Shows

GamerGeeks PodcastDoom En Oblivion Obsessie - GamerGeeks Podcast #286Uitgever Bethesda heeft de vrije uren van vele gamers in hun greep. Mede door The Elder Scrolls IV: Oblivion Remastered, maar nu ook dankzij de release van Doom: The Dark Ages. Kan dit derde deel in de Slayer-trilogie tippen aan Doom 2016 en Doom Eternal? Jim geeft zijn oordeel!Daarnaast nieuws over Marathon, de nieuwe shooter van Bungie lijkt in de nesten te zitten. Jade Raymond, hoofd van Haven Studios vertrekt na tegenvallende speeltests omtrent Fairgame$ en Naughty Dog werkt aan meer dan Intergalactic: The Heretic Prophet! --VRAAG V/D SHOW:...

2025-05-232h 00

Vlevo doleBabiš hraje pinec, Fiala je sigma. Kdo získá srdce mladých?Nikdy nikoho nezajímali, teď se o ně přetahují všechny politické strany. Na mladé lidi, kteří letos půjdou poprvé ke sněmovním volbám, si dělá největší zálusk koalice Spolu a hnutí ANO.Čím to? Jednak poprvé přijdou volit relativně silnější ročníky - prvovoličů může být letos u uren až 240 tisíc. Jednak se v Česku rozděleném na vládní a protivládní tábor už nové voličské skupiny hledají těžko.„Také padl ten mýtus, že mladí lidé nechodí volit. V posledních letech se naopak m...

2025-04-0245 min

The Year You RetireDo I Have to Pay Taxes on My Social Security Income?Join hosts John Bever and Jim Uren in episode 17 of The Year You Retire podcast as they tackle the crucial question: "Do I have to pay taxes on my Social Security income?" This episode dives deep into the intricacies of how the IRS handles Social Security in retirement, offering valuable insights on how to minimize or even eliminate these taxes. The duo also sheds light on the infamous "Social Security tax torpedo," explaining how it can significantly impact your tax bill and what you can do to avoid it.Listen in for practical advice, historical trivia, and...

2024-06-2432 min

The Year You RetireReduce Your RMD Tax Hit: Essential Tips for RetireesAre you feeling lost with the new required minimum distribution (RMD) rules for IRAs and qualified retirement plans? Do you know when you have to start taking your RMDs and how much you need to withdrawal? Do you want to discover strategies to reduce your taxes on these distributions? Tune in to this episode for clear explanations and actionable advice! We'll cover the essentials of RMD regulations, how to navigate your lifetime income tax brackets, the impact of the Social Security tax torpedo, and smart ways to minimize your lifetime income taxes. Plus, we’ll reveal our top recommendation fo...

2024-06-0336 min

The Year You RetireShould I Pay Off My Mortgage Before I Retire?Did you know that paying off your mortgage before you retire might not always be your best move? In this episode of The Year You Retire, Jim Uren and John Bever delve into the hot topic of whether to pay off your mortgage before retiring. They discuss the advantages of being mortgage-free, such as potential interest savings and improved cash flow, but also emphasize the liquidity risk and misunderstood historical fears associated with mortgages. They discuss the importance of considering individual financial goals, risk tolerance, and overall liquidity when making this decision. They also touch on the...

2024-04-2931 min

The Year You RetireHow to Save Big on Your Capital Gains Tax BillDid you know that your retirement years are often accompanied by large capital gains tax bills? Do you know if you have the proper strategies in place to help reduce the damage that capital gains taxes can have on your portfolio? If you’re not sure you’re doing all you can to save big on your capital gains tax bill, then this episode is for you.In this eye-opening episode of The Year You Retire podcast, hosts John Bever and Jim Uren delve into the intricacies of capital gains taxes and the strategies you can use to hel...

2024-04-1532 min

The Year You RetireGetting the Most Out of Social Security Spousal BenefitsAre you married, widowed, or divorced? If so, then you may be eligible to receive Social Security Benefits based on your spouse's or former spouse's work history even if you have also earned your own Social Security benefits. But unfortunately, understanding and claiming these benefits can be very complicated. And once you request benefits, the Social Security administration rarely lets you fix a mistake, even if that mistake means you miss out on thousands of dollars of income every year in retirement. So be sure to listen to this entire episode to make sure you have all of the kn...

