Shows

Innovators + EntrepreneursSucceed despite chaos and uncertainty with SOSV's Sean O'SullivanSOSV managing general partner Sean O’Sullivan joins Jim Barrood to trace his path from MapInfo pioneer to global deep-tech investor. He explains SOSV’s studio model (HAX, IndieBio), Newark and Princeton plasma initiatives, and billion-plus AUM. Despite chaotic markets, he urges founders to prove revenue, persist for years, and communicate transparently, openly.

2025-09-3036 min

The Investor With Joel PalathinkalOscar Ramos: SOSV ChinaIn this episode, Oscar Ramos shares his journey to China and his diverse background leading to his role at SOSV. He discusses his early career in R&D, challenges in China, and the evolving startup community there. The conversation compares tech ecosystems in Europe and China, touching on entrepreneurship and risk perception. Oscar explores adapting to the Chinese market, regional tech ecosystems, and UI/UX differences. He offers insights into data-driven design and customer engagement. The episode concludes with SOSV's investment strategies and thoughts on emerging fund managers and future plans.

(0:00) Introduction and Speaker 1's journey to China

(1:44) Speaker 1's...

2025-08-261h 01

Selected - The Sesamers PodcastBen JoffeSOSV: Deep Tech Before It Was CoolSOSV wasn’t always a billion-dollar fund—it began as a scrappy experiment. Ten years ago, the team was writing $50K checks. Today, it’s a global operation with $1.5B under management, backing 60+ new startups annually and running two specialized programs:HAX for hard tech (robotics, industrial, mobility)IndieBio for biotech, food, health, and sustainabilityTheir formula? Hands-on acceleration + deep labs + strategic follow-on capital.“We’re not just investors—we’re builders. We have scientists and engineers on staff to help startups go from prototype to product faster...

2025-05-1229 min

Leaders on a MissionFrom Poverty to Building Industries that Transform HumanityFrom growing up in poverty in upstate New York to coining the term "cloud computing" and revolutionising venture capital, Sean O’Sullivan’s story is nothing short of remarkable. As Founder and Managing Partner of SOSV, Sean has backed over 1,000 startups through world-renowned programs like IndieBio and HAX, driving breakthroughs in synthetic biology, climate tech, and more. In this episode, Simon Leich dives into Sean’s journey, exploring his passion for empowering entrepreneurs, tackling humanity’s toughest challenges, and scaling innovations in human and planetary health. Whether you’re an entrepreneur, investor, or changemaker...

2025-02-0449 min

Clock Speed with Shamus MadanI Asked A $1.5 Billion Investor For AdviceSean O'Sullivan shares his entrepreneurial journey, from not being able to afford food to selling his company for $15 Million at 28 years old. He discusses the traits of a great founder and offers advice for young entrepreneurs navigating today's market. Sean reflects on his early programming days and the founding of MapInfo at age 21, detailing the motivations behind the company and the challenges faced in scaling and going public. He explores the role of venture capital and his transition to active investing with SOSV, focusing on deep tech. The conversation delves into risks, the value of investing in first-time founders, and...

2024-10-1541 min

SOSV Climate Tech Podcasts04e07 - Nuclear SMR - Has the technology’s moment finally arrived?In this discussion from SOSV's 2024 EarthDay+ sessions (Apr 22-26, 2024), Bret Kugelmass, the CEO and co-founder of the nuclear fission startup Last Energy, which focuses on developing small nuclear reactors, talks about:The potential of nuclear power to provide abundant, inexpensive energy with minimal environmental impact.Kugelmass emphasizes nuclear energy's efficiency and reduced environmental cost compared to traditional energy sources. He addresses common criticisms of nuclear energy, particularly focusing on the exaggerated concerns about radiation and the real challenges of cost and time to delivery.The conversation also touches on regulatory hurdles and the...

2024-05-0255 min

SOSV Climate Tech Podcasts04e06 - CVCs Doubling Down on Climate, with Microsoft Climate Innovation Fund, GS Ventures and Honda InnovationsIn this panel discussion from SOSV's 2024 EarthDay+ sessions (Apr 22-26, 2024) moderated by Dr. Pae Wu of IndieBio and SOSV, corporate venture capitalists Brandon Middaugh from Microsoft's Climate Innovation Fund, Taehong Huh from GS Futures, and Aditya Sharma from Honda Innovations discussed their strategies for investing in climate tech startups.They emphasize the importance of early engagement with startups, strategic alignment with corporate goals, and the necessity for startups to understand their market and competition.They highlight the challenges of scaling up technology in the climate sector, particularly the capital intensity and longer timelines associated with...

2024-05-011h 00

SOSV Climate Tech Podcasts04e05 - Should VCs Measure and Attribute Climate Impact, with Norrsken VC, Planet A, AENU, World Fund and Pale Blue DotIn this panel discussion from SOSV's 2024 EarthDay+ sessions (Apr 22-26, 2024) focused on measuring and attributing climate impact and moderated by Hampus Jakobsson of Pale Blue Dot, investors from various climate tech-focused funds discussed the importance of impact measurement in startups and investment decisions.The challenges and methodologies of impact assessment.The role of legislation in EuropeThe correlation between high impact and high returns.Perspectives on setting impact KPIs.The influence of investors on startups.The complexities of attributing impact across the value chain.The...

2024-05-011h 04

SOSV Climate Tech Podcasts04e04 - After the Tumble: Climate VC In 2024 With Breakthrough Energy, Lowercarbon and SOSVIn this panel discussion from SOSV's 2024 EarthDay+ sessions (Apr 22-26, 2024) moderated by Tim De Chant, Senior Climate Reporter at TechCrunch, panelists Christina Karapataki from Breakthrough Energy Ventures, Shuo Yang from Lowercarbon Capital, and Duncan Turner from HAX and SOSV discussed the current state and future of climate tech venture capital.The challenges and opportunities in the sector, noting a decrease in deal counts but robust fundraising, with venture capital and private equity firms holding significant "dry powder."The scrutiny in Series B and C funding rounds, the faster pace of seed and pre-seed investments, and...

2024-05-0153 min

SOSV Climate Tech Podcasts04e03 - Keeping the Heat On: Antora Energy’s Thermal Batteries Plan to Solve For Industrial HeatIn this discussion from SOSV's 2024 EarthDay+ sessions (Apr 22-26, 2024), Andrew Ponec, Co-founder and CEO of Antora Energy, discusses with Casey Crownhart, Climate Reporter at MIT Technology Review, the challenges and innovations in industrial heating.Antora Energy is electrifying heavy industry with thermal energy storage and raised over 200 million dollars in funding.Ponec explains that industrial heat accounts for a significant portion of global emissions, primarily from fossil fuels.Antora Energy initially explored various energy storage solutions before developing thermal batteries, leveraging cheap and abundant renewable energy sources.These batteries efficiently store...

2024-05-0157 min

SOSV Climate Tech Podcasts04e02 - Dressing for Climate Success: Three Startups Decarbonizing Fashion, with unspun, Smartex and GozenIn this panel discussion from SOSV's 2024 EarthDay+ sessions (Apr 22-26, 2024) moderated by Dr. Sabriya Stukes, Chief Scientific Officer at SOSV's IndieBio New York program, founders Beth Esponnette of unspun, Gilberto Loureiro of SMARTEX, and Onur Eren of GOZEN discussed innovative approaches to sustainable fashion.The conversation focused on leveraging technology to reduce waste and emissions in the fashion industry.Beth highlighted unspun's on-demand manufacturing model that minimizes fabric waste and promotes efficient production.Gilberto discussed SMARTEX's use of advanced technology to enhance quality control and reduce defects...

2024-05-011h 00

SOSV Climate Tech Podcasts04e01 - Can Form Energy meet the rapidly growing demand of grid-level, long-duration energy storage?In this discussion from SOSV's 2024 EarthDay+ sessions (Apr 22-26, 2024), the CEO and co-founder of Form Energy, Mateo Jaramillo, talks about:Form Energy's advancements in energy storage, with their unique iron-air battery technology designed for multi-day energy storage, which is more cost-effective and durable than traditional lithium-ion batteries.How this technology supports the integration of renewable energy sources into the grid, enhancing reliability and reducing costs.How Form Energy, which has raised close to a billion dollars, is shifting from R&D to manufacturing and preparing for large-scale production and deployment, with plans to...

2024-05-011h 01

Climate CEOs: Scaling StartupsClimate VC: $1B+ Under Management + 100M Trees — Bill Liao of SOSV on Startup Survival & Scaling Deep TechSOSV’s Bill Liao shares lessons from managing $1B+ in climate & deep tech ventures, why he planted 100M trees before flying again, & his startup mantra: don’t die, don’t quit, don’t suck.⭐ My guest today is Bill Liao, General Partner at SOSV and Chairman at Ki Tua Fund.Bill is a rare kind of guy, in the best way. He’s a thoughtful and prolific investor, recognized as one of the Top 100 minority ethnic leaders in technology by the Financial Times, as well as the kind of person who refused to fly in an...

