Shows

RBN Energy BlogcastSouthbound – New Pipelines Push More Haynesville Natural Gas South to Meet LNG DemandHaynesville natural gas production is heading back to record levels thanks to growing LNG demand and new pipelines designed to move gas from north to south in Louisiana. In today’s RBN blog, we’ll preview some of the topics RBN will be covering regularly in the new NATGAS Haynesville report.

2026-01-2611 min

RBN Energy BlogcastGo Your Own Way – The Top 10 RBN Blogs of 2025What it takes to get energy from where it is produced to where it is consumed was at the heart of many of RBN’s most popular blogs in 2025. But there were also the three T’s: Trump, tariffs and turbulence.

2025-12-3014 min

RBN Energy BlogcastTwo Countries, One Market - The Theme for RBN's 2025 School of Energy: You Ain’t Seen Nothin' Yet!It's an integrated energy market that stretches across the North American continent, from Texas and Florida to the mountains of British Columbia and Canada’s industrial heartland in Ontario/Quebec — a cross-border network so deeply connected, it functions as one massive, interdependent system for oil, natural gas and NGLs. That system is undergoing major shifts and challenges, driven not only by changing supply/demand dynamics and evolving infrastructure within the market itself, but also by powerful external forces, including regulatory policies and political pressures. That’s why we couldn’t think of a better time — or a better place — to host RBN’s 1...

2025-07-2814 min

RBN Energy BlogcastRunning on Empty - Global Refining Capacity Expected to Grow at Slowest Pace in 30 YearsGlobally, government policies have shifted away from petroleum in recent years toward lower-carbon alternatives such as renewable fuels and electric vehicles (EVs), largely driven by worries about climate change. This has pushed down investment in petroleum refining, and RBN’s Refined Fuels Analytics (RFA) practice predicts global net refining capacity will increase by only 2.1 MMb/d, or 422 Mb/d annually, from 2025-29 — the slowest rate in 30 years. In today’s RBN blog, we’ll discuss the upcoming refinery closures, proposed projects, and the obstacles new and existing refiners face.

2025-02-2117 min

RBN Energy BlogcastGimme Three Steps - The Top 10 RBN Blogs of 2024Many of this year’s most popular RBN blogs gravitated toward familiar energy market themes — rising exports, shifts in oil production, weak natural gas prices, surprising NGL pricing dynamics and the like. However, we also noted a significant uptick in interest in topics beyond the traditional energy realm, including hydrogen, carbon capture and sequestration (CCS), electric vehicles (EVs) and even the role of artificial intelligence (AI) and data centers. It’s not that RBNers have shifted their focus away from oil, gas and NGL markets. Rather, it reflects a growing recognition that the renewable and alternative energy landscape — fueled by regulati...

2024-12-3018 min

RBN TorinoRBN TORINO – “I MEDIA DANNO I NUMERI?” CON GABRIELE ADINOLFIRbn Torino attacco alla Torino bene presenta lo speciale settimanale con un ospite ormai di “casa”, Gabriele Adinolfi. “Siria e Ucraina: i media danno i numeri?” Un analisi sugli ultimi avvenimenti, critiche sulla narrazione delle guerre dai parte dei media e tanto altro, grazie al punto di vista sempre attento e e critico di Gabriele […]

2024-12-1549 min

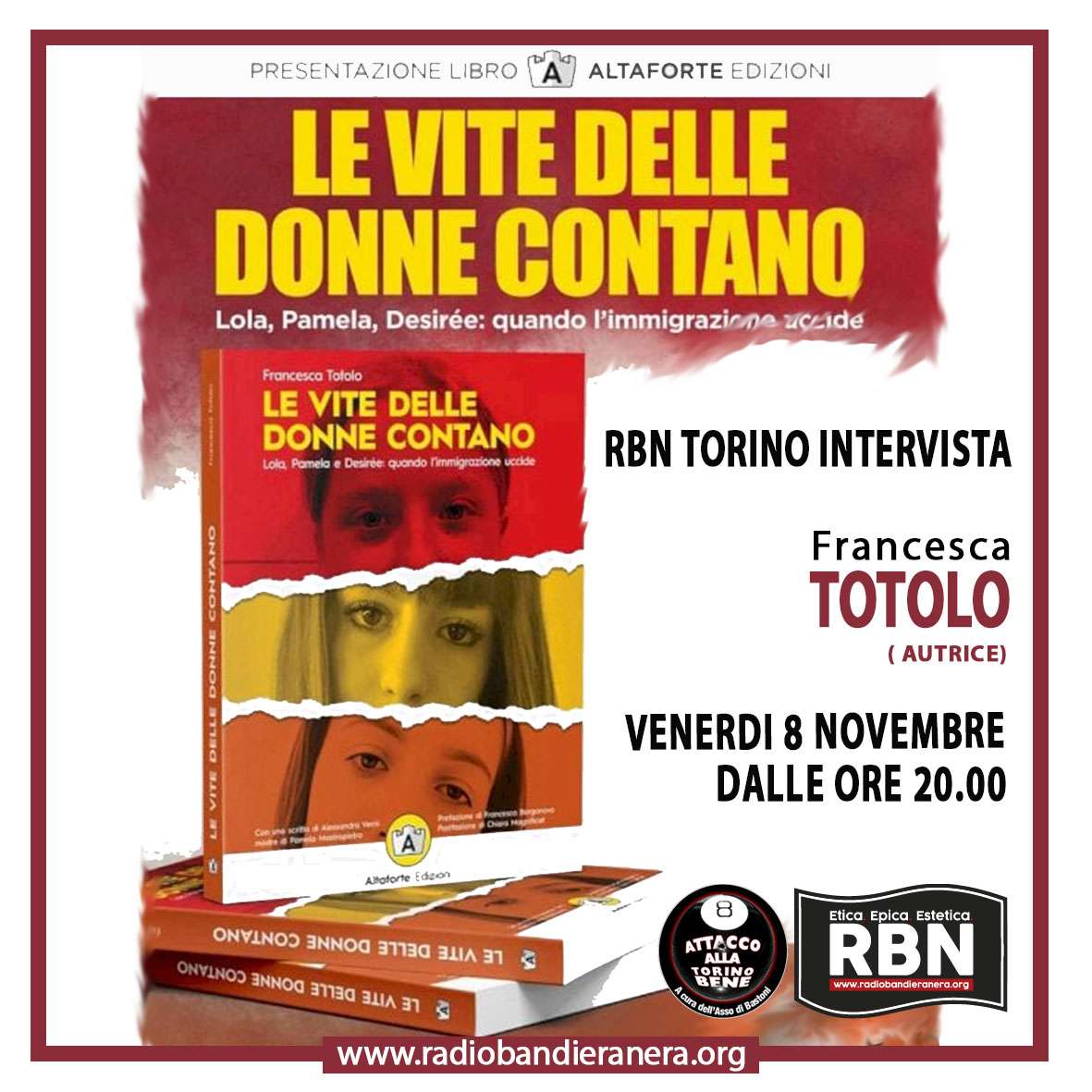

RBN TorinoRBN TORINO – LE VITE DELLE DONNE CONTANORbn Torino attacco alla Torino bene presenta lo speciale settimanale intervistando Francesca Totolo l’autrice del nuovo libro “Le vite delle donne contano”. Un libro che raccoglie e testimonia tutti i crimini commessi in Europa da immigrati, clandestini, richiedenti asilo, ovvero, omicidi, stupri e aggressioni che hanno trovato pochissimo riscontro nei media. Da Pamela a Lola, […]

