Shows

Behind the Markets PodcastThe Value Trades for 2026Show from 02/01/26

Host Jeremy Schwartz and Professor Siegel discuss the strong start to 2026, noting positive holiday spending, a dip in jobless claims, and the potential for a 3% Q4 GDP growth. Professor Siegel outlines three key market events to watch in January: the risk of a government shutdown, the Supreme Court’s decision on tariffs, and the selection of the new Fed chair. (12:34) Jeremy continues with guests Sam Rines and Jeff Weniger, who delve into geopolitical tensions impacting oil markets, the Fed’s potential policy direction, and the outlook for global equity markets. The group discusses AI competition between China and the...

2026-01-0254 min

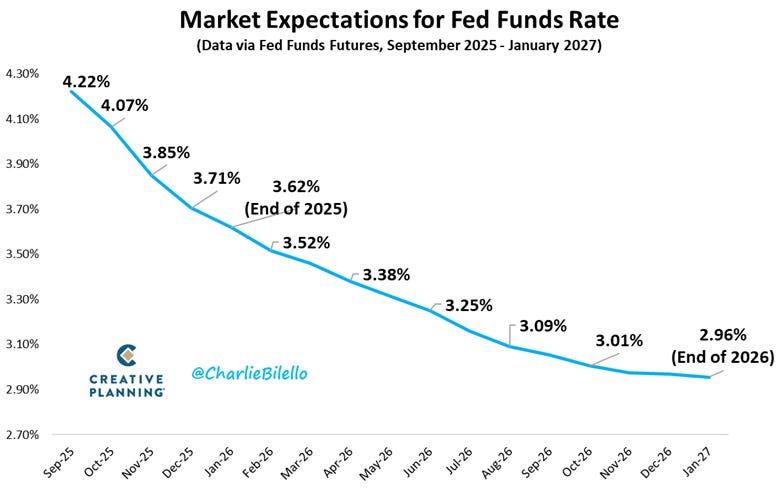

Schwab NetworkFed ‘On Hold’ For First Few 2026 Meetings, Opportunities Abroad Next YearJeff Weniger and Kevin Nicholson discuss the Fed’s path in 2026. Kevin thinks the Fed will be on hold for “the first couple of meetings” next year because they “need to actually see the data.” His base case for 2026 is 8%-12% growth in the SPX and international growth between 0%-10%. Jeff weighs in on “trepidation” around the Mag 7 and shares some of his theses for next year, including in Japanese equities. However, he’s “not sure” what would “upset the apple cart” just yet.======== Schwab Network ========Empowering every investor and trader, every market day.Option...

2025-12-3109 minBehind the Markets PodcastBear Headfakes Around the WorldShow from 11/07/25

Host Jeremy Schwartz and Professor Siegel discuss conflicting jobs data amid the government shutdown, political fallout from the recent elections, and the implications of potential Supreme Court rulings on tariffs. The Professor warns about the possible economic drag from the shutdown during the holiday season and offers his market perspective, noting AI investment strength and skepticism around market bubble fears. (15:00) Jeremy continues with guests Jeff Weniger, Chris Gannatti, and Sam Rines to unpack the Supreme Court's tariff case, recent AI market volatility, and the implications of energy constraints on future data center development. They explore earnings season surprises...

2025-11-0753 minBehind the Markets PodcastPartying like it's Nineteen Ninety... 6-7!Show from 10/31/25

Jeremy is joined by Sam Rines, Jeff Weniger, and Chris Gannatti, who analyze big tech earnings from Amazon, Meta, and others, emphasizing the early stages of the AI investment boom. The group discusses the infrastructure demands of data centers, energy policy challenges, and geopolitical developments following Trump’s Asia tour. They close by exploring how companies beyond tech are benefiting from AI, implications of potential government shutdowns, and the resilience of consumer spending ahead of the holidays. (31:34) Jeremy continues with Professor Siegel who discusses the Fed’s unclear stance on rate cuts, with Siegel noting stronger-than-expected economic data and...

2025-10-311h 02Behind the Markets PodcastCockroaches Contained?Show from 10/17/25

Host Jeremy Schwartz and Professor Siegel discussed recent signs of credit stress and how markets are reacting to pressures in private credit. Professor Siegel emphasized that while some private credit deals may go bad, there is no broader systemic risk, citing strong earnings from major banks as evidence. He maintained that the bull market remains intact and projected a 25-basis point Fed rate cut as a near certainty, while dismissing Bitcoin’s current performance as a failure in short-term diversification. He also commented on geopolitical developments, inflation data delays, and anticipated gold’s continued rise amid growing interest in b...

2025-10-1744 minBehind the Markets PodcastTalking Markets with Jim Bianco and WT TeamShow from 10/10/25

Host Jeremy Schwartz and Professor Siegel discuss the market’s resilience amid a continued government shutdown, emphasizing the positive momentum driven by AI and the broader economic environment. Professor Siegel warns about the potential for negative consumer sentiment if the shutdown lingers and points to recent data and global central bank comparisons to support the case for U.S. rate cuts. He also addresses the state of private credit markets, gold and bitcoin trends, and implications of current tariff levels, while noting AI remains a strong market driver. (13:55) Jeremy continues the conversation with Jeff Weniger and Sam Rines be...

2025-10-091h 09Behind the Markets PodcastFocusing on IntangiblesShow from 10/03/25

Host Jeremy Schwartz and Professor Siegel discuss the latest market conditions, highlighting the weakness in the ADP jobs report, stable jobless claims, and a slight decline in consumer confidence. Professor Siegel emphasizes that while the economic data points to some softening, there is no indication of a sharp downturn. He points to this quarter as a critical test for consumer spending amid new tariffs and holiday pressures, observing that inflation in housing and rents remains muted. Siegel also discusses monetary policy and comments on the growing importance of AI, the performance of major tech stocks like Tesla, and...

2025-10-031h 04Behind the Markets PodcastChirping about ValuationsShow from 09/26/25

Jeremy Schwartz and Professor Siegel review the week’s key economic developments, focusing first on inflation metrics with the PCE deflator and personal income/spending data matching expectations. Professor Siegel emphasizes the significance of stronger-than-expected durable goods orders and a narrowed trade deficit, which have led to upgraded Q3 GDP forecasts from major banks. He also comments on recent remarks from Fed Governor Myron regarding a lower neutral interest rate, citing demographic trends and productivity considerations. The Professor maintains a cautious outlook on the potential impact of tariffs, especially heading into the critical holiday season, and flags the up...

2025-09-2644 min

The Pomp LetterWall Street's Pessimist Has Finally Turned BullishToday’s letter is brought to you by MoonPay!Join over 30 million users who trust MoonPay as their universal crypto account.We make it easy to buy and sell crypto in over 180 countries, with no-to-low fees and all your favourite payment methods like Venmo, PayPal, Apple Pay, card and more.MoonPay is the only account you need in the DeFi ecosystem. Trade, stake and build your portfolio all in one place.Start now and get zero MoonPay fees* on your first transaction.To investors,Mark Spitznagel is on...

2025-09-2303 minBehind the Markets PodcastGoing All InShow from 09/12/25

Host Jeremy Schwartz and Professor Siegel analyze the recent inflation data, highlighting the implications for next week’s pivotal Fed meeting. The Professor suggests a 25-basis-point rate cut is likely, but notes that a weak retail sales report could justify a 50-basis-point move. He emphasizes the importance of the September dot plot in gauging Fed sentiment and explores the limited current impact of tariffs on inflation metrics, despite market anticipation. Siegel also points to diverging signals in the CPI and PPI reports and the potential for dissenting votes within the Fed as signs of growing internal debate. (9:28) Jeremy is...

2025-09-1254 minBehind the Markets PodcastWill AI Peak Eventually Rival 2000 Bubble Levels?Show from 09/05/25

