching's trade setups are adjusting to the current conditions.🚀 Trading Automation Update: Exciting news! Eric shares details on a new automation tool 🤖 he's testing to streamline mechanical trading strategies—...

2025-02-2408 min

Stock Market Options Trading141: Bull Call Spreads Vs. Bull Put SpreadsClick Here for the SPX Income Masterclass discussed in this week's episode. In this episode of the Stock Market Option Trading podcast, host Eric O’Rourke dives into the key differences between bull call spreads and bull put spreads, breaking down their mechanics, risk-reward profiles, and how to manage them effectively.Eric explains why bull call spreads, which are debit trades, require a directional move to profit, while bull put spreads, as credit trades, can benefit from time decay. He also discusses strike selection, risk-reward considerations, and win rates, helping traders determine which strategy aligns be...

2025-02-2014 min

Stock Market Options Trading140: This Week In The S&P500: Powell and InflationFor the week of February 10, 2025, SPX will likely be driven but Powell's testimony along with core CPI and Core PPI inflation reports. Mentioned in this episode is trade idea for Tuesday. Here's the link: https://www.alphacrunching.com/blog/7dte-put-credit-spread-strategy-for-spx-weekly-optionsGet more S&P500 insights at https://www.AlphaCrunching.com/blogJoin me next week as we navigate the stock market focusing on the S&P500. Want to connect? Find me on X:Eric O'Rourke: https://twitter.com/OptionAssassinAfter that, join other listeners at...

2025-02-1008 min

Stock Market Options Trading139: This Week in the S&P500: Tariff DropAnother bearish Monday on the back of Tariff announcements out of Washington. The market continues to hold up relatively well given these week over week news events. Last week it was AI news out of China and now tariff talk. Get more S&P500 insights at https://www.AlphaCrunching.com/blogEconomic events, options positioning, and technical indicators to get your ready for the week. Join me next week as we navigate the stock market focusing on the S&P500. Want to connect? Find me on X:Eric O'Rourke...

2025-02-0307 min

Stock Market Options Trading138: This Week in the S&P 500: Bulls in Trouble?Markets dropping hard today on the back of the DeepSeek AI company out of China which has achieved notable results using much less compute and resources that we've seen over the past year or so. NVDA down over 10% on this news and dragging the market down with it. Get more S&P500 insights at https://www.AlphaCrunching.com/blogEconomic events, options positioning, and technical indicators to get your ready for the week. Join me next week as we navigate the stock market focusing on the S&P500. Want to connect...

2025-01-2706 min

Stock Market Options Trading136: The Most Important Skill in Options Trading (And Why Many Ignore It)Position Sizing: The overlooked key to options trading success.I had a great discussion with John Einar from ThetaProfits.com where discussed one of the most overlooked aspects of trading which is positions sizing. Check the full episode here: https://www.thetaprofits.com/position-sizing-the-overlooked-key-to-options-trading-success/Watch the interview on YouTube here: https://www.youtube.com/watch?v=Ev-OyVE3hegWant to connect? Find me on X:Eric O'Rourke: https://twitter.com/OptionAssassinAfter that, join other listeners at https://StockMarketOptionsTrading.net and join the community for free right...

2025-01-0628 min

Stock Market Options Trading135: This Week In The S&P500Get more S&P500 insights at https://www.AlphaCrunching.com/blogEconomic events, options positioning, and technical indicators to get your ready for the week. Join me next week as we navigate the stock market focusing on the S&P500. Want to connect? Find me on X:Eric O'Rourke: https://twitter.com/OptionAssassinAfter that, join other listeners at https://StockMarketOptionsTrading.net and join the community for free right now where there are daily posts with clues to the where the market may be headed next. Also...

2024-12-1610 min

Stock Market Options Trading134: This Week In The S&P500Get more S&P500 insights at https://www.AlphaCrunching.com/blogEconomic events, options positioning, and technical indicators to get your ready for the week. Join me next week as we navigate the stock market focusing on the S&P500. Want to connect? Find me on X:Eric O'Rourke: https://twitter.com/OptionAssassinAfter that, join other listeners at https://StockMarketOptionsTrading.net and join the community for free right now where there are daily posts with clues to the where the market may be headed next. Also...

2024-12-0910 min

Stock Market Options Trading132: Options Position Sizing Case StudyIn this special Thanksgiving episode of the SMOT podcast, I want to take a moment to say thank you for being a dedicated listener. Wishing you and your family the very best this holiday season!Today, we’re diving into a case study on options position sizing. I recently posted a video on YouTube where I compared the same trading strategy across different account sizes and allocations to see how position sizing can dramatically impact performance. In this episode, you’ll hear the audio from that video.Here's the link: https://youtu.be/ThDgXklMG40If...

2024-11-2514 min

Stock Market Options Trading131: All Time Stock Market Highs! Now What?In this episode, we'll cover some thoughts at what to think about the market here has we're hitting new all time highs post US Election. We've got several key economic reports coming this week too around inflation and the labor market. Want to connect? Find me on LinkedIn or X:Eric O'Rourke: https://www.linkedin.com/in/jericorourke/Eric O'Rourke: https://twitter.com/OptionAssassinAfter that, join other listeners at https://StockMarketOptionsTrading.net and join the community for free right now where there are daily posts with clues to the where...

