Shows

Preferred Shares PodcastNestlé: The Building of a Global BehemothWelcome to Episode 30 of the Preferred Shares Podcast.In this episode, we discussed the history and founding of Nestlé.* Origins of the company in 1867* The strategic 1905 merger with Anglo-Swiss Condensed Milk Company* Nestlé’s exceptional resilience and growing scale* Nestlé’s global dominance in the coffee market* The success of its Maggi brand* The organic and inorganic growth behind its Health Science and Medical Nutrition segmentAdditional Reading & ListeningCurious to see what else we’ve been working on? Check out some of t...

2026-02-1754 min

Preferred Shares PodcastForging a Family-Owned Legacy: The Story of Thompson TradersWelcome to Episode 29 of the Preferred Shares Podcast.In this episode, we interviewed Clifford Thompson of Thompson Traders, a family-owned business founded in 2002. Since then, Thompson Traders has carved out a niche in the high-end home fixture market with a focus on luxury copper and brass sinks, range hoods, innovative designs, and strong customer relationships.We discussed a variety of topics:* Cliff shares his journey in founding Thompson Traders;* The importance of cash flow in small businesses;* Thompson Traders evolving from importing to designing their own products;...

2026-01-0859 min

Preferred Shares PodcastDavid Gearhart's Journey in Building a Private Insurance Holding CompanyWelcome to Episode 28 of the Preferred Shares Podcast.In this episode, we interview David Gearhart, CEO and Chairman of Wilmington Holdings Corporation, a private holding company of several insurance businesses. David tells the story of how he decided to try to find and acquire a small insurance business. In 2017, he successfully acquired Wilmington Insurance Company. After eight years of growth, both organic and by acquisition, Wilmington Holdings now controls about $50 million of annual premiums and has $100 million of assets on its balance sheet.We discussed a variety of topics: * David Gearhart’s background an...

2025-12-0546 min

Preferred Shares PodcastA Primer on Salmon Farming with Nick Longhurst of Marathon Asset ManagementWelcome to Episode 27 of the Preferred Shares Podcast.In this episode, Nick Longhurst, portfolio manager at London’s famed Marathon Asset Management, gives us an overview of the incredibly interesting salmon farming industry.We discussed a variety of topics: * Nick’s background;* Marathon’s investment philosophy;* A brief history of the evolution of the salmon farming industry;* Why salmon over other types of fish?;* The various barriers to entry that exist in the industry;* The size and structure of the salmon farming industry;...

2025-11-2150 min

Preferred Shares PodcastEndurance: From the Track to the Cockpit, a B-2 Pilot's StoryWelcome to Episode 26 of the Preferred Shares Podcast.Fewer people have flown the Northrop Grumman B-2 stealth bomber than have traveled to space, which is why it was a great honor for Preferred Shares to interview Lt. Col. Todd Moenster, USAF, Retired, a former B-2 pilot.We discussed a variety of topics: * Why Todd became interested in becoming a pilot;* Air Force pilot selection and the training program;* Bomber aircraft characteristics and how the bomber training program differed from the programs for other aircraft;* The challenges of...

2025-11-061h 03

Preferred Shares PodcastPool Corp. (POOL)Welcome to Episode 25 of the Preferred Shares Podcast.In this episode of the Preferred Shares podcast, Doug provides a brief history of Pool Corp. and an overview of the current business. The co-hosts discuss the pros and cons of the business and why it might be a “high quality cyclical” enterprise.In This Episode[01:11] Early History and Founding[06:22] Current Market Position and Business Model of Pool Corp[10:25] Growth Trends and Market Dynamics[13:39] Financial Performance and Revenue Breakdown[17:46] Management Structure and Company Culture[20:13] Competitive Land...

2025-09-1933 min

Preferred Shares PodcastThe Untold Story of Amphenol: Part IIWelcome to Episode 24 of the Preferred Shares Podcast.In this episode of the Preferred Shares podcast, hosts Devin, Doug, and Lawrence interview Will Kerwin, a senior equity analyst for Morningstar, to provide a current overview of Amphenol. In This Episode[01:17] Guest Introduction and Background[02:29] Exploring Amphenol’s History and Industry[04:27] Amphenol’s Market Position and Competitors[10:06] Amphenol’s Diverse End Markets[11:59] Aerospace and Defense Opportunities[14:05] Amphenol’s Unique Corporate Culture[16:31] Capital Allocation Strategies[17:53] Acquisition Strategies and Market Dynamics[20:16...

