Shows

Typical Skeptic PodcastGrey Mouse, Project Oblivion & Black Ops Mind Control — w/ Olivia James - Typical Skeptic # 2472🔥 Episode Title:Grey Mouse, Project Oblivion & Black Ops Mind Control — w/ Olivia JamesTypical Skeptic Podcast #2472 — 3 PM Eastern📘 Bio for Olivia JamesOlivia James is the author of the explosive autobiographical series Grey Mouse, which includes Grey Mouse: Sex, Space & Mind Control and its sequel Grey Mouse: Purgatory. Her work dives into the hidden world of sex trafficking networks, black-ops programming, MILAB operations, and space-based mind control infrastructures. Through her writings and testimony, Olivia lays out the mechanisms of psychological fragmentation, memory compartmentalization, MILAB timelines, and the interdimensional aspects of ritualized control.Olivia was also the f...

2026-02-2247 min

Deans Counsel81: Robert Shepard (GG+A) on PhilanthropyOn this episode of Deans Counsel, hosts Jim Ellis and Dave Ikenberry speak with Bob Shepard, a true veteran in philanthropic circles with a storied career spanning roughly 40 years, much of that running Duke University's philanthropic efforts.Today, Bob is a consultant with Grenzebach Glier & Associates, a full-service philanthropic management consulting firm (and now a part of Huron Consulting Group), where he continues to help shape philanthropic efforts at a variety of universities. In this episode, we take a deep dive into this area of philanthropy and glean some i...

2026-02-0637 min

Typical Skeptic PodcastMilab & Black Ops Whistleblowers James Bartley & Nathan Ciszek - Typical Skeptic # 2437✅ Typical Skeptic Podcast #2437 — Updated Promo Package“They Saw Me On Other Planets”James Bartley • Nathan Ciszek1/30/2026 • 1PM EasternJames Bartley Website: www.thecosmicswitchboard.comwww.youtube.com/@JamesBartleyNathan Ciszek Youtube:https://www.youtube.com/@planetaryconsciousnessproject👤 Guest Bio: James BartleyJames Bartley is a veteran UFO and alien abduction researcher specializing in MILABS, Reptilian encounters, and the military/aerospace connection to covert black operations. A protégé of Dr. Karla Turner and legendary investigator Barbara Bartholic, James has documented patterns in abductions, underground installations, and off-planet operations for over 30 years.Friends from with...

2026-01-311h 52

Typical Skeptic PodcastTSP # 2327 - Gods & Monsters, Targeting & James Rink's Passing Discussion - Brenda & Suzy BTB PodcastTSP #2327 – James Rink Has Passed | Gods & Monsters | Targeting w/ Brenda & SuzyThis keeps his name first (SEO + tribute), respects the theme she gave you, and stays under the character limit.✅ SHOW DESCRIPTION (You can paste this directly)Tonight at 9pm Eastern — Typical Skeptic Podcast #2327.A heartbreaking day in the disclosure and SSP community: James Rink, pioneer of Super Soldier Talk, has passed away. His impact on experiencers, MILAB survivors, and truth-seekers cannot be overstated.Joining me are Brenda and Suzy from Beyond the Box Podcast to discuss:The legacy and contributions of James RinkW...

2025-12-012h 55

Typical Skeptic Podcast🎙 TSP #2164 – James Bartley UFO Researcher | Rendlesham Forest, Reptilian Overlordship, Military & Alien Abductions🎙️ TSP #2164 – James Bartley | Reptilian Overlordship, Milabs & Geopolitics

📅 Today at 3 PM Eastern

📺 Watch Live on Typical Skeptic Podcast

🌟 About James Bartley

James Bartley is the host of The Cosmic Switchboard

, a veteran UFO researcher, experiencer, and investigator. His abduction encounters from childhood onwards propelled him into decades of study into Ufology, Reptilians, and military abductions (Milabs).

With a background in military history, intelligence operations, and counterintelligence, James explores the hidden layers behind the New World Order, globalist agendas, corporate and financial control systems, and their intersections with the occult.

He coined the...

2025-09-041h 36

Typical Skeptic PodcastTSP #2151 – James Gilliland & Coley (ECETI Ranch) | ET Contact, Star Family & Galactic Clearings💰 Support the Typical Skeptic Podcast

paypal.me/typicalskepticmedia

CashApp: kalil1121

Venmo: @robert-kalil

Buy Me a Coffee: www.buymeacoffee.com/typicalskeptic

🔹 Title:

TSP #2151 – James Gilliland (ECETI Ranch) | ET Contact, Star Family & Galactic Clearings

🔹 Episode Description / Intro:

Tonight at 5 PM Eastern, Typical Skeptic Podcast teams up with Coley from SNX Radio for a groundbreaking conversation with James Gilliland—author, lecturer, minister, near-death experiencer, and founder of ECETI Ranch (Enlightened Contact with ExtraTerrestrial Intelligence) in Trout Lake, Washington.

Nestled at the base of Mount Adams, ECETI has become world-famous...

2025-08-242h 18

The James Altucher ShowThe Stoic Capitalist: How Rational Thinking Creates Success | Robert RosenkranzA Note from James:Man, what a fascinating career Robert Rosenkranz has had—multi-billionaire, involved in virtually every part of finance and American industry. He wrote a book called The Stoic Capitalist, and what really stands out is how he's actively applied stoic principles to achieve immense success throughout his career. Even from a young age, stoicism played a crucial role, guiding him through critical business decisions. It's a real pleasure speaking with Robert—an American icon.Episode Description:James welcomes Robert Rosenkranz, author of The Stoic Capitalist: Advice for the...

2025-06-251h 08

Have Guitar Will Travel Podcast189 - Robert Earl Keen189 - Robert Earl Keen

In episode 189 of “Have Guitar Will Travel”, presented by Vintage Guitar Magazine, host James Patrick Regan speaks with singer, songwriter and guitarist Robert Earl Keen. In their conversation Robert tells us about a book that’s being published by Texas A and M press that shows off his guitar collection and Robert discusses his guitar collection which focuses mostly on electrics. He particularly likes Dakota Red Fenders.

Robert discusses his retirement and then his return to performing after a divorce and how he maintained his guitar collection.

Robert describes his guitar buying strategies and his fr...

2025-06-1800 min

Savage Perspective PodcastHow to Break Your Alcohol Addiction for Good with James SwanwickWhat if the key to achieving more energy, sharper focus, and greater success is simply quitting alcohol? On episode 782 of the Savage Perspective Podcast, host Robert Sikes dives deep with guest James Swanwick, an author, entrepreneur, and advocate for living alcohol-free. Together, they reveal the invisible toll alcohol takes on high-performers’ health, productivity, and ability to succeed in life and business. This episode will challenge everything you think about drinking's role in your lifestyle. Prepare to see drinking habits in a completely new light.In this powerful and eye-opening discussion, James shares his own 20-y...

