Shows

FinCrime Jobs : AML, KYC & Compliance InsightsInside Singapore’s $3 Billion Money Laundering Scandal: Lessons for Compliance, AML, and Global Financial Crime PreventionStep into the heart of Asia's largest financial crime in this gripping episode of FinCrime Jobs: AML, KYC & Compliance Insights. We dissect Singapore’s unprecedented S$3 billion money laundering case—a watershed event that tested the mettle of one of the world’s most robust financial hubs, exposed critical vulnerabilities in even the strictest anti-money laundering regimes, and sent shockwaves through financial institutions across the globe.🔎 What You’ll Hear:Unraveling a Massive Scheme: Discover how a sophisticated network of 10 foreign nationals, primarily from China’s Fujian province, funneled illicit proceeds from cross-border gambling, fraud, and unlicensed...2025-07-3142 min

FinCrime Jobs : AML, KYC & Compliance InsightsInside Singapore’s $3 Billion Money Laundering Scandal: Lessons for Compliance, AML, and Global Financial Crime PreventionStep into the heart of Asia's largest financial crime in this gripping episode of FinCrime Jobs: AML, KYC & Compliance Insights. We dissect Singapore’s unprecedented S$3 billion money laundering case—a watershed event that tested the mettle of one of the world’s most robust financial hubs, exposed critical vulnerabilities in even the strictest anti-money laundering regimes, and sent shockwaves through financial institutions across the globe.🔎 What You’ll Hear:Unraveling a Massive Scheme: Discover how a sophisticated network of 10 foreign nationals, primarily from China’s Fujian province, funneled illicit proceeds from cross-border gambling, fraud, and unlicensed...2025-07-3142 min FinCrime Jobs : AML, KYC & Compliance InsightsUnmasking Drug Trafficking Money Laundering – Global FIU Case Studies & Prevention StrategiesIn this hard‑hitting episode of FinCrime Jobs: AML, KYC & Compliance Insights, we dive deep into the intricate nexus between drug trafficking and money laundering, guided by insights from our comprehensive blog post: “Unmasking Drug Trafficking & Money Laundering: Global FIU Case Studies & Prevention Strategies.” Discover how Financial Intelligence Units (FIUs) worldwide are unearthing illicit financial networks and deploying cutting-edge prevention strategies to protect global economies and public health.📈 What You’ll Discover:Global FIU Case Studies (4):Bolivia – Fuel Contract Fraud: Learn how traffickers embedded illicit funds through state motor‑fuel contracts and front companies, leve...2025-06-1652 min

FinCrime Jobs : AML, KYC & Compliance InsightsUnmasking Drug Trafficking Money Laundering – Global FIU Case Studies & Prevention StrategiesIn this hard‑hitting episode of FinCrime Jobs: AML, KYC & Compliance Insights, we dive deep into the intricate nexus between drug trafficking and money laundering, guided by insights from our comprehensive blog post: “Unmasking Drug Trafficking & Money Laundering: Global FIU Case Studies & Prevention Strategies.” Discover how Financial Intelligence Units (FIUs) worldwide are unearthing illicit financial networks and deploying cutting-edge prevention strategies to protect global economies and public health.📈 What You’ll Discover:Global FIU Case Studies (4):Bolivia – Fuel Contract Fraud: Learn how traffickers embedded illicit funds through state motor‑fuel contracts and front companies, leve...2025-06-1652 min FinCrime Jobs : AML, KYC & Compliance InsightsFrom Panama Papers to Swiss Banks – Unveiling Tax Evasion Detection & Reform StrategiesIn this episode of FinCrime Jobs: AML, KYC & Compliance Insights, we delve into the world of tax evasion, tracing its evolution from the infamous Panama Papers leak to the clandestine operations within Swiss banks. Drawing insights from our comprehensive blog post, “From Panama Papers to Swiss Banks: A Deep Dive into Tax Evasion Detection and Reform,” we explore the methods, motivations, and global efforts to combat this pervasive issue.📈 What You’ll Learn:Historical Context of Tax Evasion: Understand how tax evasion has evolved over time, from ancient practices to modern-day schemes.Common Methods o...2025-06-1542 min

