Shows

The Trillion Dollar Opportunity: Financial Inclusion | Emerging Markets | FinTechBuilding to Last: Lessons from Two Treasury Management CEOsIn our season finale, two treasury management CEOs share what keeps them going when building gets hard. John Santillan of Octa discusses building in public and why authenticity beats pretending to have all the answers. David Hanna of Finmo explains why surrounding yourself with people who challenge your thinking is essential for making better decisions.

2025-09-2908 min

The Trillion Dollar Opportunity: Financial Inclusion | Emerging Markets | FinTechFrom Spreadsheets to No Sheets: How Two Founders are Using AI to Solve Finance’s Trillion-Dollar ProblemsTwo founders are using AI to solve finance problems that keep CFOs up at night. David Hanna, co-founder and CEO of Finmo, discusses replacing the daily ritual of downloading 20+ bank statements with real-time global cash visibility. John Santillan, co-founder and CEO of Octa, talks about using AI to cut payment delays from 120 days to 30 days, unlocking billions in working capital. Discover how these startups are dragging business finance out of the spreadsheet and into the modern age. More on Finmo at: https://finmo.net/ and more on Octa is at: https://weareocta.com/

2025-09-2223 min

LatamList EspressoOmie raises $160M, Ep 217This week’s Espresso covers news from Kamino, SunCompany, Sempli, and more!Outline of this episode:[00:30] – Omie raises $160M led by Partners Group[00:41] – Kamino raises $10M in a round led by Flourish and Quona[00:48] – SunCompany secures $15M to expand clean energy operations[01:06] – Sempli secures $10M in debt[01:20] – Bugster raises $300K from 500 Global for AI testing[01:31] – Klar acquires Bineo[01:42] – Latamlist Roundup Sep 1st – Sep 15thResources & people mentioned:Startups: Omie, Kamino, SunCompany, Sempli, Bugster, KlarVCs: Partners Group, Flourish Ventures, Quona Capital, Banco de Occidente, Bancolombia, Banco AV Villas, Bancoldex, Fondo P...

2025-09-1602 min

Sparta Chicks Radio: Mindset | Confidence | Sport | Women#106: Quona Ross Atkinson on Ageing DisgracefullyHow does ocean surf ski paddling figure into one woman’s version of a mid-life crisis?We ask Quona Ross Atkinson on Sparta Chicks Radio this week!Quona grew up on a cattle station in North Queensland and started competing in rodeos, camp drafting and show riding from the time she was 3.An extensive career in barrel racing followed before she took up adventure racing in her 40s.Fast forward to 2019 and after just 5 years in the sport of ocean surf ski paddling, she’s about to compete in the famous 52km M...

2025-09-1354 min

The Trillion Dollar Opportunity: Financial Inclusion | Emerging Markets | FinTechLinda Yu: How Embedded Finance is Reshaping Emerging MarketsLinda Yu, Growth Partner at Quona Capital and formerly at SoftBank and Warburg Pincus, shares her journey to becoming an investor deploying billions in global investments. She believes that embedded finance has evolved from a FinTech niche to become the backbone of global commerce. Linda also shares her advice for startup founders pitching venture capitalists.

2025-09-0112 min

The Trillion Dollar Opportunity: Financial Inclusion | Emerging Markets | FinTechThank a Trucker – And Embedded Finance – for Supporting Global Supply ChainsHow did the coffee you drink get to your local cafe? Or the flour that went into your breakfast pastry? Or the latest electronic gadget delivered to your doorstep? Well, you can thank a trucker. Truckers are the unsung heroes of the global economy, and this is especially true in Mexico where 75 percent of freight moves by road. Maria Jose Aguilar Belmont, Investment Analyst for Quona based in Mexico City, joins Shannon as a special guest host to share two stories about how embedded finance is integral to supporting the global supply chain, including trucking. Santiago Molina, the CEO...

2025-07-2125 min

SRI360 | Sustainable & Responsible Investing, Impact Investing, ESG, Socially Responsible InvestingEmerging Markets: 3 Women Investing for Growth, Impact & Returns (#095)The mainstream investment community has long viewed emerging and frontier markets as high-risk regions fraught with numerous challenges. However, with growing populations and expanding digital access, these regions are poised to become the economic powerhouses of the future.In this compilation episode, we revisit 3 past conversations from Eliza Foo, Asha Mehta, and Monica Brand Engel, who are leveraging the power of impact investing to drive meaningful change across emerging economies.Each of these guests shared how they are turning risks into opportunities in emerging markets while earning impressive returns for their investors.By 2050...

2025-07-151h 38

The Trillion Dollar Opportunity: Financial Inclusion | Emerging Markets | FinTechBONUS: Advice for Founders Building in Tough TimesHow can entrepreneurs in Africa navigate today's challenging fundraising environment? Hosts Shannon and Johan, joined by Adrienne Henderson from Quona Capital, share essential insights for founders building FinTech companies in emerging markets. We’ll touch on why asset-light business models matter more than ever and the critical importance of choosing long-term investor partners.

The content here does not constitute tax, legal, business or investment advice or an offer to provide such advice, should not be construed as advocating the purchase or sale of any security or investment or a recommendation of any company, and is not an off...

2025-06-2305 min

The Trillion Dollar Opportunity: Financial Inclusion | Emerging Markets | FinTechHow Can Africa Build Its Own 'Fintech Stack'?In 2023, India accounted for nearly 25% of all global IPOs with 340 public offerings, while the entire Middle East and Africa combined had just 50 IPOs. What created this massive gap, and how can Africa bridge it?

Join hosts Shannon and Johan as they explore India's remarkable transformation from a nascent market to home of the world's most sophisticated digital financial infrastructure. With guest Adrienne Henderson, Senior Associate at Quona Capital, they break down the three foundational pillars of India's success: Aadhaar (universal digital identity), UPI (unified payments interface), and open banking APIs.

The conversation examines Africa's unique...

2025-06-0919 min

The Trillion Dollar Opportunity: Financial Inclusion | Emerging Markets | FinTechBONUS: Insurtech Innovators Share Advice For FoundersWhat does it really take to disrupt traditional insurance markets in emerging economies? In this special minisode of The Trillion Dollar Opportunity, hosts Johan and Shannon share valuable entrepreneurial insights from two founders who are creating entirely new categories in Asia’s InsurTech industry. This is essential wisdom for founders creating new categories in emerging markets.

Kulin Shah, co-founder and COO of Onsurity, which provides health coverage to India's 63 million micro, small, and medium-sized employers, emphasizes building startups to solve problems rather than chasing valuations.

Cindy Kua from Sunday shares two key pieces of advice: fi...

2025-06-0203 min

The Trillion Dollar Opportunity: Financial Inclusion | Emerging Markets | FinTechMore than paperwork and policies: Innovating Insurtech in India & Southeast AsiaForget everything you thought you knew about insurance—it's not just paperwork and policies, it's a financial lifeline keeping millions from falling into poverty. In this episode of The Trillion Dollar Opportunity, co-hosts Johan Bosini and Shannon Austin explore how insurance has become the critical second phase of financial inclusion in emerging markets. When 330 million people in India lack health insurance and coverage rates remain low across much of Southeast Asia, innovative InsurTech companies are stepping in where traditional models have failed.

Kulin Shah is the co-founder and COO of Onsurity, which is bringing affordable health benefits to...

2025-05-2021 min

Insurance for the New PossibleHow Emerging Markets Are Rewriting the Fintech PlaybookJoin us to discuss how infrastructure, regulation, and venture capital are converging to drive impact and returns, with Ganesh Rengaswamy, Co-founder and Managing Partner at Quona Capital.This special episode was recorded during the Money20/20 Asia in Bangkok 2025.Learn more: https://insuranceforthenewpossible.com

2025-05-1419 min

LatamList EspressoMagalu raises $130M from the IFC, Ep 205This week’s Espresso covers news from Fintalk, Belvo, Bancoldex, and more!Outline of this episode:[00:30] – Magalu raises $130M from the IFC[00:45] – Fintalk raises $1M to expand conversational AI platform[00:53] – Nuvia raises $1.7M to Scale AI Agents for B2B Sales[01:05] – Coalize raises $570K seed round[01:15] – Belvo raises $15M to launch new products[01:34] – Bancóldex and Ruta N invests in Simma Fintech+[01:51] – Yeda Health raises $ 300K pre-seed roundResources & people mentioned:Startups: Magalu, Fintalk, Nuvia, Coalize, Belvo, Yeda HealthVCs: International Finance Corporation, HiPartners, NXTP, Gilgamesh Ventures, Quona Capital, Kaszek, Kibo Ventures, Future Positive, Citi Ve...

2025-04-3002 min

The Trillion Dollar Opportunity: Financial Inclusion | Emerging Markets | FinTechBONUS: From Toxic Debt to Building Financial Resilience with Fabio Zveibil of CreditasIn Brazil, high interest rates and revolving credit lines can trap borrowers. So how can borrowers break free of these toxic cycles? This week, hosts Shannon Austin and Johan Bosini explore how high-interest rate loans can trap borrowers, and cultural reluctance toward long-term loans. Fabio Zveibil, VP of Auto and Home Secured Lending at Creditas, joins the show again to talk about how better lending products and financial education can revolutionize credit access in Brazil, potentially multiplying available credit by up to 20 times. The content here does not constitute tax, legal, business or investment a...