2024-04-0455 min

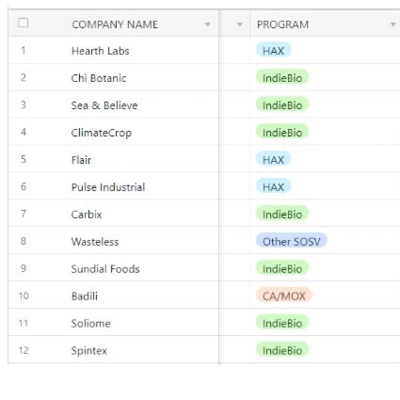

InevitableExploring Material Science Startups with SOSVOn this episode of My Climate Journey, we have two guests: Susan Schofer and Po Bronson.Susan is partner at SOSV and Chief Science Officer at Hax, which is SOSV's initiative around hard tech. She has a PhD in chemistry from Caltech, and most recently spent eight years at Modern Meadow, a growth stage startup in the bio leather space.Po is general partner at SOSV, and managing director of IndieBio, which is SOSV's initiative around biotech. Po has written seven New York Times bestsellers, and has won nine national awards for science journalism.

2024-02-2254 min

In Conversation with Nathalie Nahai131. How To Thrive In Challenging Times: On Beauty, Purpose & Longing / Bill LiaoToday I speak with Bill Liao, Chinese-Australian-Irish entrepreneur, author, investor and philanthropist who has left an indelible mark on the business, social and sustainability sectors.With a diverse career spanning decades, Bill is not only the co-founder of the popular CoderDojo movement (a free global network formed to assist young people with learning computer programming), his career in tech and business also encompasses two unicorn companies and the launch of the world’s first bio-tech accelerator.A general partner of SOSV, a venture capital fund of over $1B, and founder of the SO...

2024-01-141h 03

Sesame Asie(Rediffusion) Asie: Benjamin Joffe [SOSV] Investissement, Hardware Startup, Thought LeadershipPasser 18 ans en Asie et rejoindre un fond d'investissement US avec 750M en management

Dans cet épisode, Benjamin Joffe nous raconte ses presque 20 ans passés dans pas moins de cinq pays d’Asie: Japon, Corée, Chine, Hong Kong et Singapore.

Il nous explique comment profiter aux mieux de son expatriation, s’intégrer dans la vie locale, se faire des amis, pratiquer des activités (en l’occurence les arts martiaux).

Nous discutons aussi de son apprentissage des langues asiatiques (Japonais, Coréen, Chinois).

Mais aussi de so...

2023-10-241h 28

SOSV Climate Tech Podcasts03e23 - Our New Relationship With Electricity at Home with Span and QuiltIn this discussion from the 2023 SOSV Climate Tech Summit (Sept 26-27, 2023), the founders of Span and Quilt talk about the electrification of homes.

Span has developed a smart panel that helps homeowners integrate new devices and manage their electricity use.

Quilt is building an aesthetically pleasing residential electric heating and cooling system.

They discuss the challenges of expanding the grid and the confusion homeowners face when transitioning to electrification. They also mention the importance of building relationships with contractors and the impact of the Inflation Reduction Act, which provides subsidies for electrification. Both speakers express their excitement...

2023-10-1927 min

SOSV Climate Tech Podcasts03e22 - Taking Climate's Measure: Fire, Emissions and Sequestration withIn this discussion from the 2023 SOSV Climate Tech Summit (Sept 26-27, 2023), three startup founders discuss the importance of climate data and measurement.

Pano AI developed a solution for active wildfire detection using cameras and satellite feeds.

Kayrros use of satellite imagery to provide independent data for financial institutions, insurance companies, and government regulatory bodies.

Gaia AI uses satellite technology to measure greenhouse gas emissions, biomass, and biodiversity. He also mentions their focus on timber companies and connecting them to the carbon market.

The conversation touches on the challenges and opportunities in their respective industries. It is moderated...

2023-10-1933 min

SOSV Climate Tech Podcasts03e21 - Scientists at Venture Funds with Breakthrough Energy, Lowercarbon Capital and SOSV's HAXIn this discussion from the 2023 SOSV Climate Tech Summit (Sept 26-27, 2023), three scientists working at notable venture funds: Clea Kolster, Partner and Head of Science at Lowercarbon, Ken Caldeira, Senior Scientist at Breakthrough Energy and Susan Schofer, Partner and Chief Science Officer at SOSV’s HAX program, discuss the importance of having Phd scientists on venture capital teams and how they play a role in translating technical research into marketable solutions.

They also touch on the relationship between science and investment in their respective firms, the need for diverse expertise, and the transition from academia to investing. Ov...

2023-10-1931 min

SOSV Climate Tech Podcasts03e20 - Better Call the Specialist: VCs in Climate Verticals with AgFunder, Fifth Wall and S2G Ventures Ocean FIn this discussion from the 2023 SOSV Climate Tech Summit (Sept 26-27, 2023), we feature three speakers: Rob Leclerc, Founding Partner at AgFunder, Kate Danaher, Managing Director at S2G Ventures Ocean Fund, and Greg Smithies, Partner at Fifth Wall.

They discuss the benefits and challenges of raising funds from category-specific climate tech firms. They also talk about the most exciting spaces in agriculture, buildings, and oceans, as well as the state of the climate tech funding market. The speakers emphasize the importance of specialized underwriting, pattern recognition, and the need for realistic valuations in the climate tech sector...

2023-10-1931 min

SOSV Climate Tech Podcasts03e19 - Climate Tech Analysts: Taking the Temperature with Bloomberg NEF, CTVC and Voyager VCIn this discussion from the 2023 SOSV Climate Tech Summit (Sept 26-27, 2023), two analysts and an analyst-turned-VC discuss the need for innovative solutions in sectors such as renewable power, transportation, and hard-to-abate industries. They also discuss the potential for growth in climate tech and the importance of research and funding in driving progress. They highlight emerging segments such as sustainable mining, geothermal energy, and energy storage. Overall, they emphasize the ongoing need for climate solutions and the opportunities for career growth in the field.

This conversation is moderated by Sierra Peterson, Founding Partner, Voyager VC. The video of...

2023-10-1921 min

SOSV Climate Tech Podcasts03e18 - Iceland: Ice, Fire, and Climate Tech with Iceland's Minister of Higher Education, Science and Innovation and Climate InvestorIn this discussion from the 2023 SOSV Climate Tech Summit (Sept 26-27, 2023), we feature Iceland’s Minister of Higher Education, Science, and Innovation, and David Helgason, co-founder and former CEO of software unicorn Unity, and the founder of a climate-focused venture capital firm called Transition and an initiative called Transition Labs.

They discuss Iceland's potential as a hub for carbon removal technologies and climate tech. They highlight Iceland's commitment to renewable energy sources and its strong government support for global climate solutions. They also discuss the advantages of Iceland's agile innovation ecosystem and its willingness to pilot and de...

2023-10-1926 min

SOSV Climate Tech Podcasts03e17 - First Checks for Big Ideas with AtOne Ventures, E2JDJ, Material Impact and SOSV / IndieBioIn this discussion from the 2023 SOSV Climate Tech Summit (Sept 26-27, 2023), four investors discuss the importance of early stage funding and the need for startups to show traction and progress. They also highlight the potential of untapped sectors such as cement and agriculture in driving climate tech innovation. The conversation touches on the role of government regulation and incentives in supporting the growth of the climate tech industry.

This conversation is moderated by Alex Wilhelm, Editor in Chief at TechCrunch. The video of this episode and more can be found online at sosvclimatetech.com.

2023-10-1936 min

SOSV Climate Tech Podcasts03e16 - Heat-Proof Ag: How Will We Grow Food On A Hotter Planet with Avalo AI, Puna Bio and Drip AIIn this discussion from the 2023 SOSV Climate Tech Summit (Sept 26-27, 2023),

Three founders of AgTech startups discuss their innovative solutions in the fields of climate resilient crops, bio fertilizer, and water harvesting.

Brendan from Avalo explains how machine learning is used to identify desirable traits in plant genomes. Franco from Puna Bio discusses the use of extreme microbes to create bio fertilizer. Dr. Ramadan Borayek from Drip AI explains the passive technology behind their hydro panel that harvests water from the air. The founders also discuss the challenges of raising funds and the importance of i...

2023-10-1927 min

SOSV Climate Tech Podcasts03e15 - Solugen: Reinventing The Means Of Production, With EnzymesIn this interview from the 2023 SOSV Climate Tech Summit (Sept 26-27, 2023), Dr. Gaurab Chakrabarti, Co-founder and CEO of Solugen, a company specializing in sustainable chemicals, is interviewed by Dr. John Cumbers, Founder and CEO of SynBioBeta.

