Shows

The Contrarian Capitalist PodcastJaime Carrasco - Money Momentum: Your Silver Lining for Life-Changing WealthToday’s distinguished podcast guest is Jaime Carrasco, Senior Portfolio Manager at Harbourfront Wealth Management.AUDIO IS AVAILABLE HEREPlease SUBSCRIBE, LIKE AND SHARE THIS PODCASTThis podcast episode covers:* Gold* Silver* The key Gold to Silver ratio to watch out for* Mining companies* The biggest wealth generating opportunity that is on our doorstep* Bond Yields and the warning signal that they are sending* Financial history and why it is fundamental to understand* Democracies and Republics...2025-07-2347 min

The Contrarian Capitalist PodcastJaime Carrasco - Money Momentum: Your Silver Lining for Life-Changing WealthToday’s distinguished podcast guest is Jaime Carrasco, Senior Portfolio Manager at Harbourfront Wealth Management.AUDIO IS AVAILABLE HEREPlease SUBSCRIBE, LIKE AND SHARE THIS PODCASTThis podcast episode covers:* Gold* Silver* The key Gold to Silver ratio to watch out for* Mining companies* The biggest wealth generating opportunity that is on our doorstep* Bond Yields and the warning signal that they are sending* Financial history and why it is fundamental to understand* Democracies and Republics...2025-07-2347 min Toronto News and InformationExploring Toronto's Vibrant Sunday: Art, Music, and Outdoor AdventuresWelcome to “Things to Do in Toronto” for Sunday, July 13, 2025! Whether you’re a local or just passing through, Toronto is buzzing with energy today, offering something for every taste and age. The city is waking up to a warm and muggy summer day, with mild haze in the air—perfect weather to get outdoors or enjoy the cool indoors if you need a break from the heat[8].Let’s dive into what’s making Toronto tick today. There’s a creative spirit in the air as the 64th annual Toronto Outdoor Art Fair wraps up at Nathan Phillips Squar...2025-07-1302 min

Toronto News and InformationExploring Toronto's Vibrant Sunday: Art, Music, and Outdoor AdventuresWelcome to “Things to Do in Toronto” for Sunday, July 13, 2025! Whether you’re a local or just passing through, Toronto is buzzing with energy today, offering something for every taste and age. The city is waking up to a warm and muggy summer day, with mild haze in the air—perfect weather to get outdoors or enjoy the cool indoors if you need a break from the heat[8].Let’s dive into what’s making Toronto tick today. There’s a creative spirit in the air as the 64th annual Toronto Outdoor Art Fair wraps up at Nathan Phillips Squar...2025-07-1302 min Soar FinanciallyUS Debt “Titanic” Sinking: Grab Gold Lifeboats! I Jaime CarrascoJaime Carrasco, Senior Portfolio Manager at Harbourfront Wealth Management, joins us for a no-nonsense breakdown of where we are headed: a global credit implosion, the devaluation of fiat currency, and a historic wealth transfer into gold and silver. He explains why 30% of your portfolio should be in precious metals, why silver will outperform gold, and how to protect your assets from the storm that’s already underway.#gold #silver #marketcrash ------------👨💼 Guest: Jaime Carrasco, Senior Portfolio Manager🏢 Company: Harbourfront Wealth🌎 https://www.harbourfrontwealth.com/ 𝕏 @IJCarrasco📅 Recording date: June 26th, 2025-------------------📆 Save the Date 📆DEUTSCHE GOLDMESSE November 14 & 15, 2025 in Frankfurt, Germanywww.deutschegoldmesse.com FREE R...2025-06-3041 min

Soar FinanciallyUS Debt “Titanic” Sinking: Grab Gold Lifeboats! I Jaime CarrascoJaime Carrasco, Senior Portfolio Manager at Harbourfront Wealth Management, joins us for a no-nonsense breakdown of where we are headed: a global credit implosion, the devaluation of fiat currency, and a historic wealth transfer into gold and silver. He explains why 30% of your portfolio should be in precious metals, why silver will outperform gold, and how to protect your assets from the storm that’s already underway.#gold #silver #marketcrash ------------👨💼 Guest: Jaime Carrasco, Senior Portfolio Manager🏢 Company: Harbourfront Wealth🌎 https://www.harbourfrontwealth.com/ 𝕏 @IJCarrasco📅 Recording date: June 26th, 2025-------------------📆 Save the Date 📆DEUTSCHE GOLDMESSE November 14 & 15, 2025 in Frankfurt, Germanywww.deutschegoldmesse.com FREE R...2025-06-3041 min Toronto News and InformationSummer Sizzle in Toronto: Dragon Boats, U2 Day, and Luminato BrillianceWelcome to 'Things to Do in Toronto' on this sunny Sunday, June 15, 2025 As we step into the heart of summer, Toronto is buzzing with energy, perfect weather, and a plethora of exciting events.Today, the city is alive with several notable events that cater to a wide range of interests. If you're looking for a dose of culture and tradition, the **37th Annual Toronto International Dragon Boat Festival** is a must-visit. Taking place along Toronto’s waterfront, this festival features dragon boat races, delicious food vendors, and vibrant cultural performances. It's a great spot to enjoy the city's di...2025-06-1503 min

Toronto News and InformationSummer Sizzle in Toronto: Dragon Boats, U2 Day, and Luminato BrillianceWelcome to 'Things to Do in Toronto' on this sunny Sunday, June 15, 2025 As we step into the heart of summer, Toronto is buzzing with energy, perfect weather, and a plethora of exciting events.Today, the city is alive with several notable events that cater to a wide range of interests. If you're looking for a dose of culture and tradition, the **37th Annual Toronto International Dragon Boat Festival** is a must-visit. Taking place along Toronto’s waterfront, this festival features dragon boat races, delicious food vendors, and vibrant cultural performances. It's a great spot to enjoy the city's di...2025-06-1503 min The Slow Life - Cozy Stories for Adults (and Everyone)⚓️ 🚣♂️ At the Harbourfront - The Slow Life Stories - Bedtime Stories for Adults - Calming Stories for Grownups and All AgesWelcome to The Slow Life - A village filled with cozy stories for everyone. This story is called Spring Bake Sale, and it’s about the smell of coffee, helping the animals, and extravagant treats on every table.🇨🇦 These stories are written, edited and narrated by Jennifer Zwicker. ~~~~Benefits of listening to cozy stories or adult bedtime stories with The Slow Life:1. Relaxation and Stress Relief • You want to unwind after a stressful day. • The gentle pacing, soothing tone, and comforting narratives help calm your mind an...2025-05-3017 min

The Slow Life - Cozy Stories for Adults (and Everyone)⚓️ 🚣♂️ At the Harbourfront - The Slow Life Stories - Bedtime Stories for Adults - Calming Stories for Grownups and All AgesWelcome to The Slow Life - A village filled with cozy stories for everyone. This story is called Spring Bake Sale, and it’s about the smell of coffee, helping the animals, and extravagant treats on every table.🇨🇦 These stories are written, edited and narrated by Jennifer Zwicker. ~~~~Benefits of listening to cozy stories or adult bedtime stories with The Slow Life:1. Relaxation and Stress Relief • You want to unwind after a stressful day. • The gentle pacing, soothing tone, and comforting narratives help calm your mind an...2025-05-3017 min Writers Off the Page: From the TIFA ArchivesSeamus Heaney: Death of a NaturalistIn this captivating episode of Writers Off the Page: From the TIFA Archives, step back in time to 1990 Toronto and immerse yourself in the lyrical world of Nobel Prize-winning poet Seamus Heaney. The recording captures Heaney in an intimate reading at the Harbourfront Reading Series, where his distinctive Irish voice brings to life some of his most beloved poems, including "Digging," "Follower," and "The Railway Children."Heaney's verse resonates with the earthy cadence of his native countryside, conjuring vivid tableaux of his heritage—his father's calloused hands excavating potatoes from resistant soil, his aunt's practiced movements transforming fl...2025-05-0231 min

Writers Off the Page: From the TIFA ArchivesSeamus Heaney: Death of a NaturalistIn this captivating episode of Writers Off the Page: From the TIFA Archives, step back in time to 1990 Toronto and immerse yourself in the lyrical world of Nobel Prize-winning poet Seamus Heaney. The recording captures Heaney in an intimate reading at the Harbourfront Reading Series, where his distinctive Irish voice brings to life some of his most beloved poems, including "Digging," "Follower," and "The Railway Children."Heaney's verse resonates with the earthy cadence of his native countryside, conjuring vivid tableaux of his heritage—his father's calloused hands excavating potatoes from resistant soil, his aunt's practiced movements transforming fl...2025-05-0231 min How Canada WorksTrump’s Second Term: Strategies for Investors with Sylvanna Asia, Portfolio Manager at Harbourfront Wealth ManagementIn this episode, we bring you, Sylvanna Asia, to discuss the financial landscape under Donald Trump’s second term. As a key member of the Harbourfront Wealth Management team, Sylvanna provides a unique perspective on how Trump’s economic policies, including tariffs, deregulation, and government efficiency initiatives, could shape market dynamics and investor portfolios. The conversation offers actionable insights into how Harbourfront’s Watermark Private Portfolios team approaches uncertainty, emphasizing the importance of diversification and a disciplined investment strategy.

Sylvanna highlights the nuanced factors influencing various asset classes, from equities and fixed income to private market securities. The ep...2024-12-0540 min

How Canada WorksTrump’s Second Term: Strategies for Investors with Sylvanna Asia, Portfolio Manager at Harbourfront Wealth ManagementIn this episode, we bring you, Sylvanna Asia, to discuss the financial landscape under Donald Trump’s second term. As a key member of the Harbourfront Wealth Management team, Sylvanna provides a unique perspective on how Trump’s economic policies, including tariffs, deregulation, and government efficiency initiatives, could shape market dynamics and investor portfolios. The conversation offers actionable insights into how Harbourfront’s Watermark Private Portfolios team approaches uncertainty, emphasizing the importance of diversification and a disciplined investment strategy.

Sylvanna highlights the nuanced factors influencing various asset classes, from equities and fixed income to private market securities. The ep...2024-12-0540 min Toronto News and InformationPodcast Episode Title: A Bustling Toronto: Festivals, Farmers Markets, and Fall FestivitiesWelcome to 'Time IN Toronto' on this beautiful Thursday, September 19, 2024 Today, Toronto is buzzing with excitement as the fall season begins to set in, bringing crisp air and a hint of cooler temperatures. The city's air quality is looking good, making it a perfect day to get out and enjoy all that Toronto has to offer.First off, let's dive into some of the key events happening today. For culture enthusiasts, the **Toronto International Festival of Authors** kicks off today at the Harbourfront Centre, featuring 11 days of conversations, readings, and performances that celebrate literature from around the world.2024-09-1902 min

Toronto News and InformationPodcast Episode Title: A Bustling Toronto: Festivals, Farmers Markets, and Fall FestivitiesWelcome to 'Time IN Toronto' on this beautiful Thursday, September 19, 2024 Today, Toronto is buzzing with excitement as the fall season begins to set in, bringing crisp air and a hint of cooler temperatures. The city's air quality is looking good, making it a perfect day to get out and enjoy all that Toronto has to offer.First off, let's dive into some of the key events happening today. For culture enthusiasts, the **Toronto International Festival of Authors** kicks off today at the Harbourfront Centre, featuring 11 days of conversations, readings, and performances that celebrate literature from around the world.2024-09-1902 min Paddling Adventures RadioEpisode 443: Alan Drummond talks about life, marshmallows, Toronto Harbourfront, paddling with your partner and moreEpisode 443 ~ August 15, 2024

Podcast Info / Topics

Alan Drummond guest hosts this week and talks on a variety of topics including life, marshmallows, Toronto Harbourfront, what it is like paddling with your partner, and a whole lot more.

2024-08-151h 20

Paddling Adventures RadioEpisode 443: Alan Drummond talks about life, marshmallows, Toronto Harbourfront, paddling with your partner and moreEpisode 443 ~ August 15, 2024

Podcast Info / Topics

Alan Drummond guest hosts this week and talks on a variety of topics including life, marshmallows, Toronto Harbourfront, what it is like paddling with your partner, and a whole lot more.

2024-08-151h 20 How Canada WorksWhy Financial Advisors Leave Big Financial Institutions, with Ashley Morais Investment Advisor (Mutual Fund Restricted) at Harbourfront Wealth ManagementWelcome to the second episode of How Canada Works! Our guest today is Ashley Morais, who has had a rich career as a Financial Advisor at several institutions such as TD and RBC Wealth Management. We’re excited to welcome her to the Cherry Hill Private Wealth - Harbourfront Wealth Management team.

With Ashley, we discuss her career trajectory, what deterred her from continuing to work at big financial institutions, why she chose Harbourfront Wealth Management as her new home, client loyalty, the differences between having your wealth managed by a large institution versus a...2024-07-0433 min

How Canada WorksWhy Financial Advisors Leave Big Financial Institutions, with Ashley Morais Investment Advisor (Mutual Fund Restricted) at Harbourfront Wealth ManagementWelcome to the second episode of How Canada Works! Our guest today is Ashley Morais, who has had a rich career as a Financial Advisor at several institutions such as TD and RBC Wealth Management. We’re excited to welcome her to the Cherry Hill Private Wealth - Harbourfront Wealth Management team.

With Ashley, we discuss her career trajectory, what deterred her from continuing to work at big financial institutions, why she chose Harbourfront Wealth Management as her new home, client loyalty, the differences between having your wealth managed by a large institution versus a...2024-07-0433 min.png) The Ride: Life, Work and WealthSafeguarding Seniors: Navigating the Digital Landscape of Financial Security (Ep 73)Welcome to The Ride: Life, Work, and Wealth podcast, brought to you by Green Private Wealth, a trade name of Harbourfront Wealth Management. In this episode, hosts Kris Dureau and Mike Pakreslis delve into a crucial and timely topic that affects many: protecting seniors from financial abuse in the digital age.

Key Points Discussed:

The impact of technology on managing finances and the increased vulnerability of seniors to fraud and abuse.

The importance of initiating conversations with seniors about various forms of financial abuse, fostering awareness, and creating a supportive environment.

Practical tips for mitigating risks...2024-03-1312 min

The Ride: Life, Work and WealthSafeguarding Seniors: Navigating the Digital Landscape of Financial Security (Ep 73)Welcome to The Ride: Life, Work, and Wealth podcast, brought to you by Green Private Wealth, a trade name of Harbourfront Wealth Management. In this episode, hosts Kris Dureau and Mike Pakreslis delve into a crucial and timely topic that affects many: protecting seniors from financial abuse in the digital age.

Key Points Discussed:

The impact of technology on managing finances and the increased vulnerability of seniors to fraud and abuse.

The importance of initiating conversations with seniors about various forms of financial abuse, fostering awareness, and creating a supportive environment.

Practical tips for mitigating risks...2024-03-1312 min Les Podcasts de CHOQFM 105.1ENTREVUE – Arinola Olowoporoku, commissaire curatrice de Kuumba au centre HarbourfrontLe mois de février verra un nombre croissant de propositions culturelles consacrées à la diaspora afro-descendante. Toronto en propose plusieurs, dont Kuumba, un festival programmé cette année par Arinola Olowoporoku.Bien que les présentations francophones manquent à l’appel, ce festival permet à tous et toutes d’y assister grâce à un politique de prix ouverts, entre tarifs libres et gratuité. Caroline Guespin, productrice associée à la danse au centre Harbourfront center répond en français pour Arinola dans cette entrevue “par procuration”. Un reportage réalisé dans le cadre du programme Initiative Journa...2024-01-2409 min

Les Podcasts de CHOQFM 105.1ENTREVUE – Arinola Olowoporoku, commissaire curatrice de Kuumba au centre HarbourfrontLe mois de février verra un nombre croissant de propositions culturelles consacrées à la diaspora afro-descendante. Toronto en propose plusieurs, dont Kuumba, un festival programmé cette année par Arinola Olowoporoku.Bien que les présentations francophones manquent à l’appel, ce festival permet à tous et toutes d’y assister grâce à un politique de prix ouverts, entre tarifs libres et gratuité. Caroline Guespin, productrice associée à la danse au centre Harbourfront center répond en français pour Arinola dans cette entrevue “par procuration”. Un reportage réalisé dans le cadre du programme Initiative Journa...2024-01-2409 min The Insider's Guide To FinanceMaking Waves as One of Canada's Fastest-Growing Wealth Management Firms w. Danny PopescuWe sat down with Danny Popsescu, CEO of Harbourfront Wealth Management. We learn about the struggles he faced when starting a business and how his failures helped him grow.Harbourfront Wealth Management is one of Canada's fastest-growing wealth management firms. The company has a $500-million market evaluation!He shares his process for recruiting quality talent while being an unknown company. Danny provides the current outlook on innovation at Harbourfront and in wealth management.He explains why stocks and bonds are not the only focus...2023-03-1544 min

The Insider's Guide To FinanceMaking Waves as One of Canada's Fastest-Growing Wealth Management Firms w. Danny PopescuWe sat down with Danny Popsescu, CEO of Harbourfront Wealth Management. We learn about the struggles he faced when starting a business and how his failures helped him grow.Harbourfront Wealth Management is one of Canada's fastest-growing wealth management firms. The company has a $500-million market evaluation!He shares his process for recruiting quality talent while being an unknown company. Danny provides the current outlook on innovation at Harbourfront and in wealth management.He explains why stocks and bonds are not the only focus...2023-03-1544 min StrategyCastEpisode Title 427: Magnetic Messaging with Sandy Gerber of Harbourfront Wealth Management nowGoing beyond simply selling to your audiences to connecting and truly motivating them. Magnetic messaging with Sandy Gerber of Harbourfront Wealth Management on the Integrate & Ignite Marketing Podcast and learn about emotional magnetism.2022-11-0119 min

StrategyCastEpisode Title 427: Magnetic Messaging with Sandy Gerber of Harbourfront Wealth Management nowGoing beyond simply selling to your audiences to connecting and truly motivating them. Magnetic messaging with Sandy Gerber of Harbourfront Wealth Management on the Integrate & Ignite Marketing Podcast and learn about emotional magnetism.2022-11-0119 min Nordic TalksLibrary evolutionWhat do you think of when you hear the word library? Maybe you think of a building full of books - a place to explore other worlds and perspectives. But in the 21st century libraries have become much more than that. They mirror society and reflect the developments occurring in the surrounding world. In some libraries, you can now even borrow a so-called human book – a real human being sitting in front of you sharing their personal story. Sounds exciting, right?

In this episode, we explore the unifying power of libraries and discover why some people consider th...2022-06-2924 min

Nordic TalksLibrary evolutionWhat do you think of when you hear the word library? Maybe you think of a building full of books - a place to explore other worlds and perspectives. But in the 21st century libraries have become much more than that. They mirror society and reflect the developments occurring in the surrounding world. In some libraries, you can now even borrow a so-called human book – a real human being sitting in front of you sharing their personal story. Sounds exciting, right?

In this episode, we explore the unifying power of libraries and discover why some people consider th...2022-06-2924 min Not That MomSummer Camp!Host: Pina Crispo // https://www.instagram.com/chic_mamma Guest:Yashy Murphy // https://www.parentingtogo.ca/Rankin Middlebrook // https://harbourfrontcentre.com/program/camps/On this weeks' episode Pina is joined by friend Yashy Murphy from parentingtogo.ca and Rankin Middlebrook Senior Manager, Recreational Learning at Harbourfront Centre, to talk about summer camps and activities at the harbourfront. Learn more about your ad choices. Visit megaphone.fm/adchoices2022-06-1343 min

Not That MomSummer Camp!Host: Pina Crispo // https://www.instagram.com/chic_mamma Guest:Yashy Murphy // https://www.parentingtogo.ca/Rankin Middlebrook // https://harbourfrontcentre.com/program/camps/On this weeks' episode Pina is joined by friend Yashy Murphy from parentingtogo.ca and Rankin Middlebrook Senior Manager, Recreational Learning at Harbourfront Centre, to talk about summer camps and activities at the harbourfront. Learn more about your ad choices. Visit megaphone.fm/adchoices2022-06-1343 min Walking in PlaceHarbourfrontYou might, like I used to, think of the Harbourfront as a cold, cement, condo neighbourhood. Ok, that last part is true, but there is so more much life, warmth, and nature (!) than you might expect. Let me show you the parts of the Harbourfront you can't see from Queen's Quay W, and learn some of Toronto's waterfront history while we're at it. Walk info:Walk length: 2 hours with the stops Walkability: flat, ramps availableFirst stop: Sugar Beach Last stop: Ireland Park--------------------------------- Sources hereTranscript here...2022-05-1338 min

Walking in PlaceHarbourfrontYou might, like I used to, think of the Harbourfront as a cold, cement, condo neighbourhood. Ok, that last part is true, but there is so more much life, warmth, and nature (!) than you might expect. Let me show you the parts of the Harbourfront you can't see from Queen's Quay W, and learn some of Toronto's waterfront history while we're at it. Walk info:Walk length: 2 hours with the stops Walkability: flat, ramps availableFirst stop: Sugar Beach Last stop: Ireland Park--------------------------------- Sources hereTranscript here...2022-05-1338 min Explore with VandanaRajBhatt- All about Travel, Hotels and RestaurantsEnchanting and lively Toronto HarbourFront!Toronto Harbourfront is always lively, whether its winter or summer. During summer it holds multiple events, fairs, and activities and in winter its loved by people who want to come out to skate. Hundreds of people gather at Harborfront Centre to ring in the New Years every year. It was a warm day, snow had all melted. But when temperatures dip down to freeze the lake, you would find a different type of beauty in this place.2022-01-1901 min

