Shows

Paladin Financial Talk8 Tips for Educating Yourself FinanciallyIn this episode we discuss 8 key tips to help you financially, now and for the future.

2025-04-1900 minPaladin Financial TalkLessons from the Millionaire Next DoorIn this episode, we dive into the key takeaways from The Millionaire Next Door and explore how its principles still hold strong when planning for retirement. From disciplined spending habits to living below your means, the book offers powerful insights into how everyday people build lasting wealth.

We discuss how these lessons can be applied to retirement planning—helping clients focus on long-term financial independence rather than flashy lifestyles. Whether you're advising high-net-worth individuals or everyday savers, this conversation is packed with practical wisdom that stands the test of time.

2025-04-1200 minPaladin Financial TalkDo You Need Disability Insurance?In this episode, we’re diving into the world of disability insurance – what it is, how it works, and whether it's the right choice for you. Whether you’re a young professional just starting your career or someone weighing the pros and cons of coverage, we’ll break down the basics of disability insurance, explore the different types of policies, and discuss common myths and misconceptions. You’ll learn how to evaluate your personal risks, understand the financial benefits, and determine if disability insurance is a necessary step in protecting your income and future. Tune in for expert insights and real-life...

2025-02-2200 minPaladin Financial TalkIs Your Financial Advisor a Robot?Do you have an algorithm for a financial advisor or investing? In this episode, we explore the use of "robo-advisors" and the rise of AI-powered financial advisors. We'll discuss the pros and cons of using them for financial advice, and whether it's the right choice for you.

2024-10-2600 minPaladin Financial TalkSolving Your Financial ChallengesIn this episode, we dive deep into common financial struggles and provide practical solutions. From managing debt to saving for the future, we offer expert advice and actionable steps to help you achieve your financial goals. Join us as we empower you to take control of your finances and build a brighter financial future.

2024-10-1900 minPaladin Financial TalkWhat is a fiduciary?In this episode, we explain what it means to be a fiduciary and why it’s important when choosing a financial advisor. We discuss how fiduciaries are legally required to act in your best interest, ensuring transparency and trust in financial planning. Plus, we highlight how Paladin, as a financial planning firm, can help you navigate your financial journey with personalized, client-focused strategies.

2024-10-1200 minPaladin Financial TalkFunding Long-Term CareIn this episode, we dive deep into the complexities of funding long-term care. Learn about the various options available, from traditional insurance plans to government assistance programs. Discover strategies to protect your assets while ensuring adequate care for yourself or loved ones in the future.

2024-09-2100 minPaladin Financial TalkNavigating Retirement Healthcare ExpensesPaladin Financial Talk is bringing you a three-part series on Funding Your Future: Navigating Retirement Healthcare Expenses. We will break down the basics, clarify common misconceptions, and provide practical tips to help you make informed decisions about your healthcare in retirement. Whether you're navigating Medicare enrollment, considering long-term care options, or planning for future health needs, this episode will equip you with the knowledge you need to feel confident in your choices. Tune in and take control of your retirement health journey!

2024-09-1400 minPaladin Financial TalkThe 4 Pillars of a Solid Retirement PlanIn this episode, we dive deep into the four essential pillars that form a strong retirement foundation. Discover how to balance savings and investments, understand the importance of risk management, explore the role of Social Security and pensions, and learn about the power of estate planning. Whether you're just starting your retirement journey or looking to optimize your existing plan, this episode has valuable insights for everyone.

2024-09-0700 minPaladin Financial TalkMenopause MadnessIn this episode of Paladin Financial Talk, Nikki Foley welcomes guest Sara Larson to the show. Using her extensive knowledge and a little humor, Sara will guide us through this crazy thing called menopause with knowledge, advocacy, and intention. Listeners will walk away with a better understanding of their power and how menopause affects financial decision-making, lifestyle choices, and long-term planning. Think this topic isn’t for you? All listeners can become more informed, compassionate, and supportive in their personal and professional relationships by tuning in to this episode!

Links:

https://www.saralarsoncoaching.com/

https://www.nytimes.com/2023/02/01/magazine/menopause-hot-flashes-hormone-therapy.ht...

