Shows

Empowering Healthy Business: The Podcast for Small Business Owners#51 New Developments Impacting 2025 Year-End Tax Planning with Greg ReedAs 2025 wraps up, smart business owners are already preparing for tax season.In this episode of the Empowering Healthy Business Podcast, Calvin Wilder speaks with Greg Reed, Head of Tax at SmartBooks and Certified Tax Coach, about the latest developments affecting 2025 year-end tax planning.Greg explains how to use new rules and deductions to reduce your tax burden and plan confidently before December 31.💡 In This Episode:100% bonus depreciation vs. Section 179 — which to useSALT cap increase and PTET strategies for high-income ownersWhat’s changin...

2025-11-1126 min

Empowering Healthy Business: The Podcast for Small Business Owners#36 Tax To Dos After April 15thThink tax season is over? Think again. In this episode, Cal sits down with tax expert Greg to talk about what savvy business owners should be doing after April 15th. From maximizing deductions to planning for upcoming tax law changes, this conversation is packed with insights for those who want to stay ahead—not just compliant.Greg shares real-world strategies to avoid tax-time surprises, reduce penalties, and keep more of your hard-earned cash. Plus, he breaks down estimated taxes, business structure reviews, and how to fund retirement accounts strategically. He even clears up myths around the home of...

2025-04-1520 min

The HR Mentor#97: Inclusive Leadership and the Power of Connection with Greg MorleyIn today’s episode, I had the absolute pleasure of sitting down with Greg Morley, a seasoned global HR executive, DEI strategist, author, and speaker, who brings over two decades of experience from companies like Disney, LVMH Moët Hennesy, and Hasbro. Greg’s journey is one of bold decisions, adventurous career pivots, and a deep commitment to inclusive leadership. From starting in a call center at GE to leading HR and DEI in Paris, Hong Kong, and Shanghai, Greg shares the wisdom and lessons he’s gathered along the way. Trust me—this conversation will leave you feeling inspired...

2025-04-1052 min

Empowering Healthy Business: The Podcast for Small Business Owners#35 Beneficial Ownership Reporting Update and Tax Planning WinThe US Treasury Department announced a major change to beneficial filing requirements affecting most small business owners in the U.S. In this episode, Greg Reed, head of tax at SmartBooks, shares important updates. He also shares a tax planning success story about how he saved a client $29,000 in tax.We also discuss important informational filings that still must be made by many U.S. businesses that do business internationally that have major penalties if not done.Reach Greg Reed at greed@smartbookstax.com or book a meeting with him at smartbookstax.com.

2025-03-0309 min

The Front Porch ShowMending Greg's Broken HeartShelia has left Greg again and Greg asks the Front Porch Crew to help get her back. Enjoy the Valentine's Show on the Front Porch.

2025-02-1428 min

Empowering Healthy Business: The Podcast for Small Business Owners#34 Benefits of Proactive Tax Planning vs. Reactive Tax FilingI’m excited to announced that SmartBooks Head of Tax Greg Reed is now officially a Certified Tax Coach. Tax planning and minimization has been a core part of our tax practice. With advanced study with the American Institute of Certified Tax Planners, Greg will be able to do even more to help business owners pay less tax.More specifically, this episode includes:Accountants, CPAs, and other roles to fill in your accounting teamBenefits of working with a Certified Tax Coach The right time to do tax planningTax tactics vs. a comprehensive tax strategyGreg saves a Sma...

2025-02-1119 min

The Health Detective Podcast by Functional Diagnostic NutritionThe Life-Saving Benefits of Molecular Hydrogen w/ Greg the Hydrogen ManIn this episode of the Health Detective Podcast by Functional Diagnostic Nutrition, host Evan Transue, AKA, Detective Ev interviews Greg The Hydrogen Man!

Greg opens up about his incredible journey from facing serious health challenges, including tumors, autoimmune issues, and a heart condition, to completely turning things around with molecular hydrogen therapy. They break down the science behind hydrogen therapy and how it can support anti-aging, protect against EMF radiation, and even boost fertility. Greg also highlights the importance of clean water and shares the best practices and tools for safely using hydrogen.

With over 400...

2025-01-091h 04

Empowering Healthy Business: The Podcast for Small Business Owners#32 - Beneficial Ownership Filing Requirement Update and Preparing for Year End Tax FilingsWithin the past week, the Beneficial Ownership Information (BOI) filing requirement was both reinstated and then suspended again, pending further legal review. Greg Reed provides an update on the current status of the BOI fiing requirement and his filing recommendations.Greg also provides advice on gathering documentation to make your annual income tax filings as efficient as possible and explains that while you can extend the deadline to file your tax returns, you still need to pay tax by the initial deadline to avoid penalties and interest.Reach Greg Reed at smartbookstax.com or greed...

2025-01-0214 min

The HIP: The Housing Industry PodcastWhat’s Holding Back the Housing Workforce—and How to Fix It With Greg ReedThe skills gap in the housing sector is widening by the day. How can we bridge that gap and build a future-ready workforce?In this episode, Greg Reed, Group Chief Executive at Places for People, shares hisviews on why the sector struggles to attract talent and the forward-thinkingstrategies he's using to tackle these challenges.With a background in banking and financial services, Greg brings a fresh perspective to the UK’s largest social enterprise focused on affordable housing and community development. He shares how Places for People is addressing the skills ga...