2025-07-2153 min

Preferred Shares PodcastThe Untold Story of Amphenol: Part IWelcome to Episode 23 of the Preferred Shares Podcast.In this episode of the Preferred Shares podcast, hosts Devin, Doug, and Lawrence delve into the history and significance of Amphenol, a leading manufacturer of connectors. They explore the company’s evolution from its founding in the 1930s, its pivotal role during World War II, and its transition into the consumer electronics market. The discussion covers Amphenol’s IPO journey, acquisitions, and the influence of private equity firm KKR on its growth strategy. The episode concludes with insights into the company’s culture and the legacy of its founder, Arthur...

2025-07-1136 min

Preferred Shares PodcastThe Sweet, Storied Success of Lindt & SprüngliWelcome to Episode 20 of the Preferred Shares Podcast.We interviewed a special guest, Mark Purdy, about Lindt & Sprüngli, a Swiss chocolatier founded 180 years ago in 1845. Mark is a veteran investment analyst with a focus on consumer brands for the last forty years and is currently Portfolio Manager at Chelverton Asset Management’s Select Consumer Staples Fund.In This EpisodeHere are some highlights from the interview with Mark Purdy about Lindt:* 01:27 - Mark Purdy’s Background in Consumer Staples* 05:01 - Investment Metrics for Consumer Staples* 06:47 - Lindt...

2025-05-151h 12

Preferred Shares PodcastTexas Pacific Land Corporation: The Riches of RoyaltiesWelcome to Episode 19 of the Preferred Shares Podcast.We interviewed a special guest, Chadd Garcia, about Texas Pacific Land Corporation (TPL). Chadd is a veteran investment analyst, has worked in private equity, and is currently Vice President & Portfolio Manager at Ave Maria Mutual Funds.In This EpisodeHere are some highlights from the podcast episode about Texas Pacific Land Corporation (TPL):* [1:52] – Chadd explains how he became interested in TPL.* [2:53] – TPL’s early history* [4:48] – Oil was discovered in West Texas in the 1920s, but fracking in the 2010s signific...

2025-03-0351 min

LagniappeDoes the Market Care What Party is in Power?Greg and Doug look at polling data and betting markets marking a shift that could be happening in the race. They’ll also examine historical data that shows the party in power does not significantly impact market performance. The conversation then shifts to economic trends, highlighting the recent performance of small and mid-cap stocks and the resurgence of gold as a viable investment. Finally, they delve into technological innovations, including autonomous vehicles and energy efficiency advancements, and what that means for an exciting future.Key Takeaways

[00:16] - Polling data and betting markets - is...

2024-10-1721 min

Preferred Shares PodcastMarc Levinson on The Great A&PWelcome to Episode 14 of the Preferred Shares Podcast.In this episode, Preferred Shares explores the evolution of grocery retailing in the United States with a focus on the rise of A&P, it becoming the largest retailer in the world, and the company’s ultimate demise. To help tell this story, there is no better expert than historian, author, and economist Marc Levinson, author of The Great A&P and the Struggle for Small Business in America. Levinson has authored several other books, including The Box: How the Shipping Container Made the World Smaller and the World Ec...

2024-10-111h 06

Preferred Shares PodcastRae Maile: A Lifetime in TobaccoWelcome to Episode 13 of the Preferred Shares Podcast.We interviewed our friend and special guest, Rae Maile. Rae is a veteran analyst who has covered the tobacco industry for over 35 years. He has never held back his strong opinions, and always has the data to support them.In this episodeRae’s background in financial services, from junior analyst covering brewers and general retail to financials and tobaccoHow the tobacco industry has changed and stayed the sameThe perpetual lack of confidence about the tobacco industry - both fro...

2024-09-271h 16

The Security Analysis PodcastLawrence Hamtil & Douglas Ott: Investment Prospects for the Southern United StatesThis episodes features a discussion with Lawrence Hamtil and Douglas Ott. Lawrence is a partner and portfolio manager at Fortune Financial, and Douglas is the founder and chief investment officer at Andvari Associates. I’ve had Lawrence on the podcast before and I encourage you to check out that podcast, where we talked about a wide variety of topics. Today, we’re specifically zoning in on Lawrence and Douglas’s joint paper, called “Going South: Implications of Business and Population Migration”Please note that we have positions in the following securities discussed: Tractor Supply and...

