Shows

Today's Tax Talk with Attorney Steven LeahyAdvice For Business Owners - Plus ID.me -Thursday November 17, 2022 - At Opem Tax Advocates we are passionate about helping business owners lower their tax bill, avoid audits, and grow their business. So, today, we review an article pointing out that “New business formation has boomed,” and pointing out that “some tax changes -coupled with evergreen tax issues that tend to trip up small business – could cause headaches if owners aren’t careful.”

Attorney Steven A. Leahy also follows up on an old BIG story. Remember when the IRS wanted taxpayers to use facial recognition to use IRS services? Recently, a House Oversight Committee releas...

2022-11-1822 min

Today's Tax Talk with Attorney Steven LeahyPrepare Now, For Audit Later - EVERYONE has now heard of the massive expansion of the IRS. But, depending on who you listen to, the impact will not be great - or the impact will be HUGE!Monday October 3, 2022 - EVERYONE has now heard of the massive expansion of the IRS. But, depending on who you listen to, the impact will not be great - or the impact will be HUGE!

Which is it? Today Attorney Steven A. Leahy reviews two articles. The first, "The tax man is receiving $80bn – but US small businesses shouldn’t worry." Author Gene Marks, takes the former view. All is well. No need to panic.

The second, "When IRS Form 1099 And Tax Returns Don't Match" Author Robert W. Wood pretty much take...

2022-10-0421 min

Today's Tax Talk with Attorney Steven LeahyIRS Releases 2021 Data Book -Thursday May 26, 2022 - The Internal Revenue Service (IRS) Data Book is published annually by the IRS and contains statistical tables and organizational information on a fiscal year basis. The report provides data on collecting the revenue, issuing refunds, enforcing the law, assisting the taxpayer, and the budget and workforce.

The IRS is very good at compiling statistics, and breaking those statistics down into categories. The 2021 Data Book was released today. It will take some weeks for me to review all that data.

Because my practice focuses on helping people wit...

2022-05-2721 min

Today's Tax Talk with Attorney Steven LeahyCrypto Losses, Tax Savings? - Have you noticed - Cryptocurrency is volatile? Back in 2014 the IRS announced that crypto is property for tax purposes. Not currency, not securities, but property. So,Tuesday May 24, 2022 - Have you noticed - Cryptocurrency is volatile? Back in 2014 the IRS announced that crypto is property for tax purposes. Not currency, not securities, but property. So, some tax rules that apply to currency or securities do not apply to cryptocurrency.

Rules like the Wash Sale Rule. You can sell your crypto and buy it right back without a 30 day waiting period. Each trade is a taxable event.

The IRS is still inventing the rules for Cryptocurrency. The IRS believes that as much as 10% of the Tax Gap (t...

2022-05-2520 min

Today's Tax Talk with Attorney Steven LeahyForeclosures On The Rise - Foreclosures have not been an issue since the pandemic. One of the first things Government did was to issue a Foreclosure Moratorium.Monday May 23, 2022 - Foreclosures have not been an issue since the pandemic. One of the first things Government did was to issue a Foreclosure Moratorium.

Last August the CDC moratoriums came to and end based on a United States Supreme Court ruling on the issue.. Some States (like Illinois) maintained a foreclosure moratorium thereafter - but no more!

“A total of 50,759 U.S. properties started the foreclosure process in the first quarter of 2022, up 67% from the previous quarter and up 188% from a year ago,” Chicago saw over 3,000 foreclosures in the first...

2022-05-2423 min

Today's Tax Talk with Attorney Steven LeahyIRS Audits Are Down - Way Down - The United States Government Accountability Office recently released Report to the Chairman, Subcommittee on Oversight, Committee on Ways and Means, House of RepresentWednesday May 18, 2022 - The United States Government Accountability Office recently released Report to the Chairman, Subcommittee on Oversight, Committee on Ways and Means, House of Representatives titled "TAX COMPLIANCE Trends of IRS Audit Rates and Results for Individual Taxpayers by Income."

The Report found that In recent years, IRS has examined, or audited, a decreasing proportion of individual tax returns. This trend has raised concerns about the potential for

declining taxpayer compliance, as well as whether IRS is equitably selecting taxpayers for audit, as audit rates for

higher-income taxpayers have...

2022-05-1919 min

Today's Tax Talk with Attorney Steven LeahyCrypto Goes To Washington - Cryptocurrency has grown up - and legislators and regulators have noticed. We have covered many new regulations and proposed regulations over the last many months.Tuesday May 17, 2022 - Cryptocurrency has grown up - and legislators and regulators have noticed. We have covered many new regulations and proposed regulations over the last many months.

In response, Crypto is sending in the lobbyists and pouring millions of dollars into primary elections to gain influence over members of Congress and other government officials who are crafting regulations.

Attorney Steven A. Leahy looks over the recent Cryptocurrency lobbying efforts on Today's Tax Talk.

https://tulsaworld.com/lifestyles/technology/crypto-comes-to-washington-will-the-millions-buy-influence/article_b5dac209-1c4...

2022-05-1816 min

Today's Tax Talk with Attorney Steven LeahyIRS Destroyed 30 Million Paper Docs - The TREASURY INSPECTOR GENERAL FOR TAX ADMINISTRATION recently conducted an audit and issued a report on May 4, 2022 - A Service-Wide Strategy Is Needed to AddresMonday May 16, 2022 - The TREASURY INSPECTOR GENERAL FOR TAX ADMINISTRATION recently conducted an audit and issued a report on May 4, 2022 - A Service-Wide Strategy Is Needed to Address Challenges Limiting Growth in Business Tax Return Electronic Filing.

"This audit was initiated because the IRS’s continued inability to process backlogs of paper-filed tax returns contributed to management’s decision to destroy an estimated 30 million paper-filed information return documents in March 2021. The IRS uses these documents to conduct post-processing compliance matches to identify taxpayers who do not accurately report their income."

Th...

2022-05-1722 min

Today's Tax Talk with Attorney Steven LeahyIRS Considers Scanning Technology - Paper is the IRS's Kryptonite. So says Erin Collins the IRS National Taxpayer Advocate. IRS Commissioner Chuck Rettig told the Senate Appropriation Committee’s subThursday May 5, 2022 - Paper is the IRS's Kryptonite. So says Erin Collins the IRS National Taxpayer Advocate. IRS Commissioner Chuck Rettig told the Senate Appropriation Committee’s subcommittee on financial services and general government that the agency is “going into the direction of being able to automate paper returns.”

The IRS Requested funding in 2013 to convert to a digital scanning system - as many states did some years ago. But the Commissioner said “If we were asking for it in 2013, we are 10 years essentially, technology-wise, beyond that,”

Rettig said scanning and...

2022-05-0619 min

Today's Tax Talk with Attorney Steven LeahyThe IRS & ID.me - Last year the IRS signed an $86 million contract with identity verification provider ID.me to provide biometric identity verification services. As soon as the deal was announced, thWednesday May 4, 2022 - Last year the IRS signed an $86 million contract with identity verification provider ID.me to provide biometric identity verification services. As soon as the deal was announced, there was an outcry - and the IRS seemed to backtrack.

Yesterday IRS Commissioner Charles Rettig told a subcommittee of the Senate Appropriations Committee that the taxpayer access to the online IRS depends on ."identity proofing." Something the current system just isn't good at.

It appears from all the news, the IRS is backtracking again - going back to ID.me...

2022-05-0521 min

Today's Tax Talk with Attorney Steven LeahyNFT - The Basics - Non-Fungible Tokens (NFT) are the talk of the town. But, what is an NFT exactly. An NFT is a digital asset that represents real-world objects. The NFT may be art, music, in-game iTuesday May 3, 2022 - Non-Fungible Tokens (NFT) are the talk of the town. But, what is an NFT exactly. An NFT is a digital asset that represents real-world objects. The NFT may be art, music, in-game items or videos.

The value of NFTs come from their exclusivity, or "digital scarcity." Digital copies may be infinite. But, there is only one "original." The NFT contains built-in authentication, which serves as proof of ownership.

Attorney Steven A. Leahy covers the NFT story so you can understand what hype is all about. .

...

2022-05-0417 min

Today's Tax Talk with Attorney Steven LeahyHave You Heard of the Pro Act? - Last March, right around the time Congress enacted the American Rescue Plan Act with its hidden Cash App provisions, the United States House of Representatives passedThursday April 28, 2022 - Last March, right around the time Congress enacted the American Rescue Plan Act with its hidden Cash App provisions, the United States House of Representatives passed the Protect the Right To Organize Act (PRO Act) on a 225 -206 vote.

The Pro Act purportedly "strengthen workers' rights to strike for better wages and working conditions, strengthen safeguards to ensure that workers can hold fair union elections and allow the National Labor Relations Board to fine bosses who violate workers' rights."

What was not advertised is the PRO A...

2022-04-2916 min

Today's Tax Talk with Attorney Steven LeahyThe IRS Needs More Money? - We have been warning our viewers that news stores calling for more funding for the IRS was right around the corner. So it begins.Wednesday April 27, 2022 - We have been warning our viewers that news stores calling for more funding for the IRS was right around the corner. So it begins.

Did you know the government cannot function without funding? America could not be America without the IRS. Therefore, the logic goes, we need to double the size of the IRS - now.

