Shows

ANGLES.Noisy.It started out so well. There was green all over the board for a while with earnings mostly looking very perky. But in the end, sentiment was overwhelmed by the noise of higher interest rates, Middle East fears, bedlam in Congress, a government shutdown once again looming on the horizon, fears that consumer spending - and thereby inflation - is refusing to die and some rather nasty projections about the global financial system. Stocks began the week by jumping higher at the open on Monday and maintained their gains for the rest of the session, boosted both...2023-10-2206 min

ANGLES.Noisy.It started out so well. There was green all over the board for a while with earnings mostly looking very perky. But in the end, sentiment was overwhelmed by the noise of higher interest rates, Middle East fears, bedlam in Congress, a government shutdown once again looming on the horizon, fears that consumer spending - and thereby inflation - is refusing to die and some rather nasty projections about the global financial system. Stocks began the week by jumping higher at the open on Monday and maintained their gains for the rest of the session, boosted both...2023-10-2206 min ANGLES.Dazed And Confused.The stock market was open on Monday although the bond market wasn’t and it had its first chance to react to the latest flare up of the conflict in Israel and Palestine that broke out over the weekend. Wall Street tries to frame everything in dollars and cents, because, well, that’s its job - but it can often appear a little dazed and confused when it comes to having to suddenly price in geopolitical risk. After a predictable dip at the open, stocks recovered to push into positive territory by the close, driven higher not only...2023-10-1506 min

ANGLES.Dazed And Confused.The stock market was open on Monday although the bond market wasn’t and it had its first chance to react to the latest flare up of the conflict in Israel and Palestine that broke out over the weekend. Wall Street tries to frame everything in dollars and cents, because, well, that’s its job - but it can often appear a little dazed and confused when it comes to having to suddenly price in geopolitical risk. After a predictable dip at the open, stocks recovered to push into positive territory by the close, driven higher not only...2023-10-1506 min ANGLES.Weird.Stocks eventually ended a little higher for the week but it was a tough slog getting there with interest rates continuing to push ever higher (see AVERAGE 30-YEAR FIXED RATE MORTGAGE below) and a bizarre Jobs Report on Friday. Monday started out quietly. There was some relief at no government shutdown but an awareness that the can is now lying just a little further down the road and nothing had really changed. Markets quickly resumed their recent short-term path of least resistance by moving lower, with Small Caps once again leading the way downwards. Tuesday...2023-10-0806 min

ANGLES.Weird.Stocks eventually ended a little higher for the week but it was a tough slog getting there with interest rates continuing to push ever higher (see AVERAGE 30-YEAR FIXED RATE MORTGAGE below) and a bizarre Jobs Report on Friday. Monday started out quietly. There was some relief at no government shutdown but an awareness that the can is now lying just a little further down the road and nothing had really changed. Markets quickly resumed their recent short-term path of least resistance by moving lower, with Small Caps once again leading the way downwards. Tuesday...2023-10-0806 min ANGLES.A Bad Smell.The month of September duly lived up to its stock-killing reputation and there was a strong sense of good riddance from investors as markets closed on Friday. On the bright side, Octobers following losing Septembers have a history of being rather good for stock prices and November to December is historically a strong season. Last week began with a predictable but mild snap-back rally on Monday after the carnage that had followed the outcome of the most recent Fed meeting the week before. But the relief was short-lived. By Tuesday, markets across the board were back in...2023-10-0107 min

ANGLES.A Bad Smell.The month of September duly lived up to its stock-killing reputation and there was a strong sense of good riddance from investors as markets closed on Friday. On the bright side, Octobers following losing Septembers have a history of being rather good for stock prices and November to December is historically a strong season. Last week began with a predictable but mild snap-back rally on Monday after the carnage that had followed the outcome of the most recent Fed meeting the week before. But the relief was short-lived. By Tuesday, markets across the board were back in...2023-10-0107 min ANGLES.Reading The Tea Leaves.Last week was always going to be about Wednesday’s Federal Reserve meeting and its fallout. We are undergoing a major shift from the question being “How high will interest rates go?” (the market’s obsession over the last eighteen months) to “How long will interest rates stay high?” going forward.It is now the answer to this second question that will determine if the Fed’s stance is deemed to be hawkish (bad for stocks/bonds) or dovish (good for stocks/bonds). For any rally to continue, markets need, at a minimum, for the Fed to meet current e...2023-09-2407 min

ANGLES.Reading The Tea Leaves.Last week was always going to be about Wednesday’s Federal Reserve meeting and its fallout. We are undergoing a major shift from the question being “How high will interest rates go?” (the market’s obsession over the last eighteen months) to “How long will interest rates stay high?” going forward.It is now the answer to this second question that will determine if the Fed’s stance is deemed to be hawkish (bad for stocks/bonds) or dovish (good for stocks/bonds). For any rally to continue, markets need, at a minimum, for the Fed to meet current e...2023-09-2407 min ANGLES.Lurking.Reuters, Bloomberg and the Wall Street Journal all published articles last weekend essentially saying that the Fed is done with interest rate hikes and while that’s hardly new news, it helps counter some of the somewhat negative narratives that are emerging as investors step back to assess the state of the economy and the business cycle looking towards the end of the year.It’s leading to an increasingly popular stance among traders and investors of “strongly neutral” on stocks and bonds as markets seem to be lacking any faith in pushing things in either direction. Being st...2023-09-1707 min

ANGLES.Lurking.Reuters, Bloomberg and the Wall Street Journal all published articles last weekend essentially saying that the Fed is done with interest rate hikes and while that’s hardly new news, it helps counter some of the somewhat negative narratives that are emerging as investors step back to assess the state of the economy and the business cycle looking towards the end of the year.It’s leading to an increasingly popular stance among traders and investors of “strongly neutral” on stocks and bonds as markets seem to be lacking any faith in pushing things in either direction. Being st...2023-09-1707 min ANGLES.Trading Jabs.U.S. markets found themselves heavily impacted last week by a number of decisions made from beyond its shores. The United States and China continue to trade jabs, particularly at each other’s tech giants and it’s having an effect on the stock market. Apple stock (AAPL) is probably the largest holding in most investors’ total market and large cap fund portfolios and it fell hard, swiftly shedding over $200 billion in market value following Wednesday’s report that China now plans to expand its ban on the use of iPhones to government workers at state firm...2023-09-1007 min

ANGLES.Trading Jabs.U.S. markets found themselves heavily impacted last week by a number of decisions made from beyond its shores. The United States and China continue to trade jabs, particularly at each other’s tech giants and it’s having an effect on the stock market. Apple stock (AAPL) is probably the largest holding in most investors’ total market and large cap fund portfolios and it fell hard, swiftly shedding over $200 billion in market value following Wednesday’s report that China now plans to expand its ban on the use of iPhones to government workers at state firm...2023-09-1007 min ANGLES.Time Out.A reasonably solid last few days of the month wasn’t enough to rescue August from being the first losing month for stocks since February, with the Large Cap S&P 500, the tech-heavy NASDAQ-100 and the Small Cap Russell 2000 losing 1.8%, 2.2% and 4.5% respectively.We're now heading into what is often the rockiest part of the year. September is the only month to have historically seen more stock market declines than advances over the years and October has previously hosted some of the most spectacular bouts of volatility. This particular September/October period carries its own additional ri...2023-09-0305 min

ANGLES.Time Out.A reasonably solid last few days of the month wasn’t enough to rescue August from being the first losing month for stocks since February, with the Large Cap S&P 500, the tech-heavy NASDAQ-100 and the Small Cap Russell 2000 losing 1.8%, 2.2% and 4.5% respectively.We're now heading into what is often the rockiest part of the year. September is the only month to have historically seen more stock market declines than advances over the years and October has previously hosted some of the most spectacular bouts of volatility. This particular September/October period carries its own additional ri...2023-09-0305 min ANGLES.Interrupted?There’s a very accurate saying that that you can win just about any financial argument you like by simply adjusting the start and end dates of a scenario. There’s a perfect example of this on show right now with the most important question of all to investors. Is what we have seen over the last few weeks a temporary pullback within what is still a bull (rising) market that dates back to March of this year .. or .. is what we have seen over the last few months a temporary rally within what is still a bear...2023-08-2706 min

ANGLES.Interrupted?There’s a very accurate saying that that you can win just about any financial argument you like by simply adjusting the start and end dates of a scenario. There’s a perfect example of this on show right now with the most important question of all to investors. Is what we have seen over the last few weeks a temporary pullback within what is still a bull (rising) market that dates back to March of this year .. or .. is what we have seen over the last few months a temporary rally within what is still a bear...2023-08-2706 min ANGLES.Afraid Of Its Own Shadow.As I’ll show in a moment, earnings and economic data last week generally propped up the case for a soft landing for the US economy and should have been celebrated, but the stock market seemed jumpy and afraid of its own shadow - seizing on anything negative it could find. There’s a downside to the current high level of economic strength. In something of a return to the old “good news is bad news” narrative of 2021 and 2022, solid evidence of stronger growth was viewed suspiciously as possibly fueling inflation, maybe prompting the Fed to raise...2023-08-2008 min

