Shows

We Study Billionaires - The Investor’s Podcast NetworkTIP777: The 1999 Dot-Com Bubble w/ Clay FinckIn this episode, Clay explores the dot-com boom and bust through Roger Lowenstein’s book, Origins of the Crash. The book unpacks how distorted incentives, financial engineering, and speculative excess reshaped markets. By studying this period in market history, investors can better recognize recurring patterns in behavior, incentives, and speculation, and apply those lessons to avoid future manias.

IN THIS EPISODE YOU’LL LEARN:

00:00:00 - Intro

00:03:33 - Why stock options often misalign executives and long-term shareholders

00:08:51 - How financial engineering was abused in the 1990s market boom

00:12:45 - How distorted incentives fueled the dot-com bubble

00:27:51 - Why revo...

2025-12-191h 10

The Grind ChroniclesBuffett by Roger LowensteinThis text, primarily excerpts from Roger Lowenstein's biography "Buffett," chronicles the life and career of Warren Buffett, beginning with his family background and early influences, including his father Howard's business ventures during the Depression and his mother Leila's struggles. The narrative follows Buffett's formative experiences, his early entrepreneurial endeavors like Stable-Boy Selections and Wilson Coin Op, and his intellectual development, notably his attraction to mathematics and skepticism towards religion. His education, first at Wharton and later under the tutelage of Benjamin Graham, significantly shaped his investment philosophy. The biography details Buffett's partnership years...

2025-12-1725 min

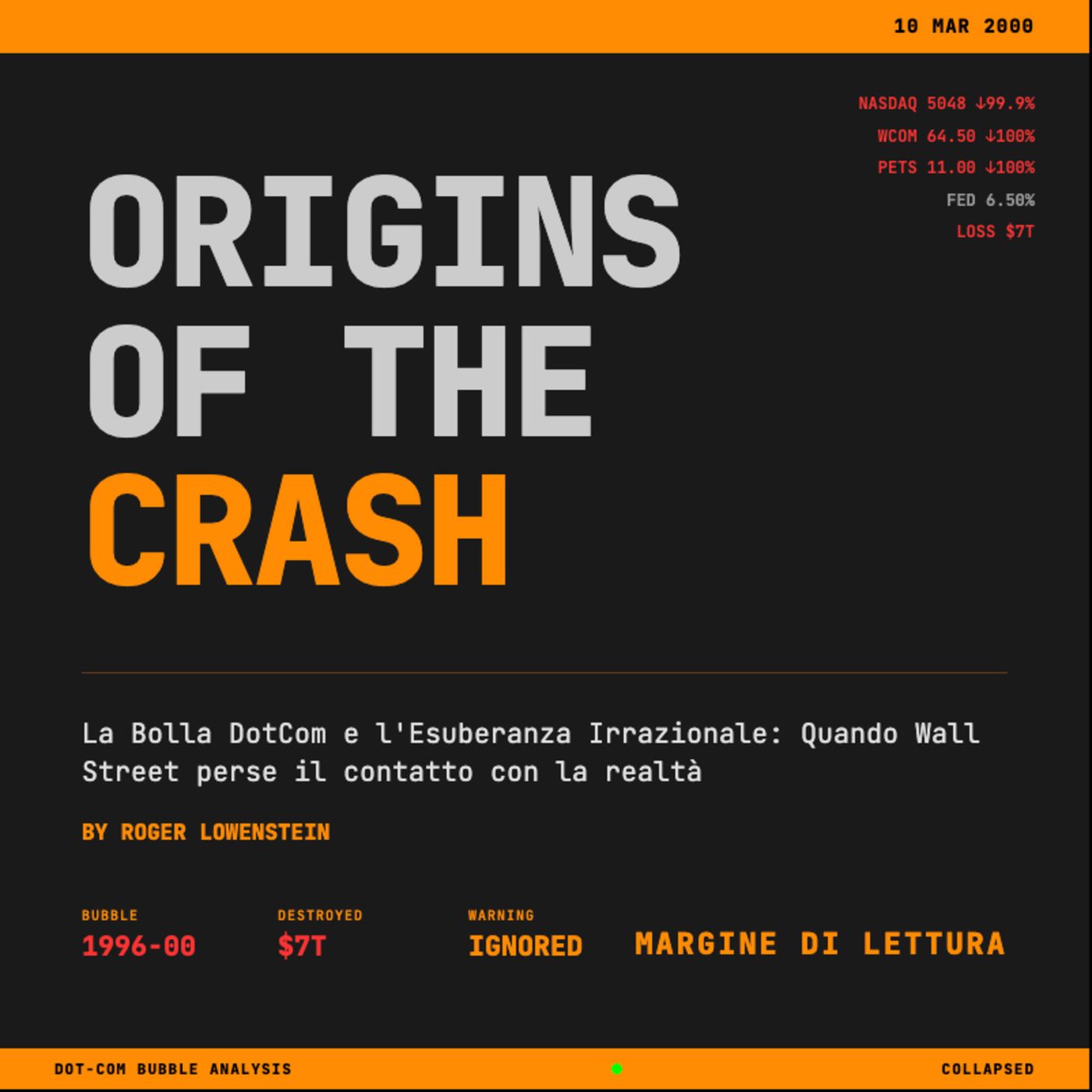

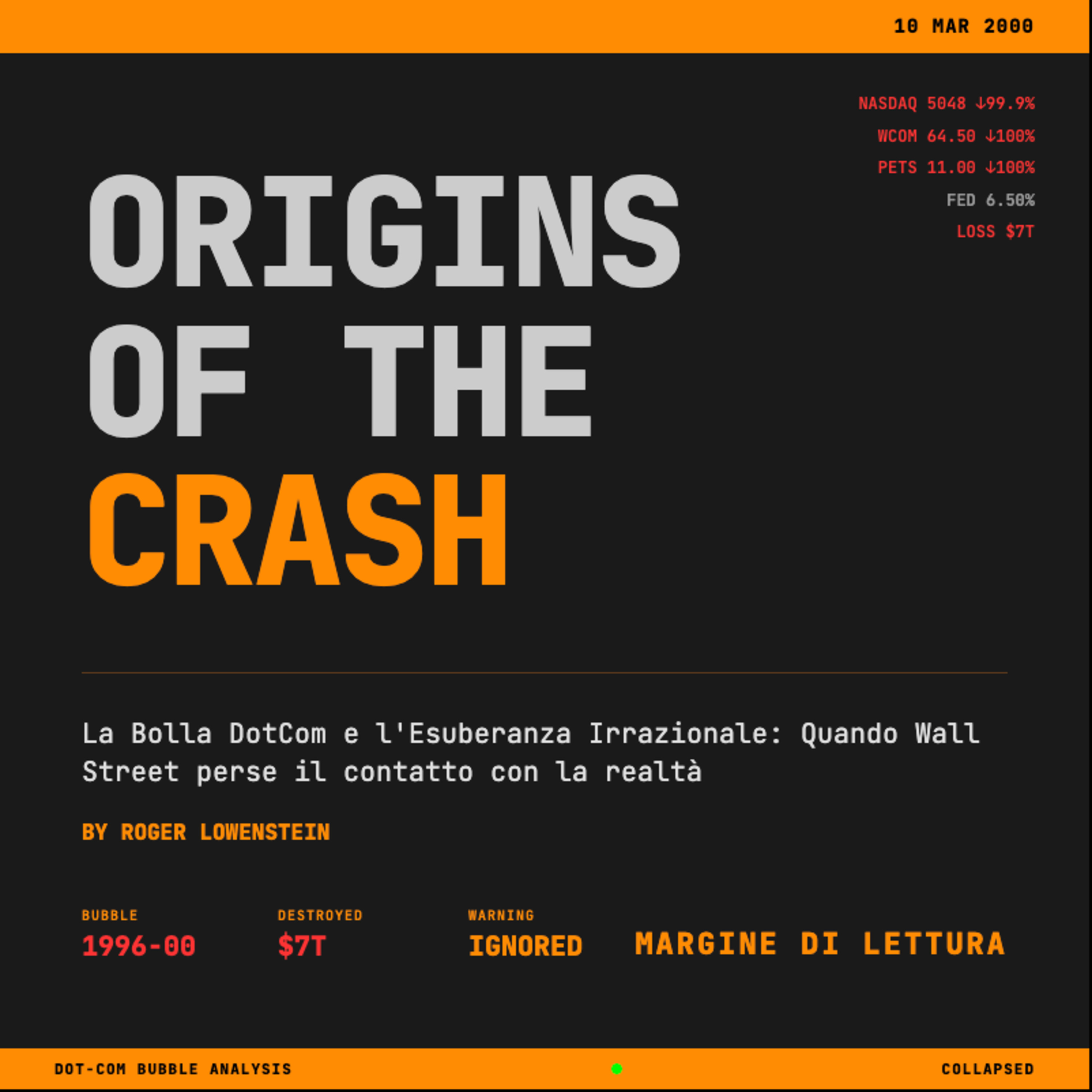

Margine di LetturaOrigins of the Crash - La Bolla DotCom e l'Esuberanza Irrazionale: Quando Wall Street perse il contatto con la realtà | Margine di LetturaCOMPRA IL LIBRO (LINK SPONSORIZZATO): https://amzn.to/4ogFt8CMargine di Lettura, il podcast che apre i grandi libri della finanza come fossero thriller. In ogni episodio ricostruiamo una storia vera di mercati, ego e scelte estreme, seguendo la trama di un volume cult.Marzo 2000. Il NASDAQ tocca 5.048 punti - il culmine di una salita che sembrava non avere fine. Cisco vale più di General Motors, Ford e DaimlerChrysler messe insieme. Qualcomm vale quanto l'intera industria automobilistica americana. E tutti, ma proprio tutti, sono convinti che questa volta è davvero diverso. Poi arriva aprile, e in pochi mesi 7 trilioni di...