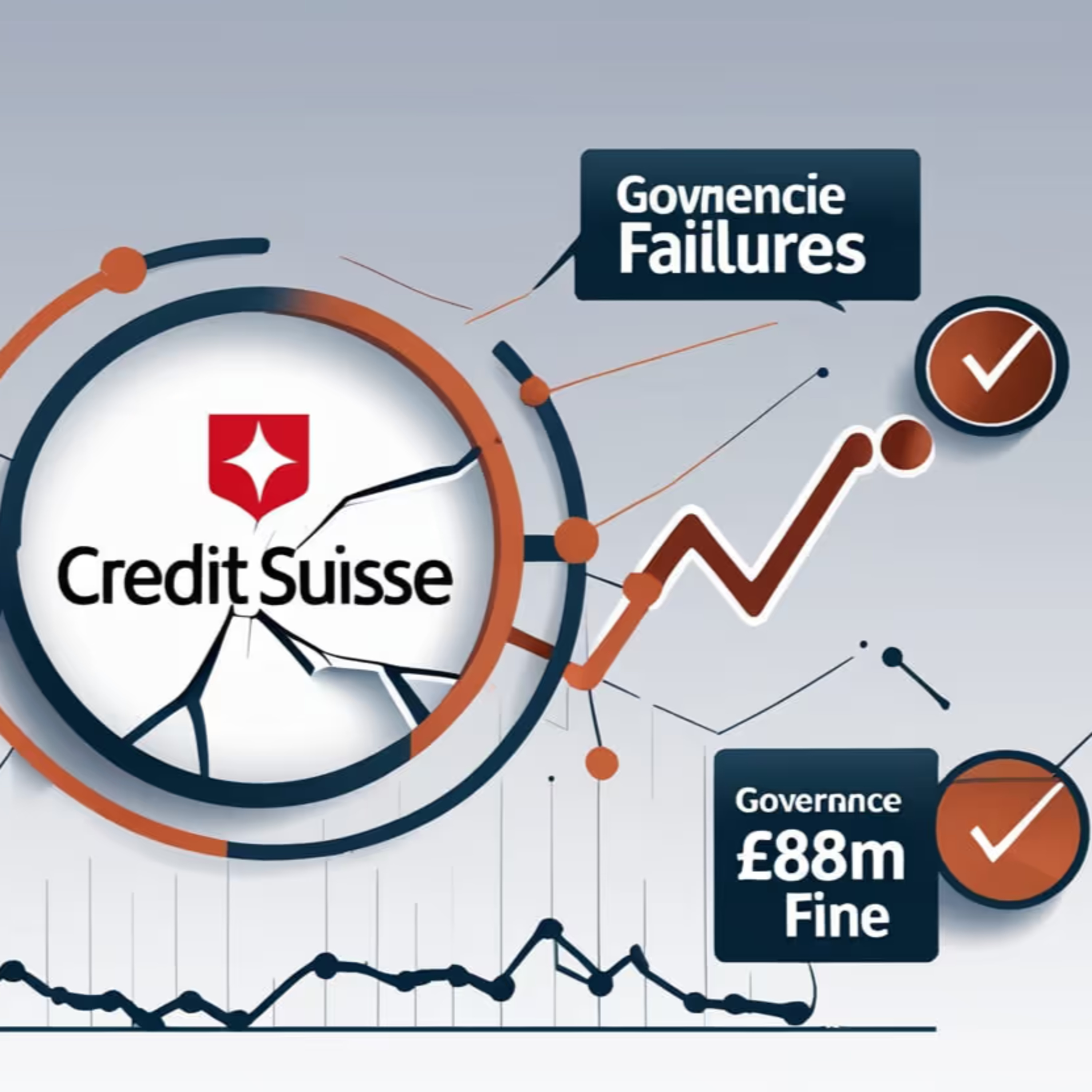

FinCrime Jobs : AML, KYC & Compliance InsightsFrom Panama Papers to Swiss Banks – Unveiling Tax Evasion Detection & Reform StrategiesIn this episode of FinCrime Jobs: AML, KYC & Compliance Insights, we delve into the world of tax evasion, tracing its evolution from the infamous Panama Papers leak to the clandestine operations within Swiss banks. Drawing insights from our comprehensive blog post, “From Panama Papers to Swiss Banks: A Deep Dive into Tax Evasion Detection and Reform,” we explore the methods, motivations, and global efforts to combat this pervasive issue.📈 What You’ll Learn:Historical Context of Tax Evasion: Understand how tax evasion has evolved over time, from ancient practices to modern-day schemes.Common Methods o...2025-06-1542 min FinCrime Jobs : AML, KYC & Compliance InsightsCredit Suisse’s £87 Million Fine: Anatomy of Risk Management & Compliance FailuresIn this episode of FinCrime Jobs: AML, KYC & Compliance Insights, we dissect one of the most dramatic enforcement actions in recent UK banking history: the £87 million fine levied by the Prudential Regulation Authority (PRA) against Credit Suisse in July 2023. Drawing on our in‑depth analysis of the “Credit Suisse’s £87M Financial Crime Scandal: Risk Management Failures & Regulatory Lessons” blog post, we walk you through how a series of missteps—from opaque reporting lines to unchecked leverage—led to multi‑billion‑dollar losses, severe reputational damage, and urgent lessons for compliance professionals worldwide.📈 What You’ll Discover:The Archegos Conne...2025-06-1434 min

FinCrime Jobs : AML, KYC & Compliance InsightsCredit Suisse’s £87 Million Fine: Anatomy of Risk Management & Compliance FailuresIn this episode of FinCrime Jobs: AML, KYC & Compliance Insights, we dissect one of the most dramatic enforcement actions in recent UK banking history: the £87 million fine levied by the Prudential Regulation Authority (PRA) against Credit Suisse in July 2023. Drawing on our in‑depth analysis of the “Credit Suisse’s £87M Financial Crime Scandal: Risk Management Failures & Regulatory Lessons” blog post, we walk you through how a series of missteps—from opaque reporting lines to unchecked leverage—led to multi‑billion‑dollar losses, severe reputational damage, and urgent lessons for compliance professionals worldwide.📈 What You’ll Discover:The Archegos Conne...2025-06-1434 min FinCrime Jobs : AML, KYC & Compliance InsightsMirror Trading Money Laundering Exposed: Detection & Prevention Strategies by 2025In this episode of FinCrime Jobs : AML, KYC & Compliance Insights, we uncover the sophisticated world of mirror trading—a deceptive financial mechanism co-opted by criminals to launder billions of illicit funds. Based on our in‑depth blog “Mirror Trading in Money Laundering: Detection & Prevention by 2025,” we break down how this tactic exploits legitimate trading practices to obscure illegal money and evade regulatory scrutiny.📈 What You'll Discover:Mirror Trading Explained: Originally a legitimate investment strategy where an account mirroring another trades concurrently, criminals misuse this simultaneous buy-sell technique across jurisdictions, creating complex money trails. They leverage multiple ac...2025-06-1342 min