2024-12-1129 min

Empowering Healthy Business: The Podcast for Small Business Owners#29 - Suspension of Beneficial Ownership Filing RequirementsA federal court in Texas issued a preliminary injunction suspending the enforcement of the new beneficial ownership reporting requirement. While this ruling provides relief for small business owners, it is TBD whether the reporting requirement will be rescinded or reinstated. In this brief update episode Greg Reed, head of tax at SmartBooks, shares his thoughts and recommendations around this issue. Reach Greg Reed at smartbookstax.com or greed@smartbookstax.com.Send us a textThanks for listening! Host Cal Wilder can be reached at:cal@empoweringhealthybusiness.comhttps://www...

2024-12-0905 min

Empowering Healthy Business: The Podcast for Small Business Owners#28 - Post-Election Tax Update and Year-End Tax PlanningThe incoming administration of President-Elect Donald Trump will bring significant changes to the tax code. Given that he can’t run for re-election for a third term and may thus feel more free to act on his principles than if he had to secure votes for re-election, there is the potential for some very large changes. In this episode Greg Reed, head of tax at SmartBooks, shares his insights into potential changes to the tax code. We also discuss the opportunity for year-end tax planning as we enter December. More specifically, this episode includes:Extension of the...

2024-12-0217 min

Common Cents The PodcastFrom Construction to Financial Clarity: Greg Hancock on Building Wealth and TrustIn this insightful episode of Common Cents The Podcast, Garrett Reed sits down with Greg Hancock, a former construction manager turned financial advisor, to discuss his journey into financial advising and his mission to help others achieve financial independence. Greg shares practical strategies for managing cash flow, building trust, and planning for life's uncertainties. With a focus on personalized financial coaching and relationship-driven advising, this episode offers valuable tips on budgeting, investment planning, and achieving long-term financial success.SEO Keywords: #GregHancock, #financialadvising, #financialadvisor, #fiduciary, #money, #moneymanagement, #advisor, #cashflow, #cashflowmanagement, #financialindependence, #budgeting, #GarrettReed, #CommonCentsThePodcastHighlights:Fr...

2024-11-292h 02

Tax Trails: Navigating Tax Matters with Larson & CompanyTax Provisions (ft. Greg Denning, CPA)Join Derek and Spencer as they interview Greg Denning, managing partner at Larson & Company. Greg has a long background of preparing income tax provisions for large companies and shares insights regarding the types of differences (temporary vs. permanent), considerations around NOLs, timing of provisions, and other valuable information.

2024-11-2022 min

Priority TalkSenate Pro-Tem Greg Reed to Step DownGreg Davis talks about Alabama Senate Pro-Tem Greg Reed potentially stepping down and what that could mean for Alabama politics.

2024-11-1523 min

Empowering Healthy Business: The Podcast for Small Business Owners#24 - Beneficial Ownership Reporting Requirements: New in 2024There is a new federal filing requirement for 2024 that new and existing businesses must comply with, or else face hefty fines. Businesses are required to report the identities of their Beneficial Owners. This filing is typically made by tax CPAs or attorneys and must be kept updated. Greg Reed helps us navigate these new requirements.More specifically, this episode includes:What is Beneficial Ownership?Beneficial Ownership is reported to a federal government agency (different from the IRS)Penalties for failing to file and filing deadlinesHow to file reportsThe need to file informational updates Next steps for b...

2024-10-0817 min

CinemAddictsAnand Tuker, The Critic, The 4:30 Movie, Austin Zajur, Nicholas Cirillo, Siena Agudong, Reed NorthrupFor this interview installment, CinemAddicts co-host Eric Holmes interviews The Critic filmmaker Anand Tucker and The 4:30 Movie actors Austin Zajur, Nicholas Cirillo, Reed Northrup, and Siena Agudong.

The Critic poster/photos courtesy of Greenwich Entertainment

The 4:30 Movie poster/photos courtesy of Ralph Bavaro / Saban Films.

Both movies hit theaters Friday, September 13, 2024.

YouTube Channel: https://www.youtube.com/c/CinemAddicts

Facebook Page: https://www.facebook.com/thecinemaddicts

CinemAddicts Facebook Group: https://www.facebook.com/groups/cinemaddictspodcast/

Email: info@findyourfilms.com.

Find Your Film: https://findyourfilms.com/

Shop our CinemAddicts Merch store: https://www...

2024-09-1124 min

IGNITE RADIO LIVE PODCASTEPISODE 432: Catholic Women's Night with Kelly ReedEPISODE 432: Catholic Women's Night with Kelly Reed

Kelly Reed, wife and once-very-reluctant mother of eight, shares her moving, honest, authentic story of transformation and wisdom from decades of parenting and grandparenting.

Also in this episode, we dive into the Gospel:

"I am the living bread..." (John 6:41-51)

And we discuss consequential news stories from The Loop (https://join.catholicvote.org/43908073/)

Be challenged. Be encouraged. Be blessed.

LISTEN NOW! SHARE!

WE NEED YOU! WE ARE PRAYING FOR FAITHFUL to respond to the call to be more than merely religious consumers but multipliers. Beginning in September, we'r...

2024-08-0757 min

The 95 Podcast: Conversations for Small-Church PastorsIs It Time To Become A Life Coach? (w/ Jon Sanders & Greg Reed) - Episode 237In today's episode of The 95Podcast, Jon Sanders talks with guest Greg Reed about his journey from pastoring to an incredible new season of ministry called “workplace life coaching.” With over four decades of pastoral ministry experience and a passion for reaching others,Greg transitioned to a workplace life coach role, bringing faith into the marketplace. From car dealerships to Coca-Cola distribution sites, he's impacting lives and boosting business environments. Learn how he's turning ministry into a thriving business model and get inspired by his story of faith, mentoring, and real success in corporate America.Show Notes: https://www.9...