2024-11-1117 min

Stock Market Options Trading130: GOOGL Earnings Trade SuccessIn this episode, I walk through my recent GOOGL earning trade in which I held shares into the earnings event but added a risk free collar trade for protection. As you'll hear, the collar trade caps my upside but gives some downside protection in case the stock were to rollover. At the time of this posting, GOOGL was up a little over 5% on an earnings pop and I've since exited most of the trade for profit. Feel free to reach out to your host Eric O'Rourke on Twitter for any follow up questions, comments, or...

2024-10-3011 min

Stock Market Options Trading129: Case Study: Take Profits Early or Hold To Expiration?In this episode, we'll dive into an options strategy and compare backtest results of holding the trades to expiration, aka HTE, versus taking profits at 50% of the max gain. We'll discuss some of the less discussed nuances of a strategy like this that may get you thinking about which is best for you and your trading style and risk tolerance. Here's the link to the video discussed in the episode that explains the strategy:https://youtu.be/2sM-6QTWWz8Check out the Alpha Crunching Blog for more strategies like the one in today's...

2024-10-2119 min

Stock Market Options Trading128: The New Spot Gamma TRACE Indicator ExplainedIn this episode, we have Brent Kachuba from Spot Gamma on to discuss their newly released game changing indicator called TRACE. The TRACE indicator is expertly designed to show options positioning from a dealer's perspective in a heat map form making it so much easier to structure various types of trades.If you are an SPX weekly options trader, pay close attention to this episode and use this link to learn more: https://spotgamma.com/trace-the-market-vertical-spread-academy/?aff=VSacademyBe sure to follow Spot Gamma on X at: https://twitter.com/spotgamma

2024-09-2747 min

Fitness + TechnologyFranchise Growth & Innovation: LIVE From Beyond Activ With Bryan O'RourkeThis week, on the Fitness + Technology podcast, Bryan O'Rourke shares his presentation live from Beyond Activ in New York. Beyond Activ is a leadership, investment, and business development event for owners, managers, and investors of health, wellness, fitness, and hospitality brands. Bryan was invited to present and host a panel on franchise innovation and growth with Emily Seaman, Head of Marketing from Momence, Bradford Smith, Chief Development Officer from PureGym, Eric Keller, VP of Support at Self Esteem Brands, and Justin Vartanian, Senior VP of International Division at Planet Fitness. You can access Bryan's presentation deck here...

2024-09-2354 min

Stock Market Options Trading127: The Psychology of Automated Trading w/ Mike Christensen of TradersPost.ioGreats discussion this week around the psychology of automated trading with Co-Founder Mike Christensen of TradersPost.io. Traders Post allows you to automate trades using buy and sell signals from platforms like Trading View and Trend Spider. Even though automated trading can reduce human execution errors, the psychology of automated trading is still something traders have to grapple with despite offloading some of the work to an algo rhythm. Feel free to reach out to Mike or Eric on Twitter for any following questions, comments, or feedback. Mike Christensen: https://twitter...

2024-09-1237 min

Stock Market Options Trading126: For Every Strategy, Cash Is A PositionPatience and discipline are a big part of trading and when you are executing on a strategy, its important to understand that being in cash and not in a particular trade is part of that strategy.Want to connect? Find me on LinkedIn or X:Eric O'Rourke: https://www.linkedin.com/in/jericorourke/Eric O'Rourke: https://twitter.com/OptionAssassinAfter that, join other listeners at https://StockMarketOptionsTrading.net and join the community for free right now where there are daily posts with clues to the where the market may be headed...

2024-09-0309 min

Stock Market Options Trading125: What the Books Don’t Teach About Vertical SpreadsUpdated options trading research now available in the SPX Income Masterclass geared towards beginners with small accounts and for those who don't want to watch the market all day. The strategies included in this Lifetime Access and Updates course are mechanical in nature and lend themselves to automated trading which is also discussed in the course. Here's the link to the SPX Income Masterclass:https://www.stockmarketoptionstrading.net/spaces/4688450In this episode, I discuss something about vertical spreads that options education books typically don't include. We'll explore comparing buying a single call option...

2024-08-2314 min

Stock Market Options Trading123: My Secret To Staying Profitable Over TimeUpdated options trading research now available in the SPX Income Masterclass geared towards beginners with small accounts and for those who don't want to watch the market all day. The strategies included in this Lifetime Access and Updates course are mechanical in nature and lend themselves to automated trading which is also discussed in the course. Here's the link to the SPX Income Masterclass:https://www.stockmarketoptionstrading.net/spaces/4688450In this episode, I'll discuss what I think my secret is to staying profitable over time.Want to connect with myself? Find...

2024-08-0113 min

Stock Market Options Trading122: Hedging With a Put Spread CollarAs the market continues to defy gravity and hit new highs every week it seems, you may be thinking about how you can protect any stocks you may be holding. In this episode, we'll discuss a put spread collar trade which can allow you to get some downside protection while at the same time giving you room for more upside participation. I came across this trade idea on X and brought Jon on the show to walk us through it. Here's Jon's Twitter if you want to check him out: https://twitter.com...

