Shows

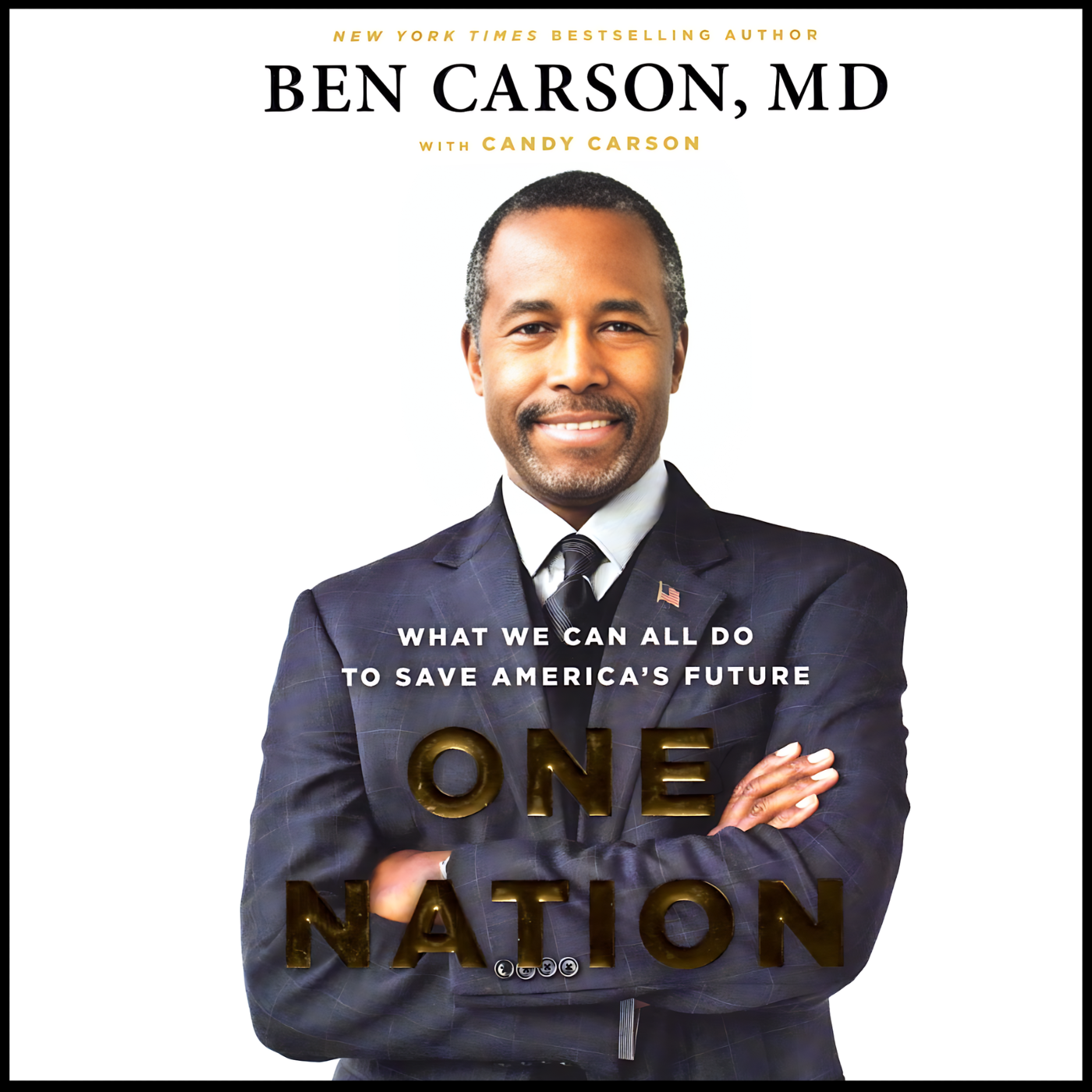

Podcast | Jason Hartman2358 FBF: Dr. Ben Carson – What We Can All Do to Save America’s Future with 2016 US Presidential CandidateThis Flashback Friday is from episode 464 published last January 14, 2015. Today on the Creating Wealth show, Jason returns from the Meet the Masters event and tells his listeners that he still believes that investing within the United States is your best option as oppose to internationally. He also introduces his guest Dr. Ben […]

The post 2358 FBF: Dr. Ben Carson – What We Can All Do to Save America’s Future with 2016 US Presidential Candidate first appeared on Jason Hartman.

2025-11-1400 min

Creating Wealth Real Estate Investing with Jason Hartman2358 FBF: Dr. Ben Carson – What We Can All Do to Save America's Future with 2016 US Presidential CandidateThis Flashback Friday is from episode 464 published last January 14, 2015. Today on the Creating Wealth show, Jason returns from the Meet the Masters event and tells his listeners that he still believes that investing within the United States is your best option as oppose to internationally. He also introduces his guest Dr. Ben Carson on the show where they talk about the medical system, debt, big government, and Ben's latest book entitled One Nation. Mentioned In This Episode: Abundance: The Future Is Better Than You Think by Peter Diamandis http://ww...

2025-11-1437 min

Total Movie RecallTMR 066 – Full Metal Jacket This week on Total Movie Recall, we go to the suck. Steve develops a thousand yard stare reserved for veterans of nightmare wars and mediocre podcasts. Ryan chalks up another point in the Irresponsible Father column, reflecting on his father’s prudent decision to let him watch this vision of insanity at a tender age yet again. If you listen to this episode, you can go to my house and fornicate with my sister. Full Metal Jacket (1987) d. Stanley Kubrick w. Gustav Hasford based on his novel The Short-Timers St...

2021-05-041h 12

Creating Wealth Real Estate Investing with Jason Hartman1494 FBF: Dr. Ben Carson - What We Can All Do to Save America's Future with 2016 US Presidential CandidateThis episode of FlashBack Friday was Originally Released: January 14, 2015 Today on the Creating Wealth show, Jason returns from the Meet the Masters event and tells his listeners that he still believes that investing within the United States is your best option as oppose to internationally. He also introduces his guest Dr. Ben Carson on the show where they talk about the medical system, debt, big government, and Ben's latest book entitled One Nation. Key Takeaways: [2:00] Should you invest internationally or nationally? [7:10] Arthur C Clarke once said, “The only thing we can be...