2024-12-111h 02

RBN Energy BlogcastTake A Look At Me Now - Enterprise's Ambitious Goal for Expanding Its Hydrocarbon Liquids ExportsEnterprise Products Partners continues to grow its export capabilities and set ambitious goals, including one noted by CEO Jim Teague during his appearance at RBN’s recent NACON: PADD 3 conference — growing liquid hydrocarbon exports by about 50% to a remarkable 100 MMbbl per month (100 MMb/month), or about 3.33 MMb/d. And that doesn’t include the company’s planned Sea Port Oil Terminal (SPOT), which could send out up to 2 MMb/d! While that goal may seem lofty, Enterprise is already a major player in export markets and has extensive hydrocarbon delivery, storage and distribution assets in place to feed its coastal terminal...

2024-11-2514 min

RBN Energy BlogcastThe Long Road, Encore Edition - More EVs Coming, But Forecasts For Sales Growth, Impact On Gasoline Demand VaryThere’s been a lot of speculation about whether the pace of electric vehicle (EV) adoption has slowed, with JD Power now expecting EVs to make up 9% of U.S. new-car sales in 2024, down from its earlier estimate of 12.4% but still up from 7% in 2023. The group remains bullish on EVs in the long term, expecting market share to reach 36% by 2030 and 58% by 2035. The forecast from RBN’s Refined Fuels Analytics (RFA) group forecast has been — and continues to be — more conservative than most but still anticipates EVs will reach 50% of U.S. new-car sales by the early 2040s. In today’s RBN blog...

2024-11-1110 min

RBN TorinoRBN TORINO – I RUSSI DELLA NATORbn Torino attacco alla Torino bene presenta lo speciale settimanale con Gabriele Adinolfi. Una puntata fuori dal coro e dalle solite polemiche sterili in cui si focalizzerà l’attenzione sulla complicità americano – russa non solo nell’ attuale conflitto Ucraino ma nei vari scenari Europei. Venerdì 1 Novembre ore 20.00 solo su ? www.radiobandieranera.org

2024-11-0252 min

RBN Energy BlogcastThe Long Road - More EVs Coming, But Forecasts For Sales Growth, Impact On Gasoline Demand VaryThere’s been a lot of speculation about whether the pace of electric vehicle (EV) adoption has slowed, with JD Power now expecting EVs to make up 9% of U.S. new-car sales in 2024, down from its earlier estimate of 12.4% but still up from 7% in 2023. The group remains bullish on EVs in the long term, expecting market share to reach 36% by 2030 and 58% by 2035. The forecast from RBN’s Refined Fuels Analytics (RFA) group forecast has been — and continues to be — more conservative than most but still anticipates EVs will reach 50% of U.S. new-car sales by the early 2040s. In today’s RBN blog...

2024-10-1110 min

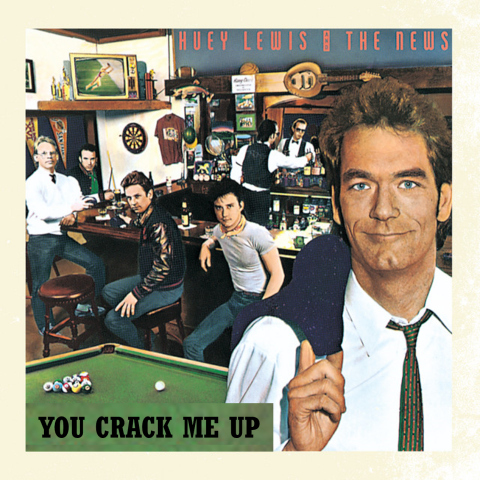

RBN Energy BlogcastYou Crack Me Up - Refiners Increasingly Relying on Hydrocracking Capacity As Fuel Demand ShiftsMore than a decade ago, several U.S. refiners brought new hydrocracking capacity online, wagering that rising demand for middle distillates made such major investments necessary. They were good bets. Demand for jet fuel is expected to continue to grow, and while diesel demand is seen as relatively flat in the U.S. over the next few years, it will continue to climb globally through 2045, according to RBN’s recently released Future of Fuels report. In contrast, the report also sees domestic gasoline demand declines accelerating post-2026 and peaking globally by about 2030, as more consumers turn to electric vehicles (EVs). Th...

2024-07-2916 min

RBN Energy BlogcastSlow Your Roll - How a Slower Energy Transition Might Impact Oil Producers, Refiners and ConsumersThe last few years have been filled with often-spirited debate about the global energy transition and the move away from fossil fuels to fully embrace renewables and alternatives to keep the lights on, fuel vehicles and power the world’s economy. But there are a growing number of signs that a swift shift from petroleum is not realistic, which has implications in many areas, including which refinery expansion projects move forward (and where), when oil demand might peak, and which of the many forecasts for gasoline and distillate production will prove to be the most accurate. In today’s RBN blog...

2024-07-2215 min

RBN TorinoRBN TORINO – ELEZIONI FRANCESI CON GABRIELE ADINOLFIRbn Torino attacco alla Torino bene presenta lo speciale con Gabriele Adinolfi dedicata alle elezioni Francesi. Un analisi completa sullo scenario francese, tra affluenze e nuove dinamiche interne. Venerdi 12 Luglio ore 20.00 www.radiobandieranera.org

2024-07-1352 min

RBN Energy BlogcastChange is Going to Come - U.S. Oil, Gas and NGL Markets Face Challenges and OpportunitiesBack in the early 2010s, U.S. crude oil and NGL exports were minimal and LNG exports were non-existent, but there were omens that the U.S. would soon regain its status as an energy production juggernaut. Now the U.S. is a critically important global supplier of oil, gas and NGLs, with exports crucial to managing supply and demand as infrastructure rushes to keep up and industry players simultaneously explore alternative energy possibilities. How all these moving parts interconnect was the focus of RBN’s 18th School of Energy last week and it’s the subject of today’s RBN bl...

