Shows

Tax Notes TalkTrump's Tariffs on Trial: Supreme Court PreviewTax Notes contributing editor Robert Goulder discusses the upcoming oral arguments before the Supreme Court on the validity of the Trump administration's recent reciprocal tariffs and speculates on the Court's reaction.For more tax news and analysis, read the following in Tax Notes:Nonprofits Urge SCOTUS to Side With Trump Admin in Tariff DisputePresident Can Impose Tariffs Under IEEPA, Admin Tells SCOTUSANALYSIS: V.O.S. Selections, Part 2: Will SCOTUS Rescue Trump's Tariffs?ANALYSIS: V.O.S. Selections, Part 1: Are Trump's Tariffs 'Too Big to Fail'?Supreme Court Will Hear Trump's Appeal of Tariff RulingsFo...

2025-10-1723 min

Tax Notes TalkThe Nvidia Deal and Taxing Exports: The Constitutionality of It AllTax Notes contributing editors Robert Goulder and Joseph Thorndike discuss the recent Nvidia deal to export chips to China, and they question its constitutionality and implications. For more coverage, read the following in Tax Notes:ANALYSIS: The Nvidia Affair: So Now We're Taxing Exports?ANALYSIS: Trump’s Nvidia Deal Is Almost Certainly Unconstitutional — Not That It MattersWhite House Eyes Replicating Nvidia Deal for Other IndustriesNvidia Deal Sparks Dismay From Tax ObserversFollow us on X:Robert Goulder: @RobertGoulderJoe Thorndike: @jthorndikeDavid Stewart: @TaxStewTax Notes: @TaxNotes**CreditsHos...

2025-09-1219 min

Tax Notes TalkPope Leo the Taxed: How the U.S. Tax System May Affect the VaticanTax Notes contributing editor Robert Goulder discusses how Pope Leo XIV’s American citizenship creates a unique tax issue and how the United States may try to avoid taxing the pope. For more coverage, read the following in Tax Notes:Expats Eye Pope's Tax Woes as Opportunity to Ditch Worldwide TaxAnalysis: The American Pope and Citizenship-Based TaxationFollow us on X:Robert Goulder: @RobertGoulderDavid Stewart: @TaxStewTax Notes: @TaxNotes**CreditsHost: David D. StewartExecutive Producers: Jeanne Rauch-Zender, Paige JonesProducers: Jordan Parrish, Pey...

2025-08-2929 min

PREP Podcaster - ”Success Favours The PREPared Mind”A Simple Regulatory Fix For Citizenship TaxationIn November of 2020, SEAT members John Richardson, Karen Alpert and Laura Snyder published “A Simple Regulatory Fix For Citizenship Taxation”. This was the first article (and possibly suggestion) that the problems of Americans abroad could be solved through regulation.

We participated in a video podcast with Robert Goulder at Tax Notes.

Here is the AI Description of the ar

2025-07-1326 min

ExpatriationLaw - X Spaces Lives Discussions - Ending Double Taxation Of Americans AbroadA Simple Regulatory Fix For Citizenship TaxationIn November of 2020, SEAT members John Richardson, Karen Alpert and Laura Snyder published “A Simple Regulatory Fix For Citizenship Taxation”. This was the first article (and possibly suggestion) that the problems of Americans abroad could be solved through regulation. We participated in a video podcast with Robert Goulder at Tax Notes.Here is the AI Description of the article.A Simple Regulatory Fix For Citizenship Taxation 1 source This Tax Notes Federal article by John Richardson, Laura Snyder, and Karen Alpert examines the complex challenges faced by U.S. citizens livi...

2025-07-1326 min

Tax Notes TalkTaxing What You Can't See: Targeting Foreign AssetsTax Notes contributing editor Robert Goulder shares his take on the effects of the Foreign Account Tax Compliance Act and common reporting standards on the feasibility of taxing foreign assets.Listen to our previous episodes on taxing hidden assets:The Constitutionality of Penalties on Undeclared AssetsAmerica the Tax Haven? Exploring the U.S. Trade DeficitFor more coverage, read the following in Tax Notes:Trump Vows to End ‘Double Taxation’ of Overseas CitizensCourt Tells DOJ No Do-Over in Venture Capitalist FBAR CaseEU, Belgium Say Domestic Bank Secrecy Hinders Tax TransparencyU.S., Switzerland to Exch...