2025-11-2346 min

Margine di LetturaOrigins of the Crash - La Bolla DotCom e l'Esuberanza Irrazionale: Quando Wall Street perse il contatto con la realtà | Margine di LetturaCOMPRA IL LIBRO (LINK SPONSORIZZATO): https://amzn.to/4ogFt8CMargine di Lettura, il podcast che apre i grandi libri della finanza come fossero thriller. In ogni episodio ricostruiamo una storia vera di mercati, ego e scelte estreme, seguendo la trama di un volume cult.Marzo 2000. Il NASDAQ tocca 5.048 punti - il culmine di una salita che sembrava non avere fine. Cisco vale più di General Motors, Ford e DaimlerChrysler messe insieme. Qualcomm vale quanto l'intera industria automobilistica americana. E tutti, ma proprio tutti, sono convinti che questa volta è davvero diverso. Poi ar...

2025-11-2346 min

Risk of RuinInside Long Term CapitalThe story of Long Term Capital Management as told by LTCM partner Eric Rosenfeld. Eric earned a PhD from MIT, then taught at Harvard Business School, then became a trader at Salomon, then was a founding partner of LTCM.Resources:HBS Study on LTCM dividendEric's talk at MIT in 2009Michael Lewis article on LTCMWhen Genius Failed, Roger LowensteinFollow the show on Twitter: @halfkellyEmail: riskofruinpod@gmail.comWeb: halfkelly.com

2025-08-071h 03

The Security Analysis PodcastBuffett: The Making of an American CapitalistThis is a discussion between Matt Cochrane & I about Buffett: The Making of anAmerican Capitalist by Roger Lowenstein. This was the first biography of Warren Buffett, published in 1995, and it remains one of the best.It was written when Buffett was already an investing legend, one of the wealthiest men in the world, and well-known in the investing community. However, it was before Buffett was a mainstream celebrity. It remains the best biography of Warren Buffett ever written.LinksThe book: https://www.amazon.com/Buffett-American-Capitalist-Roger-Lowenstein-ebook/dp/B00DPTL2F0

2025-06-211h 14

We Study Billionaires - The Investor’s Podcast NetworkTIP707: The Collapse of Long-Term Capital Management w/ Clay FinckIn this episode, Clay explores When Genius Failed by Roger Lowenstein, the gripping story of the rise and fall of Long-Term Capital Management (LTCM). Founded by Wall Street’s brightest minds, including Nobel Prize-winning economists, LTCM generated astronomical returns using complex mathematical models and extreme leverage—until a financial crisis in 1998 exposed its fatal flaws. Clay also discusses the dangers of overconfidence, the illusion of diversification, and why excessive leverage can be a ticking time bomb. Additionally, he shares details on an exclusive value investing event hosted by TIP in Big...

2025-03-211h 20

Flourishing Edge Podcast with Ashish KothariEmployee Flourishing: Why Growing Your People Is the Ultimate Growth Strategy with Ryan HeckmanIf you want your company to scale, here's one question you need to ask yourself: Are you growing your people as fast as you're growing your revenue? Too many leaders obsess over business expansion but ignore the foundation that makes it possible—PEOPLE. In this episode of the Happiness Squad Podcast, Ashish Kothari and Ryan Heckman remind us that when you invest in your people’s growth, your business follows. Ryan reveals the leadership shift that can turn any stagnant company into an unstoppable force.Ryan Heckman is a seasoned private equity investor with o...

2025-03-181h 10

The Summary Series: Top 100 Finance and Investing Books055-When Genius Failed: The Rise and Fall of Long-Term Capital Management by Roger LowensteinSummary of When Genius Failed: The Rise and Fall of Long-Term Capital Management by Roger Lowenstein📚 Buy this book on Amazon: https://amzn.to/4aPQUyP💻 Free month of Kindle Unlimited: https://amzn.to/3ZYVJAK🎧 Grab audio version for free on an Audible trial: https://amzn.to/3PeeivQ"When Genius Failed" by Roger Lowenstein is a dramatic account of the rise and catastrophic collapse of Long-Term Capital Management (LTCM), a hedge fund run by some of the most brilliant financial minds in the world. The book explores...

2025-02-1811 minEconoFact ChatsAbraham Lincoln and the Role of Government in the Economy (Re-broadcast)In 1860, the United States had no national currency, no national bank, and no income tax. Lincoln had a vision of advancing the economic fortunes of the country and fostering greater economic equality through, for example, incentivizing railroads and creating land-grant universities. He and his Treasury Secretary Salmon Chase also faced the challenge of financing the hugely expensive Civil War. This week on EconoFact Chats, Roger Lowenstein describes how Lincoln and Chase revolutionized the role of the federal government, played a crucial part in the Union Army’s victory, and helped forge a national identity – a story that offers a mirror to th...

2025-01-1221 min

Bookey App 30 mins Book Summaries Knowledge Notes and MoreReminiscences of a Stock Operator: Key Insights and LessonsChapter 1 What's Reminiscences of a Stock Operator by Edwin Lefèvre, Roger Lowenstein, Rick Rohan"Reminiscences of a Stock Operator," written by Edwin Lefèvre and often associated with figures like Roger Lowenstein and Rick Rohan, is a fictionalized biography of Jesse Livermore, one of the most famous stock traders in history. First published in 1923, the book chronicles Livermore’s trading techniques, philosophies, and psychological challenges in the stock market. It offers insights into market dynamics, speculation, and the emotional rollercoaster that traders face. Through the narrative, readers witness Livermore’s journey from a young boy working in a b...

2024-10-1716 min

Bookey App 30 mins Book Summaries Knowledge Notes and MoreBuffett: The Making of an American CapitalistChapter 1:Summary of Buffett"Buffett: The Making of an American Capitalist" by Roger Lowenstein is a detailed biography of Warren Buffett, one of the most successful and respected investors of all time. The book delves deep into the life and investment philosophy of Buffett, tracing his rise from his early years in Omaha, Nebraska, to his position as the chairman and CEO of Berkshire Hathaway.Lowenstein provides a comprehensive look at Buffett's unique approach to investing, which is characterized by buying undervalued companies with strong intrinsic values and holding them for a long time. The...

2024-09-0110 min

Taylor Made Macro#4 - Practice 3: Find Inflections in Cyclical Businesses Undergoing Secular Change Like Kuppy“But I'm buying stuff where, revenue’s growing rapidly. I'm buying stuff where value creation is happening rapidly. I'm buying, you know, growth momentum names. I’m buying them before anyone else realizes that they’re growth momentum names...they're still valued like uh, value stocks. If you look at this sort of stuff we're doing, we call it--, I call it inflection investing for lack of a better word, but they tend to be industries that have destroyed a lot of capital that have bored people to death, that give people PTSD.” -Kuppy, Praetorian Capital --Kuppy...

2024-05-0353 min

Book Summaries 2024When Genius Failed The Rise and Fall of Long-Term Capital Management Roger LowensteinIn this guide, we’ll explore the history of LTCM, how its models operated, how it achieved such dizzying success, and how it suffered such a crushing and ignominious fall. Throughout the guide, we’ll supplement Lowenstein’s account with commentary from other financial experts and analysts, including commentators who wrote after the book’s initial publication in 2000—adding insights to the LTCM story in light of subsequent events.

2024-04-2801 min

The Security Analysis PodcastThe Snowball: Warren Buffett and the Business of LifeThis is a long discussion between myself and Nelson – the Canadian Dividend Investor – about The Snowball: Warren Buffett and the Business of Life by Alice Schroeder. There are really two definitive books about Warren Buffett – this one and Buffett: The Making of An American Capitalist by Roger Lowenstein. Lowenstein’s book is excellent, but he wrote it in 1995 without the cooperation of Warren Buffett. The book was also written before Warren Buffett was extremely famous.The Snowball, in contrast, was written with the cooperation of Warren Buffett. Alice Schroeder covered Berkshire for Morgan Stanley and knew War...

2024-04-241h 25

History Behind News ProgramS4E5: Would the North Have Gone To War If Slavery Was Not At Issue?While Ms. Nikki Haley was reluctant to say the "S" word (read slavery), we all know that slavery caused the Civil War. In this episode, we discuss whether slavery was the Civil War's immediate cause or its underlying cause.The in-depth analysis of this history is important for our current political moment because race is placed in front and center. For example, did you know that not all Southern states seceded? Or that most Northerners were deeply racist? Or that some slave states, such as Maryland, did not secede and that the Emancipation Proclamation did not apply to them...

2024-01-311h 09

Bookey SummaryMastering the Market: Reminiscences of a Stock OperatorChapter 1:what is Reminiscences Of A Stock Operator book about"Reminiscences of a Stock Operator" is a classic financial literature published in 1923. While it is often associated with Edwin Lefèvre, it is actually a fictionalized biography of stock trader Jesse Livermore. The book is written in the first person and takes the reader through the life and experiences of Livermore in the late 19th and early 20th centuries.The narrative follows Livermore's journey, starting with his early days as a bucket shop runner and his rise to becoming one of the m...

2024-01-1806 min

the Bestsellers SummaryLessons from the Legendary Stock Operator: Reminiscing the Journey of Edwin LefèvreChapter 1:what is Reminiscences Of A Stock Operator book about

"Reminiscences of a Stock Operator" is a book written by Edwin Lefèvre that tells the life story of Jesse Livermore, one of the greatest stock traders in history. It provides a fictionalized biography, based on Livermore's experiences, from his early days as a "bucket shop" trader to his rise as a Wall Street speculator.