2020-06-2637 min

Accredited Income Property Investment Specialist (AIPIS)AIPIS 191 - The Color of Law: A Forgotten History of How Our Government Segregated America with Richard RothsteinNeighborhoods throughout America are more segregated than ever, and a lot of people don't realize that governmental action is a big reason why. Richard Rothstein is author of The Color of Law: A Forgotten History of How Our Government Segregated America, and he tells Jason about how laws kept certain groups of people in certain areas of society, and how it still resonates today. Richard also tells Jason some pretty simple rule changes that could spur integration, and more affordable housing in general, throughout the country. Key Takeaways: [1:27] The government's involvement in the segregation of...

2017-06-3037 min

Creating Wealth Real Estate InvestingCW 763 FBF - Dr. Ben Carson – What We Can All Do to Save America’s Future with 2016 US Presidential CandidateSurvive and thrive in today's economy! With over 400 episodes produced, business and investment guru Jason Hartman interviews top-tier guests, bestselling authors and financial experts including; Steve Forbes (Freedom Manifesto), Tomas Sowell (Housing Boom and Bust), Noam Chomsky (Manufacturing Consent), Jenny Craig (Health & Fitness CEO), Jim Cramer (Mad Money), Harvey Mackay (Swim With The Sharks & Get Your Foot in the Door), Todd Akin (Former US Congressman), William D. Cohan ( The Price of Silence, The Last Tycoon, & House of Cards), G. Edward Griffin (The Creature from Jekyll Island), Daniel Pink (National Geographic). Jason Hartman is the Founder and CEO of Platinum Properties...

2016-12-0938 min

The Creating Wealth Show BlogcastCW Blogcast 79 -What's the Home Buying "Freedom Threshold"?While everyone’s attention has been focused on the Millennials and their housing choices, it turns out that it may be those famous Baby Boomers who wield more influence in today’s housing market. According to new article from the Bryan Ellis Investing Letter, research from Merrill Lynch reveals that the “magic age” for housing choices is not those post college years, but one much farther away: age 61. That’s the age when, according to Merrill lynch analysts, people really feel free to choose where they want to live. This “Freedom Threshold” comes at a time when people are abl...

2015-06-3004 min

The Creating Wealth Show BlogcastCW Blogcast 78 - Solving Real Estate's "Millennials" ProblemThe Millennials have taken a lot of heat lately, criticized for poor work ethics, overdependence on technology and general lack of interest in notching up the traditional milestones of “adult” life. Now, as home sales continue to drop, market watchers are looking once again to the attitudes and behaviors of Millennials for explanations. Millennials - those born between about 190 and 2000 – do account for 76 percent of first time homebuyers. But since as a group they’re postponing home buying and other major life decisions, their numbers aren’t doing much to change the overall slump in first time home purch...

2015-06-2303 min

The Creating Wealth Show BlogcastCW Blogcast 77 - Where Are The First Time Home Buyers?The recovery from the much publicized housing crash of a few years ago may be hitting a wall, thanks to declining numbers of a group that’s essential to a robust housing market: first time home buyers. Although the US housing market continues to show encouraging signs of emerging from the rubble of the 2008 collapse, its long term recovery depends on those first time buyers, who inject new life into the market not just by purchasing new and resale homes, but also by spending money after the purchase on a variety of consumer goods and services. Otherwise, th...

2015-06-1604 min

The Creating Wealth Show BlogcastCW Blogcast 76 - What's Behind the Housing Shortage?By a number of indicators, the US housing market is bouncing back after its massive collapse of 2008. But US homeowner rates are at near historic lows, with few first time buyers. Among the many factors contributing to those low rates are an often overlooked, but essential one: in many areas around the country, there’s a housing shortage: the supply of avaialble homes to buy is lower than the demand. After the housing collapse put unprecedented numbers of homes into foreclosure and millions of homeowners into crisis, home prices have begun to rise, new regulations on the mo...

2015-06-0905 min

The Creating Wealth Show BlogcastCW Blogcast 75 - Investing: 4 Trends For the FutureFifteen years can seem like a pretty long time – and the year 2030 sounds like a date from a science fiction novel. But the future is now – and, as a recent article from Business Insider reports, today’s emerging trends will shape the investing landscape of tomorrow. According to Business Insider, KPMG, the international tax and financial advisory consortium, recently released a report detailing likely changes in the financial and investing fields over the next fifteen years, and their potential impact on the world of investing in all its forms. While many of KPMG’s predictions are directed to inves...

2015-06-0404 min

The Creating Wealth Show BlogcastCW Blogcast 74 - Inflation: An Investor's Friend?The specter of inflation strikes chills into the hearths of many consumers – even more than its cousin, deflation. But not all inflation is created equal – and for both the economy at large and for income property investors, some inflation can be a very good thing indeed. Consumers fear inflation because to them it means higher prices for the goods they buy every day. In oth4er words, the dollar doesn’t go as far as it once did. And most people don’t give much thought to inflation’s opposite number, deflation, which economists and financial experts consider f...

2015-06-0404 min

The Creating Wealth Show BlogcastCW Blogcast 73 - New Technology Promises Big Changes for Real EstateNo more real estate agents? In the brave new world of real estate, agents, brokers and just about every other part of the traditional way of buying and selling property could be going the way of the dinosaur, thanks to innovations in virtual reality and artificial intelligence technologies. Online access and social media have already brought big changes to the world of real estate. Most real estate agents and other professionals involved in real estate transactions do business online, and Internet listings bring buyers and sellers together from all over the world. Online listings can also feature...

2015-05-1404 min

The Creating Wealth Show BlogcastCW Blogcast 72 - Renters Will Be Renters – Not Home Owners?Time was, renting an apartment – or maybe a house – was just a temporary arrangement until you saved up enough to buy your very own home. But for a growing number of today’s renters, that scenario just doesn’t appeal – and that trend has big implications for investors in rental real estate. According to recent statistics reported by Business Insider, at the end of 2014, only 14.7 percent of tenants moving out of an apartment did so because they were buying a home. And in the years since the housing collapse of 2008, the percentage of renters moving out to buy a home...

2015-05-0704 min

The Creating Wealth Show BlogcastCW Blogcast 71 - Millennials Are Making Money In Real EstateThe “Millennials” have been in the headlines a lot lately – and not for good reasons. Alternately criticized for their values and work ethic and pitied for their crushing load of student loan debt, this generation of new and recent college grads seems to be facing a bleak financial future. But a young real estate investor is proving that smart money management can pay off handsomely – even for those cash strapped millennials. A recent article from NextShark profiles 27-year-old Brian Maida, who bought his first house two years after graduating from college. Now, with two properties under his belt, he...