2024-08-2400 minPaladin Financial TalkComplete Guide to Health and WellnessJoin hosts Nikki Foley and Tony Shore on Paladin Financial Talkl, where we provide a comprehensive guide to health and wellness and its critical impact on your financial plan. In this series in this series, We'll cover the essentials of managing chronic diseases and conditions, recognizing anxiety and depression, navigating menopause, and understanding their potential financial implications.

Stay tuned for upcoming episodes where we will continue to explore how various health issues can influence your financial decisions and provide actionable insights to help you maintain both your well-being and financial security. Whether you're planning for the future or dealing with...

2024-08-0300 minPaladin Financial TalkFrugal Living: Making it a LifestyleIn this episode, host Jeff Foley, CFP, and co-host Tony Shore discuss how frugal living can be a path to financial independence and early retirement. Listen to stories and strategies from those who have achieved financial freedom through disciplined saving and spending.

2024-07-2700 minPaladin Financial TalkThe Art of Frugal Living: Achieving Health on a BudgetIn this episode of Paladin Financial Talk, we provide listeners with tips and techniques for planning nutritious and delicious meals on a tight budget as well as staying fit without expensive gym memberships and more!

2024-07-2000 minPaladin Financial TalkCreative Ways to Save MoneyTired of the same old budgeting tips? This episode bursts the bubble on boring savings strategies. We'll explore unconventional ways to boost your bank account, from hacking your hobbies to becoming a savvy swapper. Tune in and discover how to make saving money exciting and effective!

2024-07-1300 minPaladin Financial TalkCan Frugal be Fun?Forget deprivation diets for your wallet! This episode dives into the surprising world of frugal living, where you'll discover how to save money without sacrificing enjoyment. We'll explore creative ways to stretch your dollars and unlock the fun that comes with being financially savvy.

2024-07-0600 minPaladin Financial TalkLiving the Dream? Buying Timeshares and RVs in RetirementToday, we're delving into a topic that's gaining popularity among retirees: the decision to purchase timeshares and RVs. These options offer unique lifestyle benefits, but how do they impact your financial plan and what are some of the pros and cons?

2024-06-2900 minPaladin Financial TalkWedding Planning with Jess SchoenToday, we have a special guest joining us to dive into a summer lifestyle topic of wedding planning! We will discuss the financial aspects of planning a wedding because, let's face it, weddings can have a significant impact on your financial plan if not properly managed or anticipated with your advisor.

2024-06-2200 minPaladin Financial TalkPlaying the Income Game in RetirementTired of the guessing game of how much you'll need in retirement? This episode breaks down sustainable income strategies, from pensions and Social Security to tapping your nest egg. Discover how to create a retirement income stream that lets you play for keeps, not just hope for the best.

2024-04-2700 minPaladin Financial TalkSide Hustles!Who says "extra cash" has to be extra work? We're breaking down the hottest side hustles that let you turn your passions and skills into profit, from pet sitting to online courses. Ditch the boring 9-to-5 grind and join us for financial freedom, one side hustle at a time!

2024-01-2000 minPaladin Financial TalkA Comprehensive Financial PlanFeeling lost in the labyrinth of investments, savings, and retirement woes? A Comprehensive Financial Plan is your roadmap to financial freedom.

Join us as we demystify financial jargon, build actionable strategies, and empower you to chart your own path to prosperity.

2024-01-1300 minPaladin Financial TalkPlanning for the Future - Income TaxesIn this episode Jeff and Nikki talk about the importance of planning for income taxes.

2023-10-0700 minPaladin Financial TalkHow to Start InvestingThe key to investing is to start now. If you're already investing that's great. But we talk about why it's good to invest early and often, as well as how to get started.

2023-09-3000 minPaladin Financial TalkWhen in doubt FAFSA!!!College can be expensive, and saving for it is a long-term goal for many. In this episode we talk about some college savings vehicles that families can consider.

2023-09-2300 minPaladin Financial Talk5 Tax Breaks to Help Parents Save MoneyThere are five areas of focus today: Adoption, Child Tax Credit, Dependent Care Savings Account, 529 Plans or other savings vehicles, and Hiring your Kids. Listen into Jeff and Tony as they discuss those 5 areas and how they may help you save money in the long run.

