Shows

Income Protection Journal PodcastSurgeon Realizes His Hands Are His Livelihood [Podcast]When I spoke with board-certified trauma surgeon Dr. Nii Darko, DO, MBA, FACS for this episode of The Income Protection Journal Podcast, he started with a moment humiliating in its simplicity. He was cutting up a hospital mattress his town's local rubbish service wouldn't pick up, put a little too much tension on one finger, and felt what he described as a rubber band snapping. The next day he was supposed to drive four hours for a locums assignment. Instead, he went to urgent care, learned he had torn a ligament, and was told a wire would be drilled into...

2026-02-1034 min

Income Protection Journal PodcastCat Bite Ends Veterinarian’s Career [Podcast]Disability coverage for veterinarians is often treated like something you think about later, after the practice is stable, after the loans feel manageable, after life quiets down. In my conversation with Dr. Michelle Custead, a board-certified veterinary medical oncologist and practice owner, what stood out was how rarely “later” arrives on schedule — and how quickly an ordinary day can turn into a career interruption that no one planned for.

Custead runs Ally Veterinary Specialty Center, a boutique referral practice in Waltham, Massachusetts. When we started talking about disability risk, she didn’t begin with dramatic scenarios. She began with the temperam...

2026-02-0343 min

Income Protection Journal PodcastHis Disability Policy Looked Fine — Until a Claim Tested It [Podcast]I went into this conversation expecting to talk about claims the way most people imagine them: paperwork, delays, frustration, maybe a denial that needs to be appealed. What I didn’t expect was how quickly the discussion shifted to something more unsettling—the realization that many people buy disability insurance believing they’re protected, only to discover years later that the policy language quietly gives the insurer a way out.

In this episode of The Income Protection Journal Podcast, I talk to Mark DeBofsky, an ERISA litigation attorney with more than four decades of experience challenging insurer and plan-administrator benefit denials...

2026-01-2737 min

Income Protection Journal PodcastThe Disability Insurance Window Most Physicians Don’t See Closing [Podcast]A physician told me he thinks about disability insurance for physicians the same way he thinks about a dashboard warning light: by the time it flashes, you’re already behind the ball.

That line landed harder than I expected, because it came from someone who lives on the other side of the exam room. In a recorded conversation for The Income Protection Podcast, I spoke with Dr. Isheet Patel, a board-certified internal medicine physician and co-founder of a concierge practice in Lone Tree, Colorado. I went into the interview looking for a straightforward answer to a simple question: what actually takes...

2026-01-2030 min

Income Protection Journal PodcastWhen Disability Insurance Leaves High Earners Exposed [Podcast]There’s a point in some careers when protection that once felt solid starts to feel thin. Nothing has gone wrong yet. No diagnosis. No accident. Just a quiet realization that the numbers no longer line up the way you assumed they would.

That tension came up repeatedly in my recent conversation on The Income Protection Podcast, where I sat down with Tom Petersen, a senior partner at Petersen International Underwriters. We weren’t setting out to talk about physicians specifically. We were talking about athletes, entertainers, founders, and people whose income behaves in unconventional ways. But the further we went...

2026-01-1351 min

Income Protection Journal PodcastWhy High Earners Are Quietly Underinsured—and Don’t Find Out Until It’s Too Late with Tom PetersonSome of the most interesting insurance solutions are built after someone is told “no.” Tom Petersen shares stories from the specialty market that reveal how income protection works when traditional disability insurance falls short.

Traditional disability insurance wasn’t built for elite earners. In this episode of The Income Protection Podcast, Jamie Fleischner sits down with Tom Petersen of Petersen International Underwriters to explain how specialty disability insurance fills the gaps left by traditional coverage. They discuss income caps, excess coverage, and the unique challenges of protecting athletes, entertainers, ultra-high-income professionals, and those with complex or pre-existing health conditions. If your i...

2026-01-1251 min

Income Protection Journal PodcastThe Scan He Wasn’t Supposed to See [Podcast]Disability insurance for physicians is easy to think about in abstract terms until the moment your own health forces the issue. I was reminded of that in a recent episode of THE Income Protection Podcast, when I spoke with Dr. Peter Crane, a rural family physician in Idaho, about the night he accidentally opened his own CT scan while working an emergency department shift.

I’m Jamie Fleischner, CLU, ChFC, LUTCF, and I host the podcast. Over the years, I’ve spoken with countless physicians about income risk, but this conversation unfolded differently from the start. Peter wasn’t sitting in a w...

2026-01-0636 min

Income Protection Journal PodcastWhy Midlife Income Protection Depends More on Timing Than Assets [Podcast]Most people in their fifties and early sixties think income protection means safeguarding earnings during their working years. But on the latest Income Protection Podcast, MassMutual’s Marcus Watson explains why the real pressure point comes later — when income stops, responsibilities continue, and the financial path a family takes depends entirely on which version of the future arrives first. The sequence of events, not just the events themselves, is what determines whether a household preserves savings, absorbs a major care expense, or unintentionally jeopardizes the legacy they’ve spent decades building.

That friction between uncertainty and planning is why income protec...

2025-12-1628 min

Income Protection Journal PodcastMost High-Income Professionals Are Underinsured — And Don’t Realize It [Podcast]As a disability-insurance specialist, I meet high-earning professionals every day who carefully insure their homes, cars and health needs, yet overlook the one asset that makes everything else possible: their income. The ability to get up in the morning and earn a living underpins every financial decision a household makes. When that ability disappears, even temporarily, the effects are immediate and far-reaching.

That reality is at the heart of a conversation I’m having on the latest episode of the Income Protection Podcast, produced by Income Protection Journal. I’m speaking with Michael Sir, the president and co-founder of One Protect...

2025-12-0936 min

NAIFA's Advisor Today Podcast SeriesBuilding Financial Security Through Mentorship and Education With Brandon SmithBrandon Smith is an Executive Vice President at Milestone Financial Solutions, a firm that offers financial planning, investment, retirement, and estate-planning services to help clients reach key life goals. In his role, he provides comprehensive short-term and long-term financial and business planning catered to the needs of each client. His professional designations include CLU, ChFC, LUTCF, and CPFA. Before joining Milestone, Brandon began his career with AXA Advisors and later became a Registered Representative with The Leaders Group. In this episode… The financial services industry is constantly evolving, and new advisors face steep challenges as th...

2025-10-0653 min

Physician Family Finances Podcast#131 Physicians' Guide to Disability Insurance with Lawrence B. Keller, CFP®, CLU®, ChFC®, RHU®, LUTCFDisability insurance may feel like just another thing physicians have to figure out. Like a retirement account, your employer may offer a plan, but that is almost never enough to cover your bases. Nate Reineke and Ben Utley are joined by Lawrence B. Keller, CFP®, CLU®, ChFC®, RHU®, LUTCF (or Larry to us). From his New York office, he’s been working with doctors for more than 30 years. We break down when an individual, private policy is necessary, and when in your career you can consider dropping your policy. Be sure to listen to the end, where Larry explains the mo...

2025-09-0338 min

Insuring Your Wellbeing Cost and differences of Long-term care insurance for 3 types of plans by Dennis James LUTCF, CLTCCost and differences of Long-term care insurance for 3 types of plans by Dennis James LUTCF, CLTC

2024-12-2133 min

C4G SuccessBushido Code – With Christopher Wilks, LUTCF - Episode 15 In this conversation, John Kailunas II interviews Christopher Wilks, LUTCF a long-time affiliate and friend, about his journey in the financial service industry and his commitment to the martial arts. They discuss the importance of family, the influence of Wilks' parents, and his dedication to living by the Bushido code. Wilks explains how he applies the code to his work in financial services, emphasizing the need to be a professional problem solver and act in the best interest of clients. They also touch on the challenges of self-control and handling situations where other advisors have done a...

