Shows

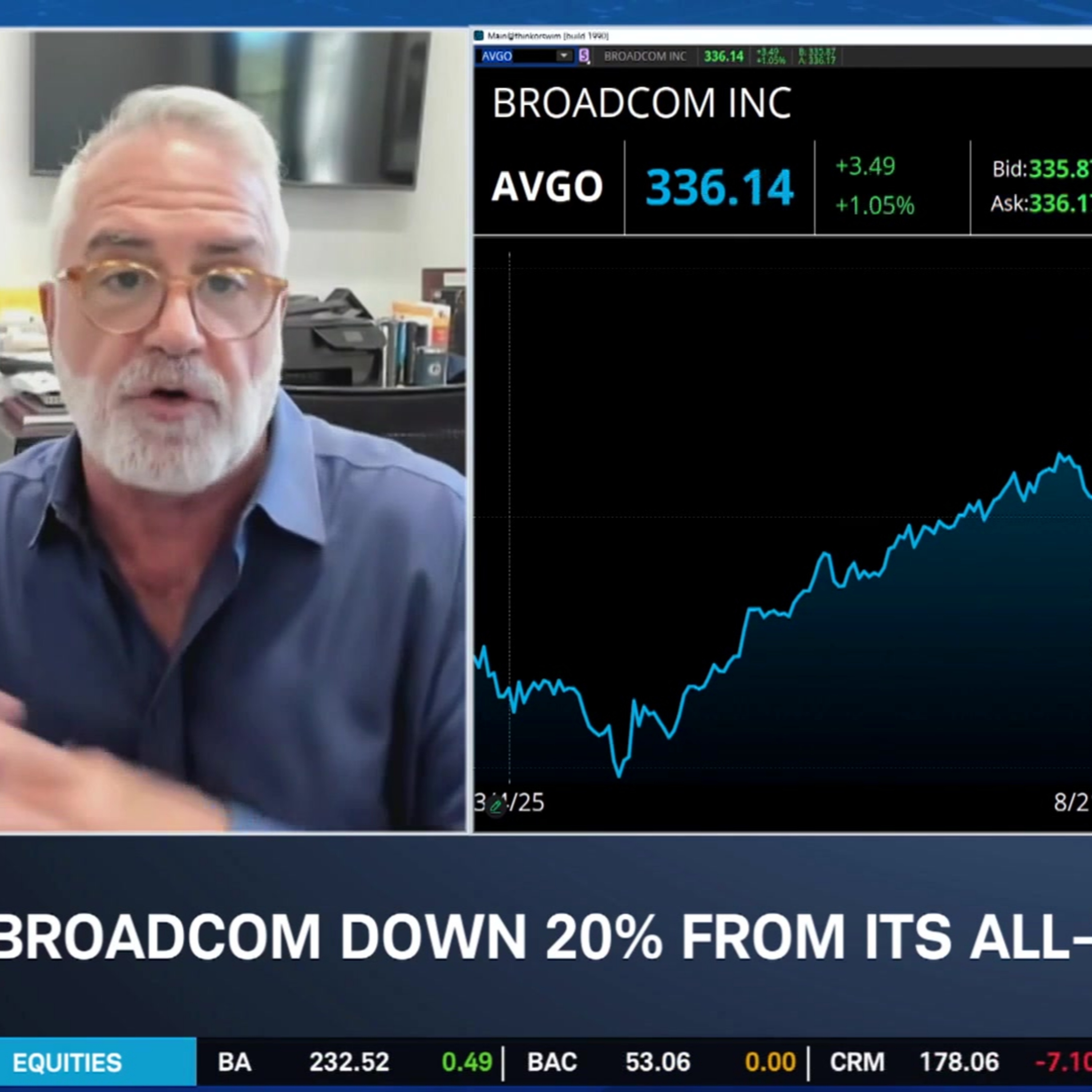

Schwab NetworkKenny Polcari: AVGO Can Jump on NVDA Earnings, Likes MMM, CMI, SWKThe market focus is on Nvidia (NVDA) earnings this week, says Kenny Polcari, and he doesn’t think the company will disappoint. “You have to take advantage” of the tech selloff by picking through beaten-up names, he argues. He highlights Broadcom (AVGO) as a name sold of “arbitrarily” and thinks it can break out after NVDA’s report. Kenny’s other picks are 3M (MMM), Cummins (CMI), and Stanley Black & Decker (SWK).======== Schwab Network ========Empowering every investor and trader, every market day.Options involve risks and are not suitable for all investors...

2026-02-2309 min

Schwab NetworkPolcari: 'Solidly In This Bull Market'A "6200% increase" in the Dow Jones Industrial Average. That's the margin between Kenny Polcari's first day on Wall Street and last week's historical milestone as the index crossed 50k. He joins Diane King Hall to provide his animated analysis of all things trading. He sees more opportunity and more jobs as AI adoption could create the "4th industrial revolution." However, he admits the tech sector could be "taking a break" after momentum lifted it to new highs. Kenny points to the broadening out in the markets, specifically outperformance in industrials and consumer staples. With that in mind, he sees...

2026-02-0907 min

Schwab Network"Nothing Like the Dot Com Bubble:" Kenny Polcari's AI & Memory Chip Bull CaseAbout 100 companies report earnings this week, including Mag 7 companies like Microsoft (MSFT), Meta Platforms (META), and Tesla (TSLA). Kenny Polcari remains "very bullish" on tech's strength for the rest of the year, citing strong earnings growth that is "nothing like the dot com bubble." Even with Mag 7 in focus, Kenny's also watching the memory chip trade starting with Seagate's (STX) earnings Tuesday evening, calling the space the "true bottleneck" of AI. ======== Schwab Network ========Empowering every investor and trader, every market day.Subscribe to the Market Minute newsletter...

2026-01-2708 min

Schwab NetworkPolcari: Don't Get Caught in Market Downslide, Top Picks in VZ, LHX & NBIXKenny Polcari tells investors to shake off the negative price action on Wednesday. He points to the start of earnings season and a stronger-than-expected CPI backing a bullish narrative to start 2026. As for his top picks, Kenny makes the case for Neurocrine Biosciences (NBIX), Verizon (VZ), and L3Harris Technologies (LHX). ======== Schwab Network ========Empowering every investor and trader, every market day.Options involve risks and are not suitable for all investors. Before trading, read the Options Disclosure Document. http://bit.ly/2v9tH6DSubscribe to the Market...

2026-01-1407 min

Life22Life22: Interview with Kenny Polcari (Day 13,756)Our Interview today is with Chief Market Strategist at Slatestone Wealth, Kenny Polcari. Where you can catch Kenny On: Sub-Stack: https://kennypolcari.substack.com YouTube: https://www.youtube.com/@kennypolcarimedia X: https://x.com/KennyPolcari Check us out on Transistor.FM: https://life22.transistor.fm/ Creators & Guests

Dr. Rev. Kevin M. Dougherty - Host

Kenny Polcari - Guest

★ Support this podcast on Patreon ★

Reply on Bluesky

2025-12-1050 min

Trader TalkCoreWeave leads AI infrastructure stocks poised to surgeCoreWeave (CRWV) is emerging as a significant force in the AI infrastructure boom. Michael Lee, founder of Michael Lee Strategy and former Morgan Stanley vice president, says Wall Street underestimates its growth potential. On this episode of Trader Talk, Kenny Polcari and Lee reveal why CoreWeave and other AI infrastructure stocks could deliver massive gains, how rising demand for compute power is reshaping the market, and why hedge funds may be underinvested. They also cover growth versus value strategies, risks from energy grid limits, and the sectors that benefit most as AI spending accelerates into 2026.

Trader Talk...

