Shows

LiveSquawk Market TalkA Subtle Fed Shift: Language Changes, Leadership Speculation & Global RipplesJamie Dutta joins Harry on LiveSquawk’s Market Talk to analyze the Fed’s latest rate decision and why small changes in policy language signaled a less dovish view of the labor market than investors expected. The discussion also explores the potential impact of Kevin Walsh’s nomination as the next Fed Chair, alongside key economic signals from the Eurozone and Canada. Looking ahead, they assess geopolitical risks in the Middle East, preview upcoming meetings from the ECB, BoE, and RBA, and question the reliability of US employment data amid renewed government shutdown concerns.Follow...

2026-02-0230 min

LiveSquawk Market TalkFed on Hold, Markets on Edge: Inside January’s FOMC Balancing ActJoseph Choi and Sam Cutler join LiveSquawk’s Market Talk to preview the January 2026 FOMC meeting and the challenges facing policymakers. The discussion centers on expectations for unchanged rates, potential dissent among Fed officials, and the growing disconnect between strong GDP growth and a weakening labor market. They also examine how geopolitical noise — including President Trump’s remarks and speculation around Rick Rieder as a potential Fed Chair nominee — could influence market sentiment. The episode concludes with a look at Jerome Powell’s likely neutral stance as the Fed navigates low volatility, political pressure, and shifting global asset dynamics.

2026-01-2929 min

LiveSquawk Market TalkGreenland Gambits & Hawkish Turns: Markets React to a Shifting Global OrderRyan Littlestone and Michael Brown join LiveSquawk’s Market Talk to unpack the latest global market developments as January draws to a close. The discussion explores Donald Trump’s unconventional positioning at Davos — including renewed attention on Greenland — and the resulting moves in US Treasuries and the dollar. The episode also examines the UK’s mixed economic picture, with solid retail data offset by labor market strain and lingering inflation risks. Attention then turns to the Bank of Japan’s cautious stance, doubts surrounding Chinese growth data, and a forward look at upcoming Federal Reserve and Bank of Canada decisions as...

2026-01-2636 min

LiveSquawk Market TalkMarkets in Limbo: Politics, Policy Drift & the Search for Safe HavensBeat Nussbaumer joins Harry on LiveSquawk’s Market Talk to assess a market environment defined more by uncertainty than conviction. The discussion covers resilient US data, including soft inflation and strong retail sales, set against rising political volatility and growing concerns over central bank independence. They explore how instability in the UK and France is reshaping investor behavior, why the yen remains under pressure ahead of Japanese elections, and why precious metals are gaining importance as protection against fiat debasement. The episode paints a picture of markets navigating confusion, caution, and shifting macro narratives.Fo...

2026-01-1934 min

LiveSquawk Market TalkTariffs, Troops & Teflon Markets: Why 2026 Resilience Is Being TestedMike Zaccardi and Sam Cutler join Harry on LiveSquawk’s Market Talk to unpack the latest U.S. labor data, showing a cooling yet stable jobs market following the recent government shutdown. The conversation expands to major geopolitical developments, including U.S. military action in Venezuela, the strategic push around Greenland, and Supreme Court rulings that could reshape tariffs, inflation, and corporate profits. Looking ahead, the panel discusses expectations for a broadening equity rally and why markets may remain resilient despite rising political and macro risks heading into 2026.Follow Mike Zaccardi on X: x.co...

2026-01-1236 min

LiveSquawk Market TalkCentral Banks Hit the Brakes: Yen Shock, Data Doubts & 2026 Risk SignalsRyan Littlestone of Forex Analytix and Michael Brown, market analyst at Pepperstone UK, join LiveSquawk’s Market Talk to review the major global market shifts closing out 2025. The discussion covers the ECB’s decision to pause rate cuts despite weak growth, criticism of the Bank of England for falling behind the curve, and the Bank of Japan’s rare rate hike and its impact on yen volatility. They also question the reliability of recent US labor and inflation data amid shutdown distortions and look ahead to 2026, flagging fading AI enthusiasm and rising debt as key risks for global markets.

2025-12-2934 min

LiveSquawk Market TalkYear-End Central Bank Crossroads: Europe Holds, Japan MovesGuenter Grimm and Eric Culp join LiveSquawk’s Market Talk to break down the year-end outlook for global central banks. The discussion covers the ECB’s expected rate hold and lingering inflation risks tied to German fiscal spending, expectations for a Bank of England rate cut amid cooling inflation and a softer labor market, and why a potential Bank of Japan rate hike could mark a historic shift—hinging on wage growth data. They also explore how evolving trade policies and geopolitical dynamics may shape the next phase of global monetary strategy.Follow Eric on X...

2025-12-1928 min

The Contrarian Capitalist PodcastSilver, Oil and the Macro Turning Point Most Investors Are MissingThis is a free preview of a paid episode. To hear more, visit contrariancapitalist.substack.comWelcome to Mid-Month Macro with Chris Stadele of LiveSquawk Commodity CornerAs per usual, there is a LOT to talk about!5 small bits of housekeeping* None of this is to be constituted as investment or trading advice. We are NOT financial advisors.* This video was recorded just after 09:00 ET on Monday 15th December* The Monthly Wrap for December will be recorded on 31st December 2025* Please continue to provide feedback...

2025-12-1501 min

LiveSquawk Market TalkThe Yen Trade Endgame: Global Markets Face a Structural ShiftBeat Nussbaumer and Guenter Grimm join LiveSquawk’s Market Talk Weekly Review to assess the latest global macro developments. The discussion covers the Fed’s latest meeting and rate-cut implications, weak UK GDP data, and the Swiss National Bank’s decision to hold rates. They also weigh in on the Eurozone outlook, upcoming US non-farm payrolls, and the underestimated geopolitical risks surrounding China, Russia, and the future of the Eurozone. The episode concludes with a deep dive into Japan’s potential rate hike and why the end of the global yen funding trade could mark a major turning point for mark...

2025-12-1551 min

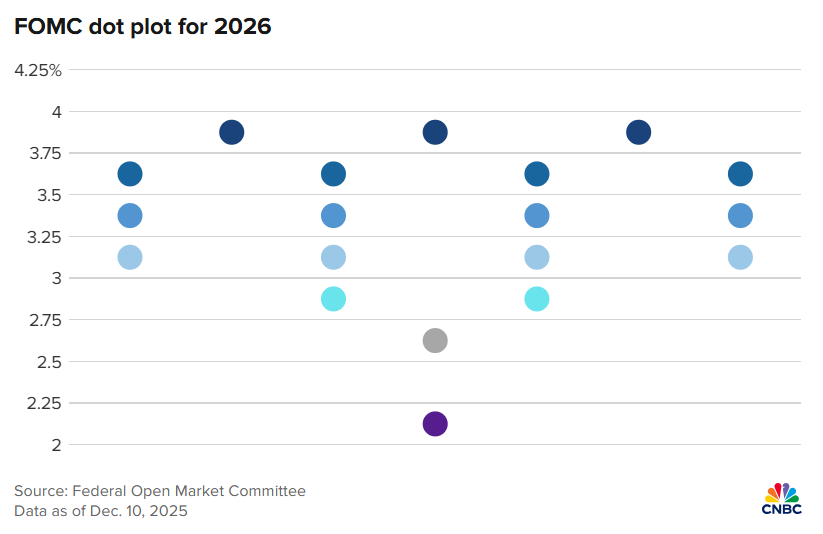

LiveSquawk Market TalkThe Hawkish Cut Dilemma: Fed Politics, Projections & Credibility on TrialGuests Joseph Choi and Sam Cutler join Harry on LiveSquawk’s Market Talk to preview the upcoming FOMC interest rate decision. They discuss the anticipated 25 basis point “hawkish cut,” potential dissents among committee members, modest changes to the dot plot, and the influence of the upcoming Fed chair transition. Plus, an analysis of current labor market data and what it could mean for the Fed’s credibility and future policy trajectory.Follow Joseph Choi on X: https://x.com/curveadvisorFollow Sam Cutler on X: https://x.com/search4yield3