2025-05-2654 min

Athlete Transition AcceleratorRobert van der Horst – Leadership beyond sportWe sit down with Robert Van Der Horst, former Dutch Olympic hockey player and World Player of the Year, to explore his journey beyond elite sport.Robert opens up about the challenges of leaving professional hockey, the mindset shifts required to navigate life after sport, and how he found his new purpose in the world of business and coaching. From the highs of being the best in the world to the uncertainty of what comes next, he shares invaluable lessons for athletes at any stage of their careers.Key Takeaways:Success in...

2025-03-0551 min

Typical Skeptic Podcast🛸👽 James Bartley – Reptilian Aliens & The Cosmic Agenda 🦎✨ | Typical Skeptic Podcast # 1825🛸 Reptilian Alien Manipulation & The War for Human Consciousness | James Bartley | Typical Skeptic Podcast Intro: Are reptilian aliens secretly influencing humanity? Are there hidden interdimensional agendas at play? Tonight, I sit down with James Bartley, an expert on military abductions, MILABs, reptilian entities, and ET contact. We’ll uncover the layers of deception, discuss how these entities operate, and explore what it means for human sovereignty. 👀💀 🔥 Tune in for an eye-opening conversation that dives deep into ET influence, mind control, and the battle for human...

2025-02-281h 22

The Dr. Robert Whitfield ShowEpisode 102: The Healing Power of Organ Meats with Chef James Berry

In this episode, Dr. Robert Whitfield speaks with Chef James Berry, founder of Pluck, a company dedicated to making organ meats more accessible and appealing. They delve into topics such as breast implant illness, nutrition, and food quality. Dr. Whitfield provides valuable insights into the effects of breast implant illness, and available treatment options, and shares personal stories from women who have undergone explant surgery. Chef Berry underscores the importance of nutrition and aims to make organ meats more accessible to the public. Together, they examine the evolution of food quality, the importance of mindful eating, and the impact...

2025-01-3037 min

Abundant Journey PodcastHow To Scale A Business Using The 80/20 Percent Rule with Robert Mallon | Ep. 90Summary

In this episode of the Abundant Journey Podcast, host Nick James interviews Robert Mallon, an experienced entrepreneur and executive coach. Robert shares his journey from the restaurant industry to becoming a successful coach, emphasizing the importance of personal growth, leadership development, and a holistic approach to coaching. He discusses the significance of identifying one's purpose, the value of transformation over mere information, and the necessity of balancing various life aspects to achieve success. Robert also provides insights into the coaching process, including how to identify the most impactful areas of focus in one's life and business...

2024-12-3158 min

The Sounds of ChristmasJames Robert Webb Renews Old Toy TrainsSend us a textKen from the Sounds of Christmas talks to singer/songwriter James Robert Webb about splitting his time between medicine and music, his new version of "Old Toy Trains" and the possible re-release of his Christmas album, along with conversation about lots and lots of music!James Robert Webb WebsiteJames Robert Webb linksGet James Robert Webb's "Old Toy Trains"Show links:Listen to the Sounds of Christmas stationFind the Sounds of Christmas podcastConnect with the Sounds of Christmas on social media

2024-12-0257 min

Fatrank PodcastODYS Mentor Robert Niechcial Interviewed by James DooleyJames Dooley sits down with OYS Mentor and CTO Rob Nitel to talk about how mentorship transforms both technical and business growth. Rob explains how moving from pure engineering and SEO into C level management forced him to seek mentors for operations, HR, scaling and systems, rather than trying to figure everything out alone.They break down how to choose the right mentor, why you should buy knowledge instead of paying for your own mistakes, and how AI, automation and programmatic SEO are changing the game. Rob shares his background as a lifelong tech geek, building sites...

2024-11-1320 min

James Dooley PodcastJames Dooley Interviews ODYS Mentor Robert NiechciałJames Dooley sits down with ODYS Mentor and industry veteran Robert Niechciał to discuss the power of mentorship, scaling companies, AI, programmatic SEO and the mindset needed to grow fast in a rapidly changing digital world. Robert explains how moving from engineering into C-level management exposed gaps in operations, HR, strategy and leadership that only high-level mentorship could solve. He shares lessons learned from experts like Mads Singers, why buying knowledge is cheaper than learning through failure and how AI is reshaping business. James presses Robert on choosing the right mentor, avoiding generic advice and understanding the ROI behind e...

2024-11-1120 min

Faithclip - Robert Woeger019 - You Do Not Have, Because You Do Not Ask - Robert WoegerYou Do Not Have, Because You Do Not Ask - Robert Woeger. The Faithclip podcast with Robert Woeger helps to increase your faith in God and in God's Word. Robert Woeger is an author and publisher, known for his teachings on faith, healing, and the power of always speaking words in agreement with God's Word. Visit Robert Woeger's official website: Robert Woeger.The Faithclip Christian podcast makes a great daily devotional.You Do Not Have, Because You Do Not Ask. This is Robert Woeger, and I'm speaking today about James chapter 4, verse 2, where God puts the...

2024-09-2405 min

The CU2.0 PodcastCU 2.0 Podcast Episode 318 James Robert Lay on Banking on ChangeSend us a textJames Robert Lay is back with a new book, Banking on Change, and a message that will rock credit union executives out of complacency: “The Age of Artificial Intelligence spares no one from its transformative power.”This podcast is a fast paced, 40 minute romp through the changes that are transforming banking as we’ve known it into something that looks entirely different.Consider the words: checking account. Or even more obscure: sharedraft accoun...

2024-09-1845 min

The Senior Journal3-16-24: James Robert Kalsu of Del City to be Honored with StatueDo you know who Robert Kalsu is??? … He is an award winning Del City, Oklahoma athlete (football & baseball, OU football 🏈 award-winning athlete and served through the ROTC from OU … Robert (Bob) Kalsu played one year with the Buffalo Bills before he was drafted into the Vietnam War.

Robert was drafted in the Vietnam War and commanded no special treatment!

Left in studio is: Gina Standridge, on the committee for the James Robert Kalsu Legacy Project as well is in the center is Gray Banz and retired veteran...

2024-03-1647 min

The James Altucher ShowMastering the 48 Laws of Power | Robert GreeneJames welcomes renowned author Robert Greene back on the show to discuss the intricacies of power, strategy, and human nature, as explored in Greene's bestselling book, "The 48 Laws of Power." The episode kicks off with James sharing his journey to reclaim his old chess ranking, a challenge that's not only about the game but also about rediscovering and harnessing personal strengths and strategies. This journey has inspired James to pen a book, and the conversation naturally flows into the writing process and the lessons learned from such endeavors.The spotlight then turns to the special 25th Anniversary edition of "The 48 L...