ANGLES.Afraid Of Its Own Shadow.As I’ll show in a moment, earnings and economic data last week generally propped up the case for a soft landing for the US economy and should have been celebrated, but the stock market seemed jumpy and afraid of its own shadow - seizing on anything negative it could find. There’s a downside to the current high level of economic strength. In something of a return to the old “good news is bad news” narrative of 2021 and 2022, solid evidence of stronger growth was viewed suspiciously as possibly fueling inflation, maybe prompting the Fed to raise...2023-08-2008 min ANGLES.Just Following The Playbook.The stock market playbook is being followed exactly as we would expect and in the way that I have been banging on about in my recent weekly reports. The plain fact is that, around 4500, the S&P 500 index is priced for near-term perfection with zero room for any kind of disappointments, meaning that even the most modest of negatives (an uptick in market interest rates, some lackluster earnings, a less impressive economic report) or simply news or data that isn’t constantly positive, can cause market choppiness and sometimes significant pullbacks - not because the news is th...2023-08-1306 min

ANGLES.Just Following The Playbook.The stock market playbook is being followed exactly as we would expect and in the way that I have been banging on about in my recent weekly reports. The plain fact is that, around 4500, the S&P 500 index is priced for near-term perfection with zero room for any kind of disappointments, meaning that even the most modest of negatives (an uptick in market interest rates, some lackluster earnings, a less impressive economic report) or simply news or data that isn’t constantly positive, can cause market choppiness and sometimes significant pullbacks - not because the news is th...2023-08-1306 min ANGLES.All Aboard The Happy Train?Bank of America became the latest to hop aboard the now-rather crowded Happy Train early last week, eagerly joining Team No Recession. The abrupt change of stance comes just a week after Federal Reserve Chair Jerome Powell told reporters that the central bank’s own economists are no longer forecasting a recession. As BofA economists put it in a note to clients on Wednesday;“Recent incoming data has made us reassess our prior view that a mild recession in 2024 is the most likely outcome for the US economy,” The no-recession narrative appeared to have been endorsed by the la...2023-08-0605 min

ANGLES.All Aboard The Happy Train?Bank of America became the latest to hop aboard the now-rather crowded Happy Train early last week, eagerly joining Team No Recession. The abrupt change of stance comes just a week after Federal Reserve Chair Jerome Powell told reporters that the central bank’s own economists are no longer forecasting a recession. As BofA economists put it in a note to clients on Wednesday;“Recent incoming data has made us reassess our prior view that a mild recession in 2024 is the most likely outcome for the US economy,” The no-recession narrative appeared to have been endorsed by the la...2023-08-0605 min ANGLES.Open Door.To the surprise of precisely nobody, the Federal Reserve resumed its campaign of interest rate increases on Wednesday, pushing its target Fed Funds rate up another quarter of a percentage point to a range of 5.25%-5.50%, the highest level since J-Lo joined forces with Ja Rule to point out to us that she was real back in 2001. It marked the eleventh increase since March 2022, at which time the rate was near zero. There were only the slightest of tweaks to the wording of the committee's eagerly-awaited June policy statement and no hint that the Fed might react...2023-07-3006 min

ANGLES.Open Door.To the surprise of precisely nobody, the Federal Reserve resumed its campaign of interest rate increases on Wednesday, pushing its target Fed Funds rate up another quarter of a percentage point to a range of 5.25%-5.50%, the highest level since J-Lo joined forces with Ja Rule to point out to us that she was real back in 2001. It marked the eleventh increase since March 2022, at which time the rate was near zero. There were only the slightest of tweaks to the wording of the committee's eagerly-awaited June policy statement and no hint that the Fed might react...2023-07-3006 min ANGLES.Soon To Be Erased?Less than twenty months after it began, the bear market that engulfed the S&P 500 in early 2022 is now just 260 points away from being completely erased.2023 has barely passed its midpoint and the market has already blown through even the most optimistic estimates for where Wall Street thought the S&P 500 might be by year end. In the process, it has constantly defied all the early-year gloom accompanied by talk of a guaranteed recession, soaring inflation and an aggressive Federal Reserve interest rate policy.However, while it’s undeniable that the fears of a hard lan...2023-07-2305 min

ANGLES.Soon To Be Erased?Less than twenty months after it began, the bear market that engulfed the S&P 500 in early 2022 is now just 260 points away from being completely erased.2023 has barely passed its midpoint and the market has already blown through even the most optimistic estimates for where Wall Street thought the S&P 500 might be by year end. In the process, it has constantly defied all the early-year gloom accompanied by talk of a guaranteed recession, soaring inflation and an aggressive Federal Reserve interest rate policy.However, while it’s undeniable that the fears of a hard lan...2023-07-2305 min ANGLES.Short And Shallow?Short and shallow seems to be the growing expectation surrounding any 2023 recession, if it ever even arrives at all. The US economy is stronger than most people expected and inflation is clearly stabilizing. This is the “immaculate disinflation” that many optimists talked about a year ago, with an economy simply showing signs of normalizing after a pandemic. Under this theory, the Federal Reserve may just get to have its cake and eat it, too.At the beginning of the year, stocks were priced for a meaningful economic slowdown and an earnings drop that never in fact happened. This...2023-07-1606 min

ANGLES.Short And Shallow?Short and shallow seems to be the growing expectation surrounding any 2023 recession, if it ever even arrives at all. The US economy is stronger than most people expected and inflation is clearly stabilizing. This is the “immaculate disinflation” that many optimists talked about a year ago, with an economy simply showing signs of normalizing after a pandemic. Under this theory, the Federal Reserve may just get to have its cake and eat it, too.At the beginning of the year, stocks were priced for a meaningful economic slowdown and an earnings drop that never in fact happened. This...2023-07-1606 min ANGLES.Evaporating.Fears of an imminent destructive recession and hopes of any interest rate cuts in 2023 are evaporating in equal measure, with each narrative pulling markets in opposite directions.We learned last week that the Fed was apparently a lot less united at its recent interest rate-setting June meeting than the announced unanimous decision suggested. According to the minutes of that gathering released on Wednesday, some officials favored another quarter-point increase right then and there, but eventually went along somewhat reluctantly with a decision to pause the hikes. Nearly all members of the rate-setting committee appeared to a...2023-07-0905 min

ANGLES.Evaporating.Fears of an imminent destructive recession and hopes of any interest rate cuts in 2023 are evaporating in equal measure, with each narrative pulling markets in opposite directions.We learned last week that the Fed was apparently a lot less united at its recent interest rate-setting June meeting than the announced unanimous decision suggested. According to the minutes of that gathering released on Wednesday, some officials favored another quarter-point increase right then and there, but eventually went along somewhat reluctantly with a decision to pause the hikes. Nearly all members of the rate-setting committee appeared to a...2023-07-0905 min ANGLES.Higher For Longer.Q2 and H1 2023 came to close on Friday. I’ll be releasing a full deep-dive review of the quarter in the financial markets in my feed in the next few days. For the moment, suffice to say that the TL;DR for the month of June is that it was defined by higher stock index prices but with a modest narrowing of the performance gap between the Super-Cap tech stocks and the rest of the market. Recent events in Russia have obviously injected more geopolitical uncertainty into the world, but as long as commodity prices don’t spik...2023-07-0207 min

ANGLES.Higher For Longer.Q2 and H1 2023 came to close on Friday. I’ll be releasing a full deep-dive review of the quarter in the financial markets in my feed in the next few days. For the moment, suffice to say that the TL;DR for the month of June is that it was defined by higher stock index prices but with a modest narrowing of the performance gap between the Super-Cap tech stocks and the rest of the market. Recent events in Russia have obviously injected more geopolitical uncertainty into the world, but as long as commodity prices don’t spik...2023-07-0207 min ANGLES.Pushing Back.US stocks endured a difficult holiday-shortened week amid concerns that higher interest rates could cause a slowdown in economic growth both here and abroad and a sense that stock market professionals may be starting to take profits on mega-cap tech and put the proceeds into bonds. There was also a feeling coming into the week that the recent rally had stretched short term valuations a bit and some cooling off of an over-bought condition was to be expected. And that’s exactly what we saw. The S&P 500 snapped its five-week winning streak, falling more than 1.4% (its wo...2023-06-2506 min