2024-06-1147 min

The 95 Podcast: Conversations for Small-Church PastorsIs It Time To Become A Life Coach? (w/ Jon Sanders & Greg Reed) - Episode 237In today's episode of The 95Podcast, Jon Sanders talks with guest Greg Reed about his journey from pastoring to an incredible new season of ministry called “workplace life coaching.” With over four decades of pastoral ministry experience and a passion for reaching others,Greg transitioned to a workplace life coach role, bringing faith into the marketplace. From car dealerships to Coca-Cola distribution sites, he's impacting lives and boosting business environments. Learn how he's turning ministry into a thriving business model and get inspired by his story of faith, mentoring, and real success in corporate America.Show...

2024-06-1147 min

EntrePastorsPastoring in the Marketplace with Greg Reed (#194)In this episode of the EntrePastors Podcast Jon talks with returning guest Greg Reed about his journey from pastoring to an incredible new season of ministry called “workplace life coaching.” With over four decades of pastoral ministry experience and a passion for reaching others, Greg transitioned to a workplace life coach role, bringing faith into the marketplace. From car dealerships to Coca-Cola distribution sites, he's impacting lives and boosting business environments. Learn how he's turning ministry into a thriving business model and get inspired by his story of faith, mentoring, and real success in corporate America. Guest...

2024-05-2451 min

Secrets for SuccessEpisode 44: Reed Floren’s Blueprint to Dominating Digital Marketing with AIIn this episode, host Greg is joined by online marketing maven Reed Floren, who shares his journey from a teenager exploring the digital realm to becoming a master of affiliate marketing and AI automation. Discover Reed's insights on leveraging AI tools like ChatGPT to revolutionize content creation, list building, and affiliate marketing with minimal effort. Tune in to learn how you can harness the power of AI to amplify your online presence, even if you're a team of one.

00:00 - Introduction

02:06 - Reed Floren

04:14 - Starting Online

11:55 - Affiliate M...

2024-02-2951 min

Triathlon TherapyGreg Bennett chats with Reedy and Clint on the Olympics, Surf Ironman, worst racing stories, Enhanced Games, PTO v Ironman, Kona, managers in triathlon and keeping a winning mindsetGreg Bennett chats with Reedy and Clint on;- Who is Greg? (0.04.00)- Regrets (0.10.40)- Olympics (0.11.30)- Training weight (0.14.45)- Surf Ironman (0.16.10)- Worst race stories (0.19.15)- Enhanced Games (0.26.45)- PTO’s T100 Series (0.34.30)- Ironman Series (0.38.4)- Is Kona safe? (0.41.10)- Triathlon managers (0.43.47)- Chip on the shoulder effect (0.54.00)You can now buy your Triathlon Therapy Mug and get another one free. This purchase comes with a one time use discount code as Aid Station. Use the link below to get your mug today:TrTherapy (stripe.com)

2024-02-1959 min

The Shooter's MindsetThe Shooter’s Mindset Episode 429 Luke Keller & Zach Reed Mammoth Sniper Challenge WinnersJen, Greg, and Cory chat with Luke Keller and Zach Reed after their win at the 2024 Mammoth Sniper Challenge at Ft. Eisenhower GA

2024-01-181h 18

Coon Hunting Confidentials PodcastCHC Ep #55 "The Grand American, Greg Reed, and A Cryptid Creature At The Top Of The World"Send us a textWelcome to episode 55 of Coon Hunting Confidentials!Every other Wednesday, The HT Mafia mixes their uniqueness, coon hunting, comedy, and creepy stories to bring you all-new episodes of CHC!!In this episode, the HT Mafia starts off the show with their unique back and forth banter. You never know where the conversation will lead. In this episode they discuss the Grand American coon hunt, their theories on the Plott dogs history, and and much more before getting into the conversation with Greg Reed. Greg is a coon hunter and preacher from...

2024-01-171h 44

SOUL FARMEREpisode #15 | Greg Reed | Lifestyle Evangelist & Life CoachA recurring theme this week, it’s all about obedience to what God says. Crystal and Jen had a great conversation with a true heart surgeon, Greg Reed. A home-grown local who has been giving back to this community for generations. He’s a true lifestyle evangelist serving in a ministry of presence.After 40+ years as pastor at Morning Star Church (Now the Connection), Greg launched a new career. Now he talks to people for a living – meeting them where they are (literally at their workplace). His vision is like that of a restaurant. He’s been running a re...

2023-11-2449 min

IGNITE RADIO LIVE PODCASTEPISODE 399: RE-IGNITE PROPHETIC EVENING of WITNESS, WORD & WORSHIP | Franciscan Friars of the Renewal, Seph Schlueter, Fr. Malachy, Aiden Reed [SANCTUS SERIES]EPISODE 399: RE-IGNITE PROPHETIC EVENING of WITNESS, WORD & WORSHIP (Part 1) | Franciscan Friars of the Renewal, Seph Schlueter, Fr. Malachy, Aiden Reed [SANCTUS SERIES]

Join us in an incredible evening of prophetic witness, word, and worship led by the Franciscan Friars of the Renewal with worship by Seph Schlueter, and an authentic, truly powerful witness by Aiden Reed that speaks to this generation. (Part 1. Go to IGNITE Radio Live Episode 400 for Part 2.)

We are living in a very consequential time. A battle for everything. With eternal consequences. Grace is being outpoured. Over the next weeks leading into...

2023-11-1057 min

Empowering Healthy Business: The Podcast for Small Business Owners#7 - Navigating State and Local TaxesAre you ready to conquer the labyrinth of state and local taxes in the United States? We'll arm you with the knowledge you need in our conversation with Greg Reed, the tax partner at SmartBooks Tax and Advisory. With each of the 50 states brandishing unique tax rules, business owners can be facing a sizeable obligation. Listen in as we dissect the multitude of taxes - from sales to income and the seemingly infinite list that follows. A simple venture into tax compliance can quickly turn into an uphill climb. Together with Greg, we unveil the challenges in...