2023-09-0900 minPaladin Financial TalkFIRE! (Financial Independence, Retire Early)Are you thinking about retiring early? How about really early? In this episode we talk about the FIRE movement and the pros and cons of retiring early.

2023-09-0200 minPaladin Financial TalkHappy Transistion Into RetirementWe all want to have a happy retirement. Making sure we are prepared for the transition can be a big part of that. In this episode we talk about those transitions and how to be happy!

2023-08-0500 minPaladin Financial TalkMy Messy HouseIn this episode Jeff Quick talks about how to stay social, maintain friendships, and stay busy in retirement.

2023-07-1500 minPaladin Financial TalkLifestyle Planning - RelationshipsIn this episode Nikki and Jeff discuss retirement and lifestyle planning for couples.

2023-07-0800 minPaladin Financial TalkLiving La Vida Local - Things To Do This Summer in MNIn this episode we discuss a list of the best vacation and travel destinations right here in Minnesota!

2023-05-2000 minPaladin Financial TalkThriving in RetirementWe continue our lifestyle series and welcome special guest Ellie Robison to talk about the importance of having a goal for your retirement and how to plan for one.

2023-05-1300 minPaladin Financial TalkLifestyle Influences: Generational, Media, Education and More.In part one of our series on Lifestyle, Jeff welcomes Nikki Foley to the show. She discusses what a lifestyle is and how yours is defined. We discuss how your lifestyle relates directly to your financial and retirement planning.

2023-05-0600 minPaladin Financial TalkMaintain Family Harmony with Enhanced PlanningDuring this episode we’re going to discuss the importance of enhanced planning in relation to finances, taxes, and family life. This includes estate planning, legacy planning and more.

2023-04-2200 minPaladin Financial TalkAnnuities: The Good the Bad and The UglyIn this show Jeff and Jaime talk about annuities. What's good and what's not.

2023-04-0800 minPaladin Financial TalkMarket Update with Tyler EllegardTyler Ellegard from Gradient Investments joins to show to give a market update and talk about the fed rate hikes, inflation, and the recent bank failures.

2023-04-0100 minPaladin Financial TalkUnderstanding InvestmentsIn this episode we talk about asset diversification and what you need to know about your investments and savings.

2023-03-2500 minPaladin Financial TalkTaxes and the Power of When Pt. 1Have you ever opened an investment account? A 401(k), 403(b), IRA … If so, you made a financial, tax and estate decision in this one action. In this episode we talk about why taxes play such a big roll in financial and retirement decisions.

2023-02-2500 minPaladin Financial TalkWhat the heck is a MYGA?In this episode the two Jeffs talk about MYGA's... what they are and why you might want them to be a part of your financial plan.

2023-02-1100 minPaladin Financial TalkThe Paladin PlanIn this episode we go over the Paladin Plan for your financial future. It's the process you need to know to help get your finances in order. Find out more here: https://financialpaladin.com/

2023-01-2800 minPaladin Financial TalkBiggest Tax Legislation in 3 years - The Secure Act. 2.0In this episode we welcome special guest Jaime Malm to discuss some of the key changes you need to be aware of from the new Secure Act 2.0.

2023-01-0700 minPaladin Financial TalkYear-End Tax Planning and a Peek at 2023Jeff welcomes special guest and CPA Jeff Stovall to talk about taxes, changes and strategies.

2022-12-1700 minPaladin Financial TalkSpecial Guest Jay Guerin, President of Gradient Life BrokerageJeff Quick is leading the charge today and he has guest Jay Guerin, president of Gradient Life Brokerage, on the show to discuss the different types of life insurance and how they may help you out.

2022-11-2600 minPaladin Financial TalkUnderstanding InvestmentsFrom stocks to taxes to other types of accounts, there's a lot to understand about your investments. We talk about the basics and strategies that you need to know.

2022-11-0500 minPaladin Financial TalkWho, What & Why of IRA'sThe 2 Jeff's discuss what you need to know about IRA's.

2022-10-2200 minPaladin Financial TalkEnd of Year Tax ReviewNow is the time to look at your finances and figure out your tax situation. We talk about important steps to help with you tax situation.

2022-10-1500 minPaladin Financial TalkMarket Commentary with Jeremy BryanJeremy Bryan, Senior Portfolio Manager for Gradient Investments, LLC, joins the show to give his views on the market, where we are now, and where we may be headed in the future.