2023-11-301h 19

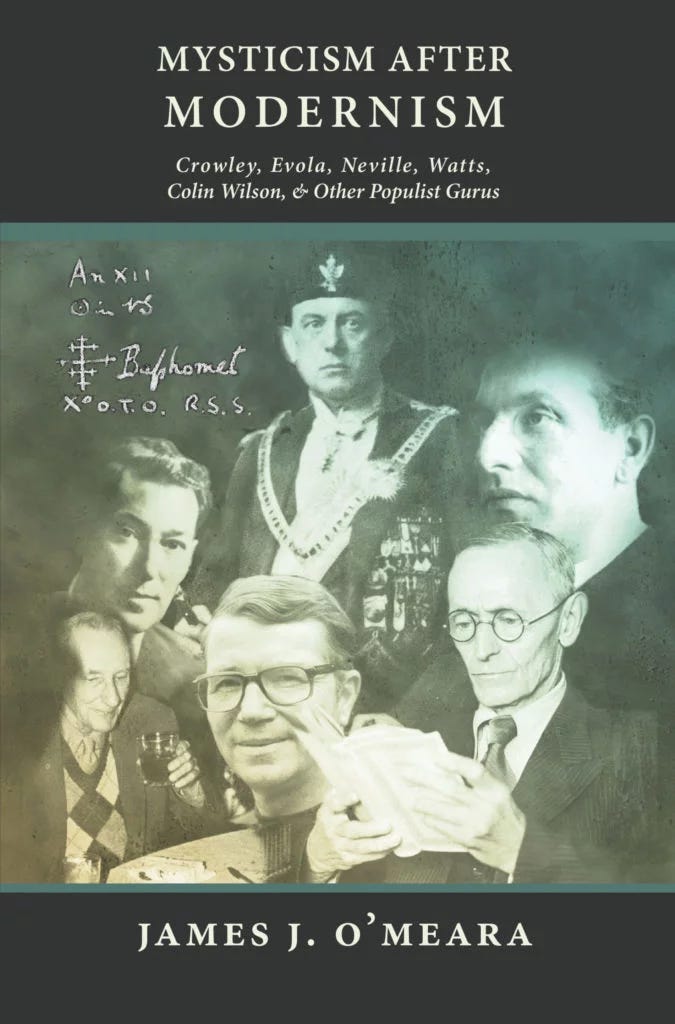

Beyond the Vapor with Robert StarkRobert Stark talks to James O’Meara about Mysticism After ModernismRobert Stark speaks with James O’Meara about his book, Mysticism After Modernism: Crowley, Evola, Neville, Watts, Colin Wilson, & Other Populist Gurus. Mysticism After Modernism is published by Manticore Press, where it is available for purchase. You can also find it at Counter-Currents and on Amazon.“Our spirituality has gotten too tame today. James J. O’Meara has a solution [in Mysticism After Modernism]–Mitch Horowitz, PEN Award-winning author of Occult America and The Miracle Club-The intersection of mysticism with politics and culture, and how mysticism is available to any political persuasion-Countering the Hippie-dippy liberal ...

2023-09-151h 42

Banking on Digital Growth300) Give Them Hope: Why Financial Podcasts Are the Modern-Day Public SquareFear shouldn't stop financial leaders from starting a podcast. Kicking off a podcast can feel daunting, but the returns can be exponential, especially for lenders and advisors with a heart for helping people.

To celebrate the 300th episode of Banking on Digital Growth, host James Robert Lay opens up about his own podcasting journey and its impact on educating, connecting, and empowering others.

Join James Robert as he unravels the power of podcasting in the financial world and why it's an investment worth making.

Join us as we discuss:

2023-05-2336 min

Apologetics ProfileRemembering Waco: Former Branch Davidian Robert Scott Interview 30 Years LaterTWO FREE BOOKS - Take advantage of the special offer mentioned at the end of this episode: Watchman.org/WacoThirty years ago this week, a small army of federal agents stormed the compound of the Branch Davidian cult led by David Koresh with armored vehicles, knocking down walls and launching tear gas. That deadly assault outside of Waco, Texas was the culmination of a 51-day standoff between government agents, four of whom were killed in the line of duty, and the Davidians. The assault ended horrifically when a tragic fire quickly consumed the...

2023-04-2418 min

CXMH: On Faith & Mental Health163 - Mr. Rogers, Hospital Chaplaincy, & Living as a Holistic Story (feat. Rick Lee James)We’re joined this week by Rick Lee James. Rick is a musician and worship leader, as well as running the biggest Mr. Rogers quotes account on Twitter, hosting a few podcasts, and is currently in a hospital chaplaincy program. We talk about all of those things, and how they interweave despite seemingly like separate areas of his life.Things we mention in this episode/other resources:- The Simple Faith of Mister Rogers by Amy Hollingsworth- CXMH ep. 143 - Seeing the Sacred in Ourselves & Each Other (feat. Dr. Hol...

2023-03-1300 min

Beyond the Image PodcastChef Robert Irvine on Overcoming the ImpossibleChef Robert Irvine on Overcoming the Impossible Hosted by: James Patrick My guest today is Chef Robert Irvine, you'll recognize him from the hit TV show, Restaurant Impossible. He's also the author of the brand new book, Overcoming Impossible. "If one ingredient of that recipe is not in there, the magic doesn't happen." IN THIS EPISODE The inspiration behind Chef Robert's decision to dive into business and self-improvement. What Chef Robert's new book is about and wh...

2023-03-0838 min

The Healthtech Podcast#292 Lessons of leadership with healthtech CEO Robert MillerIn this episode, James is joined by Robert Miller, CEO of Wellbeing Software. They explore Robert's diverse background from designing nuclear power stations to CEO of the UK's leading provider of radiology and maternity software solutions. They dive into the qualities that make a successful CEO, and why building a culture of purpose and collaboration is essential for success. Apply to be a guest: www.thehealthtechpodcast.comSubscribe to Healthtech Pigeon 🐦:www.healthtechpigeon.comGet in touch with James: www.jamessomauroo.comLearn more about SomX for your healthtech company at...

2023-02-2239 minThe Art of Allowance Podcast | Parenting | Families | Money Smarts | Financial LiteracyAOA 055: Grow Kids' Wealth with Non-Monetary Deposits - Featuring James Robert LayHow can you help your kids' wealth grow not only monetarily but also practically? James Robert Lay offers a framework through his concept of "non-monetary deposits." James Robert is one of the world's leading digital marketing authors, speakers and advisors for financial brands. Based in Houston, James Robert is the author of Banking on Digital Growth: The Strategic Marketing Manifesto to Transform Financial Brands. He is also the founder and CEO of the Digital Growth Institute, where he has guided more than 520 financial brands on a mission to simplify digital marketing and sales strategies that...