2024-12-0445 min

NAIFA's Advisor Today Podcast SeriesEmpowering Women in the Insurance Industry With Carina HatfieldCarina Hatfield is a Life Underwriting Training Council Fellow (LUTCF), Commercial Lines Coverage Specialist (CLCS), and Life and Annuity Certified Professional (LACP). As a third-generation insurance agent, she specializes in property and casualty insurance and works with locally owned businesses. Carina serves NAIFA as a National Trustee and a moderator for Pennsylvania's Leadership in Life Institute. She is also the immediate past President of NAIFA Pennsylvania. Recently, Carina helped develop the organization's new online LACP prep course. Her passion and dedication to the association earned her the 2020 Young Advisor Team Leader of the Year award. In this...

2024-03-201h 04

NAIFA's Advisor Today Podcast SeriesDiscovering and Rediscovering Your Economic VitalityJill Judd is a distinguished Life Underwriting Training Council Fellow (LUTCF), Financial Services Specialist (FSS), and Retirement Income Certified Professional (RICP) with extensive experience in the insurance industry. Her professional mission is to provide individuals with the necessary tools and resources to manage the risks of everyday life, recover from unexpected events, and achieve their aspirations. Jill's expertise in the field has also led her to serve as a past President of NAIFA. Before her career in financial services, Jill was an accomplished marketer who ran an advertising and marketing firm. Today, she leverages her knowledge and...

2024-03-1356 min

YOU SHOULD GET A LICENSEEPISODE 59: JERALD L. TILLMAN-PT 2: FOUNDER OF NAAIA-BLACK INNOVATORS OF THE INSURANCE INDUSTRYIn a special 2-Part interview, Rod speaks to Jerald Tillman, LUTCF is the owner of JL Tillman Insurance Agency in Cincinnati, OH. A successful independent risk management firm that has served the community for over four decades. However, he is nationally known as the Founder of the National African American Insurance Association. A professional trade association committed to the professional development and celebration of African American excellence in the insurance and financial service industries. Growing up with aspirations in entrepreneurship and athletics, Tillman thought he was headed to an NFL career until an injury and eye-opening conversation opened his...

2024-02-2149 min

YOU SHOULD GET A LICENSEEPISODE 58: JERALD L. TILLMAN-PT 1: FOUNDER OF NAAIA-BLACK INNOVATORS OF THE INSURANCE INDUSTRYIn a special 2-Part interview, Rod speaks to Jerald Tillman, LUTCF is the owner of JL Tillman Insurance Agency in Cincinnati, OH. A successful independent risk management firm that has served the community for over four decades. However, he is nationally known as the Founder of the National African American Insurance Association. A professional trade association committed to the professional development and celebration of African American excellence in the insurance and financial service industries. Growing up with aspirations in entrepreneurship and athletics, Tillman thought he was headed to an NFL career until an injury and eye-opening conversation opened his...

2024-02-0450 min

NAIFA's Advisor Today Podcast SeriesNavigating the Complex Landscape of the Insurance Industry With Tom PalmeriTom Palmeri is a Life Underwriting Training Council Fellow (LUTCF) committed to helping clients build and safeguard their wealth. As a financial advisor, he has over 25 years of experience in insurance, investments, estate preservation, and employee benefit plans. Tom specializes in helping individuals and businesses achieve their financial goals through compassion and empathy. He has demonstrated his leadership acumen by serving as the past President of the New York and Suffolk County chapters of NAIFA and other organizations. In this episode… Working in the insurance industry is more than just a job; it's a lifelong pr...

2024-01-2550 min

YOU SHOULD GET A LICENSEEPISODE 53: KATHY CONLEY JONES: BLACK WOMEN INNOVATORS OF THE INSURANCE INDUSTRY VOL. 1SPECIAL INNOVATORS EDITION!

Kathy Conley-Jones, LUTCF is the Founder of Conley Financial Group in St. Louis, MO. A 40-year veteran of the insurance and financial services industry...she is a trailblazer, mentor, "IBA Elite Women in Insurance", and "NAAIA Lifetime Achievement" award-winning history maker following in the footsteps of iconic women entrepreneurs like Ernesta Procope. Starting her career as a schoolteacher, she enjoyed seeing learning take place in real-time but wondered if there was more. Learning about the insurance industry from an agent with NY Life she began educating teachers about tax-deferred annuities eventually expanding into a...

2023-10-231h 06

Retiring Right!E 16 - Traditional Retirement Accounts & Taxes (Part II)A continuation of a prior episode to piggyback on the conversation we had about these commonplace retirement accounts and how, looking through a tax-focused lens, they impact your overall retirement income. You can give away tens of thousands or even hundreds of thousands of dollars to your "Silent Partner" - The Government!

We can give you sound tax-strategies to reduce or eliminate your taxes in retirement so that you get to keep most or all of your money when you need it most!

You can live the retirement of your dreams! It...

2023-07-2015 min

Retiring Right!E 15 - Choices (Part 1)In today's message - Choices (Part 1) I wanted to introduce the reality that with retirement planning there are so many choices to make! You have to make important choices regarding where to live, whether or not to "down-size", how much to save, where to save it, at what age to retire, at what age to begin Social Security, how to take money out of your traditional retirement accounts, choices regarding your health and well-being, how to have balance enough to enjoy the retirement life that you've always dreamt of!

You can live the retirement of your dreams...

2023-06-2017 min

Agency Nation RadioExpanding into BenefitsOn this edition of Agency Nation Radio podcast, guest host Bob Fee, President, Fee Insurance, Kansas and immediate past chair of the Big “I” is joined by Kathy Conley-Jones LUTCF, Chief Insurance Strategist, Williamson Financial Management Group in St. Louis. She also founded The Conley Financial Group, a multi-line insurance and employee benefits firm that provides holistic insurance solutions to its clients. They share their backgrounds in benefits and provide strategies and tips for agencies considering expanding their service as a trusted advisor. Find out how to get started, markets to consider, income potential, and staffing.

“I think it’s so impor...

2023-05-2430 min

Retiring Right!F.E.A.R. = Face Everything And Rise!In short, today's message is - Don't let "fear" stop you from living the retirement life that you've always dreamt of!

You can live the retirement of your dreams! Make the decision to and then reach out to myself or another trained professional to "take you by the hand" and show you how to get there.

Not only can you retire (even if your behind), but you can even Retire Right!!!

Jeff Sedlitz, LUTCF | President

Family Tree Financial Group

JSedlitz@FamilyTreeFG.com

---

Support this...

2023-05-1318 min

Alliance NOW! Risk & Insurance Podcast SeriesUnpacking the Minds of Two Insurance Organization Leaders: A Candid ConversationUnlock your full potential and supercharge your professional growth with the CIC Designation Program.John R. Costello, CIC, CRIS: John Costello, CIC, CRIS, is vice president and construction practice member at USI Insurance Services in Rochester, New York. Costello was installed as Big “I” chairman in September 2022. Throughout his career, Costello has volunteered in a variety of professional and community service organizations. He is former chairman of the Independent Insurance Agents & Brokers of New York, past president of the Independent Insurance Agents of Monroe County and was the 1995 Monroe County Insurance Professional of the Year. He formerly served on the...

