Shows

Debt TalkDebt Talk: January Financial PlanningJanuary is hard.The celebrations are over, the bills have arrived, and for many of us, savings have quietly disappeared. As we wait, often painfully, for the next pay cheque, January becomes the month of fresh starts, New Year’s resolutions, and, if we’re honest, a few broken promises.I’m Ripon Ray, your host, and in this episode of the Debt Talk Podcast, we focus on January Financial Planning and how money is closely linked to the promises we make to ourselves at the start of the year.To help us naviga...

2026-01-1439 min

Debt TalkDebt Talk: Financial Abuse & Our CommunitiesAs we move into the next episode of the Debt Talk podcast, Financial Abuse & Our Communities, we do so against the backdrop of growing public concern about domestic abuse in the UK, particularly the recent cases where coercive control, economic exploitation and intimate partner violence have escalated into fatal harm. This makes our conversation with front-line experts even more urgent.Dr Clare Wiper, Assistant Professor in Criminology at Northumbria University and co-author of the report “Designing Out Economic Abuse in the UK’s Banking Industry: A Call for Action”, highlights how deeply financial systems can compound the risks...

2025-12-1246 min

Debt TalkDebt Talk: The Cost of Digital InclusionIn this month’s Debt Talk podcast, Ripon Ray explores one of the most pressing challenges in modern Britain: the real cost of digital inclusion. As technology becomes central to everyday life, what happens to those left behind? How do we bring marginalised communities into the digital mainstream without deepening inequality or compromising privacy?Joining the conversation is Elizabeth Anderson, CEO of the Digital Poverty Alliance, who unpacks what true digital inclusion means in today’s society. From a student needing online tools for geography lessons to individuals struggling to upload documents or access essential services, Elizabeth illu...

2025-11-1441 minKnuth Brew TalkBeer, Life & Food With Dave Knuth & Johnnie RayWe're back after a week off with a rundown of early November events, and Dave's wife opens a new bookstore in downtown Ripon! 11/7/25

2025-11-0708 min

Knuth Brew TalkBeer, Life & Food With Dave Knuth & Johnnie RayWe're back after a week off with a rundown of early November events, and Dave's wife opens a new bookstore in downtown Ripon! 11/7/25

2025-11-0708 minKnuth Brew TalkBeer, Life & Food With Dave Knuth & Johnnie RayWe're back after a week off with a rundown of early November events, and Dave's wife opens a new bookstore in downtown Ripon! 11/7/25

2025-11-0708 min

Knuth Brew TalkBeer, Life & Food With Dave Knuth & Johnnie RayWe're back after a week off with a rundown of early November events, and Dave's wife opens a new bookstore in downtown Ripon! 11/7/25

2025-11-0708 min

Debt TalkDebt Talk: The Cost of HousingWelcome to Debt Talk, with me, your host Ripon Ray. Today, we’re diving into one of the most urgent social policy challenges of our time — the cost of housing. To unpack this complex issue, I’m joined by Assia Awaleh from Sapphire Independent Housing, an expert with deep insight into the history and realities of social housing in the UK.Assia takes us on a journey through the evolution of social housing — from its capitalist roots, when employers provided homes for their workers, to the post-war era, when local authorities stepped in to rebuild communities devastated by bombi...

2025-10-1419 min

Debt TalkDebt Talk: Poverty & Black History in BritainAs we leave the summer of 2025 behind and step into October, we enter a month that is unapologetic, bold, and powerful: Black History Month in Britain. This is a time to honour struggle and triumph, to celebrate the contributions of Black communities, and to confront the uncomfortable realities of poverty and inequality that still persist today. Welcome to the Debt Talk Podcast. I’m your host, Ripon Ray. This episode: “Poverty & Black History in Britain.” To guide us through this important conversation, I’m joined by two remarkable guests: Jerry During, founder of Money A&E, the U...

2025-09-1534 min

Debt TalkDebt Talk: Cars & their CostsIn this month’s Debt Talk podcast, we discuss: Cars & Their Costs.To explore the topic, Ripon Ray speaks with:Alison Tooze, from the British Association of ParkingSam Nurse, CEO of Money Advice HubAlison Tooze emphasised the importance of preventing parking-related crises and outlined steps drivers can take to reduce the risk of receiving fixed penalty notices or penalty charge notices. She noted that while the number of cars on the roads is increasing, available parking spaces are shrinking. Alison also stated that her members are responsible for managing parking spaces, which adds to th...