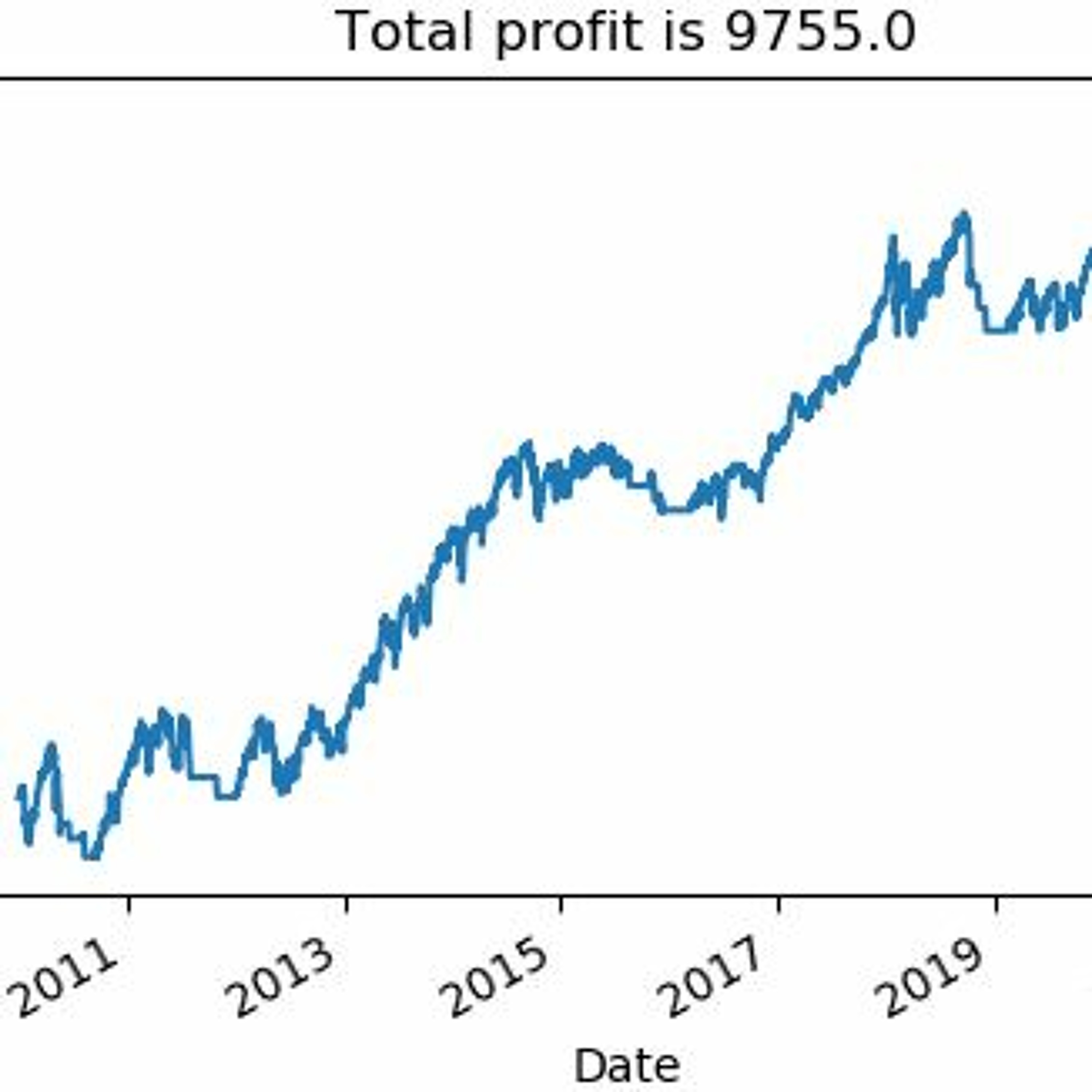

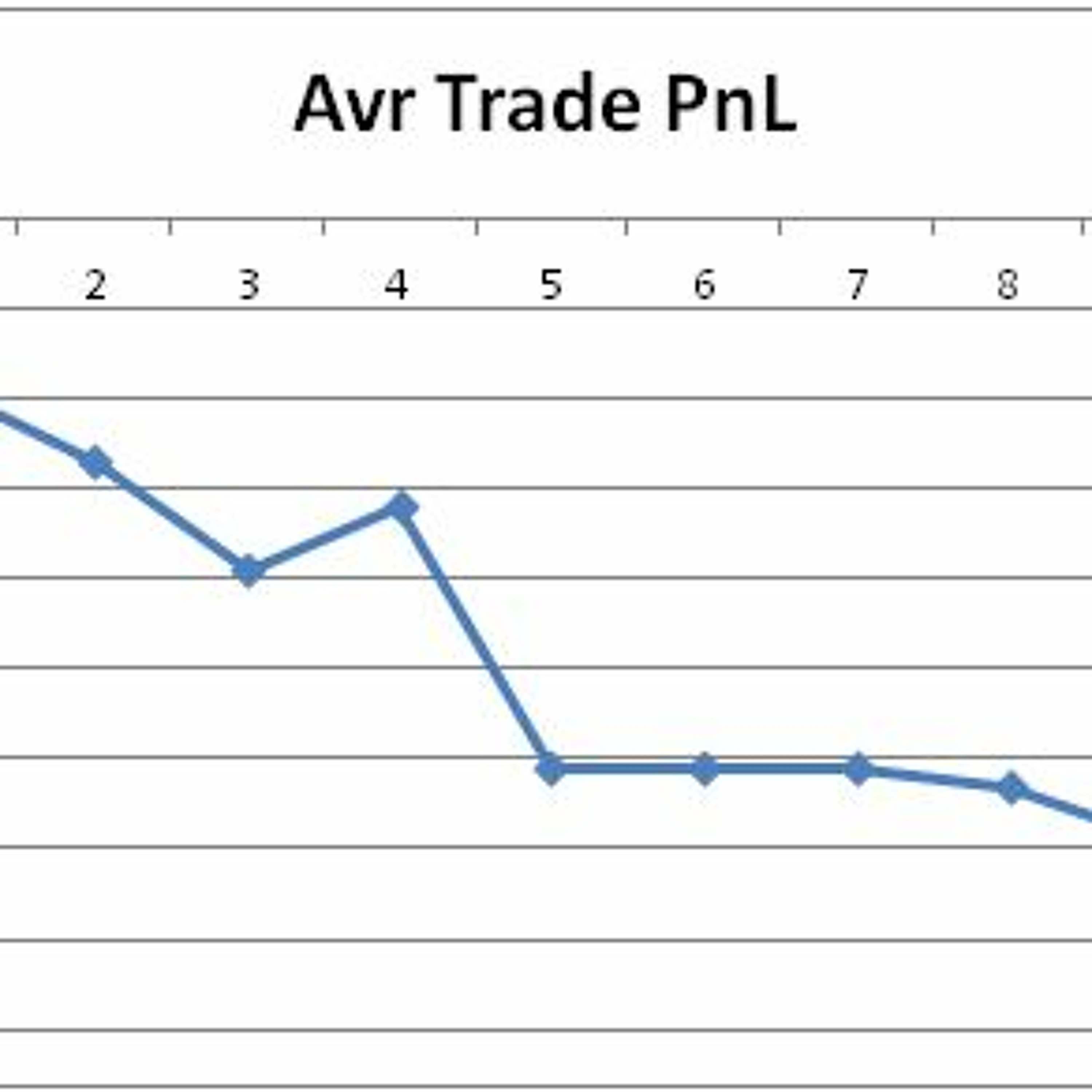

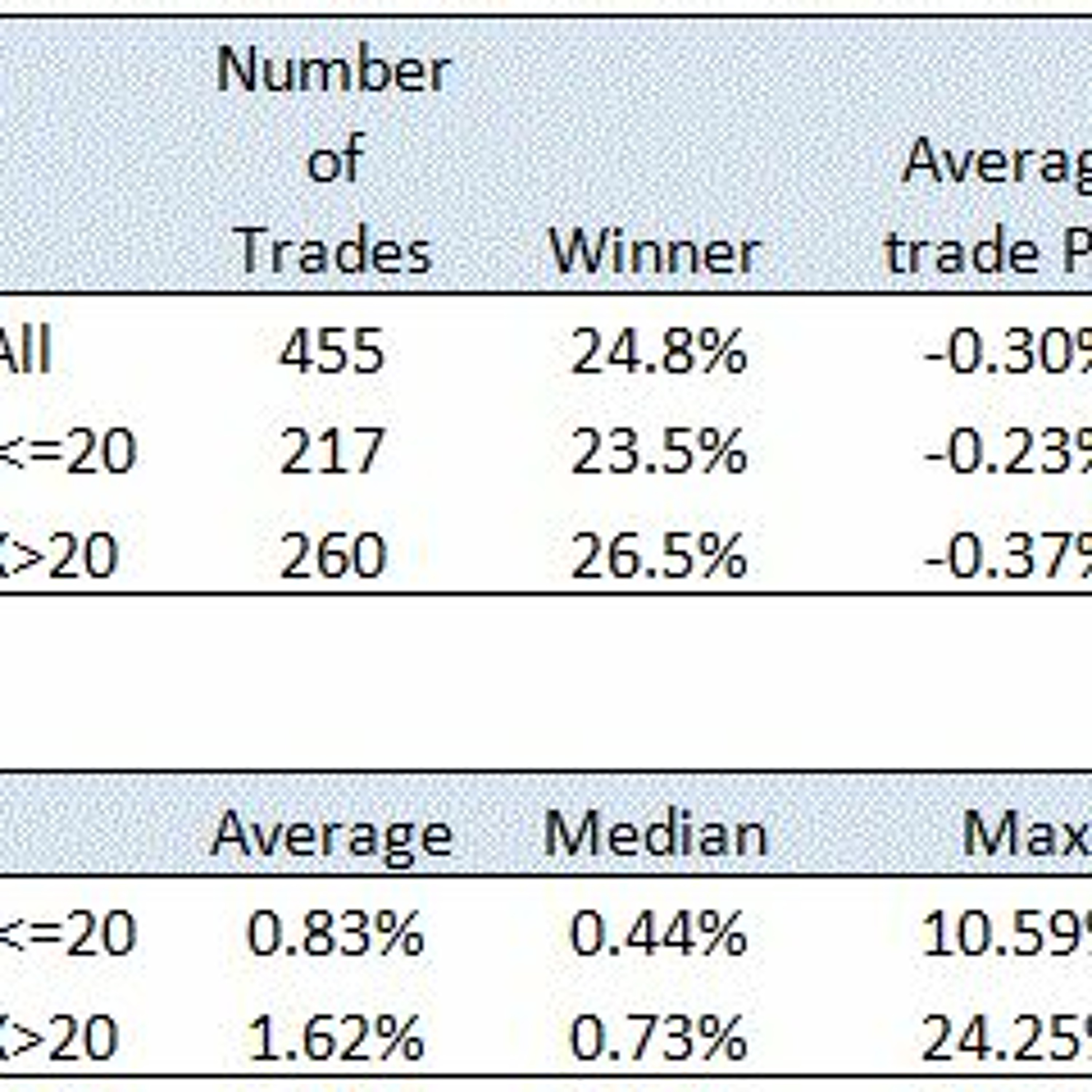

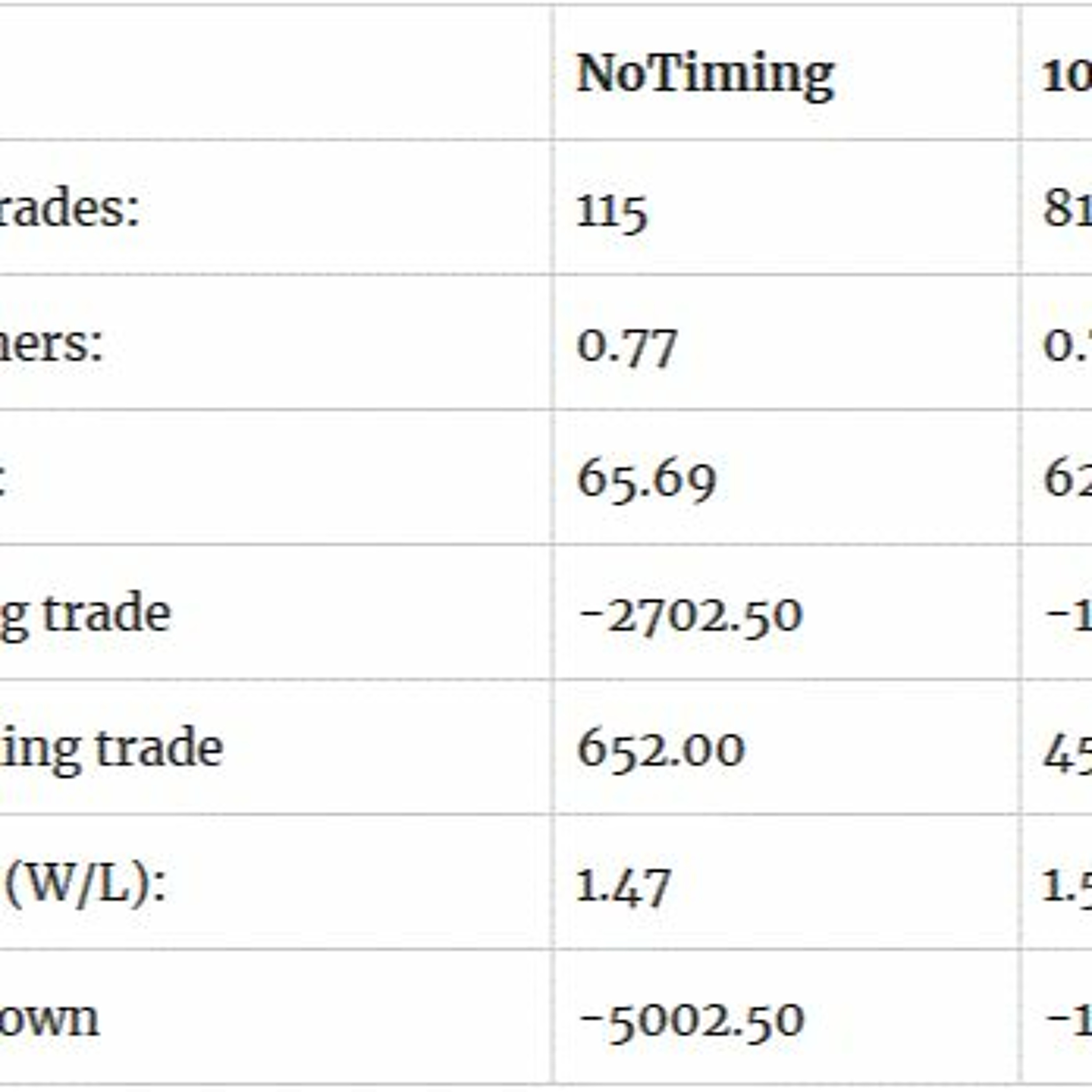

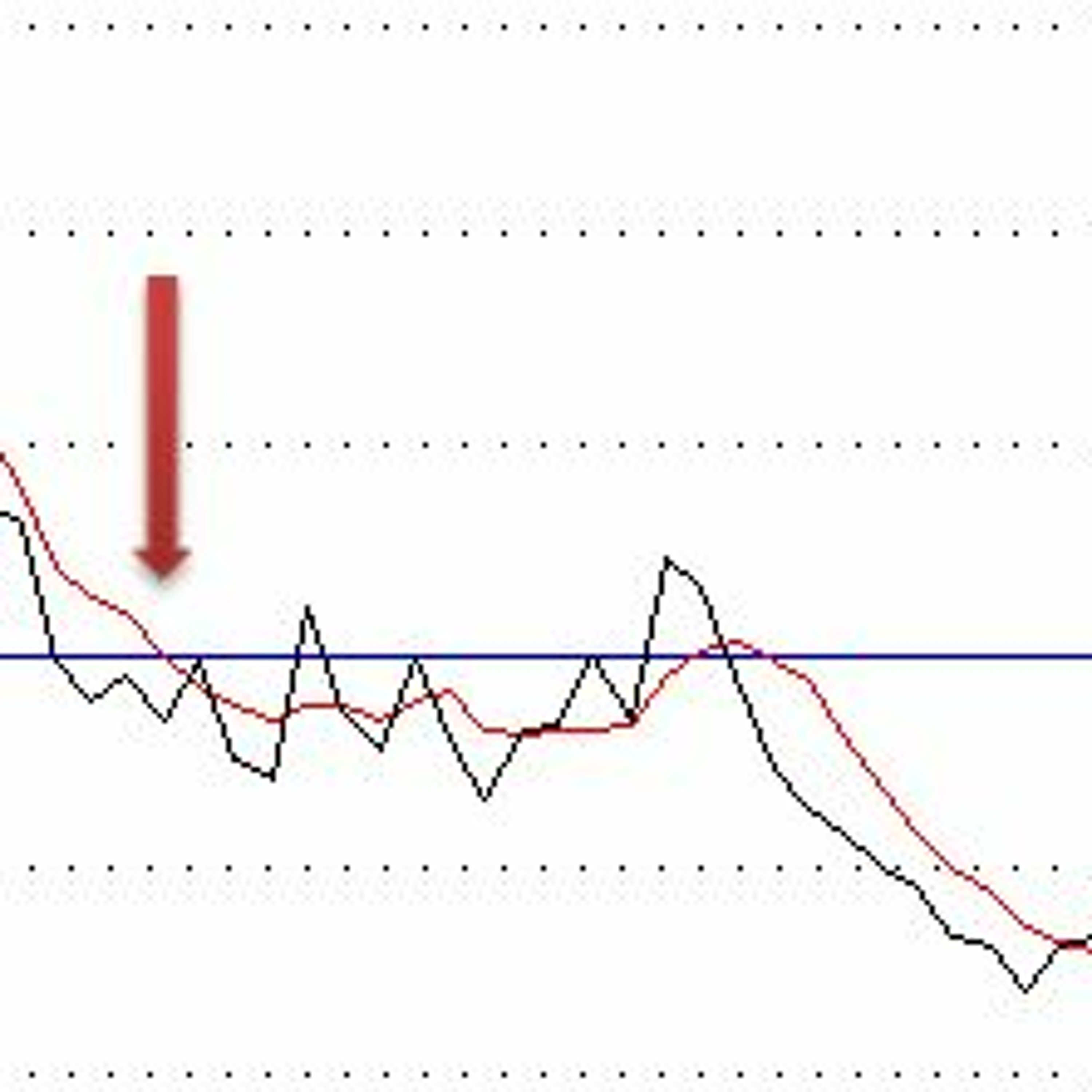

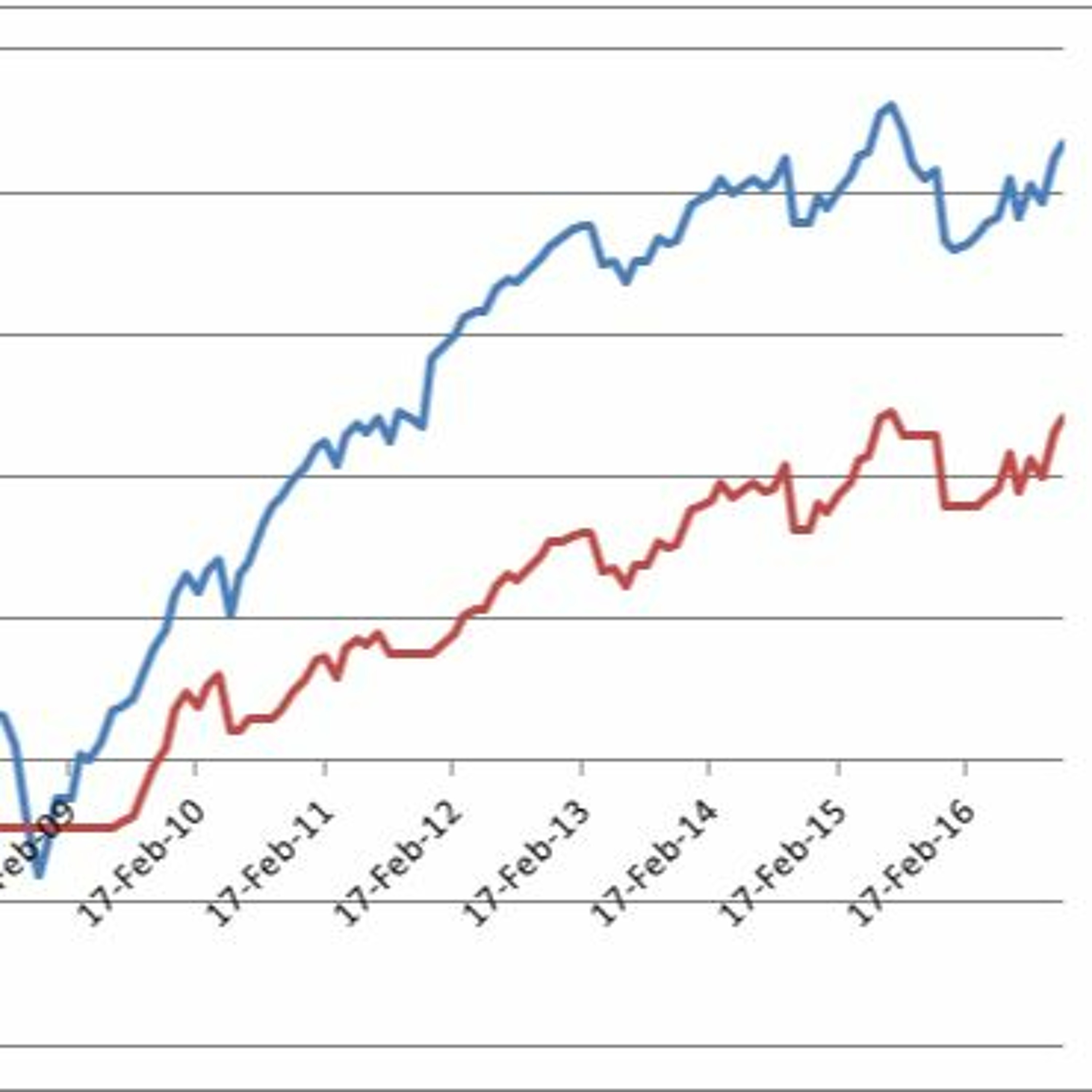

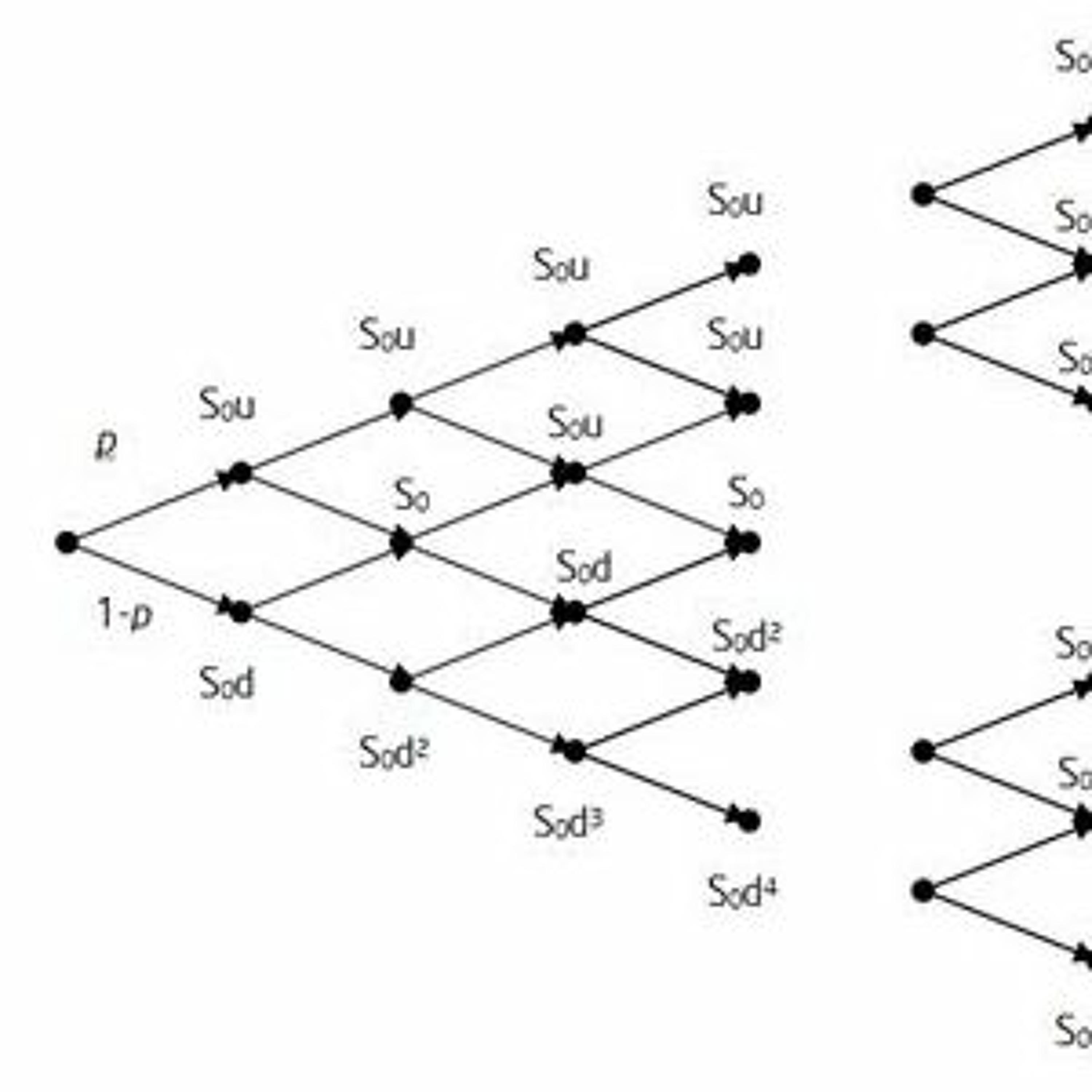

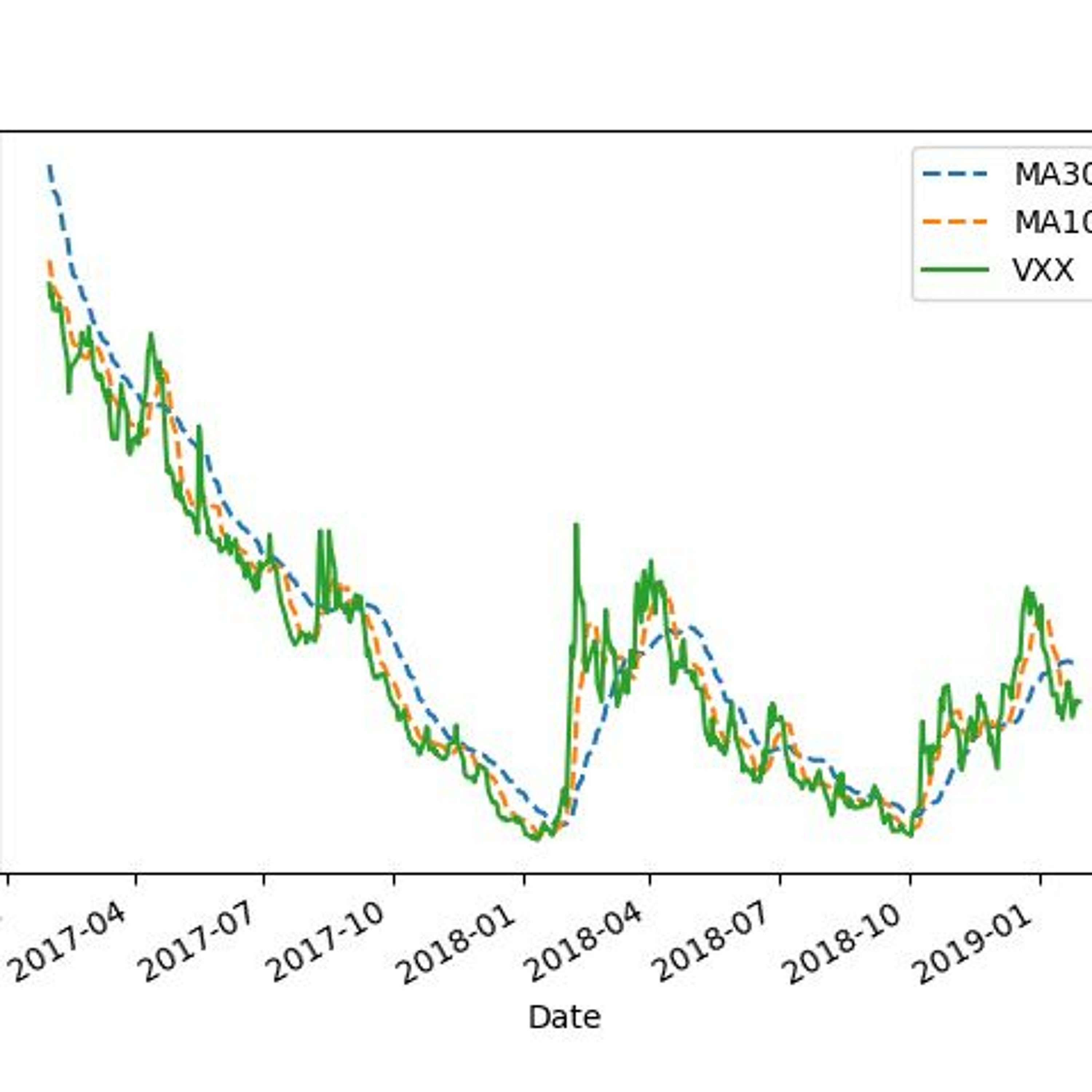

Explore with VandanaRajBhatt- All about Travel, Hotels and RestaurantsEnchanting and lively Toronto HarbourFront!Toronto Harbourfront is always lively, whether its winter or summer. During summer it holds multiple events, fairs, and activities and in winter its loved by people who want to come out to skate. Hundreds of people gather at Harborfront Centre to ring in the New Years every year. It was a warm day, snow had all melted. But when temperatures dip down to freeze the lake, you would find a different type of beauty in this place.2022-01-1901 min Harbourfront TechnologiesTrend-Following Trading System, Quantitative Trading In PythonIn a previous post, we demonstrated the mean-reverting and trending properties of SP500. We subsequently developed a trading system based on the mean-reverting behavior of the index. In this installment, we will develop a trend-following trading strategy.

http://tech.harbourfronts.com/trend-following-trading-system-quantitative-trading-in-python/2021-05-0601 min

Harbourfront TechnologiesTrend-Following Trading System, Quantitative Trading In PythonIn a previous post, we demonstrated the mean-reverting and trending properties of SP500. We subsequently developed a trading system based on the mean-reverting behavior of the index. In this installment, we will develop a trend-following trading strategy.

http://tech.harbourfronts.com/trend-following-trading-system-quantitative-trading-in-python/2021-05-0601 min Harbourfront TechnologiesMean - Reverting Trading System - Quantitative Trading In PythonWe develop a simple trading system exploiting the mean-reverting behaviour of the SP500 market index. To generate buy and sell signals, we will use simple moving averages as noise filters. Since we know that the SP500 is mean-reverting in a short term, we will use short-term moving averages.