2023-03-2231 min

NAIFA's Advisor Today Podcast SeriesNavigating Technology and Social Media for Greater Engagement With Bryon HolzBryon Holz is the President of NAIFA, providing investments and insurance to successful individuals and business owners throughout the Southeast with Bryon Holz and Associates, which he oversees as President and Registered Principal. He has obtained numerous designations and certifications over the years, including Chartered Financial Consultant (ChFC), Chartered Life Underwriter (CLU), Chartered Advisor for Senior Living (CASL), and his LUTCF designation and LACP certification. Bryon is a graduate and Presidential Scholar from the University of Tampa. He is also a graduate of Leadership Brandon and NAIFA's prestigious Leadership in Life Institute (LILI). In this...

2023-01-1839 min

Retiring Right!E 13 - IRAs Right or Wrong for you? Here are some features, etcSaving for Retirement? Want to?

Is an IRA right for you? If so, what type? Traditional IRA vs Roth IRA. What you don't know can hurt you.

Here is some useful information on the features and benefits of both Traditional and Roth IRAs. We also mention a potential Tax-Free Retirement alternative.

For more information contact us at: info@FamilyTreeFG.com or call us : (904) 657=0896.

We're here to help!

Let's get you Retiring Right!

---

Support this podcast: https://podcasters.spotify.com/pod/show/jeff-sedlitz/support

2022-11-1921 min

MDRT PodcastSteps to create consistency through communication and cultureWhat are the keys to ensuring your team is on the same page? What conflicts can arise without this structure and connection in place? In this episode, MDRT members share how they benefit from a staff that runs on clarity, process and positivity.

You’ll hear from:

Carla Brown, FPFS

Matthew Richard Duffy, LUTCF, FSS

Episode breakdown:

0:26—Learning how staff members like to be communicated with

1:23—Establishing systems so everyone knows what to expect

2:12—When team members aren’t on the same page about communication

4:03—Defining consistency and unity to avoid surprises or tension

6:01—Spotting red flags for a candidate that could be...

2022-11-0106 min

GAMA THAILAND PODCASTEP36 ผู้นำสไตล์วางแผนการเงินพบกับ คุณจิดาภา สีม่วง LUTCF Certified Financial Planner GAMA Award Diamond

2022-10-0324 min

Retire Right with Reverse RobWhat Color Are Reverse Mortgages and Yield Signs? Special Guest, Jesus Jaramillo, LUTCF with Premier Financial GroupWhat Color Are Reverse Mortgages and Yield Signs? Special Guest, Jesus Jaramillo, LUTCF with Premier Financial Group

2022-09-0143 min

Retire Right with Reverse RobWhat Color Are Reverse Mortgages and Yield Signs? Special Guest, Jesus Jaramillo, LUTCF with Premier Financial GroupWhat Color Are Reverse Mortgages and Yield Signs? Special Guest, Jesus Jaramillo, LUTCF with Premier Financial Group

2022-09-0143 min

MillionDollarConvos by HustlehousejaS2:16 : Limit-Less (Feat. Christopher Lawe) Part 1Tired of the Energy Drinks how about an organic substitute? Magic Mind is the worlds first productivity drink. Go to magicmind.co/Ja and utilize our promo code "JA20” to get 40% off your annual subscription and 20% off a one time purchase.Episode Summary:On this episode we sat down with Senior Branch Manager at Sagicor Jamaica and Leader at Holborn Spartan Christopher Lawe (LUTCF , FLMI, AIRC, ARA, ACS) and tackled the concept of breaking self-imposed limits and being tactful. He shared bits of his early life , and how his experiences lead him to beco...

2022-08-2941 min

Retiring Right!E 12 - Outlets OptionsEveryone should have an outlet - that thing that when they do it, they can release their energy and feel great! Outlets, hobbies, interests, passions, etc. are so important to staying fulfilled, vibrant. The other word in the title was Options. I also feel that everyone should create the option to retire for themselves. YOYO stands for You're On Your Own! Meaning if you want to have a great retirement, it's up to you to create it. The Corporate pensions are largely a thing of the past. Social Security is in terrible financial trouble. Therefore, now more than ever...

2022-07-0514 min

Retiring Right!E 11 - More Food For ThoughtPlenty of ideas and things to think about in planning for retirement

---

Support this podcast: https://podcasters.spotify.com/pod/show/jeff-sedlitz/support

2022-06-2812 min

MDRT PodcastWhen I realized giving is important and how it overlaps with my businessWhere do your philanthropic priorities come from, and how do you ensure these are represented in your practice? In this episode, MDRT Foundation board members explain the source of their motivation to give and how they have seen these benefits in the professional world as well as their personal lives.

You’ll hear from:

Adrian P. Baker, DipPFS

Priti Ajit Kucheria, CFP, LUTCF

Episode breakdown:

0:30 – Evaluating a nation by how it helps the next generation

1:01 – Learning to share at a young age

2:51 – Passing along your spirit of giving to family members

3:42 – Representing that generosity in your business

5:29 – Find others who want to answ...

2022-06-0107 min

Just Peachie ShowOpioids and FinancesPeachie Thompson, AALU, ALMI, ACS of Peach Insurance Services interviews Ms. Cheryl Canzanella, CLU, ChSNC, LUTCF who is passionate about educating people on the financial consequences of the opioid epidemic, who has been in the insurance brokerage business for 23 years.

2022-05-1329 min

The Trades PodcastEp28 Robert Gascho - RGascho.NYLAgents.comRobert Gascho, LUTCF, CLU® CA Insurance Lic. # 0G56051Agent, New York Life Insurance CompanyFinancial Services Professional for NYLIFE Securities LLC4365 Executive DriveSuite 800San Diego, CA 92121Office858.623.8690Mobile858.720.0731Fax858.623.9784rgascho@ft.nyl.comhttps://rgascho.nylagents.com/

About The Trades PodcastWebsitehttps://www.thetradespodcast.comHosted byJeff Mudd and Danny TorresThe Trades Podcast features real conversations with business owners, trades leaders, and industry innovators making an impact in the skilled trades community....

2022-05-0527 min

Retiring Right!E 10 - Growth & Taxes (Two things to consider when planning for retirement)!Thanks for listening to this episode of Retiring Right!

As you save for the future, there are many areas where you may want to focus your attention. Most of us know about the need to grow and protect our retirement funds. This is an important consideration in making sure you have enough money to fund your retirement & not run out of money! An area that you might not have thought much about is taxes & TAX RISK.

Taxes – just like the growth of your retirement funds – can be a critical component of ensuring you have enough reti...

2022-04-1129 min

The Leaders’ Lab with DrCharityTV⚜️How to Budget & Save Money in 2022⚜️📢THE 56th EPISODE OF THE LEADERS' LAB IS HERE! 🎉🎊🍾

——————✨ 𝗖𝗟𝗜𝗖𝗞 𝗧𝗢 𝗥𝗘𝗔𝗗 𝗠𝗢𝗥𝗘 ↓ ✨——————

I’m your host, Dr. Charity C. Campbell affectionately known as Dr. C and I can’t wait to dig into today’s topic!

⚜️How to Budget & Save Money in 2022⚜️

In this episode of the podcast, my special guest, Roger Silvera, talks about how to budget and save money in 2022. Times are tough – but with a little bit of know-how, you can make sure that your finances are as solid as they can be. Watch now for some great tips!

Let’s dig in!

———————

Episode contents:

🔅The Mindset of Financial Independence

🔅Cash Flow Plan vs. Budget Plan

🔅Money Management Tools to Use NOW

⚜️Read more about Roger A. Silvera: https://drcharitytv.com/r...

