Shows

Ready For RetirementThe Hidden Cost of Roth Conversions: Avoiding Surprise Medicare ChargesRoth conversions can save thousands in taxes, but they can also trigger Medicare IRMAA surcharges that quietly add up to more than $5,000 a year. Most retirees never see it coming, because the rules for Medicare premiums don’t line up with the tax brackets everyone focuses on.In this video, James breaks down how Roth conversions interact with Medicare Part B and Part D premiums, why modified adjusted gross income matters more than taxable income, and how crossing a threshold by even one dollar can change your costs for an entire year. The case study shows how a...

2025-12-1410 min

Living in Woodland Park and Colorado SpringsRoth’s Sea & Steak | Colorado Springs🎙️ Episode Title: Roth’s Sea & Steak – Premium Dining in Colorado Springs 🥩🦞🍷✨🌆Join us as we visit Roth’s Sea & Steak, an upscale dining experience offering prime steaks, fresh seafood, chef-driven dishes, and a polished atmosphere. Whether you're celebrating something special or simply craving quality cuisine, Roth’s delivers unforgettable flavor.📞 (719) 266-2725 | 📩 info@jdmret.net 🌐 www.jdmountainhome.com/home🔴 Visit our Communities Page for more Community Spotlight Updates:👇👇👇 https://www.jdmountainhome.com/communities 🔴 Visit our Pikes Peak Buy Local Guide:👇👇👇👇 https://www.jdmountainhome.com/buy-local-guide 🔴 Visit our Pikes Peak Relocation Guide:👇👇👇👇 https://www.jdmountainhome.com/re...

2025-12-0303 min

Geek To Me Radio489-Amazon’s “Bat-Fam” with Mark Roth | “Predator: Badlands” and “Nuremberg” Review0:00 SEGMENT 1: Emmy-winning creator Mike Roth talks about the upcoming “Bat-Fam” series on Amazon Prime Video.https://www.primevideo.com/detail/BAT-FAM/0OSSOXOG2XIRP572RWGKKIX786 https://www.imdb.com/name/nm1226489/ 19:02 SEGMENT 2: Producer Joey V. and James review “Predator: Badlands” and “Nuremberg”.45:56 SEGMENT 3: James and Producer Joey V. share some of their most anticipated movies for the rest of the year, including “Avatar: Fire and Ash”, “Knives Out 3”, and “Marty Supreme”.Keep up to date with 2 Rivers Comic Con, coming back to St. Charles in April, 2...

2025-11-1557 min

The Revenue Formula$1.2B ARR CRO on AI in GTM (w/ James Roth from ZoomInfo)James Roth, CRO at ZoomInfo, joins Toni to break down how AI is reshaping go-to-market. From the collapse of inbound demand to the rise of intelligent outbound, he explains how teams can stay efficient, use AI without the hype, and turn data into real impact.We also talk about ZoomInfo’s $1.2B ARR growth, the myth of “AI-native” startups, and what go-to-market intelligence actually means in 2025.Want to work with us? Learn more: revformula.io(00:00) - Introduction

(01:38) - ZoomInfo's Growth and Public Perception

(06:45) - AI's Role Today

(10:04) - ZoomInfo's Approach to AI and...

2025-10-0753 min

Ready For RetirementRoth vs. Traditional IRA – Which One Really Saves You More?Is a Roth IRA really better than a traditional IRA? The truth is... it depends on your tax situation. In this video, you’ll learn why your current tax bracket versus your retirement tax bracket should drive your decision, not blanket advice.Most retirees pay less in taxes later in life, which creates opportunities for smart strategies like tax arbitrage and Roth conversions. By contributing to traditional accounts during high-earning years and converting in lower-tax years, you can potentially save thousands (even hundreds of thousands) over your lifetime.James also covers why neither Roth nor tr...

2025-09-2312 min

The GTMnow PodcastGTM 159: Scaling ZoomInfo to over $1B ARR, the Upmarket Playbook, and Launching CoPilot to over $100M Revenue in 6 months | James RothJames Roth is the Chief Revenue Officer at ZoomInfo, where he oversees a global revenue engine supporting over 37,000 customers and more than $1 billion in ARR. With a background in scaling hypergrowth teams and building enterprise go-to-market machines, James has helped reposition ZoomInfo from a sales tool to the foundational data layer for modern GTM teams. Under his leadership, ZoomInfo launched Copilot, its flagship AI product, and executed a bold shift upmarket — transitioning from transactional selling to a data-first, enterprise-driven GTM strategy.Discussed in This EpisodeHow ZoomInfo transitioned from transactional selling to enterprise go-to-marketThe "Go...