2023-01-2351 min

Wine Spectator's Straight Talk2: The Robert Mondavi Legacy with Tim Mondavi and Paul HobbsHost James Molesworth takes us on a deep dive into the Robert Mondavi legacy, with exclusive interviews with Wine Spectator editor and publisher Marvin R. Shanken, Continuum Estate co-founder and Robert's son Tim Mondavi, international winemaking star and Mondavi winery alum Paul Hobbs, Mount Veeder winery founders and former Mondavi winery tour guides Arlene and Michael Bernstein, and Robert Hanson, President of Constellation’s Wine & Spirits division, which now owns the Mondavi winery and its esteemed To Kalon Vineyard. Plus, we page Dr. Vinny, and much more!Thirsty for more? Check out:• Wine Spectator's Nov. 30, 2022, issu...

2022-11-0936 min

Banking on Digital Growth238) #InsideDigitalGrowth - Strategic Planning: A Prescription for Common People ProblemsCOVID shattered our perception of predictability in strategic planning. As we boldly move forward into a post-COVID future, many financial brands have raised questions about the strategic planning mindset.

In this episode of our Inside Digital Growth series, we answer questions from you, our dear listeners, about the future of strategic planning going into and beyond 2023.

Join us as we discuss:

- Top priorities for credit unions and banks as they plan for the future (12:19)

- Measuring progress and outcomes after your plan is set in motion (26:38)

2022-10-1841 min

Tall And True Short ReadsThanks Ian St James AwardsIn their heyday, the Ian St James Awards offered the biggest fiction prize in the UK and Ireland. Launched by the thriller writer Ian St James in 1989 to encourage new writers, the awards were open to 5,000-10,000 word short stories by unpublished writers.Thanks Ian St James Awards is a blog post from the Tall And True writers' website, written and narrated by Robert Fairhead.Read the post on Tall And True: https://www.tallandtrue.com.au/blog/thanks-ian-st-james-awardsPodcast website: https://www.tallandtrueshortreads.comSupport the podcast: https://supporter.acast...

2022-08-0806 min

Banking on Digital Growth216) #DigitalGrowthJourneys - 90 Days to the Peak: Climbing the Mountain of ChangeEvery journey begins with a simple step. Oftentimes, that step is as simple as finding clarity amidst the chaos.

In this episode of our Inside Digital Growth series, one of our dear listeners asks “How can we best plan for future growth in a world that is unpredictable and full of change?”

July is the perfect time to assess how 2022 is going for your brand and whether the rest of the year is going to be a period of growth or stagnation for you and your business.

Strategic planning as a 90 day process — rather...

2022-08-0243 min

Banking on Digital Growth210) #InsideDigitalGrowth: The Exponential Growth Curve of Voice BankingWith the rise of mobile banking, voice banking has taken a backseat. Many banks still use an outdated touch-tone model for their customers’ voice banking needs.

Yet, I believe voice banking is primed to take a great leap forward in optimizing customer engagement. We’ve seen tremendous strides in AI voice recognition technology over the last decade. Soon, your voice banking experience may be no different than talking with a teller.

In this episode of our Inside Digital Growth series, I dive into the digital mailbag and answer several burning questions you have about voice bank...

2022-07-1222 min

Banking on Digital Growth206) #InsideDigitalGrowth - Third-Party Data: A Future Without CookiesWith Google intending to phase cookies out of their browser later this year, marketing teams are scrambling to fill the void that the loss of third-party data will leave behind.

Plenty of first-party data-mining options are at our disposal; you just need to look in the right places.

In this episode of our Inside Digital Growth series, I answer questions about third-party data and share insight on how your financial brand can successfully transition away from it.

Join us as we discuss:

- What dwindling accessibility of third-party data means for...

2022-06-2816 min

Banking on Digital Growth205) #InsideDigitalGrowth - Competitive Intelligence: What’s the Beat on the Digital Street?With mountains of data at their disposal, financial brands already have what they need to gain real-time insight and strategic foresight into their customer’s needs.

That is the power of competitive intelligence.

In this episode of our Inside Digital Growth series, I address your questions about competitive intelligence. You, too, can use it to empower your teams to get in touch with the ‘beat on the digital street.’

Join us as we discuss:

- Why social monitoring tools are not creepy but cutting-edge (4:22)

- Enhancing relationships with existing busine...

2022-06-2717 min

Banking on Digital Growth203) #InsideDigitalGrowth - The Sustainable Habitat of Niche BankingA lot of banks are trying to catch every fish in the ocean. But you don’t need to hook every potential customer in your market - only the ones who benefit from your expertise.

In this episode of our Inside Digital Growth series, I answer your questions about niche banking.

Banks and credit unions have the potential to build niche portfolios that will help common people with their common problems. They simply need to transform their thinking.

Join us as we discuss:

- Growth opportunities and finding a viable niche ma...

2022-06-2030 min

Banking on Digital Growth200) #InsideDigitalGrowth - Looking Back at 200 Reasons to Bank on the Future and Build Your Personal BrandSince our pilot episode two years ago, the world has undergone incredible changes. Yet, we at the Digital Growth Institute remain invested in educating and empowering people burdened by financial stress.

We have had the privilege of gathering positive deposits from the most brilliant minds in our industry. More importantly, our guests share our vision of helping first and selling second - because healthy communities reflect financial institutions that put service above selfishness.

Please join me, James Robert Lay, as I reflect on our transformation journey by revisiting eight memorable exchanges with people using their...

2022-06-0740 min

Banking on Digital Growth195) #ClarityCalls - Chasing the Ultimate Customer ExperienceGreat institutions are constantly chasing the ultimate customer service experience.

Once they’ve reached a threshold of excellence, how do they retain it?

That’s one of the great questions that Todd Treadway, Digital Channels Director and Senior Vice President at Provident Bank, had for me in this episode.

Todd and I had a wonderful conversation when we met at the Total Expert event Accelerate in Arizona last fall.

We took this opportunity to continue the dialogue and catch up on his experience with his firm’s digital growth journey.

Join...

2022-05-2324 min

Health Longevity SecretsJames Strole: The Coalition for Radical Life ExtensionOur understanding of aging and longevity is undergoing a revolution that is upending our existing beliefs that aging is simply the inevitable result of wear and tear on our DNA and can’t be slowed much less reversed.James Strole is the Executive Director of the Coalition for Radical Life Extension, which is the producer of RAADfest, the largest global longevity education event of its kind. James is also the the Co-Founder and Co-Director of People Unlimited, an organization that supports people interested in unlimited lifespans. Co-author of the book Just Getting Started: Fifty Years of Living Fo...