2025-12-1132 min

LiveSquawk Market TalkBudget Gambles & Data Vacuums: Markets Navigate a Foggy Macro LandscapeRyan Littlestone (Forex Analytix) and Michael Brown (Pepperstone) join LiveSquawk’s Market Talk to discuss the latest financial market developments. They focus on US economic data, including stale releases and jobless claims, and their potential impact on the Fed’s December rate decision amid the upcoming speaker blackout period. The episode also covers the UK budget announcement, market reactions, Eurozone inflation trends, and the outsized attention on the unofficial ADP employment report due to missing official labor data.Follow Ryan Littlestone on X: https://x.com/2bid8offeredFollow Mich...

2025-12-1129 min

LiveSquawk Market TalkStale Signals, Real Risks: What the Fed Reads Between the LinesGuest Sam Cutler joins Harry on LiveSquawk’s Market Talk Weekly Review to break down the latest economic data and its impact on central bank policy. They analyze US Core PCE inflation, ADP payrolls, and consumer sentiment, highlighting how seasonal adjustments and government shutdown delays can skew the numbers. Plus, insights on the Bank of Canada, the UK economy, and year-end portfolio management strategies in a volatile market environment.Follow Sam Cutler on X: https://x.com/search4yield3Try our 24-hour news squawking service for FREE! 👇https...

2025-12-1129 min

LiveSquawk Market TalkData Delays & Tech Whiplash: Markets Brace for a Chaotic WeekJamie Dutta joins LiveSquawk’s Market Talk to analyze the latest market-moving developments. They cover the impact of delayed US non-farm payroll data after the government shutdown, the Fed’s potential rate decisions, softening UK CPI ahead of the budget, Japan’s fiscal stimulus plans, and market reactions to Nvidia’s earnings. Plus, get a forward-looking take on upcoming US retail sales and the UK budget statement, with insights into volatility and concentration risks in the tech sector.Follow Jamie Dutta on X: https://x.com/vantagemktsTry our 24-hour ne...

2025-12-1131 min

The Contrarian Capitalist PodcastGold Breaks Records & Japan Defies Gravity. But How Long Can the Euphoria Last?This is a free preview of a paid episode. To hear more, visit contrariancapitalist.substack.comWelcome to the Monthly Wrap for October 2025, featuring The Contrarian Capitalist and LiveSquawk Commodity Corner.5 small bits of housekeeping* Due to family commitments and holidays, this video was recorded during the day of Monday 3rd November 2025.* The chart deck was done on Friday 31st October 2025.* Please do provide feedback. We want to add as much value as possible. If there is something that you do or do not like, then please do let...

2025-11-0301 min

LiveSquawk Market TalkRate Path Reckoning: Global Central Banks Signal New EraGuests Stelios Kontogoulas (Forex Analytix) and Ryan Littlestone break down recent central bank moves, including the FOMC, BoJ, BoC, and ECB decisions, and explain why traders are scrambling to reposition amid rising uncertainty. Plus, hear their insights on how the next few weeks could shape global interest rate trajectories and monetary policy for the months ahead.Follow Stelios Kontogoulas on LinkedIn: https://www.linkedin.com/in/stelios-kontogoulas-433752150/Follow Ryan Littlestone on X: x.com/2bid8offeredTry our 24-hour news squawking service for FREE! 👇liv...

2025-11-0329 min

LiveSquawk Market TalkECB October Hold: Why Europe Became the Calm in Global StormEuropean editor Eric Culp and FX macro trader Beat Nussbaumer explain why the ECB's October 30 decision could be the most important non-event of the week. While markets expect a hold, could Lagarde drop an unexpected bombshell that shifts the euro landscape?Follow Beat Nussbaumer on X: x.com/MacrobeatLTry our 24-hour news squawking service for FREE! 👇livesquawk.com/#sign-upFollow us on X: x.com/LiveSquawk

2025-10-3127 min

LiveSquawk Market TalkThe Week That Could Break Markets: Three Central Banks DecideThree major central bank decisions in one week rarely happen by coincidence, and the market implications could be massive. Get Sam Cutler's unfiltered take on which meeting matters most and why this week's outcomes could set the tone for the next quarter.Follow Sam on X: https://x.com/search4yield3Try our 24-hour news squawking service for FREE! 👇livesquawk.com/#sign-upFollow us on X: x.com/LiveSquawk

2025-10-2734 min

LiveSquawk Market TalkLiquidity Crunch: Regional Banks Signal Deeper Credit StressEarly bank earnings reveal that regional lenders are taking decent credit losses as auto and credit card delinquencies spike again, with Chris discussing how the stress is hitting smaller banks hardest while bulge bracket institutions remain relatively insulated from the brewing credit storm.Follow Chris on X: x.com/ChrisStadeleTry our 24-hour news squawking service for FREE! 👇livesquawk.com/#sign-upFollow us on X: x.com/LiveSquawk

2025-10-2325 min

LiveSquawk Market TalkQ3 Earnings: Jamie Dimon's Warning vs AI's $1 Trillion PromiseJPMorgan's CEO warns of a 30% recession probability while his own bank crushes estimates and tech earnings surge past 20%. With the government shutdown obscuring critical data and China tensions spiking the VIX to four-month highs, Christine dissects the contradictions driving Q3's most volatile earnings season.Follow Christine Short of wallstreethorizon.com on X: https://x.com/christinelshortTry our 24-hour news squawking service for FREE! 👇livesquawk.com/#sign-upFollow us on X: x.com/LiveSquawk

2025-10-1929 min

The Contrarian Capitalist PodcastGold, Silver & PGMs to continue onwards and upwards?This is a free preview of a paid episode. To hear more, visit contrariancapitalist.substack.comWelcome to Mid-Month Macro with Chris Stadele of LiveSquawk Commodity CornerAs per usual, we have a LOT to talk about!6 small bits of housekeeping* There will be no extra chart deck (unlike the monthly wrap) but the video will look at various charts* Please continue to provide feedback as it helps us to continue to provide as much value to you as possible* Please subscribe to both The Contrarian Capitalist...

2025-10-1501 min

LiveSquawk Market TalkFrance: The New Sick Man of Europe Shakes MarketsFrance has earned the brutal title of “the new sick man of Europe,” with five prime ministers in just over a year — matching Italy’s worst instability records. Commenting on the turmoil, Jamie Dutta notes that with sovereign debt reviews from Moody’s and S&P looming and fresh elections essentially a coin toss by year-end, France’s political paralysis risks spilling over into broader European markets. Even Germany’s fiscal optimism, he adds, is fading fast.Follow Jamie Dutta on X: https://x.com/vantagemktsTry our 24-hour news squawking...