Never mind the IRS abuses. Never mind our government spends money it does not have. Never mind the average taxpayer is already paying out the nose. No. we should ignore all of...

2022-04-2822 min

Today's Tax Talk with Attorney Steven LeahyBlockchain, Internet & The Future - The future is near. Nearer than we think. Advances in Blockchain technology - and its integration in the Internet are about to change the way we live and work, andTuesday April 26, 2022 - The future is near. Nearer than we think. Advances in Blockchain technology - and its integration in the Internet are about to change the way we live and work, and how we interact with others.

The emergence of Web 3.0 - using Blockchain technology - promises to take control of private data away from the Big Tech companies and place it in the hands of End users, who directly manage and control their own data and information.

To get to Web 3.0 the Blockchain has some growing to d...

2022-04-2721 min

Today's Tax Talk with Attorney Steven LeahyIRS: Is it Ready? - The IRS has an image problem. They also have a messaging problem. If only the IRS could let the citizens know how important they are to democracy, everything would be right as raMonday April 2, 2022 - The IRS has an image problem. They also have a messaging problem. If only the IRS could let the citizens know how important they are to democracy, everything would be right as rain. After all, $14 Billion Dollars only goes so far.

As we reported last week, the IRS is on a mission to get more funding, and they need the public to help. Without public support their mission will fail. To that end, IRS Commissioner Charles Rettig appeared before the members of the House Oversight and Reform Committee last Thursday..

...

2022-04-2621 min

Today's Tax Talk with Attorney Steven LeahyThe Most Expensive Tax Return! - The Biden Build Back Better Plan is still being pushed by some in Congress. You can predict, right after Tax Day, 2 things: First, the IRS will ask for more money toThursday April 21, 2022 - The Biden Build Back Better Plan is still being pushed by some in Congress. You can predict, right after Tax Day, 2 things: First, the IRS will ask for more money to preform their duties (we covered that yesterday). Second, we should give the IRS more power to make filing easier.

One can find a plethora of stories detailing how cheap it is in other countries to prepare taxes. "In Sweden, you get a text message," "In Croatia it takes five minutes." The one element these stories leave out - is government control...

2022-04-2213 min

Today's Tax Talk with Attorney Steven LeahyIs the IRS Underfunded?? -Wednesday April 20, 2022 - It is now common knowledge that the IRS is woefully understaffed and underfunded. In fact, Natasha Sarin, the Treasury's counselor for tax policy and implementation asserted "chronic underfunding [] has starved the IRS of the tools it needs to serve the American people."

Is that right? Has the IRS been starved of resources? Should the American public agree to double the size of the agency, as President Biden has asked? Would doubling the size of the IRS solve all of our budget problems?

Attorney Steven A. Leahy cons...

2022-04-2119 min

Today's Tax Talk with Attorney Steven LeahyIt' Tax Day! - Well, it's here, Tax Day 2022. Remember, Emancipation Day kicked the filing deadline from the normal April 15th date.Monday April 18, 2022 - Well, it's here, Tax Day 2022. Remember, Emancipation Day kicked the filing deadline from the normal April 15th date.

The IRS Commissioner, Charles P. Rettig, took the opportunity in an Opinion piece in NewsWeek to write "[o]n behalf of the employees of the Internal Revenue Service (IRS), I want to thank everyone for taking the time to file and pay their taxes. So, taxpayers have that.

The IRS also took this solemn day to "Plea for More I.R.S. Funding, according the the New York Ti...

2022-04-1914 min

Today's Tax Talk with Attorney Steven LeahyIRS Tax Return Extensions - Tax Season is coming to a close. Your tax return must be filed (or postmarked) by April 18, 2022. Every year, a large portion of taxpayers ask for an extension.Thursday April 14, 2022 - Tax Season is coming to a close. Your tax return must be filed (or postmarked) by April 18, 2022. Every year, a large portion of taxpayers ask for an extension.

Here are some things you should know about an IRS extension. First, extensions are automatic, as long as you file a request with the IRS before the deadline. Next, even you get an extension, the extension is only an extension of time to file the return - not to pay any tax that is due.

That begs the questi...

2022-04-1512 min

Today's Tax Talk with Attorney Steven LeahyCrypto Regulations - State by State - Federal Regulators, from most every agency, are looking into regulating all things Crypto. The Biden Administration recently issue an Executive Order - directingTuesday April 12, 2022 - Federal Regulators, from most every agency, are looking into regulating all things Crypto. The Biden Administration recently issue an Executive Order - directing them to do do. But, here is the thing about Federal Regulations - they take a VERY long time to implement.

The Crypto industry moves quickly. They don't have time to wait for the Federal Government to, first educate themselves about the nuances of Crypto, then draft meaningful regulations, get those regulations passed, and finally to apply the regulations.

So, the Crypto industry is...

2022-04-1323 min

Today's Tax Talk with Attorney Steven LeahyForeclosure Moratorium - Unconstitutional Taking? - The Governor of Minnesota, Tom Waltz, issues 3 Executive Orders imposing and modifying a moratorium on residential evictions in the state.Monday April 11, 2022 - The Governor of Minnesota, Tom Waltz, issues 3 Executive Orders imposing and modifying a moratorium on residential evictions in the state. A property owner of rental units in Minnesota objected and filed an action in District Court, contending the Executive Orders violated their rights protected under the contract clause, the takings clause, the due process clauses, and the First Amendment to the U.S. Constitution as well as state law.

The District Court dismissed the case - on all three grounds and the property owner appealed to the Eighth Circuit Court. On Ap...

2022-04-1221 min

Today's Tax Talk with Attorney Steven LeahyIRS Commissioner Makes BIG Promise - Today, IRS Commissioner Charles Rettig said "The IRS could wipe out its massive backlog of returns by the end of the year." To do that, the IRS has revealed a SurThursday April 7, 2022 - Today, IRS Commissioner Charles Rettig said "The IRS could wipe out its massive backlog of returns by the end of the year." To do that, the IRS has revealed a Surge plan and a new hiring plan that would ad another 10,000 employees.

The IRS Commissioner also revealed "“53% of the employees are in a full-time telework capacity. The rest of the employees either have a blended capacity or they are onsite.”

The good news? Rittig told the committee "We are currently running around 19 to 20 percent level of service...

2022-04-0811 min

Today's Tax Talk with Attorney Steven LeahyStates Fight Over Workers' Taxes - It's tax time and the battle is on! COVID created a whole class of employees who work in one state (where they live) for a company that has a head quarters in anotheWednesday April 6, 2022 - It's tax time and the battle is on! COVID created a whole class of employees who work in one state (where they live) for a company that has a head quarters in another state. The employee never goes to the company's state - but the state, where they never go, wants to collect taxes from them.

This is a VERY common question. I answered that question twice today. The answer is much more complicated than you would expect. In fact, New Hampshire brought a law suit against Massachusetts to stop Massachusetts from...

2022-04-0716 min

Today's Tax Talk with Attorney Steven LeahyBetter Claim Your 2018 Refund - Did you know that the IRS will confiscate your tax refund if you don't file your tax return? Actually, they will hold it for three years from the date the tax return wWednesday March 30, 2022 - Did you know that the IRS will confiscate your tax refund if you don't file your tax return? Actually, they will hold it for three years from the date the tax return was due.

This year the IRS reports almost 1.5 million taxpayers have not filed their 2018 tax returns - worth about $1.5 BILLION in unclaimed refunds. Half of the missing refunds from 2018 are more than $813.

You must file be April 18, 2022 (April 19 if you live in Massachusetts or Maine) - unless you filed for an extension for that ta...

2022-03-3115 min

Today's Tax Talk with Attorney Steven LeahyBlockchain Overrated? - We have touted the Blockchain and Cryptocurrency as the future in this space for some time. The promise of Blockchain as to tool to cut out the middleman, reduce transactionsTuesday March 29, 2022 - We have touted the Blockchain and Cryptocurrency as the future in this space for some time. The promise of Blockchain as to tool to cut out the middleman, reduce transactions costs, provide transparency - and privacy. Well, not everyone is on the Blockchain bandwagon.

Recently, a member of the Federal Reserve Board of Governors, Christopher Waller, said blockchain technology is “totally overrated,”

Speaking about cryptocurrency he said “My view is these things are just electronic gold. They’re forms of storage carrying wealth across time. Look at art, lo...

2022-03-3023 min

Today's Tax Talk with Attorney Steven LeahyAnd The Winner Is - The IRS! - You may have heard about the BIG news at the Oscar's last night. That's right the "Everyone Wins" gift bags were filled with gifts worth a total of $137,000.00!!Monday March 28, 2022 - You may have heard about the BIG news at the Oscar's last night. That's right the "Everyone Wins" gift bags were filled with gifts worth a total of $137,000.00!! And, as it turns out, those gifts are taxable to the recipient.

With most every Hollywood "Star" in the 50% tax bracket, that means that each actor/actress who accepts the gifts are on the hook for half the value.

Now, some of those eligible did not accept the gift bag. And, as it turns out, no one is taxed...

2022-03-2915 min

Today's Tax Talk with Attorney Steven LeahyThank You Emancipation Day! - Everyone knows that tax day is April 15th. Our tax returns are due on April 15th no matter what. Or are they.Wednesday March 23, 2022 - Everyone knows that tax day is April 15th. Our tax returns are due on April 15th no matter what. Or are they.