2023-09-1254 min

The Greg Bennett ShowTim Reed - Ironman 70.3 World Champion - Elite CoachTim Reed is a true legend of the triathlon world. He is an Australian superstar with an impressive resume that includes over 80 professional podium finishes, 23 Ironman 70.3 wins, the Ironman Australia Championship, and his crowning achievement of the Ironman 70.3 World Championship in 2016.

He joined us on the show almost two years ago to the day, in episode 90. Since then, he's transitioned into a full-time coach and more recently started his own podcast, the Triathlon Therapy podcast.

We recap his remarkable journey and then dive deep into the state of the sport. Covering major events like the 2023...

2023-08-281h 17

EntrePastorsHow to Become a Workplace Life Coach - with Greg Reed (#101)Greg Reed served one church in pastoral ministry for over 40 years. At some point along his pastoral journey, he began to serve in a chaplain role in the marketplace. A few years ago, Greg launched his own business as a “workplace life coach.” He has been thrilled to discover a new season of ministry in which he gets to do all the things he loved so much about pastoring, but also makes a income far greater than anything he’d ever known in the church world. Greg is soon launching a cohort where he will be teachin...

2023-07-2857 min

Empowering Healthy Business: The Podcast for Small Business Owners#3 - Top Tactics for Small Business Owners to Pay Less TaxExplore approaches and tactics that small business owners can employ to pay less tax with Greg Reed.Connect with Greg at:smartbookstax.comSend us a textSponsored by SmartBooks. To schedule a free consultation, visit smartbooks.com.Thanks for listening! Host Cal Wilder can be reached at:cal@empoweringhealthybusiness.comhttps://www.linkedin.com/in/calvinwilder/

2023-06-261h 04

Wealth Code Secrets#268: Episode 268 - How To Use AI To Grow Your Healthcare Business With Reed FlorenHow To Use AI To Grow Your Healthcare Business With Reed Floren

Let’s Connect...

Website: https://gregtoddtv.com/

Free Mentorship: https://www.facebook.com/groups/mentorwithgreg/http://bit.ly/mentorwithgreg

Instagram: https://www.instagram.com/gregtoddpthttp://bit.ly/gregtoddinstagram

Subscribe to my new Youtube Channel:

Greg Todd

Follow Reed Floren on IG: @ReedFloren

Join us in sunny Clearwater Beach, Florida for SSHC Live 2023!

SSHC Live 2023

2023-05-1827 min

IGNITE RADIO LIVE PODCASTEPISODE 378: YOUNG CATHOLIC PROFESSIONALS with Jack Kelly, Aiden Reed, and John Paul SchlueterEPISODE 378: YOUNG CATHOLIC PROFESSIONALS with Jack Kelly, Aiden Reed, and John Paul Schlueter

Join this invigorating conversation with Aiden Reed, Jack Kelly, and John Paul Schlueter at a corner pub at the intersection of young adults, business, and faith... with great testimonials, insight on our contemporary young adult culture, including impulse living, lust, godly manhood, and the call to sainthood. Young Catholic Professionals (TOLEDO SITE): "We offer a generation of restless young workers in their 20s and 30s a way to go deeper in faith, life, and work. Together, we seek authentic friendships, a richer sense of...