2024-07-0514 min

RBN TorinoRBN TORINO – RAFAH: OBBIETTIVI DI UN GENOCIDIORbn Torino attacco alla Torino bene presenta lo speciale settimanale dedicato ai tristi avvenimenti di Rafah. Ci faremo aiutare, per fare chiarezza e per analizzare quei drammatici avvenimenti da Gabriele Adinolfi, che ci spiegherà in dettaglio di Rafah e del genocidio del popolo Palestinese. Venerdì 7 Giugno dalle ore 20.00 solo su? www.radiobandieranera.org

2024-06-2457 min

RBN TorinoRBN TORINO – ELEZIONI EUROPEE CON GABRIELE ADINOLFIRbn Torino attacco alla Torino bene presenta lo speciale settimanale dedicato alle Elezioni Europee. Grazie al punto di vista di Gabriele Adinolfi, analitico e critico faremo chiarezza sulle prossime elezioni europee. Venerdì 10 Maggio dalle ore 20.00 solo su: www.radiobandieranera.org

2024-05-1951 min

RBN TorinoRBN TORINO – IL MITO DELL’EUROPARbn Torino attacco alla Torino bene presenta lo speciale settimanale presentando il libro “Il Mito dell’ Europa” di Gabriele Adinolfi. “L’Unione Europea, va da sé, non è l’Europa che ci piace. Ma quale Nazione, oggi, ci piace davvero? Quale Stato e quale regime politico, oggi, soddisfa pienamente le nostre aspettative?” … Ascolta la puntata venerdì […]

2024-05-0757 min

RBN Energy Blogcast(The EPA) Drives Me Crazy - New U.S. Rule on Tailpipe Emissions Conflicts With Energy RealityThe Biden administration recently announced a very ambitious — to say the least — rule on tailpipe emissions. But while the rule’s legal and political standing might be a bit uncertain — it’s seen by many as a de facto ban on conventionally fueled cars and trucks and is likely to face several court challenges — doubts also remain about whether it matches up with the realities of today’s energy world. In today’s RBN blog, we look at the new rule, what it would mean for U.S. consumers and automakers, and how it conflicts with the views of RBN’s Refined Fuels An...

2024-04-1212 min

RBN TorinoRBN TORINO – “BUGIE COLONIALI” CON ALBERTO ALPOZZIRbn Torino attacco alla Torino bene presenta la conferenza “Bugie Coloniali” con l’autore del libro Alberto Alpozzi. Una conferenza che fa chiarezza sul colonialismo italiano, tra cancel culture, censure e falsi miti. Ascoltatela solo su: www.radiobandieranera.org

2024-02-271h 50

RBN TorinoRBN TORINO – FOIBE ED ESODORbn Torino attacco alla Torino bene presenta lo speciale dedicato alle foibe ed esodo Italiano. La redazione torinese intervisterà Luigi Vatta, figlio di Esule, che ci racconterà un capitolo oscuro e drammatico della Storia d’Italia. Venerdì 09 Febbraio ore 20 su www.radiobandieranera.org

2024-02-1852 min

RBN Energy BlogcastWe Just Disagree - Our Contrarian Take on Refining Capacity, Product Demand and Other MattersAround the world, a lot of smart people in the public and private sectors hold similar views on where we’re all headed, energy-wise. An accelerating shift to renewables and electric vehicles, driven by climate concerns. A not-so-far-away peak in global demand for refined products like gasoline and diesel. There are also what you might call consensus opinions on some energy-industry nuances, like how much global refining capacity will be operational in 2025 and what the spread between light and heavy crude oil will be in the years ahead. In today’s RBN blog, we discuss highlights from the new Future of F...

2024-02-1613 min

RBN TorinoRBN TORINO – FABRIZIO DE ANDRE’Rbn Torino ‘attacco alla Torino bene’ presenta lo speciale su Fabrizio De Andrè: il pensiero, la poetica e la filosofia del menestrello anarchico ritenuto il più grande dei nostri cantautori. Un viaggio per conoscere la sua visione anti borghese e anticonformista. Contro il mondo dell’uguale sempre dalla parte del torto.

2024-01-2957 min

RBNRBN TORINO – IRON MAIDENhttps://radiobandieranera.org/wp-content/uploads/2024/01/PUNTATA-IRON-MAIDEN.mp3

RBN Torino attacco alla Torino bene presenta lo speciale dedicato agli Iron Maiden.

Brinderemo alla fine dell’ anno con del sano e autentico Heavy Metal, con Paulöt e Archeo alla regia una puntata dedicata ai mostri sacri dell’ Heavy Metal.

Venerdì 29 Dicembre alle ore 20.00 su www.radiobandieranera.org

2024-01-151h 07

RBNRBN TORINO – IRON MAIDENhttps://radiobandieranera.org/wp-content/uploads/2024/01/PUNTATA-IRON-MAIDEN.mp3

RBN Torino attacco alla Torino bene presenta lo speciale dedicato agli Iron Maiden.

Brinderemo alla fine dell’ anno con del sano e autentico Heavy Metal, con Paulöt e Archeo alla regia una puntata dedicata ai mostri sacri dell’ Heavy Metal.

Venerdì 29 Dicembre alle ore 20.00 su www.radiobandieranera.org

2024-01-151h 07

RBN Energy BlogcastTop 10 RBN Energy Prognostications for 2024: Year of the Dragon - Breathing Fire?Think energy markets are getting back to normal? After all, prices have been relatively stable, production is growing at a healthy rate, and infrastructure bottlenecks are front and center again. Just like the good ol’ days, right? Absolutely not. It’s a whole new energy world out there, with unexpected twists and turns around every corner — everything from regional hostilities, renewables subsidies, disruptions at shipping pinch points, pipeline capacity shortfalls and all sorts of other quirky variables. There’s just no way to predict what is going to happen next, right? Nah. All we need to do is stick our collecti...

2024-01-0118 min

RBN TorinoRBN TORINO – EUROPA VS OCCIDENTERbn Torino attacco alla Torino bene presenta la conferenza “Europa VS Occidente”. Direttamente dai microfoni dell’ Asso di Bastoni, Adriano Scianca autore del libro e Lorenzo Cafarchio. Non vi anticipiamo ma vi consigliamo di ascoltare questa fantastica e illuminante conferenza. Venerdì 22 Dicembre dalle ore 20.00 su www.radiobandieranera.org

2023-12-2856 min

RBN Energy BlogcastThe Top 10 RBN Energy Prognostications - 2023 ScorecardA year ago, as New Year’s Day approached, we were looking ahead into very uncertain market conditions, having lived through a pandemic, crazy weather events, collapsing and then soaring prices, and Russia’s horrific invasion of Ukraine. Our job was once again to peer into the RBN crystal ball to see what the upcoming year had in store for energy markets. We’ll do that again in our next blog. But another part of that tradition is to look back to see how we did with our forecasts for the previous year. That’s right! We actually check our work. An...

2023-12-2813 min

RBN Energy BlogcastOn The Road Again - The Top 10 RBN Blogs of 2023: What It Takes to Move Energy Supplies to MarketCrude oil, natural gas and NGL production roared back in 2023. All three energy commodity groups hit record volumes, which means one thing: more infrastructure is needed. That means gathering systems, pipelines, processing plants, refinery units, fractionators, storage facilities and, above all, export dock capacity. That’s because most of the incremental production is headed overseas — U.S. energy exports are on the rise! If 2023’s dominant story line was production growth, exports and (especially) the need for new infrastructure, you can bet our blogs on those topics garnered more than their share of interest from RBN’s subscribers. Today we dive int...

