Shows

Self-Taught MBA PodcastThey Made Bitcoin Work Where Banks Failed - Inside Bitcoin Ekasi with Hermann VivierIn this episode I sat down with Hermann Vivier, founder of Bitcoin Ekasi. We discuss the limitations of government handouts in alleviating poverty, and Hermann emphasises the importance of capital accumulation for true empowerment. He highlights how Bitcoin can serve as a tool for financial independence due to its accessibility and ease of use, allowing individuals to store value and save for the future without the barriers posed by traditional banking systems.Important Links: Subscribe to my newsletter: https://selftaughtmba.substack.com/ Bitcoin Ekasi Website: Ekasi Center CrowdfundBitcoin Ekasi on X: https://x...

2025-12-0435 min

Self-Taught MBA PodcastAfrica’s Venture Capital Ecosystem Explained - with MaxMax Cuvellier, writer of Africa: The Big Deal, joined me to talk about the venture capital ecosystem in Africa. We talked about the next big sectors in venture capital, why it can be important to group African countries together when looking at data, and the importance of the energy, logistics, and fintech categories for investment in Africa.Links: Africa: The Big Deal — (1) Africa: The Big Deal | Max | Substack Max on LinkedIn — https://www.linkedin.com/in/mcuvellier?utm_source=share&utm_campaign=share_via&utm_content=profile&utm_medium=ios_appRead Self-Taught MBA —...

2025-09-1037 min

Self-Taught MBA PodcastCreating an Opportunity For the Youth of Durban, South Africa, to SucceedIn this episode, Minenhle tells us about his exciting adventure while forming NT Media Group, and how he measures success as the Chairman of the Durban Chamber of Commerce Youth In Business Forum. We also talk about The Big Shoutout — an initiative to help grow youth-led small businesses in Durban, what makes a great entrepreneur, and more!Important linksMinenhle on LinkedIn: https://www.linkedin.com/in/minenhle-nzama-329378229?utm_source=share&utm_campaign=share_via&utm_content=profile&utm_medium=ios_appNT Media Group: https://www.li...

2025-08-0446 min

Self-Taught MBA PodcastShe Started Redesigning Education at 14!Alex Lutz felt that a lot of potential was being lost when high school learners weren’t able to access quality additional learning material and resources, so she built an online platform to revolutionise learning.In this episode we talk about her platform, Milani Education, the challenges of studying while building a business, how we could improve education in South Africa, AI in learning and more! Alex Lutz on LinkedIn: https://www.linkedin.com/in/alexandra-lutz-962554227?utm_source=share&utm_campaign=share_via&utm_content=profile&utm_medium=ios_app Milani Edu...

2025-07-2425 min

Self-Taught MBA PodcastThe Investment Firm That We Should All Be Talking AboutWarren Wheatley and I talked about Altvest Capital, their mission to democratise access to great investment opportunities, his unique bid for the Springbok Rugby brand, why he likes China's innovations, his thoughts on bringing bitcoin to South African institutions, and more!Important links: subscribe to the newsletter: https://selftaughtmba.substack.com/ https://altvestcapital.co.za/ Warren on LinkedIn: linkedin.com/in/warren-wheatley-13709644

2025-06-0949 min

Self-Taught MBA PodcastWhy South African Investors Should Rethink How They Back StartupsTo Investors,“Capital flows to where it’s treated best.”I’ve been pondering why the venture capital ecosystem in South Africa isn’t as vigorous as it is in other regions globally. We can talk about politics, demographics, and any of the many social issues; but I think that, although the space has grown significantly over the years, the South African venture capital ecosystem isn’t surging because fund managers aren’t using the right fund structures to effectively attract capital, allocate capital, and update the liquidity & risk profile of venture capital investing.The current...

2025-06-0212 min

Self-Taught MBA PodcastPowering South Africa’s Future: A Bold Plan to Shrink Eskom and End LoadsheddingTo Investors,Last year I wrote a letter to this group suggesting that the South African government should intentionally make Eskom smaller, reduce Eskom’s market share in the energy supply chain, for the benefit of Eskom itself – and for the benefit of South Africans. I wanted to re-publish the letter to reach out to more industry insiders and capital allocators for comments on the idea.I’ve copied and pasted the original letter, but have added a few improvements for better communication.In 2023 I wrote a short essay about how solar energy could...

2025-05-1906 min

Self-Taught MBA PodcastGuest Post: Short Primer on Venture Capital in South AfricaTo Investors,Today’s letter features a guest post by Ross Jenvey, a former Partner at Kingson Capital, with eight years of experience as an operator in the South African venture capital industry. As an insider who's seen a fair amount in the South African VC space, I asked Ross to answer four key questions that can help someone trying to understand more about venture capital in South Africa and what it would take for the industry to grow.1. What makes you most excited about VC in South Africa?Despite attempts by SARS to...