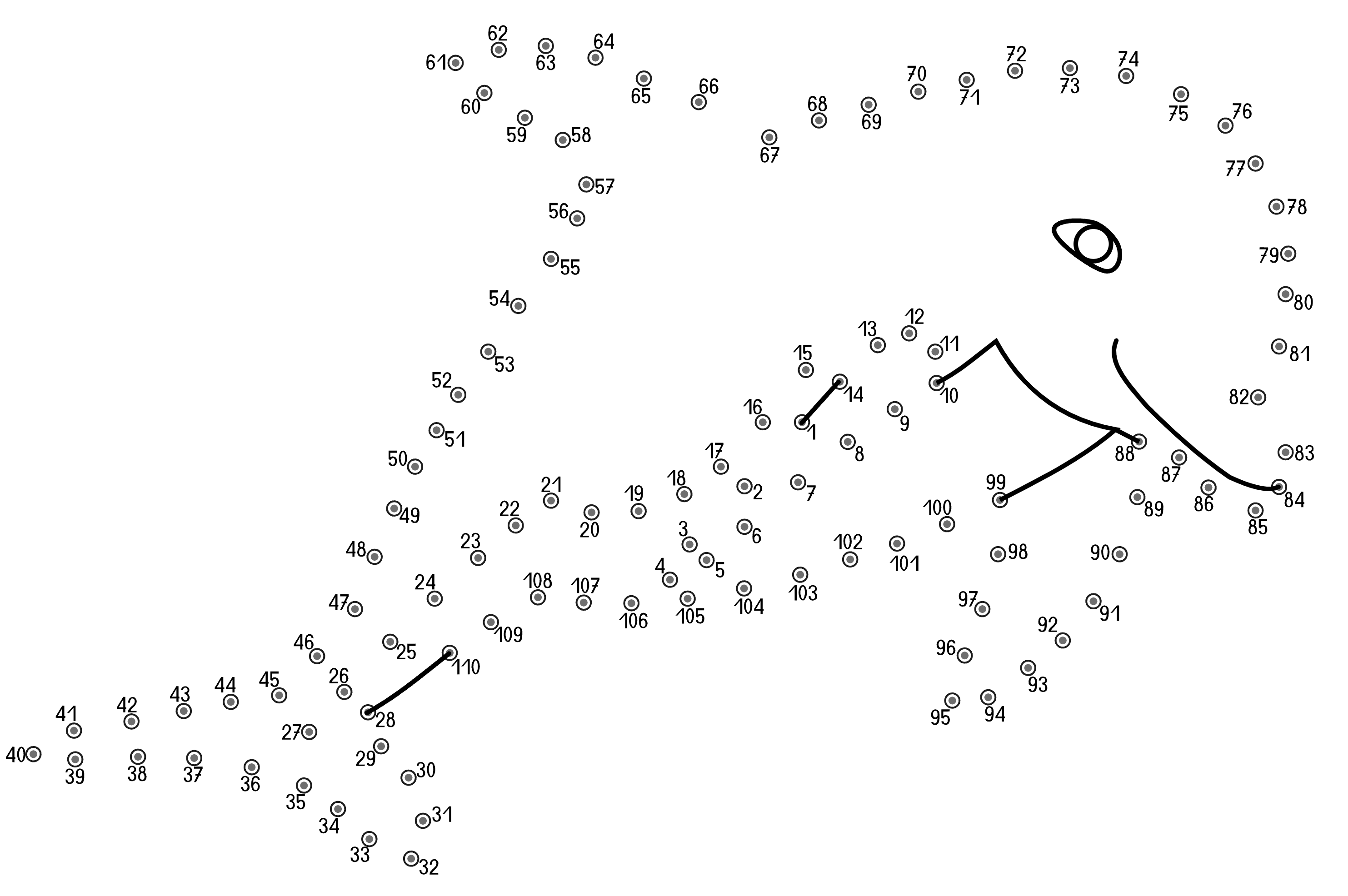

ANGLES.Pushing Back.US stocks endured a difficult holiday-shortened week amid concerns that higher interest rates could cause a slowdown in economic growth both here and abroad and a sense that stock market professionals may be starting to take profits on mega-cap tech and put the proceeds into bonds. There was also a feeling coming into the week that the recent rally had stretched short term valuations a bit and some cooling off of an over-bought condition was to be expected. And that’s exactly what we saw. The S&P 500 snapped its five-week winning streak, falling more than 1.4% (its wo...2023-06-2506 min ANGLES.Connect The Dots.It was quite an extraordinary week in financial markets and potentially a very consequential one. The S&P 500 closed on Thursday at a higher level than it was the day before the Federal Reserve first started raising interest rates in March 2022. In other words, the index has now officially erased more than a year of Fed-inflicted interest rate pain. By the time the Fed meeting wrapped up on Wednesday, we had already received significant correspondence from the trenches of the war on inflation. When the Consumer Price Index (CPI) for May came out the day before, we...2023-06-1807 min

ANGLES.Connect The Dots.It was quite an extraordinary week in financial markets and potentially a very consequential one. The S&P 500 closed on Thursday at a higher level than it was the day before the Federal Reserve first started raising interest rates in March 2022. In other words, the index has now officially erased more than a year of Fed-inflicted interest rate pain. By the time the Fed meeting wrapped up on Wednesday, we had already received significant correspondence from the trenches of the war on inflation. When the Consumer Price Index (CPI) for May came out the day before, we...2023-06-1807 min ANGLES.Over The Edge?According to Wall Street’s categorization rules, the S&P 500 index exited bear market territory on Thursday when it closed up more than 20% from its lows from October of last year after spending 248 days there - the longest bear stretch since 1948. However, it still ended the week 10% below its all-time high from January 3rd 2022. While there’s absolutely nothing in the rules that says we can’t roll over into another new bear market right away, this one we’ve just been through is technically over. For what that’s worth. With shadow of a debt ceilin...2023-06-1106 min

ANGLES.Over The Edge?According to Wall Street’s categorization rules, the S&P 500 index exited bear market territory on Thursday when it closed up more than 20% from its lows from October of last year after spending 248 days there - the longest bear stretch since 1948. However, it still ended the week 10% below its all-time high from January 3rd 2022. While there’s absolutely nothing in the rules that says we can’t roll over into another new bear market right away, this one we’ve just been through is technically over. For what that’s worth. With shadow of a debt ceilin...2023-06-1106 min ANGLES.Mixed Signals.Despite the best efforts of the whining Congressional arsonists on both sides, the Biden/McCarthy debt deal cruised comfortably through the House of Representatives and the Senate and straight to Biden’s desk for signature yesterday, bringing an end to the whole completely unnecessary psychodrama. Markets had briefly begun repricing the risk of there still being some kind of US government default, even a self-inflicted very short one, but it soon became clear that, while the burn-it-all-down crew of politicians might soon try to exact some form of internal revenge on their own “ideological traitors” who agreed to the...2023-06-0406 min

ANGLES.Mixed Signals.Despite the best efforts of the whining Congressional arsonists on both sides, the Biden/McCarthy debt deal cruised comfortably through the House of Representatives and the Senate and straight to Biden’s desk for signature yesterday, bringing an end to the whole completely unnecessary psychodrama. Markets had briefly begun repricing the risk of there still being some kind of US government default, even a self-inflicted very short one, but it soon became clear that, while the burn-it-all-down crew of politicians might soon try to exact some form of internal revenge on their own “ideological traitors” who agreed to the...2023-06-0406 min ANGLES.Skidding.Note: this report was completed before confirmation of the debt ceiling deal reached by negotiators. See my subsequent post: “Debt Ceiling Update”.Stocks skidded lower most of the week, giving back a lot of the previous week’s gains, as there was minimal reported progress towards a debt ceiling deal between the White House and Congressional Republicans. Talks seemed to collapse and restart over and over again with negotiators constantly talking out of both sides of their mouths so as to make absolutely nothing any of them said ever remotely believable. We are now just days a...2023-05-2807 min

ANGLES.Skidding.Note: this report was completed before confirmation of the debt ceiling deal reached by negotiators. See my subsequent post: “Debt Ceiling Update”.Stocks skidded lower most of the week, giving back a lot of the previous week’s gains, as there was minimal reported progress towards a debt ceiling deal between the White House and Congressional Republicans. Talks seemed to collapse and restart over and over again with negotiators constantly talking out of both sides of their mouths so as to make absolutely nothing any of them said ever remotely believable. We are now just days a...2023-05-2807 min ANGLES.Smoke And Mirrors.The S&P 500 is at exactly the same level it was at two years ago. That’s a lot of angst and stress expended for no net change in 24 months. As if to emphasize the point, the stock market spent large portions of last week just churning sideways on very low volume as traders monitored the reported progress in debt ceiling negotiations. These dreary spells were occasionally punctuated by bursts of activity as i) carefully-managed clues were tactically released about how the debt ceiling negotiations might be going and ii) Fed officials suddenly got very talkative again.Th...2023-05-2107 min