2024-07-1815 min

Fitness + TechnologyThe Download On Digital: LIVE From 2024 IDEA World With Bryan O'RourkeThis week, on the Fitness + Technology podcast, Bryan O'Rourke shares his panel discussion, The Download On Digital, from 2024 IDEA World live from Los Angeles. He is joined by fitness technology gurus Garrett Marshall, Eric Posner, Jeffrey Scott, Mike G. Hansen, and Deb/Debbie/Deborah Praver (Eble) as they take a deep dive into the latest trends, innovations, and how technology is revolutionizing the fitness industry. The panel also answers questions from the audience highlighting key topics in digitization, retention, hybrid experiences, strategies, content creation, and AI. One Powerful Quote: 37:18: "You're not gonna get what you...

2024-07-151h 05

Stock Market Options Trading120: Caitlin Clark is the NVDA of the WNBACaitlin Clark is the NVDA of the WNBA and Cathie Wood is Team USA.In today's episode, we'll go over some similarities between these two powerhouses who both have strong momentum and putting up staggering numbers in their respective domains. But the decision to leave Clark off Team USA for the 2022 Summer Olympics is like cutting your winners short leaving millions of dollars on the table. Want to connect with myself? Find me on LinkedIn:Eric O'Rourke: https://www.linkedin.com/in/jericorourke/After that, join other listeners at...

2024-06-2410 min

Stock Market Options Trading119: Choosing Your Profits and LossesWhen researching a new trading strategy, its important to not only look at things like total profit and win rate, but its just as important to look at the P/L curve of the strategy to determine if its something you'll actually be able to trade. In this episode, we'll discuss some of the nuances that the P/L curve can give you as opposed to just profits, wins, and losses. Here's the link to System #3 mentioned in the episode to get some context around the P/L curve that was discussed:Click...

2024-06-1417 min

Stock Market Options Trading118: Applying First Principles to Options TradingErik Smolinski is back on the show to talk about applying the concept of First Principles to options trading. Erik is behind the esInvests YouTube channel where he puts out regular content around trading. I had so much fun in the conversation talking about out approaches to options trading these days, how we have evolved over time, backtesting, psychology, and so much more. I hope you find this show as entertaining as it was to create. To connect with Erik, check out his links below. esInvests on YouTube: https://www.youtube.com/esinvests

2024-06-011h 30

Stock Market Options Trading117: 1DTE The Longest Trade of My LifeThe full trade details and options trading research discussed in this episode can be found in this YouTube video: https://youtu.be/RxWg5HdeiEYWhen it comes to researching and trading strategies and then implementing them, there are many additional factors that don't make it into the backtest. In this episode, I walk through a recent 1DTE trade in which the options expire the following day. Despite the trade only being 24 hours long, it was the longest trade of my life. Want to connect with myself? Find me on LinkedIn:Eric...

2024-05-1517 min

Stock Market Options Trading116: How I'd Trade Options With a $1k AccountTrading options in a small account is possible and in this episode, we'll cover several considerations for doing so. These include: realistic expectations, which strategies are best, and what to focus on. Want to connect with myself? Find me on LinkedIn:Eric O'Rourke: https://www.linkedin.com/in/jericorourke/After that, join other listeners at https://StockMarketOptionsTrading.net and join the community for free right now where there are daily posts with clues to the where the market may be headed next. There you will also find the SPX Income Masterclass...