2025-04-2808 min

Wharton FinTech PodcastCaliza Founder & CEO, Ezra Kebrab - Modernizing Cross-Border Transactions using StablecoinsIn today's episode, Wesley Aster speaks with Ezra Kebrab, Founder and CEO of Caliza, a cross-border payments platform leveraging stablecoins to eliminate geographic barriers by allowing companies around the world to open digital dollar accounts for their users to save and transact. Ezra shares how is personal journey - from his childhood to his experience at Visa and Intuit - inspired him to build infrastructure for the next generation of global payments.

Tune in to hear about:

- Ezra's path from Intuit and Visa to launching Caliza

- The problems Caliza solves for businesses in Brazil and the company's recent...

2025-04-2233 min

The Trillion Dollar Opportunity: Financial Inclusion | Emerging Markets | FinTechBacking Everyday Brazilians: How Creditas Uses Asset-Based Loans to Empower ConsumersBrazil is one of the most expensive countries to access credit. Credit cards can have 400 percent interest rates. Even business owners face loans with 20 percent interest rates. This week on the Trillion Dollar Opportunity, hosts Shannon Austin and Johan Bosini explore what happens when good credit is hard to come by, and one FinTech that has changed the credit access landscape for the better. We talk to Creditas CEO Sergio Furio, COO Anne Williams, and VP Fabio Zveibil about how Creditas is providing affordable, asset-backed loans to Brazilians. The content here does not constitute t...

2025-04-1430 min

Wise Decision Maker Show#306: Gen AI Gives Fintech an Edge Over Traditional Finance: Monica Brand Engel of Quona CapitalIn this episode of the Wise Decision Maker Show, Dr. Gleb Tsipursky speaks to Monica Brand Engel, Co-Founder of Quona Capital, about how Gen AI gives fintech an edge over traditional financial services.You can learn about Quona Capital at https://quona.com/📧 Make sure to register for the FREE Wise Decision Maker Course and get a FREE copy of the "Assessment on Dangerous Judgment Errors in the Workplace" as part of the first course module https://disasteravoidanceexperts.com/subscribe/ 📖 Check out Dr. Gleb Tsipursky's latest books:"Returning to the Office and Leadin...

2025-04-0822 min

LatamList EspressoCashU secured a $17.5M FIDC backed by Itaú BBA, Ep 198This week’s Espresso covers news from gen-t, Glim, Neofin, and more!Outline of this episode:[00:30] – Neofin raises $6M seed round led by Quona and Upload[00:37] – CashU secures $17.5M credit fund to expand B2B lending for SMEs[00:48] – Glim raises $3.47M to expand financial wellness platform[01:03] – Involves acquires Datamind to expand retail data intelligence in Latin America[01:13] – Gen-t: Pioneering stem cell research in BrazilResources & people mentioned:Startups: Neofin, CashU, Glim, Involves, Datamind, gen-tVCs: Quona, Upload, Itaú BBA, Credit Saison, Skandia, People: Lygia Pereira

2025-02-1802 min

Lifeselfmastery's podcast I Startups I Venture CapitalAnand Chandra on Transforming Rural Finance and Scaling Arya to SuccessI am thrilled to have Anand Chandra, the founder of Arya.ag, India's largest grain commerce platform which bridges the gap between sellers and buyers of agriproducts, providing complete assurance on quantity, quality, and payments. Arya Collateral has attracted funding from top-tier investors like Quona Capital, the U.S. International Development Finance Corp, Lightrock, and Stride Ventures. In this episode, Anand Chandra, founder of Arya, India's largest green commerce platform, shares his journey from banking to entrepreneurship. Anand discusses the challenges of financing small and marginal farmers, building trust in fragmented agri supply chains, and scaling a...

2025-01-1039 min

Startupeable: Emprendimiento | Tecnología | Venture CapitalCómo Venderle a Empresas con Baja Adopción Tecnológica | Santiago Molina, FinkargoConversé con Santiago Molina, cofundador y CEO de Finkargo, una plataforma de financiamiento para comercio exterior de PYMEs en Latinoamérica. Actualmente, tiene una base de 450 clientes en Colombia y México y ha facilitado más de 4,000 operaciones de importación. Recientemente, levantaron un total de $95M. en una Serie A liderada por QED Investors y CIM, con la participación de Quona, Flybridge y Nazca.Este episodio es presentado por: Hubspot para Startups:Crece tu startup sin perder tiempo ni dinero. Acelera tus ventas y marketing con automatizaciones y herramientas de IA. Empi...

2024-12-181h 03

The Trillion Dollar Opportunity: Financial Inclusion | Emerging Markets | FinTechPART 2: How Brazil’s Real Time Payments Create Real World Financial InclusionFive billion transactions are made each month with Pix, Brazil’s real time payment system, which was launched by the Central Bank of Brazil in 2020. Today Pix reaches more than 90 percent of the adult population and settles more transactions than any other financial instrument including debit, credit, and prepaid cards. This week on the podcast, we pick up with Part 2 of Quona co-founder Jonathan Whittle’s fireside chat with Carlos Eduardo Brandt, a Senior Advisor at the Central Bank of Brazil. He leads the design and implementation of Pix and he shares how financial inclusion was a big p...

2024-12-0209 min

The Trillion Dollar Opportunity: Financial Inclusion | Emerging Markets | FinTechPART 1: The Power of Pix: How Brazil Built a Revolutionary Real-Time Payment SystemBrazil has one of the most successful real-time payment systems in the world. This week on the podcast, we share a fireside chat with the man who leads the design and implementation of the real-time payment system Pix. Carlos Eduardo Brandt is the Senior Advisor at the Central Bank of Brazil. Quona Co-founder Jonathan Whittle took the stage with Carlos at Quona’s recent annual meeting to discuss how the Central Bank of Brazil implemented this real-time payment system to the tune of 5 billion transactions per month. Today Pix reaches more than 90 percent of the adult population and settles mo...

2024-11-2512 min

The J Curve with Olga MaslikhovaAdhemar Milani Neto, CEO at Brazilian car subscription platform Kovi: Why Brazil is poised to dominate the global EV marketWelcome to Season 3 of The J Curve, a podcast about entrepreneurship in Latin America with me, Olga Maslikhova. My guest today is Adhemar Milani Neto, founder and CEO of Kovi, an ‘all-inclusive’ car subscription platform for gig workers. Kovi has raised $145M from top investors like Valor Capital, Prosus Ventures, Quona, Monashees, Norte, Maya Capital, Globo Ventures, and Peter Thiel’s family office. In this episode, we talk about Brazil’s unique mobility landscape, the lessons from transforming Kovi from a pure tech company to an operational technology business, and how Adhemar is building a holistic company culture—plus so much more...

2024-11-1954 minDealMakers: Entrepreneur | Startups | Venture CapitalAnand Chandra On Raising $275 Million To Build An Agritech Platform To Streamline India’s Agricultural EcosystemIn the startup ecosystem, building a company from the ground up without extensive capital is an impressive feat, as Anand Chandra has demonstrated. But building one in agriculture—a sector with deeply embedded challenges—is a story of grit, vision, and tenacity. Anand's company, Arya Collateral has attracted funding from top-tier investors like Quona Capital, the U.S. International Development Finance Corp, Lightrock, and Stride Ventures.

2024-11-1527 min

The Trillion Dollar Opportunity: Financial Inclusion | Emerging Markets | FinTechThis is Not An AI-Generated Podcast About Emerging MarketsWhere are the opportunities for artificial intelligence to transform FinTech startups in emerging markets? And how are startups already taking advantage of what AI has to offer? This week, Quona co-founder Monica Brand Engel and Senior Investment Associate Michel Zaidler join the podcast to share insights on how generative AI is transforming the FinTech startup ecosystem in emerging markets, including some great use cases from companies like Klar in Mexico, SUKHIBA in Africa, and Onsurity in India.Referenced in this Episode:White Paper: “Generative AI and Financial Services in Emerging Markets,” is available here: https://www.f...

2024-11-1112 min

The Trillion Dollar Opportunity: Financial Inclusion | Emerging Markets | FinTechThe Thing About AssumptionsInformation is crucial to any investor. But what happens when assumptions hide the truth about market opportunities? This week on The Trillion Dollar Opportunity, Quona investors based in India, Africa, and Latin America join us to share some assumptions about their markets and the blind spots such assumptions may lead to for investors. Is banking in Africa really disorganized? Is innovation really only happening in developed markets like the US and the UK, instead of places like India? Is Latin America too fragmented for innovation to spread? The opportunities growing in these markets may surprise you. Mentioned i...