2025-05-1406 min

Self-Taught MBA PodcastWhat Does It Mean To Run A Company On A Bitcoin Standard?To Investors,I’m always intrigued by innovative ways of doing traditional things. I’ve increasingly been intrigued by how companies are looking at bitcoin and deciding on how to participate in the bitcoin market. Today I want to talk about what it means to run a company on a Bitcoin Standard.So, for starters, if a company runs on a bitcoin standard it means that the company adopts bitcoin as its unit of account, store of value, and medium of exchange. Essentially, it means if you conduct your financial operations in rands for example, then...

2025-05-1205 min

Self-Taught MBA PodcastWhy Did Warren Buffett Retire?To Investors,Last week investors and fans gathered for another Berkshire Hathaway Annual General Meeting. Towards the end of the meeting Warren Buffett announced that he’s stepping down as Berkshire CEO and will remain only as Chairman.This marked the end of an era and I’d be remiss to not note this in a letter to investors as we all ponder why he retired.But before we get into why I think Buffett retired, a quick recap of Berkshire Hathaway’s performance over the years.The Kobeissi Letter summarised Berksh...

2025-05-0705 min

Self-Taught MBA PodcastThis Company Has the Makings of a South African National ChampionTo Investors,In previous letters, while researching and writing about the significance of the recently imposed U.S. trade tariffs and various trade dynamics, I’ve also become increasingly aware of companies or projects which are deemed national champions. One example that I can’t get out of my mind is a rare earths producer and soon-to-be permanent magnet producer called MP Materials — a U.S. national champion. Another broader example is how China, through its top down economic and political structure, picks important industries and supports them through various means – which naturally breeds national capabilities such as miner...

