Shows

The Daily Lawyer PodcastFrom Small Town to GST Powerhouse: The Untold Journey of India’s New-Age Tax Lawyer | GST Law Explained SimplyIn this powerful episode of The Daily Lawyer Podcast, Jenna sits down with Mr. Ashwarya Sharma, GST and Indirect Tax legal expert, founder of RB Law Corp, first-generation professional, and one of India’s most dynamic voices in indirect tax litigation.

From growing up in Kashipur to building a multi-city boutique law firm to handling large-scale GST litigation for major Indian businesses, this conversation is equal parts inspiring, insightful, and deeply practical.

In this exciting episode, we discuss:

✔️ His journey from accidental lawyer to GST specialist

✔️ The reality of starting with zero clien...

2025-12-151h 21

Value of Life podcast by Puja KhushalGST Registration, Frauds & New Rules — COMPLETE BreakdownIn this insightful podcast episode, we host GST Officer Mr. Ravinder Sahu to discuss the real facts behind GST reforms, GST 2.0, registration challenges, and GST fraud control.Hosted by Puja Singh from Value of Life by Puja Khushal, this episode provides a clear and practical understanding of GST directly from the system.Key topics covered in this episode include:The real objective of GST 2.0Why GST reforms are necessaryMeaning and impact of slab rationalisationCommon GST registration problemsReasons for GST registration suspension or...

2025-12-1342 min

Flirting With A FishHave Better understanding of The GST | from Tax Expert PP Singh | #136Send a textDive into the depths of India's biggest tax reform!On this episode of "Flirting with a Fish," we swim straight into the often-murky waters of GST (Goods and Services Tax) with renowned Tax Expert, PP Singh. Whether you're a small business owner, a student, or just someone trying to understand where your tax money goes, this is your complete guide to the GST rules, compliance, and real-life impact.Forget the dry legal jargon—PP Singh delivers the uncommon answers to your most common GST questions. We dissect everything from the controversial tr...

2025-11-1229 min

Narendra Modi - Audio BiographyModi's Whirlwind Week: GST 2.0, World Food India, and Empowering the NationNarendra Modi BioSnap a weekly updated Biography.It has been a whirlwind few days for me Narendra Modi as I criss-cross the nation ushering in one reform after another and making headlines both at home and abroad. On September 21 I addressed the nation marking the rollout of the next-generation GST reforms from September 22. In my speech broadcast widely and picked up by Times of India and CNBC-TV18 I congratulated India for what I dubbed the GST Bachat Utsav saying these reforms will accelerate our growth story improve business ease attract new investment and crucially make every state an...

2025-09-2404 min

Finance Simplified by CA Rachana RanadeGST 2.0 Seller’s BIG Loss or Customer’s Gain ? CA Rachana Ranade✔️Register now for the Har Ghar Investor event in Borivali on 27th Sept 2025:

https://in.bookmyshow.com/events/har-ghar-investor-by-ca-rachana-rande/ET00460928

For any queries drop a WhatsApp message on +919022196678

-------------------------------------------------------------------------------------------------------------

GST 2.0 is here — but is it really a win for customers, or a hidden loss for sellers?

If a seller buys goods at 28% GST and sells at 18% GST, does he actually lose money… or does he pass the benefit on to YOU, the customer?

In this video, CA Rachana Ranade breaks down the truth behind GST inpu...

2025-09-2309 min

How India's Economy WorksThe GST Reform India Needs but Didn’t Get with Arbind ModiIn this episode, economic journalist and author Puja Mehra speaks to Arbind Modi, retired IRS officer and Senior Economist at the IMF and one of the chief architects of India’s Goods and Services Tax (GST), about what India’s broken tax system means for its growth ambitions. The conversation explores how GST’s design flaws have hurt competitiveness, why exempting large sections of income undermines fairness, and how Centre–State revenue sharing has created new fiscal strains.The discussion connects India’s tax choices to global shifts, from the Trump-era trade wars to the reordering of supply cha...

2025-09-101h 00

BharatvaartaHow GST 2.0 could transform Indian Middle Class | Ajay Rotti - Taxation ExpertIndia’s tax system is once again at a crossroads with GST 2.0. What began as the biggest reform in independent India was riddled with compromises, complexities, and billion-rupee disputes — but what do the new changes really mean for ordinary citizens? Tax lawyer and founder of Tax Compaas, Ajay Rotti, joins us to break it all down.

In this insightful conversation, Ajay explains why GST was born more political than economic, how disputes over popcorn, KitKat, and cosmetic creams exposed deep flaws in the system, and why rate rationalisation today is less a revolution than a course correction.

We also dive...

2025-09-081h 03

Daily Stock Market News and Analysis (DNA by InvestYadnya)Daily Stock Market News (8 Sept 25): US Jobs Data, GST Impact, Auto Price Cuts, Gold Price Surge#StockMarket #IndiaStockMarket #DailyMarketNews #GST #AutoNews #GoldPrice #USJobsReport #FederalReserveSign up for Pune Sessionhttps://shop.investyadnya.in/pages/event-enquiry-formStay informed with your daily dose of market intelligence! This video covers the crucial news impacting the stock market, providing insights for investors and traders.Key Market Movers:US Jobs Report & Treasury Yields: Discover how weaker-than-expected US jobs data sent 10-year Treasury yields to their lowest since April, signaling a potential Fed rate cut. Understand the implications for global markets.GST Impact on Consumption & Autos: Get the latest on how the GST restructuring is expected to boost consumption in India. Learn about the...

2025-09-0824 min

Coffee AffairsIndia's GST 2.0 : What does it impact and meant for whom ?🎙️GST has been simplified to two levels: 5% and 18%. GST reforms have reduced taxes on essential household items like soaps, toothpaste, and Indian breads to 5% or 0%, making them more affordable.🎙️Life-saving drugs and medicines have been reduced from 12% to 0% or 5%, making healthcare more accessible. Two-wheelers, small cars, TVs, ACs, and cement have been reduced from 28% to 18%, providing relief to the middle class.🎙️Farm machinery and irrigation equipment have been reduced from 12% to 5%, reducing farming costs. Tobacco, pan masala, aerated drinks, and luxury goods are now taxed at 40%.Credits: Press Information Bureau_________CHAPTERS

2025-09-0719 min

Daily Stock Market News and Analysis (DNA by InvestYadnya)Daily Stock Market News (Sept 4, 2025): Next Gen GST Reform & Rate Cuts, US Jobs, Knowledge Section#stockmarketnews #gst #gstreforms #indianeconomy #marketanalysis #investing #financialnews #indiabusiness Start your day with the most crucial stock market news for September 4, 2025! In this video, we break down the major factors influencing the market, from global events to key policy changes.Here's what we cover:Next-Gen GST Reform: We dive deep into the significant GST reforms and new GST rates announced by the Government of India yesterday. Learn how these changes will impact various sectors - GST on cars, GST on Mobile Phones, GST on Cement, consumer spending, and the broader economy. This is a game-changer you need to understand.US...

2025-09-0423 min

What This MeansEP131: GST 2.0: Everything You Wanted To Know About GST ReformsTax expert and founder and CEO of Tax Compaas, Ajay Rotti, helps us decode 3 things: problems that the existing GST solved, problems that the GST reforms will solve, and the problems that will still remain, in this episode of What This Means with Diksha Yadav.-Why GST Was Brought In -How GST Changed Indian Taxation-What GST Fixed And What It Didn't-What GST 2.0 Is Trying To Fix-The Two-Slab Reform: What It Means-GST Reforms — Challenges That Still Remain-What More Needs To Be Do...