2025-08-1947 min

Whispered HiringWhispered Hiring with James Roth - CRO @ ZoomInfoIn this episode of How I Hire, Andy Mowat speaks with James Roth, Chief Revenue Officer at ZoomInfo, about his systematic approach to executive hiring at scale. Having risen from door-knocking outside sales to leading GTM at the company behind the literal GTM ticker symbol, James reveals how ZoomInfo maintains hiring velocity while raising the bar—processing thousands of applications for senior roles while consistently identifying transformational talent. His frameworks challenge hiring orthodoxy and expose the operational realities of talent acquisition at publicly traded SaaS companies.

Topics discussed:

The organizational design trap of proliferative C-suite titles—why...

2025-07-2349 min

The Revenue Leadership Podcast with Kyle NortonE39: CRO James Roth on Resilience, Reinvention, and AI at ZoomInfoWhat does it take to lead a public go-to-market organization through rapid change without losing focus? In this episode, Kyle Norton sits down with James Roth, CRO of ZoomInfo, to unpack the leadership principles, GTM evolution, and cultural shifts powering ZoomInfo's next chapter. From rethinking account ownership models to re-centering around core strengths like data and AI enablement, James shares how he's helping rebuild ZoomInfo into a sharper, more focused enterprise. Thanks for tuning in! New episodes of The Revenue Leadership Podcast drop every Wednesday. Don't miss GTM2025 — the only B2B tech con...

2025-07-091h 34

Root ReadyRoth Conversions Done Right: What Great Advisors Know That Software Doesn’tIn this episode of Root Ready, James shares how advisors should think about Roth conversions—starting with the basics and not just relying on software.Software can help with numbers, but it can’t see the full picture. James explains why Root advisors use software as a tool, not the final answer.He talks through key things to consider before doing a Roth conversion, like future tax brackets, RMDs, charitable giving, and income thresholds. You’ll also hear why Roth conversions are more like “tax insurance” than a perfect plan.If you want to better...

2025-05-1422 min

Enlightened Wealth StrategiesEP 7 - The A B C's of Roth IRA'sIn our latest podcast, Enlightened Wealth Strategies, James and Jim discuss the A B C's of Roth IRAs.

2025-04-1730 min

Ready For RetirementYour Roth IRA Could be Locked For 5 Years. Here's WhyRoth IRAs are a great way to build tax-free retirement income—but the withdrawal rules can be tricky. In this video, I’ll break down the five-year rules, how contributions, conversions, and growth are treated, and smart strategies to avoid unnecessary taxes.Understanding these rules can help you make the most of your Roth IRA and keep more of your money tax-free. Let’s dive in!Questions answered?1. When can you withdraw money from a Roth IRA without paying taxes or penalties?2. How do the two different five-year rules for Roth IRAs a...

2025-03-1112 min

Ready For RetirementRoot Talks: How Should I Split Retirement Withdrawals Between Pretax and Roth Accounts?In this episode, we're talking about the importance of a strategic withdrawal plan in retirement to keep taxes in check and set you up for long-term financial stability. Ari and I break down why a simple 50/50 split between traditional and Roth accounts isn't enough—you need to plan based on your tax situation and future needs. Using a listener's example, we walk you through how to think about tax brackets, required minimum distributions (RMDs), and when it might make sense to convert funds to a Roth IRA.We also discuss the role of asset location—putting riskier inve...

2025-02-1324 min

Open Forum in The Villages, FloridaPodfest 2025 with Sean James, Forbes Riley & Natasha Graziano on OwwillSend us a textExploring The Villages: Insights from Podfest 2025In this episode of Open Forum in The Villages, Florida, host Mike Roth introduces his passion project podcast, highlighting its aim to bring knowledge and inspiration to its audience. Recorded at Podfest 2025, the episode features discussions on various topics including the misconceptions about senior living in The Villages, the importance of staying mentally and physically active, and the educational opportunities at The Villages' Enrichment Academy, particularly courses on AI and podcasting. The show also delves into personal growth, the significance of lifelong learning...