2024-11-0412 min

The Trillion Dollar Opportunity: Financial Inclusion | Emerging Markets | FinTechGlobal and Local: Quona’s Approach to Emerging MarketsWhere are the opportunities in emerging markets? This week, Quona’s three founders, Monica Brand Engel, Jonathan Whittle, and Ganesh Rengaswamy, share the specific regions where Quona focuses —India and Southeast Asia, Latin America, Africa and MENA. But why these regions? And how do the opportunities in these markets differ or overlap? These markets are closely connected, often borrowing innovations and lessons that accelerate progress across borders. Drawing from a decade of investing in these areas, we’ll share key insights about what sets these markets apart and the lessons we’ve learned about harnessing their massive potential. The con...

2024-10-2812 min

Ángeles de LatAmLa curiosidad es el primer paso para la Innovación. - Arturo Galván - EP66Si eres Ángel Inversionista, te invitamos al club de Ángeles de LatAm registrándote en nuestro sitio: https://www.angelesdelatam.com/

Sé parte del club donde estaremos haciendo eventos, compartiendo dealflow, haciendo comunidad y mucho más.

—

Contactos:

(Host) René Lomelí: https://www.linkedin.com/in/rlomeli88/

(Invitado) Arturo Galván: https://www.linkedin.com/in/arturogalvan/

—

Ángeles de LatAm es un podcast donde René Lomelí, Partner en 500 Global, conversa con inversionistas de la región para conocer más de su historia como ángel, su tesis de inversión, portafolio y mucho más.

2024-10-241h 06

The Trillion Dollar Opportunity: Financial Inclusion | Emerging Markets | FinTechFrom Biryani to Big Impact: Quona's Origin StoryHow did Quona Capital come to identify and pursue the trillion-dollar opportunity in emerging markets? This week, hosts Shannon Austin and Johan Bosini delve into Quona's journey from its roots in Accion's pioneering microfinance investments—including a significant windfall from a standout company—to becoming independent venture investors with a bold vision. Quona’s three founders, Monica Brand Engel, Jonathan Whittle, and Ganesh Rengaswamy, share how the focus on financial technology is the key to unlocking growth in vast, untapped populations of underbanked and unbanked consumers. We'll also explore how rapid digital adoption has enabled emerging markets to leapfrog tradit...

2024-10-2110 min

VC React PodcastVC React Podcast (E15): Managing a Large Seed Fund, FoFs in MENA, Global vs. Local Startups & VCsVC React Podcast:

Every week, we bring you insights and reactions from top VCs, reacting to the latest news on MENA startups, VCs, and investment rounds. Stay tuned for: expert analysis, independent opinions, and maybe some heated conversations!

Host: Ahmad Takatkah, VCpreneur.

Sign up to VCpreneur Newsletter on https://www.vcpreneur.com/

Co-Host: Jamie Lane, FWDstart.

Sign up to FWDstart Newsletter on https://www.fwdstart.me/

---

Available on:

Youtube: VC React Podcast

Spotify: VC React Podcast

Apple: VC React Podcast

Amazon: VC React Podcast

---

Guests:

1. Asher Siddiqui, General Partner @ Sukna Ventures

- LinkedIn Profile: https://www.linkedin.com/in/ashersiddiqui/

- VC Firm Website: https://suknaventures.com/

2. Faris AlRashed, CEO @ Sharaka

- LinkedIn Profile: https://www.linkedin.com/in/faris-alr...

2024-10-1751 min

The Trillion Dollar Opportunity: Financial Inclusion | Emerging Markets | FinTechIntroducing: The Trillion Dollar OpportunityThe world as we know it is changing. As the global economy continues to grow and expand, investors will be missing out on opportunities if they hold a blind spot to emerging markets. That’s what we call the Trillion Dollar Opportunity. This podcast from Quona, hosted by Shannon Austin and Johan Bosini, will share insights from investors and founders who are localized experts in emerging markets. Listen every Monday so you can understand how to unlock the growth of The Trillion Dollar Opportunity.

2024-10-1201 min

SRI360 | Sustainable & Responsible Investing, Impact Investing, ESG, Socially Responsible InvestingFinTech & Capital Markets for the Underbanked: Quona Capital Brings the Margins into the Mainstream (#054)Today, I'm speaking with Monica Brand Engel, a Co-Founder and Managing Partner of Quona Capital, an impact pioneer focusing on financial inclusion in emerging and frontier markets. Quona’s mission is to generate impact and returns by investing in micro, small, and medium-sized businesses across South and Southeast Asia, Latin America, and Africa. The company is dedicated to transforming lives in underserved and underbanked communities through fintech solutions that bridge the gap between emerging markets and advanced financial infrastructures. It offers a range of financial products that meet the unique needs of consumers in these ma...

2024-09-031h 58

Wharton FinTech PodcastQuona Co-Founder & Managing Partner Jonathan Whittle - Fintech Regulation, Innovation, & Financial Inclusion in Latin AmericaIn today's episode, Wesley Aster hosts Jonathan Whittle, the co-founder and Managing Partner of Quona Capital, a global venture capital firm investing in fintech in emerging markets.

Tune in to hear about:

- Jonathan's journey from entrepreneur to investor and how his experience as a founder has shaped his approach to investing

- Quona's mission to drive financial inclusion, its recent advanced impact verification from BlueMark, and success stories from its portfolio.

- Insights into fintech opportunities in Brazil and Mexico, and how regulation influences innovation in Latin America

For more FinTech insights, follow us on

WFT Medium: medium.com...

2024-06-1843 min

Delusional PodcastRCP #4 Bridging Africa, LatAm & Asia with $800m+ for fintech, with Johan Bosini [Quona Capital]Johan Bosini is a partner at Quona Capital, a $800 million pan-emerging-markets fintech VC firm.

Timestamps:

(1:58) Quona overview in numbers

(4:05) Imposter syndrome and self-assessment

(5:08) Investing in LatAm vs Africa: different mental models

(8:07) Lose-lose situation: too many VCs backing a model/space

(10:38) Africa & LatAm: similar [but delayed] growth trajectories

(12:49) Do not expand across continents! [for most startups]

(13:49) Fintech 1.0, Fintech 2.0, Fintech 3.0

(17:21) Thesis behind investing in Sava [Brex for Africa]

(19:25) Thesis behind investing in Orda [Toast for Africa]

(21:57) Not enough digital banks???

(23:11) African multi-billion dollar exits: is the dream still alive?

(24:09) Crazy founder story

References:

Yoco - https://techcrunch.com/2021/07/27/south-african-payments-startup-yoco-raises-83m-series-c-led-by-dragoneer/

Sava...

2024-04-0427 min

BRAVE (Bahasa Indonesia) Teknologi Asia Tenggara: Singapura, Indonesia, Vietnam, Filipina, Thailand & Malaysia Perusahaan Rintisan, Pendiri Dan Modal Ventura VCChia Jeng Yang Tentang Menakar Orang - E2Chia adalah seorang Principal di Saison Capital, dana modal ventura terkemuka yang berfokus pada FinTech, yang telah berhasil dengan baik di pasar negara berkembang seperti Asia Tenggara dan India. Investasi langsung mereka meliputi Grab, startup dan super-app terbesar di Asia Tenggara, serta ShopBack, platform belanja dan cashback rewards terbesar di Asia Tenggara. Investasi mitra terbatas mereka mencakup beberapa dana dengan kinerja terbaik di Asia Tenggara, seperti East Ventures dan Beenext, serta dana global seperti Quona Capital dan Antler.

Sebelumnya, ia adalah karyawan kelima di Antler, perusahaan pembangun usaha pra-tim global terkemuka. Dia juga berinvestasi dan meluncurkan pasar u...

2024-02-2017 min

The Pnyx“The pendulum of entrepreneurship...can swing widely.”Can fintech thrive in a volatile world? How will 2024 compare to 2023? Where will remote work remain? What is the Asian market outlook?

In this episode, the final in our series on reflections on 2023 and the outlook for 2024, we cover challenging questions and market insights with Ganesh Rengaswamy of Quona Capital. Listen as we look to the past and the future, cover entrepreneurial cycles, dive into regulatory trends, and consider which fintech product categories are ripe for future growth

2024-01-2519 min

Talking Success | The Home of FintechFunding Financial Inclusion with Johan BosiniSend us a textIn this episode, Darren Franks chats with Johan Bosini, Partner at Quona Capital.Highlights🤝 Supporting SMMEs in emerging markets🏆 South Africa is noted for its competitive landscape💰 International capital making its presence felt in African marketsJohan Bosini's LinkedIn: https://www.linkedin.com/in/johanbosini/Quona's Website: http://www.quona.com/Darren Franks' Linkedin: https://www.linkedin.com/in/darrenfranks/

2023-11-0646 min

The Daily Scrum - Asian Startup and Tech NewsDCG acquires Lamudi Philippines and Indonesia, Cosmos Innovation raises $19.7 million series a roundFor today's headlines:DCG acquires Lamudi Philippines and IndonesiaCosmos Innovation raises $19.7 million series A roundPayPal announces investments in the Southeast Asia Women’s Economic Empowerment Fund (SWEEF) and Quona Opportunity fundHave a story you want us to cover? Please hit us up at pr@hustleshare.comThis episode is brought to you by PodmachineTo support Hustleshare, please subscribe at http://premium.hustleshare.comDiamond Supporters: Sarisuki, PayMongo, UnionDigital Bank, SeekCap, Shoppable Business, Qapita, GoTyme BankGold Supporters: BUOSi...