2025-08-2137 min

Accountants Daily Podcast NetworkUnder the Hood: GST reform: To be, or not to be?This week Miriam Holme and David Perrott from Fab Tax join Imogen on UTH to chat about their thoughts on GST reform, its history and if it is a framework that needs to be revised. Their take on GST might surprise you! Tune in to hear about: Why GST was first introduced. How GST was first proposed to the Australian community and the history beforehand. Why GST is effective and why your clients should stop worrying about it. The complications surrounding GST and the valid argument for reform. Other taxes and topics that should be revised...

2025-07-1543 min

EY India Insights Podcast8 Years of GST: Achievements, challenges, and future of tax reformJoin us for a special episode as we mark eight years of the Goods and Services Tax (GST) in India – a reform that has redefined the nation's business landscape. This insightful discussion features Saurabh Agarwal, Tax Partner at EY India , who brings his extensive expertise to explore GST’s transformative journey.Discover the key achievements of the GST regime, from the rise in taxpayer formalization to groundbreaking digitization efforts. Learn about its impact on various sectors and hear perspectives on rate rationalization and how GST can further empower India’s ‘Make in India’ ambitions.Whether you’re a t...

2025-06-3005 min

The Numbers GameRaising GST in Australia and Why it Would WorkShould Australia raise the GST and lower income tax? Today, we dive into one of the most controversial tax reform ideas, exploring how increasing GST while cutting income tax could simplify the system, boost business, and create a fairer economy. We compare Australia’s tax system to other countries, discuss capital gains tax, corporate tax loopholes, and economic impacts, and break down why no politician is willing to touch this topic. Is it time for a change? Let’s debate!(00:00) Intro(0:40) Should We Raise GST? The Big Debate Begins(04:01) Higher GST, Lower Income Tax – Would It Wor...

2025-03-0927 min

Revaluate PodcastCanadians Are EATING The FUTURE As Trudeau’s GST Holiday BACKFIRES | Canada's TOP EXPERT | EP 33Canada's GST holiday has sparked debates across the nation. Is this tax break helping Canadians, or is it a political gimmick? Canada's top expert, Dr. Sylvain Charlebois, reveals how Trudeau’s GST holiday impacts the cost of living. From Canadian politics to HST and taxes, we unpack the holiday tax break’s effects. Featuring insights on Chrystia Freeland, Justin Trudeau, Pierre Poilievre, and the House of Commons, this podcast episode discusses missing facts from media's coverage of GST holiday (CBC) and the conservatives’ response to Trudeau news about the GST relief list. Watch now to understand the real story behind...

2025-02-1045 min

Revaluate PodcastREMOVE TAXES PERMANENTLY: Why Canada's GST Food Taxes Are IMMORAL | Canada's TOP FOOD ProfessorIs taxing food fair, or should it be removed entirely? In this podcast episode, we unpack the debate on food tax, food GST, and food tax cut in Canada with insights into Trudeau gst break, GST on food Canada, and the affordability crisis Canada. From tax policy to food inflation Canada, we discuss how tax on groceries impacts cost of living, the Canadian economy crash, and grocery industry Canada. Featuring sharp analysis of gst holiday, gst break, and Trudeau's tax break Canada list, we also discuss Pierre Poilievre, Justin Trudeau, and the growing concerns of food shortage and tax...

2025-01-2510 min

Smarten Up! The Tax and Business Podcast34: Navigating GST on Property: Essential Insights for OwnersGet ready to be enlightened about GST on property transactions - something every property investor and developer needs to know!In this episode, Sally Preston dives deep into the intricate world of GST as it applies to property transactions. From taxable supplies to input tax credits, Sally breaks down the essential concepts that property owners, investors, and developers must grasp to navigate GST effectively. In this episode of the Smarten Up! The Tax and Business Podcast, you'll learn:Understanding taxable supply, input tax supply, and GST-free supply (01:20) What input tax credits are and how th...

2024-07-0825 min

Smarten Up! The Tax and Business Podcast33: GST Key Terms and Obligations Every Business Owner Should KnowDive into the essentials of GST and make sure you're GST-compliant. Not doing so could result in costly mistakes.In this episode, Sally Preston breaks down the essentials of Goods and Services Tax (GST) in Australia. Whether you're new to business or looking to brush up on your GST knowledge, this episode is packed with crucial information and eye-opening insights to help you avoid common pitfalls.In this episode of the Smarten Up! The Tax and Business Podcast, you'll learn:What constitutes a taxable supply and why it's crucial for your GST obligations (02:00)The...

2024-07-0122 min

GST JunkiesGST Junkies PodCast Ep.11 Training on HolidaysWe had a good question from one of our listeners, Nich, in regards to training on holidays.

Should you train on holiday?

Erdi and StreTch share their holiday training experiences and tips.

Planning to take time off.

Training harder before you go on holiday, is it worth it?

Do you put training on maintenance or push for higher levels of progress?

Adjusting the program to suit the environment. Having a plan. Training...

2024-02-211h 12

GST JunkiesGST Junkies PodCast Ep.10 Quality over Quantity ConundrumThe debate about quality over quantity in the fitness industry,

including gymnastics strength training, stems from differing

perspectives on how to achieve optimal results and prevent injury.

Quality Advocates: Emphasize the importance of proper form and technique during exercises. They argue that performing fewer repetitions with correct form is more effective for building strength, preventing injuries, and promoting long-term success.

Quantity Advocates: Argue that volume and repetition are essential for skill development and muscle adaptation. They believe practising movements more frequently, even if it means occasionally sacrificing perfect form, helps improve overall...

2023-11-281h 18

Your Bookkeeping MattersYou're GST Registered, Now What?Today we’re delving into a topic that often baffles small business owners: GST registration. If you've recently taken the plunge into registering for the Goods and Services Tax (GST) in Australia, you're not alone in your uncertainty. Many entrepreneurs find themselves lost in the maze of GST regulations and deadlines, leading to sleepless nights and the fear of making costly mistakes.But here's the good news: you don't have to navigate the complex world of GST registration on your own. In this episode, I’ll shine a light on the path ahead once you've beco...

2023-10-2412 min

Straight Up Small BusinessDon't be scared of GSTI’ve been hearing some strange comments of late from business owners around GST, so I thought I’d clear up a few things on this important topic. In an earlier episode on the podcast, I gave a general overview of GST registration and how it works. Today, I’m going a little more niche and talking about why you shouldn’t be scared of it as a business owner. Understanding GST and its implications for business owners is crucial in ensuring compliance, as well as giving you the confidence to expand your business and keep moving it forwar...

2023-10-1611 min

GST JunkiesGST Junkies PodCast Ep.9 Flexibility SecretsWelcome back to another episode of GST Junkies.

This month, Erdi and Stretch share some less well-known flexibility secrets.

There are loads of great tips in this episode that you can experiment with in your own flexibility training.

How the environment you train in can impact your flexibility progress.

Some different flexibility methods:

Reach to Target

Ballistic (or pulsing) stretching

Bent-Joint to straight Joint (example is bent-knee to straight leg squat to pike)

Bent-Knee to increase hip abduction...

