Shows

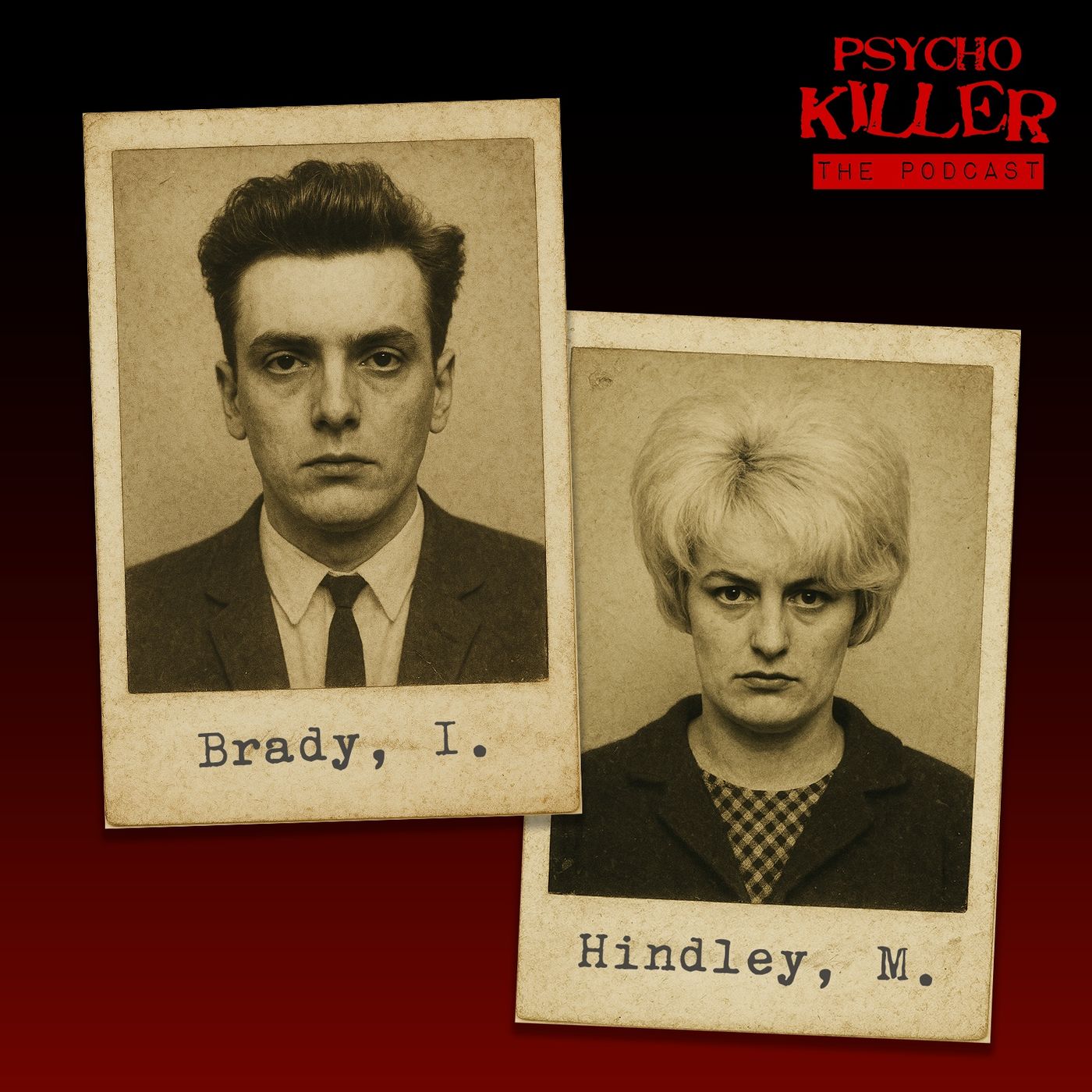

Psycho Killer: Shocking True Crime StoriesIt Takes Two: The Dark Synergy Of Ian Brady And Myra HindleyMurder Was The Glue That Bound ThemIan Brady and Myra Hindley are remembered as the Moors Murderers. But beyond the horror, their story forces us to ask: how does a psychopath recruit a partner, and what happens when love and loyalty become tools of murder? In this episode of Psycho Killer: Shocking True Crime Stories, Simon Ford and Jacques Morrell explore the dark synergy between Brady and Hindley — complementary fit, closed-world isolation and the momentum of co-offending.We revisit psychiatrist Jeremy Coid’s insight that Brady may have been “born evil,” and hear...

2025-10-1323 min

Inner-Strength Check PodcastEp. 55: [Interview] w/ SIMON CALABRESE of DAYSEND, Ahead of The ‘Revisiting Severance’ Tour.A massive privilege and honour to have frontman Simon Calabrese of influential Australian melodic death metal legends Daysend, ahead of their upcoming national tour revisiting the massively-acclaimed album Severance. We discuss Simon's thoughts on said tour, stepping back into the band for the first time in 19 years and more! Check out the link below for tour info and links/RSVP for each of the tour dates across Australia. Massive thanks to Anthony from YourMateBookings for facilitating such a phenomenal opportunity - this is a rare Aussie metal treat you won't cop...

2025-08-0829 min

Inner-Strength Check PodcastEp. 55: [Interview] w/ SIMON CALABRESE of DAYSEND, Ahead of The ‘Revisiting Severance’ Tour.A massive privilege and honour to have frontman Simon Calabrese of influential Australian melodic death metal legends Daysend, ahead of their upcoming national tour revisiting the massively-acclaimed album Severance. We discuss Simon's thoughts on said tour, stepping back into the band for the first time in 19 years and more! Check out the link below for tour info and links/RSVP for each of the tour dates across Australia. Massive thanks to Anthony from YourMateBookings for facilitating such a phenomenal opportunity - this is a rare Aussie metal treat you won't cop...

2025-08-0829 min

Above & Beyond: Where Excellence Meets ElevationCrafting Charisma: The Brady Bogen ExperienceSend us a text In this episode, radio personality Brady Bogen takes us on a wild ride through his colorful career—from selling flooring to co-hosting Holmberg’s Morning Sickness on 98 KUPD for over 20 years. Brady shares hilarious behind-the-scenes stories, reflects on life in radio, and dives into his passion for barbecue, including his ventures with BTP sauce and the restaurant Porkopolis. From mascot to pitmaster, Brady’s journey is as unexpected as it is entertaining. Support the showwww.abovebeyondpodcast.com Please LIKE, SHARE & SUBSCRIBE.