2024-05-0224 min

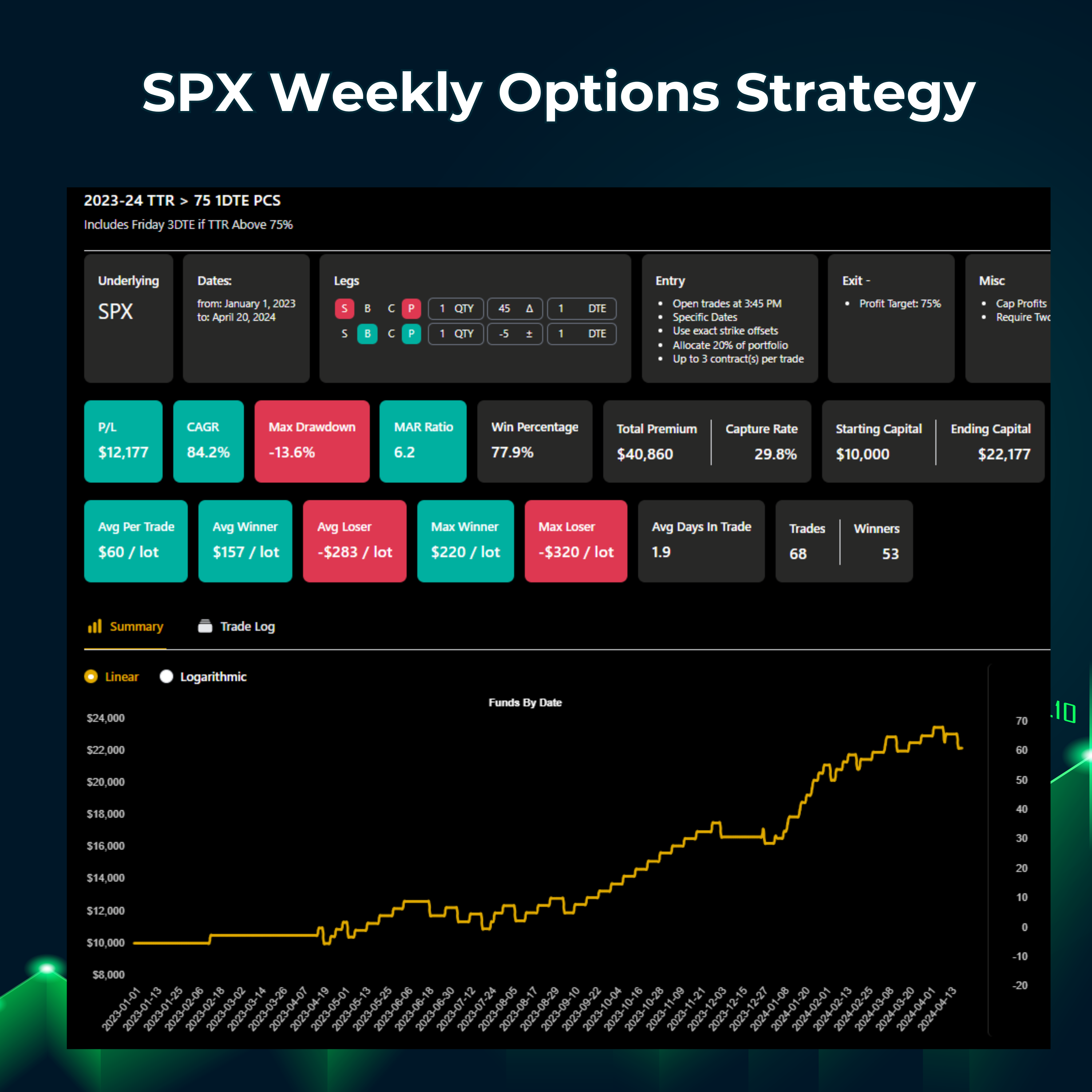

Stock Market Options Trading115: Edge Alert: Mechanical Next Day Put Credit Spread StrategyIn this episode, we reveal a SPX weekly options strategy selling put credit spreads that expire the following day. This strategy uses bullish TTR readings from Alpha Crunching to determine whether or not to take the trade that day. Today's episode is from a video training recently sent to Alpha Crunching subscribers and posted in the free community. Here's the link to watch the 10m video presentation of this strategy:https://www.stockmarketoptionstrading.net/posts/55173187The TTR is a metric from https://www.alphacrunching.com that shows the tendency for the...

2024-04-2213 min

Stock Market Options Trading114: What is Options Net Flow?In this episode, I'll briefly explain what options net flow is. In short, many of the options flow providers now offer some version of options net flow which is a graphical way to gauge the options sentiment of a stock or index. I find this mush more useful and applicable compare to the traditional overwhelm of a grid based data feed. Want to connect with myself? Find me on LinkedIn:Eric O'Rourke: https://www.linkedin.com/in/jericorourke/After that, join other listeners at https://StockMarketOptionsTrading.net and join the community for free...

2024-04-1513 min

Stock Market Options Trading113: The Life Cycle of an Options TradeIn this episode, I got to speak to Mat Cashman, Principal of Investor Education at OCC. Mat takes us through the life cycle of an options trade by explaining the inner workings of the market and some of the players and institutions that make it all possible. One of those institutions is the OCC (The Options Clearing Corporation) which is the world’s largest equity derivatives clearing organization. For nearly 50 years, OCC has provided financial stability and risk management to the U.S. listed-options marketplace.Want to connect with myself or Mat? Follow us on Li...

2024-03-2847 min

Future of FitnessBryan O'Rourke - A Realist's Take On The Future of FitnessIn this episode, Eric Malzone engages in a conversation with Bryan O'Rourke, the CEO of Core Health and Fitness. They explore Bryan's background and his "fundamentalist" approach to the fitness industry, emphasizing core principles and a long-term outlook. The discussion covers shifts in the industry, including technological advancements, AI, wearables, and the pandemic's impact. Bryan shares insights into the historical context of the fitness sector, drawing parallels to the mid-'90s. The dialogue transitions to Bryan's role as CEO, detailing his relationship with the company's founder and the growth opportunities he envisions. Looking ahead, they address challenges, predicting increased...

2024-01-2252 min

Stock Market Options TradingOptions Trading This Week: FOMC, Calendars, Covered CallsEric O'Rourke and Brian Terry discuss what they're looking at this week for their options trades. Got to https://www.stockmarketoptionstrading.net/ and join the free podcasts community to discuss the trade ideas discussed in this episode. Disclaimer: This episode is for informational purposes only. Eric and Brian are not financial advisors and this is not financial advice. Want to connect with myself and other listeners of this podcast?Go to https://StockMarketOptionsTrading.net and join the community for free right now where there are daily posts about the clues to...