2023-10-021h 21

The Canadian Real Estate News PodcastCanadian Real Estate News: Buyers Agent Commission, First Time Home Buyers, and GSTEpisode 1: Canadian Real Estate News!This week in real estate there were three interesting stories regarding; buyers agent commission, first time buyer expectations, and GST on purpose built rentals.Join me while I discuss these three stories and click the links below if you'd like to read them for yourself!Buyer's Agent Commission:https://betterdwelling.com/class-action-against-toronto-real-estate-industry-price-fixing-get-approved/First Time Buyer Expectations:https://betterdwelling.com/half-of-canadas-young-adults-gave-up-on-homeownership-mortgage-pros/GST on Purpose Built Rentals:

2023-09-3014 min

Business News - English₹55,000 crore GST notices hit online gaming, Dream11 leads chargeThe Directorate General of GST Intelligence (DGGI) has taken action against several online real money gaming (RMG) companies, issuing a series of pre-show cause notices that collectively amount to a staggering ₹55,000 crore in alleged goods and services tax (GST) evasion. Among the companies targeted, Dream11, a prominent fantasy sports platform led by Harsh Jain, stands at the forefront with a GST demand notice exceeding ₹25,000 crore. This notice is notably one of the largest indirect tax claims made in the country's history, as per a Business Today report. In addition to Dream11, Play Games 24x7, along with its affiliated platforms, and Head...

2023-09-2600 min

Business News - English28% GST on online games: Delta Corps shares tank 20% after receiving tax noticeThe shares of online gaming firm Delta Corp tanked 20% in Monday morning trade after the gaming and casino firm said it has received tax notices totalling Rs 16,822 crore from the Directorate General of GST Intelligence. The company said that the tax demand is for the period between July 2017 and March 2022. The GST money is based on the gross bet value of all the games played at the casinos during the relevant period. The notice further mentioned that a show cause notice will be issued to the company if it fails to pay. Also Read: Delta Corp, Nazara shares crash after...

2023-09-2500 min

DataSpotS2E7: Six Years of GSTIn this episode, we embark on a data-driven exploration of India's GST since its inception in 2017. As of June 2023, GST has completed 6 years, so, we thought of analyzing the GST data.

As we navigate through the twists and turns, starting from the early challenges and leading up to the present state of affairs. Our exploration unveils the connection between how the economy grows, the way taxes are structured, and how policies are put into action. We'll take a closer look at how GST has impacted different aspects of India's economy, from giving smaller businesses a boost in the formal...

2023-08-1814 min

GST JunkiesGST Junkies PodCast Ep.8 Approaching more advanced bodyweight skills

Today’s episode discusses some key concepts around training more advanced gymnastics skills.

Having a few basics is essential before you start chasing the more advanced skills. What are the basics? Once you've got the basics, what's next? A strong pull-up and dip often lead to the goal of muscle-ups.

After you achieve a muscle-up, you can move on to goals like forward and backward rolls.

Another common goal is the press to handstand. So, are the prerequisites? Some people are strong but not flexible. Others are flexible but not st...

2023-08-161h 20

THE SDA HOUSING PODCASTEPISODE 155 - Tax Implications: Claiming GST, Input Tax Credits, ATO etcToday Minh and Jess try to navigate the environment of Input Tax Credits, GST Free supplies and claiming for GST within the specific lens of investing in SDA (What are these concepts? When do they apply? When and for what can you claim?).Thanks to some determinations and ATO rulings - this area has become somewhat complex. With the ATO determining that "the owner must be a registered SDA Provider", some investors have been undertaking the process to become a registered SDA Provider themselves, in order to claim back GST on constructions. This flows on to traditional S...

2023-08-0330 min

Canterbury Mornings with John MacDonaldJohn MacDonald: Labour's fruitloop thinking on GSTHow likely is it, do you think, that when the Australian Prime Minister jumped on the plane yesterday after his visit to Wellington and headed back to Canberra, Chris Hipkins wished he was on the plane too? You know, like kids, they’ll have a playdate with one of their mates, but they don’t want the party to end and then they want to turn it into a sleepover. I reckon that’s how Hipkins will have been feeling yesterday when he saw Anthony Albanese’s plane heading down the runway. Or maybe it was US S...

2023-07-2805 min

Kerre Woodham Mornings PodcastKerre Woodham: Labour's plan to remove GST from fruit and veges a desperate plan to win votesI was about to write my opener this morning on Labour's widely anticipated move to announce the removal of GST on fruit and veg, when an ACT party press release landed in my inbox and I thought David Seymour said it best: “If Labour announces a policy to remove GST from fruit and vegetables, that's not a sign they want to address the cost of living. It's a sign of a truly desperate political party willing to throw any semblance of sensible policy making out the window to snare some votes.” Absolutely right. I thought that Labour had shown despera...

2023-07-2805 min

BusinessLine PodcastsGST Council Meet: 28% GST on online gaming, tax relief for cancer drugs and moreIn its 50th meeting, the GST Council recommended a 28 per cent GST on online gaming, casinos, and horse racing, leading to concerns within the gaming industry. This has led to concerns in the gaming industry regarding the potential impact on investments, job opportunities, and the overall economy. In this latest episode of the News Explained podcast, Shishir Sinha, Associate Editor, provides insights into the outcomes of the 15th GST Council meeting and its impact on various sectors.

The government focuses on treating these activities as acceptable claims rather than distinguishing between games of skill and games of c...

2023-07-1311 min

GST JunkiesGST Junkies PodCast Ep.7 Pike FlexibilityCan you touch your toes?If not, you'll want to listen to

this episode of the GST Junkies podcast, where Erdi and StreTch talk all things pike flexibility.

We cover:

- Why should you work on your pike?- As an "unflexible adult", where do you even start?- Why core compression strength and pike flexibility go hand in hand. - Lengthen then strengthen or strengthen then lengthen?- Using gravity to your advantage.- Jefferson Curl's prerequisites- Different flexibility methods and ideas....

2023-07-121h 14

booksgim's PodcastEffortless GST Compliance: Introducing Gim Info Solutions Pvt Ltd's GST Invoice ManagerGim Info Solutions Pvt Ltd. is proud to introduce its cutting-edge GST Invoice Manager, a comprehensive software solution designed to streamline and simplify the invoicing process for businesses. With the ever-changing landscape of Goods and Services Tax (GST) regulations, maintaining compliance can be a daunting task. However, with Gim Info Solutions' GST Invoice Manager, businesses can automate their invoicing workflows, ensuring accurate and error-free GST calculations and seamless generation of GST-compliant invoices

2023-07-0800 min

BusinessLine PodcastsHow 6 years of GST transformed India’s indirect tax systemSix years after its introduction, India’s indirect tax system has undergone substantial changes because of the Goods and Services Tax (GST).

In this podcast, businessline’s Shishir Sinha talks to Darshan Bora, Partner, Economic Laws Practice and M S Mani, Senior Partner, Deloitte about various aspects of GST in India.

Initially, businesses faced challenges, but the landscape of indirect taxes has significantly improved. The GST has eliminated multiple taxes and brought uniformity in tax rates across states, making it easier for businesses and consumers. A survey conducted by Deloitte also showed that 75% of industry prof...

2023-06-3024 min

booksgim's PodcastEffortless GST Invoicing Made Simple: Discover the Power of Online Invoice Generator with GST ComplianceManaging GST invoicing has never been easier than with GimBooks' online invoice generator. Whether you're a small business owner or a freelancer, GimBooks provides a user-friendly platform that allows you to generate GST-compliant invoices effortlessly. Simply input your business and customer details, along with the relevant product or service information, and GimBooks will take care of the rest. With its intelligent features, the online invoice generator GST automatically calculates the GST amount, ensuring accuracy and compliance with GST regulations.