2024-11-0119 min

Tax Notes TalkThe Constitutionality of Penalties on Undeclared AssetsTax Notes contributing editor Robert Goulder discusses the history of foreign bank account reporting penalties and how two recent court cases could affect the FBAR regime. For more coverage, read the following in Tax Notes:Jury Finds Professor’s FBAR Failures WillfulFBAR Penalty Circuit Split Has Potential for Supreme Court ReviewSchwarzbaum FBAR Penalty Dispute Results in Circuit SplitCourt Tells DOJ No Do-Over in Venture Capitalist FBAR CaseNinth Circuit Approves Prejudgment Interest for FBAR PenaltiesFollow us on X:Bob Goulder: @RobertGoulderDavid Stewart: @TaxStewTax Notes: @TaxNotes***CreditsHost: Davi...

2024-10-1120 min

Tax Notes TalkTaxing Immigrant Families: The Personal Exemption After the TCJASarah Lora of Lewis & Clark Law School discusses the personal exemption after the Tax Cuts and Jobs Act and the implications for immigrant families with nonresident dependents. For more, read Lora's paper, "Righting Tax Wrongs for Immigrants."Follow us on X:Robert Goulder: @RobertGoulderDavid Stewart: @TaxStewTax Notes: @TaxNotes***CreditsHost: David D. StewartExecutive Producers: Jasper B. Smith, Paige JonesShowrunner: Jordan ParrishAudio Engineers: Jordan Parrish, Peyton RhodesGuest Relations: Alexis Hart

2024-08-1620 min

Tax Notes TalkTaxing Billionaire Borrowing: A New Kind of Wealth Tax?Professors Edward Fox and Zachary Liscow discuss their proposal for a new tax on billionaires that would apply to borrowing against their assets. For more, read Fox and Liscow's article, "No More Tax-Free Lunch for Billionaires: Closing the Borrowing Loophole," in Tax Notes.For more on wealth taxes, listen to The Wealth Tax Debate.Follow us on Twitter:Robert Goulder: @RobertGoulderDavid Stewart: @TaxStewTax Notes: @TaxNotes**This episode is sponsored by the University of California Irvine School of Law Graduate Tax Program. For more information, visit law.uci.edu/gradtax.

2024-02-2330 min

Tax Notes TalkMoore 2.0? Analyzing Altria Group Inc. v. United StatesTax Notes contributing editor Robert Goulder discusses the downward attribution dispute in Altria Group Inc. v. United States and the case’s similarities to Moore.Listen to our Moore episodes:A Recap of SCOTUS Oral Arguments in Moore v. United StatesMoore Money, More Tax Problems? Analyzing Moore v. United StatesFor additional coverage, read these articles in Tax Notes:Analysis: The Excise Power: Altria Waits Its TurnAltria’s Case Stayed Pending Realization Decision in MooreAltria Challenges IRS Downward Attribution Control AnalysisFollow us on Twitter:Robert Goulder: @RobertGoulderDavid Stewart: @TaxStewTax Notes: @T...

2024-01-1921 min

Tax Notes TalkHow Fake News Affects the Tax WorldProfessors Kathleen DeLaney Thomas and Erin Scharff discuss fake tax news and the effect it has on public policy. For more, read the professors' article "Fake News and the Tax Law."Follow us on Twitter:Robert Goulder: @RobertGoulderDavid Stewart: @TaxStewTax Notes: @TaxNotes***CreditsHost: David D. StewartExecutive Producers: Jasper B. Smith, Paige JonesShowrunner and Audio Engineer: Jordan ParrishGuest Relations: Alexis Hart

2023-07-0738 min

Tax Notes TalkBad Credit: A Look at Switzerland’s Bank SecrecyTax Notes contributing editor Robert Goulder discusses the history of bank secrecy, Credit Suisse’s role in it, and the bank’s recent collapse. For additional coverage, read these articles in Tax Notes:Government Goes After ‘Bank Hopping’ Couple for FBAR PenaltiesFinance Committee Says Hidden Swiss Bank Accounts Fight Isn't OverUBS May Have Bought Credit Suisse’s Undeclared Account TroublesFATCA Shortfalls Bring Calls for Elimination, Better EnforcementFrance Again Denies UBS Whistleblower’s Compensation RequestReport: U.K. Residents Have £570 Billion Stashed in Tax HavensFollow us on Twitter:Robert Goulder: @RobertGoulderDavid Stewart: @TaxStewTax Notes: @TaxNotes

2023-04-0730 min

Tax Notes TalkA Closer Look at the National Sales Tax ProposalTax Notes Capitol Hill reporter Doug Sword discusses the latest national sales tax proposal in Congress, and contributing editor Robert Goulder shares his thoughts on the challenges of implementing the tax. For additional coverage, read these articles in Tax Notes:Perspective: The Orgy of NontaxationBiden Criticizes Republican Plans to Abolish IRSConservatives Say McCarthy Is Committed to National Sales Tax VoteFollow us on Twitter:Doug Sword: @doug_swordRobert Goulder: @RobertGoulderDavid Stewart: @TaxStewTax Notes: @TaxNotes**This episode is sponsored by the University of California Irvine School of Law Graduate Tax...

