Shows

Wall Street Wildlife Investing PodcastE85: Martin Shkreli vs Quantum Computing | A Pro Trader's Guide to Cutting Losses🍕 Pentagon Pizza Index: Reading Geopolitical Tea Leaves - Ever noticed takeout orders spike near the Pentagon before major crises? Sometimes unconventional data points can provide valuable market sentiment insights🧬 Martin Shkreli's Quantum Computing Crusade - The controversial pharma entrepreneur turned quantum computing bear makes his case for why the sector is a massive bubble. We dissect his debate performance and whether his "never ever" stance goes too far⚡ EOS Energy Options Strategy Deep Dive - Krzysztof breaks down his sophisticated options play on EOS after the stock's 40% crash, using standard deviation calculations and long-dated LEAPs to maxim...2025-06-2451 min

Wall Street Wildlife Investing PodcastE85: Martin Shkreli vs Quantum Computing | A Pro Trader's Guide to Cutting Losses🍕 Pentagon Pizza Index: Reading Geopolitical Tea Leaves - Ever noticed takeout orders spike near the Pentagon before major crises? Sometimes unconventional data points can provide valuable market sentiment insights🧬 Martin Shkreli's Quantum Computing Crusade - The controversial pharma entrepreneur turned quantum computing bear makes his case for why the sector is a massive bubble. We dissect his debate performance and whether his "never ever" stance goes too far⚡ EOS Energy Options Strategy Deep Dive - Krzysztof breaks down his sophisticated options play on EOS after the stock's 40% crash, using standard deviation calculations and long-dated LEAPs to maxim...2025-06-2451 min Wall Street Wildlife Investing PodcastE83: AI Has Arrived, What Comes Next?🤖 The AI Paradigm Shift: Beyond Resource Optimization - Krzysztof takes us on a philosophical journey through history's technological eras, from Greek substance thinking to medieval God-centered worldviews, to our current technological age where everything is seen as a resource to be optimized. What happens when AI makes this optimization obsolete?🧠 From Human Resources to Human Flourishing - In a world where AI handles efficiency and productivity, how do we transition from viewing people as resources to prioritizing human wellbeing? We explore investment opportunities in this fundamental shift.🚗 Post-Scarcity Society & Universal Basic Income - what happens when AI e...2025-06-101h 12

Wall Street Wildlife Investing PodcastE83: AI Has Arrived, What Comes Next?🤖 The AI Paradigm Shift: Beyond Resource Optimization - Krzysztof takes us on a philosophical journey through history's technological eras, from Greek substance thinking to medieval God-centered worldviews, to our current technological age where everything is seen as a resource to be optimized. What happens when AI makes this optimization obsolete?🧠 From Human Resources to Human Flourishing - In a world where AI handles efficiency and productivity, how do we transition from viewing people as resources to prioritizing human wellbeing? We explore investment opportunities in this fundamental shift.🚗 Post-Scarcity Society & Universal Basic Income - what happens when AI e...2025-06-101h 12 Wall Street Wildlife Investing PodcastE82 (bonus): Trump vs Elon - Which Stocks are DOOMED?Is character really destiny?Elon Musk vs Donald Trump: Which stocks will suffer most from this lover’s quarrel? Which investments have better than ever odds? Badger and Monkey pontificate and make some portfolio moves. Was this inevitable? Are we missing something important? Pipe up, ye chipmunks!Segments:00:00 Introduction02:30 Trump and Musk's Character08:03 Our Break-Up Prediction Came True11:11 How does this impact Tesla? $TSLA16:25 SpaceX19:52 Rocket Lab & Blue Origin $RKLB20:37 AST Space Mobile $ASTS25:13 EOS Energy? $EO...2025-06-0632 min

Wall Street Wildlife Investing PodcastE82 (bonus): Trump vs Elon - Which Stocks are DOOMED?Is character really destiny?Elon Musk vs Donald Trump: Which stocks will suffer most from this lover’s quarrel? Which investments have better than ever odds? Badger and Monkey pontificate and make some portfolio moves. Was this inevitable? Are we missing something important? Pipe up, ye chipmunks!Segments:00:00 Introduction02:30 Trump and Musk's Character08:03 Our Break-Up Prediction Came True11:11 How does this impact Tesla? $TSLA16:25 SpaceX19:52 Rocket Lab & Blue Origin $RKLB20:37 AST Space Mobile $ASTS25:13 EOS Energy? $EO...2025-06-0632 min Wall Street Wildlife Investing PodcastE82: Is Crypto The Future Of The Internet?In this special episode, Krzysztof takes Luke (and us) on an eye-opening journey through the revolutionary potential of blockchain technology. Forget everything you think you know about crypto - this isn't about meme coins or get-rich-quick schemes. This is about the fundamental architecture of the internet's future.🧠 What is Crypto Really? - the shocking truth: crypto isn't just digital money, it's an entirely new form of computing that runs on software, not hardware. Think of it as a distributed computer that no single entity can control or shut down📊 Serious Tokens vs. Casino...2025-06-031h 16

Wall Street Wildlife Investing PodcastE82: Is Crypto The Future Of The Internet?In this special episode, Krzysztof takes Luke (and us) on an eye-opening journey through the revolutionary potential of blockchain technology. Forget everything you think you know about crypto - this isn't about meme coins or get-rich-quick schemes. This is about the fundamental architecture of the internet's future.🧠 What is Crypto Really? - the shocking truth: crypto isn't just digital money, it's an entirely new form of computing that runs on software, not hardware. Think of it as a distributed computer that no single entity can control or shut down📊 Serious Tokens vs. Casino...2025-06-031h 16 Wall Street Wildlife Investing PodcastE80: Google AI: Revolution or Delusion? Is The Trade War Over Already? + $1500 Crypto Airdrop Win! 🤑🌐 Tariff Chaos Comes to an End? - Is the market doom over? We break down the surprise US-China trade agreement and what it means for investors navigating the chaos🔗 Chainlink Build Rewards: Crypto Dividends in Action - Krzysztof receives his first airdrop worth $1,500 from the Chainlink Build program. Is this the future of non-casino crypto investing? $LINK🛒 Two International E-Commerce Titans - Luke dives deep into his biggest holdings, comparing two international e-commerce giants💸 Investing in Quantum Computing: When Shorts Go Wrong - Krzysztof's options play...2025-05-201h 10

Wall Street Wildlife Investing PodcastE80: Google AI: Revolution or Delusion? Is The Trade War Over Already? + $1500 Crypto Airdrop Win! 🤑🌐 Tariff Chaos Comes to an End? - Is the market doom over? We break down the surprise US-China trade agreement and what it means for investors navigating the chaos🔗 Chainlink Build Rewards: Crypto Dividends in Action - Krzysztof receives his first airdrop worth $1,500 from the Chainlink Build program. Is this the future of non-casino crypto investing? $LINK🛒 Two International E-Commerce Titans - Luke dives deep into his biggest holdings, comparing two international e-commerce giants💸 Investing in Quantum Computing: When Shorts Go Wrong - Krzysztof's options play...2025-05-201h 10 Wall Street Wildlife Investing PodcastE79: Market Momentum, Amazon's Robot Edge & the AI Power-Play📈 Markets on Historic Winning Streak - after the chaos of tariffs and "Liberation Day," the markets are currently on their longest winning streak in 20 years! We analyze what's driving this surprising bull run and discuss whether it's sustainable or just a temporary bounce.🤖 Big Tech Earnings & AI's Unstoppable Momentum - despite economic uncertainty, the tech giants are doubling down on AI with massive capital expenditures. Microsoft ($80B), Alphabet ($75B), Amazon ($100B+), and Meta ($65-72B) are all betting big on winning the AI race. We explore what this means for investors.🏭 Inside Amazon's Robotic Empire - Luke sh...2025-05-131h 17

Wall Street Wildlife Investing PodcastE79: Market Momentum, Amazon's Robot Edge & the AI Power-Play📈 Markets on Historic Winning Streak - after the chaos of tariffs and "Liberation Day," the markets are currently on their longest winning streak in 20 years! We analyze what's driving this surprising bull run and discuss whether it's sustainable or just a temporary bounce.🤖 Big Tech Earnings & AI's Unstoppable Momentum - despite economic uncertainty, the tech giants are doubling down on AI with massive capital expenditures. Microsoft ($80B), Alphabet ($75B), Amazon ($100B+), and Meta ($65-72B) are all betting big on winning the AI race. We explore what this means for investors.🏭 Inside Amazon's Robotic Empire - Luke sh...2025-05-131h 17 Wall Street Wildlife Investing PodcastE78: Poker Mindset, Space Bets & Retail vs. Pro Showdown🤔 Is it more important to make good investment decisions or to make money? We dive into this fundamental question that shapes investment strategy and psychology🏦 Why poker players focus on process while many investors chase outcomes. We explore the differences between short-term performance measurement and long-term success🎲 Survivorship Bias in Investing - The 99 investors who took big bets and lost don't get to tell their stories. We examine how this distorts our perception of successful investing strategies📊 Professional vs Retail Investors - Hedge funds have sold over a trillion dollars in shares while individual i...2025-05-061h 17

Wall Street Wildlife Investing PodcastE78: Poker Mindset, Space Bets & Retail vs. Pro Showdown🤔 Is it more important to make good investment decisions or to make money? We dive into this fundamental question that shapes investment strategy and psychology🏦 Why poker players focus on process while many investors chase outcomes. We explore the differences between short-term performance measurement and long-term success🎲 Survivorship Bias in Investing - The 99 investors who took big bets and lost don't get to tell their stories. We examine how this distorts our perception of successful investing strategies📊 Professional vs Retail Investors - Hedge funds have sold over a trillion dollars in shares while individual i...2025-05-061h 17 Wall Street Wildlife Investing PodcastE77: Tariff-Proof your Portfolio in Europe🧠 Kant's Revolutionary Investing Paradigm - how 18th century philosopher Emmanuel Kant's "Copernican Revolution" in thinking applies to investing. Discover how shifting your perspective from "risk exists out there" to "we construct risk" can transform your approach to volatile markets.💱 Dollar Defense: Getting European Exposure - with uncertainty around the US dollar, we break down four practical strategies for US investors to increase their European exposure.🚢 Tariffs and Supply Chain Disruption - how recent tariffs are already causing massive shipping declines between China and the US. Learn why these disruptions could take up to a year to fully...2025-04-291h 25