The book explores Livermore's journey to financial success and the lessons he learned along the way. It delves into the psychology of trading, emphasizing the importance of understanding h...

2024-01-1806 min

Reading Recap: Book SummariesThe Undoing of Wall Street: The Roger Lowenstein StoryWhat books did Warren Buffett recommend?

"The Intelligent Investor" by Benjamin Graham: This is a classic investment book that Buffett has often cited as one of his favorites.

"Common Stocks and Uncommon Profits" by Philip Fisher: Buffett has praised this book for its insights into stock analysis and long-term investing.

"Security Analysis" by Benjamin Graham and David Dodd: Buffett has recommended this book for its detailed analysis of investment strategies and valuation techniques.

"Business Adventures" by John Brooks: Buffett has mentioned this book as one of his favorites for its collection of stories about business and investing.

"The Outsiders" by...

2023-11-2310 min

Read Book Briefs PodcastThe Unprecedented Insights of Roger Lowenstein: Revealing the Mind of FinanceWhat books did Warren Buffett recommend?

Warren Buffett has recommended many books over the years. Some of the notable ones include:

1. "The Intelligent Investor" by Benjamin Graham

2. "Common Stocks and Uncommon Profits" by Philip Fisher

3. "Business Adventures" by John Brooks

4. "The Outsiders: Eight Unconventional CEOs and Their Radically Rational Blueprint for Success" by William N. Thorndike

5. "The Essays of Warren Buffett: Lessons for Corporate America" by Warren Buffett and Lawrence A. Cunningham

6. "The Snowball: Warren Buffett and the Business of Life" by Alice Schroeder (biography...

2023-11-2310 min

Resúmenes de lectura rápidaRoger Lowenstein: Master of Financial Insight

What is the Buffett book about?

The book "Buffett: The Making of an American Capitalist" by Roger Lowenstein is a biography that delves into the life and investing strategies of Warren Buffett. It provides an in-depth look at Buffett's background, his early years as an investor, and his journey to becoming one of the most successful and respected investors in the world. The book explores his investment philosophy, focusing on long-term value investing, as well as his personal life and philanthropic activities. Overall, it offers valuable insights into the life and principles of Warren Buffett and the strategies t...

2023-11-2010 min

Read Book Briefs PodcastThe Wall Street Wizard: Unlocking the Mind of Roger LowensteinBuffett book summary

"Buffett" by Roger Lowenstein is a comprehensive biography of billionaire investor Warren Buffett. The book takes readers through Buffett's life, from his childhood in Omaha, Nebraska, to his early investment experiences, to the building of his conglomerate Berkshire Hathaway, and his reputation as the "Oracle of Omaha."

Lowenstein delves into Buffett's investment philosophy, focusing on his emphasis on long-term value investing and his avoidance of speculation and risk. He explores Buffett's approach to studying companies and his ability to unearth undervalued assets, as well as his aversion to technology stocks and his...

2023-11-2010 min

Tóm Tắt Sách Miễn PhíWarren Buffett - Quá Trình Hình Thành Một Nhà Tư Bản Mỹ [Tóm Tắt Sách]Nghe thêm 1000+ Tóm tắt sách và nhiều nội dung hấp dẫn khác trên ứng dụng Fonos: https://fonos.link/PCFonos--Về Fonos:Fonos là Ứng dụng âm thanh số - Với hơn 13.000 nội dung gồm Sách nói có bản quyền, Podcast, Ebook, Tóm tắt sách, Thiền định, Truyện ngủ, Nhạc chủ đề, Truyện thiếu nhi. Bạn có thể nghe miễn phí chương 1 của tất cả sách nói trên Fonos. Tải app để trải nghiệm ngay!--Warren...

2023-10-1110 minBOOKEY Book Summary and ReviewThe Oracle of Omaha: Unlocking the Investment Strategies of Warren BuffettChapter 1:Summary of the Buffett „Buffett“ by Roger Lowenstein is a comprehensive biography of billionaire investor Warren Buffett. The book takes readers through Buffett’s life, from his childhood in Omaha, Nebraska, to his early investment experiences, to the building of his conglomerate Berkshire Hathaway, and his reputation as the „Oracle of Omaha.“ Lowenstein delves into […]

2023-10-1110 min

Bookey SummaryThe Oracle of Omaha: Exploring the Life and Strategies of Warren BuffettChapter 1:what is the Buffett about"Buffett: The Making of an American Capitalist" by Roger Lowenstein is a biography that explores the life of Warren Buffett, one of the most successful investors of all time. The book delves deep into Buffett's early years, his approach to investing, and the principles that have guided his career.Lowenstein begins by tracing Buffett's childhood in Omaha, Nebraska, and his early fascination with stocks and investing. The author then provides insights into Buffett's time at Columbia Business School, where he studied under...

2023-10-1110 min

the Bestsellers SummaryThe Oracle of Omaha: Unveiling the Investment Genius of Warren BuffettThe Oracle of Omaha: Unveiling the Investment Genius of Warren Buffett

Chapter 1:Summary of the Buffett

"Buffett: The Making of an American Capitalist" by Roger Lowenstein is a detailed biography of billionaire investor Warren Buffett.

The book traces Buffett's life and career from his childhood in Omaha, Nebraska, to his successful investments and business ventures. Lowenstein explores Buffett's early interest in the stock market and his early experiences in the field. He also delves into the influence of his father, a stockbroker, on shaping his investment philosophy and mindset.

The book...

2023-10-1110 min

suket urip[Pdf] free Download Ways and Means: Lincoln and His Cabinet and the Financing of the Civil War by Roger Lowenstein [Pdf] free Download Ways and Means: Lincoln and His Cabinet and the Financing of the Civil War by Roger Lowenstein Read Online Ways and Means: Lincoln and His Cabinet and the Financing of the Civil War by Roger Lowenstein is a great book to read and that's why I recommend reading or downloading ebook Ways and Means: Lincoln and His Cabinet and the Financing of the Civil War for free in any format with visit the link button below. **Read Book Here ==> https://baksoanakan.blogspot.com/58494811-ways-and-means **Download Book Here ==> https://baksoanakan.blogspot.com/58494811...

2023-09-0100 min

kisah bahaya[EPUB] [Read] America's Bank: The Epic Struggle to Create the Federal Reserve by Roger Lowenstein [EPUB] [Read] America's Bank: The Epic Struggle to Create the Federal Reserve by Roger Lowenstein Read Online America's Bank: The Epic Struggle to Create the Federal Reserve by Roger Lowenstein is a great book to read and that's why I recommend reading or downloading ebook America's Bank: The Epic Struggle to Create the Federal Reserve for free in any format with visit the link button below. **Read Book Here ==> https://sr-book-sudut.blogspot.com/24611598-america-s-bank **Download Book Here ==> https://sr-book-sudut.blogspot.com/24611598-america-s-bank Book Synopsis : A tour de force of historical reportage, America’s Bank ill...

2023-09-0110 min

kisah bahayadownload [EPUB] America's Bank: The Epic Struggle to Create the Federal Reserve by Roger Lowenstein download [EPUB] America's Bank: The Epic Struggle to Create the Federal Reserve by Roger Lowenstein Read Online America's Bank: The Epic Struggle to Create the Federal Reserve by Roger Lowenstein is a great book to read and that's why I recommend reading or downloading ebook America's Bank: The Epic Struggle to Create the Federal Reserve for free in any format with visit the link button below. **Read Book Here ==> https://karunggonisan.blogspot.com/24611598-america-s-bank **Download Book Here ==> https://karunggonisan.blogspot.com/24611598-america-s-bank Book Synopsis : A tour de force of historical reportage, America’s Bank ill...

2023-08-3110 min

Read & RepeatEP53 When Genius Failed - The Rise & Fall of Long-Term Capital ManagementRoger Lowenstein's book "When Genius Failed" is one of the best business failure case studies I've ever read. As we come up on the 25-year anniversary of Long-Term Capital Management's downfall, I thought it would be a great time to explore the lessons behind their fall from grace. LTCM started as a hot new hedge fund in the mid-90s, ready to deliver outstanding returns through their team of "genius" Ph.D. financial experts and unique bond arbitrage strategy. They posted incredible results over the first 4 years, multiplying their investor's capital by 4x, but then only 6 months later, nearly...

2023-08-291h 11

Bookey App 30 mins Book Summaries Knowledge Notes and MoreBuffett: Unraveling the Path to Warren Buffett's SuccessChapter 1 What’s the Book Buffett"Buffett: The Making of an American Capitalist" is a biography written by Roger Lowenstein that explores the life and investment strategies of Warren Buffett, one of the most successful investors in history. Published in 1995, the book delves into Buffett's early years, his journey to becoming a billionaire, and his approach to investing. It provides insights into his value investing philosophy, long-term thinking, and his unique ability to identify undervalued companies. The book offers readers a comprehensive understanding of Buffett's life, career, and the principles that guided his remarkable success in the wo...

2023-08-2806 min

Alpha ExchangeRoger Lowenstein, Author: "When Genius Failed"25 years post the chaotic unwind of Long Term Capital Management, there are lessons a plenty to be gleaned from this event. With this in mind, it was a pleasure to welcome acclaimed writer Roger Lowenstein, author of the famous book “When Genius Failed”, to the Alpha Exchange. His work is a compelling chronical of the vast success but ultimate failure of this storied hedge fund.We discuss some of the philosophical underpinnings of the firm’s risk management framework, focusing on the influence of Nobel Prize winners Myron Scholes and Robert Merton. We review some of LTCMs favori...