COVID caused a disruption. In 2021 the IRS granted an extra month - the returns were due May 15, 2021. And, remember, 2020? Those returns were not due until July 15th.

There are other reasons why Tax Day may fall on another day. For example, if the 15th falls on a Saturday, Sunday or Holiday - the date gets pushed to the nearest day that is not a Saturd...

2022-03-2410 min

Today's Tax Talk with Attorney Steven LeahyTaxing NFTs -Tuesday March 23, 2022 - NFTs have gone mainstream - but the IRS has not yet come up with guidelines on how they should be taxed - Capital Gains, Income, dividends, or collectibles?

“The digital economy is rapidly evolving, but our tax code is lagging behind. Currently, the burden to report and calculate gains on virtual currency transactions falls on the consumer,” DelBene said in a statement to POLITICO. “This includes purchasing NFTs.”

“While the IRS is aware of and monitors developments with digital assets, the IRS has not issued specific guidance o...

2022-03-2320 min

Today's Tax Talk with Attorney Steven LeahySteve Harvey's Tax Woes - Steve Harvey, the popular “Family Feud” host, told a Podcast audience recently that he owed the IRS $22 Million in 2008. Then he worked for 4 years and paid $650,000 PER MOMonday March 21, 2022 - Steve Harvey, the popular “Family Feud” host, told a Podcast audience recently that he owed the IRS $22 Million in 2008. Then he worked for 4 years and paid $650,000 PER MONTH to pay the IRS in full.

Steve Harvey's problems stem from outright theft at the hands of his accountant. Mr. Harvey explained how his account prepared his tax returns, took his tax payments, then did not file the returns and took the tax payments for himself.

All this came as a big surprise to Mr. Harvey - and came to...

2022-03-2215 min

Today's Tax Talk with Attorney Steven LeahyFormer Taxpayer Advocate "The Trouble With The IRS" - Nina Olson, former IRS National Taxpayer Advocate from 2001 to 2019, describes the current problems at the IRS as the worst she’s ever seen. ThiThursday March 17, 2022 - Nina Olson, former IRS National Taxpayer Advocate from 2001 to 2019, describes the current problems at the IRS as the worst she’s ever seen. This is the second year in a row that the IRS entered the year with a backlog of millions of not yet processed returns and pieces of correspondence.

Internal Revenue Service Commissioner Charles Rettig appeared before The House Ways and Means Oversight Subcommittee today regarding how the IRS will spend the additional $675 Million approved by Congress recently.

The Commissioner said “Taxpayer service remains the mos...

2022-03-1818 min

Today's Tax Talk with Attorney Steven LeahySecuritized Blockchain Assets - Security Tokens are all the rage Will security tokens transform equity just as bitcoin has transformed currency?Tuesday March 15, 2022 - Security Tokens are all the rage Will security tokens transform equity just as bitcoin has transformed currency?

Security Tokens give the owner a direct, liquid economic interest and the expedited delivery of proceeds from a specific project. Because every type of ownership can be tokenized, the sky is the limit.

The market for security tokens took off in 2021 - and many expect an unprecedented acceleration in 2022.

Attorney Steven A. Leahy examines all the hype and explains exactly what a security token is...

2022-03-1617 min

Today's Tax Talk with Attorney Steven LeahyCongress Wants Answers From IRS - Bipartisan group of lawmakers pushes IRS for answers on ‘numerous problems’ facing taxpayers. From unprocessed tax returns to failure to answer the phones, the IRS hMonday March 14, 2022 - Bipartisan group of lawmakers pushes IRS for answers on ‘numerous problems’ facing taxpayers. From unprocessed tax returns to failure to answer the phones, the IRS has an unprecedented backlog.

Representatives, as well as Senators, have sent letters to Internal Revenue Service Commissioner, Charles Rettig.

“We remain concerned that the IRS does not have a comprehensive plan to remedy the numerous problems affecting taxpayers, despite the fact that this filing season is already well underway,” the members wrote.

Attorney Steven A...

2022-03-1512 min

Today's Tax Talk with Attorney Steven LeahyIRS Budget Boost! - Buried in the $1.5 trillion omnibus spending package is a 6 percent raise for the IRS - it isn't the 80 Billion in 10 year package they were looking for, but it will have to do - fThursday March 10, 2022 - Buried in the $1.5 trillion omnibus spending package is a 6 percent raise for the IRS - it isn't the 80 Billion in 10 year package they were looking for, but it will have to do - for now.

We have reported on IRS Surge I and IRS Surge II designed to tackle the huge backlog. The new money will be used to hire 5000 new IRS employees this year. And another 5000 after that.

The IRS claims its aggressive plan will clear the backlog by the end of 2022.

...

2022-03-1116 min

Today's Tax Talk with Attorney Steven LeahyCrypto Executive Order - Not all Crypto news happens on Tuesday. Today was such a day. President Joe Biden announced some weeks ago that an Executive Order was coming concerning Cryptocurrency. TodWednesday March 9, 2022 - Not all Crypto news happens on Tuesday. Today was such a day. President Joe Biden announced some weeks ago that an Executive Order was coming concerning Cryptocurrency. Today it arrived.

The EO focuses on 6 key areas - consumer protection, financial stability, illicit activity, U.S. competitiveness, financial inclusion and responsible innovation.

The administration is also interested in creating a Stablecoin, a digital version of the dollar.

Attorney Steven A. Leahy reports on the Whitehouse FACT SHEET: "President Biden to Sign Executive Orde...

2022-03-1017 min

Today's Tax Talk with Attorney Steven Leahy2022 Crypto Tax Guide - Cryptocurrency was designed to be independent of any organized market - decentralized is the promise. As Cryptocurrency grew, so too, did Government intervention.Tuesday March 8, 2022 - Cryptocurrency was designed to be independent of any organized market - decentralized is the promise. As Cryptocurrency grew, so too, did Government intervention.

The IRS has taken the lead role - ostensibly to reduce the tax-gap, protect consumers and prevent tax cheating. The Biden Administration recently announced the President's delivery of an Executive Order on Cryptocurrency.

The order is expected to outline the actions government agencies should take to develop policies and regulations on digital currencies. The State Department will be directed to ensure that American cry...

2022-03-0920 min

Today's Tax Talk with Attorney Steven LeahySNOOP Reverses $600 Venmo Reporting - Remember Obama Care (Affordable Care Act)? There was a provision within the Obama Care Act which would have required businesses to send 1099 forms for all purchaMonday March 7, 2022 - Remember Obama Care (Affordable Care Act)? There was a provision within the Obama Care Act which would have required businesses to send 1099 forms for all purchases of goods and services over $600 annually.

That was the part of the Bill that we needed to pass in order to find out what was in it. When Americans found out that this provision was in the Act, there was an immediate movement to repeal that reporting requirement.

The expanded 1099 requirement was not set to go into affect until 2012. But, in 20...

2022-03-0819 min

Today's Tax Talk with Attorney Steven LeahyIRS Passport Revocation - My office is getting lots of calls about passports. My clients (or soon to be clients) are receiving Notice CP508C - Notice of Certification of your seriously delinquent fedThursday March 3, 2022 - My office is getting lots of calls about passports. My clients (or soon to be clients) are receiving Notice CP508C - Notice of Certification of your seriously delinquent federal tax debt to the State Department. And they are rightfully, concerned.

Attorney Leahy "What is going on here? " is the question they ask.

Back in 2015 the Fixing America’s Surface Transportation (FAST) Act, became law, The FAST Act includes a provision requiring the IRS to notify the U.S. Department of State if a certification is made t...

2022-03-0417 min

Today's Tax Talk with Attorney Steven LeahyPenalty for Underpayment of Estimated Tax Explained - Most of my clients run a small business. And small business owners generally are required to pay the IRS an estimated tax each quarter, becauseWednesday March 2, 2022 - Most of my clients run a small business. And small business owners generally are required to pay the IRS an estimated tax each quarter, because, the United States income tax system is a pay-as-you-go tax system, which means that you must pay income tax as you earn or receive your income during the year..

In my experience, many don't pay quarterly and this leads to an underpayment of estimated tax penalty.

The IRS wants to stop referring this as a penalty - because, technically, the IRS sim...

2022-03-0321 min

Today's Tax Talk with Attorney Steven LeahyCrypto Firsts Keep Comin - Blockchain has been around for some time now, since at least 2008 - but most everyday we learn of new firsts.Tuesday March 1, 2022 - (Crypto Tuesday) Blockchain has been around for some time now, since at least 2008 - but most everyday we learn of new firsts.

In June 2021 El Salvador become the first county to accept Bitcoin as legal tender.

In October 2015, the first NFT project, Etheria, was launched and demonstrated at DEVCON 1.

In 2021 the first NFT “Quantum” to sell for more than $1 million.

We could go on and on...Every day there seems to be a new "First."