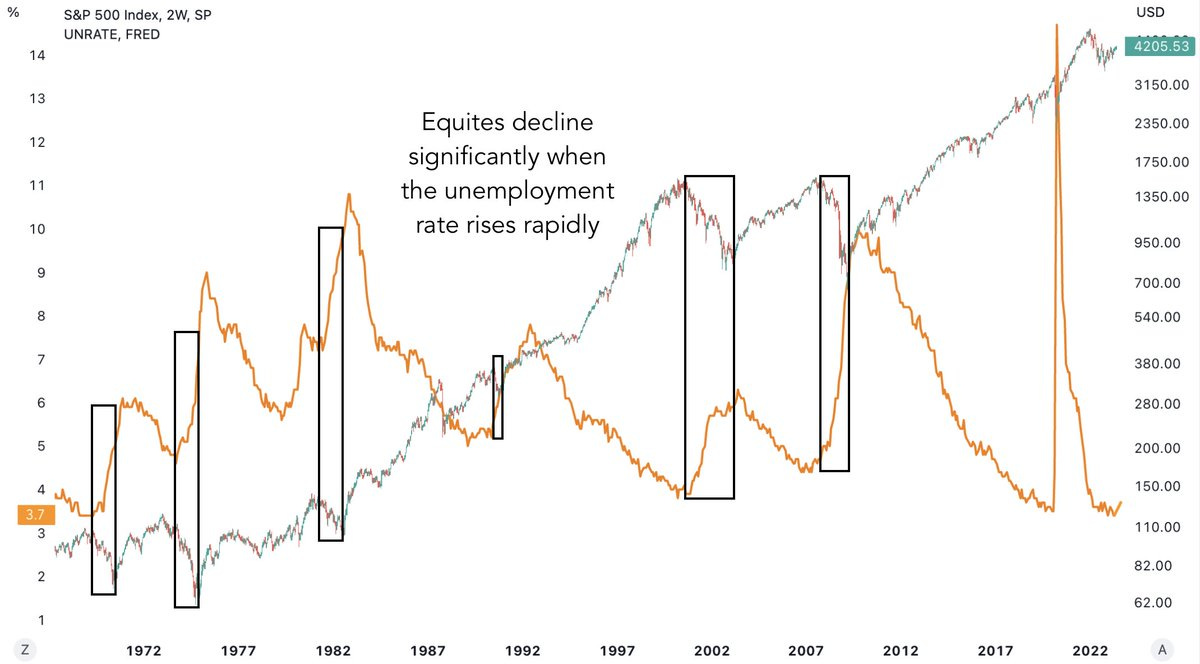

Host Jeremy Schwartz and Professor Siegel discuss the latest job report, which showed weaker-than-expected numbers, particularly in manufacturing and healthcare. The Professor highlights that while the household survey showed a gain, it's too volatile to weigh heavily. He emphasizes that the labor market is softening, which aligns with the bond market's pricing-in of rate cuts at upcoming Fed meetings. Siegel also notes productivity data remains unimpressive despite a recent bounce and reiterates his belief that equity markets remain in a bull phase, supported by anticipated rate cuts and broader AI optimism. (11:51) Jeremy is then joined by Sam Rines...

2025-09-051h 07

The Pomp LetterIs The Stock Market Overvalued?Join us at the Independent Investor Summit in NYC on September 12th!Markets are breaking records. Public equities are outperforming. And individual investors are driving it all. It’s officially the rise of the retail investor.On September 12th in NYC, I’m hosting the Independent Investor Summit — a one-day event built exclusively for self-directed investors.We’re bringing together some of the smartest public market investors I know for a full day of macro insights, market predictions, and one-on-one fireside chats. Speakers include Darius Dale, Jordi Visser, Jeff Park, Chris Camillo, Tom Sosnoff...

2025-08-1802 minBehind the Markets PodcastPlanting Seeds for the FutureShow from 08/01/25

Host Jeremy Schwartz and Professor Siegel dive into market sentiment following Powell's recent remarks. The Professor discusses the Fed's hawkish stance, Powell's views on the neutral rate, and the implications of inflation driven by tariffs. He emphasizes concern over potential delays in Fed action and critiques Powell's consistency in messaging. (29:20) Jeremy continues the show with Sam Rines, Jeff Weniger, and Chris Gannatti to break down the August jobs report, implications of the two FOMC dissents, and the Fed’s hesitancy to pivot despite softening labor data. They discuss WisdomTree’s acquisition of Series Partners and the strategic importance of f...

2025-08-011h 09Behind the Markets PodcastPowell Should Resign to Safeguard Fed IndependenceShow from 07/18/25

Host Jeremy Schwartz and Professor Siegel open with a deep dive into the tense dynamics between President Trump and Fed Chair Jerome Powell, with Professor Siegel controversially suggesting Powell should resign to maintain the Fed’s independence. Siegel argues Powell faces only downside if economic conditions worsen, becoming a convenient scapegoat for Trump's economic policies. (23:13) Jeremy and the WisdomTree macro team, including Sam Rines, Jeff Weniger, and Chris Gannatti, then analyze the week's geopolitical developments, the ongoing Russia-Ukraine conflict, European defense spending trends, implications of Trump's tariffs, and recent earnings from key companies like Netflix, Pepsi, Johnson & Johnson, an...

2025-07-181h 01Behind the Markets PodcastLooking for the GeoAlpha?Show from 07/11/25

Host Jeremy Schwartz and Professor Siegel discuss the recent tariff headlines and market reactions. Professor Siegel highlights that tariffs and guidance for Q3 are currently driving the markets, but he remains skeptical that new tariffs will significantly impact economic growth. (11:41) Jeremy then talks with Sam Rines, Chris Gannatti, and Jeff Weniger about the broader implications of tariff escalation, the surprising resilience of consumer spending, and the ongoing tech dominance, especially around AI, Apple, Nvidia, and Alphabet. The group also covers geopolitical strategies in investing and the rationale behind redefining emerging markets, particularly with a focus on India and...

2025-07-1153 min

Cultural Edge by Hi-OneApple, dein Ex und deine Angst: Was sie gemeinsam habenIch beginne mit einem Geständnis: Die ersten beiden Folgen dieses Podcasts habe ich aus Angst wieder gelöscht. In dieser Pilotfolge seziere ich den Grund dafür: Psychologische Projektion. Wir analysieren, warum wir unsere eigenen Unsicherheiten auf unsere Projekte, Marken und Mitmenschen werfen. Du lernst, warum du eine irrationale Wut auf bestimmte Marken verspürst, warum der Erfolg von Apple weniger mit Technologie und mehr mit Identität zu tun hat und wie du aufhörst, der größte Feind deines eigenen Erfolgs zu sein.

2025-07-0710 minBehind the Markets PodcastJobs Report Better than Feared… But is AI Coming for Your Job?Show from 07/03/25

Host Jeremy Schwartz and Professor Siegel break down the latest jobs report, noting that while headline numbers surprised to the upside, underlying data show mixed signals and tame wage growth. The Professor expects no rate changes from the Fed in July and sees continued market optimism supported by stable money supply and upcoming trade deals. (11:16) Jeremy is joined by Sam Rines, Jeff Weniger, and Chris Gannatti for an in-depth discussion on the recent Vietnam trade deal, the stalled Japan negotiations, the AI-driven productivity boom, and shifting market leadership from mega-cap tech to industrials, biotech, and small caps. They...

2025-07-0352 minBehind the Markets PodcastH2 Outlook: A Bullish SetupShow from 06/27/25

Host Jeremy Schwartz and Professor Siegel discuss the S&P 500 hitting new highs, positive developments from the NATO meetings, and the impact of Middle East dynamics on the markets. The Professor also weighs in on potential Fed moves, a slowing economy, and how firms might use AI to offset tariffs and labor costs. (11:10) Jeremy is joined by Warren Pies of 3Fourteen Research, along with Sam Ryans, Jeff Wenniger, and Chris Gannatti, to unpack second-half market outlooks, the fading oil risk premium, and opportunities in global equities. They cover the technical setup for stocks, the impact of tariffs and...

2025-06-2753 min

MOMENT DailyJeff Bezos’ Hochzeits-Exzess: Luxus auf Kosten der Menschen, 24.06.2025 #momentliveJeff Bezos feiert in Venedig Hochzeit mit Luxus und Privatjets - Während die lokale Bevölkerung darunter leidet.

Integrationsministerin Claudia Plakholm sagt: „Klar möchte ich nicht, dass Kinder in Österreich arm aufwachsen müssen…“ – und schlägt dann vor, das Kindergeld ab dem zweiten Kind zu kürzen und beim dritten noch mehr zu streichen.

Eine neue Bürgergeld-Studie aus Deutschland zeigt, wie Sozialhilfe wirklich aussieht – und warum Sanktionen nicht helfen.

Zum Abschluss diskutieren wir Norwegens mutige „Nur Ja heißt Ja“-Reform im Sexualstrafrecht und die dringende Notwendigkeit, dass Österreich endlich nachzieht.

WERDE JETZT FÖRDERMITGLIED! :D

RECHTSRUCK STOPPEN!

https...

2025-06-2436 minBehind the Markets PodcastIran Lessons and Too Late Powell Strikes AgainShow from 06/20/25

Host Jeremy Schwartz and Professor Siegel assess the Fed's latest policy posture, ongoing tariff impacts, and inflation expectations. The Professor critiques Powell’s stance on tariff-induced inflation, expresses concern over rising jobless claims and layoffs, and notes the Fed’s significant upcoming workforce reduction. He also discusses the subdued market response to Middle East tensions and his views on AI as a productivity offset. (31:41) Jeremy continues the show with Chris Gannatti, Sam Rines, and Jeff Weniger to explore the implications of geopolitical developments, especially the Israel-Iran conflict, on energy and markets. They dive into U.S. trade negotiations, Japa...

2025-06-201h 00Behind the Markets PodcastTrades for this week GeoPol VolShow from 06/13/25

Host Jeremy Schwartz and Professor Siegel discuss the geopolitical ramifications of Israel's recent military strike on Iran, its muted market impact, and the broader implications for inflation and Fed policy. Professor Siegel emphasized Iran’s weakened position, the role of U.S. coordination, and reiterated his view that inflation remains on a downward trend, supporting a Fed rate cut. (10:00) Jeremy continues the conversation with Sam Rines, Jeff Weniger, and Chris Gannatti from WisdomTree. The group explores the geopolitical and market implications of the Israeli strike, oil market reactions, and implications for energy and defense stocks. They also assess in...