2024-04-0142 min

The Year You RetireTo Convert or Not to Convert: How to Know if a Roth Conversion is Right for YouAre you looking for a tax strategy that may help reduce the amount of taxes you pay during retirement? How about a strategy that may help increase the lifespan of your retirement portfolio? If so, then a Roth conversion may be the right move for you.In this episode of The Year You Retire, hosts John Bever and Jim Uren delve deep into the world of Roth conversions. They reveal the potential tax savings that a well-timed Roth conversion can provide during the retirement years. Through their insightful conversation you’ll gain valuable knowledge and practical strategies to hel...

2024-03-1837 min

The Year You RetireA Guided Tour Through Our Financial Planning ProcessHave you thought about working with a financial planner, but you’re just not sure what to expect? Have you thought you might benefit from creating a financial plan, but you just don’t know what the process might be like or if it would even be helpful? Wonder no more. In this episode you’ll be given a guided tour through the financial planning process at Phase 3 Advisory Services.Join hosts John Bever and Jim Uren as they reveal each step of the financial planning process that they follow with every client. From your initi...

2024-03-0432 min

Justin Moorhouse About 30 Minutes No More Than 45Don't Be So 'Dad' About ItThis week, Justin catches up Tony Carroll, Ambrose Uren, Anna Beros, and Barca Jim. We hear from the front row-ers in Darwen, and Izzy tells us about her friend's new theatre group. Get in touch, #AskIzzy, or Dear Jon here: WhatsApp – 07495 717 860 Twitter – @3045podcast Email – podcast@justinmoorhouse.com THIS WEEK'S GUESTS: Tony Carroll: https://www.hotwatercomedy.co.uk/comedian/66/tony-carroll/#:~:text=Tony%20Carroll%20had%20been%20performing,win%20various%20competitions%20and%20accolades. Anna Beros: https://www.annaberos.com/

2024-02-2748 min

The Year You Retire7 Primary Retirement PredatorsIn this episode of The Year You Retire, hosts John Bever and Jim Uren reveal their list of the seven primary retirement predators. These retirement predators are the biggest threats to your financial lifestyle in retirement and it is critical that you prepare yourself against the potential damage they can cause. So listen along as John and Jim discuss each of the seven predators and provide practical steps you can take to help protect yourself. With a friendly and relatable approach, they share real-life examples and their professional insight, making this episode an essential resource for individuals approaching retirement.

2024-02-1934 min

The Year You RetireBudgeting Tools and AppsThe buzz about Mint exiting the market has sent shockwaves through its user base, leaving many in search of a worthy alternative. Whether you've been a dedicated Mint user or are just diving into the world of budgeting apps, we've got you covered in this episode.The silver lining? There's a plethora of apps ready to empower you in taking charge of your spending and to help kick start your savings journey. However, with the sea of options out there, navigating through the information overload to find the perfect app for you can be a bit overwhelming.

2024-02-0540 min

The Year You RetireFinancial Advisor or DIY?In this episode, Jim Uren and John Bever discuss the decision of using a financial advisor versus managing retirement planning on your own. They cover the advantages and disadvantages of both approaches, highlighting the cost-saving potential and personal enjoyment of the DIY method, but also cautioning about the time and potential for costly mistakes. On the other hand, they emphasize the expertise and knowledge that financial advisors bring to the table, along with the potential for costly mistakes. However, they also address the drawbacks, including the cost and the possibility of working with the wrong advisor. Jim and John...

2024-01-2345 min

The Year You RetireGetting the Most Out of Your Charitable GivingJoin John Bever and Jim Uren in this episode of "The Year You Retire" podcast as they tackle the topic of Getting the Most Out of Your Charitable Giving. Enjoy their friendly and approachable style, as you discover strategies like bunching charitable contributions and using donor advised funds, with real-life examples. Get inspired, informed, and uplifted with valuable insights on optimizing your charitable contributions for maximum tax benefits. In this episode, you will be able to:Learn why claiming the standard deduction may eliminate the tax advantage of your charitable giving.Uncover the potential advantages of bunc...

2024-01-0830 min

The Year You Retire7 Principles of Retirement HappinessIn this episode of The Year You Retire podcast, hosts John Bever and Jim Uren delve into the topic of retirement happiness, drawing from extensive research and insights to provide valuable takeaways for retirees. Listen along as they discuss the positive trend of happiness during retirement and emphasizes the importance of finding meaning and purpose beyond your financial circumstances. Explore the transformative aspect of aging, the complex relationship between money and happiness, the role of relationships in retirement happiness, and the potential benefits of religious involvement. Furthermore, discover the positive impact that volunteering and practicing gratitude can have in...

