Shows

Podcast – Fintech NewscastEp 274- Fifth Era Partners CEO Matthew Le MerleVery smart take on blockchain applications and technology investments from our guest Fifth Era Partners CEO Matthew Le Merle. Why the current payment system needs an update and the challenges of getting to the next step this week on the Fintech Newscast https://www.fifthera.com Click Subscribe to keep up to date on the world of fintech! Reach … Continue reading Ep 274- Fifth Era Partners CEO Matthew Le Merle

2026-01-2153 min

Breaking BanksNavigating the Evolving Landscape of Banking in the AI Era: What Every Institution Must KnowIn This Episode

In this episode of Breaking Banks, hosts Jason Henrichs, Brett King and JP Nicols delve into the transformative impact of AI and technology on the banking industry, and share insights on what institutions must do to not only survive, but thrive as AI rewrites playbooks.

The conversation covers the role of stablecoins, agentic AI, the future of smart contracts, smarter digital infrastructure, and how accelerated innovation cycles are reshaping the global financial system.

They explore the structural changes they see coming and the potential of AI in automating cross-border transactions...

2025-11-2732 min

Wharton FinTech PodcastThe Past & Future of Fintech Regulation with Michele AltIn this episode, Wharton FinTech’s Abhi Chadha sits down with Michele Alt, Co-Founder of The Klaros Group and former OCC regulator, to unpack the evolving relationship between fintechs and the U.S. banking system. Michele shares her insights from two decades at the Office of the Comptroller of the Currency (OCC) and her current work helping non-banks pursue bank charters. They discuss the shifting regulatory climate across administrations - from the OCC’s early fintech charter attempts, to the Biden-era freeze, and now a renewed openness under Trump 2.0. Michele explains the nuances of charter types like industrial loan companies (ILCs...

2025-11-1932 min

The New Barbarians PodcastAgentic Finance: Building AI Analysts for the Debasement Trade Era — with Vlad Stanev of QuantlyAgentic Finance: Building AI Analysts for the Debasement Trade Era — with Vlad Stanev of QuantlyAs global currencies face increasing debasement pressures, the next evolution in finance is here — Agentic AI Analysts. 💡In this episode, we sit down with Vlad Stanev, Founder of Quantly, to explore how AI-driven financial agents are redefining strategy, analysis, and alpha generation in the new economic era.We discuss:✅ What “Agentic Finance” really means — and why it matters now✅ How AI analysts are transforming trading and portfolio management✅ The role of automation in navigating currency debasement✅ What the future of human + AI collaboration in finance looks likeIf you want...

2025-11-011h 00

Breaking BanksThe Futurists Takeover: A Fascinating Interview With Physicist Brian CoxIn This Episode

This week on Breaking Banks, we feature a fascinating and thought-provoking episode from our sister podcast, The Futurists, where Brett King welcomes celebrated experimental astrophysicist Professor Brian Cox.

Professor Cox, an English physicist and musician, is widely recognized for presenting science programs such as BBC Radio 4’s The Infinite Monkey Cage and the Wonders of... series. He is also the author of two popular science books: Why Does E=mc²? (And Why Should We Care?) and The Quantum Universe. He’s selected to deliver the keynote address at The Futurists X Summit in Dubai on Septe...

2025-09-1144 min

New Era FinTech PodcastEpisode 64: Using ChatGPT's Agent to accept LinkedIn requestsIn this episode, I'm exploring the capabilities of ChatGPT's Agent tool, demonstrating its ability to manage rather simple tasks such as accepting LinkedIn requests. I wanted to record the capability -- as it is today -- for posterity. As they say, this is the 'worst' that the technology will be -- it should, theoretically, always be improving. So what's it like? How good is it? Watch along. I'll show you how it moves the cursor around its screen, navigating and completing (ultra simple!) tasks on my behalf. Then I briefly discuss the implications of this...

2025-07-2411 min

New Era FinTech PodcastEpisode 63: Reimagining Wholesale Banking: Mustafa Zafarullah on Oman’s Digital ShiftIn this episode, I recently sat down with my former colleague Mustafa Zafarullah , to explore the evolving world of wholesale and digital banking in Oman and the wider GCC. Mustafa has 20+ years of banking experience across conventional and Islamic finance. He shares fascinating insights into how corporates are demanding greater autonomy through API banking, self-administration, and real-time reconciliation. We discuss the growing role of FinTech partnerships, the challenges banks face balancing innovation with cost (or the famous 'ROI' phrase!) and why hyper-personalisation will be key for digital banks. Mustafa also offers advice for...

2025-07-2130 min

New Era FinTech PodcastEpisode 62: Ali Hassan Moosa on Oman's Digital Banking & FinTech sectorIn this episode, I had the pleasure of reconnecting with the brilliant Mr. Ali Hassan Moosa, one of the most experienced and thoughtful voices in Oman’s banking and fintech sector. We explored the evolution of digital banking in Oman over the last decade, from legacy system upgrades to the recent launch of a forward-thinking digital banking regulatory framework.Mr. Ali shared insights from his time leading the Oman Banks Association, reflecting on the challenge of uniting competitive banks around shared goals like financial inclusion, digital literacy, and sector-wide modernisation. We discussed the rapid rise of...

2025-07-0832 min

New Era FinTech PodcastEpisode 61: Who owns AI in your bank? Who should own it?In this episode, I explore the complexities around who truly owns AI within a bank. I talk about the strategic and operational ambiguity that often gets in the way of successful implementation, and why moving from Proof-of-Concept ("PoC") to production is such a challenge. I examine the roles of different teams across the organisation, the political dynamics that can slow progress, and the vital importance of senior leadership stepping up to take real ownership. I also highlight the risks of leaving things vague and the need for a clear, structured approach to deploying AI across...

2025-07-0830 min

Fintech Talks - PodcastFintech Talks Podcast #85 - Contextual & Conscious Banking in the AI Age (With Paolo Sironi)(PT-BR) Em um cenário financeiro marcado por rupturas tecnológicas, mudanças regulatórias e a ascensão da inteligência artificial, conceitos como Contextual Banking e Conscious Banking começam a ganhar destaque como alternativas para repensar a função dos bancos na sociedade.Neste episódio especial do Fintech Talks, recebemos Paolo Sironi, autor, keynote speaker e líder global de pesquisa em banking e mercados financeiros da IBM, para uma conversa profunda sobre os rumos do setor financeiro na era da IA. Ao longo do episódio, discutimos a trajetória de Paolo...

2025-07-081h 06

New Era FinTech PodcastEpisode 60: Why banks should be learning about AI, not doing AIIn this episode I'm tackling the critical need for banks to focus on learning about AI rather than rushing into Proof-of-Concepts and implementations. I take a look at the macro current state of AI in financial institutions, highlighting that while there are some outliers, the majority are not actively utilising AI technologies in any compelling manner beyond "a bit of Microsoft Copilot". I also discuss the importance of building a foundational understanding of AI across all levels of an organisation - and I point to the Lloyds Bank Data & AI Summer School initiative as a...

2025-07-0521 min

Wharton FinTech PodcastGreylock General Partner, Seth Rosenberg - Building Fintech for the AI EraIn this episode of the Wharton Fintech Podcast, host Sabrina Fathi chats with Seth Rosenberg, General Partner at Greylock, about what it takes to build and back enduring companies at the intersection of fintech and AI. Seth shares lessons from launching Facebook Messenger, insights on founder-market fit, and how great early-stage companies validate ideas, build defensibility, and navigate market shifts. With deep takes on AI, blockchain, and the future of financial services, this episode is packed with practical wisdom for builders and investors alike.

2025-06-1953 min

New Era FinTech PodcastEpisode 59: Executives need to learn about AIIn this episode, I'm discussing the importance of learning when it comes to AI. Learning for board members, executives, team leaders and employees. Only when you've got a basic grasp on what the current range of technology can do, are you in the best position to decide how to move forward. Too many financial service organisations I see have pulled the trigger out of hope -- and ended up spending a lot of money for very little tangible outcomes. Playing, testing, learning, these are seriously important in today's environment. Have a...