2025-06-1352 minBehind the Markets PodcastTariff Truths? Bull, Bears, and Bets on a TruceShow from 05/23/25

Host Jeremy Schwartz and Professor Siegel break down the latest market concerns, focusing on President Trump's Truth Social posts and the potential impact of threatened tariffs on Apple and the EU. Professor Siegel expresses a cautiously optimistic view on markets, contingent on the rollback of these tariffs, and comments on unemployment claims, inflation indicators, and bond market reactions. (14:56) Jeremy continues with guests Sam Rines, Chris Gannatti, and Jeff Weniger to explore the implications of Trump's tariff threats, particularly on luxury European goods and Apple’s production strategy. They delve into trade negotiations, the bond market's influence on fiscal po...

2025-05-2349 minBehind the Markets PodcastA Macro+Charts Special EpisodeShow from 05/09/25

Host Jeremy Schwartz and Professor Siegel focus on Powell’s Fed commentary, discussing the lack of policy surprises, concerns about stagflation, and Siegel's critique of the Fed's rigid rate-setting practices. The professor also warns about supply chain disruptions from China and the risk of economic slowdown if tariffs persist. (34:15) Jeremy is joined by Macro Charts (referred to as MC), who shares his views on global market sentiment, tactical asset shifts, and the potential for a dollar rebound. MC discusses underperformance in international markets, rotation out of growth stocks, and strong momentum in Bitcoin, expressing cautious optimism about US eq...

2025-05-091h 26

Basis PointsPositioning Portfolios for a New Trade RegimeGlobal trade is being redefined through structural tariffs and new alliances. This week on Basis Points, Kevin Flanagan is joined by WisdomTree Macro Strategist of Model Portfolios, Sam Rines and Head of Equity Strategy, Jeff Weniger to discuss how investors should position for the next phase of global macro realignment. Basis Points: 1/100th of 1 percent. Please see the WisdomTree Glossary for Definitions of terms and indexes: https://www.wisdomtree.com/glossary

2025-04-3012 min

Money Life with Chuck JaffeWisdomTree's Weniger: One reason to be bullish now is 'you'd be the only bull'Jeff Weniger, head of equity strategy at WisdomTree Asset Management, seems to only be half joking when he says investors might want to be bullish right now just because they would be the last bull standing, but he also notes that long-term investors, in conditions like these, must bite their lip and keep buying equities. That said, he thinks some of those equities should be international, and he particularly likes Japan right now. In an extended Danger Zone segment, David Trainer, founder and president at New Constructs, taslks about how the market's turmoil is putting an end to the...

2025-04-141h 00Behind the Markets PodcastReasons For Optimism Amidst Tariff TremorsShow from 04/11/25

Host Jeremy Schwartz and Professor Siegel reviewed a volatile week in the markets, focusing on rising yields and the dollar’s slide. The Professor attributed bond market moves to growing concerns about the U.S. deficit and potential shifts in global reserve currency dynamics. He emphasized the inflation impact of tariffs, potential recessionary risks, and questioned the long-term dominance of the U.S. economy. (47:03) Jeremy continues with Kevin Flanagan, Chris Gannatti, Jeff Weniger, and Sam Rines to unpack market reactions to geopolitical tensions, shifts in monetary policy expectations, and emerging market dynamics. The group discusses bond market mechanics, fo...

2025-04-111h 13Behind the Markets PodcastOur Take on Trump's Tariffs, Markets, and the White House Digital Asset SummitHost Jeremy Schwartz and Professor Siegel discuss the market reaction to tariffs and their potential impact on inflation and sentiment. The Professor highlights the sharp decline in the University of Michigan sentiment index, the risks of continued tariff escalation, and his expectations for the upcoming FOMC meeting. He warns that a full-scale tariff war could further pressure equities, while a lighter approach might stabilize markets. (11:52) Jeremy is joined by WisdomTree’s macro team—Chris Gannatti, Jeff Weniger, and Sam Rines—to discuss market rotations, the impact of tariffs on different economies, and trends in Japan’s wage growth. They examine the valu...

2025-03-1354 min

Power Your AdviceEpisode 252 – Navigating Market Volatility: Market Insights and Portfolio Strategies with Jeff WenigerJeff Weniger is the Head of Equity Strategy at WisdomTree. WisdomTree works to create a better way to invest, offering a leading product range that offers access to an unparalleled selection of unique and smart exposures.

Today, Doug and Jeff discuss how WisdomTree’s investment strategies can help investors navigate market volatility in 2025. He highlights the firm’s two key funds—WisdomTree U.S. Value Fund (WTV) and WisdomTree U.S. Quality Growth Fund (QGRW)—and explains how combining value and growth strategies can create a well-diversified, risk-balanced portfolio.

Resources: WisdomTree

Investors should carefull...

2025-02-2520 min

今日美股WisdomTree策略师称中国“十大科技股”能与美股“七巨头”比肩大家好,欢迎收听今天的节目。今天我们要聊的是一个关于全球科技竞争的新话题,那就是中国的“十大科技股”正在崛起,并逐渐与美国的“科技七巨头”展开激烈的竞争。这个话题来自于WisdomTree Investments的证券策略主管Jeff Weniger,他在社交媒体上提出了“Terrific 10”这一概念,指的是中国的十大科技公司,其中包括阿里巴巴、腾讯、美团、小米、比亚迪、京东、网易、百度、吉利和中芯国际。Weniger认为,这些公司正在与美国的“科技七巨头”形成强有力的对抗。说到“科技七巨头”,大家应该很熟悉,这七家公司分别是苹果、微软、Alphabet、特斯拉、Meta、英伟达和亚马逊。而中国的这些公司,也正是通过创新、强大的市场布局和技术突破,不断在全球范围内抢占一席之地。

2025-02-2102 minBehind the Markets PodcastTech Bros and Buffett - Why They Could Both Be RightShow from 02/21/25

Host Jeremy Schwartz and Professor Siegel discuss the latest market trends, focusing on tariff uncertainties, economic data, and market resilience. Professor Siegel highlights the market’s response to geopolitical developments, earnings expectations, and the potential impact of rising bond yields. He also weighs in on Nvidia, Tesla, and the broader AI landscape, emphasizing the importance of earnings in market performance. (11:41) Jeremy is joined by Chris Gannatti, Sam Rines, and Jeff Weniger to delve into the evolving tech landscape, including Nvidia’s role, Microsoft’s AI push, and the future of quantum computing. They also discuss Apple’s challenges, Tesla’s...

2025-02-2059 minBehind the Markets PodcastFly Tariffs Fly: On the Road to Victory?Show from 02/14/25

Host Jeremy Schwartz and Professor Siegel reflect on the Eagles' Super Bowl victory and discuss key economic data, including CPI and PPI surprises, the market's reaction to inflation expectations, and the impact of potential tariff negotiations. Siegel notes that while inflation data was hotter than expected, markets found relief in the lower-than-expected PCE components. He also discusses retail sales disappointments, GDP outlook adjustments, and global economic trends. (13:19) Jeremy continues with Sam Rines, Jeff Weniger, and Christopher Gannatti from WisdomTree to break down geopolitical and market trends. The group covers Modi's U.S. visit and tariff negotiations, India's potential...

2025-02-1448 minBehind the Markets PodcastSuper Bowl for Markets: Jobs, Earnings, and Portfolio DiversifiersShow from 02/07/25

Host Jeremy Schwartz opens the show, discussing market trends and economic indicators. Jeremy is then joined by Sonu Varghese from the Carson Group, along with Jeff Weniger, Sam Rines, and Chris Gannatti, for a deep dive into market trends, asset allocation, and economic outlooks. Sonu discusses his positive outlook on the U.S. economy, citing strong labor market fundamentals and productivity growth. The conversation covers key sectors of interest, potential risks from tariffs, and expectations for interest rates. The guests also touch on AI’s impact on productivity and broader market trends shaping investment strategies.

Guest: Sonu has ov...

2025-02-0758 minBehind the Markets PodcastAI, Tariffs, and the Fed: Market Shifts and Risks AheadShow from 01/31/25

Host Jeremy Schwartz and Professor Siegel discuss key market developments this week, covering the Fed meeting, the impact of DeepSeek on AI and chipmakers, and the potential consequences of new tariffs. The Prof notes that while the Fed’s latest move wasn’t highly consequential, the removal of certain inflation-related language raised some market expectations. He also highlights how DeepSeek’s AI advancements could challenge high-end chipmakers like NVIDIA while benefiting AI users and the broader economy. (15:13) Jeremy continues with Jeff Winnegar and Sam Rines, diving into the evolving AI landscape, China’s latest moves in AI with Alibaba’...

2025-01-3155 minBehind the Markets PodcastThe Professor’s Take on Trump 2.0Show from 01/24/25

Chris Gannati and Jeff Weniger host this week’s Behind the Markets, sharing insights on the latest market trends. They discuss inflation metrics like CPI and PPI, noting stable progress in controlling inflation, and emphasizing confidence in Federal Reserve policy adjustments. (15:33) Chris and Jeff delve into European markets' performance and shifting investor sentiment, particularly towards Germany and France, driven by improving economic data and valuation opportunities. They also explore currency trends, global investor flows, and the implications of U.S. equity valuations compared to other regions.