Wall Street Wildlife Investing PodcastE77: Tariff-Proof your Portfolio in Europe🧠 Kant's Revolutionary Investing Paradigm - how 18th century philosopher Emmanuel Kant's "Copernican Revolution" in thinking applies to investing. Discover how shifting your perspective from "risk exists out there" to "we construct risk" can transform your approach to volatile markets.💱 Dollar Defense: Getting European Exposure - with uncertainty around the US dollar, we break down four practical strategies for US investors to increase their European exposure.🚢 Tariffs and Supply Chain Disruption - how recent tariffs are already causing massive shipping declines between China and the US. Learn why these disruptions could take up to a year to fully...2025-04-291h 25 Wall Street Wildlife Investing PodcastE76: Are Stocks about to Blow Up?! 💣📊 Volatility vs Catastrophe - What's Happening in Markets? The S&P recently hit a 13% drawdown, is this normal volatility or the beginning of something worse? Monkey and Badger examine historical patterns and what they tell us about today's market turbulence📉 Understanding Market Fear Through VIX Analysis - We dive into volatility measurements showing this recent spike was the third highest in 10 years (behind only COVID and the Japan carry trade unwind), revealing investor psychology and potential opportunities🌍 Are We Witnessing a Changing World Order? Exploring Ray Dalio's thesis on the rise and fall of empires - is Amer...2025-04-221h 01

Wall Street Wildlife Investing PodcastE76: Are Stocks about to Blow Up?! 💣📊 Volatility vs Catastrophe - What's Happening in Markets? The S&P recently hit a 13% drawdown, is this normal volatility or the beginning of something worse? Monkey and Badger examine historical patterns and what they tell us about today's market turbulence📉 Understanding Market Fear Through VIX Analysis - We dive into volatility measurements showing this recent spike was the third highest in 10 years (behind only COVID and the Japan carry trade unwind), revealing investor psychology and potential opportunities🌍 Are We Witnessing a Changing World Order? Exploring Ray Dalio's thesis on the rise and fall of empires - is Amer...2025-04-221h 01 Wall Street Wildlife Investing PodcastE75: Market Crash Survival Guide📉 Market Madness: Navigating the Crash - In this special episode, we dissect the recent market turmoil and share our survival strategies. Is this the beginning of a recession or just another buying opportunity? We explore different perspectives on handling market chaos.🧠 The Psychology of Market Fear - Every investor faces fear during market downturns. We discuss how to transform fear into opportunity instead of panic, and why emotional discipline is crucial when your portfolio drops more than your annual salary in a single day.💰 Free Cash Flow: The Ultimate Survival...2025-04-151h 29

Wall Street Wildlife Investing PodcastE75: Market Crash Survival Guide📉 Market Madness: Navigating the Crash - In this special episode, we dissect the recent market turmoil and share our survival strategies. Is this the beginning of a recession or just another buying opportunity? We explore different perspectives on handling market chaos.🧠 The Psychology of Market Fear - Every investor faces fear during market downturns. We discuss how to transform fear into opportunity instead of panic, and why emotional discipline is crucial when your portfolio drops more than your annual salary in a single day.💰 Free Cash Flow: The Ultimate Survival...2025-04-151h 29 Wall Street Wildlife Investing PodcastE74: VOLATILITY & CHAOS!📉 Navigating Market Turbulence - we share our perspectives on weathering the current market volatility. Why most investors get things wrong during inevitable market downturns and how to maintain emotional discipline when everything feels chaotic.🧠 The Psychology of Market Panic - why professional economists are often wrong about market predictions, and why systems thinking is crucial for understanding complex market dynamics that take time to play out.💰 Investment Strategy During Uncertainty - the benefits of having cash on hand (25%) during volatile periods, the importance of focusing on company fundamentals rather than market noise, and why "stop looking at your portfolio" might be...2025-04-081h 12

Wall Street Wildlife Investing PodcastE74: VOLATILITY & CHAOS!📉 Navigating Market Turbulence - we share our perspectives on weathering the current market volatility. Why most investors get things wrong during inevitable market downturns and how to maintain emotional discipline when everything feels chaotic.🧠 The Psychology of Market Panic - why professional economists are often wrong about market predictions, and why systems thinking is crucial for understanding complex market dynamics that take time to play out.💰 Investment Strategy During Uncertainty - the benefits of having cash on hand (25%) during volatile periods, the importance of focusing on company fundamentals rather than market noise, and why "stop looking at your portfolio" might be...2025-04-081h 12 Wall Street Wildlife Investing PodcastE73: Ten Essential Investing LessonsCinema Meets Investing Wisdom - we revisit our "10 Laws of the Investing Jungle," bringing each principle to life through the lens of iconic films and TV shows. This is a back to the fundamentals episode, perfect for when you need help navigating intense market volatility (like - right now!)🚀 The Shawshank Redemption Long Game - how patience and persistence, exemplified by Andy Dufresne’s tunnel, can transform your investing outcomes📉 The Big Short & Dangers of Leverage - the devastating consequences of leverage💡 Moneyball's Independent Thinking - the importance of making your own in...2025-04-011h 14

Wall Street Wildlife Investing PodcastE73: Ten Essential Investing LessonsCinema Meets Investing Wisdom - we revisit our "10 Laws of the Investing Jungle," bringing each principle to life through the lens of iconic films and TV shows. This is a back to the fundamentals episode, perfect for when you need help navigating intense market volatility (like - right now!)🚀 The Shawshank Redemption Long Game - how patience and persistence, exemplified by Andy Dufresne’s tunnel, can transform your investing outcomes📉 The Big Short & Dangers of Leverage - the devastating consequences of leverage💡 Moneyball's Independent Thinking - the importance of making your own in...2025-04-011h 14 Wall Street Wildlife Investing PodcastE71: Recession Fears, Tesla Turmoil & Nintendo’s Next Move📉 Recession Watch: Navigating Market Turbulence - we tackle recent market volatility. Is it time to worry, or is the market overreacting? We discuss strategies to navigate all the uncertainty!🚗 Tesla’s Rocky Road Ahead - Tesla’s facing tough questions: margins shrinking, market share concerns, and intense competition. Should investors hold steady or hit the brakes? $TSLA🎮 Nintendo’s Game-Changing Strategy - Nintendo prepares for its next era with Switch 2. Can the legendary gaming company avoid past boom-and-bust cycles and unlock consistent growth? $NTDOY🔋 EOS Energy Update: Expansion & Earnings - Krzysztof breaks down EOS Energy’s lates...2025-03-181h 10

Wall Street Wildlife Investing PodcastE71: Recession Fears, Tesla Turmoil & Nintendo’s Next Move📉 Recession Watch: Navigating Market Turbulence - we tackle recent market volatility. Is it time to worry, or is the market overreacting? We discuss strategies to navigate all the uncertainty!🚗 Tesla’s Rocky Road Ahead - Tesla’s facing tough questions: margins shrinking, market share concerns, and intense competition. Should investors hold steady or hit the brakes? $TSLA🎮 Nintendo’s Game-Changing Strategy - Nintendo prepares for its next era with Switch 2. Can the legendary gaming company avoid past boom-and-bust cycles and unlock consistent growth? $NTDOY🔋 EOS Energy Update: Expansion & Earnings - Krzysztof breaks down EOS Energy’s lates...2025-03-181h 10 Wall Street Wildlife Investing PodcastE70: ARK Invest's Big Ideas 2025 – The Future UnveiledIn this week's episode, we walk through ARK Invest's Big Ideas 2025 Research, highlighting the key disruptive innovation technologies that are set to transform the global landscape🤖 The AI Paradigm Shift - from neural networks to large language models, how will AI reshape industries, and the companies poised to win🌌 Space Innovation & Satellite Connectivity - including SpaceX, AST SpaceMobile’s potential disruptions, and the future of satellite communications🔋 Energy Storage Revolution - Tesla’s remarkable market share in global energy storage to exciting developments in nuclear power and renewables. How will these trends...2025-03-111h 15

Wall Street Wildlife Investing PodcastE70: ARK Invest's Big Ideas 2025 – The Future UnveiledIn this week's episode, we walk through ARK Invest's Big Ideas 2025 Research, highlighting the key disruptive innovation technologies that are set to transform the global landscape🤖 The AI Paradigm Shift - from neural networks to large language models, how will AI reshape industries, and the companies poised to win🌌 Space Innovation & Satellite Connectivity - including SpaceX, AST SpaceMobile’s potential disruptions, and the future of satellite communications🔋 Energy Storage Revolution - Tesla’s remarkable market share in global energy storage to exciting developments in nuclear power and renewables. How will these trends...2025-03-111h 15 Wall Street Wildlife Investing PodcastE69: Moats, The Magnificent Seven & Never Sell – Smart or Suicide? With Special Guest Matt Cochrane🏰 Do Moats Still Matter in 2025? What exactly is a competitive moat in today’s fast-moving market? Are brands like Coca-Cola and Apple still untouchable, or is AI changing the game? We debate whether classic economic moats still hold up.🚀 Are The Magnificent Seven Still Magnificent? Once the undisputed kings of the stock market, are the Mag7 tech giants still as dominant as they seem? Or is there an undercurrent of risk threatening their long-term reign? We break down each company and where they stand today.🔒 Never Sell: The Ultimate Investing Strategy or a Dangerous Myth? Holding sto...2025-03-041h 23