2025-08-1459 minKnuth Brew TalkBeer, Life & Food with Dave KnuthThe Ripon Summer Concert Series continues, and J Ray is headed to the Twin Cities this weekend! All on this week's segment! August 8th, 2025

2025-08-0808 min

Knuth Brew TalkBeer, Life & Food with Dave KnuthThe Ripon Summer Concert Series continues, and J Ray is headed to the Twin Cities this weekend! All on this week's segment! August 8th, 2025

2025-08-0808 min

Knuth Brew TalkBeer, Life & Food with Dave KnuthThe Ripon Summer Concert Series continues, and J Ray is headed to the Twin Cities this weekend! All on this week's segment! August 8th, 2025

2025-08-0808 minKnuth Brew TalkBeer, Life & Food with Dave KnuthThe Ripon Summer Concert Series continues, and J Ray is headed to the Twin Cities this weekend! All on this week's segment! August 8th, 2025

2025-08-0808 min

Debt TalkDebt Talk: Crypto, Digital Assets & GamblingOnce an unknown territory, crypto and other digital assets have now become part of everyday life in Britain — and across the globe. On this episode of the Debt Talk podcast, Ripon Ray explores the complex intersections of cryptocurrency, digital finance, and gambling harms.To help unpack this topic, Ripon is joined by:Ismail Malik – Executive Chairman of Blockchain Lab and CEO of InfraStaking, which develops AI-generated digital assetsMatt Zarb-Cousin – Co-founder of Gamban and prominent gambling reform campaignerIsmail Malik sheds light on how crypto products are being treated by governments across the UK, EU, and the US...

2025-07-1447 min

Debt TalkDebt Talk: Family Planning, Divorce & DebtAccording to UK government data for the year ending 2023, there were an estimated 2.4 million separated families and 3.8 million children living in those households. More than half of divorced families had formal child maintenance arrangements—a figure that highlights the growing intersection of family separation and financial strain.This month’s Debt Talk with Ripon Ray dives deep into the theme: ‘Family Planning, Divorce & Debt’, bringing forward real-life stories that reveal how personal relationships, cultural expectations, and legal frameworks collide—often with emotional and financial consequences.Bilckis Khanom, a British Bangladeshi woman, bravely shares her story of marryin...

2025-06-1347 min

Knuth Brew TalkKnuth Brew TalkOn Friday June 6th, 2025, Johnnie Ray & Dave discuss the weekend events including live music at Knuth's, and the Downtown Ripon Concert Series!

2025-06-0608 minKnuth Brew TalkKnuth Brew TalkOn Friday June 6th, 2025, Johnnie Ray & Dave discuss the weekend events including live music at Knuth's, and the Downtown Ripon Concert Series!

2025-06-0608 min

Knuth Brew TalkKnuth Brew TalkOn Friday June 6th, 2025, Johnnie Ray & Dave discuss the weekend events including live music at Knuth's, and the Downtown Ripon Concert Series!

2025-06-0608 minKnuth Brew TalkKnuth Brew TalkOn Friday June 6th, 2025, Johnnie Ray & Dave discuss the weekend events including live music at Knuth's, and the Downtown Ripon Concert Series!

2025-06-0608 min

Knuth Brew Talk2025-05-29 250529-knuth-brew-talkJohnnie Ray and Dave Knuth recap Memorial Day Weekend with a boating story that left one fisherwoman in a predicament in Winneconne. We also talk live entertainment at Knuth Brewing Co. in Ripon this weekend. Cheers! -J Ray

2025-05-3008 minKnuth Brew Talk2025-05-29 250529-knuth-brew-talkJohnnie Ray and Dave Knuth recap Memorial Day Weekend with a boating story that left one fisherwoman in a predicament in Winneconne. We also talk live entertainment at Knuth Brewing Co. in Ripon this weekend. Cheers! -J Ray

2025-05-3008 minKnuth Brew Talk2025-05-29 250529-knuth-brew-talkJohnnie Ray and Dave Knuth recap Memorial Day Weekend with a boating story that left one fisherwoman in a predicament in Winneconne. We also talk live entertainment at Knuth Brewing Co. in Ripon this weekend. Cheers! -J Ray

2025-05-3008 min

Knuth Brew Talk2025-05-29 250529-knuth-brew-talkJohnnie Ray and Dave Knuth recap Memorial Day Weekend with a boating story that left one fisherwoman in a predicament in Winneconne. We also talk live entertainment at Knuth Brewing Co. in Ripon this weekend. Cheers! -J Ray