ANGLES.Smoke And Mirrors.The S&P 500 is at exactly the same level it was at two years ago. That’s a lot of angst and stress expended for no net change in 24 months. As if to emphasize the point, the stock market spent large portions of last week just churning sideways on very low volume as traders monitored the reported progress in debt ceiling negotiations. These dreary spells were occasionally punctuated by bursts of activity as i) carefully-managed clues were tactically released about how the debt ceiling negotiations might be going and ii) Fed officials suddenly got very talkative again.Th...2023-05-2107 min ANGLES.Turning Sour.Attention on Wall Street is shifting away from guessing future interest rates to the distinct possibility of an economic downturn. And that is encouraging investors to reward the strong and punish the weak. This is causing increasing divergences between the performance of different stocks within the same index or even the same sector.Winners offsetting losers is giving the impression of a quiet market not really going anywhere when you look down on it from an index level, but there is a lot going on under the surface. We are also seeing bonds finally beginning t...2023-05-1406 min

ANGLES.Turning Sour.Attention on Wall Street is shifting away from guessing future interest rates to the distinct possibility of an economic downturn. And that is encouraging investors to reward the strong and punish the weak. This is causing increasing divergences between the performance of different stocks within the same index or even the same sector.Winners offsetting losers is giving the impression of a quiet market not really going anywhere when you look down on it from an index level, but there is a lot going on under the surface. We are also seeing bonds finally beginning t...2023-05-1406 min ANGLES.Lurking In The Shadows.Note: I have published an updated version of my recent article “Cash Is Interesting Again. And Safe.” to reflect the higher interest being paid on cash accounts starting tomorrow with millions of dollars in insurance by both Flourish (increased to 4.55% for Tier 1 and 4.25% for Tier 2) and Betterment (increased to 4.50%). The updated version of the article can be viewed here. Markets woke up on Monday morning to the news that First Republic Bank (FRC) had finally been taken behind the woodshed and shot in what is now the new second-largest bank failure in US history, snatching that dubious hono...2023-05-0706 min

ANGLES.Lurking In The Shadows.Note: I have published an updated version of my recent article “Cash Is Interesting Again. And Safe.” to reflect the higher interest being paid on cash accounts starting tomorrow with millions of dollars in insurance by both Flourish (increased to 4.55% for Tier 1 and 4.25% for Tier 2) and Betterment (increased to 4.50%). The updated version of the article can be viewed here. Markets woke up on Monday morning to the news that First Republic Bank (FRC) had finally been taken behind the woodshed and shot in what is now the new second-largest bank failure in US history, snatching that dubious hono...2023-05-0706 min ANGLES.A Low Bar.With trading volumes contracting rapidly, the stock market - at least as represented by the major indexes - was acting early last week like it had already checked out for summer and it’s not even May yet. It was proving to be something of a snooze-fest with a generally negative tilt as far as the headline indexes were concerned. But under the surface, things were playing out rather differently.Earnings and guidance are generally holding up better than expected, mostly beating estimates at a good clip - notably Microsoft (MSFT), Alphabet/Google (GOOGL), Meta/Facebook (META) an...2023-04-3007 min

ANGLES.A Low Bar.With trading volumes contracting rapidly, the stock market - at least as represented by the major indexes - was acting early last week like it had already checked out for summer and it’s not even May yet. It was proving to be something of a snooze-fest with a generally negative tilt as far as the headline indexes were concerned. But under the surface, things were playing out rather differently.Earnings and guidance are generally holding up better than expected, mostly beating estimates at a good clip - notably Microsoft (MSFT), Alphabet/Google (GOOGL), Meta/Facebook (META) an...2023-04-3007 min ANGLES.Maximum Pain.It is said on Wall Street that the goal of the market is to extract the maximum amount of pain from the greatest number of people. What this is getting at is that when everyone is positioned as bullish, the pain trade is for markets to move lower. When everyone is bearish, the pain trade is for them to go higher. As such, the pain trade has been mostly inflicted on the bears so far in 2023 and is helping support stocks, despite decidedly dodgy economic fundamentals. Sentiment matters in the short-term and so the pain trade was...2023-04-2305 min

ANGLES.Maximum Pain.It is said on Wall Street that the goal of the market is to extract the maximum amount of pain from the greatest number of people. What this is getting at is that when everyone is positioned as bullish, the pain trade is for markets to move lower. When everyone is bearish, the pain trade is for them to go higher. As such, the pain trade has been mostly inflicted on the bears so far in 2023 and is helping support stocks, despite decidedly dodgy economic fundamentals. Sentiment matters in the short-term and so the pain trade was...2023-04-2305 min ANGLES.Hard Times Or Great Expectations?Last week was a busy one with plenty of economic data to chew on and lots of soundbites from International Monetary Fund (IMF) officials and Federal Reserve presidents. It also marked the opening of the Q1 2023 earnings season.Monday started out mostly jittery and trendless as the stock market tried to digest the Jobs Report from the holiday Friday before. Interestingly, the laggards were stocks in the defensive sectors like Utilities and Consumer Defensive that had outperformed the previous week, as worries eased about the prospect of an economic “hard landing” (i.e. inflation is only finally kill...2023-04-1607 min

ANGLES.Hard Times Or Great Expectations?Last week was a busy one with plenty of economic data to chew on and lots of soundbites from International Monetary Fund (IMF) officials and Federal Reserve presidents. It also marked the opening of the Q1 2023 earnings season.Monday started out mostly jittery and trendless as the stock market tried to digest the Jobs Report from the holiday Friday before. Interestingly, the laggards were stocks in the defensive sectors like Utilities and Consumer Defensive that had outperformed the previous week, as worries eased about the prospect of an economic “hard landing” (i.e. inflation is only finally kill...2023-04-1607 min ANGLES.The Major Unknown.The week and the month began with investors shifting their attention away from March's banking turmoil and back to the risk of a recession that could drag down consumer spending, thereby corporate profits and thereby stock prices. And the holiday-shortened week provided plenty for them to focus on. Unexpected output cuts from the Organization of Petroleum Exporting Countries (OPEC, see EXPLAINER: FINANCIAL TERM OF THE WEEK below) were announced on Monday after oil prices dipped in March amid the banking stress and fears over the global economic outlook. Unsurprisingly, oil prices and oil stocks soared to...2023-04-0906 min

ANGLES.The Major Unknown.The week and the month began with investors shifting their attention away from March's banking turmoil and back to the risk of a recession that could drag down consumer spending, thereby corporate profits and thereby stock prices. And the holiday-shortened week provided plenty for them to focus on. Unexpected output cuts from the Organization of Petroleum Exporting Countries (OPEC, see EXPLAINER: FINANCIAL TERM OF THE WEEK below) were announced on Monday after oil prices dipped in March amid the banking stress and fears over the global economic outlook. Unsurprisingly, oil prices and oil stocks soared to...2023-04-0906 min ANGLES.No News Is Good News.The S&P 500 ended the week, month and quarter sitting almost exactly in the middle of its range over the last year and a strange calm seems to have descended upon markets. No scary news from the banking sector last week allowed investors to focus on other things, such as earnings and economic releases, which were mostly pretty good. Traders started the week with a smile on their faces as they learned that First Citizens BancShares (FCNCA), a North Carolina-based regional bank, had agreed to take over substantially all of the assets and liabilities of collapsed Silicon...2023-04-0206 min

ANGLES.No News Is Good News.The S&P 500 ended the week, month and quarter sitting almost exactly in the middle of its range over the last year and a strange calm seems to have descended upon markets. No scary news from the banking sector last week allowed investors to focus on other things, such as earnings and economic releases, which were mostly pretty good. Traders started the week with a smile on their faces as they learned that First Citizens BancShares (FCNCA), a North Carolina-based regional bank, had agreed to take over substantially all of the assets and liabilities of collapsed Silicon...2023-04-0206 min ANGLES.Almost There.A decent gain in stock prices on Monday was put down to a combination of an oversold bounce from the anguish of the two prior sessions, UBS finally putting Credit Suisse (CS) out of its misery by buying their Swiss banking rival for less than half of its value as well as not-too-guarded optimism about what Federal Reserve Chair Jerome Powell might say in his press conference later in the week, specifically speculating that he might formally announce that the rate-hiking cycle was over. Concerns about First Republic Bank (FRC) just refused to go away. Despite stories...2023-03-2605 min

ANGLES.Almost There.A decent gain in stock prices on Monday was put down to a combination of an oversold bounce from the anguish of the two prior sessions, UBS finally putting Credit Suisse (CS) out of its misery by buying their Swiss banking rival for less than half of its value as well as not-too-guarded optimism about what Federal Reserve Chair Jerome Powell might say in his press conference later in the week, specifically speculating that he might formally announce that the rate-hiking cycle was over. Concerns about First Republic Bank (FRC) just refused to go away. Despite stories...2023-03-2605 min ANGLES.Get Out Of Jail Free?A week following three major US bank failures that then saw two other banks sail very close to the wind ended with stock markets higher, the S&P 500 was up 1.4% for the week and the NASDAQ closed 4.4% higher. Anyone who claims they can correctly predict this stuff is such a liar. Monday was the largest trading volume day so far this year on US exchanges (a record that lasted until Friday, when it was surpassed) and saw a bloodbath for shares of many regional banks on the back of the failures of Silvergate, Silicon Valley Bank and...2023-03-1907 min