Wall Street Wildlife Investing PodcastE69: Moats, The Magnificent Seven & Never Sell – Smart or Suicide? With Special Guest Matt Cochrane🏰 Do Moats Still Matter in 2025? What exactly is a competitive moat in today’s fast-moving market? Are brands like Coca-Cola and Apple still untouchable, or is AI changing the game? We debate whether classic economic moats still hold up.🚀 Are The Magnificent Seven Still Magnificent? Once the undisputed kings of the stock market, are the Mag7 tech giants still as dominant as they seem? Or is there an undercurrent of risk threatening their long-term reign? We break down each company and where they stand today.🔒 Never Sell: The Ultimate Investing Strategy or a Dangerous Myth? Holding sto...2025-03-041h 23 Wall Street Wildlife Investing PodcastE68: Scams, Stocks, and Self-Driving Dreams⚠ Badger’s Brush with a Scam! Luke narrowly avoids a sophisticated Twitter account takeover scam. Learn how the phishing attack worked and how to protect yourself from falling for similar traps🚗 Uber’s Autonomous Ambitions: Real Talk or PR Spin? The Uber CEO claims self-driving cars won’t be commercially viable for at least a decade. Is this a realistic projection or just an attempt to keep the human drivers from panicking? Badger and Monkey break it down $UBER💊 Hims & Hers Health: Meme Stock or Real Growth? Luke takes us on a deep dive into HIMS, a telehe...2025-02-251h 06

Wall Street Wildlife Investing PodcastE68: Scams, Stocks, and Self-Driving Dreams⚠ Badger’s Brush with a Scam! Luke narrowly avoids a sophisticated Twitter account takeover scam. Learn how the phishing attack worked and how to protect yourself from falling for similar traps🚗 Uber’s Autonomous Ambitions: Real Talk or PR Spin? The Uber CEO claims self-driving cars won’t be commercially viable for at least a decade. Is this a realistic projection or just an attempt to keep the human drivers from panicking? Badger and Monkey break it down $UBER💊 Hims & Hers Health: Meme Stock or Real Growth? Luke takes us on a deep dive into HIMS, a telehe...2025-02-251h 06 Wall Street Wildlife Investing PodcastE67: Doge, Politics, the Space Race, and the Future of Meat $ASTS $SpaceX💥 Is the USA becoming uninvestable? A thought-provoking question from a Patreon supporter sparks a deep dive into the political and economic future of the United States. Are we heading toward autocracy, and what does that mean for investors? Bonus shout-out to fans of the TV show The Americans!🚀 AST SpaceMobile vs. Starlink - The Space Race Heats Up! T-Mobile’s big Super Bowl announcement puts satellite-to-phone connectivity in the spotlight. Is $ASTS primed to disrupt SpaceX’s Starlink, or is this a two-horse race with room for both?🪙 $TRUMP & $MELANIA Coins...2025-02-181h 16

Wall Street Wildlife Investing PodcastE67: Doge, Politics, the Space Race, and the Future of Meat $ASTS $SpaceX💥 Is the USA becoming uninvestable? A thought-provoking question from a Patreon supporter sparks a deep dive into the political and economic future of the United States. Are we heading toward autocracy, and what does that mean for investors? Bonus shout-out to fans of the TV show The Americans!🚀 AST SpaceMobile vs. Starlink - The Space Race Heats Up! T-Mobile’s big Super Bowl announcement puts satellite-to-phone connectivity in the spotlight. Is $ASTS primed to disrupt SpaceX’s Starlink, or is this a two-horse race with room for both?🪙 $TRUMP & $MELANIA Coins...2025-02-181h 16 Wall Street Wildlife Investing PodcastE64: This Crypto Could Be Bigger Than Bitcoin! $LINKDon’t miss this deep dive into one of the most promising crypto projects of all time!In this week's episode, special guest Daniel Shapiro @_dshap, a crypto expert from Blockworks Research, demystifies the potential and challenges of Chainlink $LINK and the evolving world of blockchain technology.Key Topics:🌐 What is Chainlink? Bridging the Real World and Blockchain, and how Chainlink could become the standard for blockchain interoperability⚙ Decentralized Oracle Networks (DONs): The Foundation of Chainlink🌱 Chainlink’s Role in Sustainability and Insurance, from weather...2025-01-281h 44

Wall Street Wildlife Investing PodcastE64: This Crypto Could Be Bigger Than Bitcoin! $LINKDon’t miss this deep dive into one of the most promising crypto projects of all time!In this week's episode, special guest Daniel Shapiro @_dshap, a crypto expert from Blockworks Research, demystifies the potential and challenges of Chainlink $LINK and the evolving world of blockchain technology.Key Topics:🌐 What is Chainlink? Bridging the Real World and Blockchain, and how Chainlink could become the standard for blockchain interoperability⚙ Decentralized Oracle Networks (DONs): The Foundation of Chainlink🌱 Chainlink’s Role in Sustainability and Insurance, from weather...2025-01-281h 44 Wall Street Wildlife Investing PodcastE61: Is this the End of the Magnificent Seven? + Two Quantum Computing Stocks! $RGTI $QUBTHappy New Year! We kick off 2025 with bold predictions and a touch of drama. After reflecting on our 2024 forecasting showdown (spoiler: eggnog-fueled chaos), we dive into the biggest investing and stock market trends and opportunities for 2025!

We also open the box on quantum computing and analyse two hot names in this sector, Rigetti Computing $RGTI and Quantum Computing Inc $QUBT!

💹 S&P 500 in 2025 – Bullish, bearish, or just plain sideways?

📈 Small-Cap Comeback – Are the underdogs finally ready to shine, and is this the end of the Magnificent 7?

🖥 Quantu...2025-01-071h 17

Wall Street Wildlife Investing PodcastE61: Is this the End of the Magnificent Seven? + Two Quantum Computing Stocks! $RGTI $QUBTHappy New Year! We kick off 2025 with bold predictions and a touch of drama. After reflecting on our 2024 forecasting showdown (spoiler: eggnog-fueled chaos), we dive into the biggest investing and stock market trends and opportunities for 2025!

We also open the box on quantum computing and analyse two hot names in this sector, Rigetti Computing $RGTI and Quantum Computing Inc $QUBT!

💹 S&P 500 in 2025 – Bullish, bearish, or just plain sideways?

📈 Small-Cap Comeback – Are the underdogs finally ready to shine, and is this the end of the Magnificent 7?

🖥 Quantu...2025-01-071h 17 Wall Street Wildlife Investing PodcastE60: Investing for Your Children - A Guide for ParentsThe Power of Starting Early:

👨👩👧👦 Why beginning an investment journey for your kids today can lead to life-changing outcomes

💰 How compound interest can turn $20 a week into more than $50,000!

Step-By-Step Guide to Getting Started (Today!):

🏦 How to open a tax efficient account

❔ What to invest in

💪 How to resist market noise and stay consistent with your long-term plan

Investing as a Family Journey:

☕ Teaching kids about investing using brands they love, like Starbucks, Tesla, or Netflix

🎮 Leveraging tools like Green...2024-12-3152 min

Wall Street Wildlife Investing PodcastE60: Investing for Your Children - A Guide for ParentsThe Power of Starting Early:

👨👩👧👦 Why beginning an investment journey for your kids today can lead to life-changing outcomes

💰 How compound interest can turn $20 a week into more than $50,000!

Step-By-Step Guide to Getting Started (Today!):

🏦 How to open a tax efficient account

❔ What to invest in

💪 How to resist market noise and stay consistent with your long-term plan

Investing as a Family Journey:

☕ Teaching kids about investing using brands they love, like Starbucks, Tesla, or Netflix

🎮 Leveraging tools like Green...2024-12-3152 min Wall Street Wildlife Investing PodcastE59: Monkey vs Badger 2024 Annual Review Holiday Extravaganza🥂 Festive Chaos in our live-streamed holiday special, complete with cocktails, banter, and a drunk Badger and Monkey!

🍸 Signature drinks take center stage with live cocktail mixing on-air. Festive classics plus questionable new inventions!

🎄 A spirited review of our bold 2024 market predictions, with penalty shots for errors $NVDA $EOSE $META $BTC #WeWork

🚗 $TESLA vs. $BYD: Who’s the EV market leader? Surprising results!

💡 Big Tech in 2024: Predictions about AI advancements, antitrust movements, and disruptive innovations. $CRWD $DDOG

🤔 Patreon Q&A: Fans weigh in with tough questions including “What kind of investor would Nietzsc...2024-12-241h 27

Wall Street Wildlife Investing PodcastE59: Monkey vs Badger 2024 Annual Review Holiday Extravaganza🥂 Festive Chaos in our live-streamed holiday special, complete with cocktails, banter, and a drunk Badger and Monkey!

🍸 Signature drinks take center stage with live cocktail mixing on-air. Festive classics plus questionable new inventions!

🎄 A spirited review of our bold 2024 market predictions, with penalty shots for errors $NVDA $EOSE $META $BTC #WeWork

🚗 $TESLA vs. $BYD: Who’s the EV market leader? Surprising results!

💡 Big Tech in 2024: Predictions about AI advancements, antitrust movements, and disruptive innovations. $CRWD $DDOG

🤔 Patreon Q&A: Fans weigh in with tough questions including “What kind of investor would Nietzsc...2024-12-241h 27 Wall Street Wildlife Investing PodcastE58: Beyond Frothy Valuations: Investing for Success in Any Season💹 Managing Market Volatility: Handling frothy valuations in today’s wild market (Badger values his whole portfolio!)

🧠 The Role of AI in Investing: How AI impacts valuation metrics, company performance, and its influence on investor sentiment.

📈 Using Options for Market Insurance: Monkey is hedging his portfolio risk by buying Palantir $PLTR PUTS, but Badger is still long!

🪙 Crypto Winter Is Coming: The importance of fundamentals, avoiding circus coins, and opportunities in Bitcoin $BTC and Chainlink $LINK

Listener Takeaways:

🔑 Start Your Investing Journey: Overcoming inertia and building wealth over time with co...2024-12-171h 04

Wall Street Wildlife Investing PodcastE58: Beyond Frothy Valuations: Investing for Success in Any Season💹 Managing Market Volatility: Handling frothy valuations in today’s wild market (Badger values his whole portfolio!)

🧠 The Role of AI in Investing: How AI impacts valuation metrics, company performance, and its influence on investor sentiment.

📈 Using Options for Market Insurance: Monkey is hedging his portfolio risk by buying Palantir $PLTR PUTS, but Badger is still long!