2023-05-1659 min

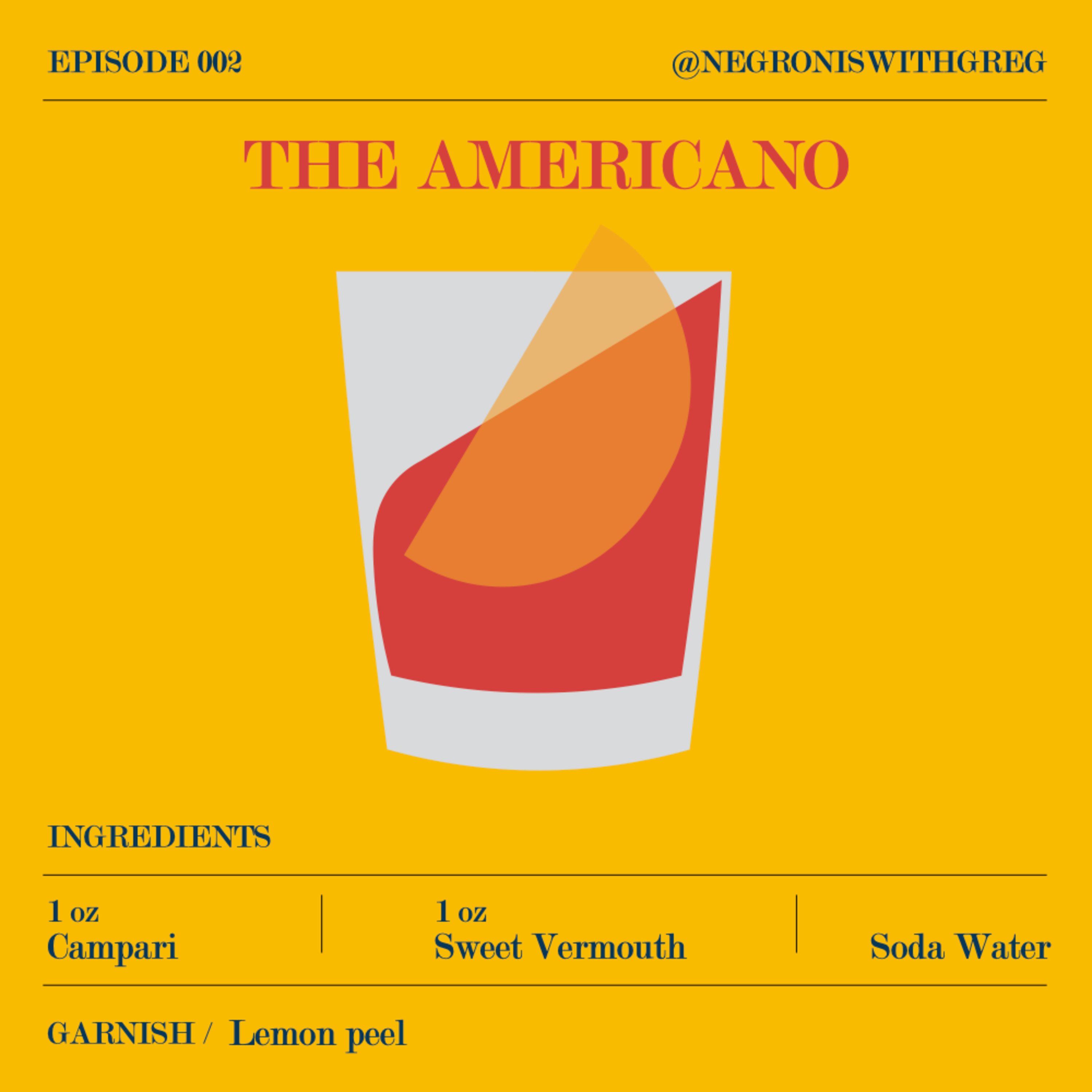

Negronis With GregNegronis With Greg - Episode 004 (The Rum Negroni)Over the last couple of years, we talked about doing some fun video or live chat to talk about different versions of the drink we had concocted, rare bottles we had stumbled upon, or use it as an excuse to pour a cold one and chop it up. Well, Greg moved from Chicago to Orlando, schedules become surprisingly more complex, and we never found time. Fast forward to this spring WM Brown’s own Matt Hranek (@Matthranek) released a book, ‘The Negroni A Love Affair with a Classic Cocktail,’ and it got us talking about Negroni’s again.

Over t...

2023-03-1626 min

Negronis With GregNegronis With Greg - Episode 003Over the last couple of years, we talked about doing some fun video or live chat to talk about different versions of the drink we had concocted, rare bottles we had stumbled upon, or use it as an excuse to pour a cold one and chop it up. Well, Greg moved from Chicago to Orlando, schedules become surprisingly more complex, and we never found time. Fast forward to this spring WM Brown’s own Matt Hranek (@Matthranek) released a book, ‘The Negroni A Love Affair with a Classic Cocktail,’ and it got us talking about Negroni’s again.

Over t...

2023-02-0831 min

The Impact Room - Conversations That Shape Exceptional LeadershipEpisode 9 - Greg Reed, CEO Homeserve and Places For PeopleThe Impact Room welcomes Greg Reed, Board Director, Advisor and Former CEO of HomeServe UK, presently CEO of Places for People, ex Bank of New York.

Hear from Greg on how best to progress your board career.

The benefits of sideways moves and learning...

Look after your people and they will look after your customers and the rest will look after itself...

What are the most critical traits to success to be a successful board level leader, authenticity, being the best version of yourself, inspirational leadership.

The Impact Room – Wh...

2023-01-2514 min

Negronis With GregNegronis With Greg - Episode 002Over the last couple of years, we talked about doing some fun video or live chat to talk about different versions of the drink we had concocted, rare bottles we had stumbled upon, or use it as an excuse to pour a cold one and chop it up. Well, Greg moved from Chicago to Orlando, schedules become surprisingly more complex, and we never found time. Fast forward to this spring WM Brown’s own Matt Hranek (@Matthranek) released a book, ‘The Negroni A Love Affair with a Classic Cocktail,’ and it got us talking about Negroni’s again.

Over t...

2022-11-2223 min

Leaders In PaymentsFinancial Inclusion: Reed Luhtanen & Gail Hillebrand, Faster Payments Council | Episode 191It’s financial inclusion month! And in this 4th episode of the month we have two top-notch experts discussing one of the main drivers for financial inclusion: faster payments. With me today are Faster Payments Council Executive Director Reed Luhtanen and National Consumers League Representative Gail Hillebrand have much to say about financial inclusion and so much more!Coming to us with more than 40 years of combined experience in the payments industry, Reed himself was a part of the Federal Reserve task force payments initiative to create an overall governance framework for the transition to faster payments in...

2022-10-2025 min

Greg Klein's Old School Rasslin TalkEpisode 10: The Butch Reed tributeEpisode 10: The Butch Reed tributeIn Episode 10 of Greg Klein's Old School Rasslin Talk, Greg:Talks about one of his territory favorites, Hacksaw Butch Reed. Traces his love to Reed to a magazine article about his success in Florida. Looks at the first half of Reed's career, including his Central States pedigree, start in Vancouver, first trip to Georgia, big star push in Florida, return to Georgia as a star, and, of course, his three great years in Mid South. Focuses on Reed's NWA title shots against R...

2022-10-151h 14

Negronis With GregNegronis With Greg - Episode 001Over the last couple of years, we talked about doing some fun video or live chat to talk about different versions of the drink we had concocted, rare bottles we had stumbled upon, or use it as an excuse to pour a cold one and chop it up. Well, Greg moved from Chicago to Orlando, schedules become surprisingly more complex, and we never found time. Fast forward to this spring WM Brown’s own Matt Hranek (@Matthranek) released a book, ‘The Negroni A Love Affair with a Classic Cocktail,’ and it got us talking about Negroni’s again.