2023-09-1821 min

Stock Market Options TradingStock Market Startup: TradersPost.io with Jonathan WageWelcome to Stock Market Startup series here on the Stock Market Options Trading Podcast where we dive into the world of stock market software companies and the founders behind them. Join me as I interview some of the most innovative minds in the industry, exploring their journey from ideation to execution and everything in between. From trading platforms to investment analysis tools, we'll explore the latest trends and technologies driving the future of the stock market.In this episode, I spoke with Jonathan Wage from TradersPost.io. TradersPost can automate stocks, options and futures trading strategies from...

2023-02-2135 min

Stock Market Options TradingAre You Guilty of Survivorship Bias?Want the latest in trading research and support the podcast at the same time?Come join me at https://www.patreon.com/VerticalSpreadOptionsTrading to get started. Summary:Survivorship bias or survival bias is the logical error of concentrating on entities that passed a selection process while overlooking those that did not. This can lead to incorrect conclusions because of incomplete data.In this episode, we'll discuss how this can apply in the financial world as well as the rest of the world. Note: This is not financial advice and...

2022-11-2908 min

Stock Market Options TradingCould You Trade This Strategy?Want the latest in trading research and support the podcast at the same time?Come join me at https://www.patreon.com/VerticalSpreadOptionsTrading to get started. Summary:In this episode we talk through the results of a backtested winning strategy and go into details about various aspects of the results and ask the question, "Could you trade this strategy?"Here's the link to the strategy results discussed in this episode:https://www.stockmarketoptionstrading.net/posts/28983911Come join conversation. Note: This is not financial advice and...

2022-11-1516 min

Stock Market Options TradingAre You A "Real" Options Trader?Want the latest in trading research and support the podcast at the same time?Come join me at https://www.patreon.com/VerticalSpreadOptionsTrading to get started. Summary:"Are you a real options trader?" is our topic today and is meant to hep you understand what you are actually trading so that you can know what to do when a trade goes against you. Are you trading the greeks, trying to create income, or using options for trading price action of a stock? In this episode, we'll discuss a question that was...

2022-11-0810 min

Stock Market Options Trading3 Tips For Trading a New StrategyWant the latest in trading research and support the podcast at the same time?Come join me at https://www.patreon.com/VerticalSpreadOptionsTrading to get started. Summary:Trading a new strategy can be difficult so in this episode, I'll give 3 tips to help you balance between the research and the execution your strategy so you can trade with confidence. Note: This is not financial advice and I am not a financial advisor. Additional Resources:Stock Market Options Trading Free Community:https://www.stockmarketoptionstrading.net/

2022-11-0112 min

Stock Market Options TradingBuilding a Position in Amazon (AMZN)Want the latest in trading research and support the podcast at the same time?Come join me at https://www.patreon.com/VerticalSpreadOptionsTrading to get started. Summary:In this episode, I share how I am building a long term position in Amazon (AMZN) via buying shares and covered calls. Note: This is not financial advice and I am not a financial advisor. Additional Resources:Stock Market Options Trading Free Community:https://www.stockmarketoptionstrading.net/Stock Market Options Trading YouTube Channel:https...

2022-10-2519 min

Stock Market Options TradingThe Best Fed Pivot IndicatorWant the latest in trading research and support the podcast at the same time?Come join me at https://www.patreon.com/VerticalSpreadOptionsTrading to get started. Summary:The Fed continues to raise interest rates at the fastest pace in recent history which continues to pressure the stock market to new lows. Once demand has been reduced and inflation starts to level off, the Fed will have to pivot and become more neutral to dovish to avoid a major recession. This is when the stock market will find a major bottom and this episode...

2022-10-1909 min

Stock Market Options TradingTrading The Drunk ManThe stock market is a drunk man that never falls down and doesn't ever go to sleep. Let's discuss this analogy and the challenges it brings to trading stocks and options. Want the latest in trading research and support the podcast at the same time?Come join me at https://www.patreon.com/VerticalSpreadOptionsTrading to get started. Additional Resources:Stock Market Options Trading Free Community:https://www.stockmarketoptionstrading.net/Stock Market Options Trading YouTube Channel:https://www.youtube.com/c...

2022-10-0610 min

Stock Market Options TradingThe Stock Market Doesn't Like You, Here's WhyIn order to even begin to trade, it's likely you are smart and successful. What many underestimate though is a certain skill that worked in their day job or career that simply doesn't translate over into trading. So in this episode, we're going to talk about that skill and what you should be focusing on to become a successful trader. Deep Work by Cal Newport was mentioned in this episode. You can find it on Amazon and Audible for this who want to learn more. Want the latest in trading research and support the podcast...

2022-09-1915 min

Stock Market Options TradingWhat is a Call Wall? w/ Brent Kochuba from SpotGamma.comExcited to have Brent Kochuba back on the show to help explain call and put walls in regards to the options market. Here's a link to a study they did on the subject: https://spotgamma.com/option-wall-stats/Spotgamma.com provides powerful insights from the options market through their proprietary stats and indicators. Be sure to check them out. Want the latest in trading research and support the podcast at the same time?Come join me at https://www.patreon.com/VerticalSpreadOptionsTrading to get started. Additional Resources:Stock...

