Shows

Mortgage Brokers AdvisorsCredit Track Credit Simulator Mortgage QualifierReady to boost your credit and get pre-approved for a mortgage?Thinking of buying a home but not sure if your credit is ready?Take control of your financial future with MKG Enterprises Corp.Our Credit Simulator Service shows you exactly what steps to take to improve your credit and get pre-approved for a mortgage—with no monthly fees, just a simple one-time investment.Individual Package – $76.20• Tri-Merge Credit Report (valid 90 days for mortgage pre-approval)• Personalized credit improvement insights• One-time Credit Sim...2025-05-2108 min

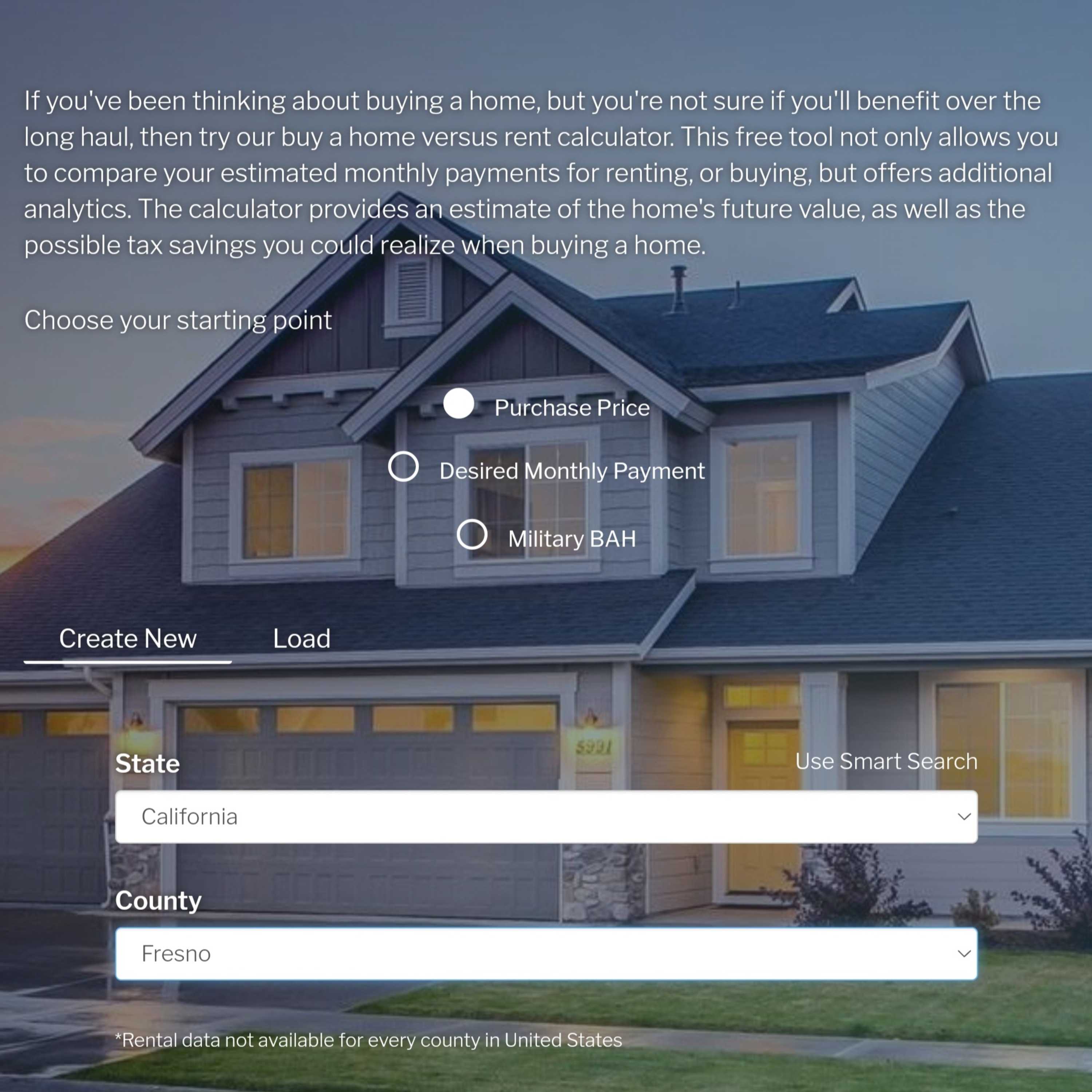

Mortgage Brokers AdvisorsCredit Track Credit Simulator Mortgage QualifierReady to boost your credit and get pre-approved for a mortgage?Thinking of buying a home but not sure if your credit is ready?Take control of your financial future with MKG Enterprises Corp.Our Credit Simulator Service shows you exactly what steps to take to improve your credit and get pre-approved for a mortgage—with no monthly fees, just a simple one-time investment.Individual Package – $76.20• Tri-Merge Credit Report (valid 90 days for mortgage pre-approval)• Personalized credit improvement insights• One-time Credit Sim...2025-05-2108 min Mortgage Brokers AdvisorsBuying vs Renting Make the right choice for your futureBuying vs Renting Make the right choice for your futureMake the right choice for your futureAre you torn between buying or renting a home? The decision is never easy, but we're here to help you make an informed choice. Introducing Buy vs Rent Comparison - your ultimate guide to making the right decision for your future.With Buy vs Rent Comparison, you'll get access to a free market report that goes beyond just comparing monthly payments. Our mortgage advisors will provide you with valuable analytics and insights that...2025-05-0907 min

Mortgage Brokers AdvisorsBuying vs Renting Make the right choice for your futureBuying vs Renting Make the right choice for your futureMake the right choice for your futureAre you torn between buying or renting a home? The decision is never easy, but we're here to help you make an informed choice. Introducing Buy vs Rent Comparison - your ultimate guide to making the right decision for your future.With Buy vs Rent Comparison, you'll get access to a free market report that goes beyond just comparing monthly payments. Our mortgage advisors will provide you with valuable analytics and insights that...2025-05-0907 min Mortgage Brokers AdvisorsAs of May 25, 2025, non-permanent residents will no longer qualify for FHA loans.“As of May 25, 2025, non-permanent residents will no longer qualify for FHA loans.”This comes directly from HUD’s Mortgagee Letter 2025-09. Why the change? The federal government is tightening access to FHA benefits to only U.S. citizens and lawful permanent residents.This means: • No more FHA loans for buyers with work permits, student visas, or temporary immigration status. • Your buyer MUST have USCIS documentation or be a citizen of the Marshall Islands, Palau, or Micronesia.This is a critical update—especially in diverse mark...2025-04-0302 min

Mortgage Brokers AdvisorsAs of May 25, 2025, non-permanent residents will no longer qualify for FHA loans.“As of May 25, 2025, non-permanent residents will no longer qualify for FHA loans.”This comes directly from HUD’s Mortgagee Letter 2025-09. Why the change? The federal government is tightening access to FHA benefits to only U.S. citizens and lawful permanent residents.This means: • No more FHA loans for buyers with work permits, student visas, or temporary immigration status. • Your buyer MUST have USCIS documentation or be a citizen of the Marshall Islands, Palau, or Micronesia.This is a critical update—especially in diverse mark...2025-04-0302 min Mortgage Brokers AdvisorsBuilding Generational Wealth through Real Estate Dough Bess PodcastWhy Homeownership Matters for Generational WealthOwning a home is a key step toward building Generational Wealth. Real estate provides several long-term benefits: • Physiological Needs: Homeownership fulfills basic needs for shelter and stability. • Safety and Security: A home offers job security, personal safety, and financial stability. • Love and Belonging: It fosters family relationships, creates a sense of belonging, and provides a secure environment for future generations. • Self-Actualization: Achieving homeownership represents living the American dream, as it empowers individuals to take control of their financial future and build equity.Homeow...2024-09-201h 16