2025-05-3008 min

Debt TalkDebt Talk: Foodbanks & the Welfare State6% of UK children now rely on foodbanks. What does that say about the state’s responsibility toward children and other vulnerable members of society? Is the current welfare state fit for purpose? Or are we sleepwalking into the slow erosion of what remains of it?In this month’s Debt Talk podcast, hosted by Ripon Ray, three distinguished experts joined the conversation on “Foodbanks & the Welfare State.”Helen Barnard from the Trussell Trust spoke about how poverty in the UK runs far deeper than it appears. The prevalence of child poverty reflects the shameful state of publi...

2025-05-1441 min

Debt TalkDebt Talk: Insecurities of being self employedJust over 13% of the UK population are self-employed. Is being self-employed the way forward or are we forced to take the path in some sectors? In this month’s Debt Talk podcast, Ripon Ray spoke with three guests from many different perspectives.James Harris has been self-employed for nearly 25 years in the creative sector. He explained how funding in his sector has been reducing since the 1990s. There are also very few fashion shows compared to when he began his career. His biggest worry is personal finance since Universal Credit introduced the Minimum Income Floor leading to hi...

2025-04-1434 min

Debt TalkDebt Talk: Prison & Council TaxImprisonment is an option for many councils in England to enforce council tax debt as a last resort if residents are wilfully refusing or are culpably neglectful to pay. On this month's Debt Talk podcast, Ripon Ray explored the ‘Prison & Council Tax’.He invited Chris Daw KC and Russell Hamblin-Boone to join him to find out whether it is fair and cost-effective to imprison communities for non-payment of council tax.Chris Daw KC, a criminal law expert, explained the history of debtors' prisons in the UK and how the measures were used against impoverished communities. He e...

2025-03-1434 min

Debt TalkDebt Talk: Credit ratings & debtConsumer credit data held by credit reference and other organisations have become an essential part of the financial market, both in lending and borrowing and debt collection to make the financial sector sustainable. In this month’s Debt Talk podcast, Ripon Ray discussed a crucial topic: ‘Credit Ratings & Debt.’ To navigate the essential subject, he has representatives from two major global credit reference agencies - Experian and Equifax, the Registry Trust, which holds data on a money judgement, and the debt collection and purchaser trade body representative - Credit Services Association.James Jones from Experian spoke about its or...

2025-02-1459 min

Debt TalkDebt Talk: January bluesJanuary is a month of cold weather, dark mornings, and possible failure in our New Year resolutions, which combine to create a perfect recipe for ‘January Blues’. To understand the cause of such blues, Debt Talk host Ripon Ray invited three guests from the mental and debt, financial inclusion, and open banking sectors.Charlene Marks, Head of Mental Health & Money Advice at Mental Health UK, confessed that there is a genuine reason for feeling gloomy this month: our finances have taken a beating during the festive period and the New Year. She explained that there is a comm...

2025-01-1330 min

Debt TalkDebt Talk: Christmas festive worriesAs we head towards this winter and people begin to prepare to celebrate Christmas festive period, lenders start to lend more than in other periods of time and customers borrow more; many no doubt will also suffer in silence due to the changes in winter fuel payment introduced by the current government. The subject for this month on the Debt Talk podcast is: 'Christmas festive worries'. To navigate the subject with Ripon Ray, there are two distinguished guests: Michael Agmoh-Davison, who is one of the organizers for the Unite the Trade Union, and Alison Berry, the debt coach lead...

2024-12-1336 min

Debt TalkDebt Talk: Financial exclusion & lendingGlobally, Britain has a two-tier system: a thriving financial services sector on the one hand but millions of people who cannot access essential financial services on the other. Would the current Labour government make any difference to the millions of struggling residents excluded from the financial services market to help reduce such an exclusion? To navigate on the Debt Talk podcast on this month’s subject: ‘Financial Exclusion & lending’, with Ripon Ray, there are two panel members to share their experience and knowledge:Fran Boait, Co-Executive Director of Positive Money, outlined the severity of financial exclusion due to bra...