2025-08-071h 32

The RDX Sports Podcast with Simon HeadUFC London recap: Sean Brady DOMINATES at The O2Philadelphia's finest welterweight Sean Brady delivered a lights-out performance in the main event of UFC London as he dominated former UFC welterweight champion Leon Edwards en route to a fourth-round submission victory at The O2 Arena.On this episode of the RDX Sports Podcast, editor-in-chief Simon Head unpacks the night's action as he gives his verdict on the night's big stories, including Brady's dominant victory, Carlos Ulberg's win over Jan Blachowicz, and Molly McCann's retirement announcement following her loss to the impressive debutant, Alexia Thainara.

2025-03-2552 min

The Digital Publishing PodcastEpisode 11: Laura Brady, Accessibility BusybodyLaura Brady has been advocating for, training in and talking about accessibility in publishing for longer than almost anyone, and we are deeply privileged to have her join us for this fascinating talk on all things accessible publishing. We learn about her journey through various parts of publishing to where she is today, and get her take on recent developments.Laura mentioned the following metadata report: https://apln.ca/accessibility-metadata-best-practices-for-ebooks/CREDITS:Produced and Presented by Simon MellinsTranscript provided by Lumina DatamaticsMusic: Better Days by penguinmusic at Pixabay

2025-03-1048 min

Réalisé Sans TrucageBREAKING NEWS : James Bond, Brady Corbet, les BAFTA & Captain AmericaOyez, oyez ! Voici les actualités ! Que se passe-t-il en ce moment dans le monde du cinéma ? Réponse dans cet épisode !Au programme : Amazon obtient le contrôle créatif de la franchise James Bond, le box-office mitigé de Captain America : Brave New World, le palmarès des BAFTA 2025 et la réalité économique du métier de cinéaste selon Brady Corbet.Bonne écoute !--------------------------------------------------------------------------Chapitres :00:00 Brady Corbet08:28 Le palmarès des BAFTA15:35 Captain America20:18...

2025-02-2426 min

Trick PlayNFL Week 2 Predictions | Tom Brady Fox Debut | Early Playoff Predictions | Sept. 15th, 2024Simon and Caleb give their picks for all the Week 2 NFL Games, then give waaaay too early playoff and Super Bowl predictions and talk about Tom Brady's Broadcasting Debut.

2024-09-152h 09

Thriving Adoptees - Let's ThriveSpiritual Growth With Alejandra BradySpiritual growth is the ultimate healer. That sums up the 500 episodes of Thriving Adoptees in six words. And spiritual in this sense doesn't mean religious. Spiritual growth is seeing more of our essence underneath our psychology. Listen in as Alejandra shares the insights that fuelled her spiritual growth to catalyse ours.Adopted at five weeks into a loving and happy Mexican-American family, Alejandra had never sought her family of origin, but when they arrived unexpectedly, they showed up with a raft of issues that would test her inner strength and drive her spiritual growth. It was then...

2024-06-281h 09

The CXChronicles PodcastCXChronicles Podcast 223 with Simon Taylor, CEO & Founder at HYCUHey CX Nation,In this week's episode of The CXChronicles Podcast #223 we welcomed Simon Taylor, the CEO and founder of HYCU, the worlds fastest growing multicloud data protection company. Simon has more than 20 year's experience in go-to-market strategy development, product marketing and channel sales management for the tech industry. He has worked with leading companies such as Comtrade Group, Forrester Research, Putnam Investments and Omgeo. Simon is a board member at Uncornered, an active member of YPO, and a Research Fellow at Boston College. Simon founded, HYCU in 2018 as a pio...

2024-03-1950 min

The CXChronicles PodcastCXChronicles Podcast 220 with Simon Kriss, Leading Voice On AI In CXHey CX Nation,In this week's episode of The CXChronicles Podcast #220 we welcomed Simon Kriss, Leading Voice On AI In CX, Author, Futurist, Board & C-Suite AI Mentor based in Melbourne, Australia. Simon is a customer experience futurologist and thought leader who works with Company Boards and C-Suite Executives on innovation in their customer experience.He's also the author of the book The AI Empowered Customer Experience & the host of The CXII Podcast, please see the links below. In this episode, Simon and Adrian chat through how he has tackled The Four CX...

2024-02-2843 min

Air Quality Matters#12.1 - Francesca Brady: Investing in the Air We Breathe and a Thriving Workplace Environment.Send us a textPart 1Francesca Brady - is CEO and Co-Founder of AirRated an indoor air quality (IAQ) certification company She is an advisory member for the Camden Clean Air Initiative, the BREEAM Health and Wellbeing technical group, and a member of the International WELL Building Institute's Covid-19 Taskforce. A rising star in air quality in many ways including on the Forbes 30 under 30 list in 2021 for her work with Air rated.With a Masters in Environmental Geoscience specialising in indoor atmospheric chemistry she was Formerly Head of...

2024-01-2952 min

Air Quality Matters#12.2 - Francesca Brady: Harmonizing Air Quality and ESG Strategies for Healthier Workspaces and Sustainable FuturesSend us a textPart 2Francesca Brady - is CEO and Co-Founder of AirRated an indoor air quality (IAQ) certification company She is an advisory member for the Camden Clean Air Initiative, the BREEAM Health and Wellbeing technical group, and a member of the International WELL Building Institute's Covid-19 Taskforce. A rising star in air quality in many ways including on the Forbes 30 under 30 list in 2021 for her work with Air rated.With a Masters in Environmental Geoscience specialising in indoor atmospheric chemistry she was Formerly Head of...

2024-01-2958 min

Mass Timber Group Show: Sustainable Building ExpertsWhat Europe's Biggest Mass Timber Producer Has Planned | Simon Siegert of Binderholz | 25Mass Timber construction is exploding in popularity in North America due to increased demand for green building practices, and Europe's largest cross laminated timber producer, Binderholz, is paying attention. This episode unpacks the differences between the European and North American lumber and mass timber markets. Then, we talk about Binderholz's plan for expansion into the United States. Sustainable construction is going mainstream!Simon Siegert is known as the "US Guy" and head of Business Development here in North America. He's been highly involved in the Mass Timber industry for years, and is helping to lead Binderholz's entry...

2024-01-181h 00

Simon Says: Educate!Episode #6: The Blueprint w/Brady HagemanIn Episode 6 of Simon Says: Educate!, Geoff Cain, Ronald Lethcoe, and e-learning expert Brady Hageman join us to demystify Canvas Blueprint. We differentiate between blueprints as guides and templates as elements, emphasizing blueprint's adaptability for various teaching styles. The "Week Zero" concept for pre-course orientation and incorporating instructor photos for engagement are discussed. We also explore FutureTools.io for AI resources and ChatGPT Plus's new features, highlighting the importance of campus clubs in student engagement, with Brady sharing his gaming club experience.