2025-10-1335 min

LiveSquawk Market TalkData Blackout: How the U.S. Government Shutdown is Rewiring MarketsWith NFP missing and traders flying blind, markets are abandoning long-term narratives for profit-taking on Swiss Franc and Gold winners. Beat Nussbaumer reveals how the data vacuum is forcing a complete recalibration of Fed expectations and trading strategies.Beat Nussbaumer of https://macrobeat.co.ukFollow Beat on X: x.com/MacrobeatLTry our 24-hour news squawking service for FREE! 👇livesquawk.com/#sign-upFollow us on X: x.com/LiveSquawk

2025-10-0632 min

The Contrarian Capitalist PodcastSilver +17.5%, Gold +11.9% - metals breakout! Monthly Wrap SEP 2025This is a free preview of a paid episode. To hear more, visit contrariancapitalist.substack.comWelcome to the Monthly Wrap for September 2025, featuring The Contrarian Capitalist and LiveSquawk Commodity Corner.3 small bits of housekeeping* This video was recorded just after the opening bell on Tuesday 30th September 2025* Please do provide feedback. We want to add as much value as possible. If there is something that you do or do not like, then please do let us know. This helps us to improve this every time we do it....

2025-09-3001 min

LiveSquawk Market TalkShutdown Showdown: How 69% Odds Could Derail Fed PolicyMarkets price a 69% chance of government shutdown disrupting fiscal support and delaying crucial NFP data. With the Fed caught between persistent 2.8% core inflation and a labor market sending conflicting signals, could a shutdown force Powell's hand?Sam Cutler warns that the Fed may be entering “uncharted waters.” He argues that without reliable NFP data, policymakers risk either overreacting to noise or moving too cautiously while inflation pressure lingers. Follow Sam Cutler on X: x.com/search4yield3Try our 24-hour news squawking service for FREE...

2025-09-2925 min

LiveSquawk Market TalkSeptember Scaries Defeated: When Markets Defy SeasonalityThe S&P 500 is tracking toward its best September since 2010, defying one of the market's strongest seasonal patterns. When historical trends break this dramatically, smart money pays attention. Guest Mike Zaccardi discusses what's powering this unprecedented September surge.Follow Mike Zaccardi on X: x.com/mikezaccardiTry our 24-hour news squawking service for FREE! 👇livesquawk.com/#sign-upFollow us on X: x.com/LiveSquawk

2025-09-2220 min

LiveSquawk Market TalkBehind the Curve: Four Months of Hidden Payroll Weakness ExposedNew QCEW data reveal payrolls were overstated by 911,000 jobs, and the revisions keep getting worse each month. Could the Fed be staring at four consecutive months of negative job growth without realizing it?Follow Joseph Choi on X: https://x.com/curveadvisorCheck out Curve Advisor Substack: https://curveadvisor.substack.com/Try our 24-hour news squawking service for FREE! 👇livesquawk.com/#sign-upFollow us on X: x.com/LiveSquawk

2025-09-1831 min

LiveSquawk Market TalkThe Great Dissent: FOMC Split Could Shock MarketsMarket analysts warn of an unprecedented three-way FOMC split as committee members push for everything from 50bp cuts to no action at all. Michael and Ryan break down why this internal discord could be more market-moving than the rate decision itself.Follow Ryan on X: https://x.com/2bid8offeredFollow Michael on X: https://x.com/MrMBrownTry our 24-hour news squawking service for FREE! 👇livesquawk.com/#sign-upFollow us on X: x.com/LiveSquawk

2025-09-1533 min

LiveSquawk Market TalkGlobal Fiscal Reckoning: Why Bond Yields Are Rising EverywhereLong-end yields are surging globally as markets judge the fiscal mess across the US, UK, Japan and Europe. Littlestone warns we still haven't paid the piper for 2008 and COVID borrowing - and the reckoning is building.Follow Ryan on X: https://x.com/2bid8offeredTry our 24-hour news squawking service for FREE! 👇livesquawk.com/#sign-upFollow us on X: x.com/LiveSquawk

2025-09-0838 min

LiveSquawk Market TalkThe Employment Pivot: Fed's New Priority Sparks Market RevolutionThe Fed's quiet revolution prioritizing employment over inflation has set the stage for a September rate cut, but political interference threatens the entire framework. With UK gilt yields hitting 1998 levels and French spreads widening, Harry and Beat Nussbaumer navigate a world where 'stagflation cocktails' meet government meddling. Uncover the trading strategies that work when politics trumps economics.Follow Beat on X: x.com/MacrobeatLTry our 24-hour news squawking service for FREE! 👇livesquawk.com/#sign-upFollow us on X: x.com/LiveSquawk

2025-09-0137 min

The Contrarian Capitalist PodcastMonthly Wrap AUGUST 2025 - Gold Hits Record Close, Silver Jumps 8.17%This is a free preview of a paid episode. To hear more, visit contrariancapitalist.substack.comWelcome to the Monthly Wrap for August 2025, featuring The Contrarian Capitalist and LiveSquawk Commodity Corner.3 small bits of housekeeping* This video was recorded just after the opening bell on Thursday 28th August 2025.* Please do provide feedback. We want to add as much value as possible. If there is something that you do or do not like, then please do let us know. This helps us to improve this every time we do it....

2025-08-3035 min

LiveSquawk Market TalkWeekly Review: The Great Fed FlipDespite mounting evidence that inflation isn't going anywhere, the Fed just signaled September cuts - and Sam Cutler isn't buying it. From Walmart's rising tariff costs to manipulated unemployment data, uncover why this dovish pivot could backfire spectacularly.Follow Sam Cutler on X: x.com/search4yield3Try our 24-hour news squawking service for FREE! 👇livesquawk.com/#sign-upFollow us on X: x.com/LiveSquawk

2025-08-2533 min

The Contrarian Capitalist PodcastMid-Month Macro AUGUST 2025 - $4,000 Gold, 7,000 S&P, Zinc and moreThis is a free preview of a paid episode. To hear more, visit contrariancapitalist.substack.comWelcome to Mid-Month Macro with Chris Stadele of LiveSquawk Commodity CornerNB - None of this is to be constituted as investment or trading advice. We are NOT financial advisors.And apologies for cutting my face off with the camera positioning!!4 small bits of housekeeping* There will be no extra chart deck (unlike the monthly wrap) but the video will look at various charts and a p…

2025-08-1401 min

LiveSquawk Market TalkThe Trader's Mind: Why Stress Kills Performance with Sylvain AsimusAfter 30 years in markets, veteran trader Sylvain Asimus reveals why the emotional roller coaster destroys more trading accounts than any technical indicator. Discover the neuroscience behind why stress triggers ancient fight or flight responses that sabotage modern market performance.Follow Sylvain on X: https://x.com/SylvainAsimusTry our 24-hour news squawking service for FREE! 👇livesquawk.com/#sign-upFollow us on X: x.com/LiveSquawk

2025-08-111h 12

LiveSquawk Market TalkTrump's Tariff Win: Why 15% Feels Like VictoryGuest Sam Cutler discusses why markets hit near record highs despite looming EU tariffs of 15-30% by August 7th, as Trump's negotiation tactics make moderate tariffs feel like wins. His "art of the deal" approach started with triple-digit threats, making 15% look reasonable to both markets and trading partners. But division among EU members could complicate the response strategy.Follow Sam Cutler on X: x.com/search4yield3Try our 24-hour news squawking service for FREE! 👇livesquawk.com/#sign-upFollow us on X: x.com/Liv...