🪙 Crypto Winter Is Coming: The importance of fundamentals, avoiding circus coins, and opportunities in Bitcoin $BTC and Chainlink $LINK

Listener Takeaways:

🔑 Start Your Investing Journey: Overcoming inertia and building wealth over time with co...2024-12-171h 04 Wall Street Wildlife Investing PodcastE57: Don't Be a Sheep! Why Price Action Controls Your Brain (and Portfolio) + $RCEL $ENPH🤡 Why crypto remain a “huge circus” $XRP vs. $LINK

🤔 Should you short Palantir? Timing and understanding market trends before jumping in $PLTR

🧔🏻♂️ A bearded Monkey is humbled by admirers of his new furry face while Badger dives into the challenges of being a patient long-term investor and how price drives sentiment in unhelpful ways

🧬 Avita Medical: Exploring their innovative approach to regenerative skin wound reconstruction $RCEL

☀️ Enphase Energy: Breaking down the political and market forces shaping renewable energy investments $ENPH

🦁 King of the Jungle Portfolio Updates $ASML $BTC $IREN $RKLB

🌴 Than...2024-12-101h 04

Wall Street Wildlife Investing PodcastE57: Don't Be a Sheep! Why Price Action Controls Your Brain (and Portfolio) + $RCEL $ENPH🤡 Why crypto remain a “huge circus” $XRP vs. $LINK

🤔 Should you short Palantir? Timing and understanding market trends before jumping in $PLTR

🧔🏻♂️ A bearded Monkey is humbled by admirers of his new furry face while Badger dives into the challenges of being a patient long-term investor and how price drives sentiment in unhelpful ways

🧬 Avita Medical: Exploring their innovative approach to regenerative skin wound reconstruction $RCEL

☀️ Enphase Energy: Breaking down the political and market forces shaping renewable energy investments $ENPH

🦁 King of the Jungle Portfolio Updates $ASML $BTC $IREN $RKLB

🌴 Than...2024-12-101h 04 Wall Street Wildlife Investing PodcastE56: 10x Stocks and Penny Shares, plus Rocket Lab $RKLB 🚀 and Cassava Sciences $SAVA 🧬📉In this week's episode:

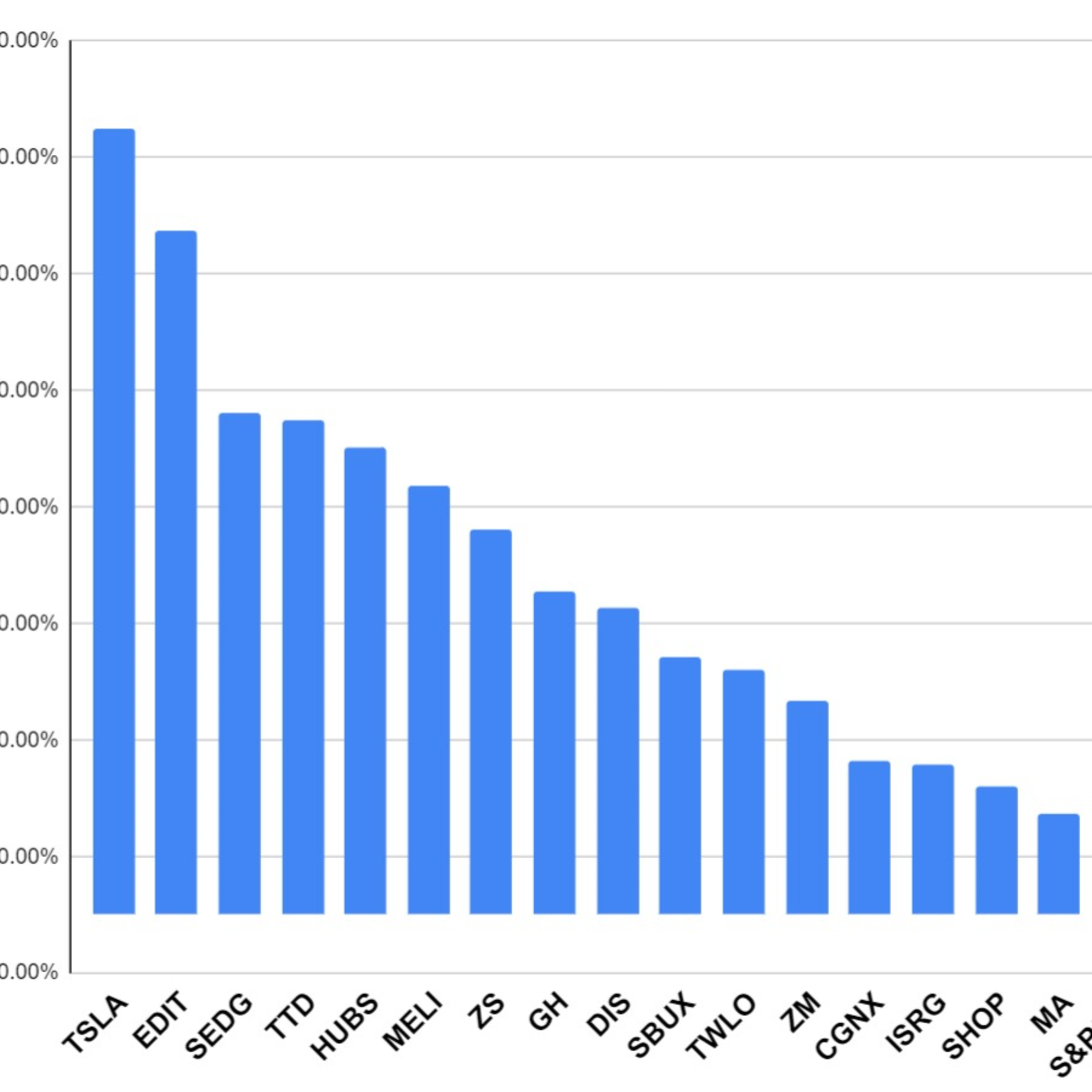

📗 Lessons from 100-Baggers by Christopher Mayer

💭 Monkey dreams of 10x returns, exploring market inefficiencies and why they matter $TSLA $EOSE

🧪 The dramatic fall of Cassava Sciences, the dangers of fraud in biotech, and the importance of robust due diligence $SAVA

🚀 How Rocket Lab became one of Badger's top holdings and why he's not trimming profits just yet $RKLB

🎩 Why penny stocks are high-risk gambles, and how to know a penny stock from a company that's just down on its luck $CHRS

🥃 Badger wins the NVIDIA earning...2024-12-031h 09

Wall Street Wildlife Investing PodcastE56: 10x Stocks and Penny Shares, plus Rocket Lab $RKLB 🚀 and Cassava Sciences $SAVA 🧬📉In this week's episode:

📗 Lessons from 100-Baggers by Christopher Mayer

💭 Monkey dreams of 10x returns, exploring market inefficiencies and why they matter $TSLA $EOSE

🧪 The dramatic fall of Cassava Sciences, the dangers of fraud in biotech, and the importance of robust due diligence $SAVA

🚀 How Rocket Lab became one of Badger's top holdings and why he's not trimming profits just yet $RKLB

🎩 Why penny stocks are high-risk gambles, and how to know a penny stock from a company that's just down on its luck $CHRS

🥃 Badger wins the NVIDIA earning...2024-12-031h 09 Wall Street Wildlife Investing PodcastE55: Drunken Wisdom AMZN LINK PLTR Cash🥂 Drunk Wisdom: Reflecting on market highs and lows over a sea of booze. Key lessons about taking a long-term view, and having a process to improve your process (the machine that builds the machine?)

💼 $AMZN Amazon’s Strategy Reboot: Deep dive into Amazon’s current moves in e-commerce and cloud services

🪙 $LINK Chainlink’s Future Potential: Exploring why Chainlink ($LINK) is a foundational player in Web3 and the crypto economy

📈 Palantir’s Playbook for the Future: How $PLTR is positioning itself in AI and data analytics, with potential as a long-term investment. Is there a case for a short position?

🔄 Compound...2024-11-261h 09

Wall Street Wildlife Investing PodcastE55: Drunken Wisdom AMZN LINK PLTR Cash🥂 Drunk Wisdom: Reflecting on market highs and lows over a sea of booze. Key lessons about taking a long-term view, and having a process to improve your process (the machine that builds the machine?)

💼 $AMZN Amazon’s Strategy Reboot: Deep dive into Amazon’s current moves in e-commerce and cloud services

🪙 $LINK Chainlink’s Future Potential: Exploring why Chainlink ($LINK) is a foundational player in Web3 and the crypto economy

📈 Palantir’s Playbook for the Future: How $PLTR is positioning itself in AI and data analytics, with potential as a long-term investment. Is there a case for a short position?

🔄 Compound...2024-11-261h 09 Wall Street Wildlife Investing PodcastE54: Could Tesla Be a 100-Bagger? $AXON $TSLA $BTC $CHRS $IREN👑 Badger plays poker in Vietnam; Monkey sees an important investing lesson for 'busting on the bubble'.

👾 Trump’s election is a 🟢 for $BTC and $LINK, legit crypto. Monkey talks about journalist Laura Shin’s article on the Dem’s regulatory mistakes

💵 Monkey wants crypto back in his King of the Jungle portfolio and found a way to do so with a new Robinhood account $HOOD

🚗 Could Tesla deliver a 100x return by 2035?

💰Monkey buys more $CHRS and $IREN for King of the Jungle, Round 2, Week 1

🔫 Badger discuss $AXON’s earnings

❓Does compoun...2024-11-1956 min

Wall Street Wildlife Investing PodcastE54: Could Tesla Be a 100-Bagger? $AXON $TSLA $BTC $CHRS $IREN👑 Badger plays poker in Vietnam; Monkey sees an important investing lesson for 'busting on the bubble'.

👾 Trump’s election is a 🟢 for $BTC and $LINK, legit crypto. Monkey talks about journalist Laura Shin’s article on the Dem’s regulatory mistakes

💵 Monkey wants crypto back in his King of the Jungle portfolio and found a way to do so with a new Robinhood account $HOOD

🚗 Could Tesla deliver a 100x return by 2035?