Remember to subscribe to Simon Says: Educate! on your favorite podcast platform for more insightful discussions on teaching...

2024-01-0533 min

Simon Says: Educate!Episode #4: Accessibility w/Brady HagemanIn Episode 4 of Simon Says: Educate!, Brady Hageman, LMS administrator at Clover Park Technical College, shares insights on online course accessibility, focusing on Canvas. We tackle challenges students face, like login issues, and Brady offers practical solutions like email logins to avoid password expiry. The episode delves into streamlining processes for a better user experience, suggesting strategies like simplified logins and the use of copy-paste functionality. We emphasize the value of resources like the accessibility report and learning from peers in creating engaging Canvas courses. The episode underscores the importance of the Teaching and Learning Center as a vital resource...

2024-01-0527 min

Achieving Success with Olivia AtkinEp 56 Knowledge To Successfully Build Your Financial Plan Starting Early In Life with Simon BradyAchieving Success with Olivia Atkin Episode 56 "Knowledge To Successfully Build Your Financial Plan Starting Early In Life with Simon Brady”Olivia talks personal and professional achievements with Simon Brady. Simon is a Certified Financial Planner and the founder and owner of Anglia Advisors, a personal finance and investment consulting service that focuses on helping individuals, couples, families, foreign nationals living and working in the United States that are young professionals between the ages of their early 20s and mid 40s.Join Olivia every Tuesday as she brings on top notch guests to talk about how they ar...

2023-11-2140 min

ANGLES.Noisy.It started out so well. There was green all over the board for a while with earnings mostly looking very perky. But in the end, sentiment was overwhelmed by the noise of higher interest rates, Middle East fears, bedlam in Congress, a government shutdown once again looming on the horizon, fears that consumer spending - and thereby inflation - is refusing to die and some rather nasty projections about the global financial system. Stocks began the week by jumping higher at the open on Monday and maintained their gains for the rest of the session, boosted both...

2023-10-2206 min

ANGLES.Dazed And Confused.The stock market was open on Monday although the bond market wasn’t and it had its first chance to react to the latest flare up of the conflict in Israel and Palestine that broke out over the weekend. Wall Street tries to frame everything in dollars and cents, because, well, that’s its job - but it can often appear a little dazed and confused when it comes to having to suddenly price in geopolitical risk. After a predictable dip at the open, stocks recovered to push into positive territory by the close, driven higher not only...

2023-10-1506 min

ANGLES.Weird.Stocks eventually ended a little higher for the week but it was a tough slog getting there with interest rates continuing to push ever higher (see AVERAGE 30-YEAR FIXED RATE MORTGAGE below) and a bizarre Jobs Report on Friday. Monday started out quietly. There was some relief at no government shutdown but an awareness that the can is now lying just a little further down the road and nothing had really changed. Markets quickly resumed their recent short-term path of least resistance by moving lower, with Small Caps once again leading the way downwards. Tuesday...

2023-10-0806 min

ANGLES.A Bad Smell.The month of September duly lived up to its stock-killing reputation and there was a strong sense of good riddance from investors as markets closed on Friday. On the bright side, Octobers following losing Septembers have a history of being rather good for stock prices and November to December is historically a strong season. Last week began with a predictable but mild snap-back rally on Monday after the carnage that had followed the outcome of the most recent Fed meeting the week before. But the relief was short-lived. By Tuesday, markets across the board were back in...

2023-10-0107 min

ANGLES.Reading The Tea Leaves.Last week was always going to be about Wednesday’s Federal Reserve meeting and its fallout. We are undergoing a major shift from the question being “How high will interest rates go?” (the market’s obsession over the last eighteen months) to “How long will interest rates stay high?” going forward.It is now the answer to this second question that will determine if the Fed’s stance is deemed to be hawkish (bad for stocks/bonds) or dovish (good for stocks/bonds). For any rally to continue, markets need, at a minimum, for the Fed to meet current e...

2023-09-2407 min

ANGLES.Lurking.Reuters, Bloomberg and the Wall Street Journal all published articles last weekend essentially saying that the Fed is done with interest rate hikes and while that’s hardly new news, it helps counter some of the somewhat negative narratives that are emerging as investors step back to assess the state of the economy and the business cycle looking towards the end of the year.It’s leading to an increasingly popular stance among traders and investors of “strongly neutral” on stocks and bonds as markets seem to be lacking any faith in pushing things in either direction. Being st...

2023-09-1707 min

ANGLES.Trading Jabs.U.S. markets found themselves heavily impacted last week by a number of decisions made from beyond its shores. The United States and China continue to trade jabs, particularly at each other’s tech giants and it’s having an effect on the stock market. Apple stock (AAPL) is probably the largest holding in most investors’ total market and large cap fund portfolios and it fell hard, swiftly shedding over $200 billion in market value following Wednesday’s report that China now plans to expand its ban on the use of iPhones to government workers at state firm...

2023-09-1007 min

ANGLES.Time Out.A reasonably solid last few days of the month wasn’t enough to rescue August from being the first losing month for stocks since February, with the Large Cap S&P 500, the tech-heavy NASDAQ-100 and the Small Cap Russell 2000 losing 1.8%, 2.2% and 4.5% respectively.We're now heading into what is often the rockiest part of the year. September is the only month to have historically seen more stock market declines than advances over the years and October has previously hosted some of the most spectacular bouts of volatility. This particular September/October period carries its own additional ri...

2023-09-0305 min

ANGLES.Interrupted?There’s a very accurate saying that that you can win just about any financial argument you like by simply adjusting the start and end dates of a scenario. There’s a perfect example of this on show right now with the most important question of all to investors. Is what we have seen over the last few weeks a temporary pullback within what is still a bull (rising) market that dates back to March of this year .. or .. is what we have seen over the last few months a temporary rally within what is still a bear...

2023-08-2706 min

ANGLES.Afraid Of Its Own Shadow.As I’ll show in a moment, earnings and economic data last week generally propped up the case for a soft landing for the US economy and should have been celebrated, but the stock market seemed jumpy and afraid of its own shadow - seizing on anything negative it could find. There’s a downside to the current high level of economic strength. In something of a return to the old “good news is bad news” narrative of 2021 and 2022, solid evidence of stronger growth was viewed suspiciously as possibly fueling inflation, maybe prompting the Fed to raise...