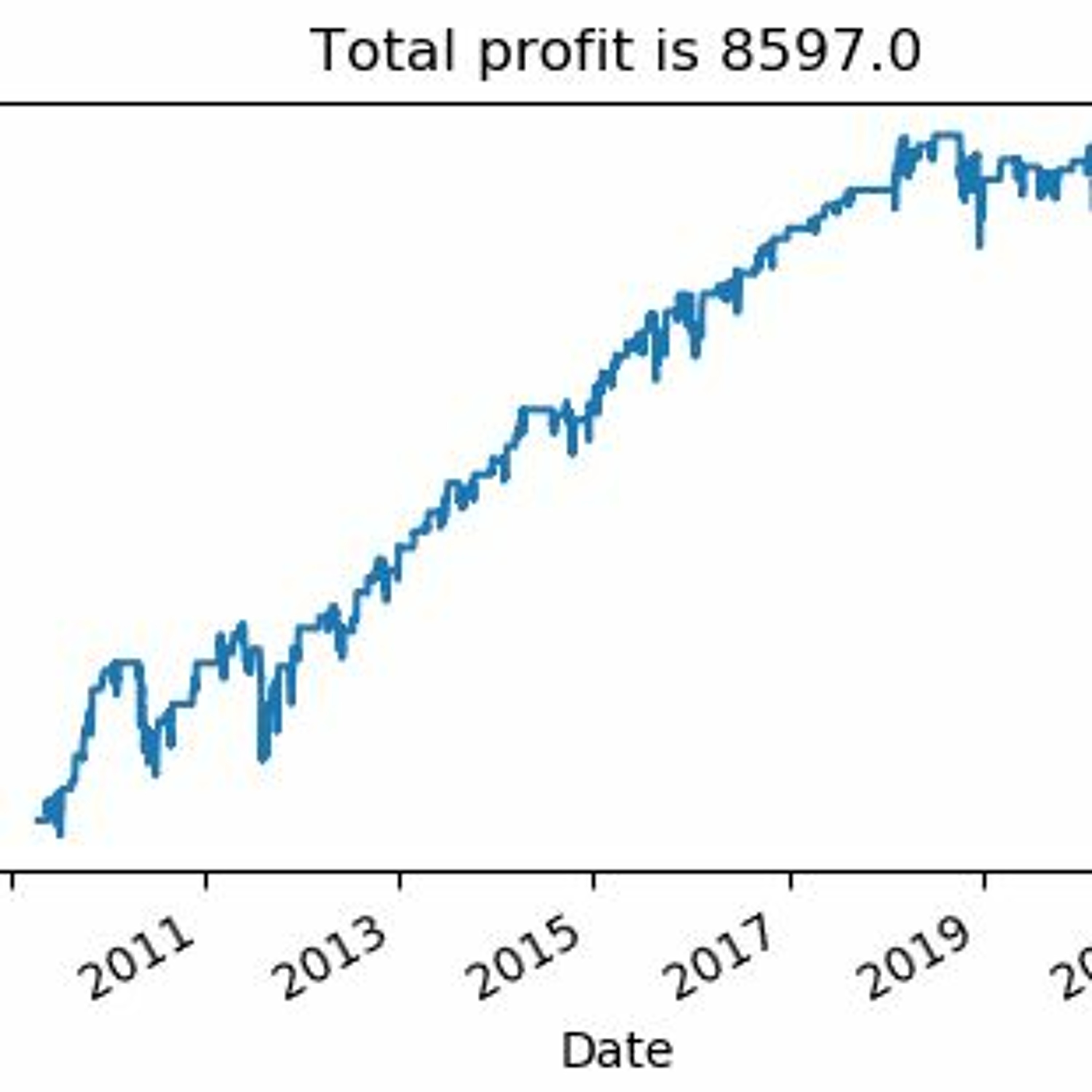

http://tech.harbourfronts.com/mean-reverting-trading-system-quantitative-trading-in-python/2021-04-2701 min

Harbourfront TechnologiesMean - Reverting Trading System - Quantitative Trading In PythonWe develop a simple trading system exploiting the mean-reverting behaviour of the SP500 market index. To generate buy and sell signals, we will use simple moving averages as noise filters. Since we know that the SP500 is mean-reverting in a short term, we will use short-term moving averages.

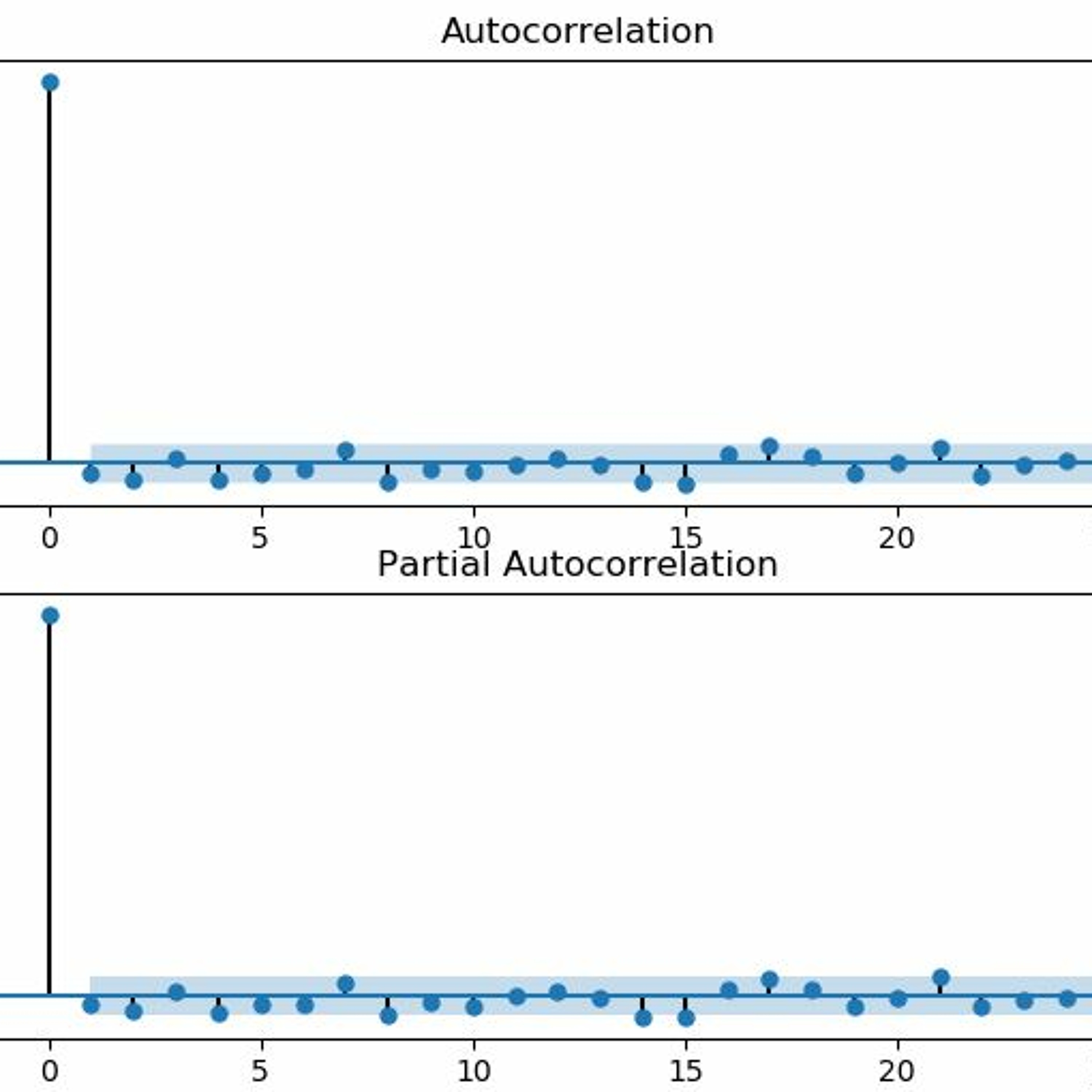

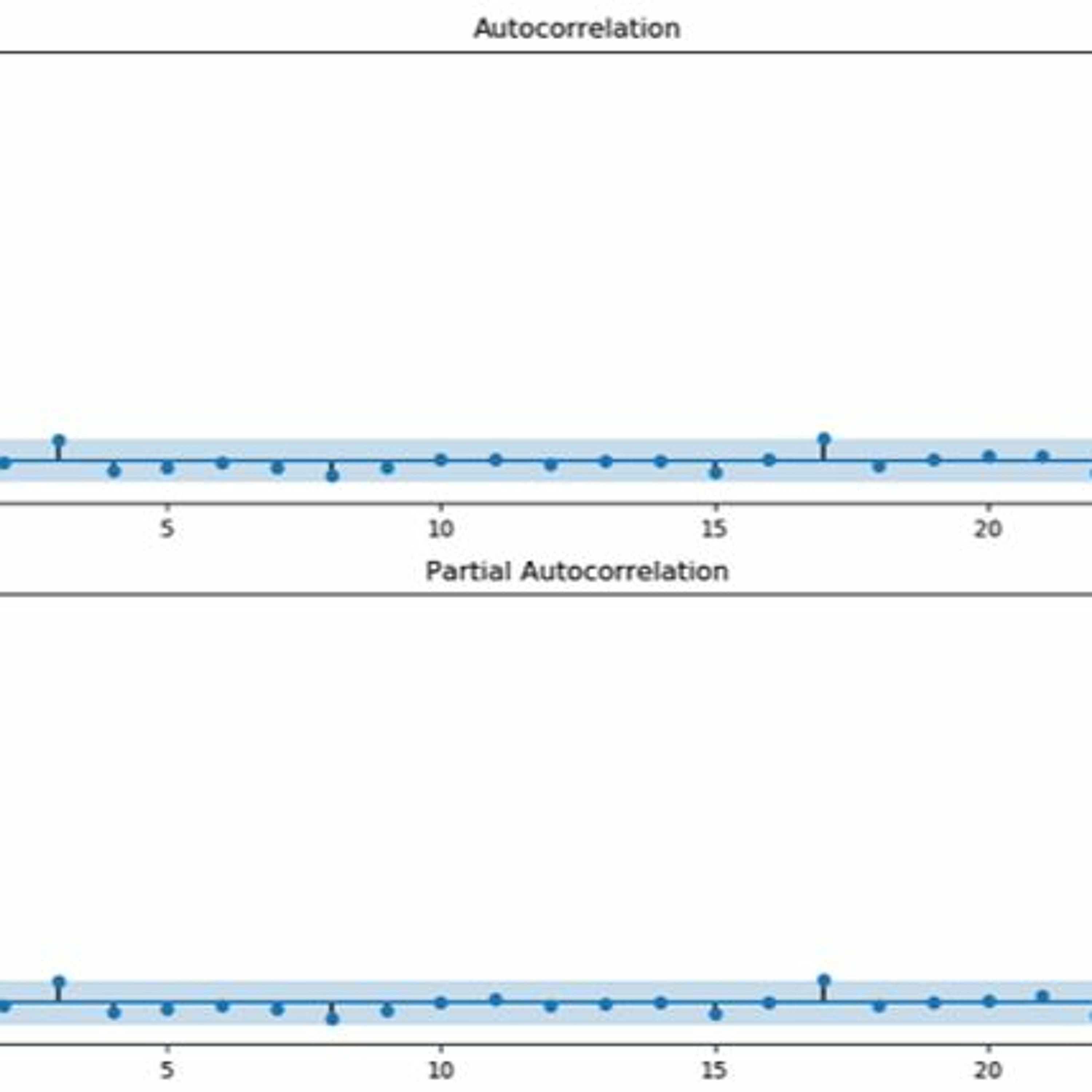

http://tech.harbourfronts.com/mean-reverting-trading-system-quantitative-trading-in-python/2021-04-2701 min Harbourfront TechnologiesAutocorrelation Properties of SP500-Quantitative Trading in PythonWe are going to examine the mean-reverting and trending properties of SP500 directly using the autocorrelation functions. We do so with the goal of designing quantitative trading systems on stock indices.

http://tech.harbourfronts.com/autocorrelation-properties-of-sp500-quantitative-trading-in-python/2021-04-0102 min

Harbourfront TechnologiesAutocorrelation Properties of SP500-Quantitative Trading in PythonWe are going to examine the mean-reverting and trending properties of SP500 directly using the autocorrelation functions. We do so with the goal of designing quantitative trading systems on stock indices.

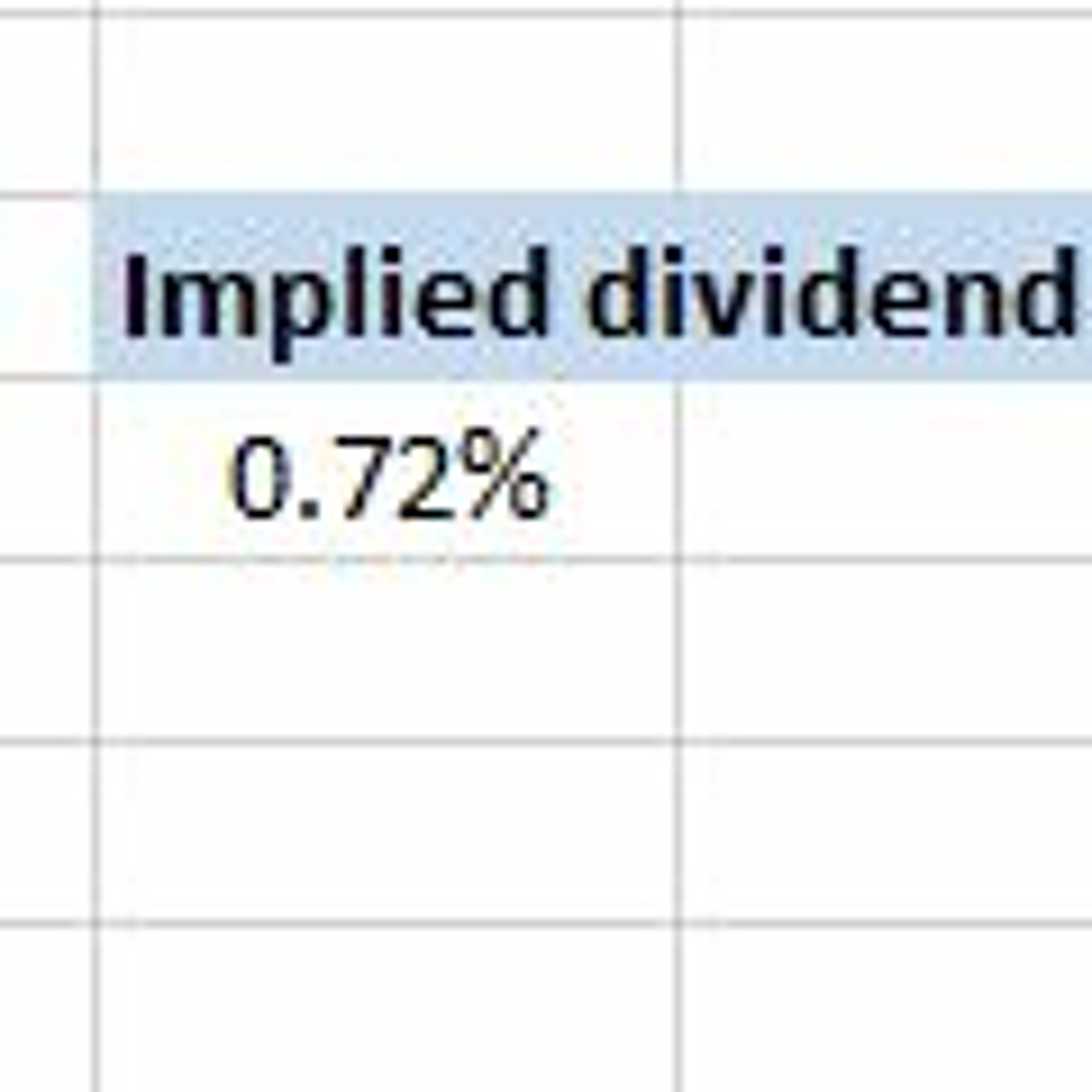

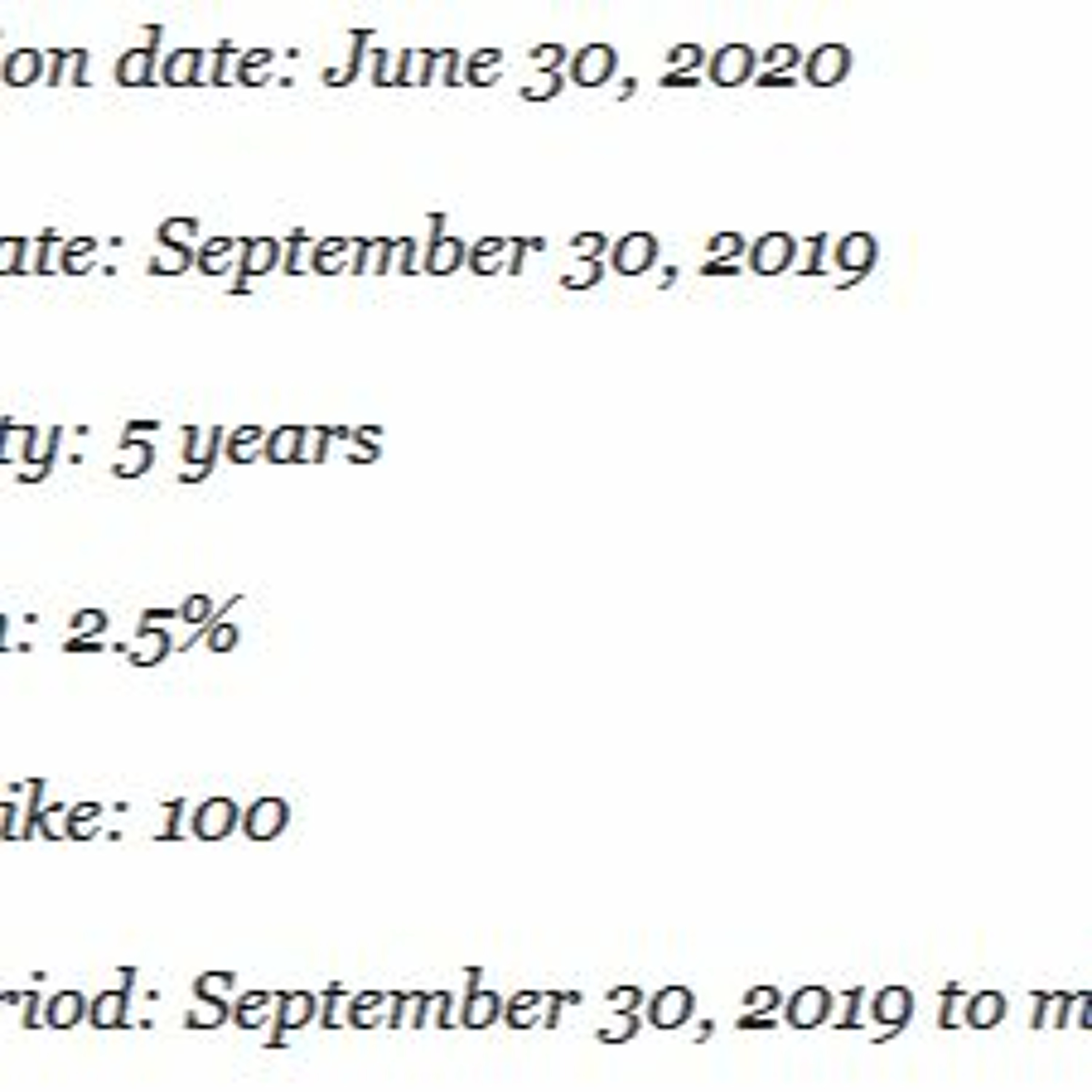

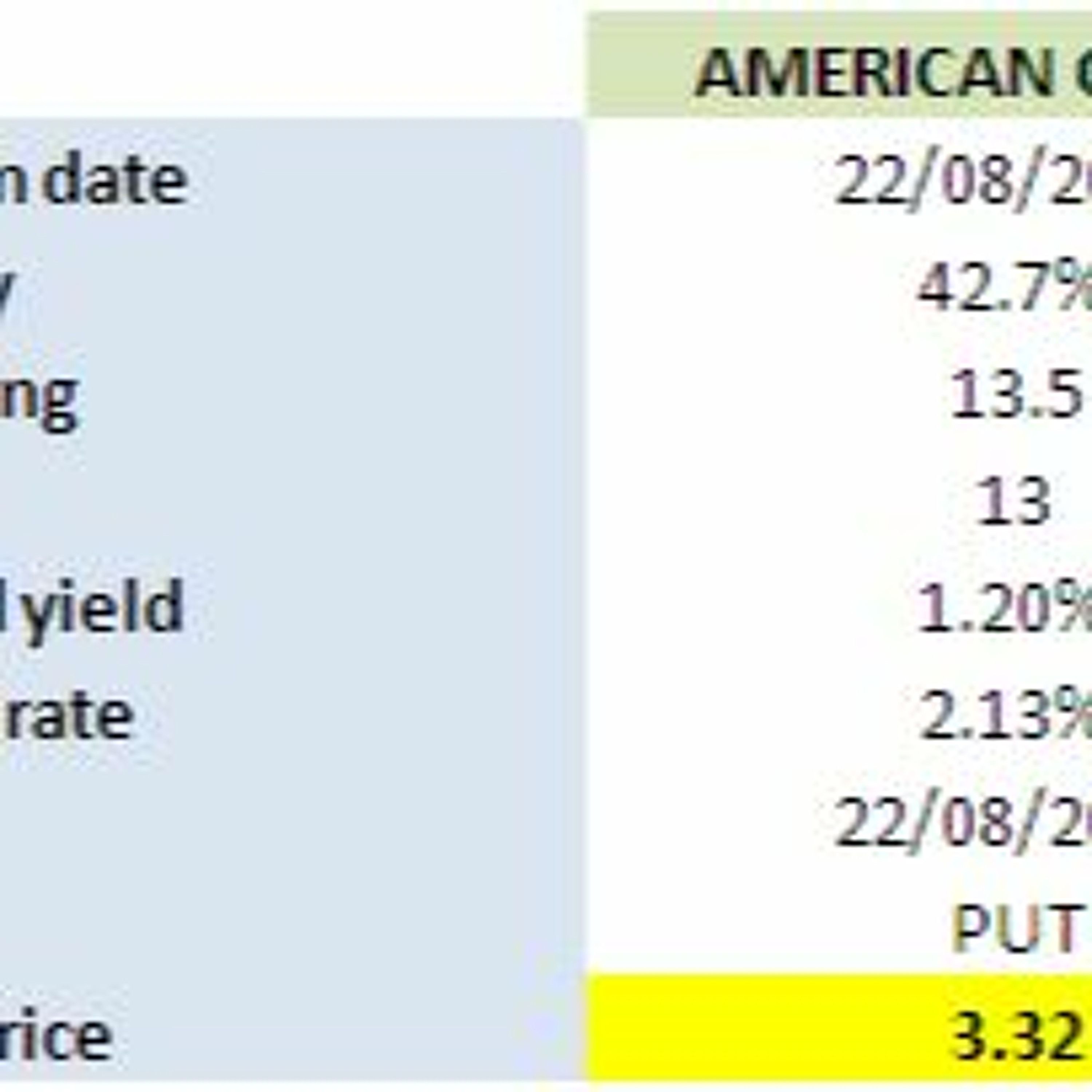

http://tech.harbourfronts.com/autocorrelation-properties-of-sp500-quantitative-trading-in-python/2021-04-0102 min Harbourfront TechnologiesHow to Determine Implied Dividend Yield-Derivative Valuation in ExcelWe discuss ways to determine the dividend yield accurately. We use traded options to determine the implied dividend yield. Specifically, if the options are of European-style exercise, then we can use the put-call parity to create a synthetic single stock future.

http://tech.harbourfronts.com/how-to-determine-implied-dividend-yield-derivative-valuation-in-excel/2021-03-0602 min

Harbourfront TechnologiesHow to Determine Implied Dividend Yield-Derivative Valuation in ExcelWe discuss ways to determine the dividend yield accurately. We use traded options to determine the implied dividend yield. Specifically, if the options are of European-style exercise, then we can use the put-call parity to create a synthetic single stock future.

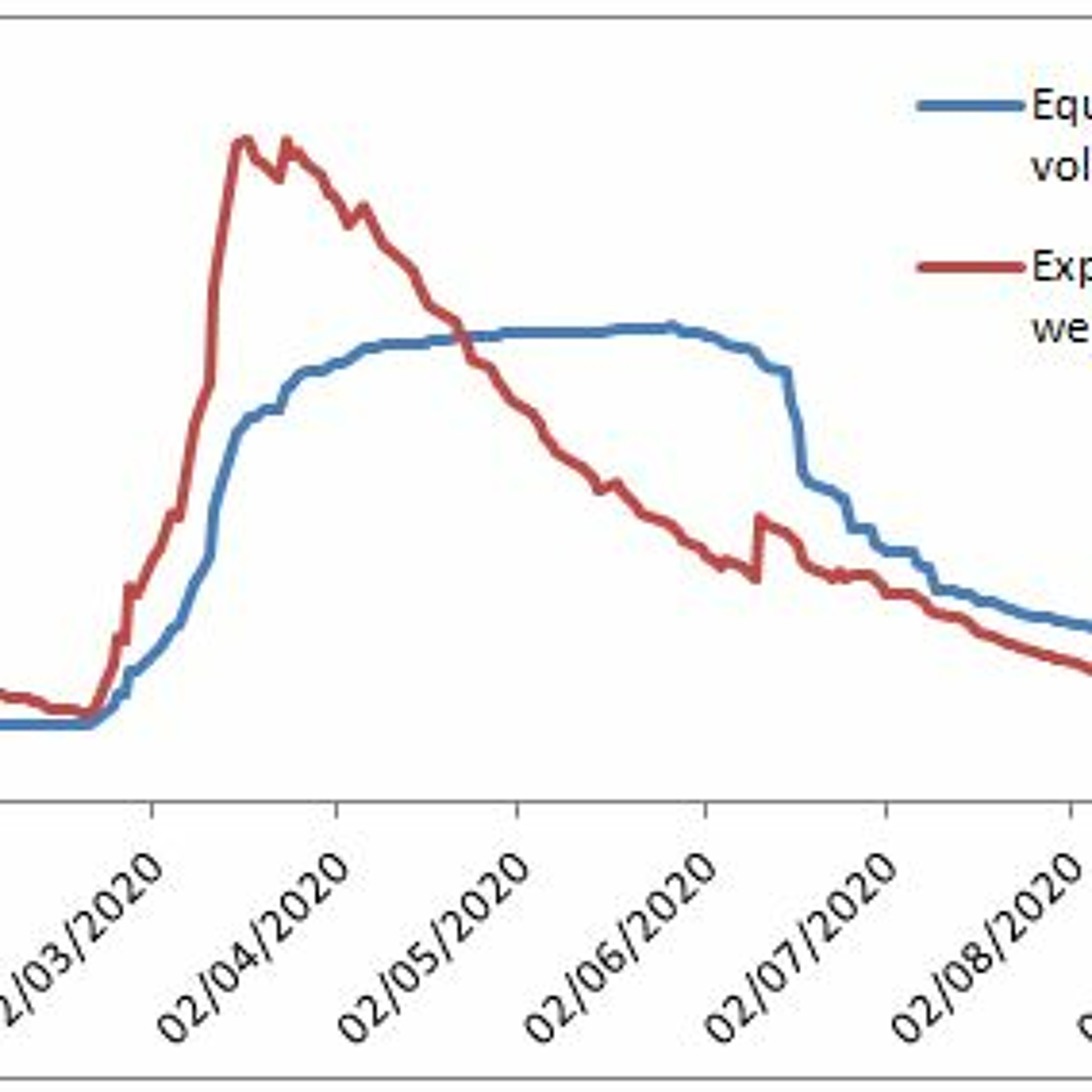

http://tech.harbourfronts.com/how-to-determine-implied-dividend-yield-derivative-valuation-in-excel/2021-03-0602 min Harbourfront TechnologiesExponentially Weighted Historical Volatility In ExcelWe use the Exponential Weighted (EW) historical volatility that assigns bigger weights to the recent returns, and smaller weights to the past ones. The EWHV is more responsive than the equally weighted historical volatility. Also, the decline of the EWHV from its peak is smoother than that of the equally weighted HV.

http://tech.harbourfronts.com/exponentially-weighted-historical-volatility-in-excel-volatility-analysis-in-excel/2021-03-0502 min

Harbourfront TechnologiesExponentially Weighted Historical Volatility In ExcelWe use the Exponential Weighted (EW) historical volatility that assigns bigger weights to the recent returns, and smaller weights to the past ones. The EWHV is more responsive than the equally weighted historical volatility. Also, the decline of the EWHV from its peak is smoother than that of the equally weighted HV.

http://tech.harbourfronts.com/exponentially-weighted-historical-volatility-in-excel-volatility-analysis-in-excel/2021-03-0502 min Harbourfront TechnologiesModern Portfolio Theory - Effect Of Diversification On The Optimal PortfolioWe are going to perform some numerical experiments. Specifically, we are going to use the portfolio optimization program developed in the previous post in order to study the effect of diversification.