Mortgage Brokers AdvisorsBuilding Generational Wealth through Real Estate Dough Bess PodcastWhy Homeownership Matters for Generational WealthOwning a home is a key step toward building Generational Wealth. Real estate provides several long-term benefits: • Physiological Needs: Homeownership fulfills basic needs for shelter and stability. • Safety and Security: A home offers job security, personal safety, and financial stability. • Love and Belonging: It fosters family relationships, creates a sense of belonging, and provides a secure environment for future generations. • Self-Actualization: Achieving homeownership represents living the American dream, as it empowers individuals to take control of their financial future and build equity.Homeow...2024-09-201h 16 Mortgage Brokers AdvisorsUSDA Mortgage 100% Financing and No Closing Cost through SmartBuy DPAUSDA Mortgage 100% Financing and No Closing Cost through SmartBuy DPAMKG Enterprises Corp digital mortgage brokerage goal is to assist families and individuals interested in becoming first-time homebuyers by offering 100% financing and no closing costs through USDA Mortgage and SmartBuy Down Payment Assistance (DPA).Benefits Include: • No down payment required • Low monthly mortgage insurance • Lower income requirements for borrowers • Assistance with down payment and/or closing costsQualifying Credit Scores: • 660 for 3.5% or 5% repa...2024-07-2602 min

Mortgage Brokers AdvisorsUSDA Mortgage 100% Financing and No Closing Cost through SmartBuy DPAUSDA Mortgage 100% Financing and No Closing Cost through SmartBuy DPAMKG Enterprises Corp digital mortgage brokerage goal is to assist families and individuals interested in becoming first-time homebuyers by offering 100% financing and no closing costs through USDA Mortgage and SmartBuy Down Payment Assistance (DPA).Benefits Include: • No down payment required • Low monthly mortgage insurance • Lower income requirements for borrowers • Assistance with down payment and/or closing costsQualifying Credit Scores: • 660 for 3.5% or 5% repa...2024-07-2602 min Mortgage Brokers Advisors100% USDA Mortgage Financing with No Closing CostHomebuyers Alert!Did you know there are over 100 rural homes available in Fresno that can be purchased with $0 down and no closing costs?Homeownership is now just a pre-approval away! With our USDA Mortgage and SmartBuy DPA, you can achieve your dream of owning a home without the upfront financial burden.To qualify, you need: • A minimum credit score of 620 to 660 • An annual income of less than $70,300 • 2 years of employment history • 2 months of bank statements • The last two years...2024-07-2402 min

Mortgage Brokers Advisors100% USDA Mortgage Financing with No Closing CostHomebuyers Alert!Did you know there are over 100 rural homes available in Fresno that can be purchased with $0 down and no closing costs?Homeownership is now just a pre-approval away! With our USDA Mortgage and SmartBuy DPA, you can achieve your dream of owning a home without the upfront financial burden.To qualify, you need: • A minimum credit score of 620 to 660 • An annual income of less than $70,300 • 2 years of employment history • 2 months of bank statements • The last two years...2024-07-2402 min Mortgage Brokers AdvisorsReal Estate Referral Agent Benefit from a maximum agent referral of up to $10,000 per transaction"Maximize Your Income as a Real Estate Referral Agent: Join Our Realtor Agent Referral Program Today!"Are you a licensed real estate professional seeking to enhance your earnings? Our exclusive Real Estate Referral Agent Program offers an excellent opportunity to earn additional income through real estate referrals that successfully close escrow. **Maximum Referral Reward**: Benefit from a maximum agent referral of up to $10,000 per transaction, offering significant earnings for your referrals.https://bit.ly/3SJtX812024-03-0803 min

Mortgage Brokers AdvisorsReal Estate Referral Agent Benefit from a maximum agent referral of up to $10,000 per transaction"Maximize Your Income as a Real Estate Referral Agent: Join Our Realtor Agent Referral Program Today!"Are you a licensed real estate professional seeking to enhance your earnings? Our exclusive Real Estate Referral Agent Program offers an excellent opportunity to earn additional income through real estate referrals that successfully close escrow. **Maximum Referral Reward**: Benefit from a maximum agent referral of up to $10,000 per transaction, offering significant earnings for your referrals.https://bit.ly/3SJtX812024-03-0803 min Mortgage Brokers AdvisorsOne-Time Close New Construction LoanOne closing! Which means one interest rate (with the option to modify down if the market improves), one down payment, one full credit report to order and one approval.Eligible on 15-and 30-year fixed conventional and high balance loans and 7- and 10-year ARMsAvailable on primary, second and investment property purchases and rate/term refinances700+ FICO, up to 95% LTV11-month maximum build period with 1-month modification periodLoan amounts up to the conforming loan limits$726,200 for regular one-unit loans (increased from $647,200 in 2022)$1,089,300 for one-unit...2024-03-0503 min

Mortgage Brokers AdvisorsOne-Time Close New Construction LoanOne closing! Which means one interest rate (with the option to modify down if the market improves), one down payment, one full credit report to order and one approval.Eligible on 15-and 30-year fixed conventional and high balance loans and 7- and 10-year ARMsAvailable on primary, second and investment property purchases and rate/term refinances700+ FICO, up to 95% LTV11-month maximum build period with 1-month modification periodLoan amounts up to the conforming loan limits$726,200 for regular one-unit loans (increased from $647,200 in 2022)$1,089,300 for one-unit...2024-03-0503 min Mortgage Brokers AdvisorsPiggyback HELOCs are available on primary and second home purchases, rate/term and cash-out refinances on conventional loansStandalone HELOCs are available on primary and second home loans as 20-year loans, in amounts up to $350,000. MKG Enterprises Corp Third-Party Originator is please to offers Home Equity Lines of Credit up to 85% LTV with 640 credit score minimum loan amount $75,000 can be a standalone or Piggyback HELOCStandalone HELOCs are a popular option for homeowners looking to access cash to consolidate and pay down debt, allocate money to home improvements, or cover life events.A minimum 640 FICO score is required, as is a $25,000 minimum credit line, the...2024-03-0304 min

Mortgage Brokers AdvisorsPiggyback HELOCs are available on primary and second home purchases, rate/term and cash-out refinances on conventional loansStandalone HELOCs are available on primary and second home loans as 20-year loans, in amounts up to $350,000. MKG Enterprises Corp Third-Party Originator is please to offers Home Equity Lines of Credit up to 85% LTV with 640 credit score minimum loan amount $75,000 can be a standalone or Piggyback HELOCStandalone HELOCs are a popular option for homeowners looking to access cash to consolidate and pay down debt, allocate money to home improvements, or cover life events.A minimum 640 FICO score is required, as is a $25,000 minimum credit line, the...2024-03-0304 min Mortgage Brokers AdvisorsDream for All Homebuyer program, providing up to 20% down payment assistance (DPA)MKG Enterprise Corp is proud to announce the availability of Round 2 Funding for the Dream For All Shared Appreciation Loan program, providing up to 20% down payment assistance (DPA) specifically for black families and individuals aiming to achieve homeownership in California.The Dream For All Shared Appreciation Loan program is designed to empower first-time homebuyers by offering up to 20% for down payment or closing costs, with a maximum limit of $150,000. This invaluable assistance can be utilized in conjunction with the Dream For All Conventional first mortgage, facilitating the realization of homeownership dreams. ...2024-03-0202 min

Mortgage Brokers AdvisorsDream for All Homebuyer program, providing up to 20% down payment assistance (DPA)MKG Enterprise Corp is proud to announce the availability of Round 2 Funding for the Dream For All Shared Appreciation Loan program, providing up to 20% down payment assistance (DPA) specifically for black families and individuals aiming to achieve homeownership in California.The Dream For All Shared Appreciation Loan program is designed to empower first-time homebuyers by offering up to 20% for down payment or closing costs, with a maximum limit of $150,000. This invaluable assistance can be utilized in conjunction with the Dream For All Conventional first mortgage, facilitating the realization of homeownership dreams. ...2024-03-0202 min Mortgage Brokers AdvisorsFix and Flip Bridge LoansFast Financing For a Fast-Paced MarketMKG Enterprises Corp bridge loans can provide the leverage on both your purchase and repairs that you need to grow your real estate portfolio. Benefits include:Up to 90% of your Purchase and Repairs*.Receive Financing in as little as a weekBuild a trusted partnership with one mortgage broker for all your propertiesStrategic planning to help scale your businessAdvantages of our Fix and Flip LoansNo hurdles – flexible loan options designed to...2024-03-0103 min