2022-03-0217 min

Today's Tax Talk with Attorney Steven LeahyWarning; 2022 Tax Season - The IRS faced the “most challenging year taxpayers and tax professionals have ever experienced,” in 2021. This according to the National Taxpayer Advocate 2021 Annual RepoMonday February 28, 2022 - The IRS faced the “most challenging year taxpayers and tax professionals have ever experienced,” in 2021. This according to the National Taxpayer Advocate 2021 Annual Report to Congress. In that report,

The Taxpayer Advocate, Erin Collins states “I am deeply concerned about the upcoming [2022] filing season, . .[p]aper is the IRS’ Kryptonite, and the agency is still buried in it.” She concluded, "The IRS is in Crisis."

We have covered much of this crisis in this space since the beginning of the year and the beginning of the 2022 tax filing se...

2022-03-0119 min

Today's Tax Talk with Attorney Steven Leahy1099 NEC - 1099 Misc - What You Need To Know -Thursday February 24, 2022 - 1099 employees are not employees at all. They are independent contractors - separate companies. Many who take up 1099 status do not understand this.

1099 independent contactors are responsible for their own taxes - AND contributions to Social Security and Medicare. So, when they collect payments, much of those payments actually should go to the federal government. Unfortunately, Americans are conditioned to spend their income and collect a tax refund from the IRS each tax season.

1099 Independent contractors are required to make payments to the IRS quarterly and pay their...

2022-02-2520 min

Today's Tax Talk with Attorney Steven LeahyCrypto Wednesday?? IRS Taxes Crypto Assets & Updates ID.me Policy - We focus on Blockchain Technology, including cryptocurrency, Non Fungible Tokens (NFT), & Decentralized Autonomous Organizations (DWednesday February 23, 2022 - We focus on Blockchain Technology, including cryptocurrency, Non Fungible Tokens (NFT), & Decentralized Autonomous Organizations (DAO) every Tuesday in this space - we call it Crypto Tuesday.

Every once in a while a Cryptocurrency and IRS story pops up on a day not Tuesday. A story so relevant we don't want to wait until next Tuesday to cover.

Such is the Story today in Forbes "How The IRS Is Looking For Its Share Of Cryptocurrency And NFT Growth" by Lynn Mucenski Keck. The mix of blockchain technology and...

2022-02-2423 min

Today's Tax Talk with Attorney Steven LeahyTaxing Cryptocurrency - What better time to discuss how cryptocurrency is taxed then tax season - before there is a problem. While we have talked about taxing crypto many times - this little refresheTuesday February 22, 2022 - What better time to discuss how cryptocurrency is taxed then tax season - before there is a problem. While we have talked about taxing crypto many times - this little refresher won't hurt.

First, remember, cryptocurrency is not treated like fiat currency (government issued currency) - it's treated like property; like stocks.

Simply buying Crypto is not a taxable event - it becomes a taxable event when you sell, trade or convert it. In addition, if you receive crypto as payment for goods or services it is...

2022-02-2320 min

Today's Tax Talk with Attorney Steven LeahyPPP - Back In The News - The Paycheck Protection Program (PPP) administered by the Small Business Administration (SBA) provided over 11.7 million loans totaling nearly $800 billion in relief to over 8Monday February 21, 2022 - The Paycheck Protection Program (PPP) administered by the Small Business Administration (SBA) provided over 11.7 million loans totaling nearly $800 billion in relief to over 8.5 million small businesses.

The plan was to forgive these loans. A borrower was to apply for forgiveness once all loan proceeds for which the borrower requested forgiveness were used. Then they were to apply for forgiveness any time up to the maturity date of the loan.

If borrowers do not apply for forgiveness within 10 months after the last day of the covered period, t...

2022-02-2219 min

Today's Tax Talk with Attorney Steven LeahyIRS "Surge" Battles The Backlog - The Internal Revenue Service's (IRS) Taxpayer Advocate Erin Collins appeared at the Senate Finance Committee hearing today. It was the Taxpayer Advocate's report, isThursday February 17, 2022 - The Internal Revenue Service's (IRS) Taxpayer Advocate Erin Collins appeared at the Senate Finance Committee hearing today. It was the Taxpayer Advocate's report, issued in January 2022, that characterized the IRS operations as "In Crisis."

In her testimony today, Ms. Collins made several recommendations to help clear the IRS backlog. Remember, it was only 2 weeks ago that the IRS reassigned 1200 employees to create a "Surge Team": A team tasked with cutting into a backlog that included millions of unprocessed returns from last year.

Today, Ms. Collins and th...

2022-02-1820 min

Today's Tax Talk with Attorney Steven LeahyForeclosures Rise - Foreclosure numbers have been at record lows across the country since March 2020. Foreclosure moratoriums have a lot to do with those numbers. Now that the moratoriums have endedWednesday February 16, 2022 - Foreclosure numbers have been at record lows across the country since March 2020. Foreclosure moratoriums have a lot to do with those numbers. Now that the moratoriums have ended, should we start to see a rise in foreclosures?

Well, January 2022 saw a sharp increase - Foreclosure filings such as default notices, scheduled auctions or bank repossessions more than doubled compared with January 2021.- still at lower levels than before the pandemic.

But, we can expect those numbers to continue to rise. An estimated 7.1 million borrowers -- 14% of all...

2022-02-1721 min

Today's Tax Talk with Attorney Steven LeahyTaxman Seizes NFTs - 1st Time Ever! - Her Majesty’s Revenue and Customs office (HMRC) became the first law enforcement body in the United Kingdom (The world??) to seize Non Fungible Tokens during an iTuesday February 15, 2022 - Her Majesty’s Revenue and Customs office (HMRC) became the first law enforcement body in the United Kingdom (The world??) to seize Non Fungible Tokens during an investigation into a suspected value-added tax (VAT) fraud case.

Three NFTs, representing digital art, were seized, with an estimated value of $1.9 million (USD). “Our first seizure of a Non-Fungible Token serves as a warning to anyone who thinks they can use cryptoassets to hide money from HMRC,” Nick Sharp, HMRC’s deputy director of economic crime, said in a statement Monday.

“We...

2022-02-1613 min

Today's Tax Talk with Attorney Steven LeahyWhere Is My IRS Refund?? - The IRS is behind - WAY BEHIND. There are still millions of 2020 returns that are still not processed.Monday February 14, 2022 - The IRS is behind - WAY BEHIND. There are still millions of 2020 returns that are still not processed. So, where are they with my 2022 refund? Here is a schedule provided by the IRS: The list shows the filed-by date on the left, and the tax refund payment date on the right.

February 7 - February 18

February 14 - February 25

February 21 - March 4

February 28 - March 11

March 7 - March 18

March 14 - March 25

March 21 - April 1

March 28 - April 8

Apri...

2022-02-1517 min

Today's Tax Talk with Attorney Steven LeahyEVERYTHING is Taxable! - The Sixteenth Amendment to the United States Constitution states: "The Congress shall have power to lay and collect taxes on incomes,Thursday February 10, 2022 - The Sixteenth Amendment to the United States Constitution states:

"The Congress shall have power to lay and collect taxes on incomes, from whatever source derived, without apportionment among the several states, and without regard to any census or enumeration."

This year the IRS is driving that point home. Today, IRS Tax Tim 2022-23 warns "Taxpayers must report tip money as income on their tax return." Most of those accepting tips as part of their income already know that tips are taxable - although some don't report al...

2022-02-1115 min

Today's Tax Talk with Attorney Steven LeahyIRS Stops Notices - "The IRS announced today the suspension of more than a dozen additional letters, including the mailing of automated collection notices normally issued when a taxpayer owes additionWednesday February 9, 2022 - "The IRS announced today the suspension of more than a dozen additional letters, including the mailing of automated collection notices normally issued when a taxpayer owes additional tax, and the IRS has no record of a taxpayer filing a tax return."

Some taxpayers, who have filed their tax returns that remain unprocessed, started receiving collection notices in error. Those notices are sent out automatically. So, when the return is not put into the system, the system assumes the return is unfiled. The unprecedented delays the IRS is experiencing continues to create unfor...

2022-02-1021 min

Today's Tax Talk with Attorney Steven LeahyBlockchain - NFT - DAO - Explained - To understand Cryptocurrency, you have to understand blockchain technology. Once you understand blockchain technology, you wil+l also understand Non Fungible TokTuesday February 8, 2022 - To understand Cryptocurrency, you have to understand blockchain technology. Once you understand blockchain technology, you wil+l also understand Non Fungible Tokens (NFTs), & Decentralized Autonomous Organizations (DAOs).

Today we have two stories - one looks at blockchain and NFT. The second is a story of DAOs and investing. Each story has lessons to understand how blockchain technology is changing the way the world works.

Attorney Steven A. Leahy uses these stories as a learning tool We all should understand these new mechanisms.

---

Send in a vo...

2022-02-0927 min

Today's Tax Talk with Attorney Steven LeahyIRS - "ID.me Out" - Last week we reported on the IRS plan to use facial recognition software from ID.ne to verify taxpayers identities before they could gain access to their own tax information. We pMonday February 7, 2022 - Last week we reported on the IRS plan to use facial recognition software from ID.ne to verify taxpayers identities before they could gain access to their own tax information. We pointed out the potential and real problems with such a plan.

Late last week a bipartisan group of Senators, including Democratic Senator Jeff Merkley of Oregon and Republican Senator Roy Blunt of Missouri wrote in a letter to Commissioner Charles P. Rettig that the IRS has a “poor track record of protecting taxpayer data” and that facial recognition technology, in partic...