2025-02-0709 min

15 Minutes of FinanceHow backdoor Roth conversions can save you tens of thousands of dollars and provide you retirement freedomSend us a textThe Tax Plan walks you through various tax planning strategies to help you keep more of your hard earned money. Today, we talk a more advanced topic: backdoor Roth conversions to convert pre-tax money into a tax-free Roth account. Roth accounts avoid the RMD restrictions that affect retired taxpayers, and allow money to compound tax FREE forever. Learn how to utilize this powerful wealth building tool.

2025-01-3119 min

Ready For RetirementSTOP! Why You Shouldn't Do a Roth ConversionRoth conversions are almost a buzzword today, with many people jumping into them like they’re a guaranteed fix for tax worries—much like rushing into surgery hoping it will solve all your problems. But just like surgery, Roth conversions require careful consideration, and they’re not always the right solution. Before deciding to convert, it’s essential to understand why not to do it.Here are some key reasons to skip—or at least pause—on Roth conversions:- Lower Future Tax Bracket: If you anticipate being in a lower tax bracket during retir...

2024-11-2829 min

Ready For Retirement7 Things You Need to Know About Roth IRAs to Maximize Tax-Free IncomeRoth IRAs offer great tax-free income benefits, but to make the most of them in retirement, here are seven things you need to know:Contribution Limits: In 2024, you can contribute up to $7,000 annually ($8,000 if 50+), across both Roth and traditional IRAs.Access to Contributions: You can withdraw your contributions at any time, tax-free and penalty-free. Only earnings are subject to penalties if withdrawn early.The Five-Year Rule: To withdraw earnings tax-free, the Roth IRA must be held for at least five years.Income Limits & Backdoor Roths: High earners may not be able to contribute directly, but a...

2024-11-1217 min

Sales Is King189: ZoomInfo CRO James Roth | Skills + Expectations For High PerformersSummary

In this conversation, Dan Sixsmith speaks with James Roth, the CRO of ZoomInfo, about the evolving landscape of sales, particularly in the SaaS industry. They discuss the importance of understanding the buying committee, the challenges of longer sales cycles, and the need for sellers to be well-prepared and knowledgeable. Roth shares insights on selling to the C-suite, the skills required for a successful CRO, and his personal journey from musician to sales leader. The discussion emphasizes the significance of data-driven sales strategies and the role of technology in enhancing sales effectiveness.

...

2024-10-071h 10

The CRO Spotlight PodcastEnterprise CRO Insights and Strategic Career Growth with James RothIn this insightful episode of the CRO Spotlight Podcast, host Warren Zenna sits down with James Roth, Chief Revenue Officer of ZoomInfo, to explore the critical elements that shape a successful CRO career. James delves into the importance of "knowledge stickiness," explaining how the ability to absorb and retain valuable insights from various roles and experiences is more important than simply having a diverse resume. He shares his journey from a sales leader to a CRO, emphasizing the value of staying focused on your current role while being open to continuous learning.James and Warren also discuss...

2024-09-041h 04

Ready For RetirementAm I Too Old for Roth Conversions? 3 Things to ConsiderGary is a 73-year-old with $8 million in savings. Despite having substantial assets, he’s concerned about missed opportunities for Roth conversions as he faces significant required minimum distributions.James encourages Gary to reassess his investment strategy, particularly the bond funds in his Roth IRA, and align his tax planning with his broader financial goals. By doing this, Gary could make more informed decisions that support his retirement goals and charitable aspirations.Questions answered:How can I give money to friends and family without them incurring a huge tax bill?What advice do yo...

2024-08-0623 min

Ready For RetirementThe Roth Conversion Sweet Spot: Maximize Retirement Savings (And Avoid Costly Mistakes)Listener Nael opens up a discussion about Roth conversions. There are benefits to doing Roth conversions, but can you do too many? Are there any downsides to Roth conversions?Reaping the tax benefits from Roth conversions requires hitting a specific sweet spot. If you convert too little or too much, you’ll be leaving money on the table. So, how do you find Roth-conversion the sweet spot? James lays out five things you should consider as you plan when and how much to convert:1. Macro and micro tax environment2. Required minimum distributions

2024-07-0924 min

AFIO PodcastAFIO Now Presents: James RothJames Roth, author and former CIA Officer, on The Dead Drop: Espionage is a Dangerous Game for Amateurs, explores themes of duplicity and betrayal. The novel captures the human tension of real-world espionage with a memorable cast of characters. Former CIA Officer James Lawler wrote of the book: "...a riveting tale of spies, youthful idealism, and adult betrayal, which accelerates to a thrilling climax worthy of a major motion picture."