2023-08-2008 min

ANGLES.Just Following The Playbook.The stock market playbook is being followed exactly as we would expect and in the way that I have been banging on about in my recent weekly reports. The plain fact is that, around 4500, the S&P 500 index is priced for near-term perfection with zero room for any kind of disappointments, meaning that even the most modest of negatives (an uptick in market interest rates, some lackluster earnings, a less impressive economic report) or simply news or data that isn’t constantly positive, can cause market choppiness and sometimes significant pullbacks - not because the news is th...

2023-08-1306 min

ANGLES.All Aboard The Happy Train?Bank of America became the latest to hop aboard the now-rather crowded Happy Train early last week, eagerly joining Team No Recession. The abrupt change of stance comes just a week after Federal Reserve Chair Jerome Powell told reporters that the central bank’s own economists are no longer forecasting a recession. As BofA economists put it in a note to clients on Wednesday;“Recent incoming data has made us reassess our prior view that a mild recession in 2024 is the most likely outcome for the US economy,” The no-recession narrative appeared to have been endorsed by the la...

2023-08-0605 min

ANGLES.Open Door.To the surprise of precisely nobody, the Federal Reserve resumed its campaign of interest rate increases on Wednesday, pushing its target Fed Funds rate up another quarter of a percentage point to a range of 5.25%-5.50%, the highest level since J-Lo joined forces with Ja Rule to point out to us that she was real back in 2001. It marked the eleventh increase since March 2022, at which time the rate was near zero. There were only the slightest of tweaks to the wording of the committee's eagerly-awaited June policy statement and no hint that the Fed might react...

2023-07-3006 min

ANGLES.Soon To Be Erased?Less than twenty months after it began, the bear market that engulfed the S&P 500 in early 2022 is now just 260 points away from being completely erased.2023 has barely passed its midpoint and the market has already blown through even the most optimistic estimates for where Wall Street thought the S&P 500 might be by year end. In the process, it has constantly defied all the early-year gloom accompanied by talk of a guaranteed recession, soaring inflation and an aggressive Federal Reserve interest rate policy.However, while it’s undeniable that the fears of a hard lan...

2023-07-2305 min

ANGLES.Short And Shallow?Short and shallow seems to be the growing expectation surrounding any 2023 recession, if it ever even arrives at all. The US economy is stronger than most people expected and inflation is clearly stabilizing. This is the “immaculate disinflation” that many optimists talked about a year ago, with an economy simply showing signs of normalizing after a pandemic. Under this theory, the Federal Reserve may just get to have its cake and eat it, too.At the beginning of the year, stocks were priced for a meaningful economic slowdown and an earnings drop that never in fact happened. This...

2023-07-1606 min

ANGLES.Evaporating.Fears of an imminent destructive recession and hopes of any interest rate cuts in 2023 are evaporating in equal measure, with each narrative pulling markets in opposite directions.We learned last week that the Fed was apparently a lot less united at its recent interest rate-setting June meeting than the announced unanimous decision suggested. According to the minutes of that gathering released on Wednesday, some officials favored another quarter-point increase right then and there, but eventually went along somewhat reluctantly with a decision to pause the hikes. Nearly all members of the rate-setting committee appeared to a...

2023-07-0905 min

ANGLES.Higher For Longer.Q2 and H1 2023 came to close on Friday. I’ll be releasing a full deep-dive review of the quarter in the financial markets in my feed in the next few days. For the moment, suffice to say that the TL;DR for the month of June is that it was defined by higher stock index prices but with a modest narrowing of the performance gap between the Super-Cap tech stocks and the rest of the market. Recent events in Russia have obviously injected more geopolitical uncertainty into the world, but as long as commodity prices don’t spik...

2023-07-0207 min

ANGLES.Pushing Back.US stocks endured a difficult holiday-shortened week amid concerns that higher interest rates could cause a slowdown in economic growth both here and abroad and a sense that stock market professionals may be starting to take profits on mega-cap tech and put the proceeds into bonds. There was also a feeling coming into the week that the recent rally had stretched short term valuations a bit and some cooling off of an over-bought condition was to be expected. And that’s exactly what we saw. The S&P 500 snapped its five-week winning streak, falling more than 1.4% (its wo...

