Shows

THE VON GREYERZ PERSPECTIVE - vongreyerz.substack.comHow Will CBDCs Impact Gold?How Will CBDCs Impact Gold?Using Gold as a means to opt out of a darkening digital financial futureUsing precious metals as a means to opt out of a darkening digital financial future.n this commentary, Matthew Piepenburg delivers a passionate critique of Central Bank Digital Currencies (CBDCs), portraying them as instruments of centralized control and financial surveillance. While the stated topic may appear to be about how CBDCs will affect precious metals, the content does not directly answer that question. Instead, the entire thrust—especially in the final four mi...2025-07-0610 min

THE VON GREYERZ PERSPECTIVE - vongreyerz.substack.comHow Will CBDCs Impact Gold?How Will CBDCs Impact Gold?Using Gold as a means to opt out of a darkening digital financial futureUsing precious metals as a means to opt out of a darkening digital financial future.n this commentary, Matthew Piepenburg delivers a passionate critique of Central Bank Digital Currencies (CBDCs), portraying them as instruments of centralized control and financial surveillance. While the stated topic may appear to be about how CBDCs will affect precious metals, the content does not directly answer that question. Instead, the entire thrust—especially in the final four mi...2025-07-0610 min Commodity Culture'Grotesque' Debt Crisis To Destroy Markets - Is Gold the Lone Survivor? Matthew PiepenburgMatthew Piepenburg believes there's a connection between escalating global conflict, insane levels of government debt, and overinflated financial markets, and he sees a massive debt crisis on the horizon that could wipe out wealth in the blink of an eye. Matthew explains why gold could be the last asset standing as the rest of the market collapses, his views on silver and why it could speed past gold, the trillions of cracks he's watching in the financial system and the catalysts that could make them break, and much more.Get Your Commodity Culture Merch: https://commodity-culture-shop.fourthwall...2025-07-021h 00

Commodity Culture'Grotesque' Debt Crisis To Destroy Markets - Is Gold the Lone Survivor? Matthew PiepenburgMatthew Piepenburg believes there's a connection between escalating global conflict, insane levels of government debt, and overinflated financial markets, and he sees a massive debt crisis on the horizon that could wipe out wealth in the blink of an eye. Matthew explains why gold could be the last asset standing as the rest of the market collapses, his views on silver and why it could speed past gold, the trillions of cracks he's watching in the financial system and the catalysts that could make them break, and much more.Get Your Commodity Culture Merch: https://commodity-culture-shop.fourthwall...2025-07-021h 00 THE VON GREYERZ PERSPECTIVE - vongreyerz.substack.comFrom Sound Money to the “Big, Beautiful Bill”From Sound Money to the “Big, Beautiful Bill”A 73-Year Ride from Monetary Discipline to $324 Trillion in Global Debt — A Guided Walk ThroughHemingway, though a fiction writer, had a clearer view of economics: debt-driven prosperity always ends in inflation and war.Matthew Piepenburg offers not just a critique but a warning—an urgent reflection on the accelerating debt crisis, and its inextricable ties to time itself. In one of the most compelling moments of his address, he underscores:The difference between a million, a billion, and a trillion seconds—a seemingly...2025-06-2305 min

THE VON GREYERZ PERSPECTIVE - vongreyerz.substack.comFrom Sound Money to the “Big, Beautiful Bill”From Sound Money to the “Big, Beautiful Bill”A 73-Year Ride from Monetary Discipline to $324 Trillion in Global Debt — A Guided Walk ThroughHemingway, though a fiction writer, had a clearer view of economics: debt-driven prosperity always ends in inflation and war.Matthew Piepenburg offers not just a critique but a warning—an urgent reflection on the accelerating debt crisis, and its inextricable ties to time itself. In one of the most compelling moments of his address, he underscores:The difference between a million, a billion, and a trillion seconds—a seemingly...2025-06-2305 min Thoughtful Money with Adam Taggart'No Way Out' As Debt Crisis Looms | Matt PiepenburgToday's guest expert has long warned about the dangers of "Too Much Debt" in the global economy.The ever-growing mountain of it enables nations to spend beyond their means, creating asset price bubbles & wealth inequality in the present, and destroying the purchasing power of their fiat currencies in the long term.So where are we today on the timeline of debt-driven monetary decline?And how are precious metals -- the historic defense against such currency debasement -- faring this year in protecting those savvy enough to own them?For answers, we welcome back to the program Matthew Piepenburg, Partner at...2025-06-151h 26

Thoughtful Money with Adam Taggart'No Way Out' As Debt Crisis Looms | Matt PiepenburgToday's guest expert has long warned about the dangers of "Too Much Debt" in the global economy.The ever-growing mountain of it enables nations to spend beyond their means, creating asset price bubbles & wealth inequality in the present, and destroying the purchasing power of their fiat currencies in the long term.So where are we today on the timeline of debt-driven monetary decline?And how are precious metals -- the historic defense against such currency debasement -- faring this year in protecting those savvy enough to own them?For answers, we welcome back to the program Matthew Piepenburg, Partner at...2025-06-151h 26 THE VON GREYERZ PERSPECTIVE - vongreyerz.substack.comRubino & Piepenburg: Trapped, Doors ClosedRubino & Piepenburg: Trapped, Doors ClosedInside the Terminal Spiral – Time Is UpDecades of monetary excess, political denial, and unchecked debt creation have brought us to a breaking point.Matthew Piepenburg hosts financial analyst and author John Rubino for a hard-hitting conversation on what happens when “all exits are gone”.From inflation traps to policy failure and rising geopolitical risk, they unpack the spiral now trapping markets, central banks, and the global financial system. In this climate, gold emerges not as an option—but as a necessity.The system is corne...2025-06-0645 min

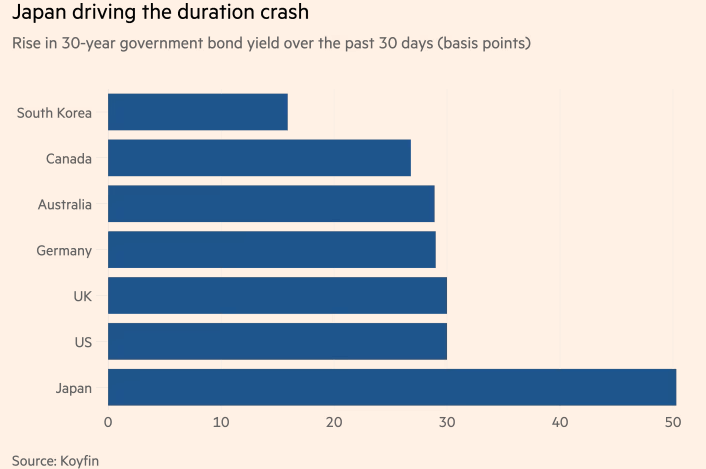

THE VON GREYERZ PERSPECTIVE - vongreyerz.substack.comRubino & Piepenburg: Trapped, Doors ClosedRubino & Piepenburg: Trapped, Doors ClosedInside the Terminal Spiral – Time Is UpDecades of monetary excess, political denial, and unchecked debt creation have brought us to a breaking point.Matthew Piepenburg hosts financial analyst and author John Rubino for a hard-hitting conversation on what happens when “all exits are gone”.From inflation traps to policy failure and rising geopolitical risk, they unpack the spiral now trapping markets, central banks, and the global financial system. In this climate, gold emerges not as an option—but as a necessity.The system is corne...2025-06-0645 min THE VON GREYERZ PERSPECTIVE - vongreyerz.substack.comBond Market CracksBond Market Cracks - Why the global debt machine is breakingIn this podcast, Matthew Piepenburg lays out the escalating crisis in long-duration debt, focusing on the U.S. Treasury market and its implications for global finance. Matthew explains why rolling over trillions in debt at higher interest rates is creating a structural trap, how foreign buyers are exiting the U.S. debt market, and why central banks are turning to gold. The message is clear: the old system of debt-funded growth is cracking—and faith is shifting fast. This is a public episode. If...2025-05-2605 min

THE VON GREYERZ PERSPECTIVE - vongreyerz.substack.comBond Market CracksBond Market Cracks - Why the global debt machine is breakingIn this podcast, Matthew Piepenburg lays out the escalating crisis in long-duration debt, focusing on the U.S. Treasury market and its implications for global finance. Matthew explains why rolling over trillions in debt at higher interest rates is creating a structural trap, how foreign buyers are exiting the U.S. debt market, and why central banks are turning to gold. The message is clear: the old system of debt-funded growth is cracking—and faith is shifting fast. This is a public episode. If...2025-05-2605 min Reinvent MoneyMatthew Piepenburg on mouse-click money, Tier 1 gold and the desperate global CBDC resetPaul Buitink talks to Matthew Piepenburg, partner at @GoldSwitzerland , about Trump, the tariff war between China and the US and whether Trump is showing the art of the deal or whether he caved in.He understands Trump though when it comes to protecting certain industries. And China has major problems too, including debt and real estate and too much reliance on key imports.Piepenburg thinks the US debt ($37 trillion) and unfunded liabilities ($100 trillion) are unsustainable regardless of the steps Trump is taking. They are at World War II levels in peace time. Not even Santa, Einstein or Mother Teresa ca...2025-05-1752 min