Interview on Friday, 9 February 2024. Host and Interviewer is AFIO President James Hughes, a former senior CIA Operations Officer and Former NSA Associate Deputy Director of Operations. The...

2024-07-0121 min

Grainmaker Wrestling PodcastEp 171 - The Return of James Roth!Its a big weekend for wrestling in Winnipeg as WPW presents Fight at the Museum with a massive WPW Heavyweight Championship match as Tyler Colton defends the championship against my guest this week, making his return to the podcast, James Roth!!

James and I talk about what has happened since his last appearance here, and there has been quite a bit to unpack! We talk about whats happened with him in WPW since the last museum show(including the busted nose, Rumble at the Burt, and the Voyageur cup!). You'll also get a look beyond t...

2024-04-251h 01

Ready For RetirementPay ZERO Capital Gains Tax vs Roth Conversions in Retirement: How to Determine Which is BestListener Drew asks about a tax strategy for juggling capital gains and Roth conversions. While it can be a complicated question – especially when large accounts are involved – James provides some general guidelines that can be helpful for anyone with similar gnarly tax strategy challenges in retirement. In this episode, we’ll cover the extent to which required distributions will be an issue, what you need to alleviate that issue, and the timeframe within which you have to do that.James explains how to work backward to project your various tax brackets and determine how to priorit...

2024-03-2634 min

Ready For RetirementRoth Conversion Strategies to Protect Your Spouse's Future Tax BurdenA listener says, “Eventually, one spouse will pass before the other, which will often catapult the survivor into a significantly higher tax bracket. Shouldn’t a Roth strategy take this into account?” James explores several factors that could positively and negatively impact a survivor’s tax liability and what to consider when creating a Roth conversion strategy. Questions Answered: How can Roth conversions benefit married couples beyond tax savings?What factors should be considered when determining the optimal strategy for Roth conversions to protect a surviving spouse?Timestamps:0:00 - Steve’s q...

2024-03-1235 min

SaaS FuelJames Roth - Rising from the Sales Trenches: Tales of Triumph in the Leadership ArenaIn this episode of our SaaS Fuel, Jeff Mains is joined by James Roth, the Chief Revenue Officer of ZoomInfo. Together, they unpack the importance of continuous personal growth, the evolution of sales tactics, and the critical role of data-driven insights in the modern business landscape.Throughout the conversation, James emphasizes the value of embracing diverse experiences and learning from each role, comparing it to collecting gold coins in a video game that contributes to overall leadership and success.They dig into the transformative powers of technology in the sales process, discussing the centralization of...

2024-02-061h 03

Ready For RetirementWhat's the Right Roth Conversion Amount to Avoid a Tax Nightmare in the Future?Sammy, a 51-year-old retiree, is seeking advice on how much she should convert from her traditional IRA to a Roth IRA each year to avoid jumping tax brackets and minimize the taxation of her social security benefits. James analyzes Sammy's current financial situation and offers guidance on approaching the tax planning aspect of her retirement strategy.Learn:How to determine how much to convert from an IRA to a Roth IRA Why forward-looking tax planning is essentialThe potential consequences of certain financial decisionsQuestions Answered:What factors should yo...

2024-01-2326 min

The Nova Show: Real Estate RecordsSEASON 3 | Episode 2: Tristan Hammett hosts James RothJoin host Tristan Hammett in an inspiring episode as she welcomes James Roth, a remarkable figure in the real estate world. James, a true Real Estate Prodigy, has been a licensed agent since 2019 and boasts an impressive track record with over 30 closings in 2023 alone.Not only is James a dedicated father, but he has also established himself as a four-time Top 500 Agent, achieving this prestigious recognition every year since he embarked on his real estate journey. Starting out as an investor, James brings a unique perspective to the industry, and his passion for helping the community sets...