FinCrime Jobs : AML, KYC & Compliance InsightsMirror Trading Money Laundering Exposed: Detection & Prevention Strategies by 2025In this episode of FinCrime Jobs : AML, KYC & Compliance Insights, we uncover the sophisticated world of mirror trading—a deceptive financial mechanism co-opted by criminals to launder billions of illicit funds. Based on our in‑depth blog “Mirror Trading in Money Laundering: Detection & Prevention by 2025,” we break down how this tactic exploits legitimate trading practices to obscure illegal money and evade regulatory scrutiny.📈 What You'll Discover:Mirror Trading Explained: Originally a legitimate investment strategy where an account mirroring another trades concurrently, criminals misuse this simultaneous buy-sell technique across jurisdictions, creating complex money trails. They leverage multiple ac...2025-06-1342 min FinCrime Jobs : AML, KYC & Compliance InsightsAML Compliance Jobs Explained: Roles, Skills & Career Paths for 2025In this episode of FinCrime Jobs, we explore the fast‑growing world of AML compliance jobs, unpacking the day‑to‑day responsibilities, essential skills, and career trajectories that define this critical function in financial services. Drawing on our in‑depth blog post “What Are AML Compliance Jobs? Understanding Roles and Responsibilities,” we guide you through:Core AML Roles & ResponsibilitiesAML Analyst & Investigator: Investigate suspicious transactions, structure alerts, and file Suspicious Activity Reports (SARs) with Financial Intelligence Units (FIUs).KYC/CDD Specialist: Execute robust Customer Due Diligence and Enhanced Due Diligence (EDD) programs to verify ident...2025-06-1247 min

FinCrime Jobs : AML, KYC & Compliance InsightsAML Compliance Jobs Explained: Roles, Skills & Career Paths for 2025In this episode of FinCrime Jobs, we explore the fast‑growing world of AML compliance jobs, unpacking the day‑to‑day responsibilities, essential skills, and career trajectories that define this critical function in financial services. Drawing on our in‑depth blog post “What Are AML Compliance Jobs? Understanding Roles and Responsibilities,” we guide you through:Core AML Roles & ResponsibilitiesAML Analyst & Investigator: Investigate suspicious transactions, structure alerts, and file Suspicious Activity Reports (SARs) with Financial Intelligence Units (FIUs).KYC/CDD Specialist: Execute robust Customer Due Diligence and Enhanced Due Diligence (EDD) programs to verify ident...2025-06-1247 min FinCrime Jobs : AML, KYC & Compliance InsightsInside Kerala’s ₹500 Crore CSR Scam: Ponzi Scheme, Fake NGO Promises & 40,000 Victims Duped by “Half-Price” Laptops and ScootersIn this gripping new episode of FinCrime Jobs AML, KYC & Compliance Insights, we unravel one of the most shocking financial crime stories of recent times—the ₹500 crore CSR scam in Kerala that duped over 40,000 unsuspecting citizens with fake promises of laptops, scooters, and jobs at “half price.”Based on our in-depth article “Kerala ₹500 Crore CSR Scam: Ponzi Scheme Duped 40,000 With ‘Half-Price’ Scooters & Laptops,” this podcast episode breaks down the anatomy of an elaborate Ponzi scheme disguised as a Corporate Social Responsibility (CSR) initiative. Learn how a seemingly generous scheme snowballed into a major financial fraud, luring victims with the promise o...2025-06-1135 min

FinCrime Jobs : AML, KYC & Compliance InsightsInside Kerala’s ₹500 Crore CSR Scam: Ponzi Scheme, Fake NGO Promises & 40,000 Victims Duped by “Half-Price” Laptops and ScootersIn this gripping new episode of FinCrime Jobs AML, KYC & Compliance Insights, we unravel one of the most shocking financial crime stories of recent times—the ₹500 crore CSR scam in Kerala that duped over 40,000 unsuspecting citizens with fake promises of laptops, scooters, and jobs at “half price.”Based on our in-depth article “Kerala ₹500 Crore CSR Scam: Ponzi Scheme Duped 40,000 With ‘Half-Price’ Scooters & Laptops,” this podcast episode breaks down the anatomy of an elaborate Ponzi scheme disguised as a Corporate Social Responsibility (CSR) initiative. Learn how a seemingly generous scheme snowballed into a major financial fraud, luring victims with the promise o...2025-06-1135 min FinCrime Jobs : AML, KYC & Compliance InsightsFinCrime Jobs: Unlocking Financial Crime Careers – Insider Guide to the Indian AML & Fraud Job MarketIn this episode of FinCrime Jobs: AML, KYC & Compliance Insights, we spotlight the explosive growth of financial crime careers in India. Based on our blog “Financial Crime Jobs & Careers | Join FinCrimeJobs.in” we explore how AML, fraud, KYC, forensic accounting, and sanctions roles are driving a hiring boom. Learn how to leverage our platform to access thousands of exclusive listings, career resources, and professional networks—essential listening for anyone aiming to build a future in compliance and financial crime prevention.📈 What You’ll Discover:Market Snapshot: Over 217,560 financial crime openings in India in April 2025, fueled by tighter re...2025-06-1011 min