Guest: Christopher Gannatti began at WisdomTree as a Research Analyst in December 2010, wo...

2025-01-2353 minBehind the Markets PodcastA cautious take for 2025's market expectationsShow from 01/03/25

Host Jeremy Schwartz and Professor Siegel began the first episode of 2025 by reflecting on the market's robust end to 2024 and the economic outlook for the new year. Professor Siegel emphasized the strong but balanced economic data, predicting no changes in Federal Reserve policy for 2025 and cautioning about potential corrections in the market. He discussed key risks, such as narrow market leadership driven by big tech and lingering bond market pressures, while emphasizing the complexities surrounding tariffs and fiscal policy under the new administration. (16:00) Jeremy was then joined by WisdomTree colleagues Sam Rines and Jeff Weniger for an in-depth...

2025-01-031h 00Behind the Markets Podcast2025 Top Ideas and Outlook with Deep Rooted Macro TeamShow from 12/20/24

Host Jeremy Schwartz and Professor Siegel recap the Fed’s recent rate cuts and their implications for 2024. Professor Siegel discusses the market's reaction to the Fed’s decisions, inflation indicators, and the evolving economic outlook, emphasizing potential rotation within the market’s major sectors. (13:13) Jeremy continues with WisdomTree’s macro team—Sam Rines, Christopher Gannatti, and Jeff Weniger—covering key global developments. They explore the U.S. government’s fiscal negotiations, Google’s efficiency push in AI, and Japan's investment landscape. The team also discusses market prospects for China, India, and emerging technologies like quantum computing, offering a comprehensive ye...

2024-12-2052 minBehind the Markets PodcastDeep Rooted Macro from Tokyo to DC: Insights on Inflation, Tech and TariffsHost Jeremy Schwartz and Professor Siegel discuss the tech sector's recent surge, focusing on portfolio rebalancing, the inflation outlook, and upcoming Fed decisions. The professor highlights the resilience of tech stocks, potential market corrections, and expectations for future interest rate cuts. (13:00) Jeremy leads a roundtable with Sam Rines, Jeff Weniger, and Christopher Gannatti covering global markets. They explore economic and geopolitical developments, including Japan's market strength, Korean political risks, and Europe's energy challenges. The team also examines China's volatile market environment, quantum computing advances, and the potential resurgence of Argentina's economy. Looking ahead, they discuss investment themes like AI, IPO...

2024-12-1358 minBehind the Markets PodcastDeep Rooted Realities: The Election and MarketsShow from 11/08/24

Host Jeremy Schwartz and Professor Siegel reflect on the intense week in the markets, touching on the Federal Reserve’s latest rate decision, upcoming economic data, and the potential impacts of political changes following the U.S. election. Professor Siegel also notes the significant market reaction to the election results, particularly regarding fiscal policies, tariffs, and tax concerns. (13:10) Jeremy turns to his panel, with guests Sam Rines, Jeff Weniger, and Christopher Gannatti, to delve into global shifts in trade, the nearshoring trend, and China’s economic outlook. They discuss the impacts of geopolitical events on market stability, as well...

2024-11-0852 minBehind the Markets PodcastDeep Rooted Macro: Jobs, Rates and the ElectionShow from 11/01/24

Host Jeremy Schwartz and Professor Siegel discuss the recent jobs report, with Professor Siegel noting that while the labor market shows signs of slowing, it remains strong enough to avoid immediate recession concerns. They also talk about potential Fed rate cuts and Siegel’s view that bond market conditions may reflect defensiveness around political uncertainties ahead of the election. (16:00) Jeremy is joined by WisdomTree colleagues Sam Rines, Chris Gannatti, and Jeff Weniger to discuss upcoming election implications for markets, insights from recent earnings, and the outlook for China. They cover sector-specific earnings impacts, especially within tech, automotive, and re...

2024-11-0153 min

Money Life with Chuck JaffeWisdomTree's Weniger: Fed chair Powell needs to be careful nowJeff Weniger, head of equity strategy at WisdomTree Asset Management, says that while rate cuts tend to be good for the market, there is an unusual circumstance now where the cuts upend the Japanese yen carry trade. That created the market's short-lived August drawdown, but that circumstance could resurface; while the market has moved past that problem, Weniger notes that the Fed's expected actions in cutting rates are happening during a bull market run, which tends to be unusual, but which has to be taken as a bullish sign this time. Weniger notes that he particularly likes small caps a...

2024-08-271h 00

Insight is Capital™ PodcastWisdomTree: Navigating These Unusual Market and Economic SignalsIn this conversation Jeff Weniger, Head of Equity Strategy and Samuel Rines, Macro Strategists, Model Portfolios at WisdomTree Asset Management, join us to discuss various topics including the performance of the equity and bond markets, inflation, the labor market, and the real estate market. We explore the potential impact of rising yields on equities, the relationship between bonds and stocks, and the role of the US dollar as a hedge. We get into the challenges of navigating the current economic landscape and the reluctance of individuals and businesses to make changes in their financial strategies. Jeff and Sam unpack t...

2024-05-281h 13

The Raise Your Average™ PodcastNavigating These Unusual Market and Economic Signals with Jeff Weniger and Samuel RinesIn this conversation Jeff Weniger, Head of Equity Strategy and Samuel Rines, Macro Strategists, Model Portfolios at WisdomTree Asset Management, join us to discuss various topics including the performance of the equity and bond markets, inflation, the labor market, and the real estate market. We explore the potential impact of rising yields on equities, the relationship between bonds and stocks, and the role of the US dollar as a hedge. We get into the challenges of navigating the current economic landscape and the reluctance of individuals and businesses to make changes in their financial strategies. Jeff and Sam unpack t...

2024-05-281h 13

Resolve Riffs Investment PodcastJeff Weniger-Pension Wars: Why Everything is About to Change and How to ProfitIntroductionIn this episode, we are thrilled to have Jeff Weniger, the Chief U.S. Strategist for WisdomTree ETFs, back on the show. Jeff shares his insights on a range of topics, including the 'pension wars' concept, the potential for a domino effect in global equity markets, and the role of financial engineering in shaping investment strategies.Topics Discussed• Discussion on the 'pension wars' concept and its potential impact on asset flows over the next several years• Exploration of the potential domino effect in global equity markets and the implications for inve...

2024-04-121h 10

Money Life with Chuck JaffeWisdomTree's Weniger: Lean in, because it's a bull marketJeff Weniger, head of equity strategy at WisdomTree Asset Management, says that the "rip-roaring rally" that started in late October on account of declining interest rates, and it slowed in January but now "Boom, suddenly you're back off to the races" with the stock market at new highs and the Standard & Poor's 500 now eyeing 5000. Weniger notes that there are plenty of concerns for the rally, and he notes that a downturn could test the classic 60-40 portfolio, where he thinks investors may be disappointed with how fixed income does its job of providing portfolio protection. Talking technicals, Lawrence McMillan...

2024-01-2358 minBehind the Markets PodcastBehind the Markets Podcast: Liqian & JeffShow from 01/19/24

Host Jeremy Schwartz and Professor Siegel begin this week's episode discussing how the market is hitting an all time high. They comment on the current labor market and upcoming layoffs. Jeff asks the professor about the current state of the Chinese Market. (06:03) Liqian and Jeff join to discuss in depth what is happening geopolitically across the world. Liqian covers the Taiwan election and how that will affect the world markets. Jeff asks her about the potential for stimulation in China and if it is necessary. Weniger joins in to comment on China’s current market state and how Ta...

2024-01-1953 min 2023-11-211h 23

2023-11-211h 23

Insight is Capital™ PodcastInvestment Insights from WisdomTree's Jeremy Schwartz & Jeff WenigerWe're excited to share our conversation with two distinguished guests from WisdomTree, Jeremy Schwartz and Jeff Weniger. Jeremy Schwartz, CFA, Global Chief Investment Officer at WisdomTree, shares his views on the market and economy from his vantage point of overseeing all of WisdomTree's investment activity. Jeff Weniger, CFA, Head of Equity Strategy at WisdomTree, shares current insights from his team's analysis of stock market trends and macroeconomic developments. Where to find our guests:Jeremy Schwartz Jeff WenigerTimestamped Highlights[00:00] Fed Rate Hikes and Economic Impact - We begin with...

2023-11-211h 23

Aus dem Maschinenraum für Strategie | Marketing | VertriebWeniger Meetings, mehr Wirkung (#243)

Meetings sind ein fester Bestandteil des Alltags für viele von uns. Sie nehmen nicht nur viel Zeit in Anspruch, sondern liefern oft auch nicht die erwarteten Ergebnisse. In dieser Episode bespricht Michael Stiller das Dilemma: Wann sind Meetings notwendig und wann ist asynchrone Kommunikation die bessere Option? Er geht auch auf die Praxis von Jeff Bezos ein, der vor jedem Meeting eine 30-minütige Lesezeit einplant. Warum macht er das und was können wir davon lernen? Hört rein und findet es heraus.