2024-01-1231 min

Ready For RetirementRoth IRA Tax-Free Withdrawals: 5-Year Rule ExplainedJames explores the nuanced aspects of Roth IRAs, shedding light on intricacies that can confound even experienced investors. Through a listener question from Manfred, a retiree contemplating a $50,000 conversion from a 401k to a Roth account, James dissects the crucial five-year holding period and the order in which contributions, conversions, and earnings are treated during withdrawals. James also provides clarity on distribution rules, exceptions, and strategic considerations, offering a comprehensive guide to navigating the complexities of Roth IRAs for optimal retirement planning.Questions Answered:How does the timing of subsequent conversions impact th...

2023-12-0519 min

Ready For RetirementIs Your Portfolio Big Enough to Benefit From Roth Conversions?What are the benefits of Roth conversions in retirement planning? James addresses questions about when Roth conversions become worthwhile.This episode explores key factors:Changes in tax bracketSpousal scenariosImpact of portfolio size on tax savingsPotential tax savings tend to increase with a higher portfolio balance but be careful not to take unnecessary Roth conversions. James explains different strategies to optimize tax planning.Questions answered:Is there a specific portfolio value at which Roth conversions should be considered?Why might one choose not to do a...

2023-11-0721 min

Ready For RetirementPretax vs Roth- Which is Better for You If You're in the 24% Tax Bracket?If you're in a high tax bracket now and expect to remain in a high tax bracket after retirement, should you prioritize pre-tax retirement accounts or Roth retirement accounts for individuals? James answers this and discusses various factors to consider in making this decision, including current and future tax brackets, required minimum distributions (RMDs), charitable giving, life expectancy, and the impact on heirs. Using a real-life scenario, James offers a thoughtful approach to help you make an informed decision based on your unique circumstances.Questions Answered:Should individuals in high current tax brackets prioritize p...

2023-10-2422 min

Ready For RetirementIs It Possible to Have Too Much in Roth IRAs?DescriptionThere are a lot of good reasons to put your money into a Roth account. But does it make sense to have all your money in Roth accounts?The truth is, there is a point at which it's potentially harmful to continue putting money into Roth accounts. James explains the nuances of Roth accounts and tax planning, while answering a listener's question.Questions Answered: Is there a point at which you can have too much in a Roth account?How can you use tax planning in retirement?Ti...

2023-07-1822 min

The James Altucher ShowUnveiling a Financial World Order: Challenging the 'Own Nothing' Paradigm | Carol RothIn this thought-provoking episode of The James Altucher Show, renowned author and entrepreneurial powerhouse, Carol Roth, joins James to delve deep into the captivating themes explored in her groundbreaking book, "You Will Own Nothing." Prepare for a riveting conversation that challenges the status quo and offers fresh perspectives on the future of wealth, ownership, and personal freedom.Drawing from her extensive research and insightful analysis, Carol Roth exposes an underlying agenda shared by numerous international institutions that seeks to diminish the influence of the dollar and hinder millions of Americans from attaining true financial autonomy. She expertly elucidates why owning...

2023-07-181h 02

Ready For RetirementHere’s How You Can Tell If a Roth Conversion Is Right For YouOne of the best things you can do for your portfolio is to implement the right tax strategy. Each situation is unique and requires a personalized approach.Using a listener’s question, James explains one specific example to show when and how to implement the right strategy. Questions Answered: Why should or shouldn't you do Roth conversions?What should you be mindful of when doing Roth conversions?Timestamps:0:00 Introduction0:53 Listener question4:03 Two core things to focus on5:56 Should we do a Roth conversion?7:13 Taxable inco...

2023-06-1321 min

Ready For Retirement4 Reasons You SHOULDN'T do a Roth ConversionIn this episode of Ready for Retirement, James discusses how 4 reasons to NOT do a Roth Conversion.Questions Answered: How to think through whether a Roth Conversion makes sense for youUnderstanding how to implement effective Roth Conversions How can your overall retirement strategy be improved?Timestamps:00:00 - Introduction 2:13 - Example4:25 - Plan for Conversions7:22 - Age / Life Expectancy10:19 - Not ONLY A Dollar Amount12:49 - RMDs14:58 - RMD Example17:02 - RMD Issue19:00 - Working With UsCheck out all of our pod...