💰Monkey buys more $CHRS and $IREN for King of the Jungle, Round 2, Week 1

🔫 Badger discuss $AXON’s earnings

❓Does compoun...2024-11-1956 min Wall Street Wildlife Investing PodcastE53: Interview with Slouching Towards Utopia author, Bradford DeLong🌴 Thank you for supporting Wall Street Wildlife on https://www.patreon.com/wallstreetwildlife ! 💵 The few bucks you won’t miss will help us make the show even better.

📚 Bradford DeLong, Economic historian and author of Slouching Towards Utopia: An Economic History of the Twentieth Century, joins us for a kick-ass conversation about the intersection of history, economics and investing.

We learned a tremendous amount from Professor DeLong’s book and his depth of historical and economic understanding.

Brad DeLong regularly shares his economic insights at https://braddelong.substack.com/

Segments:

00:00 Introduction to Tesla and Guest Speaker

00:43 Welco...2024-11-131h 25

Wall Street Wildlife Investing PodcastE53: Interview with Slouching Towards Utopia author, Bradford DeLong🌴 Thank you for supporting Wall Street Wildlife on https://www.patreon.com/wallstreetwildlife ! 💵 The few bucks you won’t miss will help us make the show even better.

📚 Bradford DeLong, Economic historian and author of Slouching Towards Utopia: An Economic History of the Twentieth Century, joins us for a kick-ass conversation about the intersection of history, economics and investing.

We learned a tremendous amount from Professor DeLong’s book and his depth of historical and economic understanding.

Brad DeLong regularly shares his economic insights at https://braddelong.substack.com/

Segments:

00:00 Introduction to Tesla and Guest Speaker

00:43 Welco...2024-11-131h 25 Wall Street Wildlife Investing PodcastE52: Crowning the King of the Jungle! $RKLB $EOSE $CHRS👑 Badger wins year 1 of King of the Jungle! You won’t believe the margin of victory! And his Banana trophy 🏆🍌

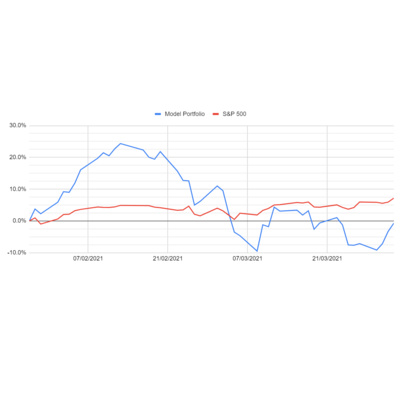

🤓 Monkey tries hard to identify his mistakes while Badger tries hard to remain gracious: lots of lessons and reflections on how we can both improve our process to get even better

💵 How to think about cash as a position

🚀 $RKLB Rocket Lab: Badger’s best performer, and one of Monkey’s worst. Learn all about the dark dangers of options

📆 How we’re thinking about year two: $200 per month, consistency of adding, watching emergent tre...2024-11-0840 min

Wall Street Wildlife Investing PodcastE52: Crowning the King of the Jungle! $RKLB $EOSE $CHRS👑 Badger wins year 1 of King of the Jungle! You won’t believe the margin of victory! And his Banana trophy 🏆🍌

🤓 Monkey tries hard to identify his mistakes while Badger tries hard to remain gracious: lots of lessons and reflections on how we can both improve our process to get even better

💵 How to think about cash as a position

🚀 $RKLB Rocket Lab: Badger’s best performer, and one of Monkey’s worst. Learn all about the dark dangers of options

📆 How we’re thinking about year two: $200 per month, consistency of adding, watching emergent tre...2024-11-0840 min Wall Street Wildlife Investing PodcastE51: Are Small Caps Set to Outperform? $GAW $ASTS $RLAY $CHRSIn this week's episode:

🤏 Why small-caps will outperform in 2025

❌ A horrific, down-in-the-dumps share price does not equal a broken thesis. $CHRS

🧬 The trend is your friend in investing; is biotech an exception? $RLAY

🧑🍳 Badger shares his investment todo list, and explains why he's planning to short $CAVA

📕 Bradford DeLong, Professor of Economics and author of 'Slouching Toward Utopia: An Economic History of the 20th Century' will be a guest on our show in the near future. Read his insightful book to get the most out of our conversation

🎮 Stock Safari: B...2024-10-2949 min

Wall Street Wildlife Investing PodcastE51: Are Small Caps Set to Outperform? $GAW $ASTS $RLAY $CHRSIn this week's episode:

🤏 Why small-caps will outperform in 2025

❌ A horrific, down-in-the-dumps share price does not equal a broken thesis. $CHRS

🧬 The trend is your friend in investing; is biotech an exception? $RLAY

🧑🍳 Badger shares his investment todo list, and explains why he's planning to short $CAVA

📕 Bradford DeLong, Professor of Economics and author of 'Slouching Toward Utopia: An Economic History of the 20th Century' will be a guest on our show in the near future. Read his insightful book to get the most out of our conversation

🎮 Stock Safari: B...2024-10-2949 min Wall Street Wildlife Investing PodcastE50: I’m a single mom: How do I start investing? + $META $CLMT $OKLO $HOOD☢️ $OKLO is up over 150% since Badger put it on his radar a month ago. Is it investable?

🤑 Monkey talks about Robinhood Legend, $HOOD’s new trading platform, its dangers and perks

🦉 We address Patreon Steven’s question about how to get the best investing results and how to create a successful framework. Are 30+ stocks too many? What about valuation? And emerging trends?

🦉 A single mom asks us how to start investing. All single moms and all beginning investors should listen to this!

🤖 Stock Safari: Badger talks about Meta $META AI projects while Monkey throws...2024-10-2256 min

Wall Street Wildlife Investing PodcastE50: I’m a single mom: How do I start investing? + $META $CLMT $OKLO $HOOD☢️ $OKLO is up over 150% since Badger put it on his radar a month ago. Is it investable?

🤑 Monkey talks about Robinhood Legend, $HOOD’s new trading platform, its dangers and perks

🦉 We address Patreon Steven’s question about how to get the best investing results and how to create a successful framework. Are 30+ stocks too many? What about valuation? And emerging trends?

🦉 A single mom asks us how to start investing. All single moms and all beginning investors should listen to this!

🤖 Stock Safari: Badger talks about Meta $META AI projects while Monkey throws...2024-10-2256 min Wall Street Wildlife Investing PodcastE49: Tesla's Robotaxi Event - 10/10 or Flop, And Should You Buy, Sell, Or Hold?Vaporware or Vision? We dissect Tesla's 10/10 Cybercab event (that's a date, not a score!) and debate if it lived up to the hype. Was it a Muskian inside joke at shareholder expense? We tackle the tough questions:

* Did Waymo already beat Tesla to the autonomous driving punch?

* Why wasn't Optimus the AI breakthrough we hoped for (and why it might not matter)?

* What are the likely real economics of being a robotaxi shepherd? Is it the cash cow Musk claims?

* And ultimately...how much $TSLA should you own after this reveal?2024-10-1441 min

Wall Street Wildlife Investing PodcastE49: Tesla's Robotaxi Event - 10/10 or Flop, And Should You Buy, Sell, Or Hold?Vaporware or Vision? We dissect Tesla's 10/10 Cybercab event (that's a date, not a score!) and debate if it lived up to the hype. Was it a Muskian inside joke at shareholder expense? We tackle the tough questions:

* Did Waymo already beat Tesla to the autonomous driving punch?

* Why wasn't Optimus the AI breakthrough we hoped for (and why it might not matter)?

* What are the likely real economics of being a robotaxi shepherd? Is it the cash cow Musk claims?

* And ultimately...how much $TSLA should you own after this reveal?2024-10-1441 min Wall Street Wildlife Investing PodcastE48: America Is Broke, How Could It Affect You? + Nintendo $NTDOY & $Anduril🚨🌴Welcome to the jungle Debra F and Sam G! With a special shout-out to our first Team Monkey patreon, Bruce B! 🍌 Thank you for supporting Wall Street Wildlife on https://www.patreon.com/wallstreetwildlife!

We love seeing who’s committed to being in our inner circle of trusted investors and jungle beasties. 🍌The few bucks you won’t miss will help us make the show and your investing returns better. All patreon questions get boosted to the top of the queue!

In this week's episode:

☕️🦖 Badger dis...2024-10-0859 min

Wall Street Wildlife Investing PodcastE48: America Is Broke, How Could It Affect You? + Nintendo $NTDOY & $Anduril🚨🌴Welcome to the jungle Debra F and Sam G! With a special shout-out to our first Team Monkey patreon, Bruce B! 🍌 Thank you for supporting Wall Street Wildlife on https://www.patreon.com/wallstreetwildlife!

We love seeing who’s committed to being in our inner circle of trusted investors and jungle beasties. 🍌The few bucks you won’t miss will help us make the show and your investing returns better. All patreon questions get boosted to the top of the queue!

In this week's episode:

☕️🦖 Badger dis...2024-10-0859 min Wall Street Wildlife Investing PodcastE47: Opportunity Costs in Investing, $EXAS and $TMDX🚨🌴Welcome to the jungle Paul and Steven P! Thank you for supporting Wall Street Wildlife on https://www.patreon.com/wallstreetwildlife! We love seeing who’s committed to being in our inner circle of trusted investors and jungle beasties.

🍌The few bucks you won’t miss will help us make the show and your investing returns better. And all patreon questions get boosted to the top of the queue for podcast chat!

In this week's episode:

📉 Badger discusses his Chinese investments including $JD and $BAIDU, making Monkey appear like a savant

💋 Keep it Simple Stup...2024-10-0141 min

Wall Street Wildlife Investing PodcastE47: Opportunity Costs in Investing, $EXAS and $TMDX🚨🌴Welcome to the jungle Paul and Steven P! Thank you for supporting Wall Street Wildlife on https://www.patreon.com/wallstreetwildlife! We love seeing who’s committed to being in our inner circle of trusted investors and jungle beasties.

