Shows

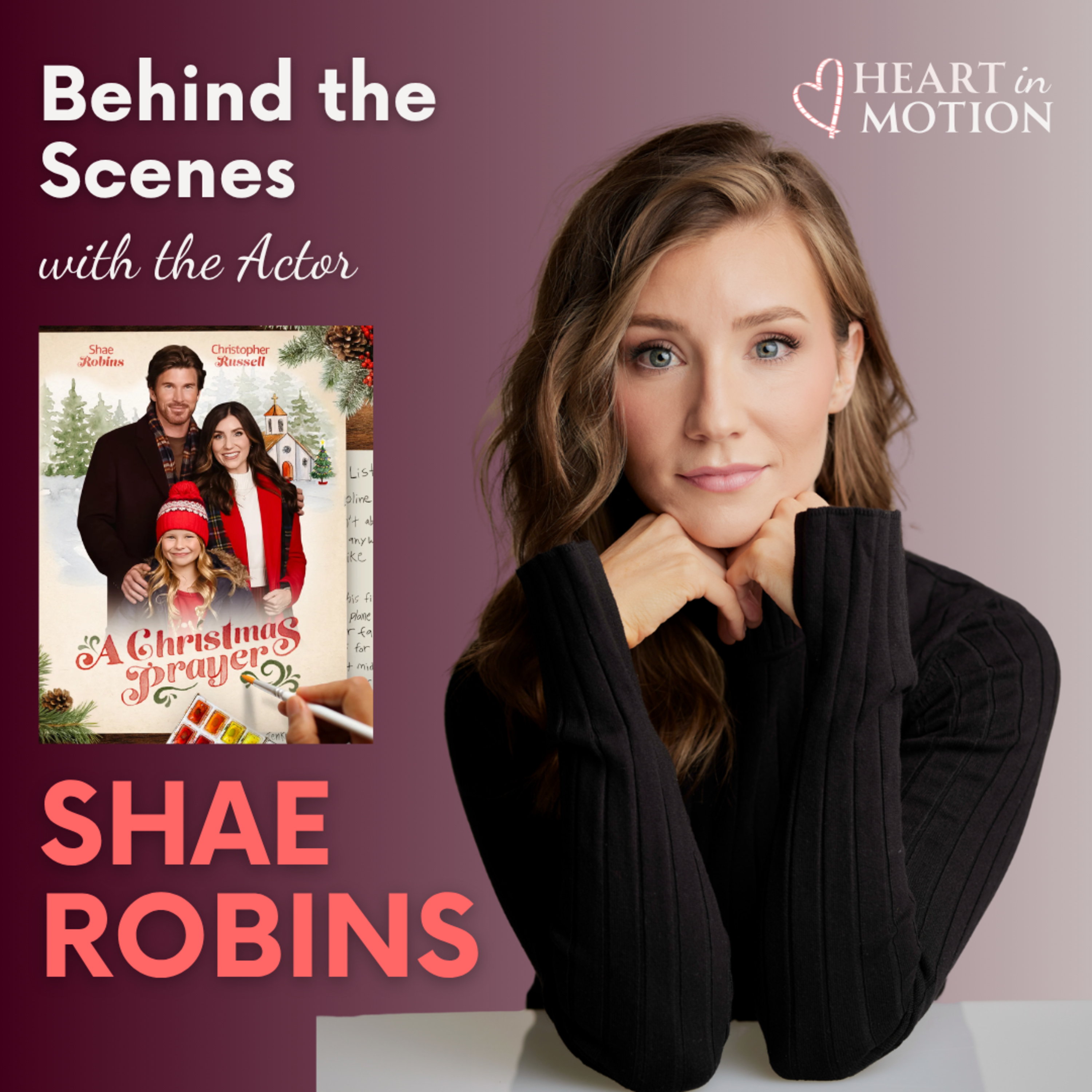

Heart in Motion Podcast: Celebrating Stories that Move UsShae Robins (A Christmas Prayer - Actor)I sat down with actress Shae Robins to dig into her journey—from making Christmas films on Great American Family, to stepping into the role of Natalie in A Christmas Prayer alongside Christopher Russell.In this conversation:- How Shae found her way into holiday-movies and what drew her to this particular project.- Who Natalie really is, how Shae brought pieces of herself into the character, and the emotional arc that carries through the story.- The dynamic with co-star Christopher Russell, playing a widower seeking new beginnings, and how that balances with Natalie’s path of healing and...

2025-10-1838 min

Stars of Big Sky CountryShae Sweeney (C. M. Russell Rustlers)Episode 10 takes us to the soccer pitch for the first time as Richard sits down with CMR goal keeper, Shae Sweeney!She discusses her soccer career with the Rustlers, her recent signing with @avila_wsoc, and her decision to leave home to continue her soccer career and get a jump start on her PROFESSIONAL career!That and more on Stars of Big Sky Country!Presented by:-Russell Country Federal Credit Union-Mars of Great Falls-Burger Bunker-Schulte's 38th Street Store-Stadium Sports Bar & casino-Spirit of Design Salon

2025-03-1328 min

The Pod of GoldNavigating Market Volatility: Short-Term Downside and Long-Term Upside for GoldIn this episode of The Pod of Gold, host Shae Russell and Nicholas Frappell, Global Head of Institutional Markets at ABC Refinery, delve into the recent market volatility and its impact on gold.

They discuss the factors driving recent market events, including significant changes in non-farm payrolls and the Bank of Japan's rate hike.

Nicholas provides a detailed analysis of gold's performance, technical indicators like the Ichimoku Cloud and Point and Figure charts, and the broader macroeconomic influences affecting gold prices.

Tune in to gain insights into the short-term downside and long-term upside...

2024-08-0720 min

The Pod of GoldGold's Consolidation and the Impact of a Strong DollarIn this episode, Nicholas Frappell and Shae Russell delve into gold's recent consolidation, the impact of a strong dollar on Asian currencies, and the effects of market narratives on the yellow metal.

They also explore the implications of US non-farm payrolls, China's pause on gold purchases, and the ongoing expectations around Fed rate cuts.

Finally, they touch on Japan's economic policies and the broader implications for global markets.

PODCAST INFO:

ABC Refinery website: https://www.abcrefinery.com/podcast

Nick Frappell: https://twitter.com/nick_frappell

Shae Russell: https://twitter.com/shaearussell

OUTLINE: Here's the timestamps for the episode. On some podcast players you should be able to click the ti...

2024-06-2721 min

The ShaeMac ShowLet's Take It To Barclay's! [Russell Steinberg from ClutchPoints]SHAE was joined by WNBA media personality, New York Liberty beat reporter and writer Russell Steinberg from ClutchPoints as joined the show the break down the 2024 WNBA season, along with things such as expectations for the season, Ionescu + Stewart connection. Jonquel Jones, and more. Tune into this episode to hear what he has to say,

[Some parts were cut out due to technical difficulties, sorry for the inconvenience]

For more content, follow the show now on social media:

Instagram: https://www.instagram.com/theshaemacshow

X (formerly...

2024-06-2029 min

Cocktails and CommoditiesLincoln Minerals: The graphite winter is almost overIn this episode, Julian Babarczy, non executive director of Lincoln Minerals, explains why graphite is unloved, but that’s where the long term opportunity is.

3:29 – Prefers the less crowded trades

7:03 – The graphite winter is nearly over

9:02 – No longer a one project company

12:11 – Reshoring battery mineral supply chains

17:21 – Bullish on most commodities

22:26 – Embracing the long term investment cycle

25:43 – A twist on a margarita

If you’d like to learn more about Lincoln Minerals, go here: lincolnminerals.com.au

2024-05-0626 min

Cocktails and CommoditiesEarths Energy: Hot rocks can power AustraliaBlurb: In this episode, Matt Kay, managing director of Earth Energy (ASX:EE1) explains how we can embrace geothermal energy even though Australia isn’t on the ring of fire, why their projects run through ‘mining central’ and

how geothermal energy use could one day outstrip nuclear energy globally.

Timestamps:

(1:30) Don’t need the ring of fire anymore

(3:51) Trying to get to net zero

(5:10) Tenements along ‘mining central’

(11:10) Geothermal energy use may outstrip nuclear power world wide

(16:20) Three events to watch for this years

(18:28) Great minds think...

2024-04-1919 min

Cocktails and CommoditiesWest Wits Mining: Is the ASX’s next gold producer?Eight weeks to production. Six months to revenue. An AISC half of the spot price of gold. In this episode Michael Quinert, chairman of West Wits Mining, says the company is already stockpiling ore on the pad, how they plan to mine 200,000 ounces of

gold per annum and the trigger that could see the share price rise.

