Shows

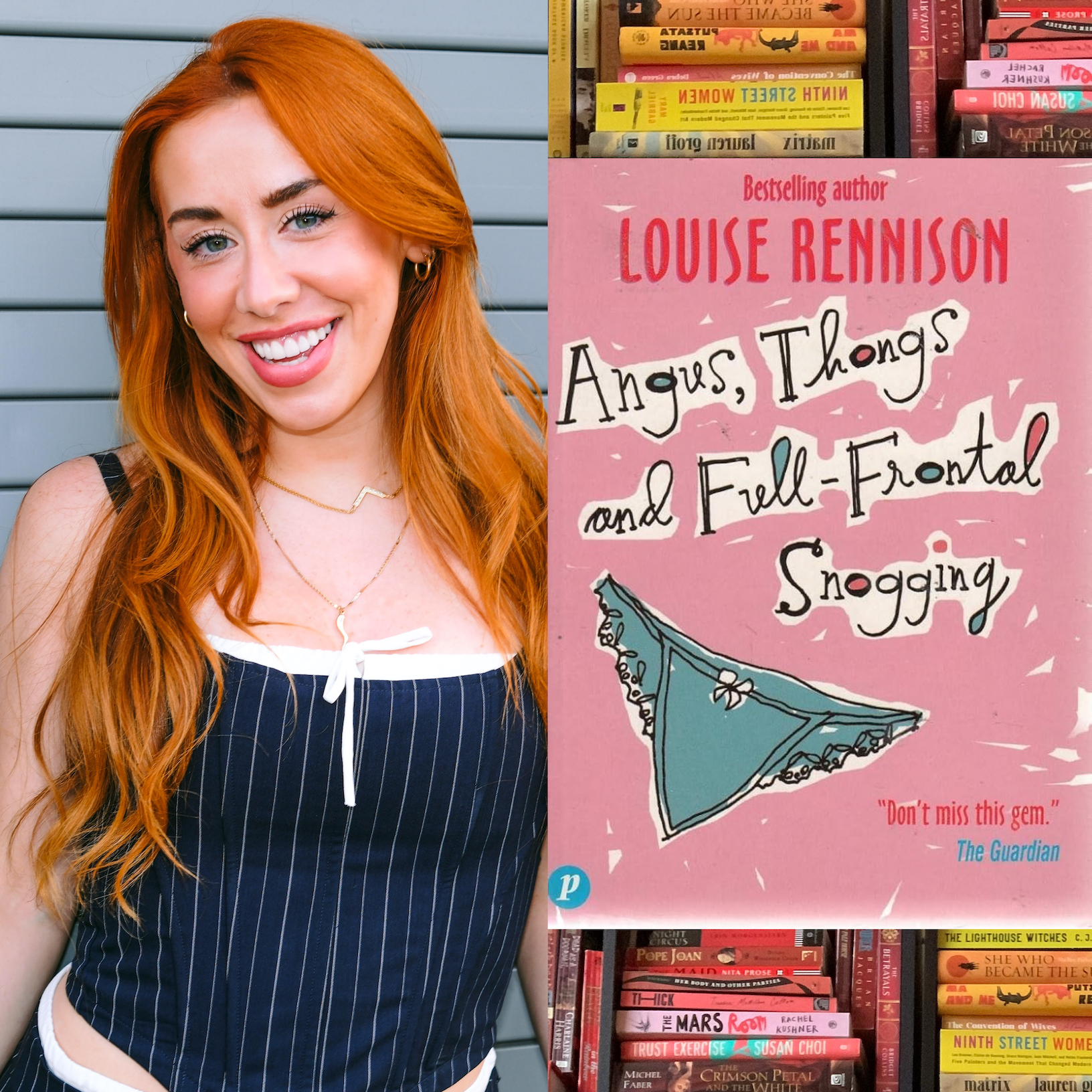

Required ReadingAngus, Thongs, and Full-Frontal Snogging with Britt MigsAn ode to the magic and miseries of girlhood - but mostly the magic. Comedian and Emmy-winning producer Britt Migs joins me to discuss Louise Rennison's 1999 British classic: Angus, Thongs, and Full-Frontal Snogging.Follow Britt!Follow Erin!Support the podcast!

2025-12-0359 min

Budget Effect: How to Budget, How to Pay off Debt, Save Money, Live on a Budget, Improve your Money Mindset on a single income80// How to Plan Now for a Calm, Budget-Friendly Holiday Season🎅Link to HOLIDAY PLANNER The holidays are coming — but you don’t have to rush or stress this year. In this episode, Erin helps you get ahead now so you can feel calm, organized, and financially prepared when the season arrives.You’ll walk through how to plan your time, money, and mindset in advance — so you can be present with your kids and actually enjoy the holidays.💡 What You’ll LearnHow to start future-thinking with your holiday budget and calendarThe first steps to take with your money and ti...

2025-10-2122 min

Budget Effect: How to Budget, How to Pay off Debt, Save Money, Live on a Budget, Improve your Money Mindset on a single income78// Are You an “If” or a “Because” with Your Money?🎉Grab your free Budget School JUMPSTART.Ever notice how your thoughts about money shape your results? In this episode, Erin breaks down two powerful ways of thinking about your household money: “if” and “because.”Are you telling yourself:“I’ll stick to my budget if everything goes smoothly”?“I’ll save if there’s anything left over”?Or are you shifting toward:“I’ll stay consistent because I want freedom”?“I’ll save because it matters to my family’s future”?This small mindset shift changes everything. When...

2025-10-0909 min

Budget Effect: How to Budget, How to Pay off Debt, Save Money, Live on a Budget, Improve your Money Mindset on a single income58// Strategies for Flexibility and Momentum in your BudgetWhat if tweaking the way you set up your budget could give you more wiggle room and even more momentum toward your goals? In this episode, I’m sharing two key strategies. The first creates space and grace in your budget. The second pushes you more aggressively toward your goals. Not everyone will agree with this approach, but my main point is this: your budget is a tool to get you what you want. It's YOURS - make it work for YOU.If you're...

2025-03-2519 min

Budget Effect: How to Budget, How to Pay off Debt, Save Money, Live on a Budget, Improve your Money Mindset on a single income57// Let's Talk Credit CardsCredit cards can be helpful or harmful—so how do you know if they fit into your budget? In this episode, we’re answering:💳 Should you avoid credit cards altogether?💳 How can you use them wisely without falling into debt?💳 What’s the best way to track credit card spending in your budget?✨Do you want me to come into your email with the Budget Foundations Jumpstart? By the end of this email challenge, you’ll have the essential numbers you need to begin budgeting, a goal, and plan to work it int...

2025-03-1822 min

Budget Effect: How to Budget, How to Pay off Debt, Save Money, Live on a Budget, Improve your Money Mindset on a single income56//You're not “bad with money," you just need to work on these identity shiftsIt’s important to have a money goal. It’s important to have a system. But it’s also important to work on your money identity. If you want to reach your money goals - whatever they may be - then you should work on that foundational layer of your identity. -What do I mean by your money identity?-How might this be holding you back from reaching your money goals right now?-What kind of positive money identities are there?-How can we take steps t...

2025-03-1129 min

Budget Effect: How to Budget, How to Pay off Debt, Save Money, Live on a Budget, Improve your Money Mindset on a single income55//Too busy to budget? Think again!In this episode we'll break down the question: How long does it take to budget?We include:⌚How long does it take to set up your budget for the first time?⌚How long does it take to write your budget each month?⌚How much time do you need to engage with your budget throughout the month?⌚What about a budget close-out?!✨Plus 5 Bonus Tips to make it even smoother and faster! The result: It doesn't take that long! Get started with your budget today! 📌 Free...

2025-02-2529 min

Budget Effect: How to Budget, How to Pay off Debt, Save Money, Live on a Budget, Improve your Money Mindset on a single income54// How TINY habits can help you reach your financial goals: Atomic Habits for BudgetingAre Your Money Goals Being Held Back by Your Systems? Here’s How to Fix ItWhat if reaching your financial goals was as simple as opening a drawer, taking out a notebook, and putting it back? Sounds too easy, right? But tiny, intentional steps—repeated over time—are what actually create success. In this episode, I break down the power of small habits, inspired by Atomic Habits by James Clear, and how you can apply these principles to your budgeting and money management. Whether you're just starting out or refining your system, this episode will h...