2022-02-2347 min

ACB Events20211020 RSVA Mini BEP Training Day 1

“How to present to legislators and others about the Randolph-Sheppard Program”

Part I: “Getting advocates involved in Reaching Legislators and others”

Robert Jackson (VA), NAMA Government Affairs Manager, National Automatic Merchandising Association (NAMA)

Part II: “Telling Your Story”

Donna Seliger (IA), Long-time IA advocate

Jeff Thom (CA), California Council of the Blind Governmental Affairs Director

Advocates will share Examples of telling your own story to lawmakers.

“The importance of Necessary Business Insurance”

Mark Polak (CA), Owner Lemark Insurance

This session explains the need for the following: Product liability, Employee Non-owner Driver vehicle Insurance (ENOD), and Workm...

2022-02-012h 24

MDRT PodcastFinding appropriate ways to discuss insurance at unexpected timesDo you know when you should and shouldn’t try to find new clients – and how to start the conversation when the time is right? In this episode, MDRT members share how they toe that line and make sure to say the right things to the right people.

You’ll hear from:

Carla Brown, FPFS

Matthew Richard Duffy, LUTCF, FSS

Episode breakdown:

0:29 – Appropriately sharing a story if someone mentions a topic related to what you do

1:33 – Unexpectedly coming back with new clients after family events

2:32 – Developing new clients around the campfire

4:01 – Making a priority of working with nice people

Listen to the monthly...

2022-02-0107 min

Retiring Right!E9 - Tom Brady InspiredRetiring Right is about more than money. This week's (unconfirmed) news is that 44 year old Tom Brady, QB of the Tampa Bay Bucs is retiring. For Tom it is not a financial decision. Tom and his wife have a reported net worth of around $650,000,000, give or take a dollar or two! WOW!

That's enough money to allow them to take their children to Disney World (a short drive from their Tampa home) without having to save up and plan for it like many (maybe most) families. So Tom's retirement decision is not about money or age, but "...

2022-01-3019 min

Lead To Excel PodcastWhat Women Need to Know About Financial Planning - E63Send us a textJanuary is a time many of us reflect and reset, so I am thrilled to be joined by Shelley Nadel, CFP®, CLTC®, LUTCF, - a native Houstonian passionate about empowering helping professional women and their families, as well as small business owners apply the same excellence to their personal finances that they use every day to succeed in their work environment. Shelley has spent the past 14 years helping women control their financial destiny and commits her “free” time to community leadership, including serving as Co-President of Ellevate Network’s Houston Chapter. He...

2022-01-2440 min

MDRT PodcastA specific challenge I have with a client or staff memberHow do you handle difficulties in your practice that come from generational disagreements? Or from clients whose behavior can be draining on you? In this episode, MDRT members share their challenges and strategies to handle them.

You’ll hear from:

Peter Jason Byrne

Danielle J. Genier, CFP, CLU

Jonathan Godshall Camacho, LUTCF, MBA

Randall D. Kaufmann

Episode breakdown:

0:34 – Reconciling generational challenges and client service moving forward

2:11 – Changing processes rather than changing individuals

4:25 – Adapting approaches when working with your spouse

6:32 – Handling clients who refuse to listen to your budget recommendations

10:02 – Maintaining calm when a client becomes overwhelming

Listen to the monthly series, MDRT...

2022-01-0315 min

Retiring Right!E8 - Some things to consider when creating Retirement IncomeThis episode talks a bit about 2 main areas to keep in mind when planning and structuring your retirement income. Those two things are GROWTH - of your savings, and the role TAXES can play in your retirement income and therefore quality of life in retirement.

If you have questions, would like to learn more or would like to use our team as a resource to guide you through retirement contact us at info@FamilyTreeFG.com or call us at (904) 657-0896.

If you appreciate the content being shared here and would like more...

2021-10-1526 min

Meet The Author ShowSeason 1 | EPISODE 11: Juli McNeelyOn the latest episode of The Females and Finance Meet the Author Show, Tony Steuer spoke with Juli McNeely, President of McNeely Financial Services about her book "No Necktie Needed: A Woman's Guide to Success in Financial Services".

Juli McNeely, CLU, CFP, LUTCF is the President of McNeely Financial Services. Juli specializes in the areas of retirement planning, education funding, business continuity planning and estate planning. Her clientele consists of business owners, individuals, married couples, and successful professionals. Juli also served as the only female President of the National Association of Insurance and Financial Advisors (NAIFA).

2021-10-0127 min

MDRT PodcastSocial media lessons to drive prospectingHow do you ensure that the right people are seeing what you post on social media? Should you be sharing information about your products, your team, or your family? In this episode, MDRT members share the digital changes that have helped connect with new clients.

You’ll hear from:

Carla Brown, FPFS

Matthew Richard Duffy, LUTCF, FSS

Episode breakdown:

0:27 – Adjusting strategy on Facebook to increase exposure

3:21 – Driving engagement through posts about your team

6:18 – How to evaluate what is and isn’t working

Listen to the monthly series, MDRT Presents: @mdrtpresents

2021-09-1509 min

MDRT PodcastBest practices for consistent productionHow do you ensure your practice is running smoothly throughout the year? Do you gather feedback from clients, and what do you do with that information? In this episode, MDRT members share changes they have made to ensure consistency in their business.

You’ll hear from:

Carla Brown, FPFS

Matthew Richard Duffy, LUTCF, FSS

Episode breakdown:

0:27 – The benefits of bringing in an operations manager

2:16 – Avoiding inconsistency with an intake form and a survey

5:41 – The value of using a follow-up questionnaire

6:43 – Changes made to improve and learn from the survey

9:16 – Determining that the operations manager was helping establish consistency

Listen to the monthly...

2021-09-0110 min

MDRT PodcastAdapting to new and surprising circumstances with staffIn the last year, many advisors have had to embrace virtual options that they never considered before. In this episode, MDRT members share how they adapt to continuing changes to ensure not just that their practice is running smoothly but that their team members are happy as well.

You’ll hear from:

Carla Brown, FPFS

Matthew Richard Duffy, LUTCF, FSS

Episode breakdown:

0:35 – Changing from all face-to-face to all virtual

1:50 – The benefits of asking staff "What do you like least about your job?"

3:51 – How to decide between standardized vs. customizable policies for clients and staff

5:20 – When something mandatory becomes merely encouraged

7:40 – Determining...

2021-07-3010 min

Retire Right with Reverse RobHow to Incorporate Reverse Mortgages in Retirement Planning with Jim Silbernagel, CFP, CEPS, LACP, LUTCFHow to Incorporate Reverse Mortgages in Retirement Planning with Jim Silbernagel, CFP, CEPS, LACP, LUTCF

2021-06-1843 min

Retire Right with Reverse RobHow to Incorporate Reverse Mortgages in Retirement Planning with Jim Silbernagel, CFP, CEPS, LACP, LUTCFHow to Incorporate Reverse Mortgages in Retirement Planning with Jim Silbernagel, CFP, CEPS, LACP, LUTCF

2021-06-1843 min

Money, Mortgage, MindsetTalking Insurance with Chester WinterIt’s very important to have insurance coverage. A lot of people think insurance is a scam - there is a big misunderstanding of how insurance works. It’s not a tangible thing. Chester Winter from Liberty Mutual joins us to dig deep into insurance policies and why we all need to be covered.“All insurance is great until you need it, then that’s when you separate the good companies from the bad ones.”Insurance companies can be separated into two categories – the 1-800 companies and the more personal ones. If you’re working with a 1-800 c...