2025-08-0538 min

LiveSquawk Market TalkFed's Wait-and-See Trap: Why Powell Won't Cut Despite Market PressureWith CPI data that could derail any September cut hopes and the specter of the transitory mistake still haunting the Fed, Powell faces an impossible balancing act. Find out why the FOMC might stay frozen through October, even as markets desperately want relief.Follow Jamie Dutta on X: https://x.com/vantagemktsTry our 24-hour news squawking service for FREE! 👇livesquawk.com/#sign-upFollow us on X: x.com/LiveSquawk

2025-08-0430 min

LiveSquawk Market TalkThe 15% Question: How Trump's Trade Template Changes EverythingGuest Guenter Grimm joins to discuss why the 15% tariff template from Japan could be the eurozone's best-case scenario, but what if Trump delivers something worse? With 20% tariffs marking 'bad deal' territory and 30% spelling disaster, the ECB's September cut plans hang in the balance. The noise-to-information ratio from Washington has never been higher—and neither have the stakes.Try our 24-hour news squawking service for FREE! 👇livesquawk.com/#sign-upFollow us on X: x.com/LiveSquawk

2025-07-2523 min

LiveSquawk Market TalkQ2 Earnings Preview: Growth Slows to 5% as Banks Set ToneChristine Short reveals why Q2 S&P 500 earnings growth expectations dropped from 9% to 5%, marking the lowest in six quarters. Discover why banks are setting the tone for earnings season and how IPO resurgence with companies like Circle up 500% signals broader market confidence.Follow Christine Short of wallstreethorizon.com on X: https://x.com/christinelshortTry our 24-hour news squawking service for FREE! 👇livesquawk.com/#sign-upFollow us on X: x.com/LiveSquawk

2025-07-1628 min

The Contrarian Capitalist PodcastMid-Month Macro JULY 2025 - Bitcoin tops $122k & key price points for PGM'sThis is a free preview of a paid episode. To hear more, visit contrariancapitalist.substack.comWelcome to Mid-Month Macro with Chris Stadele of LiveSquawk Commodity Corner4 small bits of housekeeping* There will be no extra chart deck (unlike the monthly wrap) but the video will look at various charts* Please like and share this article/video with your network.* Please provide feedback as it helps us to improve and deliver the content* Please subscribe to both The Contrarian Capitalist and LiveSquawk Commodity Corner using the butt…

2025-07-1501 min

LiveSquawk Market TalkWeekly Review: Trump's Tariff Reaffirmation, Dollar Stall, and Market IndifferenceBeat Nussbaumer examines why Trump's new 35% Canadian tariff and August 1st deadline triggered "very muted" market reactions despite aggressive trade measures. Learn why the dollar's downtrend has "got a little bit stuck" and why traders are shifting from preemptive to reactive strategies.Beat Nussbaumer of https://macrobeat.co.ukFollow Beat on X: x.com/MacrobeatLTry our 24-hour news squawking service for FREE! 👇livesquawk.com/#sign-upFollow us on X: x.com/LiveSquawk

2025-07-1530 min

LiveSquawk Market TalkWeekly Review: Jobs Data Deception, Debt Ceiling Impact, and Market VulnerabilitySam Cutler reveals why May's employment beat is heavily distorted by government jobs with 73,000 government hires masking cyclical job weakness. Learn why the debt ceiling resolution requires $600 billion in new Treasury issuance and why markets face potential weakness around August 20th.Follow Sam Cutler on X: x.com/search4yield3Try our 24-hour news squawking service for FREE! 👇livesquawk.com/#sign-upFollow us on X: x.com/LiveSquawk

2025-07-0936 min

The Contrarian Capitalist PodcastMonthly Wrap JUNE 2025 - Platinum UP 28.60%, Palladium UP 13.58%, Silver up 9.42% & Gold edges higherThis is a free preview of a paid episode. To hear more, visit contrariancapitalist.substack.comWelcome to the Monthly Wrap for June 2025, featuring The Contrarian Capitalist and LiveSquawk Commodity Corner.3 small bits of housekeeping* This video was recorded just after the opening bell on Monday 30th June 2025.* Please do provide feedback. We want to add as much value as possible. If there is something that you do or do not like, then please do let us know. This helps us to improve this product/service.* NB - None...

2025-06-3001 min

LiveSquawk Market TalkCommodity Corner: Inflation, Oil Bottoms, and Copper HypeGuest Chris Stadale warns about inflation complacency, challenges consensus on oil, and pushes back against copper fear-mongering in this week's commodity update.Access the full newsletter here 👉 https://livesquawkcommoditycorner.substack.comFollow Chris on X: x.com/ChrisStadeleTry our 24-hour news squawking service for FREE! 👇livesquawk.com/#sign-upFollow us on X: x.com/LiveSquawk

2025-06-2805 min

LiveSquawk Market TalkWeekly Review: US Strikes Iran, Central Bank Dovish Shift, and Oil Market DynamicsSam Cutler analyzes the market impact of US strikes on Iranian nuclear facilities while examining the broader dovish shift across central banks. Learn why oil's initial 5% surge retreated to equilibrium and why the Fed's "dots" showing two cuts disappointed despite market expectations for just one.Follow Sam Cutler on X: x.com/search4yield3Try our 24-hour news squawking service for FREE! 👇livesquawk.com/#sign-upFollow us on X: x.com/LiveSquawk

2025-06-2426 min

LiveSquawk Market TalkCommodity Corner: Oil Trading, Overvalued Platinum, and Dollar RecoveryGuest Chris Stadale discusses why he doesn't expect oil to spike to $150, why he believes platinum has quite overvalued and his contrarian view on the dollar.Access the full newsletter here 👉 https://livesquawkcommoditycorner.substack.comFollow Chris on X: x.com/ChrisStadeleTry our 24-hour news squawking service for FREE! 👇livesquawk.com/#sign-upFollow us on X: x.com/LiveSquawk

2025-06-2406 min

LiveSquawk Market TalkFOMC: Rate Hold Expected as Labor Market Shows Troubling SignsGuests Joseph Choi and Mike Zaccardi examine why a rate cut is unlikely amid concerning job market data including continuing claims near 2021 levels. Plus, why Trump's calls for 100-250bp cuts are very shortsighted and potentially economy-crushing.Follow Joe Choi on X: https://x.com/curveadvisorCheck out Curve Advisor Substack: https://curveadvisor.substack.com/Follow Mike Zaccardi on X: x.com/mikezaccardiTry our 24-hour news squawking service for FREE! 👇livesquawk.com/#sign-up

2025-06-1932 min

LiveSquawk Market TalkWeekly Review: CPI Cooling, Tariff Lag Effects, and Central Bank CautionGuests Mike Brown and Ryan Littlestone analyze why oil jumped 8-9% and "everyone's gone running back to the dollar" amid Middle East tensions. Plus, discover why UK GDP's 0.3% April decline reflects "payback" from Q1 frontloading and signals deeper economic challenges ahead.Follow Micheal Brown on X: x.com/MrMBrownFollow Ryan Littlestone on X: x.com/2bid8offeredTry our 24-hour news squawking service for FREE! 👇livesquawk.com/#sign-upFollow us on X: x.com/LiveSquawk

2025-06-1627 min

LiveSquawk Market TalkInflation Outlook: May CPI Expectations and 'Sell America' ThemeExperts guests Jeffrey Hirsch and Beat Nussbaumer discuss their most defensive CPI positioning in months while examining why the dollar continues to sell off hard. Follow Jeffrey Hirsch on X: x.com/AlmanacTraderFollow Beat Nussbaumer on X: x.com/MacrobeatLTry our 24-hour news squawking service for FREE! 👇livesquawk.com/#sign-upFollow us on X: x.com/LiveSquawk

2025-06-1228 min

LiveSquawk Market TalkWeekly Review: Jobs Data Illusions and Trump-Musk Market ChaosGuest Sam Cutler joins Harry for weekly review and what to keep an eye on next week. While US payrolls beat at 140K, discover why "headline numbers can be pretty deceiving" with net gains of just 14K over three months after revisions. Plus, how the Trump-Musk public spat created market volatility despite being dismissed as "two grown men arguing."Follow Sam Cutler on X: x.com/search4yield3Try our 24-hour news squawking service for FREE! 👇livesquawk.com/#sign-upFollow us on X...

