Shows

Serebro en Los DeportesANTHONY JOSHUA QUIEBRA LA MANDIBULA DE JAKE PAUL, PERO NO SU NEGOCIOJoshua no consiguió el nocaut temprano que prometió, pero sí lo más importante: imponer jerarquía.

Castigó al cuerpo, tuvo paciencia y cerró la noche con una derecha demoledora.

No fue brillante, pero fue suficiente para volver a ponerse en la conversación grande del peso pesado.

Anthony Joshua noqueó a Jake Paul, pero el resultado va más allá del nocaut. En este análisis te explico por qué ambos ganaron algo: Joshua avanza hacia una posible pelea con Tyson Fury, mientras Jake Paul confirma que su modelo de espectáculo en el boxeo sigue funcionando. ¿Quién salió mejor para...

2025-12-241h 02

Planet MicroCap Podcast | MicroCap Investing StrategiesThe Anatomy of a Fallen Angel: Management, Mispricing, and Turnarounds + Weight Watchers $WW Thesis with Paul Cerro, Founder and CIO of Cedar Grove Capital ManagementMy guest on the show today is Paul Cerro, Founder and CIO of Cedar Grove Capital Management, and today’s conversation is all about fallen angels — once high-profile companies that collapse due to poor execution, leverage, or macro pressure, but can become some of the most mispriced and compelling opportunities in the market.Paul breaks down the anatomy of a fallen angel, why these setups create structural market inefficiencies — especially in illiquid micro-caps — and how forced selling, headline-driven reactions, and information scarcity can disconnect price from fundamentals. Most importantly, he explains the key dividing line between a genuine...

2025-12-101h 00

Planet MicroCap Podcast | MicroCap Investing StrategiesThe Anatomy of a Fallen Angel: Management, Mispricing, and Turnarounds + Weight Watchers $WW Thesis with Paul Cerro, Founder and CIO of Cedar Grove Capital ManagementMy guest on the show today is Paul Cerro, Founder and CIO of Cedar Grove Capital Management, and today’s conversation is all about fallen angels — once high-profile companies that collapse due to poor execution, leverage, or macro pressure, but can become some of the most mispriced and compelling opportunities in the market.

Paul breaks down the anatomy of a fallen angel, why these setups create structural market inefficiencies — especially in illiquid micro-caps — and how forced selling, headline-driven reactions, and information scarcity can disconnect price from fundamentals. Most importantly, he explains the key dividing line between a genuine opportunity and a value...

2025-12-101h 00

The Investors' Corner🎙️ IC #7: A Phoenix Rising From the Ashes - Talking Weight Watchers (WW) Post-BankruptcyWeight Watchers: From Short to Long - An In-Depth Look at Post-Bankruptcy Strategies with Investor Relations Director David HeldermanIn this episode of The Investors Corner Podcast, Paul Cerro from Cedar Grove Capital Management speaks with David Helderman, Director of Investor Relations at Weight Watchers International (WW). The discussion covers the intriguing journey of Weight Watchers from facing bankruptcy to presenting new growth opportunities. Initially, Paul recounts how they shorted Weight Watchers in 2023 due to the company's financial struggles and slow adaptation to medication-based weight loss solutions. With the company now emerging from bankruptcy with significantly reduced debt, new leadership...

2025-12-0244 minSermonsAre People basically good?Paul sets out to tell us why God's work on our behalf is necessary. Why do we need Jesus? Why do we need salvation? Aren't human beings basically good?

2025-11-0200 minSermonsFor the ChurchWhen Paul says that God's power is toward us (the church), what does that mean? And how is the church the fullness of Christ? These two questions broaden our understanding of just how important the church is in God's plan of redemption.

2025-10-1900 minSermonsA Prayer for New EyesAfter exulting in the blessings that God has given the church, Paul prays that we would be able to see and comprehend those blessings, so that we may be able to live the Christian life.

2025-10-0500 min

The Investors' Corner🎙️ IC #6: Talking Sanuwave Health (SNWV) w/Tenva CapitalExploring SANUWAVE Health: An In-Depth Discussion with Jesse from Teneva CapitalIn this episode of The Investors Corner Podcast, host Paul Cerro from Cedar Grove Capital Management speaks with Jesse, the founder of Tenva Capital, about the small-cap healthcare company SANUWAVE Health (ticker: SNWV). They delve into the company's background, its innovative UltraMist device for treating complex, non-healing wounds, and its significant growth potential. Jesse details his investment thesis, the improved financial position of Sonu Wave, and the recent transformative changes under new CEO Morgan Frank. The episode also covers the market potential, competitive advantages, revenue model...

2025-10-021h 02SermonsRedemption and RevelationPaul continues in this word of praise by counting the blessings of those who are in Christ. This week's passage centers around the redemption we have in Christ and the revelation we have of Christ.

2025-09-2100 minSermonsUnseen BlessingsPaul emphasizes that the blessings we have in Christ are "in the heavenly places," why is this such an important idea in Christianity? Why does it matter?

2025-09-1400 min

The Investors' Corner🎙️ IC #5: Can PTON Sail Again? w/Alex MorrisEvaluating Peloton's Turnaround: A Deep Dive with Paul and Alex MorrisIn this episode of The Investors Corner, host Paul from Cedar Grove Capital Management is joined by Alex Morris, the founder of TSOH Investment Research. The discussion focuses on Peloton, its tumultuous journey through the COVID-19 pandemic, and efforts to stabilize and reignite growth under new management. Paul and Alex examine the challenges Peloton faces, including churn, product diversification, and financial restructuring, and debate its future prospects. They also consider whether Peloton might be a good acquisition target for a tech giant like Apple, and speculate...

2025-06-042h 28

Best Anchor Stocks17. Understanding Shorting w/ Paul CerroThis week I was lucky to be joined by my good friend Paul Cerro, founder of Cedar Grove Capital Management. We discussed the topic of shorting.I hope you enjoy it!Link to Cedar Grove: https://www.cedargrovecm.com/Link to Best Anchor Stocks: https://www.bestanchorstocks.com/Disclosure in Podcast Description: All investing involves the risk of loss, including loss of principal. Brokerage services for US-listed, registered securities, options and bonds in a self-directed account are offered by Public Investing, Inc., member FINRA & SIPC. Public Investing offers a High-Yield Cash...

2025-03-201h 07

Preferred Shares PodcastTexas Pacific Land Corporation: The Riches of RoyaltiesWelcome to Episode 19 of the Preferred Shares Podcast.We interviewed a special guest, Chadd Garcia, about Texas Pacific Land Corporation (TPL). Chadd is a veteran investment analyst, has worked in private equity, and is currently Vice President & Portfolio Manager at Ave Maria Mutual Funds.In This EpisodeHere are some highlights from the podcast episode about Texas Pacific Land Corporation (TPL):* [1:52] – Chadd explains how he became interested in TPL.* [2:53] – TPL’s early history* [4:48] – Oil was discovered in West Texas in the 1920s, but fracking in the 2010s signific...

2025-03-0351 min

The Investors' Corner🎙️ IC #4: The Future of Defense - The History, Advances, And OutlookThe Evolution of Defense: A Deep Dive with Lawrence HamillJoin Paul Cerro, Chief Investment Officer of Cedar Grove Capital Management, in the fourth episode of the Investor’s Corner Podcast. Paul sits down with fellow investment manager Lawrence Hamill from Fortune Financial to discuss the defense industry. They explore its historical context, technological advancements, and current geopolitical tensions, particularly focusing on the Ukraine-Russia conflict and potential scenarios involving China and Taiwan. They discuss the strategic implications for investors, the importance of industrial base readiness, and the evolving nature of defense spending, particularly wi...