2015-04-3004 min

The Creating Wealth Show BlogcastCW Blogcast 70 - California's Drought: Changing Real Estate?In the Gold Rush days, the slogan was “California or Bust!” But now, as the Golden State faces yet another year of its historic drought, “Leave California or Bust!” may become the new rallying cry for the people and enterprises facing a waterless future. And that, say real state experts, could change the US housing landscape forever. The entire state of California is under drought conditions ranging from “abnormally dry” to “extraordinary drought,” which trumps even “extreme drought” in severity. The drought has been going on for so long that not even heavy rainfall has made a dent in the statewid...

2015-04-2304 min

The Creating Wealth Show BlogcastCW Blogcast 69 - The US Rental Market: Headed for a Slowdown?Is the red-hot rental market getting ready to cool down? The US housing market continues to recover, fueled by promising numbers for employment and other consumer sectors. But major shifts in the housing landscape may be changing all that, as the balance tilts between renting and owning houses in 2015 and beyond. The devastating crash of 2008 that left the housing sector in tatters and created conditions for dramatic changes in the way Americans choose and maintain places to live. When a combination of reckless lending and unprepared buyers led to large-scale mortgage defaults and foreclosures, the...

2015-03-2604 min

The Creating Wealth Show BlogcastCW Blogcast 68 - Real Estate: The Only Private Investment?Time was, anybody who wanted a safe and anonymous hideaway for financial assets turned to offshore banking. Swiss bank accounts and offshore havens in places like the Cayman Islands allowed depositors both legal and not so legal a way to safeguard assets from risks of taxation or seizure by the home government. But as new and proposed laws threaten to eradicate that privacy, real estate investing remains the only really private way to safeguard assets abroad. Offshore banking has always offered big benefits to foreign accountholders: privacy, security and access to other currencies and marketplaces. Until recently...

2015-03-1904 min

The Creating Wealth Show BlogcastCW Blogcast 67 - For Successful Investing, Sweat the Small StuffIt’s often said that the devil is in the details. But for investors, attention to some things that may not seem so significant can make a big difference in long-term returns. That’s the topic of a recent article and infographic from Visual Capitalist, which points out how very small tweaks to an investor’s mindset and strategies can yield more wealth. And it’s also what Jason Hartman has been saying all along: Invest early. Diversify your portfolio. Minimize risks. Keep expenses down. Though these four simple keys apply to investors of all kinds, t...

2015-03-1204 min

The Creating Wealth Show BlogcastCW Blogcast 66 - Failed Policies Keep Renters RentingIt’s practically a given in American society that owning a home is the key to stability and success. But although the US government has spent more than two decades drafting a variety of policies to create that “homeownership society,” the percentage of homeowners has hardly changed at all. And that’s good news for income property investors ready to reap the benefits of the shift to a “renter society.” As a new article from The Washington Post points out, home ownership in the US has always represented more than just a possession. Staking out your own little plot...

2015-03-0704 min

The Creating Wealth Show BlogcastCW Blogcast 65 - Internet Real Estate Sales: Changing the Game?Online real estate transactions now account for over half of all housing purchases in the US alone. The Web offers a place for buyers, sellers, agents and investors to do business that bypasses the traditional “brick and mortar” style of doing business – and it’s changing the game for all concerned in ways both good and bad. The online world of real estate takes many forms. Only databases provide a place for agents to list their services and properties. Buyers can search by price, location, agency and more. These sites serve agents and brokers who make the initial...

2015-02-2605 min

The Creating Wealth Show BlogcastCW Blogcast 64 - Would You Buy a House With Bitcoin?he Bitcoin has changed the way the world thinks about money, and its influence continues to grow. Since the first Bitcoin transaction took place 2009, the digital currency has been accepted by a steadily growing list of businesses, institutions and marketplaces – including real estate. And it’s a trend investors need to watch. The Bitcoin was created in 2008 as an experiment in freeing financial transactions from the control of traditional institutions and regulations. Completely digital and totally unconnected with any kind of government agency or banking concern the Bitcoin promised to democratize money completely. Developed out of a...

2015-02-1905 min

The Creating Wealth Show BlogcastCW Blogcast 63 - Real Estate - Still the Leading US AssetIf you put your money on coffee and cattle in 2014, you might be smiling all the way to the bank. But if you backed crude oil and gas – well, not so much. That’s the verdict from Business Insider’s recent charting of the performance of what it claims are all the major asset classes in the world. It’s a complex, visually striking chart that lays out, in shades of green and red, which assets showed a profit at the end of the year, and which didn’t. While the results are striking in some ways and strang...

2015-02-1204 min

The Creating Wealth Show BlogcastCW Blogcast 62 - Millennials: The "Renter" Generation?Coming your way: a new generation of (probably permanent) renters. It’s the millennials, making news once again for the basic contradiction of their lives: better educated than their parents, but simultaneously economically more disadvantaged. And because this generation is both the largest demographic and one of the poorest, their circumstances may mean new opportunities for income property investors. According to census data reported in a recent article from The Atlantic, the median income for the nation’s youngest members of the workforce lags far behind that of their parents at similar ages and locations. On average, youn...

2015-02-0604 min

The Creating Wealth Show BlogcastCW Blogcast 61 - Single Moms Drive Shifts in Rental HousingMore than half of American children live with a single mom. That’s the finding of a new study on the changing demographics of American culture – and those numbers, and the economic realities behind them, mean new challenges and opportunities for rental property investors. The new findings by researchers from Princeton and Harvard aren’t really new. The trend toward single-mother households was first noted in studies dating from the 1960s. And while research into the impact of that rend focused mainly on the outcomes for children, the shift from the traditional two-parent household has implications for a mult...

2015-01-2904 min

The Creating Wealth Show BlogcastCW Blogcast 60 - Do You Make These 4 Real Estate Investing Mistakes?Jason Hartman maintains that investing in income properties is not a difficult process. Where too many people go wrong is messing up the simple stuff. Today we’d like to point out a few common ways investors accidentally lay waste to their property portfolio and how it could be avoided.

1. Make a Plan: Just because you stumble across a great deal doesn’t mean you should pull the trigger immediately. The time to decide exactly how this new property fits into your larger investment scheme is BEFORE you buy it. Not after. Keep this bit of Hartman wisdo...