2021-05-0732 min

In the Suite43. Grinding It Out While Exploring the Inspiring Truth About Mentoring, Masterminds and Female Breadwinners with Meredith Moore LUTCF, CLTC, Founder & CEO of Artisan Financial StrategiesSend us a textIt is an absolute joy to welcome Meredith Moore, LUTCF, CLTC to In The Suite for this episode. Meredith is a CEO, a financial guru, a speaker, a writer, a leader, and a growth junkie. She’s also a fighter with a fiery passion to help lift up her community. Meredith is the Founder and CEO of Artisan Financial Strategies, where she helps Atlanta families coordinate their financial world. She won the greater North Fulton Chamber of Business, “Women of Excellence” award and is also a proud graduate of “Leadership Atlanta.”“My pas...

2021-04-271h 07

Retiring Right!E7 - Retirement - It's about more than the money!The first thing most people think of when the topic of retirement comes up is "money"... In this episode of "Retiring Right" we talk about non-monetary things that help to make for a great retirement. Please enjoy!

If you appreciate the content being shared here and would like more of the same from us, please support us with a monthly donation and we will gladly keep the content coming!

Just click the link. and thank you very much for your support!: Click Here

And, here's to "Retiring Right!"

J...

2021-04-2020 min

Retiring Right!E6 - AdviceWhen it comes to advice on where to eat, what movie to see, etc advice from friends and neighbors is fine. But, when it comes to your financial well-being and retirement planning, advice should be sought after from a licensed and trained professional. No one wants to get to 68 years of age, put in their retirement notice only to discover at age 77 they're 8 months away from running out of money to remain retired! A financial professional who is trained and certified in all facets of retirement planning is essential to your retirement success.

Jeff...

2021-04-1415 min

ZC InformaticsThe Educational Talk Show (ETS) | Talk Show on MPSC and UPSC | Interview by Ram SirOur Guest:

*Ramkrishna Rawool* popularly known as Ram Sir, is the *Founder & Director of Indian Institute of Knowledge & Development,* Last 5 years Ram Sir is closely working with youngstars & helping them to get employment by making them 'Job Ready'. For his work in education sector he received to prestigious awards *"Reserch Excelence Academic Award" (2018) & "Global Excellence Education Award" (2019)*

Ram Sir has 16 years of Professional & Entrepreneurial experience with corporate like Sun Pharma, Aditya Birla Group & Kotak Mahindra. His core competencies are...

2021-03-0920 min

Retiring Right!E5 - Making a Commitment to Your RetirementFamily Tree Financial Group is a full service financial advisory firm located in Northeast Florida, serving the nation. We have over 200 years of combined industry experience and believe in the philosophy that "None of us are as great as all of us"

When one of our Financial Professionals takes on a new client, that client gets the expertise and collaboration from our entire team. We treat everyone as a family member!

---

Support this podcast: https://podcasters.spotify.com/pod/show/jeff-sedlitz/support

2021-03-0319 min

The Bill Levinson ExperienceStrategies to Win Large Business Owner Cases!Mark DiTondo, LUTCF & Top Sales Strategist for Business Owner Retirement Plans with Whole Life Products discusses sales strategies that have helped agents set sales records! Mark is a graduate of Cornell University and holds Series 7 and 63 licenses, in addition Mark is the recipient of Lafayette Life's Regional of the year award and Joint Chiefs of staff qualifier. Mark was also a Presidents Club Qualifier for three consecutive years!

2020-12-0944 min

BetterWealth with Caleb GuilliamsThe Future of Taxes & Tax Diversification with Jim SilbernagelWe have to anticipate the future and put ourselves in the best position to deal with whatever happens! In today's Better Wealth Episode, I had the pleasure of interviewing Jim Silbernagel one of the biggest thought leaders in our space. Jim is President of the Silbernagel Group and Real Wealth Professionals. In my episode with Jim I ask him a few questions on current events, what the future might look like financially with all the increased taxes. Jim gives an overview of Biden’s tax proposal and how it will impact America. The biggest issue that faces mos...

2020-12-0953 min

In the Suite26. Inspiring Personal Financial Responsibility and Leadership in Life Insurance with Faisa Stafford, LUTCF, SHRM-SCP, President & CEO Life HappensSend us a textIt’s a joy to welcome our guest, Faisa Stafford, LUTCF, SHRM-SCP to In The Suite . She’s a leader, a Mom, and a CEO who is passionate about streamlining processes to better serve the industry and Life Happens’ members. Prior to her role as Life Happens CEO and President, she served as the COO and CFO for more than 10 years. As the company’s first female CEO, Faisa has seen Life Happens grow from every angle. She’s worked at Life Happens since 2003 back when it was called The LIFE Foundation...

2020-11-121h 02

Hollywood of ParenthoodHow will the Payroll Tax Holiday affect Parents?Get the scoop on how Payroll Tax Holiday will affect you and your family. In short, the tax holiday is the result of a presidential memorandum that allows for the deferment of payroll taxes from September 1 to December 31st. This Payroll Tax Holiday may increase your paycheck for 4 months but at what cost? In this podcast you will find out all the juicy details. Featuring insight information to contact Mary Anne Leichliter-Rice, MBA, LUTCF® CLTC® of https://www.trianglewealthcare.com Direct: 919.785.7112 Mobile: 919.740.8720

2020-11-0915 min

MDRT PodcastHow advisors overcome staffing challengesWhat do you do if employees don’t work out the way that you expect? What’s the lesson from a staff member who doesn’t know to put a stamp on a letter? In this episode, MDRT members explain difficulties they have encountered and what they have gained from these experiences.

You’ll hear from:

David Braithwaite, Dip PFS

Sofia Dumansky, MBA, LUTCF

Jonathan Peter Kestle, CLU, B Com

Mark D. Olson, MSFS, CFP

Episode breakdown:

0:27 – Refining the job description to find the right person to replace departing staff

1:57 – Realizing the problems caused by continually extending a staff member’s probationary...

2020-10-0111 min

MDRT PodcastHow the MDRT Foundation has impacted meMaybe it’s seeing the opportunities and memories created for people around the world. Maybe it’s recognizing your perspective on the world has changed. In this episode, two MDRT members who currently serve on the MDRT Foundation Board of Trustees share how they have seen a difference in their lives through volunteering with the MDRT Foundation.

You’ll hear from:

Adrian P. Baker, DipPFS

Priti Ajit Kucheria, CFP, LUTCF

Episode breakdown:

0:26 – My biggest memory from more than a decade with the Foundation

1:22 – The first moment when I realized the power of the Foundation

4:07 – How I noticed the impact of the Foundati...

2020-07-3108 min

Retiring Right!E4 - Business Owner DilemmaWe all have major, difficult financial decisions to make. But, the average business owner has even more. Not only do they have all of the "personal" decisions to make over the typical obligations and goals, but they also have several other financial considerations due to the business. Today, in this episode of Retiring Right, we're going to talk briefly about Business Continuation Planning and how important it is!

We also hope that if you like us, you'll support us and allow us the opportunity to bring you much more great content in the upcoming...

2020-07-3012 min

MDRT PodcastWhat sets me apart as an advisorDo you provide unique gifts to fit your clients’ interests? Do you hold them accountable to their goals? In this episode, MDRT members share some ways in which they make themselves stand out to their clients.

You’ll hear from:

Peter Jason Byrne

Danielle J. Genier, CFP, CLU

Jonathan Godshall Camacho, LUTCF, MBA

Randall D. Kaufmann

Episode breakdown:

0:33 – The benefit of branded teddy bears

3:11 – Calling clients to sing “Happy birthday” to them

4:27 – Having clients identify their interests to utilize as gift opportunities

6:37 – Holding clients accountable as a means to ensure success

10:58 – Inviting clients to send postcards from their dream vacation spot

Listen to the...