2024-09-1846 min

Best Anchor Stocks9. The United States Is Going South w/ Lawrence Hamtil & Douglas OttWelcome back to another episode! This time I was lucky enough to be joined by Lawrence Hamtil and Douglas Ott to discuss a relevant migration taking place in the US. They recently uploaded a white paper on the topic discussing the industries and companies that could be most impacted by this trend. Here it is: https://andvariassociates.com/wp-content/uploads/2024/06/2024-06-Andvari-Fortune-Southern-migration.pdf Lawrence and Doug also host (together with Devin Lasarre) an excellent and atypical podcast called 'Preferred Shares', which I definitely recommend following: https://open.spotify.com/show/0eAZkSKXiEhqT7o2nNplrO?si=172375d7111...

2024-08-1552 min

Flyover StocksFlyover Stocks Interview with Lawrence Hamtil and Doug OttIn this episode, Todd Wenning of Flyover Stocks and KNA Capital speaks with Lawrence Hamtil of Fortune Financial and Doug Ott of Andvari Associates about their recent white paper on the US population shift toward the Southeast, entitled "Going South: Implications of Business and Population Migration".

Speakers, their families, and/or their firms may own shares of companies mentioned. None of this is financial advice and is meant for informational purposes only.

Please see flyoverstocks.com for charts, tables, and other important disclosures. Disclaimers for KNA Capital Management, LLC...

2024-07-1136 min

Preferred Shares PodcastThe Rocks That Connect AmericaWelcome to Episode 11 of the Preferred Shares Podcast.In this episode—the second part in our series on the beneficiaries of the spending on the interstate highway system of the United States—Preferred Shares explores the aggregates industry. In particular, we go over the early history of Birmingham Slag, the family-owned business that evolved into Vulcan Materials Company (VMC).In this episodeInterstate Highway System background refresherThe unique qualities of the aggregates industryEarly Vulcan Materials historyRole of inheritance tax in driving industry consolidationSt...