2023-10-2305 min

Sovereign FrontierSats & Gwei | 40% of South Africans familiar with web3 | Chipper Cash enters Rwanda | Nigeria’s Crypto tax - a premature move? | Pillow fund discontinues operations | And more !Welcome to another episode of Africa’s Crypto Rollup - Sats & Gwei. like we always do weekly, in this episode we bring you the latest and most relevant crypto news and updates across Africa.

Highlights

40% of South Africans Familiar With the 'Concept of Web3' says Study

https://news.bitcoin.com/40-of-south-africans-familiar-with-the-concept-of-web3-study/

Chipper Cash Formally Launches Operations in Rwanda, its 6th African Country

https://bitcoinke.io/2023/07/chipper-cash-launches-in-rwanda/

BlockchainUNN hosts the biggest campus Blockchain Conference in Africa

https://technext24.com/2023/07/05/blockchainunn-biggest-campus-conference/

Nigerian crypto tax move...

2023-07-0928 min

The Enthusiast: Founders and VCs beyond the ValleyGanesh Rengaswamy (Quona) & Kulin Shah (Onsurity) on the insurtech landscape in India, the founder-investor relationship and scaling OnsurityOn this episode Pat sits down with seasoned entrepreneur and investor Ganesh Rengaswamy, co-founding partner of leading fintech inclusion fund Quona and Kulin Shah, Co-Founder and CEO of Onsurity, a leading Indian insurtech. We dive into the founder-investor relationship, the insuretech space in India and how to manage boards successfully. So much to unpack here with the two of the on the show. You will learn about: Kulin & Ganesh's journey into the world of entreprene...

2023-07-0550 min

Find The Way#19 - Victor NogueraVictor Noguera is the Co-founder of a Mexican property tech startup Flat.mx. They are transforming the buying and selling of real estate in Mexico. He received a Bachelor's degree in Industrial Engineering at the Polytechnic University of Catalonia and an MBA at Berkeley-Haas in California. Prior to Flat.mx, Victor served as a Director at Boston Consulting Group in New York and Barcelona.

In addition, together with Bernardo Cordero, Victor co-founded STARTegy, a Seed fund that invested in worky.mx, klar.mx, belvo.com, and mymoons.mx which later raised funds from Founders...

2023-04-1246 min

Radically Yours by RadhikaHow women Lead, Parent, Partner and Thrive ||Ft. Monica Brand Engel-Co-Founder and MP, Quona CapitalIn our conversation with Monica Brand Engel, she talks about: How women lead, parent, partner and thrive , the various fads in investing, having your own 'wolf pack', women supporting women, Women personalizing negative comments, while men attribute them externally and much more! Monica is an accomplished fund manager with a proven track record of successfully launching and expanding investment vehicles and business lines targeting underbanked populations in both emerging markets and the United States. As a leader and mentor, Monica has taken on P&L responsibilities, building cross-functional and cross-cultural teams to achieve sales, innovation, an...

2023-04-061h 06

Forbes India - The Startup Fridays PodcastStartup Fridays S4 Ep9: Ganesh Rengaswamy’s fascinating trip from Travel Guru to Quona Capital

In this episode, Ganesh Rengaswamy, co-founder and managing partner at Quona Capital, looks back at how he once juggled being a co-founder at Travel Guru and an MBA student at Harvard Business School, and what he would have done differently. Ganesh also talks about Quona’s deep interest in fintech in India and several other markets; and how India’s public digital infrastructure and private startups will eventually unlock the massive potential of our SMBs. He also talks about his own experience with respect to seeking and learning from mentors

2023-04-0555 min

The Enthusiast: Founders and VCs beyond the Valley[Investor Stories] Jonathan Whittle (Quona) on why and when it pays to become a bank, parallels to previous bust cycles and Brazil's fintech masterplanOn this episode Pat sits down with Jonathan Whittle, Co-Founder and Managing Partner of emerging markets fintech inclusion fund Quona Capital. We dive into his journey from operator to VC, lessons learned from the dot-com bust and what it means for today's market correction, the status of Fintech in emerging markets and why it pays to become a bank at the final stage of a B2C fintech's growth journeyOn this episode you will learn about: Jonathan's journey into VC and long time engag...

2023-02-2140 min

Semilla.VCJonathan Whittle, Quona Capital Co-Founder and Managing Partner, Semilla.VC InterviewOn episode 31 of Semilla.VC, the podcast highlighting the most exciting and revolutionary figures in Latin American Venture Capital, Tech, and Society, Trip Gorman spoke with Jonathan Whittle, Co-Founder and Managing Partner at Quona Capital. Quona invests in fintech innovators that are advancing inclusion across three emerging market regions. Jonathan exclusively focused on Latin American FinTech and other Quona partners are specialists in “Africa & the Middle East” as well as “South & South East Asia.” Jonathan is currently on the Board of 13 Latin American technology companies including Creditas, Konfio, BizCapital, Klar, ADDI, Facily, Monkey Exchange, nocnoc, Finkargo, Destaxa, Neon, Contabilizei, and Kovi...

2023-01-0934 min

DigFin VOXEM fintech VC | Ganesh Rengaswamy, Quona | DigFin VOX Ep. 47Ganesh Rengaswamy is managing partner at Quona Capital, based in Bangalore. His VC firm has just raised a fund focused on fintech in emerging markets.Rengaswamy speaks with Jame DiBiasio about why invest in fintech now, making decisions in the new macro environment, and what fintech business models look attractive – and which do not.He also discusses how fintech can scale across the region, the importance of public digital infrastructure, and the rewards of backing companies that drive financial inclusion.Timecodes:0:00 – Ganesh Rengaswamy, Quona Capital1:45 – Why raise a fintech fund, and why now4:05 – Standalone versus embe...

2022-12-0133 min

Fintech LeadersKatlego Maphai, Yoco CEO/Co-Founder – Building a South African Digital Giant, Empowering Small Businesses, & Founder Lessons to Overcome AdversitySend a textMiguel Armaza interviews Katlego Maphai, CEO & Co-Founder of Yoco, a South African payments company that processes billions of dollars annually, and serves hundreds of thousands of small businesses every day. Founded in 2013, the company has raised $100+ million from great investors, including Quona, Dragoneer, Partech, HOF Capital, and many more.In this episode, we discuss:The evolution of fintech in South Africa Overcoming massive challenges since 2013Drawing inspiration from companies like Square, but adapting your product to the local marketYoco’s unique relationship with the...

2022-11-2240 min

Fintech Insider Podcast by 11:FS680. News: Apple and PayPal call a truce – but who wins?

Our expert hosts, Kate Moody and Benjamin Ensor, are joined by some great guests to talk about the most notable fintech, financial services and banking news from the past week.

This week's guests include:

Alex Johnson, Creator, Fintech Takes

Sophie Winwood, Principal, Anthemis

With soundclips from:

Kristin Sadler, Head of Impact, Quona Capital

We cover the following stories from the fintech and financial services space:

PayPal, Apple reach truce and will accept each other’s products - 3:20

Stripe cuts 14% of its workforce, CEO says they ‘overhired for the world we’re in’ - 14:45

...

2022-11-1459 min

LatamList EspressoQuinio raises $40M in equity and debt. Nubank launches Nucoin, its digital currency, Ep 119This week’s Espresso covers updates from Nubank, Franq, Selina and more!Outline of this episode:[00:28] - Selina goes public and continues expansion in LatAm[00:53] - Wareclouds closes $1.2M round[01:21] - Ubanku closes $1M pre-seed round[01:51] - Kapital arrives in Colombia[02:15] - Nubank introduces its digital currency Nucoin[02:37] - Franq raises $12M in Series A round[03:00] - Quinio raises $40M in equity and debt[03:31] - New episode of How to be the Difference[03:45] - New episode of Crossing BordersResources & people mentioned:Companies & Startups: Se...

2022-11-0804 min

Crack The MBA ShowEp009 From Startup to Kellogg with $80K Scholarship to VC: Garima Sharma's JourneyWelcome to today's episode of the ‘Crack The MBA Show’ with Garima Sharma who is a graduate of Kellogg School of Management. Garima completed her B. Tech. degree in 2014 from NIT Warangal and worked with ITC for two years and LetsTransport for another two years. Garima got through Kellogg with $80,000 in scholarship and a GMAT score of 730. For her summer internship, Garima interned with Quona Capital, a VC fund in Bangalore. Prior to the MBA, Garima also pursued a pre-MBA internship in VC at Lightbox Ventures.

Through our conversation, we discussed Garima's pre-MBA experiences, MBA admissions jour...

2022-09-271h 05

The MoneyPotRiseUp and ReBalance: How Women Lead, Parent, Partner, and ThriveIn this episode of The MoneyPot Raw, Tracey Davies, President of Money20/20 and I sit down with Monica Engel, Partner and Co-Founder of Quona Capital, to talk about her new book - Rebalance: How women lead, parent, partner, and thrive. We discuss the importance of the THRIVE group - a group of working women with ambitions for good careers, families, partnerships, and community- that she helped establish. And why intentionally seeking these groups is so vital for women to succeed and maintain balance. We also discuss about what changes we see coming and how professional women can play a role in t...