2025-06-0921 min

LiveSquawk Market TalkCommodity Corner: Copper's Strange Behavior and Treasury OutlookChris Stadele explains copper's "weird" market dynamics while providing new Treasury price projections as futures roll to a new prompt month. Learn why recent data revisions (April jobs cut by 30K) reinforce his advice to "not chip anything in stone nowadays" amid volatile conditions.Access the full newsletter here 👉 https://livesquawkcommoditycorner.substack.comFollow Chris on X: x.com/ChrisStadeleTry our 24-hour news squawking service for FREE! 👇https://www.livesquawk.com/#sign-upFollow us on X: https://x...

2025-06-0905 min

LiveSquawk Market TalkECB Preview: Rate Cut 'Baked in the Cake' Amid Trade ChaosGuest Guenter Grimm explains why Eurozone inflation falling to 1.9% "basically all but guarantees a cut today." Also discover why Trump's steel tariff hike to 50% makes the ECB decision easier and why central banks are operating in "purely reaction mode" amid unprecedented trade uncertainty.Try our 24-hour news squawking service for FREE! 👇https://www.livesquawk.com/#sign-upFollow us on X: https://x.com/LiveSquawk

2025-06-0522 min

LiveSquawk Market TalkCommodity Corner: Bond Opportunity and Holiday Weekend EffectsChris Stadele shares why contrarian bond market positioning could be profitable despite widespread negativity following Moody's downgrade. Plus, discover which agricultural market is getting "absolutely pummeled" and why three-day weekends historically mark turning points for market trends.Access the full newsletter here 👉 https://livesquawkcommoditycorner.substack.comFollow Chris on X: x.com/ChrisStadeleTry our 24-hour news squawking service for FREE! 👇https://www.livesquawk.com/#sign-upFollow us on X: https://x.com/LiveSquawk

2025-05-2109 min

LiveSquawk Market TalkCommodity Corner: Are the Bears Hibernating? Tesla Rival's Mining Plans and Hidden WarningsChris Stadele unpacks why BYD's potential Chilean mining investment may not be a good idea based on historical precedents. Plus, discover what's "alarming and perplexing" about companies abandoning forward guidance despite seemingly calmer markets and reduced tariffs.Access the full newsletter here 👉 https://livesquawkcommoditycorner.substack.comFollow Chris on X: x.com/ChrisStadeleTry our 24-hour news squawking service for FREE! 👇https://www.livesquawk.com/#sign-upFollow us on X: https://x.com/LiveSquawk

2025-05-2105 min

The Trading Battle30 Years of Markets, 3 Maxed Credit Cards, 1 Global News Service | Harry DanielsIn this insightful interview, Harry Daniels (@livesquawkmarkets), a veteran of the financial markets and founder of LiveSquawk, shares his remarkable journey from a young floor trader to providing real-time market intelligence to traders worldwide. This revealing conversation explores Harry's experiences on trading floors in London and Chicago, his transition to building a vital market news service, and his unique perspective on market information.Key Highlights:- Trading Floor Origins: Harry's start in financial markets at age 18, working his way from back-office settlements to the adrenaline-charged futures trading floors- Hand Signal Trading...

2025-05-1952 min

LiveSquawk Market TalkCPI Reaction: April's Inflation Ease May Be 2025's Low PointGuests Sam Cutler and Jamie Dutta break down why April's 2.3% headline CPI could be the year's low before tariffs push inflation back above 3%. Learn why Fed rate cut expectations have shifted from June to September and potentially December amid the challenging balance of faster inflation with a weakening economy.Follow Sam Cutler on X: x.com/search4yield3Try our 24-hour news squawking service for FREE! 👇livesquawk.com/#sign-upFollow us on X: x.com/LiveSquawk

2025-05-1427 min

LiveSquawk Market TalkCommodity Corner: Crude Oil Analysis, Fed Uncertainty, and Geopolitical RisksChris Stadele shares insights from energy analyst Doomberg on crude oil's trajectory while explaining his cautious stock market stance. Plus, learn why Powell mentioned "uncertainty" at least 15-20 times in his press conference and why India-Pakistan tensions remain an under-discounted global risk.Access the full newsletter here 👉 https://livesquawkcommoditycorner.substack.comFollow Chris on X: x.com/ChrisStadeleTry our 24-hour news squawking service for FREE! 👇https://www.livesquawk.com/#sign-upFollow us on X: https://x.com/LiveSq

2025-05-1309 min

LiveSquawk Market TalkEarnings Season Review: Strong Results Meet Tariff UncertaintyChristine Short reveals why S&P 500 companies delivered surprising 13% bottom-line growth despite mounting concerns. Learn why Big Tech's massive AI investments are "reigniting the AI trade" while CEOs like Tim Cook refuse to predict future tariff impacts amid widespread guidance suspensions.Follow Christine Short of wallstreethorizon.com on X: https://x.com/christinelshortTry our 24-hour news squawking service for FREE! 👇https://www.livesquawk.com/#sign-upFollow us on X: https://x.com/LiveSquawk

2025-05-1323 min

LiveSquawk Market TalkFed Decision: Powell's Tone, Beige Book Warnings, and Long-Term Economic RisksBeyond the expected rate hold, our experts reveal why Powell's language may shift despite his previous hawkish stance. Learn about Joseph Choi's concerning theory that international alienation could create "a prolonged period of economic weakness" regardless of future trade deals.Follow Joseph Choi on X: https://x.com/curveadvisorCheck out Curve Advisor Substack: https://curveadvisor.substack.com/Follow Christian Putz of arrinvestments.com on LinkedIn: https://www.linkedin.com/in/christian-putz-founderofarr/Try our 24-hour news squawking service for...