ANGLES.Get Out Of Jail Free?A week following three major US bank failures that then saw two other banks sail very close to the wind ended with stock markets higher, the S&P 500 was up 1.4% for the week and the NASDAQ closed 4.4% higher. Anyone who claims they can correctly predict this stuff is such a liar. Monday was the largest trading volume day so far this year on US exchanges (a record that lasted until Friday, when it was surpassed) and saw a bloodbath for shares of many regional banks on the back of the failures of Silvergate, Silicon Valley Bank and...2023-03-1907 min ANGLES.Caught Offside.New features in the report (see below): - Weekly updates on the latest official average 30 year fixed mortgage rate with comps going back one week, one month and one year- FedWatch Tool information: What the latest important market expectations are on interest rates with comps going back one week and one monthFederal Reserve Chairman Jerome Powell basically killed risk appetite on Tuesday with a change of tone on inflation in remarks before the Senate Banking Committee. Not for the first time, he contradicted previous statements he has made recently, stating that...2023-03-1206 min

ANGLES.Caught Offside.New features in the report (see below): - Weekly updates on the latest official average 30 year fixed mortgage rate with comps going back one week, one month and one year- FedWatch Tool information: What the latest important market expectations are on interest rates with comps going back one week and one monthFederal Reserve Chairman Jerome Powell basically killed risk appetite on Tuesday with a change of tone on inflation in remarks before the Senate Banking Committee. Not for the first time, he contradicted previous statements he has made recently, stating that...2023-03-1206 min ANGLES.Over-Enthusiastic?February delivered a reality check to investors after a giddy January; the S&P 500 fell 2.6% for the month and the NASDAQ dropped 1.1%.Stock and bond prices had risen impressively in January on the ideas that i) Inflation was declining, ie., disinflation, ii) the Fed was almost done with rate hikes and iii) there wasn’t going be a hard economic landing (ie., we were going to get inflation conquered without a recession). At least two of those three ideas are now pretty much considered off the table right now as a result of the data of the pa...2023-03-0506 min

ANGLES.Over-Enthusiastic?February delivered a reality check to investors after a giddy January; the S&P 500 fell 2.6% for the month and the NASDAQ dropped 1.1%.Stock and bond prices had risen impressively in January on the ideas that i) Inflation was declining, ie., disinflation, ii) the Fed was almost done with rate hikes and iii) there wasn’t going be a hard economic landing (ie., we were going to get inflation conquered without a recession). At least two of those three ideas are now pretty much considered off the table right now as a result of the data of the pa...2023-03-0506 min ANGLES.Reversing?For all the different feel of this market in 2023, the price action is revealing that it is actually still broadly behaving much as it did in 2022. It’s still being driven by Fed expectations and those expectations are being determined by earnings and economic data.In January, the data was mostly better-than-feared and the market developed the view that the Fed was close to ending rate hikes and that end-of-2023 interest rates would actually be lower than they were at the end of 2022. Stocks rallied hard and tech/growth names outperformed, including many of those that were sl...2023-02-2606 min

ANGLES.Reversing?For all the different feel of this market in 2023, the price action is revealing that it is actually still broadly behaving much as it did in 2022. It’s still being driven by Fed expectations and those expectations are being determined by earnings and economic data.In January, the data was mostly better-than-feared and the market developed the view that the Fed was close to ending rate hikes and that end-of-2023 interest rates would actually be lower than they were at the end of 2022. Stocks rallied hard and tech/growth names outperformed, including many of those that were sl...2023-02-2606 min ANGLES.Still Unclear.Those of us hoping for a clearer picture to emerge from the release of the January’s Consumer Price Index (CPI) measure of retail inflation and other subsequent data were left sorely disappointed last week. If anything, things just became more confused.Stocks drifted nicely higher on Monday as traders laid their bets ahead of the high-stakes inflation reports that would start arriving the following morning.When CPI came out pre-market on Tuesday, it showed that consumer prices rose at a more rapid monthly pace in January, interrupting a months-long streak of cooler month-to-month readings. Pr...2023-02-1906 min

ANGLES.Still Unclear.Those of us hoping for a clearer picture to emerge from the release of the January’s Consumer Price Index (CPI) measure of retail inflation and other subsequent data were left sorely disappointed last week. If anything, things just became more confused.Stocks drifted nicely higher on Monday as traders laid their bets ahead of the high-stakes inflation reports that would start arriving the following morning.When CPI came out pre-market on Tuesday, it showed that consumer prices rose at a more rapid monthly pace in January, interrupting a months-long streak of cooler month-to-month readings. Pr...2023-02-1906 min ANGLES.Bumpy Road.“This process is likely to take quite a bit of time, it’s not going to be smooth, it’s probably going to be bumpy”, Federal Reserve Chair Jerome Powell said on Tuesday in a speech in Washington DC, referring to getting inflation back to the Fed’s 2% target. But he could just as easily have been talking about the road to an eventual end of this bear market and a transition to a more sustainably bullish environment for stocks.The conventional wisdom is that the current bottom recorded last October is probably “in” and, going forward, dips are going...2023-02-1206 min

ANGLES.Bumpy Road.“This process is likely to take quite a bit of time, it’s not going to be smooth, it’s probably going to be bumpy”, Federal Reserve Chair Jerome Powell said on Tuesday in a speech in Washington DC, referring to getting inflation back to the Fed’s 2% target. But he could just as easily have been talking about the road to an eventual end of this bear market and a transition to a more sustainably bullish environment for stocks.The conventional wisdom is that the current bottom recorded last October is probably “in” and, going forward, dips are going...2023-02-1206 min ANGLES.The Rebellious Teen.The Federal Open Market Committee (FOMC, see EXPLAINER: FINANCIAL TERM OF THE WEEK) surprised absolutely no-one by raising interest rates on Wednesday by a quarter of a percent to a target range of 4.50% to 4.75%.Fed Chair Jerome Powell dropped a few hawkish soundbites at his post-announcement press conference, all designed to be played out of context on CNBC, saying that monetary policy “does not yet look sufficiently restrictive” and that“ongoing increases in the target range will be appropriate”. But he also said, “We can now say, I think for the first time, that the disinflati...2023-02-0506 min

ANGLES.The Rebellious Teen.The Federal Open Market Committee (FOMC, see EXPLAINER: FINANCIAL TERM OF THE WEEK) surprised absolutely no-one by raising interest rates on Wednesday by a quarter of a percent to a target range of 4.50% to 4.75%.Fed Chair Jerome Powell dropped a few hawkish soundbites at his post-announcement press conference, all designed to be played out of context on CNBC, saying that monetary policy “does not yet look sufficiently restrictive” and that“ongoing increases in the target range will be appropriate”. But he also said, “We can now say, I think for the first time, that the disinflati...2023-02-0506 min ANGLES.Mind The Gap.The already-wide gap between what the Fed says will happen and what the market thinks will happen just keeps on getting wider. Fed presidents are out there barking at us at every opportunity that the Fed Funds rate that it controls will be around 5.1% by year-end, or a full percentage point higher than where we are now. The stock market, by means of the Fed Funds futures prices set by large institutional traders, have this rate priced at south of 4.4%. Such a divergence is extremely unusual and one of them will probably end up being right. If...2023-01-2905 min

ANGLES.Mind The Gap.The already-wide gap between what the Fed says will happen and what the market thinks will happen just keeps on getting wider. Fed presidents are out there barking at us at every opportunity that the Fed Funds rate that it controls will be around 5.1% by year-end, or a full percentage point higher than where we are now. The stock market, by means of the Fed Funds futures prices set by large institutional traders, have this rate priced at south of 4.4%. Such a divergence is extremely unusual and one of them will probably end up being right. If...2023-01-2905 min ANGLES.Chicken.Financial markets and the Fed are playing a game of chicken. The Fed continues to wheel out its own people to double-down on their position that interest rates will be shortly be raised to above 5% and will stay there for ages until inflation is unquestionably showing signs of being 2% again, like it was in the good old days.Financial markets, as shown by fed funds futures rates and trader sentiment, are calling BS on this. They insist that upcoming data will sway the Fed to stop raising interest rates soon and possibly even force them into a...2023-01-2207 min