Reinvent MoneyMatthew Piepenburg on mouse-click money, Tier 1 gold and the desperate global CBDC resetPaul Buitink talks to Matthew Piepenburg, partner at @GoldSwitzerland , about Trump, the tariff war between China and the US and whether Trump is showing the art of the deal or whether he caved in.He understands Trump though when it comes to protecting certain industries. And China has major problems too, including debt and real estate and too much reliance on key imports.Piepenburg thinks the US debt ($37 trillion) and unfunded liabilities ($100 trillion) are unsustainable regardless of the steps Trump is taking. They are at World War II levels in peace time. Not even Santa, Einstein or Mother Teresa ca...2025-05-1752 min Soar FinanciallyGOLD: The Lifeboat Amid $300 Trillion Debt Crisis, “The Dollar War is Over” | Matthew PiepenburgIs this the final chapter for the U.S. dollar’s dominance? Matthew Piepenburg joins us to break down historic global shifts, surging gold prices, and what he calls the ‘Stalingrad moment’ of the U.S. dollar. From tariff wars and autocratic rises to BRICS realignment and bond market breakdowns, Piepenburg outlines why everything is pointing to a new global order.Is gold finally vindicated? Is the Titanic sinking? Why aren’t we hearing more about BRICS in 2024?#Gold #USDollar #macroeconomics ------------Thank you to our #sponsor MONEY METALS. Make sure to pay them a visit: https://bit.ly/BUYGoldSilver------------👨💼 Guest: Matthew P...2025-05-1259 min

Soar FinanciallyGOLD: The Lifeboat Amid $300 Trillion Debt Crisis, “The Dollar War is Over” | Matthew PiepenburgIs this the final chapter for the U.S. dollar’s dominance? Matthew Piepenburg joins us to break down historic global shifts, surging gold prices, and what he calls the ‘Stalingrad moment’ of the U.S. dollar. From tariff wars and autocratic rises to BRICS realignment and bond market breakdowns, Piepenburg outlines why everything is pointing to a new global order.Is gold finally vindicated? Is the Titanic sinking? Why aren’t we hearing more about BRICS in 2024?#Gold #USDollar #macroeconomics ------------Thank you to our #sponsor MONEY METALS. Make sure to pay them a visit: https://bit.ly/BUYGoldSilver------------👨💼 Guest: Matthew P...2025-05-1259 min THE VON GREYERZ PERSPECTIVE - vongreyerz.substack.comBasel III: July Gold ReckoningBasel III: July ReckoningHow Central Bank Regulations Are Quietly Rewriting the Future of Global FinanceIn a world awash with debt, distrust, and digital currencies, something far more grounded is regaining its place in the financial hierarchy—physical gold.In this thought-provoking podcast, Matthew Piepenburg dissects the real implications of Basel III regulations, stripping away the media noise to uncover how global central banks, led by the Bank for International Settlements (BIS), are quietly steering the financial system toward gold and away from an over-leveraged, over-weaponized U.S. dollar. 2025-05-0608 min

THE VON GREYERZ PERSPECTIVE - vongreyerz.substack.comBasel III: July Gold ReckoningBasel III: July ReckoningHow Central Bank Regulations Are Quietly Rewriting the Future of Global FinanceIn a world awash with debt, distrust, and digital currencies, something far more grounded is regaining its place in the financial hierarchy—physical gold.In this thought-provoking podcast, Matthew Piepenburg dissects the real implications of Basel III regulations, stripping away the media noise to uncover how global central banks, led by the Bank for International Settlements (BIS), are quietly steering the financial system toward gold and away from an over-leveraged, over-weaponized U.S. dollar. 2025-05-0608 min Discourse with ChristianThe Debt Bubble Will Pop: Why 2025 Could Eclipse 2008 | Matthew PiepenburgIs this the most dangerous moment in modern financial history? In this explosive episode of Discourse with Christian, we’re joined by macro strategist and author Matthew Piepenburg (Rigged to Fail, VON GREYERZ AG) to break down the global economic storm few are prepared for.We cover:🔻 Why 2025 could eclipse 2008 as the biggest financial crisis of our lifetime💣 The debt supercycle and why it’s too late to “fix” the system💵 How trust is evaporating in U.S. Treasuries—and why that’s terrifying🏦 Central banks, inflation lies, and the silent destruction of your purchasing power📉 What history teaches us about what's coming next...2025-04-2458 min

Discourse with ChristianThe Debt Bubble Will Pop: Why 2025 Could Eclipse 2008 | Matthew PiepenburgIs this the most dangerous moment in modern financial history? In this explosive episode of Discourse with Christian, we’re joined by macro strategist and author Matthew Piepenburg (Rigged to Fail, VON GREYERZ AG) to break down the global economic storm few are prepared for.We cover:🔻 Why 2025 could eclipse 2008 as the biggest financial crisis of our lifetime💣 The debt supercycle and why it’s too late to “fix” the system💵 How trust is evaporating in U.S. Treasuries—and why that’s terrifying🏦 Central banks, inflation lies, and the silent destruction of your purchasing power📉 What history teaches us about what's coming next...2025-04-2458 min WTFinanceCurrency Crisis As Debt Explodes Out of Control with Matthew PiepenburgInterview recorded - 17th of April, 2025On this episode of the WTFinance podcast I had the pleasure of welcoming back Matthew Piepenburg. Matthew is a Partner of Von Greyerz AG.During our conversation we spoke about the current state of the economy, tariffs, why all problems lead to debt and liquidity, a complete shift in the world order, collapse of the FIAT currency and more. I hope you enjoy!0:00 - Introduction0:57 - What are you seeing in the economy?8:39 - Tariffs impact on liquidity20:14 - Complete shift in the world...2025-04-2345 min

WTFinanceCurrency Crisis As Debt Explodes Out of Control with Matthew PiepenburgInterview recorded - 17th of April, 2025On this episode of the WTFinance podcast I had the pleasure of welcoming back Matthew Piepenburg. Matthew is a Partner of Von Greyerz AG.During our conversation we spoke about the current state of the economy, tariffs, why all problems lead to debt and liquidity, a complete shift in the world order, collapse of the FIAT currency and more. I hope you enjoy!0:00 - Introduction0:57 - What are you seeing in the economy?8:39 - Tariffs impact on liquidity20:14 - Complete shift in the world...2025-04-2345 min The Contrarian Capitalist PodcastMatthew Piepenburg - Bond Yields, Trump, Powell, Tariffs, Debt, Gold & moreToday’s podcast features Matthew Piepenburg, a finance professional and co-author of Gold Matters, a book on gold as a wealth-preservation asset. He writes and speaks on topics such as debt, inflation, central banks, and geopolitics.YOU CAN WATCH THE VIDEO HEREIn this thoroughly informative podcast, Matthew Piepenburg deep dives into:* Bond Yields and why they are the key thing to watch moving forwards* Trump v Powell* Why QE is going to happen and what will happen to currencies as a result* The financial endgame and ho...2025-04-2249 min

The Contrarian Capitalist PodcastMatthew Piepenburg - Bond Yields, Trump, Powell, Tariffs, Debt, Gold & moreToday’s podcast features Matthew Piepenburg, a finance professional and co-author of Gold Matters, a book on gold as a wealth-preservation asset. He writes and speaks on topics such as debt, inflation, central banks, and geopolitics.YOU CAN WATCH THE VIDEO HEREIn this thoroughly informative podcast, Matthew Piepenburg deep dives into:* Bond Yields and why they are the key thing to watch moving forwards* Trump v Powell* Why QE is going to happen and what will happen to currencies as a result* The financial endgame and ho...2025-04-2249 min The David Lin Report$300 Trillion 'Debt Crisis' Is Here: It's Over For Dollar | Matt PiepenburgMatthew Piepenburg, Partner of Von Greyerz AG, discusses the the debt crisis the country is facing and the future of the U.S. dollar. This video was distributed on behalf of West Red Lake Gold Mines (TSXV: WRLG | OTCQB: WRLGF). Learn more about WRLG: https://westredlakegold.com/*This video was recorded on April 14, 2025Use my promo codes to get a 10% discount on BTC Vegas (May 27-29), the world's biggest Bitcoin conference:BTC Vegas 2025: B25:https://tickets.b.tc/event/bitcoin-20...BitcoinAsia: https://tickets.b.tc/event/bitcoin-as...Subscribe to my free newsletter: https://davidlinreport.substack.com/Listen on Spotify...2025-04-1659 min

The David Lin Report$300 Trillion 'Debt Crisis' Is Here: It's Over For Dollar | Matt PiepenburgMatthew Piepenburg, Partner of Von Greyerz AG, discusses the the debt crisis the country is facing and the future of the U.S. dollar. This video was distributed on behalf of West Red Lake Gold Mines (TSXV: WRLG | OTCQB: WRLGF). Learn more about WRLG: https://westredlakegold.com/*This video was recorded on April 14, 2025Use my promo codes to get a 10% discount on BTC Vegas (May 27-29), the world's biggest Bitcoin conference:BTC Vegas 2025: B25:https://tickets.b.tc/event/bitcoin-20...BitcoinAsia: https://tickets.b.tc/event/bitcoin-as...Subscribe to my free newsletter: https://davidlinreport.substack.com/Listen on Spotify...2025-04-1659 min THE VON GREYERZ PERSPECTIVE - vongreyerz.substack.comFort Knox, Fake Narratives, and the Fall of the DollarIn this essential episode of “Gold Telegraph: Conversations with Alex Deluce”, Matthew Piepenburg explores the accelerating unraveling of the current monetary order. With decades of experience in law, hedge funds, and private wealth, Matt outlines why the world isn’t facing a political or inflationary crisis—but rather, a deep and dangerous liquidity crisis born from unchecked debt and systemic monetary distortion.From the weaponization of the U.S. dollar, to the stealth rise of gold as a settlement asset, to central banks quietly preparing for a new financial architecture—this is a comprehensive breakdown of what most...2025-04-141h 29