2022-10-0100 min

Artist Interviews on Maverick 100.9Jeffery Allen Imler Interviews September 2022Jeffery Allen Imler makes Corliss cry in today's interview for the BEST reasons!

2022-09-2609 minPaladin Financial TalkEstate Planning 101Estate Planning is the #1 thing people put off, but doing so can also be the biggest and costliest financial mistake you can make. We talk about that and what you can do about it.

2022-09-2400 minPaladin Financial TalkStudent Loan DebtIn this episode Jeff welcomes special guest Ellie Robinson to talk about student loans, their background and how to deal with student load debt.

2022-08-2000 min

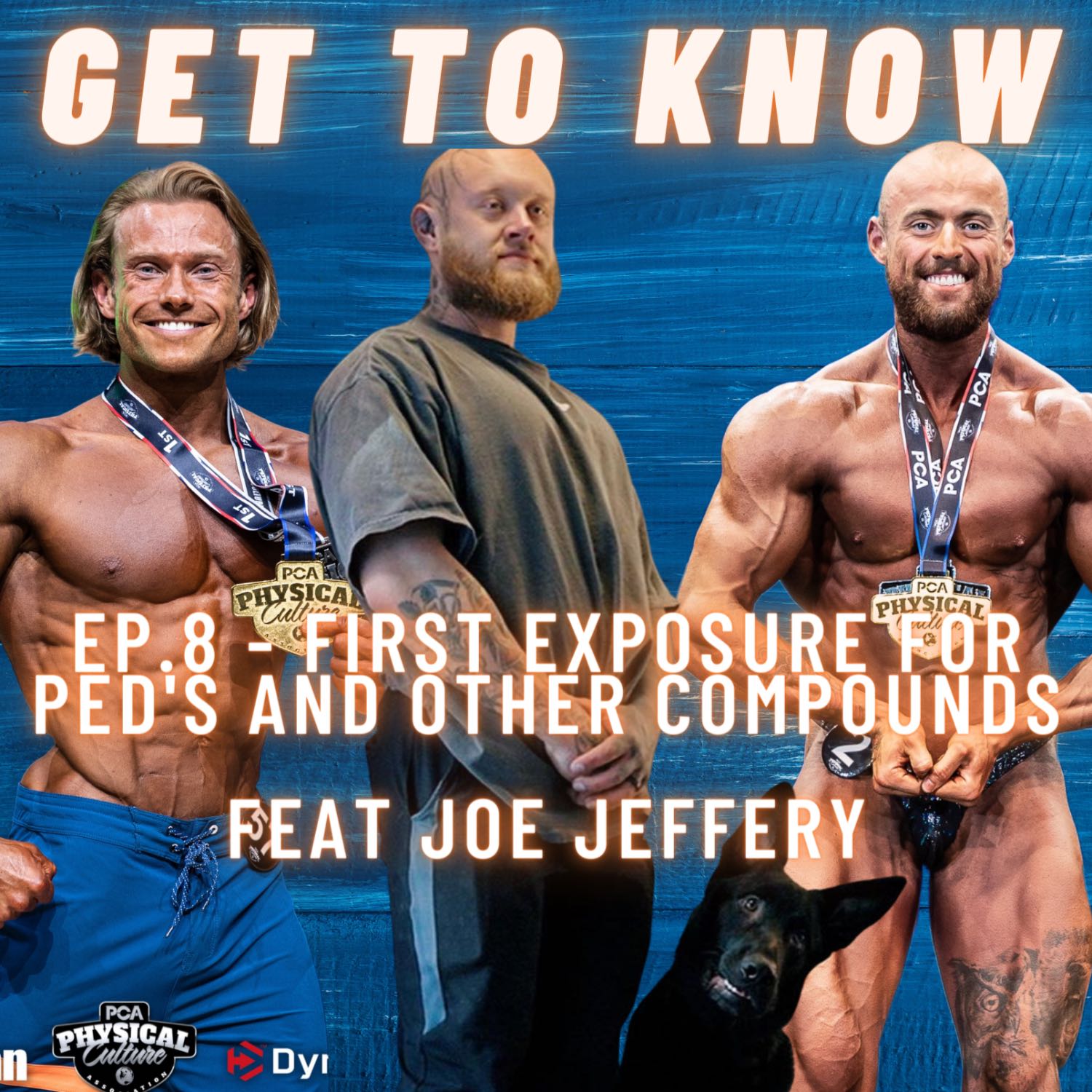

Get to Know - with Dallen and AlexEp. 8 - Your First Exposure to PEDs feat. Joe Jeffery | When, What and How Much To UseWe had the pleasure of having mr. Joe Jeffery on the podcast today discussing when, what and how much drugs to use for your first exposure to PEDs should you wish to go down this path. We also discussed potential implications and alternative pathways and drugs available you may consider instead of or alongside these drugs. If you wish to learn more about this topic, we strongly recommend joining The Physique Collective subscription site (only £7pm) and you can access a free 7-day trial here : app.physiquecollective.com/register/?pa=FREETRIAL

2022-08-1450 minPaladin Financial TalkWhat’s your favorite flavor of ice cream?In this episode we talk about about how your favorite ice cream relates to your finances... along with some helpful financial tips!

2022-08-1300 minPaladin Financial TalkHow Do I Know When It’s Time to Retire?During this episode, we’re going to discuss and analyze some of the most common signs that you’re ready to retire.

2022-07-3000 min

MentorCoreEpisode 15: Jeff PealJoining us this week is Jeff Peal, Information Security Officer at Sullivan Potter. Jeff joins us today to talk about these great topics:

The importance of curiosity and wanting to knowhow things work when in information security

Resources available for learning more about how systems work

What is exciting in information security right now?

Key tips for people entering or wanting to enter the information security field now

How does wellbeing fit into our own lives and creating the culture of wellbeing for teams?

And, of course, we learn the best advice that Jeff has ever gotten...

2022-07-0827 minPaladin Financial TalkWhat's Up with Inflation?Inflation, the markets and rising interest rates have people concerned about their finances. In this episode we tackle the problems and possible solutions to help you with your finances and retirement income.