2025-05-0829 min

LiveSquawk Market TalkNFP Preview: Labor Market Slowdown and Recession Warning SignsFrom private sector layoffs jumping to 100K monthly to the worrying Conference Board sentiment drop, guests Sam Cutler and Gunter Grimm break down why April's jobs report signals deeper economic trouble.Follow Sam on X: https://x.com/search4yield3Try our 24-hour news squawking service for FREE! 👇https://www.livesquawk.com/#sign-upFollow us on X: https://x.com/LiveSquawk

2025-05-0527 min

LiveSquawk Market TalkCommodity Corner: Dollar Collapse Impact on Treasuries, Silver, and the YenChris Stadele breaks down why the US dollar has collapsed in recent weeks and its connection to treasury market volatility. Plus, get a bullish deep dive on silver and updated price targets for the Japanese Yen.Access the full newsletter here 👉 https://livesquawkcommoditycorner.substack.comTry our 24-hour news squawking service for FREE! 👇https://www.livesquawk.com/#sign-upFollow us on X: https://x.com/LiveSquawk

2025-04-2805 min

LiveSquawk Market TalkCommodity Corner: Treasury Volatility, Gold Caution, and Tariff ImpactChris Stadele shares his contrarian gold outlook and why steel and nickel demand may remain subdued. Plus, why Powell's explicit "absolutely not" to a stock market "Fed put" is alarming amid tariff uncertainties and Treasury market volatility.Access the full newsletter here 👉 https://livesquawkcommoditycorner.substack.comTry our 24-hour news squawking service for FREE! 👇https://www.livesquawk.com/#sign-upFollow us on X: https://x.com/LiveSquawk

2025-04-2208 min

LiveSquawk Market TalkECB Rate Decision: Cut Now, Pause LaterDespite consensus on a 25bp rate cut, questions remain about the ECB's forward guidance amid "known unknowns" in global trade. Ryan Littlestone explains the disconnect between soft sentiment data and resilient hard numbers, while examining how US policy unpredictability is reshaping central bank strategies.Try our 24-hour news squawking service for FREE!👇https://www.livesquawk.com/#sign-upFollow us on X: https://x.com/LiveSquawk

2025-04-2225 min

The Contrarian Capitalist PodcastChris Stadele - Cobalt, Commodities, Corn and moreToday’s podcast features Chris Stadele of the popular LiveSquawk Commodity Corner newsletter.In this thoroughly informative podcast, Chris and I discuss:* Tariffs/recent exemptions and non-exemptions on commodities* The 1 element that Chris is quasi-bullish on - and why* A recent company CC invested in and why (not a financial recommendation)* A plethora of elements including gold, silver, platinum, palladium, rhodium and the potential outlooks and plays that are available* The importance of having physical metals as part of your portfolio* And much more...

2025-04-1737 min

LiveSquawk Market TalkCommodity Corner: Metals Analysis, Oil Targets, and Technical IndicatorsChris Stadele breaks down how "crazy tariffs" are impacting copper and aluminum differently while providing fresh price targets for recently slammed crude oil. Plus, essential technical analysis on moving averages during unprecedented market volatility.Access the full newsletter here 👉 https://livesquawkcommoditycorner.sub...Try our 24-hour news squawking service for FREE!👇https://www.livesquawk.com/#sign-upFollow us on X: https://x.com/LiveSquawk

2025-04-1404 min

LiveSquawk Market TalkMarket Earthquake: Trump's Tariff Reversal Overshadows CPI DataGuest Beat Nussbaumer analyzes the "biggest market event of the decade" that sent indices soaring 8-10% in unprecedented moves. Learn why March's expected CPI softening to 2.5% became "irrelevant" amid concerns about lasting reputational damage to US assets despite the 90-day tariff pause.Try our 24-hour news squawking service for FREE! 👇https://www.livesquawk.com/#sign-upFollow us on X: https://x.com/LiveSquawk

2025-04-1130 min

LiveSquawk Market TalkEarnings Preview: Strong Q1 Numbers Meet Murky GuidanceChristine Short from Wall Street Horizon reveals why S&P 500 earnings may grow 7% despite a high number of negative guidance warnings. Learn why trade disputes are creating "murky" corporate outlooks and which sectors might show resilience amid recession concerns.Try our 24-hour news squawking service for FREE! 👇https://www.livesquawk.com/#sign-upFollow us on X: https://x.com/LiveSquawk

2025-04-1128 min

LiveSquawk Market TalkTariff Tsunami: Economic Impact and Trading Implications of "Liberation Day"Expert guests Sam Cutler and Joseph Choi analyze why markets initially rallied on misleading headlines before the true scope of the tariffs became clear. Discover potential stagflation risks, retaliation concerns, and why foreign investors might begin unwinding their significant US positions.Follow Sam on X: https://x.com/search4yield3Follow Joseph on X: https://x.com/CurveAdvisor and SubStack: https://curveadvisor.substack.comTry our 24-hour news squawking service for FREE! 👇https://www.livesquawk.com/#sign-upFollow us on X...

2025-04-0735 min

LiveSquawk Market TalkCommodity Corner: Treasury Markets, Metals Rally, and Japan's StrugglesDiscover why traditional focus on Fed policy may be less relevant than broader market forces impacting treasuries. Chris Stadele shares cautionary analysis on copper and gold after their bullish runs, while examining how Japan's fiscal challenges affect global markets.Access the full newsletter here 👉 https://livesquawkcommoditycorner.sub...Try our 24-hour news squawking service for FREE!👇https://www.livesquawk.com/#sign-upFollow us on X: https://x.com/LiveSquawk

2025-03-2806 min

LiveSquawk Market TalkFed Focus: Economic Projections, Trump's Policies, and Recession OddsDiscover what the Fed's revised economic projections reveal about inflation concerns despite unchanged rates. Plus, why fiscal constraints could push the BOE toward surprising easing and what's behind the Swiss National Bank's anticipated rate cut despite market highs.Try our 24-hour news squawking service for FREE! 👇https://www.livesquawk.com/#sign-upFollow us on X: https://x.com/LiveSquawk

2025-03-2024 min

LiveSquawk Market TalkCommodity Corner: Bitcoin, Steel, and the LoonieChris Stadale breaks down Bitcoin's muted response to White House crypto initiatives and potential tariff impacts on US indices. Plus, critical insights on Canadian aluminum imports and cautious guidance on recent gold volatility.Access the full newsletter here 👉 https://livesquawkcommoditycorner.substack.comTry our 24-hour news squawking service for FREE! 👇https://www.livesquawk.com/#sign-upFollow us on X: https://x.com/LiveSquawk

2025-03-1806 min

LiveSquawk Market TalkCPI Preview: Market Volatility and the Bank of Canada's Next MoveSam Cutler of 333 Capital breaks down why this CPI report could trigger a reflexive market rally despite extreme volatility. Plus, why tariff uncertainty is driving an expected Bank of Canada rate cut despite strong economic data.Follow Sam on X: https://x.com/search4yield3Try our 24-hour news squawking service for FREE! 👇https://www.livesquawk.com/#sign-upFollow us on X: https://x.com/LiveSquawk

2025-03-1831 min

LiveSquawk Market TalkEurope's New Economic Reality: Unpacking the ECB's Latest Rate DecisionThe ECB cuts rates while Germany embraces massive fiscal spending – our experts break down what this policy shift means for markets and why we may be witnessing a historic divergence from US economic direction.Try our 24-hour news squawking service for FREE! 👇https://www.livesquawk.com/#sign-upFollow us on X: https://x.com/LiveSquawk

2025-03-0726 min

LiveSquawk Market TalkCommodity Corner: From Lithium to Corn - This Week's Market MovesCommodity expert Chris Stadele breaks down the latest moves in lithium, platinum, crude oil, and corn, offering practical insights for traders navigating volatile markets. Learn which commodities are being rocked by pandemic fears, tariff threats, and changing fundamentals, and why Stadele sees opportunity in corn despite bearish signals.Access the full newsletter here 👉 https://livesquawkcommoditycorner.substack.comTry our 24-hour news squawking service for FREE! 👇https://www.livesquawk.com/#sign-upFollow us on X: https://x.com/LiveSquawk