THE VON GREYERZ PERSPECTIVE - vongreyerz.substack.comFort Knox, Fake Narratives, and the Fall of the DollarIn this essential episode of “Gold Telegraph: Conversations with Alex Deluce”, Matthew Piepenburg explores the accelerating unraveling of the current monetary order. With decades of experience in law, hedge funds, and private wealth, Matt outlines why the world isn’t facing a political or inflationary crisis—but rather, a deep and dangerous liquidity crisis born from unchecked debt and systemic monetary distortion.From the weaponization of the U.S. dollar, to the stealth rise of gold as a settlement asset, to central banks quietly preparing for a new financial architecture—this is a comprehensive breakdown of what most...2025-04-141h 29 THE VON GREYERZ PERSPECTIVE - vongreyerz.substack.comECHOES OF EMPIRETrump’s tariffs may have ignited today’s trade tensions, but the roots of instability run deeper—through rising debt, shrinking liquidity, and eroding trust in global systems. Where Rome once prospered through open trade across its vast empire, modern powers now weaponize commerce, echoing a dangerous shift from cooperation to confrontation. As safe havens disappear and unrest brews in the West, history offers a sobering mirror for what lies ahead.In this sobering and historically grounded conversation, Egon von Greyerz and Matthew Piepenburg of VON GREYERZ offer a clear-eyed view of a g...2025-04-1048 min

THE VON GREYERZ PERSPECTIVE - vongreyerz.substack.comECHOES OF EMPIRETrump’s tariffs may have ignited today’s trade tensions, but the roots of instability run deeper—through rising debt, shrinking liquidity, and eroding trust in global systems. Where Rome once prospered through open trade across its vast empire, modern powers now weaponize commerce, echoing a dangerous shift from cooperation to confrontation. As safe havens disappear and unrest brews in the West, history offers a sobering mirror for what lies ahead.In this sobering and historically grounded conversation, Egon von Greyerz and Matthew Piepenburg of VON GREYERZ offer a clear-eyed view of a g...2025-04-1048 min THE VON GREYERZ PERSPECTIVE - vongreyerz.substack.comBlack Monday 2.0?As U.S. markets opened on April 7th, Dow futures plunged 1,000 points and the S&P 500 slid into bear territory—Matthew Piepenburg of VON GREYERZ didn't mince words: There is blood starting to flow in these streetsOn April 7th, U.S. markets plunged into chaos—Dow futures down 1,000 points, the S&P crashing into bear territory. Matthew Piepenburg of VON GREYERZ called it market mayhem, but warned it was no surprise. He points to a toxic cocktail of Trump’s tariff shock, Powell’s early rate-cut signals, and what he calls a “Pavlovian...2025-04-0705 min

THE VON GREYERZ PERSPECTIVE - vongreyerz.substack.comBlack Monday 2.0?As U.S. markets opened on April 7th, Dow futures plunged 1,000 points and the S&P 500 slid into bear territory—Matthew Piepenburg of VON GREYERZ didn't mince words: There is blood starting to flow in these streetsOn April 7th, U.S. markets plunged into chaos—Dow futures down 1,000 points, the S&P crashing into bear territory. Matthew Piepenburg of VON GREYERZ called it market mayhem, but warned it was no surprise. He points to a toxic cocktail of Trump’s tariff shock, Powell’s early rate-cut signals, and what he calls a “Pavlovian...2025-04-0705 min THE VON GREYERZ PERSPECTIVE - vongreyerz.substack.comThe World Has Changed - And We’re Still Pretending It Hasn’tMatthew Piepenburg offers a sharp, unfiltered summary of the current global financial and societal landscape. From the abandonment of the gold standard to the unchecked expansion of central bank balance sheets, he outlines the systemic consequences we can no longer ignore. This is not a forecast—it’s a reality check.We left the gold standard behind a generation ago. What did we get in return?* A manipulated inflation narrative no one fully believes.* Central banks printing trillions with no accountability.* Asset bubbles where 90% of market wealth flows to the top 10%.2025-03-2500 min

THE VON GREYERZ PERSPECTIVE - vongreyerz.substack.comThe World Has Changed - And We’re Still Pretending It Hasn’tMatthew Piepenburg offers a sharp, unfiltered summary of the current global financial and societal landscape. From the abandonment of the gold standard to the unchecked expansion of central bank balance sheets, he outlines the systemic consequences we can no longer ignore. This is not a forecast—it’s a reality check.We left the gold standard behind a generation ago. What did we get in return?* A manipulated inflation narrative no one fully believes.* Central banks printing trillions with no accountability.* Asset bubbles where 90% of market wealth flows to the top 10%.2025-03-2500 min THE VON GREYERZ PERSPECTIVE - vongreyerz.substack.comThe Energy Lies That Are Undermining the WestThe world is being sold a dangerous myth: that a seamless energy transition is possible, that renewables are "cheap," and that net-zero policies can be implemented without sacrificing economic stability. But as the West chases ESG narratives, deindustrialization, and political optics, China and Russia are playing a far more strategic energy game—one grounded in physics, economics, and power.In this explosive conversation, Matthew Piepenburg and Doomberg break down the biggest energy lies being pushed today, why Europe’s self-inflicted crisis is accelerating its decline, and how Russia and China are using gold and hydrocarbons to reshape glob...2025-03-141h 05

THE VON GREYERZ PERSPECTIVE - vongreyerz.substack.comThe Energy Lies That Are Undermining the WestThe world is being sold a dangerous myth: that a seamless energy transition is possible, that renewables are "cheap," and that net-zero policies can be implemented without sacrificing economic stability. But as the West chases ESG narratives, deindustrialization, and political optics, China and Russia are playing a far more strategic energy game—one grounded in physics, economics, and power.In this explosive conversation, Matthew Piepenburg and Doomberg break down the biggest energy lies being pushed today, why Europe’s self-inflicted crisis is accelerating its decline, and how Russia and China are using gold and hydrocarbons to reshape glob...2025-03-141h 05 Commodity Culture'The Jig is Up' - Why is Gold Flying Out of the COMEX? Matthew PiepenburgMatthew Piepenburg believes we are living in a historic moment, where the paper manipulation of the gold market is rapidly coming to a close as sovereign nations and other massive players in the finance industry are demanding delivery of physical gold, right now. Matthew also gives his opinion on the potential of the US revaluing its gold reserves, discussions of auditing Fort Knox, his forecast for silver, and much more.Subscribe to the TRENDS Journal: https://trendsjournal.com/subscribe (Use coupon code COMMODITY for 10% off)Von Greyerz: https://vongreyerz.goldFollow Jesse Day...2025-03-1154 min

Commodity Culture'The Jig is Up' - Why is Gold Flying Out of the COMEX? Matthew PiepenburgMatthew Piepenburg believes we are living in a historic moment, where the paper manipulation of the gold market is rapidly coming to a close as sovereign nations and other massive players in the finance industry are demanding delivery of physical gold, right now. Matthew also gives his opinion on the potential of the US revaluing its gold reserves, discussions of auditing Fort Knox, his forecast for silver, and much more.Subscribe to the TRENDS Journal: https://trendsjournal.com/subscribe (Use coupon code COMMODITY for 10% off)Von Greyerz: https://vongreyerz.goldFollow Jesse Day...2025-03-1154 min ITM Trading PodcastThe Safe Haven Assets You Need in Today’s Market – What You Need to Know🚨 Central Banks Are Buying Gold at RECORD Levels.Are you prepared for what’s coming? 💰📉 The smart money is moving into physical gold as an inflation hedge, while central banks stock up at record levels. ITM Trading’s Joshua Espinoza breaks down why gold is outperforming stocks, bonds, and real estate—and what it means for your financial future.Don’t wait until it’s too late! Watch now to learn how to protect your wealth before the next big crash. ⚠️📊 #GoldInvesting #WealthProtection #ITMTrading #FinancialSecurity📞 ACT NOW, BEFORE IT'S TOO LATE: Matthew Piepenburg warn...2025-02-0610 min

ITM Trading PodcastThe Safe Haven Assets You Need in Today’s Market – What You Need to Know🚨 Central Banks Are Buying Gold at RECORD Levels.Are you prepared for what’s coming? 💰📉 The smart money is moving into physical gold as an inflation hedge, while central banks stock up at record levels. ITM Trading’s Joshua Espinoza breaks down why gold is outperforming stocks, bonds, and real estate—and what it means for your financial future.Don’t wait until it’s too late! Watch now to learn how to protect your wealth before the next big crash. ⚠️📊 #GoldInvesting #WealthProtection #ITMTrading #FinancialSecurity📞 ACT NOW, BEFORE IT'S TOO LATE: Matthew Piepenburg warn...2025-02-0610 min ITM Trading PodcastTrump Didn’t Kill CBDCs - This “Wolf in Sheep’s Clothing” Will Track Your Every Move“Bitcoin's narrative of decentralized, anti-fiat, anti-government maverick ironically is the exact opposite of that,” says Matthew Piepenburg, Advisor & Partner at Matterhorn Asset Management AG. In an interview with Daniela Cambone, he argues that Bitcoin and Tether are not truly decentralized but part of a broader financial and intelligence strategy led by governments and central banks.

Questions on Protecting Your Wealth with Gold & Silver? Schedule a Strategy Call Here ➡️ https://calendly.com/itmtrading/podcast

or Call 866-349-3310

👋 STAY IN TOUCH WITH US ⬇️

🟩 Schedule a Strategy Session: 866-349-3310

🟩 Email us a...2025-02-0343 min

ITM Trading PodcastTrump Didn’t Kill CBDCs - This “Wolf in Sheep’s Clothing” Will Track Your Every Move“Bitcoin's narrative of decentralized, anti-fiat, anti-government maverick ironically is the exact opposite of that,” says Matthew Piepenburg, Advisor & Partner at Matterhorn Asset Management AG. In an interview with Daniela Cambone, he argues that Bitcoin and Tether are not truly decentralized but part of a broader financial and intelligence strategy led by governments and central banks.