2022-06-2500 minPaladin Financial TalkMarket Update - This is Bear CountryThe market has fallen into bear territory. But what does that mean for you and your finances? In this episode Jeff talks about ways to deal with the market volatility and what to avoid.

2022-06-1800 minPaladin Financial TalkRetirement Checklist Part 2What are the most important things you need to do and know before you retire? We continue our countdown of the top 8 things you need to know.

2022-06-0400 minPaladin Financial TalkRetirement ChecklistWe go over the things you need to know and do to have a successful retirement.

2022-05-2800 minPaladin Financial TalkDifferent Strategies of Annuitization - Getting the Most Out of Your AnnuityWhat if you have an annuity that's not right for you? In this episode Jeff welcomes Trevor Neufeld to help discuss strategies to get the most out of your annuity.

2022-04-2300 minPaladin Financial TalkAnnuities - The Good, The Bad, and The TruthWhen people hear the word annuity they almost immediately have a strong reaction either good or bad. What is an annuity and Why are they often polarizing?

2022-04-1600 minPaladin Financial TalkThe Baby Boomer DilemmaIn this episode Jeff welcomes special guest Jaime Malm to discuss the new documentary, The Baby Boomer Dilemma and the path to a comfortable retirement.

2022-04-0900 minPaladin Financial Talk6 Investment Tips That Can Reduce Worry in RetirementIn this show Jeff covers 6 investment tips that could help reduce your worry in retirement.

2022-04-0200 minPaladin Financial TalkGeopolitical Risk - Russia/Ukraine (with special guest Jeff Quick)In this episode Jeff welcomes special guest, Financial Planner Jeff Quick, to discuss inflation and the geopolitical risk of a global economy.

2022-03-1200 minPaladin Financial TalkPlanning Your Income NeedsWhen planning for retirement the biggest question people have is do I have enough money to retire? Jeff welcomes special guest Trevor Neufeld to talk about tips and strategies to help you figure out how much you might need to retire.

2022-02-1900 minPaladin Financial TalkWho's Driving Your Retirement PlanDo you have a comprehensive retirement plan that addresses: income, risk, tax minimization, insurance needs, legacy and estate planning? How often is that plan being updated? We discuss strategies to help you achieve this goal to have a complete financial and retirement plan.