2025-02-1425 min

Budget Effect: How to Budget, How to Pay off Debt, Save Money, Live on a Budget, Improve your Money Mindset on a single income53// Why I Hated a Yearly Budget (But You Might Love It!)Everywhere I look, people are talking about how they’ve planned their entire budget for 2025—and I had to find out what that actually looks like! How do you plan a whole year’s worth of spending? How do you account for unexpected expenses? In this episode, I break down:What a yearly spending plan actually is and why some people swear by it.The two smart reasons you might want to try it.How to create one if you’re curious (even if it’s not January).Why I personally hated it, how it made me feel, and why I’...

2025-02-0719 min

Budget Effect: How to Budget, How to Pay off Debt, Save Money, Live on a Budget, Improve your Money Mindset on a single income52//Make budgeting stick beyond the New Year motivation: How to Build a Money System That LastsAre you ready to make budgeting a lifestyle instead of a fleeting goal?Many people start the year strong with financial resolutions, but motivation fades quickly. In this episode, we dive into what it takes to stick with your money goals long after the new year energy wears off.You'll learn:Why budgeting doesn't have to mean living a restrictive, frugal life.The importance of building a sustainable budget SYSTEM you can rely on month after month.How to plan for challengesWorking on shifting your mindsets.📌 Free Resource: Do you...

2025-01-2818 min

Budget Effect: How to Budget, How to Pay off Debt, Save Money, Live on a Budget, Improve your Money Mindset on a single incomeEp 51// 4 reasons your budget categories are more important than you thinkIs it possible to love your budget? Is it possible to enjoy budgeting?I SAY YES. And figuring out the right budget CATEGORIES makes your budget goal-focused, future-focused, and intentional. that you actually like and want to stick to! In this episode, we’re diving into why categories are a critical part of loving your budget and making it work for your lifestyle. You’ll learn how the right categories can simplify decision-making, improve your money habits, and keep you on track toward your financial goals.Listen to this episode to answer these...

2025-01-2228 min

Budget Effect: How to Budget, How to Pay off Debt, Save Money, Live on a Budget, Improve your Money Mindset on a single income50// What categories should I put in my budget?Struggling to figure out what categories to include in your budget? Learn how to simplify your categories and align them with your values for real progress. In this episode, we break down budget categories into fixed needs, variable needs, wants, and savings. I’ll show you how to keep it simple, adjust for your unique circumstances, and build a budget that reflects your goals and values. Let’s make budgeting intentional, flexible, and effective!Listen to the episode to answer these questions:What’s the easiest way to decide which...

2025-01-1421 min

Budget Effect: How to Budget, How to Pay off Debt, Save Money, Live on a Budget, Improve your Money Mindset on a single income49//A List of New Year Financial Goals - Pick one!Feeling stuck when it comes to your finances? Let’s change that! In this episode, I’m sharing a list of financial goals. Pick one and make real progress with your money this year.Setting financial goals doesn’t have to be overwhelming! I’ll break it down into categories like building better habits, cutting unnecessary expenses, upgrading your financial systems, and even making exciting plans for your future. Whether you’re tired of debt, want to save more, or just want to feel more in control, there’s a goal here for you. Let’s pick one and get st...

2024-12-3116 min

Budget Effect: How to Budget, How to Pay off Debt, Save Money, Live on a Budget, Improve your Money Mindset on a single income48// 6 Habits for Reducing Money Stress - Even During the Busiest SeasonsThe holidays brought some of the busiest and most stressful weeks of the year for me. So much pressure! Overwhelmed! But during that time, even though I overspent a little, I never felt stressed about money. As I reflected, I came up with six reasons why I never felt stressed about money, and I put them in this episode. Check it out! ❤️. Listen to the Episode to Answer These Questions:What is a future-focused budget, and how can it help reduce financial stress?Why is simplifying your financial accounts a key to staying organized?How can cons...

2024-12-2718 min

Budget Effect: How to Budget, How to Pay off Debt, Save Money, Live on a Budget, Improve your Money Mindset on a single income47// 3 Reasons You Should Do a Spending AuditDo you want to pay off your debt and save more money this year? DO THIS FIRST. With a spending audit, you can get clear on your spending habits so you know can be prepared to build your budget, catch your bad habits, and more. If you want to start a budget, but you aren't sure where to get started, you may want to try a spending audit. There is stress in not knowing where your money goes and not feeling in control. There is peace in getting clear. That's what a spending audit can do...

2024-12-1712 min

Budget Effect: How to Budget, How to Pay off Debt, Save Money, Live on a Budget, Improve your Money Mindset on a single income46//A quick budget hack that simplifies how you track your spendingIs it taking too long to track your spending as you work on your budget? I have a quick trick for you today that will simplify and speed up the process of tracking your spending. We have money goals, we have set intentions, now we have to stick to it! This episode will help with just a smoother, faster way to stick to your budget. Here's the trick: Split your purchases as you buy. Check it out! Resources:Episode 15: Create this List to Save Money on...

2024-12-1010 min

Budget Effect: How to Budget, How to Pay off Debt, Save Money, Live on a Budget, Improve your Money Mindset on a single income45// How to say "no" to the constant PRESSURE to spend when you'd rather stick to your money goalsAs a mom, do you feel constant pressure to spend money on all the things? Team pictures, fundraisers, birthday gifts, and more?! What about the social pressure to buy at the right time, for every occasion, and to "keep up" with your neighbors? In this episode we’ll discuss the many situations where you might feel pressured to spend money - when you DON’T even want to! By the end of this episode you’ll have practical strategies to release the pressure and confidently say, “no” saving your money for what truly matters and aligning yo...

2024-12-0424 min

Budget Effect: How to Budget, How to Pay off Debt, Save Money, Live on a Budget, Improve your Money Mindset on a single income44//The 2 Biggest Holiday Budget Struggles, and 8 Tips for Staying on TrackAre you struggling to stay on budget during the holidays without feeling like you’re missing out? During the holidays, you might do one of these two things:1. Throw your budget out the window.2. Feel like you are the ONLY one on a budget and that you are missing out.In this episode, we explore those two big holiday budget struggles and give you 8 actionable strategies to stay financially confident and stress-free. You’ll learn how to block temptation, shop intentionally, and appreciate your financial journey without comparison.Liste...

2024-11-2718 min

Budget Effect: How to Budget, How to Pay off Debt, Save Money, Live on a Budget, Improve your Money Mindset on a single income43//The Key to Never Feeling Broke AgainThe Key to Never Feeling Broke AgainHow to Normalize Having Money and Saving Money in Your LifeWhy does it feel like money always slips through your fingers? What if budgeting didn’t feel like a short-term fix but instead became a habit that makes saving and having money feel normal?In this episode, we’re diving into how to shift budgeting from something you do “when money’s tight” into a life habit that sticks. When budgeting becomes second nature, you’ll start to feel confident and in control of y...

2024-11-2019 min

Budget Effect: How to Budget, How to Pay off Debt, Save Money, Live on a Budget, Improve your Money Mindset on a single income42// Use this process to have a budget-friendly holidayThe holiday season is around the corner, and with it can come the stress of extra spending. In this episode, we’re talking about how to plan ahead for any big event—whether it’s the holidays, a special celebration, or a family vacation—without letting your budget get out of hand. I’ll share simple, realistic strategies to help you avoid overspending, stick to your goals, and make this season feel meaningful and manageable. Let’s dive into how a little planning now can make a huge difference later! 👉 Grab Your 3-Part Holiday Planner Here to make this holida...