2013-06-2003 min

The Creating Wealth Show BlogcastCW Blogcast 59 - Cash and Carry in the Housing MarketInterest rates that continue to run low and rising prices make the housing market pretty hot right now. Banks are offering attractive mortgage packages, too. But, say some market watchers, it’s hotter still for buyers who can pay cash. To compete in the cash wars, what’s an investor to do? Recent data crunched by DataQuick reveal that the number of homes bought with cash has been rising steadily over the last few years, with cash transactions accounting for as much as 30 percent of home sales in some major markets. The reasons? Although hosing pric...

2013-06-1903 min

The Creating Wealth Show BlogcastCW Blogcast 58 - Some Threats to the Economy Are Out of This WorldThe recent spate of natural disasters – superstorms, tornadoes, earthquakes and floods – has homeowners and property investors throughout the country checking their insurance policies and talking to their lenders about how to recover. But, as recent news reminds us, the biggest threat to the economy – not to mention a little thing like the planet – may come from space. And while there’s not much we can do about that, it’s a reminder to take the actions we can to protect assets and investments. In 2013 alone, the Earth has been buzzed by several asteroids, one big enough to sport its ow...

2013-06-1803 min

The Creating Wealth Show BlogcastCW Blogcast 57 - Why do we say "Refi 'til ya die!"?We recently mentioned that the Platinum Properties Investor Network believes in a real estate strategy that is exactly opposite of flipping. We think that the strategy of buying and holding prudent rental properties over a long period of time offers tremendous advantages, one of which is the ability to refinance your loan mortgage time and time again.

“But wait,” you say. “I thought the goal was to pay off the mortgage.”

Not so fast. That’s what most people think - and that is not it at all. As you property gains value (typically doubling every seve...

2013-05-1401 min

The Creating Wealth Show BlogcastCW Blogcast 56 - The problem with flipping...If you’ve been a follower of Jason Hartman and Platinum Properties Investor Network's style of investing for any length of time, you know we don’t believe flipping properties is the best approach for creating wealth in real estate.

There are several reasons we think this way, but let’s consider a single one - taxes. Part of any investor’s success is the extent to which he manages to avoid paying taxes. Let’s make it clear we’re not encouraging illegal activity. What we do suggest is you take advantage of each and every method of le...

2013-05-1301 min

The Creating Wealth Show BlogcastCW Blogcast 55 - Why it's good to be a control freak.When it comes to your real estate investments, it’s good to be a control freak. This is not what talking head hosts will tell you on the cable financial shows. They want you to drink the Wall Street Kool-Aid and do your best zombie imitation as you follow the broker of your choice's advice down the hemlock-laced path.

The surest way to become a spectacular failure as an investor is to give up control of your portfolio to someone else. We’ve talked before about the three essential problems with this, especially when it comes to stoc...

2013-05-1002 min

The Creating Wealth Show BlogcastCW Blogcast 54 - The greatest Ponzi Schemes ever.The term Ponzi Scheme, named for Italian-American, Charles Ponzi, back in 1920, describes an investment flim-flam that requires an ever-increasing volume of cash to stay afloat. The influx of new investor money is used to pay original investors and to line the pocket of the person that started the whole thing. The problem is, the model is destined to fail. Either the pool of suckers runs dry or the SEC figures out something illegal is going on, usually very late in the game.

Does the name Bernie Madoff ring a bell? He was recently jailed for his multi-billion...

2013-05-1002 min

The Creating Wealth Show BlogcastCW Blogcast 53 - Destroyer of currencies.Here’s a question for you. Fill in the blank.

“My government is ___”

A. criminally stupid

B. criminally criminal

C. criminally insane

D. desperate

E. all of the above and then some

At Platinum Properties Investor Network, we would like to make a case for answer D. For quite some time now, it appears our politicians and others who contribute to economic policy have had their brains replaced with sawdust.

You’ve heard of inflation, right? It’s that nasty little superbug that trivialize...

2013-05-0902 min

The Creating Wealth Show BlogcastCW Blogcast 52 - Grow rich borrowing money.We know it sounds counter-intuitive to say you can get rich borrowing money during inflationary times but, if you’ll stick with us for a few minutes, we’ll show you how it makes perfect sense. Let’s start with a simple economic truth – the value of a dollar declines over time. In fact, it declines a whole lot.

In real terms of stuff you can buy, a dollar in 1972 has fallen all the way down to where it’s only worth .24 cents today. This is what is referred to as inflation. It attacks the value of your asset...

2013-05-0902 min

The Creating Wealth Show BlogcastCW Blogcast 51 - One life-changing idea.At Platinum Properties Investor Network, we don’t know any other way to do it than to keep beating the same drum – investing in Wall Street’s lies will lead to disappointment. That game is rigged to siphon your money a little at a time (or sometimes a lot at once) until you have nothing.

We know it’s hard to turn your back on the stock market. Your parents and grandparents probably invested in it also. The ultra-rich con men who run it, along with their willing accomplices in the media, have managed to make stock, bond, an...

2013-05-0802 min

The Creating Wealth Show BlogcastCW Blogcast 50 - Is pre-foreclosure an even better deal?These days, investors are poised like vultures in trees along the roadway, ready to dive on the next foreclosure hitting the market like roadkill on pavement. Do your homework and there’s no doubt you can find a heck of a deal investing in foreclosures but think one step ahead and you might get an even better deal by buying the property BEFORE it’s foreclosed upon.

This method of acquirement is known as a short sale or pre-foreclosure. The term “short sale” simply means the bank is ready to unload it, so they might accept an offer of...

2013-05-0802 min

The Creating Wealth Show BlogcastCW Blogcast 49 - You're welcome.At some point, most of us realize that life is a gradual process of acquiring the knowledge necessary to stay alive and maybe make a little money along the way. Remember when Mom told you not to eat stuff off the sidewalk? There’s a reason for that – you could get very sick.

Or when Dad told you not to stand on the very highest rung of the ladder because it’s not safe, as he soon proved by going to the very top in a psychotic effort to clean the last leaf from the gutter – and promptly...

2013-05-0702 min

The Creating Wealth Show BlogcastCW Blogcast 48 - Stocks are extinct assets.As you may know, we at Platinum Properties Investor Network believe that real estate, income properties specifically, are the premium investment asset in the world. It vexes us mightily to realize that millions of hard-working Americans are coming home from a day’s work to plop themselves down at the computer and see what their stocks have done that day.

We can already tell you the answer to that without even looking – up, down, sideways. Forward two steps, backwards two steps. It’s all over the place. What is this supposed to be? A retirement plan or a sals...

2013-05-0702 min

The Creating Wealth Show BlogcastCW Blogcast 47 - Countdown to inflation.Like a broken record, we keep telling you that big-time inflation is just around the corner and now is the time to adjust your investment strategy. But why do we think inflation is coming? Okay, fair question. Here is the chain of economic events we see coming.