2025-02-271h 23

The Investors' Corner🎙️ IC #3: Guest Interview with Head of Build-A-Bear's Investor RelationsExploring Build-A-Bear's (BBW) Strategic Evolution and GrowthIn this episode of The Investor's Corner, Paul Cerro, Chief Investment Officer at Cedar Grove Capital Management, talks with Gary Schnierow, Head of Investor Relations at Build-A-Bear Workshop (BBW). They discuss the company's growth and adaptation strategies over the past few decades, from its focus on experiential retail to its diverse store formats, e-commerce penetration, and international expansion through asset-light strategies. Schnierow highlights Build-A-Bear's shareholder-friendly capital allocation, recent initiatives like the Mini Beans product line, and content creation efforts. A significant emphasis is placed on the company's robust...

2024-12-1635 min

Mining Stock DailyPaul Gurney on Trade Wars, Commodities and the Need of More Capital Allocations for Resource DevelopmentIn this long-form episode, the conversation with Paul Gurney of Beacon Securities delves into the current geopolitical landscape and its implications for the commodities market. The discussion covers China's export controls on critical minerals, the volatility in global politics, and the challenges faced by the mining sector. The speakers also explore the future of monetary systems and the impact of tariffs on trade, while emphasizing the importance of critical minerals in technology and manufacturing. In this conversation, the speakers discuss the current state of the tech and commodity markets, the impact of interest rates, and the unique aspects of...

2024-12-0650 min

The Investors' Corner🎙️ IC #2: Diving into the ParkerVision (PRKR) Litigation Against Qualcomm (QCOM)David vs. Goliath: Parker Vision's Battle Against QualcommIn this deep dive episode, we unravel the intricate legal battle between Parker Vision and Qualcomm, highlighting the underdog's fight against a tech giant. The episode explores the revolutionary D2D technology developed by Parker Vision, the breakdown of licensing negotiations, and subsequent lawsuits alleging patent infringement by Qualcomm. As we navigate through emails, internal documents, and courtroom battles, we contemplate the broader implications for the tech industry, intellectual property rights, and the future of innovation. This gripping tale of corporate drama, technological breakthroughs, and high-stakes litigation promises insights...

2024-12-0114 min

The Security Analysis PodcastPaul Cerro: From Investment Banking to Fund ManagementPaul Cerro is a professional investor who runs Cedar Grove Capital Management, which focuses on long/short equity, merger arb, IPOs, and special situations. He also operates a substack where he posts his thoughts on various stocks and market trends.Links* Paul’s Twitter Feed: https://x.com/paulcerro* Cedar Grove Capital Management: DisclaimerNothing on this podcast is investment advice.The information in this podcast is for information and discussion purposes only. It does not constitute a recommendation to purchase or sell any financial instruments or other products. Inves...

2024-11-1354 min

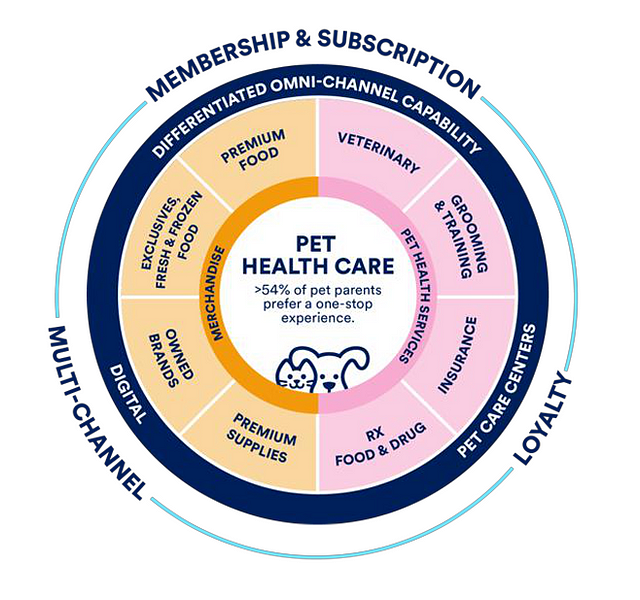

The Investors' Corner🎙️ IC #1: Post-Mortem On Our Thematic Pet TradeWelcome to The Investors Corner: Evaluating the Pet Trade In the inaugural episode of The Investors Corner podcast, Paul Cerro, Chief Investment Officer at Cedar Grove Capital Management, discusses the investment learnings behind their thematic pet trade. Paul explains the rationale for going long on Petco and shorting Chewy during the post-COVID pet adoption boom. The episode covers industry trends, such as the humanization of pets, pet spending habits, and the impact of COVID-19 on pet adoption rates. Paul also shares insights on the unexpected market reversals due to the return to work...

2024-11-0641 min

The Investing for Beginners Podcast - Your Path to Financial FreedomExploring Investment Strategies with Cedar Grove's Paul Cerrooin us on the Investing for Beginners podcast as we welcome Paul Cerro, Chief Investment Officer of Cedar Grove Capital Management. Discover his journey from Wall Street to Cedar Grove, and gain insights into his unique investment strategies and market perspectives.

- 00:00:51 - Paul Cerro's background: From Merrill Lynch to Cedar Grove.

- 00:01:18 - Competitive nature drives Paul's passion for stock investing.

- 00:02:22 - Focus on beating the S&P, not other investors.

- 00:03:43 - Investment strategy evolved pre, during, and post-COVID.

- 00:05:18 - Prefers long-term holds with lower volatility for stability.

- 00:06:07 - Discusses IPOs, arbitrage, and...

2024-11-0459 min

Planet MicroCap Podcast | MicroCap Investing StrategiesIt’s Not Necessarily Bottom Fishing Looking at MicroCaps with Paul Cerro, CIO of Cedar Grove Capital ManagementMy guest on the show today is Paul Cerro, CIO of Cedar Grove Capital Management. Paul was recently on Andrew Walker's Yet Another Value Podcast having a conversation about Red Cat Holdings $RCAT - a company we actually interviewed, now way back in the day, in 2019 when they were still on the Pink Sheets. He did an awesome job on the show, and invited him on today to learn more about his investing philosophy, strategy and why it's not necessarily bottom fishing when looking at MicroCaps.For more information about Paul Cerro and Cedar Grove Capital Management...

2024-10-2439 min

Planet MicroCap Podcast | MicroCap Investing StrategiesIt’s Not Necessarily Bottom Fishing Looking at MicroCaps with Paul Cerro, CIO of Cedar Grove Capital ManagementMy guest on the show today is Paul Cerro, CIO of Cedar Grove Capital Management. Paul was recently on Andrew Walker's Yet Another Value Podcast having a conversation about Red Cat Holdings $RCAT - a company we actually interviewed, now way back in the day, in 2019 when they were still on the Pink Sheets. He did an awesome job on the show, and invited him on today to learn more about his investing philosophy, strategy and why it's not necessarily bottom fishing when looking at MicroCaps.

For more information about Paul Cerro and Cedar Grove Capital Management...

2024-10-2439 minSermonsAgainst HagarismWith the use of an old story from Genesis, Paul reframes the debate about the law. What does it me to be born of the Spirit?

2024-10-2000 min

Yet Another Value PodcastCedar Grove's Paul Cerro on what makes $RCAT drones unique + odds for winning SRR contractPaul Cerro, CIO of Cedar Grove Capital Management, joins the podcast to discuss his thesis on Red Cat Holdings (NASDAQ: RCAT), a drone technology company integrating robotic hardware and software for military, government, and commercial operations.

Cedar Grove RCAT thesis: https://www.cedargrovecm.com/p/red-cat-rcat-trade-worth-up-to-200-prcnt

Chapters:

[0:00] Introduction + Episode sponsor: Ycharts

[2:28] What is Red Cat $RCAT and why are they so interesting to Paul

[6:26] Why is $RCAT relevant in the drone market? What is unique about $RCAT drones?

[13:29] Capabilities of $RCAT drones and how much they are selling...