2025-03-0304 min

LiveSquawk Market TalkCommodity Corner: Why Tariffs Could BackfireIn this week's Commodity Corner, Chris Stadele delivers a contrarian view on tariffs that every trader should hear, along with timely insights on silver's volatility, orange juice's correction, and aluminum's technical breakout. Find out why budget cuts at the USDA could matter more than most traders realize.Check out LiveSquawk Commodity Corner on SubStack: https://livesquawkcommoditycorner.substack.comTry our 24-hour news squawking service for FREE! 👇https://www.livesquawk.com/#sign-upFollow us on X: https://x.com/LiveSquawk

2025-02-2706 min

LiveSquawk Market TalkMid-Season Earnings Check: Strong Beats, Hidden ConcernsAs earnings season hits its stride with a 77% beat rate, Christine Short of Wall Street Horizon explains why revenue growth and tariff concerns might matter more than EPS surprises. Learn why even the strongest earnings season in three years comes with significant caveats about what's ahead for markets.Try our 24-hour news squawking service for FREE! 👇https://www.livesquawk.com/#sign-upFollow us on X: https://x.com/LiveSquawk

2025-02-1829 min

LiveSquawk Market TalkJanuary CPI Preview: The Devil's in the DetailsAs markets await January's CPI print, our experts explain why rounding effects and seasonal adjustments could surprise traders. Learn why Trump's tariffs might be underestimated, and how everything from gold prices to crypto markets are signaling rising inflation concerns.Guests: Sam Cutler of 333 Capital and @tradeboicarti16Try our 24-hour news squawking service for FREE! 👇https://www.livesquawk.com/#sign-upFollow us on X: https://x.com/LiveSquawk

2025-02-1438 min

LiveSquawk Market TalkDouble Header: Why NFP and BoE Might Not MatterAs markets brace for NFP and the BoE's rate decision, our experts explain why Trump's tariffs and shifting global dynamics might matter more than the numbers themselves. Learn why weak data could pack more punch than strong prints, and why Sterling faces headwinds regardless of the BoE's move.Try our 24-hour news squawking service for FREE! 👇https://www.livesquawk.com/#sign-upFollow us on X: https://x.com/LiveSquawk

2025-02-1336 min

LiveSquawk Market TalkECB's Dilemma: Fighting Fire on Multiple FrontsAs the ECB prepares its first rate cut to 3%, our experts explain why Europe's problems run deeper than monetary policy can fix. From contracting economies to Trump's looming policy shifts, learn why this rate decision could mark the start of a significant easing cycle for the Eurozone.Try our 24-hour news squawking service for FREE! 👇https://www.livesquawk.com/#sign-upFollow us on X: https://x.com/LiveSquawk

2025-02-1329 min

LiveSquawk Market TalkFOMC Preview: The Calm Before Trump's Storm?Join our experts as they explain why January's "most predictable" Fed meeting could still surprise markets. From DeepSeek's impact on tech stocks to Trump's looming policy shifts, learn why the real action might come from Powell's careful choice of words rather than the rate decision itself.Try our 24-hour news squawking service for FREE! 👇https://www.livesquawk.com/#sign-upFollow us on X: https://x.com/LiveSquawk

2025-02-1332 min

LiveSquawk Market TalkCPI Preview: Is Inflation Really Under Control?As markets brace for December's inflation data, our experts explain why even a modest uptick in headline CPI to 2.9% could rattle investors. Learn why core inflation remains the key concern, and how Trump's looming presidency could reshape the inflation narrative for 2024.Try our 24-hour news squawking service for FREE! 👇https://www.livesquawk.com/#sign-upFollow us on X: https://x.com/LiveSquawk

2025-02-1332 min

LiveSquawk Market TalkQ4 Earnings Season: Why Good Might Not Be Good EnoughWith Q4 earnings growth expected to hit 12%, Wall Street Horizon's Christine Short explains why investors might still not be satisfied. Discover which sectors could lead the charge, why even strong beats might not impress markets, and how Trump's policies could reshape corporate America's outlook for 2024.Try our 24-hour news squawking service for FREE! 👇https://www.livesquawk.com/#sign-upFollow us on X: https://x.com/LiveSquawk

2025-02-1328 min

LiveSquawk Market TalkNFP Preview: Why This Jobs Report Might Not MatterMarkets expect 165,000 new jobs in December's report, but our experts reveal why Trump's upcoming presidency and surging bond yields might overshadow any NFP surprise. Discover the specific market levels to watch and why traditional trading playbooks might need updating in 2024's complex environment.Try our 24-hour news squawking service for FREE! 👇https://www.livesquawk.com/#sign-upFollow us on X: https://x.com/LiveSquawk

2025-02-1327 min

LiveSquawk Market TalkCommodity Corner: The Super Bowl of Grain ReportsIn our Commodity Corner debut, expert analyst Chris Stadale reveals why January's WASDE report could pack an extra punch for grain markets. From record positioning in corn and soybeans to brewing storms in South America, learn what's really driving agricultural commodities as we kick off 2024.Try our 24-hour news squawking service for FREE! 👇https://www.livesquawk.com/#sign-upFollow us on X: https://x.com/LiveSquawk

2025-02-1320 min

LiveSquawk Market TalkFOMC Preview: The Last Dance of 2023As markets brace for the year's final Fed meeting, our experts expose the growing disconnect between market expectations and Fed projections. Discover why the combination of political uncertainty, sticky inflation, and concentrated market risks could make 2024 more challenging than many anticipate.Try our 24-hour news squawking service for FREE! 👇https://www.livesquawk.com/#sign-upFollow us on X: https://x.com/LiveSquawk

2025-02-1340 min

LiveSquawk Market TalkTriple Header: US CPI and Global Central Bank DecisionsMarkets face a perfect storm as November's US CPI report coincides with a slate of major central bank decisions. Our experts reveal why the headline numbers might matter less than you think, and what traders should really watch in this final crucial week of central bank action.Try our 24-hour news squawking service for FREE! 👇https://www.livesquawk.com/#sign-upFollow us on X: https://x.com/LiveSquawk

2025-02-1332 min

LiveSquawk Market TalkNFP Preview: December's High-Stakes Jobs ReportMarkets anticipate a robust bounce in November's jobs numbers, but our expert trader explains why the underlying trends tell a different story. Learn why this NFP release comes at a crucial juncture for markets, and how to position for potential surprises in increasingly thin year-end trading conditions.Try our 24-hour news squawking service for FREE! 👇https://www.livesquawk.com/#sign-upFollow us on X: https://x.com/LiveSquawk

2025-02-1329 min

LiveSquawk Market TalkInflation Watch: Making Sense of October's CPI ReportOctober's CPI report arrives at a critical juncture, with fresh political dynamics and uncertain Fed policy hanging in the balance. Our analysts dive into the consensus forecasts, potential market reactions, and why this inflation reading could be a game-changer for interest rates.Try our 24-hour news squawking service for FREE! 👇https://www.livesquawk.com/#sign-upFollow us on X: https://x.com/LiveSquawk

2025-02-1335 min

LiveSquawk Market TalkCPI Preview: High Stakes for Markets After Trump VictoryOctober's CPI report arrives at a critical juncture, with fresh political dynamics and uncertain Fed policy hanging in the balance. Our analysts dive into the consensus forecasts, potential market reactions, and why this inflation reading could be a game-changer for interest rates.Try our 24-hour news squawking service for FREE! 👇https://www.livesquawk.com/#sign-upFollow us on X: https://x.com/LiveSquawk

2025-02-1312 min

LiveSquawk Market TalkMarkets React: Trump's Victory and the Fed's Next MoveIn the wake of Trump's victory and Republican sweep of Congress, markets are grappling with a new political reality just as major central banks prepare to make crucial rate decisions. Our expert panel breaks down the immediate market reaction to the election results and provides essential insights into what to expect from both the Federal Reserve and Bank of England's upcoming announcements. Discover the potential market anomalies traders should watch for and learn why the BoE meeting might prove more interesting than the Fed's this time around.Try our 24-hour news squawking service for...