Mortgage Brokers AdvisorsFix and Flip Bridge LoansFast Financing For a Fast-Paced MarketMKG Enterprises Corp bridge loans can provide the leverage on both your purchase and repairs that you need to grow your real estate portfolio. Benefits include:Up to 90% of your Purchase and Repairs*.Receive Financing in as little as a weekBuild a trusted partnership with one mortgage broker for all your propertiesStrategic planning to help scale your businessAdvantages of our Fix and Flip LoansNo hurdles – flexible loan options designed to...2024-03-0103 min Mortgage Brokers AdvisorsBuy vs Rent Make the right choice for your futureMake the right choice for your futureAre you torn between buying or renting a home? The decision is never easy, but we're here to help you make an informed choice. Introducing Buy vs Rent Comparison - your ultimate guide to making the right decision for your future.With Buy vs Rent Comparison, you'll get access to a free market report that goes beyond just comparing monthly payments. Our mortgage advisors will provide you with valuable analytics and insights that will help you understand the long-term benefits of buying a home.2023-12-2307 min

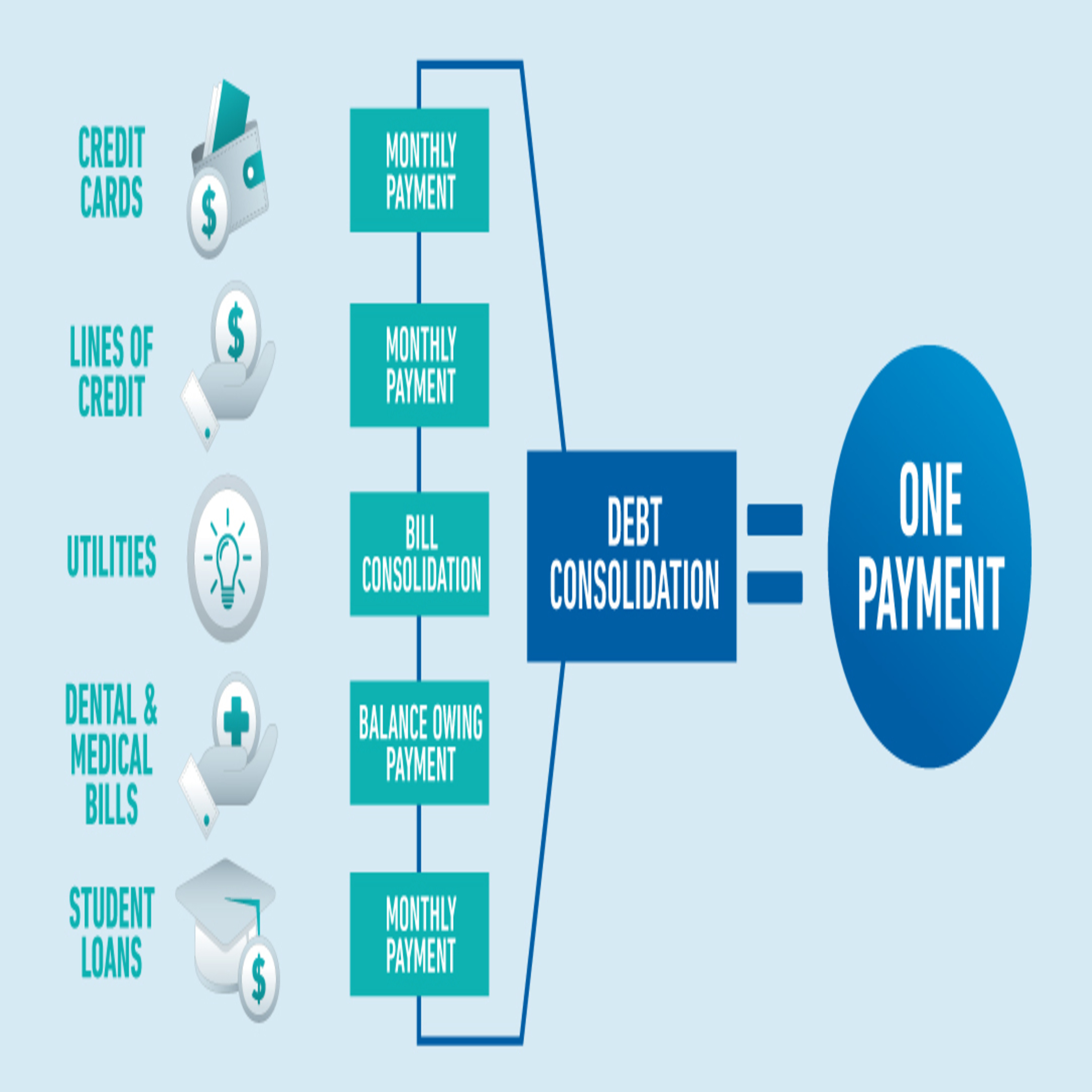

Mortgage Brokers AdvisorsBuy vs Rent Make the right choice for your futureMake the right choice for your futureAre you torn between buying or renting a home? The decision is never easy, but we're here to help you make an informed choice. Introducing Buy vs Rent Comparison - your ultimate guide to making the right decision for your future.With Buy vs Rent Comparison, you'll get access to a free market report that goes beyond just comparing monthly payments. Our mortgage advisors will provide you with valuable analytics and insights that will help you understand the long-term benefits of buying a home.2023-12-2307 min Mortgage Brokers AdvisorsTake control of your finances with Debt ConsolidationTake control of your finances with Debt ConsolidationAre you tired of juggling multiple debts and high-interest rates? It's time to take charge and start fresh! Introducing Debt Consolidation - the solution to your financial worries.With Debt Consolidation, you can refinance or cash-out refinance your mortgage at a great rate. Start the new year with a clear path to financial freedom by consolidating your debt and paying off your mortgage faster.Our team of experts are here to guide you through the process. Whether you have a minimum FICO score of 620 for...2023-12-2208 min

Mortgage Brokers AdvisorsTake control of your finances with Debt ConsolidationTake control of your finances with Debt ConsolidationAre you tired of juggling multiple debts and high-interest rates? It's time to take charge and start fresh! Introducing Debt Consolidation - the solution to your financial worries.With Debt Consolidation, you can refinance or cash-out refinance your mortgage at a great rate. Start the new year with a clear path to financial freedom by consolidating your debt and paying off your mortgage faster.Our team of experts are here to guide you through the process. Whether you have a minimum FICO score of 620 for...2023-12-2208 min Mortgage Brokers AdvisorsUnleash Your Real Estate Potential with DSCR Loans for LLCs and EntitiesUnleash Your Real Estate Potential with DSCR Loans for LLCs and EntitiesReal estate investment is a powerful wealth-building strategy, and for business owners, it just got even more accessible. MKG Enterprises Corp proudly presents DSCR Loans, short for Debt Service Coverage Ratio Loans, designed to transform your real estate ambitions. Unlike conventional mortgages that hinge on personal income, DSCR Loans revolutionize the game by evaluating the cash flow generated from investment properties to secure your mortgage.Apply onlinehttps://mkgenterprisescorp.com/dscr-loans-/**The Advantages of DSCR Loans:**1. **No...2023-10-2705 min

Mortgage Brokers AdvisorsUnleash Your Real Estate Potential with DSCR Loans for LLCs and EntitiesUnleash Your Real Estate Potential with DSCR Loans for LLCs and EntitiesReal estate investment is a powerful wealth-building strategy, and for business owners, it just got even more accessible. MKG Enterprises Corp proudly presents DSCR Loans, short for Debt Service Coverage Ratio Loans, designed to transform your real estate ambitions. Unlike conventional mortgages that hinge on personal income, DSCR Loans revolutionize the game by evaluating the cash flow generated from investment properties to secure your mortgage.Apply onlinehttps://mkgenterprisescorp.com/dscr-loans-/**The Advantages of DSCR Loans:**1. **No...2023-10-2705 min Mortgage Brokers AdvisorsDon't let interest rates affect real estate decisionsThe Counterintuitive Wisdom of Buying a House When Interest Rates Are HighHow Rates Impact the Housing MarketIn general, when interest rates are higher or increasing, the housing market slows down. When interest rates are going up, the cost of owning a home becomes more expensive due to the higher interest rate, which reduces demand. This reduction in demand then results in a drop in home prices.When the Fed increases rates to slow down the economy, particularly in times of inflation, the above goal is what it's looking for; a reduction...2023-10-2407 min