2024-08-2752 min

Chit Chat StocksBig Tech Cash Flow Projections; The Current Macro Puzzle; Is $HIMS Flying Too Close to The Sun?The Investing Power Hour is live-streamed every Wednesday on the Chit Chat Stocks YouTube channel at 1:30 PM EST. This week we were joined by special guest Paul Cerro to discuss:

(04:44) Hims & Hers: Flying Too Close to the Sun

(11:58) The Risk of Regulation in the Healthcare Space

(17:08) The Value Proposition of Hims & Hers in the Healthcare Industry

(23:55) Hims & Hers' Competitive Advantage in Telehealth

(33:34) Earnings Reports and Future Growth Potential

(35:52) Navigating Uncertainty and Understanding Market Indicators

(38:56) The Challenges and Opportunities for Lululemon and Celsius

2024-08-251h 04

The Investors' CornerRCAT: Event-Driven Trade Could Be Worth ~200%TL;DR* Red Cat Holdings (RCAT) is in the final two to be considered for a multi-year Army drone contract that could be worth ~$450 million; ~3.3x current market cap* Strong probability the company wins the contract given current contractor's (incumbent) battlefield issues and arguably inferior drone design* Additional exposure to other programs/contracts means a no-contract win does not mean the company’s future is not bright* Massive tailwinds for American-made drones to be built and put into field use as a direct result of the Russia/Ukraine war and military bu...

2024-07-2344 min

The Investors' CornerHims & Hers Health (HIMS): Much Upside, But Currently Tight Around the BeltThis is a free preview of a paid episode. To hear more, visit cedargrovecapital.substack.comPreliminary disclaimer: In order to continue being completely transparent with you all, I need to disclose that I was previously an employee of Roman Health Ventures (“Ro”), a direct competitor of Hims & Hers Health (HIMS). While I have not been an employee of them for several years, I’m still very knowledgeable about the inner workings of this industry and still hold shares as a previous employee.While I may drop in publicly available information about Ro for this partic...

2024-06-1204 min

The Investors' CornerM&A Arb Update: Analyzing the FTC Complaint Against Tapestry (TPR) and Capri (CPRI)As my first paid research post, I’m going to be going over the FTC complaint in detail and address all of their concerns, and provide rebuttals and counterpoints to each argument.Those of you reading this for the first time can read my prior two posts below from December of 2023 and March of this year.In each of those posts, I addressed the deal overall, and why before the FTC suit, it should not be blocked under anti-trust concerns.However, as we all know by this point, the FTC sued to block th...

2024-05-0831 min

The Investors' CornerDefense Contractors: Peace Means Having the Bigger StickMy old man had a philosophy: peace means having a bigger stick than the other guy.- Tony StarkEver since the dawn of time, men have been engaged in conflict primarily for economic, religious, and political reasons. From the ashes of WW2, the United States rose to become one of the world’s superpowers and thus, a key player in shaping the new world order. However, to be the keeper of the peace, wars still need to be fought both directly and indirectly and deterrents need to be put in pl...

2024-04-2815 min

Disruptivo con Juan del CerroEl deporte para el desarrollo y la paz - Efecto DisruptivoEl deporte tiene el poder de alinear nuestra pasión, energía y entusiasmo en torno a una causa colectiva". Amina J. Mohammed - Secretaria General de las Naciones Unidas En este programa Juan y Cris nos hablaron de la importancia de usar el deporte como el motor de impulso en el empoderamiento de las mujeres y las niñas, los jóvenes, las personas con discapacidad y otros grupos marginados hasta la promoción de los objetivos de salud, sostenibilidad y educación, el deporte ofrece un enorme potencial para impulsar los Objetivos de Desarrollo Sostenible y promov...

2024-04-2422 min

Baseball By Design: Stories of Minor League Logos and NicknamesCedar Rapids KernelsThe High-A Cedar Rapids Kernels fully embrace the corniness of their home state. Their logo has been around for more than a decade and a half, but it often goes underappreciated. Guests this week include:

Scott Wilson, General Manager, Cedar Rapids Kernels

Dan Simon, Studio Simon: www.studiosimon.net, Insta @studio_simon

Heather Hucka, Cerro Gordo County Conservation, Lime Creek Nature Center

Find the Baseball By Design podcast online:

Twitter @Count2Baseball

Instagram @baseballbydesign

linktr.ee/BaseballByDesign

Baseball By Design is a member of the Curved Brim Media Network.

2024-03-1957 min

The Investors' CornerCRE: "$1.2 Trillion of Losses Somewhere"“Once a $3 trillion asset class, offices now are probably worth $1.8 trillion. There’s $1.2 trillion of losses spread somewhere, and nobody knows exactly where it all is.”- Barry SternlichtThe first real public domino to fall in the CRE trade was New York Community Bank NYCB . In one day after the company reported $185 million in net charge-offs in the fourth quarter and cut its dividend, the stock closed down ~37%.This sent shockwaves in the market about the rising risks associated with the current state of the CRE market. Borrowers are due to rep...

2024-02-2411 min

The Investors' CornerIPO Notes: Amer Sports Goes PublicAmer Sports, an outdoor and sports equipment maker, recently announced that it was going public and is looking to begin trading on February 1st, 2023 under the ticker symbol (AS). F-1 here.The Finland-based company is looking to raise ~$1.7 billion at an $8.7 billion market cap. For those of you who might not recognize the name (not surprising), you should hopefully recognize some of the brands in its portfolio.I know I use Arc’teryx and Salomon for a lot of my footwear and outdoor gear for hiking/backpacking trips. They’re high quality and cons...

2024-01-3010 min

The Investors' CornerWeight Watchers International: Dreams & Aspirations**First and foremost before I dive into today’s post, I want to apologize for not sharing this note sooner with you all. 2023 was quite a hard year personally as I had both parents dealing with cancer-related issues and a portfolio company to manage.Because of that, I wasn’t able to really post my notes much last year as I clearly had other priorities. Thankfully, they’re both in the clear and the portfolio company has been sold. Going forward, I’ll be much more active and be back to my old self.With that, le...

2024-01-1516 min

The ModGolf PodcastSEASON 14 WRAP-UP / SEASON 15 PREVIEWThat's a wrap for Season 14 of The ModGolf Podcast! Our team is currently working on your next twelve episodes for Season 15, which launches in February 2024. We heard some amazing stories from a diverse group of guests who discussed how inclusion, technology, entertainment, music, celebrity, hospitality and community building intersect to shape the future of golf.

We want to thank our partner inrange® for presenting this episode of The ModGolf Podcast!

inrange® is a radar-based ball-tracking company that enhances the driving range experience by offering the most engaging gameplay and precise ball-tracking on the market. From pr...

2024-01-1424 min

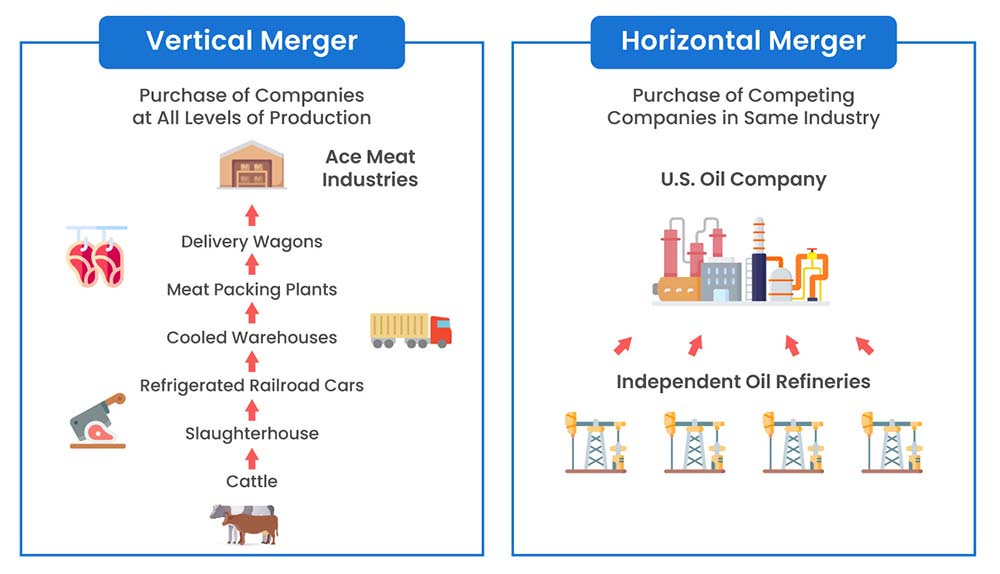

The Investors' CornerM&A Arb Update: Amazon Buying iRobotTL;DR* Having originally agreed to be acquired for $61/share in cash by Amazon in 2022, the deal price got revised down over the summer to $51.75/share* Given the FTC’s assault on big tech, Amazon is coming under fire for its history of anti-competitive practices on the Amazon website, thus putting the deal at risk* What was a rumored sure thing from the EU commission, they have changed their tune on the matter and believe that Amazon owning IRBT would lead to anti-competitive practices* Given IRBT relies heavily on user data to...