2020-07-0115 min

Retiring Right!E3 - Retiring Right - Annuity Awareness MonthToday we offer a brief understanding of annuities and how they can be used in retirement planning to generate a "self-made pension plan"

---

Support this podcast: https://podcasters.spotify.com/pod/show/jeff-sedlitz/support

2020-06-1715 min

Abundance DynamicsGuest Mike CarterMichael L. Carter, LUTCF began his financial services career with a major insurance company in Las Vegas, NV in 1995 and has been a resident of Southern Nevada since 1977. Mike founded Carter Investment Services, to assist clients in achieving financial independence. http://www.carterinvestmentservices.com/

Watch on YouTube : https://youtu.be/KqNBmltbhgE

2020-06-151h 15

Retiring Right!E2 - Changes To Life As We Knew It!So much has changed with regards to retirement - Retirement age, Life Expectancy, Retirement Funding, Pensions, Social Security, 401-k, IRA, etc

Throw in the market volatility we've been experiencing of late and the question is "Now what do I do?"

In this episode, we offer some insight and some thought provoking ideas.

Stay tuned. Enjoy. Reach out to us . Say hello and don't be afraid to ask us questions.

For now....Stay safe!

---

Support this podcast: https://podcasters.spotify.com/pod/show/jeff-sedlitz/support

2020-05-0415 min

Retiring Right!E1 - Retiring Right! IntroHi! This is just a little introduction so that you get to know a little about me, my firm, my past and what "Retiring Right!" will be all about!

If you want to know how to maximize retirement, ideas to make retirement great, planning and preparing for retirement and more...this is the place to be!

I look forward to sharing with you in upcoming episodes of Retiring Right! Please join us and add us to your favorites to listen to!

---

Support this podcast: https://podcasters.spotify.com/pod/show/j...

2020-01-3021 min

Retiring Right!Retiring Right! (Trailer)---

Support this podcast: https://podcasters.spotify.com/pod/show/jeff-sedlitz/support

2020-01-2900 min

MDRT PodcastLessons from mistakes in client communicationOccasionally you don’t choose the right words with clients, whether it’s because of something you wish you said or something you wish you didn’t. In this episode, MDRT members share times when the conversation did not go well and how they adapted their approach moving forward.

You’ll hear from:

Peter Jason Byrne

Danielle J. Genier, CFP, CLU

Jonathan Godshall Camacho, LUTCF, MBA

Randall D. Kaufmann

Episode breakdown:

0:31 – Do not say anything unless you’re sure your client is pregnant

1:03 – When a young advisor learns to treat every client with respect

2:56 – Making sure not to make assumptions about less-engag...

2019-12-0208 min

Money Matters Top Tips with Adam TorresSamantha Jackson CLU, CLTC, LUTCF, Managing Director & Registered Principal at MassMutual Greater PacificSamantha Jackson CLU, CLTC, LUTCF, Managing Director & Registered Principal at MassMutual Greater Pacific is interviewed in this episode.

Follow Adam on Instagram at Ask Adam Torres for up to date information on book releases and tour schedule.

Apply to be interviewed by Adam on our podcast:

https://www.moneymatterstoptips.com/podcastguest

2019-11-2813 min

CEO Money with Michael YorbaEpisode 164: Robert GardnerRobert Gardner, CEPA joined the financial services industry in 2000. Prior to joining this industry Robert was a successful business owner. His previous experience shaped his passion for working with business owners to help them fully understand the importance of several key planning areas that often are overlooked. Robert then helps those owners to implement the appropriate strategy to meet their goals.Robert provides comprehensive exit/succession planning, key employee retention, employee benefits, executive benefits, and legacy planning services. He uses a discovery process to identify financial goals and objectives, analyze information, and evaluate options available to his clients...

2019-10-2212 min

90 Day Money Pro - Expert Money Tips and Financial Advice for Any and All Income Levels!State 6 South Carolina - Fellow Advisor Brian Falconer LUTCF and Real Estate Talk in CharlestonIn this episode, I explore South Carolina’s coolest cities including Myrtle Beach and Charleston. From conversations with a fellow advisor, to ‘crashing’ a Chamber of Commerce networking event and linking up with local realtor Annabel Tichy, the #moneyprotour was busy busy busy in SC! Listen in to some of the highlights, cool reflections, and valuable money tips. —— Free E Book www.linktr.ee/90daymoneypro —— www.instagram.com/90daymoneypro

2019-09-1616 min

MDRT PodcastSomething you do that other advisors don’tHow do you foster your own strategies and expertise, and how do you communicate that to clients? In this episode, MDRT members share what makes them unique and how it benefits their practice.

You’ll hear from:

David Braithwaite, Dip PFS

Sofia Dumansky, MBA, LUTCF

Jonathan Peter Kestle, CLU, B Com

Mark D. Olson, MSFS, CFP

Episode breakdown:

0:35 – Utilizing specialized knowledge of the tax code

2:21 – The benefits of unique software

4:08 – Gaining prospects from teaching university classes

5:39 – The student/teacher relationship compared to client/advisor relationship

6:44 – Creating your own opportunity on the radio

10:52 – Keeping a moving list of goals on you at all times

1...

2019-08-0119 min

MDRT PodcastDetermining what clients do or don’t haveSome clients overspend so people will perceive them as being successful. Others may be reluctant to share the truth about their financial situation. How do you find out what clients actually have and how you can help? In this episode, MDRT members share techniques that have helped them better understand what client assets really look like.

You’ll hear from:

Peter Jason Byrne

Danielle J. Genier, CFP, CLU

Jonathan Godshall Camacho, LUTCF, MBA

Randall D. Kaufmann

Episode breakdown:

0:32 – When someone presents as wealthier than they are

2:04 – Establishing trust so a client will share challenges happening in their business

3:44 – When clients aren’t r...

2019-05-0114 min

MDRT PodcastThe wildest client experience I’ve hadWhat would you do if a client’s dog starting drinking your tea? Believe it or not, an MDRT member had this experience. In this episode, members share how they handled unusual circumstances and what they learned.

You’ll hear from:

David Braithwaite, Dip PFS

Sofia Dumansky, MBA, LUTCF

Jonathan Peter Kestle, CLU, B Com

Mark D. Olson, MSFS, CFP

Episode breakdown:

0:33 – Sliding up a prominent media figure’s stairs on your bottom

2:25 – When prospects think the state will pay for their insurance

3:15 – When a client’s dog drinks your tea

4:55 – Traversing dangerous conditions, surrounded by wild animals

6:15 – A client choosing between c...

2019-04-0113 min

SharkPreneurJohn GrossOn today's episode, Seth interviews John Gross of JC Gross Agency about how he specialize in all kinds of insurance and an extra emphasis on Life insurance and business insurance.

John C. Gross III LUTCF is a native St. Louis born and raised within a mile of where his office set today. John started working full time when he was 15 years old spending the first 8 years of his work life in the restaurant business. John is married 37 years and has 2 grown children, four grandchildren, three horses’ two dogs and one very fast cat!

...

2019-03-2720 min

MDRT PodcastWhy you shouldn’t ignore clients’ kidsWithout your help, clients’ children may feel unprepared to discuss their parents’ finances and almost certainly will not become clients of yours. In this episode, James J. Silbernagel, LUTCF, CFP, explains how connecting with his clients’ kids enhances professional and personal relationships and provides essential lessons for multiple generations.

Episode breakdown:

0:32 – Don’t just “go where the money is”

1:01 – The value of the family meeting

2:15 – Why power of attorney is crucial

4:12 – Silbernagel’s personal connection

Listen to the new monthly series, MDRT Presents: @mdrtpresents

2018-02-0106 min

Making Waves at C-Level: Business Tips for Executives, Leaders, and EntrepreneursPersistent Consistency with Jim Silbernagel"If I am going to work - I might as well work hard" said young Jim Silbernagel. In his early job of making cold calls to set appointment he realized he was only going to be paid if he succeeded. Thus he jumped in and did the work. Today Jim Silbernagel is an independent agent registered with Woodbury Financial Services, Inc. He entered the insurance industry in 1982 followed by the financial services industry in 1986. Jim holds securities licenses; Series 6, 7, 63 and 66. He is insurance licensed for life, health and property/casualty since 1985. Jim has earned both his C...