2024-05-2955 min

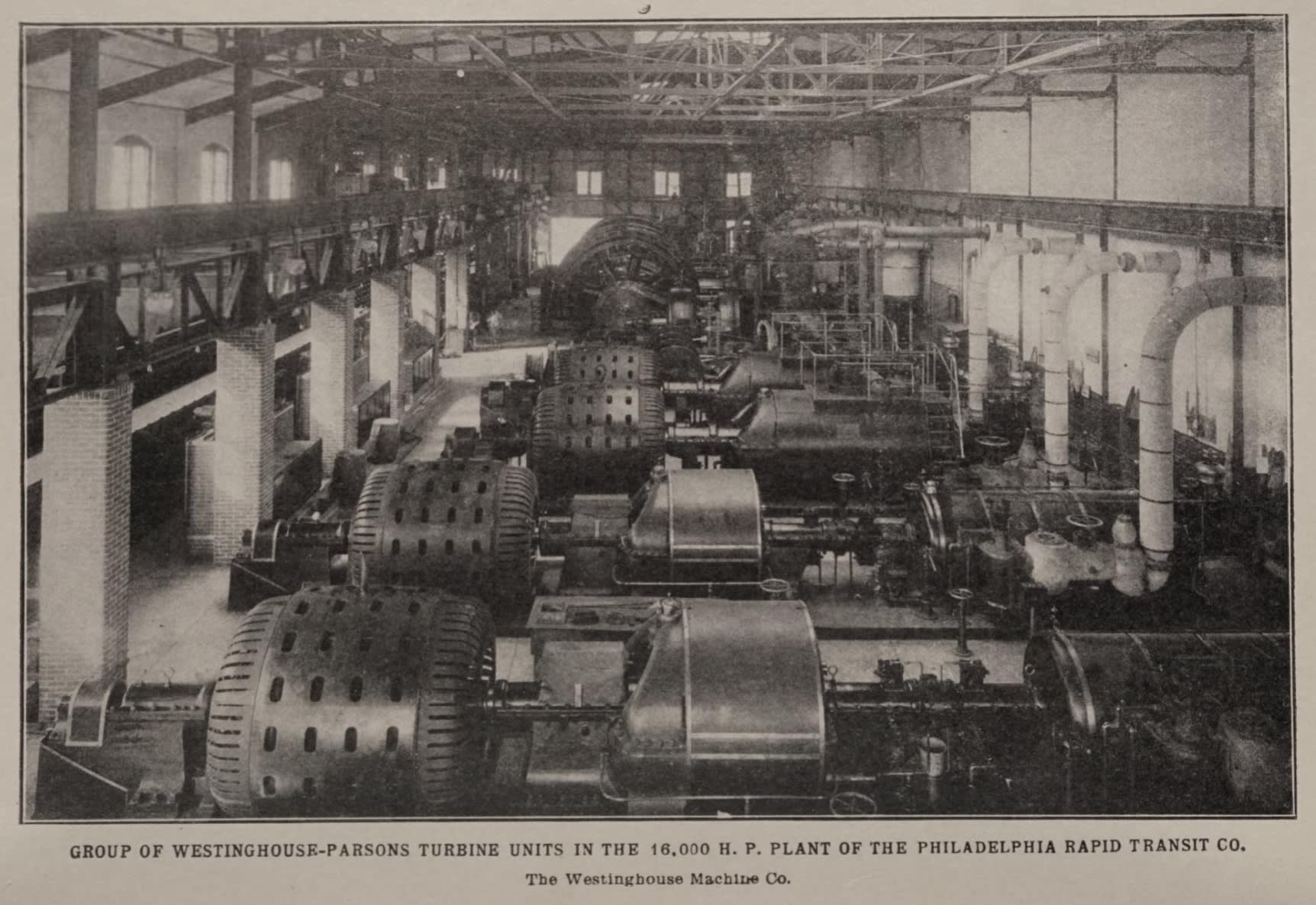

Preferred Shares PodcastBreaking down the Utility Industry: Expert Insights From Ian Clark of Dichotomy CapitalWelcome to Episode 10 of the Preferred Shares Podcast.Lawrence Hamtil, of Fortune Financial Advisors, and Douglas Ott, of Andvari Associates, were the primary researchers for this episode. In this episode, we are joined by Ian Clark, founder and head of Dichotomy Capital, a power market focused investment manager that utilizes intensive research to find attractive opportunities in the public and private markets. In this episodeIan Clark’s personal and professional backgroundWhat is a fat pitch for an expert in the utility space?Difference between regulated and unregulated mar...

2024-04-251h 17

Preferred Shares PodcastConnecting a Continent: The Rise of the United States Interstate Highway SystemWelcome to Episode 9 of the Preferred Shares Podcast.Lawrence Hamtil, of Fortune Financial Advisors, and Douglas Ott, of Andvari Associates, were the primary researchers for this episode.In this episode- The Federal Aid Road Act of 1916- Route 66- Strong road advocate Cyrus Avery- Dwight D. Eisenhower- Influences of the Trans-Continental Motor Truck Trip and German Autobahn- The Federal Aid Highway Act of 1956- Quantifying the enormity of resources needed to build the interstate system...

2024-04-0843 min

Preferred Shares PodcastTrophy Assets: The Families That Built the NFLWelcome to Episode 7 of the Preferred Shares Podcast.Douglas Ott, of Andvari Associates, was the primary researcher for this episode.In this episode-The battle between the NFL and the AFL-The origins of specific franchises, including the Colts, Cardinals, and Giants-Lamar Hunt’s influence and the Hunt family’s wealth and other endeavors-Commonalities across original and current franchise owners-Long-term mentality and ‘permanent capital’-Future outlook for franchise and league expansionEpisode resourcesNational Football League, Wikiwand...

2024-02-0842 min

Preferred Shares PodcastThe Rat Man: Otto Orkin and the Birth of the Modern Pest Control IndustryWelcome to Episode 5 of the Preferred Shares Podcast.Lawrence Hamtil, of Fortune Financial Advisors, and Douglas Ott, of Andvari Associates, were the primary researchers for this episode.In this episode* Immigrating to the Unites States* Pest control on the family farm* Experimentation with poisons* Winning early clients* Lucky breaks* Family squabbles* The first leveraged buyout* Rapid, sustained growth* Reflections on seemingly unstoppable industry dynamicsEpisode resources* Q3 2023 Letter: Introducing Rollins, Douglas Ott, 11/7/2023

2023-12-181h 10

Preferred Shares PodcastMars Incorporated: Inside America's Most Secretive Consumer Goods EmpireWelcome to Episode 4 of the Preferred Shares Podcast.Lawrence Hamtil, of Fortune Financial Advisors, was the primary researcher for this episode.In this episode* Consecutive failures before rapid success* Family fallout* Suspected espionage* Corporate overhauls* Iteration and innovations* Principles for exceptional performance* True long-term orientation* An eye for global dominationEpisode resources* Brenner, Joël Glenn. The Emperors of Chocolate : Inside the Secret World of Hershey and Mars. New York :Random House, 1999* The E...