2023-06-2200 min

GST JunkiesGST Junkies PodCast Ep.6: Sustainable Human - Training PhilosophyThis week, Erdi and Stretch share their unique stories and training philosophies, explaining how they got into gymnastics strength training.

They have worked with clients face-to-face in London, opened gyms, and now moved their business online.

Their journey has led them to where they are today.

They delve into why they choose to train GST, the values they uphold, and the aspects of their lifestyle that have influenced this style of training. Discover who they enjoy working with and what they love about training.

All the answers are here.

2023-06-151h 16

GST JunkiesGST Junkies PodCast Ep.5: Adult Only HandstandsAs an adult, mastering the skill of balancing on your hands can prove to be quite daunting.

Overcoming the fear of being upside down, falling, and failing is the first challenge in this journey.

Building the necessary strength and flexibility to maintain a freestanding handstand is the next step.

But where does one begin?

For those new to handstands, it’s crucial to avoid the common mistake of trying to kick-up and balance in the middle of the room. This approach can impede progress and hinder advancement towards your g...

2023-05-231h 39

all Law.Withholding Income Tax: Withholding the ambiguity in GST Valuation?The podcast discusses the intricacies of TDS (tax deducted at source) withholding, which affects the taxable value under the Goods and Services Tax (GST) system in India. Under the Income Tax Act, 1961, TDS is withheld by Indian service recipients on the amount payable to foreign service providers. To clarify the taxable value under service tax, the Central Board of Excise and Customs (CBEC) stated that the taxable value shall be the gross value, including TDS. However, the net receipt in the hands of foreign service providers is reduced to the extent of TDS, which can be overcome by restructuring...

2023-05-0510 min

Michigan Talent TalkHow Young Adults can Unlock their Career Potential with Raymond BarryIn this episode of Talent Talk, we are joined by Raymond Barry, Youth Services Leader at GST Michigan Works!, to explore how to unlock your potential and achieve career growth. Raymond, a seasoned career coach and mentor, shares insights and strategies on how to identify your strengths, set career goals, and overcome common obstacles. No matter where you are in your career journey, this episode offers valuable advice and actionable tips to help you succeed.

2023-05-0315 min

GST JunkiesGST Junkies PodCast Ep.4: Free GainzUnlocking new gymnastic moves requires strength, flexibility and skill.

Often we see people sticking to a specific style of training. If you enjoy training strength, you may need to get stronger to unlock a particular gymnastics skill.

So, you continue to build strength and train the skill.

If you enjoy flexibility training, you may need to get more flexible to unlock a particular gymnastics skill.

So you continue stretching and training the skill.

But...

2023-04-191h 11

Michigan Talent TalkApprenticeships and Getting Started in a Skilled Trade with Wanda BigelowIn this episode, we are joined by Wanda Bigelow, Apprenticeship Manager at GST Michigan Works! Wanda shares her insights into the benefits of pursuing a career in the trades via an apprenticeship. She explains how GST Michigan Works plays a role in helping employers develop an apprenticeship program and pair them with job seekers who are interested in starting a career in the skilled trades.

2023-04-1914 min

Michigan Talent TalkGoing PRO: Empowering Michigan's Workforce with Cindy ThornthwaiteIn this episode, we are joined by Cindy Thornthwaite, Business Services Manager from GST Michigan Works! We explore the Going PRO program and how it is helping to upskill and reskill Michigan's workforce for in-demand industries. We discuss the benefits of the program for both employees and employers by providing various training opportunities such as apprenticeships, on-the-job training, and classroom instruction.

2023-04-1215 min

SAG Infotech Private Limited- A CA Software CompanyWhat You Need to Know About GST Interviews Q&ATaking the example of GST, which stands for Goods and Services Tax. Services and goods are taxed indirectly through this tax. There are multiple stages of taxation associated with GST at each point of sale where goods and services are provided. In the entire country, there is only one domestic indirect tax, the GST. On March 29, 2017, parliament enacted the GST, which entered into force on July 1. There are no exceptions when it comes to GST rates in Indian states, including union territories. Here we've compiled a list of the top GST interview questions and answers. This post is a...

2023-03-2802 min

GST JunkiesGST Junkies PodCast Ep.3: Flexibility TrainingIn this episode of GST Junkies, Erdi and Stretch take about flexibility training.

What led both of them to start doing more flexibility?

Why has it taken so long for the fitness industry to adopt flexibility training?

What about the "research" around flexibility making you weak, slow, and more prone to injury?

Is it true?

Or is it BS?

What are some of our favourite flexibility methods?

Where should beginners start?

How to include more flexibility in your existing training?

Flexibility...

2023-03-191h 27

Profit First For Tradies009: Demystifying the GST BAS and Tax Account: A Practical Guide to Simplifying Your Trades Business Finances with Profit First When it comes to managing the finances of your trade business, every business owner needs to take control of their GST/BAS and Tax Account in order to ensure they are following the right steps. While this can seem like an insurmountable task, demystifying these accounts and making sense of them is easier than you think. The Profit First system can simplify and clarify the entire process, providing an accessible and enjoyable way to take stock of your company's finances without getting bogged down. In this episode of Profit First for Tradies, we’ll talk about your...

2023-03-0609 min

GST JunkiesGST Junkies PodCast Ep.2: Level up your chin-upYou'll get a lot from this episode if you're a gymnastics skill seeker looking to get your first chin-up or looking for some training ideas to increase your chin-up strength.

In this episode, Erdi and StreTch talk about:

- Why do chin-ups and pull-ups?

- How they got their first chin-up

- Arching or Hollow Body Chin-ups?

- Progressions they use to help online students get their first chin-up

- Isometrics chin-up holds

- Eccentric Chin-ups

...

2023-02-171h 26

Michigan Talent TalkHuman Trafficking Prevention with Detroit Homeland Security InvestigationsJanuary is National Human Trafficking Prevention Month and we are joined by Special Agent in Charge Angie Salazar and Acting Assistant Special Agent in Charge Lisa Keith to help raise awareness. Angie & Lisa discuss how to recognize the indicators of human trafficking, some of the most common misconceptions, and how to appropriately respond to possible cases.They also share some of the career opportunities available within the Department of Homeland Security. To learn more, visit usajobs.gov.Disclaimer: The views expressed during this interview are of Homeland Security Investigations and do not necessarily reflect the...

2023-01-1727 min

GST JunkiesGST Junkies PodCast Ep.1: Goal setting for strength & flexibility training.What are your gymnastics strength and flexibility goals?

Are they SMART (Specific, Measurable, Achievable, Realistic and Timely)?

In this episode StreTch and Erdi share:

- Their current strength and flexibility goals.

- The importance of setting training goals.

- Motivation and sense of direction.

- Breaking bigger goals down into smaller milestones.

- Not putting all your eggs in one basket and looking at the bigger lifestyle picture.

- Embracing failure.

We hope you enjoy this episode!

2023-01-161h 01

Wealth ActuallyEP-125 GENERATION SKIPPING TAX (GST) with FIDUCIARY TAX EXPERT, MICHAEL GROSSMANWith the end of the year approaching, the focus of HNW and Family Office Space has turned to intergenerational planning.

One of the ideas on the minds of many families is providing for future generations.

It would be natural to make gifts to future generations to avoid the estate tax.

However, Congress figured that out and implemented the Generation Skipping Transfer Tax back in 1976. It’s not easy to understand, implement or track especially across generations.

MICHAEL GROSSMAN is here to help us understand the GST,

Michael is Tax Man...