2017-07-1832 min

MDRT PodcastPart 1: The decision that got me to Top of the TableThere are many ways to reach Top of the Table-level production. In this episode, MDRT members discuss how they’ve been able to qualify for Top of the Table annually, often as a result of recognizing client needs that aren’t being served.

You’ll hear from:

Alison Murdock

Van Mueller, LUTCF

James J. Silbernagel, LUTCF, CFP

Part 2: How to grow beyond Top of the Table

https://soundcloud.com/mdrt-podcast/part-2-how-to-grow-beyond-top-of-the-table

Listen to the new monthly series, MDRT Presents: @mdrtpresents

2017-04-0310 min

MDRT PodcastPart 2: How to grow beyond Top of the TableNo matter what your level of production, you can do other things to benefit your clients and yourself. In this episode, MDRT members address how they’ve expanded beyond Top of the Table by continuing to learn, educate and volunteer.

You’ll hear from:

Alison Murdock

Van Mueller, LUTCF

James J. Silbernagel, LUTCF, CFP

Part 1: The decision that got me to Top of the Table

https://soundcloud.com/mdrt-podcast/part-1-the-decision-that-got-me-to-top-of-the-table

Listen to the new monthly series, MDRT Presents: @mdrtpresents

2017-04-0308 minBreaking Money SilenceIf my adult children are college educated, do I need to talk to them about family finances? | Episode 13

If my adult children are collegeeducated, do I need to talk tothem about family finances?

Episode 13

Jim was motivated to discuss this myth because it can be heartbreaking to see situations when the parents pass away and fights over the will resulted in their children not speaking to each other again. Estate planning is a crucial conversation parents need to have with their adult children. However, some parents believe that if their kids are smarter than they were, then they don’t need to talk to them about money. The tr...

2016-08-2423 min

MDRT PodcastPositioning fair compensation with clientsProducers around the world have transitioned to a fee-for-service model, often as a result of their local regulatory environment. In this episode, listen in as five MDRT members from four different countries discuss the topic of compensation and how to initiate the discussion with clients.

You'll hear from:

• Diane L. McCurdy, CFP, EPC

• Steven P. Arengo, CFP, AIF

• Simon John Gibson, Dip PFS

• Stephen Kagawa, FSS, LUTCF

• Roy Hall

The Million Dollar Round Table® (MDRT) does not guarantee the accuracy of tax and legal information and is not liable for errors or omissions. You are urged to check with tax and legal p...

2016-04-0110 min

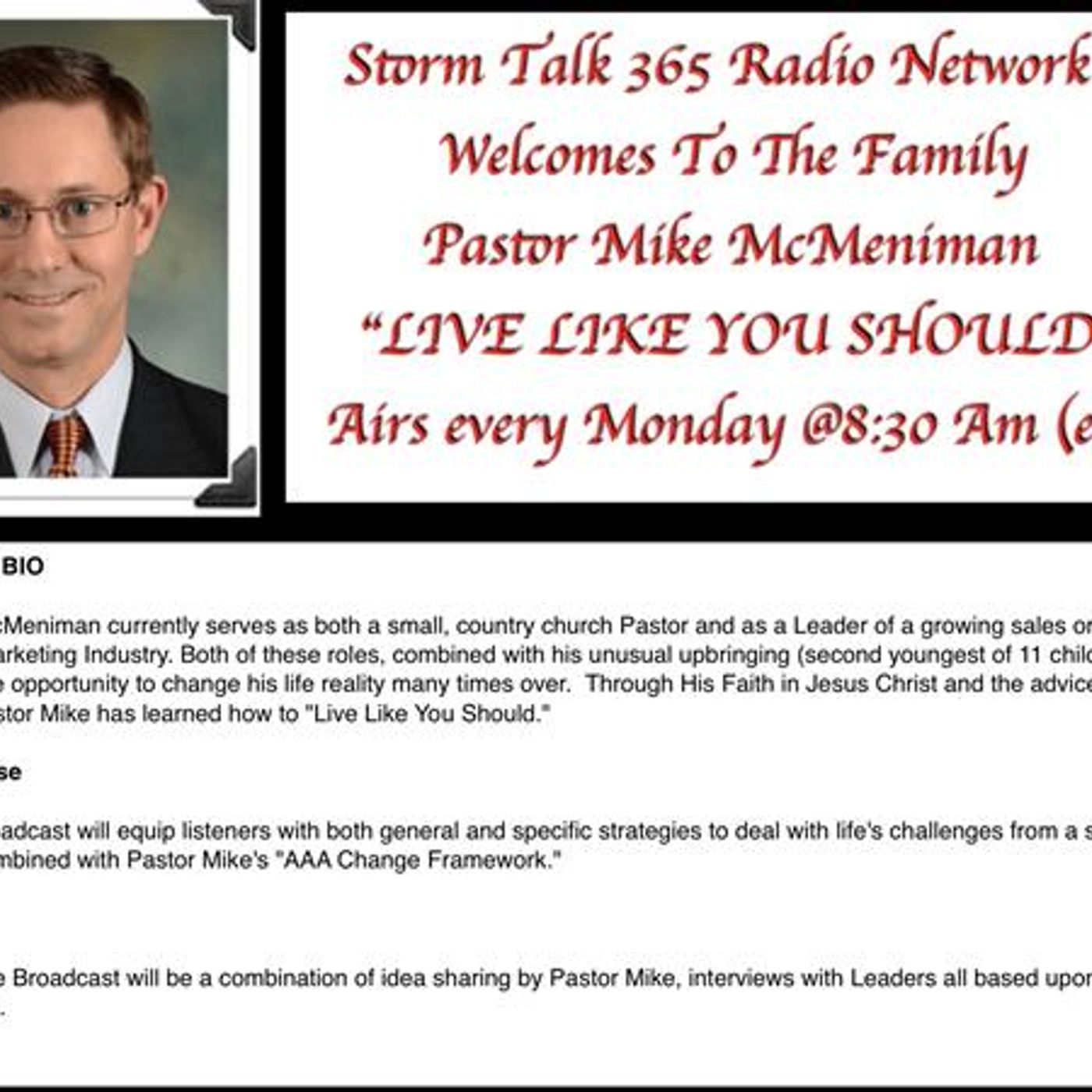

Storm Talk 365 RadioLive Like You Should with Pastor MikeHOST SHORT BIO Pastor Mike McMeniman currently serves as both a small, country church Pastor and as a Leader of a growing sales organization in the Network Marketing Industry. Both of these roles, combined with his unusual upbringing (second youngest of 11 children) have allowed him the opportunity to change his life reality many times over. Through His Faith in Jesus Christ and the advice and support of Mentors, Pastor Mike has learned how to "Live Like You Should." Overall Purpose The weekly broadcast will equip listeners with both general...

2016-02-0835 min

Storm Talk Radio ArchivesLive Like You Should with Pastor MikeHOST SHORT BIO Pastor Mike McMeniman currently serves as both a small, country church Pastor and as a Leader of a growing sales organization in the Network Marketing Industry. Both of these roles, combined with his unusual upbringing (second youngest of 11 children) have allowed him the opportunity to change his life reality many times over. Through His Faith in Jesus Christ and the advice and support of Mentors, Pastor Mike has learned how to "Live Like You Should." Overall Purpose The weekly broadcast will equip listeners with both general...