Michael Stiller hat an der RWTH Aachen am Lehrstuhl für Unternehmenspolitik und M...

2023-11-0612 minBehind the Markets PodcastBehind the Markets Podcast: Jeff & LiqianShow from 9/8/23

Prof. Siegel joins Jeremy Schwartz and their colleagues Jeff and Liqian with his reaction to the softer tones of the market this week. He feels that China’s threat to remove Apple is a bit out of proportion which has affected the market. Although the market is not doing strong, he feels we aren’t anywhere near a recession. He doesn’t think the Fed should increase rates in September, nor does he think they will. He also explains how rising bond correlations affect the market. (12:42) Jeff begins by describing his take on the current job market and great...

2023-09-0852 min

Resolve Riffs Investment PodcastEric Basmajian: Cyclical Drivers and Trends of the US EconomyThe ReSolve Team welcomes Eric Basmajian, founder of EPB Research, and Jeff Weniger, a renowned financial analyst. We delve into the current state of the economy, the potential for a recession, and the role of the banking sector in these dynamics. We also discuss the influence of leading, coincidental and lagging indicators in economic cycles.• Introduction to Eric Basmajian and Jeff Weniger, discussing their backgrounds and influences• Discussion on the potential disparity between equity markets and recession indicators• Exploration of Eric's economic framework and its ap...

2023-08-011h 15

The Pomp Podcast#1223 Jeff Weniger On State Of The 2023 Macro EconomyJeff Weniger is the Head of Equity Strategy at WisdomTree Asset Management. In this conversation, we talk about the federal reserve, inflation, bitcoin, housing market, bank crisis, and the insanity that has ensued since 2020. Jeff helps break down all the chaos in the markets.

=======================

Pomp writes a daily letter to over 250,000+ investors about business, technology, and finance. He breaks down complex topics into easy-to-understand language while sharing opinions on various aspects of each industry. You can subscribe at https://pomp.substack.com/

2023-07-121h 05

The Pomp LetterThe Fed Is Playing Chicken With A RecessionRead the end of today’s letter for information on Sidebar:To investors,There are a few graphics and visuals that I came across over the weekend that tell a scary story for the US economy. First, we know that the Federal Reserve has been hiking interest rates aggressively. Most people have heard the Fed’s increase from 0% to 5%+ is the fastest in history, but it seems even crazier when you see the comparison visually. The United States has never seen anything like this before — the Fed has raised rates faster and further than a...

2023-07-1004 min

The Acquirers PodcastValue After Hours S05 E20: Jeff Weniger on Value v Growth, Housing, and the 70s Stock Market CrashesValue: After Hours is a podcast about value investing, Fintwit, and all things finance and investment by investors Tobias Carlisle and Jake Taylor. See our latest episodes at https://acquirersmultiple.com/

We are live every Tuesday at 1.30pm E / 10.30am P.

Jeff Weniger, CFA serves as Head of Equity Strategy at WisdomTree. In his role, Weniger helps to formulate the firm’s stock market outlook by assessing macro and fundamental trends.

Twitter: https://twitter.com/JeffWeniger

About Jake: Journalytic

Jake is a partner at Farnam Street: http://farnam-street.com/vah

J...

2023-05-291h 00

The Dividend Mailbox®Downfalls of a Lottery Ticket Mindset with Jeff Weniger — Head of Equity Strategy at WisdomTreeMore on dividend growth investing -> Join our market newsletter!In this month’s episode, Greg sits down with Jeff Weniger, Head of Equity Strategy at WisdomTree. For the unfamiliar, WisdomTree is a fund and ETF manager with roughly $90 billion in assets under management. What makes WisdomTree’s funds special is that most of them focus on dividend and dividend growth strategies. One of their largest funds is the US Quality Dividend Growth Fund ($DGRW), which incidentally is our largest core position and is one we have mentioned over past episodes. Among their other funds, $DGRW is excep...

2023-04-241h 00

The Dividend Mailbox®Downfalls of a Lottery Ticket Mindset with Jeff Weniger — Head of Equity Strategy at WisdomTreeIn this month’s episode, Greg sits down with Jeff Weniger, Head of Equity Strategy at WisdomTree. For the unfamiliar, WisdomTree is a fund and ETF manager with roughly $90 billion in assets under management. What makes WisdomTree’s funds special is that most of them focus on dividend and dividend growth strategies. One of their largest funds is the US Quality Dividend Growth Fund ($DGRW), which incidentally is our largest core position and is one we have mentioned over past episodes. Among their other funds, $DGRW is exceptional for gaining exposure to quality dividend growth. Jeff has spent...

2023-04-221h 00

Money Life with Chuck JaffeDeCarley's Garner sees stock and bond gains ahead as investors' FOMO kicks inCarley Garner, senior commodity strategist at DeCarley Trading, says that 'people are way underallocated,' nervously sitting in cash and Treasuries while waiting for market troubles to play out, but when those investors get FOMO -- a fear of missing out -- and the money starts flowing back into investments, it will lift both the stock and bond markets. DeGarner expects a big comeback in 60-40 portfolios this year and says that several commodities markets are now trading at levels that present a good opportunity for investors to get back in, in turn spurring the FOMO of investors to hel...

2023-03-311h 01

Nachtprogramm - Der Podcast für B-ActionfilmeA Face To Forget But A Kick To Remember - Das Jeff Wincott Double Feature: Mission Of Justice & Last Man StandingDie Hauptrolle in einer populären TV-Serie hatte er nie, auch prominente Rollen in Hollywood-Blockbustern blieben ihm verwehrt: Jeff Wincott kennen nur hartgesottene Actionfreunde, die sich beim Stöbern durch die Videothekenregale nicht vom Mangel an Hollywood-Glamour abschrecken ließen und auch weniger bekannten Namen eine Chance einräumten. Das führte zu mancher Enttäuschung beim Klopperfilmabend, gelegentlich aber auch zu freudigen Überraschungen. Erfahrene Videotheken-Stöberer wie Martin und unser B-Action-Stammgast Markus Köhler vom Erstkontakt-Podcast wissen natürlich, in welche Kategorie die beiden heute besprochenen Wincott-Filme fallen, Sergej hingegen betritt mal wieder Neuland. Hoffentlich heißt es ihn willkom...

2023-03-092h 05

Advisor Success SeriesWhat Kind of Landing? A Macro/Market Update from Jeff Weniger, WisdomTree Asset ManagementIn this episode, we discuss the market and economic landscape with Jeff Weniger, Head of Equity Strategy at WisdomTree. At the time of this recording, we find ourselves at an inflection point between peak inflation, peak economic activity, and peak central bank tightening - or are we? Jeff shares his views through a cross-sectional analysis of housing, labor, production, and valuations and where the risk/reward looks most favorable and unfavorable.

2023-02-2448 min

China of TomorrowInterview with Head of Equity Strategy Jeff Weniger, WisdomTreeOn this week’s episode of China of Tomorrow, Liqian Ren is joined by WisdomTree’s Head of Equity Strategy, Jeff Weniger to discuss the unique considerations for investments in China and broader emerging markets, including: housing markets, growth vs. value investing and more.

2022-11-1735 min

Money Life with Chuck JaffeWisdomTree's Weniger: Strong dollar creates a headwind for American businessesJeff Weniger, head of equity strategy at WisdomTree Asset Management, says that the strong dollar is dramatically changing business conditions for U.S. companies, even as they deal with recessionary conditions. The dollar has gotten so strong, Weniger says, that it's an expensive country for companies and consumers, all of whom will have to deal with the headwinds created by the dollar. Weniger says that he expects the next six months to be characterized by significant volatility, which will give technology stocks a tough ride, which has him turning to utilities and consumer staples while waiting to see how t...

2022-10-031h 00

Basis PointsNavigating the Uncharted Waters Between Growth and InflationThis week on the Basis Points podcast, Kevin Flanagan is joined by WisdomTree thought leaders Jeff Weniger, Nitesh Shah and Aneeka Gupta to cover a compelling blend of global research and analysis regarding the recent dramatic shift in monetary policy by just about every central bank in the developed world, including:

The latest economic and investing developments in emerging and developed markets.

A macroeconomic outlook.

Market preparedness and engagement.

Basis Point: 1/100th of 1 percent.

2022-09-2810 min

Resolve Riffs Investment PodcastReSolve Riffs with Jeff Weniger on the Housing Recession, Perky Consumers, and Where to Invest NowOur friend Jeff Weniger, Head of Equity Strategy at Wisdom Tree, returned as this week’s guest. Our wide-ranging conversation covered topics including: How sticky has inflation really become Many ways to measure inflation Leading and lagging indicators The recent drop in US home prices and the health of the real-estate market How the recent rise in interest rates affects mortgages and affordability US money supply and the reversal of the TINA trade Japan – demographics, debt burden and a collapsing Yen Reverse currency wars What makes a country (and its currency) a safe haven The apparent disconnect between fina...