2025-08-1325 min

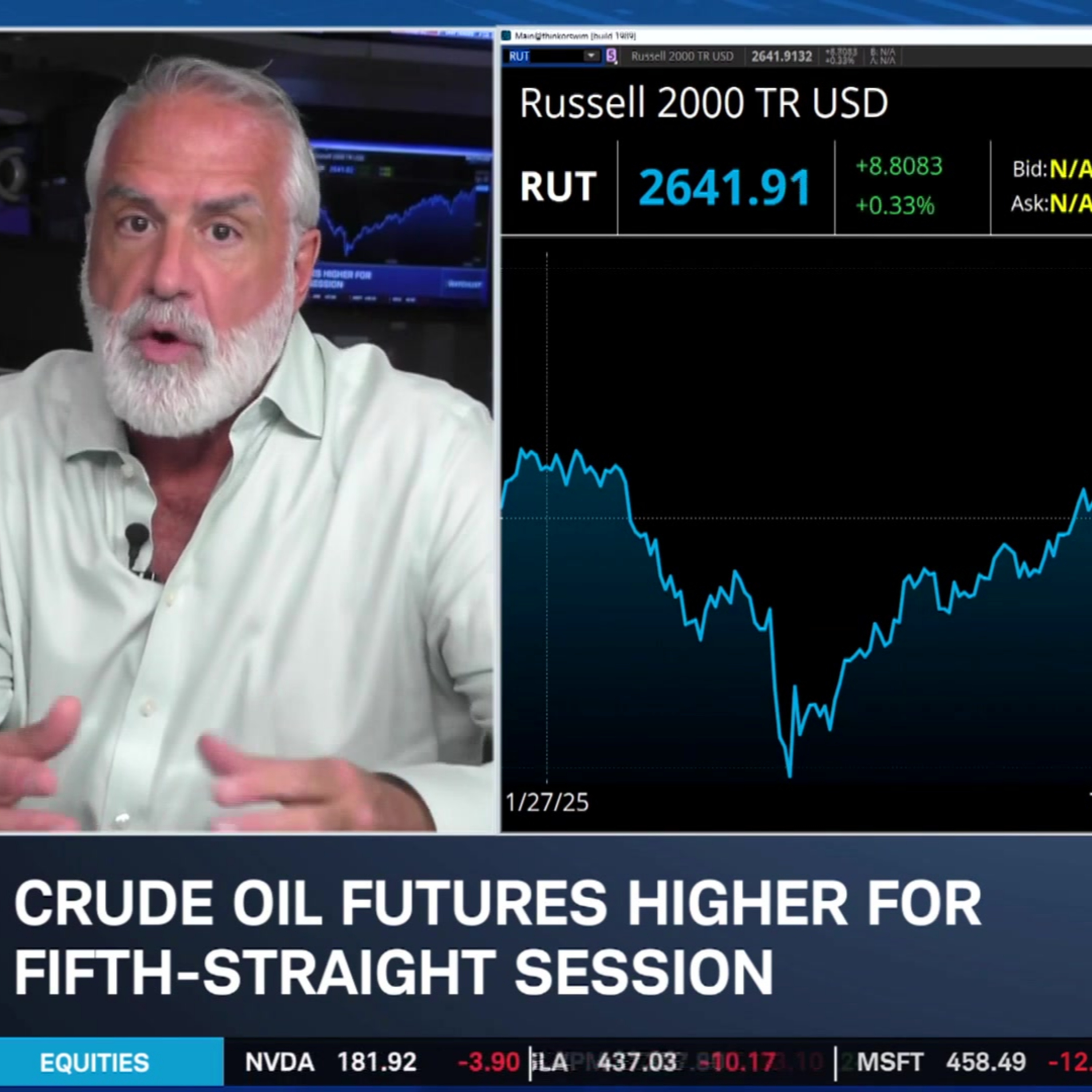

Trader TalkHow AI stocks and earnings are driving the market rallyIs this bull market stronger than Wall Street thinks? On this episode of Trader Talk, Kenny Polcari and Bullseye Brief founder Adam Johnson explain why artificial intelligence (AI)–driven capital spending, strong earnings, and resilient consumer demand could push stocks even higher. They reveal how savvy investors read earnings reports for future signals and why the Federal Reserve may not need to cut rates as soon as traders expect.

Trader Talk with Kenny Polcari on Yahoo Finance delivers expert analysis and actionable insights. Drawing on decades of trading floor experience, we empower you to navigate market volatility an...

2025-08-0625 min

Trader TalkAI and biotech take on brain cancerWhen a biotech startup lands in a major index just months after its IPO, investors take notice. In this episode of Trader Talk, Kenny Polcari speaks with Amir Heshmatpour, executive chairman and president of NeOnc Technologies (NTHI), about how the company defied a tough market to go public, secure a $50 million partnership in the Middle East, and join the Russell Microcap Index. Heshmatpour explains NeOnc’s focus on intranasal drug delivery for brain cancer, the significance of its partnership with USC’s medical school, and how global clinical trials are expanding the company’s reach. The conversation also includes how AI...

2025-07-3024 min

Trader TalkFiring Fed Chair Jerome Powell could spark market chaosTrump’s threats to fire Federal Reserve Chairman Jerome Powell are more than political noise and could send shockwaves through global markets. On this episode of Trader Talk, Kenny Polcari speaks with Dan Payne, chief investment officer at SlateStone Wealth, about what this kind of policy disruption means for investors. Payne stock his four Ps of investing—philosophy, process, people, and performance—and emphasizes the importance of discipline and emotional control. With rising volatility and political uncertainty ahead, this episode shows how savvy investors can stay grounded and seize opportunity while others overreact.

Trader Talk with Kenny Polcar...

2025-07-2323 min

Trader TalkWhy Nvidia, Microsoft and Google still dominate the AI tradeEveryone wants in on AI, but few understand what is really driving the trade. In this episode of Trader Talk, Kenny Polcari sits down with William Lee, investor at SuRo Capital, to unpack the infrastructure powering the AI boom. From Nvidia's (NVDA) dominance to Microsoft's (MSFT) and Google's (GOOG, GOOGL) strategic positioning, Lee explains why these giants are still central to the AI story. The conversation also highlights emerging players like CoreWeave (CRWV) and Vast Data and why capital efficiency, not hype, will separate the winners from the noise. For investors chasing the next wave of innovation, this episode...

2025-07-1623 min

Trader TalkWhy smart investors never trade on fearAmid rising tariffs, geopolitical tensions, and economic uncertainty, how should long-term investors navigate today’s volatile market? Invesco’s Chief Market Strategist Brian Levitt joins Kenny Polcari on Trader Talk to break it all down. From the evolving US-China trade dynamic to the Fed’s interest rate stance, Levitt explains why clarity, not calm, is what markets crave. They dig into inflation, potential rate cuts, housing pressure, and the behavioral traps that lead investors to sell at the worst times. The big message is to stay focused, stay invested, and avoid letting headlines dictate your portfolio.

Watch more e...

2025-07-0225 min

Trader TalkSmart investors protect themselves before the chaos hitsMarkets may look calm, but the real risks hide under the surface. In this episode of Trader Talk, Kenny Polcari sits down with Amy Wu Silverman, managing director and head of derivatives strategy at RBC Capital Markets, to explain why low short-term volatility may lull investors into a false sense of security. Silverman explains how longer-term volatility is quietly rising as traders hedge against growing risks like tariffs, recession fears, and geopolitical uncertainty. They also explore how social media, algorithms, and fake headlines can ignite sudden market swings, leaving unprepared investors vulnerable.

Trader Talk with Kenny Polcari...

2025-06-2523 min

Trader TalkWhy waiting to invest could cost you more than you thinkThink you're too late to start investing? Think again. In this episode of Trader Talk, Kenny Polcari sits down with Steve Sosnick, chief strategist at Interactive Brokers, to discuss strategies for investors who are getting a late start. Sosnick emphasizes the importance of risk management, advocating for a disciplined approach focused on capital preservation and high-quality dividend stocks rather than speculative, high-risk trades. They also explore the responsible use of options to enhance income, how AI and algorithmic trading are reshaping the markets, and why understanding your personal risk tolerance is crucial for successful investing.

Trader Talk...