2023-04-1451 min

Creating Wealth Real Estate Investing with Jason Hartman1941 FBF: ‘The End of Wall Street’ with Roger Lowenstein of the Wall Street Journal’s ‘Heard on the Street’ ColumnToday's Flashback Friday is form episode 237 published last 27 January 2012. Get more awesome content when you follow Jason's YouTube channel! Join Jason Hartman as he interviews author and financial journalist Roger Lowenstein regarding the history of Wall Street’s demise. Roger talks about the increases in choice, risk, hedging, more volatility, and how free markets are open to speculation, greed, fear and manipulation. There are more markets today susceptible to booms and busts. In the old days, local bankers determined loan eligibility. Today, bankers internationally, who don’t know anything about their clientele, determine eligibility, often to t...

2022-12-3048 min

The Moment with Brian KoppelmanRoger Lowenstein - 07/19/22Legendary author Roger Lowenstein on how America keeps repeating itself.

To learn more about listener data and our privacy practices visit: https://www.audacyinc.com/privacy-policy

Learn more about your ad choices. Visit https://podcastchoices.com/adchoices Learn more about your ad choices. Visit megaphone.fm/adchoices

2022-07-191h 02

Forward GuidanceBirth of the U.S. Dollar | Roger LowensteinOn today's episode of Forward Guidance, Jack Farley is joined by Roger Lowenstein to discuss his new books and the intricacies of the American financial institution during and before the Civil War. Taking a look back at history, Roger is able to make connections to our modern day and how we can empower ourselves by knowing our backstory.--BCB is Europe’s leading provider of business accounts and trading services for the digital asset economy. With a dedicated focus on institutional payment services, BCB Group provides business banking, cryptocurrency and foreign exchange market liquidity fo...

2022-04-1049 min

History Behind News ProgramTrading With the Enemy! | S2E14Does the history of the U.S. Civil War have anything to teach about our time? Yes, a lot. I know! This does sound amazing, even a bit fantastic. But our guest, Roger Lowenstein, who has written several New York Times bestsellers, makes sense of it all and brings the perspective of the past to make sense of our present. Examples include cries of blasphemy for the introduction of paper money, general Grant's and Sherman's frustration with the Union policy of buying cotton from the South while waging war against it (this is not a typo), and the Southern...

2022-04-081h 13

Booktalk with Diana KorteSimilarities between Mr. Putin's War and the Confederacy? Roger Lowenstein, author of “WAYS & MEANS," explains.In WAYS & MEANS. Lincoln and his Cabinet and the Financing of the Civil War, author Roger Lowenstein not only spells out how each side in very different ways paid for the war, but reveals the largely untold story of how Lincoln used the urgency of the Civil War to transform a union of states into a nation.

Through a financial lens, he explores how this second American revolution, led by Lincoln, his cabinet and a Congress studded with towering statesmen, changed the direction of the country and established a government of the people, by the people, and f...

2022-04-0110 min

Talking Beats with Daniel LelchukEp. 133: Lincoln and the Financing of the Civil War“Lincoln was wise and humble. He didn’t lecture or harangue—he was pragmatic, opportunistic. The quality we lack today was his humility.”

Roger Lowenstein joins the podcast. The admired financial writer is out with the book Ways and Means: Lincoln and His Cabinet and the Financing of the Civil War. It tells the largely untold story of how the North and the South handled the finances of the Civil War—and the drastically different routes they took. Upon his election to the presidency, Abraham Lincoln inherited a country in crisis. Even before the Confederacy’s secession, the United S...

2022-03-2945 minCivil War Talk Radio1824-Roger Lowenstein-Ways and Means: Lincoln and His Cabinet and the Financing of the Civil WarRoger Lowenstein, author of "Ways and Means: Lincoln and His Cabinet and the Financing of the Civil War"

2022-03-2300 min

This Week in Intelligent InvestingSPECIAL: Roger Lowenstein on Ways and Means: Lincoln and His Cabinet and the Financing of the Civil WarIn this special episode, TWIII co-host Phil Ordway welcomes Roger Lowenstein, author of the newly published book, Ways and Means: Lincoln and His Cabinet and the Financing of the Civil War.

About the Guest:

Roger Lowenstein reported for The Wall Street Journal for more than a decade. His work has appeared in The Wall Street Journal, Bloomberg, The New York Times, the Washington Post, Fortune, Atlantic, the New York Review of Books, and other publications. His books include the NYT bestsellers Buffett, When Genius Failed, and The End of Wall Street, and the critically acclaimed...

2022-03-2039 min

Feel The Full Audiobook Everyone Is Talking About — So Game-Changing!Ways and Means: Lincoln and His Cabinet and the Financing of the Civil War by Roger LowensteinPlease visithttps://thebookvoice.com/podcasts/1/audiobook/525807to listen full audiobooks.

Title: Ways and Means: Lincoln and His Cabinet and the Financing of the Civil War

Author: Roger Lowenstein

Narrator: Kaleo Griffith

Format: Unabridged Audiobook

Length: 13 hours 31 minutes

Release date: March 8, 2022

Genres: The Americas

Publisher's Summary:

“Captivating . . . [Lowenstein] makes what subsequently occurred at Treasury and on Wall Street during the early 1860s seem as enthralling as what transpired on the battlefield or at the White House.” —Harold Holzer, Wall Street Journal “Ways and Means, an account of the Union’s financial policies, examines a subject long overshadowed by military narratives . . . Lowenstein is a lucid...

2022-03-081h 31

Download Best Full-Length Audiobooks in History, The AmericasWays and Means: Lincoln and His Cabinet and the Financing of the Civil War by Roger LowensteinPlease visithttps://thebookvoice.com/podcasts/1/audiobook/525807to listen full audiobooks.

Title: Ways and Means: Lincoln and His Cabinet and the Financing of the Civil War

Author: Roger Lowenstein

Narrator: Kaleo Griffith

Format: Unabridged Audiobook

Length: 13 hours 31 minutes

Release date: March 8, 2022

Genres: The Americas

Publisher's Summary:

“Captivating . . . [Lowenstein] makes what subsequently occurred at Treasury and on Wall Street during the early 1860s seem as enthralling as what transpired on the battlefield or at the White House.” —Harold Holzer, Wall Street Journal “Ways and Means, an account of the Union’s financial policies, examines a subject long overshadowed by military narratives . . . Lowenstein is a lucid...

2022-03-081h 31

Get Lost In This Inspiring Full Audiobook — Perfect While Cooking.Ways and Means by Roger LowensteinPlease visithttps://thebookvoice.com/podcasts/2/audible/40008to listen full audiobooks.

Title: Ways and Means

Author: Roger Lowenstein

Narrator: Kaleo Griffith

Format: mp3

Length: 13 hrs and 31 mins

Release date: 03-08-22

Ratings: 4.5 out of 5 stars, 217 ratings

Genres: Banks & Banking

Publisher's Summary:

Upon his election to the presidency, Abraham Lincoln inherited a country in crisis. Even before the Confederacy’s secession, the United States Treasury had run out of money. The government had no authority to raise taxes, no federal bank, no currency. But amid unprecedented troubles Lincoln saw opportunity—the chance to legislate in the centralizing spirit of the “more perfect union”...

2022-03-081h 31

Download Top Full Audiobooks in Business & Economics, Accounting & FinanceWays and Means: Lincoln and His Cabinet and the Financing of the Civil War by Roger LowensteinPlease visithttps://thebookvoice.com/podcasts/1/audiobook/525807to listen full audiobooks.

Title: Ways and Means: Lincoln and His Cabinet and the Financing of the Civil War

Author: Roger Lowenstein

Narrator: Kaleo Griffith

Format: Unabridged Audiobook

Length: 13 hours 31 minutes

Release date: March 8, 2022

Genres: Accounting & Finance

Publisher's Summary:

“Captivating . . . [Lowenstein] makes what subsequently occurred at Treasury and on Wall Street during the early 1860s seem as enthralling as what transpired on the battlefield or at the White House.” —Harold Holzer, Wall Street Journal “Ways and Means, an account of the Union’s financial policies, examines a subject long overshadowed by military narratives . . . Lowenstein is a lucid...

2022-03-081h 31

Thư Viện Sách Nói Có Bản QuyềnWarren Buffett - Quá Trình Hình Thành Một Nhà Tư Bản Mỹ [Sách Nói]Tác giả cuốn sách, phóng viên tờ Wall Street Journal, Roger Lowenstein đã chỉ ra rằng phương pháp đầu tư của Buffett là sự phản chiếu của nhũng giá trị cuộc sống mà ông luôn theo đuổi. Bằng cách vén lên tấm màn bí mật bao quanh con người này, Roger Lowenstein khám phá ra những phẩm chất đáng quý ở ông - nhẫn nại, trung thành, liêm chính, kiên định. Cuốn sách này lần theo mọi dấu vết của cuộc đời một nhà tư bản...

2021-07-061h 24

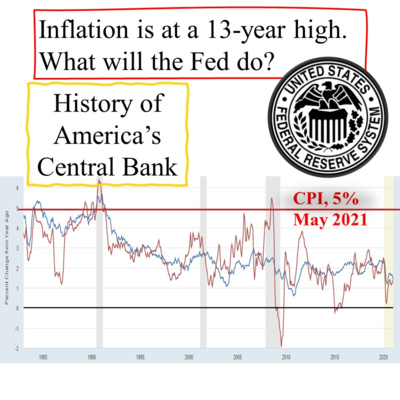

History Behind News ProgramS1E18: The Fed - secrecy & subterfuge at its founding, inflation control and interest ratesThe consumer price index rose to 5% in May, a level it had not reached since August 2008, when it was at 5.4%. Economists and the business community are now wondering when the Federal Reserve will raise interest rates to combat and control inflation. Changing interest rates may affect the stock market, our economy, and our lives - the lives of ordinary Americans, which means that the Federal Reserve is a very powerful institution, and an independent one. But where did the Federal Reserve come from? There is nothing about it in the Constitution. We did not have a Federal Reserve at...