2022-05-0347 min

Banking on Digital Growth187) #InsideDigitalGrowth - Transforming Together: Questions About Digital GrowthDigital growth is about collaboration through transformation, which means we’re on this journey together.

That’s why we’re answering more of your questions about how you and your teams can incorporate digital growth.

Once again, James Robert dives into the digital mailbox to address your questions and concerns about financial health.

Learning the language of digital growth is essential to overcoming the silent killer that is financial stress.

We break down some marketing tactics that influence the overall strategy of digital growth.

Join us as we discuss:

...

2022-04-2518 min

Banking on Digital Growth184) #InsideDigitalGrowth - Opening Up the Digital Mailbox: Catching Up With Our ListenersYou’ve got questions - we’ve got answers.

In this episode, James Robert digs into the Digital Growth mailbag for questions that will help us all guide more people out of financial stress and into a bright future.

We are all on the journey of digital growth together, because digital growth is ultimately about people.

Join us as we discuss:

-The importance of people-centered transformation

-Building a strong foundation for your company’s digital growth

- How financial coaching may be the future of digital banking

...

2022-04-1216 min

Banking on Digital Growth176) #Exponential Insights - Behind the Scenes of the Digital Growth InstituteAfter having such a good conversation the first time around, I have my wife, Delena Lay back on the show to flip the script.

She’s asking me about the trends, lessons, and patterns I’ve seen in finance over the past 20 years; and, ultimately, how my stories can help your brand.

Join us as we discuss:

James Robert’s younger years & what’s going well in 2022

The most energizing projects & biggest lessons of the present

Looking 20 years to the future

Letting go to grow personally & professionally

You can find this interview and many more by...

2022-03-1748 min

THE SIDNEY ST. JAMES SHOWSeason 2 Episode 11: Poetry Interpretation - The Road Not Taken by Robert FrostSeason 2

Episode 11

THE ROAD NOT TAKEN by ROBERT FROST

LIFE IS ABOUT THE PATHS YOU

CHOOSE TO WALK THROUGH

Walking together with a good friend in the darkness is far better than walking all alone in the light!

Did I ever tell you I am a packrat? I never throw anything away. I still got the four-letter jackets I won in high school in football. And, I still have the dried flowers from the Powder Puff Football Game when I was runner-up for Homecoming King. William Brunner...

2022-01-2335 min

The Prime Life Project#92- Developing An Adaptable Mindset - Ft. Robert OverwegRobert and I discuss the fascinating topic of developing an adaptable mindset and why its so important in modern society. Robert shares how he originally got hooked on this topic and how he helps people create cognitive flexibility to reconnect with meaning and experience life optimally. About Robert Robert Overweg is the founder of the Adaptable Mindset program. He and his team empower people to develop their own Adaptable Mindset, to develop mental flexibility, Learn how to create mental space and find new possibilities. Robert has over a decade of experience in i...

2021-10-261h 02

Banking on Digital Growth119) #ExponentialInsights: Being Human at Every Turn - Sales & Customer ExperienceWhen was the last time you were happy to get an automated email? Probably… well, never. Right?

Meanwhile, sales is rarely held accountable for the terrible customer experience they create.

We can do better. We just need to be a little more human.

My guest today,James Gilbert, Head of Marketing - CRMNext, is a big believer that more empathy — more humanity — in business is the only path forward for financial brands in today’s world.

In this episode, we discuss:

- How to have better conversations

- How to in...

2021-08-1733 min

Banking on Digital Growth117) #ExponentialInsights: Why You’ve Been Overlooking the Female Financial MarketIt was only a 1988 bill that allowed women not to have a male signature for their business loan. Women just haven’t had the same generational runway that men have had, especially when it comes to business and finance.

In this episode, I interview Brian Harris, Executive Creative Director at Bradley and Montgomery, about growing a niche market and improving our marketing messaging to women.

Brian talks with me about:

- The size and nature of the perceived financial gap

- How FinTech has fostered an attitude of empathy...

2021-08-1041 min

Watching the Watchers with Robert Gouveia Esq.AG James' Cuomo Allegations, January 6th Washington DC Police Deaths, Cori Bush Eviction MoratoriumGovernor Cuomo facing serious allegations in a new report from New York Attorney General Letitia James details ongoing sexual harassment from Cuomo’s office – we review the report. Two more officers who responded on January 6 die by suicide – what is going on? Biden’s White House continues to flail on the eviction moratorium as homeless Congressperson Cori Bush is evicted from Congress.And more! Join criminal defense lawyer Robert F. Gruler in a discussion on the latest legal, criminal and political news, including:🔵 New York Attorney General Letitia James releases a new report detailing sexual harassment alle...

2021-08-041h 39

Banking on Digital Growth115) #InsideDigitalGrowth: Consumer Personas - Obtaining Executive Buy-In on NichingToday, I’m tackling this listener question: How can our marketing team get executive buy-in to commit and focus our marketing and sales on a niche with the development of consumer personas?

In this solo episode, you’ll hear from me, James Robert Lay, CEO at Digital Growth Institute, about how to reimagine niches as defined not by geographical boundaries but mental ones.

In this episode we discuss:

- What personas are and how they create empathy

- Setting geography aside in favor of targeting niche beliefs

- Ex...

2021-08-0330 min

Banking on Digital Growth106) #InsideDigitalGrowth - The Impact of One Bad Review: Strategies for Improving the Ratings System ExperienceRatings & reviews of a business can make all the difference in the business’ success. But with so many options for rating systems, where should a business focus their attention? Yelp or Google My Business or a combination of the two?

James Robert Lay, Host of the Banking of Digital Growth Podcast, discusses his take on best strategies for navigating rating systems.

What we talked about:

The Importance of a Good or Bad Review for the Success of a Business

The Secret of Ratings Ratios

Whether to Focus Attention on Yelp or Google My...

2021-07-0526 min

Watching the Watchers with Robert Gouveia Esq.Chauvin Trial Leak, Letitia James vs. Trump Criminal Investigation, Karen Garner Officers ChargedEric Nelson, Derek Chauvin’s criminal defense lawyer throughout the #ChauvinTrial, filed an interesting affidavit today along with his co-counsel – what did he say? Letitia James opens “criminal investigation” into the Trump organization after over 2 years of investigating - Donald Trump responds. Two Colorado officers are criminally charged for the abuse of 73-year-old Karen Garner. And more! Join criminal defense lawyer Robert F. Gruler in a discussion on the latest legal, criminal and political news, including:• Interesting development in the Derek Chauvin case as criminal defense lawyer Eric Nelson files an affidavit declaring that he was not the source...