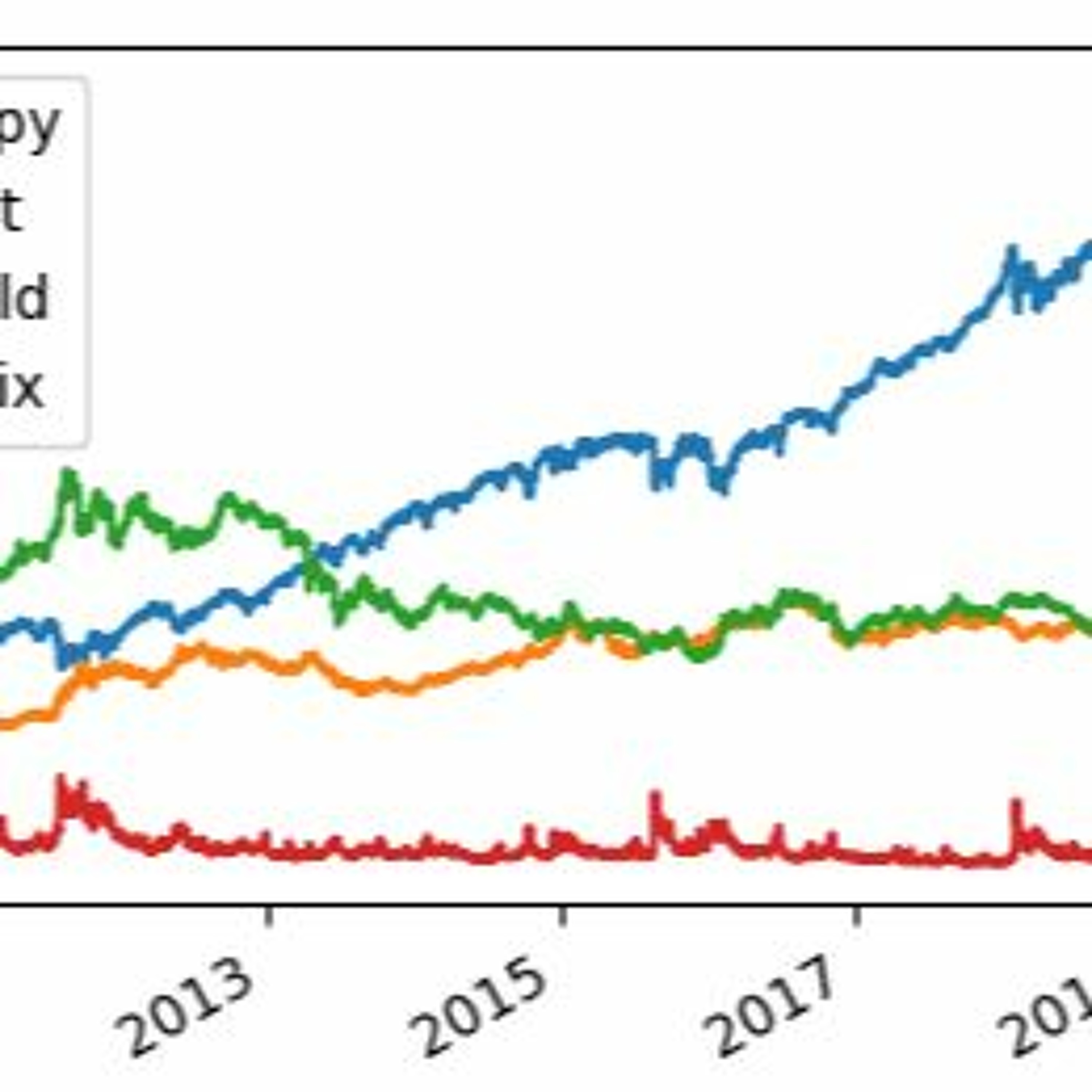

http://tech.harbourfronts.com/modern-portfolio-theory-effect-of-diversification-on-the-optimal-portfolio-portfolio-management-in-python/2021-02-1402 min

Harbourfront TechnologiesModern Portfolio Theory - Effect Of Diversification On The Optimal PortfolioWe are going to perform some numerical experiments. Specifically, we are going to use the portfolio optimization program developed in the previous post in order to study the effect of diversification.

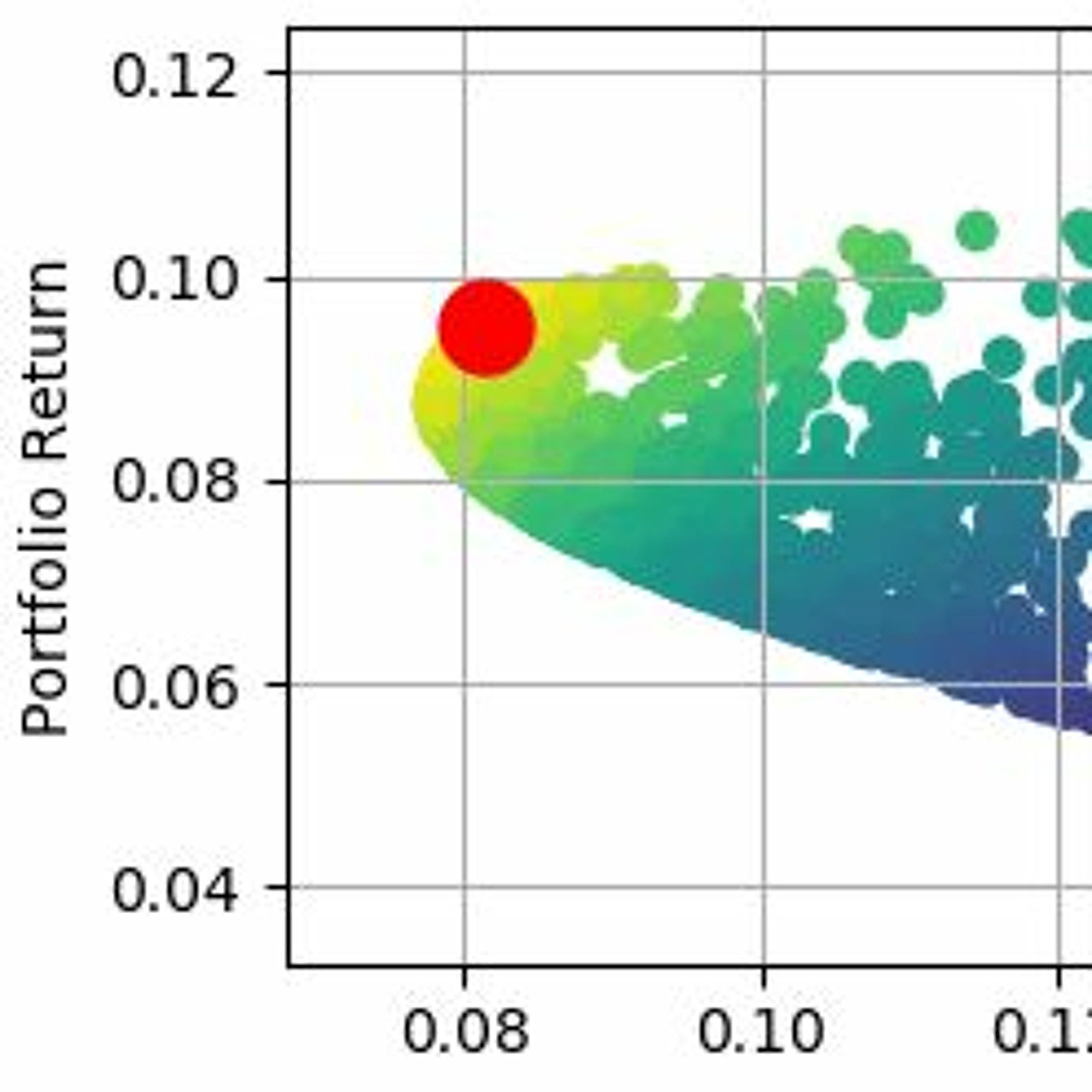

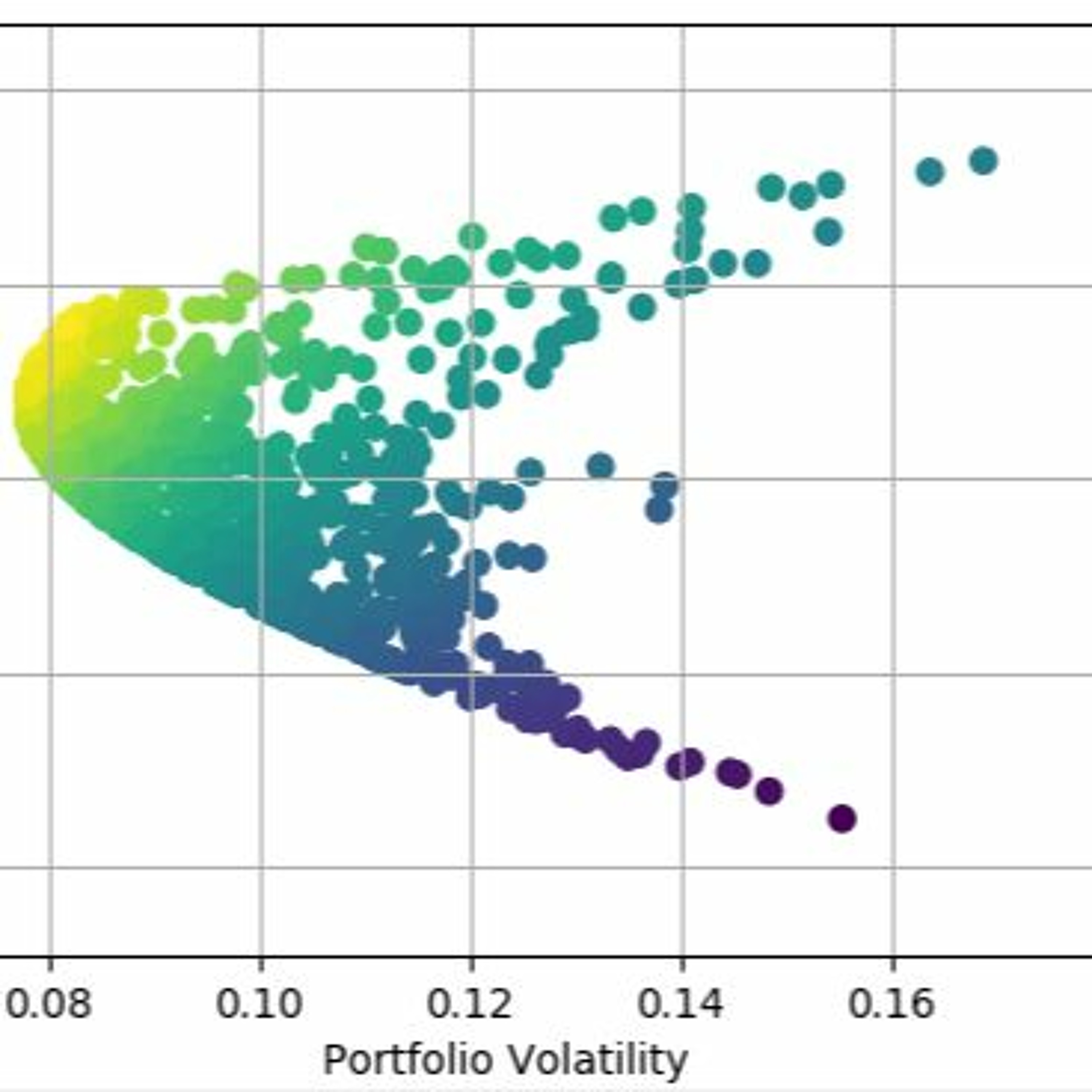

http://tech.harbourfronts.com/modern-portfolio-theory-effect-of-diversification-on-the-optimal-portfolio-portfolio-management-in-python/2021-02-1402 min Harbourfront TechnologiesModern Portfolio Theory-Searching For the Optimal Portfolio-Portfolio Management in PythonWe are going to search for the optimal portfolio, i.e. one that has the highest risk-adjusted return. To do so, we will maximize the portfolio’s Sharpe ratio. The Sharpe Ratio is a financial metric that helps investors determine the return of an investment compared to its risk. The higher the Sharpe Ratio of a portfolio, the better it is in terms of risk-adjusted return.

http://tech.harbourfronts.com/modern-portfolio-theory-searching-for-the-optimal-portfolio-portfolio-management-in-python/2021-01-2602 min

Harbourfront TechnologiesModern Portfolio Theory-Searching For the Optimal Portfolio-Portfolio Management in PythonWe are going to search for the optimal portfolio, i.e. one that has the highest risk-adjusted return. To do so, we will maximize the portfolio’s Sharpe ratio. The Sharpe Ratio is a financial metric that helps investors determine the return of an investment compared to its risk. The higher the Sharpe Ratio of a portfolio, the better it is in terms of risk-adjusted return.

http://tech.harbourfronts.com/modern-portfolio-theory-searching-for-the-optimal-portfolio-portfolio-management-in-python/2021-01-2602 min The BMW Podcast | Changing Lanes#040 The most spectacular city race tracks| BMW PodcastAt 200 km/h, the BMW races across the road, closely followed by its competitors, and then takes the bend. The overwhelming skyscrapers and the glittering lights of Hong Kong pass him by. Besides the Central Harbourfront Circuit in Hong Kong, there are numerous exciting race tracks in the middle of the city. Monaco, Singapore, Macau… need we say more? In this episode of Changing Lanes, the official podcast of BMW, we tell you about six spectacular tracks around the world.

00:50 Marina Bay Street Circuit in Singapore

02:00 Circuit de Monaco

03:35 Brooklyn Street Circuit in the USA

04:40 Guia Circuit in Macau

05:35 Baku City...2020-12-0708 min

The BMW Podcast | Changing Lanes#040 The most spectacular city race tracks| BMW PodcastAt 200 km/h, the BMW races across the road, closely followed by its competitors, and then takes the bend. The overwhelming skyscrapers and the glittering lights of Hong Kong pass him by. Besides the Central Harbourfront Circuit in Hong Kong, there are numerous exciting race tracks in the middle of the city. Monaco, Singapore, Macau… need we say more? In this episode of Changing Lanes, the official podcast of BMW, we tell you about six spectacular tracks around the world.

00:50 Marina Bay Street Circuit in Singapore

02:00 Circuit de Monaco

03:35 Brooklyn Street Circuit in the USA

04:40 Guia Circuit in Macau

05:35 Baku City...2020-12-0708 min Harbourfront TechnologiesModern Portfolio Theory-Portfolio Management in PythonHarry M. Markowitz is the founder of Modern Portfolio Theory (MPT) which originated from his 1952 essay on portfolio selection. In this post, we are going to provide a concrete example of implementing MPT in Python. Our portfolio consists of 3 Exchange Traded Funds (ETF): SPY, TLT, and GLD which track the S&P500, long-term Treasury bond, and gold respectively.

http://tech.harbourfronts.com/trading/modern-portfolio-theory-portfolio-management-python/2020-12-0502 min

Harbourfront TechnologiesModern Portfolio Theory-Portfolio Management in PythonHarry M. Markowitz is the founder of Modern Portfolio Theory (MPT) which originated from his 1952 essay on portfolio selection. In this post, we are going to provide a concrete example of implementing MPT in Python. Our portfolio consists of 3 Exchange Traded Funds (ETF): SPY, TLT, and GLD which track the S&P500, long-term Treasury bond, and gold respectively.

http://tech.harbourfronts.com/trading/modern-portfolio-theory-portfolio-management-python/2020-12-0502 min Harbourfront TechnologiesStatistical Analysis of an ETF Pair-Quantitative Trading In PythonPair trading, or statistical arbitrage, is one of the oldest forms of quantitative trading. We are going to present some relevant statistical tests for analyzing the Australia/Canada pair. We chose this pair because these countries’ economies are tied strongly to the commodity sector, therefore they share similar characteristics and could be a good candidate for pair trading

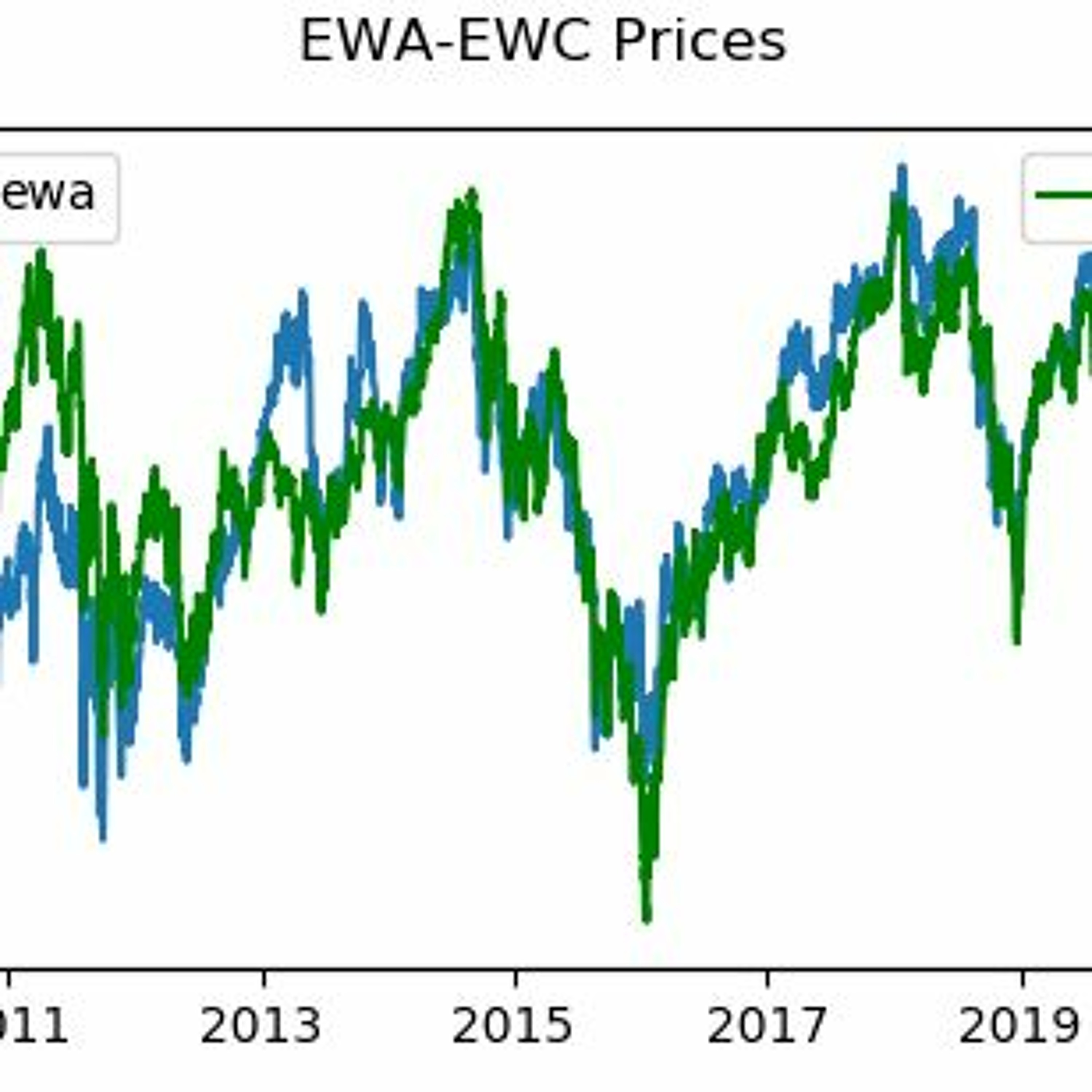

http://tech.harbourfronts.com/trading/statistical-analysis-etf-pair-quantitative-trading-python/2020-12-0102 min

Harbourfront TechnologiesStatistical Analysis of an ETF Pair-Quantitative Trading In PythonPair trading, or statistical arbitrage, is one of the oldest forms of quantitative trading. We are going to present some relevant statistical tests for analyzing the Australia/Canada pair. We chose this pair because these countries’ economies are tied strongly to the commodity sector, therefore they share similar characteristics and could be a good candidate for pair trading

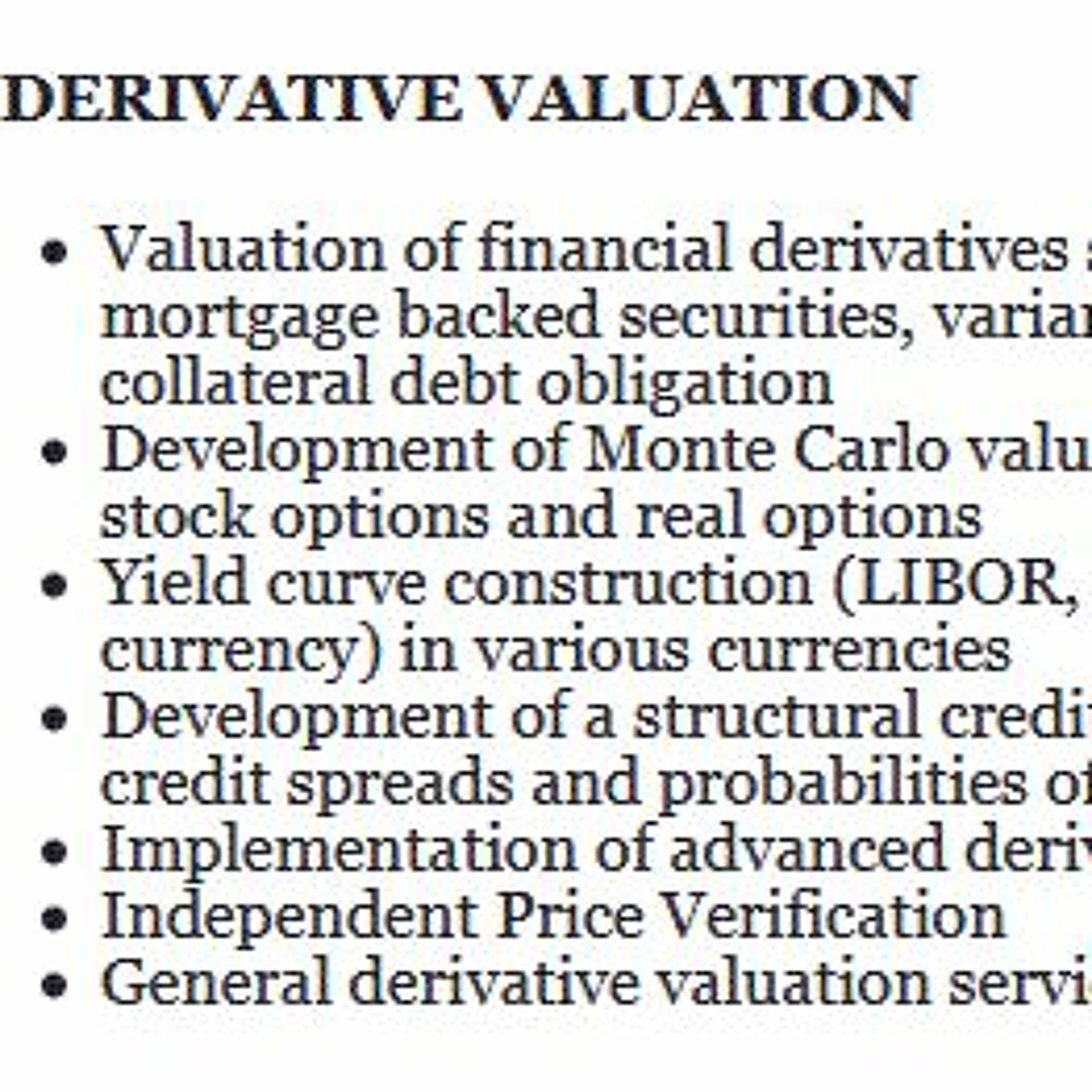

http://tech.harbourfronts.com/trading/statistical-analysis-etf-pair-quantitative-trading-python/2020-12-0102 min Harbourfront TechnologiesDerivative Valuation ServicesWe are a boutique financial service firm specializing in quantitative analysis, derivative valuation and risk management. Our clients range from asset management firms to industrial, non-financial companies. Our services include: Valuation of financial derivatives such as convertible bonds, mortgage backed securities, variance swaps, credit default swaps, collateral debt obligation

http://tech.harbourfronts.com/2020-11-1401 min

Harbourfront TechnologiesDerivative Valuation ServicesWe are a boutique financial service firm specializing in quantitative analysis, derivative valuation and risk management. Our clients range from asset management firms to industrial, non-financial companies. Our services include: Valuation of financial derivatives such as convertible bonds, mortgage backed securities, variance swaps, credit default swaps, collateral debt obligation