ANGLES.Chicken.Financial markets and the Fed are playing a game of chicken. The Fed continues to wheel out its own people to double-down on their position that interest rates will be shortly be raised to above 5% and will stay there for ages until inflation is unquestionably showing signs of being 2% again, like it was in the good old days.Financial markets, as shown by fed funds futures rates and trader sentiment, are calling BS on this. They insist that upcoming data will sway the Fed to stop raising interest rates soon and possibly even force them into a...2023-01-2207 min ANGLES.Cooling Down.The highlight of the week, the all-important latest Consumer Price Index (CPI) measure of retail inflation numbers, came out before the market opened on Thursday and was right in line with forecasts, showing a continued cooling of inflation in the US. Headline CPI fell 0.1% between November and December, following a 0.1% increase the previous month. Over the past twelve months, the index is up 6.5%, falling from a 7.1% rate a month earlier. Core CPI, which excludes food and fuel costs, rose by 0.3% month-to-month and 5.7% year-on-year, the smallest twelve month gain since late 2021. The previous month, those numbers...2023-01-1506 min

ANGLES.Cooling Down.The highlight of the week, the all-important latest Consumer Price Index (CPI) measure of retail inflation numbers, came out before the market opened on Thursday and was right in line with forecasts, showing a continued cooling of inflation in the US. Headline CPI fell 0.1% between November and December, following a 0.1% increase the previous month. Over the past twelve months, the index is up 6.5%, falling from a 7.1% rate a month earlier. Core CPI, which excludes food and fuel costs, rose by 0.3% month-to-month and 5.7% year-on-year, the smallest twelve month gain since late 2021. The previous month, those numbers...2023-01-1506 min ANGLES.The Song Remains The Same.The calendar may have flipped, but the song remains the same. Last week was something of a microcosm of 2022; a steady downward grind for the most part, occasionally punctuated by a sharp spike. Last year these spikes all failed to trigger a true turnaround, always eventually fizzling out and leading to subsequent further new lows. It remains to be seen if that pattern will continue or benefit from the so-called “January Effect” (see EXPLAINER: FINANCIAL TERM OF THE WEEK, below).Many of the market’s big dogs stumbled right out of the gate in 2023’s opening...2023-01-0807 min

ANGLES.The Song Remains The Same.The calendar may have flipped, but the song remains the same. Last week was something of a microcosm of 2022; a steady downward grind for the most part, occasionally punctuated by a sharp spike. Last year these spikes all failed to trigger a true turnaround, always eventually fizzling out and leading to subsequent further new lows. It remains to be seen if that pattern will continue or benefit from the so-called “January Effect” (see EXPLAINER: FINANCIAL TERM OF THE WEEK, below).Many of the market’s big dogs stumbled right out of the gate in 2023’s opening...2023-01-0807 min ANGLES.Mark Your Calendar.To reiterate what I said last week, the absolutely key question when it comes to financial markets in 2023 is: Will inflation fall faster than economic growth and earnings?Mark your calendars for when we will get the next hints at an answer .. * Thursday, January 12th when the US Consumer Price Index (CPI) measure of retail inflation is released. Why It’s Important: The key for the next CPI report (and every CPI report in 2023) is solid evidence of continued downward momentum in inflation. Specifically, the headline CPI number turning negative month-over-month (down from the 0.1% increase la...2023-01-0106 min

ANGLES.Mark Your Calendar.To reiterate what I said last week, the absolutely key question when it comes to financial markets in 2023 is: Will inflation fall faster than economic growth and earnings?Mark your calendars for when we will get the next hints at an answer .. * Thursday, January 12th when the US Consumer Price Index (CPI) measure of retail inflation is released. Why It’s Important: The key for the next CPI report (and every CPI report in 2023) is solid evidence of continued downward momentum in inflation. Specifically, the headline CPI number turning negative month-over-month (down from the 0.1% increase la...2023-01-0106 min ANGLES.Conflicts.The much-anticipated Santa Claus Rally window came and went last week with only more volatility and a lot of lower prices to show for it. With hardly any discernable meaningful catalysts and a lot of end of year tax-loss selling going on, there simply wasn’t much to stop stocks from rolling over early in the week. Wednesday (good) and Thursday (bad) basically cancelled each other out. Friday was a moderately decent low-volume snooze-fest.As we begin the transition that I highlighted last week (investors shifting to taking note of what data actually shows about inflation and th...2022-12-2607 min

ANGLES.Conflicts.The much-anticipated Santa Claus Rally window came and went last week with only more volatility and a lot of lower prices to show for it. With hardly any discernable meaningful catalysts and a lot of end of year tax-loss selling going on, there simply wasn’t much to stop stocks from rolling over early in the week. Wednesday (good) and Thursday (bad) basically cancelled each other out. Friday was a moderately decent low-volume snooze-fest.As we begin the transition that I highlighted last week (investors shifting to taking note of what data actually shows about inflation and th...2022-12-2607 min ANGLES.The Transition.The Transition from the primary market driver no longer being the expectations of what Fed interest rate policy will be and instead turning to tangible, evidence-based economic growth and inflation levels officially began last week with stocks trading on the back of growth and inflation perceptions rather than just reacting to Fed rhetoric like obedient lemmings. That’s something that will likely continue and intensify moving forward into 2023, as investors search for the answers to the two key questions:1) How fast will inflation decline?2) How bad will the economy get?The wh...2022-12-1807 min

ANGLES.The Transition.The Transition from the primary market driver no longer being the expectations of what Fed interest rate policy will be and instead turning to tangible, evidence-based economic growth and inflation levels officially began last week with stocks trading on the back of growth and inflation perceptions rather than just reacting to Fed rhetoric like obedient lemmings. That’s something that will likely continue and intensify moving forward into 2023, as investors search for the answers to the two key questions:1) How fast will inflation decline?2) How bad will the economy get?The wh...2022-12-1807 min ANGLES.The Skies Have Not Cleared Yet.Over the past few weeks, the macro environment has generally become “less bad” and that does justify some kind of a rally, but it’s important not to confuse “less bad” conditions with actual “good” ones. It’s also important not to mis-interpret year-end seasonal factors and positioning, combined with a sudden burst of optimism, with the implication that this has sown the seeds for a sustainable rally and an end to all this volatility. We saw in full technicolor (mostly red) last week that it has not. Not yet. When the day finally arrives when the Fed stops hiking...2022-12-1106 min

ANGLES.The Skies Have Not Cleared Yet.Over the past few weeks, the macro environment has generally become “less bad” and that does justify some kind of a rally, but it’s important not to confuse “less bad” conditions with actual “good” ones. It’s also important not to mis-interpret year-end seasonal factors and positioning, combined with a sudden burst of optimism, with the implication that this has sown the seeds for a sustainable rally and an end to all this volatility. We saw in full technicolor (mostly red) last week that it has not. Not yet. When the day finally arrives when the Fed stops hiking...2022-12-1106 min ANGLES.Powell's Dance.Watching a grandfatherly, white-haired 69 year old man doing performative dance doesn’t sound like something hot-shot Wall Street traders and stock market professionals would choose to spend their time doing, but they very much are and that somewhat elderly gentleman is by far the the most important influence right now on the immediate trajectory of your net worth. We are talking, of course, about Jerome Powell, the current Chair of the Federal Reserve, which needs financial conditions to remain tight to ensure its rate increases filter through the economy as desired: slowing demand and helping bring down in...2022-12-0405 min

ANGLES.Powell's Dance.Watching a grandfatherly, white-haired 69 year old man doing performative dance doesn’t sound like something hot-shot Wall Street traders and stock market professionals would choose to spend their time doing, but they very much are and that somewhat elderly gentleman is by far the the most important influence right now on the immediate trajectory of your net worth. We are talking, of course, about Jerome Powell, the current Chair of the Federal Reserve, which needs financial conditions to remain tight to ensure its rate increases filter through the economy as desired: slowing demand and helping bring down in...2022-12-0405 min ANGLES.Steps In The Right Direction?It was a quiet week, so let’s take the opportunity to zoom out a bit, look at the bigger picture and see where we stand in the ongoing saga of this bear market .. There wasn’t too much to take from a choppy, vacation-shortened week with increasingly thin attendance and extremely low volume (see EXPLAINER: FINANCIAL TERM OF THE WEEK as well as UNDER THE HOOD below) ahead of and right after the Thanksgiving holiday. We got the minutes from the last Fed meeting earlier this month which raised interest rates by 0.75% and they clea...2022-11-2706 min