Over t...

2022-10-1212 min

Negronis With GregNegronis With Greg - Episode 000Over the last couple of years, we talked about doing some fun video or live chat to talk about different versions of the drink we had concocted, rare bottles we had stumbled upon, or use it as an excuse to pour a cold one and chop it up. Well, Greg moved from Chicago to Orlando, schedules become surprisingly more complex, and we never found time. Fast forward to this spring WM Brown’s own Matt Hranek (@Matthranek) released a book, ‘The Negroni A Love Affair with a Classic Cocktail,’ and it got us talking about Negroni’s again.

Over t...

2022-09-1502 min

The Dreaded Archer PodcastEpisode 10: Greg Gondella Jr.Trey chats with the host of Rack and Rod Chronicles and owner of High Tines Archery and Outdoors Greg Gondella Jr. Greg shares his knowledge of the archery industry, self filming, and reflects on his journey to opening his own archery shop.

2022-03-311h 07

Investing In The U.S.RG 301 - From Basketball Coaching to Capital Raising: Why I Made the Switch – w/ Greg LyonsFor this week’s episode, we have former university basketball coach, Greg Lyons, walk us through how they help real estate professionals create passive income. Click on that ‘Play’ button to learn more about capital raising, passive income, wealth generation, and more!

Greg Lyons is a former basketball coach who used to lead university basketball teams to victory. In 2020, Greg and his brother Tim Lyons started Cityside Capital, a real estate capital raising firm that helps other real estate professionals make the most out of their investment dollars. More than that, Greg is the co-host of The Passive Income Brothers, a podc...

2022-03-2340 min

Pool Chasers PodcastEpisode 183: @pool_volution - Turning Over a New Leaf and Embracing Positivity with Brandon Reed Episode Summary: Today, we speak with Brandon Reed, owner of Pool Volution. He sits down to talk about what drives him to provide insight and education to fellow pool pros and why he believes that business ownership is the key to making a serious living out of a career in this industry. Brandon then explains what led him to establish Pool Volution. He admits that the brand began simply as a way to “prove himself” to those who doubted his potential, but later, as his audience grew, his motivation changed to something more selfless. “Than...

2022-01-031h 06

Bearded Comic Bro PodcastEpisode 95: Interview with Reed Tucker (author of SlugFest: The 50 Year Battle Between Marvel and DC)Bearded Comic Bro got to sit down and talk with Reed Tucker. Reed is the author of Slugfest: Inside the Epic 50- Year Battle between Marvel and DC.He looks at how over the years, the companies have deployed an arsenal of schemes in an attempt to outmaneuver the competition, whether it be stealing ideas, poaching employees, planting spies, ripping off characters or launching price wars. Sometimes the feud has been vicious, at other times, more cordial. But it has never completely disappeared, and it simmers on a low boil to this day.Make sure you w...

2021-11-0231 min

The Greg Bennett ShowTim Reed - Australian Ironman 70.3 World Champion & Coach - 2021 IM 70.3 Predictions

Today, I’m joined in the studio by Tim Reed. Tim has over 80 professional podium finishes, winning 23 Ironman 70.3 distance events, add to that Ironman Australia, and in 2016 won the Ironman 70.3 World Championships on home soil on the Sunshine Coast. Queensland, Australia.

Somehow, he’s able to balance his professional racing with his wife and raising their three young boys.

It’s been a pleasure watching him win so consistently over the years. And now I get to sit with him in the studio.

In this episode, we discuss Tim's journey and his process, we dissect the Ironman 70.3 World Championships and we have s...

2021-09-161h 27

Mission in 52021 Region Expo Guests J.D. and Rhonda ReedJ.D. and Rhonda Reed are Global Servants for International Ministries to Santa Cruz, Bolivia.

They work primarily with the House of Hope. Rhonda a nurse with multiple medical certifications, leads the House of Hope a ministry that provides a variety of health and development ministries in urban contexts. JD trains and equips missionaries, pastors, and leaders in his role as a regional consultant for theological education and partners with Palmer Seminary in the United States to provide masters degrees in Latin Studies in Spanish and Portuguese

We have invited JD and Rhonda to Mission...

2021-09-0931 min

The Business Alabama PodcastBusiness Alabama, Episode 11: Director Bill Poole and Sen. Greg Reed on the Alabama Innovation CommissionAlabama Finance Director Bill Poole and Sen. Greg Reed talk about the Alabama Innovation Commission, the statewide entrepreneurship and innovation commission that they lead.

2021-08-2327 min

The Word With G PodcastFrank Reed-UTC Softball 2021 Season in Review 5-17-21The 2021 season has come to a close for the UTC Mocs softball team and despite not defending their 2019 SoCon Title by winning the tournament this season there are a lot of positives that coach Reed can take from this young team as they head into the future...He and G get into that along with what went wrong for his team in the SoCon Tournament, how they teach to attack a tricky rise ball, what he thinks most about this past season, how the off-season plays out from here until August, and much more.

2021-05-1722 min

The Word With G PodcastFrank Reed-Mocs Playoff Push in Final Weekend 5-3-21The UTC Mocs softball team had the week off last week with no games before they attack a potential playoff spot this coming weekend as they host Samford. This week, coach Reed joined G to talk about how the girls stayed sharp with the week off, focusing on academics, how he spent the weekend off, his Golden Gloves boxing past, and much more.

2021-05-0319 min

The Church Digital PodcastBETA22: Greg Atkinson & Tips from an Online Secret ShopperFounder of The First Impressions Conference, and one of the early Church Online guys, Greg is an expert in Church Guest Services, physical & digital. What are visitors looking for in digital church?