2021-05-211h 27

The Internal Marketing Podcast#4: Building Brands with Employee Social Media Advocacy (with James Robert Lay)Content marketing in the social/digital space isn't new; but, who distributes that content will impact its success.People want to connect with people, not 'faceless' brands. Connection builds trust. So how can a brand drive deeper connections and growth? By leveraging its people (its employees), through an employee social media advocacy group.In this episode, we'll be 'flipping' the marketing conversation from external to internal with the James Robert Lay, who'll breakdown why companies need to incorporate employee social media advocacy into their digital marketing.I invite you to join The Internal...

2021-01-1530 min

Banking on Digital Growth56) #ExponentialInsights: How Payments UX Can Catch Up to Digital Transformation w/ Michael Bank & Seth FensterWhen’s the last time you went into a bank to pay bills?

Even if that’s your preferred method of payment, the pandemic has probably brought it to a screeching halt.

In this Exponential Insights episode of Banking On Digital Growth, James Robert Lay chats with Blip co-founders, Michael Bank and Seth Fenster, about improving payments UX. They also discuss…

How accelerated digital transformation has affected financial institutions

Ways banks can appeal to the digitally native consumer

How Blip helps financial institutions improve customer experiences

You can find this interview, and many more, by s...

2021-01-0533 min

Coffee With Robert1: James Schramko - On How He Made $1000 Per Day As A Newbie Internet Marketer James Schramko On How He Made $1000 Per Day As A Newbie Internet Marketer - Coffee With Robert S2 E1

In the premiere of Coffee With Robert Season 2, I'm joined by another incredible guest. Mr. James Schramko.

James Schramko is one of the most recognised internet marketers and his success speaks for itself.

In this candid session with Robert, James speaks about how he made $1000 per day a newbie internet marketing. The process is easy to understand so that you can implement it to and perhaps get similar results for yourself.

This is...

2020-11-2438 min

Banking on Digital Growth46) #ExponentialInsights: Three Exponential Growth Insights w/ James CarbaryYou've thought about your financial brand's purpose and your culture because as the ancient wisdom says, without purpose — without vision — you have no future. You need a future because we're not going back to the way things were pre-pandemic.

But how can you create purpose and culture for the digital world we're entering?

In this episode of Banking on Digital Growth, I talk with James Carbary, founder of Sweet Fish Media, about education, empowerment, and elevation as we build digital teams for the future.

James and I discuss:

How to v...

2020-11-2441 min

The Not So Simple Life19.) James & Robert Welsh: All things makeup & skincare with The Double Cleanse podcast co-hosts.In this episode, Kylie & Sophie are joined by the dynamic duo behind The Double Cleanse Podcast, James & Robert Welsh. Skincare enthusiast James Welsh and Professional Makeup Artist Robert Welsh are joining the girls for a discussion about everything beauty. James will be sharing his extensive knowledge about skincare. He is getting into must-have products, breaking down clean beauty, discussing if less is more in a skincare routine, exposing overrated skincare brands & so much more. Robert is talking about his favorite makeup lines, the importance of clean makeup brushes, beauty trends on social media, brands to stay away from & more...

2020-11-0337 min

Banking on Digital Growth27) #ByTheBook: A Digital Experience: Marketing to People in the Age of AIWe're living in the midst of the fourth industrial revolution, The Age of AI. In this age, we'll see a massive shift towards one-to-one messaging. The financial brands that excel will be the ones that can communicate at scale through a one-to-one perspective. On this 27th episode of the Banking on Digital podcast, host James Robert Lay shares insights about banking in the age of AI from his bestselling book, Banking on Digital Growth: The Strategic Marketing Manifesto to Transform Financial Brands. James discusses: -The 3 things that happen when we think...

2020-10-0727 min

Banking on Digital Growth25) #InsideDigitalGrowth: How to Demystify Your DataWe keep talking about data in marketing. But we don't really do anything with it because we have more of it than we can handle. How do we demystify the data? On this Silver Jubilee episode of the Banking on Digital podcast, host James Robert Lay answers this question about data from Justin, marketing director at a bank in South Dakota. We discuss: -The 4 gears of the digital growth engine -The 2 primary categories of big data -Thick data -Digital empathy You ca...

2020-10-0528 min

The CU2.0 PodcastCU2.0 Podcast Episode 98 James Robert Lay on the Real Meaning of Digital TransformationSend us a textYou want to read James Robert Lay's Banking on Digital Growth. It's a book not about digital tools but rather about the transformation of community financial institutions, credit unions included, into organizations that can compete with and win against the mega banks.Too small to do that? Nope, says Lay. That size can be a strength. It means a credit union can turn on a dime - if it chooses to.It starts with recognizing that the traditional branch first marketing model is b...

2020-06-2432 min

Banking on Digital Growth12) #ByTheBook: The Humanity of Digital GrowthThe most important element of digital growth is not technology. It’s not sales. It’s not marketing. In fact, it’s something ancient. Something that’s missing in almost every conversation that happens in every boardroom across the country. Humanity. I’ve talked before about how you can generate 10X more loans & deposits. But 10x growth is only made possible through 10X thinking. And any digital growth strategy that doesn’t place human connection at its heart is at best only half of a strategy.

2020-05-2719 min

Banking on Digital Growth9) #ByTheBook: Ask 3 Questions, Generate 10x Digital GrowthWhat if you could generate 10x more loans and deposits by asking 3 questions? (Caveat: They’re hard questions about fear and uncertainty.) You’d still give it a try, right? Especially in the post-COVID-19 world, insights from Banking on Digital Growth have the power to supercharge your growth potential. I’m James Robert Lay, CEO of Digital Growth Institute and author of Banking on Digital Growth, excited to share with you 3 questions that will supercharge your digital growth strategy. What I talk about: -If you’re the hero of your nar...

2020-05-2016 min

Banking on Digital Growth8) #ExponentialInsights: How Can Financial Brands Help Community Businesses w/ Seth Siegel-GardnerA life in hospitality prepared my guest, Seth Siegel-Gardner Chef and Owner of Para Llevar, for a creative life where thinking on your feet in a chaotic environment is a valuable asset. In a post-Covid 19 world, everyone from the hospitality industry, to mom and pop shops, most of the local businesses in our communities are being forced to adapt and pivot into entirely new business models or face shutting their doors. Your financial brand can help if you also adapt and pivot towards your community. What we talked about: -The role of...

2020-05-1927 min

Banking on Digital Growth7) #InsideDigitalGrowth: 3 Ways to Help Guide Customers Through Their Post- Covid Financial StruggleThese are challenging times for all of us. Unemployment numbers are devastating. Your account holders’ finances very well may be affected, as they struggle to adapt to a Post-Covid world. People are going to remember how you treat them during this time of their greatest need. What strategies do you have in place to connect with your customers as they adjust to life after Covid-19? Help them along their financial journey with empathy and hope by implementing a few key changes! What we talked about:-The stresses customers are u...