2023-06-2506 min

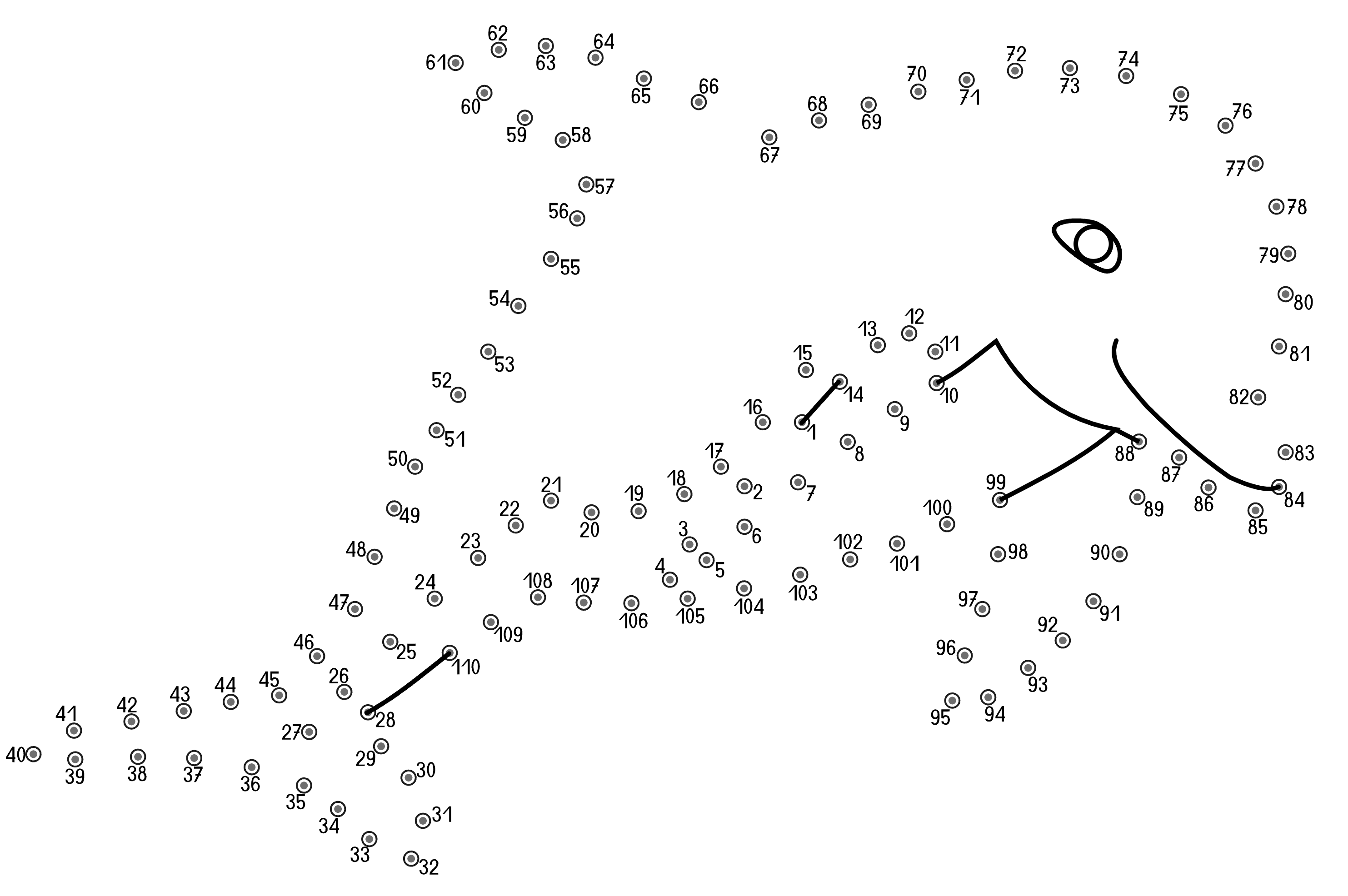

ANGLES.Connect The Dots.It was quite an extraordinary week in financial markets and potentially a very consequential one. The S&P 500 closed on Thursday at a higher level than it was the day before the Federal Reserve first started raising interest rates in March 2022. In other words, the index has now officially erased more than a year of Fed-inflicted interest rate pain. By the time the Fed meeting wrapped up on Wednesday, we had already received significant correspondence from the trenches of the war on inflation. When the Consumer Price Index (CPI) for May came out the day before, we...

2023-06-1807 min

ANGLES.Over The Edge?According to Wall Street’s categorization rules, the S&P 500 index exited bear market territory on Thursday when it closed up more than 20% from its lows from October of last year after spending 248 days there - the longest bear stretch since 1948. However, it still ended the week 10% below its all-time high from January 3rd 2022. While there’s absolutely nothing in the rules that says we can’t roll over into another new bear market right away, this one we’ve just been through is technically over. For what that’s worth. With shadow of a debt ceilin...

2023-06-1106 min

ANGLES.Mixed Signals.Despite the best efforts of the whining Congressional arsonists on both sides, the Biden/McCarthy debt deal cruised comfortably through the House of Representatives and the Senate and straight to Biden’s desk for signature yesterday, bringing an end to the whole completely unnecessary psychodrama. Markets had briefly begun repricing the risk of there still being some kind of US government default, even a self-inflicted very short one, but it soon became clear that, while the burn-it-all-down crew of politicians might soon try to exact some form of internal revenge on their own “ideological traitors” who agreed to the...

2023-06-0406 min

ANGLES.Skidding.Note: this report was completed before confirmation of the debt ceiling deal reached by negotiators. See my subsequent post: “Debt Ceiling Update”.Stocks skidded lower most of the week, giving back a lot of the previous week’s gains, as there was minimal reported progress towards a debt ceiling deal between the White House and Congressional Republicans. Talks seemed to collapse and restart over and over again with negotiators constantly talking out of both sides of their mouths so as to make absolutely nothing any of them said ever remotely believable. We are now just days a...

2023-05-2807 min

ANGLES.Smoke And Mirrors.The S&P 500 is at exactly the same level it was at two years ago. That’s a lot of angst and stress expended for no net change in 24 months. As if to emphasize the point, the stock market spent large portions of last week just churning sideways on very low volume as traders monitored the reported progress in debt ceiling negotiations. These dreary spells were occasionally punctuated by bursts of activity as i) carefully-managed clues were tactically released about how the debt ceiling negotiations might be going and ii) Fed officials suddenly got very talkative again.Th...

2023-05-2107 min

ANGLES.Turning Sour.Attention on Wall Street is shifting away from guessing future interest rates to the distinct possibility of an economic downturn. And that is encouraging investors to reward the strong and punish the weak. This is causing increasing divergences between the performance of different stocks within the same index or even the same sector.Winners offsetting losers is giving the impression of a quiet market not really going anywhere when you look down on it from an index level, but there is a lot going on under the surface. We are also seeing bonds finally beginning t...

2023-05-1406 min

ANGLES.Lurking In The Shadows.Note: I have published an updated version of my recent article “Cash Is Interesting Again. And Safe.” to reflect the higher interest being paid on cash accounts starting tomorrow with millions of dollars in insurance by both Flourish (increased to 4.55% for Tier 1 and 4.25% for Tier 2) and Betterment (increased to 4.50%). The updated version of the article can be viewed here. Markets woke up on Monday morning to the news that First Republic Bank (FRC) had finally been taken behind the woodshed and shot in what is now the new second-largest bank failure in US history, snatching that dubious hono...

2023-05-0706 min

ANGLES.A Low Bar.With trading volumes contracting rapidly, the stock market - at least as represented by the major indexes - was acting early last week like it had already checked out for summer and it’s not even May yet. It was proving to be something of a snooze-fest with a generally negative tilt as far as the headline indexes were concerned. But under the surface, things were playing out rather differently.Earnings and guidance are generally holding up better than expected, mostly beating estimates at a good clip - notably Microsoft (MSFT), Alphabet/Google (GOOGL), Meta/Facebook (META) an...

2023-04-3007 min

DFS BY THE NUMBERSUFC Vegas 72 Full Card Breakdown & Predictions | Ricky Simon vs Yadong SongCheck out my website "dfsbythenumbers.com". There you will find all my MMA betting and DFS content. Check out my affordable pricing options and get access to my bets right when I place them, my stats you see on screen, betting articles, and extra content that is not shown on Youtube!I also put my content on Patreon as well for those who are more comfortable with that platform. You can find me there at patreon.com/dfsbythenumbersBe sure to follow me on social media for live updates and my DM's are always open...

2023-04-2439 min

ANGLES.Maximum Pain.It is said on Wall Street that the goal of the market is to extract the maximum amount of pain from the greatest number of people. What this is getting at is that when everyone is positioned as bullish, the pain trade is for markets to move lower. When everyone is bearish, the pain trade is for them to go higher. As such, the pain trade has been mostly inflicted on the bears so far in 2023 and is helping support stocks, despite decidedly dodgy economic fundamentals. Sentiment matters in the short-term and so the pain trade was...