2022-11-2330 min

FunnTaxxGST: A state of confusion in daily life.The one tax one nation agenda has been fairing well so far since GST was rolled out in the year 2017. According to a statistic, the pre-GST non-compliance of more than 55% has reduced to less than 20%. As a result, we have become privy to a colossal formalization of the economy, with record direct tax collections.

Furthermore, it has also been observed that the formation of the GST network has opened up profitable avenues for businesses, government, economists, and much more leading to an overall boost in the economy. GST has also been pretty successful in eliminating tax evasion...

2022-11-0603 min

Canterbury Mornings with John MacDonaldJohn MacDonald: I'm happy to pay GST - but not on thisOver the weekend, there was an anniversary that I’m picking most people didn’t know about and certainly didn’t celebrate. On Saturday, GST turned 36. For 36 years, we’ve been paying that little bit extra on pretty much everything we buy. It started off as 10 percent extra when Roger Douglas kicked it off on the 1st of October 1986, and there’ve been increases along the way to get us to the 15 percent we pay now. And it’s probably coincidental that GST is in the news today. This time it’s GST on the Governm...

2022-10-0304 min

Your Bookkeeping MattersWhat the heck is GST and when should I registerIs the concept of GST overwhelming you? You’ve heard that you should register for GST at some point, but when? In this episode, I’m diving into what GST even is and when you should register for it. I’ll talk about the types of transactions that are GST free, the benchmark and timeframe for registering for GST, deciding on the method of registration (cash or accrual) and how to absorb it into your pricing. Goods and Services Tax (GST) is a 10% tax and is de...

2022-06-1412 min

Straight Up Small BusinessLet's talk GSTI’m so excited to discuss my absolute favourite bookkeeping topic - GST. It’s absolutely essential that you grasp the ins and outs of GST to ensure you pay the right amount to the Australian Tax Office. But, from experience, I’ve found many businesses don’t understand it fully and end up making mistakes, so I’m on a mission to help educate everyone.GST, Goods and Services Tax, is a 10% consumption tax on goods and services that has been in operation since its introduction back in 2000. Businesses that are registered for GST need to cha...

2022-04-1116 min

Michigan Talent TalkGetting Work Experience as a Young Adult with Ray BarryIn this episode, we are joined by Raymond Barry, Youth Services Leader from GST Michigan Works! We discuss the difficulties young adults face getting their foot in the door to gain necessary work experience. Ray explains how GST Michigan Work's Young Professionals program can help adults ages 18-24 kickstart their career by getting valuable on-the-job experience.

2022-03-2423 min

Instade Knowledge Base (KB)25.Registration of GSTIf one has to do business in India, he has to get GST registration as it is the only tax levied on goods and services. For certain businesses, GST Registration is mandatory, however other businesses can opt for GST Registration voluntarily.Documents required for getting GST registrationFor Sole proprietorship/Individual business1. Passport size Photograph of the Proprietor.2. PAN Card of the Proprietor3. Aadhaar of the Proprietor4. Address proof of the Proprietor.· In the case of leased/rented property, the copy of the lease deed/rent agreement for along with a NOC from the Landlord and EB bill/property tax receipt/w...

2022-02-1106 min

Cheques and BalancesCommon GST Questions Accountants are asked about Property | Do you pay GST on Air BnB income?Join James and Mike in this week's episode of Cheques & Balances as they are joined once again by property guru and Managing Director of Lighthouse Financial services, Matt Harris. This week they discuss when you need to pay GST on a property, AirBnB and GST, common mistakes clients make on property transactions, GST on new builds, GST on lifestyle blocks, affordable housing for Kiwis, subdividing properties and much more. The content in this podcast are the opinions of the hosts. It should not be treated as financial advice. It is important you take into consideration your...

2021-12-2914 min

BPA EducatorsWhy GST important || BPA Educators ||Why GST important || BPA Educators ||

HELLO EVERYONE,

In this video you will know about why GST registration is important and GST important as well as.

also discuss about number of GST and how many characters in GST number with alphabet.

C - company

T - trust

P - person

F - partnership Ferm

Stay tuned to our channel for grabbing knowledge .

#gst #incometax #tax #icai #business #accounting #ca #cgst #gstr #india #gstindia #gstupdates

contact us for any query or doubt : 85128...

2021-10-0125 min

Accounting On PurposeGST in Australia 101Have you ever wondered what GST in Australia is? How does GST apply to your business? In this episode I walk you through what is GST in Australia but for the sake of having a preliminary understanding, if you asked me what is GST? I’d say that it is a goods and services tax that you need to pay in Australia as your revenue hits a certain threshold. We will look at the benefits of GST registration as well as some of the downfalls. We will look at the types of businesses that need to apply for...

2021-09-1506 min

Digital BizsolHow To Prepare For Departmental Audit Under GST?In this video, our Bizsolindia Founder, CMA Ashok Nawal, shares how to prepare for GST Departmental Audit. As the GST department has started issuing notices to the assesses. It is now very important for business owners and runners to understand GST and GST Audits. Watch this episode and be prepared for GST Departmental Audit...#gst #departmentalaudit #gstauditSupport the show (https://instagram.com/bizsolindia)

2021-08-0344 min

Michigan Talent TalkEpisode 6 - Founder & CEO of M.A.D.E. Institute, Leon A. El-Alamin - from poverty, crime, incarceration to CEOIn this episode, we are joined by Leon A. El-Alamin, Founder & C.E.O. of the M.A.D.E. Institute. Leon shares his story that started when he was a young man in North Flint; he became involved with crime, which led him to incarceration. He details how his time in the prison system inspired him to develop the M.A.D.E. Institute. M.A.D.E. provides returning citizens and at-risk youth opportunities to have equal access to employment, education, and full participation in the community's economic, political, and cultural life.The views, thoughts, a...

2021-06-231h 15

BPA EducatorsLearn GST ACCOUNTING on Busy | How to add Vouchers | Part 1| Sneak peakThis is a 7 days series in which you will learn how to implement GST Accounting entries in busy (the UPGRADED version of busy). Learn A to Z of busy like how to create company, how to add stock item, Local Purchase and Sales, Sundry Creditors, GST Tax Ledgers, how to set stock group wise GST Rates, how to Post Purchase and Sales Entry using GST.

Master in GST Accounting on busy with our COURSE

To get more details

Call on: 8512851249

or

visit our website: https://www.bpaeducators.com/

v...

2021-06-2308 min

BPA EducatorsLearn GST ACCOUNTING on TALLY PRIME | How to add aditional charges in vouchers | Part 6| Sneak peakThis is a 7 days series in which you will learn how to implement GST Accounting entries in Tally PRIME (the UPGRADED version of TALLY). Learn A to Z of Tally prime like how to create company, how to add stock item, Local Purchase and Sales, Sundry Creditors, GST Tax Ledgers, how to set stock group wise GST Rates, how to Post Purchase and Sales Entry using GST.

Master in GST Accounting on Tally Prime with our COURSE

To get more details

Call on: 8512851249

or

visit our website: https://www.bpa...

2021-06-2203 min

BPA EducatorsLearn GST ACCOUNTING on TALLY PRIME | How to analyse GST Reports | Part 7| Sneak peakThis is a 7 days series in which you will learn how to implement GST Accounting entries in Tally PRIME (the UPGRADED version of TALLY). Learn A to Z of Tally prime like how to create company, how to add stock item, Local Purchase and Sales, Sundry Creditors, GST Tax Ledgers, how to set stock group wise GST Rates, how to Post Purchase and Sales Entry using GST.