2024-11-1435 min

Debt TalkDebt Talk: Pensioners & winter fuel paymentAs the winter unfolds, there is going to be an inevitable increase in fuel bills due to the high usage of gas and electricity especially for those who are on prepayment meter. During this time, the fuel cost is also to go up and access to fuel support is to be removed for pensioners who are not on pension credit by the current government. In this month’s Debt Talk podcast, Ripon Ray spoke about: 'Pensioners & winter fuel payment'. To navigate the subject, two panellists took part on the podcast to raise awareness of the impact of removal of Wi...

2024-10-1433 min

Debt TalkDebt Talk: Indebted with buy now pay later productsOne of the important changes in the last decade is the rise in the consumption of products and services on Buy Now Pay Later, as many low-income households are using these products to buy household items.In this month’s Debt Talk podcast, Ripon Ray discusses ‘Indebted with Buy Now Pay products’. To address this pressing subject, Sean Breen from the Consumer Council for Northern Ireland and Gulsah T from Bromley Citizens Advice highlight some of the issues faced by communities struggling with buy-now-pay-later products and services.Sean Breen, Director of Financial and Postal Service from t...

2024-09-1319 min

Debt TalkDebt Talk: Carers & benefit overpaymentThousands of unpaid carers have been fined due to falling foul of earnings rules in the UK. Some of them also faced prosecution. The Department of Work and Pension (DWP) is recovering the overpayment of carers’ allowance from their existing benefit or salaries. On this month’s Debt Talk podcast, Ripon Ray explored: ‘Carers & benefit overpayment’ with distinguished guests from a funder and civil society organisations.Rory Ewan, Senior Analyst from Policy in Practice, spoke about financial and non-financial challenges carers face in the UK. He explained the nature of carers’ role and how they have fallen foul of th...

2024-08-1428 min

Debt TalkDebt Talk: Leasehold & chargesLabour's landslide victory in the General Election raises questions about what the policy development will be for leaseholders' benefit in the United Kingdom. In this month’s Debt Talk podcast with Ripon Ray, three distinguished individuals share their knowledge on another important subject, ‘Leasehold & charges’.Suz Muna from the Social Housing Action Campaign says that renting and leasehold are two sides of the same coin where leaseholders are very much trapped in an exploitative situation from developers, freeholders, and management companies. Many of the leaseholders are living in unsalable homes whilst service charges are rocketing up. She argues...

2024-07-1446 min

Debt TalkDebt Talk: UK waters & our billsThames Water considered a rise of 40% whilst its parent company is on the verge of liquidation. Southern Water requested Ofwat last October to increase its bill to consumers by 66% on top of the rise in inflation. In this month's Debt Talk podcast, Ripon Ray explored 'UK waters & our bills’.Eugenio Vaccari - Senior Lecturer from Royal Holloway, London, who researches sustainable restructuring procedures, explored the legal framework in which Thames Water and its parent company work and the potential challenges faced from the perspective of shareholders, government and sustainability of the water companies for the public interest....

2024-05-1830 min

Debt TalkDebt Talk: Poverty & ethnicity premiumAnother thought-provoking podcast on Debt Talk is ‘Poverty & ethnicity premium’. This time, leading experts from academia, think tanks, debt advice, and funders spoke about issues that matter in financial services.Maria Booker from Fair By Design explained the poverty premium and how communities are paying more and being financially discriminated against because many can’t afford to pay by direct debit and are also on low incomes. This is particularly the case with paying for insurance and fuel or customers who pay a fee for withdrawing cash from a cashpoint when they have no alternative option.Sara...

2024-04-1456 min

Debt TalkDebt Talk: Consumer duty & the debt sectorIntroducing Consumer Duty principles by the Financial Conduct Authority resulted in a dramatic shift from treating customers fairly to focusing on customer outcomes, which requires a readjustment of thinking for many regulated firms in Britain. To navigate such an insightful subject on the Debt Talk podcast, Ripon Ray invited distinguished experts from research and consultancy, debt recovery, and the advice sector.Kathy Ellison from Savanta, a research and consultancy firm, explained how some regulated firms had changed their governance structure, consumer terms and conditions, communications and marketing, and in dealing with vulnerable consumers. Savanta's research showed that...

2024-03-1444 min

Debt TalkDebt Talk: Council finance, tax & debt recoveryBirmingham Council went bankrupt and accelerated its debt recovery to collect council tax and other fines by 500% between 2022 and 2023. It was revealed under the Freedom of Information Request. Other councils throughout the United Kingdom also use enforcement agents to recover unpaid debts since many are overstretched with their finances. To highlight the severity of this issue in this month's podcast on Debt Talk, Ripon Ray explored: 'Council finance, tax & debt recovery’.To assist him with the subject, Helen Ganney from Christians Against Poverty explained the challenges the debt advice sector faces in negotiating with some councils when ma...