Mortgage Brokers AdvisorsDon't let interest rates affect real estate decisionsThe Counterintuitive Wisdom of Buying a House When Interest Rates Are HighHow Rates Impact the Housing MarketIn general, when interest rates are higher or increasing, the housing market slows down. When interest rates are going up, the cost of owning a home becomes more expensive due to the higher interest rate, which reduces demand. This reduction in demand then results in a drop in home prices.When the Fed increases rates to slow down the economy, particularly in times of inflation, the above goal is what it's looking for; a reduction...2023-10-2407 min Mortgage Brokers AdvisorsUnlock new possibilities with Fannie Mae's Multifamily Home 5% down paymentUnlock new possibilities with Fannie Mae's Multifamily Home Financing UpdateIn a game-changing policy shift, Fannie Mae is ushering in a new era of multifamily homeownership. Starting November 18, 2023, homeownership dreams become more achievable with a reduced 5% down payment requirement, coupled with a minimum FICO score of 580. MKG Enterprises Corp is also offering 5% percent down payment assistance, further expanding your financing choices for multifamily homes.This policy overhaul extends to standard purchases, no-cash-out refinances, HomeReady, and HomeStyle Renovation loans for owner-occupied transactions. It opens doors for first-time buyers and those seeking respite from burdensome mortgage payments...2023-10-1103 min

Mortgage Brokers AdvisorsUnlock new possibilities with Fannie Mae's Multifamily Home 5% down paymentUnlock new possibilities with Fannie Mae's Multifamily Home Financing UpdateIn a game-changing policy shift, Fannie Mae is ushering in a new era of multifamily homeownership. Starting November 18, 2023, homeownership dreams become more achievable with a reduced 5% down payment requirement, coupled with a minimum FICO score of 580. MKG Enterprises Corp is also offering 5% percent down payment assistance, further expanding your financing choices for multifamily homes.This policy overhaul extends to standard purchases, no-cash-out refinances, HomeReady, and HomeStyle Renovation loans for owner-occupied transactions. It opens doors for first-time buyers and those seeking respite from burdensome mortgage payments...2023-10-1103 min Mortgage Brokers AdvisorsMortgage Loan Officer Career OpportunitiesMKG Enterprises Corp. Third-Party Originators NLMS 1370494 understands that great people are the key to great companies. We are looking for intelligent, hard-working, passionate individuals that want to be part of something very different. We need people that dream big and possess a work ethic that will inspire those around them. We are seeking forward thinking people, who produce results rather than wait for them. You will not be micromanaged; but you will need to meet specific expectations and it will be entirely up to you to make sure that this happens. You will be backed by one...2023-10-0507 min

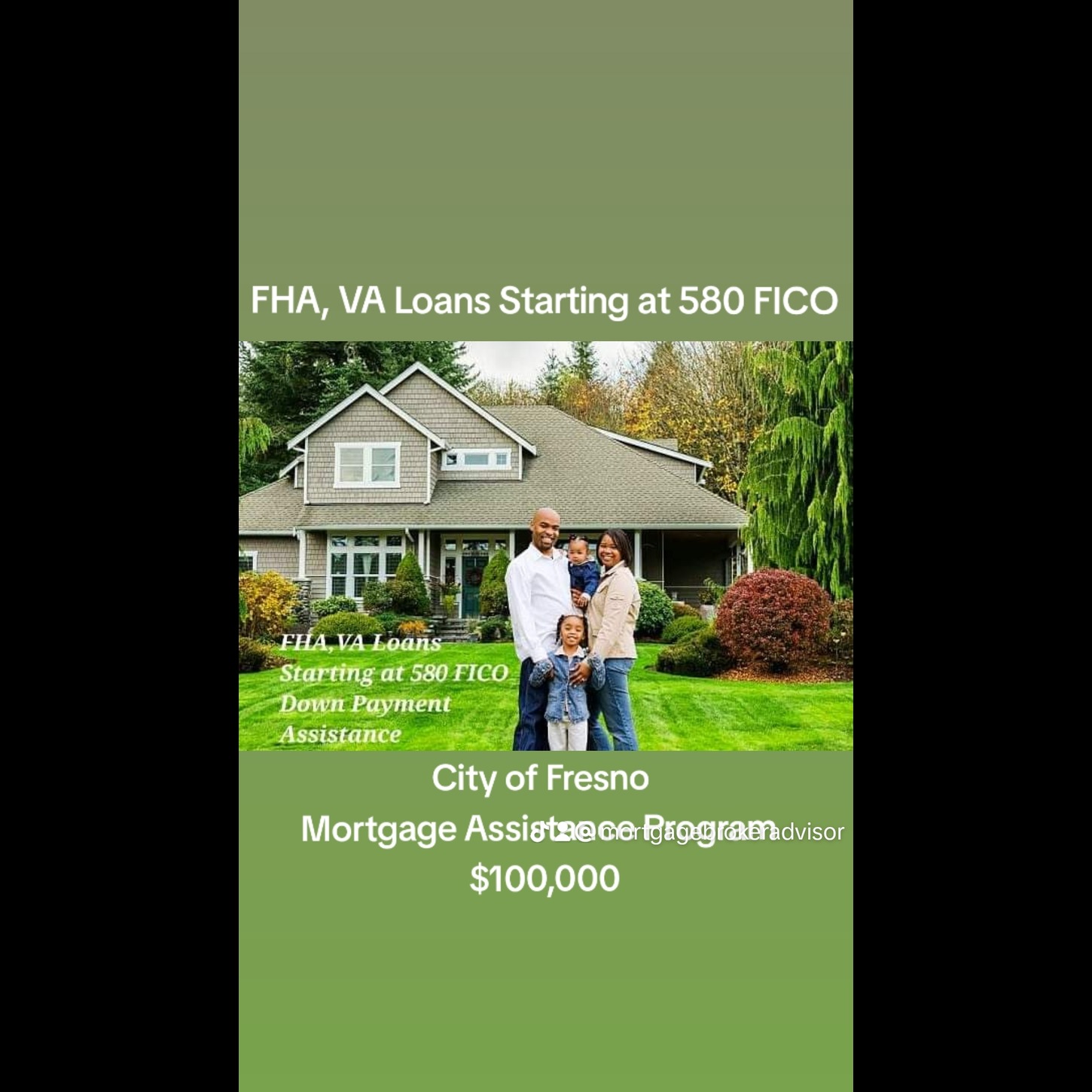

Mortgage Brokers AdvisorsMortgage Loan Officer Career OpportunitiesMKG Enterprises Corp. Third-Party Originators NLMS 1370494 understands that great people are the key to great companies. We are looking for intelligent, hard-working, passionate individuals that want to be part of something very different. We need people that dream big and possess a work ethic that will inspire those around them. We are seeking forward thinking people, who produce results rather than wait for them. You will not be micromanaged; but you will need to meet specific expectations and it will be entirely up to you to make sure that this happens. You will be backed by one...2023-10-0507 min Mortgage Brokers AdvisorsFHA, VA Loans Starting at 580 FICOFHA, VA Loans Starting at 580 FICOCity of Fresno DPA Available. FHA loan limits apply $472,030. 33/43 percent of "MAP" Mortgage Assistance Program Income limits1 Person - $46,200 Maximum Purchase Limit $200,0002 People - $52,800 Maximum Purchase Limit $225,0003 People- $59,400 Maximum Purchase Limit $250,0004 People - $65,950 Maximum Purchase Limit $280,0005 People - $71,250 Maximum Purchase Limit $300,0006 People - $76,550 Maximum Purchase Limit $325,0007 People - $81,800 Maximum Purchase Limit $346,0002023-07-1003 min