2023-04-2305 min

ANGLES.Hard Times Or Great Expectations?Last week was a busy one with plenty of economic data to chew on and lots of soundbites from International Monetary Fund (IMF) officials and Federal Reserve presidents. It also marked the opening of the Q1 2023 earnings season.Monday started out mostly jittery and trendless as the stock market tried to digest the Jobs Report from the holiday Friday before. Interestingly, the laggards were stocks in the defensive sectors like Utilities and Consumer Defensive that had outperformed the previous week, as worries eased about the prospect of an economic “hard landing” (i.e. inflation is only finally kill...

2023-04-1607 min

ANGLES.The Major Unknown.The week and the month began with investors shifting their attention away from March's banking turmoil and back to the risk of a recession that could drag down consumer spending, thereby corporate profits and thereby stock prices. And the holiday-shortened week provided plenty for them to focus on. Unexpected output cuts from the Organization of Petroleum Exporting Countries (OPEC, see EXPLAINER: FINANCIAL TERM OF THE WEEK below) were announced on Monday after oil prices dipped in March amid the banking stress and fears over the global economic outlook. Unsurprisingly, oil prices and oil stocks soared to...

2023-04-0906 min

ANGLES.No News Is Good News.The S&P 500 ended the week, month and quarter sitting almost exactly in the middle of its range over the last year and a strange calm seems to have descended upon markets. No scary news from the banking sector last week allowed investors to focus on other things, such as earnings and economic releases, which were mostly pretty good. Traders started the week with a smile on their faces as they learned that First Citizens BancShares (FCNCA), a North Carolina-based regional bank, had agreed to take over substantially all of the assets and liabilities of collapsed Silicon...

2023-04-0206 min

ANGLES.Almost There.A decent gain in stock prices on Monday was put down to a combination of an oversold bounce from the anguish of the two prior sessions, UBS finally putting Credit Suisse (CS) out of its misery by buying their Swiss banking rival for less than half of its value as well as not-too-guarded optimism about what Federal Reserve Chair Jerome Powell might say in his press conference later in the week, specifically speculating that he might formally announce that the rate-hiking cycle was over. Concerns about First Republic Bank (FRC) just refused to go away. Despite stories...

2023-03-2605 min

ANGLES.Get Out Of Jail Free?A week following three major US bank failures that then saw two other banks sail very close to the wind ended with stock markets higher, the S&P 500 was up 1.4% for the week and the NASDAQ closed 4.4% higher. Anyone who claims they can correctly predict this stuff is such a liar. Monday was the largest trading volume day so far this year on US exchanges (a record that lasted until Friday, when it was surpassed) and saw a bloodbath for shares of many regional banks on the back of the failures of Silvergate, Silicon Valley Bank and...

2023-03-1907 min

ANGLES.Caught Offside.New features in the report (see below): - Weekly updates on the latest official average 30 year fixed mortgage rate with comps going back one week, one month and one year- FedWatch Tool information: What the latest important market expectations are on interest rates with comps going back one week and one monthFederal Reserve Chairman Jerome Powell basically killed risk appetite on Tuesday with a change of tone on inflation in remarks before the Senate Banking Committee. Not for the first time, he contradicted previous statements he has made recently, stating that...

2023-03-1206 min

Mind Muscle with Simon de VeerTom Brady SmoothieEpisode Description: Welcome to the Mind Muscle Podcast where there is nothing new, except all that has been forgotten.Today Simon dives into the health routine of Tom Brady. The brand TB12 has become a staple of Brady’s lifestyle, so today Simon takes a look at the Tom Brady smoothie, and if it's everything it's cracked up to be. Will Simon be able to throw a 60 yard touchdown pass by the end of this episode? Pfff. Of course he can!Relevant Sources:Men’s Health Magazine The Pla...

2023-03-0247 min

The Starters on TSN 690E2, Hour 1: Will the NFL retire Tom Brady's number 12?The Starters: Joey Alfieri, Simon Tsalikis and Dave Trentadue discuss and debate the NHL All-Star Game, Tom Brady and more.

2023-02-0838 min

The Starters on TSN 690E1, Hour 1: Can the All-Star Game be fixed? Will Tom Brady come back?On the debut episode of The Starters, Joey Alfieri, Simon Tsalikis and Dave Trentadue discuss and debate the NHL All-Star Game, Tom Brady and more.

2023-02-0448 min

CoverTwoPodcast282 - "Purdy=Brady" Divisional Round 2023282.

DRAFT DISCORD | STREAM

STORYLINE SHIRT

DICKE DICKE FOLGE

News en masse... Alles zu den Coaches mit Payton, Harbaugh, den Teams in Frage, neuen Coordinator Spots uvm.

+ ein bisschen QB Offseason Talk.

Dazu die umfangreiche preview auf die Divisional Round

- Wer hat die Nase vorn?

- Was können wir aus der WC Round mitnehmen?

- Welche Matchups sind entscheidend

und warum Purdy=Brady

Enjoy!

Hier könnt ihr uns auf Twitter & Instagram folgen und euch sofort über neue Folgen und...

2023-01-191h 43

Green and Yellow Packers PodcastFolge 84: Brady WeekLiebe Leute, diese Woche fliegen die Packers endlich wieder nach Tampa Bay, Florida, um es erneut mit Tom Brady aufzunhemen. Können wir endlich Rache nehmen und wenn ja, wie? Wir wünschen viel Spaß beim Hören!!!

2022-09-221h 15

Practical Tax with Steve Moskowitz#30 | Filing Statuses and Estate Planning feat. Simon Brady & Brian LevyFinancial specialist Simon Brady asks a simple question; are your finances ready should you get divorced or your spouse were to die? Divorce and taxes; And what about your parents in their final days; will they, or YOU, outlive your money?

Episode Transcript

Intro:

Welcome to the Practical Tax podcast, with tax attorney Steve Moskowitz. The Practical Tax podcast is brought to you by Moskowitz, LLP, a tax law firm.

Disclaimer:

The information contained in this podcast is based upon information available as of date of recording and will not be updated for changes in law regulation. Any information is...

2022-08-0935 min

ANGLES.Nothing's sticking.Investor frustration and confusion at the fact that nothing’s sticking is growing. Authentic-looking rallies like what we saw the previous week end up having no value as they disappear in a puff of red smoke as happened last week. Back to square one as if the rally never happened. This low-traction environment seems (as suggested in my Under The Hood section last week) to be pivoting around the 3800 level for the SPX index (S&P 500). The index is the at the same level now as it was in the second week of June having been 300 points hi...

2022-07-0307 min

Shock Your PotentialProject Management For Your Money - Simon Brady“Start to take saving and investing particularly seriously, and as early as possible.” Simon Brady

We know that we need to invest in our financial future, but tackling it can be so daunting and downright overwhelming. It however doesn’t have to be that hard, especially for young people who still have the time and potential to accomplish their financial goals. Simon Brady helps people to plan their personal finances, and insists that the only person in charge of taking care of your financial future is yourself.