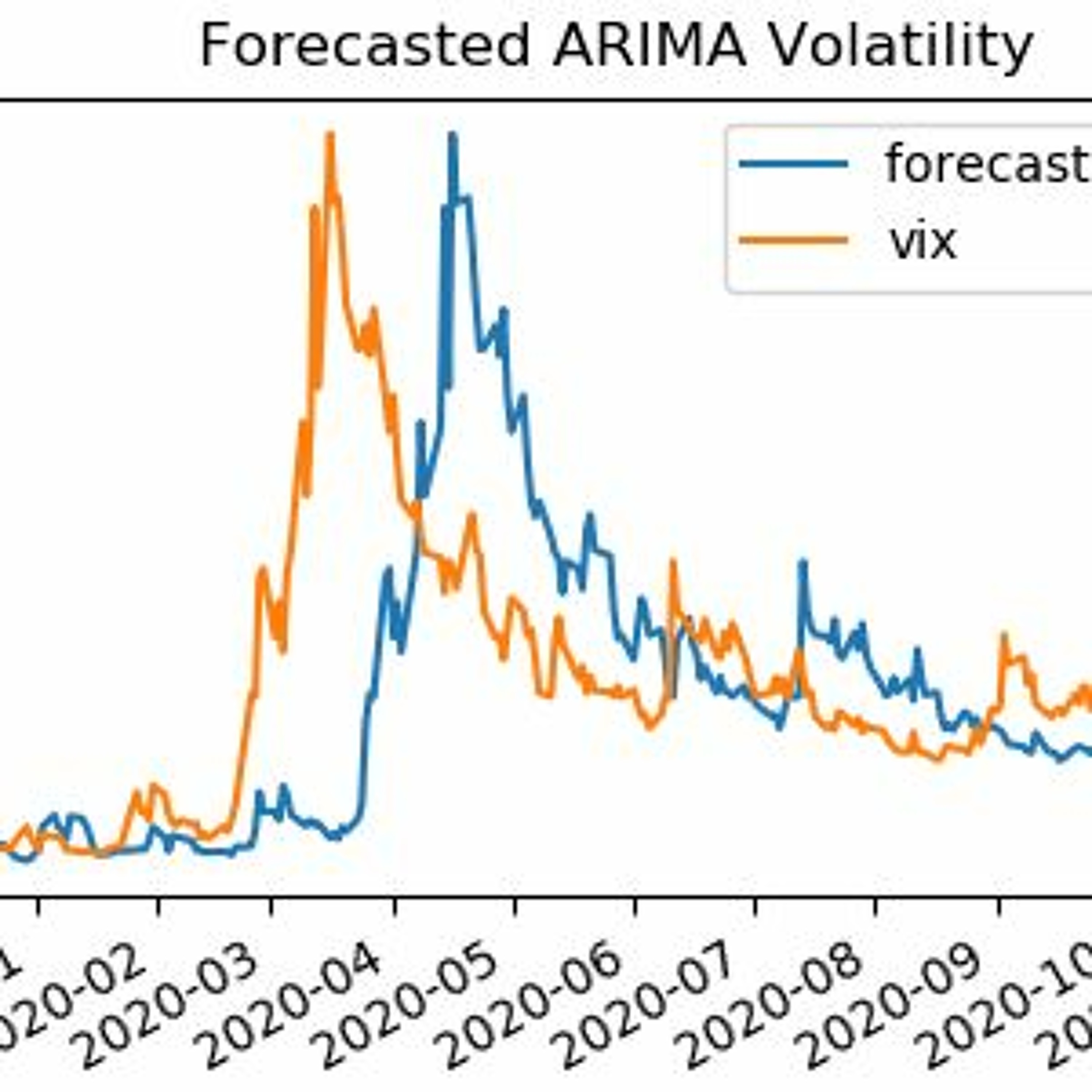

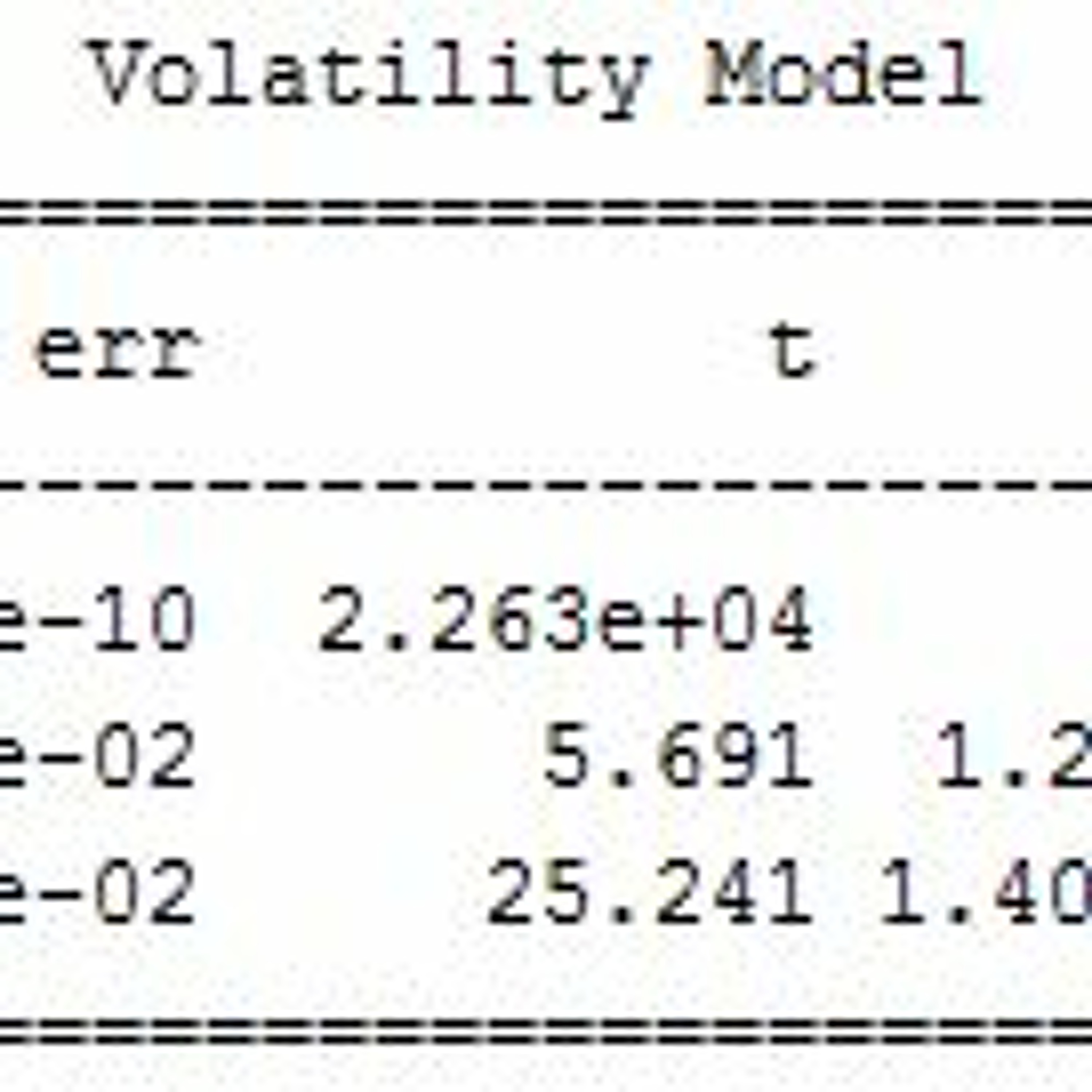

http://tech.harbourfronts.com/2020-11-1401 min Harbourfront TechnologiesForecasting Implied Volatility with ARIMA Model-Volatility Analysis in PythonIn a previous post, we presented theory and a practical example of calculating implied volatility for a given stock option. In this post, we are going to implement a model for forecasting the implied volatility. Specifically, we are going to use the Autoregressive Integrated Moving Average (ARIMA) model to forecast the volatility index VIX.

http://tech.harbourfronts.com/trading/forecasting-implied-volatility-arima-model-volatility-analysis-python/2020-11-0102 min

Harbourfront TechnologiesForecasting Implied Volatility with ARIMA Model-Volatility Analysis in PythonIn a previous post, we presented theory and a practical example of calculating implied volatility for a given stock option. In this post, we are going to implement a model for forecasting the implied volatility. Specifically, we are going to use the Autoregressive Integrated Moving Average (ARIMA) model to forecast the volatility index VIX.

http://tech.harbourfronts.com/trading/forecasting-implied-volatility-arima-model-volatility-analysis-python/2020-11-0102 min Harbourfront TechnologiesForecasting Volatility With GARCH Model-Volatility Analysis in PythonIn a previous post, we presented an example of volatility analysis using Close-to-Close historical volatility. In this post, we are going to use the Generalized Autoregressive Conditional Heteroskedasticity (GARCH) model to forecast volatility.

http://tech.harbourfronts.com/trading/forecasting-volatility-garch-model-volatility-analysis-python/2020-10-2601 min

Harbourfront TechnologiesForecasting Volatility With GARCH Model-Volatility Analysis in PythonIn a previous post, we presented an example of volatility analysis using Close-to-Close historical volatility. In this post, we are going to use the Generalized Autoregressive Conditional Heteroskedasticity (GARCH) model to forecast volatility.

http://tech.harbourfronts.com/trading/forecasting-volatility-garch-model-volatility-analysis-python/2020-10-2601 min Harbourfront TechnologiesImplied Volatility Of Options-Volatility Analysis in PythonThere are two types of volatility: historical volatility and implied volatility. In a series of previous posts, we presented methods and provided Python programs for calculating historical volatilities. In this post, we are going to discuss implied volatility and provide a concrete example of implied volatility calculation in Python.

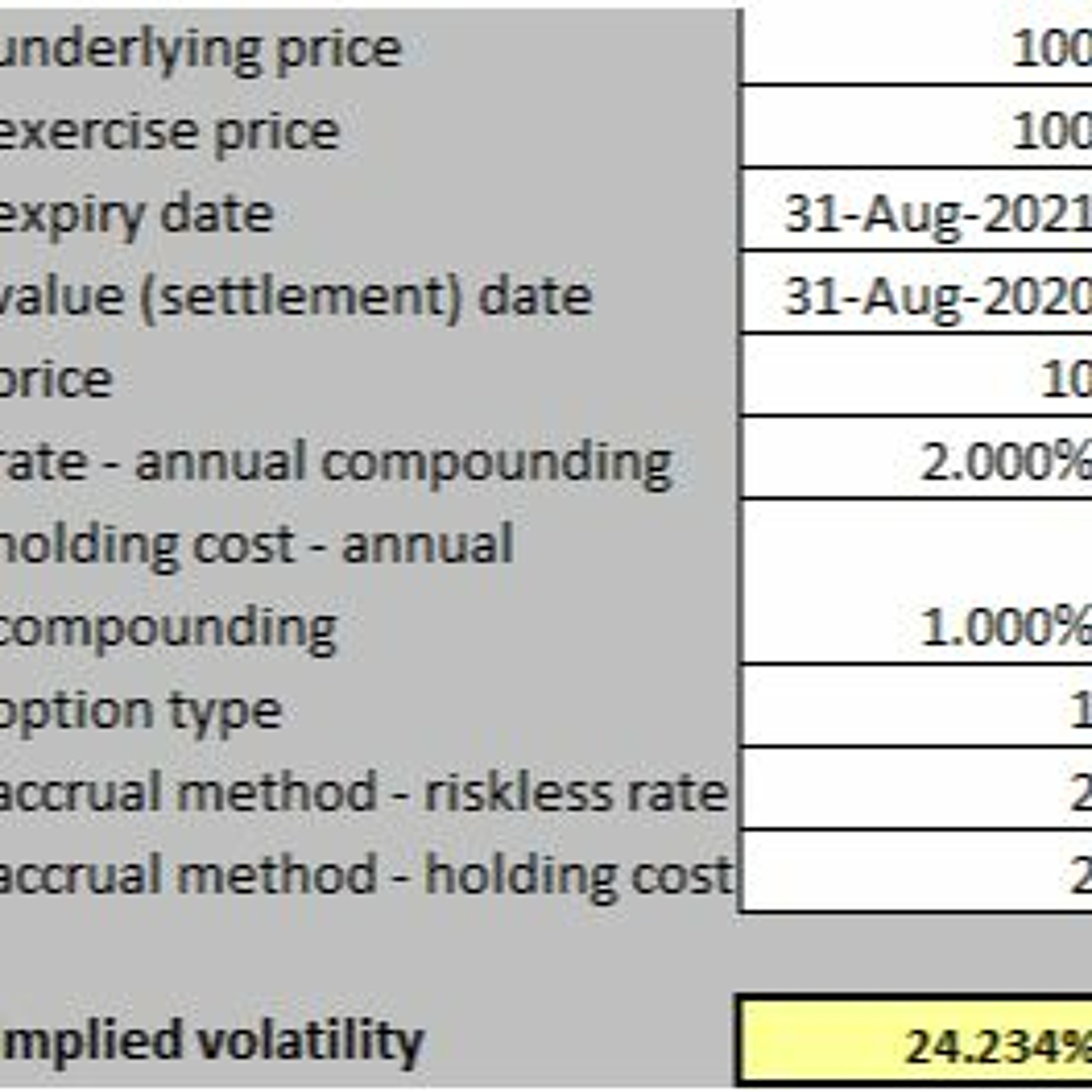

http://tech.harbourfronts.com/trading/implied-volatility-options-volatility-analysis-python/2020-09-2702 min

Harbourfront TechnologiesImplied Volatility Of Options-Volatility Analysis in PythonThere are two types of volatility: historical volatility and implied volatility. In a series of previous posts, we presented methods and provided Python programs for calculating historical volatilities. In this post, we are going to discuss implied volatility and provide a concrete example of implied volatility calculation in Python.

http://tech.harbourfronts.com/trading/implied-volatility-options-volatility-analysis-python/2020-09-2702 min Harbourfront TechnologiesHow to Calculate Stock Beta in Excel-Replicating Yahoo Stock BetaIn a previous post, we presented a method for calculating a stock beta and implemented it in Python. In this follow-up post, we are going to implement the calculation in Excel. We continue to use Facebook as an example.

http://tech.harbourfronts.com/trading/calculate-stock-beta-excel-replicating-yahoo-stock-beta/2020-09-1101 min

Harbourfront TechnologiesHow to Calculate Stock Beta in Excel-Replicating Yahoo Stock BetaIn a previous post, we presented a method for calculating a stock beta and implemented it in Python. In this follow-up post, we are going to implement the calculation in Excel. We continue to use Facebook as an example.

http://tech.harbourfronts.com/trading/calculate-stock-beta-excel-replicating-yahoo-stock-beta/2020-09-1101 min Harbourfront TechnologiesValuation of Callable Putable Bonds-Derivative Pricing in PythonWe are going to discuss valuation of a callable bond. We chose the Hull-White model to describe the interest rate dynamics. We then use a Python program to build a trinomial tree for the risk-free rates

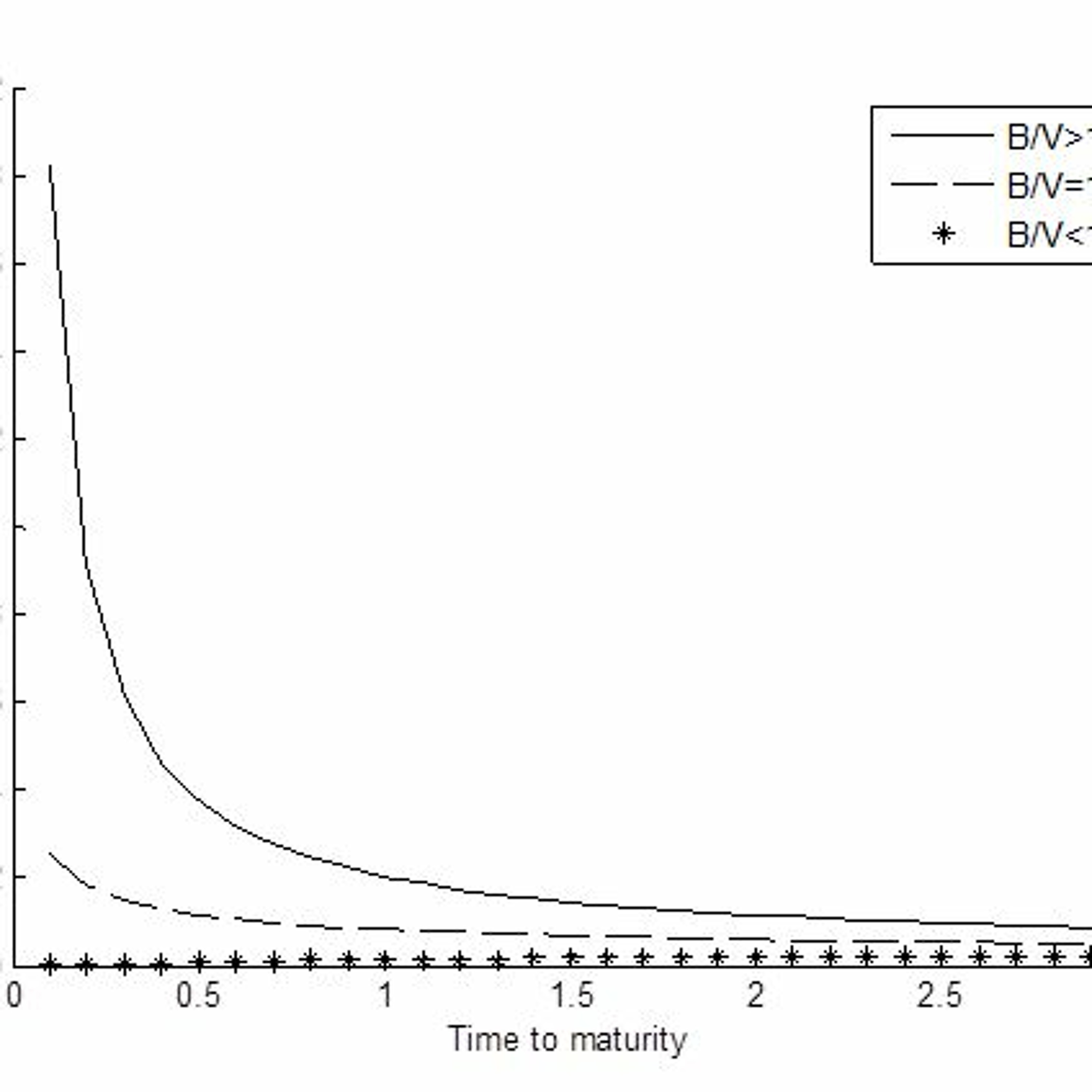

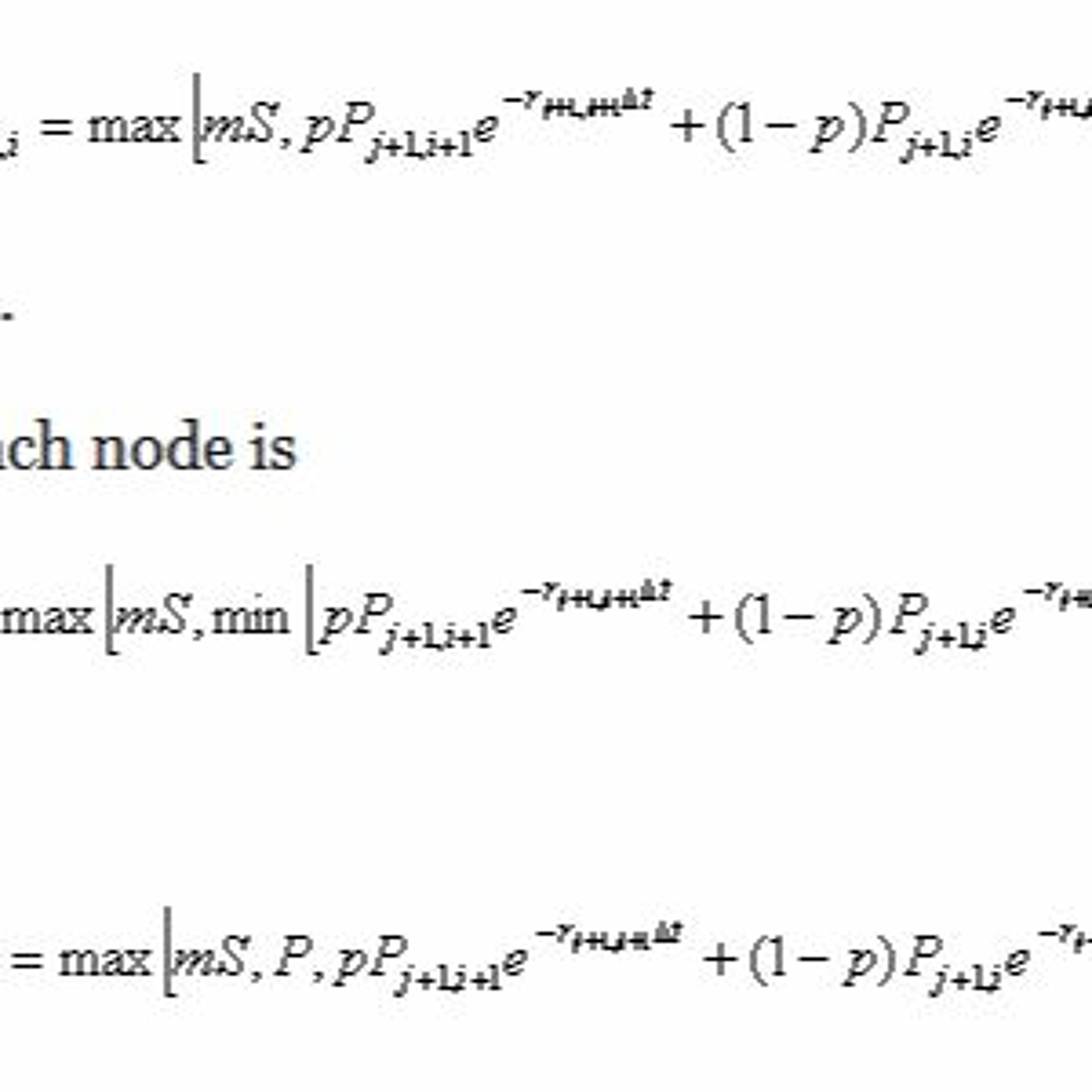

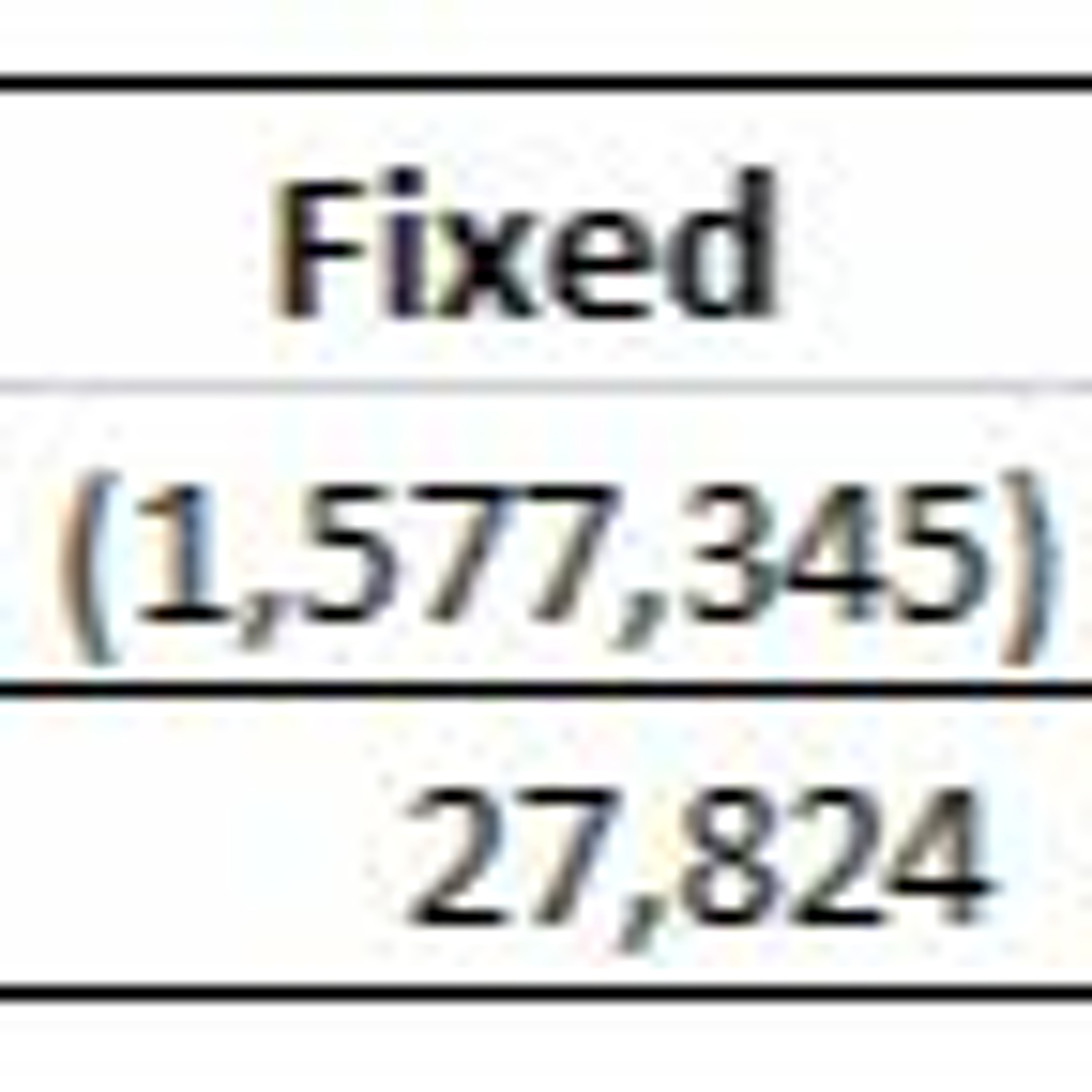

http://tech.harbourfronts.com/derivatives/valuation-callable-puttable-bonds-derivative-pricing-python/2020-08-3104 min

Harbourfront TechnologiesValuation of Callable Putable Bonds-Derivative Pricing in PythonWe are going to discuss valuation of a callable bond. We chose the Hull-White model to describe the interest rate dynamics. We then use a Python program to build a trinomial tree for the risk-free rates

http://tech.harbourfronts.com/derivatives/valuation-callable-puttable-bonds-derivative-pricing-python/2020-08-3104 min Harbourfront TechnologiesValuation of Warrants-Derivative Pricing in PythonA warrant is a financial derivative instrument that is similar to a regular stock option except that when it is exercised, the company will issue more stocks and sell them to the warrant holder. The valuation of warrants is similar to the valuation of stock options except that the effect of dilution should be considered.

http://tech.harbourfronts.com/derivatives/valuation-warrants-derivative-pricing-python/2020-08-1904 min

Harbourfront TechnologiesValuation of Warrants-Derivative Pricing in PythonA warrant is a financial derivative instrument that is similar to a regular stock option except that when it is exercised, the company will issue more stocks and sell them to the warrant holder. The valuation of warrants is similar to the valuation of stock options except that the effect of dilution should be considered.

http://tech.harbourfronts.com/derivatives/valuation-warrants-derivative-pricing-python/2020-08-1904 min Harbourfront TechnologiesPerformance Share Units-Derivative Valuation in PythonPerformance share units are hypothetical share units that are granted to you based mainly on corporate and/or individual performance. Structurally, they are very similar to restricted stock units except these are more focused on your performance. They are designed to mirror share ownership and you will generally be granted additional units having the same value as dividends being paid on the regular shares

http://tech.harbourfronts.com/derivatives/performance-share-units-derivative-valuation-python/2020-08-0802 min

Harbourfront TechnologiesPerformance Share Units-Derivative Valuation in PythonPerformance share units are hypothetical share units that are granted to you based mainly on corporate and/or individual performance. Structurally, they are very similar to restricted stock units except these are more focused on your performance. They are designed to mirror share ownership and you will generally be granted additional units having the same value as dividends being paid on the regular shares

http://tech.harbourfronts.com/derivatives/performance-share-units-derivative-valuation-python/2020-08-0802 min Harbourfront TechnologiesEmployee Stock Options-Derivative Pricing in PythonValuation of Employee Stock Options is different from regular stock options. In this post, we are going to implement the approach proposed by Hull and White. Specifically, we are going to implement the vesting and forfeiture rate features. Other features can also be implemented without difficulty

http://tech.harbourfronts.com/derivatives/employee-stock-options-derivative-pricing-python/2020-08-0302 min

Harbourfront TechnologiesEmployee Stock Options-Derivative Pricing in PythonValuation of Employee Stock Options is different from regular stock options. In this post, we are going to implement the approach proposed by Hull and White. Specifically, we are going to implement the vesting and forfeiture rate features. Other features can also be implemented without difficulty

http://tech.harbourfronts.com/derivatives/employee-stock-options-derivative-pricing-python/2020-08-0302 min Harbourfront TechnologiesValuing American Options Using Monte Carlo Simulation –Derivative Pricing in PythonWe are going to present a method for valuing American options using Monte Carlo simulation. This method will allow us to implement more complex option payoffs with greater flexibility, even if the payoffs are path-dependent. Specifically, we use the Least-Squares Method of Longstaff and Schwartz in order to take into account the early exercise feature. The stock price is assumed to follow the Geometrical Brownian Motion.

http://tech.harbourfronts.com/derivatives/valuing-american-options-using-monte-carlo-simulation-derivative-pricing-python/2020-07-3002 min

Harbourfront TechnologiesValuing American Options Using Monte Carlo Simulation –Derivative Pricing in PythonWe are going to present a method for valuing American options using Monte Carlo simulation. This method will allow us to implement more complex option payoffs with greater flexibility, even if the payoffs are path-dependent. Specifically, we use the Least-Squares Method of Longstaff and Schwartz in order to take into account the early exercise feature. The stock price is assumed to follow the Geometrical Brownian Motion.

http://tech.harbourfronts.com/derivatives/valuing-american-options-using-monte-carlo-simulation-derivative-pricing-python/2020-07-3002 min Harbourfront TechnologiesGarman-Klass-Yang-Zhang Historical Volatility Calculation – Volatility Analysis in PythonWe present an extension of the Garman-Klass volatility estimator that also takes into consideration overnight jumps. Garman-Klass-Yang-Zhang (GKYZ) volatility estimator consists of using the returns of open, high, low, and closing prices in its calculation. It also uses the previous day’s closing price.

http://tech.harbourfronts.com/trading/garman-klass-yang-zhang-historical-volatility-calculation-volatility-analysis-python/2020-07-2801 min

Harbourfront TechnologiesGarman-Klass-Yang-Zhang Historical Volatility Calculation – Volatility Analysis in PythonWe present an extension of the Garman-Klass volatility estimator that also takes into consideration overnight jumps. Garman-Klass-Yang-Zhang (GKYZ) volatility estimator consists of using the returns of open, high, low, and closing prices in its calculation. It also uses the previous day’s closing price.

http://tech.harbourfronts.com/trading/garman-klass-yang-zhang-historical-volatility-calculation-volatility-analysis-python/2020-07-2801 min Downtown Lowdown with Downtown Halifax Business CommissionEpisode 29: Guest Jenny Nodelman, Marketing and Events Officer at the Maritime Museum of the AtlanticJenny Nodelman, Marketing and Events Officer at the Maritime Museum of the Atlantic. Plus, on Biz Buzz today, we’ll talk discuss what’s new, what’s newly re-open, and what’s happening Downtown. Paul MacKinnon, CEO of Downtown Halifax Business Commission, will give us an update on Bedford Row, the Peace and Friendship Park, and the Department of Education’s back to school announcement and how it affects Downtown.