FinCrime Jobs : AML, KYC & Compliance InsightsFinCrime Jobs: Unlocking Financial Crime Careers – Insider Guide to the Indian AML & Fraud Job MarketIn this episode of FinCrime Jobs: AML, KYC & Compliance Insights, we spotlight the explosive growth of financial crime careers in India. Based on our blog “Financial Crime Jobs & Careers | Join FinCrimeJobs.in” we explore how AML, fraud, KYC, forensic accounting, and sanctions roles are driving a hiring boom. Learn how to leverage our platform to access thousands of exclusive listings, career resources, and professional networks—essential listening for anyone aiming to build a future in compliance and financial crime prevention.📈 What You’ll Discover:Market Snapshot: Over 217,560 financial crime openings in India in April 2025, fueled by tighter re...2025-06-1011 min FinCrime Jobs : AML, KYC & Compliance InsightsFinCrime Jobs: Your Gateway to Specialized Careers in Financial Crime PreventionIn this empowering episode of FinCrime Jobs: AML, KYC & Compliance Insights, we spotlight the career-connecting mission of FinCrimeJobs.in—India’s premier platform for financial crime professionals. Inspired by our blog post, “FinCrimeJobs.in: Your Gateway to Specialized Careers and Talent in Financial Crime Prevention” (April 23, 2025), this episode reveals how the platform bridges employers and candidates, enabling rapid role fulfillment and nurturing a community of AML, KYC, forensic accounting, and fraud-investigation experts.📌 Key Highlights You'll Explore:1. Why FinCrimeJobs.in exists: In an age of evolving financial crime—covering fraud, money laundering, and cybercrime—the platform meets skyrocketing dema...2025-06-1014 min

FinCrime Jobs : AML, KYC & Compliance InsightsFinCrime Jobs: Your Gateway to Specialized Careers in Financial Crime PreventionIn this empowering episode of FinCrime Jobs: AML, KYC & Compliance Insights, we spotlight the career-connecting mission of FinCrimeJobs.in—India’s premier platform for financial crime professionals. Inspired by our blog post, “FinCrimeJobs.in: Your Gateway to Specialized Careers and Talent in Financial Crime Prevention” (April 23, 2025), this episode reveals how the platform bridges employers and candidates, enabling rapid role fulfillment and nurturing a community of AML, KYC, forensic accounting, and fraud-investigation experts.📌 Key Highlights You'll Explore:1. Why FinCrimeJobs.in exists: In an age of evolving financial crime—covering fraud, money laundering, and cybercrime—the platform meets skyrocketing dema...2025-06-1014 min FinCrime Jobs : AML, KYC & Compliance InsightsTop 4 FIU Case Studies: How Financial Crime Units Combat Cybercrime & Crypto FraudIn this episode of FinCrime Jobs, we dive into four landmark FIU case studies that showcase how Financial Intelligence Units around the world are stepping up to tackle increasingly sophisticated cybercrime and cryptocurrency fraud. As digital assets surge in popularity, fraudsters exploit anonymity, decentralized exchanges, and darknet markets—forcing FIUs to innovate new detection and enforcement protocols. Join us as we unpack these real-world investigations, extract best practices, and explore what compliance professionals can learn to safeguard their organizations.1. The Crypto Mixer Takedown (EU FIU)Our first case study examines a major joint operation led by...2025-06-0941 min

FinCrime Jobs : AML, KYC & Compliance InsightsTop 4 FIU Case Studies: How Financial Crime Units Combat Cybercrime & Crypto FraudIn this episode of FinCrime Jobs, we dive into four landmark FIU case studies that showcase how Financial Intelligence Units around the world are stepping up to tackle increasingly sophisticated cybercrime and cryptocurrency fraud. As digital assets surge in popularity, fraudsters exploit anonymity, decentralized exchanges, and darknet markets—forcing FIUs to innovate new detection and enforcement protocols. Join us as we unpack these real-world investigations, extract best practices, and explore what compliance professionals can learn to safeguard their organizations.1. The Crypto Mixer Takedown (EU FIU)Our first case study examines a major joint operation led by...2025-06-0941 min FinCrime Jobs : AML, KYC & Compliance InsightsTop 5 FIU Case Studies: Exposing Global Terrorist Financing & Financial Crime NetworksIn this episode, we delve into the world of Financial Intelligence Units (FIUs) and explore five impactful case studies that reveal how FIUs around the globe uncover terrorist financing and intricate financial crime networks. We begin by defining what an FIU is—a national agency tasked with collecting, analyzing, and disseminating suspicious transaction reports (STRs) to combat money laundering, terrorist financing, and other illicit activities. We then walk through each of the five case studies, highlighting methodologies, collaboration techniques, red flags identified, and lessons learned.1. Case Study 1: Unraveling a Hezbollah-Linked Money Laundering Network2. Case Study 2: Southeast Asian Ca...2025-06-0826 min

FinCrime Jobs : AML, KYC & Compliance InsightsTop 5 FIU Case Studies: Exposing Global Terrorist Financing & Financial Crime NetworksIn this episode, we delve into the world of Financial Intelligence Units (FIUs) and explore five impactful case studies that reveal how FIUs around the globe uncover terrorist financing and intricate financial crime networks. We begin by defining what an FIU is—a national agency tasked with collecting, analyzing, and disseminating suspicious transaction reports (STRs) to combat money laundering, terrorist financing, and other illicit activities. We then walk through each of the five case studies, highlighting methodologies, collaboration techniques, red flags identified, and lessons learned.1. Case Study 1: Unraveling a Hezbollah-Linked Money Laundering Network2. Case Study 2: Southeast Asian Ca...2025-06-0826 min FinCrime Jobs : AML, KYC & Compliance InsightsCorporate Red Flags: Spot and Mitigate Risks in Corporate StructuresIn this episode, we explore the critical realm of corporate red flags—early warning signs that can indicate vulnerabilities within an organization’s structure and operations. We start by defining red flags, showing how they can range from subtle financial discrepancies to obvious behavioral and structural issues. Next, we discuss identifying red flags in a corporate structure, highlighting the value of analyzing financial statements, operational workflows, and personnel dynamics to uncover hidden threats.Our discussion then covers types of red flags:Financial Performance Red Flags: Sudden revenue declines, inconsistent cash flows, and excessive debt can sign...2025-06-0713 min