2022-08-1222 min

Stock Market Options TradingStop Asking This Question!Who's taking the other side of your trade and why would someone take the other side if your analysis is so good?Stop asking these types of questions and focus on your analysis and risk management. The stock market is simply a way for you to express your opinion in a financial way. Want the latest in trading research and support the podcast at the same time?Come join me at https://www.patreon.com/VerticalSpreadOptionsTrading to get started. Additional Resources:Stock Market Options Trading Free Community:...

2022-08-0505 min

Stock Market Options Trading$22Million SPY Put Order Today!On June 28, 2022, SPY had a small gap up and then $22Million worth of SPY put options were bought and then the market tanked. Talking through this trade and why it would've put some pressure on the market. Here's a quick video showing the trades and charts:https://youtu.be/k6obAo16W6UBe sure to check Episode 42 with Brent Kachuba from SpotGamma.com to learn more about the hedging impact of options flow. Additional Resources:Stock Market Options Trading Free Community:https://www.stockmarketoptionstrading.net/

2022-06-2807 min

Stock Market Options TradingOptions Trading and Darkpools with Angie GaskillWant the latest in trading research and support the podcast at the same time?Come join me at https://www.patreon.com/VerticalSpreadOptionsTrading to get started. Angie Gaskill is an independent trader, wife, and mom. She's been trading 15 years and share her approach to options trading and how she uses darkpool data in her trading. Angie Gaskill Twitter:https://twitter.com/MomAngtradesAdditional Resources:Stock Market Options Trading Free Community:https://www.stockmarketoptionstrading.net/Stock Market Options Trading YouTube Channel:

2022-06-2037 min

The One You FeedMeghan O'Rourke on The Challenges of Chronic Illnesses

Meghan O’Rourke is a journalist, poet, and New York Times Bestselling author. Her work often tackles challenging subjects like grief, illness, and more. Her previous books include the best-selling memoir The Long Goodbye, and the acclaimed poetry collections Sun in Days, Once, and Halflife. Meghan is passionate about advocating for those living with chronic illness and is the recipient of Guggenheim Fellowship and many other awards. Today, Eric and Meghan discuss her book The Invisible Kingdom: Reimagining Chronic Illness Get Text Messages from Eric that will remind and encourage you to help stay on...

2022-06-101h 06

The One You FeedMeghan O'Rourke on The Challenges of Chronic Illnesses

Meghan O’Rourke is a journalist, poet, and New York Times Bestselling author. Her work often tackles challenging subjects like grief, illness, and more. Her previous books include the best-selling memoir The Long Goodbye, and the acclaimed poetry collections Sun in Days, Once, and Halflife. Meghan is passionate about advocating for those living with chronic illness and is the recipient of Guggenheim Fellowship and many other awards. Today, Eric and Meghan discuss her book The Invisible Kingdom: Reimagining Chronic Illness Get Text Messages from Eric that will remind and encourage you to help stay on...

2022-06-101h 06

Stock Market Options TradingTrading in 2022 With Erik SmolinskiWant the latest in trading research and support the podcast at the same time?Come join me at https://www.patreon.com/VerticalSpreadOptionsTrading to get started. Erik Smolinski joined me for this weeks episode where we discussed his evolution of trading and some of the adjustments he made for trading options in 2022. You can find Erik over on his YouTube channel where posts informative and educational content for beginners and advanced traders. You can also connect with him Twitter as well. esInvests YouTube Channel:https://www.youtube.com/c...

2022-05-1741 min

The Dad Stuff PodcastEric O‘Rourke - Stock Market Education and Teaching Kids About MoneyThis week I am talking with Eric O’Rourke. Eric is a professional options trader who also maintains a community for stock market options education and trading guidance. Eric took a leap of faith leaving a 15 year career in the technology field to trade and educate on a full-time basis. Listen in as we discuss Eric’s decision to launch his endeavor and how he tries to teach finance and money management to his kids. You will also get some advice on managing your own accounts for retirement or savings. You can listen to Eric’s podcast on just about any p...

2021-12-1734 min

Stock Market Options TradingAre Option Probabilities B.S.?One of the attractions of trading options is the idea that you can create trades with varying degrees of probabilities of profit. In this episode, I put the option probabilities that the trading platforms give us to the test by doing a 10year backtest. The focus is on comparing both the call and put side to see if over a long term period of time, if the probabilities play out as expected. As a bonus, listeners can view the studies discussed in this episode over on the community website in the Podcast section. Here's the...

2021-06-2213 min

Stock Market Options TradingTeen Investing with Jack RosenthalWant to discuss this episode with us?Come join us over on the podcast trading community at https://www.stockmarketoptionstrading.net where you can ask questions and discuss this with other traders.In this week's episode, I got to speak with Jack Rosenthal on teen investing. Jack started investing at a very young age and started a Teen Investing club over at http://younginvestorsclub.org/He's written a couple books on Teen Investing and Entrepreneurship that are available on Amazon. Here's a link to learn more about his books on Amazon. ht...