2022-07-2346 min

Connecting the dots in FinTech... by Marcel van OostYour Daily FinTech Podcast - June 22nd, 2022Sign up for my Daily Fintech or Daily Digital Banking Newsletters here. Check out my latest podcast episode below:

Welcome to another episode of our Daily Fintech Podcast.

THE NEWS HIGHLIGHT OF THE DAY IS

FROST has launched to the general public after initially opening its app to its first wave of users. More than 16,000 people signed up to receive early access to the new e-money offering, which aims to give users greater control over several typically time-consuming financial tasks. Now, everyone in the UK can download the app and sign up for...

2022-06-2103 min

My Startup Podcast200 मिलियन डॉलर में अशनीर ग्रोवर स्टार्टअप की योजना बनाई।Headline1.अशनीर ग्रोवर ने नए स्टार्टअप की योजना बनाई, 200 मिलियन डॉलर जुटाना चाहता है।2. टेक स्टार्टअप महिलाओं की भर्ती में तेजी लाते हैं।3.भारत शीर्ष वैश्विक स्टार्टअप केंद्रों में 19वें स्थान पर; बेंगलुरू, दिल्ली एनसीआर और मुंबई शीर्ष 20 शहरों में।अब समाचार विस्तार से ।1.भारतपे के पूर्व मुख्य कार्यकारी और सह-संस्थापक अशनीर ग्रोवर एक नया व्यवसाय शुरू करने के लिए 200-300 मिलियन डॉलर जुटाने के लिए यूएस-आधारित पारिवारिक कार्यालयों और अपतटीय निजी इक्विटी खिलाड़ियों के साथ बातचीत कर रहे हैं।2. नैसकॉम की विविधता और समावेशन शिखर सम्मेलन डेटा, (नैस्कॉम डी एंड आई डेटा) महिलाएं कुल उद्योग कार्यबल का 35 प्रतिशत हिस्सा बनाती हैं।3. स्टार्टअपब्लिंक की एक रिपोर्ट के अनुसार, 2021 में दुनिया के शीर्ष 100 स्टार्टअप हब की सूची में भारत 28 स्थानों की छलांग लगाकर 100 देशों में 19वें स्थान पर पहुंच गया।4. सेतु के पूर्व अधिकारियों द्वारा लॉन्च किए गए फिनटेक स्टार्टअप डीपीडीजेरो ने बुधवार को कहा कि उसने बेटर कैपिटल के नेतृत्व में अपने प्री-सीड फंडिंग राउंड के एक हिस्से के रूप में 3.9 करोड़ रुपये जुटाए हैं।5. D2C मीट और सीफूड स्टार्टअप, FreshToHome की नजर एक यूनिकॉर्न वैल्यूएशन पर है, जिसमें सीरीज D फंड्स $100mn- $150mn जुटाए गए हैं।6.सूक्ष्म, लघु और मध्यम उद्यमों (MSMEs) पर केंद्रित एक बैंकिंग ऐप Mewt ने Quona Capita के नेतृत्व में अपने सीड फंडिंग राउंड में 4.6 मिलियन डॉलर जुटाए हैं।7. ग्लोबल स्टार्टअप इकोसिस्टम रिपोर्ट (जीएसईआर) में किफायती प्रतिभा के मामले में केरल में स्टार्टअप इकोसिस्टम को एशिया में सर्वश्रेष्ठ और चौथे स्थान पर रखा गया है।8. भारतीय प्रधान मंत्री नरेंद्र मोदी ने चिरायु प्रौद्योगिकी सम्मेलन में मुख्य भाषण दिया। उन्होंने कहा कि भारत यूरोप के सबसे बड़े स्टार्टअप और टेक इवेंट में स्टार्टअप्स के फलने-फूलने का आदर्श स्थान है।9. केंद्रीय मंत्री नारायण राणे ने सूक्ष्म, लघु और मध्यम उद्यमों (MSMEs) को बकाया भुगतान में देरी के मुद्दे को हल करने के लिए सभी हितधारकों द्वारा समन्वित प्रयासों का आह्वान किया है।10. भारतीय शेयर बाजार के हरे रंग में खुलने की उम्मीद है क्योंकि SGX निफ्टी पर रुझान 126 अंकों की बढ़त के साथ भारत में व्यापक सूचकांक के लिए सकारात्मक शुरुआत का संकेत देते हैं।

2022-06-1603 min

The Mindshare Podcast by Monumental Me - tools to take you from here to there. Find your thrive!Rebalance: How to thrive while having it all ~ Season 3 Episode 10Can we have it all? Can we balance a meaningful career, live our purpose, have a family, maintain quality relationships, live in good health and really thrive while doing so in an ever-changing world? That’s a tall order and the 3 authors of the new book “Rebalance: How women lead, parent, partner ... and thrive” explore how they really are thriving while enjoying this cocktail of demands and accomplishments. I challenged authors Monica Brand, Lisa Neuberger, and Wendy Teleki with my own perspective that something’s gotta give or you always feel like you’re failing, and they explain how to rebalanc...

2022-06-1543 min

LatamList EspressoKushki becomes Ecuador’s first unicorn. Google announces $1.2B investment commitment in Latin America, Ep 98This week’s Espresso covers updates from Yummy, Klar, Kushki, and more!Outline of this episode:[00:28] - Kushki becomes a unicorn after a $100M extension of its Series B[01:11] - Delivery startup Yummy raises $47M in a funding round[01:48] - Brazilian payment platform Zippi raises $16M Series A round[02:23] - Ozon raises $25M in debt and $4M in a seed round[03:08] -Mexican fintech Klar raises $70M in equity funding[03:47] -Google and Alphabet CEO Sundar Pichai announced $1.2B investment commitment in Latin America[04:21] - Interview with Marcos Esterli, co-founder of Pandas on...

2022-06-1407 min

Disrupt PodcastDP #24: The essential guide to African VC - episode 4Disrupt Africa has partnered Quona Capital, 10X Entrepreneur, Catalyst Fund, and Knife Capital to put together a four-part podcast series on the African venture capital space – how it works, what its dynamics are, and what is happening in the sector.

“The essential guide to African VC” educates listeners in the “A-Z of African VC”, digging into venture capital, looking at its business model, how startups and VCs can work together to build Africa’s tech ecosystem, and what issues still remain to be resolved.

Episode four, the last in the series, looks at VCs as people, and what makes them tick. It dis...

2022-05-0123 min

Disrupt PodcastDP #23: The essential guide to African VC - episode 3Disrupt Africa has partnered Quona Capital, 10X Entrepreneur, Catalyst Fund, and Knife Capital to put together a four-part podcast series on the African venture capital space - how it works, what its dynamics are, and what is happening in the sector.

“The essential guide to African VC” educates listeners in the “A-Z of African VC", digging into venture capital, looking at its business model, how startups and VCs can work together to build Africa’s tech ecosystem, and what issues still remain to be resolved.

Episode three covers the different ways in which startups and venture capitalists work together once a deal i...

2022-04-2429 min

Disrupt PodcastDP #22: The essential guide to African VC - episode 2Disrupt Africa has partnered Quona Capital, 10X Entrepreneur, Catalyst Fund, and Knife Capital to put together a four-part podcast series on the African venture capital space - how it works, what its dynamics are, and what is happening in the sector.

“The essential guide to African VC” educates listeners in the “A-Z of African VC", digging into venture capital, looking at its business model, how startups and VCs can work together to build Africa’s tech ecosystem, and what issues still remain to be resolved.

Episode two takes listeners through the anatomy of a VC deal - discussing how investments are made...

2022-04-1728 min

Fintech Insider Podcast by 11:FS618. News: Qonto looks to builds a community, while Fast runs out of steam

Our expert hosts, David M. Brear and Nicole Perry, are joined by some great guests to talk about the most notable fintech, financial services and banking news from the past week.

This week's guests include:

Dan Hardy, VP - Sales, Crowdcube

Peter Renton, Co-Founder and Chairman, LendIt Fintech

With soundclips from:

Prakash Pattni, Managing Director of Financial Services & Digital Transformation (EMEA), IBM

We cover the following stories from the fintech and financial services space:

Unicorn Qonto partners with Crowdcube to open up ownership - 5:10

Fast shuts doors after slow growth - 16:30

The...

2022-04-1159 min

Disrupt PodcastDP #21: The essential guide to African VC - episode 1Disrupt Africa has partnered Quona Capital, 10X Entrepreneur, Catalyst Fund, and Knife Capital to put together a four-part podcast series on the African venture capital space - how it works, what its dynamics are, and what is happening in the sector.

“The essential guide to African VC” educates listeners in the “A-Z of African VC", digging into venture capital, looking at its business model, how startups and VCs can work together to build Africa’s tech ecosystem, and what issues still remain to be resolved.