2023-12-2717 min

RBN TorinoRBN TORINO – I PIT BULL TERRIERRBN Torino attacco alla Torino bene presenta lo speciale dedicato ai Pit Bull Terrier. Una razza con origini e una storia unica. Molto discussa e conosciuta spesso in modo errato. Ma lo faremo con Archeo, allevatore di due Pit Bull, che ci racconterà di questa magnifica razza canina. Venerdì 8 Dicembre dalle ore 20.00 su […]

2023-12-1051 min

RBN Energy BlogcastRoamin' Thru the Gloamin' With 40,000 Headmen and Headwomen - Inside the RBN BlogosphereWell, thanks to you all, we reached another important milestone this week: 40,000 subscribers to RBN’s daily blog. We are quite proud of the achievement. That’s a lot of folks taking time out of their busy day to read a couple thousand words about what’s happening with oil, gas, NGLs and renewables — all in the context of a rock & roll song. We couldn’t have done it without you. Today, after posting a total of about 3,000 blogs over nearly 12 years, we pull back the curtain on the RBN blogosphere and discuss how and why it all happens — and how you help...

2023-11-0812 min

RBN Energy BlogcastOne Week - A Record Seven Days for Gulf Coast Crude Exports, and a Lot MoreThe level of activity at crude oil export terminals from Corpus Christi to the Louisiana Offshore Oil Port (LOOP) is nothing short of extraordinary — a record 4.8 MMb/d was loaded the week ended August 25, according to RBN’s Crude Voyager report, and Houston-area terminals loaded an all-time high of 1.4 MMb/d. But there’s a lot more to the crude exports story. When you live this stuff day-in, day-out, you see subtle changes that often extend into trends and, if you’re lucky, you sometimes get signals that things you’d been predicting are actually happening. In today’s RBN blog, we dis...

2023-09-0112 min

RBN Energy BlogcastI'm a Believer - U.S. Refiners Stand to Benefit from Longer Reliance on Liquid Fuels, Limited Global Capacity AdditionsThe world consumes about 100 MMb/d of liquid fuels, which are critically important to every segment of the global economy and to nearly every aspect of our daily lives. The size and scope of this market means it’s impacted by all kinds of short-term forces — economic ups and downs, geopolitics, domestic developments and major weather events, just to name a few — some of which are difficult, if not impossible, to foresee. But while these events can sometimes come out of nowhere, there are some long-term forces on the horizon that will shape markets in the decades to come, even if the...

2023-08-1813 min

RBN Energy BlogcastFuel Rollercoaster - Anticipating the Twists and Turns Ahead in U.S. and Global Product MarketsA wide range of ever-changing economic and other forces — domestic and international — are constantly impacting the U.S. refinery complex, for good and for bad. Fluctuations in crude oil supply and prices. Ups and downs in demand for refined products. Refinery closures and expansions. And don’t forget this: the pace of the much-discussed transition to lower-carbon energy sources. There’s a lot at play in the world of gasoline, middle distillates and resid — renewable fuels too — and while industry players can’t fully anticipate what’s next in the refined-product roller coaster ahead, it’s critically important to keep up with the latest...

2023-07-1816 min

RBN Energy BlogcastThe Price You Pay - How Much Will Price Impact Future U.S. Crude Production Growth?For the first 10 years of the Shale Revolution, it was a foregone conclusion: High prices stimulated more drilling, and more drilling meant higher production. It worked in both directions. When prices crashed, so did production. The correlation was great. The relationships were right on cue in 2014-15 when $100/bbl crude crashed to $30, rebounded to $60 by 2019, and wiped out in 2020 when the COVID meltdown hit. But then the market shifted. As prices ramped up in 2021 — eventually to astronomical levels in 2022 — the phenomenon of producer discipline kicked in, with E&Ps capping their drilling programs and returning a significant slice of their risi...

2023-03-0912 min

RBN Energy BlogcastThe Future's So Bright, Encore Edition - What's Ahead for Refined Products in the U.S. and AbroadOver the next couple of years — and the next couple of decades — global supply/demand dynamics in refined products markets will be driven by two critically important factors. The first is the understandable reluctance of refiners to expand capacity in the face of climate policy and ESG headwinds. The second is a growing gap between policymakers’ aggressive energy-transition goals and the global pivot to a renewed focus on energy security brought about by the Russia-Ukraine war and worries about China’s global ambitions. These factors, which will fuel the prospects for constrained supply and higher-for-longer demand, have far-reaching implications, not only for...

2023-02-2017 min

RBN Energy BlogcastThe Future's So Bright - What's Ahead for Refined Products in the U.S. and AbroadOver the next couple of years — and the next couple of decades — global supply/demand dynamics in refined products markets will be driven by two critically important factors. The first is the understandable reluctance of refiners to expand capacity in the face of climate policy and ESG headwinds. The second is a growing gap between policymakers’ aggressive energy-transition goals and the global pivot to a renewed focus on energy security brought about by the Russia-Ukraine war and worries about China’s global ambitions. These factors, which will fuel the prospects for constrained supply and higher-for-longer demand, have far-reaching implications, not only for...

2023-02-1417 min

Speciali RBNRBN Novara – Speciale 10 FebbraioIn questa puntata Cristina intervista Silvano Olmi, presidente nazione del Comitato 10 Febbraio.

2023-02-1357 min

RBN Energy BlogcastThe Final Countdown, Part 2 - RBN's Five-Year Natural Gas Market OutlookThe CME/NYMEX Henry Hub prompt natural gas futures price has fallen precipitously in recent months and 2023 has the potential to be one of the most bearish in recent history. But longer term, the stage is set for tighter balances, price spikes and increased volatility. After a slowdown in 2022-23, LNG export capacity additions will come fast and furious over the next several years. As they do, they will outpace production growth, which will increasingly depend on pipeline and other midstream expansions. In other words, 2023 will be the last aftershock of Shale Era surpluses. We got a taste of what...

2023-02-1310 min

RBN Energy BlogcastThe Final Countdown - Bearish 2023 Gas Market Punctuates Last Throes of Shale Era AbundanceThe Lower 48 natural gas market has had the most bearish start to a new year in a long time. Production has been at record highs, an exceptionally warm start to January suppressed demand, and LNG exports have been hobbled since last June when Freeport LNG went offline. The CME/NYMEX Henry Hub February gas futures contract slid to an 18-month low of $2.94/MMBtu last Thursday and expired Friday at $3.109/MMBtu, down 54% from where the prompt contract closed just two months earlier. The March contract extended the slide Monday to a 20-month low of $2.677/MMBtu. Freeport’s eventual return will restore ex...