Questions on Protecting Your Wealth with Gold & Silver? Schedule a Strategy Call Here ➡️ https://calendly.com/itmtrading/podcast

or Call 866-349-3310

👋 STAY IN TOUCH WITH US ⬇️

🟩 Schedule a Strategy Session: 866-349-3310

🟩 Email us a...2025-02-0343 min The David Lin ReportFed To Launch 'Bazooka' After Crash: Why Risk-On Investor Turns Bearish | Matt PiepenburgMatthew Piepenburg, Partner of Von Greyerz AG, discusses market sentiment, navigating a U.S. debt crisis, and the outlook for gold, the dollar, and monetary policy.

*This video was recorded on January 19, 2025

Subscribe to my free newsletter: https://davidlinreport.substack.com/

Listen on Spotify: https://open.spotify.com/show/510WZMFaqeh90Xk4jcE34s

Listen on Apple Podcasts: https://podcasters.spotify.com/pod/show/the-david-lin-report

FOLLOW MATTHEW PIEPENBURG:

Website: https://goldswitzerland.com/

FOLLOW DAVID LIN:

X (@davidlin_TV): https://x.com/davidlin_TV

TikTok (@davidlin_TV): https://www.tiktok.com/@davidlin_tv

Instagram (@davidlin_TV): https://www.instagram.com/davidlin...2025-01-2741 min

The David Lin ReportFed To Launch 'Bazooka' After Crash: Why Risk-On Investor Turns Bearish | Matt PiepenburgMatthew Piepenburg, Partner of Von Greyerz AG, discusses market sentiment, navigating a U.S. debt crisis, and the outlook for gold, the dollar, and monetary policy.

*This video was recorded on January 19, 2025

Subscribe to my free newsletter: https://davidlinreport.substack.com/

Listen on Spotify: https://open.spotify.com/show/510WZMFaqeh90Xk4jcE34s

Listen on Apple Podcasts: https://podcasters.spotify.com/pod/show/the-david-lin-report

FOLLOW MATTHEW PIEPENBURG:

Website: https://goldswitzerland.com/

FOLLOW DAVID LIN:

X (@davidlin_TV): https://x.com/davidlin_TV

TikTok (@davidlin_TV): https://www.tiktok.com/@davidlin_tv

Instagram (@davidlin_TV): https://www.instagram.com/davidlin...2025-01-2741 min Soar FinanciallyGold & Chaos: Is the US Turning Japanese? | Matthew Piepenburg

In this episode titled "Gold & Chaos: Is the US Turning Japanese?", host Kai Hoffmann is joined by Matthew Piepenburg, Partner at von Greyerz Gold, to discuss the state of the U.S. economy and its potential parallels with Japan's financial trajectory. Key topics include the Federal Reserve's policies, the bond market's impact on interest rates, and the BRICs' shift away from the U.S. dollar. Matthew also shares insights into gold's role as a safe haven and its importance for investors in an era of rising debt and economic uncertainty. Tune in for expert perspectives on macroeconomic trends, fiat...2024-12-1336 min

Soar FinanciallyGold & Chaos: Is the US Turning Japanese? | Matthew Piepenburg

In this episode titled "Gold & Chaos: Is the US Turning Japanese?", host Kai Hoffmann is joined by Matthew Piepenburg, Partner at von Greyerz Gold, to discuss the state of the U.S. economy and its potential parallels with Japan's financial trajectory. Key topics include the Federal Reserve's policies, the bond market's impact on interest rates, and the BRICs' shift away from the U.S. dollar. Matthew also shares insights into gold's role as a safe haven and its importance for investors in an era of rising debt and economic uncertainty. Tune in for expert perspectives on macroeconomic trends, fiat...2024-12-1336 min The David Lin Report$36 Trillion Debt Crisis And New Trade Wars; Economy About To Implode? | Matthew PiepenburgMatthew Piepenburg, Partner of Von Greyerz AG, discusses the likely impacts of tariffs on inflation and economic growth, outlook for the dollar, and the "crazies times" for the economy.

To learn more about Nexgold, visit: https://nexgold.com/

*This video was recorded on November 27, 2024

Subscribe to my free newsletter: https://davidlinreport.substack.com/

Listen on Spotify: https://open.spotify.com/show/510WZMFaqeh90Xk4jcE34s

Listen on Apple Podcasts: https://podcasters.spotify.com/pod/show/the-david-lin-report

FOLLOW MATTHEW PIEPENBURG:

Website: https://goldswitzerland.com/

FOLLOW DAVID LIN:

X (@davidlin_TV): https://x.com/davidlin_TV

TikTok (@davidlin_TV): https://www...2024-12-0348 min

The David Lin Report$36 Trillion Debt Crisis And New Trade Wars; Economy About To Implode? | Matthew PiepenburgMatthew Piepenburg, Partner of Von Greyerz AG, discusses the likely impacts of tariffs on inflation and economic growth, outlook for the dollar, and the "crazies times" for the economy.

To learn more about Nexgold, visit: https://nexgold.com/

*This video was recorded on November 27, 2024

Subscribe to my free newsletter: https://davidlinreport.substack.com/

Listen on Spotify: https://open.spotify.com/show/510WZMFaqeh90Xk4jcE34s

Listen on Apple Podcasts: https://podcasters.spotify.com/pod/show/the-david-lin-report

FOLLOW MATTHEW PIEPENBURG:

Website: https://goldswitzerland.com/

FOLLOW DAVID LIN:

X (@davidlin_TV): https://x.com/davidlin_TV

TikTok (@davidlin_TV): https://www...2024-12-0348 min WTFinanceCentral Banks Desperate Action to Avoid Currency Collapse with Matthew PiepenburgInterview recorded - 27th of September, 2024On this episode of the WTFinance podcast I had the pleasure of welcoming back Matthew Piepenburg. Matthew is a Partner of Von Greyerz AG and critic of current monetary policy actions of central banks.During this conversation we spoke about his thoughts on the economy, why there is a debt trap, no expectation of real growth in the future, private vs public debt, calculating US Dollar devaluation, precious metals and more. I hope you enjoy!0:00 - Introduction1:42 - Current thoughts on the economy?7:16 - Concentration...2024-10-0253 min

WTFinanceCentral Banks Desperate Action to Avoid Currency Collapse with Matthew PiepenburgInterview recorded - 27th of September, 2024On this episode of the WTFinance podcast I had the pleasure of welcoming back Matthew Piepenburg. Matthew is a Partner of Von Greyerz AG and critic of current monetary policy actions of central banks.During this conversation we spoke about his thoughts on the economy, why there is a debt trap, no expectation of real growth in the future, private vs public debt, calculating US Dollar devaluation, precious metals and more. I hope you enjoy!0:00 - Introduction1:42 - Current thoughts on the economy?7:16 - Concentration...2024-10-0253 min Commodity CultureEndless Debt, Wars for Profit and the Policy Makers Destroying the West: Matthew PiepenburgMatthew Piepenburg poses an important question: how does one hedge against the open stupidity, willful ignorance, and downright power mad behavior of policy makers in the West who seem intent on destroying the very countries they claim to serve? Matthew breaks down why reckless debt levels, expanding global conflict, and deep-rooted corruption threaten to shatter the foundations of democracy and free speech, in favor of centralized control and the endless expansion of government.Coppernico Metals (TSX: COPR)https://coppernicometals.comDisclaimer: Commodity Culture was compensated by Coppernico Metals for promotion. Jesse Day...2024-09-2559 min

Commodity CultureEndless Debt, Wars for Profit and the Policy Makers Destroying the West: Matthew PiepenburgMatthew Piepenburg poses an important question: how does one hedge against the open stupidity, willful ignorance, and downright power mad behavior of policy makers in the West who seem intent on destroying the very countries they claim to serve? Matthew breaks down why reckless debt levels, expanding global conflict, and deep-rooted corruption threaten to shatter the foundations of democracy and free speech, in favor of centralized control and the endless expansion of government.Coppernico Metals (TSX: COPR)https://coppernicometals.comDisclaimer: Commodity Culture was compensated by Coppernico Metals for promotion. Jesse Day...2024-09-2559 min Soar FinanciallyGOLD: Your #1 Defensive Weapon | Matthew PiepenburgMatthew Piepenburg, Partner at Von Greyerz Gold, returns to discuss this week's extreme market volatility, the Yen carry trade, tech stock sell-off and gold resilience. We also discuss whether gold was weaponized.

#goldprice #gold #marketcrash

------------

Skip the waitlist and invest in blue-chip art for the very first time by signing up for Masterworks: https://masterworks.art/soarfinancially

Purchase shares in great masterpieces from artists like Pablo Picasso, Banksy, Andy Warhol, and more.

See important Masterworks disclosures: https://www.masterworks.com/cd

Thank you to our #sponsor MONEY METALS. Make sure to pay them a visit: https://bit.ly...2024-08-121h 02

Soar FinanciallyGOLD: Your #1 Defensive Weapon | Matthew PiepenburgMatthew Piepenburg, Partner at Von Greyerz Gold, returns to discuss this week's extreme market volatility, the Yen carry trade, tech stock sell-off and gold resilience. We also discuss whether gold was weaponized.

#goldprice #gold #marketcrash

------------

Skip the waitlist and invest in blue-chip art for the very first time by signing up for Masterworks: https://masterworks.art/soarfinancially

Purchase shares in great masterpieces from artists like Pablo Picasso, Banksy, Andy Warhol, and more.