Master in GST Accounting on Tally Prime with our COURSE

To get more details

Call on: 8512851249

or

visit our website: https://www.bpa...

2021-06-1608 min

BPA EducatorsLearn GST ACCOUNTING on TALLY PRIME | How to add Vouchers | Part 6| Sneak peakThis is a 7 days series in which you will learn how to implement GST Accounting entries in Tally PRIME (the UPGRADED version of TALLY). Learn A to Z of Tally prime like how to create company, how to add stock item, Local Purchase and Sales, Sundry Creditors, GST Tax Ledgers, how to set stock group wise GST Rates, how to Post Purchase and Sales Entry using GST.

Master in GST Accounting on Tally Prime with our COURSE

To get more details

Call on: 8512851249

or

visit our website: https://www.bpaeducat...

2021-06-1208 min

BPA EducatorsLearn GST ACCOUNTING on TALLY PRIME | How to add Vouchers | Part 5| Sneak peakThis is a 7 days series in which you will learn how to implement GST Accounting entries in Tally PRIME (the UPGRADED version of TALLY). Learn A to Z of Tally prime like how to create company, how to add stock item, Local Purchase and Sales, Sundry Creditors, GST Tax Ledgers, how to set stock group wise GST Rates, how to Post Purchase and Sales Entry using GST.

Master in GST Accounting on Tally Prime with our COURSE

To get more details

Call on: 8512851249

or

visit our website: https://www.bpaeducato...

2021-06-0903 min

BPA EducatorsLearn GST ACCOUNTING on TALLY PRIME | How to add Vouchers | Part 4| Sneak peakThis is a 7 days series in which you will learn how to implement GST Accounting entries in Tally PRIME (the UPGRADED version of TALLY).

Learn A to Z of Tally prime like how to create company, how to add stock item, Local Purchase and Sales, Sundry Creditors, GST Tax Ledgers, how to set stock group wise GST Rates, how to Post Purchase and Sales Entry using GST.

Master in GST Accounting on Tally Prime with our COURSE To get more details

Call on: 8512851249

or

visit our website: https://www.bp...

2021-06-0511 min

BPA EducatorsLearn GST ACCOUNTING on TALLY PRIME | How to add stock category | Part 3| Sneak peakThis is a 7 days series in which you will learn how to implement GST Accounting entries in Tally PRIME (the UPGRADED version of TALLY).

Learn A to Z of Tally prime like how to create company, how to add stock item, Local Purchase and Sales, Sundry Creditors, GST Tax Ledgers, how to set stock group wise GST Rates, how to Post Purchase and Sales Entry using GST.

Master in GST Accounting on Tally Prime with our COURSE To get more details

Call on: 8512851249

or

visit our website: https://www.bpaeducat...

2021-06-0219 min

BPA EducatorsLearn GST ACCOUNTING on TALLY PRIME | How to add Stock Items | Part 2| Sneak peakThis is a 7 days series in which you will learn how to implement GST Accounting entries in Tally PRIME (the UPGRADED version of TALLY).

Learn A to Z of Tally prime like how to create company, how to add stock item, Local Purchase and Sales, Sundry Creditors, GST Tax Ledgers, how to set stock group wise GST Rates, how to Post Purchase and Sales Entry using GST.

Master in GST Accounting on Tally Prime with our COURSE To get more details

Call on: 8512851249

or

visit our website:

https://ww...

2021-05-2509 min

BPA EducatorsLearn GST ACCOUNTING on TALLY PRIME | Create Company | Part 1| Sneak peakThis is a 7 days series in which you will learn how to implement GST Accounting entries in Tally PRIME (the UPGRADED version of TALLY).

Learn A to Z of Tally prime like how to create company, how to add stock item, Local Purchase and Sales, Sundry Creditors, GST Tax Ledgers, how to set stock group wise GST Rates, how to Post Purchase and Sales Entry using GST.

Master in GST Accounting on Tally Prime with our COURSE To get more details

Call on: 8512851249

or

visit our website:

https://www...

2021-05-2201 min

Voice of Findex37. Individuals & SMEs | GST for education 2021Join us for our GST for Education 2021 podcast. Crowe Australasia Audit Partner Wicus Wessels and Findex Tax Advisory Partner Mark Reynolds will ensure you are informed on the recent developments and provide an in-depth analysis of the GST issues applicable to schools. Our Findex GST team will take you through:- Recent GST changes- Recap on GST and education supplies - Benefits of using GST charity provisionsFor more information, please visit the Findex Australia website: www.findex.com.au

2021-05-201h 01

Michigan Talent TalkEpisode 4 - Resume and Interview Tips with Sharis ReavesWe are joined by Sharis Reaves, Workshop Facilitator for Partnership Accountability Training Hope (PATH) at GST Michigan Works. We will discuss some advice on getting back into the workplace, including ways to update your resume, tips for interviewing, improving your soft skills and more!

2021-03-1642 min

Michigan Talent TalkEpisode 3 - Developing Lifelong Learning Skills with Danielle LepineIn this episode we are joined by Danielle Lepine from the Talent Development Center at GST Michigan Works! Danielle explains how the Talent Development Center helps individuals overcome barriers to achieve their career and educational goals.

2021-03-0533 min

Michigan Talent TalkEpisode 2 - Services & Programs for Job Seekers with David PlamondonIn episode 2 of the Michigan Talent Talk podcast, we are joined by David Plamondon who is a Unit Leader with GST Michigan Works and former career coach. We discuss the many different programs offered by GST Michigan Works to help job seekers, including the PATH program which helps participants identify barriers and connect to the resources they need to obtain employment.

2021-02-1635 min

Concept TalkGST 3 - 101st Constitution AmendmentIn this episode of Concept Talk, Dr. Vikas Divyakirti has done a detailed review of the GST Bill The podcast explanation is full of interesting examples that will help learn Economics concept with full clarity. The language of this podcast is in Hindi and are easy to understand to common.The discussion is about GST-2 (Hindi) - How GST System works?History of GST tax reforms: In 2002, NDA Finance Minister Jaswant Singh appointed two committees (on direct and indirect taxes, both headed by Vijay Kelkar) and from 2003 it was being toyed upon (what can we...

2021-02-081h 25

Concept TalkGST FEATURES- COMPREHENSIVE, MULTI-STAGE, VALUE-ADDED, DESTINATION BASED TAXIn this episode of Concept Talk, Dr. Vikas Divyakirti has done a detailed review of the GST Bill The podcast explanation is full of interesting examples that will help learn Economics concept with full clarity. The language of this podcast is in Hindi and are easy to understand to common.The discussion is about GST-2 (Hindi) - How GST System works?GST FEATURES- COMPREHENSIVE, MULTI-STAGE, VALUE-ADDED, DESTINATION BASED TAXGST is an indirect tax which has certain characteristics: it is comprehensive, multi-stage tax (such as purchase, production, warehousing, sale), value-added tax and destination...

2021-02-0859 min

Concept TalkUNDERTANDING GST- HISTORY & WHY IS IT NEEDED ?In this episode of Concept Talk, Dr. Vikas Divyakirti has done a detailed review of the GST Bill The podcast explanation is full of interesting examples that will help learn Economics concept with full clarity. The language of this podcast is in Hindi and are easy to understand to common.The discussion is about UNDERTANDING GST- WHY IS IT NEEDED ?Dr. Vikas Divyakirti (in part one of the 3-part video)explains why GST is needed. First it is important to understand why it was brought in the first place. What is GST comes later in...