2024-01-0139 min

The Year You RetireNavigating the Medicare MazePlanning for retirement involves navigating the complexities of Medicare sign-up, a process that can be confusing and lead to regrettable mistakes. Join hosts John Bever and Jim Uren as they break down key decisions, such as choosing between traditional Medicare and Medicare Advantage, understanding when to sign up, and avoiding enrollment penalties. They'll also address the need for separate prescription drug coverage and provide valuable insights to help you make informed choices. Tune in to gain essential knowledge, recognize pitfalls, and successfully navigate the Medicare maze with confidence.In this episode, you will be able to:...

2023-12-2532 min

The Year You RetireGetting The Most Out of Social SecurityDeciding when to start claiming your Social Security retirement benefits is one of the biggest decisions you need to make in the year you retire. In this episode of The Year You Retire, hosts John Bever and Jim Uren will help you discover how you can get the most out of your individual Social Security benefits. With a laid-back and personable tone, they delve into key considerations such as the irrevocable nature of Social Security decisions, the earnings limit, timing of benefit payments, and the advantages of delaying benefits. Offering practical insights, the hosts stress the importance of individual f...

2023-12-1841 min

The Year You RetireHow Can I Earn More on My Short-Term Savings?In the year you retire, you need to make sure that you are well versed in the world of short-term investments. So in this episode, we’ll explore the short-term investment options that you should consider adding to your retirement planning arsenal. We’ll guide you through the financial thrill ride of different bond types and the potential benefits that may help boost your earnings. We’ll also discuss FDIC insurance and the pros and cons of brokered CDs. And we discuss the tax implications and various levels of investment security. In this episode, you will b...

2023-12-1848 min

The Year You RetireHead-to-Head Battle of the IRA vs 401kOne of the key decisions you need to make in the year you retire is what to do with the money in your 401(k). In this episode hosts John Bever and Jim Uren bring you the epic battle of the IRA versus the 401k. Do you leave all of your hard earned money in the 401(k)? Or do you move it into an IRA? Hold on to your seats as we unveil the thrilling pros and cons of each option. And be sure to listen until the end to discover the special circumstances that, if they apply to you, wi...

2023-12-1841 min

The Year You RetireWhat's This Going to Cost Me?If you're feeling overwhelmed by the uncertainty of retirement expenses and struggling to find an accurate estimation, then you are not alone! Many individuals nearing retirement are taking generic approaches, relying on rough estimates or outdated advice, which often leads to financial unpreparedness and anxiety about the future. Instead of achieving the desired result of a clear understanding of retirement expenses, they find themselves stuck in a cycle of guesswork and worry. But fear not, there are proven methods available to help you accurately calculate your retirement expenses and achieve better financial preparedness.In...

2023-12-1840 min

The Year You RetireTrailerLearn the purpose behind The Year You Retire podcast and discover the topics to be covered in future episodes.

2023-11-1406 min

GamerGeeks PodcastBonusaflevering: Duitsers achter het stuur, Schnitzels & AnimeBONUSAFLEVERING!!

Als je bezoeker bent van Gamescom, dan weet je dat er nok de Duitse gaming beurs een aantal elementen horen. Eentje daarvan is file rondom het beursgebouw de Koelnmesse. De ene wat groter dan de ander...

GamerGeeks Jim, Vincent en Rocky zaten op één van de beursdagen al uren in de auto en besloten hun frustraties op te nemen wat resulteerde in gesprekken over Animé, Schnitzels, Duitsers achter het Stuur en mooie levenslessen.. of spekkies.

2023-09-241h 03

Beter Worden#77 TRAININGSKAMPTrainen, eten, slapen. Elke wielrenner - amateur of prof - heeft er wel eens mee te maken gehad of er stiekem over nagedacht, een trainingskamp. Ook wel ‘fietsweek’ genoemd in sommige gevallen. Want of je nou lange tijd naar het buitenland trekt om beter te worden of je probeert zoveel mogelijk uren te maken tijdens de vakantie met je gezin, iedereen heeft er wel vragen over. Zo bleek uit de uitpuilende Beter Worden mailbox. De vragen die de heren deze week beantwoorden zijn onder andere: wanneer is iets nu eigenlijk een trainingskamp? Hoe deel je zo’n week...