1. The natural consequence of our politicians “print more money no matter what” philosophy is increasing inflation. As prices go up, more investors will sell bonds in an attempt to preserve their wealth. This will place an upward pressure on bond yields as rock bottom interest rates for government treasuries will no l...

2013-05-0602 min

The Creating Wealth Show BlogcastCW Blogcast 46 - Platinum Properties Investor Network - more than a middleman.What’s to stop an interested income property investor from showing up at one of our heralded educational events, find out which markets we’re recommending, and head out to make your own connection with your own real estate agent?

The short answer is nothing. There is absolutely to stop anyone from doing that. It’s not illegal. It’s not immoral, and we won’t hate you for it.

We do, however, sort of cringe because we know a certain percentage of educational event attendees are doing just that. The problem is that even though we...

2013-05-0602 min

The Creating Wealth Show BlogcastCW Blogcast 45 - Your own private bank.Ahh, your own private bank. Wouldn’t it be great? Working, well, uh, banker’s hours. Plenty of cash at hand when you’re ready to begin investing. At Platinum Properties Investor Network, we’d like to point out there is a private bank you can use for income property investing you might not have thought about.

It’s called your home.

Yep, the structure you live in. You’ve got equity in there, right? Our average customer comes to us with about $300,000 equity in their home but don’t get discouraged if you don’t have anywhere...

2013-05-0502 min

The Creating Wealth Show BlogcastCW Blogcast 44 - Don't believe the hype.If you’ve been interested in income property investing for any length of time, whether you’ve actually pulled the trigger and bought a property or not, you’ve likely run across the “No money down!” hucksters. They’ll show you pictures of happy couples relaxing on their favorite beach, living a life of frivolity and luxury on the income from their rentals.

Don’t get us wrong, you can create plenty of wealth using the income property approach but at Platinum Properties Investor Network, we feel it’s our duty to sprinkle a little truth dust on certain claim...

2013-05-0502 min

The Creating Wealth Show BlogcastCW Blogcast 43 - When will we shut up about inflation?The answer to the question posed in the headline is “When hell freezes over” or, to put it more politely, “Never.” We feel pretty sure in making such a definitive statement because there is no logical way inflation will ever stop being a serious economic issue as long as our wrongheaded politicians think increasing the money supply is going to solve every problem.

How does the government cause inflation?

We love a good conspiracy theory as much as anyone but this time it’s straight forward. Money supply drives inflation for the overall economy. When the govern...

2013-05-0402 min

The Creating Wealth Show BlogcastCW Blogcast 42 - The loan that can make you rich.Most of the time, we at Platinum Properties Investor Network would tell you that taking out a loan against your 401k retirement plan would be a bad idea. The reason is that the majority of people would waste the proceeds on the trappings of wealth – boats, cars, expensive vacations. If that describes what you would likely do with a 401k loan, you have our permission to skip the rest of this blog.

For those of you still with us, there is one situation where we think it’s a great idea to borrow against your retirement nest egg...

2013-05-0402 min

The Creating Wealth Show BlogcastCW Blogcast 41 - Why Warren Buffett makes money in stocks and you don't.Warren Buffett, the Sage of Omaha, seems like a kindly old gentleman when you see him on television but never forget the man got to where he is in life with an eagle eye constantly cocked for opportunity. Recent events in the stock market are a good lesson for why we say the average investor should run from Wall Street investments with all due speed.

Buffett, banks, and other elite investors are using the bodies of the middle class American to climb to even more wealth. How does it work? Here’s one example.

Due to...

2013-05-0301 min

The Creating Wealth Show BlogcastCW Blogcast 40 - Will corporate credit make your wildest dreams come true?Spend any time with television or radio these days and you likely will hear the pitch that corporate credit is the answer to it all. World peace, hunger, nuclear proliferation, a veritable free flow of money that gushes into your pocket any time you want it to.

At this point, any thinking human with more than two brain cells to rub together should be a little suspicious. Is there anything in life that works like that? To this, we feel safe in saying “no.”

But there are some potential advantages to corporate credit, especially if your...

2013-05-0302 min

The Creating Wealth Show BlogcastCW Blogcast 39 - Break it down - foreclosure rehab.We talked earlier about the four critical areas of rehab when you’re considering a foreclosure purchase for your income property portfolio. It’s good to be at least somewhat aware of these four areas. After all, accurate estimates could be the key to profitability.

Most foreclosures recommended by Platinum Properties Investor Network are not going to have major trouble in these areas but it’s a good idea to at least be aware of the possibility.

Roof – The primary areas for concern are wood rot, termite damage, and loose shingles. Also check the ceiling for wate...

2013-05-0202 min

The Creating Wealth Show BlogcastCW Blogcast 38 - Don't miss these 4 areas when rehabbing foreclosures.Until recently, Platinum Properties Investor Network didn’t like to recommend foreclosures to our network. With the generally low quality of the selection, it was just too much of a risk to our reputation for finding excellent properties. But, for reasons you’re probably aware of, things have changed a little bit.

Much of our track record for success can be traced to our ability to quickly react to changing market conditions. We now take foreclosures into consideration and even recommend buying them to our clients in many of the 41 local markets around the country we specialize in...

2013-05-0201 min

The Creating Wealth Show BlogcastCW Blogcast 37 - More income property investing myths.Just when you thought we were done proving how easy it is to create wealth in real estate through income property investing, we’re back with three more reasons.

Reason #4 – “Realtors are a difficult bunch.”

This is very NOT true when you work with Platinum Properties Investor Network. Our local area managers are real estate agents who LOVE to work with you. If they don’t, we quit sending them business and, believe us, they want our business.

Reason #5 – “I might lose money.”Real estate is way safer than the stock market. It’s funny. The...

2013-05-0101 min

The Creating Wealth Show BlogcastCW Blogcast 36 - Income property investing myths.Why aren’t more people investing in income properties when it’s the most lucrative, safest choice in history? Good question. Probably because people would rather watch television than improve their financial condition. Sure, everybody says they want to get rich but what are they actually doing about it besides flapping their gums?

Talking wistfully about something you have taken no action to achieve is called whining. Don’t go into the Green Parrot Bar in Key West with that attitude. It’s an official ‘no sniveling’ zone.

So let’s take a quick peek a some of the...