2025-06-1826 min

Trader TalkWhy defensive stocks could be your best bet in a wild marketThink defensive stocks are boring? Dryden Pence, Chief Investment Officer at Pence Capital Management, says you're missing the point. On this episode of Trader Talk, host Kenny Polcari sits down with Pence, a military intelligence veteran turned investment expert, to uncover why defensive sectors like consumer staples, utilities, and healthcare can be your strongest allies in volatile markets. Pence explains how understanding investor psychology, economic fundamentals, and consumer necessities can help investors stay steady amid chaos. If market volatility makes you anxious, this episode might just be the reality check you need.

Trader Talk with Kenny Polcari...

2025-06-1124 min

Trader TalkBad trades are part of the businessOn this week’s Trader Talk, host Kenny Polcari sits down with Atish Davda, CEO and cofounder of EquityZen, to discuss how average investors can gain access to pre-IPO shares in private tech companies. Davda explains how EquityZen connects shareholders, often early employees at high-growth startups, with accredited investors looking to buy in before an IPO. With private markets becoming increasingly important to diversified portfolios, Davda breaks down how the platform works, what makes a company investable, and how these trades differ from traditional public stock transactions. If you have ever wanted to own a slice of the next bi...

2025-06-0424 min

Trader TalkTrust the process, not the pitchIn the latest episode of Trader Talk, Kenny Polcari sits down with Chris Versace, chief investment officer at Tematica Research, to discuss how thematic investing can help navigate today’s volatile markets. Versace shares insights into identifying structural changes like AI, digital infrastructure, and sustainability, as well as building portfolios aligned with these long-term trends. They also touch on the recent rebound in tech, rising trade tensions, and shifting earnings expectations, concluding that clear strategies and adaptability are key to success in uncertain times.

Trader Talk with Kenny Polcari on Yahoo Finance delivers expert analysis and actionable in...

2025-05-2824 min

Trader TalkIt’s not about picking stocks it’s about building habitsIn this episode of Trader Talk, Kenny Polcari talks with Brandon Krieg, co-founder of Stash, about how fintech is changing the way everyday Americans invest. Krieg explains how tools like fractional shares, automated savings, and personalized portfolios help new investors build long-term wealth. They discuss how financial education and behavioral tools can reduce fear and promote smarter decisions. With more people gaining access to the market through apps like Stash, the conversation highlights how technology is breaking barriers and encouraging consistent, goal-based investing. It’s a must-listen for anyone looking to better understand the future of personal finance and in...

2025-05-2124 min

Trader TalkYou can't manage risk if you don't know what you're holdingIn the latest episode of "Trader Talk," Kenny Polcari sits down with Mark Malek, chief investment officer of SiebertNXT, to explore how quantitative investing and clear investment theses can help investors navigate today's volatile markets. Malek emphasizes using data-driven models to cut through noise, avoid over-diversification, and focus on high-probability opportunities, especially in defensive sectors. The two also weigh in on rate-cut expectations, soft versus hard data, and why sticking to fundamentals matters more than ever.

'Trader Talk with Kenny Polcari on Yahoo Finance delivers expert analysis and actionable insights. Drawing on decades of...

2025-05-1423 min

Trader TalkLearn to invest for the next 5 years, not the next 5 minutesIn the latest episode of Trader Talk, Kenny Polcari speaks with Chad Morganlander, Senior Portfolio Manager at Washington Crossing Advisors, about building durable portfolios amid market uncertainty. Morganlander explains why low-debt, dividend-growing companies with stable cash flows are ideal for long-term investors, especially in volatile environments. He highlights sectors like tech, consumer staples, and industrials while steering clear of highly leveraged financials and utilities. The key, he says, is to focus on high-quality, low-volatility stocks and invest with a five-year outlook—not a five-minute one.

Trader Talk with Kenny Polcari on Yahoo Finance delivers expert analysis and ac...

2025-04-3028 min

Trader TalkThis sell-off could be your golden ticket to AI and fintech gainsIn the latest episode of Trader Talk, Kenny Polcari sits down with Drew Pettit, director of US equity strategy at Citi, to unpack how thematic investing is evolving in a volatile market. Pettit explains how investors can use structural themes—like AI, fintech, and digital leisure—to identify long-term opportunities beyond traditional sector classifications. While recent market volatility has been driven by tariff headlines and valuation resets, Pettit sees this as a chance to re-enter high-quality names at discounted prices. The key, he says, is understanding what you own and making intentional, informed decisions—not panicking.T...

2025-04-2322 min

Trader TalkCould Trump's economic chaos spark stagflation?In the latest episode of Trader Talk, Kenny Polcari speaks with Cameron Dawson, CIO at NewEdge Wealth, about why traditional recession indicators no longer hold the same weight in today’s post-pandemic market. Dawson sees slower growth ahead—not a recession—citing fading tailwinds like stimulus and labor gains. The two also discuss the recent pullback in the “Mag 7,” with Dawson urging investors to re-evaluate stretched valuations. The episode wraps with Polcari’s timeless shrimp scampi recipe.Garlicky Shrimp ScampiIngredients

Olive oil (about 1–2 tablespoons)

4 tablespoons butter (divided)

5 large garlic cloves, sliced

1 pound...

2025-04-1624 min

Life22Life22: Interview with Kenny Polcari (Day 13,515)Our Interview today is with Chief Market Strategist at Slatestone Wealth, Kenny Polcari. Where you can catch Kenny On: Sub-Stack: https://kennypolcari.substack.com YouTube: https://www.youtube.com/@kennypolcarimedia X: https://x.com/KennyPolcari Check us out on Transistor.FM: https://life22.transistor.fm/ Creators & Guests

Dr. Rev. Kevin M. Dougherty - Host

Kenny Polcari - Guest

★ Support this podcast on Patreon ★

Reply on Bluesky

2025-04-121h 14

Trader TalkThe surprising way smart investors survive market chaosn the latest Trader Talk, host Kenny Polcari reveals how to navigate market volatility with disciplined, fundamentals-based investing. He emphasizes that despite uncertainties from tariffs, geopolitical tensions, and shifting consumer sentiment, thorough financial analysis and a focus on quality large-cap growth stocks are key to long-term success.Join Polcari on Trader Talk as he speaks with Barbara Doran, founder and CEO of BD8 Capital Partners. Doran advises investors to resist panic, manage risk carefully, and stay committed to their investment thesis even during turbulent times.Trader Talk with Kenny...

2025-04-0923 min

MoneyShow MoneyMasters PodcastWhy Kenny Polcari Says 'Don't Panic' Over TariffsIn this episode, we sit down with Kenny Polcari, a seasoned financial expert and Chief Market Strategist at SlateStone Wealth, to discuss the latest tariff news and its impact on the financial markets.

Kenny shares his insights on why the market's reaction might be an overreaction and why investors should take a step back and not panic. He breaks down how to navigate the current volatility, covers the importance of staying diversified, explains why it's crucial not to make emotional decisions during turbulent times, and suggests that keeping a long-term investment perspective during periods of un...

2025-04-0407 min

Trader TalkWhy this strategist raised their recession oddsOn this week’s Trader Talk, host Kenny Polcari stresses that emotional trading—chasing hot stocks or panic-selling at minor dips—is a surefire way to lose. Instead, decisions should hinge on strategy and data.Guest Kristina Hooper, Chief Global Market Strategist at Invesco, raises U.S. recession odds to 30–35%, citing four simultaneous “swing factors”: tariffs, China’s stimulus uncertainty, renewed inflation pressures, and looming spending cuts. This combination has rattled corporate plans and heightened market volatility.The bottom line? Markets hate guesswork and emotional overreactions. Polcari and Hooper agree that lev...

2025-03-1924 min

Trader TalkHow Trump's foreign policies impact your portfolioIn the latest Trader Talk episode, where host Kenny Polcari and Dr. Scholl Foundation President and CEO Dan Mahaffee explore the geopolitical myths and realities shaping today’s markets. Broadcasting from the New York Stock Exchange, Polcari leverages decades of institutional experience to cut through the noise and help investors focus on what truly matters.Polcari opens by debunking the popular belief in imminent rate cuts—a comforting bedtime story for many investors. He points out that the economy isn’t collapsing: the labor market remains robust, wages are strong, and corporate earnings are mostly solid. Rate cuts...