2023-05-281h 00

IBRT PlaysRum Runner Sue: For Whom the Wedding Bell Tolls

This has been, Rum Runner Sue, for whom the wedding bell tolls. Our play starred Billie Jo Konze as Sue, Trelawney Erwin as Mary, Timothy Uren as Harry and Big Sam, Jim Yount as Beau, Diane Adams as Madam Rose, Charis Boyer as Myrtle the maid, and Justin Kapla was your announcer, and Al. Other voices provided by the talented cast. Tonight’s script written by Jeffrey Adams. Jeffrey also did the editing, sound effects and partial music for this episode created with loops from Loopmasters. Some sound effects from The FreeSound Project at Freesound dot org. The son...

2023-04-1800 min

Being A Dad...On PurposeSaving For Education:A Conversation with Jim Uren-Financial AdvisorIn this current economic climate we want to be sure we are making wise decisions with our finances, especially when it comes to saving for our kid's education. Jim Uren, Financial Advisor for Phase 3 Advisory Services and Royal Alliance Services joins me to answer some questions about saving and specific funds to consider.

Intro music by: IEarn Fist Check out his music and shoot some support his way!

2022-06-1724 min

Wednesdays With Watson: Faith & Trauma Amy Watson- PTSD Patient-Trauma SurvivorAdopting Trauma: Bi-Racial Adoption With Jenn Uren, life in a multi-cultural familySend a textCONTACT AMYCONTACT Jenn Uren, This Mom Knows PodcastWhat are the dynamics in multi-cultural families? What about the trauma that is sure to come with any adoption? How does society receive white families who adopt outside their race? How does the black and brown community feel about it? How does society as a whole feel about it? Curator of the This Mom Knows Podcast, Jenn Uren and her husband, Jim, got the surprise of their lives after raising three biological children. Jenn tells us the story o...