2016-02-0835 min

Storm Talk 365 Radio"Live Like You Should" with Pastor MikeJoin Pastor Mike for the weekly broadcast of "Live Like You Should" Internet Radio. This week learn how to change any area of your life in three simple steps! HOST SHORT BIO Pastor Mike McMeniman currently serves as both a small, country church Pastor and as a Leader of a growing sales organization in the Network Marketing Industry. Both of these roles, combined with his unusual upbringing (second youngest of 11 children) have allowed him the opportunity to change his life reality many times over. Through His Faith in Jesus Christ and the advice...

2016-02-0804 min

Storm Talk Radio Archives"Live Like You Should" with Pastor Mike - My TestiomonyHOST SHORT BIO Pastor Mike McMeniman currently serves as both a small, country church Pastor and as a Leader of a growing sales organization in the Network Marketing Industry. Both of these roles, combined with his unusual upbringing (second youngest of 11 children) have allowed him the opportunity to change his life reality many times over. Through His Faith in Jesus Christ and the advice and support of Mentors, Pastor Mike has learned how to "Live Like You Should." Overall Purpose The weekly broadcast will equip listeners with both general...

2016-02-0139 min

Storm Talk 365 Radio"Live Like You Should" with Pastor Mike - My TestiomonyHOST SHORT BIO Pastor Mike McMeniman currently serves as both a small, country church Pastor and as a Leader of a growing sales organization in the Network Marketing Industry. Both of these roles, combined with his unusual upbringing (second youngest of 11 children) have allowed him the opportunity to change his life reality many times over. Through His Faith in Jesus Christ and the advice and support of Mentors, Pastor Mike has learned how to "Live Like You Should." Overall Purpose The weekly broadcast will equip listeners with both general...

2016-02-0139 min

Storm Talk Radio ArchivesDebut "Live Like You Should" with Pastor MikeHOST SHORT BIO Pastor Mike McMeniman currently serves as both a small, country church Pastor and as a Leader of a growing sales organization in the Network Marketing Industry. Both of these roles, combined with his unusual upbringing (second youngest of 11 children) have allowed him the opportunity to change his life reality many times over. Through His Faith in Jesus Christ and the advice and support of Mentors, Pastor Mike has learned how to "Live Like You Should." Overall Purpose The weekly broadcast will equip listeners with both general...

2016-01-2534 min

Storm Talk 365 RadioDebut "Live Like You Should" with Pastor MikeHOST SHORT BIO Pastor Mike McMeniman currently serves as both a small, country church Pastor and as a Leader of a growing sales organization in the Network Marketing Industry. Both of these roles, combined with his unusual upbringing (second youngest of 11 children) have allowed him the opportunity to change his life reality many times over. Through His Faith in Jesus Christ and the advice and support of Mentors, Pastor Mike has learned how to "Live Like You Should." Overall Purpose The weekly broadcast will equip listeners with both general...

2016-01-2534 min

Chattanooga Business RadioMel Tryon with Lions Club International and Mary Sedrick with BrightBridgeMel Tryon / Lions Club International Mel Tryon, CPCU, LUTCF Founded Signal Mountain Insurance Agency in 1992, owned and operated the business until his retirement and sale of the business in 2014. Prior to starting this business he worked for Merastar Insurance Company in Chattanooga, TN and Travelers Insurance Company in Buffalo, NY, Manchester, NH, […]

The post Mel Tryon with Lions Club International and Mary Sedrick with BrightBridge appeared first on Business RadioX ®.

2015-11-2435 min

Chattanooga Business RadioMel Tryon with Lions Club International and Mary Sedrick with BrightBridgeMel Tryon / Lions Club International Mel Tryon, CPCU, LUTCF Founded Signal Mountain Insurance Agency in 1992, owned and operated the business until his retirement and sale of the business in 2014. Prior to starting this business he worked for Merastar Insurance Company in Chattanooga, TN and Travelers Insurance Company in Buffalo, NY, Manchester, NH, [...]

2015-11-2435 min

MDRT PodcastGetting into the BusinessMDRT members are some of the most successful producers in the field. But everyone had to get started somewhere, and for most, it wasn't on top of the industry.

On today's episode, hear from newer MDRT members on how they got their start, and what they had to struggle through before reaching MDRT. Jeanmarie Elizabeth Kricher; Vasilios K. Danas, ChFC, CLU; Alla Kushnir, CLU; Ella Ligay, LUTCF

The Million Dollar Round Table® (MDRT) does not guarantee the accuracy of tax and legal information and is not liable for errors or omissions. You are urged to check with tax and legal p...

2015-10-0109 minIt's Your Money and Your LifeJenn Martinsen from HUB International, & Neal Stehly from Marrs Maddocks & AssociatesAired: 9/26/2015 7 PM:: Neal Stehly of Marrs Maddocks & Associates (a Division of HUB International). Mr. Stehly is an executive Vice President in the Benefits Division of Hub. He is a native of San Diego who attended the University of San Diego, earning a degree in political science. He has been in the the Employee Benefits field for 25 years. He continues to keep himself abreast of the changes that are happening in the industry, obtaining specialist level certifications for LUTCF, CEBS, PPACA (Health Care Reform), COBRA, and HIPAA to name a few.

Jennifer Martinsen, the West Region Director, Health & Performance...

2015-09-2700 min

MDRT PodcastEpisode 4: Top of the Table TipsUnsure of how to handle incoming government regulation? Out of fresh prospecting ideas? Hear tips from Top of the Table level producing members and more in this newest episode.

Featured in this episode are Van Mueller, LUTCF, Michael L. Weintraub, CLU, Micheline Varas, RHU, Simon Singer, CFP, RFC, and Susan Catherine Paterson, FChFP.

This example is for educational purposes only. Each professional should set his own terms and conditions of engagement with the client through the process of negotiation.

The Million Dollar Round Table® (MDRT) does not guarantee the accuracy of tax and legal information and is not liable for e...

2015-04-1312 min

Retire Secure!Episode 88 - Life Insurance & Estate Planning with Terry Headley, LUTCF, FSSEpisode 88 - Life Insurance & Estate Planning with Terry Headley, LUTCF, FSS - TOPICS COVERED: Introduction of Guest –Terry Headley, LUTCF, FSS; Price Increases For Universal Life Policies; Life Insurance As A Guaranteed Investment; Client Profile For Guaranteed Universal Life; Life Insurance With A Long-Term Care Rider; Candidates For A Second-To-Die Life Insurance Policy

2014-08-1849 min

Clear Money ProgramHomeowners Insurance 101Sarae is joined by Chad Otto to discuss what you need to know about homeowners' insurance, including how liability coverage works and the extent to which your personal belongings are covered. Mr. Otto is a Life Underwriter Training Council Fellow (LUTCF) and an experienced insurance salesman with Liberty Mutual Insurance.

2013-11-2500 min

Clear Money ProgramRenters Insurance 101Sarae is joined by Chad Otto to discuss what you need to know about renters' insurance, including how liability coverage works and the extent to which your personal belongings are covered. Mr. Otto is a Life Underwriter Training Council Fellow (LUTCF) and an experienced insurance salesman with Liberty Mutual Insurance.

2013-11-0400 min

Clear Money ProgramLife Insurance 101It's Life Insurance Awareness Month! Join Sarae as she speaks with Chad Otto about what you need to know about life insurance. Mr. Otto is a Life Underwriter Training Council Fellow (LUTCF) and an experienced insurance salesman with Liberty Mutual Insurance.

2013-09-2600 min