Simon Brady grew up in London but came to Wal...

2022-04-0831 min

The CXChronicles PodcastCXChronicles Podcast 148 with Simon Severino, CEO at Strategy SprintsHey CX Nation,In episode #148 of The CXChronicles Podcast we welcomed Simon Severino, CEO and Business Growth Coach at Strategy Sprints based in Austria. Strategy Sprints is currently working with a number of awesome startups, growth focused executives & leading brands around the world helping them get better clients, & focusing on doubling their revenues in 90 days .Simon talks with the CXNation about how they can create better marketing strategies, which leads to repeatable sales & over time improves your company's operations as you scale.Adrian and Simon also chat through The Four CX P...

2021-12-0841 min

How to Split a Toaster: A Divorce Podcast About Saving Your RelationshipsProtecting the Suddenly Single and their Money with Simon BradyIf you’re newly divorced, this episode is going to hit home. Today, we’re dealing with one of the central questions that form the overall arc of your divorce story: how do you handle the money? This week on the show, we have a guest seasoned in helping the “suddenly single” through the uncertainly, a financial educator for his clients in how to avoid the financial vultures the circle the divorce process.You’re going to learn some important concepts in this episode that you’ll need to know as you rebuild toward financial health. What is a fiduciary and why is t...

2021-11-2337 min

The Justin Brady ShowA matchmaking service for you and journalists? Dan Simon, founder of Qwoted.Dan Simon founded Qwoted as a matchmaking service for journalists and expert sources. He explains how broken the relationship is between PR people and journalists is, and how he's trying to change it with technology. We also discuss how many PR agencies operate and how it's highly offensive for most journalists. To learn about the FART Method, go to https://justinkbrady.com/perfect-pitch-email/ To download the free PDF guide to get more press, go to https://justinkbrady.com/access To try out Qwoted, go to https://www.qwoted.com/

2021-09-0834 min

ANGLES.Shock Your Potential podcast .. Simon's interview with Michael Sherlockhttps://podcasts.apple.com/us/podcast/shock-your-potential/id1336097089 This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit simonbrady.substack.com

2021-04-2600 min

Shock Your PotentialThe Best Time To Invest Is Now - Simon BradyWhen is the best time to begin investing? 5 year ago! Missed that deadline? Begin today.

Simon Brady grew up in London and studied business and finance before being transferred to New York to take on trading and senior management roles at a major Wall Street trading firm. After more than twenty-five years of trading experience during which time he saw 'behind the curtain' of how equity and currency markets operate, Simon eventually left the institutional trading world and became fully qualified as a CERTIFIED FINANCIAL PLANNER™ (CFP®) personal finance professional.

He subsequently worked for the United Nat...

2021-04-2633 min

ANGLES.The Rockstar Dad Show .. Simon's interview with Jaret Reddick and Gary Wiseman (starts at 26:30)I talk all things personal finance with Jaret and Gary, the rockstar dads (my interview starts at 26:30). This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit simonbrady.substack.com

2021-02-211h 05

Rockstar Dad ShowSimon Brady, CFPThis week, Jaret and Gary are answering parenting questions you've had for years. Tune in as they share the solution to getting your kid an iPhone before inviting this week’s guest to the air.

Simon Brady is the founder of Anglia Advisors and specializes in helping young people with their finances. He joins the show to share tips and tricks to spark your kids’ interest in saving and investing.

Plus, he chats money goals —and where your priorities should be. Whether you’re looking for a house, saving for retirement, or putting your kids through co...

2021-02-171h 05

Average Joe Finances33. From Wall Street Madness to Financial Gladness with Simon BradyIn this episode I had a great interview with Simon Brady from Anglia Advisors. Originally from London, Simon spent over 25 years in an institutional currency and equity derivatives trading environment both in the financial district of London and on Wall Street. He began his CERTIFIED FINANCIAL PLANNER™ education in 2010 at New York University and earned my CFP® designation.Simon worked for the United Nations as a financial advisor for a while and in 2016 registered his own independent firm, Anglia Advisors, and began providing full-time fee-only personal finance consulting and investment management services.His practice focuses on...

2021-02-1433 min

ANGLES.Crushing Debt podcast .. Simon's interview with Shawn YesnerShawn Yesner, host of the Crushing Debt podcast, quizzed me on how a fee-only CERTIFIED FINANCIAL PLANNER™ can help younger people navigate the multitude of life events that are thrown at them between college graduation and their early 40s. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit simonbrady.substack.com

2021-02-0732 min

DreamsRecycled hosted by Tiffany AnnDreamsRecycled with Simon Brady CFP Avoiding Financial mistakesSimon joins Tiffany to discuss the financial mistakes made in divorce and relationships.

Originally from London, Simon Brady spent 25+ years trading currency and equities for firms both in the financial district of London and on Wall Street. He began his CERTIFIED FINANCIAL PLANNER™ education in 2010 at New York University and earned his CFP® designation.

Simon worked for the United Nations as a financial advisor for a while but then registered his own independent firm, Anglia Advisors, and began providing fee-only personal finance consulting and investment management services to clients in 2016. You can find out more about Simon at www.angliaadvisors.com

2021-02-0527 min

ANGLES.Tax Resolution Ninja podcast .. Simon's interview with Allan RollnickAllan Rollnick, the Tax Resolution Ninja, talks to me about the way I would approach different personal finance scenarios when working with clients under the age of 40. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit simonbrady.substack.com

2021-02-0428 min

The Tax Resolution Ninja ShowSmart Financial Planning for People Under 40 with Simon Brady, Principal of Anglia AdvisorsSimon Brady is the Founder and Principal of Anglia Advisors, a New York City-based Registered Investment Advisor that offers fee-only financial planning or personal finance consulting services and professional investment management. Simon is a Certified Financial Planner with extensive experience in global financial market and investment management. In this episode… The world is your oyster when you’re young but if you’re not maximizing your time, then you are likely setting yourself up for bigger problems down the road. As you work your way into establishing a successful career in your chosen field...