They discuss Solugen’s progress in fundraising and building infrastructure, as well as its focus on developing climate-neutral and climate-negative chemicals. They talk about the industrial uses of Solugen’s products, such as disinfecting water in agriculture and industrial water treatment. They also discuss the climate impact of its chemicals and their goal to replace 30% of US chemical demand with domestically bio...

2023-10-1924 min

SOSV Climate Tech Podcasts03e14 - Science, Scale, Markets, and Big Meat: The Future of Alt Proteins with UPSIDE Foods, Prolific and OSI GroupIn this panel from the 2023 SOSV Climate Tech Summit (Sept 26-27, 2023), three experts discuss the future of meat and the challenges faced by the cultivated meat industry.

Eric from Upside Foods emphasizes the need for access to public funds and international harmonization of regulatory policies. Deniz from Prolific talks about the importance of reducing costs and increasing yields in order to compete with factory farming. Last, Philip from OSI Group mentions the role of traditional meat companies in providing sustainable options and the importance of clear and accurate labeling. They also discuss the need for transparency and...

2023-10-1933 min

SOSV Climate Tech Podcasts03e13 - How Corporate VCs Invest In Climate Tech with Toyota Ventures, Solvay Ventures and ADM VentureIn this panel from the 2023 SOSV Climate Tech Summit (Sept 26-27, 2023), three corporate investors, from Toyota Ventures, Solvay Ventures and ADM Ventures discuss their mandates as investors in the climate space and how they prioritize investments. Toyota Ventures looks at technologies and solutions for emissions reduction, removal, and adaptation to support Toyota's efforts in achieving carbon neutrality. Solvay Ventures focuses on sustainability goals and investing in companies that leverage chemicals and materials to solve climate issues. Finally, ADM Ventures focus on investing in agriculture-related startups to achieve corporate sustainability goals.

This conversation is moderated by Jonathan...

2023-10-1930 min

SOSV Climate Tech Podcasts03e12 - Climate Tech Investing In The Global South with Wavemaker, Africa Climate Ventures, Avaana Capital and GriIn this panel from the 2023 SOSV Climate Tech Summit (Sept 26-27, 2023), four investors based in emerging markets discuss the importance of the global south in addressing climate change and the opportunities for climate tech in their respective regions.

Marie from Wavemaker emphasizes the need for startups to drive adoption and change behavior, while James from Africa Climate Ventures highlights Africa's potential for leapfrogging to non-emitting technologies and carbon removal. Anjali from Avaana Capital discusses India's young population and high rate of technology adoption as key factors in driving climate tech solutions. Last, Matias from...

2023-10-1935 min

SOSV Climate Tech Podcasts03e11 - The Earth is Hiring: Tackling the Talent Transition with Drawdown Labs, Work On Climate and Terra.doIn this panel from the 2023 SOSV Climate Tech Summit (Sept 26-27, 2023), three founders of platforms promoting careers in climate discuss the misconception that climate jobs are only for scientists and activists and emphasize that climate jobs can be found in various industries. They also highlight the need for more skilled workers in the clean economy and the importance of building a talent pipeline. They encourage individuals to take action and contribute to the climate movement in their respective fields.

This conversation is moderated by Matt Myers, Founder & General Partner of Climate Tech Circle. The video of this e...

2023-10-1831 min

SOSV Climate Tech Podcasts03e10 - Making The Hydrogen Value Chain Work with Electric Hydrogen, Amogy and Ayrton EnergyIn this panel from the 2023 SOSV Climate Tech Summit (Sept 26-27, 2023), the founders of three startups discuss the challenges and potential of the hydrogen value chain, particularly in terms of green hydrogen production. They highlight the importance of renewable electricity in producing truly green hydrogen and the need for collaboration and support from governments and policymakers. They also discuss the existing infrastructure for hydrogen and the potential for expansion. The panelists finally express cautious optimism about the future of the hydrogen industry and emphasize the importance of clarity and stability in legislative and incentive structures.

This...

2023-10-1830 min

SOSV Climate Tech Podcasts03e09 - The Missing Link: Grid-level Energy Storage with Malta, Energy Dome and RenewellIn this panel from the 2023 SOSV Climate Tech Summit (Sept 26-27, 2023), three founders of startups involved in long-duration energy storage discuss the importance of such technologies in the changing grid and the need for new ways to store energy. Each speaker explains their company's technology and how it fits into the energy system. They also discuss the challenges they have faced in funding their projects and the importance of proving the business case for their technologies. Finally, they highlight the cost competitiveness of renewable energy and the role of energy storage in enabling the transition to a greener future.

2023-10-1836 min

SOSV Climate Tech Podcasts03e08 - Re-inventing The Means Of Production for the Chemical Industry, Materials and Industrial HeatIn this panel from the 2023 SOSV Climate Tech Summit (Sept 26-27, 2023), three startup founders discuss the industrial sector's focus on reducing carbon emissions and the challenges they face. Their technologies cover alternatives to various materials, and approaches to reduce energy consumption in the chemical industry and for the production of industrial heat. They also discuss the investment landscape and the role of strategic investors in the industry.

This conversation is moderated by Duncan Turner, SOSV General Partner and HAX Managing Director. The video of this episode and more can be found online at sosvclimatetech...

2023-10-1729 min

SOSV Climate Tech Podcasts03e07 - The Age of Small Nuclear Reactors with Last Energy, Core Power and NewCleoIn this panel from the 2023 SOSV Climate Tech Summit (Sept 26-27, 2023), three founders of startups building small nuclear reactors discuss the development of advanced nuclear technologies and their potential in the energy landscape.

They highlight the shift in business models, the need for private investment, and the importance of addressing safety concerns. The speakers express optimism about the future of nuclear energy and emphasize the importance of collaboration in achieving clean and sustainable energy systems.

This conversation is moderated by Shannon Bragg-Sitton, Director of the Integrated Energy and Storage...

2023-10-1732 min

SOSV Climate Tech Podcasts03e06 - Greener Mining For Critical Minerals with Lilac Solutions, Impossible Metals and Still BrightIn this discussion from the 2023 SOSV Climate Tech Summit (Sept 26-27, 2023), three startup founders discuss the importance of critical minerals in the energy transition and how their companies are working to secure access to these minerals. One focuses on lithium extraction from brine, another on refining copper ore with electricity, and the last one on extracting minerals from the ocean floor. They also discuss the challenges of the current supply chain and the need for innovative and sustainable solutions.

This conversation is moderated by Andy Gollach, Principal at HAX, SOSV’s startup program focused on...

2023-10-1730 min

SOSV Climate Tech Podcasts03e05 - FDA and USDA-approved. When Will Upside's Cultivated Meat Reach Your Table?In this discussion from the 2023 SOSV Climate Tech Summit (Sept 26-27, 2023), Dr. Uma Valeti, founder of UPSIDE Foods, a pioneer in cultivated meat is in conversation with Po Bronson. Dr. Valeti trained as a cardiologist before turning his attention to sustainable meat production. Po Bronson is a general partner at SOSV and managing director of Indie Bio, who wrote the first investment check in Upside Foods back in 2015.

They discuss the recent FDA approval of Upside Foods and their expansion into Illinois. They talk about the significance of Chicago as the birthplace of meat...

2023-10-1719 min

SOSV Climate Tech Podcasts03e04 - Vinod Khosla and SOSV's Sean O'Sullivan On Climate InvestmentIn this discussion from the 2023 SOSV Climate Tech Summit (Sept 26-27, 2023), Vinod Khosla, Founder of Khosla Ventures and Sean O'Sullivan, Managing General Partner and Founder of SOSV discuss the time it takes for climate tech investments to mature and the potential for exponential growth in the future.

Vinod Khosla emphasizes the importance of focusing on major areas of carbon reduction and advises founders and investors to tackle large problems in the climate space and be patient. They also discuss various technologies and approaches, including fusion, geothermal, and AI, and express optimism about the potential...

2023-10-1732 min

SOSV Climate Tech Podcasts03e03 - The IRA One Year In, With Professor Jesse Jenkins from Princeton ZERO LabIn this conversation from the 2023 SOSV Climate Tech Summit (Sept 26-27, 2023), Professor Jesse Jenkins, director of the zero lab at Princeton University is interviewed by Robinson Meyer, Founding Executive Editor of Heatmap. They discuss the progress of the Inflation Reduction Act one year after its passing. They talk about the implementation of the act, the flow of money, and the rules that need to be written and implemented by federal agencies. They also discuss the impact of the act on clean energy, particularly in the areas of electric vehicles, manufacturing, wind and solar deployment, and the need for further...