2022-02-0820 min

Today's Tax Talk with Attorney Steven LeahyAvoid IRS Audits - Top Reasons Taxpayers Get Audited. The IRS calls an audit an “Examination of Returns.”Wednesday February 2, 2022 - The IRS calls an audit an “Examination of Returns.” The IRS accepts most federal tax returns just as they are filed. Some returns, however, are selected for review. The IRS selects returns for audit by computerized screening, random sample, or by an income document matching program.

Attorney Steven A. Leahy reviews the top reasons taxpayers get audited.

---

Send in a voice message: https://podcasters.spotify.com/pod/show/steven-leahy1/message

2022-02-0317 min

Today's Tax Talk with Attorney Steven LeahySEC Approves BOX Exchange (BSTX) - The U.S. Securities and Exchange Commission has added a new stock exchange - one that will contain blockchain technology.Tuesday February 1, 2022 -The U.S. Securities and Exchange Commission has added a new stock exchange - one that will contain blockchain technology.

BOX Exchange (BSTX), is the 17th Exchange in the US, The SEC has taken an important step forward today in its approval of BSTX as a national securities exchange facility,” said BSTX CEO Lisa Fall in a statement. “We are eager to continue to work closely with the SEC to launch BSTX as a fully regulated exchange and to help provide capital markets with more modern tools for issuers and investors.”

2022-02-0217 min

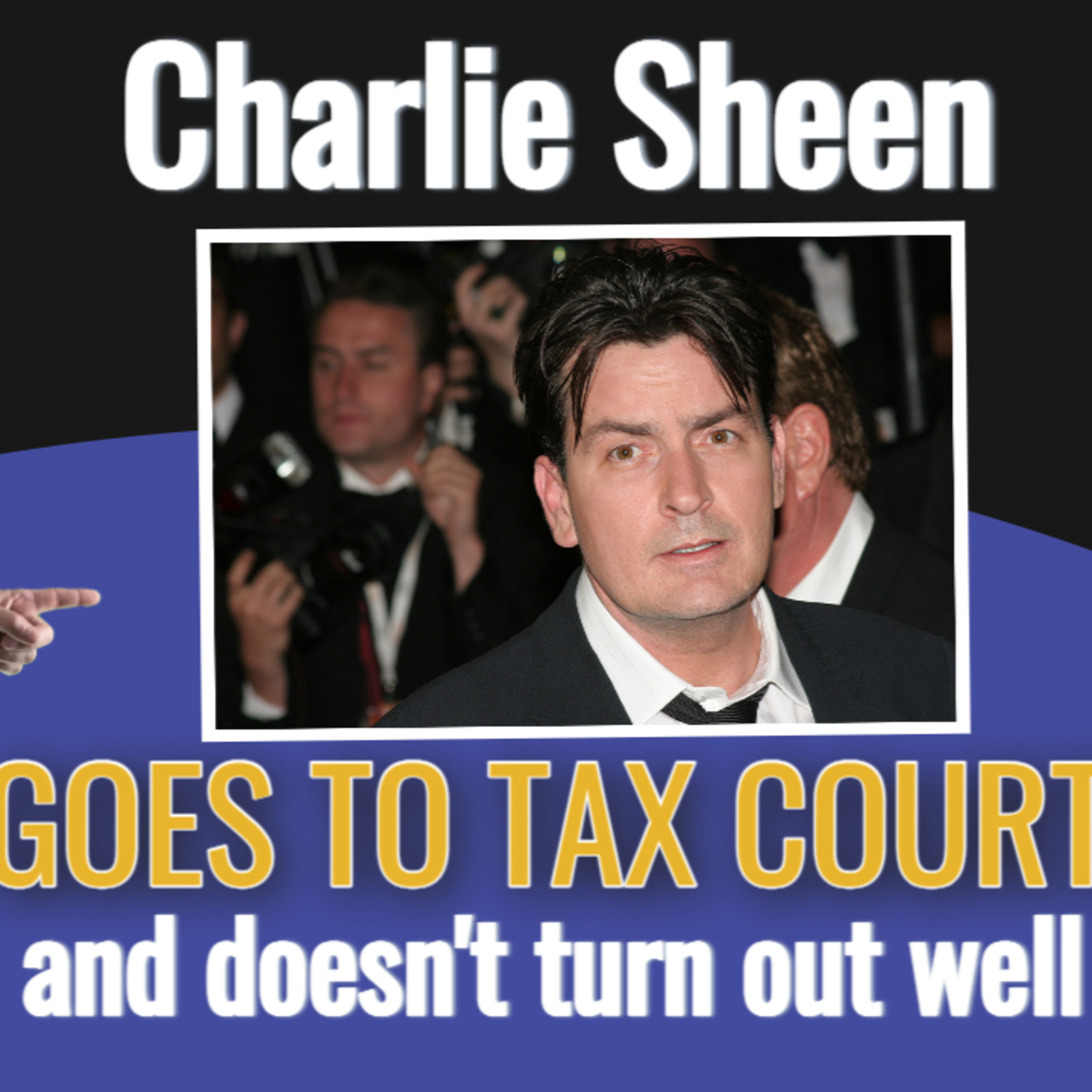

Today's Tax Talk with Attorney Steven LeahyCharlie Sheen - Again -Monday January 31, 2022 - Charlie Sheen's CPA is getting around. I reviewed the email he sent to me about our December story on this case. Mr. Jager also contacted Forbes about this case.

We will look over the latest Forbes article because the author, Peter Reilly, does a very good job explaining "What Happens When You Don't Pay." He goes on to discuss a Collection Due Process or Equivalent Hearing in general and how that worked into the Charlie Sheen case.

One more item - Mr. Reilly included his "Reilly's Tent...

2022-02-0115 min

Today's Tax Talk with Attorney Steven LeahySerious IRS Problems "At a Glance" - Recently we reviewed the National Taxpayer Advocate's Annual Report to Congress. The big news out of that report was the finding - by the Taxpayer Advocate ErinThursday January 27, 2022 - Recently we reviewed the National Taxpayer Advocate's Annual Report to Congress. The big news out of that report was the finding - by the Taxpayer Advocate Erin Collins - that the IRS is in "Crisis." Her words, not mine.

In that report, the Taxpayer Advocate lists "THE MOST SERIOUS PROBLEMS ENCOUNTERED BY TAXPAYERS." The report goes on to report "Services Taxpayers Want and the Problems the IRS Faces in Delivering Them."

Attorney Steven A. Leahy goes through the Taxpayer Advocate Report "At a Glance."

---

Sen...

2022-01-2818 min

Today's Tax Talk with Attorney Steven LeahyCharlie Sheen Tax Court Update - We reported on the Charlie Sheen Tax Court case. My reporting was based on a story in Forbes. Charlie Sheen's representative, Steven Jager, contacted me about our orWednesday January 26, 2022 - We reported on the Charlie Sheen Tax Court case. My reporting was based on a story in Forbes. Charlie Sheen's representative, Steven Jager, contacted me about our original story. I re-watched that episode and it looks like the story was accurate - but not complete.

It seems the story is ongoing - and Mr. Jager pointed me to a new article and his own take on the case. The 2021 case has been remanded (sent back) to appeals. “This case is remanded to respondent’s Office of Appeals for the purpose of affording...

2022-01-2720 min

Today's Tax Talk with Attorney Steven LeahyCrypto Executive Orders Coming - The Biden Administration is causing a stir with a recent announcement there is an executive order under development that will "address the economic, regulatory, and naTuesday January 25, 2022 - The Biden Administration is causing a stir with a recent announcement there is an executive order under development that will "address the economic, regulatory, and national security challenges posed by cryptocurrencies."

The Executive Order will "assign specific roles to a broad spectrum of federal departments and agencies in developing a comprehensive U.S. digital asset strategy." Including looking into establishing a Central Bank Digital Currency (CBDC).

The talk of creating a CBDC vs a Stablecoin. The need to move quickly is emphasized by some. But the sur...

2022-01-2617 min

Today's Tax Talk with Attorney Steven LeahyTax Season Opener - The 2021 Tax Filing Season opens today. The IRS begins accepting individual tax returns and sending out refunds. The IRS has already alerted the public - through the National TaxpMonday January 24, 2022 - The 2021 Tax Filing Season opens today. The IRS begins accepting individual tax returns and sending out refunds. The IRS has already alerted the public - through the National Taxpayer Advocate Erin Collins and Charles P. Rettig, commissioner of the Internal Revenue Service no less.

While the IRS places much of the blame on inadequate funding - the real culprit - in my opinion - is the number of paper returns that resulted from COVID restrictions and the additional responsibilities that came with them.

Attorney Steven A. Le...

2022-01-2519 min

Today's Tax Talk with Attorney Steven LeahyNext IRS Plan - Facial Recognition - The IRS has been promoting IRS.gov for some years, promising a list of online services and ease of use for the taxpayer. Now that there is a record number of onliThursday January 20, 2022 - The IRS has been promoting IRS.gov for some years, promising a list of online services and ease of use for the taxpayer. Now that there is a record number of online users, the IRS is implementing a new plan "to secure your data." Facial recognition.