Episode one takes listeners through the nuts and bolts of VC, defining what venture actually is, tell...

2022-04-1039 min

Latitud Podcast#88 - Altitud | Tackling the trade finance gap in LatAm: Santiago Molina, FinkargoColombian-born Santiago Molina got his degree in business administration and finance from Houston Baptist University on a soccer scholarship, and moved back to his home country after his MBA to start his entrepreneurial journey. Santi is second-time founder focused on promoting financial inclusion, and is now on a quest to create an innovative solution to democratize access to capital in Latin America.He and his co-founders Andres Ferrer and Tomas Shuk came together to start Finkargo, LatAm's first import financing platform. They're enabling small and medium-sized importers to...

2022-04-0709 min

The Enthusiast: Founders and VCs beyond the Valley[Investor Journey] Tackling poverty through financial inclusion - Monica Brand Engel (Quona) on the intersection of profit and purpose, measuring impact and managing boardsOn this episode Patrick sat down with Quona Co-Founder and Managing Partner Monica Brand Engel. This is a truly special conversation as we dive into Monica's multicultural upbringing and how it shaped her way to see the world. Monica makes a compelling case on how the lines between profit and purpose become increasingly blurred and how investing in financial inclusion can provide a solution to one of the world's greatest problems, poverty. On this episode you will learn about: Monica's j...

2022-03-2941 min

LatamList EspressoParrot secures $9.5M in a Series A round. Klar raises $70M in a Series B round, Ep 79In this week’s Espresso, we cover updates from AgendaPro, Parrot, Vozy and more!Outline of this episode:[0:27]- AgendaPro closes a financing round for $3.7M[0:55]-Interview with Julio Guzmán, AgendaPro’s CEO[8:22]-Parrot secures $9.5M in a round led by F Prime Capital[8:54]-Interview with Roberto Cebrian, founder of Parrot[12:45]-Klar raises a $70M Series B funding round[13:13]-Laika raises a $48M Series B funding round [13:45]-Vozy partners with Latin Leap through its Seed Investment Club.[14:25]-Ubits announces a $25M Series B funding round[14:52]-a55 raise...

2022-01-2516 min

Tracxn's Weekly Deals Roundup | India TechJan 10, 2022 - Dunzo raised $240 million, Vidooly got acquired by Good GlammWelcome back to India Tech Weekly Deals Roundup, a weekly podcast by Tracxn for key startup deals in India from last week. In this edition, we will cover funding rounds of Dunzo, udaan, Zupee and more. In exits, we will cover the acquisition of Vidooly by Good Glamm.Starting with our deep dive into funding rounds, tech companies in India raised around $712 million funding across 26 funding rounds during this week.In a major funding round event, Bangalore-based transportation and logistics tech startup, Dunzo, raised $240 million in a Series E funding round led by R...

2022-01-1009 min

One Thing Today in TechCCI seeks feedback on Google’s payments policies; TCS, Infosys Q3 results in this week; and BMW’s chameleon carsCCI seeks feedback on Google’s payments policies

The Competition Commission of India will seek a detailed report from app developers explaining the impact of Google’s payment policies on their balance sheet and also suggest an alternative payment mechanism if possible, Economic Times reports.

Google is seeking to enforce its policy of limiting developers to solely use its billing system for in-app sales of digital goods, on which it charges up to 30 percent commission. It has, however, pushed the deadline for Indian app developers to integrate with Google Play’s billing system to Oct. 31 from M...

2022-01-1004 min

The Frye Show#168: Santiago Suarez - Cofounder & CEO Addi - Tienes que Ver la Siguiente Carta, No Hay Plan B“Los top executives son obsesivos con los detalles. Lo que tu te das cuenta es que ellos operan a 10000 pies y a un pie. Nunca operan a 5000 pies. Están obsesionados con cada detalle o sobre el futuro” - Santiago Suarez ( 👈🏽 link a persona, mis pensamientos del audio, libros, el podcast, y más)Santiago Suarez es el cofundador y CEO de Addi, una compañía de tecnología con la misión de hacer que todo el comercio sea digital, respaldado por más de $300 millones en inversiones de Andreessen Horowitz, GIC, Greycroft, Monashees, Quona, Softbank y Union Square Ventu...

2021-12-291h 41

The Frye Show#168: Santiago Suarez - Cofounder & CEO Addi - Tienes que Ver la Siguiente Carta, No Hay Plan B“Los top executives son obsesivos con los detalles. Lo que tu te das cuenta es que ellos operan a 10000 pies y a un pie. Nunca operan a 5000 pies. Están obsesionados con cada detalle o sobre el futuro” - Santiago Suarez ( 👈🏽 link a persona, mis pensamientos del audio, libros, el podcast, y más)Santiago Suarez es el cofundador y CEO de Addi, una compañía de tecnología con la misión de hacer que todo el comercio sea digital, respaldado por más de $300 millones en inversiones de Andreessen Horowitz, GIC, Greycroft, Monashees, Quona, Softbank y Union Square Ventu...

2021-12-291h 41

VentureEpisode 50. Varun Maholtra. Partner at Quona Capital. "Fintech: The Best Answer"Varun Malhotra is a partner at Quona Capital, a firm that invests in early stage fintechs in India and Southeast Asia. Varun knows that experience and networking with contacts can elevate you to another stage, in this episode he tells us how Fintech is working today and how disruptive innovations are creating a more financially inclusive world.

2021-11-1027 min

Women in Venture CapitalA Conversation with Sooah Cho | Principal, Underscore VC | PM, Devoted Health and CVS Health | Bain Capital | Quona Capital | FSG | HBS'17See our episode with Sooah Cho from Underscore VC, where she talks to us about her interest in fintech and its ever-rising prominence, advice for women looking to break into the VC ecosystem, and the value of operating experience in setting yourself apart in the VC world.

2021-11-0527 min

BRAVE Southeast Asia Tech: Singapore, Indonesia, Vietnam, Philippines, Thailand & Malaysia Startups, Founders & Venture Capital VC (English)Chia Jeng Yang on Local vs. Foreign VCs in SE Asia, Transactional vs. Relational, Winners vs. Losers - E81Chia is a Principal at Saison Capital, a leading FinTech-focused venture capital fund, who has done especially well in emerging markets like Southeast Asia and India. Their direct investments include Grab, Southeast Asia's largest startup and super-app, as well as ShopBack, Southeast Asia's largest shopping and cashback rewards platform. Their limited partner investments include some of the top- performing funds in Southeast Asia, like East Ventures and Beenext, as well as global funds like Quona Capital and Antler.

Previously he was the fifth employee for Antler, the leading global pre-team venture builder. He also both invested an...

2021-08-021h 14

Cuentos CorporativosEP #070 - T2. FLAT. Startup en Bienes Raices. - Conoce a Victor NogueraVíctor Noguera y Bernardo Cordero, se han enfocado a resolver el problema de vender los departamentos en urbes complejas, como la Ciudad de México.Víctor es co-fundador de Flat.mx, es una startup de bienes raíces que busca “eliminar el estrés y la incertidumbre de comprar y vender una vivienda”. Flat.mx cuenta con el apoyo de grandes inversores, entre ellos:, Expa, YCombinator, Next Billion Ventures, Picus Capital, Anthemis, entre otros.Nuestro invitado estudió Licenciatura en Ingeniería Industrial en la Universitat Politécnica de Catalunya y una Maestría en Administra...

2021-07-0546 min

The Development DilemmaWhy is African start-up funding reserved for Expats?Only 6% of Kenyan start-ups in 2019 that received over 1m USD of funding were led by locals. It is clear the investing space is disproportionately skewed to expats whilst local entrepreneurs seem to be crowded out. In this discussion with Efayomi Carr, we explore in detail why the ecosystem of funders, investors and entrepreneurs leads to this and what needs to change. We discuss the bias towards trusted networks but also why Efayomi believes change is arising and why he would caution judging too quickly.Efayomi speaks from a place of experience, having worked in 2 start-ups (Jumia, Lori), 2...

2021-04-2844 min

The Development DilemmaWhy is African start-up funding reserved for Expats?Only 6% of Kenyan start-ups in 2019 that received over 1m USD of funding were led by locals. It is clear the investing space is disproportionately skewed to expats whilst local entrepreneurs seem to be crowded out. In this discussion with Efayomi Carr, we explore in detail why the ecosystem of funders, investors and entrepreneurs leads to this and what needs to change. We discuss the bias towards trusted networks but also why Efayomi believes change is arising and why he would caution judging too quickly.Efayomi speaks from a place of experience, having worked in 2 start-ups (Jumia, Lori), 2...

2021-04-2844 min

Wharton FinTech PodcastYoco Co-Founder, Carl Wazen - Revolutionizing South Africa's Digital PaymentsMiguel Armaza sits down with Carl Wazen, Co-Founder & Chief Business Officer at Yoco, South Africa’s leading payments platform for small businesses offering a convenient way to accept card payments in-person or online.

Founded in 2012, the company serves over 100,000 small businesses and has received multiple rounds of investment from industry leaders like Quona, Partech, Greyhound Capital, FMO, and many more.