Mortgage Brokers AdvisorsFHA, VA Loans Starting at 580 FICOFHA, VA Loans Starting at 580 FICOCity of Fresno DPA Available. FHA loan limits apply $472,030. 33/43 percent of "MAP" Mortgage Assistance Program Income limits1 Person - $46,200 Maximum Purchase Limit $200,0002 People - $52,800 Maximum Purchase Limit $225,0003 People- $59,400 Maximum Purchase Limit $250,0004 People - $65,950 Maximum Purchase Limit $280,0005 People - $71,250 Maximum Purchase Limit $300,0006 People - $76,550 Maximum Purchase Limit $325,0007 People - $81,800 Maximum Purchase Limit $346,0002023-07-1003 min Mortgage Brokers AdvisorsInstant Funding at the Closing Table: Empowering Faster Transactions for Real Estate ProfessionalsLooking to close real estate transactions faster? Instant funding at the closing table can help you achieve just that! With this efficient process, you can secure funds immediately, eliminating the delays associated with wet funding. Say goodbye to lengthy paperwork and hello to a streamlined closing experience. Ready to get started? Visit https://1l.ink/34FCMVS today!2023-07-0604 min

Mortgage Brokers AdvisorsInstant Funding at the Closing Table: Empowering Faster Transactions for Real Estate ProfessionalsLooking to close real estate transactions faster? Instant funding at the closing table can help you achieve just that! With this efficient process, you can secure funds immediately, eliminating the delays associated with wet funding. Say goodbye to lengthy paperwork and hello to a streamlined closing experience. Ready to get started? Visit https://1l.ink/34FCMVS today!2023-07-0604 min Mortgage Brokers AdvisorsInstant Funding at the Closing Table: Empowering Faster Transactions for Real Estate ProfessionalsLooking to close real estate transactions faster? Instant funding at the closing table can help you achieve just that! With this efficient process, you can secure funds immediately, eliminating the delays associated with wet funding. Say goodbye to lengthy paperwork and hello to a streamlined closing experience. Ready to get started? Visit https://1l.ink/34FCMVS today!2023-07-0605 min

Mortgage Brokers AdvisorsInstant Funding at the Closing Table: Empowering Faster Transactions for Real Estate ProfessionalsLooking to close real estate transactions faster? Instant funding at the closing table can help you achieve just that! With this efficient process, you can secure funds immediately, eliminating the delays associated with wet funding. Say goodbye to lengthy paperwork and hello to a streamlined closing experience. Ready to get started? Visit https://1l.ink/34FCMVS today!2023-07-0605 min Mortgage Brokers AdvisorsTRU Approval provides homebuyers and realtors with a level of confidence and strength comparable to cash offers.MKG Enterprises Corp. Wholesale Channel is excited to announce its partnership with Sun West Mortgage to offer first-time homebuyers a unique opportunity called TRU Approval. TRU Approval stands for Thoroughly Reviewed and Underwritten Approval, providing buyers with a level of confidence and strength comparable to cash offers.With TRU Approval, homebuyers can place offers on properties without the need for a loan contingency. This means that their offer carries the same weight and assurance as a cash offer, making them stand out in competitive real estate markets. By eliminating the loan contingency, buyers can increase their chances...2023-06-2602 min

Mortgage Brokers AdvisorsTRU Approval provides homebuyers and realtors with a level of confidence and strength comparable to cash offers.MKG Enterprises Corp. Wholesale Channel is excited to announce its partnership with Sun West Mortgage to offer first-time homebuyers a unique opportunity called TRU Approval. TRU Approval stands for Thoroughly Reviewed and Underwritten Approval, providing buyers with a level of confidence and strength comparable to cash offers.With TRU Approval, homebuyers can place offers on properties without the need for a loan contingency. This means that their offer carries the same weight and assurance as a cash offer, making them stand out in competitive real estate markets. By eliminating the loan contingency, buyers can increase their chances...2023-06-2602 min Mortgage Brokers AdvisorsFHA 203k Renovation LoanThe limited FHA 203(k) rehab loan is geared toward minor improvements and repairs. No structural work is allowed, so you won’t be able to knock out walls or add rooms. In some cases, borrowers may be allowed to do some of the home improvement work, but a licensed contractor must be involved in the process. A 203(k) consultant isn’t required on a limited 203(k) loan.The maximum loan-to-value (LTV) factor is 96.5% for a purchase case and 97.75% for a refinance case.So if your purchase price is $265,000 and the ARV after repair value is $325,000 your...2023-06-2307 min

Mortgage Brokers AdvisorsFHA 203k Renovation LoanThe limited FHA 203(k) rehab loan is geared toward minor improvements and repairs. No structural work is allowed, so you won’t be able to knock out walls or add rooms. In some cases, borrowers may be allowed to do some of the home improvement work, but a licensed contractor must be involved in the process. A 203(k) consultant isn’t required on a limited 203(k) loan.The maximum loan-to-value (LTV) factor is 96.5% for a purchase case and 97.75% for a refinance case.So if your purchase price is $265,000 and the ARV after repair value is $325,000 your...2023-06-2307 min Mortgage Brokers AdvisorsHow to save for a mortgage on a tight budgetMany homebuyers across the U.S. wonder how to save for a down payment with a tight budget. With rent rates climbing, inflation rising, and house prices still high, saving money for a down payment has become more tricky.The good news is that you can use several tips and tricks to save money and cut expenses. Let's explore some ways you can save money for a down payment.DPAhttps://www.mkgenterprisescorp.com/first-time-homebuyer-dpa-program-/* Specific loan program availability and requirements may vary. Please get in touch with...2023-06-2204 min

Mortgage Brokers AdvisorsHow to save for a mortgage on a tight budgetMany homebuyers across the U.S. wonder how to save for a down payment with a tight budget. With rent rates climbing, inflation rising, and house prices still high, saving money for a down payment has become more tricky.The good news is that you can use several tips and tricks to save money and cut expenses. Let's explore some ways you can save money for a down payment.DPAhttps://www.mkgenterprisescorp.com/first-time-homebuyer-dpa-program-/* Specific loan program availability and requirements may vary. Please get in touch with...2023-06-2204 min Mortgage Brokers Advisors5 Step Plan to Buying A House With A 620 FICO Without Breaking The Bank5 Steps to Buying A House with 620 FICO Without Breaking The Bank Must have a minimum 620 FICO Must be employed and currently working at your job for at least 2 yearsParticipate in a Employer Retirement Plan 401k, 403b, Safe Harbor 401k.Have at least 3/mo to 6/mo reserves $6,561 -$13,122 saved in the bank.DTI less than 43%If you meet all the requirements above you may be eligible to qualify for DPA and buying a...2023-06-1317 min

Mortgage Brokers Advisors5 Step Plan to Buying A House With A 620 FICO Without Breaking The Bank5 Steps to Buying A House with 620 FICO Without Breaking The Bank Must have a minimum 620 FICO Must be employed and currently working at your job for at least 2 yearsParticipate in a Employer Retirement Plan 401k, 403b, Safe Harbor 401k.Have at least 3/mo to 6/mo reserves $6,561 -$13,122 saved in the bank.DTI less than 43%If you meet all the requirements above you may be eligible to qualify for DPA and buying a...2023-06-1317 min Mortgage Brokers Advisors80% AMI Limits for Fresno County Down Payment Assistance Increased $63,520 for First-Time HomebuyersThe income limit for Fresno County has increased by $6,500 and AMI limits is now $63,520 which is 80% of the Area Median Income. Calculate your debt-to-income ratio (DTI) with 43% of AMI income limits to determine your eligibility for the loan.Don’t miss out on this chance to get a large sum of money with zero interest! Invest in yourself and make your dreams a reality. Get financial security and peace of mind to turn your dreams into reality and own your home.Apply now for the City of Fresno DPL 5-Year Forgivable Loan and make sure yo...2023-06-1217 min