🍌The few bucks you won’t miss will help us make the show and your investing returns better. And all patreon questions get boosted to the top of the queue for podcast chat!

In this week's episode:

📉 Badger discusses his Chinese investments including $JD and $BAIDU, making Monkey appear like a savant

💋 Keep it Simple Stup...2024-10-0141 min Wall Street Wildlife Investing PodcastE46: Stocks on Our Radar - $OKLO & $SPHR + How to Invest Your First $1,000In a brand new segment, we each pitch a stock that's on our radar:

⚡️ Luke looks at Oklo $OKLO, pioneering next-generation nuclear power plants, and with a close relationship to OpenAI

⚪️ Krzysztof thinks bananas are to be made in Sphere Entertainment $SPHR, a best in class venue located in the entertainment capital of the world, Las Vegas

Find us online and vote for your 'most interesting watchlist idea'!

This week we also deep dive into a crucial question 📬 from one of our listeners: “I have $1,000 to invest — how do I get started?”

2024-09-2654 min

Wall Street Wildlife Investing PodcastE46: Stocks on Our Radar - $OKLO & $SPHR + How to Invest Your First $1,000In a brand new segment, we each pitch a stock that's on our radar:

⚡️ Luke looks at Oklo $OKLO, pioneering next-generation nuclear power plants, and with a close relationship to OpenAI

⚪️ Krzysztof thinks bananas are to be made in Sphere Entertainment $SPHR, a best in class venue located in the entertainment capital of the world, Las Vegas

Find us online and vote for your 'most interesting watchlist idea'!

This week we also deep dive into a crucial question 📬 from one of our listeners: “I have $1,000 to invest — how do I get started?”

2024-09-2654 min Wall Street Wildlife Investing PodcastE45: Heartbreak, Ugly Ducklings, and the Economic History of the 20th Century + $CHRSThis week's episode of Wall Street Wildlife kicks off on a somber note as Krzysztof shares the heartbreaking loss of his beloved dog, Bunk. It's a poignant reminder that investing is ultimately about creating the freedom to spend precious time with those we love. Every moment counts.

Buckle up though, in this episode we also dive into the wild world of "ugly duckling" investments – those overlooked companies with the potential to transform into magnificent swans. We'll explore the contrasting views of Warren Buffett and a successful microcap investor, highlighting the risks and rewards of both, and why ei...2024-09-1746 min

Wall Street Wildlife Investing PodcastE45: Heartbreak, Ugly Ducklings, and the Economic History of the 20th Century + $CHRSThis week's episode of Wall Street Wildlife kicks off on a somber note as Krzysztof shares the heartbreaking loss of his beloved dog, Bunk. It's a poignant reminder that investing is ultimately about creating the freedom to spend precious time with those we love. Every moment counts.

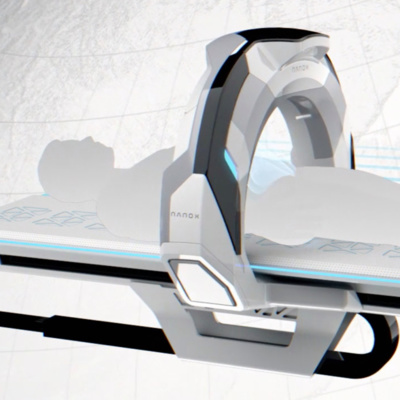

Buckle up though, in this episode we also dive into the wild world of "ugly duckling" investments – those overlooked companies with the potential to transform into magnificent swans. We'll explore the contrasting views of Warren Buffett and a successful microcap investor, highlighting the risks and rewards of both, and why ei...2024-09-1746 min Wall Street Wildlife Investing PodcastE44: Luke's Intuitive Surgical Deep DiveIntuitive Surgical is the world leader in robotic minimally invasive surgery. In this week's podcast, Luke deep dives what makes $ISRG tick, and how it's shaping a better future through technology and innovation!

Segments:

[00:00:00] Introduction

[00:04:15] Intuitive Surgical Deep Dive

[00:05:01] Agenda

[00:05:50] Intuitive Surgical at a Glance

[00:08:24] How Intuitive Surgical is Creating a Better Tomorrow

[00:09:55] "Robots and Blades" Business Model

[00:11:03] Competitive Edge

[00:12:59] Tesla Driving Miles

[00:15:45] Financials - Income Statement

[00:17:13] Financials - Balance Sheet

[00:18:39] Financials...2024-09-1025 min

Wall Street Wildlife Investing PodcastE44: Luke's Intuitive Surgical Deep DiveIntuitive Surgical is the world leader in robotic minimally invasive surgery. In this week's podcast, Luke deep dives what makes $ISRG tick, and how it's shaping a better future through technology and innovation!

Segments:

[00:00:00] Introduction

[00:04:15] Intuitive Surgical Deep Dive

[00:05:01] Agenda

[00:05:50] Intuitive Surgical at a Glance

[00:08:24] How Intuitive Surgical is Creating a Better Tomorrow

[00:09:55] "Robots and Blades" Business Model

[00:11:03] Competitive Edge

[00:12:59] Tesla Driving Miles

[00:15:45] Financials - Income Statement

[00:17:13] Financials - Balance Sheet

[00:18:39] Financials...2024-09-1025 min Wall Street Wildlife Investing PodcastE43: Renewable Energy > Coal + Snowflake and the “Too Hard to Understand” Pile🚨Badger has gone wild and the law tries to reign him in — with what success? Monkey, meanwhile, studies political theory and comes to the conclusion that nuanced political conversations require carefully defining the terms — and who has time for that? We reap what we sow.

⏳Is Badger a true long-term investor? Luke analyzes his long-term holdings and finds his average holding period to be 3.5 years, with a few outliers, including Enphase $ENPH and SolarEdge $SEDG. We discuss the costs and benefits of taking the long view.

⚡️Renewable energy sources are set to eclipse power generated by coal for t...2024-09-031h 01

Wall Street Wildlife Investing PodcastE43: Renewable Energy > Coal + Snowflake and the “Too Hard to Understand” Pile🚨Badger has gone wild and the law tries to reign him in — with what success? Monkey, meanwhile, studies political theory and comes to the conclusion that nuanced political conversations require carefully defining the terms — and who has time for that? We reap what we sow.

⏳Is Badger a true long-term investor? Luke analyzes his long-term holdings and finds his average holding period to be 3.5 years, with a few outliers, including Enphase $ENPH and SolarEdge $SEDG. We discuss the costs and benefits of taking the long view.

⚡️Renewable energy sources are set to eclipse power generated by coal for t...2024-09-031h 01 Wall Street Wildlife Investing PodcastE42: Six Skills to Sharpen your Investing ClawsIf you’ve ever wondered about the difference between Badger and Monkey, here it is: Monkey spent his weekend getting a haircut, while Badger was playing poker until 6am in a literal castle on the outskirts of Edinburgh. Whose team are you on now?

In this week's episode, Luke buys Coherus $CHRS January 2026 options on the strength of Krzysztof's sales pitch in episode 41. “Deep Value” seems to have been the magic phrase that made his claws tingle, despite the “likelihood of failure still being high”, a fact rebutted with sound reason, logic and facts. We'll agree to disagree...2024-08-2740 min

Wall Street Wildlife Investing PodcastE42: Six Skills to Sharpen your Investing ClawsIf you’ve ever wondered about the difference between Badger and Monkey, here it is: Monkey spent his weekend getting a haircut, while Badger was playing poker until 6am in a literal castle on the outskirts of Edinburgh. Whose team are you on now?

In this week's episode, Luke buys Coherus $CHRS January 2026 options on the strength of Krzysztof's sales pitch in episode 41. “Deep Value” seems to have been the magic phrase that made his claws tingle, despite the “likelihood of failure still being high”, a fact rebutted with sound reason, logic and facts. We'll agree to disagree...2024-08-2740 min Wall Street Wildlife Investing PodcastE41: Investing in Coherus Biosciences $CHRS; plus Waymo Woes and a Disney DebacleKrzysztof explains why he’s now heavily invested in a tiny $140 million dollar biotech company, Coherus Biosciences $CHRS. There are two ways to make money in the market, and both have to do with a gap in perceived value. Coherus had very encouraging second quarter results, but an analyst downgrade sent the stock tumbling regardless. Are the downgrade reasons based on how the wall street game is played, or something more fundamental to the company broken?

Also in this week's episode, Luke is unhappy with the state of the UK as a place for his investing dollars. Do...2024-08-201h 05

Wall Street Wildlife Investing PodcastE41: Investing in Coherus Biosciences $CHRS; plus Waymo Woes and a Disney DebacleKrzysztof explains why he’s now heavily invested in a tiny $140 million dollar biotech company, Coherus Biosciences $CHRS. There are two ways to make money in the market, and both have to do with a gap in perceived value. Coherus had very encouraging second quarter results, but an analyst downgrade sent the stock tumbling regardless. Are the downgrade reasons based on how the wall street game is played, or something more fundamental to the company broken?

Also in this week's episode, Luke is unhappy with the state of the UK as a place for his investing dollars. Do...2024-08-201h 05 Wall Street Wildlife Investing PodcastE40: Recession Realities - Unpacking Economic Indicators, Techno-Feudalism, Selling Airbnb, AXON vs EOSE betAre we in a recession or not? What is the Sahm Rule Recession Indicator? Why does Claudia Sahm herself not trust its conclusion at the moment?

Are we no longer in a capitalist system? A preview of an upcoming conversation about techno-feudalism and the contradictions of capitalism. Blame Monkey for this one.

Did Luke get lucky selling Airbnb $ABNB before earnings based on local anecdotal evidence from his visit to the Paris Olympics? When and what is anecdotal evidence good for? We consider some examples: $AAPL $NFLX $TSLA.

Luke reaches 12,000 followers on X on the strength of his investing...2024-08-1355 min

Wall Street Wildlife Investing PodcastE40: Recession Realities - Unpacking Economic Indicators, Techno-Feudalism, Selling Airbnb, AXON vs EOSE betAre we in a recession or not? What is the Sahm Rule Recession Indicator? Why does Claudia Sahm herself not trust its conclusion at the moment?