Beginning this summer, in order for taxpayers to access their online account they will need to provide a government identification document, a selfie, credit report information, and copies of their bills to a private security company called ID.me.

That's rig...

2022-01-2120 min

Today's Tax Talk with Attorney Steven LeahyCash App - UPDATE! - The new Cash App rule is still all over the news. The reason it is still all over the news is because there is much confusion and no one seems to be cutting to the chase and tellWednesday January 19, 2022 - The new Cash App rule is still all over the news. The reason it is still all over the news is because there is much confusion and no one seems to be cutting to the chase and telling the truth.

Attorney Steven A. Leahy has read article after article, researched the IRS website, rules and regulations - and now, does an analysis of the statute - 26 USCS Section 6050W and accompanying IRS regulations.

There is good news - bad news - and ambiguities. The purpose of this...

2022-01-2026 min

Today's Tax Talk with Attorney Steven LeahyThe Future of Crypto & Blockchain - After reminiscing about the last year, the new year always turns to look to the future. What does the future hold for Cryptocurrency in particular, and BlockchainTuesday January 18, 2022 -After reminiscing about the last year, the new year always turns to look to the future. What does the future hold for Cryptocurrency in particular, and Blockchain in general?

In my view, new technology brings with it the promise for a better, more independent future. I dreamt the Internet would bring an infinite number of participants into the "village square" to discuss issues and collaborate on a better future.

That's not what happened. A few large corporations now dominate the internet and drown out independent voices.

...

2022-01-1918 min

Today's Tax Talk with Attorney Steven LeahyFree 2022 Tax Preparation - Tax Season officially opens January 24, 2022 - and the IRS has launched Free File Program on January 14th. The IRS Free file Program is a partnership between the IRS and tMonday January 17, 2022 - Tax Season officially opens January 24, 2022 - and the IRS has launched Free File Program on January 14th. The IRS Free file Program is a partnership between the IRS and tax preparation and filing software firms that provide their brand-name tax filing products for free.

The popular Turbo Tax will not participate in the IRS program this year. Turbo Tax does, however, have a free file option on its website.

“This decision will allow us to focus on further innovating in ways not allowable under the current Free...

2022-01-1813 min

Today's Tax Talk with Attorney Steven LeahyIRS "IN CRISIS" - In its annual report to Congress the Taxpayer Advocate's office concludes "The IRS is in crisis.Thursday January 13, 2022 - In its annual report to Congress the Taxpayer Advocate's office concludes "The IRS is in crisis. The Internal Revenue Code requires the National Taxpayer Advocate to submit an annual report to the House Committee on Ways and Means and the Senate Committee on Finance that includes a summary of the ten most serious problems encountered by taxpayers and makes administrative and legislative recommendations to mitigate those problems.

The Crisis determination is largely related to the delays taxpayer's are facing. Delays in return processing. Delays in refunds. Delays in answer phone calls. Delay...

2022-01-1423 min

Today's Tax Talk with Attorney Steven Leahy$600 Cash App - 1099K Explained; did a report titled "$600 Cash App Reporting" in October 2021, and a second Report in November 2021. In those reports I explained the new cash app rules and the impWednesday January 12, 2022 - I did a report titled "$600 Cash App Reporting" in October 2021, and a second Report in November 2021. In those reports I explained the new cash app rules and the impact it will have on regular Americans.

Recently, I responded to several YouTube comments on the October report, and I realized - Most People Still Don't understand the rules. And, the Government and Media are not helping answer the most common question - What will happen If I use a cash App for private purposes - will I get a 1099K?

2022-01-1324 min

Today's Tax Talk with Attorney Steven LeahyTaxing Crypto & Blockchain Assets - 2021 saw a boom in cryptocurrency and other Blockchain assets (NFTs, DAOs) activity by taxpayers who never even heard of these assets before this year.Tuesday January 11, 2022 - 2021 saw a boom in cryptocurrency and other Blockchain assets (NFTs, DAOs) activity by taxpayers who never even heard of these assets before this year. If these taxpayers are not prepared, they could be facing a big tax liability AND audits by the IRS - both things to avoid.

When it comes to Cryptocurrency, the first thing to know is -Crypto is taxed as property - and, therefore, likely creates a taxable event each time it is traded, sold, or used as an exchange of value (think buying something). Because Crypto is co...

2022-01-1219 min

Today's Tax Talk with Attorney Steven LeahyIRS Sets Date For 2022 Tax Season - The IRS has set the date of January 24, 2022 to officially open tax filing season, 19 days earlier than last year. That's the first day the agency will start acceptToday, Monday January 10, 2022, the IRS has set the date of January 24, 2022 to officially open tax filing season, 19 days earlier than last year. That's the first day the agency will start accepting and processing 2021 federal tax returns.

The IRS encouraged taxpayers to file electronically with direct deposit to receive their tax refunds as soon as possible. The IRS claims taxpayers should receive their refunds within 21 days of filing their return electronically if they use direct deposit and as long as there are no issues with the return.

Remember, the IRS...

2022-01-1114 min

Today's Tax Talk with Attorney Steven LeahyIRS "Tech Giants" - The IRS Budget is $14 Billion Plus, for 2022. They propose spending $4.4 Billion Dollars on Information Services and Modernization, shared services and infrastructure.The IRS Budget is $14 Billion Plus, for 2022. They propose spending $4.4 Billion Dollars on Information Services and Modernization, shared services and infrastructure. That's a whole lot of money!

The IRS has been Modernizing their IT infrastructure for more than 50 years, and, last year, they answer less than 10% of taxpayer telephone calls during tax season.

Attorney Steven A. Leahy reviews the 2022 IRS Tech Budget.

---

Send in a voice message: https://podcasters.spotify.com/pod/show/steven-leahy1/message

2022-01-0719 min

Today's Tax Talk with Attorney Steven LeahyBlockchain Crowdfunding - Blockchain technology is at the heart of Cryptocurrency. Innovators are using that same technology to crowdfund projects, law suits and even commercials.Blockchain technology is at the heart of Cryptocurrency. Innovators are using that same technology to crowdfund projects, law suits and even commercials.

Last week we told you about the Decentralized Autonomous Organization (DAO) that raised millions of dollars to purchase a copy of the Constitution. While that effort failed, the idea seems to be catching on.

This week we review stories about funding law suits and even crowdfunding to raise money for a Super Bowl ad. It won't stop there!

Attorney Steven A. Leahy let's...

2022-01-0515 min

Today's Tax Talk with Attorney Steven Leahy2022 Tax Planning - Hey it's 2022 - Let's start the new year thinking ahead. Too often my clients ask about tax planning after the year is over.Hey it's 2022 - Let's start the new year thinking ahead. Too often my clients ask about tax planning after the year is over. The right time for tax planning is at the beginning of the tax year.

This year will be a challenge because Congress may pass tax laws retroactively. They have done it before. But this year is ripe for these changes, given the Biden Build Back Better Bill is still on the horizon.

So, Attorney Steven A. Leahy shares some tax tips for 2022.

---

Send in a voic...

2022-01-0416 min

Today's Tax Talk with Attorney Steven LeahyIRS - Stolen Property Is Taxable - IRS recently issued Publication 17 (2021), Your Federal Income Tax designed to help individual taxpayers prepare their 2021 tax return.IRS recently issued Publication 17 (2021), Your Federal Income Tax designed to help individual taxpayers prepare their 2021 tax return. Think of it as the Instruction sheet for Form 1040 or 1040 -SR.

The publication covers everything, from the date your tax return is due (April 18, 2022 because of the Emancipation Day holiday in the District of Columbia) to deducting Personal protective equipment (PPE).

Part Two of the publication, Income and Adjustments to Income explains which income is and isn’t taxed and discusses some of the adjustments to income that you can make in figu...

2021-12-3125 min

Today's Tax Talk with Attorney Steven LeahyDAO - NFT - WEB3- Oh My? - Have you heard of a Decentralized Autonomous Organization (DAO), Non-Fungible Tokens (NFT), or WEB3? If you haven't, listen up.Have you heard of a Decentralized Autonomous Organization (DAO), Non-Fungible Tokens (NFT), or WEB3? If you haven't, listen up.

First Decentralized autonomous organizations (DAOs) are typified by the use of blockchain technology to provide a secure digital ledger to track digital interactions across the internet, hardened against forgery by trusted timestamping and dissemination of a distributed database.

Non-Fungible Tokens (NFT) are cryptographic assets on a blockchain with unique identification codes and metadata that distinguish them from each other. Unlike cryptocurrencies, they cannot be traded or exchanged at equivalency. This di...

2021-12-2920 min

Today's Tax Talk with Attorney Steven LeahyIRS Wants To Prepare Your Tax Returns - We don't have to pass the Biden's Build Back Better Bill to find out what is in it. Now that the Congress has recessed, Americans can look into the bill to finWe don't have to pass the Biden's Build Back Better Bill to find out what is in it. Now that the Congress has recessed, Americans can look into the bill to find out what's in it - the way it is supposed to be.

One of the proposals floating in Build Back Better is to allow the IRS to prepare all American's tax returns, FOR FREE. An Elizabeth Warren idea.

There are at least three reasons to oppose this idea. First, it is an obvious conflict of interest. The IRS m...