2024-02-1450 min

Debt TalkDebt Talk: Gambling & debtIn this month's Debt Talk podcast with Ripon Ray, the subject is: 'Gambling and debt'. To navigate such a sensitive topic, he has experts from academia and gambling therapy.Prof John McAlaney from Bournemouth University speaks about the meaning of gambling, the different types of gambling activities in the UK and how the behaviour of gambling differs based on age and sex. He also explores the role of the Gambling Commission and how the Commission and the British government could be influenced to drive change for the benefit of vulnerable communities who face problem gambling....

2024-01-1428 min

Debt TalkDebt Talk: Debt, housing costs & homelessnessAccording to Shelter, a homelessness charity, there are 271,000 people recorded as homeless in England of which 123,000 children.To navigate this month’s Debt Talk podcast with Ripon Ray on: ‘Debt, housing costs and homelessness', expert panellists who specialise in the benefits system, policy and debt.Deven Ghelani, Founder and Director of Policy in Practice, spoke about the true meaning of homelessness in the UK, and how the current benefit system that was initially ‘designed ‘to simplify things, as it stands, appears not fit for purpose because the current system does not pay sufficient financial assistance to suppo...

2023-12-1432 min

Debt TalkDebt Talk: Alternative lending & debtMainstream lenders are here to stay. It does not mean we are not seeing a variety of lenders in the financial market. In this month's podcast on Debt Talk, Ripon Ray spoke about: 'Alternative lending & debt'. To navigate the subject, there were experts from financial inclusion and debt.Gareth Evens - Co-founder and director of the Financial Inclusion Centre - spoke about the variety of lenders and the make-up of lenders in the United Kingdom. He explored the relevance of alternative lenders, such as the role of local credit unions within the consumer credit market, the benefit...

2023-11-1337 min

Debt TalkDebt Talk: The cost of fuelAs we head towards another winter, the cost of electricity and gas will yet again be of concern for many households. Ripon Ray spoke with a savvy pensioner and a Fuel Poverty Action representative to address such an important issue on this Debt Talk podcast episode to explore the causes of the fuel crisis.Barry Duckett, a local pensioner in South London, spoke about the challenges he and many pensioners fear in the coming winter due to the existing fuel cost. Yet, no government subsidy support is being provided to them compared to last winter....

2023-10-1323 min

Debt TalkDebt Talk: DRO or IVA? That is the question...One in 422 adults entered insolvency between 1 July 2022 and 30 June 2023. The economic factor is crucial in considering bankruptcy for many individuals, particularly when personal Individual Voluntary Arrangements (IVA) and Debt Relief Orders (DRO) are concerned. In this episode of the Debt Talk podcast, Ripon Ray explored: ‘DRO or IVA? That is really the question...’Sara Williams, the founder of Debt Camel, began the conversation by looking at the history of bankruptcy and IVA leading up to the introduction of DRO in 2009, the commercial drive for many IVA providers to solely provide the only option who do not consider the...

2023-09-1359 min

Debt TalkDebt Talk: The cost of financial exclusionThere are 17.5 million people in financially vulnerable circumstances, one in three adults in the UK. Some of these vulnerabilities can be seen in the form of financial exclusion. In this episode, Ripon Ray discusses: ‘The cost of financial exclusion’. To navigate the Debt Talk podcast topic, panellists were from a financial inclusion funder, a debt crisis and money training social enterprise, and a household debt campaigner.Diane Burridge, Community Finance Propositions and Segmentation Lead for Fair4AllFinance, develops strategies for financial inclusion projects and provides funds. She focused on supporting innovation to reduce financial exclusion by undertaking rese...

2023-08-1452 min

Debt TalkDebt Talk: Artificial Intelligence, financial services & debt sectorDo you know about Artificial Intelligence (AI) and, most importantly, AI within the financial services and debt sector? You will once you have listened to the 12th episode of the Debt Talk podcast. In this episode, Ripon Ray explored the subject with experts from academia, visionaries and tech gurus as they spoke about the actual workings of AI in the financial services and debt sector.Prof Carmine Ventre - Director of King's Institute for Artificial Intelligence - explained the history of AI, the actual workings of machine learning and the algorithm required to create a tool where...