Are we no longer in a capitalist system? A preview of an upcoming conversation about techno-feudalism and the contradictions of capitalism. Blame Monkey for this one.

Did Luke get lucky selling Airbnb $ABNB before earnings based on local anecdotal evidence from his visit to the Paris Olympics? When and what is anecdotal evidence good for? We consider some examples: $AAPL $NFLX $TSLA.

Luke reaches 12,000 followers on X on the strength of his investing...2024-08-1355 min Wall Street Wildlife Investing PodcastE39: Special Black Monday August ’24 Emergency Edition!While Luke comes home from front row seats at the Paris Olympics, the market tries to rain on his fur by having a historical meltdown and a global margin call.

We discuss the $VIX volatility index and just how rocky Monday morning was relative to the 2008 financial crisis and the COVID scare.

What caused it all? Krzysztof explains the Japanese carry trade, how it's tied to leverage and why NVIDIA

$NVDA potentially seems to have been a trade as much about AI as it was a trade taking advantage of free money loans given out...2024-08-0645 min

Wall Street Wildlife Investing PodcastE39: Special Black Monday August ’24 Emergency Edition!While Luke comes home from front row seats at the Paris Olympics, the market tries to rain on his fur by having a historical meltdown and a global margin call.

We discuss the $VIX volatility index and just how rocky Monday morning was relative to the 2008 financial crisis and the COVID scare.

What caused it all? Krzysztof explains the Japanese carry trade, how it's tied to leverage and why NVIDIA

$NVDA potentially seems to have been a trade as much about AI as it was a trade taking advantage of free money loans given out...2024-08-0645 min Wall Street Wildlife Investing PodcastE38: Beyond the Balance Sheet - US Debt and the Dark Side of Short SellingKrzysztof returns from a Hobbit house getaway while Luke gets ready to head to Paris for the Olympics; tales of travel spark some short-term trauma about lost luggage and Crowdstrike’s $CRWD hand in making lots of people maddeningly upset. If that’s not spicy enough, we briefly discuss historical revolutions and national identities sparked by the Olympics’ opening ceremony’s raw political themes - or is it just a ton of fun that's really only supposed to make sense to the locals?

We discuss whether the US is facing a debt crisis worse than 2008, highlighting alarming insights from Balaji S...2024-07-301h 04

Wall Street Wildlife Investing PodcastE38: Beyond the Balance Sheet - US Debt and the Dark Side of Short SellingKrzysztof returns from a Hobbit house getaway while Luke gets ready to head to Paris for the Olympics; tales of travel spark some short-term trauma about lost luggage and Crowdstrike’s $CRWD hand in making lots of people maddeningly upset. If that’s not spicy enough, we briefly discuss historical revolutions and national identities sparked by the Olympics’ opening ceremony’s raw political themes - or is it just a ton of fun that's really only supposed to make sense to the locals?

We discuss whether the US is facing a debt crisis worse than 2008, highlighting alarming insights from Balaji S...2024-07-301h 04 Wall Street Wildlife Investing PodcastE37: From Blue Screens to Ballot Boxes - Disruption in Tech and PoliticsThis week, we’re swinging through the vines of US politics, wrestling with the CrowdStrike $CRWD chaos, and dishing updates on Luke’s NuScale Power $SMR position. Strap in — it’s a wild ride!

Political Safari:

Joe Biden exits the presidential race, shaking up the political landscape. Luke's prediction pays off handsomely, while Krzysztof welcomes the fresh air this brings to the democratic process.

CrowdStrike Struck Out:

CrowdStrike’s software update causes Windows PCs worldwide to crash, creating tech mayhem in critical sectors. Luke explains the fix: patch was swiftly issued, but in man...2024-07-2351 min

Wall Street Wildlife Investing PodcastE37: From Blue Screens to Ballot Boxes - Disruption in Tech and PoliticsThis week, we’re swinging through the vines of US politics, wrestling with the CrowdStrike $CRWD chaos, and dishing updates on Luke’s NuScale Power $SMR position. Strap in — it’s a wild ride!

Political Safari:

Joe Biden exits the presidential race, shaking up the political landscape. Luke's prediction pays off handsomely, while Krzysztof welcomes the fresh air this brings to the democratic process.

CrowdStrike Struck Out:

CrowdStrike’s software update causes Windows PCs worldwide to crash, creating tech mayhem in critical sectors. Luke explains the fix: patch was swiftly issued, but in man...2024-07-2351 min Wall Street Wildlife Investing PodcastE36: Ark Invest controversy, plus Palantir, NuScale & Rocket Lab Under the MicroscopeFresh off an assassination attempt, Donald Trump’s political future looms large. Is his return to the Oval Office now inevitable, and what could this mean for the investment landscape?

While Krzysztof battles the tail end of COVID, he passes the analytical baton to Luke, who takes a deep dive into three high-stakes companies:

Palantir $PLTR

NuScale Power $SMR

Rocket Lab $RKLB

Tune in to find out which of these is Krzysztof's favourite investment, and which he firmly parks in the uninvestible bucket!

We also unpack a co...2024-07-161h 03

Wall Street Wildlife Investing PodcastE36: Ark Invest controversy, plus Palantir, NuScale & Rocket Lab Under the MicroscopeFresh off an assassination attempt, Donald Trump’s political future looms large. Is his return to the Oval Office now inevitable, and what could this mean for the investment landscape?

While Krzysztof battles the tail end of COVID, he passes the analytical baton to Luke, who takes a deep dive into three high-stakes companies:

Palantir $PLTR

NuScale Power $SMR

Rocket Lab $RKLB

Tune in to find out which of these is Krzysztof's favourite investment, and which he firmly parks in the uninvestible bucket!

We also unpack a co...2024-07-161h 03 Wall Street Wildlife Investing PodcastE35: Generating Alpha, Crypto Crash, is Corporate Real Estate Next?Krzysztof's back from Europe, but he brought COVID with him -- is his pink Care Bears hat an essential part of the recuperative process?

Luke commends Krzysztof's bet against corporate real estate and regional banks (puts on $KRE!), and shares some data that supports the doom thesis.

Is thorough research essential in identifying investment opportunities, or is it sufficient to take deep abdominal breaths and visualise winning? (Hint - if you have a fool as a counterparty, you're on the right side of the trade)

We also make a new bet: $EOSE vs $...2024-07-0939 min

Wall Street Wildlife Investing PodcastE35: Generating Alpha, Crypto Crash, is Corporate Real Estate Next?Krzysztof's back from Europe, but he brought COVID with him -- is his pink Care Bears hat an essential part of the recuperative process?

Luke commends Krzysztof's bet against corporate real estate and regional banks (puts on $KRE!), and shares some data that supports the doom thesis.

Is thorough research essential in identifying investment opportunities, or is it sufficient to take deep abdominal breaths and visualise winning? (Hint - if you have a fool as a counterparty, you're on the right side of the trade)

We also make a new bet: $EOSE vs $...2024-07-0939 min Wall Street Wildlife Investing PodcastE33: High Stakes in High Tech: Al Predictions and the Pitfalls of PrideWhile Luke is motorbiking across Europe, Krzysztof is doing aerial acrobatics above Warsaw and dropping down on jet-skis, Bond-style.

Luke reads about Ray Kurzweil's latest AI prognostications, which include discovering how to use hundreds of thousands of new compounds, leading to the promise of free energy and the need to capture that energy. Krzysztof, despite his $EOSE investment waiting to flower, cautions in favor of more tempered expectations with all things AI-pie-in-the-sky. $RLAY therapeutics being a good example: while it has the strongest AI platform in biotech, getting the drugs from clinical trials to revenue is a...2024-06-2519 min

Wall Street Wildlife Investing PodcastE33: High Stakes in High Tech: Al Predictions and the Pitfalls of PrideWhile Luke is motorbiking across Europe, Krzysztof is doing aerial acrobatics above Warsaw and dropping down on jet-skis, Bond-style.

Luke reads about Ray Kurzweil's latest AI prognostications, which include discovering how to use hundreds of thousands of new compounds, leading to the promise of free energy and the need to capture that energy. Krzysztof, despite his $EOSE investment waiting to flower, cautions in favor of more tempered expectations with all things AI-pie-in-the-sky. $RLAY therapeutics being a good example: while it has the strongest AI platform in biotech, getting the drugs from clinical trials to revenue is a...2024-06-2519 min Wall Street Wildlife Investing PodcastE32: Cybersecurity Showdown, AI Disruption, and Apple's Big MoveAfter Badgering Monkey about selling Crowdstrike $CRWD (yet again), Luke discusses the differences between Crowdstrike and Palo Alto Networks $PANW, two strong cybersecurity companies. But l can there only be one?

Monkey, meanwhile, wonders whether AI is going to disrupt everything, including SaaS companies like Crowdstrike, or whether certain mega-trends can overpower the impending disruptions.

We also discuss the difference in mindset required when investing in best of class businesses with lofty valuations, and small caps that are much riskier but cheaper and with more binary outcomes.

Krzysztof offers his view on the...2024-06-1839 min

Wall Street Wildlife Investing PodcastE32: Cybersecurity Showdown, AI Disruption, and Apple's Big MoveAfter Badgering Monkey about selling Crowdstrike $CRWD (yet again), Luke discusses the differences between Crowdstrike and Palo Alto Networks $PANW, two strong cybersecurity companies. But l can there only be one?

Monkey, meanwhile, wonders whether AI is going to disrupt everything, including SaaS companies like Crowdstrike, or whether certain mega-trends can overpower the impending disruptions.

We also discuss the difference in mindset required when investing in best of class businesses with lofty valuations, and small caps that are much riskier but cheaper and with more binary outcomes.

Krzysztof offers his view on the...2024-06-1839 min Wall Street Wildlife Investing PodcastE31: Tech Tangles and Ethical Angles: Navigating the Investment Jungle with Tesla, Palantir, and BitcoinLuke shares his experience surprising his wife with the new Tesla Model 3 Highland, complete with its futuristic driving features $TSLA — is the smooth buying process enough of a differentiator for Tesla as a car company?