Producers:

Ivy Ho and Allana MacDonald Mills

Downtown Halifax Business Commission (DHBC)

104-1546 Barrington Street

Halifax, Nova Scotia, B3J 3X7

...2020-07-2854 min

Downtown Lowdown with Downtown Halifax Business CommissionEpisode 29: Guest Jenny Nodelman, Marketing and Events Officer at the Maritime Museum of the AtlanticJenny Nodelman, Marketing and Events Officer at the Maritime Museum of the Atlantic. Plus, on Biz Buzz today, we’ll talk discuss what’s new, what’s newly re-open, and what’s happening Downtown. Paul MacKinnon, CEO of Downtown Halifax Business Commission, will give us an update on Bedford Row, the Peace and Friendship Park, and the Department of Education’s back to school announcement and how it affects Downtown.

Producers:

Ivy Ho and Allana MacDonald Mills

Downtown Halifax Business Commission (DHBC)

104-1546 Barrington Street

Halifax, Nova Scotia, B3J 3X7

...2020-07-2854 min Artists At Home: Keeping Busy During QuarantineEpisode Nine: Mary-Margaret AnnabOn today's episode, we talk with Mary-Margaret Annab, multi-disciplinary artist and current Production Coordinator at Harbourfront Centre, about making theatre during the pandemic. We talk about the problems theatre artists face in the midst of re-opening, the experience of making online content, and the mental impact this pandemic has on artists.

Mary-Margaret Annab is a multi-disciplinary artist and youth arts educator based in Toronto, Ontario. A graduate of York University’s BFA Production program, she currently works as a Production Coordinator at the Harbourfront Centre and as a teacher with studios across the GTA. She...2020-07-2040 min

Artists At Home: Keeping Busy During QuarantineEpisode Nine: Mary-Margaret AnnabOn today's episode, we talk with Mary-Margaret Annab, multi-disciplinary artist and current Production Coordinator at Harbourfront Centre, about making theatre during the pandemic. We talk about the problems theatre artists face in the midst of re-opening, the experience of making online content, and the mental impact this pandemic has on artists.

Mary-Margaret Annab is a multi-disciplinary artist and youth arts educator based in Toronto, Ontario. A graduate of York University’s BFA Production program, she currently works as a Production Coordinator at the Harbourfront Centre and as a teacher with studios across the GTA. She...2020-07-2040 min Harbourfront TechnologiesGarman-Klass Volatility Calculation – Volatility Analysis in PythonIn the previous post, we introduced the Parkinson volatility estimator that takes into account the high and low prices of a stock. In this follow-up post, we present the Garman-Klass volatility estimator that uses not only the high and low but also the opening and closing prices.

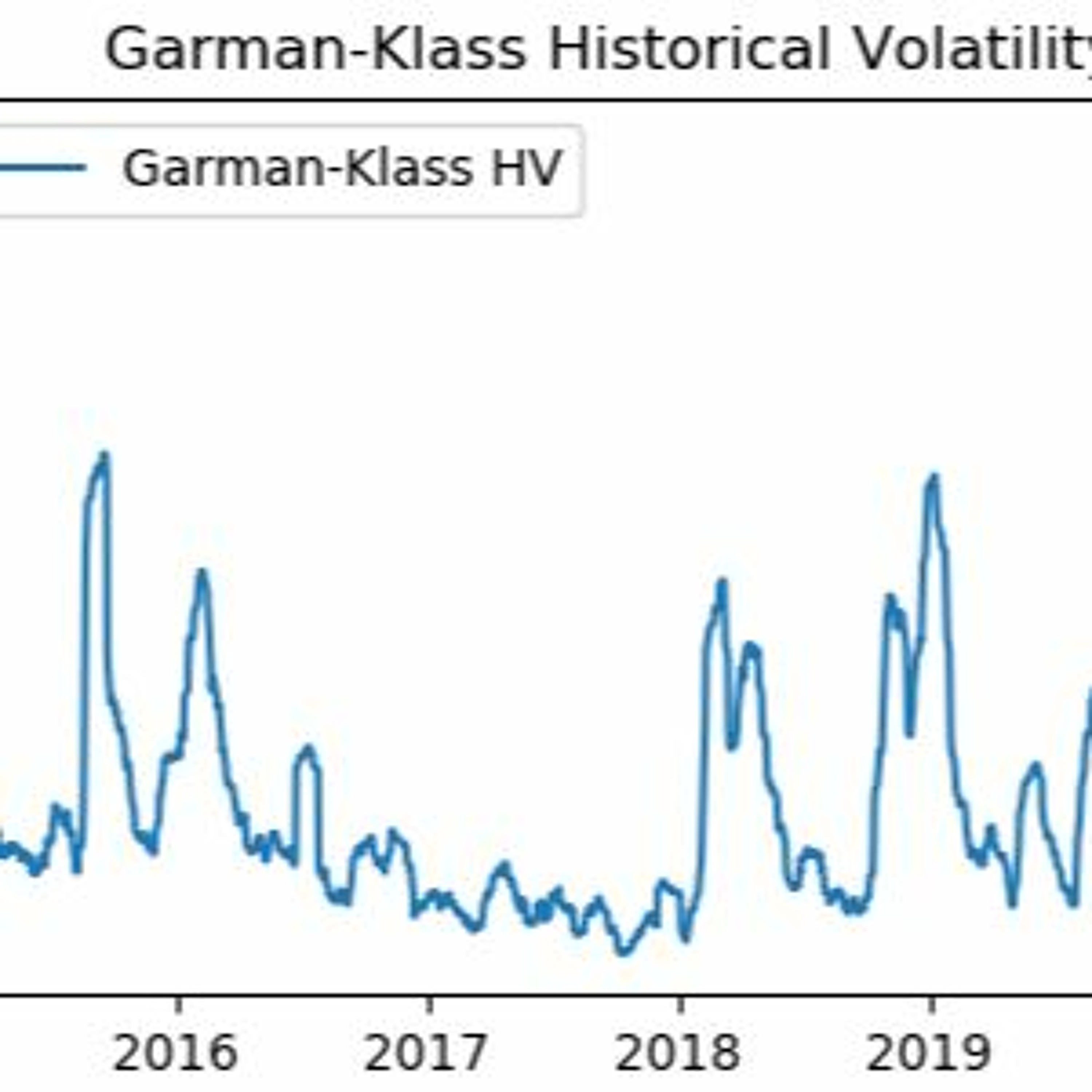

http://tech.harbourfronts.com/trading/garman-klass-volatility-calculation-volatility-analysis-python/2020-07-0101 min

Harbourfront TechnologiesGarman-Klass Volatility Calculation – Volatility Analysis in PythonIn the previous post, we introduced the Parkinson volatility estimator that takes into account the high and low prices of a stock. In this follow-up post, we present the Garman-Klass volatility estimator that uses not only the high and low but also the opening and closing prices.

http://tech.harbourfronts.com/trading/garman-klass-volatility-calculation-volatility-analysis-python/2020-07-0101 min Harbourfront TechnologiesParkinson Historical Volatility Calculation – Volatility Analysis in PythonA disadvantage of using the CCHV is that it does not take into account the information about intraday prices. The Parkinson volatility extends the CCHV by incorporating the stock’s daily high and low prices.

http://tech.harbourfronts.com/trading/parkinson-historical-volatility-calculation-volatility-analysis-python/2020-06-3001 min

Harbourfront TechnologiesParkinson Historical Volatility Calculation – Volatility Analysis in PythonA disadvantage of using the CCHV is that it does not take into account the information about intraday prices. The Parkinson volatility extends the CCHV by incorporating the stock’s daily high and low prices.

http://tech.harbourfronts.com/trading/parkinson-historical-volatility-calculation-volatility-analysis-python/2020-06-3001 min WorkInCulture Success StoriesPivoting with the TimesTim Walker, Manager of School Visits Programs for Harbourfront Centre discusses the challenges and silver linings that arts organizations are faced with during the pandemic - and how to pivot with the times.Tim Walker completed his Bachelor of Arts Honours degree at the University of Toronto in Geography and Sociology. He went on to complete his Bachelor of Education at Trent University, and completed his Masters of Education at York University. When he is not managing the School Visits team, he serves on the Board of Directors for PAONE (Professional Arts Organization Network for Education) and S...2020-06-2924 min

WorkInCulture Success StoriesPivoting with the TimesTim Walker, Manager of School Visits Programs for Harbourfront Centre discusses the challenges and silver linings that arts organizations are faced with during the pandemic - and how to pivot with the times.Tim Walker completed his Bachelor of Arts Honours degree at the University of Toronto in Geography and Sociology. He went on to complete his Bachelor of Education at Trent University, and completed his Masters of Education at York University. When he is not managing the School Visits team, he serves on the Board of Directors for PAONE (Professional Arts Organization Network for Education) and S...2020-06-2924 min Downtown Lowdown with Downtown Halifax Business CommissionEpisode 27: Downtown Halifax Covid 19 Report 15, June 19, 2020 - Jeff Ransome, General Manager of the Halifax Marriott Harbourfront HotelA conversation with Jeff Ransome, General Manager of the Halifax Marriott Harbourfront Hotel – a 352-room, four-diamond hotel located directly on the boardwalk overlooking the Halifax Harbour. Jeff will talk to us about how the Marriott Harbourfront has coped with the pandemic and he’ll also give us his take on the pandemic’s impact on the hotel industry as a whole.

Paul MacKinnon, CEO of Downtown Halifax Business Commission, will give us updates on DHBC’s virtual AGM and latest advocacy efforts.

We’ll also review what businesses have been doing since the Nova Scotia government...2020-06-2347 min

Downtown Lowdown with Downtown Halifax Business CommissionEpisode 27: Downtown Halifax Covid 19 Report 15, June 19, 2020 - Jeff Ransome, General Manager of the Halifax Marriott Harbourfront HotelA conversation with Jeff Ransome, General Manager of the Halifax Marriott Harbourfront Hotel – a 352-room, four-diamond hotel located directly on the boardwalk overlooking the Halifax Harbour. Jeff will talk to us about how the Marriott Harbourfront has coped with the pandemic and he’ll also give us his take on the pandemic’s impact on the hotel industry as a whole.

Paul MacKinnon, CEO of Downtown Halifax Business Commission, will give us updates on DHBC’s virtual AGM and latest advocacy efforts.

We’ll also review what businesses have been doing since the Nova Scotia government...2020-06-2347 min StageworthyPlayME Podcast: Laura Mullin & Chris TolleyChris Tolley is a writer, director and producer, and the Co-Artistic Director of Expect Theatre. After graduating from York University he teamed up with Laura Mullin, and together they have created award-winning multi-disciplinary productions that have toured across Canada and the US.

Chris’ work has been nominated for five Dora Awards in the General Theatre category, and has been shortlisted twice for the Toronto Arts Foundation Awards. In 2006 both Chis and Laura won Harbourfront Centre’s inaugural FreshGround commissioning award.

His most notable works include Romeo/Juliet REMIXED (Toronto and Philadelphia), STATIC (World Stage Festival) and...2020-05-1943 min

StageworthyPlayME Podcast: Laura Mullin & Chris TolleyChris Tolley is a writer, director and producer, and the Co-Artistic Director of Expect Theatre. After graduating from York University he teamed up with Laura Mullin, and together they have created award-winning multi-disciplinary productions that have toured across Canada and the US.

Chris’ work has been nominated for five Dora Awards in the General Theatre category, and has been shortlisted twice for the Toronto Arts Foundation Awards. In 2006 both Chis and Laura won Harbourfront Centre’s inaugural FreshGround commissioning award.

His most notable works include Romeo/Juliet REMIXED (Toronto and Philadelphia), STATIC (World Stage Festival) and...2020-05-1943 min Harbourfront TechnologiesClose-to-Close Historical Volatility Calculation – Volatility Analysis in PythonIn this post, we are going to discuss historical volatilities of a stock in more details. There are various types of historical volatilities such as close to close, Parkinson, Garman-KIass, Yang-Zhang, etc. Here we will discuss the close-to-close historical volatility. It’s observed that the volatility is a mean-reverting process.

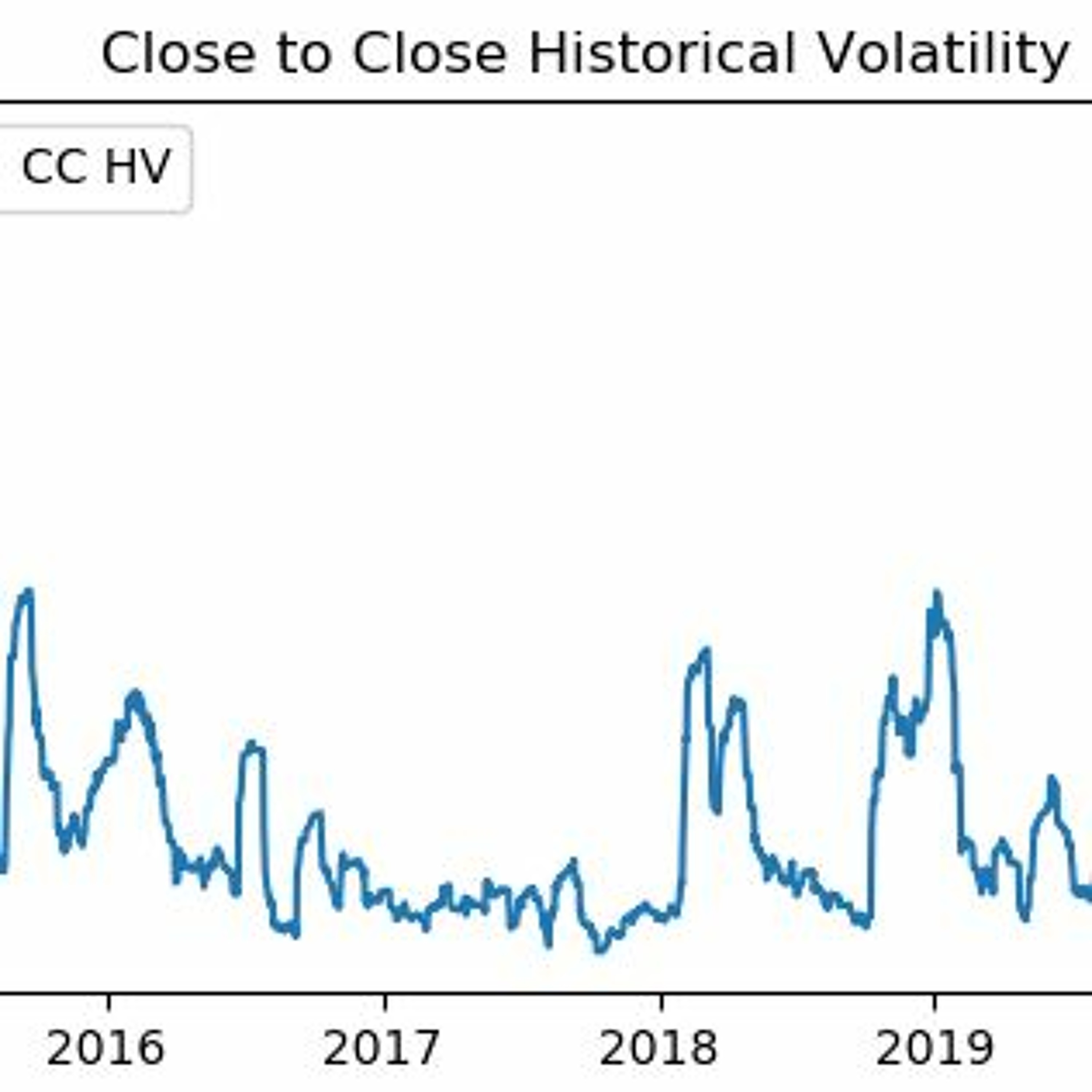

http://tech.harbourfronts.com/trading/close-close-historical-volatility-calculation-volatility-analysis-python/2020-04-3002 min

Harbourfront TechnologiesClose-to-Close Historical Volatility Calculation – Volatility Analysis in PythonIn this post, we are going to discuss historical volatilities of a stock in more details. There are various types of historical volatilities such as close to close, Parkinson, Garman-KIass, Yang-Zhang, etc. Here we will discuss the close-to-close historical volatility. It’s observed that the volatility is a mean-reverting process.

http://tech.harbourfronts.com/trading/close-close-historical-volatility-calculation-volatility-analysis-python/2020-04-3002 min Harbourfront TechnologiesWhat is Stock Beta and How to Calculate Stock Beta in PythonIn finance, beta measures a stock’s volatility with respect to the overall market. It is used in many areas of financial analysis and investment, for example in the calculation of the Weighted Average Cost of Capital, in the Capital Asset Pricing Model and market-neutral trading. In this post, we present a concrete example of calculating the beta of Facebook, a technology stock. As for the market benchmark, we utilize SPY.

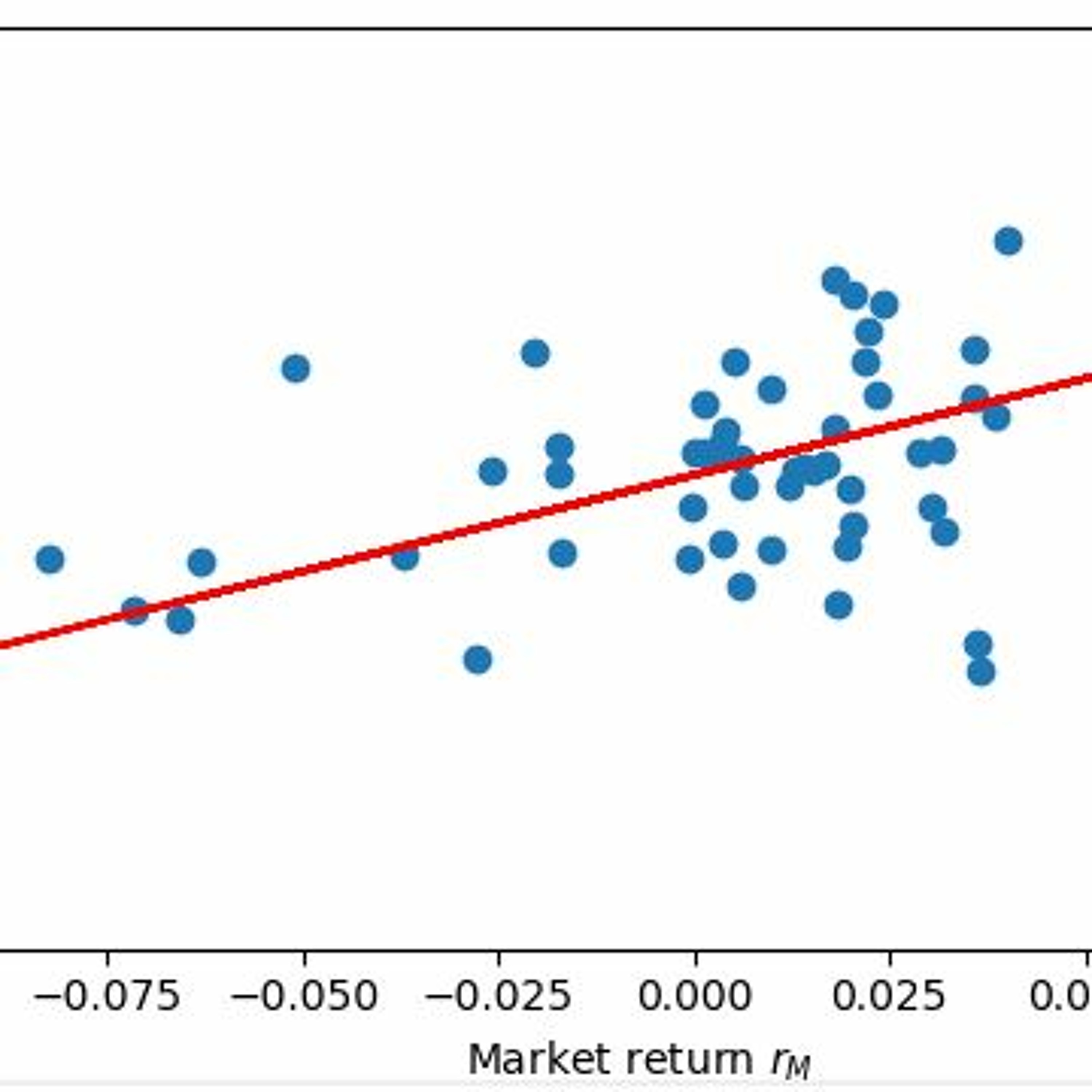

http://tech.harbourfronts.com/trading/stock-beta-calculate-stock-beta-python/2020-04-2502 min

Harbourfront TechnologiesWhat is Stock Beta and How to Calculate Stock Beta in PythonIn finance, beta measures a stock’s volatility with respect to the overall market. It is used in many areas of financial analysis and investment, for example in the calculation of the Weighted Average Cost of Capital, in the Capital Asset Pricing Model and market-neutral trading. In this post, we present a concrete example of calculating the beta of Facebook, a technology stock. As for the market benchmark, we utilize SPY.

http://tech.harbourfronts.com/trading/stock-beta-calculate-stock-beta-python/2020-04-2502 min Work. Shouldnt. Suck.Live with Syrus Marcus Ware!Work. Shouldn't. Suck. LIVE: The Morning(ish) Show with special guest Syrus Marcus Ware, a Vanier Scholar, visual artist, activist, curator and educator. [Live show recorded: April 13, 2020.]SYRUS MARCUS WARE uses painting, installation and performance to explore social justice frameworks and black activist culture. His work has been shown widely, including in a solo show at Grunt Gallery, Vancouver (2068:Touch Change) and new work commissioned for the 2019 Toronto Biennial of Art and the Ryerson Image Centre (Antarctica and Ancestors, Do You Read Us? (Dispatches from the Future)) and in group shows at the Art Gallery of Ontario...2020-04-1530 min

Work. Shouldnt. Suck.Live with Syrus Marcus Ware!Work. Shouldn't. Suck. LIVE: The Morning(ish) Show with special guest Syrus Marcus Ware, a Vanier Scholar, visual artist, activist, curator and educator. [Live show recorded: April 13, 2020.]SYRUS MARCUS WARE uses painting, installation and performance to explore social justice frameworks and black activist culture. His work has been shown widely, including in a solo show at Grunt Gallery, Vancouver (2068:Touch Change) and new work commissioned for the 2019 Toronto Biennial of Art and the Ryerson Image Centre (Antarctica and Ancestors, Do You Read Us? (Dispatches from the Future)) and in group shows at the Art Gallery of Ontario...2020-04-1530 min Harbourfront TechnologiesCorrelation Between the VVIX And VIX IndicesThe VIX index is an important market indicator that everyone is watching. VVIX, on the other hand, receives less attention. In this post, we are going to take a look at the relationship between the VIX and VVIX indices.

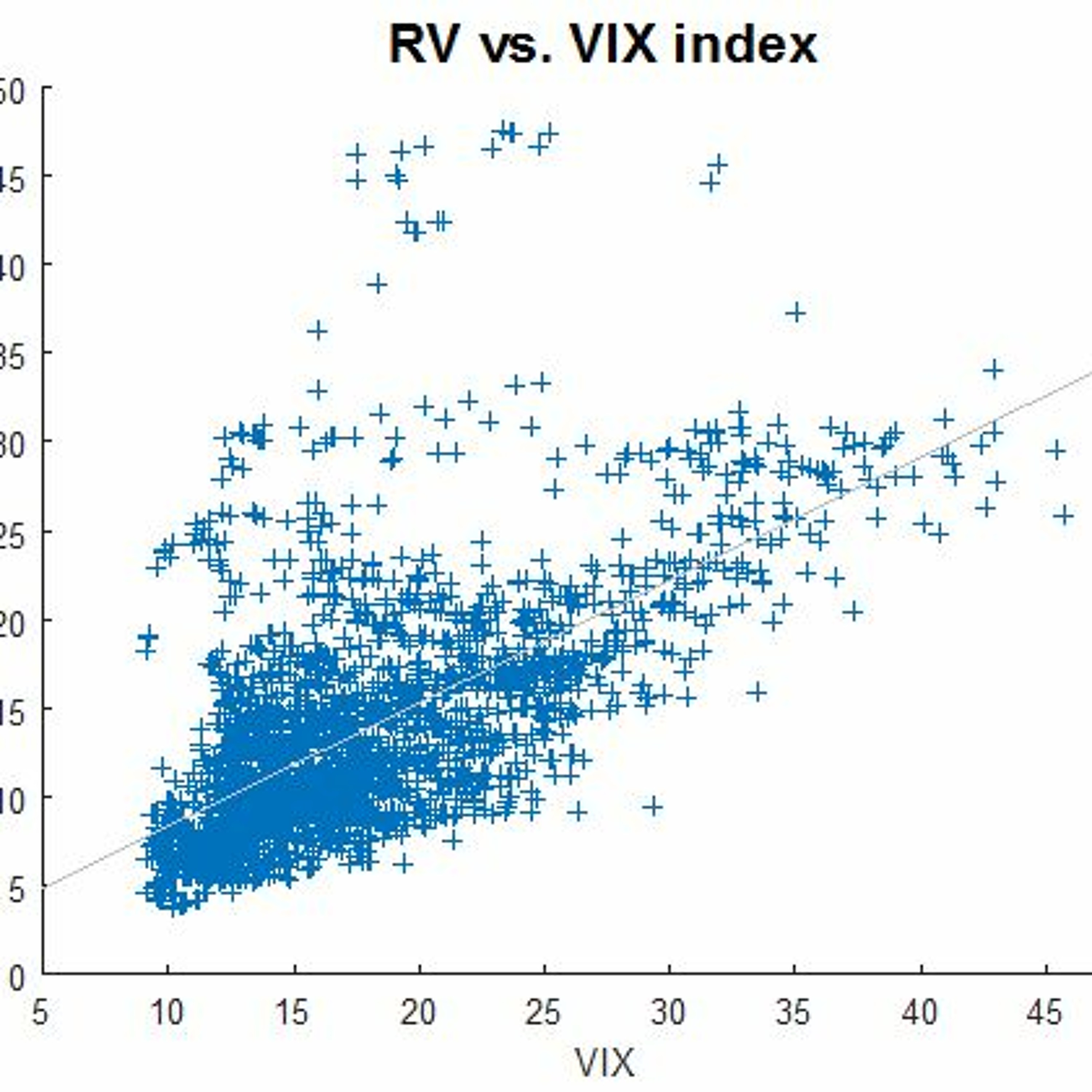

http://blog.harbourfronts.com/2020/03/25/correlation-vvix-vix-indices/2020-03-2601 min

Harbourfront TechnologiesCorrelation Between the VVIX And VIX IndicesThe VIX index is an important market indicator that everyone is watching. VVIX, on the other hand, receives less attention. In this post, we are going to take a look at the relationship between the VIX and VVIX indices.

http://blog.harbourfronts.com/2020/03/25/correlation-vvix-vix-indices/2020-03-2601 min WavyQ&A with Gemma + Wellness Tips from Catherines CabinetWavy host Gemma answers questions that the audience asked. During the second portion of the episode, Catherine Sugrue (catherinescabinet) who is a certified Holistic Nutritionist offers some wellness tips on how to stay healthy both mentally and physically during isolation. Catherine has also been featured/appeared in a number of online and in-person events – including the Harbourfront Hot & Spicy Food Festival, The National Women’s Show, The National Post, Live Daytime TV segments in Toronto, Peterborough, Kingston, and Ottawa, as well as numerous workshops.