2025-02-1330 min

LiveSquawk Market TalkThe Great Earnings Divide: Tech Giants vs RealityWith the Magnificent Seven masking flat S&P 500 growth and only 59% of companies beating revenue estimates, earnings expert Christine Short unpacks what's really driving markets. Learn why Thursday's Apple and Amazon reports could make or break the quarter, and why surging consumer confidence might be the wildcard nobody saw coming.Try our 24-hour news squawking service for FREE! 👇https://www.livesquawk.com/#sign-upFollow us on X: https://x.com/LiveSquawk

2025-02-1225 min

LiveSquawk Market TalkPerfect Storm: PCE, Payrolls, and Politics PreviewWith markets facing a crucial PCE print ahead of the Fed meeting and potentially storm-impacted payroll data, we decode what traders should watch. From short squeezes in the dollar to the market implications of the upcoming US election, discover why even seasoned traders are approaching these events with caution.Try our 24-hour news squawking service for FREE! 👇https://www.livesquawk.com/#sign-upFollow us on X: https://x.com/LiveSquawk

2025-02-1228 min

LiveSquawk Market TalkECB Preview: Is Europe's First Rate Cut Just Hours Away?As markets anticipate a pivotal 25bp rate cut from the ECB, our experts unpack why falling inflation might not be the whole story. From Germany's economic struggles to potential sequential cuts in 2024, discover why tomorrow's press conference could mark a major shift in European monetary policy.Try our 24-hour news squawking service for FREE! 👇https://www.livesquawk.com/#sign-upFollow us on X: https://x.com/LiveSquawk

2025-02-1221 min

LiveSquawk Market TalkSeptember CPI Preview: What's Next for Fed Policy?With markets yo-yoing between rate cut expectations, veteran traders break down what to watch in September's crucial CPI report. Beyond the headline numbers, discover why 'super core' components could be the real market mover and how recent strikes and Middle East tensions might reshape the Fed's policy path.Try our 24-hour news squawking service for FREE! 👇https://www.livesquawk.com/#sign-upFollow us on X: https://x.com/LiveSquawk

2025-02-1231 min

LiveSquawk Market TalkQ3 Earnings Preview: Why Lower Expectations Could Drive MarketsJoin Wall Street Horizon's Christine Short for an insider's look at why Q3 earnings season might surprise markets. Discover why analysts' lowered expectations could lead to more market movement than Q2, and learn why tech's 15% projected growth isn't the whole story. Essential listening for understanding what could be a pivotal earnings season amid mounting global uncertainties.Try our 24-hour news squawking service for FREE! 👇https://www.livesquawk.com/#sign-upFollow us on X: https://x.com/LiveSquawk

2025-02-1222 min

LiveSquawk Market TalkNFP Preview: When Global Risks Overshadow Jobs DataJoin market veterans as they discuss why September's jobs report might not be the main event moving markets. Learn why global turmoil could overshadow labor market data, and discover how the Fed might interpret a 'resilient but not robust' economy. Essential listening for understanding the complex interplay between jobs data and mounting global risks.Try our 24-hour news squawking service for FREE! 👇https://www.livesquawk.com/#sign-upFollow us on X: https://x.com/LiveSquawk

2025-02-1226 min

LiveSquawk Market TalkPCE Preview: Beyond the Fed's Favorite Inflation GaugeMarket experts examine why October's PCE report might not be the straightforward inflation story markets expect. Discover why an unusually low savings rate could overshadow core PCE data, and learn why the Fed's shifting focus to labor markets might change how we interpret these numbers. Essential preview for understanding what could be a pivotal economic indicator.Try our 24-hour news squawking service for FREE! 👇https://www.livesquawk.com/#sign-upFollow us on X: https://x.com/LiveSquawk

2025-02-1209 min

LiveSquawk Market TalkFOMC Preview: The Case for 25 vs 50bp Rate CutsTop market experts break down why October's FOMC meeting could be the most anticipated event of the year. Discover why the debate between 25 and 50 basis points isn't the whole story, and learn why the Fed's communication strategy might matter more than the actual cut. Essential listening for understanding what could be a pivotal moment in Fed policy.Try our 24-hour news squawking service for FREE! 👇https://www.livesquawk.com/#sign-upFollow us on X: https://x.com/LiveSquawk

2025-02-1240 min

LiveSquawk Market TalkECB Preview: Rate Cut Consensus vs German Growth ConcernsJoin top market experts as they dissect why the ECB's widely expected rate cut may not be the main event. Discover why German economic weakness could reshape the ECB's path forward, and hear why Lagarde's communication style might create unexpected market volatility. Essential listening for understanding the crossroads facing European monetary policy.Try our 24-hour news squawking service for FREE! 👇https://www.livesquawk.com/#sign-upFollow us on X @LiveSquawk

2025-02-1236 min

LiveSquawk Market TalkNFP Preview: Why September's Jobs Report Could Reshape Dollar TrendsVeteran trader breaks down why September's NFP report could be a game-changer for the dollar. Discover why market positioning suggests an asymmetric trading opportunity, and hear why a weak number could have far more significant implications than a strong one. A must-listen preview of one of the most anticipated economic releases of the month.Try our 24-hour news squawking service for FREE! 👇https://www.livesquawk.com/#sign-upFollow us on X @LiveSquawk

2025-02-1135 min

Rocket FuelRocket Fuel - Feb 4th - Episode 534A daily update on what's happening in the Rocket Pool community on Discord, Twitter, Reddit, and the DAO forum.

#RocketPool #rpl #Ethereum #eth #crypto #cryptocurrency #staking #news

Podcast RSS: https://anchor.fm/s/cd29a3d8/podcast/rss

Anchor.fm: https://anchor.fm/rocket-fuel

Spotify: https://open.spotify.com/show/0Mvta9d2MsKq2u62w8RSoo

Apple Podcasts: https://podcasts.apple.com/us/podcast/rocket-fuel/id1655014529

0:00 - Welcome

0:50 - Crypto market collapse

https://www.binance.com/en/trade/RPL_USDT?theme=dark&type=spot

https://x.com/scottmelker/status/1886240863145087116

https://x.com/antiprosynth/status/1886237016746000441

https://x.com/sassal0x...

2025-02-0442 min

BIGtv - all shows audioFebruary 5th – Trading NewsTrading News Harry Daniels from Livesquawk tells BIGtv what to watch in the days to come.

BIGtv is a channel dedicated to big ideas with a finance lean.

2014-02-0600 min