2022-06-1552 min

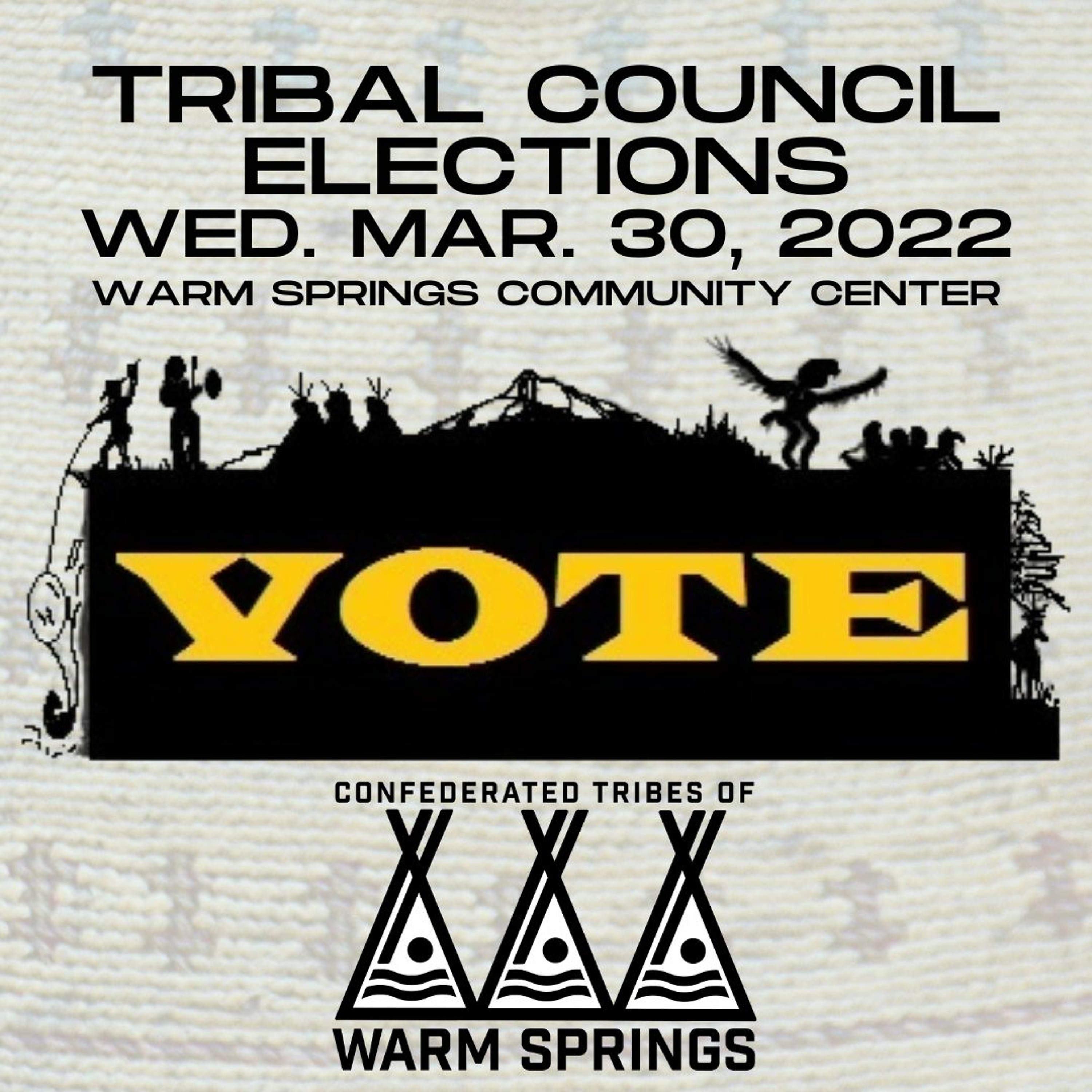

KWSO RadioJim Manion CTWS TC Candidate - KWSO Warm Springs Program PodcastPodcast Versions of those running for Tribal Council for the Confederated Tribes of Warm Springs.

Election Day is March 30, 2022 for CTWS Tribal Membership to vote on the members of the 29th Tribal Council. Voting will be 8am - 8pm at the Warm Springs Community Center

Agency Candidates (3 seats)

• Rain Circle

• Michael Clements

• Reina Estimo

• Eugene Greene Jr.

• Anita Jackson

• Danni Katchia

• Uren Leonard Jr

• James Manion

• Daniel Martinez

• Cyrille Mitchell

• William Sam

• Alvis Smith III

• Glendon Smith

• Jason Wesley Smith

• Jonathan W Smith

• Ryan Smith Jr.

• Valerie Switzler

• Dennis White III

Simnasho Candidates (3 seats)

• Carlos Calica

• TJ Foltz

• Raymond Moody

• Emerson Squiemphen

• Lincoln Jay Suppah

• Le...

2022-03-0703 min

GamerGeeks PodcastXbox koopt Activision-Blizzard, de Grootste overname ooit - GamerGeeks Podcast #181Dat er weleens wat gebeurd in de gaming-industrie, dat mag geen geheim zijn. Wekelijks kunnen we er uren over praten. Zelden is er een gebeurtenis die alles op zijn kop zet, die de toekomst van gaming kan definiëren. Dit is zo'n moment.

Xbox neemt Activision-Blizzard over, de uitgever achter o.a. Call of Duty, World of Warcraft, Overwatch en veel meer! Een deal waar bijna 70 miljard dollar in zit. Jim neemt je uitgebreid door deze deal met alle betekenissen en geruchten die daarbij horen. Hij bespreekt met je wat de uiteindelijke strategie hierachter is, wat er v...

2022-01-191h 22

The Practice of Therapy PodcastJenn Uren | Balancing Home Life and Private Practice | TPOT 202In this episode, Jenn Uren of This Mom Knows Podcast joins the show. She talks about staying organized and letting go of her perfectionism while homeschooling five children. If your systems and processes aren't working as smoothly as possible, Jenn explains why you need to remove yourself from the process. If you can't remove yourself from your practice, then find a fresh set of eyes to look for you. Tune in as Jenn talks about the importance of support, finding time to focus, and how to make your least favorite tasks more doable. Meet Jenn Uren As...

2021-11-0134 min

Beter Worden#13 BASIS LEGGENEen geschikter moment voor deze aflevering is er eigenlijk niet. We kunnen namelijk wel vaststellen dat herfst nu echt is begonnen. Dat betekent dat het vroeger donker wordt en het weer minder uitnodigend is om op de fiets te stappen. Dus hoe kan je eigenlijk het beste doortrainen tijdens de herfst en winter?In het komende halfuur maakt Jim korte metten met de aloude traditie dat je tijdens deze periode wat rustiger aan moet doen. Kijk immers maar naar Mathieu en Van Aert die ook de strijd met elkaar aangaan bij de cross. De k...

2021-10-1834 min

Being A Dad...On PurposeLife Insurance Discussion with Jim UrenIn this episode Jim Uren, from Phase III Advisory Services, discusses the different options in life insurance, why it's important, and what to be looking for when deciding on a policy.