Meanwhile, Krzysztof reveals his strategic moves in the “King of the Jungle" portfolio challenge, including a bullish stance on $BTC mining and AI data-warehouser Iris Energy $IREN and why he sold 20% of that position to buy even more shares of Coherus Biosciences $CHRS.

The jungle duo also dives into ethical investing as Luke considers adding Palantir $PLTR and explains how the...2024-06-1122 min

Wall Street Wildlife Investing PodcastE31: Tech Tangles and Ethical Angles: Navigating the Investment Jungle with Tesla, Palantir, and BitcoinLuke shares his experience surprising his wife with the new Tesla Model 3 Highland, complete with its futuristic driving features $TSLA — is the smooth buying process enough of a differentiator for Tesla as a car company?

Meanwhile, Krzysztof reveals his strategic moves in the “King of the Jungle" portfolio challenge, including a bullish stance on $BTC mining and AI data-warehouser Iris Energy $IREN and why he sold 20% of that position to buy even more shares of Coherus Biosciences $CHRS.

The jungle duo also dives into ethical investing as Luke considers adding Palantir $PLTR and explains how the...2024-06-1122 min Wall Street Wildlife Investing PodcastE26: Telescope Investing Reunion! Lessons from Pandemic Investing & Should You YOLO on Rocket Lab?Remember the Telescope Investing podcast? Hosts Luke and Albert are back for a special reunion episode! While Krzysztof is taking a well-deserved break, Luke and Albert have plenty to catch up on since their last show in 2022.

They'll discuss how investing fueled their early retirement, the lessons learned from pandemic-era stock picks (both the wins and the losses!), and the exciting new companies they're watching. Expect laughter as they reminisce about Luke's surprise dance routine at Albert's wedding. And of course, they'll swap their favorite (and maybe not-so-favorite) TV recommendations.

If you're looking for an...2024-05-0750 min

Wall Street Wildlife Investing PodcastE26: Telescope Investing Reunion! Lessons from Pandemic Investing & Should You YOLO on Rocket Lab?Remember the Telescope Investing podcast? Hosts Luke and Albert are back for a special reunion episode! While Krzysztof is taking a well-deserved break, Luke and Albert have plenty to catch up on since their last show in 2022.

They'll discuss how investing fueled their early retirement, the lessons learned from pandemic-era stock picks (both the wins and the losses!), and the exciting new companies they're watching. Expect laughter as they reminisce about Luke's surprise dance routine at Albert's wedding. And of course, they'll swap their favorite (and maybe not-so-favorite) TV recommendations.

If you're looking for an...2024-05-0750 min Wall Street Wildlife Investing PodcastE25: Tesla's Autonomy Gamble: Invest or Avoid? + Founder-Led DebateIn Episode 25, Luke reflects on his magnum-opus 50-day portfolio review on X, including selling $AMZN “too early” to buy a couple of cars. We debate whether that was a mistake or using money appropriately to live fully?

https://twitter.com/7LukeHallard/status/1781627421243908513

Monkey wonders how Luke got through 2008 beating the market by double-digits: was it luck in owning $ISRG at the right time, or an aggressive risk profile appropriate for life-stage and life circumstances?

How to Beat the Market Principle 2: Look for founder-led companies like...2024-04-3052 min

Wall Street Wildlife Investing PodcastE25: Tesla's Autonomy Gamble: Invest or Avoid? + Founder-Led DebateIn Episode 25, Luke reflects on his magnum-opus 50-day portfolio review on X, including selling $AMZN “too early” to buy a couple of cars. We debate whether that was a mistake or using money appropriately to live fully?

https://twitter.com/7LukeHallard/status/1781627421243908513

Monkey wonders how Luke got through 2008 beating the market by double-digits: was it luck in owning $ISRG at the right time, or an aggressive risk profile appropriate for life-stage and life circumstances?

How to Beat the Market Principle 2: Look for founder-led companies like...2024-04-3052 min Wall Street Wildlife Investing PodcastE24: The Hidden Costs of Moving Money: A Wise PerspectiveThis week's podcast is a repost from the 7investing podcast feed, where Luke & Krzysztof are Lead Advisors.

---

If you’ve ever travelled abroad or tried to send money across international borders, hidden fees and unfair exchange rates have no doubt been a massive and expensive headache.

In this week's episode of the 7investing podcast, Lead Advisors Luke Hallard & Krzysztof Piekarski sit down with Rina Wulfing, Senior Manager for the North American policy team at Wise ($WIZEY) to discuss the company's original founding story and mission: to empower its users with a transparent sy...2024-04-2333 min

Wall Street Wildlife Investing PodcastE24: The Hidden Costs of Moving Money: A Wise PerspectiveThis week's podcast is a repost from the 7investing podcast feed, where Luke & Krzysztof are Lead Advisors.

---

If you’ve ever travelled abroad or tried to send money across international borders, hidden fees and unfair exchange rates have no doubt been a massive and expensive headache.

In this week's episode of the 7investing podcast, Lead Advisors Luke Hallard & Krzysztof Piekarski sit down with Rina Wulfing, Senior Manager for the North American policy team at Wise ($WIZEY) to discuss the company's original founding story and mission: to empower its users with a transparent sy...2024-04-2333 min Wall Street Wildlife Investing PodcastE21: Austin Adventures - Apple Vision Pro, Wise HQ, and Tesla TroublesBefore returning to the UK, Badger paid his pal Monkey a visit in Austin. Shenanigans ensued, including, but not limited to:

A trip to the Apple $AAPL store to try the Vision Pro headset. Was the demo experience enough to convince Luke to drop Android and buy into Apple’s metaverse aspirations?

Since the Wise $WIZEY Austin headquarters were nearby, we were graciously able to take a tour of the company’s new digs. You’ll hear more about Wise in an upcoming episode, but we do examine a tried and true (?) Peter Lynchian principle: invest...2024-04-0339 min

Wall Street Wildlife Investing PodcastE21: Austin Adventures - Apple Vision Pro, Wise HQ, and Tesla TroublesBefore returning to the UK, Badger paid his pal Monkey a visit in Austin. Shenanigans ensued, including, but not limited to:

A trip to the Apple $AAPL store to try the Vision Pro headset. Was the demo experience enough to convince Luke to drop Android and buy into Apple’s metaverse aspirations?

Since the Wise $WIZEY Austin headquarters were nearby, we were graciously able to take a tour of the company’s new digs. You’ll hear more about Wise in an upcoming episode, but we do examine a tried and true (?) Peter Lynchian principle: invest...2024-04-0339 min Wall Street Wildlife Investing PodcastE19: Don't Be Roadkill: 5 Must-Know Stock Market Laws (and Our Biggest Fails)

Investing that will make you wealthy is as much about your own psychology as it is about the companies you invest in.

If you skip the “know thyself” step, you will make terrible mistakes that could have been avoided.

Do you think you’re smarter than everyone else?

Do you invest for the short or long term?

Is your portfolio resilient?

Are you susceptible to FOMO?

Krzysztof “Monkey” Piekarski and Luke “The Badger” Hallard have not only had great success as investors over 40+ years, but we have also made all the mistakes so you don’t have to.

Listen as we tell you a...2024-03-1945 min

Wall Street Wildlife Investing PodcastE19: Don't Be Roadkill: 5 Must-Know Stock Market Laws (and Our Biggest Fails)

Investing that will make you wealthy is as much about your own psychology as it is about the companies you invest in.

If you skip the “know thyself” step, you will make terrible mistakes that could have been avoided.

Do you think you’re smarter than everyone else?

Do you invest for the short or long term?

Is your portfolio resilient?

Are you susceptible to FOMO?

Krzysztof “Monkey” Piekarski and Luke “The Badger” Hallard have not only had great success as investors over 40+ years, but we have also made all the mistakes so you don’t have to.

Listen as we tell you a...2024-03-1945 min Wall Street Wildlife Investing PodcastE18: Nvidia's Gamble, Cybersecurity Shields, & Your 50-Day Portfolio Power-UpIs AI a sustainable investing trend? Should AI ethics matter for investors? The newly crowned Best Picture, Oppenheimer, alerts us about how humanity's obsession with science made blowing up the world a non-zero reality. Nvidia $NVDA is a company enabling the next great revolution in technology, but is it too much too quickly? We discuss whether it has gotten too far ahead of itself in terms of capacities, ethics, and market cap, and why Krzysztof sold his position.

What’s an essential process to improve your investing gains? Luke discusses his 50-day portfolio review, why he started it...2024-03-1238 min

Wall Street Wildlife Investing PodcastE18: Nvidia's Gamble, Cybersecurity Shields, & Your 50-Day Portfolio Power-UpIs AI a sustainable investing trend? Should AI ethics matter for investors? The newly crowned Best Picture, Oppenheimer, alerts us about how humanity's obsession with science made blowing up the world a non-zero reality. Nvidia $NVDA is a company enabling the next great revolution in technology, but is it too much too quickly? We discuss whether it has gotten too far ahead of itself in terms of capacities, ethics, and market cap, and why Krzysztof sold his position.

What’s an essential process to improve your investing gains? Luke discusses his 50-day portfolio review, why he started it...2024-03-1238 min Wall Street Wildlife Investing PodcastE9 (bonus) - Rocket Lab$RKLB Monkey loves @RocketLab as the best alternative to investing in SpaceX .So for the King of the Jungle Investing Challenge he bought some Feb '24 $7 call options.

Was this a reckless bet?

Can Luke maintain his composure in the face of Monkey's shenanigans, like the Badger ninja he is?

There's also an extremely important lesson here about ODTE options. Hint: DON'T.2024-01-1207 min

Wall Street Wildlife Investing PodcastE9 (bonus) - Rocket Lab$RKLB Monkey loves @RocketLab as the best alternative to investing in SpaceX .So for the King of the Jungle Investing Challenge he bought some Feb '24 $7 call options.

Was this a reckless bet?

Can Luke maintain his composure in the face of Monkey's shenanigans, like the Badger ninja he is?