FinCrime Jobs : AML, KYC & Compliance InsightsCorporate Red Flags: Spot and Mitigate Risks in Corporate StructuresIn this episode, we explore the critical realm of corporate red flags—early warning signs that can indicate vulnerabilities within an organization’s structure and operations. We start by defining red flags, showing how they can range from subtle financial discrepancies to obvious behavioral and structural issues. Next, we discuss identifying red flags in a corporate structure, highlighting the value of analyzing financial statements, operational workflows, and personnel dynamics to uncover hidden threats.Our discussion then covers types of red flags:Financial Performance Red Flags: Sudden revenue declines, inconsistent cash flows, and excessive debt can sign...2025-06-0713 min FinCrime Jobs : AML, KYC & Compliance InsightsTop 11 Financial Crime Certifications for 2025: Elevate Your AML & Compliance CareerIn this episode, we dive into the “Top 10 Must-Have Financial Crime Certifications” that today’s compliance and risk professionals need to master to stay ahead in 2025. We begin with a broad overview of why certifications matter in the financial crime space—how they boost credibility, deepen expertise in anti-money laundering (AML) and forensic accounting, and unlock new career opportunities in both private and public sectors. As regulations tighten globally, earning the right credentials is essential to demonstrate your commitment to compliance, ethical standards, and industry best practices.We then break down each certification, covering the core curriculum, eligibil...2025-06-0615 min