See important Masterworks disclosures: https://www.masterworks.com/cd

Thank you to our #sponsor MONEY METALS. Make sure to pay them a visit: https://bit.ly...2024-08-121h 02 The David Lin ReportSocial Unrest Not Over, U.S. Becoming 'Banana Republic' | Matthew PiepenburgRemove your personal information from the web at https://joindeleteme.com/DAVIDLIN

and use code DAVIDLIN for 20% off DeleteMe international Plans: https://international.joindeleteme.com

Matthew Piepenburg, Partner of Von Greyerz AG

*This video was recorded on July 15, 2024

Subscribe to my free newsletter: https://davidlinreport.substack.com/

Listen on Spotify: https://open.spotify.com/show/510WZMF...

Listen on Apple Podcasts: https://podcasters.spotify.com/pod/sh...

FOLLOW MATTHEW PIEPENBURG:

Website: https://goldswitzerland.com/

FOLLOW DAVID LIN:

Twitter (@davidlin_TV): https://twitter.com/davidlin_TV

TikTok (@davidlin_TV): https://www.tiktok.com/@davidlin_tv

Instagram (@davidlin_TV): 2024-07-1649 min

The David Lin ReportSocial Unrest Not Over, U.S. Becoming 'Banana Republic' | Matthew PiepenburgRemove your personal information from the web at https://joindeleteme.com/DAVIDLIN

and use code DAVIDLIN for 20% off DeleteMe international Plans: https://international.joindeleteme.com

Matthew Piepenburg, Partner of Von Greyerz AG

*This video was recorded on July 15, 2024

Subscribe to my free newsletter: https://davidlinreport.substack.com/

Listen on Spotify: https://open.spotify.com/show/510WZMF...

Listen on Apple Podcasts: https://podcasters.spotify.com/pod/sh...

FOLLOW MATTHEW PIEPENBURG:

Website: https://goldswitzerland.com/

FOLLOW DAVID LIN:

Twitter (@davidlin_TV): https://twitter.com/davidlin_TV

TikTok (@davidlin_TV): https://www.tiktok.com/@davidlin_tv

Instagram (@davidlin_TV): 2024-07-1649 min SBTV PodcastMatthew Piepenburg - U.S. Dollar and Debt Crossing the RubiconPatrick Vierra from SBTV spoke with Matthew Piepenburg from von Greyerz Gold Switzerland. Matthew makes it known how the US dollar is crossing the Rubicon and there is no turning back. Wealth protection and wealth preservation with precious metals are even more vital going forward.2024-05-0635 min

SBTV PodcastMatthew Piepenburg - U.S. Dollar and Debt Crossing the RubiconPatrick Vierra from SBTV spoke with Matthew Piepenburg from von Greyerz Gold Switzerland. Matthew makes it known how the US dollar is crossing the Rubicon and there is no turning back. Wealth protection and wealth preservation with precious metals are even more vital going forward.2024-05-0635 min Silver Bullion TV (SBTV)312 Matthew Piepenburg - U.S. Dollar and Debt Crossing the RubiconPatrick Vierra from SBTV spoke with Matthew Piepenburg from von Greyerz Gold Switzerland. Matthew makes it known how the US dollar is crossing the Rubicon and there is no turning back. Wealth protection and wealth preservation with precious metals are even more vital going forward.2024-05-0235 min

Silver Bullion TV (SBTV)312 Matthew Piepenburg - U.S. Dollar and Debt Crossing the RubiconPatrick Vierra from SBTV spoke with Matthew Piepenburg from von Greyerz Gold Switzerland. Matthew makes it known how the US dollar is crossing the Rubicon and there is no turning back. Wealth protection and wealth preservation with precious metals are even more vital going forward.2024-05-0235 min NewGen MindsetEPI 113 - The Unwinding of Central Bank Illusions - w/ Matthew Pipenburg, Author & Partner at Von Greyerz: Gold SwitzerlandIn our 113th episode, we engage in a conversation with Matthew Piepenburg, Author & Partner at Von Greyerz: Gold Switzerland. We delve into some of the current distortions in the illusionary economies portrayed by central banks around the world. Touching on the political chaos afflicting the West, and the impact of political games causing major fundamental shifts in the global currency and banking systems. Other topics include interest rates, central banking, the gold market, lack of trust in the US dollar, BRICS, petrodollar, political leadership, CPI, debt levels, the Federal Reserve, the war on inflation, 10-year bonds, illusionary economic metrics...2024-04-261h 07

NewGen MindsetEPI 113 - The Unwinding of Central Bank Illusions - w/ Matthew Pipenburg, Author & Partner at Von Greyerz: Gold SwitzerlandIn our 113th episode, we engage in a conversation with Matthew Piepenburg, Author & Partner at Von Greyerz: Gold Switzerland. We delve into some of the current distortions in the illusionary economies portrayed by central banks around the world. Touching on the political chaos afflicting the West, and the impact of political games causing major fundamental shifts in the global currency and banking systems. Other topics include interest rates, central banking, the gold market, lack of trust in the US dollar, BRICS, petrodollar, political leadership, CPI, debt levels, the Federal Reserve, the war on inflation, 10-year bonds, illusionary economic metrics...2024-04-261h 07 The Intrinsic Value Podcast - The Investor’s Podcast NetworkMI Rewind: Why Warren Buffett Might Be Wrong w/ Matthew PiepenburgMatthew Piepenburg talks about the macro environment, current market trends, and risks and opportunities ahead. Matthew is the Co-Founder of SignalsMatter and Co-Author of the book, “Rigged to Fail”. He has over 20 years’ experience in investing, alternative assets, and finance, with expertise in managed futures, credit, and equity investing.IN THIS EPISODE, YOU’LL LEARN00:00 - Intro06:53 - What is a Main Street investor?06:53 - What are the risks and opportunities for Main Street investors?10:05 - Why is the next recession going to be worse than previous...2024-04-051h 17

The Intrinsic Value Podcast - The Investor’s Podcast NetworkMI Rewind: Why Warren Buffett Might Be Wrong w/ Matthew PiepenburgMatthew Piepenburg talks about the macro environment, current market trends, and risks and opportunities ahead. Matthew is the Co-Founder of SignalsMatter and Co-Author of the book, “Rigged to Fail”. He has over 20 years’ experience in investing, alternative assets, and finance, with expertise in managed futures, credit, and equity investing.IN THIS EPISODE, YOU’LL LEARN00:00 - Intro06:53 - What is a Main Street investor?06:53 - What are the risks and opportunities for Main Street investors?10:05 - Why is the next recession going to be worse than previous...2024-04-051h 17 WTFinanceStrong Economy Narrative Is Farcical! with Matthew PiepenburgInterview recorded -1st of April, 2024On this episode of the WTFinance podcast I had the pleasure of welcoming back Matthew Piepenburg. Matthew is a Partner of Von Greyerz AG.During our conversation we spoke about what is currently happening in the economy, why speculators are the only ones making money, no alternative to the US Dollar, Financial repression, wealth divide and more. I hope you enjoy!0:00 - Introduction1:45 - What is currently happening in the economy?5:57 - Debt owned by bottom 50%13:25 - Speculators the only ones making the money?2024-04-0351 min

WTFinanceStrong Economy Narrative Is Farcical! with Matthew PiepenburgInterview recorded -1st of April, 2024On this episode of the WTFinance podcast I had the pleasure of welcoming back Matthew Piepenburg. Matthew is a Partner of Von Greyerz AG.During our conversation we spoke about what is currently happening in the economy, why speculators are the only ones making money, no alternative to the US Dollar, Financial repression, wealth divide and more. I hope you enjoy!0:00 - Introduction1:45 - What is currently happening in the economy?5:57 - Debt owned by bottom 50%13:25 - Speculators the only ones making the money?2024-04-0351 min Commodity CultureGold's Return to the Monetary System is Already Happening: Matthew PiepenburgMatthew Piepenburg doesn't believe the U.S. dollar is going to collapse tomorrow, or that gold is making a dramatic return to the international monetary system, but he does believe that the trend of dedollarization is very real and gold's role as money is slowly but surely establishing itself right now. Matthew also explains why silver is the speedboat and gold is the juggernaut and provides his outlook on the broad market, energy, and more. Von Greyerz AG: https://vongreyerz.gold Follow Jesse Day on X: https://x.com/jessebdayCommodity Culture on Youtube: h...2024-03-0849 min

Commodity CultureGold's Return to the Monetary System is Already Happening: Matthew PiepenburgMatthew Piepenburg doesn't believe the U.S. dollar is going to collapse tomorrow, or that gold is making a dramatic return to the international monetary system, but he does believe that the trend of dedollarization is very real and gold's role as money is slowly but surely establishing itself right now. Matthew also explains why silver is the speedboat and gold is the juggernaut and provides his outlook on the broad market, energy, and more. Von Greyerz AG: https://vongreyerz.gold Follow Jesse Day on X: https://x.com/jessebdayCommodity Culture on Youtube: h...2024-03-0849 min Soar FinanciallyGold & the Looming Liquidity Crisis, Outlook 2030 | Rick Rule & Matthew Piepenburg

Rick Rule and Matthew Piepenburg joined me on the floor of the Vancouver Resource Investment Conference for a discussion on the outlook of the company - what will the financial world look like in 2030? Are we going to witness a liquidity crisis? What is the role of gold moving forward?