2025-06-1216 min

Fintech Bar - PodcastEP. 12 | Crédito en la Era App: Cómo el Crédito Digital Está Redefiniendo el Consumo en México💳 ¿Cómo está cambiando el crédito digital la forma en que los mexicanos consumen, acceden a financiamiento y se relacionan con servicios financieros?En este episodio de Fintech Bar Podcast, hablamos del presente y futuro del crédito en plataformas digitales con dos líderes que están revolucionando el ecosistema:🔹 Gustavo Romero – Director General de Creditea México🔹 David Lask – Managing Director de Tala México🎙️ Hosts:Beatriz Durán (VP del Comité de Open Finance de Fintech México)Francisco Guzmán, Co-Fundador de Treo📌 ¿Qué descubrirás en este episodio?✅ Cómo el crédito digital se ha adaptado al consumidor mexi...

2025-05-1555 min

Belgium FinTech MediaFinTech Belgium Media Podcast - DFS24 - Simont BraunIn this episode, Koen is joined by Philippe De Prez from Simont Braun law firm to dive into the evolving regulatory landscape of European fintech. They discuss the latest developments in key regulations such as FIDA, PSD3, and PSR, and explore how the regulatory pendulum is swinging toward a more balanced approach, rather than a shift toward deregulation.Philippe sheds light on the European Commission’s 2025 work program and explains how the emphasis is shifting from directives to regulations, creating a more unified European market and preventing “gold plating.” The conversation also touches on how the upcoming AI Act...

2025-03-2020 min

Belgium FinTech MediaFinTech Belgium Media Podcast - DFS24 - DigitealIn this episode Koen is joined by Cedric Neve, the CEO of Digiteal, a pioneering Belgian company transforming the landscape of e-invoicing, e-payment, and open banking services. Cedric shares how Digiteal's SaaS API is setting a new standard, enabling businesses to seamlessly integrate these essential services into their software—an increasingly critical capability in light of upcoming Belgian and European regulatory changes. With a focus on automated processing and seamless payment integration, Digiteal is empowering businesses to thrive in this transformative era of B2B payments.They also dive into tools like KBC's Solucio, which exemplify how in...

2025-02-1419 min

Breaking BanksSpotlight: Banker’s Bookshelf — Future MoneyIn This Episode

We are excited to introduce you to Provoke.fm‘s newest podcast….a-spinoff-of-a-spinoff of Breaking Banks. Bankers Bookshelf brings cutting edge banking and fintech research to life, sharing the stories and strategies behind financial innovation, bridging the gap between technology and finance — a perfect fit for the Breaking Banks family! Host Paolo Sironi, global research leader in banking and financial markets at IBM Institute for Business Value, is a trailblazer in fintech himself.

In this episode, Paolo connects with Ronit Ghose who runs the Future of Finance team in Citi’s thought leadership...

2025-01-3028 min

New Era FinTech PodcastEpisode 58: How good is Google's Gemini?Here's a quick episode focusing on a quick experience I had this morning with Google's Gemini AI -- suffice to say, I don't think it met my expectations!

2025-01-1704 min

Wharton FinTech PodcastOdynn Founder & CEO, John Taylor Garner - Building an Embedded Loyalty & Fintech Next-Gen Program ManagerIn today's episode, Kimberly Zhang hosts John Taylor Garner, the Founder and CEO of Odynn - an embedded loyalty and fintech next-gen program manager that is transforming the way banks and fintechs engage with their customers through smart loyalty solutions. With a background in volatility trading and a passion for travel and rewards, John brings a wealth of experience and innovation to the loyalty space.

Tune in to hear about:

- The early challenges and milestones of building Odynn, and the lessons learned along the way

- What sets Odynn apart as a holistic loyalty optimization platform

- How AI...

2024-11-1933 min

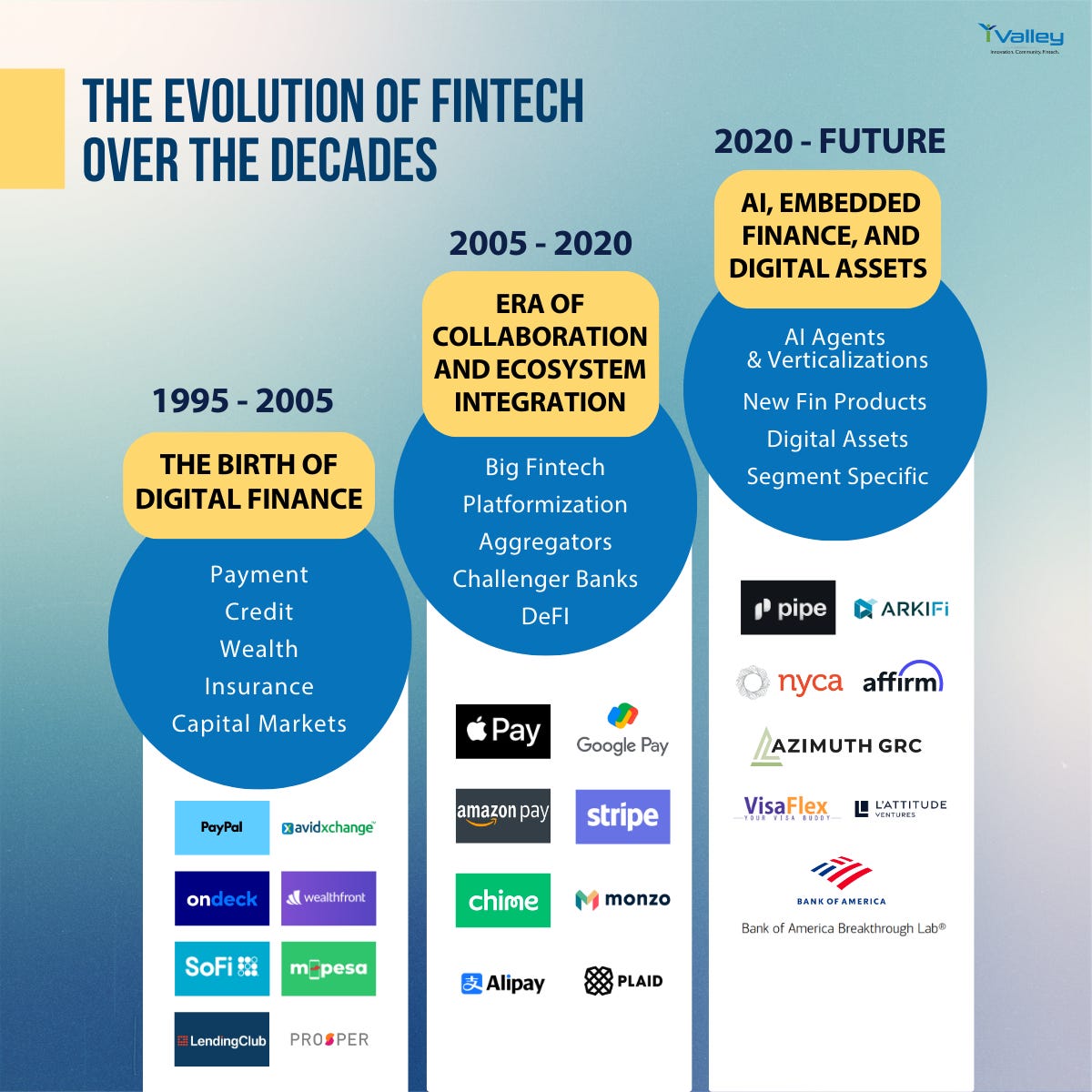

FINTECHTALKFuture of Fintech with AI - Rise of Verticalized embedded fintech and AI Agents in financial servicesHI FINTECHTALKERS, (opinion below are my own not necessarily of my guests)I sat down with Tom Brown, partner and general counsel at NYCA Partners, and Luke Voiles, a trailblazer in small business fintech and now CEO of Pipe. We explored the evolving landscape of fintech, diving into the shift from traditional financial services to embedded finance, to support vertical SaaS solutions, and the integration of AI agents into business ecosystems.Fintech began its journey of digitizing financial services in the late '90s, marked by the emergence of pioneers like PayPal. This...