2021-06-0921 min

Stock Market Options Trading0% Capital Gains with Act 60 Tax IncentivesWant to discuss this episode with us?Come join us over on the podcast trading community at https://www.stockmarketoptionstrading.net where you can ask questions and discuss this with other traders. In this week's episode, I spoke with Sam Silverman from https://relocatepuertorico.com/ where he explained the tax incentives for living in Puerto Rico for both business owners and investors and traders like. As a trader or investor, paying 0% on capital gains can be a game changer as we know but and also work for anyone who works remotely who is ru...

2021-06-0226 min

Stock Market Options TradingUnit Put Options For HedgingWant to discuss this episode with us?Come join us over on the podcast trading community at https://www.stockmarketoptionstrading.net where you can ask questions and discuss this with other traders. In this week's podcast, I talk about how to hedge your stock or option portfolio with unit put options. Also known as units or unit puts. Unit put options are options that have very little value as the options market is unable to price them properly which allows them to explode in value during a market correction. I'll share how i am...

2021-05-0618 min

Stock Market Options TradingOptions Trading Research: Selling Naked Puts on IWMWant to discuss this episode with us? Come join us over on the podcast trading community at https://www.stockmarketoptionstrading.net where you can continue this conversation with Lee and myself about this episode and any other trading topics. In this week's podcast, I expand some options trading research I've been posting on the YouTube channel around selling naked puts on IWM and SPY ETFs. We're going to focus on IWM for this episode but encourage you to check the different variations of this strategy on YouTube.Here are the links to the YouTube videos:

2021-04-1418 min

Stock Market Options TradingHacking the Option Chain with Lee SpazianoWant to discuss this episode with us?Come join us over on the podcast trading community at https://www.stockmarketoptionstrading.net where you can continue this conversation with Lee and myself about this episode and any other trading topics. Lee Spaziano is a data scientist and long time options trader and in this episode we discuss how we are working together to combine these two fields to take advantage of SPX's multiple expirations per week to increase our frequency of high probability trades. We discuss how we acquired tons of SPX intra-day options pricing and L...

2021-04-0253 min

Stock Market Options TradingIntroducing StockMarketOptionsTrading.netCome join us at www.StockMarketOptionsTrading.netThis new free community was built for podcast listeners to connect with myself and guests on the show. It operates like a Facebook group but without the distraction, spam, and negativity that comes along with Facebook. More importantly is the common purpose which is as follows:We bring together stock and options traders to create consistent profits in the stock market so that we can achieve financial freedom and create life long income.If this common purpose resonates with you and you wa...

2021-03-1909 min

The Unseen Paranormal PodcastSpooky Tales with D.C. O'Rourke from Hauntingly Yours: A Podcast For The ParanormalOn today's show we are talking to paranormal investigator, storyteller, Host of "Hauntingly Yours: A Podcast For The Paranormal", D.C. O'Rourke! D.C. has had a life of high strangeness and the paranormal. He currently gives ghost tours of Colonial Williamsburg and describes himself as an old soul and renaissance man of sorts. Check out the links to his show and more below! All the show links for D.C.'s show https://linktr.ee/hauntinglyyoursparanormal/ Hauntingly Yours Paranormal Lounge on FB https://www.facebook.com/groups/2769597580027623 The Unseen Paranormal Podcast Lounge on FB https://www.facebook.com/groups/1048687775648517 A...

2021-02-1731 min

Stock Market Options TradingSPX SPY Options Trading with David SunWe're back with the rest of my discussion with David Sun. So much great options trading insight with our discussions. Be sure to check out the previous episode if you haven't done so already. In this episode we get into how selling out of the money puts isn't necessarily a bullish strategy, managing risk of trading SPX and SPY high probability options strategies, using stop loss orders with options trading, and where on the options chain we like to sell. If you found this episode helpful in anyway, could you let me know by leaving a review o...

2021-02-1528 min

Stock Market Options TradingTastytrade Rising Star David Sun Explains Options Trading ConceptsDavid Sun has a great understanding of options and was featured on TastyTrade's Rising Star series about his approach to options trading. We had a great in depth discussion and I decided to break it into two segments with this episode being the first. In this episode, he's going to talk us through the base concepts of the TastyTrade style of options trading which leads us into a discussion around being delta neutral and what that means for your portfolio. You won't want to miss the next episode where we dive into specific strategies David tra...

2021-02-0834 min

Stock Market Options TradingTrade Tracking Software Made For Options Traders with Ben LatzWe all know that tracking your trades is important but it's often a tedious task, especially when it comes to options trading. My guest today though has helped this important area of trading by creating a piece of software that organizes and analyzes your trades automatically. His name is Ben Latz from WingmanTracker.com.Twitter: @benlatz - https://twitter.com/benlatzEmail: ben@wingmantracker.comWebsite: https://wingmantracker.com and https://benlatz.comCode Use code "eric" on sign up to get $50 off!Thank for listening. ...

2021-01-1842 min

Stock Market Options TradingMy Core Portfolio: Stocks, Bonds, Gold, Volatility, Bitcoin, and CashIn this episode, we're going to go over my Core Portfolio for trading Stocks, Bonds, Gold, Volatility, Bitcoin, and Cash. By trading a small handful of strategies across the major asset classes, we're able to make consistent gains year over year.Head over to https://optionstrading.help/core for an overview of the Core Portfolio. While you're there, you can learn how to get trade alert notifications for the Core Portfolio to trade with me and a couple hundred other retail traders. Thanks for listening. J. Eric O'Rourkehttps://opt...