2020-05-1833 min

Banking on Digital Growth6) #ByTheBook: Financial Stress in the Fourth Industrial Revolution87% of Americans reported experiencing "high" or "moderate" levels of anxiety in connection to money in a survey conducted by Northwestern Mutual. And that was before COVID19. Consumers have had to adapt to a new existence, where they conduct all of their day-to-day activities from home. The pandemic has accelerated the need for people to adopt a completely digital-based lifestyle at breakneck speed. People are sheltered. People are scared. And people are still stressed about their finances. Now perhaps more than ever. Are traditional banks and credit unions seeing an opp...

2020-05-1317 min

Banking on Digital Growth5) #ExponentialInsights: How Will Banking Adjust to Life After Covid-19? w/ Brett KingIn today’s episode, I talked to Founder and Executive Chairman of Moven, Brett King, to discuss the evolving role of AI in finance as the world is impacted by pandemic. We dive into this topic by revisiting how the banking industry answered the call for modernization as technology soared in 2012, looking at ways for financial brands to once again adapt as individuals and businesses learn to navigate a Covid-19 world. I share insights into the evolving structure solutions financial brands will be contemplating as the demand for off-site banking develops in an uncertain time....

2020-05-1233 min

Banking on Digital Growth1) #InsideDigitalGrowth: Digital Growth: What it is & Why it Matters More Than EverToday, I’m going to answer a simple question: What is digital growth? Only, I’ve answered this question before, in another version of this podcast. A version recorded before COVID-19. I’m James Robert Lay, CEO of Digital Growth Institute and host of Banking on Digital Growth. In the past few months, we’ve all had to learn to do things differently. And this podcast is no exception. In fact, we recorded 10 episodes before the crisis began. But then we hit the pause button on the launch and...

2020-05-0418 min

The Life Box Media Channel Radio PodcastOur Interview With Country Music Recording Artist James Robert WebbWe Had The Pleasure To Talk To Country Music Recording Artist James Robert Webb About His Brand New Self Titled Album James Robert Webb

That Came Out TODAY May 1, 2020

Mr Webb Talks About His Career Early Influences And Who He Listens To At The Present And What He Put Into This New Album That Separates Him From Everyone Else

We Say This Album Is Full Of Great Arrangements And Sound With Nice Vocals And Change Ups Having The Real Feel Of Some Old Classic Country Along With Something For The Modern Country Music Fan

You Can Buy James Robert Webb's Musi...

2020-05-0133 min

Banking on Digital Growth0) Why You Should Listen to Banking on Digital Growth (& Not My College Punk Band)The financial industry is rapidly changing and the traditional growth models no longer work.

Consumers make purchasing decisions before ever walking into a physical branch — if they even do at all.

The competition is changing, too. Mobile banking and digital lending have already taken over.

That can leave some financial marketers and sales teams scratching their heads in confusion and frustration.

That’s why I started the #BankingOnDigitalGrowth podcast: To help simplify their lives.

I’m James Robert Lay, CEO of Digital Growth Institute, and I’m on a mission to eleva...

2020-02-1208 min

The James Harrisson ShowHow Robert James Collier built a business around hosting dinners on yachts and at private villasHow Robert James Collier built a business around hosting dinners on yachts and at private villas IG: @robertjamescollier W: https://entrepreneursdinner.com/ What you’ll learn from this interview: The problem Robert saw with most networking events, and how he was able to disrupt this broken model How he was nearly sued for $40k which almost derailed his business before it even began How Robert was able to give a TEDx talk, and his advice for being a better speaker What Robert learned from various spiritual exper...

2019-04-211h 22

Beyond the Image PodcastMatt Tuthill, Robert Irvine MagazineIn the new episode of the Beyond the Image Podcast, host James Patrick chats with the General Manager of Robert Irvine Magazine, Matt Tuthill. The two chat about Matt's background as a journalist and his transition from working at a newspaper to working in magazines, his career at Muscle & Fitness Magazine and his work with chef Robert Irvine to launch Robert Irvine Magazine. This episode covers the importance of storytelling in the media, the requirements of emotional labor in one's work and what he looks for when hiring creatives including the need to solve problems, g...

2019-01-1653 min

JR Deal NewZEliminate Traffic Congestion with Door To Door TransitWe have a last mile problem, says Attorney James Robert Deal. We need a better way to get people from home to transit center, major bus stop, or grocery store. The solution is a flexible van system that would deliver on-call door to door service. It would fill the buses and trains, save huge amounts of money, greatly reduce carbon emissions, and will eliminate the need to own a car.

2018-12-2619 min

Attorney & Broker James Robert DealAttorney and Broker James Robert Deal on Helping Other BrokersI am both a real estate attorney and a real estate broker. I help buyers and sellers directly. I also help other brokers to help buyers and sellers. This is the case when transactions are complex and buyer or seller needs to bring in a lawyer. I am that lawyer. I can work for a negotiated flat fee payable at closing. See www.WashingtonAttorneyBroker.com/helping-brokers.

2018-09-2420 min

Attorney & Broker James Robert DealBuying Property in Partnership - Attorney and Broker James Robert DealIt is easier to buy property in partnership - especially when buying a first home. Attorney and Broker James Robert Deal. 425-774-6611

2018-09-1726 min

The James Altucher Show388 - Robert Cialdini [Anniversary Episode]: 7 Techniques To Influence Anyone Of AnythingRobert Cialdini is known as "The Godfather of Influence." People call him when they need to learn how to be persuasive & influential. And by "people" I mean some of the most powerful politicians, CEOs, and so on. The lessons Robert taught are still some of the most critical lessons I've learned on my podcast. So I'm excited to share it with you again one year later. Links and Resources Read Robert's book, "Pre-Suasion: A Revolutionary Way to Influence and Persuade" Read his New York Times business bestseller book, "Influence: The Psychology of Persuasion, Revised Edition" Visit his website: influenceatwork.com Fo...

2018-09-061h 07

JR Deal NewZJames Robert Deal - - green politics - seller-financing and buying real property in partnershipJames Robert Deal - - green politics - seller-financing and buying real property in partnershipwww.JamesRobertDeal.org/Platform, www.WashingtonAttorneyBroker.com/seller-financing, www.washingtonattorneybroker.com/lenders/leaseoptiondeals/

2018-09-0339 min

The James Altucher Show374 - Robert Greene: The Laws of Mastery: Know What You Want & How to Master ItFive years ago I interviewed one of my all-time favorite authors and brilliant thinkers. Now, I'm bringing this interview about mastery back to the surface. Before you can master something, you have to know what that "something" is. We all want to master something. And live to our full potential. That's why we ask ourselves questions like, "What's my passion?" and "What do I love?" Robert Greene told me his theory: find your voice, connect with your likes and dislikes. He digs into these strategies but also talks about seduction, manipulation, regret, writing and why he thinks everybody has creative...