2025-03-0524 min

Trader TalkHow this family office ETF outperforms the S&P 500What do market fundamentals, active ETF strategies, and global investing challenges have in common? They’re at the core of the latest Trader Talk episode, where host Kenny Polcari and guest Rob Haugen, a seasoned market maker now with River1 Asset Management, explore how to navigate today’s dynamic public markets. Broadcasting from the iconic New York Stock Exchange, Polcari leverages decades of institutional trading experience to help investors decode market behavior and capitalize on opportunities.Polcari kicks off by reminiscing about his early days on the trading floor, emphasizing that while a company’s fundamentals are crucia...

2025-02-2624 min

Trader TalkHow tariffs can create buying opportunitiesWhat do tariffs, long/short strategies, and robust market insights have in common? They’re the focus of the latest Trader Talk episode, where host Kenny Polcari and guest Tom Hayes, founder, chairman, and managing member of Great Hill Capital, dive into volatile market trends and actionable strategies for investors. Broadcasting from the iconic New York Stock Exchange, Polcari leverages decades of institutional trading experience to help you navigate market uncertainty amid shifting trade dynamics.Polcari opens by addressing how tariff headlines trigger investor panic—stocks fall and volatility spikes—despite tariffs being standard taxes on imported goods...

2025-02-1924 min

Trader TalkAre Trump's new policies enough to keep the market afloat?What do earnings season, rising interest rates, and a housing shortage have in common? They’re the focus of the latest Trader Talk episode, where host Kenny Polcari and guest Stephanie Link, Chief Investment Strategist at Hightower Advisors, tackle the biggest market trends and economic questions of 2025. Broadcasting live from the iconic New York Stock Exchange, Polcari leverages decades of institutional trading experience to help investors navigate market uncertainty, inflation pressures, and evolving GDP growth.Polcari kicks off the episode by emphasizing the importance of momentum trading—using tools like moving averages, RSI, MACD, and strict stop-loss orde...

2025-02-1223 min

Trader TalkNo rate cuts? How to navigate inflation and market uncertaintyWhat do market whipsaws, Fed uncertainty, and a classic Italian stew have in common? They’re the focus of the latest Trader Talk episode, with host Kenny Polcari and guest John Lonski tackling the biggest economic questions of 2025. From inflation risks to consumer resilience, Polcari cuts through the noise to help investors stay ahead.In this episode, Polcari welcomes John Lonski, a seasoned economist and former Chief Economist at Moody’s, to break down shifting market sentiment. The two dive into the debate over Federal Reserve policy, with Polcari firmly in the camp that rate cuts are unli...

2025-02-0424 min

Trader TalkDid Nvidia kill quantum computing? Defiance ETF CEO weighs inWhat do a rollercoaster quantum market, hawkish Fed commentary, and a sizzling grilled ribeye have in common? They’re the focus of the latest Trader Talk episode, with host Kenny Polcari and guest Sylvia Jablonski diving into the latest on Wall Street. From navigating quantum hype to predicting rate cuts, Polcari cuts through the noise to help you keep your portfolio intact.In this episode, Polcari welcomes Sylvia Jablonski, CEO and CIO of Defiance ETF, who shares her expertise on the future of quantum investing. The two discuss the fallout from Nvidia CEO Jensen Huang’s recent clai...

2025-01-2924 min

Trader TalkBuying stocks for Fed cuts? Think againWhat do a turbulent job market, surging bond yields, and a plate of Linguine Arrabiata all have in common? They’re front and center in the debut installment of Trader Talk, with host Kenny Polcari back on the New York Stock Exchange floor. As markets whipsaw on every snippet of Federal Reserve commentary, Polcari cuts through the noise, reminding viewers that “sometimes, good news is bad news”—especially if you’re banking on rate cuts alone.In this week’s episode, Polcari welcomes special guest Adam Johnson, a former hedge fund manager and Bloomberg anchor. They dig into the fal...

2025-01-2225 min

Wealthion - Be Financially ResilientTop Market Risks for 2025: Inflation, Yields & Volatility | Kenny Polcari2025 could bring some of the biggest market and economic risks in years. Inflation is back, bond yields are surging, and volatility is shaking investor confidence. Kenny Polcari, SlateStone Wealth’s Chief Market Strategist, joins Andrew Brill to dive deep into these risks, sharing insights on debt policy, energy demand, and the role of AI in reshaping the markets. Learn which sectors to watch—like tech, healthcare, and energy—and why historical patterns, like the 1980s inflation crisis, might repeat in 2025.Investment Concerns? Get a free portfolio review with Wealthion’s endorsed financial advisors at https...

2025-01-0938 min

The Weekly Money ClipThe Weekly Money Clip: March 4th Episode - Expert Analysis on Google's Gemini A.I., College Loan Policies, Bitcoin Projections, Cybersecurity, and Market TrendsDive deep into the latest episode of "The Weekly MoneyClip" featuring insights from five esteemed business experts: James Breslo, Jennifer Horn, Michael Lee, Simson Garfinkle, and Kenny Polcari. In this episode, James Breslo dissects the failure of Google's Gemini A.I. app and its potential parallels with BudLight's negative trajectory. Jennifer Horn scrutinizes the impact of no-loan policies in college and the soaring costs of degrees. Michael Lee offers projections on the surging Bitcoin prices and its implications for the rest of the year. Simson Garfinkle sheds light on the shift towards memory-safe software and the transition from C to Rust pr...

2024-04-1432 min

The Weekly Money ClipEconomic Shockwaves Unleashed: Episode 2 Exposes Global Threats | The Weekly Money Clip Unveils Financial TurbulenceWelcome to Episode 2 of "The Weekly Money Clip," where CenterClip's esteemed contributors provide invaluable insights into the latest financial trends and economic indicators. In this episode, join Scott Stantis, Michael Lee, Mitch Roschelle, Kenny Polcari, and Josh Hammer as they delve into pressing topics shaping the global economy.Kicking off the discussion, Scott Stantis, internationally syndicated editorial cartoonist and Senior Fellow at the Alabama Policy Institute, explores the looming threat of a potential UK recession and its potential global ramifications. Next, Michael Lee, Founder and Market Strategist at Michael Lee Strategy, weighs in on the transformative impact of A...

2024-04-1126 min

MoneyShow MoneyMasters PodcastMish Schneider & Kenny Polcari: Stock Strategists Talk "No Landing" Scenario, Supercycles, Small Caps, and the S&P 500Mish Schneider is chief strategist at MarketGauge.com, and Kenny Polcari is chief market strategist at SlateStone Wealth. Both sat down with me at the 2024 MoneyShow/TradersEXPO Las Vegas to share their take on stocks, sectors, gold, currencies, and more in this MoneyShow MoneyMasters Podcast twofer.Mish kicks things off by sharing her "still photograph" theory on the markets and the economy, noting that "everything's pretty good" with earnings, interest rates, and growth stocks, even if we have issues with government debt and lingering inflation. She doesn't think the Federal Reser...

2024-03-1421 min

Buy Hold SellThe Weekly Money Clip: March 4th Episode - Expert Analysis on Google's Gemini A.I., College Loan Policies, Bitcoin Projections, Cybersecurity, and Market TrendsDive deep into the latest episode of "The Weekly MoneyClip" featuring insights from five esteemed business experts: James Breslo, Jennifer Horn, Michael Lee, Simson Garfinkle, and Kenny Polcari. In this episode, James Breslo dissects the failure of Google's Gemini A.I. app and its potential parallels with BudLight's negative trajectory. Jennifer Horn scrutinizes the impact of no-loan policies in college and the soaring costs of degrees. Michael Lee offers projections on the surging Bitcoin prices and its implications for the rest of the year. Simson Garfinkle sheds light on the shift towards memory-safe software and the transition from C...