2013-05-0102 min

The Creating Wealth Show BlogcastCW Blogcast 35 - Get serious about on-time rent.Many contracts say that rent is due on the 1st of each month but the late charge doesn’t kick in until the 10th. So it’s no big deal if the check arrives on the 5th, 6th, or even the 9th. Right? We hate to break the bad news but your leniency on rent is only going to encourage more delinquency. You've heard this before from us - human nature!

Maybe it’s time to get more serious about on-time meaning ON TIME! Here’s an idea crazy enough that it just might work. Don’t give them...

2013-04-3002 min

The Creating Wealth Show BlogcastCW Blogcast 34 - Too late to be a millionaire mobile park owner?If you were starting out in real estate investing today, which direction would you go? At Platinum Properties Investor Network™, we believe that income properties are a great way to start, but another alternative to consider is a mobile home park. When we say mobile home, we mean either a traditional trailer or manufactured home.

The voracious demand for affordable housing and financing is likely to keep the demand rising into the future. Some people consider a mobile home park the closest thing you’ll find to a gold mine. So, should you buy every one you come...

2013-04-3002 min

The Creating Wealth Show BlogcastCW Blogcast 33 - Are real estate seminars a rip-off?Not ALL real estate seminars are a rip-off but you can get taken to the tune of several thousand dollars without getting much actionable material in return if you’re not careful.

Here are a few things to watch out for:

1. Be wary of price extremes. Very cheap or very expensive seminars should be examined closely, although for different reasons. If the event is cheap or free, face it, there will be a hard sell involved. Getting people into a room is expensive, so the promoter has to sell something to make it worthwhile. Conversely, if...

2013-04-2902 min

The Creating Wealth Show BlogcastCW Blogcast 32 - Don't be tempted to buy real estate with cash.Your broker has turned you on to an incredible income property deal that will cash flow big time from the beginning because it’s already leased long term. You’re so excited you might pass out. There’s cash in the bank to cover the purchase. Pull the trigger?

Not quite that fast.

Despite antiquated conventional wisdom to the contrary, buying a property with cash is not something a savvy investor would do. The problem with buying on a cash basis is that you short circuit the benefit of a beautiful little concept called leverage. Pay at...

2013-04-2902 min

The Creating Wealth Show BlogcastCW Blogcast 31 - Get off the fence, investors.If you’re part of the crowd of millions tired of getting slapped around by Wall Street chicanery, it’s only natural to be hesitant about committing more money to alternative investments, especially when you’ve been brainwashed your whole life to believe stocks, bonds, and mutual funds are IT. There is no other investment class.

At Platinum Properties Investor Network™, we’re here to tell you real estate is not an alternative to the stock market. The word “alternative” implies the two concepts are generally on the same playing field when it comes to value.

Wrong!

...

2013-04-2802 min

The Creating Wealth Show BlogcastCW Blogcast 30 - Free market? Not so much.On The Creating Wealth Show with Jason Hartman, recent guest Thomas Woods reflected upon the prevailing conventional wisdom which says the free market has failed, thus intervention by the federal government is necessary to right the ship of economy.

Nothing could be further from the truth. This economy cannot be blamed for the fiscal meltdown because there has been no free market in the United States since the early to mid 1920’s.

Think about it. Can any country which has a central bank manipulating interest rates truly call itself a free market? Our present troubles can...

2013-04-2802 min

The Creating Wealth Show BlogcastCW Blogcast 29 - Purchasing a property is S-I-M-P-L-EAfter the preliminary interview process of discovering the best investment strategy for you, it usually starts with a three way conference between your Platinum Properties Investor Network™ advisor, the local market agent in the area of your choice, and you. This is where we go over the particular properties available and you decide which one you want.

Now it’s time to get you pre-qualified for a loan. Lately, more times than not, we’ve seen clients using a lender in the local area where the property is located. The advantage is that the lender knows the local...

2013-04-2702 min

The Creating Wealth Show BlogcastCW Blogcast 28 - It costs you nothing to use Platinum Properties Investor NetworkThe look of incredulity usually pops up somewhere during the middle part of the process. We’ve been helping a client pick out a property, put them in touch with the local market specialist, we're working the phones and e-mail to help find the “deal” they’re looking for.

Then it sinks in. “We really don’t pay you anything for all this work you're doing?” The truth is, no, you really don’t. Which brings up the question of whether or not we’re in the charity business. Definitely not. We make money but not from nickel and diming...

2013-04-2702 min

The Creating Wealth Show BlogcastCW Blogcast 27 - Two little properties safer than one big one?One of the most frequent questions we get is why we recommend clients initially purchase one or two single family residential units in different geographical areas than a 10 or 20 unit apartment building located (obviously) in one spot.

This is a perfect example of what we mean by diversifying your portfolio and it is VERY important in the beginning of your income property investing career. On a recent edition of The Creating Wealth Show, Jason Hartman recounted an experience from the early days of Platinum Properties Investor Network™. South Carolina had been targeted by us as a great area...

2013-04-2602 min

The Creating Wealth Show BlogcastCW Blogcast 26 - Find the bottom of the cycle.You’re motivated to leave Wall Street investing for good and purchase an income property because, in a recent nightmare, you were visiting Bernie Madoff in prison to see if he had any hedge fund ideas. Good decision. Wall Street - bad. Income property - good. If you've been reading our blog, you already know the Platinum Properties Investor Network criteria for finding a good location.

Is it time to pull the trigger? Not so fast, Dirty Harry. There’s a little thing you should be aware of called timing. Even in the best of real estate mark...

2013-04-2602 min

The Creating Wealth Show BlogcastCW Blogcast 25 - Income property investing - find a good spot.Should you decide to buy a particular income property because it feels right, it’s located next to your favorite bar, or you’re just tired of looking? Umm, the answer to all three would be a loud, “No!” Why would you approach the most important part of the property investing paradigm with a seat-of-the-pants approach?

At Platinum Properties Investor Network, we’ve chunked it down into a standard and highly successful routine. The first thing is still the first thing. Location! Never underestimate the importance of a good location. Look at it from a macro and micro leve...

2013-04-2502 min

The Creating Wealth Show BlogcastCW Blogcast 24 - Only invest in assets you control.Have we pummeled you enough about the head lately regarding investing ONLY in things you control? Probably not, because it seems like there are still a few million crazies out there investing in Wall Street assets. Are they determined to lose their money? Let’s have a pop quiz. Investors who trusted the following people/companies were satisfied with the results – true or false?

A. EnronB. WorldComC. TycoD. HealthSouthE. Bernie Madoff

Our unofficial poll of absolutely no one related to any of these worldwide financial scandals returns a re...