Like the BETA SHOW? Check out more episodes here.

Complete Show Notes Available on THECHURCH.DIGITAL.

2021-04-221h 07

The Word With G PodcastFrank Reed on Mocs Winning Below the Surface 4-19-21This week during the conversation with UTC Mocs head softball coach Frank Reed, he and G discussed that despite losing three tough games to UNC Greensboro that he feels that the team was actually able to show really well, he talks about how the team won in other ways, how he views this team, what's upcoming for them this week, and much more.

2021-04-1918 min

On Sight - The OnSight Eyes PodcastOnSight Spotlight - Wendy Reed, the "Mayor" of Schneider ElectricThis week Jeff and Greg had the pleasure of speaking with the wonderful Wendy Reed, the Site Administrator for the Andover R&D Center of Schneider Electric, (and self-described "Jill of all trades"), about her passion and enthusiasm for caring for her employees, the value of on-site services in general, and she even pitched a new OnSight Eyes business model! Hint: it involves backyard BBQ's :)

2021-04-1616 min

The Word With G PodcastThe Word With G: Frank Reed, Mocs Drop 2/3 at Mercer 4-12-21This week on a Mocs Monday UTC head softball coach Frank Reed joined the show to talk about what happened this past weekend as the Mocs dropped two of three at Mercer, the situational hitting wasn't there which hurt but the pitching kept them in two games and the defense has been much better for UTC.

2021-04-1210 min

Digital Marketing Masters Podcast159 - Getting Smarter Books and Saving on Taxes with Greg ReedWho doesn't like paying less tax? It's time to stick it to the man with Greg Reed and how tax planning and better books (and some legal tactics) can help you claw back more from the tax-man.

Smartbooks: https://www.SmartBooks.com

Have a Virtual Coffee with Greg: https://calendly.com/gregoryreed/virtualcoffee

Digital Marketing Masters Podcast: https://hookseo.com/podcast

2021-03-1623 min

Greg's Garage Pod w/Co-Host Jason PridmoreEp116 - MotoGP Chat with Chad Reed, Battle of the Olds Star David Kolb, ARAI News and more!Greg's Garage Pod with Co-Host Jason Pridmore - A motorcycle racing Pod about MotoGP, MotoAmerica, and World Superbike, Pro Motocross, American Flat Track, Supercross, and more. In this episode, Co-Hosts Greg White and Jason Pridmore talk:

Battle of the Olds - An update about the Greg vs. David race coming up at Chuckwalla with a surprise for Jason Pridmore.

ARAI Helmets News - MotoAmerica homologates Aprilia RS 660 for Twins Cup, Rodio returns, Altus Motorsports fields two in Supersport, Jigalov returns to the US on a liter bike, Lowes to miss test, Roberts and Be...

2021-03-031h 08

Greg's Garage Pod w/Co-Host Jason PridmoreEp115 - Chad Reed on the Orlando 2 Red Flag, MotoGP Roster, ARAI News and more!Greg's Garage Pod with Co-Host Jason Pridmore - A motorcycle racing Pod about MotoGP, MotoAmerica, and World Superbike, Pro Motocross, American Flat Track, Supercross, and more. In this episode, Co-Hosts Greg White and Jason Pridmore talk:

ARAI Helmets News - Fausto Gresini passes away, Lochoff moves up and joins M4 ECSTAR Suzuki, Doyle stays with BARTCON, but moves up to Supersport, a new documentary about Joe Roberts' Moto2 season.

Supercross - Results and a chat about Orlando 2.

Supercross - Supercross Champ Chad Reed provides great insight into the 250 West first lap red flag incident.

2021-02-241h 11

CycologyEp 03: Greg LeMond has a new signature bike brand starting with two, cutting-edge e-Bike modelToday’s guest is the legendary Greg LeMond and he joins us to share some memories from his storied career and weigh in on the newest products in his signature brand! With many wins under his belt, including the Tour de France in 1986, 1989, and 1990, LeMond is considered by many to be the greatest American cyclist of all time. Our conversation begins on the subject of Greg’s brand, LeMond, and the various stages it went through on its evolution to where it is today. Greg talks about the wonder of e-bikes and shares some of the new technologies he is e...

2021-02-241h 05

The Business InfluencerFalling Share Price, Poor Marketing Reputation & Mis-selling Policies: Leading a Change in Organisational Culture - Greg Reed | Episode 5Welcome to The Business Influencer Podcast where we will interview and explore the success stories of entrepreneurs, business leaders, senior policymakers and get insights from thought leaders around the issues of the day.

In this episode, our host interviews Greg Reed, former CEO of Homeserve UK plc. He explains how he took a role in a business whose shares had plummeted by 28%, lambasted for its poor marketing and sales function and reputation for poor customer service. He discusses the importance of communication, clarity of vision, and ensuring that products are aligned to the customer journey.

2021-02-2358 min

The Voice of Alabama PoliticsSpecial Guest: Senate President Pro Tem Greg ReedGov. Ivey’s State of the State, education raises, mental health expansion, gaming talks, racist legislation and Regions Bank diversity program. Our special guest is Senate President Pro Tem Greg Reed.

2021-02-0728 min

The Voice of Alabama PoliticsSpecial Guest: Senator Greg ReedOur Special Guest is Senator Greg Reed, incoming President Pro Tem of the Alabama Senate.