▶️ Please subscribe to the channel so that we can continue inviting high-quality guests 🙏

------------

Thank you to sponsor VICTORIA GOLD CORP for making this interview possible. Learn more at: https://vgcx.com

------------

👨 Guests: Rick Rule & Matthew Piepenburg

🏢 Company: Rule Investment Media & von Greyerz Gold

𝕏 @RealRickRule

📺 @RuleInvestmentMedia

🌎

🌎 https://www.vongreyery.gold

𝕏 Kai Hoffm...2024-02-2725 min

Soar FinanciallyGold & the Looming Liquidity Crisis, Outlook 2030 | Rick Rule & Matthew Piepenburg

Rick Rule and Matthew Piepenburg joined me on the floor of the Vancouver Resource Investment Conference for a discussion on the outlook of the company - what will the financial world look like in 2030? Are we going to witness a liquidity crisis? What is the role of gold moving forward?

▶️ Please subscribe to the channel so that we can continue inviting high-quality guests 🙏

------------

Thank you to sponsor VICTORIA GOLD CORP for making this interview possible. Learn more at: https://vgcx.com

------------

👨 Guests: Rick Rule & Matthew Piepenburg

🏢 Company: Rule Investment Media & von Greyerz Gold

𝕏 @RealRickRule

📺 @RuleInvestmentMedia

🌎

🌎 https://www.vongreyery.gold

𝕏 Kai Hoffm...2024-02-2725 min Living Your Greatness#132 Matthew Piepenburg: Why Gold Matters: Real Solutions To Surreal RiskSign up for my free weekly newsletter. _ Matthew Piepenburg, Partner at Von Greyerz Gold, AG (Zurich) and board member at SignalsMatter.com, has extensive experience in real assets, alternative investments, law, and finance, with expertise in precious metal investing as a wealth preservation instrument. He also has years of experience researching, evaluating and investing in alternative investments: hedge funds, private equity vehicles, VC and real estate. Matthew Piepenburg's skills include monetary metals, asset allocation, risk management and macroeconomic analysis. He has written numerous white papers on the long-term distortions of central bank policies...2024-02-241h 19

Living Your Greatness#132 Matthew Piepenburg: Why Gold Matters: Real Solutions To Surreal RiskSign up for my free weekly newsletter. _ Matthew Piepenburg, Partner at Von Greyerz Gold, AG (Zurich) and board member at SignalsMatter.com, has extensive experience in real assets, alternative investments, law, and finance, with expertise in precious metal investing as a wealth preservation instrument. He also has years of experience researching, evaluating and investing in alternative investments: hedge funds, private equity vehicles, VC and real estate. Matthew Piepenburg's skills include monetary metals, asset allocation, risk management and macroeconomic analysis. He has written numerous white papers on the long-term distortions of central bank policies...2024-02-241h 19 Soar FinanciallyMega FED CHAOS, GOLD WINS | Danielle DiMartino Booth & Matthew Piepenburg

The FED is causing chaos and extreme volatility in the markets. The FED pivot is wreaking havoc and gold stands to profit. In this riveting roundtable with some financial market heavyweights, we discuss Powell's dovish comments, market outlook, and lagging leading indicators. Market Crash Ahead?!

▶️ Please subscribe to the channel so that we can continue inviting high-quality guests 🙏

------------

Thank you to sponsor VICTORIA GOLD CORP for making this interview possible. Learn more at: https://vgcx.com

------------

👩&👨 Guests: Danielle DiMartino Booth & Matthew Piepenburg

🏢 Company: QI Research & Von Greyerz Gold

📺 @DanielleDiMartinoBoothQI

🌎 https://quillintelligence.com/

🌎 https://vongreyerz.gold/

𝕏 Danielle DiMartino Booth @DiMartinoBooth

𝕏 Kai...2024-02-2123 min

Soar FinanciallyMega FED CHAOS, GOLD WINS | Danielle DiMartino Booth & Matthew Piepenburg

The FED is causing chaos and extreme volatility in the markets. The FED pivot is wreaking havoc and gold stands to profit. In this riveting roundtable with some financial market heavyweights, we discuss Powell's dovish comments, market outlook, and lagging leading indicators. Market Crash Ahead?!

▶️ Please subscribe to the channel so that we can continue inviting high-quality guests 🙏

------------

Thank you to sponsor VICTORIA GOLD CORP for making this interview possible. Learn more at: https://vgcx.com

------------

👩&👨 Guests: Danielle DiMartino Booth & Matthew Piepenburg

🏢 Company: QI Research & Von Greyerz Gold

📺 @DanielleDiMartinoBoothQI

🌎 https://quillintelligence.com/

🌎 https://vongreyerz.gold/

𝕏 Danielle DiMartino Booth @DiMartinoBooth

𝕏 Kai...2024-02-2123 min MEGA RadioMEGA Radio Aktuell vom 02.02.2024 - Teil 1Moderation Alexander Boos

Stunde 1

1.

Aktuelle Themen

O-Töne von: dpa, ARD, n-tv, Presse Team

Austria, axinocapital, Krissy Rieger

- Ampel schon pleite?: Ampel-Politiker Carsten Schneider (SPD)

im O-Ton im TV bei „Hart aber fair“: „Wir haben einfach kein Geld mehr“

- aktuelle Haushaltsberatungen im Bundestag: Am heutigen

Freitag soll der neue Haushalt verabschiedet werden: O-Töne (der dpa) von SPD,

Grüne, FDP & AfD bei Generaldebatte im Plenum

- Unsere Serie: DAFÜR gibt Deutschland Geld in die Welt: Wir

lesen alle Ausgabe-Posten vor

- Bundes-Landwirtsch...2024-02-0457 min

MEGA RadioMEGA Radio Aktuell vom 02.02.2024 - Teil 1Moderation Alexander Boos

Stunde 1

1.

Aktuelle Themen

O-Töne von: dpa, ARD, n-tv, Presse Team

Austria, axinocapital, Krissy Rieger

- Ampel schon pleite?: Ampel-Politiker Carsten Schneider (SPD)

im O-Ton im TV bei „Hart aber fair“: „Wir haben einfach kein Geld mehr“

- aktuelle Haushaltsberatungen im Bundestag: Am heutigen

Freitag soll der neue Haushalt verabschiedet werden: O-Töne (der dpa) von SPD,

Grüne, FDP & AfD bei Generaldebatte im Plenum

- Unsere Serie: DAFÜR gibt Deutschland Geld in die Welt: Wir

lesen alle Ausgabe-Posten vor

- Bundes-Landwirtsch...2024-02-0457 min Soar FinanciallyThe ROLE OF GOLD is Clearly Defined | Matthew PiepenburgMatthew Piepenburg joined us to discuss a lot of pressing matters, including Argentina wanting to go back to a US Dollar system. What is the real state of the economy? How does the US finance itself? What is the case for gold in a neutered dollar system? Lots of questions and lots of excellent insights from our guest.

⚠️ Please consider subscribing to our channel! 🙏

#gold #silver #soarfinancially

Recorded on November 20th, 2023

👨 Guest: Matthew Piepenburg, Partner

🏢 Company: Matterhorn Asset Management

📺 @GoldSwitzerland

🌎 https://goldswitzerland.com

DEUTSCHE GOLDMESSE FALL 2023

November 24 & 25 in Frankfurt, Germany

👉 www.deutschegoldmesse.com

Free registration for qualified investors

SAVE THE DATE:

Deutsche Gold...2023-11-2951 min

Soar FinanciallyThe ROLE OF GOLD is Clearly Defined | Matthew PiepenburgMatthew Piepenburg joined us to discuss a lot of pressing matters, including Argentina wanting to go back to a US Dollar system. What is the real state of the economy? How does the US finance itself? What is the case for gold in a neutered dollar system? Lots of questions and lots of excellent insights from our guest.

⚠️ Please consider subscribing to our channel! 🙏

#gold #silver #soarfinancially

Recorded on November 20th, 2023

👨 Guest: Matthew Piepenburg, Partner

🏢 Company: Matterhorn Asset Management

📺 @GoldSwitzerland

🌎 https://goldswitzerland.com

DEUTSCHE GOLDMESSE FALL 2023

November 24 & 25 in Frankfurt, Germany

👉 www.deutschegoldmesse.com

Free registration for qualified investors

SAVE THE DATE:

Deutsche Gold...2023-11-2951 min Thoughtful Money with Adam TaggartDebate On The US Dollar: Will It Soar Or Sink From Here? | Brent Johnson vs Matthew PiepenburgIn this video, we're witness to a "meeting of the minds" between two top monetary experts, who each will argue their predicted path for the US dollar from here.

We're very fortunate to be joined by Brent Johnson, CEO of Santiago Capital and developer of The Dollar Milkshake Theory, which will serve as the foundation upon which today's discussion will be built.

Serving as a counterpoint perspective will be Matthew Piepenburg, Commercial Director at Matterhorn Asset Management AG - GoldSwitzerland

This is not a debate so much as a "co-exploration", as there are many points our speakers agree on...2023-11-211h 23

Thoughtful Money with Adam TaggartDebate On The US Dollar: Will It Soar Or Sink From Here? | Brent Johnson vs Matthew PiepenburgIn this video, we're witness to a "meeting of the minds" between two top monetary experts, who each will argue their predicted path for the US dollar from here.

We're very fortunate to be joined by Brent Johnson, CEO of Santiago Capital and developer of The Dollar Milkshake Theory, which will serve as the foundation upon which today's discussion will be built.