2023-11-161h 05

Preferred Shares PodcastVending Machine ManiaWelcome to Episode 1 of the Preferred Shares Podcast.Lawrence Hamtil, of Fortune Financial Advisors, was the primary researcher for this episode.In this episode* The origin story of automated vending* The mechanics of the vending business* Warren Buffett’s foray into coin-operated machines* How vending machine companies turned into growth stocks* Technological innovations in the vending industry* The vending machine company stock bubble* Transformation of the industry* Parallels and lessons learnedResources & additional reading* A Re...

2023-08-311h 20

ETF PrimeIntersection of Social Media & Financial MarketsFortune Financial’s Lawrence Hamtil, along with special guest “Ramp Capital”, talk Twitter, ETFs, stock valuations, crypto, and more.

2023-07-181h 04

ETF PrimeIntersection of Social Media & Financial MarketsFortune Financial’s Lawrence Hamtil, along with special guest “Ramp Capital”, talk Twitter, ETFs, stock valuations, crypto, and more.

2023-07-181h 04

The Security Analysis PodcastLawrence Hamtil: Hunting for the Best Industries & SectorsLawrence Hamtil is a financial advisor with Fortune Financial Advisors.His work emphasizes the importance of sectors and industries in explaining market behavior, rather than traditional academic factors. He is also a proponent of high performing anti-ESG businesses, like tobacco and defense. Check out his blog at: https://fortunefinancialadvisors.com/blog/author/lawrence-hamtil/I’ve learned a lot from Lawrence’s work and his perspective is very unique. I hope you enjoy our conversation.DisclaimerNothing on this podcast is investment advice.The information in this podcast is for infor...

2023-05-0356 min

Lagniappe60% of the Time, It Works Every TimeThe Stokes Brothers pick apart negative headlines we are seeing despite coming out of a positive first quarter. They also discuss the resurgence of Bitcoin, the emergence of AI, the effects of an aging population, and of course…the Federal Reserve.Key Takeaways

[06:18] - Is there any merit to the US dollar losing its status as a reserve currency?

[09:57] - Why is Bitcoin back up?

[12:09] - The speculative mania behind new tech like AI

[16:01] - What happens when the Fed stops its rate hiking cycle?

[22:00] - US vs International performance; a shift from gr...

2023-04-0532 min

LagniappeThe Unforeseen Consequences of ESG InvestingThe focus on Environmental, Social, and Governance (ESG) investing has grown in recent years as more investors are looking to put their money into companies that align with their values. While this investment can positively impact the world, some unforeseen consequences come with it, especially in a tight supply chain. In this episode, Greg and Doug talk about the recent updates on markets and economies. Focusing on the impact of the increased price of energy, they speak about the result of Europe's shift towards renewables, the unforeseen consequences of ESG investing, and the risks associated with ESG i...

2022-09-0627 min

The Finance MemoThe Appeal of Sin Stocks with Lawrence HamtilThe Finance Memo Provides a weekly Arabic newsletter that summarizes the most important events happening in the global markets to your personal inboxYou can subscribe to our free weekly newsletter from Here

2022-07-0352 min

HAWK-EYEDEpisode 14: How can we mitigate uncertainties in our portfolios? With Lawrence HamtilIn this latest installment, Lawrence Hamtil—Investment Advisor at Fortune Financial Advisors—joins me to discuss portfolio construction, market uncertainty, and the crypto meltdown. @lhamtil@VishnuTreasurer00:00 - Intro01:52 - How did you get interested in investing?04:15 - How to navigate market full of uncertainties?07:48 - Any truth to 70's comparisons?09:39 - Advantages of sector-neutral portfolio12:25 - Tech selloff - short-term reaction or potential bubble repeat?16:00 - WTF happened with crypto?