2025-05-0609 min

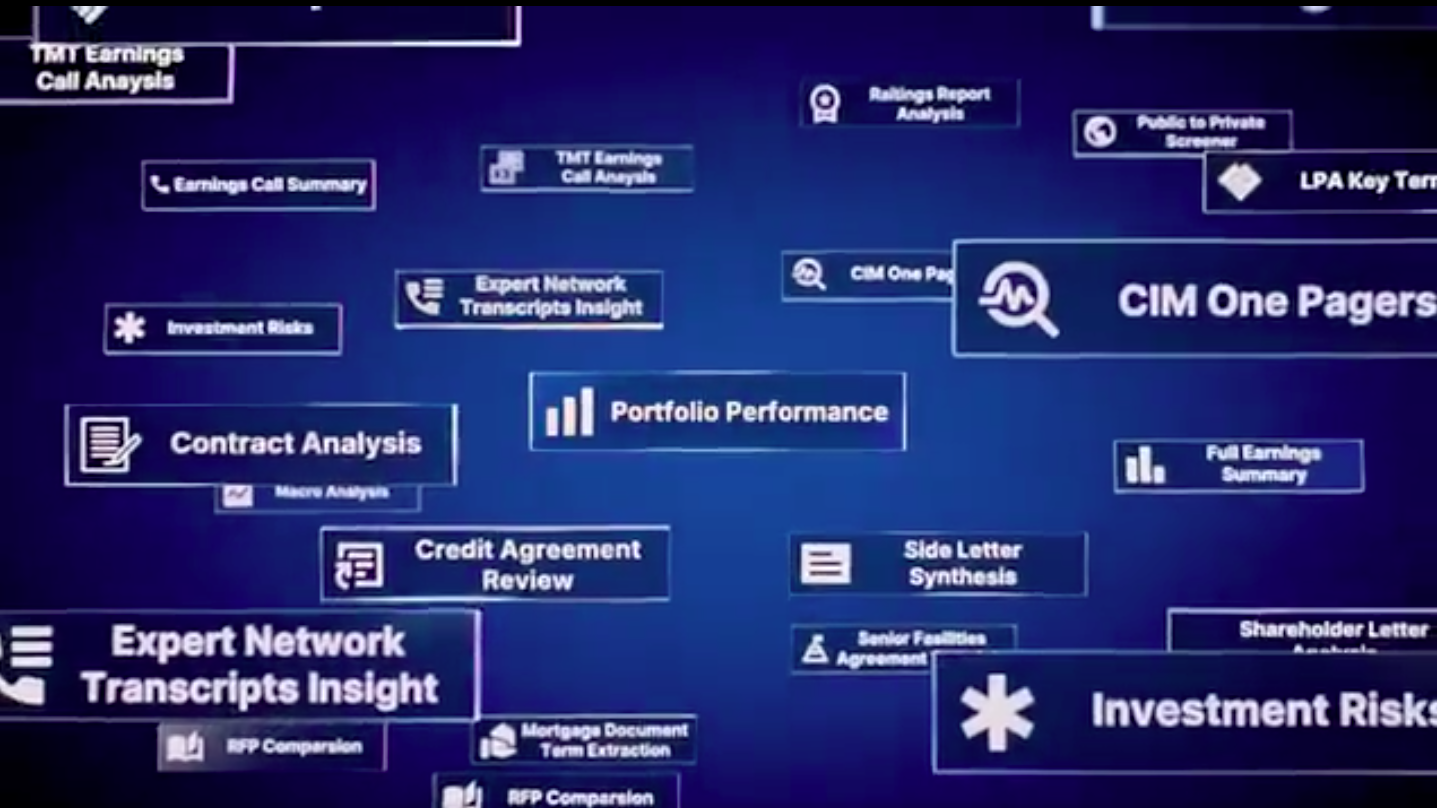

Self-Taught MBA PodcastHere’s How AI Is Disrupting Private Equity & Venture CapitalTo Investors,The other day I came across a post from Steven Bartlett about how there isn’t enough of a discussion about AI agents and how they are disrupting every industry. I wanted to discuss how these agents apply to the fields that I’m involved in, and even though I’ve tracked a lot of this activity for years, I’m continuously mind-blown at the information that I come across.What are AI agents?AI agents are software systems that perform tasks or make decisions by processing information and acting toward specific...

2025-04-2908 min

Self-Taught MBA PodcastHow One Man Grew Yale's Endowment From $1 Billion to $30 BillionTo Investors,By chance I came across some lessons about how the Yale Endowment grew from $1 billion to $30 billion between 1985 and 2021. The architect of that achievement was a guy called David Swensen, who was the Yale endowment’s chief investment officer in that period. His strategy for running the Yale endowment is referred to by capital allocators as a case study called the Yale Endowment Asset Allocation Model. Now I nerd-out about this kind of stuff all of the time so I wanted to share what I learned in today's brief letter, because I think capital allocators ca...

2025-04-2307 min

Self-Taught MBA PodcastWill This Company Be One of The Biggest Winners From the U.S. Tariffs?To Investors,In a previous letter I had mentioned how one of the main reasons for the U.S. imposing tariffs on imports is to create supply chain resiliency in key industries. I glossed through the specifics in that letter, but today I want to double-click on the rare earth minerals supply chain, why it’s important globally, but especially for the U.S., and how a company called MP Materials may emerge as one of the biggest beneficiaries of U.S. tariffs.As a quick reminder, rare earth elements are used to produce permanent ma...

2025-04-2112 min

Self-Taught MBA PodcastAre These The Three Best South African Stocks to Buy Right Now?To Investors,Yesterday I did something a little unusual, I asked Perplexity to give me the three South African stocks that it thinks are the most attractive to buy right now. I also told the model to optimise for companies that can be resilient in any market condition, but that also have significant future upside.The first stock that Perplexity recommended is The Foschini Group (TFG). The reasons where:* Why it stands out: Forecast to grow earnings by 13.6% and revenue by 7.9% per annum, with EPS growth expected at 17.5% annually; strategic acquisitions like White...

2025-04-1803 min

Self-Taught MBA PodcastWere Tariffs Just a Tactic For The Mar-a-Lago Accords?To Investors,The last 12 or so days have been wild. Trump’s Liberation Day tariff announcement shook everyone. Global stock markets were down, then went back up, tensions were high as some national leaders felt the need to announce retaliatory tariffs, and other leaders such as the Vietnamese President and President of the European Commission quickly jumped right to suggesting zero tariffs for the U.S. in order to express their desire for a trade deal.On April 9th, President Trump announced a temporary pause to the tariffs for countries that did not retaliate to hi...

2025-04-1422 min

Self-Taught MBA PodcastMaking Sense of Trump's Liberation Day - (Don't Let The Media Lie To You)To Investors,On April 2nd President Trump announced a wide range of tariffs on goods imported into the United States. This day was called “Liberation Day”. But you might wonder: ‘liberation from what? The United States of America is not a slave to anyone, or constrained by anything?’ Today I want to explain Liberation Day, break down what all of these tariffs mean, how we got here, and to highlight the hypocrisy which a lot of countries have fallen into by screaming “bloody murder” about tariffs.What happened on “Liberation Day” April 2nd, 2025?President T...

2025-04-0721 min

Self-Taught MBA PodcastNVIDIA Is Round-Tripping Revenue Through CoreWeave - Strategy or Smoke?To Investors,In any business, in any industry, revenue growth can be a dazzling figure, until you look behind the curtain. One term that I recently understood is “round-tripping revenue,” a practice where companies inflate their top lines through reciprocal deals that don’t always create real economic value. Today I wanna look at what round-tripping revenue means, whether it's legal or not, and how it might tie into NVIDIA’s cozy relationship with CoreWeave. Spoiler: it's a fascinating dynamic, and one we can’t ignore.What’s round-tripping revenue?Think about it like this: C...

2025-04-0405 min