2023-10-1727 min

SOSV Climate Tech Podcasts03e02 - Funding First-of-a-Kind Projects with the DoE's Office of Clean Energy Demonstrations, Generate and Prime CoalitionIn this panel from the 2023 SOSV Climate Tech Summit (Sept 26-27, 2023), three experts discuss the topic of funding first-of-a-kind projects and the challenges and risks associated with it. They emphasize the importance of defining such projects and the need for different types of capital, such as government funding, venture capital, and philanthropic funding. They also highlight the significance of selecting the right partners and considering equity issues and community engagement for impactful climate solutions.

This conversation is moderated by Kim Zou, Co-Founder of the climate tech media and research company CTVC. The video of...

2023-10-1732 min

SOSV Climate Tech Podcasts03e01 - Carbon Removal with Charm Industrial, Heirloom and VerdoxIn this panel from the 2023 SOSV Climate Tech Summit (Sept 26-27, 2023), three founders of carbon removal startups discuss the importance of carbon removal in achieving sustainable goals and the challenges of scaling up carbon removal technologies. They also touch on the need for community engagement, permitting, and the creation of a market for carbon removal.

The panelists emphasize the need for innovation, cost reduction, and long-term commitments to drive the growth of the carbon removal industry. Finally, they highlight the potential of advanced market commitments and the importance of workforce development in this field.

2023-10-1732 min

Levantando Podcast066 | Oscar Ramos - SOSV | Inversiones en mercados emergentes desde ChinaOscar Ramos, General Partner en SOSV, nos cuenta por qué se fue a China para invertir en tecnología, las diferencias entre algunos mercados emergentes, manejar más de 1,000 startups en el portafolio. Además, nos platica por qué el M&A está aumentando.

Contacto

Linkedin: https://www.linkedin.com/in/oscarramosm

Twitter: https://twitter.com/oscar_ramos

SOSV: https://sosv.com/

Este episodio es presentado por AWS Startups: https://aws.amazon.com/es/startups/

2023-10-0337 min

The European VCEUVC #221 Sean O'Sullivan, SOSV on building a 1.5 bn behemoth to back planetary & human health with a global studio modelFrom serving as a janitor to embracing his passions as a musician, filmmaker, and even running a humanitarian organization in Iraq, Sean O’Sullivan’s multifaceted nature reveals a remarkable tapestry of life experiences. Among the intriguing anecdotes is his encounter with a rare viral infection that affected his eye, providing a testament to resilience and adaptability. His ventures extended to the world of television, where he enjoyed a stint as a TV star in Ireland, further exemplifying his versatility.In conclusion, Sean O'Sullivan's venture journey offers a tapestry of experiences, showcasing the significance of perseverance, long-term comm...

2023-09-1952 min

EUVCEUVC #221 Sean O'Sullivan, SOSV on building a 1.5 bn behemoth to back planetary & human health with a global studio modelToday we have Sean O'Sullivan with us. Sean is a Managing General Partner at SOSV, a global, multi-stage venture capital firm that operates early stage startup development programs, notably HAX, IndieBio, and Orbit Startups. They are the first check in deep tech, starting at pre-seed.SOSV have a $1.5 Billion in AUM and an established portfolio of 1000+ companies including Upside Foods, Perfect Day, Opentrons, and Formlabs. Sean is on the board of Khan Academy, the Tyndall Institute, the Autism Impact Alliance, the Brain Foundation, and a number of private companies.From serving as a janitor to embracing...

2023-09-1952 min

Investing In AsiaSOSV’s Portfolio StrategyWilliam Bao Bean is Managing Director of Orbit Startups the first and longest-running startup program in Asia and General Partner of SOSV the #2 most active venture capital investor in the world and #5 Asia/ROW with US$1.5bn in assets under management. William joined Orbit and SOSV from SingTel Innov8 Ventures where he was a founding Managing Director. Prior to that, William was a Partner at Softbank China & India Holdings, a VC backed by Softbank and Cisco, leading investments in China and South East Asia. William started his career in equity research most recently with Deutsche Bank where...

2023-05-2643 min

The Post-Quantum WorldInvesting in Quantum – with Bill Liao of SOSVQuantum computing has been surrounded by hype from the beginning. While these machines may exceed our most ambitious imaginings in the future, investing in them today brings some challenges to venture capitalists. How do VCs vet companies in the field, and how does the so-called Quantum Winter affect all this? Join Host Konstantinos Karagiannis for a chat with Bill Liao of SOSV about investing in quantum and other emerging technologies.For more on SOSV, visit https://sosv.com/.Visit Protiviti at www.protiviti.com/postquantum to learn more about how Protiviti is helping organizations get post-quantum ready. Follow host Konsta...

2023-05-0337 min

ДжекМа ПозвонитS2:E3 | Открытие Китая | Особенности переговоров | Портфельная компания из Бангладеша | Карьерные измененияПодкаст «ДжекМа Позвонит» - это уникальный еженедельный подкаст из Шанхая для русскоязычной аудитории, интересующейся стартапами, новыми бизнес-моделями, инновациями, венчурным капиталом и бизнесом на рынке Азии.

Мы рассказываем про лучшее из бизнеса, социальных, маркетинговых, инвестиционных и венчурных трендов Азиатского региона.

Вступайте в наш чат для слушателей подкаста https://t.me/jackmacallchat.

Обзор этой недели: Открытие Китая | Особенности переговоров от Ивана | портфельная компания Никиты из Бангладеша | Карьерные изменения Семена

Присоединяйтесь к нам за последним эпизодом нашего еженедельного подкаста, в котором мы исследуем главные новости и тенденции в мире бизнеса и технологий.

В этом выпуске мы решили быть на легке и просто поговорили за жизнь.

Обсудили:

Открытие Китая;

Как Иван сгонял в командировку в Шэньчжэнь, и какие там были переговоры;

Нужны ли иностранцы на переговорах в Китае;

Новости из стана SOSV / Orbit Startups;

Портфельная компания Никиты из Бангладеша;

Формат нашего подкаста;

Карьерные изменения Семена;

Вонючий жареный сыр тофу на улицах Китая.

Ведущие:

📌 Семен Загайнов - 7+ лет в Китае. Ментор по В2В продажам и построению маркетинговой стратегии для IT проектов, работающих с китайским рынком в Orbit Startups (SOSV) (главный IT акселератор Азии).

Каждый день пишет про бизнес новости Китая, которые нельзя пропустить в телеграм канале:

https://t.me/jackmawillcall

Личные соц. сети:

Facebook - https://www.facebook.com/simonzagainov/

Instagram: https://www.instagram.com/simonzagainov/

📌Иван Мельников - Основатель CEO Asia Business Hub (сопровождение инвестиционных проектов для международных компаний в Китае, GR/PR, строительство, торговля, юридический и финансовый консалтинг), 18+ лет в Китае.

Instagram: https://www.instagram.com/ivan_brother.wan/

Телеграм канал - https://t.me/brother_wan

Сайт компании: https://www.abhgroup.co/

📌Никита Пономарев - Инвестиционная Команда в венчурном фонде SOSV ($1.5 млрд. AUM; Топ 3 самый активный инвестор в мире) и его стартап акселераторе Orbit startups (№1 стартап акселератор в Азии). Основной фокус на рынках South Asia, SEA и MENA.

Linkedin: https://www.linkedin.com/in/nikitaponomarev/

Facebook: https://www.facebook.com/nikita.ponomarev.121772

Telegram: https://t.me/vccomvc

Instagram: https://www.instagram.com/ponomarev.nkt/

2023-03-1948 min

Climate InsidersSOSV - Building the World's Most Active Climate Tech VC (feat. partner Benjamin Joffe)Benjamin Joffe is a Partner at SOSV, a global deep tech fund with 1000 portfolio companies and $1.3B AUM. They focus on early-stage planetary and human health. They invest the very first checks at pre-seed via the startup programs HAX (hard tech), IndieBio (biology), Orbit (frontier markets), and dlab (blockchain). Benjamin started in an investing role in the HAX program in Shenzhen (invested in Opentrons, now a unicorn), and later chose to work in a non-investing role across the portfolio.He's been an active angel investor, super speaker, and moderator in hundreds of events gl...

2022-10-1137 min

The Startup Tank Climate Investor Pitch Show and Climate Techies Sustainability SeriesFast Deploy EV Infrastracture, Carbon Capture to Biopolymers and Simplifying Climate Investing: The Startup Tank Aug 4th with Zero Carbon Capital and SOSV / Orbit StartupsWelcome to The Startup Tank Climate Investor Pitch Show presented by 4WARD.VC in partnership with the Zero Carbon Capital and SOSV / Orbit Startups, the ultimate climate tech pitch show where top cleantech and sustainability startups pitch their project to a panel of top climatetech and impact focused VCs looking to fund world-changing climate companies.

https://thestartuptank.com/apply

Presenting Companies:

Dara Scientific: Natural, plant-based insect repellents

Climatize: Facilitating simpler, passive investment into meaningful climate companies

We Do Solar: Residential balcony solar for faster consumer renewable adoption

CO2 Bioclean: Capturing CO2 and turning it...