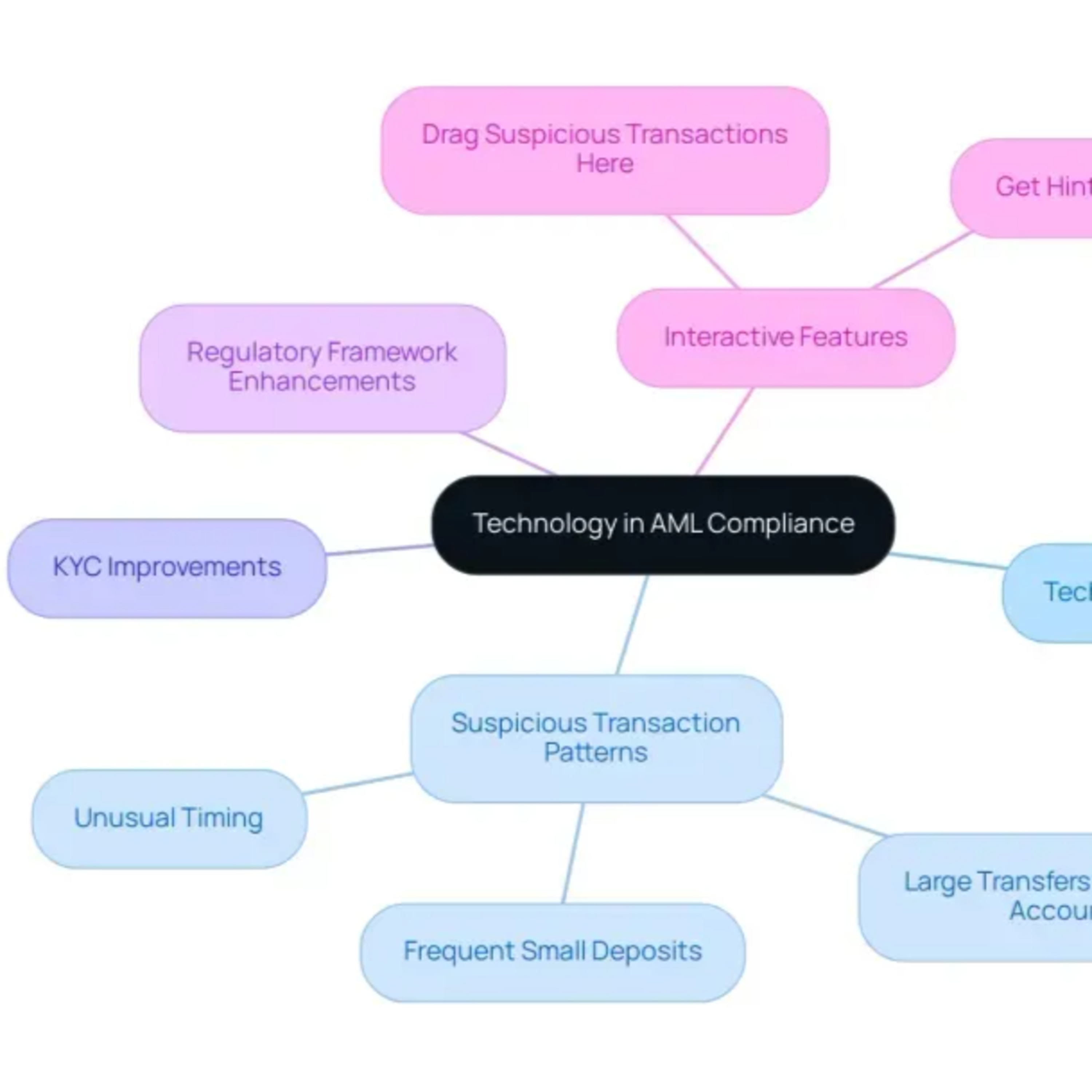

FinCrime Jobs : AML, KYC & Compliance InsightsTop 11 Financial Crime Certifications for 2025: Elevate Your AML & Compliance CareerIn this episode, we dive into the “Top 10 Must-Have Financial Crime Certifications” that today’s compliance and risk professionals need to master to stay ahead in 2025. We begin with a broad overview of why certifications matter in the financial crime space—how they boost credibility, deepen expertise in anti-money laundering (AML) and forensic accounting, and unlock new career opportunities in both private and public sectors. As regulations tighten globally, earning the right credentials is essential to demonstrate your commitment to compliance, ethical standards, and industry best practices.We then break down each certification, covering the core curriculum, eligibil...2025-06-0615 min FinCrime Jobs : AML, KYC & Compliance InsightsMoney Laundering Prevention: Essential Roles of AML & KYC in Financial ComplianceIn this episode of FinCrime Jobs, we delve into the critical roles that Anti–Money Laundering (AML) and Know Your Customer (KYC) practices play in detecting, preventing, and disrupting money laundering schemes. Drawing upon the insights from our in-depth blog “Money Laundering: The Essential Roles of AML and KYC in Financial Compliance,” we cover the foundational concepts, regulatory frameworks, real-world applications, and best practices that every compliance professional needs to master.We begin by defining AML as the set of laws, regulations, and controls designed to identify and report suspicious transactions—those that may mask the proceeds of illeg...2025-06-0517 min

FinCrime Jobs : AML, KYC & Compliance InsightsMoney Laundering Prevention: Essential Roles of AML & KYC in Financial ComplianceIn this episode of FinCrime Jobs, we delve into the critical roles that Anti–Money Laundering (AML) and Know Your Customer (KYC) practices play in detecting, preventing, and disrupting money laundering schemes. Drawing upon the insights from our in-depth blog “Money Laundering: The Essential Roles of AML and KYC in Financial Compliance,” we cover the foundational concepts, regulatory frameworks, real-world applications, and best practices that every compliance professional needs to master.We begin by defining AML as the set of laws, regulations, and controls designed to identify and report suspicious transactions—those that may mask the proceeds of illeg...2025-06-0517 min FinCrime Jobs : AML, KYC & Compliance InsightsMoney Laundering Explained: Schemes, Operations & Detection TacticsIn this episode of the FinCrimeJobs Podcast, we dive into one of the most pressing financial crime threats in the world—money laundering. Based on the insightful blog "The Basics of Money Laundering: Understanding Schemes, Operations, and Detection Points", this episode unpacks the layers of how illicit funds are “cleaned” and disguised through increasingly sophisticated laundering mechanisms.We begin with an overview of what money laundering really is—not just a crime in itself but also a critical enabler of terrorism financing, corruption, drug trafficking, and organized crime. You'll learn the classic three-stage process: Placement, Layering, and Integrat...2025-06-0412 min