2024-10-041h 17

This Week in Fintech's PodcastPlaid CEO Zach Perret: Plaid’s Next Chapter in the AI Era, ‘Fintech Spring,’ and Mastering Fintech HiringWelcome to the inaugural episode of This Month in Fintech, a new flagship podcast from the folks at This Week in Fintech.The show is hosted by Ryan Zauk, who will sit down monthly with some of the world’s most renowned tech and finance leaders, sharing their stories and products while unpacking their secrets to success.Our inaugural guest is none other than Zach Perret, Co-Founder and CEO of Plaid. Plaid has reached near ubiquity in Financial Technology, building the connective tissue underpinning many aspects of modern fintech. To give you a sen...

2024-09-2446 min

New Era FinTech PodcastEpisode 57: Sal Ghaznavi, former CFO at Careem (Uber)In this episode, I meet Sal Ghaznavi, an executive with 18 years of cross-sectoral work experience, spanning across the UAE, Ireland, Bermuda, and Pakistan, with experience working within FinTech and tech startups.

Sal has held key finance and commercial leadership positions at Careem (Uber) - the Middle East, North Africa, and Pakistan’s first and largest unicorn, operating in the ride-hailing, food and grocery delivery, and digital payments space.

Sal shares valuable insights into the business environment and opportunities in the Middle East, particularly in the UAE. He highlights the region's high smartphone and internet penetration ra...

2024-07-2933 min

New Era FinTech PodcastEpisode 56: Santander UK's chatbot walkthroughIn this episode, I show you a series of screenshots I took as I walked through the process of requesting a replacement debit card using Santander UK's chatbot, Sandi.

This might be one of those episodes that you might want to watch, rather than just listen to -- you can watch on Spotify, or you can watch the video on the podcast's YouTube channel.

Summary

Ewan reviews the chatbot capabilities of Santander UK. He compares it to other banks and highlights the strengths and weaknesses of their chatbot systems. Ewan is impressed with...

2024-07-2615 min

This Week in Fintech's Podcast🎧 The TWIF Podcast: Drew Edwards of Ingo PaymentsThis week, we're thrilled to host Drew Edwards, the CEO of Ingo Payments, on The TWIF Podcast.In this episode, we dive into Drew's 25+ year history of founding and running fintech companies, how payments has evolved since the PayPal era, the most interesting challenges to tackle in American payments today, where Ingo sits in the fintech landscape, and whether Drew will ever run a public company again.This is a Sponsored Episode.Drew has a long history as a fintech leader, and offers some...

2024-07-2250 min

Fintech Talks by Colombia FintechTradición y Reinvención: El Rol de los Abogados en la era de la Innovación Fintech¿Cómo pueden los abogados ser el motor de la innovación en la industria fintech? En este episodio de Fintech Talks, Nicolás Alonso, Senior Associate de Brigard Urrutia y Manuel Quinche, Socio Director de Cuatrecasas, exploran el papel crucial que desempeñan los abogados en la industria fintech, conectados estrechamente con sus clientes y siempre al tanto de las tendencias del mercado global. Aquí, los expertos legales no solo asesoran en ideas de negocios desde el punto de vista legal, sino que también impulsan la innovación. Acompáñanos a descubrir cómo los abogados entienden y navegan la...

2024-07-1728 min

New Era FinTech PodcastCVC Series: Episode 2 - Simon Hardie from FindexableWelcome to the second episode in our dedicated Corporate Venture Capital ("CVC") series here on New Era FinTech Podcast.

Today we're meeting Simon Hardie, CEO and founder of Findexable. Simon discusses the importance of innovation in the CVC space and. emphasizes the need for organizations to have a clear understanding of what innovation means to them and to measure its impact.

Hardie also highlights the opportunities in emerging markets, particularly in the Middle East and Africa, where there is still significant room for growth in the fintech sector.

Simon advises organizations to conduct...

2024-07-1233 min

New Era FinTech PodcastCVC Series: Episode 1, Grant Niven from MingzuluWelcome to the first episode in our dedicated Corporate Venture Capital ("CVC") series here on the New Era FinTech Podcast.

In today's episode, Grant Niven, founder and partner of Mingzulu joins me to discuss the role of CVC in the fintech and financial services ecosystem.

Grant gives us an overview of his background in financial services as well as his experience working with growth-stage founders, established banks, and the investment community.

Together we define the concept of CVC and explore the different types of CVC methodologies generally in use. We set out the...

2024-07-1046 min

New Era FinTech PodcastEpisode 53: Eric Fulwiler of Rival on better FinTech marketingIn today's episode, I'm sitting down with Eric Fulwiler, Co-Founder and CEO of Rival, the digital marketing powerhouse. Eric's storied background with the likes of 11:FS (he was CMO) and VaynerMedia (the GaryV company) means he's precisely the guy I wanted to put in front of you to discuss your marketing. FinTech companies tend to really struggle with Sales and Marketing. I know dozens who find it such a hard nut to crack. So I spent this episode firing questions at Eric about how FinTech CEOs should really be thinking about managing their Marketing -- and by extension, their...

2024-07-0828 min

New Era FinTech PodcastEpisode 52: HSBC's chatbot walkthroughHere's a screenshot walkthrough of the HSBC UK chatbot -- calling it Conversational AI is somewhat of a stretch. I've also recorded this for my other project, Conversational AI News. I would recommend you watch this one on Spotify so you can follow along with the screens, or you can find it on my LinkedIn profile or directly on the Conversational AI post.

2024-07-0312 min

New Era FinTech PodcastEpisode 51: Chatbot head-to-head (Lloyds vs NatWest)In this episode, I'm putting the Lloyds Bank chatbot head-to-head with the NatWest chatbot and see how both systems handle the same enquiry.

At the start of the episode, I begin by outlining the concept of Conversational AI chatbots and then I do a screenshot walk-through of each chatbot's responses as I experienced it.

This episode is best watched, rather than listened to - so I would recommend checking it out via Spotify so you can see the video.

2024-07-0128 min

New Era FinTech PodcastEpisode 50: Claus Nielsen from CX FactsIn this episode, I'm meeting Claus Nielsen from CX Facts. CX Facts is a platform that provides customer perception data to banks and large corporates.

Claus explains that while transactional data is readily available, there is a lack of customer perception data, which is crucial for understanding how customers view the bank's products and services.

CX Facts aims to bridge this gap by offering a SaaS tool that allows banks to collect feedback from customers in real-time and analyze the data through a dashboard.

This helps banks and corporates optimize their banking relationships...

2024-06-2719 min

prevencepodcastSkaitmenizacija – ne žodžiais, o darbais - Evaldas Remeikis | Prevence Podcast #62Ramybė, užtikrintumas ir tvirta verslo vystymo kryptis. Tai ką tikrai pajausite ir išsinešite iš mūsų paskutinio podcasto su verslininku, investuotoju Evaldu Remeikiu. Tai pašnekovas išgyvenęs įvairius investicinės aplinkos ekonominius ciklus ir žinantis kaip juose veikti.

Evaldas ir jo šeima valdo Pan Baltic rinkoje tvirtai stovinčią privataus kapitalo valdymo įmonę „Era Capital“, apimančią net 20 įmonių ir turinčią net 400 darbuotojų.

Pokalbyje išgirsite:

🔹 „ERA Capital“ istorija ir įmonių grupės valdymo ypatumai. Bendrovės „ERA Capital“ atsiradimo pradžią lėmė poreikis efektyviai valdyti vis didėjantį grupės įmonių skaičių. Su Evaldu aptarėme įvairiapusius įmonių grupės vald...