Some of her previous roles include: Chief Operations Officer for DoTheDaniel.com, a leadi...2020-03-2437 min

WavyQ&A with Gemma + Wellness Tips from Catherines CabinetWavy host Gemma answers questions that the audience asked. During the second portion of the episode, Catherine Sugrue (catherinescabinet) who is a certified Holistic Nutritionist offers some wellness tips on how to stay healthy both mentally and physically during isolation. Catherine has also been featured/appeared in a number of online and in-person events – including the Harbourfront Hot & Spicy Food Festival, The National Women’s Show, The National Post, Live Daytime TV segments in Toronto, Peterborough, Kingston, and Ottawa, as well as numerous workshops.

Some of her previous roles include: Chief Operations Officer for DoTheDaniel.com, a leadi...2020-03-2437 min Harbourfront TechnologiesValue At Risk Financial Risk Management In PythonValue at risk (VaR) is a measure of the risk of loss for investments. It estimates how much a set of investments might lose (with a given probability), given normal market conditions, in a set time period such as a day. The method presented in this post is suitable for calculating the VaR in a normal market condition. More advanced approaches such as Expected Tail Loss have been developed that can better take into account the tail risk.

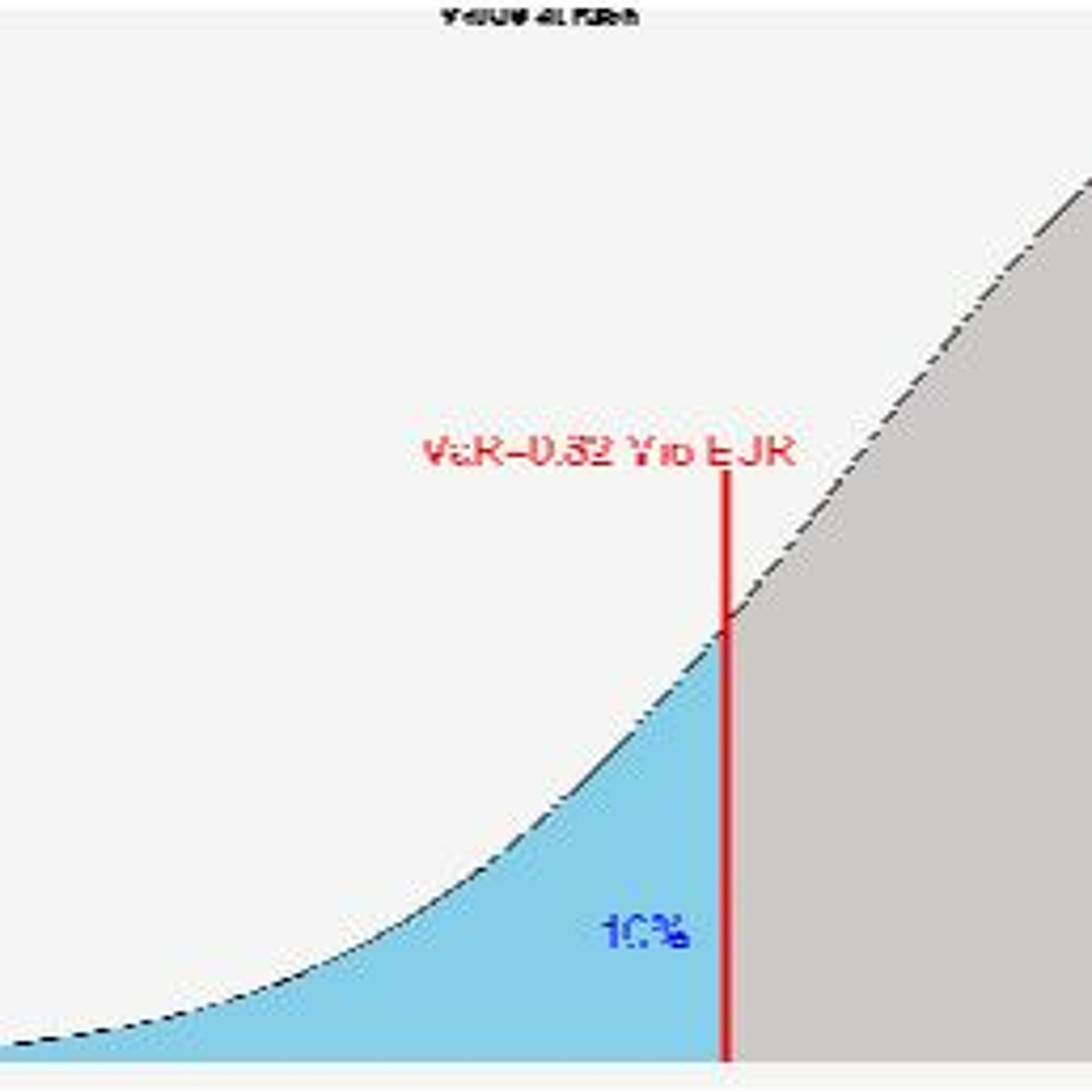

http://tech.harbourfronts.com/risk-management/value-risk-financial-risk-management-python/2020-03-1702 min

Harbourfront TechnologiesValue At Risk Financial Risk Management In PythonValue at risk (VaR) is a measure of the risk of loss for investments. It estimates how much a set of investments might lose (with a given probability), given normal market conditions, in a set time period such as a day. The method presented in this post is suitable for calculating the VaR in a normal market condition. More advanced approaches such as Expected Tail Loss have been developed that can better take into account the tail risk.

http://tech.harbourfronts.com/risk-management/value-risk-financial-risk-management-python/2020-03-1702 min Harbourfront TechnologiesValuing European Options Using Monte Carlo Simulation- Derivative Pricing in PythonTo price the options, we first simulate the price paths using the following Stochastic Differential Equation. The simulation is carried out until the options’ maturity. We then apply the terminal payoff functions and calculate the mean values of all the payoffs. Finally, we discount the mean values to the present and thus obtain the option values.

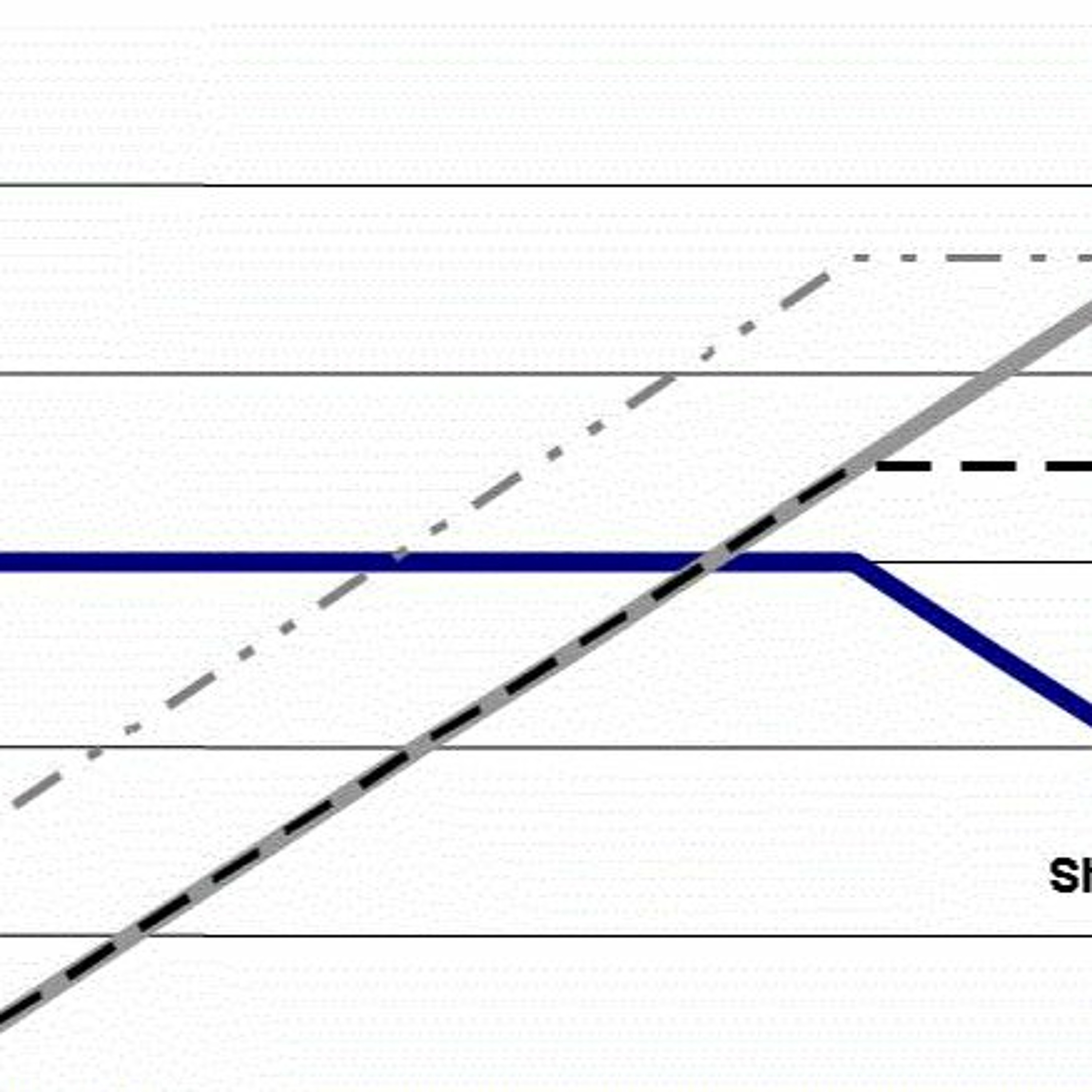

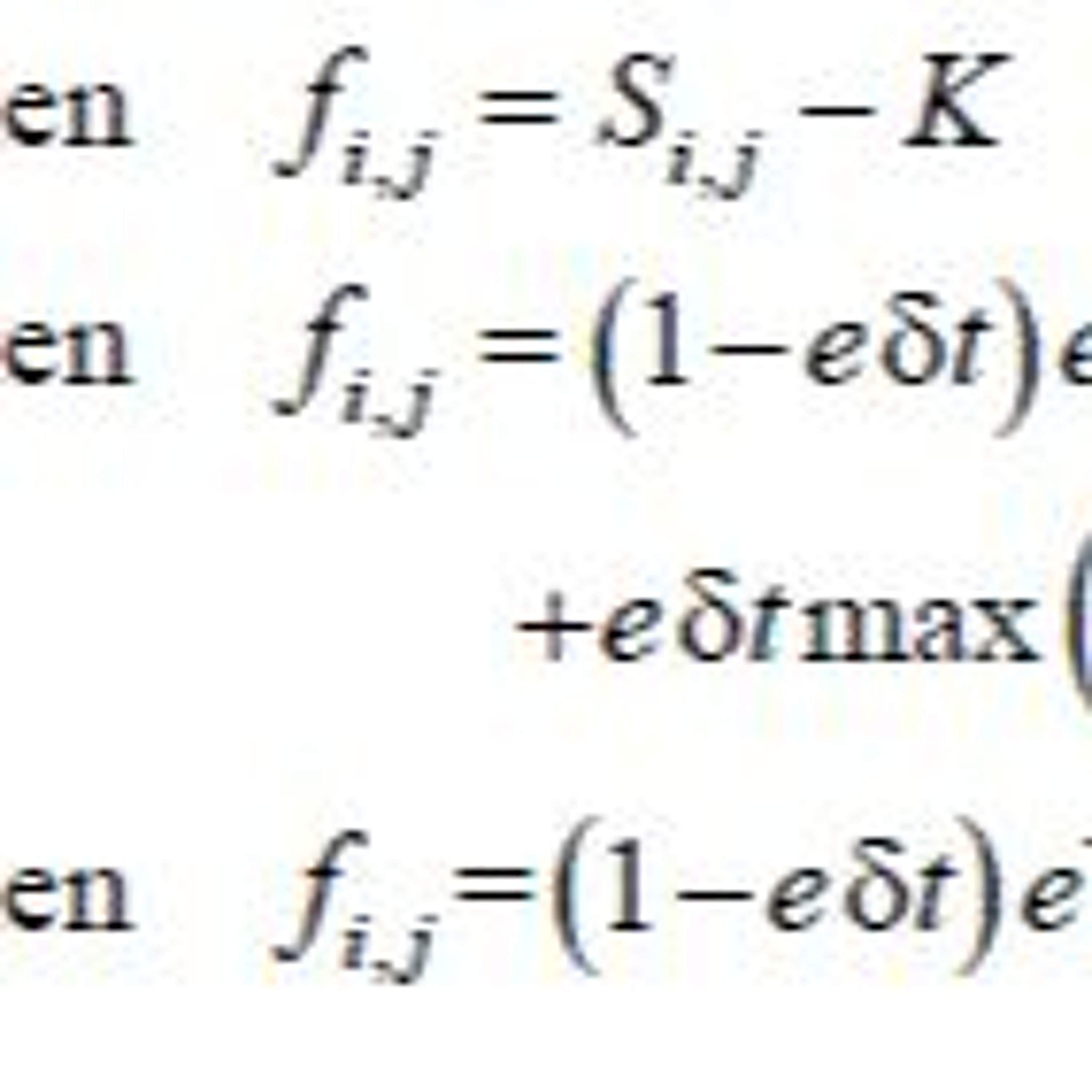

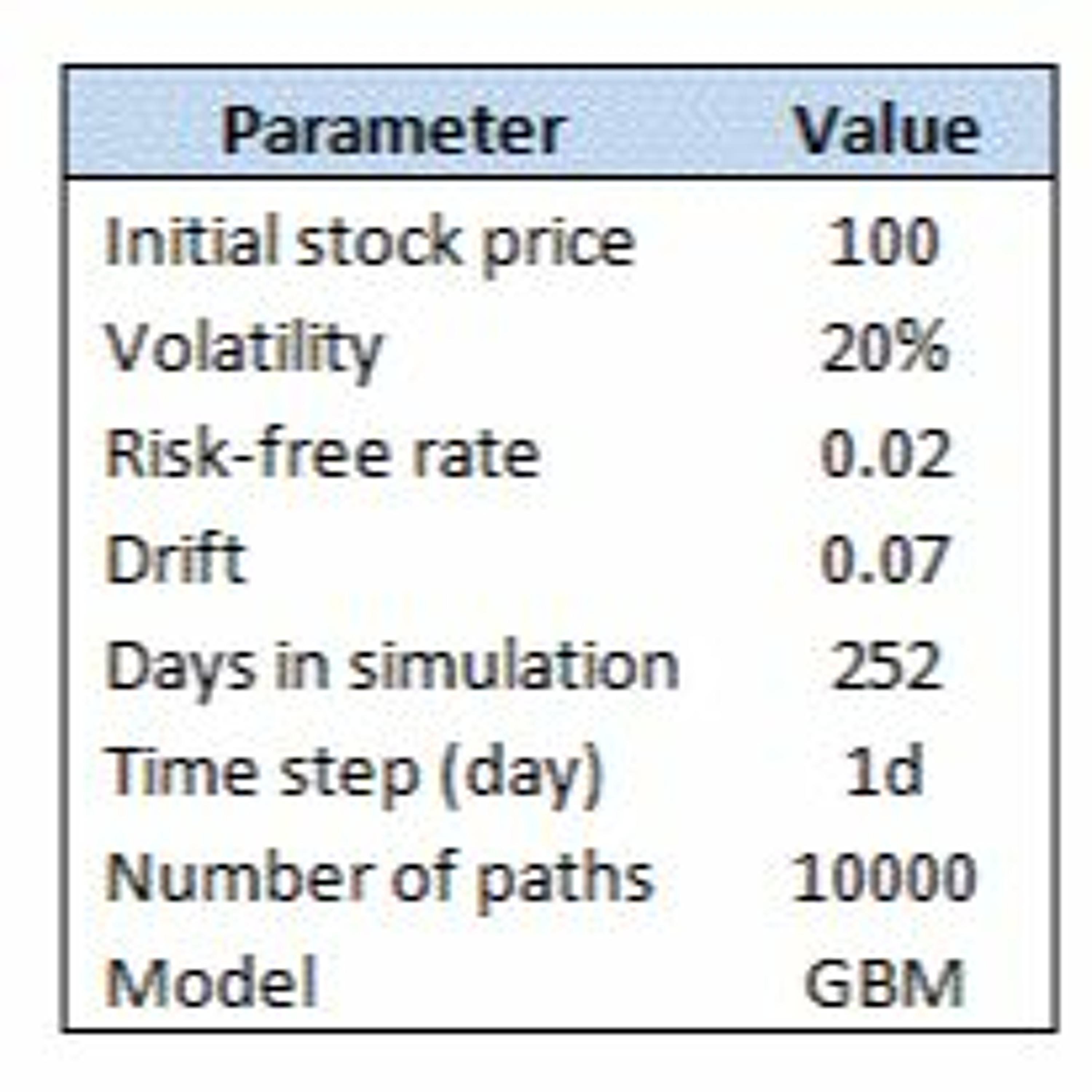

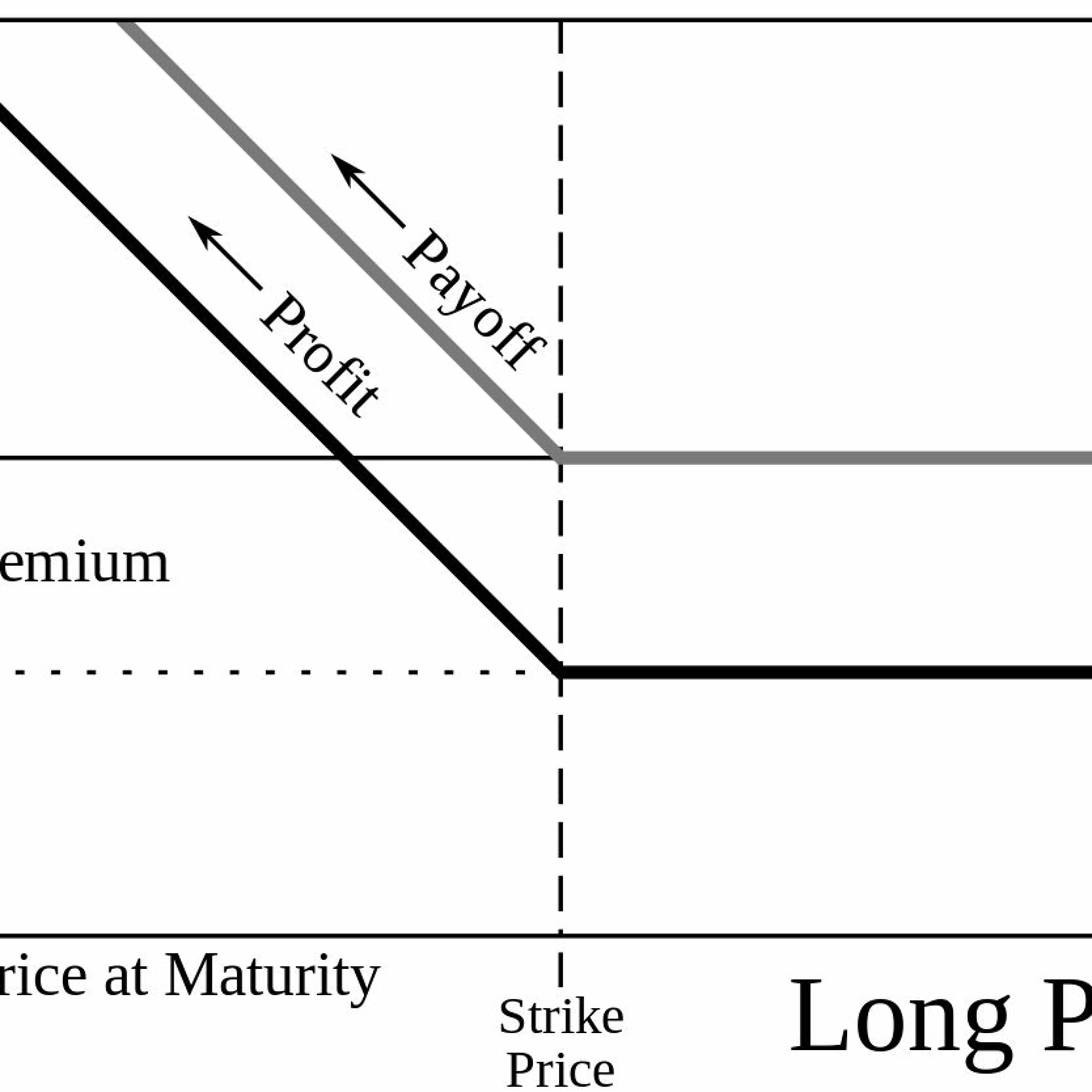

http://tech.harbourfronts.com/derivatives/valuing-european-options-using-monte-carlo-simulation-derivative-pricing-python/2020-02-0702 min

Harbourfront TechnologiesValuing European Options Using Monte Carlo Simulation- Derivative Pricing in PythonTo price the options, we first simulate the price paths using the following Stochastic Differential Equation. The simulation is carried out until the options’ maturity. We then apply the terminal payoff functions and calculate the mean values of all the payoffs. Finally, we discount the mean values to the present and thus obtain the option values.

http://tech.harbourfronts.com/derivatives/valuing-european-options-using-monte-carlo-simulation-derivative-pricing-python/2020-02-0702 min Harbourfront TechnologiesBlack - Scholes - Merton Option Pricing Model - Derivative Pricing In PythonIn this post, we focus on the implementation of the Black-Scholes-Merton option pricing model in Python. Closed-form formula for European call and put are implemented in a Python code. We compare the results to the ones obtained by using third-party software and notice that they are in good agreement.

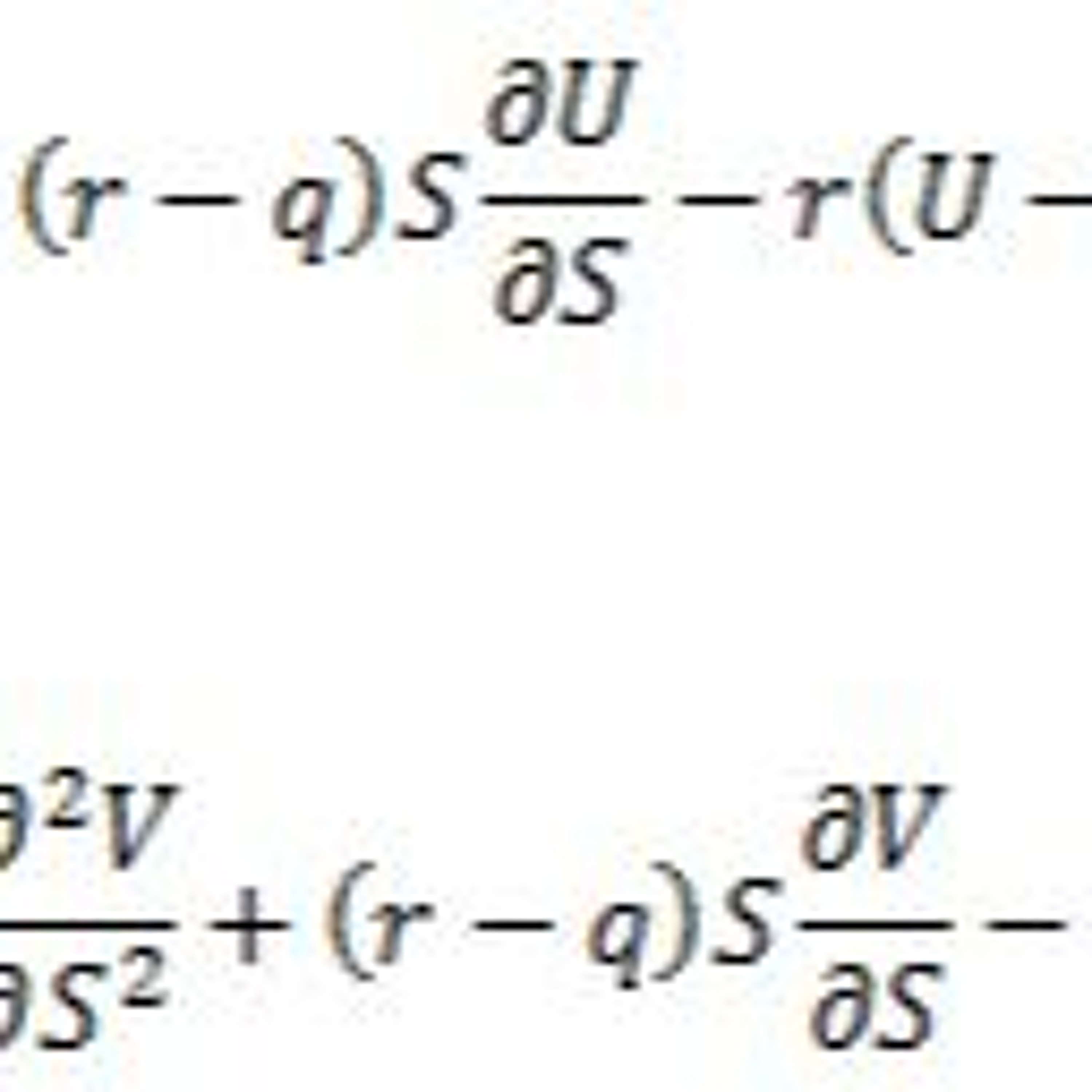

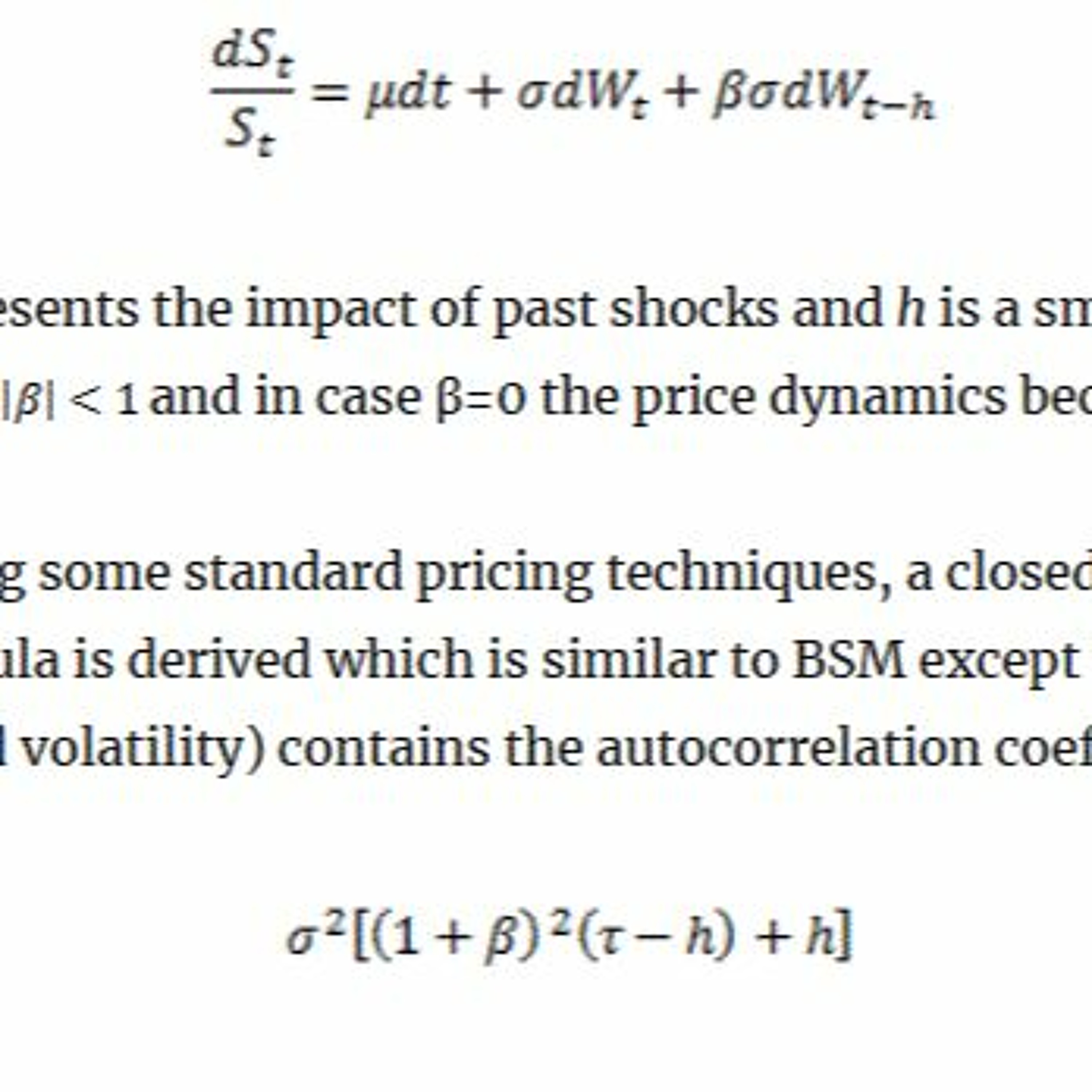

http://tech.harbourfronts.com/derivatives/black-scholes-merton-option-pricing-model-derivative-pricing-python/2020-02-0101 min