2022-09-211h 51Behind the Markets PodcastBehind The Markets Podcast: Chris Gannatti, Blake Heimann, & Jeff WenigerShow from 8/12/22

Wharton Finance Professor Jeremy Siegel starts the show with his market update discussing import prices, commodities, deterioration of the real economy, and more. Plus Guest Hosts Chris Gannatti, Blake Heimann, and Jeff Weniger discuss inflation, the corporate tax code, fed policy, and value vs growth stocks.

Guest:

Chris Gannatti – Head of Global Research at WisdomTree

Blake Heimann - Research Analyst at WisdomTree Asset Management

Jeff Weniger - CFA serves as Head of Equity Strategy at WisdomTree

Follow WisdomTree on Twitter: @WisdomTreeETFs

Follow Jeremy Schwartz on Twitter: @JeremyDSchwartz

2022-08-1252 minBehind the Markets PodcastBehind The Markets Podcast: Tobias Harris & Jeff WenigerShow from 7/22/22

How are the markets responding to the upcoming Fed meeting? Will there be more interest rate hikes? Host Jeremy Schwartz and Co-Host Jeff Weniger discuss that and more during the market update. Then, they bring on a Japan expert to discuss the state of the country after the death of Shinzo Abe.

Guest:

Tobias Harris – Author of the book “The Iconoclast: Shinzo Abe and the New Japan” and the Senior Fellow at the Asia at the Center for American Progress

Purchase his book here: https://www.amazon.com/Iconoclast-Shinzo-Abe-New-Japan/dp/1787383105

For more information on the Center for American Progre...

2022-07-2253 min

The Independent AdvisorsThe Independent Advisors Episode 155: Bad News is Good NewsShownotes:Tweet by Ryan Detrick - https://twitter.com/RyanDetrick/status/1537552028674801665Tweet from Jeff Weniger - https://twitter.com/JeffWeniger/status/1536477021840236547Tweet by Jeff Weniger - https://twitter.com/JeffWeniger/status/1537046366685478912Tweet by WallStJesus - https://twitter.com/wallstjesus/status/1538333027490836480?s=11&t=UHGbVyuwxvkyAhWoCEnbQQTweet by Ryan Detrick - https://twitter.com/ryandetrick/status/1537139588577255425?s=11&t=8W-7RVaCvkJy9koRyCU4jwTweet by Steve Liesman - https://twitter.com/steveliesman/status/1536833321480728577?s=11&t=5Vs9...

2022-06-2346 min

The Meb Faber Show - Better InvestingJeff Weniger, WisdomTree – Market Update: Inflation, FAANG 2.0 & Signs of A Bear Market Low | #421Today’s guest is Jeff Weniger, the Head of Equity Strategy at WisdomTree. In today’s episode, we’re talking about everything going on in the market and economy. We touch on inflation and why Jeff first tweeted about rising food prices over a year ago. Then we get into the market and discuss the relationship between interest rates and different sectors, the recent outperformance of consumer staples vs. consumer discretionary, and why Jeff is bullish on companies returning cash to shareholders.As we wind down, Jeff shares some signs he’s looking out for that may...

2022-06-081h 25

Casa Casi – Die Tech-WGGefährliche Milliardäre (Teil 2)Heute sprechen wir noch einmal über gefährliche Milliardäre. Aber mal weniger über Elon Musk – und dafür mehr über Amazon-Mastermind Jeff Bezos. Generell wird er als deutlich weniger gefährlich wahrgenommen als seine Milliardärskollegen Zuckeberg und Musk. Wir versuchen aber aufzubröseln, wieso es auch in seinem Fall eine gefährliche Konzentration von Macht und Daten gibt. ... und ja, nebenher reden wir auch ein wenig übers Putzen beim Podcast-Hören und über die Wahl in Frankreich. Wir wollen Euer Feedback! Ihr könnt Euch auf WhatsApp, Signal und Threema mit Sprachnachrichten (und natürlich auch Tex...

2022-04-3047 min

China of TomorrowInterview with Jeff Weniger and Jeff CollettOn this week’s episode of China of Tomorrow, Liqian Ren is joined by WisdomTree’s Head of Equity Strategy Jeff Weniger and Jeff Collett, Partner at Yuki Co LLC, a firm that advises on Japanese and global equity strategies, to discuss the rules of the road in Japanese equity and currency markets including the Yen, regulatory challenges and recent developments and more.

2022-04-2840 min

Behind the Markets PodcastBehind The Markets Podcast: John Davi on InflationShow from 4/15/22Wharton Finance Professor Jeremy Siegel talks about the future of inflation, retail sales, bond markets, and more. Then, Host Jeremy Schwartz brings on Founder and CIO at Astoria Portfolio Advisors John Davi to discuss inflation, portfolio strategy, and hedging. John suggests putting 10% of the 60/40 model into an inflation sensitive basket of securities. If inflation rises, this tactic will add incremental alpha to your portfolio. He also gets into energy, commodities, cryptocurrency, and more.Guests:John Davi - Founder, CIO at Astoria Portfolio Advisors LLCCheck out Astoria...

2022-04-1652 minBehind the Markets PodcastBehind The Markets Podcast: John Davi on InflationShow from 4/15/22

Wharton Finance Professor Jeremy Siegel talks about the future of inflation, retail sales, bond markets, and more. Then, Host Jeremy Schwartz brings on Founder and CIO at Astoria Portfolio Advisors John Davi to discuss inflation, portfolio strategy, and hedging. John suggests putting 10% of the 60/40 model into an inflation sensitive basket of securities. If inflation rises, this tactic will add incremental alpha to your portfolio. He also gets into energy, commodities, cryptocurrency, and more.

Guests:

John Davi - Founder, CIO at Astoria Portfolio Advisors LLC

Check out Astoria Advisors' website: https://www.astoriaadvisors.com/

Follow Astoria Advisors on Twitter...

2022-04-1552 min

Behind the Markets PodcastBehind The Markets Podcast: Jim Bianco & Jeff WenigerShow from 3/11/22Wharton Finance Professor Jeremy Siegel kicks off the show with his market update covering rising inflation, stocks vs bonds, earnings, and more. Then, what are the biggest market trends? How can we look to the inverted yield curve as a predictor of market health? What is the future of the commodity market considering the Russia - Ukraine War? Jeremy Schwartz talks to an expert on global macro.Guests:Jim Bianco – Bianco ResearchFollow Bianco Research on Twitter: @biancoresearchFor more on Bianco Research visit their we...

2022-03-1252 minBehind the Markets PodcastBehind The Markets Podcast: Jim Bianco & Jeff WenigerShow from 3/11/22

Wharton Finance Professor Jeremy Siegel kicks off the show with his market update covering rising inflation, stocks vs bonds, earnings, and more. Then, what are the biggest market trends? How can we look to the inverted yield curve as a predictor of market health? What is the future of the commodity market considering the Russia - Ukraine War? Jeremy Schwartz talks to an expert on global macro.

Guests:

Jim Bianco – Bianco Research

Follow Bianco Research on Twitter: @biancoresearch

For more on Bianco Research visit their website: https://www.biancoresearch.com/visitor-home/

Jeff Weniger – Head of Equity Strategy at Wisd...

2022-03-1152 min

Wealth Builders - A StatonWalsh PodcastWar, Oil & Inflation with WisdomTree Head of Equity Strategy Jeff WenigerIn this special episode we are joined by Head of Equity Strategy at WisdomTree, Jeff Weniger and Director for the Mid-Atlantic region, Brandon Liebman. During our conversation we discuss the war in Ukraine, inflation in the United States, the outlook on the Federal Reserve, the effects oil prices will have on the markets moving forward and what investors can expect through the end of 2022 and beyond in their investment portfolios.Meet with us This podcast is for informational purposes only. Although the information has been gathered from sources believed to be reliable, please note...

2022-03-0940 min

Money Life with Chuck JaffeWisdomTree's Weniger: Expect big job gains to power the economy, marketJeff Weniger, head of equity strategy at WisdomTree Asset Management, says he expects unemployment to drop potentially below the 3 percent level -- which is better than so-called 'full employment' -- which takes 'the stag' out of stagflation possibilities. With the jobs market not being stagnant, Weniger says the economy can power through rising inflation and interest-rate concerns to keep moving forward, even if consumers and investors suffer some discomfort along the way. Also on the show, David Trainer re-visits Danger Zone picks Shopify and Coinbase after their recent earnings reports and says that the big recent declines in each s...

2022-03-0758 min

Resolve Riffs Investment PodcastReSolve Riffs with Jeff Weniger on Macro Themes and Surprises in 2022To kick off the new year, our 2022 inaugural episode welcomed back Jeff Weniger, Head of Equity Strategy at WisdomTree Asset Management. Sharp-witted and pulling no punches, Jeff and the team covered topics that included: The early year equity rotation as the inflation narrative gathers steam The third leg of the portfolio stool that most investors are likely missing Owning commodities vs commodity-linked equities Most investors today have barely had any experience with inflation in markets – remembering the commodity super-cycle of the early 2000s Not all inflation is created equally – how it arises determines what asset-classes and instruments can be u...