2024-03-0429 min

Buy Hold SellEconomic Shockwaves Unleashed: Episode 2 Exposes Global Threats | The Weekly Money Clip Unveils Financial TurbulenceWelcome to Episode 2 of "The Weekly Money Clip," where CenterClip's esteemed contributors provide invaluable insights into the latest financial trends and economic indicators. In this episode, join Scott Stantis, Michael Lee, Mitch Roschelle, Kenny Polcari, and Josh Hammer as they delve into pressing topics shaping the global economy.Kicking off the discussion, Scott Stantis, internationally syndicated editorial cartoonist and Senior Fellow at the Alabama Policy Institute, explores the looming threat of a potential UK recession and its potential global ramifications. Next, Michael Lee, Founder and Market Strategist at Michael Lee Strategy, weighs in on the transformative impact...

2024-02-2523 min

Successfully Unemployed Show with Entrepreneurs Investors and Side HustleFinancial Expert Stock Trader Turned Successfully Unemployed with Kenny PolcariStock trading can make you good money but not as much as you can make when you become successfully unemployed and get paid for your value and not from your J.O.B. Kenny Polcari shares with us how we can retire early and make money in many different ways.Get my free real estate investing course: https://masterpassiveincome.com/freecoursesuYoutube Channel: https://successfullyunemployed.co/youtube// WHAT TO WATCH NEXTStart a Podcast: https://youtu.be/YdKKwSSOnJAMake Money Online: https://youtu.be/WDkRHg3uxR0Flea Mar...

2024-02-2047 min

Take It To The Board with Donna DiMaggio BergerShow Me the Money: Investment Strategies with Michael Coady and Kenny Polcari of Slatestone WealthSend us a textFinancially strapped community associations are always looking for new revenue sources but is a sound investment strategy a possible path to avoiding large budget increases or special assessments? In this episode, host Donna DiMaggio Berger, along with investment gurus Michael Coady, Chief Strategy and Growth Officer for Slatestone Wealth, and Kenny Polcari, Chief Market Strategist for Slatestone Wealth, discuss how investments can be utilized by both association boards and their residents personally as part of their overall fiscal management. What most association boards want to k...

2023-11-2253 min

Wealthion - Be Financially ResilientIs The Fed Still Hiking or Preparing for Cuts? | Kenny PolcariMeet Eric Chemi! He’s one of the many new faces joining the Wealthion team with one goal, to empower you to make the best financial decisions for you and your family.

Eric has been around economics his entire life, working as an investor on Wall Street and later as a reporter at Bloomberg and CNBC.

Kenny Polcari, Chief Market Strategist at Slatestone Wealth, shares his insights on the latest jobs data, where inflation is headed and if the Fed will be hiking rates or preparing to cut.

Kenny and Eric breakdown how this could impact you.

2023-11-0843 min

MoneyShow MoneyMasters PodcastBONUS • Mish Schneider, Jeff Hirsch, Carley Garner, Kenny Polcari, Danielle Shay: What's Impacting Markets?This week, we co-hosted a Twitter/X Space with WOLF Financial that featured speakers from our upcoming Orlando MoneyShow/TradersExpo. Mish Schneider of MarketGauge.com, Jeff Hirsch of The Stock Trader’s Almanac, Carley Garner of DeCarley Trading, Kenny Polcari of SlateStone Wealth, and Danielle Shay of Simpler Trading joined us to talk about what they see is impacting the markets right now, as well as give a sneak peek of what they'll be discussing at the Orlando MoneyShow. Visit www.OrlandoMoneyShow.com for more details.

2023-10-021h 01

Futures Edge Show: Finance Unfiltered with Jim Iuorio and Bob IaccinoElection, Inflation, and Unfiltered Opinions with Kenny Polcariifferent economic theories and philosophies propose different roles for government intervention. Kenny Polcari, Founder/CEO of Kace Capital Advisors, is a seasoned market strategist with more than 35 years at the New York Stock Exchanges (NYSE) who expresses concerns about government spending, regardless of the political party in power. He speculates about the 2024 presidential election and the possibility of different candidates emerging. He offers insights into the upcoming CPI data and the potential implications for the Federal Reserve's monetary policy decisions. He also discusses the oil market and the role of China as a significant buyer of oil, sharing statistics a...

2023-09-1850 min

MoneyShow MoneyMasters PodcastKenny Polcari: Tech, Treasuries, the Election, and a Major DistractionKenny Polcari is Chief Market Strategist at Slatestone Wealth. In this interview, he shares his take on current stock market conditions and how he sees things playing out for investors later this summer and year. He notes the technology sector is “so, so stretched” and needs to take a breather, and says other groups like small- and mid-cap stocks (SMIDs), industrials, and transports will likely start outperforming instead. Kenny further explains why high-dividend payers like utilities are a great option versus CDs and short-term Treasuries because they give you nice yields PLUS liquidity and stock market exposure. You’ll als...

2023-07-0613 min

Investing With IBDKenny Polcari: How To Stay Calm In A Stock Market CrisisKenny Polcari, Chief Market Strategist at Slatestone Wealth, discusses how having a plan can make navigating a crisis in the stock market easier. As goals change and years accumulate, the plan might not remain the same but it helps take short-term emotions out of your long-term equation. Polcari also takes a broad look at the markets and Fed action and finishes with analysis on stocks like Amazon.com (AMZN), c3.ai (AI) and Lockheed Martin (LMT). For the video version, visit investors.com/podcast. Learn more about your ad choices. Visit megaphone.fm/adchoices

2023-05-111h 01

Futures Edge Show: Finance Unfiltered with Jim Iuorio and Bob Iaccino3 Meatballs discuss the markets. The Futures Edge Podcast with guest Kenny Polcari.In our most Italian podcast yet, Kenny Polcari - Managing Partner Kace Capital Advisors and the Chief Market Strategist at Slate Stone Wealth, join Jim and Bob to talk about food, stocks, inflation, and how to survive a possible recession. Bob and Jim also introduced the meatball ranking system.

2022-07-2552 min

The Weiss InvestorFrom The Bottom Up w/ Catherine FaddisIn our latest episode of the Weiss Investor, Kenny speaks with Catherine Faddis, President and CEO of Grace Capital in Boston, which manages over $200 million, as well as a CNBC and Bloomberg contributor. Catherine has lived an extraordinary life: The child of a General and diplomat in the Ghana Army, she spent much of her childhood at a Catholic boarding school in Pakistan before coming to the United States as part of an embassy mission. But when a coup took out the nation’s leadership, her family found themselves without their wealth or a home to go back to And th...

2022-03-0351 min

The Weiss InvestorThe Crazy Comes Out Around Money w/ Michael FarrIn today’s episode, Kenny is joined by Michael Farr, the longest-serving paid contributor in CNBC history and CEO of Farr Miller Washington, a goliath recently acquired by HighTower that oversees over $2 billion in AUM. Michael worked as an English teacher at a New England prep school before landing a two year internship at Morgan Stanley, where he learned the key to success was in his people skills. Kenny and Michael catch up, tell some very funny stories before diving into the global trade war with China and Russia, the Olympics, and The Fed. This one’s a very enter...

2022-02-2448 min

The Weiss InvestorThe Exit Of A Lifetime w/ Brian Schaeffer“You don’t want to be the last guy turning off the lights in here.” So Brian Schaeffer was told when he pulled off one of the luckiest exits in history, selling Van der Moolen Capital to Lehman Brothers 6 months before it’s collapse in 2008. A serial entrepreneur and private equity specialist who has always tried to stay away from the massive banks, Brian has pulled off some truly impressive deals, Kenny and Brian talk about the many companies that have brought him great success. including InvestX, World Trade Securities, and Clearpool. They also dive into SPVs, GPLPs, Peter Thiel’s Zero to...

2022-02-1753 min

The Weiss InvestorBuilding Business w/ Rob LunaKenny talks life, success, and very big money with Rob Luna, educator, adviser, and strategist to entrepreneurs, CEOs, athletes, and others with typically $10 million+ in assets. Growing up extremely poor in inner-city Los Angeles, Rob worked two jobs to put himself through school. One day, he found an ad for a Waterhouse stockbroker trainee program in the newspaper and everything changed. You know a guest is going to be interesting when building and selling a billion dollar business is just the beginning! Learn more about us at WeissRatings.com.