2021-12-2818 min

Today's Tax Talk with Attorney Steven LeahyDo We Need A Bigger, More Powerful IRS? - Biden's Build Back Better Plan has been delayed - but not killed!Biden's Build Back Better Plan has been delayed - but not killed! the US Chamber of Commerce, Republican Senators, and Editorial Boards across the Nation are still strongly opposing making the IRS bigger and more powerful than ever.

They oppose the $80 billion increase in IRS funding and the 87,000 additional employees proposed by the Bill. The best step, say many, would be to eliminate the IRS altogether, pointing to the history of abuse and targeting for politics rather than policy.

The Bank Reporting scheme is also not yet dead. So, Sen...

2021-12-2316 min

Today's Tax Talk with Attorney Steven LeahyCrypto Lingo - 10 Terms To Know - This week on Crypto Tuesday we begin, like we always do, with a review of the markets. We all know the rollercoaster ride cyrpto can be. Where are we this week?This week on Crypto Tuesday we begin, like we always do, with a review of the markets. We all know the rollercoaster ride cyrpto can be. Where are we this week?

Next, while Cryptocurrency is not new, many are hearing the "Crypto Lingo" for the first time. We review and comment on an article from Kim Komando in which she lists "10 cryptocurrency terms people use every day." How many terms do you know?

Finally, Attorney Steven A. Leahy looks at the progress of El Salvador and their Bitcoin experiment.

...

2021-12-2214 min

Today's Tax Talk with Attorney Steven LeahyIRS Audit Finds Taxpayer Info At Risk - The TREASURY INSPECTOR GENERAL FOR TAX ADMINISTRATION (TIGTA) conducts a yearly audit to "assess the adequacy and security of the IRS’s information technology."The TREASURY INSPECTOR GENERAL FOR TAX ADMINISTRATION (TIGTA) conducts a yearly audit to "assess the adequacy and security of the IRS’s information technology."

Problems were reported in the IRS’s handling of the privacy of taxpayer data, access controls, system environment security, information system boundary components, network monitoring and audit logs, disaster recovery, roles and responsibilities, and separation of duties, as well as security policies, procedures, and documentation.

Two of five function areas of the IRS’s Cybersecurity Framework were rated “not effective,” namely its ability to identify its cyberse...

2021-12-2216 min

Today's Tax Talk with Attorney Steven LeahyBiden's Build Back Better Bill - has hit a brick wall in the Senate. After fighting its way through the House last month - passing with the help of 13 "Republicans" - it appeared the Bill would sailBiden's Build Back Better Bill has hit a brick wall in the Senate. After fighting its way through the House last month - passing with the help of 13 "Republicans" - it appeared the Bill would sail through the Senate.

But, with many Senators objecting to Bank Reporting Requirements, others objecting to doubling the size of the IRS and still others objecting to the expanded child credits the demise of the Bill was inevitable.

The objections to other items in the legislation, such as long-term home health care, generous child car...

2021-12-1716 min

Today's Tax Talk with Attorney Steven LeahyIRS Increased Enforcement - Chris Tucker Now - You Next? - Biden's Build Back Better Plan proposes a whooping $80 Billion increase to the IRS budget, adding roughly 87,000 new employees. That's nearlBiden's Build Back Better Plan proposes a whooping $80 Billion increase to the IRS budget, adding roughly 87,000 new employees. That's nearly doubling the current size of the IRS.

Many in Congress are questioning the wisdom of such a move. Senators Grassly, Capito, & Thune and others have publicly objected to the IRS budget increase. Citing past IRS indiscretions and outright bulling of taxpayers, those Senators have said no to the Build Back Better Plan.

Last week Attorney Leahy talked about the IRS case against Charlie Sheen. This week the IRS publicized their...

2021-12-1616 min

Today's Tax Talk with Attorney Steven LeahyCharlie Sheen Goes To Tax Court - Charlie Sheen owes the IRS. For tax year 2015 the IRS said Sheen owed nearly $5 million. Sheen claimed he could not pay the full amount. He sought an installment aCharlie Sheen owes the IRS. For tax year 2015 the IRS said Sheen owed nearly $5 million. Sheen claimed he could not pay the full amount. He sought an installment agreement, then an offer-in-compromise. The IRS denied both.

So, in 2018 Sheen took his case to the United States Tax Court. While the case was pending, the IRS claimed Sheen owed additional monies for 2016 and 2018. Sheen combined all the cases and offered $3.1 million to settle the matter. The IRS calculated he could pay 3 or 4 times that amount. The Tax Court agreed with the IRS.

At...

2021-12-1020 min

Today's Tax Talk with Attorney Steven LeahyIRS Phone Policy - Don't Answer - The IRS National Taxpayer Advocate's Office recently held discussions about temporarily shutting down IRS phone lines.The IRS National Taxpayer Advocate's Office recently held discussions about temporarily shutting down IRS phone lines. The IRS needs to focus on clearing the unprecedented backlog of unfiled returns. Some 5.9 million individual 2021 returns and 2.7 million amended 2021 returns are still unprocessed.

Attorney Steven A. Leahy reveals the disappointing numbers as released by the IRS

In addition, the Taxpayer Advocates Service has stopped accepting cases for those with amended returns. “Under our current procedures, [we do] not accept cases in which we cannot meaningfully expedite or improve case resolution for taxpayers,” it said...

2021-12-0916 min

Today's Tax Talk with Attorney Steven LeahyCrypto Roller-Coaster - Any Cryptocurrency observer knows the Crypto Roller-Coaster can occur at ANY time. It happened again! Bitcoin lost more than 20% OVERNIGHT!Any Cryptocurrency observer knows the Crypto Roller-Coaster can occur at ANY time. It happened again! Bitcoin lost more than 20% OVERNIGHT!

Why is the price Fluctuating? Many different reasons have been presented - the stock market.- new Omicron variant - the Federal Reserve's response to Inflation - Pick your poison.

The BIG winner this week was the new Omicrom, a lesser known Cryptocurrency that took off after the World Health Organization named the newest Coronavirus variant after the Greek letter.

Attorney Steven A. Leahy ride...

2021-12-0815 min

Today's Tax Talk with Attorney Steven LeahyNew IRS Cannabis Rules? - Under the federal Controlled Substances Act, Marijuana is a “controlled substance.”Under the federal Controlled Substances Act, Marijuana is a “controlled substance.” The United State Supreme Court has held that “no exception in the Controlled Substances Act exists for marijuana that is medically necessary.” Or, for recreational use for that matter.

IRS Code Section 280E “prohibits taxpayers[] from deducting any expense of a trade or business that consists of the trafficking of a controlled substance such as marijuana.” The controlled substance status also makes it difficult or impossible for Cannabis business to get a bank account. Forcing these business to deal in cash.

Ther...

2021-12-0214 min

Today's Tax Talk with Attorney Steven LeahyIt Ain't Over...Til It's Over - Bank Reporting Reconsidered - The public has objected. The Republicans have objected. 21 Democrat Congressman have objected. Several Democrat Senators have objected.The public has objected. The Republicans have objected. 21 Democrat Congressman have objected. Several Democrat Senators have objected. Yet, Janel Yellen, The Secretary of the Department of Treasury is still pushing to have the Bank Reporting provision included in the Build Back Better Plan.

The Bank Reporting requirement would allow the IRS access to individual's bank account "inflows and Outflows." In addition to the $80 billion and 87,000 more tax collectors, the IRS hopes to generate $400 billion of additional tax revenue.

Attorney Steven A. Leahy campaigns against this provision AND The Build Back...

2021-12-0216 min

Today's Tax Talk with Attorney Steven LeahyCryptocurrency & Your 2021 Tax Return - The IRS has made cryptocurrency (or virtual currency as the IRS calls it) a priority.The IRS has made cryptocurrency (or virtual currency as the IRS calls it) a priority. The IRS specifically asked, for the first time, about "virtual currency" on Schedule 1 of the 2019 1040 tax form. In 2020 - that question was moved to page one of the 1040 return.

The early draft of 2021 IRS Tax Form 1040 includes the language "At any time during 2021, did you receive, sell, exchange, or otherwise dispose of any financial of any financial interest in any virtual currency?" directly under your name and address information. So there is no getting around reporting cryptocurrency to the IRS...

2021-12-0128 min

Today's Tax Talk with Attorney Steven LeahyBBB = "Total Financial Surveillance" - The Biden Administration's Build Back Better Plan (BBB) includes a massive increase in the size and scope of the IRS.The Biden Administration's Build Back Better Plan (BBB) includes a massive increase in the size and scope of the IRS. The plan provides an additional $80 Billion Dollars and 80,000 more "tax cops.." The IRS will use these additional resources to expand IRS Audits on "small businesses and households of modest means."

The Bank Statement Reporting was not included in the house version of the Bill, but is expected to be added on the Senate side. Many Democrats in Congress have come out against that scheme, but there really is no other way to pay for BB...

2021-11-3017 min

Today's Tax Talk with Attorney Steven LeahyCrypto News - El Salvador - IRS CI - Hillary Clinton - Get the latest Cryptocurrency news from Attorney Steven A. LeahyIt's Crypto-Tuesday and there a number of big stories in Cryptocurrency News. First, El Salvador is continuing their push to move to the front of Bitcoin economy. You may remember that in September 2021 El Salvador became the first country to declare Bitcoin as it's national currency. Since then they have taken measures to lead the world in assisting Crypto investors.