2023-04-1819 min

ChalkTalkJim: Breaking Down the Game - A Guide to the Future of HealthcareThe Logic of the Heart: How Dr. Scott Roth Co-founder, CEO, and CMO at ImaCor Found His Calling in CardiologySend us a textThe physician's role is changing, and here’s a cardiologist’s perspective on what’s coming down the road.In this episode, Scott Roth, co-founder, CEO, and Chief Medical Officer at ImaCor, questions the current medical education system with a full-circle conversation based on his experience in cardiology, the transition to team-based care with a value-based model, and the evolution of noninvasive imagery technologies. Healthcare industry incentives have changed in the past decades, and so Dr. Roth discusses how motivation is a challenge that should be addressed by the educational system and su...

2023-03-2236 min

You're HomeJames Roth | Navigating Utah's Real Estate MarketJames Roth has a remarkable track record of delivering results. He is a top-ranked agent with EXP Realty in Utah and is committed to helping his clients understand every step of the buying or selling process. James's dedication to his clients is unparalleled, and he is known for going above and beyond to ensure their satisfaction. Tune in to hear more about James's journey in the industry and his invaluable insights into real estate.

2023-03-1828 min

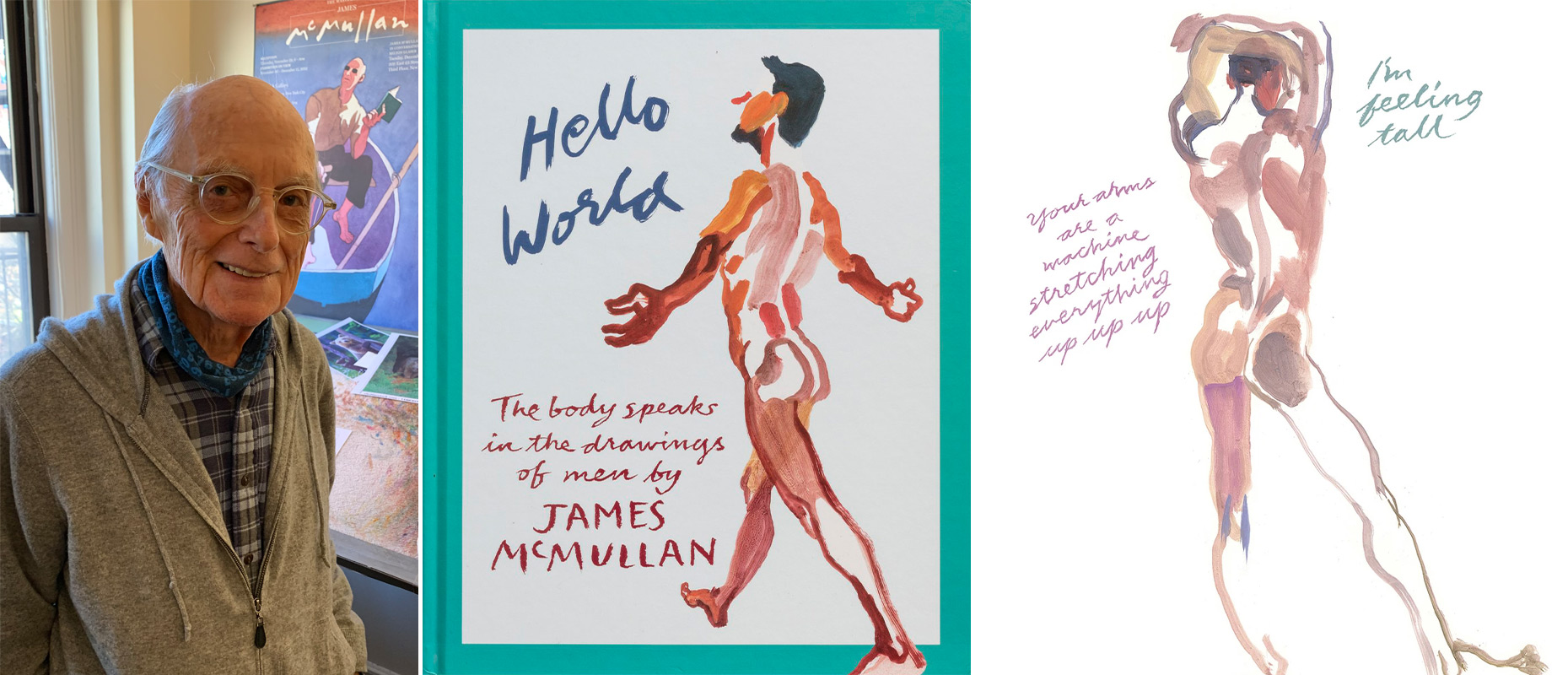

The Virtual Memories ShowEpisode 526 - James McMullanLegendary artist and illustrator James McMullan joins the show to celebrate his new book, HELLO WORLD: The Body Speaks in the Drawings of Men (Pointed Lead Press). We talk about James' three-plus decades of posters for Lincoln Center Theater, the importance of the human figure in his art, how drawing with color opened a more expressive channel for him, and why Hello World is his most personal project (even more than his memoir). We get into the intersection of illustration & fine art and whether he resented being overlooked by the museum set, the experience of making more than 90 (!) posters...

2023-02-141h 37

The Dr. Jeffrey Roth‘s Looking Good Feeling Great PodcastExplained - Blunt and Penetrating trauma, plus much more on this new 2023 episode of season 04 on Dr. Jeffrey J. Roth’s Looking Good Feeling Great Podcast from Las Vegas.Hi Again and welcome back to episode 1 of our new season 04 starting off 2023.

Haven’t you always wished to gain a greater understanding of the mysterious and complicated field of plastic procedures? Finally, now you can. Get connected and learn! Tune in and bookmark the “Dr. Jeffrey J. Roth's Looking Good Feeling Great Podcast from Las Vegas” with his co-host, Darrell Craig Harris.