2022-06-1519 min

Resolve Riffs Investment PodcastReSolve Riffs on Lifting and Low Risk Investing with FinTwits Lawrence HamtilThis is “ReSolve’s Riffs” – live on YouTube every Friday afternoon to debate the most relevant investment topics of the day, hosted by Adam Butler, Mike Philbrick and Rodrigo Gordillo of ReSolve Global. This week we were joined by Lawrence Hamtil, founder and principal at Fortune Financial Advisors, author of their popular blog, as well as an active member of the FinTwit community. His power lifting hobby and contrarian nature permeate his writing and investment philosophy, which made for a great conversation that included: Why you can’t fire a cannon from a canoe – the importance of building...

2021-04-271h 22

The 7investing PodcastOverlooked Investing Opportunities with Lawrence HamtilIs the market getting frothy? With some of the valuations for sexier stocks looking a little bit stretched, 7investing Lead Advisor Matthew Cochrane sat down with Lawrence Hamtil, a co-founder of Fortune Financial Advisors, to look at some companies with durable economic moats in industries that might be overlooked by most investors, including tobacco and defense.

Their conversation begins, however, with a comparison between valuation metrics of the U.S. stock market and international markets. Hamtil explains that while international markets often look cheaper at first glance, that once other factors such as sector allocation are taken in...

2021-03-0436 min

Value Hive PodcastSix Industries With Durable Moats w/ Lawrence Hamtil, Fortune Financial AdvisorsThis episode is brought to you by TIKR. Join the free beta today at TIKR.com/hive. They're constantly releasing new updates that make the platform better including a new Business Owner Mode that hides share count, market cap, and enterprise value. I couldn't be more excited to partner with TIKR.

Lawrence Hamtil is a sixteen-year veteran of the financial services industry, having served clients in all aspects of the business during his career, which started in 2002. In 2005, he joined Dennis Wallace of Fortune Financial Services, LLC, becoming, at the time, one of Multi-Financial Securities, Inc’s yo...

2021-01-081h 29

Chit Chat StocksLawrence Hamtil: Boring Businesses & Exciting ReturnsThis week Ryan and Brett discuss what industries will be around for the long haul with Lawrence Hamtil. Among these industries, the three highlight tobacco, airports, and trash collection services. Before the interview, your hosts share their favorite stories from the week. After the interview you'll find out who's in hot water, buy-sell-hold and anecdotal evidence. As always enjoy today's episode.

Find Lawrence's Blog Posts: https://fortunefinancialadvisors.com/blog/author/lawrence-hamtil/page/3/

Visit Lawrence on Twitter: https://twitter.com/lhamtil?s=20

Subscribe to 7 Investing with the code "CCM": https://7investing.com/subscribe/

Watch this episode on YouTube: https://www.youtube...

2020-11-241h 12

Odd LotsHow Tobacco Became One Of The Greatest Investments In HistoryFor over a century, tobacco stocks have been among the greatest investments in history, consistently outperforming other sectors decade after decade. But what is it about tobacco companies specifically that has led to this incredible performance? On this episode, we speak with financial advisor Lawrence Hamtil along with Gene Hoots, a financial advisor and the author of “Going Down Tobacco Road”, to discuss the extraordinary performance of this sector.See omnystudio.com/listener for privacy information.

2020-10-1552 min

Planet MicroCap Podcast | MicroCap Investing StrategiesEp. 127 - Understanding Risk, Conservative Investing and Appreciating the Downside with Lawrence Hamtil, Fortune Financial AdvisorsIn this episode of the Planet MicroCap Podcast, I spoke with Lawrence Hamtil, Investment Advisor at Fortune Financial Advisors. Lawrence Hamtil is a sixteen-year veteran of the financial services industry, having served clients in all aspects of the business during his career, which started in 2002. We had a great time answering hard hitting questions from Twitterverse, and getting a better understanding of his investing philosophy and strategy.Planet MicroCap Podcast is on YouTube! All archived episodes and each new episode will be posted on the SNN Network YouTube channel. I’ve provided the link in the...

2020-06-2446 min

ETF Expert Corner Archives | ETF Prime PodcastFortune Financial’s Lawrence Hamtil on Current Market EnvironmentFortune Financial’s Lawrence Hamtil covers a range of topics including stock valuations, the Coronavirus shutdown, and the Fed.