The latest move is an announcement that El Salvador is building a Bitcoin City. The City will be built at the foot of Conchagua Volcano. The volcano will help El Salvador Mine Bitcoin with green...

2021-11-2420 min

Today's Tax Talk with Attorney Steven LeahyBBB IRS Agent Army - The Build Back Better Act (BBB) sets aside $80 Billion For the IRS. With that increase, the IRS plans on hiring 87.000 new IRS workers to target "wealthy" taxpayers.The Build Back Better Act (BBB) sets aside $80 Billion For the IRS. With that increase, the IRS plans on hiring 87.000 new IRS workers to target "wealthy" taxpayers.

However, as Elon Musk points out, there are only 614 billionaires in America. And, “[t]he IRS already has dedicated audit teams for high net worth individuals. The doubling of staff is for everyone else,” Musk warned,

The Administration has already told us not to pay attention to the warned Congressional Budget Office's analysis - "The CBO has previously underestimated the revenues that increas...

2021-11-2316 min

Today's Tax Talk with Attorney Steven LeahyStorage of Value or Medium of Exchange. The promise of Cryptocurrency is in the use - or is it in the value. That is the conflict.The promise of Cryptocurrency is in the use - or is it in the value. That is the conflict. It is hard to buy something with Crypto that may grow in value the next day. Still the real promise in Crypto, in my mind, has to do with the elimination of the middleman and the efficient transfer of value.

I spoke with Dave Guttman, Chief Growth Officer of CoinFlip about his view on Crypto. You might find that discussion interesting - here is the link to that interview - https://vimeo.com/645310789.

2021-11-1719 min

Today's Tax Talk with Attorney Steven LeahyRecord Tax Collection! After all the hand-wringing about the Tax Gap, wealthy tax evaders and Crpto cheats the US Treasury collected a record taxAfter all the hand-wringing about the Tax Gap, wealthy tax evaders and Crpto cheats the US Treasury collected a record $283,927,000,000 in total taxes in October, which was the first month of fiscal 2022. However, Federal spending hit $448,983,000,000 in October, which was the second highest ever for the first month of a fiscal year.

Do these numbers demonstrate a need form more money, or a need to cut spending? That is ALWAYS the battel question.

Attorney Steven A. Leahy reviews the latest tax numbers.

---

Send in a voice message: htt...

2021-11-1219 min

Today's Tax Talk with Attorney Steven LeahyInfrastructure: Tax Breaks For Trial Attorneys is in the new Bill? We aren't sure. We need to pass the bill to find out what's in it. Really?The 2,100-page Infrastructure Bill is full of payoffs for special interests. One of the most egregious examples is the change in the tax law granting trial attorneys to deduct legal fees as they incur them - even though these fees may be reimbursed by their clients at a later date.

The up front fees have never been deductible. These fees have been treated like non-deductible loans to clients since they may eventually get reimbursed at the end of the case when the client settles or wins.

Attorney Steven A. Leahy reveals the new generous for Trial...

2021-11-1117 min

Today's Tax Talk with Attorney Steven LeahyFlawed Infrastructure Crypto Provision - The new infrastructure bill expands the definition of cash to include “digital assets”The new infrastructure bill expands the definition of cash to include “digital assets” and includes tax reporting provisions that capture Miners, stakers, lenders, decentralized application and marketplace users, traders, businesses, and individuals into these reporting requirements

The Crypto Industry and many in Government want to :"fix" the legislation by narrowing the definition of “broker” so the Internal Revenue Service can not target crypto miners, developers and others, who don’t have any customers or have access to information needed to comply with tax reporting requirements.

Attorney Steven A. Leahy reviews the new Bill and the impact on t...

2021-11-1015 min

Today's Tax Talk with Attorney Steven LeahyNew Tax Plan Expands SALT, an includes many ideas previously abandoned. Attorney Leahy reviews the latest proposals before Congress.Congress has proposed yet another version of a Tax Bill Today. Although, as Senator Manchin points out, no one really knows what provisions are in any of the versions. Different elements are suggested as a trial balloon and quickly removed - then reinserted.

For example, the Bank Reporting provision has been floated, removed, floated again, then changed, then struck down and now it may be part of the new bill. Like wise, the family leave provisions. Initially, 12 Weeks was proposed, and then quickly eliminated. Only to be family leave reintroduced for 4 weeks.

...

2021-11-0516 min

Today's Tax Talk with Attorney Steven LeahyRIP IRS Bank Reporting - Democratic Lawmakers have come out against the IRS Bank Reporting Provision of the spending bill. Is it all dead? Or, just mostly dead?IRS Bank Reporting has been a hot issue all summer long. Today's Tax Talk has been bringing this issue to the forefront since May 2021, knowing if the public knew of these plans there would be a ground swell of opposition.

In September 2021, because of bank and constituent complaints the Congressional Committee pulled the provision for the Bill, only to have it reinserted days later with a promise to increase the threshold from $600. In mid October Congressional Leaders announced the threshold change to $10,000.00. But it wasn't enough.

At least 100 Banks and...

2021-10-2915 min

Today's Tax Talk with Attorney Steven LeahyThe Constitution Stands In The Way of Congress violating American Citizen's rights. Thank you 4th and 16th Amendments!The Administration looks to upend the Constitution in order to obtain the money necessary to "reshape" America. The Bank Reporting provision may have been defeated. So, the Wealth tax has been introduced as an alternative.

The Constitution appears to stand in the way. The 4th Amendment proclaims "The right of the people to be secure in their persons, houses, papers, and effects, against unreasonable searches and seizures, shall not be violated." This amendment, I believe, prohibits the administration's Bank Reporting proposal.

The 16th Amendment allows Congress the "power to lay an...

2021-10-2821 min

Today's Tax Talk with Attorney Steven LeahyFree IRS Money?? Maybe Not. The IRS has handed out lots of money recently. What should you do if they ask for it back?The IRS handed out Child Tax Credits, Stimulus Money, Unemployment refunds and tax refunds to millions of Americans. Now, the IRS has sent out millions of Math Error Letters alerting some taxpayers that the money they received may have to be repaid. If the taxpayer can't pay it right away, they may owe thousands in penalties and interest on top of the repayment amount.

Attorney Steven A. Leahy reports on this new IRS development.

---

Send in a voice message: https://podcasters.spotify.com/pod/show/steven-leahy1/message

2021-10-2613 min

Today's Tax Talk with Attorney Steven LeahyIs IRS Spying Defeated??We reviewed The United States Department of Treasury Fact Sheet yesterday. Today, United States Senator Mike Crapo (R-Idaho) requested details about the "new approach" outlined in that Fact Sheet. According to him - this new approach has never been presented to Congress.

However, "critics" still oppose this new approach. Attorney Steven A. Leahy reviews the ongoing debate about IRS Spying.

---

Send in a voice message: https://podcasters.spotify.com/pod/show/steven-leahy1/message

2021-10-2221 min

Today's Tax Talk with Attorney Steven LeahyTreasury Doubles Down!!The right to privacy is a fundamental human right in any democratic country.

The United States Treasury Department published a "fact" sheet yesterday titled "Tax Compliance Proposals Will Improve Tax Fairness While Protecting Taxpayer Privacy" in response to the strong opposition to the Biden Bank Reporting Proposal. The "fact: sheet doubles down on the inaccruies and half truths perpetuated by the proposals supporters.

Attorney Steven A. Leahy breaks down the fact sheet into truths we can all understand. Protect our privacy!

---

Send in a voice message: https://pod...

2021-10-2126 min

Today's Tax Talk with Attorney Steven LeahyBiden's American Families PlanThe Biden Administration has been advocating for the American Families Plan, the American Jobs Plan and the American Rescue Plan. Each of these plans have price tags in the Trillions of dollars.

On this episode of Today's Tax Talk, Attorney Steven A. Leahy looks at the specific proposals in the American Family Plan using the administration's own "Fact" sheets.

---

Send in a voice message: https://podcasters.spotify.com/pod/show/steven-leahy1/message

2021-10-1422 min

Today's Tax Talk with Attorney Steven LeahyCyrpto Tuesday - The El Salvador ExperimentAttorney Steven A. Leahy reviews the Cryptocurrency market using CoinFlip.tech's Market Page.

And reports on El Salvador Experiment. The first country in the world that made Bitcoin its legal tender, now has more citizens with a Chivo Bitcoin wallet than a bank account. In under one month, 46 percent of the population have a Chivo Wallet compared to just 29 percent of Salvadorans with a bank account (as of 2017).

Finally, Attorney Leahy discusses the continued efforts of the US government to regulate Cryptocurrency and Cryptocurrency Markets.

---

Send in a...

2021-10-1317 min

Today's Tax Talk with Attorney Steven Leahy#1 - What to do With Unfiled Tax Returns After Tax Day 2021For many business owners who are behind on their taxes, tax day can be a stressful time. Luckily, there are options for those who find themselves in a tough situation. In this episode of "Tax Matters w/ Attorney Steven Leahy," we will be discussing the options people have to get into compliance with the IRS.

---

Send in a voice message: https://podcasters.spotify.com/pod/show/steven-leahy1/message