2024-11-1218 min

Budget Effect: How to Budget, How to Pay off Debt, Save Money, Live on a Budget, Improve your Money Mindset on a single income41// A mindset shift to help stop your impulse purchases | Actually stick to your budget and save moneyYou are up against bazillion dollar marketing companies that cause you to feel like you are SAVING money if you buy this RIGHT NOW. But what if we just did one simple shift in our language that would help us combat those impulse purchases? That's what we are talking about today. After this episode you will have a deeper understanding around saving money and a way to combat impulse purchases. Do you want me to come into your email with the Budget Foundations Jumpstart? By the end of this email challenge, you’ll have the essential nu...

2024-11-0510 min

Budget Effect: How to Budget, How to Pay off Debt, Save Money, Live on a Budget, Improve your Money Mindset on a single income40// Finally save more money, pay off debt, and stay in your budget with this simple tipWhat is stopping you from saving, investing, or paying off debt? What is keeping you in the paycheck to paycheck cycle?Maybe you don't have this mindset: Can it wait a week? After this episode, you will walk away with a fresh mindset about your future, your goals and your budget! Let your budget EMPOWER you to get what you want. Do you want help getting started? Click here for the Budget Foundations Jumpstart. By the end of this email challenge, you’ll have the essential numbers you nee...

2024-10-3014 min

Budget Effect: How to Budget, How to Pay off Debt, Save Money, Live on a Budget, Improve your Money Mindset on a single income39// 4 Ways to Minimize the Cost of Eating Out on Busy NightsIs the constant running around and never eating at home killing your food budget? There are 4 steps you can take to minimize this cost - even in the busiest seasons. Let me walk you through what these 4 steps look like for a mom who is empowered by her budget.Listen to this episode to answer these questions: How do I stay in my food budget?How do I feed my family when we are so busy?How do I save money on food?How do I...

2024-10-2423 min

Budget Effect: How to Budget, How to Pay off Debt, Save Money, Live on a Budget, Improve your Money Mindset on a single income38// Holiday spending tips for a holiday that won't break your budgetPlanning in advance for the holidays is going to save you money and mental energy. In this episode, we'll walk through how to get your holiday mindset in check, prepare your budget, and of course strategize ways to save money this holiday while living abundantly. Click here for the free Budget Foundations Jumpstart!Let’s Connect:Instagram @budgeteffectpodcastEmail hello@thebudgeteffect.comWant to ask a question?Click below to send your question to the show. Click to Send Fan Mail

2024-10-1823 min

Budget Effect: How to Budget, How to Pay off Debt, Save Money, Live on a Budget, Improve your Money Mindset on a single income37// The most important habit to break the paycheck-to-paycheck cycleStruggling to Stay on Top of Your Spending? Here's How Weekly Tracking Can Help You Reach Your GoalsFor many busy moms, staying on top of household finances can feel overwhelming. With bills, groceries, and daily expenses piling up, it's easy to lose track of your budget. In this episode, we dive into a powerful yet often overlooked habit—weekly spending tracking. Learn why setting a plan at the start of each month and adjusting your budget weekly is a game-changer for reaching both your money and life goals. We'll also address common struggles like th...

2024-10-1017 min

Budget Effect: How to Budget, How to Pay off Debt, Save Money, Live on a Budget, Improve your Money Mindset on a single income36// Be a Fierce Protector of Your Financial GoalsWe are busy moms, taking care of a lot of things. So how can we protect our goals and visions? How can we stick with our goals?Answer: We must become a fierce protector of the goal. 1. Protect your time to have the vision. 2. Protect your time to plan. 3. Protect your plan. 4. Figure out how you will keep up with all your other commitments. And BELIEVE IN YOURSELF! You got this. Click here for the free Budget Foundations Jumpstart!Let's Connect:Instagram @budgeteffectpodcast

2024-10-0221 min

Budget Effect: How to Budget, How to Pay off Debt, Save Money, Live on a Budget, Improve your Money Mindset on a single income35// One SMALL STEP to Improve in Any Phase of BudgetingWhat phase of budgeting are you in?Procrastination Phase? Beginning Budgeter?Been Budgeting For a While?Lost your Drive?Whichever phase you are in, I bet you can find a small step to take forward in this episode.Click here for the free Budget Foundations Jumpstart!Let’s Connect:Instagram @budgeteffectpodcastEmail hello@thebudgeteffect.comLet me know what you picked! Click to send a te...

2024-09-2416 min

Budget Effect: How to Budget, How to Pay off Debt, Save Money, Live on a Budget, Improve your Money Mindset on a single income34// The 50/30/20 Budget: Pros, Cons, and Truth BombsYou know I talk more about a Values-Based Budget. So come along with me as I break down the pros and cons of a 50/30/20 budget. Click here for the free Budget Foundations Jumpstart!Let’s Connect:Instagram @budgeteffectpodcastEmail hello@thebudgeteffect.comLet’s Connect: Instagram @budgeteffectpodcastEmail hello@thebudgeteffect.com...

2024-09-1714 min

Budget Effect: How to Budget, How to Pay off Debt, Save Money, Live on a Budget, Improve your Money Mindset on a single income33// Tips for a Low or No Spend Fall | Save Money This FallFall is a great time to save money!In this episode we cover: 1. Why fall is a great time to cut spending2. How to set rules for a no-spend or low-spend fall3. Expenses that are coming up in fall and secondary options4. Fun and low cost activities in the fall. Click here for the free Budget Foundations Jumpstart!Let’s Connect: Instagram @budgeteffectpodcastEmail hello@thebudgeteffect.comWant to ask a question?Click below to send your question to...

2024-09-1031 min

Budget Effect: How to Budget, How to Pay off Debt, Save Money, Live on a Budget, Improve your Money Mindset on a single income32// How to Make Meal Planning Work for You | Meal Planning for Busy Moms on a BudgetIf you want to success with budgeting, then meal planning is something you're probably going to have to stick to. In this final episode of our 3-part meal planning series, we really zoom in on how to make meal planning work for you. Click here to join the Meal Planning ChallengeClick here for the free Budget Foundations JumpstartLet’s Connect:Instagram @budgeteffectpodcastEmail hello@thebudgeteffect.comText the Show!

2024-09-0318 min

Budget Effect: How to Budget, How to Pay off Debt, Save Money, Live on a Budget, Improve your Money Mindset on a single income31// Tips for Meal Planning on a Budget with Plandy.MandyToday we have expert meal planner, Plandy Mandy, to share some of her top tips for how to meal plan, sticking to a meal plan, and how to meal plan on a budget.It's Part 2 of our 3-episode series on Meal Planning!You can find Mandy on her Instagram page @Plandy.Mandy You can join the Meal Planning Challenge by signing up here.If you are ready to stop messing around and really get started with your budget, I can help: FREE Budget Foundations Jumpstart Email CourseMoney Movement...

2024-08-2734 min

Budget Effect: How to Budget, How to Pay off Debt, Save Money, Live on a Budget, Improve your Money Mindset on a single income30// Meal Planning vs. Eating out on a Budget | Meal Planning ChallengeMeal planning is challenging for a lot of people! If you are doing well with meal planning then you should be proud! But regardless of the challenge, it's something that is beneficial for our budget, our nutrition and even our mental health.This episode will hopefully motivate you to build your habit of meal planning. JOIN the MEAL PLANNING CHALLENGEJoin the Money Movement Course - Closes August 31stFREE Budget Jumpstart ChallengeParents.com article that I cite in this episodeLet’s Connect:

2024-08-2021 min

Budget Effect: How to Budget, How to Pay off Debt, Save Money, Live on a Budget, Improve your Money Mindset on a single income29// Reaching Money Goals in a Holistic Way | More than one way to pay off debtYou are doing big things when you decide to start moving forward with money. So start to think bigger. It’s not just your budget and looking for good deals and finding out how to live frugally while you fix your money situation. It’s a holistic endeavor: your mindset, your other home habits, your self-care, your money-saving strategies, your budgeting strategies. It all matters to your success. Tune in to learn how there are many unexpected ways to move forward with money beyond just budgeting. Click here fo...