2023-12-2616 min

The Investors' CornerNegative Equity FalloutLast year in my “Winter is Coming” post, there was one particular callout I made around housing that I was concerned about if it materialized. Post below and link to callout.The call was regarding homeowners who, in a rush to purchase a home, would see their equity in the home significantly decrease or even face a total equity wipe. This was largely due to them paying ridiculous prices while rates did the job that rates do, affecting the homes’ value as they kept rising.My example from the article is below.For...

2023-12-2113 min

Chit Chat StocksRH (Formerly Restoration Hardware, Ticker: RH) with Paul CerroRH (formerly Restoration Hardware) is a luxury home furnishings retailer known for its high-end products and innovative design, but it contends with challenges in the retail sector and the impact of economic fluctuations on consumer spending in the home decor market. Listen as Brett and Ryan ask questions about the company, its business model, and its valuation. Enjoy the show!

*****************************

Chit Chat Money is presented by Interactive Brokers. Switch to the best brokerage in investing today: ibkr.com/info

******************************

Want updates on future shows and projects? Follow us on Twitter: https://twitter.com/chitchatmoney ...

2023-12-1459 min

Banrepcultural PodcastVoces Banrepcultural 21 - Las verdades que conviven. Una conversación entre John Paul Lederach y el padre Francisco de Roux.John Paul Lederach, académico estadounidense y experto en mediación de conflictos, es el invitado a la última conferencia del ciclo Hablemos de Verdad, organizado por el proyecto La paz se toma la palabra, en alianza con la Comisión de la Verdad.

Lederach conversó en 2019 con el padre Francisco de Roux, presidente de la Comisión de la Verdad acerca de los retos acerca de los retos y las oportunidades que permiten imaginar dinámicas y elementos de interacción social en escenarios polarizados con el ánimo de emprender caminos de convivencia.

El académico...

2023-12-011h 19SermonsCursed by the Law, Redeemed by ChristPaul continues his argument that Justification is by Faith using examples from the Old Testament

2023-10-2900 min

Mass Timber Construction PodcastMass Timber Market Updates - May 2023 - Week TwentyoneGet ready to dive into the world of mass timber construction with your host, Paul Kremer! This week's episode is packed with exciting news and developments, including Immersa International's recent court approval to purchase Structural and Mass Timber Corporation assets for a whopping 81 million US dollars. You'll also learn about Ascent and Cerro Cultural House winning the prestigious 2023 CTBUH Structure Award and the Best Building under 100 meters, respectively. In addition to these achievements, we explore our own feature in the CTBUH quarterly journal, which investigates the feasibility of mass timber vertical extensions in urban landscapes. You'll also h...

2023-06-0508 min

The Investors' CornerSlowly At First, Then All At OnceSlowly at first, then all at once.- Ernest HemingwayThe dialogue above is from Ernest Hemingway's 1926 novel, The Sun Also Rises. It's often attributed to Mark Twain or F. Scott Fitzgerald, or misquoted as something like “At first you go bankrupt slowly, then all at once.” But the theme is the same. Not much happens at the drop of a hat. A car traveling very fast down a road doesn’t abruptly slam into a wall without “things” happening along the way.Just like nations, banks, and consumers, they don’t...

2023-05-2912 min

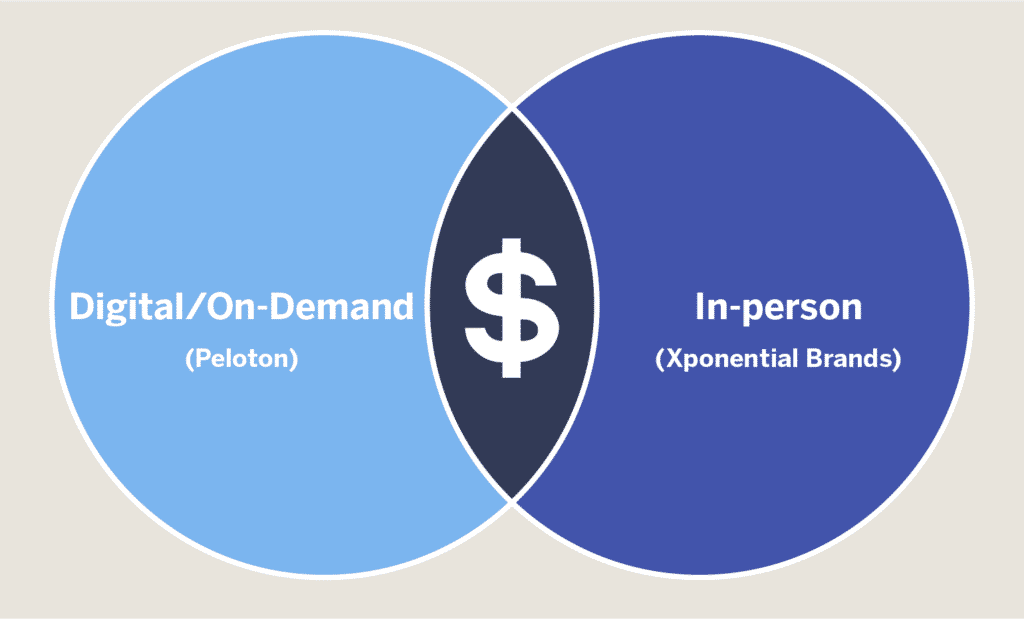

The Investors' CornerEarnings Recap: XPOF & PTONIf you enjoyed today’s post, please hit the heart button and if you have any feedback, comment below.Hi there, welcome to another earnings recap post by Cedar Grove Capital Management. Just a heads up, if you’re reading this in an email and it abruptly cuts off, that means it was too long to send this way so you’ll have to click through to read the rest.Today we’re going to be going over earnings for two companies that I’ve talked about quite a bit over the last 1.5 years.* Xponen...

2023-05-2814 min

The Investors' CornerM&A Arb: Microsoft / Activision Deal Part IIThis is a free preview of a paid episode. To hear more, visit cedargrovecapital.substack.comIf you like today’s post, please like and share. I run a combination of a free and paid notebook that highlights my notes, thoughts, opinions, and trade ideas.You can do so by subscribing via the link below and selecting which “tier” you would like to be a part of.Hello everyone, thanks for making it back to part II of my two-part notes on the Microsoft $MSFT and Activision $ATVI deal. If you missed part I, you...

2023-04-2402 min

The Investors' CornerQ1'23 CGC Quarterly LetterFund PerformanceIn Q1 2023, Cedar Grove Capital Management, LLC (“Cedar Grove Capital” or the Fund” or “CGC”) returned -10.1% gross return compared to 7.5% for the S&P 500, 16.8% for the S&P Consumer Discretionary ETF XLY, -17.2% for the Cannabis ETF, and 3.0% for the Russell 2000.Q1 Market CommentaryQ1 had an interesting start to the year as buyers that took advantage of tax loss harvesting looked to restart their positions. Heavily shorted companies were squeezed and holders looking to quickly cover their positions only added fuel to the fire. However, the narrative that infla...