2022-02-1200 minPaladin Financial TalkAre you ready for RMDs?During this show, we’re going to first look at some of things you need to know about RMDs and then in our final segment we’ll discuss some of the financial mistakes that could put your retirement at risk.

2022-02-0500 minPaladin Financial TalkDon't Go Mad When The Market DoesIn this episode Jeff talks about market volatility and strategies to use to help avoid emotional mistakes with your money.

2022-01-2900 min

FIND US ON THE DEEP TWO PODCASTING NETWORK#79 2nd Annual Kyrgiosfest & Grayson Allen go to hellIt's that time of year where the streets of Melbourne fill with the exasperated grunts of tennis players and the racist groans of Fairfax columnists. Lukas and Marco celebrate pod idol Nick Kyrgios, dissect the latest "thinkpiece" moaning about his "antics" and pat themselves on the back for cancelling Novak Djokovic over his donkey milk monopoly a year ago. Then, after Grayson Allen's awful foul on Alex Caruso, should he even be in the league? Plus: Bryn Forbes join the Nuggs and Marco suggests another trade to Lukas.

2022-01-2458 minPaladin Financial TalkSocial Security COLA is on the riseDuring this episode, we’re going to break down the recent news that Social Security’s Cost of Living Adjustment will go up by 5.9 percent in January 2022. We’ll also look at some Social Security and retirement strategies.

2021-12-0400 min

Flipboard EDU PodcastEpisode 61: Josh Allen and CurationJosh Allen is the technology integration specialist and unofficial communication specialist at Lewis Central. He is a former president of the Nebraska Educational Technology Association, Nebraska’s ISTE affiliate, and an ISTE Making It Happen Award winner. He is an avid Flipboard user like myself and uses it in many unconventional ways, including teachers’ professional development, school-to-community communication, and curating exceptional content to share with students.In this episode, we speak to Josh about using Flipboard as an educator. We discuss how it allows him to share and curate useful content from across the web. We also spea...

2021-11-2229 min

Flipboard EDU PodcastEpisode 61: Josh Allen and CurationJosh Allen is the technology integration specialist and unofficial communication specialist at Lewis Central. He is a former president of the Nebraska Educational Technology Association, Nebraska’s ISTE affiliate, and an ISTE Making It Happen Award winner. He is an avid Flipboard user like myself and uses it in many unconventional ways, including teachers’ professional development, school-to-community communication, and curating exceptional content to share with students.In this episode, we speak to Josh about using Flipboard as an educator. We discuss how it allows him to share and curate useful content from across the web. We also spea...

2021-11-2229 min

Flipboard EDU PodcastEpisode 61: Josh Allen and CurationJosh Allen is the technology integration specialist and unofficial communication specialist at Lewis Central. He is a former president of the Nebraska Educational Technology Association, Nebraska’s ISTE affiliate, and an ISTE Making It Happen Award winner. He is an avid Flipboard user like myself and uses it in many unconventional ways, including teachers’ professional development, school-to-community communication, and curating exceptional content to share with students.In this episode, we speak to Josh about using Flipboard as an educator. We discuss how it allows him to share and curate useful content from across the web. We also spea...

2021-11-2229 minPaladin Financial TalkFrightful Mistakes That Could Haunt Your RetirementOn this fiendishly fun episode, we’re going to thrill you and chill you with frightful mistakes that could haunt your retirement.

2021-10-3000 minPaladin Financial TalkProtect yourself, and your money, from scamsDuring this episode, we’re going to highlight some common financial scams and what you can do to better protect yourself and your money.

2021-10-1600 minPaladin Financial TalkWorking in RetirementThis episode focuses on part-time jobs that may be a perfect fit for retirees because they provide enjoyment and socialization in addition to income.

2021-09-2500 minPaladin Financial TalkTaking StockIn this episode Jeff talks about taking stock of your financial situation and the questions you need to be asking.

2021-08-2800 minPaladin Financial TalkFinding Money in RetirementDuring this show, we’ll examine some ways you may be able to find extra cash after you’ve retired, in a variety of options.

2021-08-0700 minPaladin Financial TalkRetirement and Financial Steps at Ages 50 and 65During this show, we examine some of the financial resources and possibilities that are available to you at the very important ages of 50 and 65.