We covered a wide range of topics, including:

- Carl’s background and his entrepreneurial journey in Cape Town, South Africa as an immigrant outsider

- Stories about the early days of Yoco and how they took the company from 0 to 1...

2021-04-0432 min

Startupeable: Emprendimiento | Tecnología | Venture Capital009. Santiago Suarez, Addi | Diagnóstico de Fintech en LatAm, Crecimiento exponencial como CEO, y Gestión de CrisisEn este episodio, conversamos con Santiago Suarez, cofundador y CEO de Addi, la fintech líder de crédito de consumo en punto de venta en Latinoamérica. Addi ha levantado capital de fondos como Andreeseen Horowitz y Quona Capital. Antes de Addi, Santiago fue VP de Corporate Development en Lending Club, una fintech famosa en EEUU, y fue socio part-time en Y Combinator enfocado en startups fintech.La manera más sencilla de ayudarnos es dejando una reseña en Apple Podcasts: https://ratethispodcast.com/startupeableEste episodio es auspiciado por:• Jeeves, la plat...

2021-03-0858 min

BRAVE Southeast Asia Tech: Singapore, Indonesia, Vietnam, Philippines, Thailand & Malaysia Startups, Founders & Venture Capital VC (English)Chris Sirisereepaph on SE Asia VC Dynamics, Thought Leadership Via Investment Thesis & Sharing Your Secret Sauce - E41Chris Sirisereepaph is a partner at Saison Capital, a FinTech-focused venture capital fund, that has done especially well in emerging markets like Southeast Asia and India. Their direct investments include Grab, Southeast Asia's largest startup and super-app, as well as ShopBack, Southeast Asia's largest shopping and cashback rewards platform. Their limited partner investments include global funds like Better Tomorrow Ventures, Quona Capital and Antler. This year they invested in companies such as Bukukas, Ula, Repute and Tazapay.

Chris grew up mostly in Singapore and graduated from the National University of Singapore with a Bachelors in Engineering. His...

2021-02-1845 minDisrupt PodcastDP #18: Funding Cowrywise and African fintech, and the return of a corporate-backed acceleratorTom and Gabriella are joined by Johan Bosini from the fintech-focused Quona Capital to discuss the founding round raised by Nigerian startup Cowrywise, while Philip Kiracofe from Startupbootcamp AfriTech discusses the return of Africa's premier corporate-backed accelerator programme. Episode also includes a wrap of all the latest African tech startup happenings, while Adetolani Eko of Nigerian dating startup Vybe “pitches the pod”.

2021-02-1437 min

Wharton FinTech PodcastSantiago Suarez, Co-Founder/CEO of Addi - Financing for the Digital AgeIn this episode, my guest is Santiago Suarez, Co-Founder & CEO of Addi, the leading POS financing platform in Latin America, backed by Andreessen Horowitz, Foundation, Monashees, Quona, and Village Global.

Prior to returning to his native Colombia to launch Addi, Santiago started his career in finance in New York City at JP Morgan, and later moved to Silicon valley for a leadership role at Lending Club.

We talk about:

- Santiago’s entrepreneurial fintech journey and fundraising experience

- Regional market dynamics

- The virtues of applying an American credit-scoring approach in Latin America

- Navigating an evolving regulatory landscape

...

2020-12-2042 min

VentureACV Webinar 05. "The Fintech Evolution"Welcome to ACV Webinars!

Today we’ll talk about: “Embedded Fintech: The Fintech Evolution”: a discussion about integration of Fintech within other industries, the technology involved and the trends expected for coming years.

We thank our speakers: Tayo Oviosu (Nigeria) from Paga and Jonathan Whittle (USA) from Quona Capital.

Please follow us and register:

ACV Linkedin: www.linkedin.com/company/acv-vc

ACV Medium: medium.com/@ACV_VC

ACV Spotify: https://rb.gy/u5szgg

ACV Newsletter: https://forms.gle/Z4q1qPgdjq4hU6rXA

2020-10-2855 min

The Portico PodcastMonica Brand Engel on Fintech & Financial InclusionIn the third episode of The Portico Podcast I speak with Monica Brand Engel — a co-founding Partner at Quona Capital, a venture capital firm focused on fintech for inclusion in emerging markets.If you’ve looked into EM fintech, you’ve probably come across Quona and their portfolio companies. For example:Sokowatch in East Africa, a working capital provider and last-mile distributor of fast-moving consumer goods to informal retailers;Coins in the Philippines, a mobile, branchless, blockchain-based platform that provides unbanked and underbanked customers with direct access to basic financial services (and which was acquire...

2020-10-2738 min

Wharton FinTech PodcastRewriting the History of Banking - Stefan Möller, Co-Founder & CEO of KlarIn this episode, Miguel Armaza interviews Stefan Möller, Co-Founder and CEO of Klar, a Mexican challenger bank working to democratize debit and credit in Mexico. Klar is making credit accessible to all Mexicans, including those with no credit history. It helps people build credit by looking at how and where they spend their money, without having to rely on obsolete and traditional credit scores.

Klar’s business has experienced rapid growth having issued over 25,000 credit lines amongst its 200,000 customers in less than 12 months and their growth has tripled during the pandemic.

Klar has raised almost $73 million in debt and equ...

2020-10-2130 min

BRAVE Southeast Asia Tech: Singapore, Indonesia, Vietnam, Philippines, Thailand & Malaysia Startups, Founders & Venture Capital VC (English)Insider’s Guide to VC: Building Venture Backable Startups, Raising Capital in a Downturn and Increasing your Valuation - E18The Insider's Guide to Venture Capital is a podcast series hosted by Chia Jeng Yang, Venture Capitalist, and myself, Jeremy Au, a serial exited Founder.

Chia is a Principal at Saison Capital, a leading FinTech-focused venture capital fund, who has done especially well in emerging markets like Southeast Asia and India. Their direct investments include Grab, Southeast Asia's largest startup and super-app, as well as ShopBack, Southeast Asia's largest shopping and cashback rewards platform. Their limited partner investments include some of the top-performing funds in Southeast Asia, like East Ventures and Beenext, as well as global funds...

2020-08-2733 min

The Neon ShowGanesh Rengaswamy, Quona Capital, on the growth of Digital Lending and Neo Banking in IndiaGanesh began his career working in Strategy & Acquisition at Infosys in the San Francisco Bay area. He founded his first startup - Travelguru (later acquired by Travelocity) while he was pursuing his MBA from Harvard Business School.In 2006, he began his journey as a VC with Greylock Partners. In 2014, he Co-Founded Quona Capital, which is a Fintech-focused VC firm, making investments across Asia, Latin America, and Sub-Saharan Africa.A few of its successful exits include - IndiaMart (went IPO) & Coins.ph (acquired by Gojek).Some of its current Portfolio includes - ZestMoney, Fisdom, & Neogrowth among others.In this podcast, Ganesh...

2020-06-1444 min

Wharton FinTech PodcastEmpowering Underserved Markets with Monica Brand Engel, Co-Founder & Partner at QuonaIn our latest episode of the Wharton FinTech Podcast, Miguel Armaza (WG'21/G'21) is joined by Monica Brand Engel, Co-Founder and Partner at Quona, a venture capital firm that invests in growth-stage financial technology companies in emerging markets.

Quona Capital is a venture capital firm that invests in growth-stage financial technology companies in emerging markets. The firm was formed with a simple idea - technology has the power to radically improve the quality, access, and affordability of financial services for underserved consumers and businesses in Africa, Latin America, and Asia. Quona invests in disruptive innovations to create a more financially incl...

2020-05-2126 min

BRAVE Southeast Asia Tech: Singapore, Indonesia, Vietnam, Philippines, Thailand & Malaysia Startups, Founders & Venture Capital VC (English)Chia Jeng Yang On Scaling People - E2Chia is a Principal at Saison Capital, a leading FinTech-focused venture capital fund, who has done especially well in emerging markets like Southeast Asia and India. Their direct investments include Grab, Southeast Asia's largest startup and super-app, as well as ShopBack, Southeast Asia's largest shopping and cashback rewards platform. Their limited partner investments include some of the top-performing funds in Southeast Asia, like East Ventures and Beenext, as well as global funds like Quona Capital and Antler.

Previously he was the fifth employee for Antler, the leading global pre-team venture builder. He also both invested and launched m...

2020-04-2317 min

En ContxtoS. 29 - Aportaciones latinoamericanas contra el coronavirus1.- [Min 02:57] La app para el coronavirus de Colombia [http://bit.ly/coronapp-colombia-es]

2.- [Min 07:22] IA boliviana para el coronavirus [http://bit.ly/coronavirus-view-factor-es]

3.- [Min 09:08] El nuevo fondo de inversión de Quona Capital [http://bit.ly/quona-accion-fondo]

4.- [Min 15:07] La regulación argentina para las startups de entregas de última milla [http://bit.ly/ultima-milla-ley-argentina]

2020-03-1026 min

Fintech One-On-OnePodcast 236: Monica Brand Engel of Quona CapitalConnect with Fintech One-on-One: Tweet me @PeterRenton Connect with me on LinkedIn Find previous Fintech One-on-One episodes

2020-02-2835 min

Bank On ItEpisode 287 Monica Brand Engel from Quona CapitalEvery week the show host John Siracusa talks with impressive fintech leaders and entrepreneurs, through conversation uncovers the remarkable stories behind them, their creations and the most important topics in fintech. You can subscribe to this podcast and stay up to date on all the stories here on iTunes, Google Play, Stitcher, Spotify and iHeartRadio. In this episode the host John Siracusa chats with Monica Brand Engel, co-founder and managing partner of Quona Capital. Quona Capital is a venture capital firm that invests in growth-stage financial technology companies in global emerging mar...