2021-06-1822 min

Being A Dad...On PurposeTeaching Kids Financial Responsibility with Jim UrenIn our monthly interview with Jim Uren, Financial Advisor Specialist for Phase III Advisory, we have a great discussion about encouraging financial responsibility with our kids. He gives some great advice and I hope you enjoy the conversation! Be sure to rate, share and subscribe to the podcast!

The book Jim mentions in the interview: The First National Bank of Dad by David Owen

2021-05-0721 min

Being A Dad...On PurposeInterview with Dr. Srikanth GarlapatiOn this episode I have a great conversation about well-child visits with Dr. Srikanth Garlapati from Davis Medical Center in Elkins, WV. He shares some insight into why we should take well-child visits seriously and why dads should be engaged in the process.

We also have our monthly financial segment with Jim Uren, Certified Financial Planner with Phase III Advisory Services out of Buffalo Grove, Illinois. He shares some wisdom around wills and trusts.

Enjoy the episode! Remember to like, rate, and/or share this podcast for others to engage in the conversation!

2021-03-2641 min

Being A Dad...On PurposeFunding College and Valentine's Day...Somehow they go togetherIn this episode we have our monthly financial segment with Jim Uren, a Certified Financial Planner from Phase 3 Advisory Services out of Buffalo Grove, Illinois. You can visit Phase3advisory.com for more information. I also take a few minutes to discuss Valentine's Day and why we should at least try to do something, but it shouldn't be the only time we do.

Here is the list from the document of information for college savings Jim mentioned in our segment.

College Savings Account Comparison

Regular Taxable Account (eg Individual or Joint)

...

2021-02-1228 min

Staantribune102 - Hand van Godcast #9 - Magie van de beker en de Black Country DerbyIn de 9e aflevering van de Hand van Godcast doen we het een keer even anders dan jullie van ons gewend zijn. Na 100 podcasts voor Staantribune heeft Edwin Muis afscheid genomen. Als host, maar ook als technische man op de achtergrond was hij verantwoordelijk voor vele uren podcastplezier. Wij, als Staantribune, willen Edwin daarom ook bedanken voor al zijn inzet. Wij zijn door deze ontwikkelingen op zoek naar een vervanger voor de Hand van Godcast. Interesse? Luister dan hoe je het beste contact op kan nemen,

Jim Holterhuës, Joris van de Wier en Jeroen Heijink praten i...

2021-01-181h 00

Being A Dad...On PurposeThe Value of Budgeting: An Interview with Jim UrenIn this episode, I have a conversation with Jim Uren, a Certified Financial Planner Professional with Phase III Advisory Services out of Buffalo Grove, IL.

Jim shares some fantastic information on creating and keeping a healthy budget.

Why is budgeting important? (goals, debt relief, stress relief, and more)

Where should we start when it comes to creating a healthy budget? (Income, Fixed Expenses, and miscellaneous expenses)

What are common mistakes? (Overly complicated, Lack of review, and not enough time given for the budget to work)

What tools are available for people creating a budget? (Quicken, Mint.c...

2021-01-0832 min

GamerGeeks PodcastDe Epische strijd van Metro - GamerGeeks Podcast #69Je wekelijkse dosis gaming gebabbel is er weer in de vorm van de GamerGeeks Podcast! Jim en Jesper praten je bij over alle zaken die te maken hebben met gaming!

Allereerst is het zaak om het over de nieuwste releases te hebben! Gaat Anthem bijvoorbeeld de hype waarmaken en hoe waren de eerste uren van de Resident Evil 2 remake? Het nieuws zit bomvol controverse! Metro: Exodus is in strijd met zijn community vanwege de beslissing een jaar lang exclusief op de Epic Game Store te verschijnen. Of deze beslissing de juiste zet was, dat bespreken de heren.

2019-02-031h 32

GamerGeeks PodcastOverwerken - GamerGeeks Podcast #55Je talkshow over alles wat er gaande is wat betreft videogames is er weer! In de GamerGeeks Podcast behandelen we het laatste nieuws, wat we spelen en natuurlijk jouw vragen!

Deze week is het galopperen naar de release van Red Dead Redemption 2. Er is veel ophef over de studio nadat één van de co-founders van Rockstar had gezegd dat sommige 100+ uren maakte in een week. De 'crunch'-tijd is bij veel studio's het probleem. De heren geven hier hun visie over.

Days Gone is uitgesteld, Epic Games sleurt Fortnite-cheaters voor de rechter en Johan is alleen maar naar zijn mobiel aan he...

2018-10-201h 12