(1:59) Eight weeks to production, six months to revenue

(6:50) ‘Project 200’

(10:34) Bird Reef package has gold and uranium

(13:59) Site well powered (unlike parts of the outback…)

(17:09) Exploring the Patterson region with Rio

(21:22) A single malt

2024-04-0124 min

Cocktails and CommoditiesJim Rickards: The Fed is out of rabbitsIn this episode, economist and geopolitical expert Jim

Rickards why the market needs to stop banking on more than one rate cut from the Fed, how Wall Street has been wrong for two years and the looming threat of

commercial property held by the banks.

Timestamps:

(2:30) – How does the market continue to get the Fed wrong

(8:00) – How a 3% inflation halves in value in three years

(12:03) – Central banks rarely do anything quickly

(18:30) – Inflation: Supply chain driven or easy money?

(27:30) – A glut of commercial property

(33:50) – “You’re out of rabbits”

...

2024-03-1958 min

Cocktails and CommoditiesCallum Newman: “I’m super bullish on small caps”“I’m super bullish on small caps…now is the time to do your homework”.

In this episode Callum Newman, small cap specialist from Fat Tail Investment Research, joins the podcast to talk how iron ore producers are ‘mining money’, why ‘less bad’ news has been boosted the small cap sector, how “risk-on” is back and there’s plenty of quality resource stocks ready to boom.

Timestamps:

(2.23) Making a buck from the volatile small cap sector

(4:45) Small caps: Will they be the ‘bounce back belters’ of 2024?

(8:56) The reflation trade and less bad news

...

2024-03-1139 min

Cocktails and CommoditiesBrent Cook: True exploration requires patience, time, and money.In this episode, veteran economic geologist Brent Cook explains

why exploration is slow as a company ‘build’s a scientific case’, be careful what fin-influencers you follow and what key information investors need to know before buying exploration stocks.

(1:10) ‘Turning rocks into money’

(5:11) Stop drilling for news, drill for discovery

(9:01) True exploration requires patience, time and money.

(12:50) The essence of exploration

(18:12) Climate change: The multi trillion investment opportunity coming our way

(23:17) Geopolitics and mining

(26:20) The more holes you dig the more you know

(30:00) A guest wh...

2024-02-2831 min

Cocktails and CommoditiesChris Judd on rocks, stocks and kicking investing goalsIn this episode, former professional athlete now Cerutty Macro

Fund’s portfolio manager, Chris Judd joins Shae Russell to talk about Cerutty view gold as a currency, why uranium is looking a little bubbly and the enormous potential in tin.

(2:35) Leaning a new trade

(4:27) How a share magazine from the 1990s blossomed into an

investing career

(6:28) ‘Fish where other people aren’t fishing’

(9:12) Why Cerutty views gold as a currency

(12:30) Not your average investment partner

(16:44) Tolerating volatility for (hopeful) long term rewards

(24:02) Being socially mindful regardin...

2024-02-1332 min

Cocktails and CommoditiesGreenwing Resources: Breaking new ground in the Lithium TriangleToday, Rick Anthon and Peter Wright join Cocktails & Commodities to discuss the San Jorge Lithium Project located inside Argentina’s famous lithium tringle. San Jorge has never been explored and the team explain how drilling on the edge of the salar suggests the project is even bigger than they first thought.

Timestamps:

(1:52) Sorting your brines from your spodumenes

(4:19) What is the ‘Lithium Triangle’?

(8:30) Enormous structural changes happening which will increase lithium demand

(12:09) Excellent ground crew at San Jorge

(15:30) Maiden exploration suggests the best is yet to come

...

2024-02-0128 min

Cocktails and CommoditiesUranium bulls charge ahead...but how high will the price go?Resource news in under 15 minutes: Four weeks into the new

and commodity prices are on the move. Gold is trapped as the markets bet the farm on rate cuts, nickel dives so hard it knocks out Twiggy, the uranium bull charges ahead and what’s on your barbie this long weekend?

Timestamps:

(0:53) Gold's movements remain tied to Fed actions

(2:39) Crashing nickel prices takes out industry giants

(8:12) Uraium spot prices soar past US$100 per pound

(10:53) Will lamb prices rebound in 2024?

(13:43) Let's chat

...

2024-01-2714 min

Cocktails and Commodities"You don’t have to fall in love with the frog"…and other commodity exploration lessons from a geologist.On Air at IMARC: Kicking off the new year, Hedley Widdup from Lion Selection Group joins Shae Russell at IMARC 2023. Together they discuss why explorers should be nimble, how one company’s hype faded when it collided with reality and what's the time on the famous Lion Selection clock…

Timestamps:

1:17 – The resource industry is optimistic, but stocks struggle to catch a bid

5:44 – “You don’t have to fall in love with the frog”

9:37 – Getting it wrong: when hype and reality collide

16:02 – Sell half: “You won’t die wondering, but you won’t go broke eit...

2024-01-1836 min

Cocktails and CommoditiesHexagon Energy: Helping Australia become a clean energy super powerIn this episode, Stephen Hall, CEO of Hexagon Energy Ltd [HXG] explains the role blue ammonia will play in reducing carbon emissions, how Japan is kick starting a new industry in Australia and why Hexagon’s WAH2 Project ticks all the infrastructure boxes.

Timestamps:

(1:30) Low carbon intensity ammonia

(4:21) Old world chemical can work for future decarbonisation

goals

(7:10) Hydrogen at present has limitations ammonia doesn’t

(9:09) History repeats: Japan to build a new energy industry in Australia once again

(13:07) Strategic overview of Australia’s energy goals

(17:30) WAH2 P...

2023-12-2225 min

Cocktails and CommoditiesLotus Resources: Uranium soars as supply gap loomsIn this episode, Keith Bowes, managing director from Lotus Resources Ltd [ASX:LOT] jumps on the mic to talk about the rising uranium spot price, a looming supply gap and possible production by 2025.

Timestamps

(0:54) – Spot uranium at the highest price since 2008

(2:30) – Merger gives Lotus Resources, large, multi decade uranium assets

(5:19) – Kayelekera will be a low cost uranium producer

(7:33) – Looming uranium supply gap from 2025

(14:10) – Investing in grid infrastructure for Kayelekera

(18:45) – Big exploration opportunities to expand mine life

(22:20) – A proactive approach to working with local communities

2023-12-2027 min

Cocktails and CommoditiesWildcat Resources: From micro-cap stock to billion dollar beast'It's a premium project'.

Sam Ekins from Wildcat Resources joins Cocktails & Commodities to discuss the Tabba Tabba lithium project in the Pilbara, how 'Leia' changed the companies fortunes and why the full potential of Tabba Tabba is still to be revealed.

Timetamps:

(1:03) – What is spodumene?

(5:06) – Pilbara now a major hard rock lithium district

(7:35) – ‘May the force be with you’ – Tabba Tabba’s secret code names

(9:02) – The forgot child of Sons of Gwalia

(11:25) – Thirty eight pegmatites to mapped at surface

(13:22) – Potential for a top ten global ore body

(14...

2023-12-1626 min

Cocktails and CommoditiesOPEC can't prop up oil prices...and why copper will flip to a deficit in 2024Resource news in under 20 minutes: Gold screams higher and lands back with a thud, what does this mean for future gold prices? Metals bounce around as Chinese stimulus

whispers nudge prices north, OPEC cuts again yet crude still falls and China

follows through on its graphite export controls.

Timestamps:

(1:02) – Gold’s hits a new high in all but one currency

(2:32) – Fed speaks, gold reacts…but aggressive rate cuts may not happen

(7:11) – Copper supply flips to a deficit & restocking of steel drives iron ore higher

(11:21) – OPEC cuts…yet prices still fell

(1...

2023-12-1418 min

The Pod of GoldGold's bold move, but where to next?In this episode Nicholas Frappell covers the gold’s all time high, price retreat and what targets to look for as the price settles.

Why the US data released later this week will determine the outlook going into 2024 and what the Taylor Rule says about the Federal Reserve Bank’s current rate settings.

PODCAST INFO:

ABC Refinery website: https://www.abcrefinery.com/podcast

Nick Frappell: https://twitter.com/nick_frappell

Shae Russell: https://twitter.com/shaearussell

OUTLINE: Here's the timestamps for the episode. On some podcast players you should be able to click the timestamp to jump to that time.

(0:00) – Intro

(0:55) – Gold hits a high

(1:20) – What drove gold higher

(4:25) – Th...