2021-07-3100 minPaladin Financial TalkRunning your personal finances like a businessDuring this episode we discuss how running your personal finances like a business makes sense. It's accounting 101, using the two main reports for any business. Balance Sheet and Income Statement (P and L). The same applies to your personal finances.

2021-07-1000 minPaladin Financial TalkWhat Mt. Everest Can Teach YouIn this episode Jeff talks about people that are at or near retirement and are trying to determine what they're going to do with their assets going forward. We talk about the risks and tips that can hopefully help you properly handle your assets for retirement.

2021-05-0800 min

Hip Hop Marvels PodcastINBETWEENERS: ALL CAPS - MF DOOM Web Comic (Troy Jeffery Allen, Maia "Crown" Williams & Sean "SMACK!" Mack)Hip Hop Marvels Podcast INBETWEENERS, showcasing MARVELous people doing MARVELous things within the culture! This time Dub chops it up with writer, publisher, producer extraordinaire... Troy Jeffery Allen, executive manager, CEO & founder of MECCAcon... Maia "Crown" Williams & illustrator... Sean "SMACK!" Mack about their new six page MF DOOM web comic, "ALL CAPS" which is FREE & dropped all across the net on 4/20! "WE GOT IT LOCKED FROM THE BLOCK TO THE COMIC SHOP!" 🗨️💥ALL CAPS... In the wake of his passing last October, the true life story of MF DOOM (real name: Daniel Dumile) has been the topic of many...

2021-05-0458 min

The Short Box Podcast: A Comic Book Talk ShowEp.319 - PREVIEWS World w/ Troy Jeffery-AllenTroy Jeffery-Allen is an Editor & Content Manager for PREVIEWS World, home of the monthly catalog: PREVIEWS, which contains hundreds and hundreds of pages of upcoming comics and related merchandise, and a pop culture network of the same name. Troy joins Badr and Cesar this week to chat about the perks of the job, comic journalism and his new MF DOOM tribute comic, which is available to read for FREE at CreateTheCulture.Today Like our content and want to support the show? Join our Patreon community and get access to tons of bonus content!

2021-04-211h 35Paladin Financial TalkWhy Work with a Financial AdvisorIn this episode we talk about the benefits of working with a financial advisor and how they can help you with a financial plan for your future.

2021-04-1700 minPaladin Financial TalkRoth Conversion: Is Now The Time?In this episode Jeff talks about Roth Conversions with helpful tips to consider when converting your traditional retirement account to a Roth. Register now for our online seminar to learn more on this topic! Go to Webinar registration link: https://rb.gy/lyio6t You can also register by calling 651-842-8406 or email us at info@financialpaladin.com

2021-04-0300 min

The Hot Ticket Cigar PodcastEP 191 - Jeffery & Chris (Owners of Amendola Cigars) Interview!We welcome to the show for the first time, Jeffery Amendola & Chris Monaco, Owners of Amendola Cigars. We talk about how it all got started, how they weathered the FDA scare and the COVID-19 pandemic and their big plans for the future. All on this week's episode of "The Hot Ticket"

***Please subscribe, rate, & review!***

Check out our website @

www.hotticketweekly.com

Reach us at:

IG Chris - hotticketchris

IG Cory - thehotticketpod

Check out our show sponsor MyCigarPack.

www.mycigarpack.com

2021-03-291h 44Paladin Financial TalkJust Be YourselfTo be yourself you need to understand. Socrates: “To know thyself is the beginning of wisdom.” In this episode we talk about translating this to our finances and retirement plans.

2021-03-1300 minPaladin Financial TalkAdulting Sprint: Choose Your AdventureRemember those choose your adventure books you read as a kid? In this episode Jeff makes a financial version and shares some adulting goals for your consideration.

2021-03-0600 minPaladin Financial TalkRandom Acts of Financial PlanningIn this episode Jeff tackles a number of financial planning topics, from market volatility, retirement accounts and more!