2022-08-042h 11

The Startup Tank Climate Investor Pitch Show and Climate Techies Sustainability SeriesFast Deploy EV Infrastracture, Carbon Capture to Biopolymers and Simplifying Climate Investing: The Startup Tank Aug 4th with Zero Carbon Capital and SOSV / Orbit StartupsWelcome to The Startup Tank Climate Investor Pitch Show presented by 4WARD.VC in partnership with the Zero Carbon Capital and SOSV / Orbit Startups, the ultimate climate tech pitch show where top cleantech and sustainability startups pitch their project to a panel of top climatetech and impact focused VCs looking to fund world-changing climate companies.

https://thestartuptank.com/apply

Presenting Companies:

Dara Scientific: Natural, plant-based insect repellents

Climatize: Facilitating simpler, passive investment into meaningful climate companies

We Do Solar: Residential balcony solar for faster consumer renewable adoption

CO2 Bioclean: Capturing CO2 and turning it...

2022-08-042h 11

Climate CEOs: Scaling StartupsClimate Tech Trends: 2x Valuations → FOAK Financing (+ Live Funding Course)Unpack how SOSV’s Climate Tech 100, FOAK project funding tactics, & founder-focused training can supercharge your climate startup journey.In this episode, I'm once again trying a new format, something less formal. A solo recording where I talk through a few recent news stories in climate tech finance.Let me know if you like it.https://twitter.com/DrChrisWeddinghttps://www.linkedin.com/in/christopherwedding/In this show, I cover two topics:(1) Highlights from my newsletter💸 2x valuation increase — SOSV Climate Tech 100 list.☀️ New report — How to finance a “First of a Kind...

2022-05-1909 min

InevitableEp. 199: Sean O'Sullivan, Managing Director & Founder of SOSVToday's guest is Sean O'Sullivan, Managing Partner & Founder of SOSV.SOSV is a venture capital firm with more than $1.2B in assets under management. SOSV pioneers & runs world-leading startup development programs. Sean O'Sullivan is Managing Partner & Founder of SOSV, a venture capital firm with over $1 Billion in assets under management. SOSV specializes in programs for very early stage, deep-tech startups and is one of the most active venture investors in the world, with more than 1,000 companies in its portfolio. O'Sullivan's first company, MapInfo, popularized street mapping on computers. Credited with co-creating the term "cloud computing," Se...

2022-03-0750 min

Capital Allocators – Inside the Institutional Investment IndustrySean O'Sullivan – Start-up Development at SOSV, Venture is Eating the Investment World 3Sean O'Sullivan is the founder of SOSV, a $1 billion global venture capital firm that seeds 150 companies a year through start-up development programs that support entrepreneurs across hardware, bioengineering, China, mobile apps, and the blockchain. Sean has pretty much done it all. He grew up on welfare, found his way to technology in the 1970s, and started his first company in his early 20s. That company, called MapInfo, was the original street map technology well before the days of the internet. Sean formed more companies and began angel investing with the proceeds. Along the way, he created twenty patents...

2022-01-1749 min

InevitableStartup Series: Boston MetalToday's guest is Tadeau Carneiro, Chairman & CEO of Boston Metal.This episode was part of the SOSV Climate Tech Summit. The SOSV Climate Tech Summit aims to convene the climate tech startup ecosystem of founders, investors, technologists, corporates, policymakers, and media to discuss the extreme challenges ahead. This year, the summit was held virtually on October 20th & 21st.Spun-out of MIT in 2012, Boston Metal has invented a coal-free, emissions-free, modular method of industrial steel production based on the use of electricity. The company's molten oxide electrolysis (MOE) provides the metals industry with a greener solution...

2021-12-0226 min

The Butterfly EffectEpisode 35 / The Butterfly Story of Entrepreneurship & Climate Change Hosting Bill LiaoThis butterfly is excited to be speaking with Bill Liao.

Bill is a Chinese-Australian-Irish entrepreneur, investor, former diplomat, business mentor, author, passionate leader and speaker, with a distinguished record in business development and community activism.

Co-founder of the CoderDojo movement and of WeForest, his career in tech and business encompasses two unicorn companies and launching the world’s first bio-tech accelerator. He is a general partner of SOSV, a venture capital fund of over $1B, and founder of the SOSV Momentum Pre-accelerator program.

In this episode you will hear about his commitment to th...

2021-12-0137 minOn Boards PodcastJoe Hurd: Every company is a technology companyThanks for listening! We love our listeners! Drop us a line or give us guest suggestions here. Episode Description Joe Hurd is a public and non-profit board director and early-stage investor. As an operating executive, Joe is the Operating Partner at SOSV, LLC, a $1B early-stage venture fund, where he leads strategy and business development efforts for the fund's life sciences, deep tech hardware and mobile portfolio companies. In this episode, we talk about how technology is impacting every business and differences between US and UK boards Quotes My...

2021-12-0136 min

SOSV Climate Tech Podcasts01e02 - How to capture and use carbon dioxide emissions with Lowercarbon Capital, Noya and NovoNutrientsIn this discussion from the 2021 SOSV Climate Tech Summit (Oct. 20-21, 2021), two startup founders join a climate investor to discuss the importance of carbon capture and utilization in climate mitigation. They cover:The need to remove trillions of tons of CO2 from the atmosphere and the potential for large-scale carbon removal.The role of different technologies and markets in carbon utilization, such as the production of alternative proteins and other valuable products.The importance of partnerships with corporate players and the challenges of scaling up their technologies.Their hope for a...

2021-10-2233 min

SOSV Climate Tech Podcasts01e01 - Bill Gates: Creating the Next Tech Giants and Avoiding a Climate DisasterIn this discussion from the 2021 SOSV Climate Tech Summit (Oct. 20-21, 2021), Bill Gates, founder of Microsoft and Breakthrough Energy Ventures, and Author of the best-selling book “How to Avoid a Climate Disaster: The Solutions We Have and the Breakthroughs We Need”, talks about climate tech investments and the challenges they pose compared to other areas. Gates mentions the need for patience and the potential for high returns in climate tech investments.He also emphasizes the need for government involvement and the importance of investing in hard-to-abate sectors.The conversation ends with Gates expressing exci...

2021-10-2224 min

Philly Maker Faire PodcastPhilly Maker Faire Co-Chair and Entrepreneur Marvin WeinbergerOther makers and inspirations:

Yo Yo Ma https://www.yo-yoma.com/

Wazer desktop waterjet https://www.wazer.com/

Sean O'Sullivan – SOSV https://sosv.com/team/sean-osullivan/

Amira Idris Radović TheraV https://www.theravnetwork.com/

Yasmin Mustafa https://en.wikipedia.org/wiki/Yasmine_Mustafa

David Brin – The Postman https://www.davidbrin.com/postman.html

Alumnus Basil Harris, MD, PhD – Qualcomm Tricorder XPrize competition winner in 2017

https://drexel.edu/engineering/news-events/news/archive/2018/October/xprize-winner-bridges-science-fiction-and-science/

Vijay Kumar, Dean, Penn Engineering https://www.linkedin.com/in/v...

2021-08-2057 min

The Investor With Joel PalathinkalChat with Oscar Ramos, Partner at SOSVJoin Joel Palathinkal and Oscar Ramos as they explore Oscar's journey to SOSV and his move to China. Discover how he adapted to the culture and language, and gain insights into the evolving startup ecosystems in China and Europe. Oscar shares his experiences with regional differences and the Great Firewall, comparing Western and Chinese design preferences. They discuss the importance of data-driven decisions in app development and tailoring products for local markets. The episode also covers the transition from startup to scale-up, the role of venture capital, and supporting corporates and startups in China.

Experienced manager with strong technical...

2021-07-031h 00

Startup Life Show with Ande LyonsEP 128 Scaling a Healthy, Plant-Based and Sustainable Food BusinessTaking a recipe and scaling it for mass production, especially when it has a shelf-life, is one of the hardest business models to start.Our guest, JimmyTay Trinh, is the founder of Naturally Noah’s, a food business providing an array of delicious, vegan instant pho noodle soups.JimmyTay and his family members were suffering from chronic illnesses and obesity. While they loved consuming pho noodles, JimmyTay knew the instant soups on the shelf were toxic – filled with high levels of sodium and saturated fat.A former restauranteur who honed his craft at the Culi...