2023-04-0911 min

The Investors' CornerRH '22 Earnings: An Inflection PointHi there, welcome to another post by Cedar Grove Capital Management and our first post sharing our thoughts on a recent earnings release.Posts like this will generally go to paid subs but this one will be completely free and the following earnings recap will be partially free with all others after being paywalled.If you enjoyed today’s post, please hit the heart button and if you have any feedback, comment below.Earnings RecapLast week, RH $RH released its Q4’22 and FY’22 earnings and they weren’t the most spectacu...

2023-04-0315 min

The Investors' CornerM&A Arb: Microsoft / Activision Deal Part IIf you like today’s post, please like and share. I run a combination of a free and paid newsletter that highlights my notes, thoughts, opinions, and trade ideas.You can do so by subscribing via the link below and selecting which part you would like to be a part of.Hey folks, thanks for joining me again for another post by Cedar Grove Capital Management. Today I’m revisiting the Microsoft $MSFT and Activision $ATVI deal that we originally wrote about in April of 2022.If you’re interested in our thoughts and our tr...

2023-03-2412 minSermonsThe Divine Origins of the Gospel of ChristIn his letter to the churches in Galatia the Apostle Paul frontloads the Gospel

2023-03-0500 min

Chit Chat StocksInvesting Power Hour #40: $AMZN Fires 18,000 People, $MSFT and ChatGPT, $TSLA Delivery NumbersThe CCM Investing Power Hour is a live-streamed show every Thursday at 4:00 PM PST. On the show, Ryan, Brett, and a rotating list of guests have an unscripted discussion on a variety of investing topics.

You can watch the show on our YouTube channel here: https://www.youtube.com/c/ChitChatMoney

Follow the show on Twitter: https://twitter.com/chitchatmoney

Subscribe to our newsletter: https://chitchatmoney.substack.com/

Interested in more of Paul's work? Find it here: https://substack.com/profile/28187575-paul-cerro

******************************

This episode is sponsored by...

2023-01-081h 02

The Investors' CornerWinter is ComingHey everyone, welcome back to another article by Cedar Grove Capital Management.If you like today’s post, please hit the heart button, comment with any feedback, and share it with friends if you find it useful.This post might be too long for your email so if it abruptly cuts out, just open it in your browser to see the whole thing.IntroductionBack in September, we published our thoughts on the consumer and what led us to liquidate our positions due to what we believed was not a light at...

2022-12-2420 min

Chit Chat StocksCan Anyone Buy a Small Business? With Paul CerroPaul Cerro is the CEO of Cedar Grove Capital. As he joins us today, Paul describes the transition that he is making with his investing decisions. Paul is focusing on buying small private companies. Listen closely to learn more about this strategy and how Paul expects it to play out. Enjoy the show!

*****************************

Interested in becoming a member of 7investing? Subscribe with code “MONEY” and get $100 off your annual subscription for life: https://7investing.com/checkout/

*****************************

Want updates on future shows and projects? Follow us on Twitter: https://twitter.com/chitchatmoney

2022-12-2259 min

The Investors' CornerEmpty Words. Empty Promises. Exert Patience.If you like today’s post, please be sure to hit the heart button, comment with any feedback, and share it with friends if you find it useful.Cannabis has been quite the whirlwind over the last few years. Many investors know the pain of holding onto the hopes of a change in governmental policy that would immediately change the cannabis market.These changes specifically revolve around SAFE banking and the effect of what 280E would have on each of U.S. cannabis’ financial statements. I wrote about this late last year in the post belo...

2022-12-1300 min

Mega-Brands: Investing in Mega Trends & the Mega Brands Best Positioned to Add Value to Your WalletS3 Ep 3 - Paul Cerro, Cedar Grove Capital on markets, the consumer, cannabis, private investingToday I chatted with a dedicated Cannabis, Consumer and Consumer Tech investor, Paul Cerro from Cedar Grove Capital.

I met Paul on Twitter ( @paulcerro )and really enjoy his thoughts and reading his notes on substack https://www.cedargrovecm.com

We talked about the Fed, ZIRP and consumer behavior. We talked about Pauls current views on consumer spending and markets and when markets might bottom. We then talked about his firms new investment in a private pet grooming business and their plans for that new investment. Then we closed on cannabis and where we are with t...

2022-12-081h 02

Disruptivo con Juan del CerroMéxico 10 Emprendedores Sustentables #5 "Economía regenerativa para los bosques y el turismo"En este quinto y último episodio de la serie México 10 Empresas Sustentables podrás aprender sobre Economía regenerativa para los bosques y el turismo con dos increíbles empresas: Ejido Verde y Playa Viva. Por una parte David Leventhal fundador de Playa Viva nos habló que significa regenerativo, y a su vez nos explicó lo importante que es la naturaleza parra nuestra vida, es por ello que nació esta empresa para generar un impacto tanto en las comunidades cercanas, como en los visitantes y el ambiente. Y por otro lado Shaun Paul fundador de Ejido...

2022-11-231h 06

The Investors' CornerPTON: A Zero or Hero?If you like today’s post, please be sure to hit the heart button, comment with any feedback, and share it with friends if you find it useful.For those of you that may or may not know, I’ve said one or two negative things about Peloton (PTON) in the past.Okay, so I’ve been pretty pessimistic about Peloton, but how could you not be? The stock has performed so poorly that PTON is down >68% from its IPO day closing price back in 2019!Once one of the best-performing darlings during COVID, this c...

2022-10-3122 min

The Investors' CornerF45 (FXLV) M&A Arbitrage PlayIf you like today’s post, please be sure to hit the heart button, comment with any feedback, and share it with friends if you find it useful.At the end of September, F45 Training (FXLV) received an unsolicited proposal from one of its investors, Kennedy Lewis Investment Management LP (KLIM), to acquire the company in a $385 million take-private offer at $4.00 a share. For those of you that don’t know, F45 Training is the fitness studio brand that had a big investment from actor Mark Wahlberg back in 2019.It is also the comp...

2022-10-1011 min

The Investors' CornerQ3'22 CGC Quarterly LetterNote: All information and commentary are as of September 30, 2022.*Correction, an earlier post/recording referenced a gross 5.9% return.Fund PerformanceIn Q3 2022, Cedar Grove Capital Management, LLC (“Cedar Grove Capital” or the Fund” or “CGC”) returned 10.2% gross return compared to -5.3% for the S&P 500, 3.8% for the S&P Consumer Discretionary ETF XLY, -13.9% for the Cannabis ETF, and -2.5% for the Russell 2000.Market CommentaryI will be the first to admit that 1H of this year took me completely by surprise. The beginning of the year was all about mult...

2022-10-0113 min

The Investors' CornerWhy Petco Is A Better ROI Than ChewyIf you would like to listen to this post on Spotify, click here to visit our Podcast.If you like today’s post, please be sure to hit the heart button, comment with any feedback, and share it with friends if you find it useful.Petcare has been a big COVID beneficiary given the exponential growth in adoptions during the pandemic. This significant growth led to virtually increased spending in all categories: consumables, accessories, veterinary care, insurance, etc.With big-name public players like Chewy (CHWY) and Petco (WOOF), it might be difficult to un...