2023-01-3114 min

RBN Energy BlogcastTop 10 RBN Energy Prognostications for 2023, Encore Edition – Year of the RabbitWorried about 2023? Well, you’ve got good reason to be. This year energy markets are at the mercy of a hot war in Europe, the threat of a global recession, looming China/Taiwan hostilities, the impending onslaught of new energy transition programs from recent legislation, and all sorts of other random black swans paddling around out there. With so much uncertainty ahead, predictions this year would be just crazy talk, right? Nah. No mere market murkiness will dissuade RBN from sticking our collective necks out to peer into our crystal ball one more time. Let’s hope it’s no bad bu

2023-01-1616 min

RBN Energy BlogcastTop 10 RBN Energy Prognostications for 2023 - Year of the RabbitWorried about 2023? Well, you’ve got good reason to be. This year energy markets are at the mercy of a hot war in Europe, the threat of a global recession, looming China/Taiwan hostilities, the impending onslaught of new energy transition programs from recent legislation, and all sorts of other random black swans paddling around out there. With so much uncertainty ahead, predictions this year would be just crazy talk, right? Nah. No mere market murkiness will dissuade RBN from sticking our collective necks out to peer into our crystal ball one more time. Let’s hope it’s no bad bu

2023-01-0316 min

RBN Energy BlogcastThe Top 10 RBN Energy Prognostications - 2022 ScorecardAs we bid adieu to 2022, it’s once again time for the Top 10 RBN Energy Prognostications, our long-standing tradition where we look into our crystal ball to see what the upcoming year has in store for energy markets. And unlike many forecasters, we also look into the rearview mirror to see how we did with last year’s predictions. Ouch. No, we did not predict a lingering, hot war in Europe in 2022, and that had a variety of ramifications for our scorecard this time around. Even so, we actually feel pretty good about those market calls. Most turned out to be s...

2023-01-0216 min

RBN Energy BlogcastI Want Security, Yeah - The Top 10 RBN Blogs of 2022: All About Energy SecurityWell, you might say energy markets got smacked upside the head in 2022. After a decade of energy abundance, a meltdown in demand in 2020, and what looked like a budding recovery in 2021, energy security had devolved into a back-burner issue. After all, why worry about existing fuel sources when they would soon be replaced by waves of renewable and sustainable fuels? Then, literally overnight, the world changed on February 24, when Russia invaded Ukraine. Prior assumptions about energy security were out the window. Suddenly, the availability, source of production and, of course, the price of traditional energy were front-and-center. In fact, those...

2022-12-3016 min

RBN Energy BlogcastI Need You - FERC's New Spire STL Decision Helps Secure Future of Key Gas InfrastructureOn December 15, the Federal Energy Regulatory Commission (FERC) issued a permanent certificate authorizing the Spire STL natural gas pipeline serving the St. Louis area to continue operations. Spire STL had been on a treacherous legal roller-coaster, wherein its owner got a FERC certificate in 2018, built and started operation of the 65-mile pipeline in 2019, then in 2021 saw its certificate “vacated” — wiped out — by a U.S. Court of Appeals. Then, during the white-knuckled tail end of the ride, with the winter of 2021-22 looming, Spire STL got emergency/temporary authorization from FERC to keep operating while a brand-new application for a certific...

2022-12-2210 min

RBN Energy BlogcastWhere It's At, Part 2 - Timing Is Everything for Gulf Coast Gas Producers, LNG OfftakersAs U.S. LNG export project development accelerates along the Gulf Coast, one of the big uncertainties is where will all that feedgas come from? We estimate that there are a dozen Gulf Coast projects totaling 16 Bcf/d of export capacity in the running for completion in the next decade, with 60% of that capacity sited along a less-than-100-mile stretch of coastline straddling the Texas-Louisiana border. One of the major factors that will influence the timing and commercialization of the projects is the availability of feedgas supply where and when it is needed. With pipeline projects and production growth in...

2022-12-2111 min

RBN Energy BlogcastKeep It Comin' Love, Part 3 - Outlook for Permian Gross Gas Production vs. Processing CapacityThe crude-oil-driven Permian has been a hotbed of midstream development in recent years and that’s unlikely to change anytime soon. RBN estimates Permian gross gas production surpassed 22 Bcf/d last month and projects that, if unconstrained by infrastructure, it would grow by another 4 Bcf/d or so over the next couple of years. One determinant of that rate of growth is adequate capacity to process gross gas volumes. In today’s RBN blog, we conclude this series with an assessment of the timing of processing capacity additions in the basin vs. RBN’s Mid-case gross gas production forecast.

2022-11-0711 min

Quella Strana StoriaQuella Strana Storia – storie di pauraNella nuova puntata di Quella Strana Storia, la trasmissione di Crimini e Misteri che tinge di giallo la domenica sera di RBN, questa settimana non abbiamo potuto fare altro che immergerci nell’atmosfera tutta brividi della Notte di Halloween. Dimenticatevi zucche intagliate, dolcetti e scherzetti però: tra folli autostoppisti, inquietanti visitatrici notturne, spaventosi incontri sui sentieri […]

2022-11-061h 09

RBN Energy BlogcastKeep It Comin’ Love, Part 2 - Permian Crude Leads Growth, But Will Gas Processing Capacity Keep Up?Permian crude oil production has climbed ~30% since the lows of 2020 to about 5.2 MMb/d this summer and helped keep crude oil — and gasoline — prices in check as market balances tightened. With that has come a lot of gross gas, which surged by over 40% to 21.3 Bcf/d on average this summer, up from the 2020 low of just under 15 Bcf/d. If unconstrained by infrastructure, RBN expects that to grow another 30%, or more than 6 Bcf/d, in the next three years, but only if there is adequate midstream capacity — everything from gathering lines to processing plants and, ultimately, gas and liquids transportation lines...

2022-10-2014 min

Quella Strana StoriaQuella Strana Storia – strumenti di morteNella nuova puntata di Quella Strana Storia, la Trasmissione di Crimini e Misteri di RBN, parliamo di Strumenti di Morte, dove gli strumenti sono proprio…strumenti, quelli per eccellenza, ovvero quelli musicali. Lo sapevate che non hanno nulla da invidiare a pistole e coltelli per compiere azioni delittuose? Se non lo sapevate, lo scoprirete stasera in […]

2022-10-171h 05

RBN Energy BlogcastGood Lookin', So Refined - RBN's New Consulting Team: Refined Fuels AnalyticsGasoline and diesel prices are skyrocketing. Refineries are running near maximum capacity. The Biden administration is asking refiners to bring more capacity online to relieve refining constraints. And as the economy recovers from the COVID meltdown, it looks set to get worse before it gets better. So the timing could not be better to launch our new team focused on refineries and refined products: RBN Refined Fuel Analytics. We readily admit that this is an advertorial but stick with us, it will be worth it. We’re building out a whole new approach to the understanding of refined fuel markets –– both t...

2022-07-1209 min

RBN Energy BlogcastDefying Gravity, Encore Edition - Western Midstream Presses Permian Advantage to Offset Legacy Basin DeclinesWe’ve written a lot lately about how U.S. E&Ps, whipsawed over the last decade by extreme price volatility and negative investor sentiment, have adopted a new fiscal discipline that de-emphasizes production growth and prioritizes generation of free cash flow to reduce debt and reward shareholders. But what about midstreamers? They too have been buffeted in recent years by volatile commodity prices, eroding investor support, shifting upstream investment patterns, and finally, a global pandemic. Midstream companies face a different set of challenges than oil and gas producers in repairing their balance sheet and restoring investor confidence, however, mostly be...

2022-07-0413 min

RBN Energy BlogcastPoint of Know Return - The Fundamentals Driving the Energy TransitionIf you want to get the energy world’s full attention, give it a global pandemic, a rush to decarbonize, and a brutal land war in Europe — all in quick succession. Bam! Bam! Bam! The past two-plus years have shaken the global oil, natural gas and NGL markets to the core, and forced just about everyone involved to rethink the expectations and plans they had before everything seemed to unravel. So what happens next? How do we provide energy security, put a lid on inflation, and save the planet? To answer those questions, a good place to start is to gain...