2021-06-241h 03

AugmentImmersive Labs and SOSV raises funds | Info Edge India has acquired Zwayam DigitalUK’s cybersecurity trainer Immersive Labs, which helps enterprises increase their human capabilities in cybersecurity, has netted $75M in Series C. The proceeds would be used to scale its presence in the US and for increasing its headcount, as per reports.Global VC firm SOSV has closed its special fund, which it calls a growth-stage fund to invest in startups in their Series B and beyond stages. Using these funds, it aspires to invest up to $5M in about 20-30 startups. Also, it aims to deploy its SOSV IV select fund, which was oversubscribed in 2019, for deep-tech st...

2021-06-1401 min

A Few Things with Jim Barrood#41 Investor Chat: Sean O'Sullivan + Jeff Hoffman - A Few Things - 30 MinJeff is an award-winning global entrepreneur, proven CEO, worldwide motivational speaker, bestselling author, Hollywood film producer, a producer of a Grammy Award winning jazz album, and executive producer of an Emmy Award winning television show. In his career, he has been the founder of multiple startups, he has been the CEO of both public and private companies, and he has served as a senior executive in many capacities. Jeff has been part of a number of well-known successful startups, including Priceline.com/Booking.com, uBid.com and more. Jeff is the CEO of Driving Force Enterprises, a strategic consulting fi...

2021-05-0330 min

Dinis Guarda YouTube Podcast Series - Powered by citiesabc.com and businessabc.netWilliam Bao Bean General Partner at SOSV, Chinaaccelerator - Changing The Way The Internet WorksWilliam Bao Bean is a General Partner at SOSV - The Accelerator VC - the #2 most active angel and seed stage investors in the world 2019 with US$700m under management. At SOSV he is the Managing Director of Chinaccelerator the first accelerator to launch in Asia and the only accelerator in Asia to have a unicorn come through its program – Bitmex the #1 crypto exchange in the world by trading volume enabling anyone with a smartphone to access financial products and opening up investment to the unbanked. William Bao Bean Interview Focus1. An introduction from you...

2020-11-2457 min

Asia Startup Pulse那些投资人们错失的亿级投资机会(分布式资本,远毅资本,SOSV)Welcome to the second episode of our new series “Inside the VC Mind” where we bring you the professionals from the venture capital world, who will deliver their observations, thoughts, and opinions.Today we are going to talk about those startups that investors missed but would have loved to invest in, with Remington Ong, Partner at Fenbushi Capital, Ray Yang, Partner at Marathon Venture Partners, and William Bao Bean, General Partner at SOSV and Managing Director at Chinaccelerator and MOX.Our guests:Remington OngRemington is Partner at Fenb...

2020-11-0221 min

Asia Startup PulseInside the VC Mind Ep2: Billion-dollar Opportunities That Investors Missed (Remington Ong, Ray Yang, William Bao Bean)Our guests:Remington OngRemington is Partner at Fenbushi Capital, one of the earliest and most active blockchain-focused venture capital firms, where he has managed investments into over 40 leading startups around the world leveraging blockchain technology to disrupt a wide range of industries, such as finance, healthcare, supply chain, and consumer goods.Ray YangRay is Partner at Marathon Venture Partners, a China-based early to growth stage fund focusing on digital healthcare transformation. Prior to Marathon Venture Partners, Ray was MD at Northern Light Venture Capital and Investment Director at Orchid Asia...

2020-11-0221 min

A Few Things with Jim Barrood#2 Investor Chat: Sean O'Sullivan, SOSV, MapInfo, JumpStart International, NetCentricWe discussed a few things including:1. How SOSV's portfolio startups are responding to crisis and the new IndieBio Coronavirus Initiative which seeks up to 8 startups to receive a minimum of $250k each. 2. State of investing globally and how the coronavirus is affecting funding activity.3. Advice for entrepreneurs in these unprecedented and challenging times.4. SOSV's new IndieBio accelerator which is launching in NYC this spring.Sean is the founder and managing partner of SOSV which has invested in over 900 startups, investing about $65 million per year in the 150 startups that go t...

2020-10-1448 min

SOSV Climate Tech PodcastLtM ep16 - The State Of Mental Health Tech, With Daniel Månsson, CEO of Flow NeuroscienceTelemedicine and Mental health are hot topics, especially in those times of economic uncertainty and forced isolation.

In this episode, Daniel Månsson, a clinical psychologist and CEO of Flow Neuroscience (a SOSV portfolio company), explains how they are bringing the first medication-free depression treatment to the home of patients.

This podcast is hosted by Benjamin Joffe (@benjaminjoffe), Partner at SOSV, a global early stage fund focused on deep tech. SOSV runs multiple accelerator programs including HAX (hard tech) and IndieBio (new biotech).To hear about new e...

2020-09-2025 min

SOSV Climate Tech PodcastLtM ep15 - How The Fashion and Textile Industry Is Embracing Technology, With Alex Chan, Director At The Mills FabricaThe fashion and textile industry is at a turning point.

First, it is one of the most polluting due to its use of chemicals (polyester, dyes, etc.), large amounts of water, long-distance logistics, and waste (defective products and unsold inventory that ends up burnt or in landfills.

The Covid-19 pandemic put pressure on both retail and supply chains.

In this episode, we talk with Alex Chan, Co-Director of The Mills Fabrica about the industry’s growing appetite for innovation.

2020-09-1028 min

SOSV Climate Tech PodcastLtM ep14 - The State and Opportunities In Robotics, with Fady Saad of MassRoboticsMassRobotics helps startups commercialize innovations in robotics. Its ecosystem includes 350 startups, 40 corporates and over 100 VCs, PEs and LPs they advise. In this episode, Fady Saad talks about trends, acquisitions, failures and what has changed over the past decade in robotics. It is a little crash course on the robotics market.

This podcast is hosted by Benjamin Joffe (@benjaminjoffe), Partner at SOSV, a global early stage fund focused on deep tech. SOSV runs multiple accelerator programs including HAX (intelligent hardware) and IndieBio (life sciences).

...

2020-08-3142 min

SOSV Climate Tech PodcastLtM ep13 - How Khosla Ventures Invests In Deep Tech, with Kanu Gulati and Rajesh SwaminathanKhosla Ventures (KV) has been an active investor in deep tech for 15 years. In this episode they share ideas on how they select sectors to invest in and prioritize and retire risk, how to best support startups, and what investors need to enter the deep tech field (hint: it's not a PhD).

This podcast is hosted by Benjamin Joffe, Partner at SOSV, a global early stage fund focused on deep tech. SOSV runs multiple accelerator programs including HAX (intelligent hardware) and IndieBio (life sciences). To hear about new episodes...

2020-08-2337 min

SOSV Climate Tech PodcastLtM ep12 - Australia’s Deep Tech Ambitions With Phil Morle, Startup Pioneer and Partner at Main Sequence VenturesGetting innovation from lab to market is not an easy feat, and few countries do it well. Australia’s research output, for instance, punches way above its commercial applications (e.g. #10 in the SJR ranking and Nature Index).

Are there ways to accelerate that transformation? Australia set up Main Sequence Ventures (@mseqvc) as a AU$240M (about US$170M) deep tech fund backed by the CSIRO and private investors, to target that opportunity notably in domains such as ag-tech, synthetic biology, quantum and space (the CSIRO is the Australia’s federal government agency responsible for scientific research).

2020-08-1036 min

SOSV Climate Tech PodcastLtM ep11 - Funding Science Fiction That Works From The MIT Media Lab, With Habib Haddad and Calvin Chin From The E14 FundHabib Haddad and Calvin Chin are the Managing Partners of the E14 Fund, an early stage deep tech fund that invests exclusively in startups from the prolifically inventive MIT Media Lab community.

This podcast is hosted by Benjamin Joffe, Partner at SOSV, a global early stage fund focused on deep tech. SOSV runs multiple accelerator programs including HAX (intelligent hardware) and IndieBio (life sciences). To hear about new episodes, sign up to the newsletter or follow us on twitter at @LabToMarket.

For another episode covering Boston & Cambridge’s deep tech ecosystem, check out John Ho (An...

2020-07-2849 min

Market Meditations#44 - Super Angel: Guest Sean O'SullivanJoining Chris and Neal on the podcast is Sean O'Sullivan, Managing General Partner at SOSV Capital.

After Sean O’Sullivan’s first startup when public in 1994, he founded SOSV in 1995 as a “super angel”. In 2007, based on the success of two dozen investments that had done remarkably well, Sean began aggressively expanding SOSV, transitioning it from a personal investment vehicle into an organization that today has over 110 staff supporting investments in over 150 new startups every year. In 2020, SOSV has 8 general partners operating globally, with SOSV’s major offices in Shanghai, Shenzhen, Taipei, San Francisco, New York, Cork, and Tokyo.

Sean got his en...

2020-07-2500 min

SOSV Climate Tech PodcastLtM ep10 - How to Select Industrial Partners with Robert Gallenberger, Partner at btov PartnersFew VC funds focus on deep tech in industry, and few investors have a strong industrial background. Robert Gallenberger at btov Partners is one of those rare people. He invests across Europe where he sees an industrial renaissance based on the combination of fresh tech talent with industry veterans, and making use of the strong industrial base particularly in Germany, Switzerland and more.