2020-12-1725 min

Stock Market Options TradingHow to improve your trading results with Rance MasheckRetail traders get their edge through modern trading technology and today's guest are looking to help. Rance Mascheck and Chris Mercer from MarketGear.com discuss the evolution of trading technologies and how their software can improve your trading results. There are so many nuggets in this episode and I'm sure you're going to enjoy this one as much as I did. Be sure to check out www.MarketGear.com/Eric for details after listening. Thank you. J. Eric O'Rourkewww.OptionsTrading.Help/Services

2020-11-1653 min

Stock Market Options TradingTastyTrade Rising Star Fauzia Timberlake Talks OptionsTastyTrade Rising Star Fauzia Timberlake is on the show this week explaining how she using the TastyTrade principles in her options trading. She currently does one on one coaching helping traders navigate the markets. Here are some links to learn more about Fauzia and how you can connect with her online:Listen to her interview with Vonetta LoganWatch her Rising Star interviewLike her on FacebookJoin her Facebook groupSee her trades from the Follow tab.Follow her on Twitter @traderfauziaT...

2020-10-2656 min

Stock Market Options TradingOption Strategy For Small Trading AccountsHave a small trading account but thinking about trading options? You're in luck as this episode shows how trading TLT bull call spreads the past 5 years made over 600% and is perfect for small trading accounts. The bull call spread strategy discussed here is also known as an in out debit spread. An in out debit spread is a vertical spread where the option you buy is in the money and the option you sell is out of the money. In out debit spreads are great for beginners with small trading accounts who want to get d...

2020-10-1912 min

Stock Market Options TradingConservative Options Strategy with Brian Terry CFPI learned a lot from this great discussion with Brian Terry CFP. Brian shared his conservative covered call strategy where he is selling in the money calls on stocks using weekly options with the intent of getting called away every week. I've known Brian for a couple years now and I know he leans on the conservative side of trading and he thinks this strategy is great for conservative traders in retirement. It's an interesting twist on strategy used to create additional income. Brian runs a Facebook group dedicated to this st...

2020-09-2822 min

Stock Market Options TradingIndex Options ExplainedIndex Options ExplainedTo receive the free Index Options Mini Course, go to https://OptionsTrading.help/IndexOptions and I'll send you the 7 part video series to get your trading profitably on your own in as little as 1 week. The 7 part video series includes a weekly options strategy for SPX showing you exactly how to put this trade on every week. It also includes a 5 year performance look back so that you fully understand what to expect when trading this profitable strategy. As mentioned in this episode, the 3 main reasons to consider trading index op...

2020-09-1410 min

Stock Market Options TradingWhich Option Should I Buy?Which option should I buy?Thanks for listenting to this week's Stock Market Otpions Trading podcast comparing the results of buying different Delta call options on AAPL the past 5 years.To recap the optons trading strategy that was used, we backtested buying a call option with about 30 days to expiration when AAPL crossed back above its 21ema and closed the trade afetr 14 calendar days.By taking the same trade entry and trade exit, it allowed us to compare the results of choosing different strike call options from deep in the money, at the...

2020-08-1719 min

Stock Market Options TradingBollinger Bands Options Trading StrategyThanks for listening to this week's Stock Market Options Trading podcast about using Bollinger Bands as an entry signal when the RUT crosses above the upper band. Here's the link the Patreon article for podcast supporters to see more details around the 4 different credit spreads discussed in the episode. (You may need to copy then paste into your browser) https://bit.ly/2WX6W5s Becoming a Podcast Supporter is only $5 per month and gets you access to trading research with the ability to discuss trading one on one with myself or in...

2020-07-2721 min

Stock Market Options TradingHow To Invest In Work From Home StocksThanks for listening to this week's episode of investing in work from home stocks. The COVID-19 pandemic is accelerating the remote work theme as more and more people are choosing to stay home if they can. As we discussed, working from home also gives benfit to the company in the form of less overhead costs such as rent and increased talent pool for finding better workers who may not live in the same geographical area as the office. Here's the link to the Direxion website for more information regarding the WFH ETF which holds 40 stocks...

2020-07-1415 min

Stock Market Options TradingRobinhood Stock Trading Researchhttp://robintrack.net pulls price and popularity numbers for stocks from Robinhood's API and displays it in a sentiment style graph for free. This free website is a great idea in terms of data sharing but definitely has some drawbacks that I discuss in this episode.Thanks for listening.J. Eric O'Rourkehttps://www.patreon.com/VerticalSpreadOptionsTrading#robinhood

2020-06-2812 min

Stock Market Options TradingOptions Research for Trading Weekly OptionsWe're expanding last week's weekly options study by adding a moving average filter to our trades. The goal here is to determine if adding a would be bullish filter will improve the results of this already profitable strategy of trading bull put spreads with 7 days to expiration on SPY and SPX. This episode is an expansion of Episode 7 so here's the link if you'd like to go back and listen to that episode.https://www.stockmarketoptionstrading.com/episode/episode-7Here's are the links to the performance results of both studies over on my P...

2020-06-0812 min