2021-01-2300 min

Calgary Business PodcastOpen People Network | CEO and founder, JP -- Jeffery Potvin (episode 226) | 12 January 2021Jeffery (also known as Jeff or JP) has been “Open” with startups and founders for a long time, dating back to his days as an internal IT / dev guy for the Loblaw’s grocery chain. In those days, Jeffrey used his server room to meet with startups that “pitched” their ideas for the Loblaw ecosystem; fast forward a few years and now Jeffery and his Open People Network (“OPN”) team use Zoom, YouTube, Podcasts and social media to bring entrepreneurs and investors together.

Jeffery did get on the end of the Kaboose, drove down Route 15 and made a HardBoot befo...

2021-01-121h 13Paladin Financial TalkGetting an Estate Plan in PlaceIn this episode Jeff welcomes special guest and estate planning attorney Matt McClenahan from the Orchard Law Firm. They discuss the importance of estate planning and what you need to know about it.

2020-12-0500 minPaladin Financial TalkWhat impact is the election having on the markets?In this episode Jeff talks about the elections and the impacts it has on the market and why having a solid plan helps.

2020-11-0700 minPaladin Financial TalkWhat You Need to Know About AnnuitiesDuring this episode, we’ll be taking a close look at annuities to define exactly what they are, how they work, how much they cost and how to determine if they may fit your overall financial strategy. While an annuity may be able to provide lifetime income, there’s plenty of nuance, as well as risks, that you should be aware of.

2020-08-0800 minPaladin Financial TalkPink carseats are ok and what You Should Know About Life InsuranceDuring this episode, we’ll discuss some of the critical things that life insurance beneficiaries should know, including what happens if a policy has lapsed and when you can expect to receive your payout. Additionally, we discuss the pros and cons of both permanent and term life insurance. Oh, and Jeff talks about a pink carseat.

2020-07-2500 minPaladin Financial TalkPreparing for Retirement as a CoupleLooking toward retirement should be a time of optimism and excitement for couples. But in reality, there are numerous traps and obstacles standing between couples and a fulfilling retirement. Yet, with some honest conversations and comprehensive strategizing, couples can view their impending retirement with confidence.

2020-07-1800 minPaladin Financial TalkRetirement Ready Part 3 - Creating Your Personalized Retirement PlanYou need a custom financial plan for a successful retirement. In this episode we discuss the bucket methods you can use to achieve your goals. We cover the account types and the tax ramifications of each.

2020-06-2700 minPaladin Financial TalkRetirement Ready Part 2 - Maximizing Social Security and PensionsMost Americans will have Social Security to help with retirement and some may also have a pension, but what most people don't realize is that there are ways to get more money from Social Security and ways to maximize your pension. In this episode we talk about this and the strategies you can use.

2020-06-2000 minPaladin Financial TalkInvestment Strategies That Provide Protection and GrowthIn this episode we talk about an exciting strategy that many people are using to help protect their retirement next egg and still have the opportunity for meaningful participating in market gains.

2020-06-1300 minPaladin Financial TalkCOVID-19 financial strategiesWhile dealing with the COVID-19 economy, you may be able to stabilize your finances by setting clear financial goals, setting priorities and more.

2020-05-3000 minPaladin Financial TalkWhy target date funds miss the markIn this episode Jeff talks about the pros and cons of target date funds and why it's important for you to understand what they are and how they work and how they can affect your retirement plans.

2020-05-1600 minPaladin Financial TalkAvoiding Social Security ScamsEvery once in a while, we hear about a new Social Security scam that targets retirees and pre-retirees. The latest version is another reason to be cautious about who you talk to and what you say.

2020-05-0900 min

Backstage PassInterview with Kendall Shaffer and Jeffery Allen ImlerAustin James talks with South Louisiana residents and songwriters Kendall Shaffer and Jeffery Allen Imler on Backstage Pass

2020-03-1319 min

Not Just A Bikini GirlResistance, The Mind & Competing Feat Soph AllenSoph Allen is an Australian fitness girl boss (in a nutshell). Having competed herself in WBFF and helped thousands of girls both mentally and physically. We spoke about her latest project (which was under construction at the time), her competing journey and why the mind is so important to getting everything you want out of life!

Content Includes:

Who is Soph?

Her competing background

Resistance to tracking & how this can affect your mindset into prep

Taking a long off-season, the pros and cons

Her new project which is now LIVE / the deets

The skills you can learn and why it’s...

2020-01-2543 min