2023-01-2731 min

Tax Notes TalkThe NCAA vs. Taxation: How Colleges Are Caught in the MiddleProfessor Richard Schmalbeck of Duke University Law School discusses college sports and taxation, including the potential effect of compensation for coaches and athletes on colleges’ tax-exempt status. For more, read Schmalbeck and Zelenak's paper, "The NCAA and the IRS: Life at the Intersection of College Sports and the Federal Income Tax."For related coverage, read these articles in Tax Notes: Taxwriter Questions More Universities About Coaches' SalariesTaxwriter Questions Big Salaries of Two College CoachesListen to the episode mentioned: Taxing College Athletes After NCAA v. AlstonFollow us on Twitter:R...

2022-03-1135 min

Tax Notes TalkYear-End Collection: Tax Oddities of 2021Tax Notes reporters recap some of the unusual tax stories they covered in 2021, from an international basketball player’s tax troubles to a court fight in India over a Michael Jackson concert tax. Listen to the following related podcast episodes:Year-End Collection: Tax Oddities of 2020Year-End Collection: Tax Oddities of 2019Year-End Collection, Volume 2: Tax OdditiesYear-End Collection, Volume 1: Tax OdditiesFor additional coverage, read these news articles in Tax Notes: Texas Senator: Curb Sports Team Incentives Over Mavericks' Anthem DustupEx-NBA Player Hit With Tax, Wire Fraud Charges for Chinese PlayFrench Tax Authorities Can Use...

2021-12-2434 min

Tax Notes TalkThe Category Is Tax TriviaMike Kowis, author of American Tax Trivia: The Ultimate Quiz on U.S. Taxation, challenges the Tax Notes Talk team to a game of tax trivia and discusses his new book. In a special “In the Pages” segment, Tax Notes International columnist Peter Mason chats about his new book, Building Better Taxes. Listen to related episodes:Stranger Than Fiction: Lessons From Odd Tax Facts of YoreFrom Henry VIII to James Bond: Weird Tax Facts Throughout HistoryFollow us on Twitter:Robert Goulder: @RobertGoulderStephanie Soong Johnston: @SoongJohnstonDavid Stewart: @TaxStewTax Notes: @TaxNotes**This e...

2021-11-2450 min

Tax Notes TalkThe U.S. Influence on the OECD’s Global Tax Reform PlanTax Notes contributing editor Robert Goulder discusses the Biden administration’s approach to the OECD’s two-pillar solution to taxing the digital economy and the potential for global consensus. For additional coverage, read Goulder's piece in Tax Notes:Treasury’s Pillar 1 Reset: In Praise of Comprehensive ScopingAll Roads Lead to Ireland: Pillar 2 and the Path of Least ResistanceThe BEPS Gambit: Will the OECD Know When to Resign?**This episode is sponsored by Avalara. For more information, visit avalara.com/taxnotes.This episode is sponsored by University of California, Irvine Law School’s Graduate...

2021-05-1424 min

Columbus PerspectiveColumbus Perspective: February 14, 202100:00 Show Open / Lydia Mihalik, Director of the Ohio Development Services Agency, discusses winter tourism in Ohio

12:15 Courtesy of our sister station, WBNS 10-TV, Tracy Townsend presents segments about Governor Mike DeWine's state budget proposal, the vaccine rollout, and the case involving a former Columbus police officer charged with murder.

36:30 George Hobor, Senior Program Officer with the Robert Wood Johnson Foundation, discusses an interactive web site that provides local information about health outcomes covering many diseases and conditions.

45:00 Dr. Eric Goulder - a local cardiologist - and Dr. Barbara McClatchie - a local dentist - discuss the impact oral health has...