2021-02-0328 min

ANGLES.Doing Divorce Right podcast .. Simon's interview with Jennifer HurvitzJennifer Hurvitz talks to me on her popular Doing Divorce Right podcast about handling your personal finances in that turbulent time immediately following the issue of a divorce decree and avoiding that feeling of being overwhelmed by all the moving parts that inevitably arise. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit simonbrady.substack.com

2020-10-3026 min

ANGLES.Going Solo podcast .. Simon's interviewI was interviewed about Anglia Advisors by David Shriner-Cahn for his popular Going Solo podcast ..* An unusual niche for a financial advisor that many would avoid [1:50]* The benefits of a fee-only basis for both entrepreneurs and clients in the financial field [4:44]* Why the wolf quit Wall Street [7:11]* Shifting lives instead of shifting millions of dollars [10:26]* The time to get creative about arranging your time [13:38]* Why it’s crucial you realize what you don’t know [15:48] * How to keep a steady flow in the pipeline [17:04] ...

2020-10-2923 min

ANGLES.Simon interviewed on The Thoughtful Entrepreneur podcastI was interviewed on Josh Elledge’s Thoughtful Entrepreneur podcast about how Anglia Advisors came about following a Wall Street trading career, who the firm seeks to serve and what a financial planning engagement looks like. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit simonbrady.substack.com

2020-10-2920 min

ANGLES.Divorce Team Radio podcast .. Simon talks about personal finances post-divorceOn the popular Divorce Team Radio podcast, I was interviewed about the particular personal finance challenges faced by individuals coming out of a divorce and how working with a specialized, fiduciary advisor can make such an enormous difference. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit simonbrady.substack.com

2020-10-2944 min

Simon SaysSimon Says - Episode 7 - Simon Owens + Tom SiegertListen to Simon Madden catch up with Tom Siegert - aka The Suburban Footballer - and Simon Owens, best known as co-presenter alongside Phillip Brady on 3AW's longest-running show, Nightline.

Tom chats with Simon about how he got into stand-up comedy. From the experience of watching his first comic act in the Gershwin Room at Esplanade Hotel, to taking 4 years to build his confidence while being a dental technician. Then starting out by secretly doing open mic for 12mths before being spotted by a friend! He also plugs his new book 'The Suburban Footballer' is now available...

2020-10-1446 min

Going SoloSolo with Less Stress Featuring Simon BradySimon Brady is a seasoned financial advisor specializing in individuals coming out of a divorce, suddenly single (widows), millennials and individuals that are between the ages of 20-40, and immigrants, all underserved demographics that get taken advantage of due to emotional stress, naivety, or language barriers.We discuss:An unusual niche for a financial advisor that many would avoid [1:50]The benefits of a fee-only basis for both entrepreneurs and clients in the financial field [4:44]Why the wolf quit Wall Street [7:11]Shifting lives instead of shifting millions of dollars [10:26]The time to get creative about arranging your...

2020-10-0223 min

Divorce Team Radio - Your Source for Divorce and Family Law MattersPost Divorce Financial Mistakes To Avoid with Simon Brady, CFPIn this show, Leh and Todd interview Simon Brady, a Certified Financial Planner, from Anglia Advisors, about the top financial mistakes he sees people make after their divorce is over. A life lesson he learned early in life inspired him to focus his practice on helping those who are recovering from a divorce. He wants to ensure that his clients set their financial future in the right direction. If you would like a transcript of this show, you can find it on our website. If you are enjoying the show, please take a moment to post a positive review about it. No...

2020-08-1844 min

The Numberphile PodcastThe Numeracy Ambassador - with Simon PampenaSpeaking with Simon Pampena, Australia's National Numeracy Ambassador who once dreamed of being a Jedi.

Simon Pampena website

Videos with Simon on Numberphile

Epic Circles and The Legend of Question Six

Simon on Twitter

Beyond 2000

The Malls' Balls are also discussed in our Quiz Episode with Matt Parker

With thanks to

MSRI

Support us on Patreon - we appreciate your help

The Patron Wall of Fame

You can also catch this episode on the Numberphile2 YouTube channel

2020-07-011h 00

CoverTwoPodcast123 - "Brady, Brady, Brady" offseason-needs pt. 3Folge 123.

1, 2, 3... und schon sind wir kurz vor der Free Agency. Guter Zeitpunkt um die letzten 8 Teams und ihre offseason needs abzuschließen.

Dazu gibt es die News mit so wenig Tom Brady wie möglich und die Einschätzungen von Simon und Luca zu den aktuellen Trades, Signings etc.

Abschließend sprechen die beiden zum vorerst vllt letzten Mal über den Draft ehe nächste Woche CBA und Free Agency alles übernehmen.

Enjoy!

Hier könnt ihr uns auf Twitter folgen und euch sofort über neue Folgen und die NFL informieren.

Wir würden uns auch über die ein oder andere iTun...

2020-03-081h 41

The Numberphile PodcastThe Math Storyteller - with Simon SinghAuthor and campaigner Simon Singh talks about his fascinating career, a famous legal case, and his attempts to change the way mathematics is taught in UK schools.

Simon Singh's website - links to all sorts of stuff

Watch Simon's videos on Numberphile

parallel - as discussed on the show

Simon's books on Amazon

Quest for a new £50 note

Brady's video with suggestion for the £50

British Chiropractic Association v Singh - via Wikipedia

With thanks to: MSRI and episode sponsor Meyer Sound

Br...

2019-02-111h 11

Angles, The Anglia Advisors PodcastAll About Buying & Selling Real Estate in NYCAlex Mahgoub is a real estate broker in New York City and, in this episode, he shares with us what both prospective buyers and sellers need to be thinking about in the current environment, how the process works, where's "hot" and why, what mistakes consistently sabotage a sale or a purchase and much more including how the participant mentality can mirror that of the stock market.

A "must-listen" if you are thinking about joining the circus known as the New York real estate market!

http://www.alexmahgoub.com/

https://www.instagram.com/alexmahgoub/

https://medium.com/personal-growth/the-endowment-effect-why-you-cant-let-go-of-your-possessions-a6be94eea10...

2018-10-0947 min

ANGLES.AA POD: Simon on Asset TV, talking about advising foreign nationalsA bonus episode, featuring the audio of Simon's appearance on Asset TV in 2017 in which he discusses with Maya Chung what financial advisors need to know and understand when dealing with foreign national clients. It ends up being a good summary of many of the important financial planning issues that need to be considered by foreign nationals moving to the US. Unfortunately the video clip is no longer available. This is a public episode. If you would like to discuss this with other subscribers or get access to bonus episodes, visit simonbrady.substack.c...

2018-09-0310 min

Angles, The Anglia Advisors PodcastSimon on Asset TV, talking about advising foreign nationalsA bonus episode, featuring the audio of Simon's appearance on Asset TV in 2017 in which he discusses with Maya Chung what financial advisors need to know and understand when dealing with foreign national clients. It ends up being a good summary of many of the important financial planning issues that need to be considered by foreign nationals moving to the US.

Unfortunately the video clip is no longer available.

2018-09-0310 min