2021-06-181h 00

Corrupt MoneyLong-Term Capital Management with Roger Lowenstein"Financial markets are not all random and independent of each other."

In this episode, we will discuss the incredible story of Long-Term Capital Management with Roger Lowenstein, a best-selling author and a financial journalist for the WSJ, Washington Post and other publications.

2021-06-0531 min

A lo que íbamos#7. Taleb001: Mediocristán, Extremistán y cisnes negrosNasim N. Taleb es un pensador centrado en la aleatoriedad, la probabilidad y la incertidumbre. Ha introducido al gran público conceptos como cisne negro, que no siempre se utilitzan de forma correcta. Éste es el primero de una serie de podcasts donde trataremos algunos de estos conceptos talebianos.

CONTACTO

Mensaje de voz: https://anchor.fm/aloqueibamos/message

E-mail: aloqueibamos@gmail.com

Twitter: https://twitter.com/alqibamos

Instagram: https://www.instagram.com/alqibamos

TikTok: https://www.tiktok.com/@alqibamos?

En capítulos posteriores intentaremos dar respuesta a vuestros comentarios o preguntas.

LIBROS RECOMENDADOS EN ES...

2021-03-071h 18

Creating Wealth Real Estate Investing1654: Leave The City, Work From Home, Dr. Nicholas Bloom, Stanford University, National Bureau of Economic ResearchSurvive and thrive in today's economy! With over 1,100 episodes in this Monday - Friday podcast, business and investment guru Jason Hartman interviews top-tier guests, bestselling authors and financial experts including; Steve Forbes (Freedom Manifesto), Tomas Sowell (Housing Boom and Bust), Noam Chomsky (Manufacturing Consent), Jenny Craig (Health & Fitness CEO), Jim Cramer (Mad Money), Harvey Mackay (Swim With The Sharks & Get Your Foot in the Door), Todd Akin (Former US Congressman), William D. Cohan ( The Price of Silence, The Last Tycoon, & House of Cards), G. Edward Griffin (The Creature from Jekyll Island), Daniel Pink (National Geographic). Jason Hartman is the Founder...

2021-03-0141 min

Chutando a EscadaGameStop para leigosShort squeeze, liquidar posição, derivativos, hedge funds… Nessa semana, a Isabela Fontanella (PodNext) e o Fernando Malta (SciCast) vieram traduzir pra gente esses nomes pra explicar os detalhes do caso da rede GameStop, que tomou os noticiários internacionais no final de janeiro e virou o mercado financeiro de cabeça para baixo. Aperta o play e vem com a gente!

Para apoiar o Chutando a Escada, acesse chutandoaescada.com.br/apoio

Comentários, críticas, sugestões, indicações ou dúvidas existenciais, escreva pra gente em perguntas@chutandoaescada.com.br!

Participaram d...

2021-02-241h 31

Top of the PileBreaking Into Finance: Guest, Jennifer Foster, Co-Chief Investment Officer, Chilton InvestmentThinking about a career in finance? This week you'll hear how a liberal arts undergrad degree nurtured curiosity and an analytical mind. Get some amazing insights from this week's guest Jennifer Foster, Co-Chief Investment Officer at global investment management firm Chilton Investments. Jennifer credits her liberal arts undergrad degree with her ability to think analytically. This along with her natural curiosity to learn has supported Jennifer in her 23 years of success on Wall Street. A few top tips and links to share:Be...

2021-01-2536 min

EICO TalksEICO Talks 05:流量工具产品创新,与哈啰出行赵征宇对谈很多品牌方在找到 EICO 在聊自己产品的时候,避不可免会聊流量增长、工具类产品业务拓展等话题。本期,Rokey 和 Terry(EICO 上海合伙人)、赵征宇(哈啰出行创新产品总监)一起对谈了用户增长、流量路径、产品创新,具体也聊到了关于哈啰出行的业务创新、摩拜内部创新的思考。本期主播:张伟 Rokey,EICO 联合创始人;范志鹏 Terry,EICO 上海合伙人本期嘉宾:赵征宇(毛毛),哈啰出行创新产品总监EICO是一家产品设计咨询公司。EICO TALKS播客节目希望将我们对与产品设计的实践与思考,通过与优秀的产品人,创业者,思考者的对谈形式分享出来。坚持EICO产品核心论的原则,每期话题围绕产品展开,涉及体验、科技、设计、商业、消费等领域的新趋势与独立观点。以下是我们聊的主要话题:【04:44】可口可乐设立首席增长官(CGO)【05:10】互联网公司的增长部门【06:43】死飞产品社群增长收获【13:08】Patagonia 黑五倡导“买得少点”【19:02】地域性增长:优惠券、微信群【22:16】社区团购产品缠斗【26:40】All in 买菜业务背后的流量焦虑【28:10】哈啰出行的业务创新【36:08】摩拜内部业务创新【38:42】创新路径:能力的通用化【42:16】调研会更加理解用户【44:50】美联储花费 4 个 30 年统一货币相关阅读1.《美联储的诞生》,[美] Roger Lowenstein,2017年出版;2.《摩拜单车|设计城市的共享出行方式》,EICO 公众号,2016年4月。配乐:- Joker(Six Umbrellas)- Effemeah Weeps(Uncan)联系我们:EICO 公众号:EICOEICO 官网:eicoinc.com与我们联系: Service@eicoinc.com

2021-01-0746 min

Bogleheads On Investing PodcastEpisode 028: Roger Lowenstein, host Rick FerriRoger Lowenstein reported for The Wall Street Journal for more than a decade and is also an award-winning book author. His work has appeared in Bloomberg, The New York Review of Books, Fortune, The New York Times Magazine, and other publications. His best-selling books include Buffett, When Genius Failed, Origins of the Crash, While America Aged, and The End of Wall Street. In this episode, we discuss Roger's books and lessons he learned writing them.

This podcast is hosted by Rick Ferri, CFA, a long-time Boglehead and investment adviser. The Bogleheads are a group of lik...

2020-11-2943 min

Holistic Investment w Constantin Kogan💰Venture Capital Firm Focused Exclusively on Public Blockchains (w Matthew Walsh & Constantin Kogan)🔥Constantin Kogan joins Matthew Walsh - Co-Founder at Castle Island. Prior to founding Castle Island Ventures, Matt was a Vice President at Fidelity Investments where he led a number of the firm’s blockchain / cryptoasset initiatives. While at Fidelity, he led the creation, operationalization, and the investment strategy of a private fund focused exclusively on the cryptoasset sector.

Venture capital firm focused exclusively on public blockchains. Castle Island invests in infrastructure and application companies that will enable these transformative protocols to power services for the next billion users.

📌To learn more visit:

https://www.cast...

2020-06-0855 min

Beyond SocietyEpisode #8🎙 What to do when setbacks occur?Episode #8 🎙In this episode, we will look at when setbacks occur in life, what to do. We know in life there will always be setbacks, but what makes the greats different from the goods on coming back. There are little hints a couple of individuals give on what to do when these occur. Lets dive into and learn, develop, and grow when setbacks occur to go Beyond Society!

🔶** SUBSCRIBE ** 🔶

Purchase Merchandise - EMAIL - beyond.society.limits@gmail.com

Social Media Platforms:

Twitter: https://twitter.com/BeyondSociety3

Instagram: https://www.insta...

2020-05-2222 min

Candid Conversations with Amit PandeyFinance for investors, dreamers, and fools with Karthik Rangappa, Author & Curator at Zerodha Varsity & The Rupee Tales (Part 1 & 2)Thanking Karthik Rangappa to give me this amazing opportunity to interview him, know more about his life's journey, tips on life and all that surrounds that;

Some highlights from both the episodes:

- Karthik’s biggest guiding force of life - GUILT

- The Rupee Tales - Story

- Varsity

- The 100 bagger - Measurable Impact

- Start investing/saving early, three sisters story - compounding effect of money

- Recommended Books: One Up on Wall Street -Peter Lynch, When the Genius Failed, Roger Lowenstein and more

Click here to re...

2019-12-2859 min

Trading Global Markets DecodedFinancial Writer and Author Roger Lowenstein on the Next RecessionFinancial Writer and Author Roger Lowenstein has written for the Wall Street Journal and authored the bestselling book Buffett: The Making of an American Capitalist. In this episode Roger discusses his views on the next financial crisis, the Federal Reserve and the political landscape heading into 2020. Are we facing another financial crisis? And has America's Central Bank been a success? Join us in this episode of Trading Global Markets Decoded to find out.

2019-12-1300 min

Macro Musings with David BeckworthRE-AIR: Robert Samuelson on Paul Volcker and the Great InflationRobert Samuelson is an economics columnist for the Washington Post and spent several decades working at Newsweek, where he wrote on various economic topics. Robert is the author of several books, including *The Good Life and Its Discontents: The American Dream in the Age of Entitlement* and *The Great Inflation and Its Aftermath: The Past and Future of American Affluence*. He joins the show today to talk about the latter and its implications for today. David and Robert go in-depth about the Great Inflation, as they discuss the disagreement within macroeconomics during the 60s and 70s, the history and...

2019-12-1157 min

The Next-Level Income ShowISAAC PINO INTERVIEW – Beating the Market With Alternative InvestmentsWhether you own part of an apartment complex or a stock, you own a slice of a living, breathing business. How do you make the best decisions to succeed in the long term?Isaac is a partner at Huckleberry Capital Management, an alternative investment manager serving individuals, wealth managers, and institutions. He's had an interesting path to where he is today, including working as a forensic CPA with Deloitte, a senior industry analyst with The Motley Fool, and was the head of a family office for an ultra high net worth family.In this episode...