2023-12-0622 min

Cocktails and CommoditiesClyde Russell: ‘Would Rio have blown up the caves? Probably not.’In this episode, Reuters commodities analyst, joins Shae Russell to discuss why iron ore and copper rely on Chinese news for movement, what would it take for Australia to grow a downstream industry, plus after nine years in government why only now is the Coalition insisting Australia build a nuclear industry…and more importantly, what would it take to create one.

Timestamps

(1:01) - Metal prices are jumping at shadows

(3:55) – There’s no big bang stimulus from China

(7:00) – The two things holding back Australia’s downstream sector

(14:23) – What’s really holding back A...

2023-12-0141 min

Cocktails and CommoditiesNicholas Boyd-Mathews: Change must start at the topOnAir @ IMARC: Nicholas Boyd-Mathews, chief investment

officer from Eden Asset Management joins Shae Russell to tackle some difficult topics. Nick doesn’t hold back when it comes to addressing gender diversity in boardrooms across funds managers and resources companies, why ESG will become

increasingly important to fund managers in the years ahead and there is no consensus on what ‘long term investing’ is.

(0:59) – Do Exchange traded funds (ETFs) create lazy investors?

(4:08) – If women are proven to be better investors, where are all the female fund managers?

(9:30) – When ethics and investing collide

(15:39) – ESG will becom...

2023-11-2430 min

The Pod of GoldGold rally heads north but will momentum keep it there?In this week's Pod of Gold episode, Nicholas Frappell covers gold’s potential double top, the exuberance behind the recent bond rally and has the Fed reached its terminal

rate?

PODCAST INFO:

ABC Refinery website: https://www.abcrefinery.com/podcast

Nick Frappell: https://twitter.com/nick_frappell

Shae Russell: https://twitter.com/shaearussell

OUTLINE: Here's the timestamps for the episode. On some podcast players you should be able to click the timestamp to jump to that time.

(0:00) – Intro

(1:20) – How likely is a Fed rate cut?

(3:43) – Gold jumping to US$2000/oz?

(6:28) – Geopolitical vulnerabilities

(7:11) – Gold's war premium

(8:08) – How is managed money buying gold?

2023-11-2329 min

Cocktails and CommoditiesIs chocolate now a luxury? Plus what every new uranium investor needs to knowResource news in 15 minutes (Mmm, we're a little bit over but it's worth it): In this episode Shae Russell discusses why your average chocolate block is about to cost a whole lot more, crude prices reliant on OPEC moves and some decisions from Saudi Arabia suggest the oil market isn’t as robust as they’d like us to believe, what’s really pushing gold higher when perhaps it shouldn’t be up and we hear from Ilala Metals on the three most common uranium ore bodies.

Timestamps

(1:00) – Is gold overvalued right now?

(6:21) – Headwinds re...

2023-11-2017 min

The Pod of GoldThe ‘war premium’ versus gold’s fair valueIn this week's Pod of Gold episode, Nicholas Frappell discusses the ‘war premium’ versus gold’s fair value, geographic threats around the Saudi peninsula, and how the ongoing Israel-Palestine conflict will impact gold prices going forward.

Recorded at the International Mining and Resources Conference (IMARC)

PODCAST INFO:

ABC Refinery website: https://www.abcrefinery.com/podcast

Nick Frappell: https://twitter.com/nick_frappell

Shae Russell: https://twitter.com/shaearussell

OUTLINE: Here's the timestamps for the episode. On some podcast players you should be able to click the timestamp to jump to that time.

(0:00) – Intro

(0:35) – Gold technical price targets

(1:30) – Downside targets

(2:09) –...

2023-11-1319 min

Cocktails and CommoditiesThe only ratio that matters for gold“Back in the day if you couldn’t see it, you couldn’t mine it”.

Sean Russo, managing director of Noah’s Rule joins Cocktails & Commodities. In this episode, Sean revisits ‘the last of the

chalkies’, the impact the newly floated Aussie dollar had on gold miners hedging books, two key processes which transformed Australia’s gold mining industry and why the purple patch is the sweet spot for gold investors.

(1:52) – Starting out when Alan Bond ruled the gold sector

(4:00) – The last of the ‘chalkies’

(6:40) – How Australia became a gold mining behemoth

(10:17) –...

2023-11-1244 min

Cocktails and CommoditiesPatagonia Lithium: Moving from megawatts to terawattsOnAir @ IMARC: Phillip Thomas, executive director from

Patagonia Lithium joins Shae Russell to discuss the enormous amount of energy electric vehicle batteries will need, what China’s lithium stockpiling means for lithium supply and exploration in Argentina.

2023-11-0803 min

Cocktails and CommoditiesElementos Limited on tin: The glue holding electronics togetherOnAir @ IMARC: Joe David, managing director from Elementos Limited swung past the Cocktails & Commodities booth to cover why tin is a critical metal, its role in electronics with no viable substitute and the fundamentals pushing up tin demand while supply tightens.

2023-11-0706 min

Cocktails and CommoditiesGreenwing Resources: Securing graphite supply outside of ChinaOnAir @ IMARC: Peter Wright, executive director of Greenwing

Resources joins Cocktails & Commodities to discuss how graphite’s fundamentals are the same as lithium’s, the risk to the electric vehicle manufacturing if China cuts graphene, how Greenwing has quadrupled the project’s resource and Madagascar’s thriving mining economy.

2023-11-0605 min

Cocktails and CommoditiesAlligator Energy: The uranium resurgenceOnAir @ IMARC: Greg Hall CEO from Alligator Energy jumps on

the mic to discuss the uranium resurgence, the factors which have swung in nuclear energy’s favour and how Australia can shift nuclear energy sentiment out of the 1970s.

2023-11-0506 min

Cocktails and CommoditiesThese two metals should be on your buy list…and the most hated, yet profitable commodity trade around.‘Don’t conflate the energy transition with electric vehicles – the future is more bullish than we realise’.

Rick Rule jumps back on the mic for part two, where he covers

the fastest growing use for silver, vanadium’s role in the energy transition and why fossils fuels aren’t done yet.

0:50 – Silver versus coal – what’s the most hated commodity

4:49 – Coal produces raking in the profits but narrative drives investors away

7:25 – Understanding the silver fundamentals

13:12 – The fastest growing use of silver

14:15 – Vanadium’s place in the energy transition

19:17 – Th...

2023-10-2724 min

Cocktails and CommoditiesRick Rule: We’re at the front end of the exploration boomRick Rule joins Shae Russell to discuss the next generation of resource investors, why the uranium bull market still has room to run and the most hated commodity right now. Part two will play next.

1:41 – The next generation of investor

6:43 – Family offices increasingly fund new explorers

10:54 – Time in the market is better than timing the market

14:25 – Australia continues to benefit from the Inflation Reduction Act

18:53 – What happened to the long term investor?

22:23 – Uranium bull market here to stay

2023-10-2726 min

Cocktails and CommoditiesIltani Resources: Herberton's metal riches could run deepSilver at the surface, zinc in the middle and copper down below.

In this episode, Donald Garner, managing director of Iltanti Resources [ASX:ILT] explains the historical mining of the company’s Herberton project, it's sheer size and scale still to be revealed and why we need to explore for more base metals to make the energy transition happen.

Timestamps:

2:31 - Diverse projects and one with historic mining

5:22 – Herberton project full of critical minerals

8:14 – ‘Big’ system, potential for a high grade mineralisation

10:33 – Minerals stacked on minerals stacked on minerals

2023-10-2026 min

Cocktails and CommoditiesJervois Global: Wrestling specialty metals refining away from China one plant at a timeBlurb: In this episode, James May from Jervois Global explains

Finland’s role as a specialty metals refining hub outside of China, why being both miner and refiner allows the company to catch all parts of the cobalt supply chain and the company’s strategic move into nickel refining.

TIMESTAMPS:

1:19 - Jervois, Jervois or Jervois?

3:29 – Finland role as a specialty metals refining hub outside China

6:37 – Dig up rock, process rock, sell rock

8:54 – Capturing the whole value of the supply chain

13:37 – How the US’ Inflation Reduction Act helped

Australian investors

22:15 – The strategic move into nickel

24:29...

2023-10-1125 min

The Pod of GoldWhere the gold price heads nextIn this episode Nick Frappell discusses why gold's recent drop is the market accepting rates will be 'high for longer', why the Aussie dollar will remain under pressure for the foreseeable future and where gold might head to next.

PODCAST INFO:

ABC Refinery website: https://www.abcrefinery.com/podcast

Nick Frappell: https://twitter.com/nick_frappell

Shae Russell: https://twitter.com/shaearussell

OUTLINE: Here's the timestamps for the episode. On some podcast players you should be able to click the timestamp to jump to that time.