2021-02-081h 14

Michigan Talent TalkEpisode 1 - WIOA Youth & Adult Programs with Breanne PerryWe are joined by Breanne Perry, Career Coach at GST Michigan Works! of Shiawassee, to discuss the WIOA (Workforce Innovation & Opportunities Act) youth & adult programs that are offered by GST Michigan Works! There are WIOA programs for people of all ages to offer occupational skills training, financial literacy education, leadership development opportunities, mentoring and so much more! To learn more about the different WIOA programs, visit gstmiworks.org/paidfor or call 1-800-551-3575 to speak to a career coach.

2021-02-0130 min

Michigan Talent TalkMichigan Talent Talk PreviewWelcome to the Michigan Talent Talk podcast, presented by GST Michigan Works! Tune in as we discuss topics that are geared towards helping you achieve your career goals. We will have experts on to provide information on what employers are looking for, ways to standout amongst the crowd and improve your employable skills.

2021-01-2201 min

BPA Educators#Authentication of #Aadhaar #number under the #GST Act#Authentication of #Aadhaar #number under the #GST Act The #Central #Board of #Indirect #Tax and #Customs (CBIC) had issued a #notification on 23rd March 2020, about #Aadhaar #authentication for #GST #registration from 1st April 2020. The same has been #amended vide notification 62/2020 dated 20th August 2020 to be made optional. The #aadhaar #authentication for #GST #registration is not required for non-residents, #persons other than citizens of India, and persons who have already been registered under GST. As per the latest #notification, every applicant for GST registration can opt for the Aadhaar authentication. The #exceptions are person #exempted by the #Central #government under th...

2021-01-1306 min

Jansatta Hindi PodcastGST Funds पर घिरी मोदी सरकार, CAG ने खड़े किए सवाल | CAG on GST Compensation FundsCAG on GST Funds : कोरोना संकट के दौर में कई राज्य लगातार केंद्र सरकार से बकाया GST भुगतान करने की मांग कर रहे हैं। जिसको लेकर सियासत भी गर्म है। लेकिन अब ऐसे हालातों में नियंत्रक एवं महालेखा परीक्षक यानि की CAG की एक रिपोर्ट सामने आई है, जिसके बाद से केंद्र सरकार (modi govt) सवालों के घेरे में आ गई है। आरोप है की केंद्र ने नियमों का उल्लंघन कर GST क्षतिपूर्ति फंड (GST Compensation Fund) का कहीं और इस्तेमाल किया। जो की राज्यों के साथ धोखा है, तो आइए विस्तार से जानते हैं पूरा मामला

2020-09-2507 min

SAG Infotech Private Limited- A CA Software CompanyLet's View The Benefits of Gen GST Software For Taxpayers & TradersAre you looking for GST Software if yes you have come in right place?. Here you can see India's No.1 Gen GST software that is designed by SAG Infotech. If taxpayers want to file your GST return file and view what is the benefits of GST Software then you can look at the best choice Gen GST software and find out the benefits of Gen GST software for taxpayers & traders. However, when done using Gen GST software, it ensures many benefits which are as follows: facilitating the filing of data, cost-friendly, effortless access to data, and customization.

2020-09-1102 min

Digital BizsolGST A Journey Of 3 YearsIt is indeed an anniversary moment for all those who belong to finance, tax, and related business functions, as the vision of one nation one tax under GST has completed 3 years. 1st of July 2017 has been marked as a historic moment for India with the launch of GST that is Goods and Services Tax lead by a midnight session of both the Houses of Parliament assembled at the central hall of the parliament. The launch of GST in India not just created a wave of uncertainty in the trade and industry but also attracted criticism from various e...

2020-07-0934 min

The DeshBhakt With Akash Banerjee#GST: What Happened to India's ‘Second Independence’?? | Analysis by Akash Banerjee

Chapters:

0:00 - Another 'Masterstroke'

1:44 - GST: The Grand Plan!

4:05 - Why One Nation One Tax is a good idea

5:19 - 3 years (and counting) of failed implementation

8:14 - What Went Wrong with the ambitious plan?

9:20 - Center to Borrow Money to give to States … Wait, What?

Thumbnail Cartoon via Satish Acharya

Twitter - @satishacharya

Website - http://cartoonistsatish.com

3 years to what the NDA Government claimed was India’s ‘Second Independence’

After the disastrous Demonetisation experiment - GST or Goods and Services Tax was BJP’s most ambitious project to boost economic growth. GST endeavoured to change the entire way...