This podcast is hosted by Benjamin Joffe, Partner at SOSV, a global early stage fund focused on deep tech. SOSV runs multiple accelerator programs including HAX...

2020-07-2034 min

Equity 101#39 Benjamin Joffe (SOSV) - Le playbook de l'investissement Hardware“Il y a beaucoup de raisons qui expliquent qu'un projet Hardware est plus complexe qu'un projet software; déjà cela implique plus de disciplines métiers et donc plus de compétences à rassembler dans une équipe de fondateurs (mécanique, électronique, design, software, supply-chain, manufacturing, sourcing, marketing…). Dans le logiciel on peut se permettre de lancer des produits qui ne sont encore tout à fait aboutis alors que dans le Hardware on n’a pas le droit à l’erreur. Enfin le coût d'entrée pour amener un projet Hardware sur le marché est plus élevé que dans le software”

S’...

2020-07-0556 min

SOSV Climate Tech PodcastLtM [SPECIAL] - Deep Tech Startups vs Covid-19 with Khosla Ventures, Fifty Years and SOSVThis is a a live panel ran by SOSV to introduce and discuss solutions funded by some of the most active investors in deep tech startups fighting Covid-19.

Each of the three funds (Fifty Years, Khosla Ventures, SOSV) published an impressive list of their relevant portfolio startups.

IndieBio even made a call to fund Covid-fighting startups as part of its newly launched NYC program.

Here are the full video and slides.

If you’d like to know about future events, follow us on Twitter at @SOSV or sign up to our newsletter.

This podcast is hosted by...

2020-06-0845 min

SOSV Climate Tech PodcastLtM ep7 - The State of Investment in Deep Tech with Leslie Jump and Mack Kolarich from DifferentLeslie Jump is the CEO and Mack Kolarich the CPO of Different, an organization that helps institutions and family offices discover, analyze, diligence, and select venture capital funds.

They recently completed a remarkable DeepTech Investing Report based on more than 150 interviews with VCs, LPs and other stakeholders.

The report was funded by Schmidt Futures, a philanthropic vehicle created by former Google & Alphabet Chairman Eric Schmidt and his wife Wendy to “advance society through technology, inspire breakthroughs in scientific knowledge, and promote shared prosperity”.

Prior to Different, Leslie and Mack had diverse experiences including founding and inve...

2020-05-1959 min

Wish I'd Known ThatSuccess and Pitfalls of A StartUp From An Investor, With Benjamin Joffe, Partner at SOSVBenjamin Joffe is a partner at SOSV, a venture capital accelerator and the world's number one global investor in hardware startups. Ben uses his expertise in marketing and strategy to help startups go from the initial stage to being fully functional. He has worked with over 200 companies through the investment phase and is a frequent speaker at leading tech conferences. Ben is a guest writer for Forbes, TechCrunch, and VentureBeat, and he has also made appearances in several other magazines such as The Economist, Wired, Nature, and more. In this episode… In the last five ye...

2020-05-1445 min

SOSV Climate Tech PodcastLtM ep6 - Sota Nagano, Partner at Abies Ventures, on Japan's Deep Tech SceneSota Nagano is a Partner at Abies Ventures, a $40m early stage deep tech fund based in Tokyo backed by Taizo Son, a billionare active tech investor, and younger brother of Masa, creator of the famous Vision Fund.

Abies Ventures invests in Japan and abroad in industrial tech,

But also opportunistically in multiple sectors including advanced sensors, space tech and life sciences.

Prior to Abies, Sota studied in the US and Italy, worked on Wall Street. He then co-founded an automotive engineering startup named GLM, which Financial Times called Japan’s Tesla, and which he...

2020-05-1223 min

Project MedtechEpisode 1 | Duncan Turner, General Partner, SOSV & Managing Director, HAX | What He Looks For Before Investing in a CompanyThe host, Duane Mancini sits down for an interview with Duncan Turner. Duncan discusses what he looks for before investing in a company, what kind of companies he is looking for, common mistakes investors make in pitch sessions, and more.

Duane Mancini – https://www.linkedin.com/in/duanemancini

Duncan Turner - https://www.linkedin.com/in/duncan-turner-b08630/

SOSV - https://sosv.com/

2020-05-0858 min

SOSV Climate Tech PodcastLtM ep5 - Seth Bannon, Founding Partner at Fifty Years on How Science Startups Build the FutureSeth Bannon is the Founding Partner of Fifty Years, a $50m early stage deep tech fund.

Seth is a long-time advocate and campaigner, who turned to technology and investment to solve the world’s biggest problems around sustainability, food, and the digital divide.

A graduate of Y Combinator, Seth was named twice to the Forbes 30 Under 30 list for Social Entrepreneurship.

Seth believes business will be about more than just profit (more here), and Fifty Years has supported a range of startups shaping the world for the better — from microbe engineering for sustainable chemistry, to small satellites for low-cost global i...

2020-05-0653 min

SOSV Climate Tech PodcastLtM ep4 - Kelly Chen, Partner at DCVC on Investing in Old School Industries and Fundamental Demographic and Labor ShiftsKelly Chen is a Partner at DCVC — a US-based venture fund founded in 2011 that raised $725 million in November 2019 to invest mostly in deep tech.

Kelly is a China-born New Yorker now based in SF, who graduated from Columbia Engineering and Wharton with a focus on finance algorithms and manufacturing operations. She worked as a fixed income trader who started angel investing actively and eventually dived into venture capital.

DCVC has invested in Agtech, Advanced manufacturing, biology and even space tech. Kelly focuses on the transformation of manufacturing, logistics and apply chain with automation and AI.

T...

2020-04-2935 min

SOSV Climate Tech PodcastLtM ep3 - Manish Singhal, Managing Partner of Pi Ventures on India's Deep Tech SceneManish Singhal is the founding partner of pi Ventures, a $30 million early stage deep tech fund based in Bangalore. Before founding Pi Ventures in 2016 as one of the very first AI-focused funds, he has worked for over 2 decades in R&D, product and general management roles in global companies creating video technologies and consumer electronics, including Motorola and Sling Media.

This podcast is hosted by Benjamin Joffe, Partner at SOSV, a global early stage fund focused on deep tech. SOSV runs multiple accelerator programs including HAX (intelligent hardware) and IndieBio (life sciences).

In this episode...

2020-04-1334 min

SOSV Climate Tech PodcastLtM ep2 - John Ho, Partner at Anzu Partners on Investing In Industrial TechnologiesJohn Ho is a Partner at Anzu Partners, a US-based $190 million venture capital and private equity fund focused on breakthrough industrial technologies. John is a Computer Science and Electrical Engineering PhD from MIT, and long-time Bostonian, who worked in industry and management consulting.

This podcast is hosted by Benjamin Joffe, Partner at SOSV, a global early stage fund focused on deep tech. SOSV runs multiple accelerator programs including HAX (intelligent hardware) and IndieBio (life sciences).

In this episode, John talks about:

The reasons for their focus on industrial tech

2020-04-1331 min

SOSV Climate Tech PodcastLtM ep1 - Matt Clifford, Cofounder of Entrepreneur First on Investing in Deep Tech the Lean Startup WayMatt Clifford is the co-founder and CEO of Entrepreneur First. EF helps create deep tech startups by attracting exceptional talent, and having them go through a unique program to create teams, identify real problems, and fund the most promising ones. SOSV has funded several EF graduates (and likely more to come).

This podcast is hosted by Benjamin Joffe, Partner at SOSV, a global early stage fund focused on deep tech. SOSV runs multiple accelerator programs including HAX (intelligent hardware) and IndieBio (life sciences).

In this episode, you will learn about:

1. The Origins...

2020-04-0241 min

Sesame Asie#2 Asie: Benjamin Joffe [SOSV] Investissement, Hardware Startup, Thought LeadershipPasser 18 ans en Asie et rejoindre un fond d'investissement US avec 750M en management

Si vous aimez ce podcast, merci de le rendre possible en le supportant sur Patreon

Dans cet épisode, Benjamin Joffe nous raconte ses presque 20 ans passés dans pas moins de cinq pays d’Asie: Japon, Corée, Chine, Hong Kong et Singapore.

Il nous explique comment profiter aux mieux de son expatriation, s’intégrer dans la vie locale, se faire des amis, pratiquer des activités (en l’occu...