(0:00) – Intro

(0:38) – A correction from last week

(2:03) – Gold's recent price moves

(9:50) – Gold price targets

(13:23) – Interest rate...

2023-10-0534 min

Cocktails and CommoditiesThe perfect set up for uranium bulls arrives…Resources news in under 15 minutes (almost): In this episode

Shae Russell discusses gold’s drop as the Fed warns there’s another rate hike in the air, iron ore is at a five month high, Brent crude eyes off triple digit prices and uranium bulls unite.

0:51 – Gold falls but Asian bar demand is up

2:16 – Iron ore rallies on the stimulus fairytale

3:40 – ‘Only noise’ is needed to push crude to USD$100 per barrel

6:22 – September uranium rally a taste of what’s to come

7:40 – Uranium’s two prices

12:25 – The legacy clause sucking up

2023-09-2516 min

The Pod of GoldThe bulls push silver higher while gold holds ahead of FedIn this episode we discuss the short term road blocks for gold and why silver still has room to run higher. We cover what the Fed will do between now December and take a look at the why 10yr Treasury divestment is really about the negative carry trade.

PODCAST INFO:

ABC Refinery website: https://www.abcrefinery.com/podcast

Nick Frappell: https://twitter.com/nick_frappell

Shae Russell: https://twitter.com/shaearussell

OUTLINE: Here's the timestamps for the episode. On some podcast players you should be able to click the timestamp to jump to that time.

(0:55) – Spot gold bounces off US$1,904

(4:05) – Au trapped ahead of two major cent...

2023-09-2031 min

Cocktails and CommoditiesThe intricacies of agriculture: Home grown but vulnerable to a global priceSean Modd from Modd Co Capital is back on the mic for part two of our agriculture commodities chat. Today Sean talks about the risks of Ukraine swapping out wheat crops for sunflower seeds, why Russia needs the Odessa port, the two countries driving up Australia’s milk prices and the risks changing weather patterns mean for global agriculture.

Timestamps:

1:18 – The seaport favoured since Catherine the Great

5:50 – Ukraine may swap wheat for sunflower seeds this planting season

7:06 – Rising wheat prices have always led to a revolution

9:30 – Australia can feed itself but...

2023-09-1839 min

Cocktails and CommoditiesCGN Resources: Exploring Australia’s last mineral frontierIn this episode, Stan Wholley, managing director of soon to list CGN Resources, discusses why they’ve headed out to the West Arunta – one of the most remote places in Australia – to unearth a potential iron oxide copper gold deposit, plus while there CGN says the ground is also highly prospective for nick sulphides, a smattering of cobalt and even rare earths.

Timestamps:

2:23 – GCN Resources is new to the ASX but a decade in the making

5:19 – The West Arunta – Australia’s last frontier for major discoveries

8:40 – The new ‘elephant’ country

12:12 – Six target...

2023-09-1135 min

The Pod of GoldMarkets doubt hawkish Fed, but you should believe Powell. Plus, don’t get caught betting against China and where to next for gold.Recorded live at the Australian Gold Conference, Gold rallies but Managed Money isn't bullish, yet there's plenty of upside ahead for the yellow metal. Don't be too bearish on China just yet, the trade looks crowded and could surprise you. Plus Bank of Japan's yield curve control and how much lower will the Aussie dollar fall?

PODCAST INFO:

ABC Refinery website: https://www.abcrefinery.com/podcast

Nick Frappell: https://twitter.com/nick_frappell

Jordan Eliseo: https://twitter.com/jordaneliseo

Shae Russell: https://twitter.com/shaearussell

OUTLINE: Here's the timestamps for the episode. On some podcast players you should be able to click the timestamp to jump to that time.

(0:50) – US do...

2023-09-0426 min

Cocktails and CommoditiesThe humble chocolate bar may get VERY expensive…plus why Covid restrictions are still impacting food pricesRising food prices are here to stay, and it has nothing to do with central banks. Join Shae Russell and agricultural commodities trader

Sean Modd, of Modd Co Capital in this two-part ‘ag’s’ series. In part one, Sean and Shae discuss the volatility in tea prices, the insect born disease destroying orange crops and why the humble chocolate bar is about to get political.

Timestamps:

2:45 – How the financial crisis birthed an agricultural commodities trader

5:15 – Trading resources versus agriculture

8:42 – Cooking with Commodities meets Cocktails & Commodities

11:42 – We can’t blame central banks fo...

2023-09-0435 min

Cocktails and CommoditiesThe inflation problem the RBA didn’t see coming. Plus, gold falls, silver rises and one bank makes a contrarian call on oil…Resource news in under 15 mins: Property woes grip China, dragging the Aussie dollar down with it, but it’s not the only factor putting pressure on the currency. Gold heads south for the Australian winter yet copper and silver turn north. Plus, one bank makes a contrarian call on oil…

Timestamps:

0:35 - Gold heads south…will it retest US$1,840?

1:50 – Silver and copper move up on low stockpiles

3:54 – Oil bulls warn there’s an oil deficit coming

5:44 – One bank says the opposite…and that oil will see big falls next year

7:15 – Ch...

2023-08-2215 min

Cocktails and CommoditiesWhy the US-China tech war will boost this Aussie explorer...plus how the threat of industrial action has spooked gas markets.Resource news in under 15 mins: Rumblings in the LNG market could see natural gas prices double, gold dips and looks set to go lower, and China pursues the tech war with gusto but its recent announcement of export controls on semiconductor metals has had unintentional consequences.

Timestamps

0:34 – Gold dips as US inflation falls

2:24 – Strike action threatens gas prices

4:28 – No big bang for Chinese stimulus

5:54 – US locks China out of the computer chip market

7:40 – China hits back with export controls for two metals

8:55 – The unintended consequences of political...

2023-08-1413 min

Cocktails and CommoditiesThe silver renaissance: How this metal has morphed from a precious metal to a critical metal .Without silver, there’s no computers, no phone, no solar panels, or even light switches. The ‘other’ precious metal is both a commodity and a precious metal. Today, Andy Schectman, CEO of Miles Franklin Precious Metals joins Shae Russell as they discuss silver’s duality, the role it plays from green technology to military applications and why

one department warns silver may be the first element to be struck from the periodic table.

Timestamps:

2:33 – Understanding silver’s duality as a metal

4:21 – From green technology to military applications

8:08 – The 200 million ounce deficit

11:29 – ‘I...

2023-08-0927 min

Cocktails and CommoditiesWhy we need more of everything: More metals, more exploration, more funding and what the BRICS will do on August 22Resource news in under 15 minutes: Copper, tin and silver to name just a few metals are all in short supply, the best is still to come for mineral exploration, Jim Rickards on the rise of the BRICS power bloc, investing lessons from Rick Rule and too many stock holders are looking for quick gains and have forgotten patience required for long term gains.

Timestamps

1:09 – Spot silver falls…but we desperately need to find more

2:48 – Fed says there’ll be a soft landing, several others say a US recession is inevitable

4:18 – Crude rallies, co...

2023-08-0414 min

Cocktails and CommoditiesThe dirty word you can’t say anymore (but is playing pivotal role in funding energy transition projects)Dan Porter from Pure Asset Management comes back for the final installment, where he and Shae Russell discuss why incumbent energy systems don’t turn on a dime, how permitting and funding are slowing down the energy transition and the two critical minerals you must put on your watch list.

Timestamps

00:58 – The energy transition is about moving from ‘liquids to solids’

3:19 – To achieve any of the ESG requirements you need a lot more mining

4:16 – Permitting times for mining have blown out in the past decade

7:40 – Metals exchanges are drained of stockpiles

2023-07-3027 min

Cocktails and CommoditiesThe missing trillion dollars from the renewable energy equationDan Porter from Pure Asset Management joins Shae Russell in

part one of their two-part energy discussion. Today they cover the one trillion dollars not factored into the renewable equation, why crushing rocks need so much energy, the uncomfortable truth about coal, understanding our complex energy grid and how renewable energy fits into our existing distribution network.

Timestamps:

1:35 – From coal analyst to resource fund manager

4:32 – The ultimate contrarian indicator

5:36 – Why we rely on alternating current rather than direct current electricity

8:33 – Our centralised energy systems

11:23: - Solar energy is signi...

2023-07-2431 min

The Pod of GoldGold’s ‘Roaring 20s’ to continue strongToday we welcome special guest Jordan Eliseo, General Manager of ABC Bullion Australia to discuss the best gold event of 2023, what caused the gold price to pop higher and the technical indicators pointing to an uptrend in gold.