2024-08-1311 min

Budget Effect: How to Budget, How to Pay off Debt, Save Money, Live on a Budget, Improve your Money Mindset on a single income28// Back to School on a Budget | Budgeting for School Shopping and the School YearBack to School means budgeting for school supplies, school clothes, working on our back to school routines, and thinking future forward about our school year budget and school year routines.In this episode we cover all those things. *back to school mindset*back to school budget*school shopping budget*school supply budget*how to save for school expensesYOU GOT THIS.Click here for information TEST GROUP FOR NEW PROGRAMClick here for the free Budget Foundations Jumpstart!

2024-08-0627 min

Budget Effect: How to Budget, How to Pay off Debt, Save Money, Live on a Budget, Improve your Money Mindset on a single income27// End of the month and didn't track your spending? What do you do? | What to do before you start a budget.If you want to start budgeting, what should you do at the end of this month before you start next month?ORIf you wrote a budget for this month, but you haven’t looked at it since the beginning of the month, and now it’s the end of the month…what do you do?Maybe you lost motivation or maybe life just happened. Regardless of the reason, we have to find the solution and get back to the plan. This episode will tell you how to...

2024-07-3013 min

Aspire for More with ErinBuilding a Better Senior Living Community Team: HR Insights with Britt RieseSend me your feedback on this episode!Transforming HR Through Strategic Leadership and Technology with Britt Reese In this episode of the Aspire for More with Aaron podcast, Aaron welcomes Britt Reese, a strategic business consultant with Paychex. They discuss the evolving role of HR from administrative to strategic, with a focus on technology, employee well-being, and developing strong leadership. Britt shares insights into current HR trends, the importance of continuous learning, DEI initiatives, and actionable steps to enhance the employee experience and organizational culture. The conversation highlights practical examples and provides valuable a...

2024-07-2533 min

Budget Effect: How to Budget, How to Pay off Debt, Save Money, Live on a Budget, Improve your Money Mindset on a single income26// How to budget for self-care | Building a sinking fund for your personal wants and needsIn this episode, we're getting into the importance and the how-to of budgeting for self-care. A little work up front can help you get exactly what you need and want for self-care in your monthly budget. Tune in to learn how to prioritize your well-being without breaking the bank!I will also walk you through how to use this FREE self-care budget builder.Click here to get the SELF-CARE BUDGET BUILDERThis episode is for you if you’ve ever asked yourself:How can I budget for self-care?What are some tips fo...

2024-07-2323 min

Budget Effect: How to Budget, How to Pay off Debt, Save Money, Live on a Budget, Improve your Money Mindset on a single income25// How to start a budget when you are behind on billsIf you want to get ahead with money, but you’re behind on bills or just can’t figure out how to get going, then this episode is for you. The main takeaway is that you must have a plan. And I have a proven plan that can work for you. This episode is for you if you’ve ever asked yourself:How can I pay off debt?How do I stop living paycheck to paycheck?How can I budget...

2024-07-1625 min

Budget Effect: How to Budget, How to Pay off Debt, Save Money, Live on a Budget, Improve your Money Mindset on a single income24// Tips for sticking to a budget by a reflecting on your needsBUDGET JUMPSTART CHALLENGELet's reflect on our wants and needs so that we can make better choices about our spending. Use these prompts to figure out if we are spending money and time on the things that are actually going to fulfill our needs. Journal Prompts for Needs and WantsThis episode is for you if:Have trouble with impulse buying, impulse purchases, impulse shoppingYou have trouble sticking to your budget because you want to buy all the thingsYou are afraid to start budgeting because you think a budget w...

2024-07-0929 min

Budget Effect: How to Budget, How to Pay off Debt, Save Money, Live on a Budget, Improve your Money Mindset on a single income23// How to save money for big purchases (or little purchases) | How to set up sinking fundsSince we started the podcast, I've been saying we need to talk about sinking funds! In this episode I will break down sinking funds and how they can level up your finances. I will answer: What are sinking funds?How do sinking funds work in your budget?How do sinking funds help you?I hope this episode motivates you as much as it motivated me! Click here to JOIN THE BUDGET FOUNDATIONS JUMPSTART challenge.What sinking funds will you start??Click to text your answer in to...

2024-07-0219 min

Budget Effect: How to Budget, How to Pay off Debt, Save Money, Live on a Budget, Improve your Money Mindset on a single income22// 4 Tips to Pay off a Lot of Debt on a Small Income | Debt Free Journey | Paying off DebtGot debt? Let's crush your money goals. As a single mom making 28k, I paid off thousands of dollars in debt. Let me give you 4 things that worked for me and maybe they'll work for you too. Click to join the BUDGET JUMPSTART CHALLENGE. This episode is for you if...-you are working on your debt payoff.-you have a low income and want to save money.-you are a normal person with normal debt and you want to have financial freedom!-you just want to save money and get ahead.

2024-06-2526 min

Budget Effect: How to Budget, How to Pay off Debt, Save Money, Live on a Budget, Improve your Money Mindset on a single income21// How to Break the Paycheck to Paycheck Cycle | How to create a weekly budgetMany people are stuck in a cycle of living paycheck to paycheck with seemingly no way out. But there is a solution! Of course you need a budget, but even more specifically - a weekly budget. This will help you get so intentional with your money and move forward with money and in your life. Do you want help getting started with a budget? Join the BUDGET JUMPSTART CHALLENGE for FREE! What is the most challenging part of budgeting for you right now?Is it something with getting the budget set...

2024-06-1821 min

Budget Effect: How to Budget, How to Pay off Debt, Save Money, Live on a Budget, Improve your Money Mindset on a single income20// Don't start your budget without doing these 4 things | How to start a budgetIf you need help getting a budget started, start with these four things. BUDGET JUMPSTART CHALLENGESo if you have been wondering:How do I stick to a budget?How do I even get started with budgeting?How do I pay off debt?How do I invest when I live paycheck to paycheck?How can I move forward as a single mom?Then this episode is for you.My mission is to help busy moms or even single moms learn how to create and stick to...

2024-06-1116 min![brAVe [space]](https://d3wo5wojvuv7l.cloudfront.net/t_rss_itunes_square_1400/images.spreaker.com/original/bdd46f97c7b11ab9f1a9b9223cf5ef9f.jpg)

brAVe [space]Ep 39: "AV is for Everybody" with Erin Maher-MoranRecorded on May 14, 2024 With Infocomm 2024 right around the corner, Erin Maher-Moran reached out to host Britt Yenser and suggested they record this bonus episode. Together, they unpack:Erin's "ick" experiences from Infocomm 2023-- what they were, and how she handled themPrioritizing safety Navigating, surviving, and even thriving in the hustle and bustle of the trade show experience...and more!While this episode does cover some heavy topics, it also features a special guest appearance by a solicitor at Britt's front door and Erin's impression of a slot machine. Be sure to...

2024-06-0646 min

Budget Effect: How to Budget, How to Pay off Debt, Save Money, Live on a Budget, Improve your Money Mindset on a single income19// 3 Actions to Bring You More Joy (that Cost Zero Dollars)If you want to move forward in life with money, in your motherhood, in your womanhood, then work on these three things. The great thing is that they are totally free to pursue. CLICK HERE for the BUDGET JUMPSTART CHALLENGE.Click here for the Whole Life Wellness ReflectionQuestion of the Week: Click to Send Fan Mail

2024-06-0422 min

Budget Effect: How to Budget, How to Pay off Debt, Save Money, Live on a Budget, Improve your Money Mindset on a single income18// Tips for Sticking to a Summer Budget (While Still Having Fun)If you want to have an active summer, but you don’t want to break your budget, then this is the episode for you. We discuss preparing for summer with kids, summer routines, summer on a budget, budget friendly summer activities and more. Listen in.-------------------------------------------------------------------------------------------------------------We discuss 4 things you can do to save money this summer: How to prepare for summer by thinking about your new routineWays to save money when you are out of the house more oftenWays to cut costs from your budget dur...