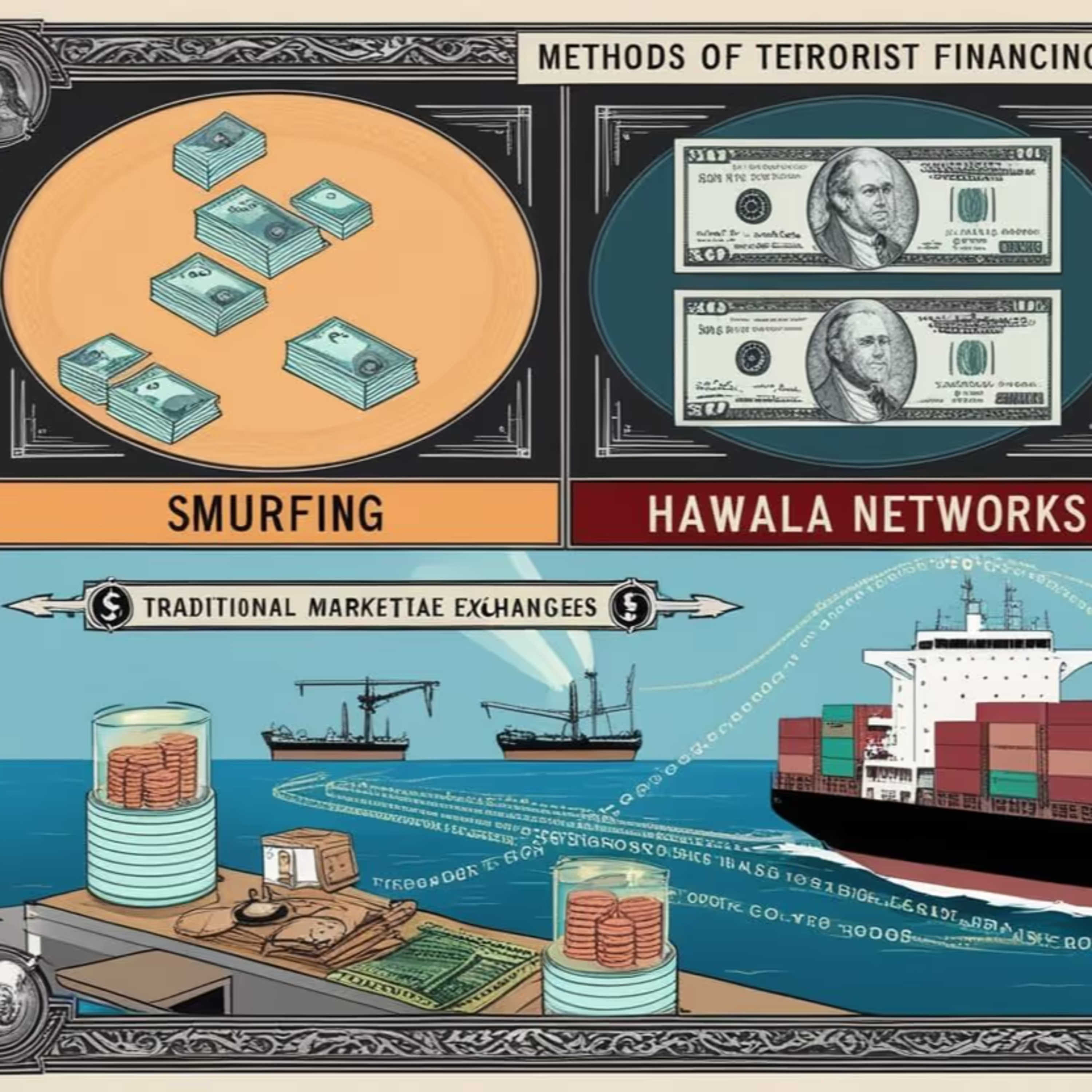

FinCrime Jobs : AML, KYC & Compliance InsightsMoney Laundering Explained: Schemes, Operations & Detection TacticsIn this episode of the FinCrimeJobs Podcast, we dive into one of the most pressing financial crime threats in the world—money laundering. Based on the insightful blog "The Basics of Money Laundering: Understanding Schemes, Operations, and Detection Points", this episode unpacks the layers of how illicit funds are “cleaned” and disguised through increasingly sophisticated laundering mechanisms.We begin with an overview of what money laundering really is—not just a crime in itself but also a critical enabler of terrorism financing, corruption, drug trafficking, and organized crime. You'll learn the classic three-stage process: Placement, Layering, and Integrat...2025-06-0412 min FinCrime Jobs : AML, KYC & Compliance InsightsTerrorist Financing: The Complex Web of Illicit Funding & Compliance StrategiesIn this comprehensive episode of FinCrime Jobs, we delve into the multifaceted world of terrorist financing, unpacking how illicit funding networks operate and the critical role that compliance professionals play in identifying and disrupting those networks. Drawing upon real-world case studies—from Hamas and ISIS to the Taliban and Hezbollah—this episode examines the interconnected nature of money laundering and terrorist financing, outlines the four primary stages of illicit fund movement, and highlights the methods that extremist organizations use to raise, store, move, and deploy funds. We discuss the regulatory frameworks and global initiatives driven by the Fina...2025-06-0317 min

FinCrime Jobs : AML, KYC & Compliance InsightsTerrorist Financing: The Complex Web of Illicit Funding & Compliance StrategiesIn this comprehensive episode of FinCrime Jobs, we delve into the multifaceted world of terrorist financing, unpacking how illicit funding networks operate and the critical role that compliance professionals play in identifying and disrupting those networks. Drawing upon real-world case studies—from Hamas and ISIS to the Taliban and Hezbollah—this episode examines the interconnected nature of money laundering and terrorist financing, outlines the four primary stages of illicit fund movement, and highlights the methods that extremist organizations use to raise, store, move, and deploy funds. We discuss the regulatory frameworks and global initiatives driven by the Fina...2025-06-0317 min FinCrime Jobs : AML, KYC & Compliance InsightsHollywood Money Laundering Myths vs Real AML TacticsIn this episode of FinCrime Jobs, we debunk common Hollywood money laundering myths and reveal genuine AML tactics used by compliance professionals. Starting with blockbuster-inspired scenarios—cash-stuffed briefcases and instant clean money—we contrast these exaggerations with real-world placement, layering, and integration processes. Learn how financial institutions leverage transaction monitoring, customer due diligence (CDD), and beneficial ownership checks to detect suspicious activity. We also examine how shell companies and offshore accounts are portrayed in movies versus how regulators actually investigate complex networks.Key takeaways include:Why Hollywood’s “launder cash in a single night” trope is unreali...2025-06-0214 min

FinCrime Jobs : AML, KYC & Compliance InsightsHollywood Money Laundering Myths vs Real AML TacticsIn this episode of FinCrime Jobs, we debunk common Hollywood money laundering myths and reveal genuine AML tactics used by compliance professionals. Starting with blockbuster-inspired scenarios—cash-stuffed briefcases and instant clean money—we contrast these exaggerations with real-world placement, layering, and integration processes. Learn how financial institutions leverage transaction monitoring, customer due diligence (CDD), and beneficial ownership checks to detect suspicious activity. We also examine how shell companies and offshore accounts are portrayed in movies versus how regulators actually investigate complex networks.Key takeaways include:Why Hollywood’s “launder cash in a single night” trope is unreali...2025-06-0214 min FinCrime Jobs : AML, KYC & Compliance InsightsTop Indian Financial Crime Certifications for 2025In this episode of FinCrime Jobs, we delve into the top financial crime certifications offered by Indian organizations, essential for professionals aiming to excel in AML, forensic accounting, and compliance roles. Drawing insights from our detailed blog post, we explore certifications such as:Certified Forensic Accounting Professional (CFAP) by India ForensicCertified Anti-Money Laundering Expert (CAME)Certified Financial Crime Risk Analyst (CFCRA)Certified Trade-Based Money Laundering ExpertCertified Sanctions Screening ExpertCertified KYC ExpertCertificate Examination in Anti-Money Laundering & Know Your CustomerCertificate...2025-06-0118 min

FinCrime Jobs : AML, KYC & Compliance InsightsTop Indian Financial Crime Certifications for 2025In this episode of FinCrime Jobs, we delve into the top financial crime certifications offered by Indian organizations, essential for professionals aiming to excel in AML, forensic accounting, and compliance roles. Drawing insights from our detailed blog post, we explore certifications such as:Certified Forensic Accounting Professional (CFAP) by India ForensicCertified Anti-Money Laundering Expert (CAME)Certified Financial Crime Risk Analyst (CFCRA)Certified Trade-Based Money Laundering ExpertCertified Sanctions Screening ExpertCertified KYC ExpertCertificate Examination in Anti-Money Laundering & Know Your CustomerCertificate...2025-06-0118 min FinCrime Jobs : AML, KYC & Compliance InsightsAl Capone: Tax Evasion & Forensic Accounting LegacyIn this episode of FinCrime Jobs, we explore how Al Capone’s empire crumbled not by violence, but through meticulous forensic accounting and tax evasion prosecution. We discuss the historical context of Prohibition-era Chicago, the IRS’s strategic use of financial records, and the pivotal role of forensic accountants in tracing hidden income streams. Listeners will learn about the investigative techniques that uncovered Capone’s illicit profits—from analyzing ledgers to leveraging bank deposit slips—and how these methods laid the foundation for modern financial crime investigations. We also examine Capone’s legacy: how his conviction under the Internal Revenue Code...2025-06-0109 min