2020-02-0431 min

Wharton FinTech PodcastSergio Furio - Founder and CEO of CreditasIn our latest podcast, Ronak Mehta (WG ’20) is joined by Sergio Furio, Founder and CEO of Creditas (www.creditas.com.br). In this extensive interview, Sergio explains how Creditas improves the lives of Brazilians by providing access to affordable credit. Sergio also provides context on the Brazilian retail banking and lending industry, shares his vision for Creditas’ future, and reflects on key learnings from his journey as an entrepreneur.

Creditas is the leading secured lending platform in Brazil. With 1,000 employees and $315 million USD in VC funding, Creditas is one of the top fintech companies in Latin America. Creditas’ backers include Softba...

2019-12-0933 min

Money + MeaningLessons Impact Investing Can Learn from Microfinance - LiveThe evolution of microfinance from radical idea to global industry was surprisingly fast, sometimes messy, and filled with successes and failures. Despite numerous challenges, microfinance grew into a global industry that has helped lift millions of people out of poverty. As impact investing continues to move into the mainstream, what can the industry learn from the early days of microfinance? This week’s episode, recorded live at SOCAP19, features a panel of leading microfinance experts and practitioners who share lessons they learned and offer insights into the current state, and potential future, of impact investing....

2019-12-0347 min

Sparta Chicks Radio: Mindset | Confidence | Sport | Women#106: Quona Ross Atkinson on Ageing DisgracefullyHow does ocean surf ski paddling figure into one woman’s version of a mid-life crisis? We ask Quona Ross Atkinson on Sparta Chicks Radio this week! Quona grew up on a cattle station in North Queensland and started competing in rodeos, camp drafting and show riding from the time she was 3. An extensive career in barrel racing followed before she took up adventure racing in her 40s. Fast forward to 2019 and after just 5 years in the sport of ocean surf ski paddling, she’s about to compete in the famous 52km M...

2019-05-1954 min

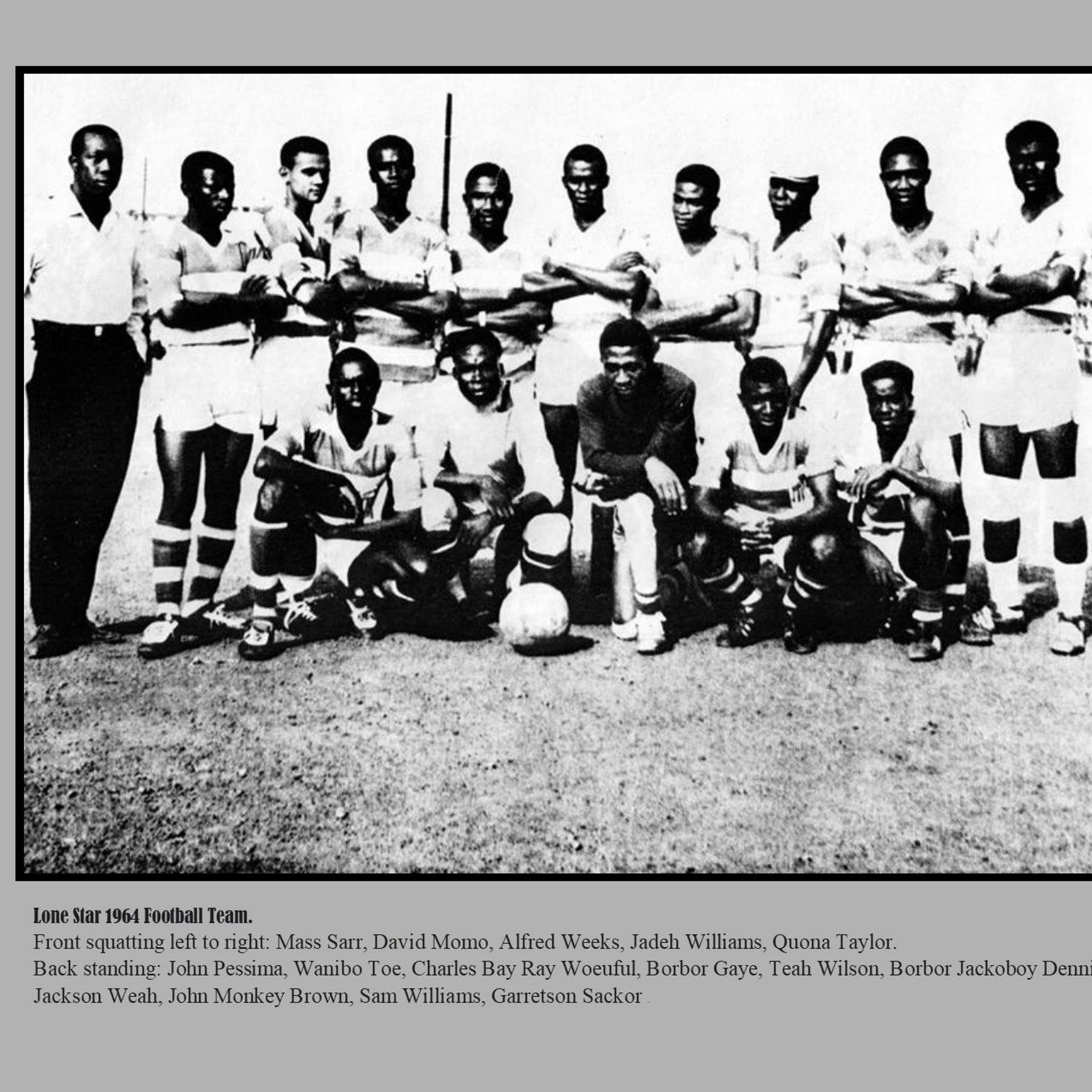

Crossatlantic MusicWanibo Toe - The Harlem Congo BandWanibo Toe ‘Great Football Wizard’ of Liberia. Born in Ghana to Liberian parents of Kru/Grebo descent, Toe was among the Liberian footballers in the West African Diaspora who returned reportedly around the 1960s; another was the “32” Jackson Weah. It is said that in Ghana Toe played for the Premier League side Real Republicans, though I do not know whether he was a member when the team won the 1962/63 title. In any case, Toe is clearly identified in the iconic photo of Lone Star believed to have been taken in 1964 during the epic game with Ghana Black Star. Though Lone Star los...

2019-01-2403 min

Wine Soundtrack - ItaliaI Veroni - Lorenzo MarianiIl cuore dell’azienda, nella zona del Chianti Rùfina, ricorda i tipici antichi spazi toscani, tutti raccolti attorno alla propria aia, abbracciati dalle vigne: in questo caso 20 ettari a prevalenza di Sangiovese tutti condotti secondo i principi dell’agricoltura biologica. Con il 2017 è arrivato un vento nuovo in azienda, Lorenzo Mariani che ne è il titolare propone due etichette, I Dòmi e Quona, destinate ad interpretare i due vigneti che hanno da sempre prodotto Annata e Riserva. I Dòmi, vino fresco ed intenso, deve il suo nome alle cupole che coprono i piccoli pozzi disseminati nella proprietà. Quona è il...

2018-11-2508 min

African Tech Roundup PodcastMonica Brand Engel of Quona Capital on why impact investment gets a bad rapMonica Brand Engel is a Peruvian American investor and entrepreneur who has been involved with a number of investment vehicles and products aimed at broadening financial inclusion. Monica spent her formative years in Silicon Valley and is a disciple of agile development and user-centered design. The financial inclusion businesses she helped launch include Quona Capital, Accion Frontier Inclusion Fund and its predecessor fund, Frontier Investments Group, Anthuri Catalysts (Cape Town venture capital accelerator), a Calvert index fund (Bethesda based socially responsible mutual fund), lending intermediaries sponsored by The Development Fund (San Francisco based) and new business lines with Compartamos...

2017-04-2515 min

African Tech Roundup PodcastKatlego Maphai of Yoco on innovating within South Africa's mobile payments sceneKatlego Maphai is the co-founder and CEO of the South African mobile payments startup, Yoco. Yoco launched out of beta in October 2015 and the venture has since acquired over 6 500 merchants, has gone on to process approximately $76,7 million (R1 billion rand) in annualised transactions. The company has recently announced the conclusion of a Series-A funding round (sum undisclosed) led by two foreign, fintech-focused institutional investors-- US-based Quona Capital (manager of Accion Frontier Inclusion Fund) and the Netherlands-based, Velocity Capital.

2017-03-0222 min