2024-05-2825 min

Budget Effect: How to Budget, How to Pay off Debt, Save Money, Live on a Budget, Improve your Money Mindset on a single income17//How to improve your shopping habits | Tips for sticking to a budgetIf you have trouble sticking to a budget and reaching your money goals, then let's take a look at your shopping habits. And I'm not talking about LACK here. I'm not going to tell you that YOU CAN'T SHOP. I'm actually teaching you how to UPGRADE your shopping habits to get MORE of what you want. There are 3 Steps to Upgrading your Shopping Habits 1. Prepare ahead of time - know your values and write your lists. 2. Block temptation - I got strategies for you on this. 3. Have a plan for "In the Moment" decisions...

2024-05-2116 min

Budget Effect: How to Budget, How to Pay off Debt, Save Money, Live on a Budget, Improve your Money Mindset on a single income16// How to Budget for Family Fun | Using your Budget to Live IntentionallyUsing your budget to live an intentional life is the goal. Since most of us value connecting and spending time with our kids, let's make sure we put that in the budget each month. This works both ways: 1. We value it, so we put it in our budget. 2. And it's in our budget, so it reminds us to live intentionally in what we value.In this episode you will learn about how "funds" can be part of your budget. You will learn the action steps to setting up and using a fund. And we will touch...

2024-05-1415 min

Budget Effect: How to Budget, How to Pay off Debt, Save Money, Live on a Budget, Improve your Money Mindset on a single incomeEp15: Create this List to Save Money on Groceries, Get Organized, and Save Mental EnergyThis one-time, 20-minute activity could save you hours! Get organized by creating a “Monthly Essentials” list. Then save yourself so much time, save mental energy, stick to a shopping budget, and save money for years to come. My mission is to teach you how to create and stick to a plan for your money that you believe in and love so that you can have less stress and more freedom.…That’s the budget effect! And this is the budget effect podcast.Erin Britt is the host and can be fou...

2024-05-0713 min

Budget Effect: How to Budget, How to Pay off Debt, Save Money, Live on a Budget, Improve your Money Mindset on a single income[BONUS] How to release resentment | How to release negative emotions: Ep14[BONUS] This slightly off-topic bonus episode is an explanation of a practice that I used to finally release the negative emotions that would not leave me. I specifically used it to release anger and resentment. You could use to it to release any negative emotion: stress, worry, anxiety, sadness. If you have processed it, felt it, sat it in for long enough and are ready to let it go, this could be what you need. My mission is to teach you how to create and stick to a plan for your money that you believe in...

2024-05-0611 min

Budget Effect: How to Budget, How to Pay off Debt, Save Money, Live on a Budget, Improve your Money Mindset on a single incomeEp13: Let go of worry, release negativity, move forward with money and in lifeMy mission is for you to have less stress and more freedom, right? Well that doesn't just magically happen because you get your money in order. Money has a big part in your stability and your peace, but there are other things you have to let go of as well. This is a conversation about how to let go of worry, how to release resentment, how to stop feeling guilty, and even how letting go of clutter is important too. What's the point in moving forward with money while these other huge things are holding...

2024-04-3023 min

Budget Effect: How to Budget, How to Pay off Debt, Save Money, Live on a Budget, Improve your Money Mindset on a single incomeEP 12: Unexpected Ideas to help you SPEND LESS and Improve your Money MindsetSticking to a budget is a lot about having a mindset for it. You know you are doing what’s best, you know you are reaching your goals, you have a vision of your future, and that’s what keeps you going. So today I have a few unexpected places to help you with this mindset.We discuss:1. Minimalism2. The Library3. The Yoga Mat 4. Cleaning your drawers5. Documentaries 6. Curating your social media7. Being present in your everyday actions8. Listening and subscribing My mission is to teac...

2024-04-2315 min

The Balance with Britt PodcastAdrenals, Burnout & Highly Ambitious Women - Why it Happens and What we Can Do About it with Funk'tional Nutritionist Erin HoltIn this episode, Britt sits down with Erin Holt, Functional Nutritionist, Stanford-Trained Compassion Teacher, & Founder of The Funk'tional Nutritionist. Erin shares her personal journey with burnout and entrepreneurship, shedding light on common hormone imbalances experienced by highly ambitious women.In this episode;Erin shares her personal story with burnout and her entrepreneurial journey, offering insights into the challenges and lessons learned along the wayCommon hormone imbalances seen in highly ambitious women How hustle culture is anti-body Common stressors of entrepreneurship, highlighting the importance of recognizing and addressing these challengesStrategies for assessing if work is ne...

2024-04-1757 min

Budget Effect: How to Budget, How to Pay off Debt, Save Money, Live on a Budget, Improve your Money Mindset on a single incomeEP 11: 11 things you can stop buying - Reach your money goals instead.This is not about being "cheap" or "stingy". It's not about rules and lack. It's about being intentional. I'm not going to say you can never buy these things. I'm just saying that your current money goal is definitely more important than anything on this list. So if you have been wondering:How do I stick to a budget?How do I stick to a budget with kids?How to budget?What are budgeting tips and tricks?What are some budgeting hacks?How to budget as a single mom?Then t...

2024-04-1616 min

Budget Effect: How to Budget, How to Pay off Debt, Save Money, Live on a Budget, Improve your Money Mindset on a single incomeEP 10: How to Create and Stick to a GOAL-FOCUSED BudgetThere are different ways to budget out there, and my mission is to help you create and stick to a budget that you love. Today I want to tell you that having a GOAL-FOCUSED money plan can be very motivating and very rewarding. It just might be the tweak in your budget you need to actually begin moving forward with money.So if you have been wondering:What should my money goal be? And then how do I budget for my goal? Then how do I stick to that...

2024-04-0915 min

Budget Effect: How to Budget, How to Pay off Debt, Save Money, Live on a Budget, Improve your Money Mindset on a single incomeEP 9: 4 Smart Ways to Spend Your Tax Refund or any Large Chunk of IncomeIf you are coming into some money from your tax refund or an inheritance or any other means, then CoNgRaTuLaTiOnS! I'm glad you are deciding to do something smart that will MOVE YOU FORWARD. In this episode I'll give you 3 ways to use it to get your foundations right, and a 4th way that just might be right for a busy mom starting your financial journey if you need a little grace and a little help. My mission is to help busy moms or even single moms learn how to create and stick to a p...

2024-04-0211 min

Budget Effect: How to Budget, How to Pay off Debt, Save Money, Live on a Budget, Improve your Money Mindset on a single incomeEP8: Value-Based Budgeting: How to stick to a budget by knowing your values and focusing on mindsetSometimes people think a budget limits us, but actually the opposite is true. A budget is putting money toward what we value, and choosing NOT to spend money on what we don’t value. It is a tool to get us to financial stability, financial freedom, debt free life, and intentional living in a life we’ve created and curated. In this episode: Why it’s important to know what you valueHow to figure out what you valueHow to build a budget around your valuesMy mission is to teach you how to create and stic...

2024-03-2622 min

Budget Effect: How to Budget, How to Pay off Debt, Save Money, Live on a Budget, Improve your Money Mindset on a single incomeEP 7: Basic Financial Health: 4 areas to work on to improve your money situationMaybe you don't feel like you can go all in on investing or estate planning or even budgeting (my heart hurts with that one). Maybe you don't have your 401K in order quite yet. But if you're wondering: "Where can I start with personal finance?" What are the basics? I've created a list of four basics you should work toward for financial wellness. Listen in as we discuss. My mission is to teach you how to create and stick to a plan for your money that you believe in and love so that you can have l...

2024-03-1914 min

Budget Effect: How to Budget, How to Pay off Debt, Save Money, Live on a Budget, Improve your Money Mindset on a single incomeEP 6: Investing Early: Why it's important and steps to get startedIf you're wondering "Why should I invest for retirement right now?" or "How do I save for retirement?" or "When should I start investing for retirement?"Girl, please listen to this episode! We talk about the foundations of being a happy, healthy mother and woman - and part of that is having security and stability. We want our future-self to have freedom and choices. And our compound interest system is just too good to miss!Something else too good to miss? This episode! My mission is to teach you how to create and...