2018-07-1935 min

JR Deal NewZWhy I run for US SenateFrom Attorney James Robert Deal: Why I run for US Senate. I run to educate regarding green politics. I run to pressure my opponents to address important issues.

2018-07-0928 min

JR Deal NewZAttorney Deal on Green PoliticsAttorney James Robert Deal on what green politics is all about.

2018-07-0637 min

JR Deal NewZJR-Deal-NewZ-4-8-2018James discusses the absurdity of smart meterss and Five G. Litigation will bring down these frauds if legislatures fail to act. Smart meters and 5G should be part of this year's campaign. Demand that your candidates state their position on smart meters and 5G. James discusses other profitable frauds such as Roundup, tetraethyl lead, fluoride and fluoridation, drilling for oil. Corporations are forms of artificial intelligence. States charter corporations. States can de-charter corporations which fail to do something good for the world, which exposes shareholders to individual liability.

2018-04-091h 26

JR Deal NewZSmart Meter Action - Traffic Congestion - Buy Real EstateSmart Meter Solution - Traffic Congestion Solution - Buy Real Estate In Partnership - James Robert Deal, Attorney - www.JamesRobertDeal.org/Smart-Meters

2018-01-291h 55

JR Deal NewZMeet James Robert Deal - Broker and AttorneyJames Robert Deal talks about all the ways he can help you when you are selling or buying real estate - as your listing broker or selling broker.

2017-12-1715 min

TK with James Scott: A Writing, Reading, & Books PodcastRobert Repino & Urban WaiteRobert Repino had a couple of false start novels before setting out on The War With No Name series, which was inspired by a dream (really) and now includes three books: MORT(E), CUL-DE-SAC, and D'ARC. He and James discuss their MFA memories, learning to write, 80s nostalgia, and fans getting MORT(E) tattoos. Plus, Urban Waite and James talk about MFAs and creating your own residency. - Robert Repino: https://robertrepino.com/ Robert and James discuss: Emerson College St. Joseph's University Press Arts Boston TKTS

2017-10-241h 31

JR Deal NewZTraffic Congestion - Lead in Lynnwood Water - Smart MetersJR Deal NewZ 7-1-17 - Attorney James Robert Deal for Lynnwood City Council Position 1

2017-07-0255 min

Mastermind.fmEpisode 38 – Persistence & Success with Security Consultant Robert AbelaThis episode James and Jean are joined by Robert Abela, an EU based freelance IT consultant and WordPress Security Professional with WP White Security.

Robert is a major player in advocacy for WordPress security, and owns the No. 1 WordPress Monitoring & Audit Trail Plugin. Additionally, aside from his own security blog, Robert is also a guest blogger on many web-security blogs and websites.

Topics Include:

Robert’s journey with WordPress.

It all started as a hobby.

Robert developed on the side, but never considered himself a developer.

At the same time he had a WordPress security cons...

2016-11-1544 min 2016-07-311h 02

2016-07-311h 02

Attorney Deal for City CouncilClose Hanford Nuke - James Robert DealThe nuke at Hanford is the same model as the Fukushima reactors which exploded in 2011. It is dirty, dangerous, and expensive. It regularly vents radioactive gasses. It is located downstream from earthen dams which could fail in an earthquake. It could flood and catch on fire. It could be the next Oso, but a million times worse. Close it down.

2016-07-2735 min

Attorney Deal for City CouncilMoney and Politics - James Robert DealMoney and Politics - James Robert Deal. Election and Campaign Finance Reform. It takes money to run a campaign, so a politician must first be good at raising money. Those who donate the most want something in exchange. So the politician represents the donors rather than the electors. There is a way literally to take the big money out of politics - by making it more affordable to run a campaign and by putting an absolute limit on money to be spent. http://JamesRobertDeal.org/election-reform

2016-07-2449 min

Attorney Deal for City CouncilSalmon Recovery - James Robert DealWe say we want our salmon runs to recover, but we do things which kill salmon. Attorney Deal is running for Washington governor.

2016-07-2328 min

Attorney Deal for City CouncilHomelessness - James Robert Deal for GovernorHomelessness - James Robert Deal for Governor. Housing the homeless is the right thing to do, and it would cost less than what we are doing now.

2016-07-2231 min

Attorney Deal for City CouncilEleminate Traffic Congestion - James Robert DealIt is possible to eliminate traffic congestion by making it easier to use transit than to drive. The solution is door-to-door transit using flex-vans of all sizes, summoned by cell phone using Uber technology Attorney James Robert Deal, green, progressive candidate for Washington governor 7-20-16

2016-07-2149 min

Attorney Deal for City CouncilAttorney Deal on Washington Becoming An Organic State 7-19-16Attorney James Robert Deal is running as a green, progressive for governor of Washington. He says that Washington can and should become an organic producing state and ban Roundup and commercial pesticides. 7-19-16

2016-07-2054 min

Attorney Deal for City CouncilAttorney James Rober Deal on the Fluoride Fraud - 7-17-16Fluoride used to fluoridate is a commercial grade toxic waste, which we consume from conception to death, two milligrams per day. Fluoride contains lead and leaches lead. After this vice has ended, we will look back in amazement at ourselves for having believed such a fraud. Jay Inslee supports fluoridation unquestioningly. http://fluoride-class-action.com/flint

2016-07-1852 min

Attorney Deal for City CouncilJames Robert Deal for Governor 7-16-16 Smart Meters, Washington State Bank, Oil TrainsJames Robert Deal for Governor 7-16-16 Smart Meters, Washington State Bank, Oil Trainst

2016-07-1739 min

The James Swanwick Show167: Robert Greene on How to Overcome Social AwkwardnessGet your question answered by James on the Podcast! Click here. “None of your technical skills will amount to anything if you don’t have social skills.” - Robert Greene (click to tweet) Do you understand the laws of human nature? Do you know why you do what you do? Why humans make the decisions that they make? And do you know how to leverage social skills to accomplish what you want to in life? Today’s guest is Robert Greene, the bestselling author of such books as “The 48 Law...

2016-07-1349 min

The James Swanwick Show167: (video) Robert Greene on How to Overcome Social AwkwardnessGet your question answered by James on the Podcast! Click here. “None of your technical skills will amount to anything if you don’t have social skills.” - Robert Greene (click to tweet) Do you understand the laws of human nature? Do you know why you do what you do? Why humans make the decisions that they make? And do you know how to leverage social skills to accomplish what you want to in life? Today’s guest is Robert Greene, the bestselling author of such books as “The 48 Law...

2016-07-1349 min

Attorney & Broker James Robert DealWashington State Bank - James Robert DealWashington should set up a state bank like the profitable state bank of North Dakota.

2016-07-0627 min