ANGLES.Steps In The Right Direction?It was a quiet week, so let’s take the opportunity to zoom out a bit, look at the bigger picture and see where we stand in the ongoing saga of this bear market .. There wasn’t too much to take from a choppy, vacation-shortened week with increasingly thin attendance and extremely low volume (see EXPLAINER: FINANCIAL TERM OF THE WEEK as well as UNDER THE HOOD below) ahead of and right after the Thanksgiving holiday. We got the minutes from the last Fed meeting earlier this month which raised interest rates by 0.75% and they clea...2022-11-2706 min ANGLES.Greater Fools?Apologies once again for last week’s report, or the lack of it. I am safely back in the US now and very much recovered. Thanks for all the good wishes that I received, they are very much appreciated.Towering over last week’s market activity was the extraordinary and shocking fraudulent collapse of the FTX crypto exchange. For many, this was a watershed moment where the whole crypto eco-system was finally exposed as being polluted by criminality and fraud and is sorely in need of subjecting itself to very meaningful regulation very soon if it is to h...2022-11-2006 min

ANGLES.Greater Fools?Apologies once again for last week’s report, or the lack of it. I am safely back in the US now and very much recovered. Thanks for all the good wishes that I received, they are very much appreciated.Towering over last week’s market activity was the extraordinary and shocking fraudulent collapse of the FTX crypto exchange. For many, this was a watershed moment where the whole crypto eco-system was finally exposed as being polluted by criminality and fraud and is sorely in need of subjecting itself to very meaningful regulation very soon if it is to h...2022-11-2006 min ANGLES.Economy Killer?In a horror movie, it often happens that the poor young person being chased in the house gets right to the front door and is just about to escape onto the street when the killer suddenly jumps out and grabs them. As an audience, we are teased with the prospect of good news when, suddenly, that hope is snatched away. That’s pretty much what happened in the stock market last week, specifically with the critical aftermath of the Federal Reserve Open Market Committee meeting on Wednesday. The market bled steadily lower early in the week amid mo...2022-11-0705 min

ANGLES.Economy Killer?In a horror movie, it often happens that the poor young person being chased in the house gets right to the front door and is just about to escape onto the street when the killer suddenly jumps out and grabs them. As an audience, we are teased with the prospect of good news when, suddenly, that hope is snatched away. That’s pretty much what happened in the stock market last week, specifically with the critical aftermath of the Federal Reserve Open Market Committee meeting on Wednesday. The market bled steadily lower early in the week amid mo...2022-11-0705 min ANGLES.Drinking From A Fire Hose.There was such a torrent of market intel to try to absorb last week that it was hard to keep up at times. It also meant that leads got buried all over the place as news and data points that would usually be the focus of market attention for a matter of days were eclipsed within hours or even minutes by yet another surprising earnings report, economic data release, geopolitical development, global interest rate change or piece of eye-popping housing market data. Let’s try to quickly make sense of it all .. The fi...2022-10-3009 min

ANGLES.Drinking From A Fire Hose.There was such a torrent of market intel to try to absorb last week that it was hard to keep up at times. It also meant that leads got buried all over the place as news and data points that would usually be the focus of market attention for a matter of days were eclipsed within hours or even minutes by yet another surprising earnings report, economic data release, geopolitical development, global interest rate change or piece of eye-popping housing market data. Let’s try to quickly make sense of it all .. The fi...2022-10-3009 min ANGLES.A Little Light At The End Of The Tunnel?A Wall Street Journal report on Friday by Nick “The Fed Whisperer” Timiraos reported that, while the early November Fed meeting will still most likely result in another 0.75% increase in interest rates, it could well be the final one that showcases a hike of that magnitude and that committee members are now actively contemplating easing up in December and beyond. Interestingly, on the same day, San Francisco Fed President Mary Daly warned of the risk of over-tightening, the first time we have heard that sentiment in a long while.As a result, the futu...2022-10-2305 min

ANGLES.A Little Light At The End Of The Tunnel?A Wall Street Journal report on Friday by Nick “The Fed Whisperer” Timiraos reported that, while the early November Fed meeting will still most likely result in another 0.75% increase in interest rates, it could well be the final one that showcases a hike of that magnitude and that committee members are now actively contemplating easing up in December and beyond. Interestingly, on the same day, San Francisco Fed President Mary Daly warned of the risk of over-tightening, the first time we have heard that sentiment in a long while.As a result, the futu...2022-10-2305 min ANGLES.As If By Magic ..The market spent the first three days of last week just shifting about in a bumpy, lethargic, generally downward-trending trading pattern, simply waiting it out for the main event in the form of the Consumer Price Index (CPI) inflation number release due on Thursday morning. There was certainly no sign that the buyers from the week before were looking to capitalize on their brief success and take any kind of control.Even when the starter course arrived on Wednesday in the form of a slightly hotter-than-expected measure of wholesale inflation, the Producer Price Index (PPI), there was...2022-10-1607 min

ANGLES.As If By Magic ..The market spent the first three days of last week just shifting about in a bumpy, lethargic, generally downward-trending trading pattern, simply waiting it out for the main event in the form of the Consumer Price Index (CPI) inflation number release due on Thursday morning. There was certainly no sign that the buyers from the week before were looking to capitalize on their brief success and take any kind of control.Even when the starter course arrived on Wednesday in the form of a slightly hotter-than-expected measure of wholesale inflation, the Producer Price Index (PPI), there was...2022-10-1607 min ANGLES.Mental Gymnastics.Bad news is often good news for investors these days, who have to perform mental gymnastics as the economic picture comes into focus. Traditionally negative indicators of a weaker economy such as rising unemployment or falling consumer spending tend to result in lower inflation, which likely means the Fed can take its foot off the gas with monetary tightening, which should mean less pressure to raise interest rates, which means potentially higher stock valuations.We saw some of great examples of this last week. First, the August Job Openings and Labor Turnover Survey (JOLTS) came...2022-10-0906 min

ANGLES.Mental Gymnastics.Bad news is often good news for investors these days, who have to perform mental gymnastics as the economic picture comes into focus. Traditionally negative indicators of a weaker economy such as rising unemployment or falling consumer spending tend to result in lower inflation, which likely means the Fed can take its foot off the gas with monetary tightening, which should mean less pressure to raise interest rates, which means potentially higher stock valuations.We saw some of great examples of this last week. First, the August Job Openings and Labor Turnover Survey (JOLTS) came...2022-10-0906 min ANGLES.R.I.P., Market Rally.KEEP AN EYE OUT FOR THE MY INAUGURAL QUARTERLY MARKET REVIEW WHICH I WILL BE SENDING TO ALL SUBSCRIBERS IN THE NEXT DAY OR TWO, TAKING A DEEP DIVE AND LOOKING BACK OVER AN EVENTFUL (TO PUT IT MILDLY!) Q3 2022. Dearly beloved, we are gathered here today to mourn the demise and end of the summer stock market rally which finally expired last week, as the entire set of gains since the June 16th prior lows were completely erased and new lows were made for 2022. The rally may have only had a short life of two and...2022-10-0208 min

ANGLES.R.I.P., Market Rally.KEEP AN EYE OUT FOR THE MY INAUGURAL QUARTERLY MARKET REVIEW WHICH I WILL BE SENDING TO ALL SUBSCRIBERS IN THE NEXT DAY OR TWO, TAKING A DEEP DIVE AND LOOKING BACK OVER AN EVENTFUL (TO PUT IT MILDLY!) Q3 2022. Dearly beloved, we are gathered here today to mourn the demise and end of the summer stock market rally which finally expired last week, as the entire set of gains since the June 16th prior lows were completely erased and new lows were made for 2022. The rally may have only had a short life of two and...2022-10-0208 min ANGLES.Lucy Has Pulled The Football.For years, corporate America and stock market investors could rely on the Federal Reserve to have their back. Ridiculously low borrowing costs turbo-charged stock prices - especially those of profitless (and sometimes mindless) tech companies. The Fed’s interests were aligned with those of the likes of Apple, Tesla and Microsoft but also with those of regular people pouring money in their 401k every two weeks. The Fed’s extended purchases of mortgage bonds drove up home prices, delighting homeowners. Everyone was a winner. Well, everyone except would-be first time home buyers who watched prices soar out of t...2022-09-2506 min

ANGLES.Lucy Has Pulled The Football.For years, corporate America and stock market investors could rely on the Federal Reserve to have their back. Ridiculously low borrowing costs turbo-charged stock prices - especially those of profitless (and sometimes mindless) tech companies. The Fed’s interests were aligned with those of the likes of Apple, Tesla and Microsoft but also with those of regular people pouring money in their 401k every two weeks. The Fed’s extended purchases of mortgage bonds drove up home prices, delighting homeowners. Everyone was a winner. Well, everyone except would-be first time home buyers who watched prices soar out of t...2022-09-2506 min ANGLES.Boom!Monday was mostly just about positioning going into the next day’s inflation print (although the surprisingly effective counter-attack by Ukrainian forces also came into play somewhat). A narrative slowly built throughout the day that maybe future inflation might not be as elevated or persistent as was previously feared and that we might expect to see an appetizing Consumer Price Index (CPI) number, boosted by the fact that three-years-ahead inflationary expectations dropped to 2.8%, the lowest since early 2021, in advance of Tuesday’s release of the latest data. And then BOOM! The CPI announcement came out and it prov...2022-09-1806 min