2024-03-1217 min

Budget Effect: How to Budget, How to Pay off Debt, Save Money, Live on a Budget, Improve your Money Mindset on a single incomeEP5: Tips for simplifying your household financesIf you want to learn how to stick to a budget, just like everything, we need to make it as simple as possible. In this episode, I will give you 3 tips for making your household budget easier to stick to. 1. One way to pay2. Automate EVERYTHING3. Get your PAPER CLUTTER under control. That's right, we discuss paper clutter too. If you are a busy mom and you want to pay off debt, save for your future, live within your budget, then we have to make it simple. ...

2024-03-0512 min

Budget Effect: How to Budget, How to Pay off Debt, Save Money, Live on a Budget, Improve your Money Mindset on a single incomeEP 4: Tips for sticking to your budget by tracking your spendingAre you tracking your spending throughout the month? This is a step a lot of people skip, but according to science, you are more likely to meet your money goals if you assess your progress along the way. In this episode we will cover what tracking your spending looks like, and how you can do it as a busy mom who has a lot on her shoulders already. My mission is to teach you how to create and stick to a plan for your money that you believe in and love so that y...

2024-02-2713 min

Budget Effect: How to Budget, How to Pay off Debt, Save Money, Live on a Budget, Improve your Money Mindset on a single incomeEP 3: How to Start a Budget (When You Are Starting from Nowhere)If you want to start a household budget, but you just don't know where to begin, this is the episode for you. The first step you can take when wondering "How to I start a budget?" is to GET CLEAR with your financial situation. In this episode, I'll tell you four steps you can take to get clear and get started. Plus, I'll give you one powerful extra credit assignment. My mission is to teach you how to create and stick to a plan for your money th...

2024-02-2017 min

Budget Effect: How to Budget, How to Pay off Debt, Save Money, Live on a Budget, Improve your Money Mindset on a single incomeEP2: Four Mistakes that Keep You from Moving Forward with Your MoneyI thought I was being responsible with money, until I fixed these four mistakes. After fixing these mistakes, I paid off thousands of dollars in debt, saved for a downpayment on a home, bought a van with cash. Fixing these four mistakes moved me ahead so much faster. Now I want YOU to fix these mistakes too so that you can move forward and reach all your money goals. My mission is to teach you how to create and stick to a plan for your money that yo...

2024-02-1323 min

Budget Effect: How to Budget, How to Pay off Debt, Save Money, Live on a Budget, Improve your Money Mindset on a single incomeEP 1: Four Effects of Budgeting (Two You Didn’t Expect)We know we are supposed to budget our money. But what we didn't realize is that budgeting our money can have mind blowing effects BEYOND just our money. That's the Budget Effect! Your action steps for today are: 1. Listen in.2. Follow Show. 3. Get started! Click to Send Fan Mail

2024-02-0718 min

Budget Effect: How to Budget, How to Pay off Debt, Save Money, Live on a Budget, Improve your Money Mindset on a single incomeWe're Changing Up the Podcast! | It's still about how to move forward as a single momMy mission has been to help busy moms move forward by focusing on self-care, systems and rhythms in your home, and your money. I'm going to tell you where I'm going from here. We talk about minimalism, simplicity, mindset, and how to create a budget. How to stick to a budget. Music from #Uppbeat (free for Creators!): https://uppbeat.io/t/infraction/summer-strutClick to Send Fan Mail

2024-01-3011 min

Budget Effect: How to Budget, How to Pay off Debt, Save Money, Live on a Budget, Improve your Money Mindset on a single incomeEP 26: Getting Back into Your Budget after Bad HabitsHow do you get back into budgeting after it's been a while? In this episode we unpack the list of difficulties with getting back into budgeting. I help busy moms gain positivity and peace in their lives through practical steps. On the podcast we talk about home rhythms, money movement, and mindset work. Connect with us on instagram @soulmothercommunity Music from #Uppbeat (free for Creators!): https://uppbeat.io/t/infraction/summer-strutClick to Send Fan Mail

2024-01-1724 min

Budget Effect: How to Budget, How to Pay off Debt, Save Money, Live on a Budget, Improve your Money Mindset on a single incomeEP 25: Basic Health for Moms: Systems and Rhythms to Support Your Well-being In this episode we talk about why these 4 aspects of basic health are important. But the main ideas you'll come away with are small steps and habits you can build to make your health a priority. I bring positivity and support to moms who have too much on their shoulders. Let's get your life simplified and systemized while taking care of YOU. EP 23 is the TIME BLOCKING episode that I mention. Link to Whole Life Wellness Reflection Tool: https://www.soulmothercommunity.com/wellness Connect with us on instagram @soulmothercommunity Join th...

2024-01-1027 min

Budget Effect: How to Budget, How to Pay off Debt, Save Money, Live on a Budget, Improve your Money Mindset on a single incomeEP 24 How to make your New Year Resolution stickDo you have a New Year Resolution? Do you need one? In this episode we talk about why you should have one and how to actually make it stick! I bring positivity and support to moms who have too much on their shoulders. Let's get your life simplified and systemized while taking care of YOU.Link to Whole Life Wellness Reflection Tool: https://www.soulmothercommunity.com/wellness Click to Send Fan Mail

2024-01-0513 min

Budget Effect: How to Budget, How to Pay off Debt, Save Money, Live on a Budget, Improve your Money Mindset on a single incomeEP 24: How to make your New Year Resolution stick Do you have a New Year Resolution? Do you need one? In this episode we talk about why you should have one and how to actually make it stick! I bring positivity and support to moms who have too much on their shoulders. Let's get your life simplified and systemized while taking care of YOU.Link to Whole Life Wellness Reflection Tool: https://www.soulmothercommunity.com/wellness Connect with us on instagram @soulmothercommunity Music from #Uppbeat (free for Creators!): https://uppbeat.io/t/infraction/summer-strut Click to Send Fan Mai...

2024-01-0213 min

Budget Effect: How to Budget, How to Pay off Debt, Save Money, Live on a Budget, Improve your Money Mindset on a single incomeEP23: Find more time for the things you want! Use this method. Do you ever feel like you just don't have time in the day for what you really want to do? Let's get clear about the time you do have and use it wisely. In this episode, I will tell you how I gained 3 and a HALF HOURS back in my day to focus on what my family and I needed. I talk about floofy mindset shifts and nerdy math that helped get me what I needed. You can do it too! I help single moms gain positivity and peace in their lives through practical steps. On the p...

2023-12-2719 min

Budget Effect: How to Budget, How to Pay off Debt, Save Money, Live on a Budget, Improve your Money Mindset on a single incomeEP 22: The 8-Minute After-Work Transition You Need In this episode we talk about a way to unwind and reset after work and transition into your night with the kids. This 8-minute ritual is GOLD! I help single moms gain positivity and peace in their lives through practical steps. On the podcast we talk about home rhythms, money movement, and mindset work. Link to Whole Life Wellness Reflection Tool: https://www.soulmothercommunity.com/wellness Connect with us on instagram @soulmothercommunity Join the community by going to www.soulmothercommunity.com Music from #Uppbeat (free for Creators!): https://uppbeat.io/t/i...

2023-12-1913 min

Budget Effect: How to Budget, How to Pay off Debt, Save Money, Live on a Budget, Improve your Money Mindset on a single incomeEP21: What I needed (and found) as an overwhelmed single mom I was asked recently how I do it all as a single mom. After I told her that I don't do it all (hahaha), I got to thinking about how I got past that stage of crushing overwhelm and got to this joyful, peaceful place of contentment. I think it's because I needed (and found) these 5 things: 1. I needed love. 2. I needed to find myself. 3. I needed to release...like a lot...of physical and mental stuff.4. I needed systems in my home. 5. I needed a win. I...

2023-12-0721 min

Budget Effect: How to Budget, How to Pay off Debt, Save Money, Live on a Budget, Improve your Money Mindset on a single incomeEP 20: One word that is giving me power through the busy seasonI needed a way to keep myself calm and focused during this busy season I'm in. I needed a way to keep my home from unraveling - because lately there's been a lot of arguing and fighting between my kids and toward me. In this episode, I'll tell you the word I've found to be truly giving me power to stay calm and grounded. I'll tell you how I asked myself the right questions to come up with this word so that you can come up with your own word as well. Thank you for being a p...