2024-05-171h 12

Fintech Talks - PodcastFintech Talks [Edição Extra] - Tendências e Perspectivas para o Mercado Fintech, com Bruno DinizNeste episódio extra o especialista Bruno Diniz, host do Fintech Talks Podcast e Cofundador da Spiralem Innovation Consulting, conta 6 tendências em inovação financeira e fintech que precisam estar no radar dos decisores e profissionais do setor.

Os insights foram registrados na última edição do evento Fintech Revolution Experience da Startse.

***

Quer ampliar seus conhecimentos sobre fintech e inovação financeira? Adquira os exemplares dos livros mencionados por Bruno Diniz neste episódio:

O Fenômeno Fintech: https://amzn.to/2PB1X7f

A Nova Lógica Financeira: https://amzn.to/45S69Dq

A Era da Criptoeconom...

2024-04-1939 min

New Era FinTech PodcastEpisode 49: Key strategies for selling to banks with Dan Ilett of TollejoIn this episode, I'm talking with Dan Ilett of Tollejo about sales and marketing techniques for FinTech companies selling to banks. We discuss the importance of building relationships, understanding customer needs, and differentiating from competitors. Dan emphasizes the need for collaboration between sales and marketing teams and the value of listening to customers. He also introduces the concept of "The Mirror", a research approach that helps companies gather feedback from customers and align their messaging and positioning. Dan recommends engaging with advisors and focusing on nurturing relationships with potential customers. Something very close to my heart -- because I've...

2024-04-1533 min

Belgium FinTech MediaBelgium Fintech Magazine Podcast - DFS23 - IxorIn this episode, let’s focus on Regtech again, Koen is joined by Roel Verbeeck, founder of Ixor. They will explain how AI-driven tools like IxorDocs are revolutionizing document processing. In a nutshell, Roel discusses the standardized e-invoicing landscape and the potential for increased data quality and innovation.A whole fascinating programme, in this era of AI development, if you ask me.Thank you for tuning into our podcast about global trends in the FinTech industry.Check out our podcast channel.Learn more about Fintech Belgium and Digital Finance Summit....

2024-04-1214 min

New Era FinTech PodcastEpisode 48: Is it time to launch eSIM data roaming in your bank mobile app?In today's episode, I'm discussing the opportunity of launching an eSIM roaming offering for your bank. I think this can be a compelling additional service feature (and fee earner) for many institutions. I talk through my thinking and give some suggestions for the vendors that banks might consider to talk with including (in no particular order) gigs.com, 1Global, Airalo and Holafly. Also Breeze given their recent announcement with Western Union. Other vendors are available I'm sure! (I don't have any relationships with these companies.)

2024-03-2826 min

New Era FinTech PodcastEpisode 47: Getting out from behind your deskIn today's episode, I'm discussing the importance of getting out from behind your desk (again). This was inspired by a conversation I had with a bank CIO last week discussing techniques and ideas of 'staying up to date' when you're surrounded by pressure on a constant basis! This one is mostly aimed at senior executives working in banks. Let me know what you think!

2024-03-2627 min

New Era FinTech PodcastEpisode 46: Roundtables - a guide for FinTech vendorsIn today's episode, I am discussing roundtables. This is an ultra-compressed version of the workshops I regularly host for FinTechs interested in learning how to host effective roundtables for bank executives. I've been to a lot of them as a bank executive and I've experienced some great ones... and some not-so-great ones. I have compressed many of the points into this episode -- so if you've got a roundtable coming up, I hope this can be useful. As always, if you need any advice or perspective, or if you need someone to host your upcoming roundtable, please reach out.

2024-03-2249 minWharton FinTech PodcastMastercard, President & CTO Ed McLaughlin: Emerging Technologies in PaymentsKailee Costello hosts Ed McLaughlin, the President & Chief Technology Officer of Mastercard

Tune in to hear about:

- Evolution of payment systems: Mastercard's journey into the digital era

- Adapting to the digital payment landscape: Mastercard's evolution and innovations

- Navigating quantum computing: securing payment systems and anticipating future challenges

- Quantum computing's potential in fraud detection and loyalty enhancement

- Mastercard's AI-powered fraud detection and prevention strategy

- The frontier of Generative AI technology

- Mastercard's role in global economies: ensuring resilience, security, and innovation

- Fostering fintech innovation: Mastercard's collaborative approach

- Shaping the future of payments: Mastercard's...

2024-02-2632 min

Fintech Talks - PodcastFintech Talks Podcast #17 - Perspectivas Para Investimentos em FintechsO ecossistema fintech presenciou um período de grandes investimentos entre 2019 e 2021, com forte atividade de fundos de Venture Capital, altos valuations das startups e extrema euforia.

Contudo, a escalada das taxas de juros nos Estados Unidos e todo o contexto pós-covid trouxe uma forte ressaca para o mercado, fazendo com que os investimentos minguassem. Assim, em 2022 e 2023, vimos um ritmo fraco de aportes e os fundos de Venture Capital exigindo uma redução da queima de caixa pelas startups investidas e movimentos mais objetivos rumo à lucratividade de suas operações.

Neste episódio do Fintech Talks Podcast, falamos...

2024-02-221h 00

New Era FinTech PodcastEpisode 45: Tom Green from UqudoI have long been a fan of identity and authentication player, Uqudo and today I'm bringing you an interview with their Chief Operating Officer, Tom Green. I asked Tom to give us an overview of Uqudo and the company's offerings and to comment on some of the trends he is seeing in the wider marketplace around the topic of digital identity and verification. You can find Tom's profile on LinkedIn right here.

2024-02-2017 min

Fintech Talks - PodcastFintech Talks Podcast #16 - O Mercado de Tokenização de Ativos FlorestaisA tokenização de ativos é um dos temas mais discutidos atualmente no mercado financeiro, algo que o próprio Banco Central do Brasil tem fomentado com a criação do Drex – abrindo caminho para a economia tokenizada.

Contudo, além do mercado financeiro, diferentes setores estão sendo fortemente transformados com a introdução dessa tecnologia. Um desses setores é o mercado de ativos florestais que encontrou na tokenização uma maneira eficiente de se financiar e de desenvolver um mercado secundário que pode ampliar ainda mais o seu alcance e liquidez.

Neste episódio do Fintech Talks Podcast, falamos sobre ess...

2024-02-151h 09

New Era FinTech PodcastEpisode 44: James Barker of Tech Market Access on the business of salesI have been banging on about the importance of the right sales methodology for FinTech companies for the longest time. In today's episode, I sit down with Sales expert, James Barker of Tech Market Access, to discuss the business of sales. James talks about his approach to enabling financial technology vendors to best engage and then convert prospects. You can find James on his LinkedIn profile.

2024-02-1225 min

New Era FinTech PodcastEpisode 43: Tesco Bank and Banking as a Service (BaaS)In today's episode, I'm discussing the LinkedIn post I wrote about the news that Barclays Bank will buy Tesco Bank for about GBP 700M. My post was asking what things would look like, instead of selling the bank, Tesco -- the British supermarket behemoth -- moved everything to run on top of a Banking as a Service provider. How would this work? Could it work? What are the possibilities? I recorded this podcast to explore the topic in a bit more detail. Some of the providers I mentioned are Griffin, The Bank of London, NatWest Boxed, Clear Bank and...

2024-02-0923 min

New Era FinTech PodcastEpisode 42: Lana Brandorne on Stockholm FinTech WeekIn this episode, I sit down with Lana Brandorne, co-founder of Stockholm FinTech Week to find out more about the event (12-16th February next week) and to get her view of the growing FinTech ecosystem in the country. You can connect directly with Lana on her LinkedIn profile and book tickets at the Stockholm FinTech Week website. If you're heading to the event, do let me know and let's see if we can meet for a coffee.

2024-02-0822 min

New Era FinTech PodcastEpisode 41: Get yourself to Stockholm!In this episode, I'm previewing the interview I've got coming up with Lana Brandorne, co-founder of Stockholm FinTech Week. I briefly discuss the Swedish (and Nordic) ecosystems and suggest that visiting the event next week in Sweden could be a good idea, especially if you're aiming to connect with banks, vendors and other suppliers driving the FinTech ecosystem in the Nordics. Let me know if we can say hello or have a coffee -- the quickest way to contact me is via my LinkedIn profile. Standby for the interview with Lana coming shortly.