2021-02-1459 min

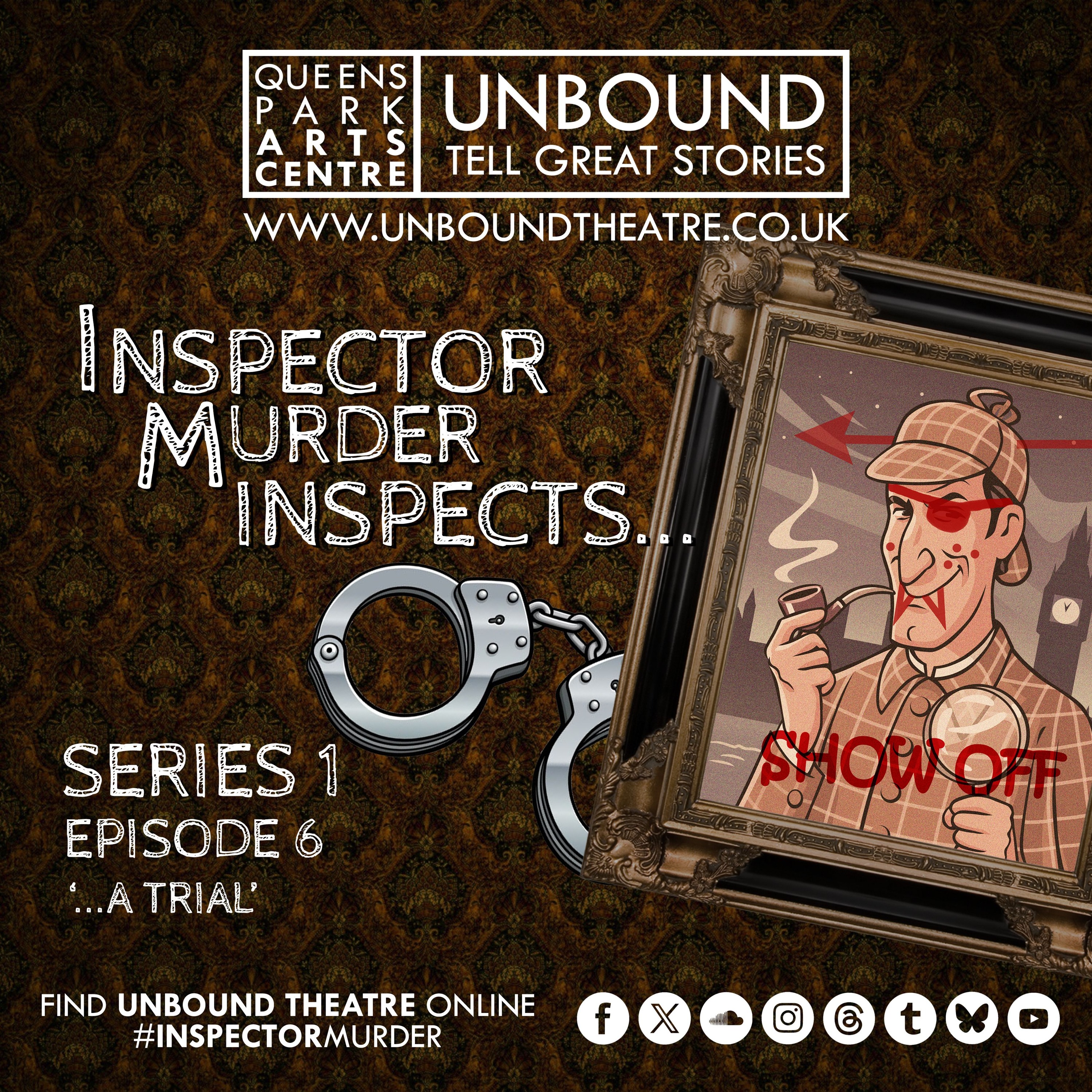

Unbound Theatre'Inspector Murder Inspects...' - Series 1, Episode 6Inspector Murder Inspects...

Series 1, Episode 6

'...A Trial'

In the final episode of the series, the Inspector is on trial for murder. It's up to Laura to prove his innocence, but both of them have figures from their past to face before the final verdict can be given...

CAST

Inspector Murder – Alistair Sanderson

Laura Norder – Emily Pugh

Constance Urveillance – Jo Pratt

Luc Vercluse – Andrew Faber

Detective Davies / Theodore – David Ault

Harry Wentworth / Barry the Boulder – Andrew Peter Shaw

Judge Wentworth – Robert Aldington

Clerk – Stephanie Hull

Herbert La Point – Chris Barnett

Maude La Point – Hannah Rogers

Freddie Beresford / Detective Brain – Gareth Johnson

Lady Carringto...

2020-12-1440 min

Unbound Theatre'Inspector Murder Inspects...' - Series 1, Episode 5Inspector Murder Inspects...

Series 1, Episode 5

'...A Forgery'

After an eventful trip to the theatre, the Inspector and Laura find themselves investigating the murky world of art forgeries. Meanwhile Luc indulges in his passion for collecting, and Constance has a quiet night in...