For a start, you will be in no doubt about the love, passion, dedication, and empathy that Dr. Roth has for his patients and community. Plus, he always seems to add in...

2023-02-0739 min

Front Row with James WhitesideEpisode 4: Anthony Roth CostanzoI love the energy that Anthony brings to this interview. We talk about his days as a backup singer for Michael Jackson, his critically acclaimed show with Justin Vivian Bond, and he even sings a bit of the Gershwin brothers’ “The Man I Love”. Not only am I a huge fan of Anthony, but he gives a great interview, here in the Front Row.Anthony Roth Costanzo is a grammy award winning countertenor who has led opera companies around the world. He has performed on Broadway, done backup for Michael Jackson, and performed alongside Luciano Pavarotti. Anthony is a g...

2023-02-0138 min

Ready For RetirementHow to Use Roth Conversions to Protect Your Spouse's FutureIn this episode of Ready for Retirement, James how to use Roth Conversions to protect your spouse's future.Questions Answered: What are the best ways to implement Roth Conversions?What are the best strategies to implement tax planning for your spouse?How can your overall retirement strategy be improved?Timestamps:00:00 - Introduction 1:45 - Roth Conversions3:23 - When To Implement6:52 - Income Assumptions9:27 - Taxable Income12:05 - Roth Conversion Planning14:35 - Surviving Spouse Tax Planning16:48 - Life Insurance Protection19:21 - Analysis Assumptions20:50 - Working Wi...

2023-01-2422 min

Retire Secure!December 2022 Roth IRA Conversions During Periods of a Down Market and Inflation Episode 4Go to https://paytaxeslater.com/webinars to register for Jim's FREE, LIVE webinar series on January 31st beginning at 11 AM Eastern. In this 4th part of a 5 part Roth series from Jim Lange's December 2022 webinar, Jim discusses how to pay the taxes in a Roth Conversion, and the considerations. Will doing a Roth pass your "stomach" test? What is the best strategy for YOU when it comes to the Roth? What about going from a taxable to a tax-free environment? Jim offers some tips and strategies that he himself has used for himself and his family.

2023-01-1718 min

Retire Secure!December 2022 Roth IRA Conversions During Periods of a Down Market and Inflation Episode 3To learn more about Jim's FREE retirement webinars coming January 2023 go to https://paytaxeslater.com/webinarsIn this third video in this Roth series, Jim Lange discusses the advanced concepts of making Roth IRA Conversions while also answering questions from the live room. If you've heard enough over the last few videos and want to know more and work with Jim, he discusses that as well! Go to https://paytaxeslater.com/contact-us to find out how to reach our offices. 00:00 - Power of a Series of Conversions/Should You Convert?00:58 - Inflation and Roth I...