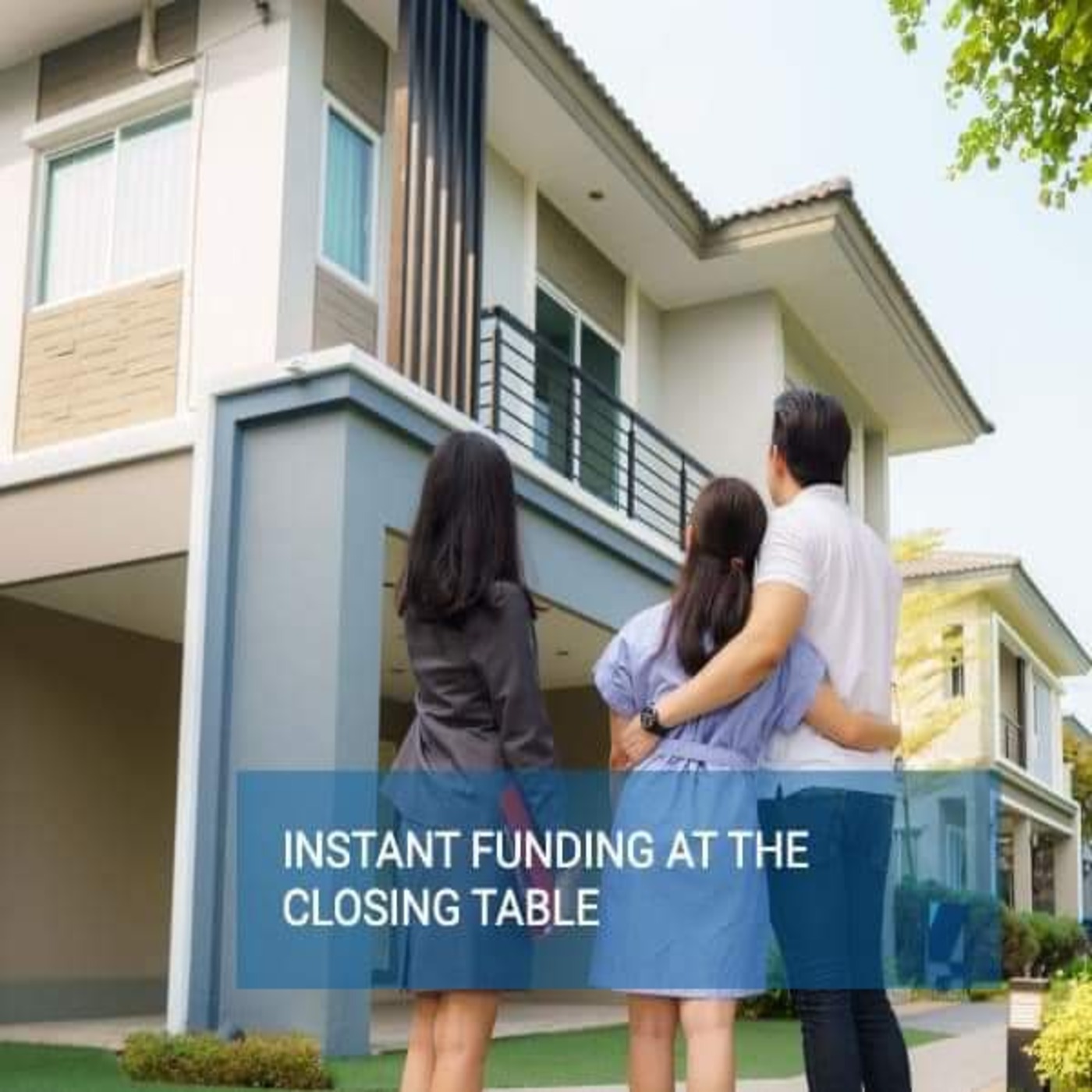

Mortgage Brokers Advisors80% AMI Limits for Fresno County Down Payment Assistance Increased $63,520 for First-Time HomebuyersThe income limit for Fresno County has increased by $6,500 and AMI limits is now $63,520 which is 80% of the Area Median Income. Calculate your debt-to-income ratio (DTI) with 43% of AMI income limits to determine your eligibility for the loan.Don’t miss out on this chance to get a large sum of money with zero interest! Invest in yourself and make your dreams a reality. Get financial security and peace of mind to turn your dreams into reality and own your home.Apply now for the City of Fresno DPL 5-Year Forgivable Loan and make sure yo...2023-06-1217 min Mortgage Brokers AdvisorsCity of Fresno $100k Down Payment Assistance 15-Year Forgivable Loan zero percent 0% interest rateOn May 25, 2023 Fresno Mayor announced $100k forgivable loans for Fresno home buyers. The City of Fresno Mortgage Assistance Program will provide down payment assistance. The City’s second mortgage loan will be a 15-Year Forgivable Deferred Payment Loan (DPL) up to $100,000 with a zero percent (0%) interest rate. FHA Loan applicants must have a miThe DPL will provide homeownership for 50-70 Fresno low-income households that meet Fannie Mae AMI of $58,320 HomeReady. For the year 2023, the maximum FHA loan amount for Fresno County is $472,030 in areas with lower housing costs.Conve...2023-05-2914 min