CAST

Inspector Murder – Alistair Sanderson

Laura Norder – Emily Pugh

Constance Urveillance – Jo Pratt

Luc Vercluse – Andrew Faber

Lola Lillard – Kati Herbert

Sidney Braithwaite – Robert Aldington

Theodore – David Ault

Marmaduke – Neil Goulder

Fran Rawson / Beryl – Erika Sanderson

Kenneth Rawson – Andrew Peter Shaw

Matthias Barracuda – Matthew Doherty

Usherette – Stephanie Hull

CREW

Writer / Director - Dario Knight

Co-created with - Gareth Johnson

Sound Rec...

2020-12-0740 min

Tax Notes TalkThe Impact of the 2020 U.S. Elections on International TaxTax Notes senior legal reporter Andrew Velarde and contributing editor Robert Goulder discuss the influence of the 2020 U.S. elections on the international tax world. For additional coverage, read these articles in Tax Notes:Biden’s International Tax Proposals Missing Many PiecesEU Hopes to Repair Bilateral Relationship With U.S.Biden Win Brings Hope for Progress in Global Tax TalksTaxOps SALT expert Tram Le talks about her recently published piece, “Simplification Initiatives to Reduce Burdens for Remote Sellers.”**This episode is sponsored by Avalara. For more information, visit avalara.com/taxnotes.

2020-11-2040 min

Tax Notes TalkHow Racial Diversity Shaped U.S. International Tax PolicyTax Notes contributing editor Robert Goulder talks with Steven A. Dean, faculty director of New York University School of Law’s graduate tax program, about the intersection of racial diversity and U.S. international tax policy. For additional coverage, read Dean's piece in Tax Notes: FATCA, the U.S. Congressional Black Caucus, and the OECD BlacklistIn the segment "In the Pages Sneak Peek," Tax Notes Executive Editor for Commentary Jasper B. Smith chats with Lucas de Lima Carvalho, an international tax law professor at the Brazilian Institute for Tax Law, about his recent piece, "The...

2020-07-2444 min

Tax Notes TalkPillar 3 for the OECD: A Global Excess Profits TaxAllison Christians, the H. Heward Stikeman Chair in Tax Law at McGill University, tells Tax Notes contributing editor Robert Goulder about her proposal for a global excess profits tax as the third pillar in the OECD’s digital economy project. For additional coverage, read her proposal in Tax Notes:It’s Time for Pillar 3: A Global Excess Profits Tax for COVID-19 and BeyondFor more background, read these articles in Tax Notes:OECD Postpones Key Meeting of Global Tax Overhaul ProjectGlobal Tax Reform Project Should Consider COVID-19, ICC SaysG-20 Global Tax Revamp More Relevant Than...

2020-05-1526 min

Tax Notes TalkNAFTA Versus USMCATax Notes contributing editor Robert Goulder discusses the decades-old North American Free Trade Agreement (NAFTA), the new U.S.-Mexico-Canada Agreement (USMCA), and what these agreements mean for the future of tariffs and trade in North America.Read Goulder's viewpoint on the subject: Hello, USMCA, Haven't We Met Before?For additional coverage, read these articles in Tax Notes:USMCA Wins Overwhelming Approval in U.S. SenateU.S. Congress Looks to Roll Back Executive Tariff AuthorityMexican Senate Passes USMCA With Little OppositionTariff Threats Not a Roadblock to USMCA, Lighthizer SaysUSMCA Unlikely to Be Finalized in...

2020-01-1724 min

Tax Notes TalkTax Policy and the EU's Unanimity RequirementRobert Goulder discusses the proposal to eliminate the EU's unanimity requirement for tax directives and what that would mean for tax policy. For additional coverage, read these articles in Tax Notes:Should the EU Scrap the Unanimity Requirement?Cost of Unanimity on Tax Rules Will Only Increase, Group SaysProposal to End EU Unanimity Requirement Coming by Year-EndEU's Moscovici Says Commission to Propose Qualified Voting on Tax MeasuresNews Analysis: Is the End Near for the Unanimity Rule for EU Tax Issues?

2019-01-1826 min

Tax Notes TalkIFA 2018: The HighlightsStephanie Johnston, Robert Goulder, and David Stewart highlight the hot topics at the 72nd Congress of the International Fiscal Association recently held in Seoul.

Check out these stories for coverage of the 2018 IFA Congress:

EU Digital Taxation Plan Is ‘Not a Master Thesis’

OECD Makes Headway on Long-Term Answers to Tax Digital Economy

OECD Finalizing Work to Enlist Digital Platforms to Collect VAT

Judicial Oversight Important for GAAR Application, Judge Says

Germany Wants Progress on BEPS, Minimum Effective Taxation

EU Member States Remain Divided Over Digital Services Tax

2018-09-1825 min