2022-09-2721 min

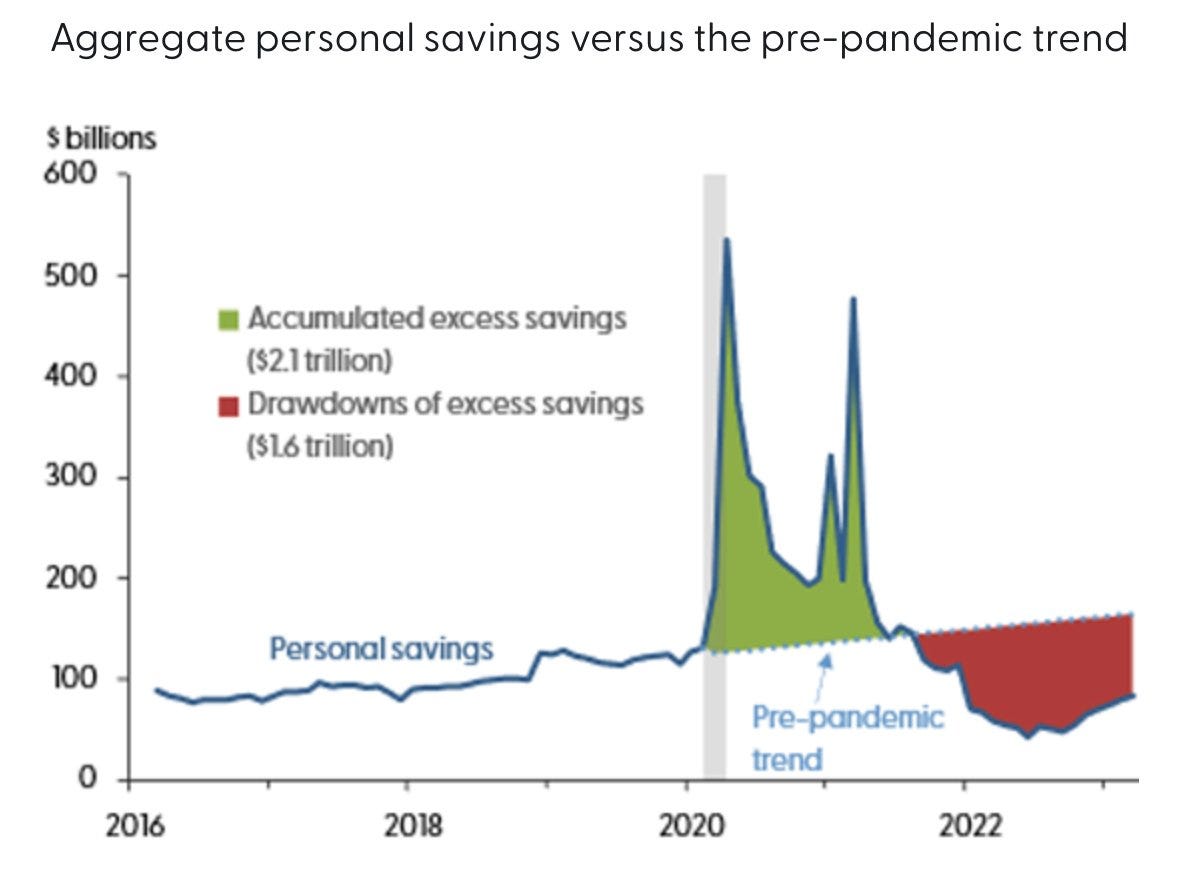

The Investors' CornerBroken Arrow: The Consumer is Not "Okay"This whole year so far, investors have been trying to gauge whether the consumer is okay. Many have pointed to various different data points that all have provided positive reassurance such as:Retail spendingTravel dataCOVID era savingsLow fixed mortgagesCompany earnings beat, etc.I know because I’m one of those investors. Investing in consumer and retail is what I do and while I have been burned in a few areas I have been more or less optimistic about the consumer based on all th...

2022-09-0619 min

The Investors' CornerBBW: Stuffed With Unrecognized ValueI never knew that Build a Bear (BBW) was actually a publicly traded company until the start of this year. In fact, I didn’t even know the company was still around. It was a store that I grew up with over two decades ago and by coincidence, heard a pitch on it back in January by Strat Becker. He discussed the company and his long thesis via a Commonstock pitch to Ross Klein, CIO at Changebridge Capital and it definitely got my attention.I opted to forgo pursuing the stock further at that time because I fe...

2022-08-3024 min

The Investors' CornerQ2'22 CGC Quarterly LetterNote: All information and commentary are as of June 30, 2022 except for M&A commentary on KSS and research posted for 1847 Goedeker.*Correction: A previous version said our Q2’22 performance was -31.2%.Fund PerformanceIn Q2 2022, Cedar Grove Capital Management, LLC (“Cedar Grove Capital” or the Fund” or “CGC”) returned -35.8% gross return compared to -16.4% for the S&P 500, -25.7% for the S&P Consumer Discretionary ETF XLY, -59.6% for the Cannabis ETF, and -23.9% for the Russell 2000.Market CommentaryThe first half of this year has definitely been one for the...

2022-08-1016 min

Mega-Brands: Investing in Mega Trends & the Mega Brands Best Positioned to Add Value to Your WalletS2 - Ep 12 Paul Cerro - Consumer/Cannabis/Tech focused Long/Short FundToday I chatted with a dedicated Cannabis, Consumer and Consumer Tech investor, Paul Cerro from Cedar Grove Capital.

I met Paul on Twitter ( @paulcerro )and really enjoy his thoughts and reading his notes on substack ( https://cedargrovecapital.substack.com )

We talked about the Cannabis industry and the absolutely huge potential for outsized gains for patient investors willing to hold through the VOL until federal regulation gets approved. It's only a matter of time, the more states approve it, the more likely a federal mandate will happen. A huge amount of investment capital will flow to...

2022-07-281h 03

Chit Chat StocksPetco (WOOF) with Paul CerroPetco focuses on enhancing the lives of pets, pet parents, and its Petco partners. The company offers everything your pet may need from food to services. Petco was founded in 1965 in San Diego, California. Listen as Brett and Ryan ask Paul questions about the company, its business model, and valuation. Enjoy the show!

*****************************

This episode is sponsored by Quartr, the new way of doing company research. Access conference calls, presentations, transcripts, and more for FREE on your mobile device.

Download Quartr on the App Store here: https://apps.apple.com/us/app/quartr-investor-relations...

2022-07-2848 min

The Investors' CornerXPOF: Unit Growth the Driver of Operational LeverageBack in January of this year, we released our research on Xponential Fitness $XPOF and revealed our long position in the name. A link to original research that breaks down the business and our thoughts can be found here as well as my chat with Chit Chat Money about the company as well.What we didn’t touch base on was how their growth will help expand their operational leverage and thus, profitable margins. So this is that post. How Xponential Fitness is a homerun based on our original findings earlier in the year.It st...

2022-06-2213 min

Chit Chat StocksXponential Fitness (XPOF) with Paul CerroXponential Fitness is the parent company of fully franchised boutique fitness locations. The company focuses on classes that are specific to the consumer and their needs. Listen as Brett and Ryan ask Paul questions about the company, its business model, and valuation. Enjoy the show!

This episode is sponsored by Commonstock, a social network for smart money investors. Check-out the platform here: https://commonstock.com/

Subscribe to 7investing with the code "Money" and get $100 off: https://7investing.com/subscribe/aff/4/

Want updates on future shows and projects? Follow us on Twitter: https://twitter.com/chitchatmoney

Interested to see more of P...

2022-06-1651 min

The Investors' CornerTwitter Merger Arbitrage Very AttractiveSo we all know about Elon Musk and his bid to acquire Twitter $TWTR earlier this spring. Given that it is Elon Musk, having a smooth acquisition was not in the cards so of course drama quickly ensued. Even though shares are trading at $38.98 and the offer price is $54.20 (so stupid), traders on the street are pricing in a deal happening at virtually zero. This is based on a pre-announcement price of $39.31 and a ($0.33) gain since then.This, however, has changed dramatically over the last two months like a rollercoaster based on three main things:

2022-06-1309 min

The Investors' CornerPetco Vital Care Economics Fueling GrowthLast week, we released our research on Petco's $WOOF pre-earnings announcement and we were happy with the results [WOOF: Banking on the Pet Industry]. The company beat on all estimates and what seemed to be retail armageddon due to the likes of Target $TGT and Walmart $WMT had appeared not to spread to Petco. Due to this, the stock has rebounded ~13% off the lows of last Monday on strong earnings.Our main thesis for Petco focused on building an “end-to-end” ecosystem that promotes and encourages pet parents to get all of their pet needs with them instead of s...