Serving as a counterpoint perspective will be Matthew Piepenburg, Commercial Director at Matterhorn Asset Management AG - GoldSwitzerland

This is not a debate so much as a "co-exploration", as there are many points our speakers agree on...2023-11-211h 23 The Jay Martin ShowOut of Control Debt Leads Governments Into War, This Time Is No Different: Matthew PiepenburgMatthew Piepenburg points out that debt distress often leads to the drumbeats of war, as reckless governments try to distract the public and find a way to stay afloat while their empire crumbles. Matthew discusses the potential for further global conflict, the new multipolar world emerging, the outcome of the debt crisis, and much more.The Commodity University: https://thecommodityuniversity.comSign up for my free weekly newsletter: https://jaymartin.substack.com/subscribe2023-10-211h 08

The Jay Martin ShowOut of Control Debt Leads Governments Into War, This Time Is No Different: Matthew PiepenburgMatthew Piepenburg points out that debt distress often leads to the drumbeats of war, as reckless governments try to distract the public and find a way to stay afloat while their empire crumbles. Matthew discusses the potential for further global conflict, the new multipolar world emerging, the outcome of the debt crisis, and much more.The Commodity University: https://thecommodityuniversity.comSign up for my free weekly newsletter: https://jaymartin.substack.com/subscribe2023-10-211h 08 Wealthion - Be Financially ResilientIt Will Take A 30-40% Market Drawdown Before The Fed Pivots | Matt PiepenburgMonetary expert Matthew Piepenburg of GoldSwitzerland.com returns for Part 2 of our interview with him in which he explains why, whenever countries become too indebted (as we are now) it's ALWAYS the currency that's sacrificed. In the long run, hyperinflation is likely to be the end result.

But in the near term, a recession & bear market correction look quite likely. Which makes the current environment a highly uncertain one for the individual investor.

************************

At Wealthion, we show you how to protect and build your wealth by learning from the world’s top experts on...2023-09-281h 10

Wealthion - Be Financially ResilientIt Will Take A 30-40% Market Drawdown Before The Fed Pivots | Matt PiepenburgMonetary expert Matthew Piepenburg of GoldSwitzerland.com returns for Part 2 of our interview with him in which he explains why, whenever countries become too indebted (as we are now) it's ALWAYS the currency that's sacrificed. In the long run, hyperinflation is likely to be the end result.

But in the near term, a recession & bear market correction look quite likely. Which makes the current environment a highly uncertain one for the individual investor.

************************

At Wealthion, we show you how to protect and build your wealth by learning from the world’s top experts on...2023-09-281h 10 Wealthion - Be Financially ResilientOur Currency Is Always, ALWAYS Sacrificed When Crisis Hits | Matt PiepenburgRight now, surprisingly robust economic growth of 4.9% is currently expected for Q3.

And inflation remains contained below 4%, less than half where it was a year ago.

This is great news, right? The economy has rebounded, the Fed is taming inflation, and we've dodged the risk of a recession.

Not really, warns Matthew Piepenburg of Matterhorn Asset Management, AG (proprietor of Goldswitzerland.com). In fact, this is a dangerously WRONG narrative that too many are swallowing right now.

To find out why, we'll hear it straight from the man himself.

Follow Matt...2023-09-271h 12

Wealthion - Be Financially ResilientOur Currency Is Always, ALWAYS Sacrificed When Crisis Hits | Matt PiepenburgRight now, surprisingly robust economic growth of 4.9% is currently expected for Q3.

And inflation remains contained below 4%, less than half where it was a year ago.

This is great news, right? The economy has rebounded, the Fed is taming inflation, and we've dodged the risk of a recession.

Not really, warns Matthew Piepenburg of Matterhorn Asset Management, AG (proprietor of Goldswitzerland.com). In fact, this is a dangerously WRONG narrative that too many are swallowing right now.

To find out why, we'll hear it straight from the man himself.

Follow Matt...2023-09-271h 12 Wealthion - Be Financially ResilientWill 'Too Much Debt' Prove Fatal To The Global Economy? | Matthew Piepenburg(This video originally aired on April 3, 2023. We are replaying it, along with a few other of our most significant interviews of the past year, while Wealthion host Adam Taggart is dealing with a death in the family).

A system is only as good as the decisions made by the people running it. Today's guest expert is highly concerned that the leaders currently in charge of our financial system are out of their depth & putting us on a course to crisis.

A crisis, that when it fully arrives, they will address with "solutions" that require even...2023-07-191h 11

Wealthion - Be Financially ResilientWill 'Too Much Debt' Prove Fatal To The Global Economy? | Matthew Piepenburg(This video originally aired on April 3, 2023. We are replaying it, along with a few other of our most significant interviews of the past year, while Wealthion host Adam Taggart is dealing with a death in the family).

A system is only as good as the decisions made by the people running it. Today's guest expert is highly concerned that the leaders currently in charge of our financial system are out of their depth & putting us on a course to crisis.

A crisis, that when it fully arrives, they will address with "solutions" that require even...2023-07-191h 11 The Fat Emperor PodcastEp195: The Financial World Fully Decoded - Listen Up, and Take Action!This interview is a Grand Slam from the uber-articulate and incredibly knowledgeable Matthew Piepenburg - it will answer ALL your questions around Global Finance, banking and personal finance decisions! PLEASE SHARE to help the people!

NOTE: My extensive research and interviewing / video/sound editing, business travel and much more does require support - please consider helping if you can with monthly donation to support me directly, or one-off payment: https://www.paypal.com/donate?hosted_button_id=69ZSTYXBMCN3W - alternatively join up with my Patreon - exclusive Vlogs/content and monthly zoom meetings with the second...2023-07-121h 10

The Fat Emperor PodcastEp195: The Financial World Fully Decoded - Listen Up, and Take Action!This interview is a Grand Slam from the uber-articulate and incredibly knowledgeable Matthew Piepenburg - it will answer ALL your questions around Global Finance, banking and personal finance decisions! PLEASE SHARE to help the people!

NOTE: My extensive research and interviewing / video/sound editing, business travel and much more does require support - please consider helping if you can with monthly donation to support me directly, or one-off payment: https://www.paypal.com/donate?hosted_button_id=69ZSTYXBMCN3W - alternatively join up with my Patreon - exclusive Vlogs/content and monthly zoom meetings with the second...2023-07-121h 10 Commodity CultureThere's a Reason Russia and China are Stacking Gold and Dumping Treasuries: Matthew PiepenburgPartner at Matterhorn Asset Management and Author Matthew Piepenburg believes that the current debt-based monetary system is headed for a reckoning, and gold will play a major role in the new world up ahead.Gold Switzerland: https://goldswitzerland.comFollow Jesse Day on X: https://x.com/jessebdayCommodity Culture on Youtube: https://youtube.com/c/CommodityCulture2023-06-2857 min

Commodity CultureThere's a Reason Russia and China are Stacking Gold and Dumping Treasuries: Matthew PiepenburgPartner at Matterhorn Asset Management and Author Matthew Piepenburg believes that the current debt-based monetary system is headed for a reckoning, and gold will play a major role in the new world up ahead.Gold Switzerland: https://goldswitzerland.comFollow Jesse Day on X: https://x.com/jessebdayCommodity Culture on Youtube: https://youtube.com/c/CommodityCulture2023-06-2857 min The Market SniperIs Gold still the ultimate wealth protection in 2023? w/ Matthew Piepenburgwatch the video version of this interview here: https://youtu.be/_iQaIcA_zcM

💥Book a free virtual call with us here: http://marketsniper.me/37mhTmi

https://themarketsniper.com

🍏 Join our Free trading course here: https://themarketsniper.com/tradesmart/

W H A T B R O K E R S D O I U S E ?:

📈Forex:

For 100x FX Margin Beat the Margin reductions, but Safe like the EU, Sweden Based Scandinavian Capital Markets for FX trading:

http://themarketsniper.com/scm/

To trade KRW and more, SimpleFX:

h...2023-06-051h 03

The Market SniperIs Gold still the ultimate wealth protection in 2023? w/ Matthew Piepenburgwatch the video version of this interview here: https://youtu.be/_iQaIcA_zcM

💥Book a free virtual call with us here: http://marketsniper.me/37mhTmi

https://themarketsniper.com

🍏 Join our Free trading course here: https://themarketsniper.com/tradesmart/

W H A T B R O K E R S D O I U S E ?:

📈Forex:

For 100x FX Margin Beat the Margin reductions, but Safe like the EU, Sweden Based Scandinavian Capital Markets for FX trading:

http://themarketsniper.com/scm/

To trade KRW and more, SimpleFX:

h...2023-06-051h 03 The Jay Martin ShowCentralization of Power is the Dying Gasp of Our Failed Economic System: Matthew PiepenburgCommercial Director at Matterhorn Asset Management Matthew Piepenburg believes the increased centralization of power in countries across the world is a sign that our failed economic system is nearing its inevitable end. Matthew also reveals how he's adjusting his portfolio to deal with the uncertainty of our current market environment.Sign up for my free weekly newsletter at https://jaymartin.substack.com/subscribe2023-04-221h 28

The Jay Martin ShowCentralization of Power is the Dying Gasp of Our Failed Economic System: Matthew PiepenburgCommercial Director at Matterhorn Asset Management Matthew Piepenburg believes the increased centralization of power in countries across the world is a sign that our failed economic system is nearing its inevitable end. Matthew also reveals how he's adjusting his portfolio to deal with the uncertainty of our current market environment.Sign up for my free weekly newsletter at https://jaymartin.substack.com/subscribe2023-04-221h 28 Wealthion - Be Financially ResilientOur Debt Is The Real Existential Threat | Matthew PiepenburgA system is only as good as the decisions made by the people running it.

Today's guest expert is highly concerned that the leaders currently in charge of our financial system are out of their depth & putting us on a course to crisis.

A crisis, that when it fully arrives, they will address with "solutions" that require even more centralized control by the people who caused the disaster in the first place.

So what risks exactly does he recommend we prepare for?

We'll find out now, as we're fortunate to be...2023-04-051h 11

Wealthion - Be Financially ResilientOur Debt Is The Real Existential Threat | Matthew PiepenburgA system is only as good as the decisions made by the people running it.