2019-08-1638 min

Newsbeat RadioWhy You Do not Know the Price Until You SellOf Dollars and DataIt was 1935 and the Austrian physicist Erwin Schrödinger had a problem with Albert Einstein. Einstein had just released a paper with two fellow scientists that discussed the concept of superposition, an idea that seemed somewhat absurd to Schrödinger. Superposition implied that an atom (or any quantum system) was simultaneously in multiple states until the point of observation. Once the system was observed, its true state would be revealed to the observer. This implied that the act of observation changed how the universe behaved. In order to convey his skeptical view on th...

2018-09-2706 min

The Finance Professor PodcastEp. 9: "A Dove to Hawk Ranking of the Martin to Yellen Federal Reserves" by Linus WilsonLinus Wilson reads his recently updated working paper entitled "A Dove to Hawk Ranking of the Martin to Yellen Federal Reserves" and talks about the current state of Federal Reserve interest rate policy. He previews his talk with the New York Times Bestselling author Roger Lowenstein which will be released in an upcoming episode.

The paper read is as follows:

"A Dove to Hawk Ranking of the Martin to Yellen Federal Reserves"

by

Dr. Linus Wilson [1]

Associate Professor of Finance

University of Louisiana at Lafayette

B. I. Mood...

2018-09-0629 min

Libros para EmprendedoresCómo acelerar empresas de éxito, con Santiago Zavala - MPE024 - Mentores para EmprendedoresNos vamos a México DF para hablar con Santiago Zavala, director de 500 Startup LatAm, una de las aceleradoras de empresas más importantes de toda Latinoamérica. Han apoyado a 130 empresas, algunas con éxitos espectaculares. Sus "acelerados" facturaron en 2017 más de 200 millones de dólares. Con Santiago hablamos de: - lo que buscan como aceleradora en empresas que quieren participar en su programa - el proceso de selección para llegar a ser una empresa 500 Startups - ¿Qué sucede a nivel económico y humano cuando entras en una aceleradora? - Qué datos de inversió...

2018-04-041h 04

How Do We Fix It?When Will Wall Street Crash? Diana HenriquesThe U.S. stock market has soared about 40% since the Trump election. But is it over-valued and ready for a meltdown?Shortly before the worst one-day crash in history in November 1987, the market had been charging ahead, with a 40% rise that year. The economy was on a roll, just like today. What would happen if giant investment funds bailed out of stocks at the same time? Would there be another financial crisis, even worse than the events in 2008?"We are more vulnerable to a radical readjustment," says our guest, New Y...

2018-02-0129 min

I Am Black Success®The New Rules To Building Generational Wealth | John W. Rogers Jr.Of the 525 US Stock Mutual Funds that existed 30 years ago, only 223 are still operating today & only six are run by the same manager. One of those six remaining managers is our guest today, Mr. John Rogers Jr.John W. Rogers, Jr. is Founder, Chairman, Chief Executive Officer and Chief Investment Officer of Ariel Investments, which is the largest minority lead mutual fund in the country. Headquartered in Chicago, the firm offers six no-load mutual funds for individual investors and defined contribution plans as well as separately managed accounts for institutions and high net worth individuals. Together they...

2018-01-0838 min

Strategic Investor RadioLessons Learned with author, journalist and columnist Roger LowensteinFormer journalist and coumnist for "Heard on the Street" for the Wall Street Journal, plus author of several books, including "When Genius Failed" and "America's Bank: The Epic Struggle to Create the Federal Reserve," Roger shares insights and thoughts from his two plus decades of investigating, interviewing and writing about the financial industry. You won't want to miss this.

2017-12-0924 min

We Study Billionaires - The Investor’s Podcast NetworkTIP161: Warren Buffett, Charlie Munger w/ Renown Author Roger Lowenstein (Business Podcast)IN THIS EPISODE, YOU’LL LEARN:

The one thing that people don’t know about Warren Buffett?

Why Charlie Munger has made Warren Buffett’s more fun, but perhaps not more prosperous.

Why we have the same conversation about Central Banks as we did 100 years ago.

Ask the Investors: What is the future of crypto currency.

BOOKS AND RESOURCES

Join the exclusive TIP Mastermind Community to engage in meaningful stock investing discussions with Stig, Clay, and the other community members.

Roger Lowenstein’s website.

Roger Lowenstein’s book, Buffett the Making of an American Cap...

2017-10-2247 min

What Goes UpRoger Lowenstein on America's Bank<p>Roger Lowenstein is one of the great minds of the financial world and has been observing and writing about Wall Street now for four decades. Roger is author of a full shelf of best-selling books about Wall Street, from When Genius Failed to The End of Wall Street, and the newest, America's Bank. Acerbic, clear-thinking, and richly informed with historical knowledge, Roger brings a rare breadth of understanding to parsing what makes the markets work. In this discussion, he talks about the Fed and the creation of a U.S. central bank, its best and worst governors...

2017-10-2054 min

TomsTalkTime - DER Erfolgspodcast498 - Sven Lorenz - Richtig Reich - DER Investment-Podcast Sven Lorenz ist ein ehemaliger TOP-Banker und seit 2015 mit seiner eigenen Beratungsgesellschaft für Vermögensverwaltung auf Investmentstrategien für große private und institutionelle Vermögen spezialisiert. Zu seinen Kunden gehören neben Profisportlern insbesondere erfolgreiche Unternehmer, Spezialärzte, Privatiers und Online-Stars aber auch z.B. Versorgungswerke. Seine Kernkompetenz liegt in der passgenauen Strukturierung des Vermögens seiner Kunden, so z.B. Schutz des privaten Vermögens bei Unternehmensinsolvenz, Steueroptimierung, passives Einkommen aus Kapitalerträgen oder auch der Erwirtschaftung des Rechnungszinses von Pensionskassen. Darüber hinaus teilt er sein Expertenwissen im Rahmen v...

2017-10-1159 min

Finanzrocker - Dein Soundtrack für Finanzen und FreiheitFolge 79: Womit sich ein Fondsmanager beschäftigt - Interview mit Daniel Kroeger von AcatisIn dieser Podcast-Folge werfe ich mit meinem Gast Daniel Kroeger von Acatis einen Blick auf den Alltag eines Fondsmanagers. Und wir klären die Fragen, wie er bei der Aktienauswahl vorgeht, wie die Kosten zustandekommen und ob ETFs eine starke Konkurrenz für aktive Fondsmanager darstellen. Ich habe Daniel vor 2 Jahren auf dem Finanzbarcamp in Offenbach kennengelernt. Dort hielt er einen interessanten Vortrag über seinen Alltag als Fondsmanager. Seitdem stand er auf meiner Interviewliste für den Podcast. Jetzt hat es geklappt und wir sprechen in 75 Minuten über den Alltag als Fondsmanager, Aktienbewertungen, Aktienauswahl, die ETF-Konkurrenz und vi...

2017-10-041h 18

每天听本书呀809 《巴菲特传》| Hi-Finance 解读《巴菲特传》| Hi-Finance 解读 关于作者

罗杰?洛温斯坦(Roger Lowenstein),《华尔街日报》资深财经记者,伯克希尔?哈撒韦公司的一名股东。

关于本书

罗杰?洛温斯坦在这本书中,详细讲述了巴菲特从小企业家到股神的成长史,并且深入分析了他的投资策略、人生智慧和管理哲学。

核心内容

本书核心观点是:巴菲特的成功原因,可分成2个部分:第一,巴菲特高明的投资策略,低价购入优秀公司,重视公司的利润率远胜企业规模。第二,巴菲特的人生智慧,他有一套自己的商业投资思考模式,能抓住最重要的因素,提前很多年就准确预测出一家公司的未来发展趋势,从而准确预估它的内在价值。

点击查看大图,保存到手机,也可以分享到朋友圈

一、巴菲特的成长史

巴菲特的人生可以分成三个阶段:第一阶段,巴菲特是一个典型的小企业家,大学毕业时,他完成了从0到9800美元的财富积累,甚至比全职工作的成年人的收入都高得多,巴菲特这个万元户,在当时算得上是一个小富翁了;第二阶段,巴菲特从小企业家转型成为一个非常成功的投资家,中年的巴菲特完成了从9800美元到2500万美元的财富积累,在入主伯克希尔?哈撒韦之前,就已经从“万元户”成功跨进了“千万富翁”的行列;第三阶段,就是奠定巴菲特“股神”地位的阶段,从1969年至今,巴菲特实现了从2500万美元到近2000亿美元市值的企业的财富增长,至今还统领着自己的公司稳步前行。

二、巴菲特的核心投资思路

1. 高度重视公司的利润率

巴菲特说:“我宁愿要一个投资规模仅为1000万元而投资回报率高达15%的企业,也不愿经营一个规模达到10亿美元而投资回报率仅为5%的企业,我完全可以把这些钱投到回报率更高的其他地方去,企业规模并不是终极目标,股东的高回报才是”。

【案例】

巴菲特在1988年的秋天,大举买入可口可乐,就是看中了可口可乐的高利润率。

2. 低价购入才有机会赚大钱

永远不要指望转让时能卖出好价钱,而是要让自己的买入价低得诱人,这样最后的售价即使不高也能让自己赚得盆满钵满。

【案例】

1962年12月,巴菲特开始入股伯克希尔?哈撒韦公司,当时伯克希尔?哈撒韦的股价才7.5美元,而实际上每股所代表的背后的企业运营价值大概是16.5美元,股价被严重低估了,巴菲特以“白菜价”买入了大量伯克希尔?哈撒韦的股票。