2020-03-261h 28

RareBirds Emerging Markets PodcastSeries 2 Broken Worlds Thinking: Understanding the Investment Landscape Episode 106 with China-based Ethiopian-American Hiruy EphremWelcome to series 2 whereby I speak to three young Ethiopian men on topics which require broken worlds thinking. The first in the three part series is episode 106 with Hiruy Ephrem. Hiruy shares with us investing basics from his experience of working with investors in the startup ecosystem. Hiruy is an Ethiopian-American from the Washington D.C. area and is currently based in Shanghai working as an Investment Analyst for Sean O’Sullivan Ventures; also known as SOSV. SOSV is dubbed as "The Accelerator VC" deploying its capital through its network of 7 accelerators around the world. Over the pa...

2020-01-131h 25

RareBirds Emerging Markets PodcastSeries 2 Broken Worlds Thinking: Understanding the Investment Landscape Episode 106 with China-based Ethiopian-American Hiruy EphremWelcome to series 2 whereby I speak to three young Ethiopian men on topics which require broken worlds thinking. The first in the three part series is episode 106 with Hiruy Ephrem.

Hiruy shares with us investing basics from his experience of working with investors in the startup ecosystem. Hiruy is an Ethiopian-American from the Washington D.C. area and is currently based in Shanghai working as an Investment Analyst for Sean O’Sullivan Ventures; also known as SOSV. SOSV is dubbed as "The Accelerator VC" deploying its capital through its network of 7 accelerators around the world. Over the past 2...

2020-01-131h 25

Republic Of WorkEpisode #6: Stephen McCannThis week we welcome Stephen McCann. Stephen is General Partner and CFO at SOSV and oversees the Cork, Ireland office. He is responsible for the strategy and execution for all of SOSV’s financial, investment and legal operations. With deep experience working with startup companies, he enjoys solving complex business challenges and enabling startups of all sizes to thrive, and is an active mentor to the 500+ companies in the SOSV portfolio.

2019-10-081h 02

Republic Of WorkEpisode #6: Stephen McCannThis week we welcome Stephen McCann. Stephen is General Partner and CFO at SOSV and oversees the Cork, Ireland office. He is responsible for the strategy and execution for all of SOSV’s financial, investment and legal operations. With deep experience working with startup companies, he enjoys solving complex business challenges and enabling startups of all sizes to thrive, and is an active mentor to the 500+ companies in the SOSV portfolio. Hosted on Acast. See acast.com/privacy for more information.

2019-10-081h 02

Asia Startup PulseChina’s Role in 4 Investment Areas with Sean O’Sullivan, Managing General Partner of SOSVHappy New Year everyone! Today we invited Sean O’Sullivan, Founder and Managing General Partner of SOSV, the fund behind Chinaccelerator, to start the Year 2019 for China Startup Pulse and our listeners. In this episode, Sean shared his experience in China and provided his analysis of the investment trends in biotech, food tech, hardware, and software areas. Also, he pointed out the role of China in the global technology ecosystem and the impact that US-China trade war will have on startups and investors.

Sean’s entrepreneur life started in 1985 as a founder of MapInfo, bringing street mapping tech...

2019-01-0332 min

The Hardware Entrepreneur#061 - RERUN - How to avoid mistakes when building a team - lessons from mentoring 1200+ hardware entrepreneurs, with Alan Clayton of SOSVThis is a rerun episode after one month of no publishing. As mentioned in the last episode, I changed the publishing frequency to monthly. Why am I doing now a re-release of a past episode? Perhaps you’ve seen the recent report by HAX, the hardware accelerator based in Shenzhen, China and in San Francisco: their first hardware report in 2018. In the report they mentioned the importance of a great team when building a company and immediately this past episode with Alan Clayton came up in my mind, who’s the person assessing hardware startup teams’ healths. Since this is a v...

2018-08-2943 min

The Hardware Entrepreneur#061 - RERUN - How to avoid mistakes when building a team - lessons from mentoring 1200+ hardware entrepreneurs, with Alan Clayton of SOSVThis is a rerun episode after one month of no publishing. As mentioned in the last episode, I changed the publishing frequency to monthly. Why am I doing now a re-release of a past episode? Perhaps you’ve seen the recent report by HAX, the hardware accelerator based in Shenzhen, China and in San Francisco: their first hardware report in 2018. In the report they mentioned the importance of a great team when building a company and immediately this past episode with Alan Clayton came up in my mind, who’s the person assessing hardware startup teams’ healths. Since this is a v...

2018-08-2943 min

Asia Startup PulseHow to build a Star Trek team with Alan Clayton, Roaming mentor of SOSVAre you struggling to form a team and curious what influence team dynamics?

Alan Clayton, roaming mentor of SOSV took us through a journey on team building, diversity and people development. Having worked with over 700 startups analysing the relationship between founders and how a diverse set of founders attribute to the future success of the company, Alan provided us some deep insights into the important elements on building and maintaining a functioning team.

Feel free to leave a comment and start a conversation with us! If you have an ideal guest whom you would like to...

2018-05-0230 min

The Hardware Entrepreneur#043 - How to avoid mistakes when building a team - lessons from mentoring 1200+ hardware entrepreneurs, with Alan Clayton of SOSVMy guest is Alan Clayton of SOSV, who’s the Roaming Mentor at the VC and who’s been with the company since the beginnings. You might know as SOSV as it’s the world’s top hardware VC. They’re special also in another aspect as unlike other VCs, SOSV runs accelerator programs, such as HAX, HAX Growth, RebelBio, IndieBio, Food-X, Chinaaccelerator, MOX. They are understandably very tech-focused and Alan Clayton is the person who understands people. This means he makes sure you have the right team to deliver the right results as otherwise things can and if the...

2017-12-0642 min

The Hardware Entrepreneur#043 - How to avoid mistakes when building a team - lessons from mentoring 1200+ hardware entrepreneurs, with Alan Clayton of SOSVMy guest is Alan Clayton of SOSV, who’s the Roaming Mentor at the VC and who’s been with the company since the beginnings. You might know as SOSV as it’s the world’s top hardware VC. They’re special also in another aspect as unlike other VCs, SOSV runs accelerator programs, such as HAX, HAX Growth, RebelBio, IndieBio, Food-X, Chinaaccelerator, MOX. They are understandably very tech-focused and Alan Clayton is the person who understands people. This means he makes sure you have the right team to deliver the right results as otherwise things can and if the...

2017-12-0642 min

Harbinger AsiaHow China's Internet Economy Evolved - with Chinaccelerator MD William Bao BeanWilliam Bao Bean is General Partner at SOSV, a $300m venture capital fund known as “the Accelerator VC” with a >30% net realized IRR. He is also the Managing Director of Chinaccelerator, SOSV’s global Internet accelerator and the first accelerator in China, as well as MOX, the mobile only accelerator platform with 130m smartphone users in SE Asia. William has spent the past two decades in Asia \and has a breadth of experience that covers not only the rise of China's original tech giants (BAT), but also core movements including: O2O, entertainment, sharing economy, social commerce and more. We'll cover...

2017-10-1532 min

Between WorldsWilliam Bao Bean on messaging, chatbots and other secrets of the Chinese digital ecosystemI met William almost ten years ago when he was a technology analyst in Hong Kong, and I was consulting for Star TV. The Chinese Internet was already rapidly evolving then, and now, a decade later, the combination of a sophisticated technology, a mobile-first culture and relative isolation behind a national firewall, has led to a vastly different digital ecosystem. Based in Shanghai, William is now an Investment Partner at SOSV and the Managing Director of Chinaccelerator. William joined SOSV from SingTel Innov8 where he was the Managing Director supporting China investment activities. Previously William was a Partner at Softbank...

2017-06-1831 min

Flyover Labs PodcastArvind Gupta, General Partner at SOSV, Founder of IndieBio - InterviewA great interview with Arvind Gupta, General Partner at SOSV and Founder of IndieBio.

2017-04-2600 min

Asia Startup PulseInvesting in Humanity - with Sean O'Sullivan, Managing Director of SOSV the Accelerator VCA treat for the China Startup Pulse as we welcome the man behind one of the most successful VC funds in the world. Sean tells us about his passion for music, engineering and humanitarian work as well as MapInfo, Sean's first start-up that put street mapping on personal computers (that subsequently went IPO).

Sean talks about his experience launching Chinaccelerator, the first start-up accelerator in China and his broader goals with SOSV. Innovating on previous VC models, Sean launched a series of global accelerators and is a key industry thought leader and investor in entrepreneurial ecosystems.

2016-03-1537 min

Asia Startup PulseHow to enter China – Everything about China’s startup ecosystem and VC scene with William Bao Bean of SOSV & ChinacceleratorCheck out our latest episode with William Bao Bean, a Partner at SOSV and the Managing Director of Chinaccelerator, the first startup accelerator in the East and sponsor of China Startup Pulse.

William shared his insights on the startup and investment scene in China and what it takes for foreign or global startups to succeed in China. We also discussed WeChat being a useful tool to engage customers or users with very low acquisition cost. This is a must-listen episode for those of you who are trying to understand what’s really going on here and how it is different fr...

2015-11-1947 min