Plus! secure your ticket to ABC Bullion’s Precious Metals Forum 2023 ‘Gold & The Roaring 20s’

https://www.eventbrite.com.au/e/abc-bullion-precious-metals-forum-tuesday-22nd-august-ivy-ballroom-6pm-tickets-662647234717

Use code: PODOFGOLD for 20% off your ticket at checkout

PODCAST INFO:

ABC Refinery website: https://www.abcrefinery.com/podcast

Nick Frappell: https://twitter.com/nick_frappell

Jordan Eliseo: https://t...

2023-07-2119 min

Cocktails and CommoditiesHope isn’t an investment strategy: Why Chinese stimulus may fall short of market expectations.Resource news in under 15 minutes: Markets hinge on hope for Chinese stimulus but it may not come the way we remember it. Silver joins gold

and rallies higher, how a Floridian frost drove up the cost of breakfast and a major miner puts the spotlight back on graphite.

Timestamps:

0:38 – Disappointing Chinese data leaves markets hoping for stimulus that may never come

3:03 – Gold reaches a five week high

4:22 – Silver breaks through past resistance

5:03 – Coppers moves higher on stockpile concerns

5:45 – Are traders becoming bullish on oil?

7:09 – Orange juice rallie...

2023-07-1914 min

Cocktails and CommoditiesThe wall of money behind renewable energy and two minerals set to benefit from itRecorded live at the Mines & Money Connect Melbourne conference

on June 15: Lowell Resources Fund chief investment officer John Forwood, joins Shae Russell to discuss the hidden costs impacting commodity prices, how the US Inflation Reduction Act will benefit ASX explorers and the two metals all investors should put on their radar.

Timestamps

1:22 – Three things impacting commodities right now

2:25 - Breaking down the moving parts within ESG

5:48 – The underinvestment in energy

7:31 – A wall of money is behind the energy transition

11:32 - How the Inflation Reduction Act could benefit Austral...

2023-07-1419 min

The Pod of GoldGold pops higher ahead of July Fed meeting and ANZ Bank forecasts more silver demandToday we discuss gold’s moves ahead of The Fed's July meeting, ANZ Bank's forecast on the Silver market entering a period of tightness unseen for decades, and key targets to watch for the Aussie dollar.

PODCAST INFO:

ABC Refinery website: https://www.abcrefinery.com/podcast

Apple Podcasts: https://podcasts.apple.com/us/podcast/the-pod-of-gold/id1592958488

Spotify: https://open.spotify.com/show/1WCw03OP7dsWJFrGR2l5Zb

RSS: https://anchor.fm/s/66995438/podcast/rss

Nick Frappell: https://twitter.com/nick_frappell

Shae Russell: https://twitter.com/shaearussell

OUTLINE: Here's the timestamps for the episode. On some podcast players you should be able to click the timestamp to jump to that time.

(0...

2023-07-1328 min

Cocktails and CommoditiesWhy is cobalt suddenly rising, Brent crude jumps, copper stockpiles empty and gold is range bound ahead of July FedResource news in under 15 minutes: Gold remains subdued, the silver price goes nowhere though ANZ bank warns of a shortage, Brent is moves higher but can it hold? Copper traders are puzzled as stockpiles are drained but it’s not matched up with demand, cobalt rallies but why, keep your eyes on the wheat price for the next week, two companies debut on the ASX and what the markets think the Fed will do in July.

Time stamps

0:45 - The ASX welcomes two new explorers

1:17 – Gold range bound ahead of expected Fed July hike...

2023-07-1115 min

Cocktails and CommoditiesFrontier Energy: How West Australian sunshine will create green hydrogenIn this episode, Sam Lee Mohan, Managing Director of Frontier Energy breaks down what the ‘colours’ of hydrogen really mean, how technology behind this gas will change the energy landscape and lays out two key pathways to revenue.

Timestamps:

1:50 – What is hydrogen?

3:08 – The ‘colours’ of hydrogen defines the technology used to create it

4:13 – Bringing these projects to life

9:43 – How solar farms make hydrogen green

13:13 – Revenue generation will come in two stages

15:42 – Baseload power coming off the WA grid and how Frontier Energy fits in

17:18 - Can you bu...

2023-07-0720 min

The Pod of GoldGold dips, investors hold steady and a possible grey swan eventToday we discuss gold’s recent dip to US$1,923, how investor interest is neither bullish nor bearish and we take a deep look at past exits from yield curve control and what pitfalls the Bank of Japan may face if they try to normalise policy.

PODCAST INFO:

ABC Refinery website: https://www.abcrefinery.com/podcast

Apple Podcasts: https://podcasts.apple.com/us/podcast/the-pod-of-gold/id1592958488

Spotify: https://open.spotify.com/show/1WCw03OP7dsWJFrGR2l5Zb

RSS: https://anchor.fm/s/66995438/podcast/rss

Nick Frappell: https://twitter.com/nick_frappell

Shae Russell: https://twitter.com/shaearussell

OUTLINE: Here's the timestamps for the episode. On some podcast pla...

2023-06-3028 min

Cocktails and CommoditiesSierra Nevada: Exploring for gold in elephant countryIn this episode, Peter Moore executive chairman of Sierra Nevada Gold [ASX:SNX] talks through the prolific Walker Lane trend in Nevada and the two key projects to keep your eye on as drilling starts next month.

Timestamps:

1:30 – Exploring in Nevada for over ten years

3:34 – Walker Lane trend hasn’t seen large scale modern exploration

5:28 – Two key projects to watch over the next six months

8:14 – Previous exploration revealed a surprising new target

10:10 – Have Sierra Nevada found a porphyry system in gold country?

13:15 – One of the few Australian...

2023-06-2920 min

Cocktails and CommoditiesSpot gold dips but the gold bull market remainsRecorded live at the Mines & Money Connect Melbourne conference: ABC Refinery’s Head of Institutional Markets Nick Frappell joins Shae Russell to discuss the recent Fed pause and how investors should brace for more hikes. Can the Aussie dollar maintain its momentum? Plus silver continues to struggle and why Shae was booed over her gold price forecast.

Please note, this episode was recorded on 15th June and all prices were correct at the time of recording.

Timestamps:

0:51 – The two biggest influences on spot gold prices

2:46 – The key metric which measures investor intere...

2023-06-2730 min

Cocktails and CommoditiesTerra Uranium: Tiptoeing through the Athabasca“Looking for something the size of a football field 1,000m deep”.

In this episode Andrew Vigar, executive chairman for Terra Uranium [ASX:T92], talks through how the company moved from concept to drilling in less than two years, what it will take to find uranium deep undercover and why ‘solution mining’ will mean less capital expenditure for development, speed up the ability to mine (should they find anything), but most importantly why this mining method will protect the environment long after extraction.

3:50 – Athabasca: a high-grade uranium rich province

4:50 – Impressive pedigree right up to the board le...

2023-06-2323 min

Cocktails and CommoditiesIron ore lifts on China's rate cut, but will it keep rising? Gold dips on Fed pause and oil struggles for direction...plus the ASX scored a near term copper producer this week.Resource news in under 20 minutes: Gold dips down and breaks below technical support, oil doesn't know which way to go and will China's central bank's rate cut stimulate the local property sector? Plus Shae looks at why investors are so excited about lithium explorer Recharge Metals and how newly listed True North Copper is out part of the new mineral economy rush in outback Queensland.

2023-06-2119 min

The Pod of GoldGold hold steady as Fed pauses…plus silver’s fortunes are tied to China’s economic recoveryIn this episode The Federal Reserve Bank pauses but assures the market there’s more hikes to come, the Aussie dollar hits its stride but does it have staying payer? Silver’s price moves remain tied to China’s slow moving economy and we have some very bullish price targets for gold.

Recorded at the Mines and Money Conference Melbourne - https://minesandmoney.com/melbourne/

PODCAST INFO:

ABC Refinery website: https://www.abcrefinery.com/podcast

Apple Podcasts: https://podcasts.apple.com/us/podcast/the-pod-of-gold/id1592958488

Spotify: https://open.spotify.com/show/1WCw03OP7dsWJFrGR2l5Zb

RSS: https://an...

2023-06-2026 min

Cocktails and CommoditiesCameron Perks: It's not just about the economics, location mattersDr Cameron Perks, principal analyst for Lithium at Benchmark Minerals Intelligence returns for part two of his lithium interview. Today he discusses the rise of economic nationalism and the impact on lithium, why Elon Musk might just need better advisors and is the market

ready to pay a premium for provenance?

Timestamps:

0:39 – Will Australian lithium miners embrace the downstream process?

2:58 – Financial incentives in the Inflation Reduction Act may not trickle down to the mining level

7:52 - Where the bottle necks in lithium are really lurking.