3. 不要迷信多元化的资产配置

华尔街的基金经理做那么多的资产配置,他们对所选择的每支股票的肤浅了解甚至还赶不上一个酋长对自己100个老婆的了解程度。

【案例】

巴菲特是坚决反对多元化资产配置的,他把整个合伙人公司的大部分资金都放在了他认为的优秀公司上中,比如:美国运通、伯克希尔?哈撒韦和其他两三支股票。由这些公司构成的投资组合收益,从1962年至1966年,连续5年,帮助巴菲特打败了道琼斯指数的上涨幅度。

4. 以合适价格买入一个优秀的公司远胜于以优惠价格买入一个普通的公司,价值投资首先追求的是优秀公司,其次才是寻找合适的买点。

三、巴菲特的人格魅力

1. 渴望成功的心态

巴菲特少年成长于美国1929年经济崩盘之后的大萧条时代,如何能变得更加富有,这个想法从来都没有在他的脑海中消失过。在沃顿商学院求学的过程中,因为学不到切实可行的赚钱方法,巴菲特不惜以退学为代价,寻找成功之路。在哥大毕业之后,曾希望以0元工资帮助导师格雷厄姆打工,巴菲特内心追求成功、渴望成功,这种心态始终伴随着他。

2. 财商

巴菲特有一套自己的商业投资思考模式,他能抓住最重要的因素,提前很多年就准确预测出一家公司的未来发展趋势,从而准确预估它的内在价值。同时,巴菲特认为大多数小道消息都没什么价值,他认为自己的那些好观点是非常私密的,是一种夹杂着神圣感的自我创造。

3. 准确的自我定位,并且与管理层保持着健康、良好的合作互信关系

术业有专攻,巴菲特清楚地知道自己不可能管理所有的公司,所以在成为伯克希尔?哈撒韦和华盛顿邮报等公司的股东以后,巴菲特充分信任现有的管理层,让专业的人做专业的事,不成为管理层的敌人,而是做他们的教练。

金句

1. 与其分散投资,将有限的资金购买十几支、甚至几十支、几百支股票,不如将资金集中投资在一两支潜力巨大的股票上。

2. 可口可乐的品牌价值巨大,任何一个人兴许可能有100亿美金,可以买到可口可乐公司所有的渠道、生产线、厂房、机器等,但无法重构一个“可口可乐”品牌。

3. 利润率才是王道,不是规模。

4. 以合适价格买入一个优秀的公司远胜于以优惠价格买入一个普通的公司,价值投资首先追求优秀公司,其次才是寻找合适的买点

2017-08-0923 min

Macro Musings with David Beckworth35 - Peter Conti-Brown on *The Power and Independence of the Federal Reserve*Peter Conti-Brown is an Assistant Professor at The Wharton School of the University of Pennsylvania. He joins the show to discuss his new book, *The Power and Independence of the Federal Reserve,* which exams the evolution of the Federal Reserve and what central bank independence really means. Peter also shares his thoughts on what a Trump presidency might mean for monetary policy. David's bio: http://macromarketmusings.blogspot.com/ Peter's UPenn bio: https://lgst.wharton.upenn.edu/profile/30645/ David's Twitter: @davidbeckworth Peter's Twitter: @PeterContiBrown Related links: *The Power and Independence of the Federal Reserve* by Peter Conti-Brown https://www.amazon.com...

2016-12-051h 07

Creating Wealth Show Archives 1-300CW 237: ‘The End of Wall Street’ with Roger Lowenstein of the Wall Street Journal’s ‘Heard on the Street’ ColumnJoin Jason Hartman as he interviews author and financial journalist Roger Lowenstein regarding the history of Wall Street’s demise. Roger talks about the increases in choice, risk, hedging, more volatility, and how free markets are open to speculation, greed, fear and manipulation. There are more markets today susceptible to booms and busts. In the old days, local bankers determined loan eligibility. Today, bankers internationally, who don’t know anything about their clientele, determine eligibility, often to the detriment of the borrowers. Roger and Jason debate whether Wall Street needs more regulation or deregulation, and discuss the cons...

2016-09-3047 min

White House ChronicleThe Epic Struggle to Create the Federal Reserve: White House Chronicle 8006White House Chronicle, Show #8006 Air Date: February 5, 2016 Run Time: 29:00 Host: Llewellyn King Co-host: Linda Gasparello Guest: Roger Lowenstein, Author Topic: A discussion of Lowenstein’s new book, “America’s Bank: The Epic Struggle to Create the Federal Reserve.” For more, follow us at whchronicle.com.

2016-02-0829 min

Masters in BusinessInterview With Roger Lowenstein: Masters in Business (Audio)Dec. 5 (Bloomberg) -- Bloomberg View columnist Barry Ritholtz interviews Roger Lowenstein, an American financial journalist for the Wall Street Journal for more than a decade and the author of America's Bank: The Epic Struggle to Create the Federal Reserve. This interview aired on Bloomberg Radio.See omnystudio.com/listener for privacy information.

2015-12-051h 15

Goldstein on GeltWhy the Huge American National Debt Isn't a Big DealWhat are the most common questions that investors ask? Doug created a series of 12 short videos with the answers to the questions he is most frequently asked.. Watch the videos at www.profile-financial.com/faq-video. Today, Doug helps you with your financial paperwork, and lets you know what papers you really need to keep.

In today’s interview Roger Lowenstein, author of America’s Bank: The Epic Struggle to Create the Federal Reserve, explains why the Federal Reserve was created and suggests why the large debt may NOT be a harbinger of doom. With a more o...

2015-12-0226 min

How Do We Fix It?#24 Why The Federal Reserve Is So Unpopular Roger Lowenstein: How Do We Fix It?The Federal Reserve plays a fundamental role in our economy. But many Americans loathe The Federal Reserve - furious that The Fed bailed out banks and other huge financial firms during the 2008 financial crisis.Our guest, Roger Lowenstein, is the author of "America's Bank - The Epic Struggle to Create The Federal Reserve." His book is a dramatic account of the chaotic years before The United States became the last major industrialized nation to form a central bank.Our podcast features a lively discussion about American history as well as the present day, with Roger giving us insights that demystify...

2015-11-0923 min

Talk CocktailThe Struggle to Create the Federal ReserveIt used to be, during the dark days of the Cold War, watching the Kremlin and trying to read meaning into every nuance, tea leaf and coming and going, was elevated to an art form.

Today, it’s the same for the Fed. Every meeting, every utterance of the Fed Chair and Fed Governors is parsed and analyzed and poured over for some hint of what the Fed will do and what it might mean for the markets, for the economy and for the politics of the country.

But it wasn’t always so. In the aftermath of the 19...

2015-11-0626 min

Money TalkingWhere We'd Be Without a National BankToday, The Federal Reserve, America's central bank, is an object of national obsession, at least for anyone wondering — or worrying — about the economy. After the financial meltdown in 2008, the Fed bailed out banks when they were in trouble and then lowered interest rates to nearly zero to jumpstart economic growth.

Now that the crisis is over, the (unending) question is, "When will the bank raise interest rates?"

But the steps the bank took to bail out the economy have also drawn criticism, especially from those who think the Fed is overstepping what it can or should...

2015-10-3016 min

The Book ReviewInside The New York Times Book Review: ‘Doomed to Succeed”This week, Scott Anderson discusses “Doomed to Succeed”; Alexandra Alter has news from the literary world; Roger Lowenstein talks about “America’s Bank”; and Gregory Cowles has best-seller news. Parul Sehgal, filling in for Pamela Paul, is the host.

Subscribe today at nytimes.com/podcasts or on Apple Podcasts and Spotify. You can also subscribe via your favorite podcast app here https://www.nytimes.com/activate-access/audio?source=podcatcher. For more podcasts and narrated articles, download The New York Times app at nytimes.com/app.

2015-10-2530 min

The Book ReviewInside The New York Times Book Review: ‘Doomed to Succeed”This week, Scott Anderson and Roger Lowenstein.

Subscribe today at nytimes.com/podcasts or on Apple Podcasts and Spotify. You can also subscribe via your favorite podcast app here https://www.nytimes.com/activate-access/audio?source=podcatcher. For more podcasts and narrated articles, download The New York Times app at nytimes.com/app.

2015-10-2530 min

Press Play On Your Ears To A Riveting Full Audiobook.America's Bank: The Epic Struggle to Create the Federal Reserve by Roger LowensteinPlease visithttps://thebookvoice.com/podcasts/1/audiobook/244909to listen full audiobooks.

Title: America's Bank: The Epic Struggle to Create the Federal Reserve

Author: Roger Lowenstein

Narrator: Robertson Dean

Format: Unabridged Audiobook

Length: 9 hours 39 minutes

Release date: October 20, 2015

Ratings: Ratings of Book: 4 of Total 2

Genres: World

Publisher's Summary:

A tour de force of historical reportage, America’s Bank illuminates the tumultuous era and remarkable personalities that spurred the unlikely birth of America’s modern central bank, the Federal Reserve. Today, the Fed is the bedrock of the financial landscape, yet the fight to create it was so protracted and divisive that it seem...

2015-10-209h 39

Grab A Powerful Full Audiobook On Your Commute.America's Bank: The Epic Struggle to Create the Federal Reserve by Roger LowensteinPlease visithttps://thebookvoice.com/podcasts/1/audiobook/244909to listen full audiobooks.