2022-05-3106 min

The Investors' CornerThe Real Reason The Stock Market Is Down* On average over the past century, according to an analysis conducted by Ned Davis Research, the S&P 500 has performed better when its EPS was lower than a year previously — not higher.* The S&P 500’s best quarterly returns in the past have come when its trailing four-quarter EPS were between 20% lower and 5% higher than where they were one year prior. * With the exception of quarters in which EPS was more than 20% lower than a year earlier, there’s an inverse relationship between EPS growth and the S&P 500’s performance.* Even with companie...

2022-05-2204 min

The Investors' CornerWOOF: Banking on the Pet IndustryTL;DR* Petco’s omnichannel push will help it solidify itself as top pet health and wellness company with a strong defensible moat and loyal customer base* Continued push into value-added services creates a closed-ended one-stop-shop ecosystem for all pet owners* Its strategic initiatives will drive top-line growth and significantly improve the company’s profitability and cash flow* Given the company’s strategic growth initiatives, the market is mispricing the potential for Petco to deliver outsized returns over the next few yearsPetco Health and Wellness $WOOF is a pet su...

2022-05-1926 min

The Investors' CornerWhat Drives Total Shareholder ReturnTSR Drivers (as % of TSR)I came across a deck made by Conor Hayley over at Alta Fox Capital which breaks down in a detailed 645-page report about what drives Total Shareholder Return for 104 companies he analyzed. Considering its length, I took one chart (above) that highlighted the three key drivers that data has shown to produce outsized returns and his commentary below.* On average, EBITDA growth contributed 59.82% of TSR and multiple expansion contributed 44.78% of TSR. * However, the medians tell a different story: EBITDA growth contributed 33.65% of TSR and multiple expansion contributed 65.71% of...

2022-05-0903 min

The Investors' CornerDPZ: Domino's Down But Not OutBackgroundDomino’s Pizza $DPZ has had a stellar run over the past decade, rising over 1,030% during that time. The company has shown its ability to rapidly expand overall store count, expand margins, and not only fend off app-based delivery companies but go toe to toe with them. Underlying business fundamentals remain strong for the company and while headwinds with inflation have put pressure on the company, for now, recent price action has led to an attractive opportunity to start a position in a long-term compounder. As part of my posts going forward, I’...

2022-04-2723 min

The Investors' CornerM&A Trade Idea Returning ~70%?TOC* Deal Specifics* Activision Context* Deal Price Action * What We Know* Odds of the Deal* Trade Strategy* Important Factors1) Deal SpecificsEarlier this year in January, Microsoft $MSFT announced it will acquire Activision Blizzard $ATVI for $95.00 per share (a 45% premium to its previous closing price), in an all-cash transaction valued at $68.7 billion, inclusive of Activision Blizzard’s net cash."With Activision Blizzard's nearly 400 million monthly active players in 190 countries and three billion-dollar franchises, this acquisition will make Game Pass on...

2022-04-2020 min

The Investors' CornerSBC: This Is A Chart You Don't Want To MissSBC Is Propping Up Adj. EBITDA* Many unprofitable companies are leveraging the use of stock-based compensation (“SBC”) when it comes to add-backs specifically geared towards improving overall adjusted EBITDA* This add-back can make many “unprofitable” companies look profitable (or less unprofitable) on a non-GAAP basis because accounting labels it as a non-cash expense* However, some companies are abusing this add-back and I wanted to show how bad by taking a few examples and showing how much SBC is as a percent of LTM sales and as a percent of total add-backs for adj. EBITDA

2022-04-1306 min

Macro InsightsHow to Analyze Sectors during Inflationary Times with Paul Cerro - SSST ep. 9In this episode I am joined by Paul Cerro (@PaulCerro on Twitter and Commonstock) where we discuss how to analyze industries, the pet and fitness industry, why supermarkets may be a good inflation hedge, how to look at companies during an inflationary time, and advise for new investors getting into investing. Paul is the Portfolio Manager for Cedar Grove Capital and brings a wealth of knowledge from his experience in the industry, so you're not going to want to miss this!

SUBSCRIBE AND GIVE A 5 STAR RATING

Follow Paul on Twitter and Commonstock @PaulCerro

2022-04-101h 10

The Investors' CornerQ1'22 CGC Quarterly LetterNote: All information and commentary are as of March 31, 2022.*Performance was miscalculated and was updated to reflect the current return.Fund PerformanceIn Q1 2022, Cedar Grove Capital Management, LLC (“Cedar Grove Capital” or the Fund” or “CGC”) returned -17.7% gross return compared to -4.9% for the S&P 500, -9.5% for the S&P Consumer Discretionary ETF $XLY , -18.5% for the Cannabis ETF $MSOS , -7.8% for the Russell 2000, and -6.0% for the Russell 2000 Midcap. The Fund believes that its long/short strategy will deliver outsized returns in the long run, and that near-term...

2022-04-0813 min

The Investors' Corner🚗 Americans Keeping Their Cars for LongerI remember when I was a kid, my dad would be the family mechanic and help tune and maintain our family cars. They weren’t anything extravagant but just the average family Toyota Camry and Nissan Altima that we held on to for over a decade. I’d always go with him to AutoZone to pick up parts to fix our cars and help out in any way I could, holding a flashlight or grabbing a tool mainly.This was traditional in our family, and I’m sure others as well, and it really got me asking myself...

2022-02-2309 min

The Investors' CornerRecession Indicator Starting to Flash* The term yield curve refers to the relationship between the short- and long-term interest rates of fixed-income securities issued by the U.S. Treasury. * An inverted yield curve occurs when short-term interest rates exceed long-term rates.* The U.S. curve has inverted before each recession since 1955, with a recession following between six and 24 months later, according to a 2018 report. It offered a false signal just once in that time.* The yield curve has been flattening over the last few months as the Federal Reserve prepares to hike rates, and some analysts are forecasting...

2022-02-1603 min

The Investors' CornerSweetgreen: Serving Green But Bleeding RedSummary* Once a VC darling, this “tech” oriented restaurant chain is anything but* The company is not differentiated and some aspects of its business expose it to more risks than others* Higher inflation and lack of pricing power will continue to eat into the company’s margins* Widening losses and no path to profitability should make investors wary of where the company’s priorities are* Compared to other restaurant brands out there, that are profitable, valuation metrics show just how overvalued Sweetgreen isBusiness OverviewSweetgre...

2022-02-1130 min

The Investors' CornerAmazon Buying Peloton? Here's The Case For Both SidesRumor Has It…Friday sparked renewed interest in Peloton $PTON after rumors leaked that Amazon $AMZN might be interested in acquiring the company. News of this sent the stock up as much as ~38% before settling down to $31.10, a ~26% increase from Friday’s close.I decided to take to Twitter to share my opinion on the matter which set off a very healthy debate on the cases for and against this deal actually happening. My Tweet, and sequential thread, garnered >63,000 views and many valid points on both sides of the fence. In resp...

2022-02-0728 min

The Investors' CornerNo Pain, No Gain. XPOF Going HigherSummary* Company hurt during COVID has executed well on a post-pandemic comeback and has almost returned to full pre-COVID levels* Broader tailwinds fueling a return to in-person workouts and the desire to try new fitness concepts* Management executing well on diversifying revenue channels, improving margins, and growing internationally* The stock is currently trading at 18.4x FY’22 earnings, a discount compared to the broader S&P index, consumer discretionary index, and other fitness namesBusiness OverviewXponential Fitness $XPOF is a boutique fitness studio franchisor that operates in No...