2022-06-2012 min

RBN Energy BlogcastDefying Gravity - Western Midstream Presses Permian Advantage to Offset Legacy Basin DeclinesWe’ve written a lot lately about how U.S. E&Ps, whipsawed over the last decade by extreme price volatility and negative investor sentiment, have adopted a new fiscal discipline that de-emphasizes production growth and prioritizes generation of free cash flow to reduce debt and reward shareholders. But what about midstreamers? They too have been buffeted in recent years by volatile commodity prices, eroding investor support, shifting upstream investment patterns, and finally, a global pandemic. Midstream companies face a different set of challenges than oil and gas producers in repairing their balance sheet and restoring investor confidence, however, mostly be...

2022-06-0913 min

Speciali RBNSpeciale dai fronti GUERRA IN BIRMANIAIl reporter volontario Filippo Castaldini racconta a RBN l’ultima missione di Popoli e Solid Onlus nella giungla birmana al fianco dei guerriglieri Karen.

2022-05-2227 min

Speciali RBNUn altro 25 aprile – Compagno MitraUN ALTRO 25 APRILE La maratona radiofonica di RBN continua con COMPAGNO MITRA il saggio storico sulle atrocità partigiane, presentato dall’autore Gianfranco Stella allo spazio sociale Rockaforte di Bolzano. Lunedì 25aprile ore13 su www.radiobandieranera.org

2022-05-0400 min

Speciali RBNUn altro 25 aprile – SAFPer la maratona radiofonica di RBN ascoltiamo in esclusiva la voce delle Ausiliarie della Repubblica Sociale Italiana intervistate dalle Ragazze di Peschiera. Preziose testimonianze di puro amor patrio delle ultime SAF

2022-05-0447 min

Speciali RBNSPECIALE RUSSIA – UCRAINA – una crisi geopolitica energeticaIn collegamento con la redazione de il Primato Nazionale, RBN intervista: ? Eugenio Palazzini ? Lorenzo Berti ? Gian Piero Joime su fakenews, scenari reali e ultime novità riguardanti le tensioni tra Mosca e Kiev, in una partita tra Oriente e Occidente che si gioca soprattutto sul piano energetico.

2022-02-171h 25

RBN[10 febbraio] Intervista a Emanuele Merlino, presidente del Comitato 10 febbraiohttps://radiobandieranera.org/wp-content/uploads/2022/02/emanueemerlinoPodcast.mp3

Per la maratona radiofonica dedicata al Giorno del Ricordo per i Martiri delle Foibe, RBN intervista in diretta il presidente del Comitato 10 Febbraio Emanuele Merlino.

2022-02-1118 min

Speciali RBN[10 febbraio] Intervista a Maurizio Puglisi Ghizzi10 FEBBRAIO RBN intervista l’ex consigliere comunale di Bolzano, discendente da esuli istriani, Maurizio Puglisi Ghizzi.

2022-02-1135 min

Speciali RBN[10 febbraio] Rbn speciale Foibe: voci dall’esodo istriano – intervista a Enrico BallettoIntervista a Enrico Balletto sardo d’adozione e figlio di una profuga istriana

2022-02-1031 min

Speciali RBN[10 febbraio] Rbn Cagliari: L’esodo giuliano dalmata – il ruolo della SardegnaQuesto giovedì 10 febbraio, giornata del ricordo, parleremo della tragedia delle foibe e degli esuli istriani-dalmati e soprattutto del ruolo che ebbe la Sardegna, in particolare Fertilia, che li accolse. Per non dimenticare. www.radiobandieranera.org

2022-02-101h 29

Speciali RBN[10 febbraio] RBN intervista FAUSTO BILOSLAVORBN intervista in esclusiva a Fausto Biloslavo, reporter di guerra, celebre firma de il Giornale ed autore del libro “Verità Infoibate”.

2022-02-1032 min

Speciali RBNSpeciale RBN – “Draghi vattene”Lo speciale RBN sulle proteste di CasaPound in tutta Italia contro il governo Draghi. Intervengono Luca Marsella, Sveva Ancora, Marzio Fucito e Nicola Di Bortolo. A cura di Cristiano C0ccanari.

2022-01-2929 min

RBN Energy BlogcastTen Years After - Celebrating a Decade of RBN Energy Blogs - Let's Rock & Roll!Here’s an idea. Let’s start up a new company that does energy market fundamentals linked to rock & roll songs. Do it with practical, commercial insights. Keep the quality top notch. Then give it away for free! Sound crazy? Maybe so. But that’s how RBN Energy got started 10 years ago, and it’s worked out pretty well. Now, 2,540 blogs later and with 35,000 members receiving our morning email each day, it seems like we ought to celebrate in RBN style by telling a couple of backstories that shed light on our approach to energy markets, delving into the whole rock & ro...

2022-01-2411 min

Speciali RBNSpeciale Circolo Futurista – Francesca Romana e Flavio NardiSPECIALE CFCB Continuano le interviste di RBN sullo sgombero del Circolo Futurista. Domenica avremo ospiti: Francesca ROMANA reporter di PaeseRoma aggredita dalla celere durante lo sgombero Flavio NARDI Storico promotore della cultura nonconforme e fondatore di RupeTarpea produzioni

2022-01-2340 min

RBNWEBRADIO NONCONFORMI –https://radiobandieranera.org/wp-content/uploads/2022/01/TRASMISSIONE-SABATO-WEBRADIO.mp3

WEBRADIO NONCONFORMI

in un unico coro all’assalto

Gli speakers radiofonici di RBN e Kultureuropa affronteranno insieme la sfida per la riaffermazione delle frequenze dei nostri spazi di libertà digitali.

2022-01-231h 14

RBN Energy BlogcastTop 10 RBN Energy Prognostications for 2022 – Year of the Tiger, Encore EditionPandemic. Deep freeze. Decarbonization. Stymied production growth. Sky-high prices. 2021 was definitely one for the record books. But thank goodness we made it and can look forward to a New Year! That means it is time for our annual Top 10 Energy Prognostications, the long-standing RBN tradition where we consider what’s coming next to energy markets. Say what? Surely it would be foolhardy to make predictions now. After all, we’re in the midst of a chaotic energy transition, a pandemic that’s becoming endemic, and political shenanigans in Washington and across the globe. Foolhardy? Nah. All we need to do is sti...

2022-01-1719 min

Speciali RBNDRAGHI DIVIDE L’ITALIA – siciliani e sardi senza GreenpassQuali sono gli effetti del nuovo Decreto Draghi sulle isole italiane? I militanti di CasaPound lo spiegano a RBN direttamente dai luoghi della protesta con collegamenti da Sardegna, Sicilia e Calabria.