2023-07-141h 00

Debt TalkDebt Talk: The welfare state, deficit budget & debtOn this month's Debt Talk podcast, Ripon Ray explored: 'The welfare state, deficit budget and debt'. Trussell Trust, a network of food banks in the UK, gave out nearly 3 million emergency food parcels to people facing financial hardship, and it has noticed a 37% rise in accessing its service compared to the previous year.The question for this month's panellists is: have we moved away from support provided by the state and diverted to the third sector? To assist Debt Talk, panellists for this month were the following:Helen Barnard - policy director of Trussell Trust...

2023-06-1435 min

Debt TalkDebt Talk: Mental health & debtIn this episode on the Debt Talk podcast, Ripon Ray explored the link between mental health and debt and how being in debt can worsen your mental health.Minara Meghna Uddin shared her experience of domestic and economic abuse, which impacted her mental health where seeking to go for support and speaking out was not an option. Whilst coming out of her marriage with children to look after and the anxiety of getting letters from debt collectors and visits from bailiffs. After having made several visits by a bailiff, he encouraged her to represent herself to go...

2023-05-1454 min

Debt TalkDebt Talk: Debt advice, MaPS and advisersIn this month’s episode on the Debt Talk podcast, Ripon Ray explored: ‘Debt advice, MaPs and advisers’.During the pandemic, free advice charities noticed a demand for debt advice. This demand had substantially increased during the cost of living crisis due to high inflation and people’s income not increasing simultaneously. Many debt advisers left the sector to join other sectors, such as the National Health Service or local councils. Their move from the industry was mainly connected to high-stress levels, targets and audits. Save Debt Advice Campaign was launched to respond to the impact in the debt...

2023-04-1438 mincelticheartbeat 3Speak PodcastBeavertown Neck Oilhttps://3speak.tv/watch?v=celticheartbeat/nycryrkx Greetings Beer Lovers

While roaming the streets of Ripon in North Yorkshire this past Tuesday night I happened to find a bar and restaurant called So! Bar & Eats which is not far from the market square in the center of the city.

In this fine establishment, I discovered the elusive Beavertown Neck Oil.I have been hearing stories about this craft IPA from a couple of my friends who play music at the Captains Rest Bar on Edinburgh Royal Mile. At the Captains they have this on...

2023-04-0900 min

Debt TalkDebt Talk: Small businesses and insolvencyDuring the cost of living crisis, the need for insolvency advice has been far greater than in the previous years as shown by Government’s data due to a rise in high inflation and change in consumer behaviour. In 2022 there has been a 56% increase in the number of companies going insolvent compared to 2021. In this episode of the Debt Talk podcast, Ripon Ray explored the financial challenges faced by small businesses and the inevitable advice needed from insolvency practitioners to save them.Robert Tame ran a catering business. During the financial crisis, his business began to have a...

2023-03-1447 min

Debt TalkDebt Talk: Council tax, debt & enforcementIn this month’s podcast on Debt Talk, Ripon Ray explored the current landscape for councils to recover council tax. Since the introduction of welfare reform over ten years ago, nearly every council in the UK expects some form of contribution from households regardless of whether many families were deemed too poor to pay prior to the introduction of the reform. At the same time, Britain has seen an increase in the recovery of council tax through the Magistrate's Courts.While the number of households in arrears has increased throughout the country, there has been a surge in...

2023-02-1445 min

Debt TalkDebt Talk: Crypto assets, gambling & debtAs we start the new year, Debt Talk speaks about a subject fairly new to the debt sector. In this episode, Ripon Ray speaks about: ‘Crypto assets, gambling and debt’. He had experts from a variety of sectors who gave an overview of the interlink between crypto assets, gambling and debt.Ismail Malik - Editor and Founder of Blockchain Lab - gave a clear analysis of the meaning of cryptocurrency and the reason for the initial success of such an asset, and the types of people who are leading the campaign to normalise crypto in Britain and in o...

2023-01-1446 min

Debt TalkDebt Talk: Alternative lending & debt recoveryDuring a festive season in December’s episode of 2022 on Debt Talk podcast with your host, Ripon Ray, I spoke about: ‘Alternative lending and debt recovery' during the cost of living crisis.The average household credit card debt in the United Kingdom in 2022 is £2,100. If you include the mortgage, it is £63,000 per household. In this episode, I had three panelists:Helen Baron, Chair of London Capital Credit Union, pointed out that the credit union holds over £2 billion worth of consumer credit industry and that nearly one in every ten people in the UK has at least o...