2020-05-2021 min

ETF PrimeETF Labeling ControversyETF.com’s Cinthia Murphy debates the merits of a recent proposal to relabel some ETFs. MacKay Municipal Managers’ David Dowden spotlights two actively managed muni bond ETFs and offers his assessment of the muni bond market. Fortune Financial’s Lawrence Hamtil covers a range of topics including stock valuations, the Coronavirus shutdown, and the Fed.

2020-05-201h 08Retirement Starts Today RadioWhat You Need to Know About Buying the Dip with Lawrence Hamtil, Ep # 134Everyone is talking about buying the dip, but what is the best way to do that? I’m not an investment advisor, but since the stock market has taken a serious downturn, now may be a good time to consider your overall investment strategy. That’s why I’ve invited investing expert, Lawrence Hamtil, co-founder of Fortune Financial […]

The post What You Need to Know About Buying the Dip with Lawrence Hamtil, Ep # 134 appeared first on Retirement Starts Today Radio.

2020-04-0600 min

Retirement Starts TodayWhat You Need to Know About Buying the Dip with Lawrence HamtilEveryone is talking about buying the dip, but what is the best way to do that? I'm not an investment advisor, but since the stock market has taken a serious downturn, now may be a good time to consider your overall investment strategy. That's why I've invited investing expert, Lawrence Hamtil, co-founder of Fortune Financial Advisors, to chat with me about the ups and downs of investing after the recent stock market collapse. Listen in on this discussion to hear the pros and cons of buying the dip, investment timelines when buying today, and exceptional industries that have stood...

2020-04-0620 min

The Long ViewLawrence Hamtil: The Virtues of Sin (Stocks)Our guest this week is Lawrence Hamtil. Lawrence is a principal at Fortune Financial Advisors, an independent Registered Investment Advisor firm he co-founded in 2008. He provides financial advice and investment management services to the firm’s high-net-worth clients. Lawrence came to our attention on social media, where he can be found on twitter at @lhamtil. A prolific researcher and excellent writer, Lawrence frequently publishes investments research and commentary on Fortune Financial’s blog. His research has covered a lot of ground, but a few topics have gained him a following, including his work on the role of sectors and...

2020-03-1151 min

The Acquirers PodcastSector Bets: Lawrence Hamtil talks about the influence of uncompensated sector bets on value, small and micro and international strategies to Tobias Carlisle on The Acquirers PodcastLawrence Hamtil is a Leawood, Kansas-based wealth manager at Fortune Financial. Through his blog and his Twitter account, Lawrence frequently discusses the under-the-radar influence of uncompensated sector bets on the performance of value, small and micro, and international strategies.

Lawrence's blog: https://www.fortunefinancialadvisors.com/blog/

Lawrence's Twitter: https://twitter.com/lhamtil

ABOUT THE PODCAST

Hi, I'm Tobias Carlisle. I've launched a new podcast called The Acquirers Podcast.

The podcast is about finding undervalued stocks, deep value investing, hedge funds, activism, buyouts, and special situations.

We uncover t...

2019-10-041h 01.jpg)

All About Your Benjamins The Podcast Archives - All About Your Benjamins™Sector Bias In Portfolios With Lawrence Hamtil (035)We’ve covered various behavior biases impacting investors’ portfolios, and in this episode, we will explore a new one…one you’ve probably never thought about–sector bias. Lawrence Hamtil, a principal with Fortune Financial Advisors, is one of FinTwit’s top investment researchers and writers, and he has written extensively on this topic. I love having guests who challenge my views on investing and portfolio…Continue Reading→The post Sector Bias In Portfolios With Lawrence Hamtil (035) appeared first on All About Your Benjamins™.

2019-01-2957 min.jpg)

All About Your Benjamins™Sector Bias In Portfolios With Lawrence Hamtil (035)We've covered various behavior biases impacting investors' portfolios, and in this episode, we will explore a new one...one you've probably never thought about--sector bias. Lawrence Hamtil, a principal with Fortune Financial Advisors, is one of FinTwit's top investment researchers and writers, and he has written extensively on this topic.

I love having guests who challenge my views on investing and portfolio construction, and this episode definitely opened my eyes. Lawrence takes us through how sector bias occurs, what options investors have to combat it, and why investors should take a closer look at where their dollars are allocated.

If y...

2019-01-2957 min