Today's guest expert is highly concerned that the leaders currently in charge of our financial system are out of their depth & putting us on a course to crisis.

A crisis, that when it fully arrives, they will address with "solutions" that require even more centralized control by the people who caused the disaster in the first place.

So what risks exactly does he recommend we prepare for?

We'll find out now, as we're fortunate to be...2023-04-051h 11 WTFinanceFIAT Currency Bubble to Burst? with Matthew PiepenburgInterview recorded - 3rd of April, 2023On todays episode of the WTFinance podcast I had the pleasure of speaking with Matthew Piepenburg, During our conversation we spoke about whether the FED has control over the debt market, Risk of US Dollar losing its hegemony, what happens with a debt collapse and the winners and losers of such an event. I hope you enjoy!0:00 - Introduction0:45 - Can the current situation get worse?7:45 - Does the FED have control over the debt market?11:55 - Risk of International US Dollars flooding the c...2023-04-0547 min

WTFinanceFIAT Currency Bubble to Burst? with Matthew PiepenburgInterview recorded - 3rd of April, 2023On todays episode of the WTFinance podcast I had the pleasure of speaking with Matthew Piepenburg, During our conversation we spoke about whether the FED has control over the debt market, Risk of US Dollar losing its hegemony, what happens with a debt collapse and the winners and losers of such an event. I hope you enjoy!0:00 - Introduction0:45 - Can the current situation get worse?7:45 - Does the FED have control over the debt market?11:55 - Risk of International US Dollars flooding the c...2023-04-0547 min WTFinanceWill a Currency Collapse lead to Bretton Wood 2.0? with Matthew PiepenburgInterview Date - 28/11/2022During todays podcast I had the pleasure of speaking to Matthew Piepenburg, Commercial Director at Matterhorn Asset Management and co-founder of SignalsMatter.com, has extensive experience in alternative investments, law, and finance, with particular expertise in managed futures, credit and equity investingDuring our conversation we talked about why the monetary system will collapse, what the catalyst for the crash would be, potential for CBDC/Bretton Wood 2.0 & how to protect your wealth during this period. I hope you enjoy!0:00 - Introduction0:20 - Why will the monetary system collapse?7:22...2022-11-3054 min

WTFinanceWill a Currency Collapse lead to Bretton Wood 2.0? with Matthew PiepenburgInterview Date - 28/11/2022During todays podcast I had the pleasure of speaking to Matthew Piepenburg, Commercial Director at Matterhorn Asset Management and co-founder of SignalsMatter.com, has extensive experience in alternative investments, law, and finance, with particular expertise in managed futures, credit and equity investingDuring our conversation we talked about why the monetary system will collapse, what the catalyst for the crash would be, potential for CBDC/Bretton Wood 2.0 & how to protect your wealth during this period. I hope you enjoy!0:00 - Introduction0:20 - Why will the monetary system collapse?7:22...2022-11-3054 min The Intrinsic Value Podcast - The Investor’s Podcast NetworkMI Rewind: Investing Like Warren Buffett w/ Jake TaylorIN THIS EPISODE, YOU’LL LEARN:

00:37 - How encountering Warren Buffett changed Jake’s life.

09:36 - Jake’s motivation for writing The Rebel Allocator.

27:19 - How Jake is positioning his portfolio in these expensive market conditions.

29:42 - Why Berkshire Hathaway’s recent under-performance shouldn’t concern investors at all.

44:42 - What Jake wishes he could go back and tell his 20 year old self.

58:37 - How Jake thinks about holding cash in his portfolio.

And much, much more!

*Disclaimer: Slight timestamp discrepancies may occur due to podcast platform differences.BOOKS AND RESOUR...2022-09-301h 02

The Intrinsic Value Podcast - The Investor’s Podcast NetworkMI Rewind: Investing Like Warren Buffett w/ Jake TaylorIN THIS EPISODE, YOU’LL LEARN:

00:37 - How encountering Warren Buffett changed Jake’s life.

09:36 - Jake’s motivation for writing The Rebel Allocator.

27:19 - How Jake is positioning his portfolio in these expensive market conditions.

29:42 - Why Berkshire Hathaway’s recent under-performance shouldn’t concern investors at all.

44:42 - What Jake wishes he could go back and tell his 20 year old self.

58:37 - How Jake thinks about holding cash in his portfolio.

And much, much more!

*Disclaimer: Slight timestamp discrepancies may occur due to podcast platform differences.BOOKS AND RESOUR...2022-09-301h 02 The Intrinsic Value Podcast - The Investor’s Podcast NetworkMI181: A Great Monetary Reset w/ Matthew PiepenburgIN THIS EPISODE, YOU’LL LEARN:

01:43 - Why a “forest fire” is needed so badly in our economy today.

12:39 - Why the Federal Reserve will eventually have to put stocks on their balance sheet.

26:30 - The role gold plays in a portfolio.

29:38 - Why now is potentially a great time to allocate to gold.

38:58 - How Matthew thinks about the valuation of gold.

And much, much more!

*Disclaimer: Slight timestamp discrepancies may occur due to podcast platform differences.BOOKS AND RESOURCES

Join the exclusive TIP Mastermind Community to engage...2022-06-1448 min

The Intrinsic Value Podcast - The Investor’s Podcast NetworkMI181: A Great Monetary Reset w/ Matthew PiepenburgIN THIS EPISODE, YOU’LL LEARN:

01:43 - Why a “forest fire” is needed so badly in our economy today.

12:39 - Why the Federal Reserve will eventually have to put stocks on their balance sheet.

26:30 - The role gold plays in a portfolio.

29:38 - Why now is potentially a great time to allocate to gold.

38:58 - How Matthew thinks about the valuation of gold.

And much, much more!

*Disclaimer: Slight timestamp discrepancies may occur due to podcast platform differences.BOOKS AND RESOURCES

Join the exclusive TIP Mastermind Community to engage...2022-06-1448 min The Intrinsic Value Podcast - The Investor’s Podcast NetworkMI125: Investing Like Warren Buffett w/ Jake TaylorIN THIS EPISODE, YOU’LL LEARN:

00:37 - How encountering Warren Buffett changed Jake’s life.

09:36 - Jake’s motivation for writing The Rebel Allocator.

28:22 - Why Berkshire Hathaway’s recent underperformance shouldn’t concern investors at all.

30:41 - What Jake wishes he could go back and tell his 20 year old self.

50:18 - How Jake is positioning his portfolio in these expensive market conditions.

55:57 - How Jake thinks about holding cash in his portfolio.

And much, much more!

*Disclaimer: Slight timestamp discrepancies may occur due to podcast platform differences.BOOKS AND RESOUR...2021-12-161h 02

The Intrinsic Value Podcast - The Investor’s Podcast NetworkMI125: Investing Like Warren Buffett w/ Jake TaylorIN THIS EPISODE, YOU’LL LEARN:

00:37 - How encountering Warren Buffett changed Jake’s life.

09:36 - Jake’s motivation for writing The Rebel Allocator.

28:22 - Why Berkshire Hathaway’s recent underperformance shouldn’t concern investors at all.

30:41 - What Jake wishes he could go back and tell his 20 year old self.

50:18 - How Jake is positioning his portfolio in these expensive market conditions.

55:57 - How Jake thinks about holding cash in his portfolio.

And much, much more!

*Disclaimer: Slight timestamp discrepancies may occur due to podcast platform differences.BOOKS AND RESOUR...2021-12-161h 02 The Intrinsic Value Podcast - The Investor’s Podcast NetworkMI Rewind: Why Warren Buffett Might Be Wrong with Matthew PiepenburgIN THIS EPISODE, YOU’LL LEARN:

6:53 - What is a Main Street investor and what are the risks and opportunities for this type of investor?

10:05 - Why is the next recession going to be worse than previous ones?

35:25 - Why might Buffett be wrong regarding macro environments and interest rates?

60:26 - How can you position yourself to mitigate risk?

And much, much more!

*Disclaimer: Slight timestamp discrepancies may occur due to podcast platform differences.BOOKS AND RESOURCES

Join the exclusive TIP Mastermind Community to engage in meaningful stock inve...2021-12-031h 20

The Intrinsic Value Podcast - The Investor’s Podcast NetworkMI Rewind: Why Warren Buffett Might Be Wrong with Matthew PiepenburgIN THIS EPISODE, YOU’LL LEARN:

6:53 - What is a Main Street investor and what are the risks and opportunities for this type of investor?

10:05 - Why is the next recession going to be worse than previous ones?

35:25 - Why might Buffett be wrong regarding macro environments and interest rates?

60:26 - How can you position yourself to mitigate risk?

And much, much more!

*Disclaimer: Slight timestamp discrepancies may occur due to podcast platform differences.BOOKS AND RESOURCES

Join the exclusive TIP Mastermind Community to engage in meaningful stock inve...2021-12-031h 20 The Drew Pearlman ShowWhat Really Matters with Matthew Piepenburg

2021-10-0945 min

The Drew Pearlman ShowWhat Really Matters with Matthew Piepenburg

2021-10-0945 min The Drew Pearlman ShowWhat Really Matters with Matthew PiepenburgMatthew Piepenburg is the Commercial Director at Matterhorn Asset Management and co-founder of SignalsMatter.com. He has extensive experience in alternative investments, law, and finance, with particular expertise in managed futures, credit and equity investing. He also has years of experience researching, evaluating and investing in alternative investments, from hedge funds and private equity vehicles to real estate. Matthew is also a published author and regular contributor to The Good Men Project and the author of the Amazon #1 New Release “Rigged to Fail,” which bluntly details the systemic and structural flaws behind central-bank distorted capital markets.

In the beginning of our co...2021-10-0700 min