2022-02-1048 min

The Weiss InvestorZoom Fatigue w/ Lou BaseneseIn today’s episode, Kenny catches up with Lou Basenese, the founder of Disruptive Tech Research and Trend Trader Daily. An independent analyst and investor currently based out of Nashville, Lou cut his teeth at Morgan Stanley before going solo and moving south, finding great success spotting trends from both the tech giants and startups with massive growth potential. Zoom, Peloton, the Metaverse, augmented reality, biotech, robotics, digital currencies and the blockchain are all discussed. Interested in learning more? Check us out at WeissRatings.com!

2022-02-0348 min

The Weiss InvestorThick Skinned w/ Jimmy IuorioKenny catches up with legendary Chicago trader and restauranteur Jimmy Iuorio, who you’ve definitely seen on CNBC and Fox Business! The energetic duo discuss the life lessons of their careers, including wild stories from the greatest bull market this country has ever known: A time of high interest rates, massive egos, and even broken ribs! Plus: Building business in changing times, owning a restaurant during the pandemic, being married to accomplished women and raising daughters, Kenny’s 9/11 story, market corrections, and more. You won’t want to miss this wildly engaging, entertaining, and informative conversation! Check us out at WeissR...

2022-01-2753 min

The Weiss InvestorTokenomics w/ Mark MonfortCalling Kenny in from Sydney, Australia, data expert Mark Monfort is here to DeFi your expectations on the future of business! As decentralized finance continues to revolutionize the global economy at lightning speed, it’s never been more important to understand how data and money intersect. What’s a DAO? What’s Discord? How does this all benefit those without access to traditional banking? What other industries will these revolutionary new blockchain technologies change? And where do you fit into these new communities? It’s so much more than just Crypto, so don’t get overwhelmed. Learn and seek opportunity...

2022-01-2051 min

The Weiss InvestorGreater Fools w/ Chris Markowski Kenny hangs out with Chris Markowski, founder of Markowski Investments and the host of the Watchdog on Wall Street radio show and podcast, which he has been hosting for over 20 years. You've seen him on CNN, Fox Business, CNBC, and countless other outlets. The two chat about changes on Wall Street, the DotCom Bubble, overvalued stocks, and the Greater Fool theory, Y2K, the repeal of the Glass Steagall act and the 2008 Crash. Plus: the work involved in building a client's portfolio, how to protect retail investors from getting ripped off, and more! Check us out at WeissRatings.com

2022-01-1354 min

The Weiss InvestorCrypto Yielding 101 w/ Marko Grujic Happy New Year! Kenny rings in 2022 with Weiss' Crypto Yielding expert Marko Grujic. A journalist and online poker player from Serbia, Marko was an early student of the blockchain before it hit the mainstream. Then the Bull Run of 2017 hit, and everything changed. What started off as a hobby became a professional calling and passion in decentralized finance and yield farming. From wallets to exchanges to stable coins vs. meme coines, no stone goes left unturned. Learn more about his unconventional journey to success and how you can benefit from his knowledge! Learn more at WeissRatings.com!

2022-01-0645 min

The Weiss InvestorWomen's Panel w/ Cameron Dawson and Julia Ferguson We're doing something different this week! Today, Kenny speaks with Field Point's Cameron Dawson and Goldman Sachs' Julia Ferguson, two young and very accomplished financial powerhouses, to share their stories and discuss the growing and changing roles of women in the markets. This is a subject near and dear to Kenny's heart, as his wife was a trailblazer who smashed the NYSE's glass ceiling in the 80s and his daughter also works in the sector. You won't want to miss this exciting and important conversation! Check out more at WeissRatings.com

2021-12-2344 min

The Weiss InvestorThe Confidence Curve w/ Malcolm Ethridge What a treat we have for you today! On today's episode of The Weiss Investor, Kenny hangs out with Malcolm Ethridge, an EVP at CIC Wealth, financial advisor and host of the Tech Money Podcast based in the Washington, D.C., area. You’ve seen him on CNBC and Cheddar, and today Malcolm dives into how he got started using his knowledge of TIAA-CREF right out of college to help professors and academics plan their retirement. After spending time at Merrill Lynch and Wells Fargo, he came to prefer independent firms and makes his case for working with them, as we...

2021-12-161h 03

The Weiss InvestorGo Where The Buck Is Going w/ Keith Fitz-Gerald You’ve seen him on FOX Business, CNBC, Bloomberg, and more! Now, market visionary Keith Fitz-Gerald joins us on the Weiss Investor! In today’s episode, Keith shares with Kenny how mowing lawns and making martinis for his savvy Mimi led him to a great success in financial services. An avid motorcyclist, fitness buff, and world traveler, Keith believes that seeing the world is key to understanding the markets. The two talk the importance of building sustainable, generational wealth through emotional detachment, rationality, and playing to win. Plus: Inflation, crypto, portfolio diversification, the Fed, keeping clients happy, and more.

2021-12-0939 min

The Weiss InvestorThere Will Always Be Potholes w/ Adam Johnson In today’s episode, Kenny catches up with Adam Johnson. You may recognize him from his days on Bloomberg TV. Today, he’s the founder and head of Bullseye Brief, a subscription and advisory service. While he has many years of experience as a journalist, his real passion is in picking American stocks (which he happily shares with us!) The two have different perspectives on the state of the economy: Kenny thinks things might get a little ugly next year and Adam disagrees. The two debate and discuss inflation, government spending, and the latest happenings at the Fed and as well...

2021-12-0250 min

The Weiss InvestorIt’s Not Transitory w/ Sue Herera Sue Herera returns to The Weiss Investor in a jam-packed episode! Kenny and Sue dive headfirst into inflation, the Delta Variant, the supply chain and the price of food and gas. Plus, the two discuss Powell and the Fed’s tough tapering spot, the difficulty of networking in the virtual space vs. in-person conferences, interest rates, raising kids, Christmas sales, and much more. Kenny and Sue also catch up on her new role at CNBC and her corporate board work involving women in business. Click here to listen to this episode now, and check us out at WeissRatings.com.

2021-11-111h 05

The Weiss InvestorA Seat on the Exchange w/ Bob McCooey In today's episode of The Weiss Investor, Kenny catches up with Bob McCooey, a former brother-in-arms on the NYSE floor who now heads NASDAQ Asia Pacific. The two dive into life as "two-dollar brokers," independent traders at the smaller family-owned firms who took on the big banks to protect their clients' investments. Their discussion ranges from specialist units to the first generation of computer terminals to the nitty-gritty of buying and leasing one of the 1,366 available seats. No details are spared from these legends of financial history! Plus: Kenny talks about how his wife helped shatter the glass ceiling...

2021-11-041h 00

The Weiss InvestorNFTs 101 w/ Joel Kruger A new intersection of art and commerce is taking the internet by storm. In today's episode of The Weiss Investor, Kenny chats with crypto expert Joel Kruger in Israel to talk all things NFT! What's a non-fungible token? Why is it taking the crypto-world by storm? What are these furry cartoons and Cryptopunks and why are they are worth so much money? What's OpenSea? The two also dive into the core concepts of Bitcoin and Ethereum, the White Paper, volatility and emerging assets and so much more! Check out more at WeissRatings.com

2021-10-281h 02

The Weiss InvestorWe’re Old School Now! w/ Jay Woods Kenny and Jay Woods, NYSE Market Maker turned Chief Market Strategist at DriveWealth, take you on a journey through the Wall Street of the 80s, 90s, and early 00s: A time before decentralization and automation ran the global economy. What was it like being on the floor with 5500 Type A Personalities? From the birth of the Bull Market in 1982, the chaotic crash of 1987, Y2K, and 9/11. This was an era when your word was your bond. The two also offer advice for new investors as our society confronts a newfound demand for financial literacy and education. And what do...