10:39 – Picking on a billiona...

2023-06-1518 min

Cocktails and CommoditiesCameron Perks: Lithium market dynamicsUnderstanding the lithium spot price: From a room full of people to several over-the-counter markets, Dr Cameron Perks joins Shae Russell to explain the lithium market dynamics. In part one of this two part series, Cameron breaks down lithium pricing, explains direct lithium extraction potential and how it will close the supply gap, plus we look at the role automakers are playing in mining off take agreements and will the broader market be prepared to pay a premium for provenance.

Timestamps

· 2:25 – Lithium is still a specialised chemical and battery grades can vary between parties

·...

2023-06-1222 min

Cocktails and CommoditiesGold pauses ahead of Fed meeting, Brent bounces and why gloomy commodity prices won't stop Australia's inflation woes just yet.Resource news in under 15 minutes: Iron ore, copper, gold and brent crude are all higher this week, but why? Mining exploration expenditure drops leaving many junior miners as potential takeover targets, why Namibia rattling the economic nationalism cage may be good for uranium stocks in the long run and how the global commodity price crash won’t stop Australia’s inflation woes just yet.

Timestamps:

· 0:30 – The four commodities making headlines this week

· 4:41 – RBA increases rates for 12th time in 13 months

· 5:50 – Australia’s inflation is proving to rate resistant

· 6:09 – How Coles & Woolworths dr...

2023-06-0715 min

Cocktails and CommoditiesRick Rule: Why bear market investors get bull market profits

Join Shae Russell and legendary mining investor Rick Rule as they discuss key events driving several commodities this year. In this episode, Rick explains why gold has room to run higher, what the Chilean government nationalising the lithium sector means for Australia and the stealth bull market building in uranium.

Timestamps

· 1:20 – Why gold will outperform in 2023

· 2:59 – Exploration stocks haven’t followed commodity prices

· 5:35 – Money put into the ground last business cycle is only now generating discoveries

· 7:24 – Your cheat sheet to investing in junior explorers (look for Rule Classroom on YouTube)

2023-05-3121 min

The Pod of GoldGold pivots away from US$2075 and why the Aussie dollar is fallingIn this episode we look at the reason’s behind gold’s pivot from 2075 back into the 1940s, how the markets appear to be pricing in a smooth debt ceiling negotiating, and what’s causing the Aussie dollar to fall.

PODCAST INFO:

ABC Refinery website: https://www.abcrefinery.com/podcast

Apple Podcasts: https://podcasts.apple.com/us/podcast/the-pod-of-gold/id1592958488

Spotify: https://open.spotify.com/show/1WCw03OP7dsWJFrGR2l5Zb

RSS: https://anchor.fm/s/66995438/podcast/rss

Nick Frappell: https://twitter.com/nick_frappell

Shae Russell: https://twitter.com/shaearussell

OUTLINE: Here's the timestamps for the episode. On some podcast players you should...

2023-05-3015 min

The Pod of GoldWill gold head to US$2,500...plus how 'powerful macro themes and powerful macro risks' support goldIn this episode we look at the ‘powerful macro themes and powerful macro risks’ providing support for gold, how US loan officers are tightening lending conditions in spite of some quantitative easing attempts and why gold could reach US$2,500.

PODCAST INFO:

ABC Refinery website: https://www.abcrefinery.com/podcast

Apple Podcasts: https://podcasts.apple.com/us/podcast/the-pod-of-gold/id1592958488

Spotify: https://open.spotify.com/show/1WCw03OP7dsWJFrGR2l5Zb

RSS: https://anchor.fm/s/66995438/podcast/rss

Nick Frappell: https://twitter.com/nick_frappell

Shae Russell: https://twitter.com/shaearussell

OUTLINE: Here's the timestamps for the episode. On some podcast players you should be...

2023-05-1531 min

The Pod of GoldWill gold attack US$2,075 again? Plus, why the ‘higher for longer’ Fed narrative is over…In this episode we look at what is keeping gold at US$2,000 per ounce and how big bar demand is increasing despite the elevated price. We discuss

managed money’s pivot into gold, how silver’s is riding both gold and copper’s coattails, and why the Fed’s higher for longer rate narrative is about to end.

PODCAST INFO:

ABC Refinery website: https://www.abcrefinery.com/podcast

Apple Podcasts: https://podcasts.apple.com/us/podcast/the-pod-of-gold/id1592958488

Spotify: https://open.spotify.com/show/1WCw03OP7dsWJFrGR2l5Zb

RSS: https://anchor.fm/s/66995438/podcast/rss

Nick Frappell: https...

2023-04-1739 min

The Pod of GoldGold holds up as the Fed faces a two-speed economy. Plus, silver falls without a big spending package from China.In today’s episode we look at the upcoming FOMC in March and discuss the mismatch between narrative and the futures market when it comes to what the Fed will do next. Nick dissects China’s recent National Party Congress, what the GDP expectations China has put forward mean and the hints which suggest China is looking to internalise consumption. Plus, as gold continues to hug the US$1,850s level, Nick casts his technical lens over the price targets that matter right now and why the US$1,800 level looks supportive.

PODCAST INFO:

ABC Refinery website: https://www...

2023-03-0929 min

The Pod of GoldWhat lies above US$2,075 for gold...plus Fed still looks to hike, markets to remain volatile and silver’s duality.In this episode of The Pod of Gold, Nick Frappell & Shae Russell discuss why central banks increased their gold position in 2022, why the Federal Reserve Bank may hike a few more times and a key multiyear gold price target to watch.

PODCAST INFO:

ABC Refinery website: https://www.abcrefinery.com/podcast

Apple Podcasts: https://podcasts.apple.com/us/podcast/the-pod-of-gold/id1592958488

Spotify: https://open.spotify.com/show/1WCw03OP7dsWJFrGR2l5Zb

RSS: https://anchor.fm/s/66995438/podcast/rss

Nick Frappell: https://twitter.com/nick_frappell

Shae Russell: https://twitter.com/shaearussell

OUTLINE: Here's the...

2023-02-2035 min

The Pod of GoldHigher rates, sticky inflation, and what this means for gold in 2023Can gold stay above US$1,800?

In this episode of The Pod of Gold, Nick Frappell & Shae Russell discuss how the potential Fed pivot fed a short covering rally in gold, why the performance of the Australian dollar hinges on China’s economic reopening, and key price targets ahead for the yellow metal.

PODCAST INFO:

ABC Refinery website: https://www.abcrefinery.com/podcast

Apple Podcasts: https://podcasts.apple.com/us/podcast/the-pod-of-gold/id1592958488

Spotify: https://open.spotify.com/show/1WCw03OP7dsWJFrGR2l5Zb

RSS: https://anchor.fm/s/66995438/podcast/rss

Nick Fr...

2022-12-2222 min

The Pod of GoldThe Fed didn’t flinchAre bond and equity asset markets pricing interest rate expectations in?

In this episode of The Pod of Gold, Nick Frappell & Shae Russell discuss why the higher for longer rate narrative is here to stay, we question if equity markets have factored this in, and what this means for gold...

PODCAST INFO:

ABC Refinery website: https://www.abcrefinery.com/podcast

Apple Podcasts: https://podcasts.apple.com/us/podcast/the-pod-of-gold/id1592958488

Spotify: https://open.spotify.com/show/1WCw03OP7dsWJFrGR2l5Zb

RSS: https://anchor.fm/s/66995438/podcast/rss

Nick Frappell: https...

2022-11-1019 min

The Pod of GoldFed – to pivot or not to pivot? Commentators say yes, market pricing suggests notChina’s political reshuffle and the impacts for Australian dollar

In this episode of The Pod of Gold, Nick Frappell & Shae Russell discuss why gold short positions are still increasing, why central bank policies will keep markets transfixed for some time, and the impact of China’s 20th National Congress meeting on the Australian dollar.

PODCAST INFO:

ABC Refinery website: https://www.abcrefinery.com/podcast

Apple Podcasts: https://podcasts.apple.com/us/podcast/the-pod-of-gold/id1592958488

Spotify: https://open.spotify.com/show/1WCw03OP7dsWJFrGR2l5Zb

RSS: https://anchor.fm/s/66995438/podcast/rss

Nick Frap...

2022-10-2732 min

The Pod of GoldWhy the Fed is unlikely to pivot in the current inflationary phasePrecious metals price action to watch out for

In this episode of The Pod of Gold, Nick Frappell & Shae Russell discuss how managed money is impacting gold positioning, why the Taylor Rule suggests the Fed won’t pivot, and how China’s 20th national congress meeting this week is likely to create a new political cycle in the middle kingdom.