2020-07-0712 min

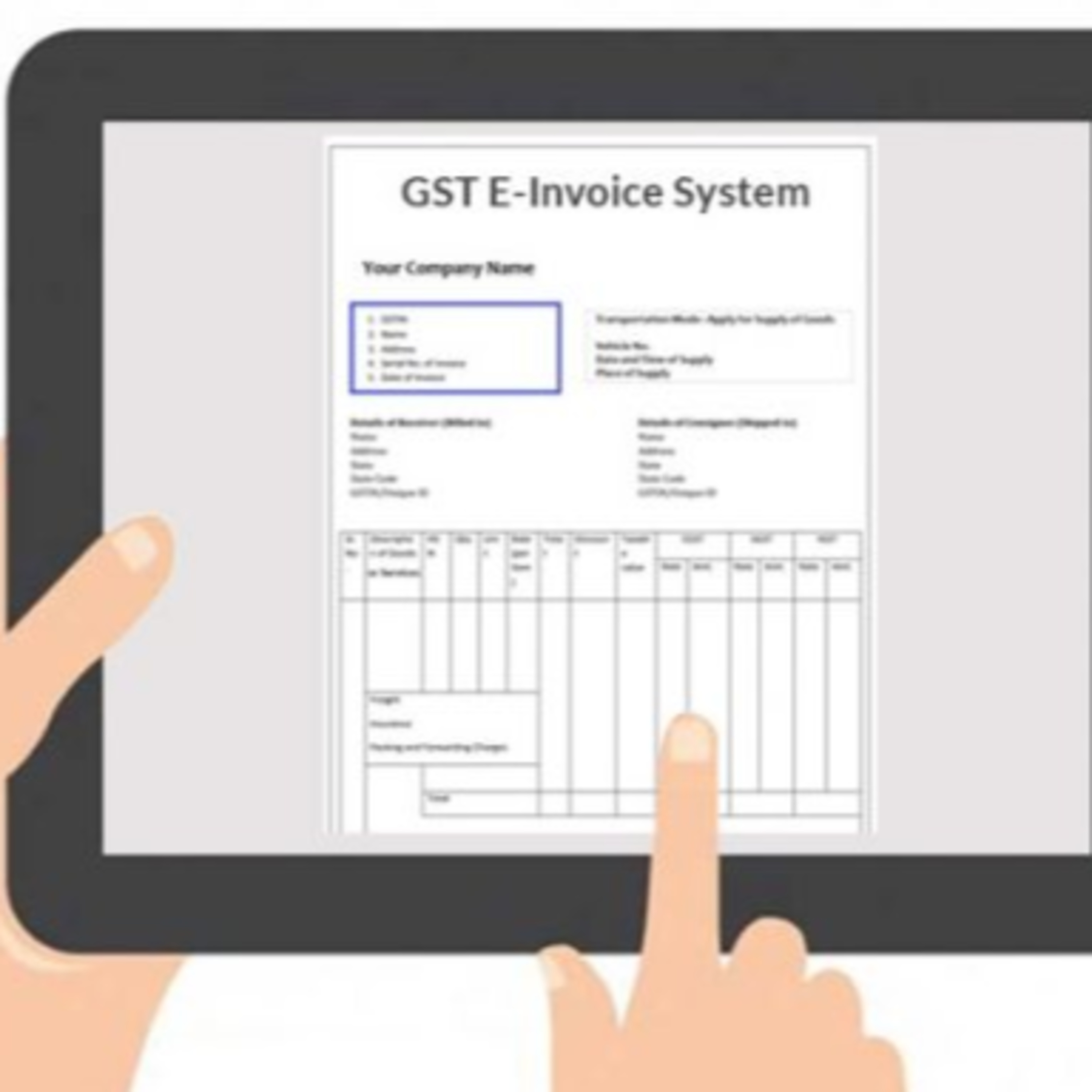

SAG Infotech Private Limited- A CA Software CompanyHow to Generate and Validate an E-invoice Under GST?E-invoice under GST is the government's endeavor towards making the billing system more transparent and reducing tax frauds done based on false bills. E-invoices shall firstly be generated on the company’s billing software and then be validated through GSTN (generally B2B invoices). Directly generating E-invoice under GST through the giant portal is not possible.

Generate and Validate a GTS E-invoice

Creating the GST invoice using own software

Generating a unique Invoice Reference Number (IRN) for the B2B invoice

Convert the invoice into the JSON file and later upload it on Invoice Registration Portal (IR...

2020-04-2403 min

Dialogue NowBreaking down GST Jargons with Neha GoenkaDivya Gupta from Dialogue Room and Neha Goenka from CAxpert dialogue about how GST came in to play and what all should businesses look out for!

GST has been designed to prevent evasion of taxes. So if anyone who was getting away with certain things, the GST has cut it down. At the moment the government’s main prerogative is it to reduce evasion.

Points of Discussion:

-Types of GST - State, Central & Integrated

-GST prevents evasion of taxes

-GST replaced 14 laws making it easier for businesses

-GST has 7 tax slab...

2020-03-1823 min

Digi GyaanEpisode #6 GST TAXATION POLICYHello and Welcome to another episode of Digi Gyaan. This is episode No 6 and in this we will talk about why to get a GST for your Business.

If you are working in any country you need to check out their taxation policies too and if you are liable to pay any tax or not.

Similarly in India you need to pay the Goods and service tax irrespective of your turnover when you are doing any online business. The most commonly GST Tax slap is 18% for e-commerce operations and other commissions but you need to...

2020-02-2401 min

SAG Infotech Private Limited- A CA Software CompanyFind The Best Gen GST Software For Return Filing And BillingSAG Infotech is a great tax software company that started in 1999 in India. This software company provides best online Gen GST software which can automate your work and let you focus on the core activities of the business. Recently, these days many software are available in the market but SAG Infotech offers affordable software like Gen GST Software that is an all-round solution and so we have invented and update GST related software such as GST billing software and Gen GST version 2.0.

Get your copy of Gen GST filing & billing software now and do all your GST r...

2019-09-3002 min

The Works PodcastInterview With Penny Poplar Of The Greater Flint Health CoalitionIn this episode, we speak with Penny Poplar, Program Director of the Flint Healthcare Employment Opportunities (FHEO) program.The FHEO Program is a workforce development program, assisting unemployed residents of the community and dislocated workers from Flint and Genesee County assisting in training, employment, and educational opportunities in the healthcare industry. Those accepted into the FHEO Program are provided with free training and supportive services. They work with the state to see what careers are currently in demand, offer talent tours for a behind-the-scenes look in the healthcare industry. Their parent company, Greater Flint Health C...

2019-05-0616 min

Afro Pop RemixThe Seventies: Ooh Wee! - Spcl. Gst. LarryA detailed look at black, African-American, culture during the "Seventies". (1970-1979) (Bonus Artists: Luck Pacheco) 1979: When MJ Was Black - Spcl. Gst. Ed Mar 1, 2019 Topics: Jimmy Carter, Donna Summer, Michael Jackson, Richard Pryor - Live In Concert, Roots: The Next Generations. 1 "My Sharona" - The Knack 2 "Bad Girls" - Donna Summer 3 "Le Freak" - Chic 1. Kramer vs. Kramer 2. The Amityville Horror 3. Rocky II 1 60 Minutes 2 Three's Company 3 That's Incredible! 1978: It's a Bird, It's a Plane, ...It's Superfreak! - Spcl. Gst. Barbara Feb 1, 2019 Topics: Muhammad Ali, Rick James, The Wiz, Max Robinson (TV). 1 "Shadow Dancing" - Andy Gibb 2 "...

2019-04-012h 17

Afro Pop RemixThe Seventies: Ooh Wee! - Spcl. Gst. LarryA detailed look at black, African-American, culture during the "Seventies". (1970-1979) (Bonus Artists: Luck Pacheco) 1979: When MJ Was Black - Spcl. Gst. Ed Mar 1, 2019 Topics: Jimmy Carter, Donna Summer, Michael Jackson, Richard Pryor - Live In Concert, Roots: The Next Generations. 1 "My Sharona" - The Knack 2 "Bad Girls" - Donna Summer 3 "Le Freak" - Chic 1. Kramer vs. Kramer 2. The Amityville Horror 3. Rocky II 1 60 Minutes 2 Three's Company 3 That's Incredible! 1978: It's a Bird, It's a Plane, ...It's Superfreak! - Spcl. Gst. Barbara Feb 1, 2019 Topics: Muhammad Ali, Rick James, The Wiz, Max Robinson (TV). 1 "Shadow Dancing" - Andy Gibb 2 "Night Fever" - Bee Gees 3 "You Li...

2019-04-012h 18

The Works PodcastPreparing Individuals For Workplace ReadinessIn this episode, we speak with two experts in the area of youth training programs in helping prepare individuals for workplace readiness: Youth and Data Specialist, Angela Libkie of GST Michigan Works! and James Avery, Director of Education and Training of the Flint and Genesee Chamber of Commerce. Angela Libkie highlights the STEP Into Work program. STEP (Summer Training and Employment Program) is designed to help get individuals ages 18-24 who are currently not working get proper training, career exploration and paid real-world work experience. This program starts in May, work experience starting in June with a t...

2019-02-2544 min 2019-01-0902 min

2019-01-0902 min 2019-01-0804 min

2019-01-0804 min 2019-01-0501 min

2019-01-0501 min 2019-01-0410 min

2019-01-0410 min

The Works PodcastApprenticeship Readiness With Wanda BigelowIn this episode, we talk with Wanda Bigelow, Apprenticeship Success Coordinator on highlighting the benefits of the Apprenticeship readiness program. Apprenticeship readiness is designed to prepare young people and transitioning adults to enter and succeed in the workforce gaining hands-on experience. This program is a gateway to good middle-class jobs in the US construction industry.Using different training centers, all students get introduced to the trade positions offered by local unions. When in training, they are given all of the skills they need; including life skills modules like personal values, financial literacy and money management. At the...

2018-12-1713 min

preferredclientservices's podcastTip of the day #22 - Managing Your GST– GST out of sight out of mind… in the bank Ah the torture of GST tax time! The pressure to pay back money you probably no longer have… Next year, WHY NOT GET PREPARED?!! Start a separate bank account for your GST at another bank…so you won’t be tempted to touch it. What you don’t use, you can’t lose. Transfer the 5% you collect on every sale to this account before making any other outgoing payments. It quickly adds up...

2017-05-0801 min