2023-11-1709 min

Budget Effect: How to Budget, How to Pay off Debt, Save Money, Live on a Budget, Improve your Money Mindset on a single incomeEP 19: Plan for the holidays now to avoid the stress later In this episode we reduce stress around the holiday season by getting organized, getting a plan in place -while focusing on what's really important to you this holiday season. I help moms who are carrying a lot on their own two shoulders gain positivity and peace in their lives through practical steps. On the podcast we talk about home rhythms, money movement, and mindset work. Link to Holiday Plan: https://www.soulmothercommunity.com/holidayplan Link to Whole Life Wellness Reflection Tool: https://www.soulmothercommunity.com/wellness Connect with us on instagram @soulmot...

2023-11-1020 min

Budget Effect: How to Budget, How to Pay off Debt, Save Money, Live on a Budget, Improve your Money Mindset on a single incomeEP 18: 3 Reasons You Feel Stuck Why do I feel stuck? It can feel extremely frustrating to feel like you're stuck and not able to move forward. In this episode, we break down 3 reasons why you may feel stuck and give you practical steps to move forward today. I help women gain positivity and peace in their lives through practical steps. On the podcast we talk about home rhythms, money movement, and mindset work. Link to Whole Life Wellness Reflection Tool: https://www.soulmothercommunity.com/wellness Connect with us on instagram @soulmothercommunity Join the community by going to ww...

2023-11-0219 min

Budget Effect: How to Budget, How to Pay off Debt, Save Money, Live on a Budget, Improve your Money Mindset on a single incomeEP 17: Is putting yourself first selfish? I hope this episode convinces you to put yourself first and clears any selfish feelings you have about that! We need you to be your most vibrant, energetic, beautiful self and the way you accomplish that is to take care of yourself first. I help single moms gain positivity and peace in their lives through practical steps. On the podcast we talk about home rhythms, money movement, and mindset work. Link to Whole Life Wellness Reflection Tool: https://www.soulmothercommunity.com/wellness Connect with us on instagram @soulmothercommunity Join the community by g...

2023-10-2720 min

Budget Effect: How to Budget, How to Pay off Debt, Save Money, Live on a Budget, Improve your Money Mindset on a single incomeEP 16: 3 Strategies for when your house is a mess but you're tired and overwhelmed In this episode we talk about a way to kick start you into action without motivation, energy, or thinking. Wow. If you are like me, you need this!I help single moms gain positivity and peace in their lives through practical steps. On the podcast we talk about home rhythms, money movement, and mindset work. Link to Whole Life Wellness Reflection Tool: https://www.soulmothercommunity.com/wellness Connect with us on instagram @soulmothercommunity Join the community by going to www.soulmothercommunity.com Music from #Uppbeat (free for Creators!): https://uppb...

2023-10-1714 min

Budget Effect: How to Budget, How to Pay off Debt, Save Money, Live on a Budget, Improve your Money Mindset on a single incomeEP 15: What if becoming a single mom is an amazing thing that happened to you? I help single moms gain positivity and peace in their lives through practical steps. On the podcast we talk about home rhythms, money movement, and mindset work. Link to Whole Life Wellness Reflection Tool: https://www.soulmothercommunity.com/wellness Connect with us on instagram @soulmothercommunity Join the community by going to www.soulmothercommunity.com Music from #Uppbeat (free for Creators!): https://uppbeat.io/t/infraction/summer-strut Click to Send Fan Mail

2023-10-1011 min

Budget Effect: How to Budget, How to Pay off Debt, Save Money, Live on a Budget, Improve your Money Mindset on a single incomeEP 14: Overcoming Overwhelm: A Mindset Shift for Moving ForwardIn this episode we talk about a practical method to recognize overwhelm and then move yourself out of it so that you don't get stuck in that stifling place! Link to Whole Life Wellness Reflection Tool: https://www.thebudgeteffect.com/singlemomreflectionI help single moms gain positivity and peace in their lives through practical steps. On the podcast we talk about home rhythms, money movement, and mindset work. Connect with us on instagram @budgeteffectpodcast Music from #Uppbeat (free for Creators!): https://uppbeat.io/t/infraction/summer-strutClick to Send...

2023-09-2616 min

Budget Effect: How to Budget, How to Pay off Debt, Save Money, Live on a Budget, Improve your Money Mindset on a single incomeEP 13: You need a self-care practice today! Here's your first step. Why self-care? What is true self-care? But how? Self-care is caring for yourself on a deeply personal level. I can help you get started. Erin brings positivity and support with a heart for single moms. She does that through simplicity strategies, money movement, and mindset work. Get your free Whole Life Wellness Reflection: https://www.soulmothercommunity.com/wellnessConnect with us on instagram @soulmothercommunity Join the community by going to www.soulmothercommunity.com Music from #Uppbeat (free for Creators!): https://uppbeat.io/t/infraction/summer-strut Click t...

2023-09-2119 min

Budget Effect: How to Budget, How to Pay off Debt, Save Money, Live on a Budget, Improve your Money Mindset on a single incomeEP 12: Girl Time - The Science and Practical Steps to Making Time for Friends In this episode, we're discussing the significance of nurturing your friendships with your fellow women. Join us as we drop the science behind women's friend connections and why they're vital for your overall well-being. Stay tuned as Erin lets you in on her favorite 'Girl Time' activity. (It's super exciting)Erin supports Single Moms. She does that through simplicity strategies, money movement, and mindset work. Connect with us on instagram @soulmothercommunity Music from #Uppbeat (free for Creators!): https://uppbeat.io/t/infraction/summer-strut Click to Send Fan Mail

2023-09-1418 min

Budget Effect: How to Budget, How to Pay off Debt, Save Money, Live on a Budget, Improve your Money Mindset on a single incomeEP 11: Traveling with Kids as a Single Parent (Chicago edition) This episode is the story of the kids and I went to Chicago. My tips for traveling with kids as a single parent: Set intentions for vacation.Loosely plan a trip.Stay in your budget.Keep it simple. I also talk about what we did in Chicago (12:15-21:45)Enjoy. Erin supports Single Moms. She does that through simplicity strategies, money movement, and mindset work. Connect with us on instagram @soulmothercommunity Join the community by going to www.soulmothercommunity.com Music from #Uppbeat (free for Creators!): https://uppbeat.io/t/infrac...

2023-09-0725 min

Budget Effect: How to Budget, How to Pay off Debt, Save Money, Live on a Budget, Improve your Money Mindset on a single incomeEP 10: How Minimalism Eased Overwhelm in My Single Mom Journey Is your home supporting you in your life? Or is your home bringin’ you down?! It’s time to learn or relearn about minimalism and simplicity. It’s time to clear your path so you can move forward.Erin supports Single Moms. She does that through simplicity strategies, money movement, and mindset work. Connect with us on instagram @soulmothercommunity Join the community by going to www.soulmothercommunity.com Music from #Uppbeat (free for Creators!): https://uppbeat.io/t/infraction/summer-strut Click to Send Fan Mail

2023-08-2923 min

Budget Effect: How to Budget, How to Pay off Debt, Save Money, Live on a Budget, Improve your Money Mindset on a single incomeEp. 9: The Home Buying Journey: Thoughts and Considerations In this episode, Erin delves into her experiences and considerations during her home-buying journey. She shares insights on her search criteria and the key question that guided her: "Can I take care of it?" Erin helps Single Moms. She does that through simplicity strategies, money movement, and mindset work. Connect with us on instagram @soulmothercommunity Join the community by going to www.soulmothercommunity.com Music from #Uppbeat (free for Creators!): https://uppbeat.io/t/infraction/summer-strut Click to Send Fan Mail

2023-08-2315 min

Budget Effect: How to Budget, How to Pay off Debt, Save Money, Live on a Budget, Improve your Money Mindset on a single incomeEp. 8: The true power of budgeting: My debt-free journey This episode will motivate you to start or keep going on your own money journey. It's more than just money; truly living intentionally with every dollar can start the momentum in so many other areas of your life!Sorry I got a little excited and I say a few "naughty words" during this episode. sh** and a**. My bad. Get resources to help you with your money journey: www.soulmothercommunity.com/money Erin supports Single Moms. She does that through simplicity strategies, money movement, and mindset work.Connect with us on in...