2024-02-0704 min

New Era FinTech PodcastEpisode 40: Getting in the room with banksIn this episode, I'm doing a mini summary of the workshop I regularly host for fintechs, regtechs and vendors selling to banks.

In many firms, the marketing, sales and business development is somewhat disjointed - often because it's been working really well that way in the past. Now though, it's increasingly difficult to connect to the target bank executives if you don't already know them.

In this taster, I take you through some of the topics I like to discuss during my workshops. If you'd like to know more, drop me a note and let's...

2024-01-2551 min

New Era FinTech PodcastEpisode 39: Subaio & subscription managementIn this episode, I'm discussing the subscription management pioneer Subaio. Just last week I was with the company at their 2024 offsite and held a workshop with them on the topic of "a day in the life of a banking executive". Thank you to the Subaio management for the opportunity to contribute and thank you to the whole team for their great welcome and hospitality. You can find more about Subaio at http://www.subaio.com.

2024-01-2117 min

New Era FinTech PodcastEpisode 38: Engaging with bank executivesIn this episode, I discuss some techniques and ideas around how to think about engaging with bank executives in the context of introducing your product or service to them in the most effective manner.

2024-01-1626 min

Fintech Talks - PodcastFintech Talks Podcast #11 - A regulamentação do mercado cripto e dos VASPs no BrasilA criptoeconomia segue avançando no Brasil, tanto que já foi dado início no processo de regulamentação deste mercado e um consulta pública referente às regras dos VASPs (Virtual Asset Service Providers) foi aberta em dezembro de 2023.

Neste episódio do Fintech Talks Podcast, falamos com Alessandra Martins, sócia responsável pelo segmento fintech no escritório de advocacia Machado Meyer, sobre esse movimento regulatório e sobre a evolução regulatória das fintechs no Brasil, de maneira ampla.

***

Quer saber mais...

2024-01-111h 03

Fintech Talks - PodcastFintech Talks Podcast #10 - Os Avanços, Oportunidade e Desafios da Inteligência Artificial (IA)Em 2023 vimos uma explosão nas discussões sobre Inteligência Artificial (IA), sobretudo puxadas pelo avanço da AI Generativa.

Neste primeiro episódio de 2024 do Fintech Talks Podcast falamos com Gil Giardelli, futurista e fundador da consultoria 5era, sobre as aplicações desta tecnologia no mercado financeiro e em diversos outros setores, sobre as iniciativas de regulamentação do tema ao redor do mundo, sobre os potenciais impactos na sociedade daqui por diante e muito mais!

***

Quer saber mais sobre a próxima front...

2024-01-041h 03

Fintech Talks - PodcastFintech Talks Podcast #9 - Perspectivas para 2024... e além!À medida em que 2023 vai ficando para trás, chega a hora de fazermos uma retrospectiva do ano que passou e pensarmos sobre o que podemos esperar do ano seguinte.

Neste episódio do Fintech Talks Podcast, Bruno Diniz (host do podcast e sócio da Spiralem Innovation Consulting) conversa com Guga Stocco (Sócio da Futurum Capital) sobre as perspectivas para 2024... e além!

***

Quer saber mais sobre a próxima fronteira do mercado financeiro? Adquira o livro "A Era da Criptoeconomia" no Link abaixo!

...

2023-12-291h 00

Fintech Talks - PodcastFintech Talks Podcast #8 - As inovações financeiras no Brasil ao longo do tempoNeste episódio especial do Fintech Talks Podcast, trouxemos Luiz Cezar Fernandes, uma lenda do mercado financeiro nacional, para discutir a evolução das inovações financeiras que aconteceram por aqui ao longo dos tempos.

Luiz Cezar foi um dos arquitetos do nosso mercado, presente na fundação de dois ícones do capitalismo brasileiro (o Garantia e o Pactual) e responsável por algumas das inovações e mecanismos que utilizamos até os dias de hoje (como Selic, CETIP, CDI, Banco Múltiplo, etc.).

Em uma ocasião única, Bruno Diniz (ho...

2023-12-211h 38

New Era FinTech PodcastEpisode 37: Vendor business models - why you're struggling to sell to banksIn today's episode, I'm exploring a theme from my recent LinkedIn post where I was discussing why vendors (and FinTechs) often struggle when selling to banks. One of the key issues is the vendor business model, combined with a misunderstanding of how bank budgets tend to work. Join me for a diatribe - or broadcast - straight from my brain! This is a flavour of the sort of thing I explore when I'm doing workshops with software vendors and FinTechs. Let me know if I can help you - just drop me a note or find me via LinkedIn.

2023-12-2130 min

Fintech Talks - PodcastFintech Talks Podcast #7 - Análises alternativas de crédito e comportamento do consumidorCom o avanço dos serviços financeiros digitais, passamos a ver o surgimento de todo um ecossistema de soluções que possibilitam uma maior compreensão do consumidor - tanto do ponto de vista de análise de crédito quanto no mapeamento do seu comportamento - através da utilização de inteligência artificial e de informações advindas de smartphones e das redes sociais.

Neste episódio do Fintech Talks Podcast, falamos com a Mintech e a 4KST, empresas que (cada uma ao seu modo) são especializadas na coleta, modelagem e aná...

2023-12-141h 04

New Era FinTech PodcastEpisode 36: Slush, the awesome start-up event in HelsinkiHello! In today's episode, I'm talking to you about Slush, one of the most exciting start-up (and therefore FinTech) ecosystem events happening this week in the Nordics -- Helsinki to be precise. This is both an autobiographical one (I talk about some of my experiences of the event) and a recommendation one as I explore some of the key aspects of the Nordic and Finnish ecosystem that should (or could?) potentially be on your radar.

And for the Spotify (or video!) viewers, I'll talk you through my special Helsinki Jacket outfit.

I couldn't be at...

2023-11-3017 min

New Era FinTech PodcastEpisode 35: Recruiting top executive talent with LeathwaiteIn today's episode I'm bringing you a talent-focused conversation for executives who are aiming to hire - and for executives looking to manage their own career development. I'm delighted to be interviewing two executive search experts - Leathwaite's co-founder, James Rust, and his colleague Gordon Stanley who focuses on marketing, product, sales, and CEO hiring.

Both individuals are enormously experienced in the business of (international) executive search - Gordon actually placed me in a number of roles and James has overseen the development of many of Leathwaite's newest service offerings across the years.

Together they...

2023-11-3037 min

ERA DIGITALCómo Crear y Escalar Productos Digitales - Claves de SaaS | Era Digital PodcastIgnacio “Guli” Moreno es co-fundador de Capchase, una fintech que transformar la forma en que las empresas tecnológicas pueden financiar su crecimiento al ofrecer a los fundadores de startups alternativas de financiación que eviten diluir su propiedad de la empresa.

Capchase viene de recaudar una ronda de inversión Serie B de 80 millones de dólares y hasta la fecha ha recaudado casi 550 millones de dólares en total en una combinación de financiación de capital y financiación mediante deuda.

Guli, que es ingeniero aeronáutico...

2023-11-121h 42

New Era FinTech PodcastEpisode 34: Zero to 10 - what does version 1 look like?In this episode, I talk about my "Zero to 10 Approach" for managing executive ideas. You are presented with a (potentially great) idea from an executive. But it's complex. It's going to need a lot of work. And although it's a good idea, fully baking it (to the tune of $10m or something similar) and then presenting it to market can result in failure -- irrespective if whether the idea was good or not.💡 Often, direct reports don't want to discourage or say no to their bosses. It feels a little difficult to challenge whether any customer will use it...

2023-11-0915 min

New Era FinTech PodcastEpisode 33: The Pumpkin Emoji TestIn this episode, I am proposing a test for whether your bank is digital-first. Here's the test - can your bank quickly update their push notifications for Halloween to add a little Pumpkin emoji to their transaction notifications? Leading British neobank Monzo did this on Monday for me (and, I presume, all of their other customers!)