2022-01-1518 min

Speciali RBNSpeciale Acca Larenzia - In ricordo di Gianmaria GuastiNel giorno degli Eroi immortali di Acca Larenzia RBN Torino vuole ricordare un uomo, un esempio, un soldato. Nel suo ricordo il testamento che ci ha lasciato per oggi e per le generazioni future. Gian Maria Guasti, il nostro Eroe

2022-01-0955 min

Speciali RBNSpeciale Acca Larenzia - Giovanni Feola, Eugenio Palazzini, Giancarlo Ferrara, Franco NerozziSpeciale RBN in ricordo delle vittime di Acca Larenzia: le interviste a Giovanni Feola (sezione Acca Larenzia), Eugenio Palazzini (Il Primato Nazionale), Giancarlo Ferrari (Radio Kulturaeuropa), Franco Nerozzi.

2022-01-0928 min

Speciali RBNSpeciale Acca Larenzia – Domenico GramazioIn ricordo della strage di Acca Larenzia RBN intervista uno dei protagonisti del MSI romano: il Senatore Domenico Gramazio.

2022-01-0924 min

RBN Energy BlogcastTop 10 RBN Energy Prognostications for 2022 – Year of the TigerPandemic. Deep freeze. Decarbonization. Stymied production growth. Sky-high prices. 2021 was definitely one for the record books. But thank goodness we made it and can look forward to a New Year! That means it is time for our annual Top 10 Energy Prognostications, the long-standing RBN tradition where we consider what’s coming next to energy markets. Say what? Surely it would be foolhardy to make predictions now. After all, we’re in the midst of a chaotic energy transition, a pandemic that’s becoming endemic, and political shenanigans in Washington and across the globe. Foolhardy? Nah. All we need to do is sti...

2022-01-0319 min

RBN Energy BlogcastThe Top 10 RBN Energy Prognostications - 2021 ScorecardFinally! It’s the last day of 2021, which means it’s time for our annual Top 10 Energy Prognostications blog, the long-standing RBN tradition where we look into our crystal ball to see what the upcoming year has in store for energy markets. And unlike many forecasters, we also look into the rear-view mirror to see how we did with last year’s predictions. That’s right! We actually check our work! And that’s what we’ll do in today’s scorecard blog. Then on Monday we’ll lay out what we see as the most important developments of the year ahead. But...

2021-12-3113 minRBN Energy BlogcastWhen Two Worlds Collide - Top 10 RBN Blogs of 2021: Energy Transition Slams into Energy RealityHow do you sum up a year like 2021? It was good times for the economic health of producers and midstreamers alike. Prices were up, as were production and flows. But 2021 also brought along more than its share of chaos, including disruptive market events like Winter Storm Uri’s deep freeze and Europe’s natural gas crisis, along with general perplexity around all things clean, green, renewable, and certified. At RBN we take a different approach to assessing common industry themes. Namely, we examine the events and trends that the market considers the most important — crowd-sourced market intelligence, if you will. We can...

2021-12-3021 min

Speciali RBNSPECIALE "LA FORESTA CHE AVANZA" - le attività del 2021 attraverso le voci dei protagonistiIn un mondo grigio in cui i Gretini vanno a braccetto con i potenti della terra, l’unica alternativa italiana alla massa del “Friday for Future” sembra essere l’ecologismo identitario e sovranista della?FORESTA CHE AVANZA?. Per concludere l’anno RBN lascia spazio alle iniziative di FCA svolte nel 2021.

2021-12-2039 min

Speciali RBNSpeciale RBN - Intervista a Francesco PolacchiIn un’era di dittatura pandemica, nel panorama giornalistico italiano, laddove i grandi media si dimostrano sempre più servili al Pensiero Unico si fa sempre più largo un mensile in grado di affrontare gli argomenti più scomodi andando controcorrente. È il Primato Nazionale! RBN intervista l’editore Francesco Polacchi per spiegare l’importanza di sostenere la campagna abbonamenti […]

2021-12-1721 min

Speciali RBNNo greenpass - Intervento di Luca MarsellaPodcast del collegamento RBN con il dirigente nazionale di Cpi, Luca Marsella, per commentare a caldo le azioni di protesta svolte in tutta Italia dalle Tartarughe Frecciate contro Greenpass e super-Greenpass.

2021-12-1106 min

RBN Energy BlogcastSeparate Ways (Worlds Apart) - Journey to Decarbonization a Tricky Path for Crude Oil, Natural Gas, NGLsThese are troubled times, as the song says, caught between confusion and pain. Following the COVID trauma of 2020, oil, gas, and NGL markets are now coping with uncertainty of medium- and long-term prospects in light of energy transition rhetoric. Will we continue to see sufficient investment in the hydrocarbon-based supplies that the world needs today, or will resources be increasingly diverted toward renewable energy technologies and wider ESG goals? Finding a way to satisfy the global appetite and fuel continued recovery while planning for the future was a core theme for RBN’s Fall 2021 School of Energy: Hydrocarbon Markets in a...

2021-11-2611 min

RBN Energy BlogcastWhich Way Are You Goin? - Crude Oil, Natural Gas and NGL Markets in a Decarbonizing WorldEnergy marketeers are faced with a conundrum. Should the focus be on producing, processing, and marketing the hydrocarbon-based energy that the world needs today? Or is it time to go an entirely different direction toward net-zero emissions, renewables, and battery-powered everything? The answer, of course, is both. That means living, working, and producing hydrocarbon-based products in today's world while at the same time preparing for and investing in the world to which we’re headed. You might think of it as kind of a mild case of schizophrenia; we live in one reality, but we must think in terms of an...

2021-11-1811 min

RBNRBN Cagliari: Giovinezzahttps://radiobandieranera.org/wp-content/uploads/2021/03/2021-03-11_18h30m35s.mp3

La nostra redazione stavolta racconterà, attraverso le parole di vari protagonisti, la storia della goliardia, dalla nascita della prima università in Italia ai nostri giorni.

2021-03-1100 min

RBNRBN Littoria – Le tracce di Romahttps://radiobandieranera.org/wp-content/uploads/2021/03/puntata090321.mp3

In questa puntata la redazione latinense di RBN ci illustrerà le tracce ancora visibili della civiltà romana nel Latium vetus.

Si parlerà del Tempio di Ercole a Cori, del Tempio di Giove Anxur a Terracina e di tante altre vestigia meno conosciute.

2021-03-1100 min

RBNRBN Littoria – Le tracce di Romahttps://radiobandieranera.org/wp-content/uploads/2021/03/puntata090321.mp3

In questa puntata la redazione latinense di RBN ci illustrerà le tracce ancora visibili della civiltà romana nel Latium vetus.

Si parlerà del Tempio di Ercole a Cori, del Tempio di Giove Anxur a Terracina e di tante altre vestigia meno conosciute.

2021-03-1100 min

RBNRBN TORINO – INTERVISTA AD ANTONIO BORRINIhttps://radiobandieranera.org/wp-content/uploads/2021/03/PUNTATA-BORRINI.mp3

RBN TORINO ATTACCO ALLA TORINO BENE PRESENTA LO SPECIALE/INTERVISTA AD ANTONIO BORRINI.

Giovane ventitreenne consigliere sovranista di Settimo Torinese, eletto nelle file della Lega e ora nel gruppo misto. Le sue mozioni e sue conquiste per onorare Norma Cossetto e i martiri delle foibe e non solo… L’entusiasmo e la passione di un ragazzo innamorato della politica su radio bandiera nera, attacco alla Torino bene.