Title: America's Bank: The Epic Struggle to Create the Federal Reserve

Author: Roger Lowenstein

Narrator: Robertson Dean

Format: Unabridged Audiobook

Length: 9 hours 39 minutes

Release date: October 20, 2015

Ratings: Ratings of Book: 4 of Total 2

Genres: Accounting & Finance

Publisher's Summary:

A tour de force of historical reportage, America’s Bank illuminates the tumultuous era and remarkable personalities that spurred the unlikely birth of America’s modern central bank, the Federal Reserve. Today, the Fed is the bedrock of the financial landscape, yet the fight to create it was so protracted and divisive that it s...

2015-10-209h 39

Discover Your Ears To A Binge-Worthy Full Audiobook.America's Bank: The Epic Struggle to Create the Federal Reserve by Roger LowensteinPlease visithttps://thebookvoice.com/podcasts/1/audiobook/244909to listen full audiobooks.

Title: America's Bank: The Epic Struggle to Create the Federal Reserve

Author: Roger Lowenstein

Narrator: Robertson Dean

Format: Unabridged Audiobook

Length: 9 hours 39 minutes

Release date: October 20, 2015

Ratings: Ratings of Book: 4 of Total 2

Genres: The Americas

Publisher's Summary:

A tour de force of historical reportage, America’s Bank illuminates the tumultuous era and remarkable personalities that spurred the unlikely birth of America’s modern central bank, the Federal Reserve. Today, the Fed is the bedrock of the financial landscape, yet the fight to create it was so protracted and divisive that it s...

2015-10-209h 39

Grab the Top Full Audiobooks in History, WorldAmerica's Bank: The Epic Struggle to Create the Federal Reserve by Roger LowensteinPlease visithttps://thebookvoice.com/podcasts/1/audiobook/244909to listen full audiobooks.

Title: America's Bank: The Epic Struggle to Create the Federal Reserve

Author: Roger Lowenstein

Narrator: Robertson Dean

Format: Unabridged Audiobook

Length: 9 hours 39 minutes

Release date: October 20, 2015

Ratings: Ratings of Book: 4 of Total 2

Genres: World

Publisher's Summary:

A tour de force of historical reportage, America’s Bank illuminates the tumultuous era and remarkable personalities that spurred the unlikely birth of America’s modern central bank, the Federal Reserve. Today, the Fed is the bedrock of the financial landscape, yet the fight to create it was so protracted and divisive that it seem...

2015-10-209h 39

Listen to Trending Full Audiobooks in History, The AmericasAmerica's Bank: The Epic Struggle to Create the Federal Reserve by Roger LowensteinPlease visithttps://thebookvoice.com/podcasts/1/audiobook/244909to listen full audiobooks.

Title: America's Bank: The Epic Struggle to Create the Federal Reserve

Author: Roger Lowenstein

Narrator: Robertson Dean

Format: Unabridged Audiobook

Length: 9 hours 39 minutes

Release date: October 20, 2015

Ratings: Ratings of Book: 4 of Total 2

Genres: The Americas

Publisher's Summary:

A tour de force of historical reportage, America’s Bank illuminates the tumultuous era and remarkable personalities that spurred the unlikely birth of America’s modern central bank, the Federal Reserve. Today, the Fed is the bedrock of the financial landscape, yet the fight to create it was so protracted and divisive that it s...

2015-10-209h 39

Explore New Full Audiobooks in Business & Economics, Accounting & FinanceAmerica's Bank: The Epic Struggle to Create the Federal Reserve by Roger LowensteinPlease visithttps://thebookvoice.com/podcasts/1/audiobook/244909to listen full audiobooks.

Title: America's Bank: The Epic Struggle to Create the Federal Reserve

Author: Roger Lowenstein

Narrator: Robertson Dean

Format: Unabridged Audiobook

Length: 9 hours 39 minutes

Release date: October 20, 2015

Ratings: Ratings of Book: 4 of Total 2

Genres: Accounting & Finance

Publisher's Summary:

A tour de force of historical reportage, America’s Bank illuminates the tumultuous era and remarkable personalities that spurred the unlikely birth of America’s modern central bank, the Federal Reserve. Today, the Fed is the bedrock of the financial landscape, yet the fight to create it was so protracted and divisive that it s...

2015-10-209h 39

Smart People PodcastRoger Lowenstein – How The Federal Reserve Was Created

In this episode we speak with Roger Lowenstein about the tumultuous era and remarkable personalities that spurred the unlikely birth of America’s modern central bank, the Federal Reserve. Today, the Fed is the bedrock of the financial landscape, yet the fight to create it was so protracted and divisive that it seems a small miracle...

Learn more about your ad choices. Visit megaphone.fm/adchoices

2015-10-2041 min

Embrace The Most Immersive Full Audiobook Today!Buffett by Roger LowensteinPlease visithttps://thebookvoice.com/podcasts/2/audible/155371to listen full audiobooks.

Title: Buffett

Author: Roger Lowenstein

Narrator: Graham Winton

Format: mp3

Length: 18 hrs and 9 mins

Release date: 03-03-15

Ratings: 4.5 out of 5 stars, 1,718 ratings

Genres: Stocks

Publisher's Summary:

2015-03-036h 09

American Monetary AssociationAMA 44 – "The End of Wall Street" with Roger LowensteinJoin Jason Hartman as he interviews author and financial journalist Roger Lowenstein regarding the history of Wall Street’s demise. Roger talks about the increases in choice, risk, hedging, more volatility, and how free markets are open to speculation, greed, fear and manipulation. There are more markets today susceptible to booms and busts. In the old days, local bankers determined loan eligibility. Today, bankers internationally, who don’t know anything about their clientele, determine eligibility, often to the detriment of the borrowers. For more details, listen at: www.JasonHartman.com. Roger and Jason debate whether Wall Street needs more regul...

2013-04-1224 min

JourneyWithJesus.net PodcastJwJ: Sunday October 3, 2010Weekly JourneywithJesus.net postings, read by Daniel B. Clendenin. Essay: *"Though the Fig Tree Does Not Bud:" Living the Questions of the Problem of Evil* for Sunday, 3 October 2010; book review: *The End of Wall Street* by Roger Lowenstein (2010); film review: *Babies* (2010); poem review: *Lead, Kindly Light* by John Henry Newman.

2010-09-2618 min

The Surreal News Show more archivesRoger Lowenstein on WSLR 96.5 LP FM April 23 2010WSLR 96.5 LP FM Sarasota's Community Radio Station News and Public Affairs welcomes

Roger Lowenstein, an American financial journalist, reported for the Wall Street Journal for more than a decade, including two years writing its "Heard on the Street" column, 1989 to 1991. Before becoming a full time journalist, Lowenstein was an attorney with various New Jersey law firms.

His newest book is "End of Wall Street". Forum Truth is pleased to announce. Financial journalist Roger Lowenstein will be appearing on Tuesday, April 27 at Holly Hall @ 7:30 pm.

2010-04-2321 min

Explore The Full Audiobook Everyone Is Talking About — So Soul-Stirring!The End of Wall Street by Roger LowensteinPlease visithttps://thebookvoice.com/podcasts/1/audiobook/202660to listen full audiobooks.

Title: The End of Wall Street

Author: Roger Lowenstein

Narrator: Erik Synnestvedt

Format: Unabridged Audiobook

Length: 11 hours 33 minutes

Release date: April 6, 2010

Ratings: Ratings of Book: 3 of Total 1

Genres: Economics

Publisher's Summary:

The roots of the mortgage bubble and the story of the Wall Street collapse-and the government's unprecedented response-from our most trusted business journalist.The End of Wall Street is a blow-by-blow account of America's biggest financial collapse since the Great Depression. Drawing on 180 interviews, including sit-downs with top government officials and Wall Street CEOs, Lowenstein tells, with grace, wit...

2010-04-0611h 33

Explore A Full Audiobook That Is Simply Next-Level.The End of Wall Street by Roger LowensteinPlease visithttps://thebookvoice.com/podcasts/2/audible/153818to listen full audiobooks.

Title: The End of Wall Street

Author: Roger Lowenstein

Narrator: Erik Synnestvedt

Format: mp3

Length: 11 hrs and 33 mins

Release date: 04-06-10

Ratings: 4 out of 5 stars, 146 ratings

Genres: Economic History

Publisher's Summary:

2010-04-0611h 33

Access Unmissable Full Audiobooks in Business & Economics, EconomicsThe End of Wall Street by Roger LowensteinPlease visithttps://thebookvoice.com/podcasts/1/audiobook/202660to listen full audiobooks.

Title: The End of Wall Street

Author: Roger Lowenstein

Narrator: Erik Synnestvedt

Format: Unabridged Audiobook

Length: 11 hours 33 minutes

Release date: April 6, 2010

Ratings: Ratings of Book: 3 of Total 1

Genres: Economics

Publisher's Summary:

The roots of the mortgage bubble and the story of the Wall Street collapse-and the government's unprecedented response-from our most trusted business journalist.The End of Wall Street is a blow-by-blow account of America's biggest financial collapse since the Great Depression. Drawing on 180 interviews, including sit-downs with top government officials and Wall Street CEOs, Lowenstein tells, with grace, wit...

2010-04-0611h 33

Escape To Your Ears To A Unforgettable Full Audiobook.While America Aged by Roger LowensteinPlease visithttps://thebookvoice.com/podcasts/2/audible/99106to listen full audiobooks.

Title: While America Aged

Author: Roger Lowenstein

Narrator: Michael McConnohie

Format: mp3

Length: 9 hrs and 13 mins

Release date: 05-01-08

Ratings: 4 out of 5 stars, 108 ratings

Genres: Business Ethics

Publisher's Summary:

Negotiating high benefits means gambling with future finances - and when the farm gets sold out from underneath major corporations or public institutions, it affects all of us, and in ways we might not imagine. With his trademark narrative panache, Lowenstein unravels the truth about how pensions work in America and illuminates the impending crisis.

2008-05-019h 13