Harbourfront TechnologiesBlack - Scholes - Merton Option Pricing Model - Derivative Pricing In PythonIn this post, we focus on the implementation of the Black-Scholes-Merton option pricing model in Python. Closed-form formula for European call and put are implemented in a Python code. We compare the results to the ones obtained by using third-party software and notice that they are in good agreement.

http://tech.harbourfronts.com/derivatives/black-scholes-merton-option-pricing-model-derivative-pricing-python/2020-02-0101 min All Write in Sin CityLooking Back at 50 Years of Publishing Success with Windsor's Black Moss PressMarty Gervais is an award-winning journalist, photographer, poet, playwright, historian, editor and teacher. He is the inaugural Poet Laureate of Windsor, Ontario, and now Poet Laureate Emeritus. His awards include the Toronto’s Harbourfront Festival Prize, the Milton Acorn People’s Poetry Award, the City of Windsor Mayor’s Award for literature, and nearly twenty awards for journalism. Marty is also is the founder and publisher of Windsor-based Black Moss Press, which celebrates its 50th anniversary this year.For the past five years, Gervais has also led a group of writers and students to France where they read a...2020-01-0546 min

All Write in Sin CityLooking Back at 50 Years of Publishing Success with Windsor's Black Moss PressMarty Gervais is an award-winning journalist, photographer, poet, playwright, historian, editor and teacher. He is the inaugural Poet Laureate of Windsor, Ontario, and now Poet Laureate Emeritus. His awards include the Toronto’s Harbourfront Festival Prize, the Milton Acorn People’s Poetry Award, the City of Windsor Mayor’s Award for literature, and nearly twenty awards for journalism. Marty is also is the founder and publisher of Windsor-based Black Moss Press, which celebrates its 50th anniversary this year.For the past five years, Gervais has also led a group of writers and students to France where they read a...2020-01-0546 min Harbourfront TechnologiesValuing A Convertible Bond - Derivative Pricing In PythonIn a previous post, we presented a theoretical framework for pricing convertible bonds and preferred shares. We also provided an example of pricing a convertible bond in Excel. In this installment, we present an example of pricing a convertible bond in Python.

http://tech.harbourfronts.com/derivatives/valuing-convertible-bond-derivative-pricing-python/2019-12-3001 min

Harbourfront TechnologiesValuing A Convertible Bond - Derivative Pricing In PythonIn a previous post, we presented a theoretical framework for pricing convertible bonds and preferred shares. We also provided an example of pricing a convertible bond in Excel. In this installment, we present an example of pricing a convertible bond in Python.

http://tech.harbourfronts.com/derivatives/valuing-convertible-bond-derivative-pricing-python/2019-12-3001 min Harbourfront TechnologiesHow Will Negative Interest Rates Affect Derivative Pricing Models?As negative interest rates started popping up around the world, quantitative analysts and traders have been asking a mundane but fundamental question: How to price trillions of dollars of financial instruments when their complex pricing models don’t work with negative numbers?

http://tech.harbourfronts.com/derivatives/how-negative-interest-rates-affect-derivative-pricing-models/2019-12-2102 min

Harbourfront TechnologiesHow Will Negative Interest Rates Affect Derivative Pricing Models?As negative interest rates started popping up around the world, quantitative analysts and traders have been asking a mundane but fundamental question: How to price trillions of dollars of financial instruments when their complex pricing models don’t work with negative numbers?

http://tech.harbourfronts.com/derivatives/how-negative-interest-rates-affect-derivative-pricing-models/2019-12-2102 min Radio Aluna Theatre21 (Spanglish): MERENDIANDO with the SolitudesFor the last episode of this season, Monica and Camila sat down with four ensemble members from the cast of The Solitudes - Lara Arabian, Janis Mayers, Liliana Suarez, and Rosalba Martinni. We talked about the show’s initial inspiration, Gabriel Garcia Marquez’s celebrated novel One Hundred Years of Solitude, their innovative two year development process, and how magical realism, reality, and personal stories are catalysts for this new piece.

Check out The Solitudes, which runs at Harbourfront Centre Theatre from January 7-19, 2020

Thanks so much for joining us this season! Stay tuned to Alun...2019-12-1128 min

Radio Aluna Theatre21 (Spanglish): MERENDIANDO with the SolitudesFor the last episode of this season, Monica and Camila sat down with four ensemble members from the cast of The Solitudes - Lara Arabian, Janis Mayers, Liliana Suarez, and Rosalba Martinni. We talked about the show’s initial inspiration, Gabriel Garcia Marquez’s celebrated novel One Hundred Years of Solitude, their innovative two year development process, and how magical realism, reality, and personal stories are catalysts for this new piece.

Check out The Solitudes, which runs at Harbourfront Centre Theatre from January 7-19, 2020

Thanks so much for joining us this season! Stay tuned to Alun...2019-12-1128 min Mind The Gap by FreshchatLast week in startups - India - Mind the Gap NewsOne of the biggest funding this week was raised by online reseller network Meesho, gaining $125 Mn in a round led by Naspers, with participation from Facebook and existing investors SAIF, Sequoia, Shunwei Capital, RPS and Venture Highway. This fund raise will help it to make deeper inroads in areas outside India’s major metro regions, by creating more entrepreneurs, and as a result, reaching remote customers not serviced by traditional e-commerce marketplaces. Also, rumours are rife that the Japanese conglomerate is reportedly looking to invest $200 Mn in the company as well.

Another major round was raised by ShareChat, ad...2019-08-2100 min

Mind The Gap by FreshchatLast week in startups - India - Mind the Gap NewsOne of the biggest funding this week was raised by online reseller network Meesho, gaining $125 Mn in a round led by Naspers, with participation from Facebook and existing investors SAIF, Sequoia, Shunwei Capital, RPS and Venture Highway. This fund raise will help it to make deeper inroads in areas outside India’s major metro regions, by creating more entrepreneurs, and as a result, reaching remote customers not serviced by traditional e-commerce marketplaces. Also, rumours are rife that the Japanese conglomerate is reportedly looking to invest $200 Mn in the company as well.

Another major round was raised by ShareChat, ad...2019-08-2100 min Mind The Gap by FreshchatLast week in startups - India - Mind the Gap NewsThis week US-based ecommerce company eBay is investing $160 Mn in Indian ecommerce company, Paytm Mall, valued at $2.86 Bn post-investment. According to the Ministry of Corporate Affairs filings accessed by Inc42, Paytm E-commerce private limited is issuing 1,28,028 equity shares at a price of $1,249.73 per share to eBay Singapore Service Pvt Ltd.

Further, Bengaluru-based digital payments company PhonePe received INR 697.9 Cr ($101.5 Mn) equity infusion from its Singapore-based parent, PhonePe Private Limited Singapore. Interestingly, the investment has come after PhonePe founders— Rahul Chari Vardha and Sameer Nigam— increased their equity stake in the company. In April, Vardha picked up 1.67 Mn equi...2019-08-0700 min

Mind The Gap by FreshchatLast week in startups - India - Mind the Gap NewsThis week US-based ecommerce company eBay is investing $160 Mn in Indian ecommerce company, Paytm Mall, valued at $2.86 Bn post-investment. According to the Ministry of Corporate Affairs filings accessed by Inc42, Paytm E-commerce private limited is issuing 1,28,028 equity shares at a price of $1,249.73 per share to eBay Singapore Service Pvt Ltd.

Further, Bengaluru-based digital payments company PhonePe received INR 697.9 Cr ($101.5 Mn) equity infusion from its Singapore-based parent, PhonePe Private Limited Singapore. Interestingly, the investment has come after PhonePe founders— Rahul Chari Vardha and Sameer Nigam— increased their equity stake in the company. In April, Vardha picked up 1.67 Mn equi...2019-08-0700 min Harbourfront TechnologiesA Simple Hedging System with Time ExitThis installment is a follow-up to the previous one on a simple system for hedging long exposure during a market downturn. It was inspired by a research paper on the power-law behaviour of the equity indices.

http://blog.harbourfronts.com/2018/07/27/simple-hedging-system-time-exit/2019-06-1602 min

Harbourfront TechnologiesA Simple Hedging System with Time ExitThis installment is a follow-up to the previous one on a simple system for hedging long exposure during a market downturn. It was inspired by a research paper on the power-law behaviour of the equity indices.

http://blog.harbourfronts.com/2018/07/27/simple-hedging-system-time-exit/2019-06-1602 min Harbourfront TechnologiesVIX Mean Reversion After a Volatility SpikePreviously we showed that the spot volatility index, VIX, has a strong mean reverting tendency. In this follow-up installment we’re going to further investigate the mean reverting properties of the VIX. Our primary goal is to use this study in order to aid options traders in positioning or hedging their portfolios.

http://blog.harbourfronts.com/2018/04/29/vix-mean-reversion-volatility-spike/2019-06-0802 min

Harbourfront TechnologiesVIX Mean Reversion After a Volatility SpikePreviously we showed that the spot volatility index, VIX, has a strong mean reverting tendency. In this follow-up installment we’re going to further investigate the mean reverting properties of the VIX. Our primary goal is to use this study in order to aid options traders in positioning or hedging their portfolios.

http://blog.harbourfronts.com/2018/04/29/vix-mean-reversion-volatility-spike/2019-06-0802 min Harbourfront TechnologiesA Simple System For Hedging Long PortfoliosWe present a trading system with the goal of using it as a hedge for long equity exposure. To this end, we test a simple, short-only momentum system.

http://blog.harbourfronts.com/2018/03/31/simple-system-hedging-long-portfolios/2019-06-0102 min

Harbourfront TechnologiesA Simple System For Hedging Long PortfoliosWe present a trading system with the goal of using it as a hedge for long equity exposure. To this end, we test a simple, short-only momentum system.

http://blog.harbourfronts.com/2018/03/31/simple-system-hedging-long-portfolios/2019-06-0102 min Harbourfront TechnologiesIs a 4% Down Day a Black Swan?In February of last year , the SP500 experienced a drop of 4% in a day. We ask ourselves the question: is a one-day 4% drop a common occurrence?

http://blog.harbourfronts.com/2018/02/28/4-day-black-swan/2019-05-2501 min

Harbourfront TechnologiesIs a 4% Down Day a Black Swan?In February of last year , the SP500 experienced a drop of 4% in a day. We ask ourselves the question: is a one-day 4% drop a common occurrence?

http://blog.harbourfronts.com/2018/02/28/4-day-black-swan/2019-05-2501 min Harbourfront TechnologiesMean Reverting and Trending Properties of SPX and VIXIn the previous post, we looked at some statistical properties of the empirical distributions of spot SPX and VIX. In this post, we are going to investigate the mean reverting and trending properties of these indices. To do so, we are going to calculate their Hurst exponents.

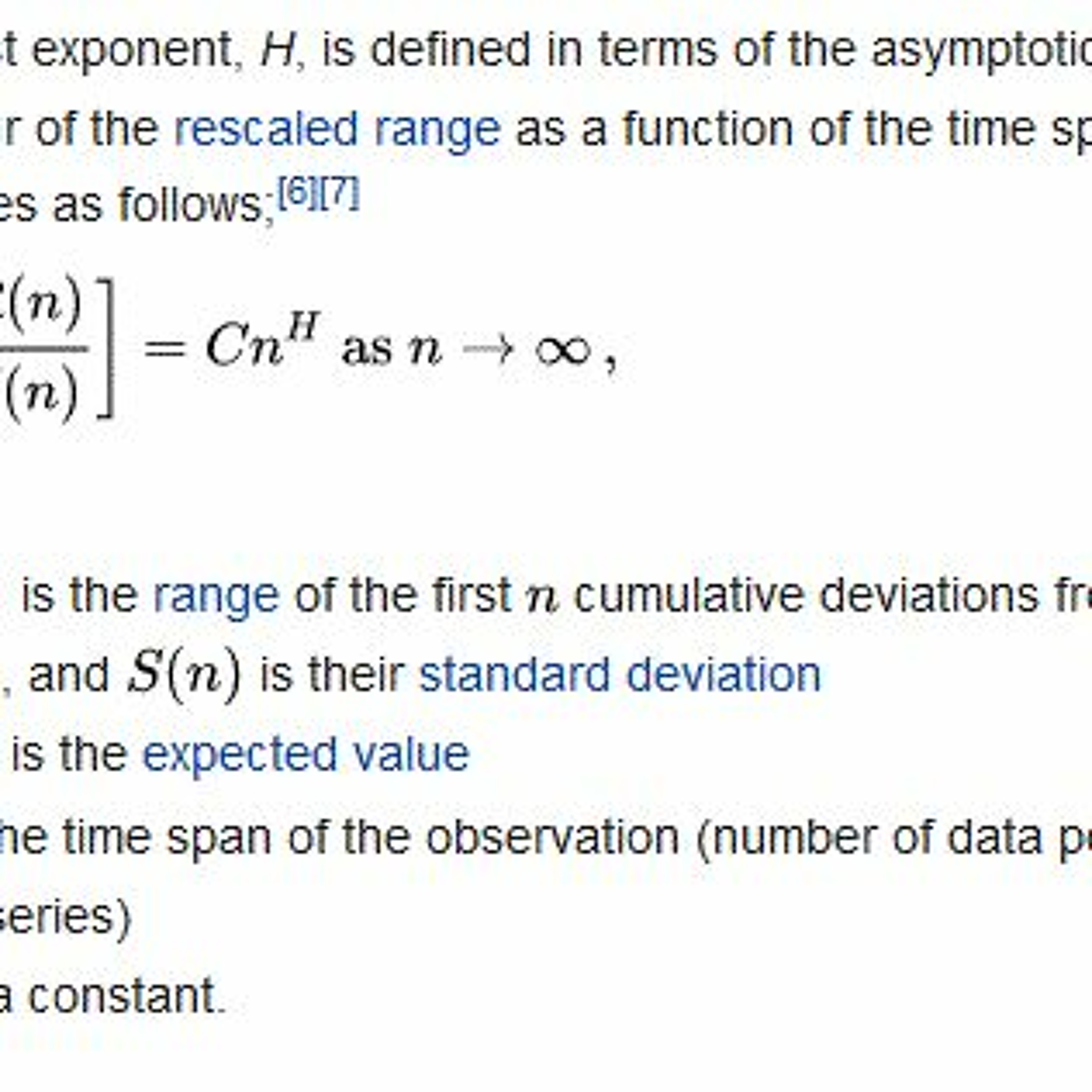

http://blog.harbourfronts.com/2017/12/29/mean-reverting-trending-properties-spx-vix/2019-05-1801 min

Harbourfront TechnologiesMean Reverting and Trending Properties of SPX and VIXIn the previous post, we looked at some statistical properties of the empirical distributions of spot SPX and VIX. In this post, we are going to investigate the mean reverting and trending properties of these indices. To do so, we are going to calculate their Hurst exponents.

http://blog.harbourfronts.com/2017/12/29/mean-reverting-trending-properties-spx-vix/2019-05-1801 min Harbourfront TechnologiesStatistical Distributions of the Volatility IndexVIX related products (exchange traded notes, futures and options) are becoming popular financial instruments for both hedging and speculation. The volatility index VIX was developed in the early 90’s. In its early days, it led the derivative markets. Today the dynamics has changed. Now there is strong evidence that the VIX futures market leads the cash index. In this installment we are going to look at some statistical properties of the spot VIX index. We used data from January 1990 to May 2017.

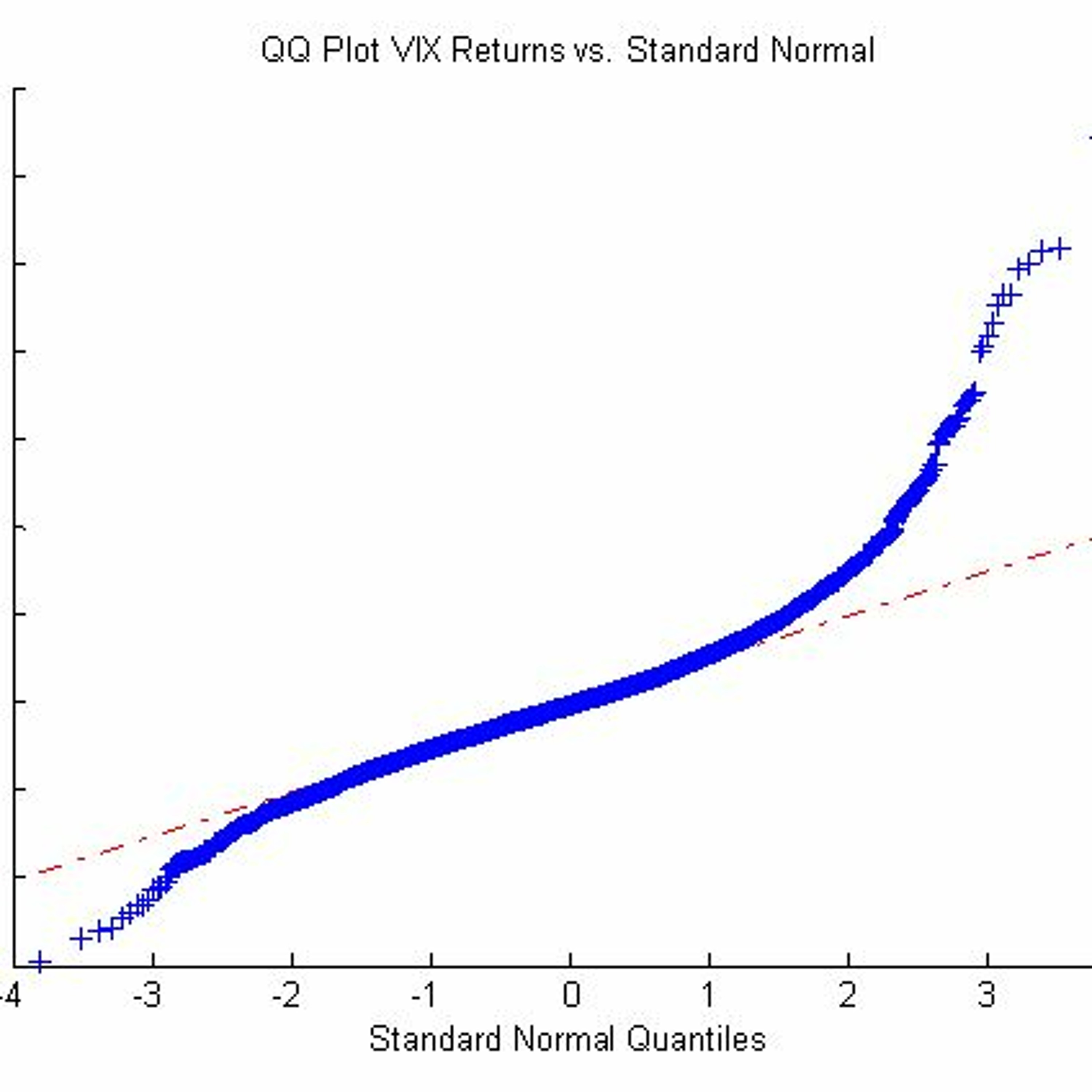

http://blog.harbourfronts.com/2017/11/30/statistical-distributions-volatility-index/2019-05-0501 min

Harbourfront TechnologiesStatistical Distributions of the Volatility IndexVIX related products (exchange traded notes, futures and options) are becoming popular financial instruments for both hedging and speculation. The volatility index VIX was developed in the early 90’s. In its early days, it led the derivative markets. Today the dynamics has changed. Now there is strong evidence that the VIX futures market leads the cash index. In this installment we are going to look at some statistical properties of the spot VIX index. We used data from January 1990 to May 2017.

http://blog.harbourfronts.com/2017/11/30/statistical-distributions-volatility-index/2019-05-0501 min Harbourfront TechnologiesAre Short Out-of-the-Money Put Options Risky? Part 2: Dynamic CaseThis installment is the continuation of the previous one on the riskiness of out-of-the-money vs. at-the-money short put options and the effect of leverage on the risk measures. Here we’re going to perform similar studies with the only exception that from inception until maturity the short options are dynamically hedged. The simulation methodology and parameters are the same as in the previous study.

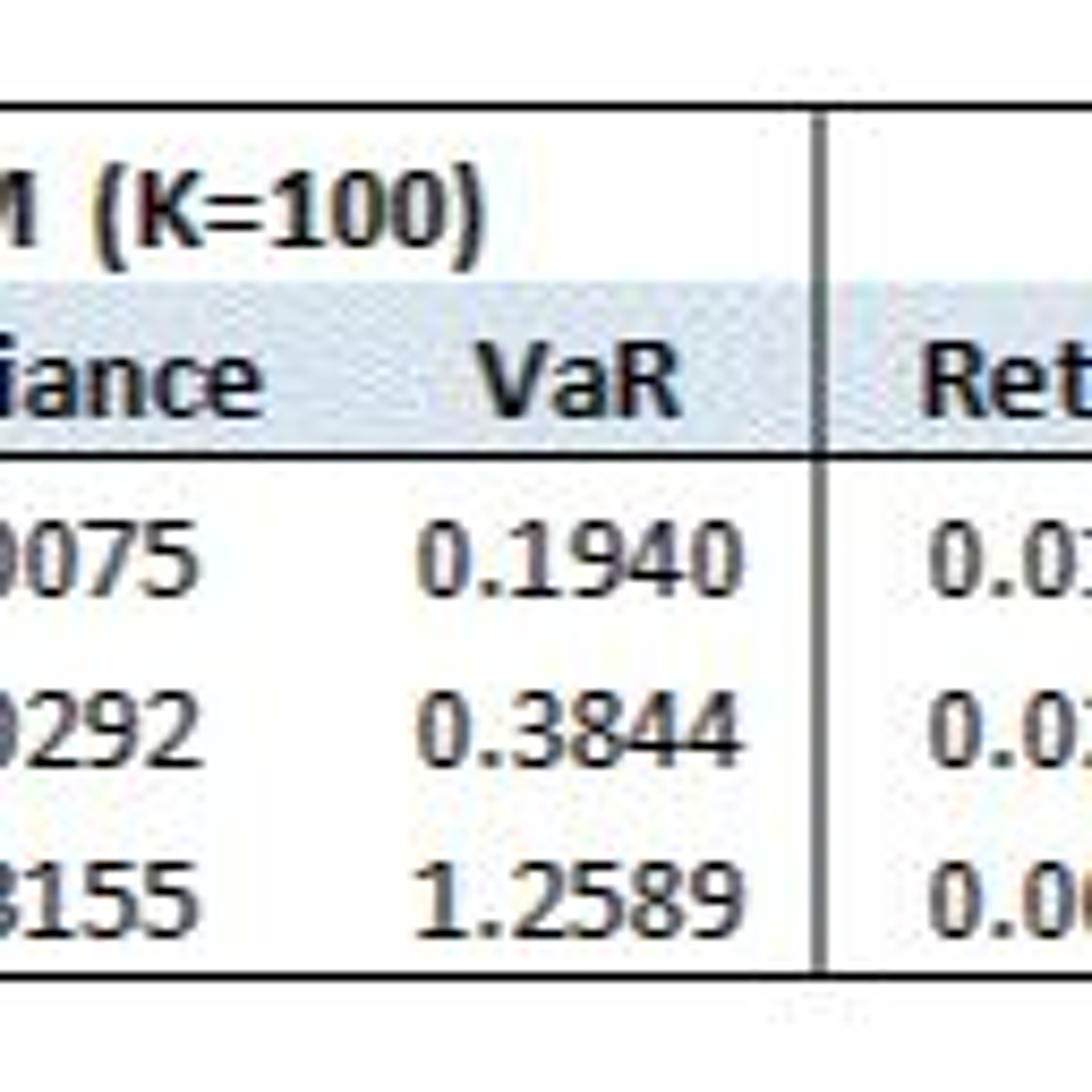

http://blog.harbourfronts.com/2017/09/28/short-money-put-options-risky-part-2-dynamic-case/2019-04-2802 min

Harbourfront TechnologiesAre Short Out-of-the-Money Put Options Risky? Part 2: Dynamic CaseThis installment is the continuation of the previous one on the riskiness of out-of-the-money vs. at-the-money short put options and the effect of leverage on the risk measures. Here we’re going to perform similar studies with the only exception that from inception until maturity the short options are dynamically hedged. The simulation methodology and parameters are the same as in the previous study.