2022-02-0126 min

The Investors' CornerHow Much is Each "Subscriber" Worth?Enterprise Value per Subscriber* With high growth startups taking a beating over the last year, premiums investors have put on valuations for subscriber growth have shown their cracks* High flyers like Rent the Runway $RENT , Hims $HIMS , and Bark $BARK , saw their EV “dollar amount” per subscriber crater 85%, 89%, and 90% respectively since they went public* Seeing the difference between these two dates shows just how euphoric the market was during peak COVID* When looking at other subscription service stocks, it’s best to use this metric to sense check how much investors are pl...

2022-01-2803 min

The Investors' CornerRH: Too Cheap to Ignore at These LevelsGood morning everyone 👋🏼!Welcome to Cedar Grove Capital — your source for actionable insights, industry deep-dives, and single name coverage in the consumer(tech), and cannabis industries. If you are new, you can join below. Please hit the heart button if you like today’s newsletter and reply with any feedback.ForewordThe start of 2022 has not been kind to many of us. With a complete sell-off in technology names and fear of more FED rate hikes than expected, investors have no clue where to go from here. The unfortunate part of all this is that pan...

2022-01-2516 min

The Investors' CornerFitness in a Post COVID WorldGood morning everyone 👋🏼!Happy Thursday! If you’re reading this but haven’t subscribed, join our community of edgy investors interested in learning more about the markets and receiving recommendations on single-name stocks in the consumer, cannabis, and tech industries. Subscribe 👇🏼, it’s free!For this week’s post, I wanted to do an Industry Deep Dive [IDD] of the fitness industry and how it not only has but will continue to drastically change in a post-pandemic world. I’ll go over what it was, is, and will become of the industry and ways that as investors...

2022-01-2015 min

The Investors' Corner2021 IPOs Are Selling OffGood morning everyone 👋🏼!Happy Tuesday! If you’re reading this but haven’t subscribed, join our community of edgy investors interested in learning more about the markets and receiving recommendations on single-name stocks in the consumer, cannabis, and tech industries. Subscribe 👇🏼, it’s free!* Nearly 400 traditional IPOs, along with an additional 600 special-purpose acquisition companies (SPACs), occurred in 2021, representing ~$316 billion in deal value* Two-thirds of the companies that went public in the U.S. in 2021 are now trading below their IPO prices.* In the first eight months of the year, IPO shares rose. In November...

2022-01-1801 min

The Investors' CornerVolatility the New Normal?Volatility the New Normal* Looking at intraday percent moves of +/-1% for the S&P 500, 2020 and 2021 combined have almost more swings than 2016→2019 combined (243 vs. 272).* 2020 saw 62% of its number of trading days experiencing this +/-1% intraday price swings compared to 34% for 2021.* Access to commission-free trading, more cash during COVID, and leniency of ability to borrow on margin have allowed investors to move in and out of stocks more frequently.* Since the beginning of 2020 (2020 and 2021), the average intraday price movement upwards and downwards has been at its 10-year high → +0.70% and -0.63% vs. the next...

2022-01-0307 min

FrikindieviduosT03 Ep.23 :: “It's dangerous to go alone! Take this” Conociendo al Friki #9: Paúl RamírezDespués de mucho tiempo, volvemos a tener un invitado muy especial en el programa. En esta ocasión nos acompaña Paul Ramírez, siendo el noveno invitado de nuestra sección "Conociendo al friki" quién nos habla un poco de él, también sobre su amor por el cine y comparte con nosotros los temas y noticias de este episodio. Hablamos también de noticias relacionadas a Fortnite, más de Spider Man: No way home; y la controversia entre Sony y Disney, además comentamos sobre lo que esperamos ver en esta película.

2021-11-121h 13

Quemar un PatrulleroEpisodio 223: Ariel Minimal, Quién Dijo Que Todo Está Perdido?La excusa para un nuevo encuentro con Ariel Minimal fue escuchar "Who's next" de los Who, su banda favorita. Aquí extendemos el relato y hablamos de todo un poco para llegar a un intento de conclusión: Somos responsables de nuestros destinos. Debemos asumirlo. Abandonar la queja. Soñar de verdad y trabajar para hacer de esos sueños una realidad. Es mentira que no se puede. No depende del azar. Con el talento necesario, si va acompañado de una pulsión interior irrefrenable, tarde o temprano, la recompensa llega. Ariel, una vez, apoyó su dedo índice sobre la foto...

2021-11-091h 01

La Vereda OcultaDe Tonatzin a la vírgen de Guadalupe - T2 Ep1Las conocidas como advocaciones de la virgen María no son más que apariciones y representaciones de la misma madre de Jesucristo en diferentes partes del mundo y cuyas imágenes toman los rasgos raciales de los habitantes de cada lugar según en donde se aparezcan.En España y todos los países católicos hay infinidad de vírgenes que representan a María, resulta obvio deducir que los primeros lugares en donde surgieron estas vírgenes y toda la variedad de santos del catolicismo fueron países dominados antiguamente por los romanos y dichos país...

2021-09-1953 min

CGS PodcastJoe & Paul's Another Mining Podcast #3 Bluestone ResourcesJoe Mazumdar, editor of Exploration Insights and Paul Harris of CGS, discuss the Cerro Blanco gold development project in Guatemala with president & CEO Jack Lundin.

2021-08-0328 min

Medita PodcastMDT208 : ¿Cómo transitar momentos de crisis y miedos? Entrevista con Gisela HenglBienvenidxs a una nueva sesión de Medita Podcast, el día de hoy te tengo una entrevista muy inspiradora, me emociona mucho presentarte el día de hoy a Gisela Hengl, a quien sigo y admiro desde hace muchos años.Gisela Hengl, Maestra De Meditación, Sanadora Energética de la Ciencia Curativa De Brennan, Facilitadora de The Work de Byron Katie, entre muchas otras cosas, nos habla acerca de su camino, cómo ha transitado sus crisis y sus miedos y todo lo que ha aprendido en su proceso.Te invito a escucha...

2021-07-131h 01

Chefs LatinosChef Paul EscuderoChef Paúl Escudero desde Quito, Ecuador.

Su curiosidad en la cocina nace a muy temprana edad en casa de sus abuelos y es por ellos que se inspiró a dedicarse a esta profesión. Sin embargo, no tuvo el apoyo de su Padre debido a los estereotipos que tenía sobre los cocineros. En sus años de adolescente se dedicó a leer libros, ver videos y ser practicante en otros restaurantes. Paúl Escudero ha sido chef en varios restaurantes y da cursos de Gastronomía. Por causa de la pandemia, su restaurante cerró las puertas, p...

2021-06-1021 min

HCJB: Nuestra historiaPaul Rader y el Chicago Gospel TabernacleEl Tabernáculo Chicago Gospel, en esos días, era una iglesia muy poco usual. Estaba dirigido por Paul Rader, un evangelista que usaba música popular, dramas y panfletos impresos para hacer atractivo el Evangelio. Rader comenzó a usar la radio con regularidad en 1922 y se lo ha considerado el primer difusor religioso.Clarence Jones era responsable de muchos y diferentes ministerios en el Tabernáculo, lo cual incluía la estación de radio WJBT- Donde Jesús Bendice a Miles. El Tabernáculo Chicago Gospel se cerró muy poco después de una década...

2021-06-0901 min

Disruptivo con Juan del CerroDTV #251- Ejido Verde - Impulsando el desarrollo económicoEn este episodio Juan habló con Shaun Paul CEO de Ejido Verde una empresa resinera, de desarrollo social, posicionada para convertirse en un proveedor líder a nivel mundial en la industria de productos derivados de resina. Shaun nos contó que Ejido Verde busca reactivar la producción de resina de pino por medio de su innovador modelo de reforestación, para regenerar tierras degradadas estableciendo plantaciones agroforestales comerciales con el propósito de aprovechar la resina de pino. Se rigen bajo la metodología de Triple Impacto, es decir, toma en cuenta tres dimensiones: económi...

2021-03-2658 min