ANGLES.Boom!Monday was mostly just about positioning going into the next day’s inflation print (although the surprisingly effective counter-attack by Ukrainian forces also came into play somewhat). A narrative slowly built throughout the day that maybe future inflation might not be as elevated or persistent as was previously feared and that we might expect to see an appetizing Consumer Price Index (CPI) number, boosted by the fact that three-years-ahead inflationary expectations dropped to 2.8%, the lowest since early 2021, in advance of Tuesday’s release of the latest data. And then BOOM! The CPI announcement came out and it prov...2022-09-1806 min ANGLES.It's All About The Destination, Not The Journey.A holiday-shortened week began uneventfully with little of interest coming over the newswires and markets simply drifted along the path of least resistance, which is currently downwards.Things soon began to pick up steam to the downside though, as the Chinese city of Chengdu extended COVID lockdowns for the majority of its 21 million residents due to rising infection numbers, dimming the demand outlook for oil and sending the price of crude oil and stocks lower. Then a new report from the Institute for Supply Management showed unexpected US growth in the services sector from a month ago. N...2022-09-1105 min

ANGLES.It's All About The Destination, Not The Journey.A holiday-shortened week began uneventfully with little of interest coming over the newswires and markets simply drifted along the path of least resistance, which is currently downwards.Things soon began to pick up steam to the downside though, as the Chinese city of Chengdu extended COVID lockdowns for the majority of its 21 million residents due to rising infection numbers, dimming the demand outlook for oil and sending the price of crude oil and stocks lower. Then a new report from the Institute for Supply Management showed unexpected US growth in the services sector from a month ago. N...2022-09-1105 min ANGLES.Doubling Down.How quickly that half-full glass I talked about last week has emptied. A third consecutive week of stock market losses ended with a thousand point fall in the Dow Jones Industrial Average on Friday as Federal Reserve chair Jerome Powell, talking at the Fed’s annual jamboree in Jackson Hole, Wyoming, ferociously doubled down on the central bank’s commitment to raise interest rates as aggressively as is needed to bring current high inflation levels back down towards the target level of 2%. I’ll come back to this later. The durable goods report for July was disappointing, which...2022-08-2805 min

ANGLES.Doubling Down.How quickly that half-full glass I talked about last week has emptied. A third consecutive week of stock market losses ended with a thousand point fall in the Dow Jones Industrial Average on Friday as Federal Reserve chair Jerome Powell, talking at the Fed’s annual jamboree in Jackson Hole, Wyoming, ferociously doubled down on the central bank’s commitment to raise interest rates as aggressively as is needed to bring current high inflation levels back down towards the target level of 2%. I’ll come back to this later. The durable goods report for July was disappointing, which...2022-08-2805 min ANGLES.It Seems The Glass Is Half Full.The market appears to have decided that the glass is half full, for the moment at least. Last week’s stock price declines, mostly concentrated on Friday, can essentially be put down to the seriously overbought conditions brought about by four straight weeks of gains and two months of solid progress. There wasn’t a whole lot else behind the price slump. Yes, perhaps economic data out of both New York state and China disappointed to start the week and some late-week Fed-speak attempted to dampen recent exuberance generated by the growing view that the days of rate...2022-08-2105 min

ANGLES.It Seems The Glass Is Half Full.The market appears to have decided that the glass is half full, for the moment at least. Last week’s stock price declines, mostly concentrated on Friday, can essentially be put down to the seriously overbought conditions brought about by four straight weeks of gains and two months of solid progress. There wasn’t a whole lot else behind the price slump. Yes, perhaps economic data out of both New York state and China disappointed to start the week and some late-week Fed-speak attempted to dampen recent exuberance generated by the growing view that the days of rate...2022-08-2105 min ANGLES.The Battle Lines Are Drawn.While the FBI searching Trump’s home at Mar-a-Lago and its aftermath might have been the biggest deal in the civilian media last week, it was a complete non-event as far as the financial markets were concerned. There was only ever going to be one story last week. Well, maybe one and a half. Data released on Wednesday showed that the Consumer Price Index (CPI) measure of retail inflation was unchanged in July after a 1.3% rise in June, as gasoline prices fell sharply, offsetting continued increases in food and shelter costs. The year-on-year increase was 8.5%, down from 9.1% in...2022-08-1407 min

ANGLES.The Battle Lines Are Drawn.While the FBI searching Trump’s home at Mar-a-Lago and its aftermath might have been the biggest deal in the civilian media last week, it was a complete non-event as far as the financial markets were concerned. There was only ever going to be one story last week. Well, maybe one and a half. Data released on Wednesday showed that the Consumer Price Index (CPI) measure of retail inflation was unchanged in July after a 1.3% rise in June, as gasoline prices fell sharply, offsetting continued increases in food and shelter costs. The year-on-year increase was 8.5%, down from 9.1% in...2022-08-1407 min ANGLES.Too Hot?Markets basically just churned last week in advance of Friday’s release of the latest jobs data, with the S&P 500 closing on Thursday afternoon just a touch higher than it started the week on Monday morning. Pelosi’s Taiwan visit and China’s entirely predictable reaction only briefly raised pulses but markets basically ignored it. Nothing to see here. Silly geopolitical stunts are not driving market sentiment, it’s still investors’ perceptions of future Federal Reserve (see EXPLAINER: FINANCIAL TERM OF THE WEEK below) actions. Federal Reserve regional presidents seem to be reverting to their play...2022-08-0705 min

ANGLES.Too Hot?Markets basically just churned last week in advance of Friday’s release of the latest jobs data, with the S&P 500 closing on Thursday afternoon just a touch higher than it started the week on Monday morning. Pelosi’s Taiwan visit and China’s entirely predictable reaction only briefly raised pulses but markets basically ignored it. Nothing to see here. Silly geopolitical stunts are not driving market sentiment, it’s still investors’ perceptions of future Federal Reserve (see EXPLAINER: FINANCIAL TERM OF THE WEEK below) actions. Federal Reserve regional presidents seem to be reverting to their play...2022-08-0705 min ANGLES.Heat (but not much light).(Slightly longer report than usual this time around, but last week was a doozy)Last week’s big story was always supposed to be the Fed’s interest rate hike on Wednesday but in the end, that proved to be rather uneventful and lacked any kind of a wow moment. The surprise-averse stock market absolutely loved that. But what really generated a huge amount of heat but precious little light was the often hyperbolic, ill-informed and sometimes blatantly politically motivated media reaction to the preliminary estimate of Q2 2022 Gross Domestic Product (GDP) on Thursday. Who knew...2022-07-3110 min

ANGLES.Heat (but not much light).(Slightly longer report than usual this time around, but last week was a doozy)Last week’s big story was always supposed to be the Fed’s interest rate hike on Wednesday but in the end, that proved to be rather uneventful and lacked any kind of a wow moment. The surprise-averse stock market absolutely loved that. But what really generated a huge amount of heat but precious little light was the often hyperbolic, ill-informed and sometimes blatantly politically motivated media reaction to the preliminary estimate of Q2 2022 Gross Domestic Product (GDP) on Thursday. Who knew...2022-07-3110 min ANGLES.Spicing Things Up.Markets seem to have firmly seized onto the hope that we are now close to 1) peak inflation, 2) peak Fed hawkishness and, as a result of the first two, 3) peak US dollar strength. The result was a very solid week for most stocks (with the occasional notable exception, like SNAP which collapsed nearly 40% on Friday alone after terrible sales growth numbers).But hope combined with some favorable readings from some frankly second-tier data points isn’t usually enough to cause such a substantial bounce (or at least the most substantial one we’ve seen in a few months). Howev...2022-07-2407 min

ANGLES.Spicing Things Up.Markets seem to have firmly seized onto the hope that we are now close to 1) peak inflation, 2) peak Fed hawkishness and, as a result of the first two, 3) peak US dollar strength. The result was a very solid week for most stocks (with the occasional notable exception, like SNAP which collapsed nearly 40% on Friday alone after terrible sales growth numbers).But hope combined with some favorable readings from some frankly second-tier data points isn’t usually enough to cause such a substantial bounce (or at least the most substantial one we’ve seen in a few months). Howev...2022-07-2407 min ANGLES.Avalanche Coming.Get ready for an avalanche of recession warnings across all media platforms. That's the conclusion from last week’s Consumer Price Index (CPI) report, as inflation hit yet another 40 year high which almost guarantees that the Fed announces on July 27th that it will raise interest rates by at least another 0.75%, putting even more pressure on the economy. Indeed, after the Bank of Canada last week hiked interest rates by 1.0%, by Wednesday evening US bond futures markets were pointing to a 78% probability of a full 1.0% raise by the Fed at that next meeting. “Peak...2022-07-1708 min