2022-12-1433 min

Debt TalkDebt Talk: Minority communities & financial struggleOn this month’s Debt Talk podcast, Ripon Ray explored structural health inequity, direct and indirect discrimination in the workplace, low income, and the inadequacy of the social security system to support minority communities.Patrick Vernon OBE explained how minority communities are more likely to be in precarious jobs; and since cuts in public services began over a decade ago, the financial pressures have intensified for many people. The cost of living crisis is just an extension of the pressure.Muna Yassin MBE - CEO of Fair Money Advice - spoke about how her organisation is...

2022-11-1443 min

Do Do Social WorkShameless Money Talk: Sarah and Paul Do Do The Cost of Living CrisisSarah and Paul and debt expert Ripon Ray discuss the cost of living crisis, money matters, anti-poverty practice and what it means for us and the people we work with.

The views represented are our own and do not reflect any organisations we work for or have worked for.

Ripon's Debt Talk podcast on Spotify: https://open.spotify.com/show/7hoqQcAQxcZjNnifU92eEc

Ripon's website: http://www.yourdoctordebt.org/

2022-11-0446 min

Debt TalkDebt Talk: Eat, heat or pay your rentIn this episode, Debt Talk explores one of the most important subjects during the cost of living crisis: ‘Eat, heat or pay your rent.Already communities are stretched with their finances; they are skipping their meals to pay their rent or pay for fuel. Financial struggle has now become epidemic in low-income communities regardless of whether you are a worker, self-employed, pensioner or affected by disability. The question really is: how sustainable is it?Ripon Ray, the debt expert, speaks to three panelists who bring experience from their local community, research, and the debt advice se...

2022-10-1429 min

Debt TalkDebt Talk: Domestic abuse & money trouble In this episode, Ripon Ray explored the journey of a domestic abuse sufferer which may resonate with the experience of many domestic abuse sufferers in Britain.Rosie Lyon FRSA vividly explains the trauma of being a victim of her abuser and how her experience carried on post-separation since her home was tied with her former partner. She was in financial ruin because she was not able to pay the mortgaged property. It was later seized by her lender. Her credit rating was also tattered. She could not get a phone contract, credit card and no doubt many...

2022-09-1429 min

Debt TalkDebt Talk: FCA, vulnerable consumer & duty Welcome to the first of many Debt Talk podcasts presented to you by Ripon Ray, a debt expert for over 10 years.In times of the cost of living crisis, discussing debt has become more important than ever. At the same time, changes in regulations and government policy, increase the cost of fuel and goods which result in people getting into debt.In this episode Ripon Ray speaks to Helen Lord, CEO of Vulnerability Registration Service, on the following issues:The meaning of vulnerability from the perspective of the FCAWays organisations...

2022-08-1418 min

Money BoxPayment HolidaysIs taking a break from regular payments on your mortgage, credit card or a loan for example a good way to help you through financial difficulties?Charmaine Cozier asks what you should consider before deferring regular payments and whether there are alternatives or long term consequences for your money.We'd love to hear your questions, experiences and views so please e-mail moneybox@bbc.co.uk now.On the panel are:Sam Nurse, Money Advice Hub.

Your Debt Doctor, Ripon Ray.

James Jones, Experian.Presenter: Charmaine Cozier

Producer: Diane Richardson

...

2020-12-0227 min

The TB PodcastPRAHRAN SUMMER JAM 2020 - Spreadin the Jam - TALKIN BALL Ep #2Welcome to our second installment of The Talkin Ball Podcast. Today’s episode couldn’t be fresher, recorded live from this past weekend’s PRAHRAN SUMMER JAM Streetball & 3x3 Tournament, featuring elite local & international basketball talent.On special occasions, we’ll be trading in the "Techno Beat" for “TALKIN BALL,” as we feature prominent athletes from the region and discuss influential sporting moments and events from across our Universe.In this episode I roamed around the Prahran Park, speaking with a diverse array of guests as we get the perceptions on this wonderful community event from various atte...