PODCAST INFO:

ABC Refinery website: https://www.abcrefinery.com/podcast

Apple Podcasts: https://podcasts.apple.com/us/podcast/the-pod-of-gold/id1592958488

2022-10-1131 min

The Pod of GoldFed drives higher for longer narrative, plus gold shrugs off geopoliticsWhen it comes to gold, in the end it’s still a rates market

In this episode of The Pod of Gold, Nick Frappell & Shae Russell discuss the Fed’s ongoing battle with inflation, the critical importance of energy security, and what’s really driving the gold price.

PODCAST INFO:

ABC Refinery website: https://www.abcrefinery.com/podcast

Apple Podcasts: https://podcasts.apple.com/us/podcast/the-pod-of-gold/id1592958488

Spotify: https://open.spotify.com/show/1WCw03OP7dsWJFrGR2l5Zb

RSS: https://anchor.fm/s/66995438/podcast/rss

Nick Frappell: https://twitter.com/nick_frappell

Shae Russel...

2022-09-2630 min

The Pod of GoldMomentum still with the US dollarIn this episode of The Pod of Gold, Nick Frappell & Shae Russell discuss the rotation from gold into US dollars, the dataset that spooked gold markets, and the continuing central bank policy divergence.

Recorded Friday 16th

PODCAST INFO:

ABC Refinery website: https://www.abcrefinery.com/podcast

Apple Podcasts: https://podcasts.apple.com/us/podcast/the-pod-of-gold/id1592958488

Spotify: https://open.spotify.com/show/1WCw03OP7dsWJFrGR2l5Zb

RSS: https://anchor.fm/s/66995438/podcast/rss

Nick Frappell: https://twitter.com/nick_frappell

Shae Russell...

2022-09-1931 min

The Pod of GoldCentral bankers in Jackson Hole continue aggressive tightening movesIn this episode of The Pod of Gold, Nick Frappell & Shae Russell discuss how gold failed to move up through a key indicator, how silver appears to have decoupled from copper, and why a once in a decade US dollar rally can trigger a crisis somewhere else.

PODCAST INFO:

ABC Refinery website: https://www.abcrefinery.com/podcast

Apple Podcasts: https://podcasts.apple.com/us/podcast/the-pod-of-gold/id1592958488

Spotify: https://open.spotify.com/show/1WCw03OP7dsWJFrGR2l5Zb

RSS: https://anchor.fm/s/66995438/podcast/rss

Nick Frappell...

2022-08-3128 min

The Pod of GoldGold and silver react to Fed’s rate riseIn this episode of The Pod of Gold, Nick Frappell & Shae Russell discuss the dovish interpretation of the Fed’s July meeting and what that means for gold, why the Australian dollar is still under pressure, and if the Chinese property woes are a contagion event or if the CCP have the problem contained.

PODCAST INFO:

ABC Refinery website: https://www.abcrefinery.com/podcast

Apple Podcasts: https://podcasts.apple.com/us/podcast/the-pod-of-gold/id1592958488

Spotify: https://open.spotify.com/show/1WCw03OP7dsWJFrGR2l5Zb

RSS: https://anchor.fm/s...

2022-08-0434 min

The Pod of GoldGold treads water ahead of July FOMCIn this episode of The Pod of Gold, Nick Frappell & Shae Russell discuss how gold is treading water ahead of the July Federal Open Market Committee, how much higher can the US dollar go, and will the Fed start cutting rates in 2023?

PODCAST INFO:

ABC Refinery website: https://www.abcrefinery.com/podcast

Apple Podcasts: https://podcasts.apple.com/us/podcast/the-pod-of-gold/id1592958488

Spotify: https://open.spotify.com/show/1WCw03OP7dsWJFrGR2l5Zb

RSS: https://anchor.fm/s/66995438/podcast/rss

Nick Frappell: https://twitter.com/nick_frappell

2022-07-2624 min

The Pod of GoldFed and ECB policies diverge – can the system handle a shock from a highly valued US dollar?In this episode of The Pod of Gold, Nick Frappell & Shae Russell discuss the impact dollar strength is having on gold and the increasing yield gap between the US dollar and major currencies. Finally, we ask, is there scope in the system for a shock from a highly valued US dollar?

Time Stamps:

· 0.41 – Gold longs aren’t strong, but shorts aren’t convinced

· 3:35 – Point n Figure suggested in April gold would fall to US$1,738

· 6:40 – Gold looked like an outlier compared to inflation linked bonds

· 8:22 – Divergent central bank polices increase the yield gap

2022-07-1035 min

The Pod of GoldRates, gold and the market that matters the mostRecorded at the Australian Gold Conference on 14th June, in this episode of The Pod of Gold, Nick Frappell & Shae Russell start with ‘the market that matters the most’, the Fed’s 75 basis point increase, discuss liquidity fears not seen since the financial crisis and how gold is holding up remarkably well...

Time Stamps:

· 1:29 – Higher interest rates triggered a ‘violent’ response from markets

· 6.48 – Fed have made it clear they will do whatever it takes to reduce inflation

· 9:55 – Terminal rate now likely above 4% in 2023

· 11:59 – Managed money not overly committed to gold, ETF positioning...

2022-06-2028 min

The Pod of GoldGold holds, Fed stays on course and China blinksIn this episode of The Pod of Gold, Nick Frappell & Shae Russell discuss the confluence of Fibonacci levels in gold, the duality of views coming from the Federal Reserve Bank, and what Dr copper can tell us about silver.

Time Stamps:

· 1:06 – Gold closes above the weekly cloud

· 5:16 – Spot gold and the confluence of Fibonacci levels

· 8:19 – Point n Figure suggests there’s room for gold to reach US$1,900s

· 9:58 – Shorts are driving silver but for how much longer?

· 14:10 – The duality of views around Fed policy

· 19:00 – Highly indebted financial s...

2022-05-3131 min

The Pod of GoldThe US dollar, war, stagflation and their impact on goldRecorded Live from RIU Sydney 2022

In this episode of The Pod of Gold, Nick Frappell & Shae Russell discuss how the US dollar may be nearing the peak of its 39-month cycle, why Russia’s war on Ukraine increased inflation risks and what these mean for spot gold.

Time Stamps:

· 0:40 — US dollar strength and real yields

· 2:12 — Russian invasion worsens inflation outlook

· 3:53 — Key factors driving the gold price

· 7:22 — What net positioning in the US dollar reveals

· 10:31 — The importance of the ‘little purple box’

· 12:07 — Three bullish price targets for spot g...

2022-05-0632 min

The Pod of GoldHow much longer can the US dollar rally last?In this episode of The Pod of Gold, Nick Frappell & Shae Russell discuss how one indicator would have tested the resolve of most traders, the absolute smashing for most currencies against the US dollar, why Brent’s retreat won’t last and what could cause gold to jump despite the current strong dollar.

Time Stamps:

· 0:40 — Gold’s shooting star was a warning

· 4:28 — An unpleasant test for traders

· 6:31 — Silver’s falls outside the cloud and challenges the bullish view

· 12:02 — The DXY and its 39-month cycle

· 16:00 — Is the US dollar rally entering i...

2022-05-0130 min

The Pod of GoldCrude's correlation to gold and why the bulls are ready to chargeIn this episode of The Pod of Gold, Nick Frappell & Shae Russell discuss managed money’s increased short position for gold and silver’s recent bounce. Nick delves into Russia’s recent monetary theatre, then takes a deep look at the bullish predictions for Brent, and crude’s correlation to gold.

Time Stamps

· 0:44 — Managed money is on the defensive, yet technical support for gold is strong

· 7:16 — Nick’s bullish call for silver played out, where to next?

· 10:18 – Russia, rubles, and gold

· 14:05 – Understanding the dollar dominance

· 15:00 — Brent demand drops and takes the crude...

2022-04-1925 min

The Pod of GoldInstability risks in China grow as gold sniffs out supportIn this episode of The Pod of Gold, Nick Frappell & Shae Russell discuss the muted moves in spot gold and how support for the yellow metal is inching higher. Nick takes a deeper look at the dollar cost of China’s relentless pursuit of Covid zero, and what the rumblings in the Middle Kingdom’s property sector may mean for the Australian dollar.

Time Stamps:

· 1.00 – Fourth consecutive week of managed money easing positions in gold

· 2.00 – Gold touched and rejected US$1,890 on a weekly basis

· 6.16 – Silver is testing support, needs to hold above US$24.2...

2022-04-0722 min

The Pod of GoldFed hawks drive dialogue as gold finds supportIn this episode of The Pod of Gold, Nick Frappell & Shae Russell look at how Managed Money has reduced their exposure to gold for the third week in a row, why the Fed’s terminal limit is higher than we think, and what the synchronised slowdown in two of the world’s largest economies means.