2021-10-2156 min

The Weiss InvestorIf You Don't Want Restrictions, Get Another Job! w/ Stephen from CongressTrading In today's episode of The Weiss Investor, Kenny chats with Stephen, a semi-anonymous young tech worker and equity trader who quit his job to launch Congresstrading.com, a service which pores through highly confusing public records to reveal investments being made by our elected officials. The two discuss insider trading rules and restrictions, the ethics of disclosure, recent resignations at the Fed, cryptocurrency regulation, and some of the more interesting stocks being picked by our public servants. Follow Stephen on Twitter at @CongressTrading,

2021-10-1448 min

The Weiss InvestorRemain Teachable w/ Morgan Brennan This week on The Weiss Investor, Kenny chats with his dear friend Morgan Brennan, co-anchor of CNBC’s Squawk on the Street. Finally back in person on the New York Stock Exchange, Morgan tells her extraordinary story of how she went from singing in a pop group to joining the world of finance. The two friends catch up and chat about the challenges the next generation of investors face today, including automated global markets, income inequality, and the “casino mindset.” Follow Morgan on Twitter at @MorganLBrennan

2021-10-0756 min

The Weiss InvestorDon’t Go Chasing It w / Mike Larson Mike Larson returns! The editor of the Safe Money Report and Weekend Windfalls joins Kenny for a broad look at where the global markets are headed as we enter the final months of 2021. What’s next for the Fed after the Jackson Hole summit? Will Powell still be leading the Fed next year? What’s going on in the European markets? Will energy, food, and housing prices keep inflating? How will the market handle a generation of investors that have never experienced interest rates? All these questions are answered along with so much more! Plus: Premium Subscribers to Mike’s newsle...

2021-09-3042 min

The Weiss InvestorIt’s Different Every Day w/ Scott “The Cow Guy” Shellady In today's episode, Kenny catches up with RFD-TV's Scott "The Cow Guy" Shellady. A commodities expert famous for his distinctive black and white suit, Scott tells the story of following his father's footsteps from America's heartland to the Chicago Board of Trade, then to the London Stock Exchange and finally Nashville. They discuss the importance of being relatable to a TV audience, the role farmers play in keeping the global economy afloat, and how the markets always evolve.

2021-09-2343 min

The Weiss InvestorIf It Doesn't Hit You in the Pocket... w/ Zaid Admani On this week’s episode of The Weiss Investor, Kenny chats with Zaid Admani, a civil engineer turned money influencer with over 9 million likes on TikTok (@admani_explains.) The two discuss the various platforms used in financial content creation, which range from YouTube to Substack to Instagram. They also discuss short term plays vs. long term aspirations, returning to the office after COVID, and the i mportance of how young investors can learn by screwing up.

2021-09-1652 min

Investing With IBDEp. 129: Kenny Polcari Shares His Memories Of 9/11 From Ground ZeroKenny Polcari, managing partner at Kace Capital Advisors, brings his four decades of experience on the floor of the NYSE to today's market. He gives his current outlook and why he's interested in "fear index" (VIXY) as a hedge and dividend plays like IBM (IBM) and the SPDR Utility ETF (XLU). Finally, Kenny shares his memories of 9/11. From his offices at the World Trade Center to the NYSE floor, his experience is unforgettable. For the video version, show notes and charts, visit investors.com/podcast. Learn more about your ad choices. Visit megaphone.fm/adchoices

2021-09-091h 17

The Weiss InvestorThe Commodity Supercycle w/ Sean Brodrick The Indiana Jones of Natural Resources returns! This week on The Weiss Investor, Kenny meets in-studio with Weiss Editor Sean Brodrick for a broad conversation on all things commodities. The two first dive into lithium, copper, nickel, and cobalt before exploring the electric vehicle market, Afghanistan, China, rare earth metals, cybersecurity, nuclear power, oil, gold, crypto, and so much more! AS A PREMIUM EXCLUSIVE FOR SEAN'S SUBSCRIBERS: Sean shares a few tips on the "Fab Four" taking the marijuana industry by storm! Sign up to his newsletters at WeissRatings.com

2021-09-0946 min

The Weiss InvestorWall Street Bets Part 2 w/ Jaime Rogozinski PART TWO OF A TWO PART SPECIAL: In Part 2 of Kenny's interview with Wall Street Bets' Jaime Rogozinski, Jaime explains the mindset of the typical user, who are in it to flip it. Without the social safety net of previous generations, Millennial and Gen Z day "thumb traders" seem much more open to taking big risks for short term gains. He also defends the board's past relationship with convicted fraudster Martin Shkreli and dives deeper into Gamestop mania, which took a $17 a share company that had been crushed over the years "to the moon!"

2021-09-0233 min

The Weiss InvestorThe Speed Of Light w/ Callie Cox Boomers and millennial experts unite! On today's jam-packed episode, Kenny and Ally Invest's Senior Investment Strategist Callie Cox quest to find a signal through the noise as the Federal Reserve convenes at Jackson Hole, Wyoming. Amidst the confusion and chaos over tapering, market corrections, cryptocurrencies, housing prices, a generation gap, and the Delta Variant, what's the best way for a long-term investor play it cool? And how do you discuss your financial plans with your spouse/partner? You won't want to miss this one! Follow Callie (and her new pug!) on Twitter @CallieABost.

2021-08-2653 min

The Weiss InvestorWall Street Bets Part 1 w/ Jaime Rogozinski PART ONE OF A TWO PART SPECIAL: Kenny chats with Jaime Rogozinski, the founder of the infamous WallStreetBets. Jaime chronicles his journey as a serial entrepreneur and how his fascination with technology, community, and finance culminated in the creation of a message board which has revolutionized trading through memes and viral content. The two discuss how Reddit works, why so many millennials look at the markets like a casino, debate Wall Street’s role in the 2008 crash, why he left the board, and much more. Follow Jaime on Twitter @WallStreetBets

2021-08-1942 min

The Weiss InvestorCore and Explore w/ Tony Sagami In today’s episode, Kenny joins Tony Sagami, editor of the Weiss Ultimate Portfolio and the Disruptors & Dominators newsletters, to discuss how his life’s journey helped him become the successful investor he is today. Born in post-World War II Japan, Tony and his mother were abandoned by his American GI father when they came to the United States. Raised by his Japanese-American stepfather on a radish and onion farm, who had been imprisoned in the internment camps, Tony learned how hard work, education, and forward thinking could lead him to great success in the tech investment sphere. For Premium Subs...

2021-08-1245 min

The Weiss InvestorThey Are Absolutely Listening To Us! w/ Randall CrowderOn today's episode, Kenny speaks with Randall Crowder. He's a West Point graduate, Army captain, venture capitalist, and the COO of Phunware, a NASDAQ listed tech company based out of Austin, Texas. Learn how Randall used his experiences developing algorithms to detect explosives in Afghanistan and Iraq and translated them into a successful career as an entrepreneur. And then, the debate continues: Are our phones spying on us? How much do algorithms know about who we are and what makes us tick?

2021-08-0541 min

The Weiss InvestorWhat It Takes... w/ David Silverman On today’s episode, Kenny speaks with David Silverman, CEO of Crosslead, on how his journey as a Navy SEAL led him to the world of consulting. They discuss how 9/11 changed the trajectory of both of their lives, the mental fortitude required to succeed in the toughest branch of the military, and how the leadership skills he learned fighting overseas prepared him for the world of business. Kenny and David are both involved with the Headstrong Project, a non-profit that helps veterans seek help for PTSD at no cost. For dinner: Mostaccioli Rigati with Arugula and Cannellini Beans!

2021-07-2943 min

The Weiss InvestorOn The Other Hand w/ Jon Fortt Join Kenny today as he catches up with fellow CNBC contributor Jon Fortt. As the co-anchor of Tech Check and a debater on Squawk Box, he is an expert on the intersection of media, finance and technology. He is also the CEO of Fortt Media and the creator of "The Black Experience In America." The two talk about journalism, Big Tech, crypto, free speech, and the joy of playing devil's advocate. And get ready for dinner, because Kenny's Lemon Basil Swordfish is as delicious as it gets!