2021-01-1828 min

Real CyberSecurityEpisode 24 - Guest: Brian Reed Talks Data Loss Prevention (DLP), and Working at GartnerBrian Reed is proof that you can be smart, nice, a great father, and successful in security. Brian is a long time Atlantan (the city in Georgia, not the underwater one) and has been doing security IBM, ISS, Gartner and Proofpoint. Brian talks about:- 2021 and the nexus between the upsides of DLP and the risks to privacy and surveillance if not done right.- Remote working and security.- Bill's dislike of open offices.- His experience at Gartner, overlapping with Bill and Greg. We each name the smartest non-security analyst at Gartner we w...

2021-01-1552 min

Franchise HoundsFranchise Opportunity: Woofies with Amy ReedJoining me today is Amy Reed. Amy is the Co-Founder of Woofies. Woofies is an award winning pet care franchise that provides pet sitting, dog walking and mobile grooming. Woofies was named one of the nation’s top 100 Small Businesses by the US Chamber of Commerce and their new Woofie’s Academy Pet Grooming School won Franchise Update Media’s 2020 Innovation AwardAmy and her co-founder were recently recognized as a Top 50 Woman of Wonder by Franchise Dictionary Magazine.I hope you enjoy toda...

2021-01-1536 min

Cash-on-Cash ConnectionsEpisode 6: Greg Reed - Associate Director of the James A. Graaskamp Center for Real EstateGreg Reed sits down with Real Estate Club at UW-Madison social chairs Blake and Luke to talk about his career experiences, from his relationship with the late Graaskamp to taking his first job in NYC and more.

2020-12-1141 min

Cougar Coburn PodcastInterview with Chief Ranger Greg ReedGreg Reed has impacted my life in so many ways. He's a leader and took me under his wing during my time at Craters. Thank you Greg, I hope this interview does you justice!

2020-11-0200 min

The Career Dad ShowBe kind to your future self, with Greg ReidGreg Reid is a 32-time best selling author; film maker; founder of The Secret Knock, he runs 6 businesses… and he even has a star on the Las Vegas Walk of Stars. But he’s also a proud dad. We talk about Greg’s upbringing and entrepreneurial spirit, the importance of seeking counsel, not opinion, and why the fear of judgement is holding us back.Contents1m 06s: What was it like growing up?3m 08s: 3 feet away from gold5m 45s: Seek counsel, not opinion8m 49s: Our dads spent 7 minute...

2020-10-1937 min

The Church Digital PodcastEP090: Greg Nettle & Digital Lessons Learned in this Global PandemicHey, it’s my birthday podcast! And for the second year in a row, we’re bringing in a special guest to celebrate my birthday. Last year it was my mom, talking about how she leads her two online small groups. Mom wasn’t available this year, so instead we got Greg Nettle, President of Stadia Church Planting to jump on the podcast.

What I love about Greg Nettle is the man is passionate about Digital Church. Oftentimes when I meet influential people in the church world, I have to cast vision to what a digital church can be...

2020-08-1751 min

Real Estate for the Rest of UsE31: Self-Storage Investing w/ Greg BondSelf-Storage Investing is a bit of a mystery to many investors. How do you get started? What are the benefits over the more conventional methods of Residential or Commercial investing? What are practical tips you can use to learn from the mistakes of others and not repeat them in your own business? Greg Bond is a veteran investor who breaks down all of this, and more, in his interview. If Self-Storage Investing is something you're looking into, get your notepad ready for this one! Don't forget to leave a rating or review on iTunes! It helps out the show...

2020-07-1744 min

Run Up The ScoreGreg Quick - Canadian Football League - Director Of Global ScoutingGreg Quick - CFL - Director Of Global Scouting talks to us about football in the CFL. From Game play, scouting, agents, and player selections.

2020-07-0236 min

The Church Digital PodcastEP073 - Greg Aukerman, Micro-churches, & Stairstepping Back to BuildingsWell, we're going back into the building. Or at least a small percentage of us are. Many, though, are opting to take a slower approach heading back into the space. Is there a different approach?

Churches like Saddleback and Elevation have been experimenting with Micro-locations for a while now, and this week we're having a conversation with another church who has been doing micro-church for almost five years now.

Greg Aukerman has served as the Director of Online Community for Crossroads Church (Cincinnati) off and on for a while now, and on his watch Crossroads...

2020-05-1857 min

The Church Digital PodcastEP072: Greg Atkinson: Physical Church, Church Online, & Why Toothpaste Won't Go Back in the TubeIf there's a lesson the church needs to learn in this Global Pandemic: Physical Church & Church Online need to learn to play together nicely. In the pre-COVID season of our life (that was merely two months ago) Physical Church was king of the hill, leaving Church Online as the red-headed stepchild. In the midst of COVID, Church Online is the only game in town as the Physical Church doors are literally locked, and let's be real... no one knows what's coming next.

What we do know is there's digital fatigue, which is understandable. We, humans of 2020, are...

2020-05-141h 02

The Church Digital PodcastEP068: Greg Nettle, DJ Soto, and The Foundation of a Virtual Reality ChurchWhat does a church look like in Virtual Reality? Greg Nettle, President of Stadia Church Planting and DJ Soto, Lead Pastor of VR Church... who's discipling and shepherding people in the digital community of Altspace VR (and Rec Room)... jump in on a conversation helping to redefine what the digital church looks like tomorrow... scratch that... what the digital church looks like today.

COMPLETE SHOW NOTE AVAILABLE AT THECHURCH.DIGITAL

2020-04-3059 min

The Greg Williams PodcastDePaul Forward Paul Reed Interview, AFC North Free AgencyNBA Prospect, Paul Reed, joins the podcast to talk with Greg Williams about the draft process, coronavirus and more.

2020-04-0227 min1050 BascomAdapting to a Covid-19 Economy with Greg ReedAdapting to a Covid-19 Economy with Greg Reed by 1050 Bascom

2020-04-0125 min