FinCrime Jobs : AML, KYC & Compliance InsightsAl Capone: Tax Evasion & Forensic Accounting LegacyIn this episode of FinCrime Jobs, we explore how Al Capone’s empire crumbled not by violence, but through meticulous forensic accounting and tax evasion prosecution. We discuss the historical context of Prohibition-era Chicago, the IRS’s strategic use of financial records, and the pivotal role of forensic accountants in tracing hidden income streams. Listeners will learn about the investigative techniques that uncovered Capone’s illicit profits—from analyzing ledgers to leveraging bank deposit slips—and how these methods laid the foundation for modern financial crime investigations. We also examine Capone’s legacy: how his conviction under the Internal Revenue Code...2025-06-0109 min FinCrime Jobs : AML, KYC & Compliance InsightsCorruption in Financial Crime: Case Studies & ComplianceIn this episode of FinCrime Jobs, we delve into the multifaceted world of corruption within financial institutions and government entities. Through real-world case studies, we examine how bribery, embezzlement, and influence peddling undermine compliance efforts and facilitate money laundering. You’ll learn about key red flags—such as suspicious payment patterns, shell company networks, and illicit influence channels—and explore best practices for conducting robust anti-corruption due diligence. We also highlight landmark legislation like the Foreign Corrupt Practices Act (FCPA) and the UK Bribery Act, outlining how organizations can strengthen their anti-bribery compliance programs to mitigate reputational and regulatory risks...2025-06-0115 min

FinCrime Jobs : AML, KYC & Compliance InsightsCorruption in Financial Crime: Case Studies & ComplianceIn this episode of FinCrime Jobs, we delve into the multifaceted world of corruption within financial institutions and government entities. Through real-world case studies, we examine how bribery, embezzlement, and influence peddling undermine compliance efforts and facilitate money laundering. You’ll learn about key red flags—such as suspicious payment patterns, shell company networks, and illicit influence channels—and explore best practices for conducting robust anti-corruption due diligence. We also highlight landmark legislation like the Foreign Corrupt Practices Act (FCPA) and the UK Bribery Act, outlining how organizations can strengthen their anti-bribery compliance programs to mitigate reputational and regulatory risks...2025-06-0115 min FinCrime Jobs : AML, KYC & Compliance InsightsBank Secrecy Act (BSA): Key Compliance InsightsIn this episode of FinCrime Jobs, we explore the Bank Secrecy Act (BSA)—the cornerstone of U.S. anti–money laundering (AML) regulation. You’ll learn how the BSA requires financial institutions to file Currency Transaction Reports (CTRs) and Suspicious Activity Reports (SARs) to detect and prevent illicit finance. We discuss the evolution of BSA compliance, including effective customer due diligence (CDD) and risk-based transaction monitoring frameworks. Tune in as we break down real-world examples of BSA violations, outline best practices for maintaining robust AML programs, and highlight career pathways in BSA compliance.Key points:Bank S...2025-06-0113 min

FinCrime Jobs : AML, KYC & Compliance InsightsBank Secrecy Act (BSA): Key Compliance InsightsIn this episode of FinCrime Jobs, we explore the Bank Secrecy Act (BSA)—the cornerstone of U.S. anti–money laundering (AML) regulation. You’ll learn how the BSA requires financial institutions to file Currency Transaction Reports (CTRs) and Suspicious Activity Reports (SARs) to detect and prevent illicit finance. We discuss the evolution of BSA compliance, including effective customer due diligence (CDD) and risk-based transaction monitoring frameworks. Tune in as we break down real-world examples of BSA violations, outline best practices for maintaining robust AML programs, and highlight career pathways in BSA compliance.Key points:Bank S...2025-06-0113 min FinCrime Jobs : AML, KYC & Compliance InsightsInside Terrorist Financing: Real FIU Case Studies and Career InsightsIn the premiere episode of FinCrime Jobs, we dive deep into real-world case studies from Financial Intelligence Units (FIUs) tackling terrorist financing. Discover how global agencies detect, investigate, and disrupt financial networks linked to terrorism. This episode is essential for aspiring AML analysts, compliance professionals, and financial crime investigators who want to understand practical typologies and investigative strategies used in the field. We also explore career tips for entering this high-impact area of compliance.🔎 Topics Covered:Terrorist financing red flagsReal FIU case examplesInvestigative methods & toolsSkills & certifications to...2025-06-0109 min

FinCrime Jobs : AML, KYC & Compliance InsightsInside Terrorist Financing: Real FIU Case Studies and Career InsightsIn the premiere episode of FinCrime Jobs, we dive deep into real-world case studies from Financial Intelligence Units (FIUs) tackling terrorist financing. Discover how global agencies detect, investigate, and disrupt financial networks linked to terrorism. This episode is essential for aspiring AML analysts, compliance professionals, and financial crime investigators who want to understand practical typologies and investigative strategies used in the field. We also explore career tips for entering this high-impact area of compliance.🔎 Topics Covered:Terrorist financing red flagsReal FIU case examplesInvestigative methods & toolsSkills & certifications to...2025-06-0109 min