2023-08-1516 min

Budget Effect: How to Budget, How to Pay off Debt, Save Money, Live on a Budget, Improve your Money Mindset on a single incomeEP 7: Back to School part 2 - Mindset for Smooth Transition How can we make the transition back to school smooth? In this episode we discuss the step-by-step process for making the transition.Erin helps Single Moms. She does that through simplicity strategies, money movement, and mindset work.Connect with us on instagram @soulmothercommunityJoin the community by going to www.soulmothercommunity.com Music from #Uppbeat (free for Creators!): https://uppbeat.io/t/infraction/summer-strut Click to Send Fan Mail

2023-08-0813 min

Budget Effect: How to Budget, How to Pay off Debt, Save Money, Live on a Budget, Improve your Money Mindset on a single incomeEP 6: Back to School part 1- Shopping with Intention In this episode we chat about shopping with intention for school supplies and clothes. Erin also mentions other expenses to plan for coming up soon. Erin helps Single Moms. She does that through simplicity strategies, money movement, and mindset work. Connect with us on instagram @soulmothercommunityTry the FREE Money Movement Jumpstart. www.soulmothercommunity.com/jumpstart Join the community by going to www.soulmothercommunity.com Music from #Uppbeat (free for Creators!): https://uppbeat.io/t/infraction/summer-strut Click to Send Fan Mail

2023-08-0113 min

Budget Effect: How to Budget, How to Pay off Debt, Save Money, Live on a Budget, Improve your Money Mindset on a single incomeEP. 5 It's okay if your budget sucks right nowIn this episode Erin covers:3 reasons people don’t start budgetingMany reasons people SHOULD start budgetingHow to get startedErin helps Single Moms. She does that through simplicity strategies, money movement, and mindset work.Need help getting started with your budget? Join the BUDGET JUMPSTART CHALLENGE for free. Connect with us on Instagram @budgeteffectpodcastJoin the community by going to www.thebudgeteffect.comMusic from #Uppbeat (free for Creators!): https://uppbeat.io/t/infraction/summer-strutQuestions or Comments? Send a text!Click to Send Fan...

2023-07-2718 min

Budget Effect: How to Budget, How to Pay off Debt, Save Money, Live on a Budget, Improve your Money Mindset on a single incomeEP 4: How to Travel with Kids as a Single Mom (St. Louis edition) Erin helps Single Moms. She does that through simplicity strategies, money movement, and mindset work.In this episode Erin discusses:Tips for long car trips with kidsBudget friendly travel tipsSetting your intention before a tripWhat she did with kids in St. Louis (19:42-31:38)andYes! You can travel with kids as a single parent!Connect with us on instagram @SoulMotherCommunityJoin the community by going to www.soulmothercommunity.com Music from #Uppbeat (free for Creators!): https://uppbeat.io/t/infraction/summer-strut Click to Send Fan Mail

2023-07-1836 min

Budget Effect: How to Budget, How to Pay off Debt, Save Money, Live on a Budget, Improve your Money Mindset on a single incomeEP 3: What can happen when you carve out time for yourself Erin helps Single Moms. She does that through simplicity strategies, money movement, and mindset work.In this episode Erin focuses on her story with mindset work and what taking time for herself has brought into her life. The goal is for you to see how important and beneficial it can be to take time for yourself, Friend.Connect with us on instagram @soulmothercommunityJoin the community by going to www.soulmothercommunity.com Music from #Uppbeat (free for Creators!): https://uppbeat.io/t/infraction/summer-strut Click to Send Fan Mail

2023-07-1117 min![brAVe [space]](https://d3wo5wojvuv7l.cloudfront.net/t_rss_itunes_square_1400/images.spreaker.com/original/bdd46f97c7b11ab9f1a9b9223cf5ef9f.jpg)

brAVe [space]7: Erin Maher-Moran Joins the brAVe spaceRecorded on March 26th, 2023TW: Sexual Harassment; Anxiety and DepressionIn this “social experiment think tank” episode, Erin and Britt talk about going from student employment to full time employment, the subtle art of being stubborn, the strength that comes from embracing your true self and your friendships, using exclamation points, and more! Erin shares her experience with sexual harassment, which may be triggering to some listeners. Britt briefly mentions her experience with depression, which could also be triggering to some listeners. If you’re able, please listen to the end so you know our action items...

2023-06-2953 min

Budget Effect: How to Budget, How to Pay off Debt, Save Money, Live on a Budget, Improve your Money Mindset on a single incomeEP 2: 5 Questions to Ask Yourself for Self Reflection Do you want to figure out your priorities and goals but don’t know where to start? These five questions will give you insight about yourself so you’ll know what’s important to you and for you.Join the community!

2023-04-1213 min

Budget Effect: How to Budget, How to Pay off Debt, Save Money, Live on a Budget, Improve your Money Mindset on a single incomeEP 1: What can I focus on to move forward as a single mom? If you're feeling stuck, this episode gives you five areas of life to focus on to get you moving forward.The 5 areas Erin discusses in this episode are:1. YOU! Figure out what you want for you and your family.2. Household Function. Set up systems of ease and function in your everyday tasks.3. Budget. Get your money working for you.4. Simplify (Minimalism). Let go of the clutter that does not serve you.5. Surround yourself with positivity.Clutter Study mentioned in this episode:https://pubmed...

2023-04-0318 min

Unspoken BraveryJoining the Canadian Ski Team, First Season Reflections, & Goal Setting with Britt RichardsonWho should you keep your eye on for the next generation of great skiers?Today, I’m talking to Canadian ski team member, Britt Richardson. After graduating from Burke Mountain Academy in Vermont, Britt Richardson entered her first full season with Team Canada in 2021/22. Despite hiccups throughout her training and competition that past couple of years due to COVID-19, Britt has overcome any challenges thrown her way and had a successful first World Cup appearance. Britt is talented, kind, hard-working, mature, and an all-around amazing person and athlete.As athletes, we can always lea...

2022-10-1158 min

b Cause Work Doesn't Have to Suck130: Redefining "Executive Presence" with Britt BlochHave you been told you need more "Executive Presence" and are left wondering, "What does 'Executive Presence" even mean?!" Or do you ever wonder what do recruiters and hiring managers look for in the talent they seek out? This week Erin talks with Britt Bloch, Vice President of Talent Acquisition Strategy and Recruiting at Navy Federal in April 2021. This interview will give you all the 3D information and inspiration you need to answer those questions, and more. Britt not only has a unique, inside-view into the world that is a...

2021-11-1649 min

b Cause Work Doesn't Have to Suck130: Redefining "Executive Presence" with Britt BlochHave you been told you need more "Executive Presence" and are left wondering, "What does 'Executive Presence" even mean?!" Or do you ever wonder what do recruiters and hiring managers look for in the talent they seek out? This week Erin talks with Britt Bloch, Vice President of Talent Acquisition Strategy and Recruiting at Navy Federal in April 2021. This interview will give you all the 3D information and inspiration you need to answer those questions, and more. Britt not only has a unique, inside-view into the world that is a...

2021-11-1649 min

GET YOUR COFFEE, GET YOUR DAYERIN RYAN: ON KNOWING THAT CHANGE IS THE ONLY CONSTANTIn this episode, I speak with Erin Ryan. Erin is a friend of mine and Executive Director of the National Alliance on Mental Health (NAMI) Westside in Los Angeles, she is a trailblazer and a true inspiration to me and so many others. I work with Erin at NAMI Westside and also as an ambassador for her “Free for Me” project which addresses the silence and stigma around Mental Health. Erin believes that NAMI Westside is for everyone. Education and advocacy are some of the important focuses she uses when supporting the Mental Health agenda. We talk about...

2021-11-0346 min