2022-01-251h 29

Money For the Rest of UsShould You Hedge Your International Stock Exposure From Currency Fluctuations?How to decide whether it is worth it to hedge currency exposure when investing outside of your home country.Topics covered include:How currency exchange rates impact investment returnsWhat factors impact currency exchange ratesWhat are carry trades and how do they influence exchange ratesHow currency forward contracts workHow ETFs and funds hedge currency exposureWhat to consider when deciding whether to hedge foreign currency exposureThanks to Egnyte and Quartr for sponsoring the episode.For more information on this episode click here.Show NotesRising U.S. y...

2021-11-0322 min

Unternehmerwissen in 15 Minuten - Mit Rayk Hahne516: Je weniger Du machst desto mehr passiert Willkommen zu Unternehmerwissen in 15 Minuten.Mein Name ist Rayk Hahne, Profisportler und Unternehmensberater.Jede Woche bekommst Du eine sofort anwendbare Trainingseinheit, damit Du als Unternehmer noch besser wirst.Danke, dass Du die Zeit mit mir verbringst. Lass uns mit dem Training beginnen. Wenn Dir die Folge gefällt, teile sie mit Deinen Freunden unter dem Link raykhahne.de/516. In der heutigen Folge geht es um "Je weniger Du machst, desto mehr passiert." Welche 3 wichtigen Punkte kannst Du Dir aus dem heutigen Training mitnehmen?

2021-04-2315 min

Behind the Markets PodcastBehind The Markets Podcast: Helmut Norpoth, Ed Clissold, & Jeff WenigerShow from 9/4/20Wharton Finance Professor Jeremy Siegel kicks off the show talking about the unemployment rate and the potential of reopening the economy. Then Host Jeremy Schwartz and Guest Co-Host Jeff Weniger bring on two political forecasting experts to discuss potential 2020 election outcomes and what it will mean for your financial portfolios.Guests:Helmut Norpoth - Professor of Political Science at Stony Brook UniversityVisit his Faculty Page: https://www.stonybrook.edu/commcms/polisci/people/_faculty/Norpoth_Helmut.phpCheck out recent articles and interviews with Professor...

2020-09-0553 minBehind the Markets PodcastBehind The Markets Podcast: Helmut Norpoth, Ed Clissord, & Jeff WenigerShow from 9/4/20

Wharton Finance Professor Jeremy Siegel kicks off the show talking about the unemployment rate and the potential of reopening the economy. Then Host Jeremy Schwartz and Guest Co-Host Jeff Weniger bring on two political forecasting experts to discuss potential 2020 election outcomes and what it will mean for your financial portfolios.

Guests:

Helmut Norpoth - Professor of Political Science at Stony Brook University

Visit his Faculty Page: https://www.stonybrook.edu/commcms/polisci/people/_faculty/Norpoth_Helmut.php

Check out recent articles and interviews with Professor Norpoth: stonybrook.edu/experts/profile/helmut-norpoth

Ed Clissord - Chief US Strategist for...

2020-09-0453 min

Behind the Markets PodcastBehind The Markets Podcast: Greg Valliere & Jeff WenigerShow from 8/7/20 Wharton Finance Professor Jeremy Siegel gives his market update covering the political landscape and the jobs report. Professor Siegel says we need to focus on the future looking at virus trends and stimulus trends. Then hosts Jeremy Schwartz and Liqian Ren continue the conversation with Professor Siegel and bring on Greg Valliere. Greg says that the election will likely tighten between Trump and Biden as we near November. Then Jeremy Schwartz and Liqian bring on Jeff Weniger and discuss China/ US relations.Guests:Greg Valliere - Chief US Policy...

2020-08-0853 min

Behind the Markets PodcastBehind The Markets Podcast: Greg Valliere & Jeff WenigerShow from 8/7/20

Wharton Finance Professor Jeremy Siegel gives his market update covering the political landscape and the jobs report. Professor Siegel says we need to focus on the future looking at virus trends and stimulus trends. Then hosts Jeremy Schwartz and Liqian Ren continue the conversation with Professor Siegel and bring on Greg Valliere. Greg says that the election will likely tighten between Trump and Biden as we near November. Then Jeremy Schwartz and Liqian bring on Jeff Weniger and discuss China/ US relations.

Guests:

Greg Valliere - Chief US Policy Strategist at AGF Investments

More on AGF Investments: https...

2020-08-0753 min

Resolve Riffs Investment PodcastReSolve's Riffs on Monetary Trifecta - Money Supply, Inflation and Asset Prices with Jeff WenigerThis is “ReSolve’s Riffs” – live on YouTube every Friday afternoon to debate the most relevant investment topics of the day. For the last 12 years, the Fed and other major central banks have exerted overwhelming influence and power over investors’ behavior and capital markets. Since the pandemic began, governments have been forced to step up and unleash a fiscal tsunami to help ailing economies during the deepest recession in living memory. To make sense of this convoluted macroeconomic environment, we invited Jeff Weniger (WisdomTree) for a wide-ranging conversation that included: Birthrates in western countries and their impact on...

2020-08-041h 14

Investment BriefingBroker-Urgestein Jeff Saut: We’re gonna be in fine shape!Warum Investoren die nächsten Unternehmenszahlen ignorieren solltenDie neuesten Unternehmenszahlen dürften den Schrecken des vergangenen Quartals zeigen. Aber die Aktienkurse sind bislang trotz schlechter Unternehmensdaten geklettert. Nie hatte die Wall Street weniger Bezug zur Realwirtschaft als in 2020. Das könnte sogar der Start einer neuen Rally sein, sagt der höchst optimistische Investmentstratege Jeff Saut. Im Interview hier sagt er: “Ich vertraue dem Aktienmarkt, nicht Ökonomen.” Und demnach gibt es keinerlei Grund zur Sorge!

2020-07-1325 min

Endlich Freitag!#16 Weniger dumm, mehr schlau!Wollt ihr so erfolgreich sein wie Jeff Bezos oder Elon Musk? Dann seid ihr HIER genau richtig! Für weitere Lifehacks stehen euch unsere Lifegurus Pasi & Yannick jederzeit bereit.Link zur Spotify-Playlist: https://open.spotify.com/playlist/3tf6uIjYQM7wHKtgQYJOcq?si=zl6stYe_SpmwqSBzBEt5vQ Hosted on Acast. See acast.com/privacy for more information.

2020-02-2853 min

Behind the Markets PodcastBehind the Markets Podcast: David RosenbergShow from 7/26/19Jeff Weniger, Director of Asset Allocation at WisdomTree, steps in to host this special edition of Behind the Markets with Jeremy Schwartz and Jeremy Siegel! They talk to David Rosenberg about the European Central Bank, interest rates and the fed. They also review the flood of corporate earnings out this week and what they say about the U.S. economy. Plus a look at global markets from Japan to Switzerland.Guest:David Rosenberg, Chief Economist and Strategist at Gluskin Sheff, a Canadian-based wealth management firm. Dave...

2019-07-2653 minBehind the Markets PodcastBehind the Markets Podcast: David RosenbergShow from 7/26/19

Jeff Weniger, Director of Asset Allocation at WisdomTree, steps in to host this special edition of Behind the Markets with Jeremy Schwartz and Jeremy Siegel! They talk to David Rosenberg about the European Central Bank, interest rates and the fed. They also review the flood of corporate earnings out this week and what they say about the U.S. economy. Plus a look at global markets from Japan to Switzerland.

Guest:

David Rosenberg, Chief Economist and Strategist at Gluskin Sheff, a Canadian-based wealth management firm. Dave was Chief North American Economist at Merrill Lynch in New York for...

2019-07-2453 min

Press Play On The Binge-Worthy Full Audiobook Now, Busy Professionals![German] - Brain Shift Collection - den Geist beruhigen: Power-Rhythmen für Heilung & Klarheit by Jeff StrongPlease visithttps://thebookvoice.com/podcasts/1/audiobook/471835to listen full audiobooks.

Title: [German] - Brain Shift Collection - den Geist beruhigen: Power-Rhythmen für Heilung & Klarheit

Series: #1 of [German Edition] Brain Shift Collection

Author: Jeff Strong

Narrator: Jeff Strong

Format: Unabridged Audiobook

Length: 0 hours 55 minutes

Release date: December 10, 2018

Genres: Mindfulness & Meditation

Publisher's Summary:

Den Geist beruhigen: hier helfen dir klärende, entspannende Tempi dein mentales Geplapper loszuwerden und den verjüngenden Thetazustand zu genießen. Diese CD hilft dir dabei, deine Wahrnehmung zu verlagern, damit du deine chaotischen Gedanken loslassen und deinen Geist beruhigen kannst. Indem du das geistige Durcheinander beseitigst und d...

2018-12-1055 min

Fuel Your Mind With An Uplifting Full Audiobook And Elevate Your Mindset.[German] - Brain Shift Collection - Kraftvoll erfrischendes Schläfchen: Power-Rhythmen für Heilung & Klarheit by Jeff StrongPlease visithttps://thebookvoice.com/podcasts/1/audiobook/472001to listen full audiobooks.