2013-04-2502 min

The Creating Wealth Show BlogcastCW Blogcast 23 - Non-dollar-based assets will rock your world.We’ve been talking a bit lately about how, in our humble opinion, the dollar is poised for a headfirst plummet off a very high cliff. When it does, get ready for the cloud of dust slowly rising up into the sky, just like in the Roadrunner cartoon when Wile E. Coyote makes yet another serious error in judgment.

It doesn’t take much pondering to arrive at the conclusion that a good place to be when the currency crashes is - drum roll please - OUT of that currency. You need hard, tangible assets. Like commodities? Yes...

2013-04-2402 min

The Creating Wealth Show BlogcastCW Blogcast 22 - Why it's good to be a borrower in inflationary times.The worst person to be with inflation looming is the bank! The catbird seat is occupied by, you guessed it, the borrower. Why do we say this and are we just full of rotten beans when we do? No. It all comes down to purchasing power and the decreasing real value of the dollar over time.

Here’s a quick, and hopefully clear, example.

Today, in 2009, your banker loans you $1 million dollars to buy income property. From his perspective, your banker could also take that $1 million and buy one million candy bars at a buck ap...

2013-04-2402 min

The Creating Wealth Show BlogcastCW Blogcast 21 - "We are out of money now."We don’t mean to scare you – well, actually we do. The words above were spoken by President Obama at a recent press conference. Ouch. Does that mean the U.S. economy is a car with a bone dry gasoline tank still rolling slightly from 233 years of inertia?

Maybe.

A better analogy might be the economy is a car with a bone dry gasoline tank still rolling slightly from 233 years of inertia heading off a cliff! What can we, as law-abiding citizens, expect when our government continues to bankrupt itself and devalue our currency? Seriously. The...

2013-04-2302 min

The Creating Wealth Show BlogcastCW Blogcast 20 - Maryland learns a hard lesson in fleecing the rich.Last year, politicians in Maryland could not figure out how to balance the state budget. As most good public servants do, they thought, “Instead of making tough choices for the amount of money we have, let’s squeeze the wealthy for more because they don’t really deserve it anyway.”

Presto! A brand new millionaire tax bracket was created with a top rate of 6.25%. And if you happened to be a millionaire with the misfortune of living in Baltimore or Bethesda, they’re going to toss more local income taxes on top of that to bring your rate as hi...

2013-04-2302 min

The Creating Wealth Show BlogcastCW Blogcast 19 - Direct control of your investments - exhibit A.Former NASDQ chairman, Bernie Madoff, will be spending the next 150 years in prison. Since he’s 71 right now, that means he’ll be a free man once again at age 221. Nobody’s feeling too sorry for The Ponzi King right now though. Even his sons refuse to talk to him. The scope and breadth of Madoff’s investment fraud is staggering.

To those who have been following Jason Hartman for any length of time, this really should come as no surprise. Any time you give up direct control of your investments, this could be the result.

We sa...

2013-04-2202 min

The Creating Wealth Show BlogcastCW Blogcast 18 - Identity theft and finding the right tenant.It’s no secret identity theft is a booming business. This can have serious impact on you as an income property owner. It’s hard enough to find quality tenants without having to worry about whether they are actually who they say they are. I mean, what better way for chronically deadbeat renters to sneak into your property than claiming a whole new identity?

But don’t worry too much. Most of these characters aren’t the brightest bulbs on the circuit, so a checklist of diligent screening processes can nip most of the miscreants malfeasance in the bud...

2013-04-2202 min

The Creating Wealth Show BlogcastCW Blogcast 17 - More on the "national" housing market.Just read a funny analogy about the myth of a US housing market. It went something like this. Coming up with a national housing number is like a weatherman who combines weather conditions in Nome, Alaska and Key West, Florida to arrive at a national average temperature of 45 degrees. While technically correct, this is basically useless information.

So it is with trying to pin down nationwide trends in housing. Real estate markets are notoriously hyper-local. Averages simply have no meaning. As income property investors, we’re very aware of how you must drill down to the neighborhood le...

2013-04-2102 min

The Creating Wealth Show BlogcastCW Blogcast 16 - Jason loves his new iPhone application.The truth is Jason not only loves his iPhone but he really loves the fact that there is now a Property Tracker application to run on it. Longtime listeners have heard of Property Tracker before. It is Platinum Properties Investor Network’s software of choice for small to medium size income property investors.

We didn’t invent the thing but we sure do love it, especially now that it has been implemented to work with the swanky new iPhone. Simply put, this is the most powerful real estate analysis tool available for the iPhone. In real life term...

2013-04-2101 min

The Creating Wealth Show BlogcastCW Blogcast 15 - Don't get hit by the shrapnel of the "fatal conceit".The "fatal conceit" is an idea coined by Friedrich Hayek. It simply means that central planners working for the government tend to miraculously consider themselves free from sin and error. Nowhere is this more evident than in watching the present gang of do-gooders try to borrow their way out of a mess created primarily by, you guessed it, debt.

So while names like Obama, Bernanke, and Geithner fervently believe they can do a better job distributing capital than the free market, we occupy ringside seats at the circus and marvel at the size of reality blinders men...

2013-04-2002 min

The Creating Wealth Show BlogcastCW Blogcast 14 - Two stages of wealth creation.Buying real estate for investment purposes can seem like a big chunk of information to digest if you look at it all at once. Let’s break it down into more manageable bites. The simplest part is Stage 1. During this time your primary focus is to stock up on debt. You want lots and lots of debt attached to high-quality, fixed-rate, long-term, investment grade debt.

More specifically, you want this debt attached to packaged commodities, basic materials that are in high demand when used to construct structures like houses and apartment buildings. You want lots of this ki...

2013-04-2001 min

The Creating Wealth Show BlogcastCW Blogcast 13 - The Reluctant Investor's Lament.Jason likes to close the monthly Creating Wealth in Today’s Economy seminar with a poem called The Reluctant Investor’s Lament. It was written in 1977, but still packs a wallop of powerful thoughts. Below is an abridged version for your reading pleasure.

“I hesitate to make a list, of all the countless deals I’ve missed;Bonanzas that were in my grip, I watched them through my fingers slip;

The windfalls which I should have bought, were lost because I over thoughtI thought of this, I thought of that, I could have swo...