2023-01-1023 min

Retire Secure!December 2022 Roth IRA Conversions During Periods of a Down Market and Inflation Episode 2To learn more about Jim's upcoming virtual events in January 2023 go to https://paytaxeslater.com/webinars for more info. In this second episode of Jim Lange's December 2022 virtual event dedicated to making Roth IRA Conversions, Jim discusses the classic time to make a Roth IRA Conversion, takes questions from the live room, discusses how he's put his philosophies into practice personally, and finally the essence and the secret to Roth IRA Conversions!00:00 - Classic Time to Make a Roth Conversion02:55 - Jim Takes Questions from the Live Room - 'Stocks and Bonds index funds...

2023-01-0330 min

Retire Secure!December 2022 Roth IRA Conversions During Periods of a Down Market and Inflation Episode 1To learn more about Jim's upcoming FREE virtual events go to https://paytaxeslater.com/webinarsIn the first edition of his latest Roth IRA Conversion webinar series, Jim Lange discusses an overview of this webinar including discussing for the first time, in-depth, his four top advanced Roth IRA Strategies as well as the basics of making a Roth Conversion. 00:00 - Intro01:44 - Things You Can Control vs. Things You Can't Control - The Market06:25 - What We Will Cover 10:35 - What is The SECURE Act 12:00 - SECURE Act: Potential Impact on Ch...

2022-12-2123 min

Ready For RetirementWhat Are the Pros and Cons of Mega Backdoor Roth Conversions?In this episode of Ready for Retirement, James discusses the pros and cons of Mega Backdoor Roth Conversions.Questions Answered: When does it make most sense to implement?What are the best strategies to implement Mega Backdoor Roth Conversions?How can your overall retirement strategy be improved?Check out our main channel on YouTube here!LET'S CONNECT!FacebookLinkedInWebsiteENJOY THE SHOW?Don't miss an episode, subscribe via Apple Podcasts, Stitcher, Spotify, or Google PlayCreate Your Custom Strategy ⬇️

2022-11-2215 min

Ready For RetirementShould You Use Roth or Pre-Tax if You're in the 24% Tax Bracket?In this episode of Ready for Retirement, James discusses if you should use Roth or Pre-Tax if you're in a 24% tax bracket.Questions Answered: How do your taxes impact your overall financial plan?What are the best strategies to understand your tax plan?How do your investments impact your overall retirement plan?Check out the podcast on YouTube here!Check out our main channel on YouTube here!LET'S CONNECT!FacebookLinkedInWebsiteENJOY THE SHOW?Don't miss an e...

2022-10-0422 min

Banking With Life PodcastDeath Benefits & Roth 401K's (BWL Q&A #36)In today's Banking With Life Q&A, James answers questions such as, "Is the cash value the death benefit?", discussion concerning roth 401K's, and owning multiple IBC® policies. As always, we hope you enjoy and thank you for listening!Today's Questions:0:22 - What are your thoughts on roth 401K's for W2 employees? 2:05 - Is the cash value the death benefit?4:05 - How can you put extra interest in the PUA that you already pay the max premium for?7:26 - Can we own multiple IBC® policies?Damascene Pt. 1...

2022-08-2016 min

Ready For RetirementHow do State Taxes Impact Roth v. Traditional Considerations?In this episode of Ready for Retirement, James discusses how state taxes impact Roth v. Traditional Contributions.Questions Answered: How should you determine what tax strategy is best based on your state?What's the best strategy to utilize when it comes to determining when to prioritize Roth contributions?How does this impact your overall retirement strategy?Check out the podcast on YouTube here!Check out our main channel on YouTube here!LET'S CONNECT!FacebookLinkedInWebsiteENJOY THE SHOW?

2022-08-0214 min

The Dr. Jeffrey Roth‘s Looking Good Feeling Great PodcastButt Lifts, London, Boxing, 21 Gun Salute, and James Caan on Episode 07, Season 03 of Dr. Jeffrey Roth’s Looking Good Feeling Great PodcastHi Again and welcome back for episode 07 of our new season 3.

Haven’t you always wished to gain a greater understanding of the mysterious and complicated field of plastic procedures? Finally, now you can. Get connected and learn! Tune in and bookmark the “Dr. Jeffrey Roth's Looking Good Feeling Great Podcast” with his co-host, Darrell Craig Harris.

For a start, you will be in no doubt about the love, passion, dedication, and empathy that Dr. Roth has for his patients and community. Plus, he always seems to add in a wonderful witty c...

2022-07-1923 min