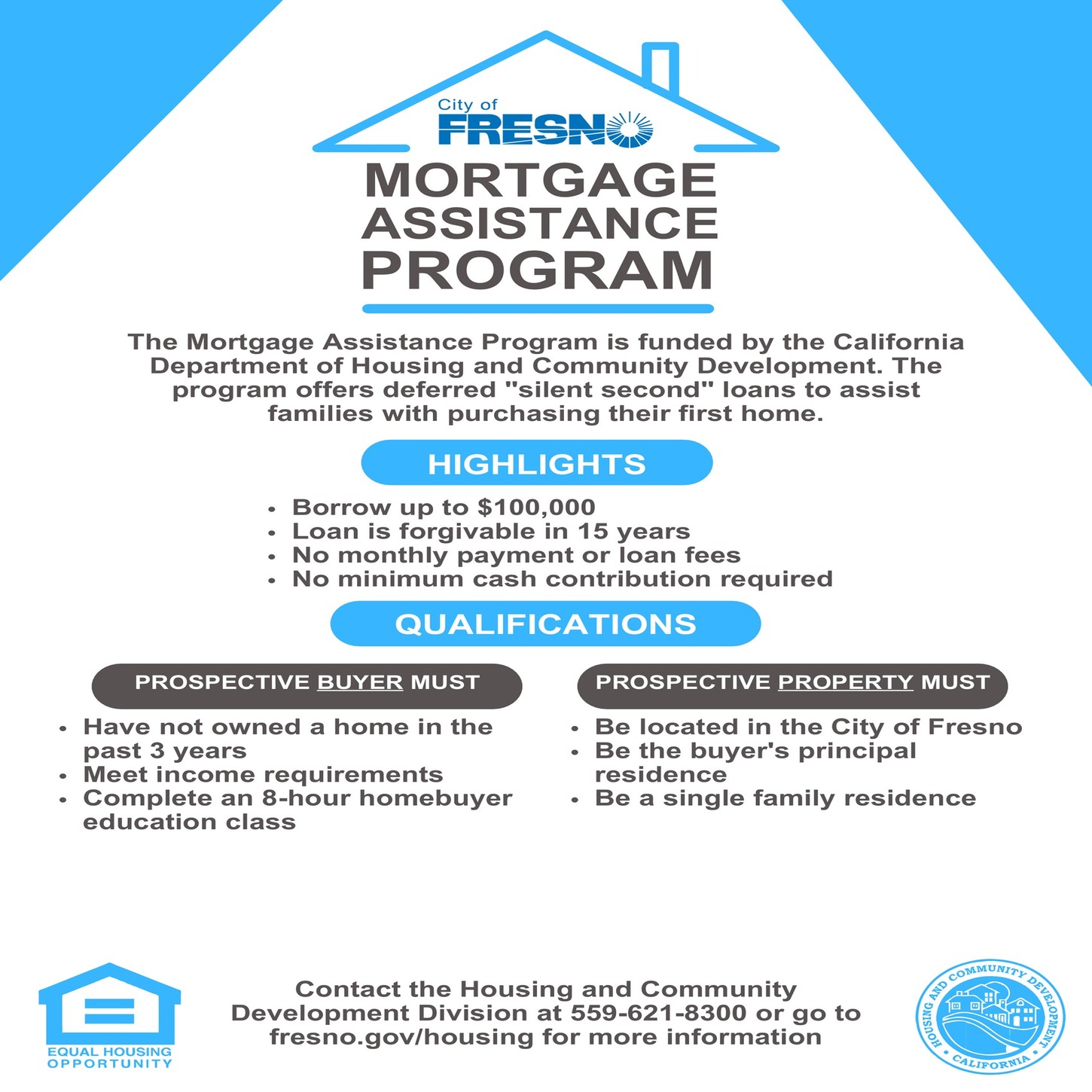

Mortgage Brokers AdvisorsCity of Fresno $100k Down Payment Assistance 15-Year Forgivable Loan zero percent 0% interest rateOn May 25, 2023 Fresno Mayor announced $100k forgivable loans for Fresno home buyers. The City of Fresno Mortgage Assistance Program will provide down payment assistance. The City’s second mortgage loan will be a 15-Year Forgivable Deferred Payment Loan (DPL) up to $100,000 with a zero percent (0%) interest rate. FHA Loan applicants must have a miThe DPL will provide homeownership for 50-70 Fresno low-income households that meet Fannie Mae AMI of $58,320 HomeReady. For the year 2023, the maximum FHA loan amount for Fresno County is $472,030 in areas with lower housing costs.Conve...2023-05-2914 min Mortgage Brokers AdvisorsMortgage Loan Officer Marshawn Govan & Realtor Linda Peltz exp Realty overview of the CalHFA California Dream For All Shared Appreciation LoanHome equity has proven to be one of the strongest ways for families to build and pass on intergenerational wealth and CalHFA is committed to improving equitable access to homeownership for all Californians. On March 27, 2023 CalHFA will make the CA Dream for All Shared Appreciation Loan Program available to California First-Time Homebuyers.20% Down Payment Assistance up to $145,240 FICO 660$726,200 Conventional Conforming Loan LimitApply Now https://mkgenterprisescorp-homeready.loanzify.io/register?mainWith the Dream for All program, the state plans to provide $300 million worth of down pay...2023-03-3028 min

Mortgage Brokers AdvisorsMortgage Loan Officer Marshawn Govan & Realtor Linda Peltz exp Realty overview of the CalHFA California Dream For All Shared Appreciation LoanHome equity has proven to be one of the strongest ways for families to build and pass on intergenerational wealth and CalHFA is committed to improving equitable access to homeownership for all Californians. On March 27, 2023 CalHFA will make the CA Dream for All Shared Appreciation Loan Program available to California First-Time Homebuyers.20% Down Payment Assistance up to $145,240 FICO 660$726,200 Conventional Conforming Loan LimitApply Now https://mkgenterprisescorp-homeready.loanzify.io/register?mainWith the Dream for All program, the state plans to provide $300 million worth of down pay...2023-03-3028 min Mortgage Brokers AdvisorsCalifornia Dream for All Shared Appreciation Loan ProgramOn March 27, 2023 CalHFA will make the CA Dream for All Shared Appreciation Loan Program available to approved lenders.Download the Digitial Mortgage Broker Mobile App in Google Play to learn more about down payment assistance programs. https://bit.ly/40Bb5esFannie Mae Area Median Income Lookup Toolhttps://ami-lookup-tool.fanniemae.com/amilookuptool80% AMI divided income limit by 12 Calculate DTI = 45% of AMI income limitsExample $58,320 /12= $4,860 X 0.45 = $2,187 must include interest + principle + property taxes and PMIDetermines borrower's Capacity ability to make interest and principal...2023-03-2412 min

Mortgage Brokers AdvisorsCalifornia Dream for All Shared Appreciation Loan ProgramOn March 27, 2023 CalHFA will make the CA Dream for All Shared Appreciation Loan Program available to approved lenders.Download the Digitial Mortgage Broker Mobile App in Google Play to learn more about down payment assistance programs. https://bit.ly/40Bb5esFannie Mae Area Median Income Lookup Toolhttps://ami-lookup-tool.fanniemae.com/amilookuptool80% AMI divided income limit by 12 Calculate DTI = 45% of AMI income limitsExample $58,320 /12= $4,860 X 0.45 = $2,187 must include interest + principle + property taxes and PMIDetermines borrower's Capacity ability to make interest and principal...2023-03-2412 min Mortgage Brokers AdvisorsFHFA raises 2023 loan limits on Fannie Mae, Freddie Mac mortgagesFHFA raises 2023 conforming loan limits on Fannie Mae, Freddie Mac mortgagesThe Federal Housing Finance Agency (FHFA) today announced the conforming loan limit values (CLLs) for mortgages to be acquired by Fannie Mae and Freddie Mac (the Enterprises) in 2023. In most of the United States, the 2023 CLL value for one-unit properties will be $726,200, an increase of $79,000 from $647,200 in 2022.National BaselineThe Housing and Economic Recovery Act (HERA) requires that the baseline CLL for the Enterprises be adjusted each year to reflect the cha...2022-11-2903 min

Mortgage Brokers AdvisorsFHFA raises 2023 loan limits on Fannie Mae, Freddie Mac mortgagesFHFA raises 2023 conforming loan limits on Fannie Mae, Freddie Mac mortgagesThe Federal Housing Finance Agency (FHFA) today announced the conforming loan limit values (CLLs) for mortgages to be acquired by Fannie Mae and Freddie Mac (the Enterprises) in 2023. In most of the United States, the 2023 CLL value for one-unit properties will be $726,200, an increase of $79,000 from $647,200 in 2022.National BaselineThe Housing and Economic Recovery Act (HERA) requires that the baseline CLL for the Enterprises be adjusted each year to reflect the cha...2022-11-2903 min Mortgage Brokers AdvisorsWhat Is a Rapid Rescore?Mortgage lenders may request a rapid rescore to have new payment information added to your credit reports quickly. This may result in a potential increase to your credit score, possibly improving your loan eligibility.When you apply for a home loan, your mortgage lender may require you to pay off any past-due debts or outstanding loans before approving your loan application. Rapid rescoring is a process lenders use to have new payment information added to your credit reports quickly—potentially increasing your credit score and improving your loan eligibility.How Rapid Rescore WorksWi...2022-11-0710 min

Mortgage Brokers AdvisorsWhat Is a Rapid Rescore?Mortgage lenders may request a rapid rescore to have new payment information added to your credit reports quickly. This may result in a potential increase to your credit score, possibly improving your loan eligibility.When you apply for a home loan, your mortgage lender may require you to pay off any past-due debts or outstanding loans before approving your loan application. Rapid rescoring is a process lenders use to have new payment information added to your credit reports quickly—potentially increasing your credit score and improving your loan eligibility.How Rapid Rescore WorksWi...2022-11-0710 min Mortgage Brokers Advisors"FHFA is eliminating upfront fees for certain first-time homebuyers"The Federal Housing Finance Agency (FHFA) today announced on October 24, 2022 targeted changes to Fannie Mae and Freddie Mac's (the Enterprises) guarantee fee pricing by eliminating upfront fees for certain borrowers and affordable mortgage products, while implementing targeted increases to the upfront fees for most cash-out refinance loans.As part of the pricing changes stemming from the Agency's ongoing review of the Enterprises' pricing framework announced last year, FHFA is eliminating upfront fees for:First-time homebuyers at or below 100 percent of area median income (AMI) in most of the United States and below 120 percent of AMI in hi...2022-11-0502 min

Mortgage Brokers Advisors"FHFA is eliminating upfront fees for certain first-time homebuyers"The Federal Housing Finance Agency (FHFA) today announced on October 24, 2022 targeted changes to Fannie Mae and Freddie Mac's (the Enterprises) guarantee fee pricing by eliminating upfront fees for certain borrowers and affordable mortgage products, while implementing targeted increases to the upfront fees for most cash-out refinance loans.As part of the pricing changes stemming from the Agency's ongoing review of the Enterprises' pricing framework announced last year, FHFA is eliminating upfront fees for:First-time homebuyers at or below 100 percent of area median income (AMI) in most of the United States and below 120 percent of AMI in hi...2022-11-0502 min Mortgage Brokers AdvisorsFHFA Approves FICO 10T and VantageScore 4.0 Credit ModelsFHFA Approves FICO 10T and VantageScore 4.0 Credit Models New Credit Models Benefit Borrowers & Enterprises The Federal Housing Finance Agency (FHFA) announced October 24, 2022 validation of both the FICO 10T credit score model and the VantageScore 4.0 credit score include rent, utilities and telecom payments, delivering a more accurate and inclusive credit model for use by Fannie Mae and Freddie Mac. The FHFA expects implementation will be a multiyear process, and lenders will be required to deliver both scores with each loan sold to Fannie Mae and Freddie Mac.“While implementing the newer credit score...2022-11-0402 min