2013-04-1902 min

The Creating Wealth Show BlogcastCW Blogcast 12 - The easy way to get a loan modification.Every once in a while you hear a story that makes you go, “Hmm, how DOES something like that even happen?” It all goes back to the secondary mortgage market and the practice of banks and Wall Street firms buying and selling pools of mortgages – one loan was sold 39 times, according to Kim Nguyen, an acquaintance of Jason’s who practices law in southern California.

Nguyen recounted how he represented a client over a $650,000.00 loan that was being refinanced but ended up in foreclosure court. One of the regulations is the plaintiff must produce the original loan document...

2013-04-1901 min

The Creating Wealth Show BlogcastCW Blogcast 11 - Owners, make your property manager happy.You’ve bought your first income property and have a property manager in place. You can’t just turn off your cell phone and take a year-long yacht cruise to the South Pacific. There are some responsibilities you, the owner, still have. Here’s a quick list.

1. Interview the property manager BEFORE executing final purchase contract to discuss reasonable rental rates for that particular area and property.

2. Sign the property management agreement.

3. Discuss the marketing program with property manager and authorize any leasing concessions you are prepared to make.

4. Pay advertising, utilit...

2013-04-1802 min

The Creating Wealth Show BlogcastCW Blogcast 10 - They're melting in CaliforniaAs a California-based business, we offer the following commentary and wonder, “Why are we still here?”

Yes, it’s warm in California but we’re talking about a different kind of melting. On June 10, 2009, California Controller John Chiang had this to say about the Golden State’s economic future. “Without immediate solutions from the governor and legislature, we are less than 50 days away from a meltdown of state government.”

This could get ugly, folks. Unlike the federal government, California doesn’t have the option of printing its own fiat currency to postpone doomsday.

The big problem...

2013-04-1801 min

The Creating Wealth Show BlogcastCW Blogcast 9 - Income property arbitrageLet’s define arbitrage. Arbitrage is when an investor profits by exploiting small price differences between similar (or identical) financial instruments. Arbitrage occurs because of pricing inefficiencies in a market. These small price blips can add up to big money for the shrewd investor. Think George Soros – he made his fortune in the margins of the currency market.

But we don’t care about George. We’re here to talk about Double Inflation Arbitrage in the income property market. Here’s how that works.

You walk up to the bank and say, “Bank, I have proposition...

2013-04-1702 min

The Creating Wealth Show BlogcastCW Blogcast 8 - How do WE make money?Maybe it’s been nibbling at the back of your brain – how do these people at Platinum Properties Investor Network make money anyway? They seem to be giving all the good information for free. We do give away a lot. It’s part of the business model. The first thing to understand is we’re not a traditional real estate company. Our focus is teaching people to invest the right way and then offering them quality opportunities via recommendations through our network.

Obviously, we make money through our own income property investments. We don’t just talk the talk...

2013-04-1702 min

The Creating Wealth Show BlogcastCW Blogcast 7 - What exactly does a property manager do?As you may know, we are BIG fans of property managers. The small percentage of monthly rent diverted to their wallets for services rendered could very well save you an aneurysm from handling tenant complaints. Trust us, whether you live next door to your investment or across the country, you DO want a good property manager.

What sorts of tasks will a property manager take off your plate? Here’s a quick overview.

1. Conduct property inspections and/or final walk though with builder.2. Advertise for tenants and conduct showings.3. Pre-screen applicants and present pr...

2013-04-1602 min

The Creating Wealth Show BlogcastCW Blogcast 6 - A definition of "investment."You see the word “investment” tossed around quite often within these posts but what do we really mean when we refer to an investment? You likely have (correctly) ascertained we don’t consider anything sold on the Wall Street exchange an investment. Ditto for NASDAQ. Double ditto for treasuries or CD’s.

But what is an investment and why do we define it as that? Anything that does not produce income or rent is only speculation. Investing is not about speculation or gambling and it is not a get-rich-quick scheme. Do it the right way, like we teach at...

2013-04-1602 min

The Creating Wealth Show BlogcastCW Blogcast 5 - Ditch the dollar during temporary deflationWhile it is our fervent belief that “inflationary times, they are a comin’ back”, there’s no denying that we are in a period of deflation right now. What does that mean? Prices are a little lower and the dollar is a little stronger. While this market condition might wander along for a couple of years, don’t kid yourself. It’s just the calm before the coming inflationary storm.

Is it time to sing praises to the economic geniuses guiding federal fiscal policy? No. Is it time to put on your happy hat because the Obama policy of ho...

2013-04-1502 min

The Creating Wealth Show BlogcastCW Blogcast 4 - Does your property make sense or is it the village idiot?One of Jason’s favorite concepts regarding the search for suitable investment property is does it make sense the day you buy it? What exactly does he mean by this? It all relates to the idea of sustainable investing. By sustainable we mean that the metrics of the deal will insure the property can sustain itself through rental income cash flow and you won’t be forced to sell it at the wrong time.

The main reason people get themselves into trouble with real estate investing is they bought on speculation a property that never made financial sens...

2013-04-1402 min

The Creating Wealth Show BlogcastCW Blogcast 3 - China needs concrete. You get rich.Did you know that house or apartment building sitting on your property is a packaged commodity? Think about it. What is a structure except a compilation of commodities like copper, wood, steel…and concrete. Low tech sticks and bricks, if you will, that contribute to how expensive or how cheap the price tag is. Despite frequent appearances to the contrary, the value of a property isn’t just a number plucked out of thin air. There are very simple forces at work behind the scenes driving the bus.

First, let’s realize that the overall value of a prop...

2013-04-0402 min

The Creating Wealth Show BlogcastCW Blogcast 2 - How does inflation devour debt?It seems counter-intuitive and the idea that debt is GREAT for the real estate investor is one of the hardest ideas to communicate to property investors who show up on our doorstep eager to learn the right way to invest in real estate.

There are plenty of wrong ways. Paying off your mortgage quickly is one of the worst ways! Please believe us when we say this. It’s much better to put as little of your own money into the property as possible and try to stretch that note out to 30 years or longer if you ca...

2013-04-0302 min

The Creating Wealth Show BlogcastCW Blogcast 1- Invest Like Jason's MomReal estate investing is in Jason’s blood. His mom has been doing it a long time and recently retired with 13 properties owned free and clear (paid off). The properties are worth about $7 million and the rental income adds up to about $220,000 annually. At this point she has several options but let’s pretend like she has decided to take the equity out and invest it.

She could toss it into “safe” CD’s or mutual funds and, even if they returned 5% a year, she would earn $350,000. Not so fast! Got to pay taxes on that, which will be a...

2013-04-0302 min