Can your (incumbent) bank do this, easily and quickly? The answer, alas, is generally no...

2023-11-0314 min

New Era FinTech PodcastEpisode 32: The end of the year approachesJust yesterday I was talking with a CEO I work with regularly. He was hoping that a new project idea he'd been discussing would be 'completed by the end of the year'. I challenged this. Especially the word 'hope'. Even though it FEELS like we have a long time before December 31st... we don't actually have much productive 'delivery' time left. I discuss this story in the episode and I talk through some brief approaches for programme and project managers to be considering right now!

2023-11-0310 min

ERA DIGITALAprendizajes De Crecer Una Fintech Internacional & Consejos Para Startups | Era Digital PodcastBenoit Menardo es co-fundador de Payflow.

Payflow es una aplicación de bienestar financiero y salario bajo demanda que permite a tu equipo cobrar cuando quieran.

Actualmente cuentan con cientos de empresas como clientes en España, Perú, Colombia, Portugal, Francia e Italia.

-------------------------------------------------------------------

Acelera el crecimiento de tu marca y negocio online: https://www.escalable.com

Escalable es una comunidad privada y filtrada de emprendedores e independientes que buscan escalar sus marcas, conseguir más clientes, digitalizar sus procesos y mantenerse altamente motivados y apoyados. Aplica en:

https://www.escalable.com

-------------------------------------------------------------------

¿Necesitas un estudio de grabación en Mad...

2023-10-151h 29

New Era FinTech PodcastEpisode 31: Nelson Wootton, CEO & Co-founder of SaaScadaIn this episode, Bryan sits down with Nelson Wootton, CEO and co-founder of SaaScada, the next-generation core banking software provider. If you're at all interested in core banking - the stuff that underpins everything - then I strongly recommend watching this one. Nelson gives an overview of the background that led to the founding of SaaScada and talks about how their platform's API-first development approach offers significant flexibility for neobanks and incumbents alike. You can find out more about SaaScada at https://saascada.com/.

2023-10-1335 min

New Era FinTech PodcastEpisode 30: Ali Noor, Senior Talent Partner at Lean TechnologiesHello! In today's episode, I'm discussing the business of talent acquisition with Ali Noor. Ali is a Senior Talent Partner at open banking leader, Lean Technologies. However we're not talking about them today, instead we're focusing on Ali's area of expertise: Talent acquisition. Have you ever thought about approaching internal recruiters like Ali before? Well, in this episode we talk through the whole process and get Ali's very experienced take on how to position yourself, how to engage and some tips on everything from LinkedIn to preparing your CV. Here's Ali's LinkedIn Profile.

2023-10-1226 min

New Era FinTech PodcastEpisode 29: Chris Purdie of Receiptable talks digital receiptsIn this episode, I sat down with Chris Purdie, CEO of digital receipts firm, Receiptable, to understand more about their business, their offering and to get his perspective on the wider FinTech ecosystem. I was particularly interested to understand how Chris and the team have developed their market offering - and I'm pleased to report that Chris gives a good overview! You can find out more about Receiptable here and find Chris via his LinkedIn profile.

2023-10-1026 min

New Era FinTech PodcastEpisode 28: George Toumbev of NatWest BoxedIn today's episode, I'm interviewing George Toumbev, Chief Commercial Officer of NatWest Boxed. You'll have heard of NatWest, one of the biggest banks in the UK, but did you know they've recently launched a new Banking-As-A-Service offering called NatWest Boxed? In our conversation, George discusses the background and gives an overview of the service offering -- I think it's going to be an incredibly compelling offering for the UK marketplace. I can't wait to see what services other companies begin to create on top of NatWest Boxed. If you'd like to find out more, George suggests contacting them directly via t...

2023-10-0220 min

New Era FinTech PodcastEpisode 27: Stewart Lockie of Hansal International on Retail Banking, Data & Customer ExperienceIn today's episode, we're joined by Stewart Lockie, a long-standing senior retail banking practitioner and CX champion. Stewart is CEO for Middle East & Africa of Hansal International, a specialist provider of business transformation services.

Stewart discusses his background in retail banking and the importance of partnership with technology to deliver great customer outcomes. You can find out more at http://www.hansal-international.com.

2023-09-2818 min

New Era FinTech PodcastEpisode 26: Mark Rennie Davis of Advistic on the GCC Payments OpportunityIn today's episode, I'm interviewing Mark Rennie Davis of Advistic. Mark is one of the leading payments experts in the GCC and consults widely on strategy for some of the largest players in the ecosystem. I asked him to give us an overview of some of the opportunities he's seeing and to give his perspective on the future of the marketplace. You can find out more about Mark by visiting https://www.advistic.com/.

2023-09-2419 min

New Era FinTech PodcastEpisode 25: A look ahead to Nordic FinTech Week in Copenhagen next weekIn today's episode, I'm discussing the upcoming Nordic FinTech Week event taking place in Copenhagen, Denmark, next week. I hope to bring you some stimulating insights from the show. There's still time to get a ticket! And if you'd like to know more, can I refer you to Episode 11 featuring Chris Crespo, one of the event organisers, giving us a great overview. You can find out more at http://www.nfweek.com. If you're heading there, do reach out and let me know, I'm looking forward to meeting lots of FinTech fans! See you in Copenhagen!

2023-09-2111 min

New Era FinTech PodcastEpisode 24: Revolut, the world's other local bankI today's episode I'm talking about the world's other local bank: Revolut. I love the fact that I can easily transfer money between other Revolut users seamlessly in all sorts of currencies - and with around 30 million users across 43 (soon to be 46) countries, Revolut is developing into a truly 'global' bank. In practical terms, you can easily transfer amounts between all these Revolut countries giving customers such a great experience, compared to making a dreaded "international payment". I have a difficult time with the patience needed for international payments that take days, and days, and days. So, do have...

2023-09-2109 min

New Era FinTech PodcastEpisode 23: Ben Goldin, Founder & CEO of PlumeryIn this episode, we bring you the origin story of Ben Goldin, Founder & CEO of Plumery, the Digital Success Fabric for banks and financial service providers. Bryan sat down with him to find out more about his journey and plans for the future with Plumery. Ben is incredibly well known in the core banking marketplace having most recently served as CTO and Chief Product Officer of cloud-based core banking platform Mambu. Prior to that, Ben was the First Chief Architect and Product Engineering Lead for Backbase. So we were obviously incredibly excited to hear about his plans with Plumery...

2023-09-1426 min

New Era FinTech PodcastEpisode 22: Managing Successful Core Banking Projects with Quantum SixIn today's episode, I'm talking with John Smith of specialist core banking experts Quantum Six. The company specialises in assuring seriously important programmes of work for banks - typically core bank replacements or migrations. I talked through with John the difficult scenarios that many banks face and how best to mitigate these with independent assurance. This is something I've had to deal with many times and unfortunately, I didn't have the opportunity to appoint third-party project assurance specialists! I definitely would next time. Find out more about the company at www.quantumsix.com or send a note to John...

2023-09-1329 minWharton FinTech PodcastBill Capuzzi - Breaking Down Wealth-tech with the CEO of Apex Fintech SolutionsJoshua Benadiva hosts Bill Capuzzi, the CEO of Apex Fintech Solutions, a leading provider of custody and clearing services for the financial industry. Apex's powerful brokerage solutions and APIs serve over 300 customers including Betterment, SoFi, and Public.com. Bill is also a partner at PEAK6 Investments, the parent company of Apex Fintech Solutions, and a board member of DTCC, a leading provider of market infrastructure for the global financial services industry.

In this episode, Joshua and Bill dive deep into the history and evolution of broker-dealers and trading, from the days of paper tickets and phone calls to the era...

2023-09-121h 04

New Era FinTech PodcastEpisode 21: Bryan's panel at Cedar-IBSi's Dubai SummitIf you didn't manage to make it to the Cedar-IBSi Digital Banking Summit today in Dubai, here's a snapshot of Bryan's panel discussion. In this episode, he outlines the importance and power of data particularly in the context of all the work he did establishing TNEX, one of the leading neobanks in South East Asia.