2021-07-221h 04

The Weiss InvestorYou Need To Have A Plan W/ Joe Saul-SehyIt's the crossover event of the century! Kenny teams up with fellow wealth management extraordinaire Joe Saul-Sehy, the host of the smash hit podcast STACKING BENJAMINS and the author of the upcoming book STACKED, for a fun and personal episode that dives into the highs and lows of managing money, both for others and themselves. Learn how Joe pulled himself out of credit card debt in college and started a new path for himself at the age of 40. Listen to tales of Kenny making it through the worst of the 2008 Wall Street crash. Find out why a good financial...

2021-07-151h 10

The Weiss InvestorCaveat Emptor w/ Dan Mahaffee In today’s episode, Kenny speaks with Dan Mahaffee, an expert on the intersection of business, policy, and technology at the Center for the Study of the Presidency and Congress. With a keen eye on national security and investing, Dan and Kenny break down how the news of today affects the markets of tomorrow. They cover the colonial pipeline hack, the rise of China and Russia, the dangers of modern surveillance culture, and the future of digital currencies. Dan also explains his work with the Dr. Scholl Foundation and the pressures and joys of running a family-operated nonprofit. For dinner: A...

2021-07-081h 00

The Weiss Investor$10 To Your Name & You Can Get Involved In This Game w/ Juan Villaverde Join Kenny for a fascinating conversation with Weiss Crypto expert Juan Villaverde, calling in from Spain. The two discuss his journey from software cracking as a child in Uruguay to learning about finance and becoming a renowned expert in the blockchain. They chat about what crypto offers people in countries without access to traditional financial services, Bitcoin versus Ethereum, Cathy Wood's latest big move, the recent big swings in the market, and so much more! Plus: Which of the hundreds of coins out there can you trust? For dinner: A delicious Spanish seafood paella!

2021-07-0151 min

The Weiss InvestorSlow and Steady Wins the Race w/ Mike LarsonKenny chats with Weiss Senior Analyst Mike Larson, editor of Safe Money Report and the Weekend Windfalls newsletters. The big question: What makes an investment safe? They dish on the new wave of young daytraders on social media, the risks and rewards of the long game vs risky short term bets, how to make the most of the Biden stimulus package, and the Coinbase IPO. And after that, Kenny will teach you how to make a simple yet delightful Chicken Parts with Tomatoes recipe!

2021-06-2446 min

The Weiss InvestorWhat's Next? w/ Art HoganIf you've ever watched CNBC or picked up a copy of the Wall Street Journal, then you've very likely already met Art Hogan, Managing Director and Chief Market Strategist for National Securities. Art joins Kenny today for a jam-packed chat about the Federal Reserve, tapering, infrastructure, debt, bonds, inflation, consumer spending, interest rates, wealth taxes, the housing market, energy prices, investing in tech innovators and the maturing of the crypto market, and the future of work, offices, and cities after a year of working from home. And for dinner? Mouthwatering Pork Cutlets with Caprese! You won't want to miss t...

2021-06-1756 min

Shares for BeginnersKenny Polcari - A Brief History of the NYSE Pt II 1987 – 2000And so the story continues with the Black Monday Crash of 1987 through to the tech boom, Y2K bug and the year 2000. By the way you can catch Kenny on ausbiz tv where he appears regularly."These big Americana blue chip names got absolutely hammered. And so thus the Dow fell, you know, 22 and a half percent, the S&P that fell. It was horrendous. I'll never forget it. Again as I tell the story, I can feel myself in the room. I can feel the phones ringing. I can feel the tension in the, in t...

2021-06-1729 min

The Weiss InvestorThe Lions Are in the Elevator w/ Sue Herera On this week’s episode of The Weiss Investor, Kenny speaks with Sue Herera, a pioneer of financial journalism and a dear friend. At the age of 21, she became the youngest reporter at Financial News Network, the first cable network dedicated to covering global markets. When it was later purchased and absorbed by NBC, she became one of the founding members and first anchors at CNBC, where she still contributes to this day. Join us as she reflects on her remarkable 40-year career chronicling the origins of televised financial news, the birth of the greatest bull markets ever, the crash of...

2021-06-101h 12

Shares for BeginnersKenny Polcari - A Brief History of the NYSE Pt I 1980 - 1987So, I’m searching around for my next guest and I come across this guy, Kenny Polcari. I’m looking at this guy and I’m thinking – he’s been on the New York Stock Exchange for like 40 years. He might know a thing or two. I normally try and keep interviews to 30 minutes but after 30 minutes we hadn’t even reached 1987. I love war stories and Kenny’s been there on the frontline on a bayonet charge through the markets. We’ve decided to record 4 episodes to chronicle this extraordinary story. Next episode will be about the Black Monday Crash of...

2021-06-1028 min

The Weiss InvestorEnter the Cryptoverse w/ Chris Coney This week, Kenny speaks to Chris Coney, founder of The Cryptoversity (https://cryptoversity.com/) and an expert on blockchain and decentralized finance. The two cover the origins of Bitcoin, the philosophy behind DeFi and what it mean for our banking system, the recent market correction, the environmental impact of the blockchain, Coinbase, and so much more. And after Chris shares three of his favorite cryptos on the exchange, Kenny’s going to help you make a Pan Seared Pounded Veal Chop that’ll make you the star of any dinner party!

2021-06-0357 min

Stocks for BeginnersKenny Polcari - A Brief History of the NYSE Pt I 1980 - 1987So, I’m searching around for my next guest and I come across this guy, Kenny Polcari. I’m looking at this guy and I’m thinking – he’s been on the New York Stock Exchange for like 40 years. He might know a thing or two. I normally try and keep interviews to 30 minutes but after 30 minutes we hadn’t even reached 1987. I love war stories and Kenny’s been there on the frontline on a bayonet charge through the markets. We’ve decided to record 4 episodes to chronicle this extraordinary story. Next episode will be about the Black Monday Crash of 198...

2021-05-2428 min

Payne Points of WealthInflation, Bonds, & Bitcoin with Kenny Polcari, Ep #36Hey, what's up! It's episode 36 of Payne Points of Wealth. We've got a special guest for you today, Kenny Polcari. He's Managing Partner at Kace Capital Advisors, Chief Market Strategist at Slatestone Wealth, and Managing Director at Campfire Capital. Most importantly, he was one of the most famous stock exchange traders going back to the ‘80s and no one gives you a better tour of the New York Stock Exchange than Kenny! We're going to talk with him about what's going on with inflation, the economy, and investing. On the tipping point, we're going to talk about bonds. Bonds ar...

2021-05-0526 min

The Weiss InvestorThe Weiss Investor w/ Dr. Martin WeissIn our inaugural episode, host Kenny Polcari speaks to Dr. Martin Weiss on his 50 year journey in the financial sector. From the S&L Crisis of 1978 to the Crypto Boom, Martin has seen it all. Learning from his father who predicted the Wall Street Crash of 1929, Weiss refuses money from the banks it rates in order to offer unbiased research that suits the needs of his clients. What's changed in the last 50 years? What's stayed the same? And how can you, the investor, navigate the markets as they enter uncharted waters? Join us as we begin this exciting journey! This...

2021-04-3057 min

Trading For KeepsEpisode 26: Kenny Polcari part 2Kenny (Twitter: @KennyPolcari LinkedIn: @KennyPolcari) is the managing partner of Kace Capital Advisors. In this episode, we talk about a wide range of subjects. Topics include bailouts, circuit breakers, and market bubbles. Mentioned: *The Big Short *Market Wizards Text INVEST to 2100 for his business card.Personal website KennyPolcari.com *Commissions received

2021-01-141h 12

Trading For KeepsEpisode 25: Kenny Polcari part 1Kenny (Twitter: @KennyPolcari LinkedIn: @KennyPolcari) is the managing partner of Kace Capital Advisors. We talk about the history of the stock market and what it was like to work on the floor of the New York Stock Exchange in the 1980s. We get a clear answers on what led to the infamous 1987 market crash. Text INVEST to 2100 for his business card. Personal website KennyPolcari.com

2021-01-071h 01