Title: [German] - Brain Shift Collection - Kraftvoll erfrischendes Schläfchen: Power-Rhythmen für Heilung & Klarheit

Series: #5 of [German Edition] Brain Shift Collection

Author: Jeff Strong

Narrator: Jeff Strong

Format: Unabridged Audiobook

Length: 1 hour 1 minute

Release date: December 10, 2018

Genres: Mindfulness & Meditation

Publisher's Summary:

Kraftvoll erfrischendes Schläfchen - eine perfekte Lösung für die kleine Erholung zwischendurch. Du tankst Energie und fühlst dich präsent und wach! Diese CD ist eine Reise durch verschiedene Bewusstseinsebenen, die als 'kraftvolles Schläfchen' für dein Gehirn fungieren und dir dabei helfen, di...

2018-12-101h 01

Discover This Next-Level Full Audiobook — Perfect While Traveling.[German] - Brain Shift Collection - den Geist beruhigen: Power-Rhythmen für Heilung & Klarheit by Jeff StrongPlease visithttps://thebookvoice.com/podcasts/1/audiobook/471835to listen full audiobooks.

Title: [German] - Brain Shift Collection - den Geist beruhigen: Power-Rhythmen für Heilung & Klarheit

Series: #1 of [German Edition] Brain Shift Collection

Author: Jeff Strong

Narrator: Jeff Strong

Format: Unabridged Audiobook

Length: 0 hours 55 minutes

Release date: December 10, 2018

Genres: Medicine & Naturopathy

Publisher's Summary:

Den Geist beruhigen: hier helfen dir klärende, entspannende Tempi dein mentales Geplapper loszuwerden und den verjüngenden Thetazustand zu genießen. Diese CD hilft dir dabei, deine Wahrnehmung zu verlagern, damit du deine chaotischen Gedanken loslassen und deinen Geist beruhigen kannst. Indem du das geistige Durcheinander beseitigst und d...

2018-12-1055 min

Discover Your Ears To A Binge-Worthy Full Audiobook.[German] - Brain Shift Collection - Kraftvoll erfrischendes Schläfchen: Power-Rhythmen für Heilung & Klarheit by Jeff StrongPlease visithttps://thebookvoice.com/podcasts/1/audiobook/472001to listen full audiobooks.

Title: [German] - Brain Shift Collection - Kraftvoll erfrischendes Schläfchen: Power-Rhythmen für Heilung & Klarheit

Series: #5 of [German Edition] Brain Shift Collection

Author: Jeff Strong

Narrator: Jeff Strong

Format: Unabridged Audiobook

Length: 1 hour 1 minute

Release date: December 10, 2018

Genres: Medicine & Naturopathy

Publisher's Summary:

Kraftvoll erfrischendes Schläfchen - eine perfekte Lösung für die kleine Erholung zwischendurch. Du tankst Energie und fühlst dich präsent und wach! Diese CD ist eine Reise durch verschiedene Bewusstseinsebenen, die als 'kraftvolles Schläfchen' für dein Gehirn fungieren und dir dabei helfen, di...

2018-12-101h 01

Listen to Best Full Audiobooks in Health & Wellness, Mindfulness & Meditation[German] - Brain Shift Collection - Kraftvoll erfrischendes Schläfchen: Power-Rhythmen für Heilung & Klarheit by Jeff StrongPlease visithttps://thebookvoice.com/podcasts/1/audiobook/472001to listen full audiobooks.

Title: [German] - Brain Shift Collection - Kraftvoll erfrischendes Schläfchen: Power-Rhythmen für Heilung & Klarheit

Series: #5 of [German Edition] Brain Shift Collection

Author: Jeff Strong

Narrator: Jeff Strong

Format: Unabridged Audiobook

Length: 1 hour 1 minute

Release date: December 10, 2018

Genres: Mindfulness & Meditation

Publisher's Summary:

Kraftvoll erfrischendes Schläfchen - eine perfekte Lösung für die kleine Erholung zwischendurch. Du tankst Energie und fühlst dich präsent und wach! Diese CD ist eine Reise durch verschiedene Bewusstseinsebenen, die als 'kraftvolles Schläfchen' für dein Gehirn fungieren und dir dabei helfen, di...

2018-12-101h 01

Listen to Best Full Audiobooks in Health & Wellness, Mindfulness & Meditation[German] - Brain Shift Collection - den Geist beruhigen: Power-Rhythmen für Heilung & Klarheit by Jeff StrongPlease visithttps://thebookvoice.com/podcasts/1/audiobook/471835to listen full audiobooks.

Title: [German] - Brain Shift Collection - den Geist beruhigen: Power-Rhythmen für Heilung & Klarheit

Series: #1 of [German Edition] Brain Shift Collection

Author: Jeff Strong

Narrator: Jeff Strong

Format: Unabridged Audiobook

Length: 0 hours 55 minutes

Release date: December 10, 2018

Genres: Mindfulness & Meditation

Publisher's Summary:

Den Geist beruhigen: hier helfen dir klärende, entspannende Tempi dein mentales Geplapper loszuwerden und den verjüngenden Thetazustand zu genießen. Diese CD hilft dir dabei, deine Wahrnehmung zu verlagern, damit du deine chaotischen Gedanken loslassen und deinen Geist beruhigen kannst. Indem du das geistige Durcheinander beseitigst und d...

2018-12-1055 min

Access Essential Full Audiobooks in Health & Wellness, Medicine & Naturopathy[German] - Brain Shift Collection - den Geist beruhigen: Power-Rhythmen für Heilung & Klarheit by Jeff StrongPlease visithttps://thebookvoice.com/podcasts/1/audiobook/471835to listen full audiobooks.

Title: [German] - Brain Shift Collection - den Geist beruhigen: Power-Rhythmen für Heilung & Klarheit

Series: #1 of [German Edition] Brain Shift Collection

Author: Jeff Strong

Narrator: Jeff Strong

Format: Unabridged Audiobook

Length: 0 hours 55 minutes

Release date: December 10, 2018

Genres: Medicine & Naturopathy

Publisher's Summary:

Den Geist beruhigen: hier helfen dir klärende, entspannende Tempi dein mentales Geplapper loszuwerden und den verjüngenden Thetazustand zu genießen. Diese CD hilft dir dabei, deine Wahrnehmung zu verlagern, damit du deine chaotischen Gedanken loslassen und deinen Geist beruhigen kannst. Indem du das geistige Durcheinander beseitigst und d...

2018-12-1055 min

Access Essential Full Audiobooks in Health & Wellness, Medicine & Naturopathy[German] - Brain Shift Collection - Kraftvoll erfrischendes Schläfchen: Power-Rhythmen für Heilung & Klarheit by Jeff StrongPlease visithttps://thebookvoice.com/podcasts/1/audiobook/472001to listen full audiobooks.

Title: [German] - Brain Shift Collection - Kraftvoll erfrischendes Schläfchen: Power-Rhythmen für Heilung & Klarheit

Series: #5 of [German Edition] Brain Shift Collection

Author: Jeff Strong

Narrator: Jeff Strong

Format: Unabridged Audiobook

Length: 1 hour 1 minute

Release date: December 10, 2018

Genres: Medicine & Naturopathy

Publisher's Summary:

Kraftvoll erfrischendes Schläfchen - eine perfekte Lösung für die kleine Erholung zwischendurch. Du tankst Energie und fühlst dich präsent und wach! Diese CD ist eine Reise durch verschiedene Bewusstseinsebenen, die als 'kraftvolles Schläfchen' für dein Gehirn fungieren und dir dabei helfen, di...

2018-12-101h 01

Behind the Markets PodcastBehind the Markets Podcast: Nick Chamie & Michael PhilbrickGuests: Jeff Weniger - CFA serves as Asset Allocation Strategist at WisdomTree Nick Chamie, Chief Investment Officer, International Wealth Management at Scotiabank. Previously, he held the position of Global Head of FX Strategy & Emerging Markets Research at a major global investment bank, focused on investment strategy research for 17 years. Michael Philbrick - President and Portfolio Manager at ReSolve Asset Management. Prior to co-founding ReSolve in 2015, Mike was a Portfolio Manager at Dundee Private Wealth, Richardson GMP and Macquarie Private Wealth Hosted on Acast. See acast.com/privacy for...

2017-12-0154 minBehind the Markets PodcastBehind the Markets Podcast: Nick Chamie & Michael PhilbrickCo-Host:

Jeff Weniger - CFA serves as Asset Allocation Strategist at WisdomTree

Guests:

Nick Chamie, Chief Investment Officer, International Wealth Management at Scotiabank. Previously, he held the position of Global Head of FX Strategy & Emerging Markets Research at a major global investment bank, focused on investment strategy research for 17 years.

Michael Philbrick - President and Portfolio Manager at ReSolve Asset Management. Prior to co-founding ReSolve in 2015, Mike was a Portfolio Manager at Dundee Private Wealth, Richardson GMP and Macquarie Private Wealth

2017-12-0154 min

Behind the Markets PodcastBehind The Markets Podcast: Global TradeGuests: Brad Setser - a senior fellow and acting director of the Maurice R. Greenberg Center for Geoeconomics at the Council on Foreign Relations Jeff Weniger - Asset Allocation Strategist at Wisdomtree Hosted on Acast. See acast.com/privacy for more information.

2017-02-2454 min