2023-09-0710 min

New Era FinTech PodcastEpisode 20: On the Business of Transformation with Thomas from DestracIn today's episode, I am excited to feature Thomas Nehring, Managing Director of DESTRAC. Whilst I am often focused on the front-end future-focused aspects of Transformation, Thomas and his team focus on another far more practical aspect of transformation: That is, the relationship between Business and IT. Many large banks find themselves getting into all sorts of trouble with shadow IT - technology systems run unofficially by business teams. They also struggle with projects and programme management - this is where Thomas and his team specialise. In this podcast, he outlines his approach to solving these issues! You can...

2023-09-0417 min

New Era FinTech PodcastEpisode 19: Wio Bank Personal's sign-up processWio Bank recently launched their personal banking offering in the United Arab Emirates and in today's episode, we take a look at their sign-up process. Does it meet your expectations of a world leading neobank? Let's take a look!

2023-08-2210 min

New Era FinTech PodcastEpisode 18: Bryan Carroll on transformation vs optimisationHere's a quick snippet of our MD of Digital Banking & Venture, Bryan Carroll, talking about the importance of encouraging and supporting digital culture in banking in an interview with The Asian Banker, published recently.

2023-08-2205 min

New Era FinTech PodcastEpisode 17: Delivering value early and oftenDelivering value early and often is a critical component of the Chief Transformation Officer's plan. If you're heading up a key project or programme of work, remembering that senior management and a whole variety of other stakeholders are expecting to see 'something' from you, regularly, is very important. You must be willing to show and tell, all the time, to help build confidence and belief - especially when there are hundreds of millions at risk. In this episode, I give a sneak peek into one of the topics I explore in our "Hard Lessons in Digital Transformation" executive workshops.

2023-08-2108 min

New Era FinTech PodcastEpisode 16: The ultra early stages of AI financial adviceIn this episode I'm showing off a demo featuring a fascinating video/audio from Justin Alvery (@JustLV on X) who has hacked a Google Nest device to run on top of a 'ChatGPT' equivalent. He's given it access to his messages and data. You'll hear him interacting with it like it's a personal AI from the future. My point in showing this off is to illustrate that it won't be long before these sorts of capabilities are available to cover all your financial demands, advice, insights and so on. What steps are your bank or FinTech taking in this...

2023-08-1908 min

New Era FinTech PodcastEpisode 15: Taking a look at ViaBillI have long been a big fan of the Danish FinTech ViaBill. They have been a favourite Buy-Now-Pay-Later provider of mine for the longest time and I regularly used their service when I lived in Denmark. I wanted to give you a bit of background on my experience and update you on the latest points - 1) did you know they raised $120m last year? 2) They're currently number 9 in the App Store Financial category in Denmark. Congratulations all. If you're looking for a BNPL partner in your region or for your financial services provider, you might want to check out...

2023-08-1810 min

New Era FinTech PodcastEpisode 14: Who are you, dear listener?I had a question from Martin asking about the profile of the listeners. Thanks for the question Martin - I decided to do a dedicated response rather than hold for the next Q&A episode. So, here we go: Mostly, I would say you are from my Linkedin profile, right? That's how the majority of you found this, I think... But it's a good question Martin because Spotify does provide some limited data - only based on those who are following the podcast via Spotify of course. It's better than nothing though - so if you were wondering who...

2023-08-1703 min

New Era FinTech PodcastEpisode 13: DIFC added hundreds of new FinTechs this yearIn this episode, I'm highlighting and discussing the rather impressive metrics released by Dubai's DIFC team for 2023 H1. They've added hundreds of new (FinTech) companies over the last year, along with more great figures. You can find out more by searching DIFC.ae for their 2023 H1 report.

2023-08-1610 min

New Era FinTech PodcastEpisode 12: How to get a senior role in Saudi Arabia with Disha PaiI've invited Disha Pai, Director of Ruya Recruitment, to discuss the Saudi Arabian job marketplace. Disha and her team have a deep, deep network across the country so she's the ideal person to give us a perspective on how the ecosystem is developing there. I ask Disha to comment on quite a lot of points - not least LinkedIn - and to talk through what she's hearing from hiring managers too. Let's begin!

2023-08-1618 min

New Era FinTech PodcastEpisode 11: Nordic FinTech Week - the inside viewYou should be thinking about attending Nordic FinTech Week. If you work in FinTech, it is one of the marquee events of the ecosystem. Because there is so much going on in the Nordic and Baltic region with FinTech, the event represents a fantastic opportunity to get a snapshot of what's moving in the marketplace.

Which, dear reader, is why I invited Chris Crespo, one of the organisers of the event, to come and chat. I asked Chris to give us an overview of the event, talk through the topics that will be covered and some of...

2023-08-1619 min

New Era FinTech PodcastEpisode 10: Getting a job in the Middle East (GCC)In this episode, I attempt to answer all of the questions I have been getting from those looking to work in the Middle East and Gulf countries. It's an in-depth one focusing heavily on LinkedIn, your CV and engaging with recruiters and talent acquisition teams in the region. If you've got any questions or you'd like additional help, please do reach out. I mention Episode 7 with Billy Brawn of FinSearch *A LOT* so I would strongly recommend listening to that one too if you haven't already.

I would very much welcome your own tips...

2023-08-1349 min

New Era FinTech PodcastEpisode 9: Q&A - your questions, my answersIt's time for our first ever Q&A episode. Please do send me your questions or comments to ewan@neweradigitalpartners.com and I'll aim to answer/feature them in the next Q&A episode. Please do also leave your name if you can, otherwise anonymous is fine. Hello to Liddie the dog (you need to listen for context).

2023-08-1211 min

New Era FinTech PodcastEpisode 8: Respaid and FinTech innovationIn today's episode, I am taking a look at a Y-Combinator FinTech startup called Respaid. They are helping companies automate the collection of small-value invoices with their AI-enabled system. However, the wider point I'm discussing with Respaid is highlighting that there is still so much innovation to be done in and around the FinTech marketplace.

Here's the link for Respaid's launch post: https://www.ycombinator.com/launches/Izr-respaid-collect-9x-more-small-overdue-bills-with-respectful-ai

2023-08-1213 min

New Era FinTech PodcastEpisode 7: Cafes vs BranchesPrompted by the interview I read today in Tearsheet (see link below), today's episode is about the seriously stimulating Capital One Cafe strategy. What is your bank strategy for branches? I ask because I know many banks will be reviewing their branch strategy at the moment. Is it time to turn your branches into Community Cafes? (And by the way, Capital One have 50 of these Cafes!)

Here's the Tearsheet interview I mentioned featuring Shaun Rowley, Head of Cafes for Capital One: https://tearsheet.co/podcasts/how-capital-one-cafes-help-gen-z-start-money-conversations-connect-into-local-communities (the piece is authored Zachary Miller at Tearsheet)

2023-08-1014 min

New Era FinTech PodcastEpisode 6: The Headhunter episode with Billy Brawn from FinSearchIn today's episode, I pull back the curtain on the world of recruitment here in the Middle East in my chat with Billy Brawn. Billy is the Co-Founder and Director of FinSearch and one of the most connected headhunters in the region. I asked him all the questions I wanted answers to - everything from his tips for your job hunt to how he and his team use LinkedIn, to the hiring trends he's seeing. Have a watch. Thanks for taking the time Billy!

2023-08-0928 min

New Era FinTech PodcastEpisode 5: The Talabat card (from ADCB)Hot off the press with the announcement today, I'm discussing my the launch of the Talabat credit card (supported by ADCB). Let's go!

2023-08-0714 min

New Era FinTech PodcastEpisode 4: Exploring your ecosystemIn this episode I'm taking inspiration from a job ad I saw on LinkedIn recruiting for a Chief Ecosystem Officer.... for a moment I thought it was a bank in the region hiring! Spoiler... it wasn't. But that got me thinking...