Mortgage Brokers AdvisorsFHFA Approves FICO 10T and VantageScore 4.0 Credit ModelsFHFA Approves FICO 10T and VantageScore 4.0 Credit Models New Credit Models Benefit Borrowers & Enterprises The Federal Housing Finance Agency (FHFA) announced October 24, 2022 validation of both the FICO 10T credit score model and the VantageScore 4.0 credit score include rent, utilities and telecom payments, delivering a more accurate and inclusive credit model for use by Fannie Mae and Freddie Mac. The FHFA expects implementation will be a multiyear process, and lenders will be required to deliver both scores with each loan sold to Fannie Mae and Freddie Mac.“While implementing the newer credit score...2022-11-0402 min Mortgage Brokers AdvisorsStrive Real Estate GroupFinding a good relator & loan officer that knows the local marketCo-founder of a top real estate team in Fresno called Strive Real Estate Group at Real Broker. Helped 144 families in 2021. Receives cash flow from 17 doors with 3 being an Airbnb.OUR MISSIONTo provide our clients with sound business advice and represent their interests with the highest level of professionalism, intelligence and integrity in the industry.Win – Win: or no dealIntegrity: do the right thingCustomers: always come firstCommitment: in all thingsCom...2022-09-251h 05

Mortgage Brokers AdvisorsStrive Real Estate GroupFinding a good relator & loan officer that knows the local marketCo-founder of a top real estate team in Fresno called Strive Real Estate Group at Real Broker. Helped 144 families in 2021. Receives cash flow from 17 doors with 3 being an Airbnb.OUR MISSIONTo provide our clients with sound business advice and represent their interests with the highest level of professionalism, intelligence and integrity in the industry.Win – Win: or no dealIntegrity: do the right thingCustomers: always come firstCommitment: in all thingsCom...2022-09-251h 05 Mortgage Brokers AdvisorsZero Percent Mortgages PitfallsZero down-payment mortgages and similar programs appear to have recently been gaining traction on Main Street.Bank of America announced Aug. 30 that it is launching a trial program, called the Community Affordable Loan Solution, offering mortgages that do not require closing costs, down payments or minimum credit scores. People in predominantly Hispanic or Black neighborhoods in Charlotte, North Carolina; Dallas; Detroit; Los Angeles; and Miami that meet specific income requirements will have access to the program.In March, TD Bank launched a similar program that includes a $5,000 lender credit that qualifying borrowers can use on...2022-09-1004 min

Mortgage Brokers AdvisorsZero Percent Mortgages PitfallsZero down-payment mortgages and similar programs appear to have recently been gaining traction on Main Street.Bank of America announced Aug. 30 that it is launching a trial program, called the Community Affordable Loan Solution, offering mortgages that do not require closing costs, down payments or minimum credit scores. People in predominantly Hispanic or Black neighborhoods in Charlotte, North Carolina; Dallas; Detroit; Los Angeles; and Miami that meet specific income requirements will have access to the program.In March, TD Bank launched a similar program that includes a $5,000 lender credit that qualifying borrowers can use on...2022-09-1004 min Mortgage Brokers AdvisorsLoan Amount Vs Purchase Price – What’s The Difference?When you borrow money to buy a home, you’ll see many numbers thrown around. Most buyers focus on the purchase price of the home. It’s an indicator of whether or not you can afford the price. But since you probably won’t pay cash only, you must consider the loan amount. The loan amount is the money you borrow to buy the home. It usually differs from the purchase price since most lenders don’t always provide 100 percent financing. Considering the loan-to-value ratio is important too. This value compares the purchase price and the loan amount an...2022-09-1003 min

Mortgage Brokers AdvisorsLoan Amount Vs Purchase Price – What’s The Difference?When you borrow money to buy a home, you’ll see many numbers thrown around. Most buyers focus on the purchase price of the home. It’s an indicator of whether or not you can afford the price. But since you probably won’t pay cash only, you must consider the loan amount. The loan amount is the money you borrow to buy the home. It usually differs from the purchase price since most lenders don’t always provide 100 percent financing. Considering the loan-to-value ratio is important too. This value compares the purchase price and the loan amount an...2022-09-1003 min Mortgage Brokers AdvisorsHow to buy a house with cryptocurrencyHow to buy a house with cryptocurrencyCryptocurrency is proving to be less of a trend and more of a force that’s here to stay. Bitcoin (BTC) reached an all-time high of over $68,000 in November 2021 after starting the year at just under $30,000, and the crypto industry as a whole grew to a total market cap of more than $2 trillion. It makes sense that cryptocurrency investors are thinking big when it comes to tapping into the power of their crypto stashes. Can you use cryptocurrency to buy a house?If yo...2022-09-0908 min

Mortgage Brokers AdvisorsHow to buy a house with cryptocurrencyHow to buy a house with cryptocurrencyCryptocurrency is proving to be less of a trend and more of a force that’s here to stay. Bitcoin (BTC) reached an all-time high of over $68,000 in November 2021 after starting the year at just under $30,000, and the crypto industry as a whole grew to a total market cap of more than $2 trillion. It makes sense that cryptocurrency investors are thinking big when it comes to tapping into the power of their crypto stashes. Can you use cryptocurrency to buy a house?If yo...2022-09-0908 min Mortgage Brokers AdvisorsWhy waste money on rent when you can buy?Why waste money on rent when you can buy?Consider being a homeowner instead of paying the landlord mortgage not earning equity. Average Home Equity Banking Return-On-Investment $377,705 x 5.4% appreciation $20,396 yearlyThe benefits of being a homeowner allows you to earn equity in your home 2% per month that will appreciate side-by-side with a traditional 401K retirement plan annually. You can contribute a maximum of $20,500 to a 401(k) in 2022Start Your Mortgage Loan Journey Today!https://www.blink.mortgage/app/signup/p/mkgenterprisescorp2022-09-0905 min

Mortgage Brokers AdvisorsWhy waste money on rent when you can buy?Why waste money on rent when you can buy?Consider being a homeowner instead of paying the landlord mortgage not earning equity. Average Home Equity Banking Return-On-Investment $377,705 x 5.4% appreciation $20,396 yearlyThe benefits of being a homeowner allows you to earn equity in your home 2% per month that will appreciate side-by-side with a traditional 401K retirement plan annually. You can contribute a maximum of $20,500 to a 401(k) in 2022Start Your Mortgage Loan Journey Today!https://www.blink.mortgage/app/signup/p/mkgenterprisescorp2022-09-0905 min Mortgage Brokers AdvisorsFirst-Time Homebuyers Down Payment Assistance ProgramMKG Enterprises Corp Third-Party Originator's NLMS #1370394 is pleased to introduce the Down Payment Assistance program through our Wholesale channel. The key features of this program are as follows: Available for FHA products Available in all states except New York and Puerto RicoAssistance amount is up to 5% of the loan amount Borrowers can use the assistance for the minimum required investment, closing costs, and/or prepaid items Refer to the table below for additional information: Parameters Soft Second Repayable Second Rate Advantage Minimum FICO...2022-09-0903 min

Mortgage Brokers AdvisorsFirst-Time Homebuyers Down Payment Assistance ProgramMKG Enterprises Corp Third-Party Originator's NLMS #1370394 is pleased to introduce the Down Payment Assistance program through our Wholesale channel. The key features of this program are as follows: Available for FHA products Available in all states except New York and Puerto RicoAssistance amount is up to 5% of the loan amount Borrowers can use the assistance for the minimum required investment, closing costs, and/or prepaid items Refer to the table below for additional information: Parameters Soft Second Repayable Second Rate Advantage Minimum FICO...2022-09-0903 min