Time Stamps:

· 0.55 – Managed Money has reduced their positioning in gold three weeks in a row

· 3.10 – Ichimoku weekly standard line has been providing excellent support for gold

· 5.05 – Outflows from gold appear to be moving into cash

· 7.11 – Si...

2022-03-3025 min

The Pod of GoldFed sticks to their plan as the gold price fallsIn this episode of The Pod of Gold, Nick Frappell & Shae Russell discuss the tilt of positioning in gold, some bullish price targets for silver and why the Fed didn’t want to spook the market. Plus, we have an update on China’s property sector, as well as a look at the LME’s day of reckoning last week.

Time Stamps:

· 0.57 – Why gold is difficult to trade during news flow

· 3.10 - Managed Money positioning

· 7.01 – Candle hints at gold price reversal, Ichimoku cloud confirms it

· 8.06 – ‘Silver can and will do anything it wan...

2022-03-1726 min

The Pod of GoldGold and commodities soar as Russia-Ukraine conflict drives marketsIn this episode of The Pod of Gold, Nick Frappell & Shae Russell discuss the different factors influencing gold and silver, soaring commodity prices and the risks to the market plus how the changing of seasons may slow Russia’s invasion in the Ukraine.

Time Stamps:

· 1.30 – Gold has had two cracks at US$2,000 per ounce

· 3.53 – Managed money positioning – shorts are driving gold buying

· 6.07 – The technical picture for silver is strong

· 10.20 – Copper reacting to sanctions on Russia

· 11.41 – Gold and silver in the Ichimoku Cloud

· 13.06 – How the Russian-Ukraine conflict impacts commo...

2022-03-0929 min

The Pod of GoldHow the Russian-Ukraine conflict may impact the Fed tightening cycleIn this episode of The Pod of Gold, Nick Frappell & Shae Russell discuss how the Russian-Ukraine conflict may lead to a less aggressive Fed tightening cycle for 2022, silver’s recent short covering and what Russia’s invasion means for gold in the weeks ahead.

Time Stamps:

· 1.00 – Gold volatility and managed money positioning

· 4.00 - ‘War drives up the price of gold but the news flow can drive it up and down tremendously’

· 5.30 – How gold is behaving compared to other currency pairs

· 6.49 – Silver short covering

· 10.04 - Ichimoku Cloud for gold and silver: Te...

2022-02-2827 min

The Pod of Gold‘When the Fed is in a tightening cycle, we all are’In this episode of The Pod of Gold, Nick Frappell & Shae Russell discuss what fast money and slow money suggest about sentiment in gold, how 'when the Fed is in a tightening cycle, we all are' and the dollar positive environment which could provide a headwind for gold.

Time Stamps:

· 1.20 – Gold breaks through the weekly cloud top signalling a swing to the medium term bullish

· 3.40 – Managed money not revealing much

· 6.10 – Silver shorts look to be on the defensive

· 8.45 – Central banking policy divergence - Fed leads pivot toward tightening

· 13.20 –...

2022-02-1832 min

The Pod of GoldHow the Fed may choke growthIn this episode of The Pod of Gold, Nick Frappell & Shae Russell discuss the gold’s price moves, managed money’s short covering in silver, how the yield curve is signalling slower growth and just how aggressive the Fed rate hikes may be. Finally, we touch on what a very long-term Point & Figure chart is telling us about the Aussie dollar.

Time Stamps:

· 1.10 – Physical gold in high demand this week

· 2.20 – Gold price moves within the support and resistance of the Ichimoku Cloud

· 4.45 – Managed money and open interest positioning in gold

· 6.15 – Si...

2022-02-0725 min

The Pod of GoldA period of indecision as gold readies to pivotIn this episode of The Pod of Gold, Nick Frappell & Shae Russell discuss gold’s lively start to 2022 and a strong tightening cycle may drive people away from risk assets to risk-off assets. We assess the recent comments from the Fed and what several rate increases will mean for US dollar denominated debt. Plus, we touch on China’s relentless pursuit of zero covid to protect their export economy.

Time Stamps:

· 0.59 — Fresh longs coming into gold suggest strong interest

· 3.45 — Higher rates may impact risk assets more than gold

· 5.15 — Silver ready to run? Managed...

2022-01-1427 min

The Pod of GoldHow the Fed’s policies will impact goldIn this episode of The Pod of Gold, Nick Frappell & Shae Russell discuss the short position building behind gold and silver, however the longs are holding their nerve. We look at the Fed’s hawkish tapering then tightening promise to the market, and the impact that will have on both the US dollar and gold. Finally, we wrap up with the paths of propagation emanating from Evergrande, and how 2022 may bring more doom for the Chinese property sector.

Time Stamps:

· 1.20 – Shorts move in behind gold, but longs provide support

· 5.00 – Room for a big move up...

2021-12-2227 min

The Pod of GoldGold versus a hawkish Fed and a strong US dollarIn this episode of The Pod of Gold, Nick Frappell & Shae Russell discuss how gold’s plunge has settled with spot gold’s consolidation looking supportive. Plus, as the Fed drops ‘transitory’ from its language, the hawkish tone from the central bank sets up a strong US dollar.

Time Stamps:

· 1.15 — Managed money gold flows – longs have reduced but not really replaced by shorts

· 3.10 — Gold holds key Fibonacci level and looks to be consolidating

· 4.35 — Momentum in silver fades, but it’s not time to get bearish

· 6.32 — Federal Reserve Bank sets a hawkish tone

·...

2021-12-0919 min

The Pod of GoldWhat Managed Money is signalling to the marketIn this episode of The Pod of Gold, Nick Frappell & Shae Russell take a look at the technical positioning building in gold and silver, as Managed Money appears to be emphatically bullish on both precious metals. Then Nick points to an unexpected move in crude shorts and what this may be signalling to the market. Listen now.

Time Stamps:

1.45 – Gold: The fall was expected

3.55 – A wall of money moves into gold

8.00 – Silver takes a hit, but the big picture hasn’t changed

10.40 – Strong interest from Managed Money forming in silver

13.25 – Short positions increase in crude and what this me...

2021-11-2524 min

The Pod of GoldWho knows more? The Fed or the MarketIn this episode of The Pod of Gold, Nick Frappell & Shae Russell discuss how the recent rally in gold brings two very exciting levels into play and Nick expands on what the increase in open interest in the futures market may mean. Then we shift gears and discuss the race between the Federal Reserve Bank and the bond markets: which one of the two knows more about when rates will rise?

To wrap up Nick looks at the paths of propagation coming from the Evergrande collapse, as smaller Chinese real estate developers miss bonds payments.

Cl...

2021-11-1128 min

Money Morning PodcastShae Russell on the Aussie Gold Market, Jackson Hole, and ChinaShae Russell on the Aussie Gold Market, Jackson Hole, and ChinaFree seat at The Gold Digger Summit here: https://signup.fattail.com.au/1851663I get familiar face, Shae Russell of Pallion, on The Money Morning Podcast to talk about a range of important factors for the gold price and Aussie gold stocks. From the physical market and premiums on gold, to what Shae's seeing in the Australian gold mining scene, there's a lot to digest and we get the inside scoop.Buy Gold Bullion @ABC Bullion https://www.abcbullion...

2021-10-2719 min

The Pod of GoldInflection point: The emerging divergence in central bank policesIn this episode Nick Frappell and Shae Russell discuss gold’s continued point of resistance and the critical price barrier it must cross through. Managed money tells us there’s indecision around the silver price.

Nick explains how global central banks policies are diverging and wrap with how the recent Australian bond price rally questions whether the Reserve Bank of Australia can wait until 2024 for a rate increase.

· 0:40 – Technical summary of gold’s current positioning

· 3:23 – Key price barrier ahead for gold

· 5:21 – Silver recent rally

· 11:58 — The global central bank rate divergence

...

2021-10-2228 min

The Pod of GoldPrecious metals and the crisis simulation you’ve never heard ofNick Frappell and Shae Russell discuss the technical pressures facing both gold and silver, as well as key prices levels ahead.

In the second half of today’s podcast, Nick looks explains how a key equity earnings index may be waving a red flag, what a crisis simulation from 2013 can reveal about the US debt ceiling problems, and the paths of propagation from Evergrande begin.

0:52 – Silver is under pressure

6:06 – Gold will struggle at 1790s

10:30 – Global earnings indicator potential red flag

12:24 – What happens if there’s no binding debt ceiling? A crisis simu...

2021-10-1529 min