2023-08-0744 min

New Era FinTech PodcastEpisode 3: Powering your projects with an assurance teamIn this episode, I discuss the value of project assurance for digital transformation. It's not that popular a concept, I think because most banks tend to rely - perhaps obviously - on their own internal project teams to make things happen. But as I discuss, introducing a third party with no agenda other than your project's success (a project assurance team) can significantly improve delivery for everyone. (Also, for most of the episode I'm standing in the pouring British rain for your viewing and or listening pleasure!)

2023-08-0507 min

New Era FinTech PodcastEpisode 2: Bringing innovation to your bankI was inspired by the recent announcement of DNB Bank's NXT Accelerator to explore the topic of bringing innovation to your bank using this method. I walk through the offering for FinTechs for the NXT Accelerator and then discuss the benefits this can bring to both the FinTech and the bank.

2023-08-0526 min

New Era FinTech PodcastNew Era FinTech - IntroductionHello and welcome to the very first delivery from the New Era FinTech Studio. I'm Ewan and I'm going to aim to bring you a series of interesting interviews and videos around the topic of FinTech. Welcome! Let's see how we get on...

2023-08-0203 min

FinTech's DEI Discussions – Powered by Harrington StarrNadia's Humans of FinTech Podcast | Matthew Jackson, VP of Relationship Management at FreemarketWelcome back to another episode of the Humans of FinTech Podcast. Joining Nadia in The DEI Discussions Studio is Matthew Jackson, VP of Relationship Management at Freemarket.Matthew retraces his journey through FinTech, sharing why he chose to join Freemarket- a move which compliments his mission-driven approach to the industry. No two career journey's through FinTech are the same, but Matthew reminds us there should be a basis to the talent experience that is applicable to everyone, irrespective of background. We are reminded of the importance of attracting a greater diversity of people to the industry, broadening...

2022-12-0817 min

ERA DIGITALCómo tener Éxito Emprendiendo con Fundadora de Culqi y B89 | Era Digital PodcastAmparo Nalvarte fue Co-fundadora y CEO de Culqi, startup que vendió a Credicorp. Hoy es Co-fundadora y CEO de B89, un Neobanco y la primera fintech peruana en ser Miembro Principal de Visa.

-------------------------------------------------------------------

En Era Digital escalamos tu negocio con nuestra Agencia Integral de Growth Marketing 🚀

Construimos y operamos un sistema online de adquisición de clientes para tu negocio que garantiza atraer nuevos clientes de manera predecible, consistente y rentable, o no pagas.

https://www.eradigital.la/agencia

-------------------------------------------------------------------

Este capítulo fue grabado en www.co...

2022-10-261h 43

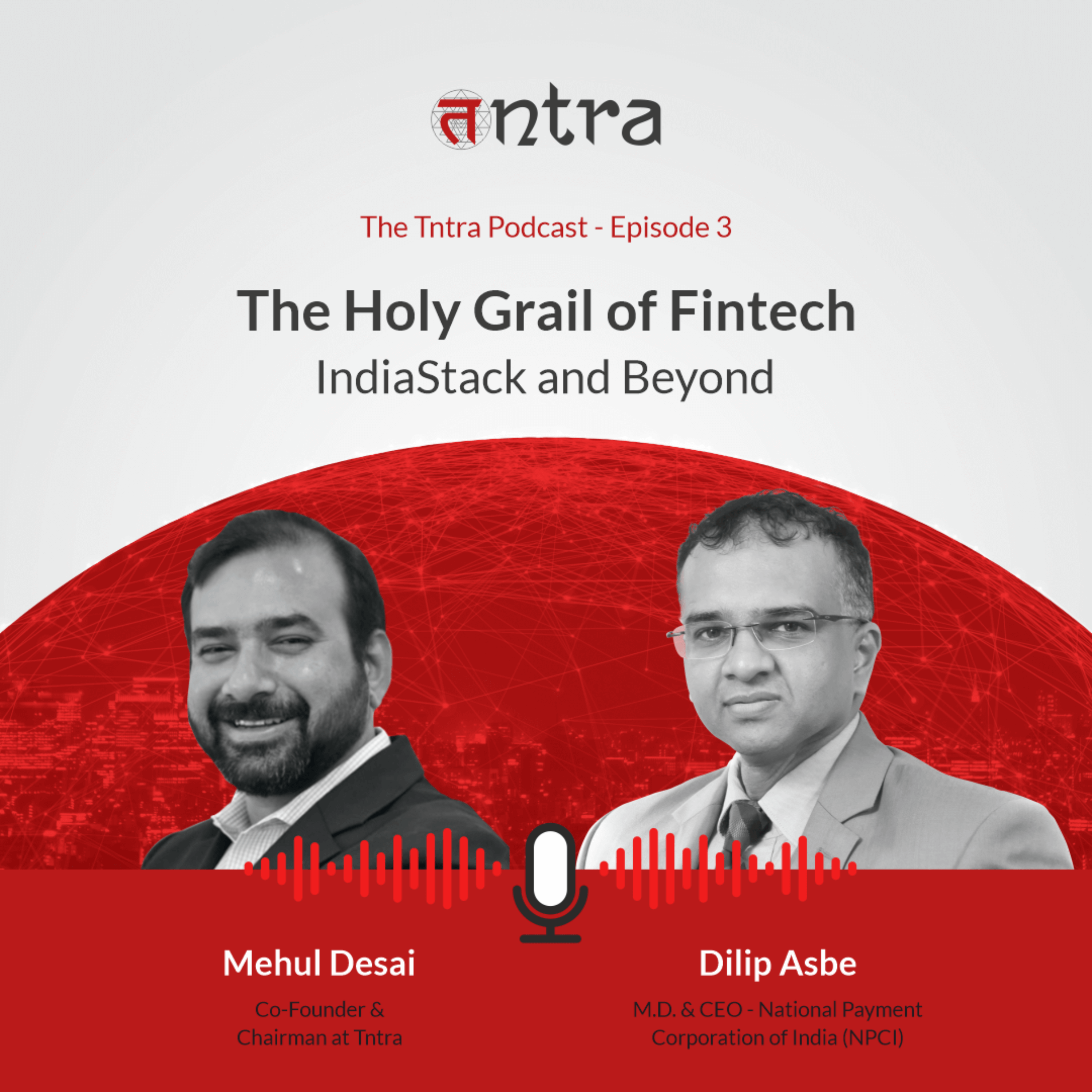

The Tntra PodcastThe Holy Grail of FinTech - IndiaStack and Beyond | Best FinTech Podcast on Apple PodcastDear Listeners, the third episode of The Tntra Podcast is out now. In this FinTech leaders podcast episode we bring to you Mr. Dilip Asbe, MD & CEO of National Payments Corporation of India (NPCI), the umbrella organization for operating retail payments and settlement systems in India. Dilip is a savant of the Indian financial services industry with over 20 years of vivid exposure ranging from Bombay Stock Exchange(BSE) to Euronet Worldwide and now the NPCI. He has played a pivotal role in designing, building and operationalization and management of large scale platforms like Unified Payment Interface (UPI...

2022-06-3056 min

Wharton FinTech PodcastJon Zanoff, Founder of Empire Startups & Stella Ventures - YOLO Fintech and the Get Sh*t Done KPI"We're in the YOLO era of fintech...it will lower CAC, but also LTV"

The always entertaining and insightful Jon Zanoff joins Ryan Zauk on today's fun episode.

Jon Zanoff is the Former Mayor of Fintech, founding Empire Startups, an 18,000+ person strong fintech community. Jon now runs Stella Ventures, an early-stage Fintech VC focused on the US & Canada.

Jon will join the Wharton Fintech Conference on April 22-23, leading a panel called “Building a Fintech, Lessons Learned” featuring Finch, Pando, Intrinio, Public.com, and MassChallenge Fintech. The conference will include numerous industry CEOs, VCs, founders, and more. Check out the star...

2021-04-1942 min