2021-03-1000 min

RBNRBN TORINO – INTERVISTA AD ANTONIO BORRINIhttps://radiobandieranera.org/wp-content/uploads/2021/03/PUNTATA-BORRINI.mp3

RBN TORINO ATTACCO ALLA TORINO BENE PRESENTA LO SPECIALE/INTERVISTA AD ANTONIO BORRINI.

Giovane ventitreenne consigliere sovranista di Settimo Torinese, eletto nelle file della Lega e ora nel gruppo misto. Le sue mozioni e sue conquiste per onorare Norma Cossetto e i martiri delle foibe e non solo… L’entusiasmo e la passione di un ragazzo innamorato della politica su radio bandiera nera, attacco alla Torino bene.

2021-03-1000 min

RBNRBN Cagliari | I Bombardamenti del ’43https://radiobandieranera.org/wp-content/uploads/2021/03/2021-03-04_18h29m15s.mp3

In questa puntata parliamo di una triste pagina della nostra storia: i bombardamenti sulla nostra bellissima Cagliari.

Tra profondo dolore, devastazione e morte.

2021-03-0400 min

RBNRBN Littoria – Viaggio tra i gigantihttps://radiobandieranera.org/wp-content/uploads/2021/02/puntata230221.mp3

Nuova puntata con la redazione latinense di RBN alla scoperta delle mura ciclopiche del Circeo, di Norma, Cori e di altre località del Lazio meridionale.

2021-02-2700 min

RBNRBN Littoria – Viaggio tra i gigantihttps://radiobandieranera.org/wp-content/uploads/2021/02/puntata230221.mp3

Nuova puntata con la redazione latinense di RBN alla scoperta delle mura ciclopiche del Circeo, di Norma, Cori e di altre località del Lazio meridionale.

2021-02-2700 min

RBNRBN TORINO – LA VESPAhttps://radiobandieranera.org/wp-content/uploads/2021/02/PUNTATA-VESPA.mp3

RBN TORINO ATTACCO ALLA TORINO BENE PRESENTA LO SPECIALE SETTIMANALE: LA VESPA.

In questo speciale la redazione torinese vi parlerà del mito per eccellenza delle due ruote, la storia, la moda di un sogno meccanico targato Italia. La vespa.

2021-02-1300 min

RBNRBN TORINO – LA VESPAhttps://radiobandieranera.org/wp-content/uploads/2021/02/PUNTATA-VESPA.mp3

RBN TORINO ATTACCO ALLA TORINO BENE PRESENTA LO SPECIALE SETTIMANALE: LA VESPA.

In questo speciale la redazione torinese vi parlerà del mito per eccellenza delle due ruote, la storia, la moda di un sogno meccanico targato Italia. La vespa.

2021-02-1300 min

RBNRBN Cagliari: Il Carnevale (Parte II)https://radiobandieranera.org/wp-content/uploads/2021/02/2021-01-14tagl.mp3

Riti ancestrali e antiche leggende si fondono nel Carnevale in Sardegna. Ne parliamo questo giovedì nel nostro consueto appuntamento su RBN!

2021-02-1100 min

RBNRBN Cagliari: Il Carnevale (Parte II)https://radiobandieranera.org/wp-content/uploads/2021/02/2021-01-14tagl.mp3

Riti ancestrali e antiche leggende si fondono nel Carnevale in Sardegna. Ne parliamo questo giovedì nel nostro consueto appuntamento su RBN!

2021-02-1100 min

RBNRBN TORINO – IL KARTINGhttps://radiobandieranera.org/wp-content/uploads/2021/02/PUNTATA-KARTING.mp3

RBN TORINO ATTACCO ALLA TORINO BENE PRESENTA LO SPECIALE DEDICATO AL KARTING.

In questa puntata la redazione torinese parlerà del Karting con un ex competitore amatoriale. Il karting lo sport di lancio per i giovani piloti. Adrenalina, passione e preparazione per uno sport di nicchia ma riservato a chi ama il rischio e la velocità.

2021-02-1100 min

RBNRBN TORINO – IL KARTINGhttps://radiobandieranera.org/wp-content/uploads/2021/02/PUNTATA-KARTING.mp3

RBN TORINO ATTACCO ALLA TORINO BENE PRESENTA LO SPECIALE DEDICATO AL KARTING.

In questa puntata la redazione torinese parlerà del Karting con un ex competitore amatoriale. Il karting lo sport di lancio per i giovani piloti. Adrenalina, passione e preparazione per uno sport di nicchia ma riservato a chi ama il rischio e la velocità.

2021-02-1100 min

RBNRBN Littoria – Il “Grand Tour” nelle paludi pontinehttps://radiobandieranera.org/wp-content/uploads/2021/02/puntata090221.mp3

Nuovo appuntamento con la redazione latinense di RBN.

In questa puntata affronteremo un viaggio tra il XVII e il XIX secolo, andando a conoscere le tappe del “Grand Tour” nelle paludi pontine e i personaggi illustri che hanno attraversato questo territorio.

2021-02-1000 min

RBNRBN Littoria – Il “Grand Tour” nelle paludi pontinehttps://radiobandieranera.org/wp-content/uploads/2021/02/puntata090221.mp3

Nuovo appuntamento con la redazione latinense di RBN.

In questa puntata affronteremo un viaggio tra il XVII e il XIX secolo, andando a conoscere le tappe del “Grand Tour” nelle paludi pontine e i personaggi illustri che hanno attraversato questo territorio.

2021-02-1000 min

RBNRBN dal Fronte dell’Essere – Viaggio nel Mos Maiorumhttps://radiobandieranera.org/wp-content/uploads/2021/02/RBN-dal-Fronte-dell-Essere-MOS-MAIORUM.mp3

Un viaggio nel mondo della Tradizione, alla scoperta del sistema etico che regolava le vite dei Romani: il Mos Maiorum.

2021-02-0500 min

RBNRBN dal Fronte dell’Essere – Viaggio nel Mos Maiorumhttps://radiobandieranera.org/wp-content/uploads/2021/02/RBN-dal-Fronte-dell-Essere-MOS-MAIORUM.mp3

Un viaggio nel mondo della Tradizione, alla scoperta del sistema etico che regolava le vite dei Romani: il Mos Maiorum.

2021-02-0500 min

RBNRBN Cagliari: Il Carnevale (Parte I)https://radiobandieranera.org/wp-content/uploads/2021/02/2021-02-04_18h38m43s.mp3

Riti ancestrali e antiche leggende si fondono nel Carnevale in Sardegna. Ne parliamo questo giovedì nel nostro consueto appuntamento su RBN!

2021-02-0400 min

RBNRBN Cagliari: Il Carnevale (Parte I)https://radiobandieranera.org/wp-content/uploads/2021/02/2021-02-04_18h38m43s.mp3

Riti ancestrali e antiche leggende si fondono nel Carnevale in Sardegna. Ne parliamo questo giovedì nel nostro consueto appuntamento su RBN!

2021-02-0400 min