2020-02-1254 min

The Health & Wellbeing ShowSugar Detox at LEAR FitnessLear Fitness in Harrogate has been running a sugar detox for a group of local residents. Julie from Ripon tells us how it’s changed her well being and Ray from Lear fitness explains why cutting out or reducing your sugar intake can give make your feel so much better.

https://www.strayfm.com/news/health/2503431/what-happens-on-a-sugar-detox/

2018-02-1306 min

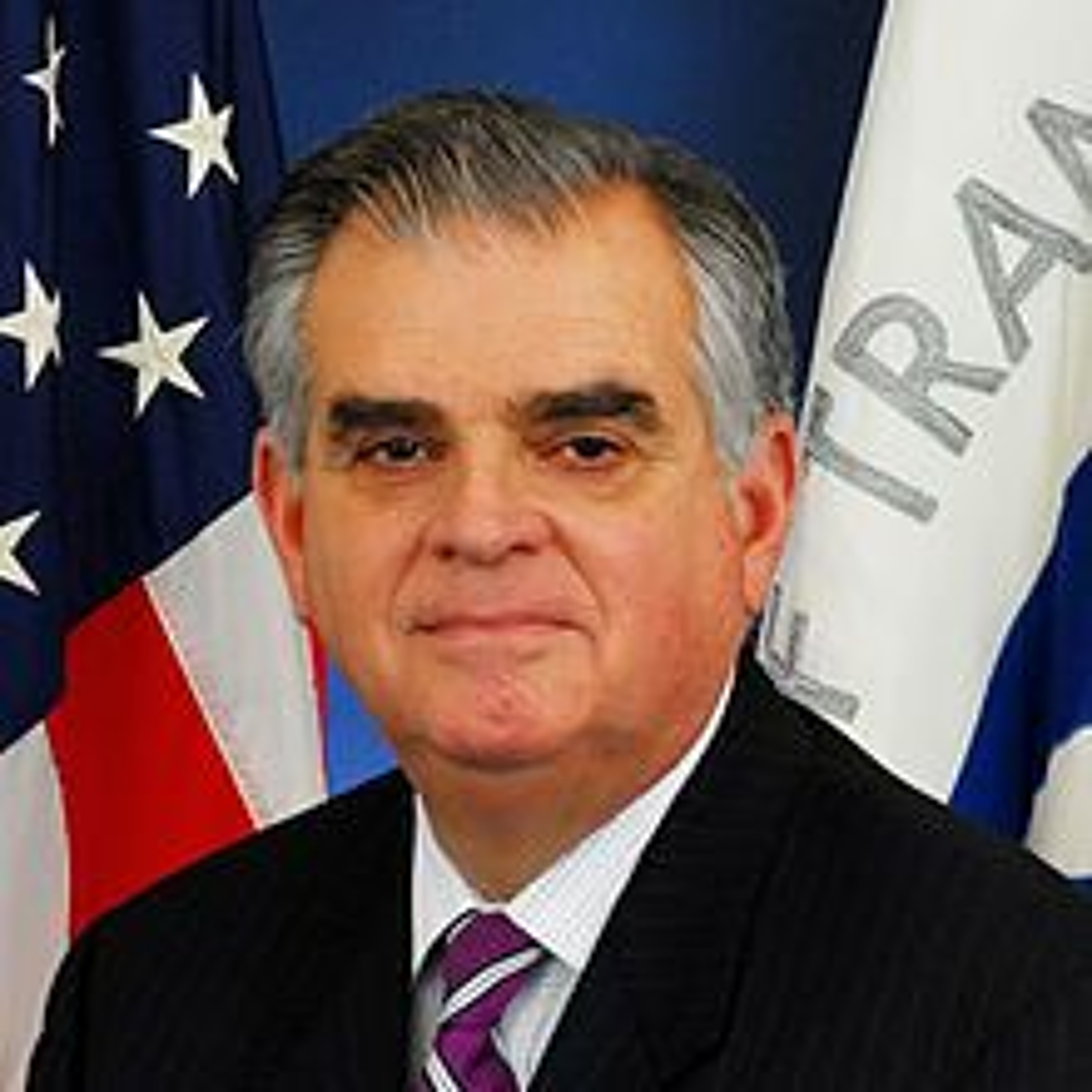

The Ripon Society Policy and Politics Series PodcastSecretary Ray LaHood Addresses The Ripon Society on November 18, 2010WASHINGTON, D.C. – In a speech to The Ripon Society, former GOP Congressman and current Transportation Secretary Ray LaHood expressed optimism that both parties will be able to work together in the wake of the mid-term elections. He also pointed to three areas – deficit reduction, transportation funding, and the war in Afghanistan — where, he believes, the Obama Administration and Republicans in Congress will be able to find common ground.

2016-07-1307 min